UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________________________ to ___________________________

or

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission

file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

Bao’an District,

(Address of principal executive offices)

Bao’an District,

Telephone:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered | ||

| The

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding ordinary shares, no par value is of December 31, 2022.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging

growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

INTRODUCTION

In this amendment to the annual report, except where the context otherwise requires and for purposes of this amendment to the annual report, only:

| ● | “BVI” refers to the British Virgin Islands; | |

| ● | “Baode” refers to Baode Supply Chain (Shenzhen) Co., Ltd, a limited liability company organized under the laws of China and a majority-owned subsidiary of Meiwu Shenzhen before December 28, 2021; | |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan for the purposes of this annual report only; | |

| ● | “Heme Shenzhen” refers to Heme Brand Chain Management (Shenzhen) Co., Ltd., a limited company organized under the laws of PRC and a 51% owned subsidiary of Meiwu Shenzhen; | |

| ● | “Meiwu Catering” is to Meiwu Catering Chain Management (Shenzhen) Co., Ltd, a limited liability company organized under the laws of China and a wholly owned subsidiary of Meiwu Shenzhen; | |

| ● | “Vande” refers to Shenzhen Vande Technology Co., Limited, a limited company organized under the laws of Hong Kong and a wholly owned subsidiary of Meiwu; | |

| ● | “variable interest entity” or “VIE” is to our variable interest entity, Wunong Technology (Shenzhen) Co., Ltd, that is 100% owned by PRC citizens and a PRC entity, that holds the business operation licenses or approvals to, and generally operates our Website for our internet businesses or other businesses in which foreign investment is restricted or prohibited, and is consolidated into our consolidated financial statements in accordance with U.S. GAAP as if it were our wholly-owned subsidiary. | |

| ● | “we,” “us,” “our company,” “our,” “the Company” and “Meiwu” is to Meiwu Technology Company Limited, a British Virgin Islands company, its subsidiaries, Shenzhen Vande Technology Co., Limited, Magnum International Holdings Limited, Mahaotiaodong Information Technology Company Limited, Xinfuxin International Holdings Limited and Guo Gangtong Trade (Shenzhen) Co., Ltd; | |

| ● | “WFOE” or “Guo Gang Tong” refers to Guo Gangtong Trade (Shenzhen) Co., Ltd, a limited liability company organized under the laws of China, which is wholly-owned by Shenzhen Vande Technology Co., Limited; | |

| ● | “Wude Shanghai” is to Wude Agricultural Technology (Shanghai) Co., Ltd, a limited liability company organized under the laws of China and a majority-owned subsidiary of Meiwu Shenzhen and | |

| ● | “Meiwu Shenzhen” refers to Meiwu Zhishi Technology (Shenzhen) Co,. Ltd, formerly known as Wunong Technology (Shenzhen) Co., Ltd, a limited liability company organized under the laws of China and a variable interest entity (“VIE”) contractually controlled by WFOE; | |

| ● | “Website” is to our online electronic retail store for the offering of the food products at www.wnw108.com. |

All references to “RMB” or “Chinese Yuan” is to the legal currency of China;

All references to “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States;

Our business is conducted by our subsidiaries, and the VIE and its subsidiaries in PRC, using RMB, the currency of China. Our consolidated financial statements are presented in United States dollars. In this annual report, we refer to assets, obligations, commitments and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

FORWARD-LOOKING INFORMATION

This annual report, as amended, on Form 20-F contains statements of a forward-looking nature. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “future” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to:

| ● | our intent to profitably grow our business through our strategic initiatives; | |

| ● | our intent to seek additional acquisition opportunities in food products and our expectation regarding competition for acquisitions; | |

| ● | our beliefs regarding our competitive strengths and ability to successfully compete in the markets in which we participate; | |

| ● | our expectations concerning consumer demand for our products, our future growth opportunities, market share and sales channels; | |

| ● | our future operating and financial performance; | |

| ● | the accuracy of our estimates and key judgments regarding certain tax matters and accounting valuations; and | |

| ● | our belief regarding our ability to comply with environmental, health and other applicable regulatory matters. |

1

The forward-looking statements contained in this annual report on Form 20-F are based on assumptions that we have made in light of our management’s experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. As you read and consider this annual report, you should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in these forward-looking statements. These factors include but are not limited to:

| ● | the adverse effects of the COVID-19 pandemic on our business or the market price of our ordinary shares; | |

| ● | the loss of any of our executive officers or members of our senior management team or other key employees; | |

| ● | the loss of any of our major customers or a decrease in demand for our products; | |

| ● | our ability to effectively compete in our markets; | |

| ● | changes in consumer preferences and our failure to anticipate and respond to such changes or to successfully develop and renovate products; | |

| ● | our ability to protect our brand names; | |

| ● | economic conditions that may affect our future performance including exchange rate fluctuations; | |

| ● | fluctuations in the availability of food ingredients and packaging materials that we use in our products; | |

| ● | disruptions in our information technology systems, supply network, manufacturing and distribution facilities or our workforce or the workforce of our suppliers; | |

| ● | increases in operating costs, including labor costs, and our ability to manage our cost structure; | |

| ● | the incurrence of liabilities not covered by our insurance; | |

| ● | the loss of our foreign private issuer status; | |

| ● | the effects of reputational damage from unsafe or poor quality food products, particularly if such issues involve products we distributed; | |

| ● | our failure to comply with, and liabilities related to, environmental, health and safety laws and regulations; and | |

| ● | changes in applicable laws or regulations. |

We would like to caution you not to place undue reliance on forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3. Key Information — D. Risk Factors.” Those risks are not exhaustive. We operate in a rapidly evolving environment. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law.

2

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

Our Corporate Structure

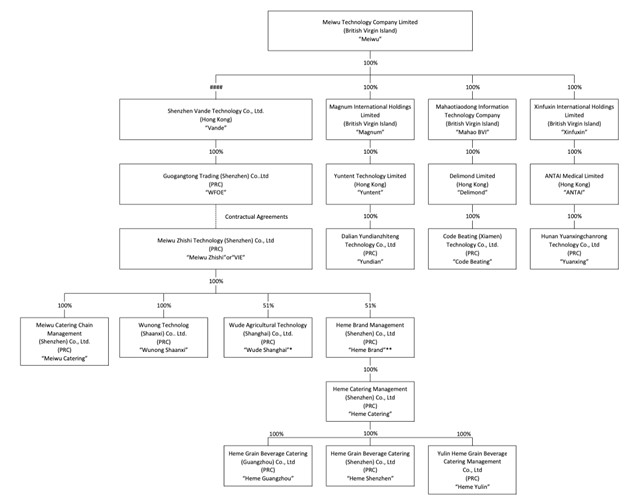

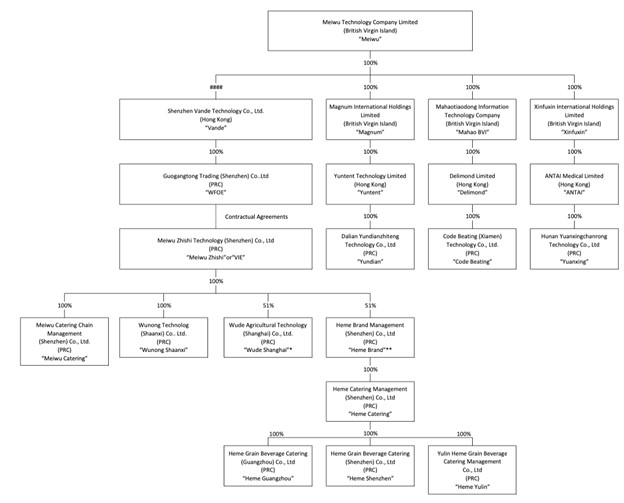

We are an offshore holding company incorporated in the British Virgin Islands and not a Chinese operating company. As a holding company with no material operations, our operations were conducted in China by (i) the VIE, Meiwu Shenzhen, and (ii) the VIE’s subsidiaries, Wunong Shaanxi, Heme Shenzhen, Wude Shanghai and Meiwu Catering. Neither we nor our subsidiaries own any equity interests in the VIE. WFOE, the VIE and the shareholders of the VIE entered into a series of contractual arrangements, also known as the “VIE Agreements”, pursuant to which we are able to consolidate the financial results of the VIE in our consolidated financial statements because we are deemed as the primary beneficial of the VIE under generally accepted accounting principles in the U.S. (“U.S. GAAP”), and this structure involves unique risks to investors. However, these VIE agreements have not been tested in a court of law in China as of the date of this annual report. The VIE structure provides contractual exposure to foreign investment in China-based companies. Chinese law though prohibits direct foreign investment in operating companies, does not prohibit direct foreign investment in the VIEs. As a result of our use of the VIE structure, investors may never directly hold equity interests in the VIE and its subsidiaries. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations and/or a material a change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. See “Item 3— Risks Associated with Our Corporate Structure and the VIE Agreements.”

The following diagram illustrates our corporate structure as of the date of this amendment to the annual report:

* The 49% equity interests of Wude Shanghai are owned by Shenzhen Heme Enterprise Consulting Partnership (Limited Partnership), a limited partnership organized under the laws of the PRC.

** The 49% equity interests of Heme Brand are owned by Yafang Liu (25%) and Guoming Huang (24%)

The VIE Agreements

Due to PRC legal restrictions on foreign ownership in the value-added telecommunications services, neither we nor our subsidiaries own any equity interest in Meiwu Shenzhen. Instead, WFOE, Meiwu Shenzhen and Meiwu Shenzhen’s shareholders entered into such a series of contractual arrangements, also known as VIE Agreements, on March 2, 2019. The VIE agreements consist of (i) exclusive technology consulting services agreement (the “Service Agreement”) which allows WFOE to receive substantially all of the economic benefits from the VIE; (ii) equity pledge agreements, pursuant to which, each shareholder of the VIE pledged all of their equity interests in Meiwu Shenzhen to WFOE as collateral to guarantee the performance of Meiwu Shenzhen to pay the service fee under the Service Agreement; (iii) exclusive purchase rights agreement, which provide WFOE with an exclusive option to purchase all or part of the equity interests in and/or assets of the VIE when and to the extent permitted by PRC laws, and (iv) proxy agreements, pursuant to which each shareholder of the VIE has authorized WFOE to exercise all of their rights as shareholders of the VIE.

Through the VIE Agreements among WFOE, the VIE, and the VIE’s shareholders, we are deemed to have a controlling financial interest in, and be the primary beneficiary of, the VIE for accounting purposes only and must consolidate the VIE because it met the conditions under U.S. GAAP to consolidate the VIE.

Each of the VIE Agreements is described in detail below:

3

Exclusive Technology Consulting Services Agreement

Pursuant to the Services Agreement by and between Meiwu Shenzhen and WFOE, WFOE provides Meiwu Shenzhen with technical and consulting services for which WFOE collects a service fee each month based on the following formula: the balance after subtracting accumulated losses, actual operating costs, retention of operating capital and taxes that have been paid from our income.

Meiwu Shenzhen has recorded a negative monthly profit from April 1, 2019 through December 31, 2022. Its after-tax monthly balance has been negative and consequently, no service fees had been paid over to WFOE.

Legend: 10,000 (RMB)

| Cumulative Income | Cumulative Cost | Cumulative Loss | Cumulative Operating Capital Retention | Income Tax Payable | Service Fee | |||||||||||||||||||

| January 2020 | 456.08 | 364.88 | 260.07 | - | - | -168.87 | ||||||||||||||||||

| February 2020 | 675.13 | 554.63 | 405.09 | - | - | -284.59 | ||||||||||||||||||

| March 2020 | 1,087.00 | 903.41 | 610.96 | - | - | -427.37 | ||||||||||||||||||

| April 2020 | 1,550.93 | 1,300.41 | 854.68 | - | - | -604.16 | ||||||||||||||||||

| May 2020 | 1,820.96 | 1,522.08 | 1,014.97 | - | - | -716.09 | ||||||||||||||||||

| June 2020 | 2,046.16 | 1,704.96 | 1,194.16 | - | - | -852.96 | ||||||||||||||||||

| July 2020 | 2,300.91 | 1,907.88 | 1,350.65 | - | - | -957.62 | ||||||||||||||||||

| August 2020 | 2,797.59 | 2,299.71 | 1,544.55 | - | - | -1,046.67 | ||||||||||||||||||

| September 2020 | 4,087.42 | 3,316.02 | 1,292.53 | - | - | -521.13 | ||||||||||||||||||

| October 2020 | 5,531.18 | 4,466.51 | 2,095.74 | - | - | -1,031.07 | ||||||||||||||||||

| November 2020 | 7,379.27 | 5,990.60 | 2,353.71 | - | - | -965.04 | ||||||||||||||||||

| December 2020 | 12,740.00 | 10,320.28 | 3,079.56 | - | - | -659.84 | ||||||||||||||||||

| January 2021 | 2,189.60 | 1,669.64 | 531.38 | - | - | -11.42 | ||||||||||||||||||

| February 2021 | 3,640.45 | 2,978.21 | 665.81 | - | - | -3.57 | ||||||||||||||||||

| March 2021 | 4,203.04 | 3,269.96 | 937.65 | - | - | -4.58 | ||||||||||||||||||

| April 2021 | 5,088.36 | 4,053.12 | 1,161.08 | - | - | -125.84 | ||||||||||||||||||

| May 2021 | 6,175.29 | 5,056.71 | 1,359.76 | - | - | -241.18 | ||||||||||||||||||

| June 2021 | 6,837.28 | 5,663.22 | 1,605.09 | - | - | -431.03 | ||||||||||||||||||

| July 2021 | 7,409.07 | 6,138.97 | 1,773.19 | - | - | -503.09 | ||||||||||||||||||

| August 2021 | 7,631.95 | 6,297.58 | 1,906.88 | - | - | -572.50 | ||||||||||||||||||

| September 2021 | 7,903.16 | 6,501.44 | 2,060.69 | - | - | -658.96 | ||||||||||||||||||

| October 2021 | 8,175.68 | 6,676.60 | 2,183.83 | - | - | -684.75 | ||||||||||||||||||

| November 2021 | 8,590.89 | 6,943.84 | 2,304.53 | - | - | -657.48 | ||||||||||||||||||

| December 2021 | 9,022.84 | 7,242.42 | 2,790.54 | - | - | -1,010.13 | ||||||||||||||||||

| January 2022 | 172.91 | 138.93 | 89.23 | - | - | -55.25 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| February 2022 | 490.95 | 378.77 | 158.83 | - | - | -46.65 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| March 2022 | 590.54 | 460.52 | 245.17 | - | - | -115.15 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| April 2022 | 624.93 | 486.78 | 363.45 | - | - | -225.30 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| May 2022 | 735.10 | 571.45 | 659.88 | - | - | -496.23 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| June 2022 | 832.23 | 648.30 | 802.35 | - | - | -618.42 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| July 2022 | 915.69 | 707.21 | 904.38 | - | - | -695.90 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| August 2022 | 979.21 | 749.99 | 994.72 | - | - | -765.50 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| September 2022 | 1,045.52 | 797.08 | 1,101.00 | - | - | -852.56 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| October 2022 | 1,083.92 | 825.32 | 1,208.06 | - | - | -949.46 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| November 2022 | 1,120.19 | 852.68 | 1,309.53 | - | - | -1,042.02 | ||||||||||||||||||

| - | ||||||||||||||||||||||||

| December 2022 | 1,160.57 | 882.50 | 1,469.69 | - | - | -1,191.62 | ||||||||||||||||||

Unless otherwise provided in this Service Agreement or separately agreed upon by WFOE and Meiwu Shenzhen, the term of this Services Agreement is ten (10) years, effective from March 2, 2019.

Equity Pledge Agreement

Pursuant to the Equity Pledge Agreement by and among WFOE and the shareholders of the VIE, the shareholders of the VIE pledged all of their equity interests in Meiwu Shenzhen to WFOE as collateral to guarantee the performance of Meiwu Shenzhen to pay the service fee under the Service Agreement. The pledge shall be effective upon recording of such pledged equity interests on Meiwu Shenzhen’s register of shareholders and registration with the competent government authorities, and shall expire two (2) years after the expiry date of term for the performance of all obligations under the Service Agreement.

Under the terms of the agreement, in the event Meiwu Shenzhen or its shareholders breach(es) its/their respective contractual obligations under the Service Agreement, WFOE is entitled to enforce its rights as pledgee including without limitation, transferring such equity interests to itself or its designee, auction, sale or other means of disposition of the equity interests as permitted under law.

4

Exclusive Purchase Rights Agreement

Pursuant to the Exclusive Purchase Rights Agreement by and among WFOE, shareholders of the VIE and Meiwu Shenzhen, each of the VIE’s shareholders irrevocably and unconditionally grant WFOE an exclusive option, to the extent permitted by PRC laws, to purchase all or partial equity interests of Meiwu Shenzhen at any time. In the event WFOE exercises said option, the purchase price of the equity interests shall be either (1) the amount of the paid-in capital contribution to the registered capital of Meiwu Shenzhen in proportion to the Equity Interests; or (2) the then lowest price allowed by the PRC laws and regulations, whichever is lower, unless the then applicable PRC laws and regulations require an appraisal of the Equity Interest or impose other restrictions in respect of the price of the Equity Interest.

Under the Exclusive Purchase Rights Agreement, WFOE is entitled to assign all of its rights and obligations under this agreement to any third party when necessary by written notice, without any consent from Meiwu Shenzhen and shareholders of the VIE. Meiwu Shenzhen and the shareholders of the VIE, however, shall not assign their rights and obligations under this agreement to any third party without the prior written consent of WFOE.

Pursuant to the PRC laws and regulations and the terms and conditions of this Exclusive Purchase Rights Agreement, WFOE and/or its designated party may exercise this exclusive option by serving written notice upon each of the shareholders of the VIE. WFOE has the sole and absolute right to determine the time, method and frequency when exercising such option.

Proxy Agreement

Under the Proxy Agreement, each shareholder of the VIE has authorized WFOE or its designated person (“Proxy”) to exercise all of their rights as shareholders including attending and voting at a general meeting of equity interest holders of Meiwu Shenzhen, appointing the Chairman, directors, general manager and other senior management personnel of Meiwu Shenzhen, and sign the shareholders’ resolutions and any other relevant documents. Additionally, the shareholders of the VIE confirmed that the Proxy may exercise such rights under this Proxy Agreement without their consent and they will provide assistance to the Proxy in the exercise of such rights. They further confirmed that they shall be liable for all the legal consequences arising out of or in connection with the exercise of such authorized rights by the Proxy.

Risks Associated with Our Corporate Structure and the VIE Agreements

The VIE structure cannot completely replicate a foreign investment in China-based companies, as the shareholders will not and may never hold equity interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign investment in us. Because we do not hold equity interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements as they have not been tested in a court of law. The VIE Agreements may not be effective in providing control over the VIE. See “Risk Factors — Risks Relating to Our Corporate Structure” starting on page 28 of this annual report, “Risk Factors — Risks Relating to Doing Business in the PRC” starting on page 31 of this annual report for more information.

Our auditor is Enrome LLP, headquartered in Singapore. Although the audit report included in this annual report is prepared by an auditor who are currently inspected by the Public Company Accounting Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”), as amended, if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely for two consecutive years, and as a result, U.S. national securities exchanges, such as Nasdaq, may determine to delist our securities. On December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. See more detailed discussion of this risk factor on page 11 of this annual report.

We are subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the VIE structure, which would likely result in a material change in our operations and the value of Ordinary Shares may depreciate significantly or become worthless. We are also subject to certain legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIE’s operations, significant depreciation of the value of our Ordinary Shares, or a complete hindrance of our ability to continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

5

Pursuant to the PRC Cybersecurity Law, which was promulgated by the Standing Committee of the National People’s Congress on November 7, 2016 and took effect on June 1, 2017, personal information and important data collected and generated by a critical information infrastructure operator in the course of its operations in China must be stored in China, and if a critical information infrastructure operator purchases internet products and services that affects or may affect national security, it should be subject to cybersecurity review by the Cyberspace Administration of China (“CAC”). Due to the lack of further interpretations, the exact scope of “critical information infrastructure operator” remains unclear. On December 28, 2021, the CAC and other relevant PRC governmental authorities jointly promulgated the Cybersecurity Review Measures (the “CAC Revised Measures”) to replace the original Cybersecurity Review Measures. The CAC Revised Measures took effect on February 15, 2022. Pursuant to the CAC Revised Measures, if critical information infrastructure operators purchase network products and services, or network platform operators conduct data processing activities that affect or may affect national security, they will be subject to cybersecurity review. On July 7, 2022, the CAC published the Measures for the Security Assessment of Outbound Data Transfer (the “Measures”), which took effect on September 1, 2022. The Measures apply to the security assessment of important data and personal information collected and generated during operation within the territory of the People’s Republic of China and transferred abroad by a data handler. According to the Measures, if a data handler transfers data abroad under any of the following circumstances, it shall file to the State Cyberspace Administration for security assessment via the provincial Cyberspace Administration: (i) a data handler who transfers important data abroad; (ii) a critical information infrastructure operator, or a data handler processing the personal information of more than 1 million individuals transfers personal information abroad;(iii) since January 1st of the previous year, a data handler cumulatively transferred the personal information of more than 100,000 individuals, or the sensitive personal information of more than 10,000 individuals abroad, or;(iv) other circumstances where the security assessment for the outbound data transfer is required by the State Cyberspace Administration. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. The cybersecurity review will evaluate, among others, the risk of critical information infrastructure, core data, important data, or a large amount of personal information being influenced, controlled or maliciously used by foreign governments and risk of network data security after going public overseas.

As confirmed by our PRC counsel, Beijing Dacheng Law Offices, LLP (Fuzhou) (“Dacheng”), we are not in violation of any of the aforementioned measures issued by the CAC, and we are not subject to cybersecurity review with the CAC in accordance with the CAC Revised Measures, because (i) we are not in possession of or otherwise holding personal information of over one million users and it is also very unlikely that it will reach such threshold in the near future; and (ii) as of the date of this amendment to the annual report, we have not received any notice or determination from applicable PRC governmental authorities identifying the PRC operating entities, the VIE or any of the VIE’s subsidiaries as critical information infrastructure operators or requiring the PRC operating entities or the VIE to go through cybersecurity review or network data security review by the CAC. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange.

6

On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), and five supporting guidelines (collectively, the “Overseas Listings Rules”), which has become effective on March 31, 2023. On the same date of the issuance of the Overseas Listings Rules, the CSRC circulated the Notice on Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises(the “Notice”). Pursuant to the Trial Measures and the Notice, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offerings or listing application. If a PRC company fails to complete required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such PRC company may be subject to administrative penalties, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. The companies that have already been listed on overseas stock exchanges or have obtained the approval from overseas supervision administrations or stock exchanges for its offering and listing before March 31, 2023 and will complete their overseas offering and listing prior to September 30, 2023 are not required to make immediate filings for its listing yet need to make filings for subsequent offerings in accordance with the Overseas Listings Rules. In addition, on February 24, 2023, the CSRC, together with Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing which was issued by the CSRC, National Administration of State Secrets Protection and National Archives Administration of China in 2009, or the Provisions. The revised Provisions is issued under the title the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies, and came into effect on March 31, 2023 together with the Trial Measures. One of the major revisions to the revised Provisions is expanding its application to cover indirect overseas offering and listing, as is consistent with the Trial Measures. The revised Provisions require that, including but not limited to (a) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (b) domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations. As of the date of this annual report, we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC with respect our listing on the Nasdaq Capital Market. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. Any failure or perceived failure of us to fully comply with such new regulatory requirements could significantly limit or completely hinder our ability to continue to offer securities to investors, cause significant disruption to our business operations, and severely damage our reputation, which could materially and adversely affect our financial condition and results of operations and could cause the value of our securities to significantly decline or be worthless.

Dividend Distributions or Assets Transfer among the Holding Company, its Subsidiaries and the VIE

As of the date of this amendment to the annual report, none of our subsidiaries or the VIE have made any dividends or distributions to our Company and our Company has not made any dividends or distributions to our shareholders. We intend to keep any future earnings to re-invest in and finance the expansion of our business, and we do not anticipate that any cash dividends will be paid or any assets will be transferred in the foreseeable future. Please see page 54 for the selected condensed consolidated financial data of us, our subsidiary and the VIE. Subject to the passive foreign investment company (“PFIC”) rules, the gross amount of distributions we make to investors with respect to our ordinary shares (including the amount of any taxes withheld therefrom) will be taxable as a dividend, to the extent that the distribution is paid out of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles.

Pursuant to the BVI Business Companies Act, 2004 as amended from time to time (the “BVI Act”), and our third amended and restated memorandum and articles of association, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think appropriate, if they are satisfied on reasonable grounds that immediately following the dividend payment, the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further British Virgin Islands statutory restriction on the amount of funds which may be distributed by us by dividends. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our Hong Kong subsidiary, Vande, and from the VIE to the WFOE in accordance with the VIE Agreements.

Current PRC regulations permit the WFOE to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, the WFOE is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through the current VIE Agreements, we may be unable to pay dividends on our Ordinary Shares.

Cash dividends, if any, on our Ordinary Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

7

In order for us to pay dividends to our shareholders, we will rely on payments made from the VIE to the WFOE, pursuant to VIE Agreements between them, and the distribution of such payments to Vander as dividends from the WFOE. Certain payments from the VIE to the WFOE are subject to PRC taxes, including business taxes and VAT.

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by the WFOE to its immediate holding company, Vande. As of the date of this amendment to the annual report, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Vande intends to apply for the tax resident certificate when the WFOE plans to declare and pay dividends to Vande. See “Risk Factors - There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of the WFOE, and dividends payable by the WFOE to our offshore subsidiaries may not qualify to enjoy certain treaty benefits.”

As of the date of this amendment to the annual report , our Company, Meiwu, WFOE, and the VIE have not distributed any earnings or settled any amounts owed under the VIE Agreements. Our Company, Meiwu, WFOE, and the VIE do not have any plan to distribute earnings or settle amounts owed under the VIE Agreements in the foreseeable future.

Our management is directly supervising cash management. Our finance department is responsible for establishing the cash management policies and procedures among our departments and the operating entities. Each department or operating entity initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and submitting it to designated management members of our Company, based on the amount and the use of cash requested. The designated management member examines and approves the allocation of cash based on the sources of cash and the priorities of the needs, and submit it to the cashier specialists of our finance department for a second review. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred nor a written policy that addresses how we will handle any limitations on cash transfers due to PRC law.

During the fiscal years ended December 31, 2022 and 2021, there has been no cash transfers and transfers of other assets between our Company, Meiwu, WFOE, and the VIE.

As of the date of this amendment to the annual report, none of our subsidiaries or the VIE have made any dividends or distributions to our Company and our Company has not made any dividends or distributions to our shareholders. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. Subject to the passive foreign investment company (“PFIC”) rules, the gross amount of distributions we make to investors with respect to our Ordinary Shares (including the amount of any taxes withheld therefrom) will be taxable as a dividend, to the extent that the distribution is paid out of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles.

8

Subject to the BVI Act and our M&A, our directors may, by resolution, declare dividends at a time and amount as they think fit if they are satisfied, based on reasonable grounds, that, immediately after distribution of the dividend, the value of our assets will exceed our liabilities and we will be able to pay our debts as they fall due.

The PRC tax authorities may require WFOE to adjust its taxable income under the contractual arrangements they currently have in place with our consolidated variable interest entity in a manner that would materially and adversely affect their ability to pay dividends and other distributions to us. See “Risks Related to Our Corporate Structure and Operation — Contractual arrangements in relation to the VIE may be subject to scrutiny by the PRC tax authorities and they may determine that we or the VIE owe additional taxes, which could negatively affect our financial condition and the value of your investment.”

Under PRC laws and regulations, our PRC subsidiaries, as wholly foreign-owned enterprises in China, may pay dividends only out of their respective accumulated after-tax profits as determined in accordance with PRC accounting standards and regulations. In addition, a wholly foreign-owned enterprise is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund certain statutory reserve funds, until the aggregate amount of such funds reaches 50% of its registered capital. At its discretion, a wholly foreign-owned enterprise may allocate a portion of its after-tax profits based on PRC accounting standards to staff welfare and bonus funds. These reserve funds and staff welfare and bonus funds are not distributable as cash dividends.

Any limitation on the ability of our PRC subsidiaries to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business. See also If we are classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders – “If we are classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders.”

To the extent cash/assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds/assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of our company, our subsidiaries, or the consolidated VIE by the PRC government to transfer cash/assets.

Permission or Approval Required from the PRC Authorities for the VIE’s Operation

In the opinion of our PRC counsel, Dacheng, to operate the general business activities currently conducted in China, the consolidated VIE and its subsidiaries are required to obtain a business license from the State Administration for Market Regulation (“SAMR”). Each of the VIE and its subsidiaries has obtained a valid business license from the SAMR, and no application for any such license has been denied.

We are aware, however, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems will be taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity and data privacy protection requirements and similar matters. The Opinions and any related implementing rules to be enacted may subject us to compliance requirement in the future. Given the current regulatory environment in the PRC, we are still subject to the uncertainty of different interpretation and enforcement of the rules and regulations in the PRC adverse to us, which may take place quickly with little advance notice.

9

On December 28, 2021, the CAC published the CAC Revised Measures, which further restates and expands the applicable scope of the cybersecurity review. The CAC Revised Measures took effect on February 15, 2022. Pursuant to the CAC Revised Measures, if a network platform operator holding personal information of over one million users seeks for “foreign” listing, it must apply for the cybersecurity review. In addition, operators of critical information infrastructure purchasing network products and services are also obligated to apply for the cybersecurity review for such purchasing activities. Although the CAC Revised Measures provides no further explanation on the extent of “network platform operator” and “foreign” listing, we do not believe we are obligated to apply for a cybersecurity review pursuant to the CAC Revised Measures, considering that (i) we are not in possession of or otherwise holding personal information of over one million users and it is also very unlikely that we will reach such threshold in the near future; (ii) as of the date of this this annual report, we have not received any notice or determination from applicable PRC governmental authorities identifying the PRC operating entities, the VIE, or any of the VIE’s subsidiaries as critical information infrastructure operators.

On February 17, 2023, the CSRC promulgated the Trial Measures of, and the Overseas Listings Rules, which has become effective on March 31, 2023. On the same date of the issuance of the Overseas Listings Rules, the CSRC circulated the Notice on Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises (the “Notice”). Pursuant to the Trial Measures and the Notice, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offerings or listing application. If a PRC company fails to complete required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such PRC company may be subject to administrative penalties, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. The companies that have already been listed on overseas stock exchanges or have obtained the approval from overseas supervision administrations or stock exchanges for its offering and listing before March 31, 2023 and will complete their overseas offering and listing prior to September 30, 2023 are not required to make immediate filings for its listing yet need to make filings for subsequent offerings in accordance with the Overseas Listings Rules. In addition, on February 24, 2023, the CSRC, together with Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing which was issued by the CSRC, National Administration of State Secrets Protection and National Archives Administration of China in 2009, or the Provisions. The revised Provisions is issued under the title the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies, and came into effect on March 31, 2023 together with the Trial Measures. One of the major revisions to the revised Provisions is expanding its application to cover indirect overseas offering and listing, as is consistent with the Trial Measures. The revised Provisions require that, including but not limited to (a) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (b) domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations. As of the date of this amendment to the annual report, we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC with respect our listing on the Nasdaq Capital Market. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. Any failure or perceived failure of us to fully comply with such new regulatory requirements could significantly limit or completely hinder our ability to continue to offer securities to investors, cause significant disruption to our business operations, and severely damage our reputation, which could materially and adversely affect our financial condition and results of operations and could cause the value of our securities to significantly decline or be worthless.

10

In summary, we, our subsidiaries, the VIE or the VIE’s subsidiaries are not required to obtain permission or approval from the PRC authorities including CSRC or CAC for the operation of the VIE or its subsidiaries, nor have we, our subsidiaries, the VIE, or any of the VIE’s subsidiaries received any denial. We are subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that the permission or approvals discussed here are not required, that applicable laws, regulations or interpretations change such that we or the VIE, or any of its subsidiaries is required to obtain approvals in the future, or that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and continue to offer securities to our investors. These adverse actions could cause the value of our Ordinary Shares to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of our securities to be listed on the U.S. exchange, which would likely cause the value of our securities to significantly decline or become worthless.

| A. | [Reserved] |

| B. | Capitalization and indebtedness |

Not applicable.

| C. | Reasons for the offer and use of proceeds |

Not applicable.

| D. | Risk Factors |

Investment in our ordinary shares involves a high degree of risk. You should carefully consider, among other matters, the following risk factors in addition to the other information in this annual report on Form 20-F when evaluating our business because these risk factors may have a significant impact on our business, financial condition, operating results or cash flow. If any of the material risks described below or in subsequent reports we file with the Securities and Exchange Commission (“SEC”) actually occur, they may materially harm our business, financial condition, operating results or cash flow. Additional risks and uncertainties that we have not yet identified or that we presently consider to be immaterial may also materially harm our business, financial condition, operating results or cash flow.

Summary of Risk Factors

Below please find a summary of the principal risks we face, organized under relevant headings. For more information, please see the section titled “Risk factors” beginning on page 11 of this annual report.

Risks Related to Our Business and Industry

| ● | We are exposed to the risks of an economic recession, credit and capital markets volatility and economic and financial crisis as a result of the COVID-19 virus pandemic. See more detailed discussion of this risk factor on page 14 of this amendment to the annual report. |

| ● | If we are unable to offer branded products at attractive prices to meet customer needs and preferences on our e-commerce platform, or if our reputation for selling authentic, high-quality products suffers, we may lose customers and our business, financial condition and results of operations may be materially and adversely affected. See more detailed discussion of this risk factor on page 14 of this amendment to the annual report. |

| ● | If we are not able to implement our strategies to achieve our business objectives, our business operations and financial performance will be adversely affected. See more detailed discussion of this risk factor on page 15 of this amendment to the annual report. |

| ● | We depend on third parties to supply our food products; any adverse changes in such supply or the costs of products may adversely affect our operations. See more detailed discussion of this risk factor on page 16 of this amendment to the annual report. |

11

| ● | Our business generates and processes a large amount of data, which subjects us to governmental regulations and other legal obligations related to privacy, information security and data protection. Any improper use or disclosure of such data by us, our employees or our business partners could subject us to significant reputational, financial, legal and operational consequences. See more detailed discussion of this risk factor on page 18 of this amendment to the annual report. |

| ● | Higher labor costs could adversely affect our business and financial results. See more detailed discussion of this risk factor on page 20 of this amendment to the annual report. |

● |

Health concerns or adverse developments with respect to the safety or quality of the food product industry in general or our own products specifically may damage our reputation, increase our costs of operations and decrease demand for our products. See more detailed discussion of this risk factor on page 20 of this amendment to the annual report. |

Risks Related to Our Corporate Structure and Operation

| ● | Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us. See more detailed discussion of this risk factor on page 29 of this amendment to the annual report. |

| ● | If the PRC government deems that the contractual arrangements in relation to the VIE, do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our ordinary shares may decline in value or become worthless if the determinations, changes, or interpretations result in our inability to assert contractual control over the assets of our PRC subsidiaries or the VIE that conduct all of our operations. See more detailed discussion of this risk factor on page 29 of this amendment to the annual report. |

| ● | Any failure by the VIE or its shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business. See more detailed discussion of this risk factor on page 30 of this amendment to the annual report. |

| ● | Contractual arrangements in relation to the VIE, may be subject to scrutiny by the PRC tax authorities and they may determine that we or the VIE owe additional taxes, which could negatively affect our financial condition and the value of your investment. See more detailed discussion of this risk factor on page 30 of this amendment to the annual report. |

| ● | We may lose the ability to use and benefit from assets held by the VIE, that are material to the operation of our business if the entity goes bankrupt or becomes subject to a dissolution or liquidation proceeding. See more detailed discussion of this risk factor on page 31 of this amendment to the annual report. |

| ● | If the chops of WFOE, our PRC subsidiaries and the VIE, are not kept safely, are stolen or are used by unauthorized persons or for unauthorized purposes, the corporate governance of these entities could be severely and adversely compromised. See more detailed discussion of this risk factor on page 31 of this amendment to the annual report. |

Risks Related to Doing Business in the People’s Republic of China

| ● | Although the audit report included in this annual report is prepared by an auditor who are currently inspected by the Public Company Accounting Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”), as amended, if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely for two consecutive years, and as a result, U.S. national securities exchanges, such as Nasdaq, may determine to delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. See more detailed discussion of this risk factor on page 31 of this amendment to the annual report. |

12

| ● | Any actions by Chinese government, including any decision to intervene or influence our operations or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to our operation, may limit or completely hinder our ability to continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless. See more detailed discussion of this risk factor on page 31 of this amendment to the annual report. |

| ● | Recent greater oversight by the Cyberspace Administration of China (“CAC”) over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business. See more detailed discussion of this risk factor on page 34 of this amendment to the annual report. |

| ● | Uncertainties in the interpretation and enforcement of Chinese laws and regulations could limit the legal protections available to us. See more detailed discussion of this risk factor on page 35 of this amendment to the annual report. |

| ● | We may have difficulty in enforcing any rights we may have under the VIE Agreements in PRC. See more detailed discussion of this risk factor on page 35 of this amendment to the annual report. |

| ● | We rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business. See more detailed discussion of this risk factor on page 35 of this amendment to the annual report. |

| ● | Fluctuations in exchange rates could have a material adverse effect on our results of operations and the price of our shares. See more detailed discussion of this risk factor on page 37 of this amendment to the annual report. |

●

|

The M&A Rules and certain other PRC regulations establish complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China. See more detailed discussion of this risk factor on page 39 of this amendment to the annual report. |

Risks Related to Our Ordinary Shares

| ● | We will incur additional costs as a result of becoming a public company, which could negatively impact our net income and liquidity. See more detailed discussion of this risk factor on page 42 of this amendment to the annual report. |

| ● | The obligation to disclose information publicly may put us at a disadvantage to competitors that are private companies. See more detailed discussion of this risk factor on page 42 of this amendment to the annual report. |

| ● | We are a “foreign private issuer,” and our disclosure obligations differ from those of U.S. domestic reporting companies. As a result, we may not provide you the same information as U.S. domestic reporting companies or we may provide information at different times, which may make it more difficult for you to evaluate our performance and prospects. See more detailed discussion of this risk factor on page 42 of this amendment to the annual report. |

| ● | We are an “emerging growth company,” and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our Ordinary Shares less attractive to investors. See more detailed discussion of this risk factor on page 43 of this amendment to the annual report. |

13

Risks Related to Our Business and Industry

We are exposed to the risks of an economic recession, credit and capital markets volatility and economic and financial crisis as a result of the COVID-19 virus pandemic, which could adversely affect the demand for our products, our business operations and expansion plans and our ability to mitigate its impact and provide timely information to our investors and the SEC.

We are exposed to the risk of a global recession or a recession in one or more of our key markets, credit and capital markets volatility and an economic or financial crisis, or otherwise, which could result in reduced consumption or sales prices of our products, which in turn could result in lower revenue and reduced profit. Our financial condition and results of operations, as well as our future prospects, would likely be hindered by an economic downturn in any of our key markets.

The purchase of our products is closely linked to general economic conditions, with levels of consumption tending to rise during periods of rising per capita income and fall during periods of declining per capita income. Additionally, per capita consumption is inversely related to the sale prices of our products.

Besides moving in concert with changes in per capita income, purchase of our products also increases or decreases in accordance with changes in disposable income.

Any decrease in disposable income resulting from an increase in inflation, income taxes, the cost of living, unemployment levels, political or economic instability or other factors would likely adversely affect the demand for our products.

Capital and credit market volatility, such as that experienced in recent years, may result in downward pressure on share prices and the credit capacity of issuers. Potential changes in social, political, regulatory and economic conditions may be significant drivers of capital and credit market volatility.

If we are unable to offer branded products at attractive prices to meet customer needs and preferences on our e-commerce platform, or if our reputation for selling authentic, high-quality products suffers, we may lose customers and our business, financial condition and results of operations may be materially and adversely affected.

Our future growth on our e-commerce platform partially depends on our ability to continue to attract new customers as well as to increase the spending and repeat purchase rate of existing customers. Constantly changing consumer preferences have historically affected, and will continue to affect, the online retail industry. Consequently, we must stay abreast of emerging lifestyle and consumer preferences and anticipate product trends that will appeal to existing and potential customers.

We are heavily dependent on our customers. Due to the high level of competition in our industry, we may fail to retain our customers, which would harm our financial condition and operating results.

We are heavily dependent on purchases of our food products by customers, who are typically middle-income young professionals and who can be extremely fickle. We operate in a very competitive environment and face strong competition in terms of distribution, brand recognition, taste, quality, price, availability, and product positioning. The market is highly fragmented, particularly in China, and the resources of our competitors may increase due to mergers, consolidations or alliances, and we may face new competitors in the future.

The business of selling healthy food products is highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. These market segments include numerous manufacturers, distributors, marketers, retailers and physicians that actively compete for the business of consumers in various countries. In addition, we anticipate that we will be subject to increasing competition in the future from sellers that utilize electronic commerce. Some of these competitors have longer operating histories, significantly greater financial, technical, product development, marketing and sales resources, greater name recognition, larger established customer bases and better-developed distribution channels than we do. Our present or future competitors may be able to develop products that are comparable or superior to those we offer, adapt more quickly than we do to new technologies, evolving industry trends and standards or customer requirements, or devote greater resources to the development, promotion and sale of their products than we do. From time to time in response to competitive and customer pressures or to maintain market share, we may be forced to reduce our selling prices or increase or reallocate spending on marketing, advertising, or promotions in order to compete. These types of actions could decrease our profit margins. Such pressures may also restrict our ability to increase our selling prices in response to raw material and other cost increases.

Accordingly, we may not be able to retain our customers, compete effectively in our markets and competition may intensify. In light of the strong competition that we currently face, and which may intensify in the future, there can be no assurance that we will be able to increase the sales of our products or even maintain our past levels of sales, or that our profit margins will not be reduced. If we are unable to increase our product sales or to maintain our past levels of sales and profit margins, our business, financial condition, results of operations and prospects may be materially and adversely affected.

In addition, because the industry in which we operate is not particularly capital intensive or otherwise subject to high barriers to entry, it is relatively easy for new competitors to emerge who will compete with our customers and their customers. Our ability customers to remain competitive therefore depends, in significant part, on our success in retaining and attracting new customers. We cannot ensure that our efforts will be successful and if we are not, our financial condition and operating results would be harmed.

14

User behavior on mobile devices is rapidly evolving, and if we fail to successfully adapt to these changes, our competitiveness and market position may suffer.

Buyers, sellers and other participants are increasingly using mobile devices in China for a wide range of purposes, including for e-commerce. While a significant and growing portion of participants access our e-commerce platform through mobile devices, this area is developing rapidly and we may not be able to continue to increase the level of mobile access to, or transactions on, our e-commerce platform by users of mobile devices. The variety of technical and other configurations across different mobile devices and platforms increases the challenges associated with this environment. our ability to successfully expand the use of mobile devices to access our e-commerce platform is affected by the following factors:

| ● | our ability to continue to provide products on our e-commerce platform and website; | |

| ● | our ability to successfully deploy apps on popular mobile operating systems; and | |

| ● | the attractiveness of alternative platforms. |

If we are unable to attract significant numbers of new mobile buyers and increase levels of mobile engagement, our ability to maintain or grow our business would be materially and adversely affected.

Sales of our products are subject to changing consumer preferences; if we do not correctly anticipate such changes, our sales and profitability may decline.