UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

FOR

THE QUARTERLY PERIOD ENDED

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE

NUMBER:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | ||

3F K’s Minamiaoyama 6-6-20 Minamiaoyama, Minato-ku, Tokyo 107-0062, Japan |

107-0062 | ||

| (Address of Principal Executive Offices) | (Zip Code) |

| 81-90-6002-4978 |

| (registrant’s telephone number, including area code) |

|

N/A |

| (former name or former mailing address, if changed since last report) |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check

mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

| Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes

[X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of March 17, 2022, there were 1,014,022,586 shares of Common Stock and 1,000,000 shares of Series A Preferred Stock issued and outstanding.

-1-

INDEX

-2-

PART I - FINANCIAL INFORMATION

WB Burgers Asia, Inc.

Condensed Consolidated Balance Sheet

(Unaudited)

January 31, 2022 |

July 31, 2021 | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | |

$ | | |

| Prepaid expenses | |||||

| Total Current Assets | |||||

| Equipment and construction in progress, net depreciation | |

- | |||

| Deposits | |||||

| Franchise rights | |||||

| TOTAL ASSETS | $ | $ | |||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |||||

| Current Liabilities | |||||

| Accounts payable | |||||

| Income tax payable | |||||

| Accrued expenses and other payables | |||||

| Total Current Liabilities | |||||

| Loan to Company – related party, net accumulated interest | |||||

| TOTAL LIABILITIES | |||||

| Stockholders’ Equity (Deficit) | |||||

| Preferred stock ($ par value, shares authorized; issued and outstanding as of January 31, 2022 and July 31, 2021) | |||||

| Common stock ($ par value, shares authorized, and shares issued and outstanding as of January 31, 2022 and July 31, 2021, respectively) | |||||

| Non-controlling interest | |||||

| Additional paid-in capital | |||||

| Accumulated earnings | ( | ||||

| Accumulated other comprehensive income | ( |

||||

| Total Stockholders’ Equity (Deficit) | |||||

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) |

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements.

F-1

WB Burgers Asia, Inc.

Condensed Consolidated Statement of Operations

(Unaudited)

|

Three Months Ended January 31, 2022 |

Three Months Ended January 31, 2021 |

Six Months Ended January 31, 2022 |

Six Months Ended January 31, 2021 | |||||

| Operating expenses | ||||||||

| General and administrative expenses | $ | $ | $ | $ | ||||

| Total operating expenses | ||||||||

| Net operating loss | $ | ( |

$ | ( |

$ | ( |

$ | ( |

| Other Income/(Loss) | ||||||||

| Gain on forgiveness of debt | ||||||||

| Interest credit (expense) | ||||||||

| Total other income | ||||||||

| Income (loss) before income taxes provision | $ | $ | ( |

$ | $ | ( | ||

| Provision for income taxes | ||||||||

| Net income (loss) | ( |

( | ||||||

| Other comprehensive income | ||||||||

| Currency translation adjustment | ||||||||

| Comprehensive Income (loss) | $ | $ | ( |

$ | $ | ( | ||

| Basic and Diluted net loss per common share | $ | $ | ( |

$ | $ | ( | ||

| Weighted average number of common shares outstanding - Basic and Diluted |

|

|

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements.

F-2

WB Burgers Asia, Inc.

Condensed Consolidated Statement of Changes in Stockholders’ Equity (Deficit)

For the Period July 31, 2021 to January 31, 2022

| Common Shares | Par Value Common Shares | Series A Preferred Shares | Par Value Series A Preferred Shares |

Non-Controlling Interest |

Additional Paid-in Capital |

|

Accumulated Other Comprehensive Income |

Accumulated Deficit | Total | ||||||||

| Balances, July 31, 2021 | $ |

|

$ |

|

$ |

|

$ |

$ |

|

$ | ( |

$ | |||||

| Common shares sold | 3,615,888 |

- |

- |

- |

- |

||||||||||||

| Common shares issued for controlling interest of subsidiary | 500,000,000 |

- |

- |

- |

( |

- |

|||||||||||

| Expenses paid on behalf of the Company and contributed to capital | - |

- |

- |

- |

- |

||||||||||||

| Net loss | - |

- |

- |

- |

- |

( |

( | ||||||||||

| Foreign currency translation | - |

- |

- |

- |

|

||||||||||||

| Balances, October 31, 2021 | 1,012,706,797 | $ |

1,000,000 |

$ |

|

$ |

|

$ |

$ |

|

$ | ( |

$ | ||||

| Common shares sold by subsidiary | - |

- |

- |

|

- |

||||||||||||

| Common shares sold | 1,315,789 | 132 |

- |

- |

- |

263,026 |

- |

- | 263,158 | ||||||||

| Expenses paid on behalf of the Company and contributed to capital | - |

- |

- |

- |

- |

||||||||||||

| Net income | - |

- |

- |

- |

|||||||||||||

| Foreign currency translation | - |

- |

- |

( |

( | ||||||||||||

| Balances, January 31, 2022 | $ |

|

$ |

$ |

|

$ |

$ |

( |

$ | $ |

WB Burgers Asia, Inc.

Condensed Consolidated Statement of Changes in Stockholders’ Equity (Deficit)

For the Period July 31, 2020 to January 31, 2021

| Common Shares | Par Value Common Shares | Series A Preferred Shares | Par Value Series A Preferred Shares | Additional Paid-in Capital |

|

Accumulated Other Comprehensive Income |

Accumulated Deficit | Total | |||||||

| Balances, July 31, 2020 | $ | - | $ | $ | $ | $ | ( |

$ | |||||||

| Net loss | - | - | ( |

( | |||||||||||

| Balances, October 31, 2020 | 1,000,000 | $ | - | $ | $ | $ | $ | ( |

$ | ( | |||||

| Expenses paid on behalf of the company and contributed to capital | - |

|

- |

- |

- |

||||||||||

| Net loss | - | - | ( |

( | |||||||||||

| Balances, January 31, 2021 | $ |

- |

$ |

$ |

$ |

- |

$ | ( |

$ | ( |

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements.

F-3

WB Burgers Asia, Inc.

Condensed Consolidated Statement of Cash Flows

(Unaudited)

|

Six Months January 31, 2022 |

Six Months Ended January 31, | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Net income/ loss | $ | $ | ( | |||

| Adjustment to reconcile net loss to net cash provided by (used in) operating activities: | ||||||

| Depreciation | ||||||

| Changes in current assets and liabilities: | ||||||

| Accounts payable | ||||||

| Prepaid expenses | ( |

|||||

| Income tax payable | ||||||

| Accrued expenses and other payables | ||||||

| Net cash provided by (used in) operating activities | ( | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Purchase fixed assets | ( |

|||||

| Construction in progress | ( |

|||||

| Net cash used in investing activities | ( |

|||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Cash received from the sale of stock | ||||||

| Non-controlling interest | ||||||

| Foreign currency translation | ( |

|||||

| Loan from related party | ( |

|||||

| Expenses contributed to capital | ||||||

| Net cash provided by (used in) financing activities | ( |

|||||

| Net increase (decrease) in cash and cash equivalents | $ | $ | - | |||

| Beginning cash and cash equivalents balance | ||||||

| Ending cash and cash equivalents balance | $ | $ | - | |||

| Cash paid for: | ||||||

| Interest | $ | - | $ | - | ||

| Income taxes | $ | - | $ | - |

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements.

F-4

WB Burgers Asia, Inc.

Notes to Condensed Consolidated Unaudited Financial Statements

Note 1 - Organization and Description of Business

We were originally incorporated in the state of Nevada on August 30, 2019, under the name Business Solutions Plus, Inc.

On August 30, 2019, Paul Moody was appointed Chief Executive Officer, Chief Financial Officer, and Director of Business Solutions Plus, Inc.

On March 3, 2021, Business Solutions Plus, Inc. (the “Company” or “Successor”) transmuted its business plan from that of a blank check shell company to forming a holding company that is a business combination related shell company. The reason for the change being that our former sole director desired to complete a holding company reorganization (“Reorganization”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250. The constituent corporations in the Reorganization were InterActive Leisure Systems, Inc. (“IALS” or “Predecessor”), the Company and Business Solutions Merger Sub, Inc. (“Merger Sub”). Our former director was the sole director/officer of each constituent corporation in the Reorganization. In preparation of the Reorganization, our former sole and controlling shareholder, Flint Consulting Services, LLC cancelled and returned to the Company’s treasury all issued and outstanding common shares of the Company held and owned by it. The Company issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of its common stock to the Company prior to the Reorganization. Immediately prior to the merger, the Company was a wholly owned direct subsidiary of IALS and Merger Sub was a wholly owned and direct subsidiary of the Company.

On March 22, 2021, the company filed articles of merger with the Nevada Secretary of State. The merger became effective on March 31, 2021 at 4:00 PM EST (“Effective Time”). At the Effective Time, Predecessor merged with and into Merger Sub (the “Merger), and Predecessor was the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of Successor common stock.

In addition, the new ticker symbol “BSPI” was announced April 14, 2021 on the Financial Industry Regulatory Authority’s daily list with a market effective date of April 15, 2021. The Company received a new CUSIP Number 12330M107.

On May 4, 2021, the Company entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

On the Closing Date, Mr. Paul Moody resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer. In addition, Mr. Moody resigned as Director on the Closing Date. Also on the Closing Date, Mr. Koichi Ishizuka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On June 18, 2021, our majority shareholder, White Knight Co., Ltd., a Japan Company, and our sole Director Mr. Koichi Ishizuka, executed a resolution to ratify, affirm, and approve a name and ticker symbol change of the Company from Business Solutions Plus, Inc., to WB Burgers Asia, Inc. A Certificate of Amendment to change our name was filed with the Nevada Secretary of State with an effective date of July 2, 2021.

On July 1, 2021, we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State, resulting in an increase to our authorized shares of common stock from 500,000,000 to 1,500,000,000.

On September 14, 2021 we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. has agreed to, and has subsequently forgiven any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

In regards to the above transaction, the Company claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales/issuances of the stock since the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The Company’s main office is located at 3F K’s Minamiaoyama 6-6-20 Minamiaoyama, Minato-ku, Tokyo

107-0062, Japan.

The Company has elected July 31st as its year end.

On September 14, 2021, we acquired 100% of the equity interest of WB Burgers Japan Co., Ltd., a Japan Company. Following the acquisition, we ceased to be a shell company and adopted the same business plan as that of our now wholly owned subsidiary, WB Burgers Japan Co., Ltd.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation

This summary of significant accounting policies is presented to assist in understanding the Company's financial statements. These accounting policies conform to accounting principles, generally accepted in the United States of America, and have been consistently applied in the preparation of the financial statements.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order to make the financial statements not misleading have been included. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents at January 31, 2022 and July 31, 2021 were $3,237,271 and $1,848,213, respectively.

Income Taxes

The Company accounts for income taxes under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations. No deferred tax assets or liabilities were recognized at January 31, 2022 and July 31, 2021.

The Company computes basic and diluted earnings (loss) per share in accordance with ASC Topic 260, Earnings per Share. Basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of common shares outstanding during the reporting period. Diluted earnings (loss) per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company.

The Company does not have any potentially dilutive instruments as of January 31, 2022 and, thus, anti-dilution issues are not applicable.

Fair Value of Financial Instruments

The Company’s balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

- Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

- Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

- Level 3 - Inputs that are both significant to the fair value measurement and unobservable.

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of January 31, 2022. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature of these instruments. These financial instruments include accrued expenses.

F-5

Related Parties

The Company follows ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

ASC 718, “Compensation – Stock Compensation”, prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based Payments to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

The Company had no stock-based compensation plans as of January 31, 2022.

The Company’s stock-based compensation for the periods ended January 31, 2022 and January 31, 2020 were $0 for both periods.

Recently Issued Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). ASU 2016-02 is amended by ASU 2018-01, ASU2018-10, ASU 2018-11, ASU 2018-20 and ASU 2019-01, which FASB issued in January 2018, July 2018, July 2018, December 2018 and March 2019, respectively (collectively, the amended ASU 2016-02). The amended ASU 2016-02 requires lessees to recognize on the balance sheet a right-of-use asset, representing its right to use the underlying asset for the lease term, and a lease liability for all leases with terms greater than 12 months. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from current GAAP. The amended ASU 2016-02 retains a distinction between finance leases (i.e. capital leases under current GAAP) and operating leases. The classification criteria for distinguishing between finance leases and operating leases will be substantially similar to the classification criteria for distinguishing between capital leases and operating leases under current GAAP. The amended ASU 2016-02 also requires qualitative and quantitative disclosures designed to assess the amount, timing, and uncertainty of cash flows arising from leases. A modified retrospective transition approach is permitted to be used when an entity adopts the amended ASU 2016-02, which includes a number of optional practical expedients that entities may elect to apply.

We do not believe we will be impacted in the foreseeable future by the newly adopted accounting standard(s) mentioned above.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Note 3 - Going Concern

The Company’s financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business.

The Company demonstrates adverse conditions that raise substantial doubt about the Company's ability to continue as a going concern for one year following the issuance of these financial statements. These adverse conditions are negative financial trends, specifically operating loss, working capital deficiency, and other adverse key financial ratios.

The Company has not yet established any source of revenue to cover its operating costs. Management plans to fund operating expenses with related party contributions to capital and the sale of shares of stock. There is no assurance that management's plan will be successful. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event that the Company cannot continue as a going concern.

Note 4 - Income Taxes

Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the recorded book basis and the tax basis of assets and liabilities for financial and income tax reporting. Deferred tax assets and liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income and tax credits that are available to offset future federal income taxes. The Company believes that its income tax filing positions and deductions will be sustained on audit and does not anticipate any adjustments that will result in a material adverse effect on the Company’s financial condition, results of operations, or cash flow. Therefore, no reserves for uncertain income tax positions have been recorded pursuant to ASC 740.

F-6

Note 5 - Commitments and Contingencies

The Company follows ASC 450-20, Loss Contingencies, to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated. There were no commitments or contingencies as of January 31, 2022.

Note 6 - Accrued Expenses

Accrued expenses totaled $

Note 7 - Shareholder Equity

Preferred Stock

The authorized preferred stock of the Company consists of 200,000,000 shares with a par value of $0.0001. There were 1,000,000 shares issued and outstanding as of January 31, 2022 and July 31, 2021.

On February 9, 2021, the Company filed, with the Secretary of State of Nevada, (“NSOS”) Restated Articles of Incorporation which amended the par value and authorized preferred stock. The Company withdrew its designated Series Z Preferred Stock and designated a new class of preferred stock described as Series A Preferred Stock. No shares of Preferred Stock of any series were issued and outstanding prior to or after the recording of the Restated Articles of Incorporation with NSOS. After the amendment, total authorized shares were 700,000,000, 500,000,000 common shares and 200,000,000 preferred shares, both with a par value of $.0001.

On March 4, 2021, the Company announced on Form 8-K plans to participate in a holding company reorganization (“the Reorganization” or “Merger”) with InterActive Leisure Systems, Inc. (“IALS” or “Predecessor”), the Company and Business Solutions Merger Sub, Inc. (“Merger Sub”), collectively (the “Constituent Corporations”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250.

Immediately prior to the Reorganization, the Company was a direct and wholly owned subsidiary of Interactive Leisure Systems, Inc. and Business Solutions Merger Sub, Inc. was a direct and wholly owned subsidiary of the Company.

As disclosed in our 8-K filed on March 26, 2021, the above-mentioned Reorganization was legally effective as of March 31, 2021.

Each share of Predecessor’s common stock issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of Successor common stock. The controlling shareholder of the Predecessor, Flint Consulting Services, LLC, (“Flint”) a Wyoming limited liability company became the same control shareholder of the Successor. Jeffrey DeNunzio, as sole member of Flint is deemed to be the indirect and beneficial holder 1,000,000 shares of Series A Preferred Stock of the Company representing approximately .17% voting control of the Company. Paul Moody, our former sole officer/director is the same officer/director of the Predecessor. The Series A Preferred shares were valued at $.10 per share when issued.

On May 4, 2021, the Company entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

Common Stock

The authorized common stock of the Company consists of 1,500,000,000 shares with a par value of $0.0001. There were 1,012,706,797 and 509,090,909 shares of common stock issued and outstanding as of October 31, 2021 and July 31, 2021, respectively.

On February 9, 2021, the Company filed, with the Secretary of State of Nevada, (“NSOS”) Restated Articles of Incorporation which amended the Company’s par value and authorized common stock. After the amendment, total authorized shares were 700,000,000, 500,000,000 common shares and 200,000,000 preferred shares, both with a par value of $.0001.

On August 30, 2019, 1,000,000 common shares were issued to Flint Consulting Services for development of the Company’s business plan.

On March 3, 2021, 1,000,000 common shares of the Company held and owned by Flint Consulting Services, LLC were cancelled and returned to the treasury of the Company. This action resulted in no shares issued and outstanding. On March 4, 2021, The Company announced on Form 8-K plans to participate in a holding company reorganization (“the Reorganization” or “Merger”) with InterActive Leisure Systems, Inc. (“IALS” or “Predecessor”), the Company and Business Solutions Merger Sub, Inc. (“Merger Sub”), collectively (the “Constituent Corporations”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250.

Immediately prior to the Reorganization, the Company was a direct and wholly owned subsidiary of Interactive Leisure Systems, Inc. and Business Solutions Merger Sub, Inc. was a direct and wholly owned subsidiary of the Company.

As disclosed in our 8-K filed on March 26, 2021, the above-mentioned Reorganization was legally effective as of March 31, 2021.

Each share of Predecessor’s common stock issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of Successor common stock. The control shareholder of the Predecessor, Flint Consulting Services, LLC, (“Flint”) a Wyoming limited liability company became the same control shareholder of the Successor.

On May 4, 2021, the Company entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

On July 1, 2021, we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State, resulting in an increase to our authorized shares of common stock from 500,000,000 to 1,500,000,000.

Subsequent to the above action, on or about July 1, 2021, we sold 9,090,909 shares of restricted common stock to SJ Capital Co., Ltd., a Japanese Company, at a price of $0.20 per share of common stock. The total subscription amount paid by SJ Capital Co., Ltd. was approximately $1,818,181.80 or approximately 200,000,000 Japanese Yen.

SJ Capital Co., Ltd., is owned and controlled by Senju Pharmaceutical Co., Ltd., a Japanese Company.

Mr. Takeshi Sugisawa, the President of SJ Capital Co., Ltd., authorized the above transaction on behalf of SJ Capital Co., Ltd. Both SJ Capital Co., Ltd., and Senju Pharmaceutical Co., Ltd. are considered non-related parties to the Company.

On August 24, 2021, we sold 1,363,636 shares of restricted common stock to Yasuhiko Miyazaki, a Japanese citizen, at a price of $.20 per share. The total subscription amount paid by Yasuhiko Miyazaki was approximately $272,727 or approximately 30,000,000 Japanese Yen. Mr. Miyazaki is not a related party to the Company.

On August 30, 2021, our largest controlling shareholder, White Knight Co., Ltd., a Japanese Company, owned and controlled by our sole officer and Director, Koichi Ishizuka, sold a total of 353,181,818 shares of restricted common stock of the Company to the following parties in the respective quantities:

| Name of Purchaser | Common Shares Purchased | Price Paid Per Share | Total Amount Paid ($) | ||

| Koichi Ishizuka | 101,363,636 | $0.0001 | 10,136.00 | ||

| Rei Ishizuka 1 | 50,000,000 | $0.0001 | 5,000.00 | ||

| Kiyoshi Noda | 100,909,091 | $0.0001 | 10,091.00 | ||

| Yuma Muranushi | 100,909,091 | $0.0001 | 10,091.00 |

1 Rei Ishizuka is the wife of our sole officer and Director, Mr. Koichi Ishizuka.

On September 14, 2021 we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. has agreed to, and has subsequently forgiven any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

On October 22, 2021, we sold 2,252,252 shares of restricted common stock to Shokafulin LLP, a Japan Company, which is controlled by Takuya Watanabe, a Japanese citizen, at a price of $0.20 per share. The total subscription amount paid by Shokafulin LLP was approximately $450,450 or approximately 50,000,000 Japanese Yen. Shokafulin LLP and Mr. Watanabe are not related parties to the Company.

On December 27, 2021, we sold 1,315,789 shares of restricted common stock to Takahiro Fujiwara, a Japanese citizen, at a price of $0.20 per share. The total subscription amount paid by Takahiro Fujiwara was approximately $263,158. Mr. Fujiwara is not a related party to the Company.

Additional Paid-In Capital

The Company’s sole officer

and director, Koichi Ishizuka, paid expenses on behalf of the Company totaling $

The Company’s sole officer

and director, Koichi Ishizuka, paid expenses on behalf of the Company totaling $

The $

Note 8 - Related-Party Transactions

Additional Paid-In Capital

The Company’s sole officer and director, Koichi Ishizuka, paid expenses

on behalf of the Company totaling $

The Company’s sole officer and director, Koichi Ishizuka, paid expenses on behalf of the Company totaling $6,400 during the period ended July 31, 2021. The Company’s former sole officer and director, Paul Moody, paid expenses on behalf of the company totaling $4,013 during the period ended July 31, 2021. Former related party, Jeffrey DeNunzio, paid expenses on behalf of the company totaling $6,500 during the period ended July 31, 2021.

The $16,913 in total payments are considered contributions to the company with no expectation of repayment and are posted as additional paid-in capital.

Note 9 - Subsequent Events

On or about February 8, 2022, we incorporated Store Foods Co., Ltd., a Japan Company. Store Foods Co., Ltd. is now a wholly owned subsidiary of the Company. Currently, Koichi Ishizuka is the sole Officer and Director of Store Foods Co., Ltd.

While our future plans for Store Foods Co., Ltd. are not definitive and may change, the intended business purpose of the Company is as follows:

1. Food sales;

2. Food wholesale and retail;

3. Chain organizations consisting of food retailers as members;

4. Restaurants;

5. Manufacturing and sales of boxed lunches for catering;

6. Alcohol sales;

7. Health supplement and health drink sales;

8. Manufacturing and sales of functional foods;

9. Lease of goods related to restaurant management;

10. System development;

11. Delivery;

12. Application development and sales;

13. Advertising;

14. Management consulting;

15. All businesses incidental to any of the above.

As a result of the above, we now have two wholly owned subsidiaries, WB Burgers Asia, Inc., and Store Foods Co., Ltd., both of which are Japan Companies.

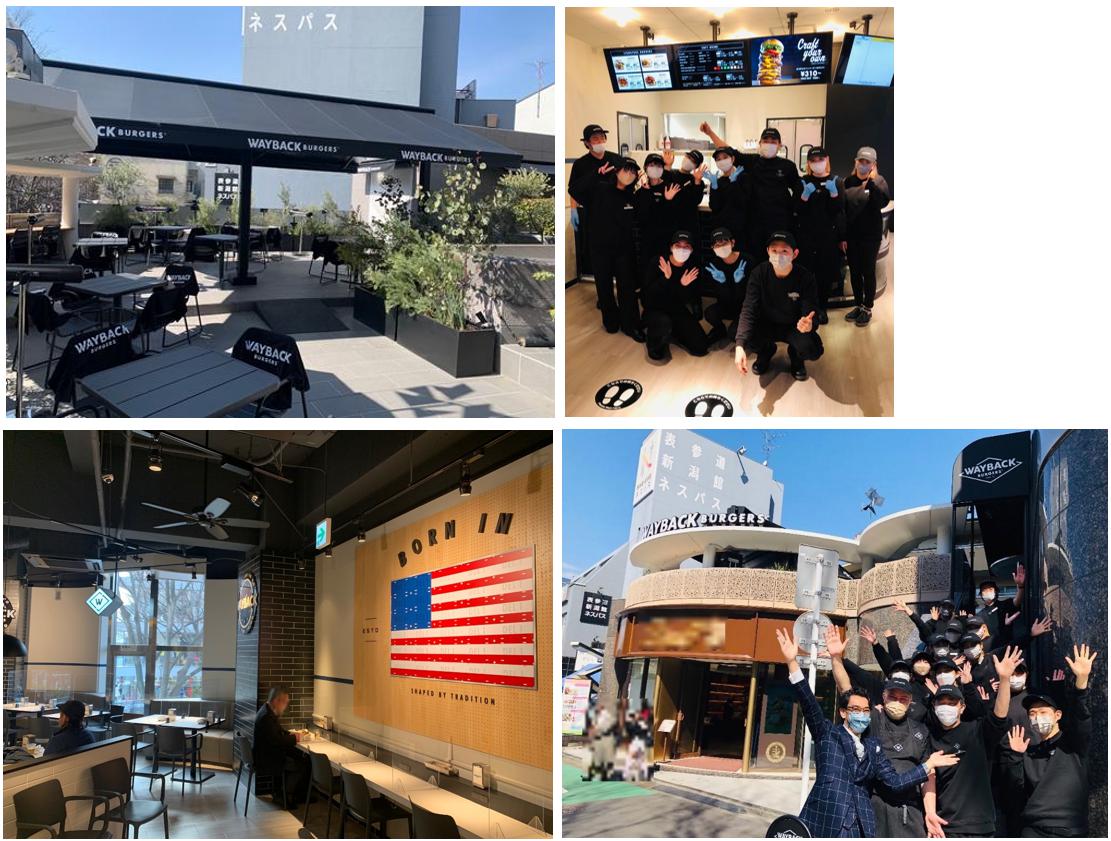

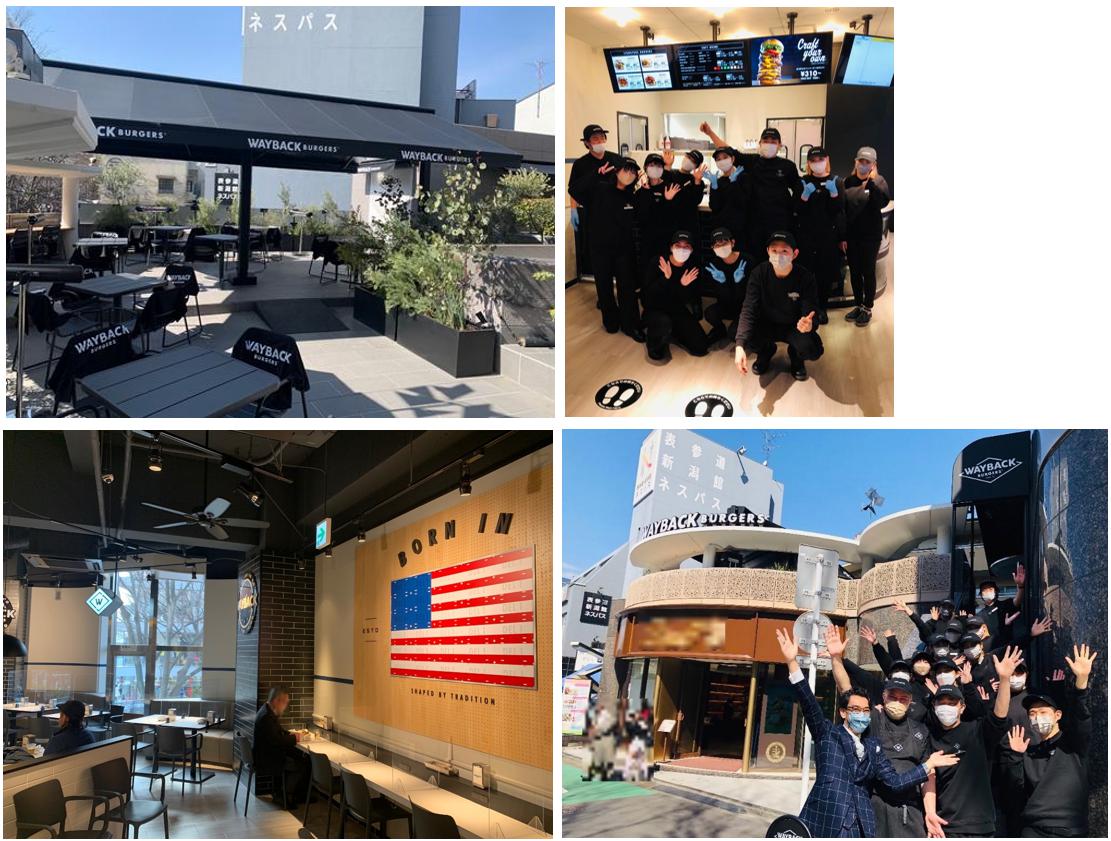

On March 11, 2022, we opened our first flagship Wayback Burgers location to the public in the Omotesando shopping plaza in Japan. We offer an array of quick bites, including but not limited to traditional hamburgers, fries, shakes, and other alternatives.

F-7

| ITEM 2 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.”

These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions.

Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Company Overview

Corporate History

We were originally incorporated in the state of Nevada on August 30, 2019, under the name Business Solutions Plus, Inc.

On August 30, 2019, Paul Moody was appointed Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On February 9, 2021, the Company filed, with the Secretary of State of Nevada (“NSOS”), Restated Articles of Incorporation.

On March 4, 2021, Business Solutions Plus, Inc., (the “Company” or “Successor”) announced on Form 8-K plans to participate in a holding company reorganization (“the Reorganization” or “Merger”) with InterActive Leisure Systems, Inc. (“IALS” or “Predecessor”), the Company and Business Solutions Merger Sub, Inc. (“Merger Sub”), collectively (the “Constituent Corporations”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250.

Immediately prior to the Reorganization, the Company was a direct and wholly owned subsidiary of Interactive Leisure Systems, Inc. and Business Solutions Merger Sub, Inc. was a direct and wholly owned subsidiary of the Company.

As disclosed in our 8-K filed on March 26, 2021, the above-mentioned Reorganization was legally effective as of March 31, 2021.

Each share of Predecessor’s common stock issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of Successor common stock. The control shareholder, (at the time) of the Predecessor, Flint Consulting Services, LLC, (“Flint”) a Wyoming limited liability company became the same control shareholder of the Successor. Jeffrey DeNunzio, as sole member of Flint is (was) deemed to be the indirect and beneficial holder of 405,516,868 shares of Common Stock and 1,000,000 shares of Series A Preferred Stock of the Company representing approximately 93.70% voting control of the Company. Paul Moody, (our now former sole officer/director), was the same officer/director of the Predecessor. There are/were no other shareholders or any officer/director holding at least 5% of the outstanding voting shares of the Company.

Immediately prior to the Effective Time, and under the respective articles of incorporation of Predecessor and Successor, the Successor Capital Stock had the same designations, rights, and powers and preferences, and the qualifications, limitations, and restrictions thereof, as the Predecessor Capital Stock which was automatically converted pursuant to the reorganization.

Immediately prior to the Effective Time, the articles of incorporation and bylaws of Successor, as the holding company, contain provisions identical to the Articles of Incorporation and Bylaws of Predecessor immediately prior to the merger, other than as permitted by NRS 92A.200.

Immediately prior to the Effective Time, the articles of incorporation of Predecessor stated that any act or transaction by or involving the Predecessor, other than the election or removal of directors of the Predecessor, that requires for its adoption under the NRS or the Articles of Incorporation of Predecessor the approval of the stockholders of the Predecessor, shall require in addition the approval of the stockholders of Successor (or any successor thereto by merger), by the same vote as is required by the articles of Incorporation and/or the bylaws of the Predecessor.

Immediately prior to the Effective Time, the articles of incorporation and bylaws of Successor and Merger Sub were identical to the articles of incorporation and bylaws of Predecessor immediately prior to the merger, other than as permitted by NRS 92A.200;

The Boards of Directors of Predecessor, Successor, and Merger Sub approved the Reorganization, shareholder approval not being required pursuant to NRS 92A.180;

The Reorganization constituted a tax-free organization pursuant to Section 368(a)(1) of the Internal Revenue Code;

Successor common stock traded in the OTC Markets under the Predecessor ticker symbol “IALS” under which the common stock of Predecessor previously listed and traded until the new ticker symbol “BSPI” was announced April 14, 2021, on the Financial Industry Regulatory Authority’s daily list with a market effective date of April 15, 2021. The CUSIP Number 45841W107 for IALS’s common stock was suspended upon market effectiveness. The Company received a new CUSIP Number 12330M107.

After completion of the Holding Company Reorganization, the Company cancelled all of its stock held in Predecessor resulting in the Company as a stand-alone and separate entity with no subsidiaries, no assets and negligible liabilities. The Company abandoned the business plan of its Predecessor and resumed its former business plan of a blank check company after completion of the Merger.

On May 4, 2021, Business Solutions Plus, Inc., a Nevada Corporation (the “Company”), entered into a Share Purchase Agreement (the “Agreement”) by and among Flint Consulting Services, LLC, a Wyoming Limited Liability Company (“FLINT”), and White Knight Co., Ltd., a Japan Company (“WKC”), pursuant to which, on May 7, 2021, (“Closing Date”) , FLINT sold 405,516,868 shares of the Company’s Restricted Common Stock and 1,000,000 Shares of Series A Preferred Stock, representing approximately 93.70% voting control of the Company. WKC paid consideration of three hundred twenty-five thousand dollars ($325,000) (the “Purchase Price”). The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC becoming the Company’s largest controlling stockholder.

The sole shareholder of White Knight Co., Ltd., a Japanese Company, is Koichi Ishizuka.

On May 7, 2021, Mr. Paul Moody resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

On May 7, 2021, Mr. Koichi Ishizuka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

A Certificate of Amendment to change our name, from Business Solutions Plus, Inc., to WB Burgers Asia, Inc. was filed with the Nevada Secretary of State on June 18, 2021, with a legal effective date of July 2, 2021. The name change to WB Burgers Asia, Inc., as well as a change of our ticker symbol from BSPI to WBBA, was announced by FINRA, via their “daily list”, on July 7, 2021, with a market effective date of both on July 8, 2021. The new CUSIP number associated with our common stock, as of the market effective date of July 8, 2021, is 94684P100.

On July 1, 2021, we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State, resulting in an increase to our authorized shares of common stock from 500,000,000 to 1,500,000,000.

Subsequent to the above action, on or about July 1, 2021, we sold 9,090,909 shares of restricted common stock to SJ Capital Co., Ltd., a Japanese Company, at a price of $0.20 per share of common stock. The total subscription amount paid by SJ Capital Co., Ltd. was approximately $1,818,181.80 or approximately 200,000,000 Japanese Yen.

SJ Capital Co., Ltd., is owned and controlled by Senju Pharmaceutical Co., Ltd., a Japanese Company.

Mr. Takeshi Sugisawa, the President of SJ Capital Co., Ltd., authorized the above transaction on behalf of SJ Capital Co., Ltd. Both SJ Capital Co., Ltd., and Senju Pharmaceutical Co., Ltd. are considered non-related parties to the Company.

The proceeds from the above sale of shares are to be used by the Company for working capital.

On August 24, 2021, we sold 1,363,636 shares of restricted common stock to Yasuhiko Miyazaki, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Yasuhiko Miyazaki was approximately $272,727 or approximately 30,000,000 Japanese Yen. Mr. Yasuhiko Miyazaki is not a related party to the Company. The proceeds from the above sale of shares are to be used by the Company for working capital.

In regards to all of the above transactions, the Company claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales/issuances of the stock since the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On August 30, 2021, our largest controlling shareholder, White Knight Co., Ltd., a Japanese Company, owned and controlled by our sole officer and Director, Koichi Ishizuka, sold a total of 353,181,818 shares of restricted common stock of the Company to the following parties in the respective quantities:

| Name of Purchaser | Common Shares Purchased | Price Paid Per Share | Total Amount Paid ($) | ||

|---|---|---|---|---|---|

| Koichi Ishizuka | 101,363,636 | $0.0001 | 10,136.00 | ||

| Rei Ishizuka 1 | 50,000,000 | $0.0001 | 5,000.00 | ||

| Kiyoshi Noda | 100,909,091 | $0.0001 | 10,091.00 | ||

| Yuma Muranushi | 100,909,091 | $0.0001 | 10,091.00 |

1 Rei Ishizuka is the wife of our sole officer and Director, Mr. Koichi Ishizuka.

In regards to all of the above transactions White Knight Co., Ltd. claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On September 14, 2021, we entered into an “Acquisition Agreement” with White Knight Co., Ltd., a Japan Company, whereas we issued 500,000,000 shares of restricted common stock to White Knight Co., Ltd., in exchange for 100% of the equity interests of WB Burgers Japan Co., Ltd., a Japan Company. Pursuant to the agreement, on October 1, 2021, White Knight Co., Ltd. agrees to, and has since forgiven any outstanding loans with WB Burgers Japan Co., Ltd. as of October 1, 2021. Following this transaction, WB Burgers Japan Co., Ltd. became our wholly owned subsidiary which we now operate through.

The aforementioned Acquisition Agreement is attached as Exhibit 10.1 to our Form 8-K filed with the Securities and Exchange Commission on September 14, 2021. All references to the Acquisition Agreement are qualified, in their entirety, by the text of such exhibit.

White Knight Co., Ltd., is owned entirely by our sole officer and Director, Koichi Ishizuka. White Knight Co., Ltd. is our largest controlling shareholder.

WB Burgers Japan Co., Ltd., referred to herein as “WBJ”, which we now operate through and share the same business plan of, holds the rights to the “Master Franchise Agreement” with Jakes’ Franchising LLC, a Delaware Limited Liability Company, as it pertains to the establishment and operation of Wayback Burger Restaurants within the country of Japan.

The Master Franchise Agreement provides WBJ the right to establish and operate Wayback Burgers restaurants in the country of Japan, and also license affiliated and unaffiliated third parties (“Franchisees”) to establish and operate Wayback Burgers restaurants in the Country of Japan. The Master Franchise Agreement, amongst other things, also provides WBJ the right of first refusal to enter into a subsequent Master Franchise Agreement with Jake’s Franchising, LLC to establish and operate Wayback Burgers restaurants in the Countries of Indonesia, Malaysia (Eastern Malaysia only, Western Malaysia if it becomes available as it is currently licensed to another party), the Philippines, Vietnam, China, India, Korea, Thailand, Singapore, and Taiwan.

WB Burgers Japan Co., Ltd. seeks to make “Wayback Burgers” a nationally recognized brand, if not a household name, within the country of Japan through the promotion and opening of various Wayback Burgers Restaurants.

Following the acquisition of our now wholly owned subsidiary, WB Burgers Japan Co., Ltd., on September 14, 2021, we ceased to be a shell company. Immediately upon our acquisition of WB Burgers Japan Co., Ltd. we adopted the same business plan as WB Burgers Japan Co., Ltd.

On October 22, 2021, we sold 2,252,252 shares of restricted common stock to Shokafulin LLP, a Japan Company, which is controlled by Takuya Watanabe, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Shokafulin LLP was approximately $450,450 or approximately 50,000,000 Japanese Yen. Shokafulin LLP and Mr. Watanabe are not related parties to the Company.

The aforementioned sale of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The sale of shares was made only to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On November 6, 2021, our largest controlling shareholder, White Knight Co., Ltd., a Japanese Company, owned and controlled by our sole officer and Director, Koichi Ishizuka, sold a total of 14,347,826 shares of restricted common stock to the following parties in the respective quantities:

| Name of Purchaser | Common Shares Purchased | Price Paid Per Share ($) | Total Approximate Amount Paid ($) | ||

|---|---|---|---|---|---|

| M&A Company 1 | 1,304,348 | 0.20 | 260,870 | ||

| Michinari Yamamoto | 1,304,348 | 0.20 | 260,870 | ||

| Atsushi Morikawa | 1,304,348 | 0.20 | 260,870 | ||

| Motoki Hirai | 1,304,348 | 0.20 | 260,870 | ||

| Tomonori Yoshinaga | 1,739,130 | 0.20 | 347,826 | ||

| Go Watanabe | 3,043,478 | 0.20 | 608,696 | ||

| Okakichi Co., Ltd 2 | 4,347,826 | 0.20 | 869,565 | ||

| Total | 14,347,826 | 0.20 | 2,869,567 |

1 The authorized party of M&A Company, a Japan entity, is Akihiro Ando.

2 The authorized party of Okakichi Co., Ltd, a Japan entity, is Shigeru Okada.

In regards to all of the above transactions White Knight Co., Ltd. claims an exemption from registration afforded by Section Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

Following the above transactions, White Knight Co., Ltd. now owns 537,987,224 shares of our Common Stock. White Knight Co., Ltd. also remains the owner of 1,000,000 shares of our Preferred Series A Stock. Every share of our Series A Preferred Stock has super voting rights that allows for 1,000 votes for every vote of Common Stock. White Knight Co., Ltd. remains our majority controlling shareholder.

On November 9, 2021, our wholly owned subsidiary, WB Burgers Japan Co., Ltd., consummated a lease agreement with Arai Co., Ltd., a Japanese realty group, for the location in which we intend to open our first Wayback Burgers restaurant. The property is located in the popular shopping plaza of Omotesando, located in the Tokyo prefecture.

On December 27, 2021, we sold 1,315,789 shares of restricted Common Stock to Takahiro Fujiwara, Japanese Citizen, at a price of $0.20 per share of Common Stock. The total subscription amount paid by Takahiro Fujiwara was approximately $263,158. Takahiro Fujiwara is not a related party to the Company.

The aforementioned sales of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The sale of shares was made only to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The Company has elected July 31st as its year end.

Liquidity and Capital Resources

Our cash balance is $3,237,271 as of January 31, 2022. We have been utilizing available cash balances and funds from our Chief Executive Officer, Koichi Ishizuka, and may continue to do so in the future.

Mr. Ishizuka has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. In order to implement our plan of operations for the next twelve-month period, we may require further funding. Being a start-up stage company, we have very limited operating history. After a twelve-month period we may need additional financing but currently do not have any arrangements for such financing.

If we need additional cash and cannot raise it, we will either have to suspend operations until we do raise the cash we need, or scale back operations entirely.

Revenues

The company has generated no revenue to date but we anticipate that once our first restaurant is operational we will begin to generate revenue.

Net Income

We recorded net income of $1,849,830 and net loss of $8,800 for the six months ended January 31, 2022 and January 31, 2021, respectively.

Cash flow

For the six months ended January 31, 2022, we had positive cash flows from operating activities in the amount of $3,756,870. For the six months ended January 31, 2021, we had negative cash flows from operating activities in the amount of $6,950.

For the six months ended January 31, 2022 we had negative cash flows from financing activities in the amount of $1,641,539 and for the six months ended January 31, 2021 we had positive cash flows from financing activities in the amount of $6,950.

Going Concern

The Company’s financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern that contemplates the realization of assets and liquidation of liabilities in the normal course of business.

The Company demonstrates adverse conditions that raise substantial doubt about the Company's ability to continue as a going concern for one year following the issuance of these financial statements. These adverse conditions are negative financial trends, specifically operating loss, working capital deficiency, and other adverse key financial ratios.

The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event that the Company cannot continue as a going concern.

Other Updates

On November 9, 2021, our wholly owned subsidiary, WB Burgers Japan Co., Ltd., consummated a lease agreement with Arai Co., Ltd., a Japanese realty group, for the location in which we intend to open our first Wayback Burgers restaurant.

The property is located in the popular shopping plaza of Omotesando, located in the Tokyo prefecture. The location is in what we believe to be an area of high foot traffic and is also in close proximity to numerous brand name retailers and stores which we believe may bolster the number of patrons who decide to dine at our location, once opened to the public.

On or about February 8, 2022, we incorporated Store Foods Co., Ltd., a Japan Company. Store Foods Co., Ltd. is now a wholly owned subsidiary of the Company. Currently, Koichi Ishizuka is the sole Officer and Director of Store Foods Co., Ltd.

While our future plans for Store Foods Co., Ltd. are not definitive and may change, the intended business purpose of the Company is as follows:

1. Food sales;

2. Food wholesale and retail;

3. Chain organizations consisting of food retailers as members;

4. Restaurants;

5. Manufacturing and sales of boxed lunches for catering;

6. Alcohol sales;

7. Health supplement and health drink sales;

8. Manufacturing and sales of functional foods;

9. Lease of goods related to restaurant management;

10. System development;

11. Delivery;

12. Application development and sales;

13. Advertising;

14. Management consulting;

15. All businesses incidental to any of the above.

As a result of the above, we now have two wholly owned subsidiaries, WB Burgers Asia, Inc., and Store Foods Co., Ltd., both of which are Japan Companies.

On March 11, 2022 we opened our first flagship Wayback Burgers location to the public. We offer any array of quick bites, including, but not limited to, traditional hamburgers, fries, shakes, and other alternatives. The below are a few images of our flagship restaurant:

| ITEM 3 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

As a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

-3-

| ITEM 4 | CONTROLS AND PROCEDURES |

Management’s Report on Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and our chief financial officer (who is acting as our principal executive officer, principal financial officer and principle accounting officer) to allow for timely decisions regarding required disclosure.

As of January 31, 2022, we carried out an evaluation, under the supervision of our chief executive officer, who also serves as our chief financial officer, of the effectiveness of the design and the operation of our disclosure controls and procedures. Our officer, Koichi Ishizuka, concluded that the disclosure controls and procedures were not effective as of the end of the period covered by this report due to material weaknesses identified below.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: domination of management by a single individual without adequate compensating controls, lack of a majority of outside directors on board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; inadequate segregation of duties consistent with control objectives, and lack of an audit committee. These material weaknesses were identified by our Chief Executive Officer who also serves as our Chief Financial Officer in connection with the above evaluation.

Inherent limitations on effectiveness of controls

Internal control over financial reporting has inherent limitations which include but is not limited to the use of independent professionals for advice and guidance, interpretation of existing and/or changing rules and principles, segregation of management duties, scale of organization, and personnel factors. Internal control over financial reporting is a process which involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis, however these inherent limitations are known features of the financial reporting process and it is possible to design into the process safeguards to reduce, though not eliminate, this risk. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal controls over financial reporting that have occurred for the fiscal quarter ended January 31, 2022, that have materially or are reasonably likely to materially affect, our internal controls over financial reporting.

-4-

PART II-OTHER INFORMATION

| ITEM 1 | LEGAL PROCEEDINGS |

There are no legal proceedings against the Company and the Company is unaware of such proceedings contemplated against it.

| ITEM 1A | RISK FACTORS |

As a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

| ITEM 2 | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

On or about July 1, 2021, we sold 9,090,909 shares of restricted common stock to SJ Capital Co., Ltd., a Japanese Company, at a price of $0.20 per share of common stock. The total subscription amount paid by SJ Capital Co., Ltd. was approximately $1,818,181.80 or approximately 200,000,000 Japanese Yen.

SJ Capital Co., Ltd., is owned and controlled by Senju Pharmaceutical Co., Ltd., a Japanese Company.

Mr. Takeshi Sugisawa, the President of SJ Capital Co., Ltd., authorized the above transaction on behalf of SJ Capital Co., Ltd. Both SJ Capital Co., Ltd., and Senju Pharmaceutical Co., Ltd. are considered non-related parties to the Company.

The proceeds from the above sale of shares are to be used by the Company for working capital.

On August 24, 2021, we sold 1,363,636 shares of restricted common stock to Yasuhiko Miyazaki, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Yasuhiko Miyazaki was approximately $272,727 or approximately 30,000,000 Japanese Yen. Mr. Yasuhiko Miyazaki is not a related party to the Company. The proceeds from the above sale of shares are to be used by the Company for working capital.

On October 22, 2021, we sold 2,252,252 shares of restricted common stock to Shokafulin LLP, a Japan Company, which is controlled by Takuya Watanabe, a Japanese Citizen, at a price of $0.20 per share of common stock. The total subscription amount paid by Shokafulin LLP was approximately $450,450 or approximately 50,000,000 Japanese Yen. Shokafulin LLP and Mr. Watanabe are not related parties to the Company.

On December 27, 2021, we sold 1,315,789 shares of restricted Common Stock to Takahiro Fujiwara, Japanese Citizen, at a price of $0.20 per share of Common Stock. The total subscription amount paid by Takahiro Fujiwara was approximately $263,158. Takahiro Fujiwara is not a related party to the Company.

The aforementioned sales of shares was conducted pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). The sale of shares was made only to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The proceeds from the above sale of shares are to be used by the Company for working capital.

| ITEM 3 | DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4 | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5 | OTHER INFORMATION |

None.

| ITEM 6 | EXHIBITS |

(b) Exhibits required by Item 601 of Regulation S-K.

| Exhibit No. | Description | |

| 3.1 | Restated Articles of Incorporation (1) | |

| 3.11 | Certificate of Amendment (2) | |

| 3.12 | Certificate of Amendment (3) | |

| 3.2 | By-laws (4) | |

| 31.1 | Certification of the Company’s Principal Executive and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, with respect to the registrant’s report on Form 10-Q for the quarter ended January 31, 2022 (5) | |

| 32.1 | Certification of the Company’s Principal Executive and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (5) | |

| 101.INS | XBRL Instance Document (6) | |

| 101.SCH | XBRL Taxonomy Extension Schema (6) | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase (6) | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase (6) | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase (6) | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase (6) | |

____________________

| (1) | Filed as an exhibit to the Company's Form 8-K, as filed with the SEC on March 4, 2021, and incorporated herein by this reference. |

| (2) | Filed as an exhibit to the Company’s Form 8-K, as filed with the SEC on June 22, 2021, and incorporated herein by this reference. |

| (3) | Filed as an exhibit to the Company's Form 8-K, as filed with the SEC on July 8, 2021, and incorporated herein by this reference. |

| (4) | Filed as an exhibit to the Company's Form 10-12G, as filed with the SEC on December 28, 2020, and incorporated herein by this reference. |

| (5) | Filed herewith. |

| (6) | Users of this data are advised that, pursuant to Rule 406T of Regulation S-T, these interactive data files are deemed not filed or part of a registration statement or Annual Report for purposes of Sections 11 or 12 of the Securities Act of 1933 or Section 18 of the Exchange Act of 1934 and otherwise are not subject to liability. |

-5-

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

WB Burgers Asia, Inc.

(Registrant)

By: /s/ Koichi Ishizuka

Name: Koichi Ishizuka

Chief Executive Officer and Chief Financial Officer

Dated: March 17, 2022

-6-