UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

OR

For the fiscal year ended

OR

For the transition period from to

OR

Date of event requiring this shell company report

Commission file number: 001-39155

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+55 (11) 3075-0429

(Address of principal executive offices)

Tel:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Manuel Garciadiaz

Byron B. Rooney

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450-4000

Fax: (212) 701-5800

Manuel Garciadiaz

Byron B. Rooney

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450-4000

Fax: (212) 701-5800

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding shares as of December 31, 2023 was 436,776,080 Class A common shares and 112,717,094 Class B common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

No ☐ (not required)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Accelerated Filer ☐

Non-accelerated Filer ☐

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this annual report:

U.S. GAAP ☐

the International Accounting Standards Board ☒

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐

Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

No ☒

| TABLE OF CONTENTS |  | ||||||||||

| Page | ||||||||

ITEM 1. | ||||||||

A. | ||||||||

ITEM 2. | ||||||||

ITEM 3. | ||||||||

ITEM 4. | ||||||||

C. | ||||||||

ITEM 4A. | ||||||||

ITEM 5. | ||||||||

| Critical Accounting Estimates | ||||||||

ITEM 6. | ||||||||

F. | Disclosure of a registrant’s action to recover erroneously awarded compensation | |||||||

ITEM 7. | ||||||||

ITEM 8. | ||||||||

ITEM 9. | ||||||||

ITEM 10. | ||||||||

i | ||||||||

J. | Annual Report to Security Holders | |||||||

ITEM 11. | ||||||||

ITEM 12. | ||||||||

ITEM 13. | ||||||||

ITEM 14. | ||||||||

ITEM 15. | ||||||||

D. | ||||||||

ITEM 16. | ||||||||

ITEM 16A. | ||||||||

ITEM 16B. | ||||||||

ITEM 16C. | ||||||||

ITEM 16D. | ||||||||

ITEM 16E. | ||||||||

ITEM 16F. | ||||||||

ITEM 16G. | ||||||||

ITEM 16H. | ||||||||

ITEM 16I. | ||||||||

ITEM 16J. | Insider Trading Policies | |||||||

ITEM 16K. | Cybersecurity | |||||||

ITEM 17. | ||||||||

ITEM 18. | ||||||||

ITEM 19. | ||||||||

ii | ||||||||

PRESENTATION OF FINANCIAL AND OTHER INFORMATION |  | ||||||||||

All references to “U.S. dollars,” “dollars” or “$” are to the U.S. dollar. All references to “real,” “reais,” “Brazilian real,” “Brazilian reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to IFRS accounting standards are to International Financial Reporting Standards, as issued by the International Accounting Standards Board, or the “IASB”, currently described as “IFRS Accounting Standards” by the IFRS Foundation.

Financial Statements

XP was incorporated on August 29, 2019, as a Cayman Islands exempted company with limited liability duly registered with the Cayman Islands Registrar of Companies. Until the contribution of the shares of XP Investimentos S.A., or XP Brazil shares, to it prior to the consummation of our initial public offering of Class A common shares completed on December 13, 2019, or the “Initial Public Offering” and the “Share Contribution,” XP had not commenced operations and had only nominal assets and liabilities and no material contingent liabilities or commitments.

We maintain our books and records in Brazilian reais, the presentation currency for our financial statements and the functional currency of our operations in Brazil. Our annual consolidated financial statements were prepared in accordance with IFRS, as issued by the IASB, currently described as “IFRS Accounting Standards” by the IFRS Foundation. Unless otherwise noted, our consolidated statement of financial position information presented herein as of December 31, 2023 and 2022 and the consolidated statements of income for the years ended December 31, 2023, 2022 and 2021 is stated in Brazilian reais, our reporting currency. Our consolidated financial information contained in this annual report is derived from our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto. All references herein to “our financial statements,” “our audited consolidated financial information” and “our audited consolidated financial statements” are to our consolidated financial statements included elsewhere in this annual report.

This financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our audited consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

Our fiscal year ends on December 31. References in this annual report to a fiscal year, such as “fiscal year 2023,” relate to our fiscal year ended on December 31 of that calendar year.

Corporate Structure

The following chart shows our corporate structure as of December 31, 2023:

1 | FORM 20-F | |||||||

As of the date of this annual report, we had a total of 549,493,174 common shares issued and outstanding; 112,717,094 of these shares are Class B common shares, which are beneficially owned by XP Control and ITB Holding Brasil Participações; and 436,776,080 of these shares are Class A common shares, which are beneficially owned by GA Bermuda and public holders. For further information on our major shareholders, please refer to “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders.”

Please read the information in the section entitled “Item 4. Information on the Company—C. Organizational Structure” for a more thorough description of the operations of our material operating subsidiaries.

Financial Information in U.S. Dollars

Solely for the convenience of the reader, we have translated some of the real amounts included in this annual report from reais into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$4.8413 to US$1.00, the commercial selling rate for U.S. dollars as of December 31, 2023 as reported by the Central Bank. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Exchange Rates” for more detailed information regarding translation of reais into U.S. dollars and for historical exchange rates for the Brazilian real.

Special Note Regarding Non-GAAP Financial Measures

This annual report presents our Float Balance, Adjusted Gross Financial Assets and Adjusted Net Asset Value information and their respective reconciliations for the convenience of the investors.

2 | FORM 20-F | |||||||

We present Float Balance because we believe this measure helps to understand the effect on our balance sheet of uninvested cash balances from retail clients’ investment accounts at XP companies. We calculate Float Balance as the sum of securities trading and intermediation (liabilities), minus securities trading and intermediation (assets). It is a metric that our management tracks internally and that investors and analysts typically want to calculate. Unlike the portions of Client Assets invested in equities, fixed income, mutual funds and almost all our other asset classes, Float Balance is accounted for on our balance sheet, resulting in a net increase in our liabilities, and is a source of funds that we allocate to securities and financial instruments, which generates interest revenues for us. Given the size of current Client Assets and the pace of our growth, Float Balance, despite being historically only in the range of 1% to 3% of total Client Assets, is material and therefore helps explain the variation of the assets and liabilities in our balance sheet.

We present Adjusted Net Asset Value because we believe this metric captures the value of financial assets that are, in fact, available to us, net of the portion of liquidity that is related to our Float Balance (and therefore attributable to clients) and debt. We calculate Adjusted Net Asset Value as the adjusted gross financial assets net of debt instruments, which consists of the sum of borrowings, debentures, structured financing and bonds. It is a measure that we track internally daily, and it more intuitively reflects the effect of the operational profits we generate and the variations between working capital assets and liabilities (cash flows from operating activities), investments in fixed and intangible assets and investments in the IFA Network (cash flows from investing activities) and inflows and outflows related to equity and debt securities in our capital structure (cash flows from financing activities). Our management treats all securities and financial instrument assets, net of financial instrument liabilities, as balances that compose our total liquidity, with sub-items (such as, for example, “securities at fair value through profit and loss” and “securities at fair value through other comprehensive income”) that are expected to fluctuate substantially from quarter to quarter as our treasury manages and allocates our total liquidity to the most suitable financial instruments.

We present Adjusted Gross Financial Assets because we believe this metric captures the value of financial assets that are, in fact, available to us, net of the portion of liquidity that is related to our Float Balance (and therefore attributable to clients) and gross of debt. We calculate Adjusted Gross Financial Assets as the sum of (1) cash and financial Assets (comprised of cash plus securities – fair value through profit or loss, plus securities – fair value through other comprehensive income, plus securities – evaluated at amortized cost, plus derivative financial instruments, plus securities (purchased under agreements to resell), plus loans, foreign exchange portfolio and deposits in the Central Bank (assets) less (2) financial liabilities (comprised of the sum of securities loaned, derivative financial instruments, securities sold under repurchase agreements and retirement plans liabilities), deposits, structured operation certificates (COE), financial bills, foreign exchange portfolio (liabilities), credit cards operations, commitments subject to possible redemption and (3) less Float Balance.

The non-GAAP financial measures described in this annual report are not a substitute for the IFRS Accounting Standards measures of earnings.

Market Share and Other Information

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the United States Securities and Exchange Commission website) and industry publications. We obtained the information included in this annual report relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research, public information and publications on the industry prepared by official public sources, such as the Central Bank, the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or the “IBGE,” the Institute of Applied Economic Research (Instituto de Pesquisa Econômica Aplicada), or the “IPEA”, the National Confederation of Insurance Companies (“Confederação Nacional das Seguradoras”), or the “CNseg,” the National Supplementary Health Agency (“Agência Nacional de Saúde Suplementar”), or the “ANS,” the National Private Pension Fund Federation (“Federação Nacional de Previdência Privada e Vida”), or the “Fenaprevi,” the Brazilian Association of Closed Pension Fund Institutions (“Associação Brasileira das Entidades Fechadas de Previdência Complementar”), or the “Abrapp,” as well as private sources, such as B3, ANBIMA, Nielsen, consulting and research companies in the Brazilian financial services industry, the Brazilian Economic Institute of Fundação Getulio Vargas (Instituto Brasileiro de Economia da Fundação Getulio Vargas), or the “FGV/IBRE,” among others.

3 | FORM 20-F | |||||||

Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable, neither we nor our affiliates or agents have independently verified it. Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. In addition, the data that we compile internally and our estimates have not been verified by an independent source. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Calculation of Net Promoter Score

Net Promoter Score, or “NPS,” is a widely known survey methodology that measures the willingness of customers to recommend a company’s products and services. It is used to gauge customers’ overall satisfaction with a company’s products and services and their loyalty to the brand, and it is typically based on customer surveys. NPS measures satisfaction using a scale of zero to 10 based on a customer’s response to the following question: “How likely is it that you would recommend XP to a friend or colleague?” Responses of nine or ten are considered “Promoters.” Responses of seven or eight are considered neutral. Responses of six or less are considered “Detractors.” The NPS, a percentage expressed as a numerical value, is calculated by subtracting the percentage of respondents who are Detractors from the percentage who are Promoters and dividing that number by the total number of respondents, which means that the higher the number, the higher the measure of customer satisfaction. The NPS calculation gives no weight to customers who decline to answer the survey question. The NPS calculation as of a given date reflects the average of the answers in the previous six months, e.g., the NPS as of December 2023 reflects the average of answers from July 2023 to December 2023. Our NPS score as calculated by us as of December 2021, 2022 and 2023 was 76, 73 and 72, respectively.

Rounding

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

4 | FORM 20-F | |||||||

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |  | ||||||||||

This annual report on Form 20-F contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this annual report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others.

Forward-looking statements appear in a number of places in this annual report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under the section entitled “Item 3. Key Information—D. Risk Factors” in this annual report. These risks and uncertainties include factors relating to:

•general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business;

•fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future;

•the economic, financial, political and health effects of pandemics (such as the coronavirus pandemic, or COVID-19), epidemics and similar crises, and governmental responses thereto, particularly as such factors impact Brazil and consumer behavior and continue to cause severe, ongoing, negative macroeconomic effects, which could intensify the impacts of other risks described under “Item 3. Certain Information—D. Risk Factors;”

•general economic, financial, political, demographic and business conditions in Europe, especially during the conflict between Russia and Ukraine, and elsewhere where military action occurs, such as the conflict between Israel and Hamas, tension along the Israeli borders or with other countries in the region, including Iran, which may result in, among other things, global security issues that may adversely affect international business and economic conditions, and economic sanctions which may impact the global economy;

•competition in the financial services industry;

•our ability to implement our business strategy;

•our ability to adapt to the rapid pace of technological changes in the financial services industry;

•the reliability, performance, functionality and quality of our products and services, the investment performance of investment funds managed by third parties or by our asset managers and the quality, reliability and performance of our suitability, risk management and business continuity policies and processes;

•the availability of government authorizations on terms and conditions and within periods acceptable to us;

•our ability to continue attracting and retaining new appropriately skilled employees;

•our capitalization and level of indebtedness;

•the interests of our controlling shareholders;

•changes in government regulations applicable to the financial services industry in Brazil and elsewhere;

•our ability to compete and conduct our business in the future;

•the success of our operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors;

•changes in consumer demands regarding financial products, customer experiences related to investments and technological advances, and our ability to innovate to respond to such changes;

•changes in labor, distribution and other operating costs;

•our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us;

•other factors that may affect our financial condition, liquidity and results of operations; and

•other risk factors discussed under “Item 3. Key Information—D. Risk Factors.”

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

5 | FORM 20-F | |||||||

PART I |  | ||||||||||

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

A. Offer Statistics

Not applicable.

B. Method and Expected Timetable

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved.]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

Our business, results of operations, financial condition or prospects could be adversely affected if any of these risks occurs, and as a result, the trading price of our common shares could decline. The risks described below are those known to us and those that we currently believe may materially affect us.

Certain Risks Relating to Our Business and Industry

•If we cannot make the necessary investments to keep pace with rapid developments and change in our industry, the use of our services could decline, reducing our revenues. The financial services market in which we compete is subject to rapid and significant changes, and in order to remain competitive and maintain and enhance customer experience and the quality of our services, we must continuously invest in projects to develop new products and features. These projects carry risks, such as cost overruns, delays in delivery, performance problems and lack of client adoption. Our future success will depend in part on our ability to develop or adapt to technological changes and evolving industry standards. Furthermore, our competitors may have the ability to devote more financial and operational resources than we can to the development of new technologies and services that provide improved functionality and features to their existing service offerings.

6 | FORM 20-F | |||||||

•Substantial and increasingly intense competition within our industry may harm our business. The financial services market is highly competitive. Our growth will depend on a combination of the continued growth of financial services and our ability to increase our market share. Our primary competitors include traditional financial services providers. We may need to reduce the fees we charge in order to maintain market share, as clients may demand more customized and favorable pricing from us.

•Client attrition could cause our revenues to decline, and the degradation of the quality of the products and services we offer, including support services, could adversely impact our ability to attract and retain clients and partners. We experience client attrition resulting from several factors, including, among others, client business closures, transfers of accounts to our competitors and lack of client satisfaction with our platform and overall user experience, including the reliability, performance, functionality and quality of our products and services. Moreover, our clients expect a consistent level of quality on our platform and in the provision of our products and services.

•Our investment services to our retail clients subject us to additional risks. We provide investment services to our retail clients, including through IFAs. The risks associated with these investment services include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence on the issuer or the provider of the security, inadequate disclosure and fraud.

•We do not have long-term contractual arrangements with most of our institutional brokerage clients, and our trading volumes and revenues could be reduced if these clients stop using our platform and solutions. Our business largely depends on certain of our institutional brokerage clients using our solutions and trading on our platforms. A limited number of such clients can account for a significant portion of our trading volumes, which in turn results in a significant portion of our transaction fees. Most of our institutional brokerage clients do not have long-term contractual arrangements with us and utilize our platform and solutions on a transaction-by-transaction basis and may choose not to use our platform at any time. These institutional brokerage clients buy and sell a variety of products within various asset classes using traditional methods, including by telephone, email and instant messaging, and through other trading platforms.

•We could fail to maintain effective internal controls over financial reporting, and thus be unable to accurately report our results of operations, meet our reporting obligations and/or prevent fraud. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as accounting standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. If we fail to maintain an effective internal control environment, we could suffer material misstatements in our financial statements, fail to meet our reporting obligations or fail to prevent fraud, which would likely cause investors to lose confidence in our reported financial information.

Certain Risks Relating to Brazil

•The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. This involvement as well as Brazil’s political and economic conditions could harm us and the price of our Class A common shares. The Brazilian federal government frequently exercises significant influence over the Brazilian economy and occasionally makes significant changes in policy and regulations. We have no control over and cannot predict what measures or policies the Brazilian government may take in the future. In recent years, economic and political instability has led to a negative perception of the Brazilian economy and higher volatility in the Brazilian securities markets, which also may adversely affect us and our Class A common shares.

•Inflation and certain measures by the Brazilian government to curb inflation have historically harmed the Brazilian economy and Brazilian capital markets, and high levels of inflation in the future would harm our business and the price of our Class A common shares. In the past, Brazil has experienced extremely high rates of inflation. Inflation and some of the measures taken by the Brazilian government in an attempt to curb inflation have had significant negative effects on the Brazilian economy generally. Inflation, policies adopted to curb inflationary pressures and uncertainties regarding possible future governmental intervention have contributed to economic uncertainty and heightened volatility in the Brazilian capital markets.

•Economic uncertainty and political instability in Brazil may harm us and the price of our Class A common shares. Brazil’s political environment has historically influenced, and continues to influence, the performance of the country’s economy. Political crises have affected and continue to affect the confidence of investors and the general public, which have historically resulted in economic deceleration and heightened volatility in the securities offered by companies with significant operations in Brazil. The recent economic instability in Brazil has contributed to a decline in market confidence in the Brazilian economy as well as to a deteriorating political environment.

7 | FORM 20-F | |||||||

•Exchange rate instability may have adverse effects on the Brazilian economy, us and the price of our Class A common shares. The Brazilian currency has been historically volatile and has been devalued frequently over the past three decades. Although long-term depreciation of the real is generally linked to the rate of inflation in Brazil, depreciation of the real occurring over shorter periods of time has resulted in significant variations in the exchange rate between the real, the U.S. dollar and other currencies. Restrictive macroeconomic policies could reduce the stability of the Brazilian economy and harm our results of operations and profitability.

•Infrastructure and workforce deficiency in Brazil may impact economic growth and have a material adverse effect on us. Our performance depends on the overall health and growth of the Brazilian economy. Brazilian GDP growth has fluctuated over the past few years, with a contraction of 4.1% in 2020, and a growth of 4.6% in 2021, 2.9% in 2022, and 2.9% in 2023. Growth is limited by inadequate infrastructure, including potential energy shortages and deficient transportation, logistics and telecommunication sectors, general strikes, the lack of a qualified labor force, and the lack of private and public investments in these areas, which limit productivity and efficiency. Additionally, despite the business continuity and crisis management policies currently in place, travel restrictions or potential impacts on personnel due to pandemics may disrupt our business, our IFAs and the expansion of our client base.

Certain Risks Relating to Our Class A Common Shares

•An active trading market for our common shares may not be sustainable. If an active trading market is not maintained, investors may not be able to resell their shares at or above offering price and our ability to raise capital in the future may be impaired. A non active trading market may also impair our ability to raise capital to acquire other companies or technologies by using our shares as consideration.

•The dual class structure of our common shares has the effect of concentrating voting control with XP Control, our controlling shareholder; this will limit or preclude your ability to influence corporate matters. Due to the ten-to-one voting ratio between our Class B and Class A common shares, our controlling shareholder, XP Control, controls a majority of the combined voting power of our common shares and therefore is able to elect a majority of the members of our board of directors, so long as the total number of the issued and outstanding Class B common shares is at least 10% of the voting share rights of the Company. XP Control owns 91.7% of our outstanding Class B common shares, which represents approximately 66.6% of the voting power of our issued share capital. This concentration of ownership and voting power limits your ability to influence corporate matters.

•We are a Cayman Islands exempted company with limited liability. The rights of our shareholders, including with respect to fiduciary duties and corporate opportunities, may be different from the rights of shareholders governed by the laws of U.S. jurisdictions. In particular, as a matter of Cayman Islands law, directors of a Cayman Islands company owe fiduciary duties to the company and separately a duty of care, diligence and skill to the company.

Certain Risks Relating to Our Business and Industry

If we cannot make the necessary investments to keep pace with rapid developments and change in our industry, the use of our services could decline, reducing our revenues.

The financial services market in which we compete is subject to rapid and significant changes. This market is characterized by rapid technological change, new product and service introductions, evolving industry standards, changing client needs and the entrance of nontraditional competitors. In order to remain competitive and maintain and enhance customer experience and the quality of our services, we must continuously invest in projects to develop new products and features. These projects carry risks, such as cost overruns, delays in delivery, performance problems and lack of client adoption. There can be no assurance that we will have the funds available to maintain the levels of investment required to support our projects, and any delay in the delivery of new services or the failure to differentiate our services or to accurately predict and address market demand could render our services less desirable, or even obsolete, to our clients.

8 | FORM 20-F | |||||||

In addition, the services we deliver are designed to process highly complex transactions and provide reports and other information concerning those transactions, all at high volumes and processing speeds. Any failure to deliver an effective and secure service, or any performance issue that arises with a new service, could result in significant processing or reporting errors or other losses. As a result of these factors, our development efforts could result in increased costs and/or we could also experience a loss in business that could reduce our earnings or could cause a loss of revenue if promised new services are not timely delivered to our clients or do not perform as anticipated. We also rely in part, and may in the future rely in part, on third parties for the development of, and access to, new technologies. Our future success will depend in part on our ability to develop or adapt to technological changes and evolving industry standards. We cannot predict the effects of technological changes on our business. If we are unable to develop, adapt to or access technological changes or evolving industry standards on a timely and cost-effective basis, our business, financial condition and results of operations could be materially adversely affected.

Furthermore, our competitors may have the ability to devote more financial and operational resources than we can to the development of new technologies and services that provide improved functionality and features to their existing service offerings. If successful, their development efforts could render our services less desirable to clients, resulting in the loss of clients or a reduction in the fees we could generate from our service offerings.

Substantial and increasingly intense competition within our industry may harm our business.

The financial services market is highly competitive. Our growth will depend on a combination of the continued growth of financial services and our ability to increase our market share. Our primary competitors include traditional financial services providers such as affiliates of financial institutions and well-established financial services companies in Brazil. We also face competition from non-traditional financial services providers that have significant financial resources and develop different kinds of services.

Many of our competitors have substantially greater financial, technological, operational and marketing resources than we do. Accordingly, these competitors may be able to offer more attractive fees to our current and prospective clients, especially our competitors that are affiliated with financial institutions. In recent years, we announced the elimination of brokerage fees for online stock trades at Rico Corretora de Títulos e Valores Mobiliários S.A., or “Rico,” and a 75% reduction in brokerage fees for online stock trades through XP Direct, which did not have a material impact on our revenues and margins. If the expected offset does not materialize, we will need to offset the impact by reducing and eliminating costs in order to maintain our profit margins. Moreover, we may not be successful in reducing or controlling costs and our margins may be adversely affected. In particular, we may need to further reduce the fees we charge in order to maintain market share, as clients may demand more customized and favorable pricing from us. In addition, we may incur increased costs from incentive payments made to independent financial advisors, or “IFAs” in order to gain or maintain market share. We may also decide to terminate client relationships which may no longer be profitable to us due to such pricing pressure. Competition could also result in a loss of existing clients, and greater difficulty in attracting new clients. One or more of these factors could have a material adverse effect on our business, financial condition and results of operations. For further information regarding our competition, see “Item 4. Information about the Company—B. Business Overview—Competition.”

Client attrition could cause our revenues to decline, and the degradation of the quality of the products and services we offer, including support services, could adversely impact our ability to attract and retain clients and partners.

We experience client attrition resulting from several factors, including, among others, client business closures, transfers of accounts to our competitors and lack of client satisfaction with our platform and overall user experience, including the reliability, performance, functionality and quality of our products and services. We cannot predict the level of attrition in the future, and our revenues could decline as a result of higher than expected attrition, which could have a material adverse effect on our business, financial condition and results of operations. In addition, our growth to date has been partially driven by the growth of our clients’ businesses. Should the rate of growth of our clients’ business slow or decline, this could have an adverse effect on our results of operations. Furthermore, should we not be successful in selling additional solutions to our active client base, we may fail to achieve our desired rate of growth.

9 | FORM 20-F | |||||||

Moreover, our clients expect a consistent level of quality on our platform and in the provision of our products and services. The support services that we provide are also a key element of the value proposition to our clients. In addition, increased market volatility may result in unexpected losses in equities, derivatives and other products, which may lead to questions regarding the accuracy of our suitability procedures and our advisory services. If the reliability, performance or functionality of our products and services is compromised or the quality of those products or services is otherwise degraded, or if we fail to continue to provide a high level of support, this could adversely affect our reputation and the confidence in and use of our products and services, and we could lose existing clients and find it harder to attract new clients and partners. If we are unable to scale our support functions and our suitability procedures to address the growth of our client and partner network, the quality of our products and services may decrease, which could adversely affect our ability to attract and retain clients and partners.

For more information on consumer complaints and proceedings, see “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal Proceedings—Consumer Matters.”

Our investment services to our retail clients subject us to additional risks.

We provide investment services to our retail clients, including through IFAs. The risks associated with these investment services include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence on the issuer or the provider of the security, inadequate disclosure and fraud and risk associated to investments in general, including those related to the issuer of the securities. Realization of these risks could lead to liabilities for client losses, regulatory fines, civil penalties and harm to our reputation and business. The realization of these risks may be heightened during periods of increased market volatility, which may result in unexpected losses in the products provided to our retail clients.

We do not have long-term contractual arrangements with most of our institutional brokerage clients, and our trading volumes and revenues could be reduced if these clients stop using our platform and solutions.

Our business largely depends on certain of our institutional brokerage clients using our solutions and trading on our platforms. A limited number of such clients can account for a significant portion of our trading volumes, which in turn results in a significant portion of our transaction fees. Most of our institutional brokerage clients do not have long-term contractual arrangements with us and utilize our platform and solutions on a transaction-by-transaction basis and may choose not to use our platform at any time. These institutional brokerage clients buy and sell a variety of products within various asset classes using traditional methods, including by telephone, email and instant messaging, and through other trading platforms. Any significant loss of these institutional brokerage clients or a significant reduction in their use of our platform and solutions could have a substantial negative impact on our trading volumes and revenues, and materially adversely affect our business, financial condition and results of operations.

Our institutional brokerage business depends on our key dealer clients providing us with liquidity and supporting our marketplaces by transacting with our other institutional and wholesale clients.

Our institutional brokerage business relies on its key dealer clients to provide liquidity on our trading platforms by posting prices on our platform and responding to client inquiries, and this business has historically earned a substantial portion of its revenues from such dealer clients. Increased market volatility and market declines can cause our key dealer clients to experience reduced liquidity or to decrease their use of our platform. Market knowledge and feedback from these dealer clients have been important factors in the development of many of our offerings and solutions. In addition, these dealer clients also provide us with data via feeds and through the transactions they execute on our trading platforms, which is an important input for our market data offerings.

Our dealer clients also buy and sell through traditional methods, including by telephone, email and instant messaging, and through other trading platforms. Some of our dealer clients have developed electronic trading networks that compete with us or have announced their intention to explore the development of such electronic trading networks, and many of our dealer clients are involved in other ventures, including other trading platforms or other distribution channels, whether as trading participants and/or as investors. In particular, some of our dealer clients or their affiliates, as is typical for a large number of major banks, have their own single bank or other competing trading platform and frequently invest in such businesses and may acquire ownership interests in similar businesses, and such businesses may also compete with us. These competing trading platforms may offer some features that we do not currently offer or that we are unable to offer, including customized features or functions and solutions that are fully integrated with some of their other offerings. Accordingly, there can be no assurance that such dealer clients’ primary commitments will not be to one of our competitors or that they will not continue to rely on their own trading platforms or traditional methods instead of using our trading platforms.

10 | FORM 20-F | |||||||

Although we have established and maintain significant long-term relationships with our key dealer clients, we cannot assure you that all of these relationships will continue or will not diminish. Any reduction in the use of our trading platforms by our key dealer clients for any reason, including increased market volatility, and any associated decrease in the pool of capital and liquidity accessible across our marketplaces, could reduce the volume of trading on our platform, which could, in turn, reduce the use of our platform by their counterparty clients. In addition, any decrease in the number of dealer clients competing for trades on our trading platforms could cause our dealer clients to forego the use of our platform and instead use platforms that provide access to more competitive trading environments and prices. The occurrence of any of the foregoing may have a material adverse effect on our business, financial condition and results of operations.

A significant part of our business depends on the B3.

The B3 is the only public stock exchange in Brazil, and a significant volume of our trading activities is conducted through the B3, for which we pay the B3 clearing, custody and other financial services fees. We cannot assure you that the B3 will not impose restrictions on trading, request additional guarantees or margin requirements, increase existing fees or introduce new fees, among other measures. The occurrence of any of the foregoing may have a material adverse effect on our business, financial condition and results of operations.

XP CCTVM depends in part on the performance of its IFAs. If XP CCTVM is unable to hire, retain and qualify such IFAs, our business may be harmed.

XP CCTVM, one of our principal operating subsidiaries and a securities broker, has a broad network of IFAs, and our business depends in part on such IFAs. Pursuant to CVM Resolution No. 178, which replaced CVM Resolution No. 16 on June 1, 2023, IFAs may carry out the following activities on behalf of a broker-dealer: (1) prospecting and acquiring customers; (2) receiving and registering orders and transmitting such orders to the appropriate trading or registration systems; and (3) providing information and recommendation on the products offered and the services provided by XP CCTVM. XP CCTVM’s reliance on IFAs creates numerous risks.

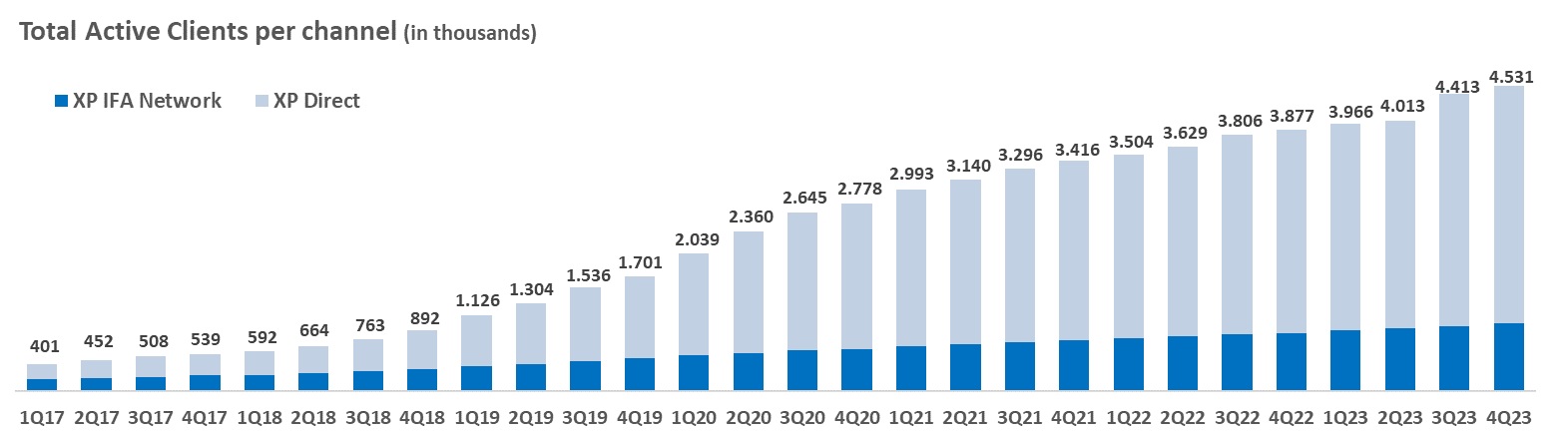

As of December 31, 2023, XP CCTVM had approximately 14,300 individual IFAs organized into approximately 2,529 IFA entities, which were responsible for serving approximately 23% of XP CCTVM’s active clients. In addition, XP CCTVM’s 20 largest IFA entities comprised 4,253 individual IFAs and were responsible for serving approximately 13% of XP CCTVM’s active clients.

In accordance with CVM Resolution No. 178 of February 14, 2023, which replaced CVM Resolution No. 16 of June 1, 2023, XP CCTVM is liable for the acts of its IFAs when acting on XP CCTVM’s behalf. As a result, XP CCTVM may be subject to claims, lawsuits, arbitration proceedings, government investigations and other legal and regulatory proceedings seeking to hold XP CCTVM liable for the actions of IFAs. We cannot give any assurances as to the outcome of any such claims, lawsuits, arbitration proceedings, government investigations or other legal or regulatory proceedings. Any claims against XP CCTVM, whether with or without merit, could be time-consuming, result in costly litigation, be harmful to its reputation and to the “XP” brand, require significant management attention and divert significant resources, and the resolution of one or more such proceedings may result in substantial damages, settlement costs, sanctions, consent decrees, injunctions, fines and penalties that could adversely affect XP CCTVM’s business, financial condition and results of operations. In addition, no assurances can be given that these IFAs’ interests will continue to be aligned with the interests of XP CCTVM, that there will be no commercial disagreements between the IFAs and XP CCTVM, that such IFAs will not compete with XP CCTVM or that they will not engage in improper conduct (i.e., churning) in their role as IFAs. In Brazil, there is competition between financial institutions seeking to attract IFAs to increase their client base, assets under custody and business possibilities. No assurances can be given that XP CCTVM will be able to remain an attractive player to such IFAs or to retain such agents in its business platform. Furthermore, many clients have their commercial relationship directly with the IFA of their choice and trust and not with the employees of XP CCTVM, despite the relation with XP to intermediate all the transactions. Accordingly, the loss of IFAs may result in loss of clients and assets under custody, which would affect XP CCTVM’s business.

Furthermore, the independent contractor status of the IFAs may be challenged in the courts of Brazil. For example, XP CCTVM has in the past been involved in, and successfully challenged, a number of legal proceedings claiming that IFAs should be treated as its employees rather than as independent contractors, and there can be no assurance that we will be successful in challenging any future claims. Changes to foreign, federal, state, and local laws governing the definition or classification of independent contractors, or judicial decisions regarding independent contractor classification, could require classification of IFAs as employees. If, as a result of legislation or judicial decisions, XP CCTVM is required to classify IFAs as employees, XP CCTVM would incur significant additional expenses for compensating IFAs, potentially retroactively to the past five years and including expenses associated with the application of wage and hour laws (including minimum wage, overtime, meal and rest period requirements), vacation, 13th-month salary, Fundo de Garantia do Tempo de Serviço, or “FGTS,” severance, employee benefits, social security contributions, taxes, and penalties (including collective moral damages in case of a collective lawsuit).

11 | FORM 20-F | |||||||

Moreover, on February 14, 2023, the CVM issued CVM Resolution No. 178, which replaced CVM Resolution No. 16 on June 1, 2023. According to such new resolution, the exclusivity provision set forth in CVM Resolution No. 16 is no longer mandatory, but is still permitted through contract between XP and the IFA. The new CVM Resolution no. 178 also allows IFA entities to become corporations and to admit unlicensed partners (i.e., non-IFA partners) as shareholders or quotaholders of an IFA entity.

Poor investment performance could lead to a loss of assets under management and a decline in revenues.

Distributing investment fund quotas managed by third parties or by our asset managers represents a relevant part of our business, which income is a percentage of the management and/or performance fee related to such funds. Moreover, a portion of our consolidated income is derived from management and performance fees collected by our three principal asset managers, XP Gestão, XP Advisory and XP Vista. Poor investment performance by the investment funds managed by third parties or by our asset managers for a number of reasons including as a result of overall market declines, could hinder our growth and reduce our revenues because (1) existing clients might withdraw funds in favor of better performing products or fixed income products, such as government debt, which would result in lower investment advisory and other fees; (2) our ability to attract capital from existing and new clients might diminish; and (3) the negative investment performance will directly reduce our managed assets and revenues base, which may have a material adverse effect on our business, financial condition, results of operations and the price of our Class A common shares.

Unauthorized disclosure, destruction or modification of data, through cybersecurity breaches, computer viruses or otherwise, or disruption of our services could expose us to liability and protracted and costly litigation and damage our reputation.

Our business involves the collection, storage, processing and transmission of customers’ personal data, including names, addresses, identification numbers, bank account numbers and trading and investment portfolio data. An increasing number of organizations, including large clients and businesses, other large technology companies, financial institutions and government institutions, have disclosed breaches of their information technology systems, some of which have involved sophisticated and highly targeted attacks, including on portions of their websites, networks or infrastructure, or those of third parties who provide services to them. We could also be subject to breaches of security by hackers. Threats may derive from human error, fraud or malice on the part of employees, third-party service providers or IFAs, or may result from accidental technological failure. Concerns about security are increased when we transmit information. Electronic transmissions can be subject to attack, interception or loss. Also, computer viruses and malware can be distributed and spread rapidly over the internet and could infiltrate our systems or those of our associated participants, which can impact the confidentiality, integrity and availability of information, and the integrity and availability of our products, services and systems, among other effects. Denial of service or other attacks could be launched against us for a variety of purposes, including interfering with our services or creating a diversion for other malicious activities. These types of actions and attacks could disrupt our delivery of products and services or make them unavailable, which could damage our reputation, force us to incur significant expenses in remediating the resulting impacts, expose us to uninsured liability, subject us to lawsuits, fines or sanctions, distract our management or increase our costs of doing business.

In 2013 and 2014, XP CCTVM suffered security breaches, through which an individual improperly accessed a small portion of our customer records and obtained certain non-material customer registration information, such as name, address and email, and subsequently publicly disclosed such information in January 2017. The security breaches were identified and immediately remedied, did not result in the imposition of penalties or fines from the relevant regulatory authorities, and did not materially impact us. We assisted all affected customers and mitigated their damages. Since 2019, we have further developed our policies and procedures regarding cybersecurity risk management and prevention of material cybersecurity incidents through what we believe are more comprehensive controls and standards that we use to monitor cybersecurity risk on an ongoing basis. We have also increased our cybersecurity team and ongoing training as well as increased board supervision of such risk as a result of our adoption of policies to comply with Brazilian Law No. 12,965/2014, known as a milestone in the development of internet in Brazil and other rules on aspects of data privacy and cyber security.

In the scope of our activities, we share information with third parties, including thousands of IFAs, commercial partners, third-party service providers and other agents, who collect, process, store and transmit sensitive data, and we may be held responsible for any failure or cybersecurity breaches attributed to these third parties insofar as they relate to the information we share with them. The loss, destruction or unauthorized modification of data by us or such third parties or through systems we provide could result in significant fines, sanctions and proceedings or actions against us by governmental bodies or third parties, which could have a material adverse effect on our business, financial condition and results of operations. Any such proceeding or action, and any related indemnification obligation, could damage our reputation, force us to incur significant expenses in defense of these proceedings, distract our management, increase our costs of doing business or result in the imposition of financial liability or sanctions that prevent us from processing data.

12 | FORM 20-F | |||||||

Our encryption of data and other protective measures may not prevent unauthorized access or use of sensitive data. A breach of our system or that of one of our associated participants may subject us to material losses or liability, including fines. A misuse of such data or a cybersecurity breach could harm our reputation and deter clients from using our products and services, thus reducing our revenues. In addition, any such misuse or breach could cause us to incur costs to correct the breaches or failures, expose us to uninsured liability, increase our risk of regulatory scrutiny, subject us to lawsuits, and result in the imposition of material penalties and fines under state and federal laws or regulations.

We cannot assure you that there are written agreements in place with every third party or that such written agreements will prevent the unauthorized use, modification, destruction or disclosure of data or enable us to obtain reimbursement from such third parties in the event we should suffer incidents resulting in unauthorized use, modification, destruction or disclosure of data. Any unauthorized use, modification, destruction or disclosure of data could result in protracted and costly litigation, which could have a material adverse effect on our business, financial condition and results of operations.

Cybersecurity incidents are increasing in frequency and evolving in nature and include, but are not limited to, installation of malicious software, unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. Given the unpredictability of the timing, nature and scope of information technology disruptions, there can be no assurance that the procedures and controls we employ will be sufficient to prevent security breaches from occurring, and we could be subject to manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our business, financial condition and results of operations.

Moreover, while we maintain cyber insurance, which may help provide coverage for these types of incidents (including both cybersecurity incidents and civil damages arising therefrom), we cannot assure you that our insurance will be adequate to cover all costs and liabilities related to these incidents. In addition, such insurance may not be available to us in the future on economically reasonable terms, or at all. Further, our insurance may not cover all claims made against us and could have high deductibles in any event, and defending a suit, regardless of its merit, could be costly and divert management attention.

As administrative sanctions established by Law No. 13,709/2018 (Lei Geral de Proteção de Dados Pessoais), or the “LGPD” are now enforceable, cybersecurity incidents and data breach or leakage events may subject us to penalties. Any proceeding or action, and any related indemnification obligation, could damage our reputation, force us to incur significant expenses in defense of these proceedings, divert the attention of our management, increase our costs of doing business or result in the imposition of financial penalties.

In 2023, the SEC issued rule No. 33-11216. This rule requires enhanced and standardized disclosures concerning cybersecurity risk management, strategy, governance, and the appropriate handling of identified incidents to prevent their recurrence. The new standard requires senior management and board oversight of cybersecurity risks, including for risk assessment action plan implementation purposes. Once a material incident is identified, we are required to promptly disclose it on Form 6-K and in our annual report.

Further, a significant part of our employees work remotely from home or in a hybrid model. Based on thorough assessments of the well-being and performance of our workforce, our management announced on September 11, 2020 the company-wide adoption of the work from home and hybrid models. This may cause increases in the unavailability of our systems and infrastructure, interruption of telecommunication services, generalized system failures and heightened vulnerability to cyberattacks. Accordingly, our ability to conduct our business may be adversely impacted.

13 | FORM 20-F | |||||||

Our business depends on well-regarded and widely known brands, including “XP Investimentos,” “Clear,” “Rico,”

“XP Asset Management,” “Infomoney,” “XP Educação,” “XP Seguros”, “XP Investments”, “Banco Modal S.A.” and “Modal DTVM Ltda.”, and any failure to maintain, protect, and enhance our brands, including through effective marketing and communications strategies, would harm our business.

“XP Asset Management,” “Infomoney,” “XP Educação,” “XP Seguros”, “XP Investments”, “Banco Modal S.A.” and “Modal DTVM Ltda.”, and any failure to maintain, protect, and enhance our brands, including through effective marketing and communications strategies, would harm our business.

We have developed well-regarded and widely known brands, including “XP Investimentos,” “Clear,” “Rico,” “XP Asset Management,” “Infomoney,” “XP Educação,” “XP Seguros”, “XP Investments” and, after regulatory approval, Banco Modal and Modal DTVM that have contributed significantly (and recently in the case of Modal Group) to the success of our business. Maintaining, protecting, and enhancing our brands are critical to expanding our client base, and that of other third-party partners, as well as increasing engagement with our products and services. This will depend largely on our ability to remain widely known, maintain trust, be a technology leader, and continue to provide high-quality and secure products and services. Any negative publicity about our industry or our company, the quality, reliability and performance of our products and services, our suitability, risk management and business continuity policies and processes, changes to our products and services, our ability to effectively manage and resolve client complaints, our privacy and security practices, litigation, regulatory activity, and the experience of clients with our products or services could adversely affect our reputation and the confidence in and use of our products and services. Harm to our brands can arise from many sources, including failure by us or our partners to satisfy expectations of service and quality, inadequate protection of personal information, compliance failures and claims, litigation and other claims, third-party trademark infringement claims, administrative proceedings at the applicable national trademark offices, employee misconduct, and misconduct by our associated participants, partners, service providers, or other counterparties. If we do not successfully maintain well-regarded and widely known brands, our business could be materially and adversely affected.

We have been from time to time in the past, and may in the future be, the target of incomplete, inaccurate, and misleading or false statements about our company, our business, and our products and services that could damage our brands and materially deter people from adopting our services. For example, over the past several years, certain persons or entities have fraudulently used the “XP” brand and/or presented themselves as part of or affiliated with the “XP” brand as IFAs carrying out activities on our behalf. Negative publicity about our company or our management, including about our product quality, reliability and performance, changes to our products and services, privacy and security practices, litigation, regulatory enforcement, and other actions, as well as the actions of our clients and other users of our services, even if inaccurate, could cause a loss of confidence in us.

In addition, we believe that promoting our brands in a cost-effective manner is critical to achieving widespread acceptance of our products and services and to expanding our base of clients. Our brand promotion activities may not generate customer awareness or increase revenue, and even if they do, any increase in revenue may not offset the expenses we incur in building our brands. If we fail to successfully promote and maintain our brands or if we incur excessive expenses in this effort, our business could be materially and adversely affected.

The introduction and promotion of new services, as well as the promotion of existing services, may be partly dependent on our visibility on third-party advertising platforms such as Google, Facebook or Instagram. Changes in the way these platforms operate or changes in their advertising prices or other terms could make the maintenance and promotion of our products and services and our brands more expensive or more difficult. If we are unable to market and promote our brands on third-party platforms effectively, our ability to acquire new clients would be materially harmed.

An increase in volume on our systems or other errors or events could cause them to malfunction.

Most of our trade orders to buy or sell securities or invest in the broad range of asset classes we offer are received and processed electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether, such as in periods of increased market volatility. Any significant degradation or failure of our systems or the systems of third parties involved in the trading process (e.g., online and internet service providers, the systems of the B3, record keeping and data processing functions performed by third parties, and third-party software), even for a short time, could cause customers to suffer delays in trading. In addition, systems errors, including as a result of human error, could occur. These delays or errors could cause substantial losses for customers and could subject us to claims from these customers for losses or other regulatory penalties or other sanctions or increased settlement disbursements. There can be no assurance that our network structure will operate appropriately in the event of a subsystem, component or software failure or error. Furthermore, we cannot assure you that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, earthquake, terrorist attack, epidemics or pandemics such as COVID-19, fire or any act of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and results of operations.

14 | FORM 20-F | |||||||

We rely on a number of external service providers for certain key market information and data, technology, processing and supporting functions.

We rely on a number of external service providers for certain key market information and data, technology, processing and supporting functions, such as Microsoft, SAP and Oracle, among others. These include trading platform, portfolio management and asset allocation services, account opening and management systems, communication systems, registration systems, data control systems, information security systems, anti-fraud systems, trading surveillance systems, exchanges, clearinghouses, accounting and others which are of critical importance for us in order to provide our services to our clients in a satisfactory manner as well as to maintain our internal control systems, including accounting and risk management. These service providers may face technical, operational and security risks of their own, including risks similar to those that we face as described herein. Any significant failures by them, including improper use or disclosure of our confidential customer, employee or company information, could interrupt our business, cause us to incur losses and harm our reputation. Particularly, we have contracted with Bloomberg, Reuters and certain other institutions to allow our clients to access real-time market information data, which are essential for our clients to make their investment decisions and take certain actions (such as making trades). Also, for our accounting, risk management and internal control processes, we rely on several other software that are subject to malfunction, errors, bugs and/or security issues. Any failure of such information or software providers to update, deliver, prepare or process the data in a timely and/or correct manner as provided in the agreements could lead our clients or us to potential losses, which may in turn affect our business operations and reputation and may cause us to incur losses.

We cannot assure you that the external service providers will be able to continue to provide these services to meet our current needs in an efficient and cost-effective manner, or that they will be able to adequately expand their services to meet our needs in the future. Some external service providers may have assets and infrastructure that are important to the services they provide us that are located in or outside Brazil, and their ability to provide these services is subject to risks from unfavorable political, economic, legal or other developments, such as social or political instability, changes in governmental policies or changes in the applicable laws and regulations of the jurisdictions in which their assets and operations are located.

An interruption in or the cessation of service by any external service provider as a result of system failures, capacity constraints, financial constraints or problems, unanticipated trading market closures or for any other reason and our inability to make alternative arrangements in a smooth and timely manner, if at all, could have a material adverse effect on our business, financial condition and results of operations.

Further, disputes might arise in relation to the agreements that we enter into with our service providers or the performance of the service providers thereunder. To the extent that any service provider disagrees with us on the quality of the products or services, terms and conditions of the payment or other provisions of such agreements, we may face claims, disputes, litigation or other proceedings initiated by such service provider against us. We may incur substantial expenses and require significant attention of management in defending against these claims, regardless of their merit. We could also face damage to our reputation as a result of such claims, and our business, financial condition, results of operations and prospects could be materially and adversely affected.

We may not be able to ensure the accuracy of the third-party product information on our platform, and we have limited control over the performance of third-party financial products we offer.

We offer certain third-party financial products. The acceptance and popularity of our platform is partially premised on the reliability and performance of the relevant underlying products and information on our platform. We rely on the relevant third-party providers of the relevant products for the authenticity of their underlying products and the comprehensiveness, accuracy and timeliness of the related financial information. While the products and information from these third-party providers have been generally reliable, there can be no assurance that the reliability can be maintained in the future. If these third-party providers or their agents provide inauthentic financial products or incomplete, misleading, inaccurate or fraudulent information, we may lose the trust of existing and prospective investors. In addition, if our investors purchase the underlying products that they discover on our platform and they suffer losses, they may blame us and attempt to hold us responsible for their losses, even though we have made risk disclosures before they invest. Our reputation could be harmed and we could experience reduced user traffic to our platform, which would adversely affect our business and financial performance.

15 | FORM 20-F | |||||||

Furthermore, as investors access the underlying products through our platform, they may have the impression that we are at least partially responsible for the quality and performance of these products. Although we have established standards to screen product providers before distributing their products on our platform, we have limited control over the performance of the third-party financial products we offer. In the event that an investor is dissatisfied with underlying products or the services of a products provider, we do not have any means to directly make improvements in response to user complaints. If investors become dissatisfied with the underlying products available on our platform, our business, reputation, financial performance and prospects could be adversely affected.

We rely upon our systems and upon third-party data center service providers to host certain aspects of our platform and content, and any systems failure due to factors beyond our control or any disruption to, or interference with, our use of third-party data center services could interrupt our service, increase our costs and impair our ability to deliver our platform, resulting in customer dissatisfaction, damaging our reputation and harming our business.

We utilize data center hosting facilities from third-party service providers to make certain content available on our platform. Our primary data centers are located in the cities of Barueri and Santana do Parnaíba, in the state of São Paulo, Brazil (which are located approximately five miles apart). Our operations depend, in part, on our providers’ ability to protect their facilities against damage or interruption from natural disasters, power or telecommunications failures, criminal acts and similar events. The occurrence of spikes in user volume, traffic, natural disasters, acts of terrorism, vandalism or sabotage, or a decision to close a facility without adequate notice, or other unanticipated problems at our providers’ facilities, could result in lengthy interruptions in the availability of our platform, which would adversely affect our business.

In addition, we depend on the efficient and uninterrupted operation of numerous systems, including our computer systems, software, data centers and telecommunications networks, as well as the systems of third parties. Our systems and operations, or those of our third-party providers, could be exposed to damage or interruption from, among other things, fire, natural disaster, power loss, telecommunications failure, unauthorized entry and computer viruses. We do not maintain insurance policies specifically for property and business interruptions. Defects in our systems or those of third parties, errors or delays in the processing of transactions, telecommunications failures or other difficulties could result in:

•loss of revenues;

•loss of clients;

•loss of client data;