UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||||||||||||||

Washington, D.C. 20549

Form | ||||||||

(Mark One)

For the fiscal year ended December 31 , 2021

OR

For transition period from to

Commission File Number: 001-39186

(Exact name of registrant as specified in its charter) | ||||||||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | ||||

(Address of Principal Executive Offices) | (Zip Code) | ||||

(805 ) 418-5006

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by a check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of June 30, 2021, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $1,082,483,639 , based on the closing price of the registrant's common stock as reported on The Nasdaq Global Select Market.

The number of shares of the registrant’s Common Stock outstanding as of February 16, 2022 was 50,380,254 .

| DOCUMENTS INCORPORATED BY REFERENCE: | ||||||||||||||

INDEX

| Page | ||||||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect”, and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

•the success, cost, and timing of our plans to develop and commercialize immune-dermatology drugs, including our current products, roflumilast cream (ARQ-151), topical roflumilast foam (ARQ-154), ARQ-252 and ARQ-255 for indications including psoriasis, atopic dermatitis, scalp psoriasis, seborrheic dermatitis, hand eczema, vitiligo, and alopecia areata;

•the anticipated impact of the coronavirus disease 2019 (COVID-19) outbreak on our ongoing and planned clinical trials and other business operations, including any potential delays, halts, or modifications to our clinical trials and other potential changes to our clinical development plans or business operations;

•our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates;

•the timing of and our ability to obtain and maintain regulatory approvals;

•future agreements, if any, with third parties in connection with the commercialization of our product candidates;

•the success, cost, and timing of our product candidate development activities and planned clinical trials;

•the rate and degree of market acceptance and clinical utility of our product candidates;

•the potential market size and the size of the patient populations for our product candidates, if approved for commercial uses;

•the potential U.S. market sales for our product candidates, if approved for commercial use;

•our commercialization, marketing, and manufacturing capabilities and strategy;

•the success of competing therapies that are or may become available;

•our ability to attract and retain key management and technical personnel;

•our expectations regarding our ability to obtain, maintain, and enforce intellectual property protection for our product candidates; and

•our estimates regarding expenses, future revenue, capital requirements, and needs for additional financing.

1

These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in “Risk factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this Annual Report on Form 10-K we have filed with the U.S. Securities and Exchange Commission (SEC) with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

2

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, including those described in Part I Item 1A. “Risk Factors” in this Annual Report on Form 10-K. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

•We are a late-stage biopharmaceutical company with a limited operating history and no products approved for commercial sale, and we have incurred significant losses since our inception. We anticipate that we will continue to incur losses for the foreseeable future, which, together with our limited operating history, makes it difficult to assess our future viability;

•We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce, or terminate our product development, other operations, or commercialization efforts;

•Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our future operating results to fall below expectations;

•Our estimated market opportunities for our product candidates are subject to numerous uncertainties and may prove to be inaccurate. If we have overestimated the size of our market opportunities, our future growth may be limited;

•The terms of our loan and security agreement require us to meet certain operating and financial covenants and place restrictions on our operating and financial flexibility. If we raise additional capital through debt financing, the terms of any new debt could further restrict our ability to operate our business;

•Our business is dependent on the development, regulatory approval, and commercialization of our current product candidates;

•Clinical drug development involves a lengthy and expensive process, with an uncertain outcome. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates;

•We may be unable to obtain regulatory approval for our product candidates under applicable regulatory requirements. The denial or delay of any such approval would delay commercialization of our product candidates and adversely impact our potential to generate revenue, our business, and our results of operations;

•Interim, topline, or preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data;

•Certain of the endpoints in our planned clinical trials rely on a subjective assessment of the effect of the product candidate in the subject by either the physician or subject, and may prove difficult to meet in subjects with more severe disease, which exposes us to a variety of risks for the successful completion of our clinical trials;

•Enrollment and retention of subjects in clinical trials is expensive and time-consuming and may result in additional costs and delays in our product development activities, or in the failure of such activities;

•Serious adverse or unacceptable side effects may be identified during the development of our product candidates, which could prevent or delay regulatory approval and commercialization, increase our costs, or necessitate the abandonment or limitation of the development of some of our product candidates;

•As a company, we have never obtained marketing approval for any product candidate and we may be unable to successfully do so in a timely manner, if at all, for any of our product candidates;

•Even if our lead product candidate or our other product candidates receive marketing approval, they may fail to achieve market acceptance by physicians, patients, third-party payors, or others in the medical community necessary for commercial success;

•If we are unable to achieve and maintain coverage and adequate levels of reimbursement for any of our product candidates for which we receive regulatory approval, or any future products we may seek to commercialize, their commercial success may be severely hindered;

3

•We currently have limited sales, marketing, or distribution capabilities and have no experience as a company in commercializing products;

•We will need to increase the size of our organization, and we may experience difficulties in executing our growth strategy and managing any growth;

•If we fail to attract and retain management and other key personnel, we may be unable to continue to successfully develop our current and any future product candidates, commercialize our product candidates, or otherwise implement our business plan;

•We currently rely on single source third-party manufacturers to manufacture nonclinical and clinical supplies of our product candidates and we intend to rely on third parties to produce commercial supplies of any approved product candidate. The loss of these manufacturers, or their failure to provide us with sufficient quantities at acceptable quality levels or prices, or at all, would materially and adversely affect our business;

•We rely on third parties to conduct our nonclinical studies and our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize roflumilast cream, roflumilast foam, ARQ-252, ARQ-255 or any future product candidates;

•Risks related to our intellectual property could materially adversely impact our business, competitive position, financial condition, and results of operations;

•Risks related to government regulation of our industry and required approvals could materially adversely impact our business, competitive position, financial condition, and results of operations; and

•Future litigation could have a material adverse effect on our business and results of operations.

TRADEMARKS

The mark “Arcutis” and the Arcutis logo are our registered trademarks, and all product names are our common law trademarks. All other service marks, trademarks, and trade names appearing in this Annual Report on Form 10-K are the property of their respective owners. Solely for convenience, the trademarks and tradenames referred to herein appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

MARKET AND INDUSTRY DATA

This Annual Report on Form 10-K contains estimates, projections and other statistical data and information concerning our industry, our business, and the markets for our product candidates. Some data and statistical information contained herein, including market size and opportunity figures for our product candidates, are based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources, our internal research, and knowledge of the industry and market in which we operate. Some data and statistical information are based on independent reports from third parties, including DR/Decision Resources, LLC, or Decision Resources Group, and Adelphi Group Limited, or Adelphi Group, as well as reports that we commissioned from third parties. Decision Resources Group makes no representation or warranty as to the accuracy or completeness of the data, or DR Materials, set forth herein and shall have, and accept, no liability of any kind, whether in contract, tort (including negligence) or otherwise, to any third-party arising from or related to use of the DR Materials by us. Any use which we or a third-party makes of the DR Materials, or any reliance on it, or decisions to be made based on it, are the sole responsibilities of us and such third-party. In no way shall any data appearing in the DR Materials amount to any form of prediction of future events or circumstances and no such reliance may be inferred or implied.

This information, to the extent it contains estimates or projections, involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates or projections. Industry publications and other reports we have obtained from independent parties generally state that the data contained in these publications or other reports have been obtained in good faith or from sources considered to be reliable, but they do not guarantee the accuracy or completeness of such data. The industry in which we operate is subject to risks and uncertainties due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications and reports.

4

Part I

Item 1. BUSINESS

Overview

We are a late-stage biopharmaceutical company focused on developing and commercializing treatments for dermatological diseases with high unmet medical needs. Our current portfolio is comprised of highly differentiated topical treatments with significant potential to treat immune-mediated dermatological diseases and conditions. We believe we have built the industry's leading platform for dermatologic product development. Our strategy is to focus on validated biological targets, and to use our drug development platform and deep dermatology expertise to develop differentiated products that have the potential to address the major shortcomings of existing therapies in our targeted indications. We believe this strategy uniquely positions us to rapidly advance our goal of bridging the treatment innovation gap in dermatology, while maximizing our probability of technical success.

Our lead product candidate, roflumilast cream, has successfully completed pivotal Phase 3 clinical trials in plaque psoriasis, demonstrating symptomatic improvement and favorable tolerability in this population. We have submitted a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA), and the FDA has set a Prescription Drug User Fee Act (PDUFA) action date of July 29, 2022. Roflumilast is a highly potent and selective phosphodiesterase type 4, or PDE4, inhibitor, an established biological target in dermatology, with multiple PDE4 inhibitors approved by the FDA for the systemic treatment of dermatological conditions. We are developing roflumilast cream for the treatment of plaque psoriasis, including psoriasis in intertriginous regions such as the groin, axillae, and inframammary areas, as well as atopic dermatitis. We have also successfully completed a long-term safety study of roflumilast cream in plaque psoriasis subjects, showing continued symptomatic improvement and favorable tolerability over a treatment period of 52 to 64 weeks. In atopic dermatitis, we have initiated three pivotal Phase 3 clinical studies: INTEGUMENT-1 and -2 are enrolling subjects six years of age or older and INTEGUMENT-PED is enrolling subjects between the ages of two and five years. We expect to provide topline data from each of INTEGUMENT-1 and -2 by the end of 2022. We intend to submit a supplemental New Drug Application (sNDA) for topical roflumilast cream for the treatment of atopic dermatitis patients aged six years or older in 2023 based on the results of INTEGUMENT-1 and -2. Due to the inherent challenges of enrolling young children in clinical trials, together with impacts on enrollment from COVID-19, we now expect to provide topline data from INTEGUMENT-PED in 2023. We intend to submit a subsequent sNDA for the younger age cohort based on INTEGUMENT-PED following the potential initial atopic dermatitis approval in patients aged six years or older.

We are also developing a topical foam formulation of roflumilast, and have successfully completed Phase 2 clinical trials in both seborrheic dermatitis and scalp and body psoriasis. In seborrheic dermatitis, we initiated a single pivotal Phase 3 clinical trial, with topline data anticipated in mid-year 2022. We also initiated a single pivotal Phase 3 clinical trial in scalp and body psoriasis, with topline data anticipated in the second half of 2022. If these pivotal Phase 3 trials for roflumilast foam are positive, we expect the data to be a sufficient basis for an NDA submission to the FDA for each indication.

Beyond topical roflumilast, we are developing ARQ-252, a potent and highly selective topical Janus kinase type 1, or JAK1, inhibitor. In May 2021, we announced that the Phase 2 study of ARQ-252 in chronic hand eczema did not meet its primary endpoint, with further analyses of the study pointing to inadequate local drug delivery to the skin. Given these analyses, we also elected to terminate the Phase 2a clinical trial evaluating ARQ-252 as a potential treatment in vitiligo, as we began reformulation efforts to develop an enhanced formulation of ARQ-252 that delivers more active drug to targets in the skin. Additionally, we have formulation and nonclinical efforts continuing for ARQ-255, an alternative deep-penetrating topical formulation of ARQ-252 designed to reach deeper into the skin and hair follicle in order to potentially treat alopecia areata. The ARQ-255 formulation is separate and distinct from ARQ-252, and thus there are no implications to ARQ-255 from ARQ-252.

5

Dermatological diseases such as psoriasis, atopic dermatitis, seborrheic dermatitis, hand eczema, alopecia areata, and vitiligo affect hundreds of millions of people worldwide each year, impacting their quality of life, and physical, functional, and emotional well-being. There are many approved treatments for these conditions, but a large opportunity remains due to issues with existing treatments. Topical treatments are used for nearly all patients, but existing topicals are limited by one or more of the following: modest response rates, side effects, patient adherence, application site restrictions, and limits on duration of therapy. Topical corticosteroids, or TCS, are commonly used as the first-line therapy for the treatment of inflammatory skin conditions such as psoriasis, atopic dermatitis, and seborrheic dermatitis. While many patients see improvements, long-term TCS treatment carries the risk of a variety of significant side effects. As a result, TCS are typically used intermittently for brief periods, which can lead to disease flares when patients stop TCS therapy. In psoriasis, vitamin D analogs are also used, but have lower response rates than TCS and are frequently irritating. In atopic dermatitis, topical calcineurin inhibitors, or TCIs, and crisaborole (Eucrisa), a topical non-steroidal PDE4 inhibitor, are used, but have lower response rates than TCS and are associated with application site burning. TCIs also have a boxed warning for cancer risk. Topical ruxolitinib (Opzelura) was approved for the treatment of atopic dermatitis in September 2021, but carries an extensive boxed warning for numerous severe side effects, and is limited to short-term, intermittent use after failure of other treatments. In seborrheic dermatitis, in addition to TCS, topical antifungals are commonly used, but have limited efficacy.

Biologic and systemic therapies are also available for some diseases, but are typically indicated for a small percentage of the affected population. Biologics for psoriasis and atopic dermatitis have shown impressive response rates but are only indicated for the minority of patients with moderate-to-severe forms of disease, are expensive, and often face reimbursement and access restrictions. Treatment with oral systemic therapies such as methotrexate and apremilast (Otezla) has also been limited given modest symptomatic improvement and the frequency of adverse events. Additionally, many patients on biologic and systemic therapies still require adjunctive topical therapy to treat residual symptoms.

Given the limitations associated with existing treatments, we believe patients with inflammatory skin conditions and their dermatologists are dissatisfied with their current treatment options. We believe that there is a significant opportunity to leverage developments in other fields of medicine, particularly inflammation and immunology, to address the significant need for effective chronic treatments in immuno-dermatology. Our initial focus is to address patients’ significant need for innovative topical treatments that directly target molecular mediators of disease, have the potential to show significant symptomatic improvement, maintain a low risk of toxicity or side effects, and are suitable for chronic use on all areas of the body. Based on market research and our internal estimates, we estimate our primary addressable market opportunity, which focuses on U.S. patients treated by dermatologists with topical therapies, at 5 million patients across psoriasis, atopic dermatitis, and seborrheic dermatitis. There are millions of additional U.S. patients suffering from chronic hand eczema, vitiligo, and alopecia areata, as well as millions of patients treated by physicians other than dermatologists for their psoriasis, atopic dermatitis, and seborrheic dermatitis.

6

Our Pipeline

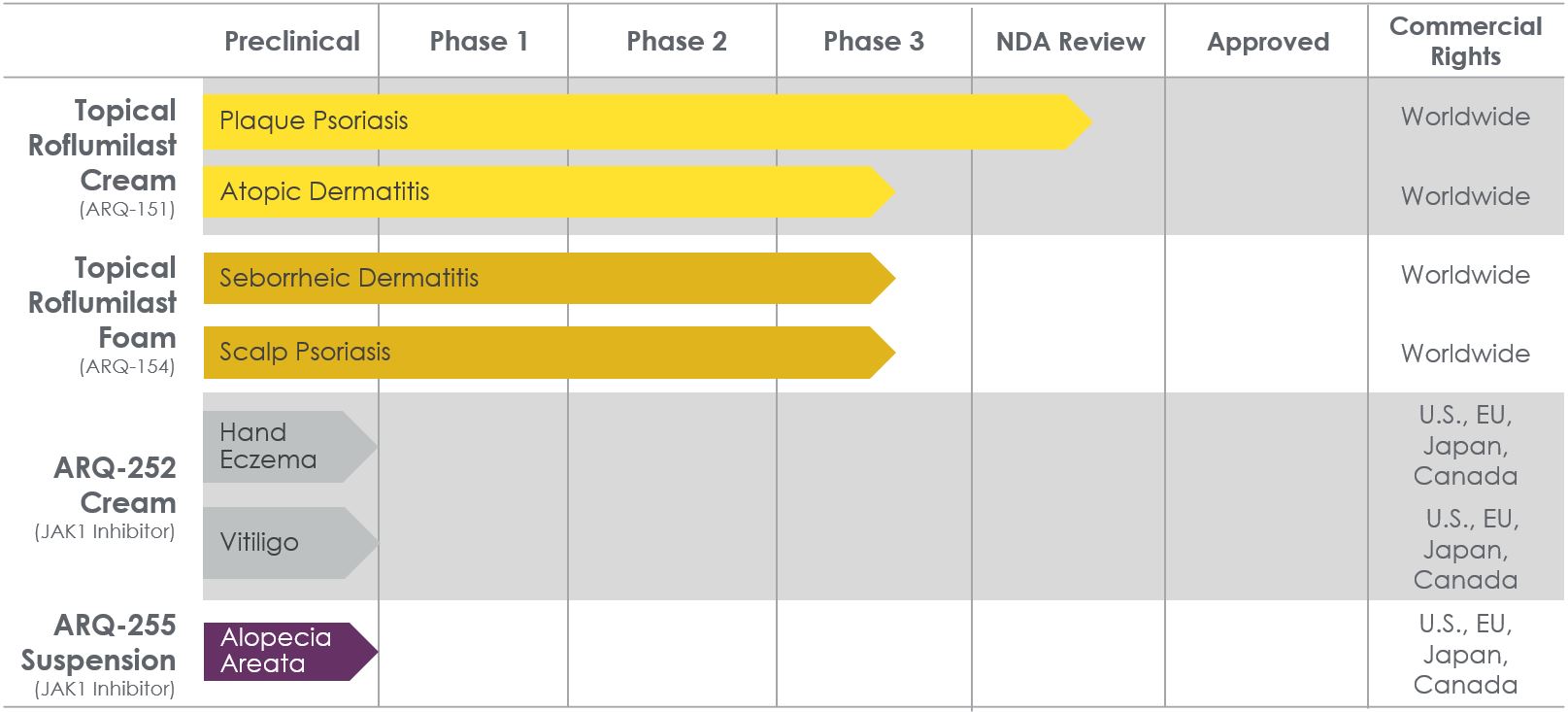

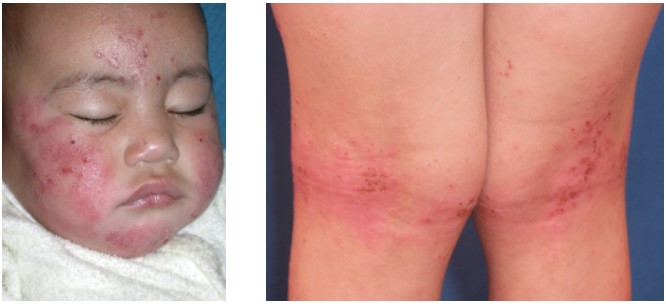

The following charts summarize our product pipeline and our upcoming anticipated milestones:

7

Our Strategy

Our strategy is to leverage recent innovations in inflammation and immunology to identify molecules against validated biological targets in dermatology, and to develop and commercialize best-in-class products based on those molecules that address significant unmet needs in immuno-dermatology:

Key elements of our strategy include:

•Rapidly develop and commercialize our lead product candidate, roflumilast cream, for the treatment of patients with plaque psoriasis and atopic dermatitis. Based on the clinical data generated to date, we believe roflumilast cream has the potential to be the best-in-class non-steroidal topical treatment, with symptomatic improvement in psoriasis patients similar to the combination of a high potency steroid and calcipotriene while potentially delivering a low risk of side effects and a favorable tolerability profile that enables chronic administration, including for pediatric patients. In plaque psoriasis, we have successfully completed pivotal Phase 3 clinical trials, as well as a long-term safety study. We have submitted an NDA to the FDA, and the FDA has set a PDUFA action date of July 29, 2022. In atopic dermatitis, we have initiated three pivotal Phase 3 clinical studies: INTEGUMENT-1 and -2 are enrolling subjects six years of age or older, and INTEGUMENT-PED is enrolling subjects between the ages of two and five years. We expect to provide topline data from each of INTEGUMENT-1 and -2 by the end of 2022. We intend to submit an sNDA for topical roflumilast cream for the treatment of atopic dermatitis patients aged six years or older in 2023 based on the results of INTEGUMENT-1 and -2. We expect to provide topline data from INTEGUMENT-PED in 2023 and submit a subsequent sNDA for the younger age cohort following the potential initial atopic dermatitis approval in patients aged six years or older.

•Expand our addressable market with roflumilast foam. We are developing a foam formulation of roflumilast for the treatment of scalp and body psoriasis and seborrheic dermatitis, diseases impacting hair-bearing areas of the body where a cream is not suitable. We have successfully completed Phase 2 clinical trials with roflumilast foam in both seborrheic dermatitis and scalp psoriasis, demonstrating promising efficacy and tolerability in both diseases. In seborrheic dermatitis, we initiated a single pivotal Phase 3 clinical trial, with topline data anticipated in mid-year 2022. We also initiated a single pivotal Phase 3 clinical trial in scalp and body psoriasis, with topline data anticipated in the second half of 2022. If these pivotal Phase 3 trials for roflumilast foam are positive, we expect the data to be sufficient basis for an NDA submission to the FDA for each indication.

•Establish an integrated development and commercial organization. We believe the concentrated prescriber base of the U.S. dermatology segment provides us with the opportunity to build a fully integrated commercial organization and targeted sales force for the commercialization of our product candidates among dermatology specialists. To further enhance the value of our product candidates, we may selectively seek partners to commercialize our products outside of the dermatology specialist segment, and to develop and commercialize our products outside of the U.S. market.

•Further expand our product portfolio through the development of ARQ-252/ARQ-255. We are developing ARQ-252 and ARQ-255, both of which contain a JAK1 inhibitor with a high relative selectivity to JAK1 over Janus kinase type 2, or JAK2, inhibitor for the treatment of chronic hand eczema and vitiligo, and potentially alopecia areata. Given its high relative selectivity to JAK1 over JAK2, we believe ARQ-252 and ARQ-255 have the potential to treat inflammatory diseases without causing the hematopoietic adverse effects associated with JAK2 inhibition, giving it the potential to be best-in-class. In May 2021, we announced that the Phase 2 study of ARQ-252 in chronic hand eczema did not meet its primary endpoint, with further analyses of the study pointing to inadequate local drug delivery to the skin. Given these analyses, we also elected to terminate the Phase 2a clinical trial evaluating ARQ-252 as a potential treatment in vitiligo, as we began reformulation efforts to develop an enhanced formulation of ARQ-252 that delivers more active drug to targets in the skin. Our formulation and nonclinical efforts for ARQ-255, an alternative deep-penetrating topical formulation of ARQ-252 designed to reach deeper into the skin in order to potentially treat alopecia areata, are continuing. The ARQ-255 formulation is separate and distinct from ARQ-252, and thus there are no implications to ARQ-255 from ARQ-252.

•Leverage our product development platform to continue innovating and developing novel new treatments for dermatological diseases. Our expertise in dermatological clinical development and commercialization allows us to identify areas of high unmet needs, and our product development platform may allow us to develop novel new treatments that address those needs, as it has already with roflumilast cream, roflumilast foam, and ARQ-252/ARQ-255.

8

•Evaluate strategic opportunities to in-license best-in-class dermatology assets consistent with our core strategy. Leveraging our deep expertise in identifying promising drug candidates in dermatology, we will continue to seek best-in-class assets across treatment modalities directed against validated targets. We will continue to explore opportunities to in-license assets and develop them to address unmet medical needs in dermatology.

We believe one of our core strengths is that we have built the industry's leading platform for dermatology product development. This platform, coupled with our deep expertise in dermatology clinical development and commercialization, is the engine that allows us to generate our highly differentiated product candidates. Our platform has already generated several significant innovations, including:

•Our innovative topical formulation of roflumilast (patented)

•The pharmacokinetic characteristics relating to improving delivery and extending half-life of both the cream and foam formulations of topical roflumilast (patented)

•A novel topical cream without skin-drying surfactants (patent pending)

•The first topical treatment for seborrheic dermatitis with dual anti-fungal and anti-inflammatory action (patent pending)

•Our novel “4D” deep-penetrating formulation allowing topical delivery deeper in the dermis (patent pending).

Roflumilast Cream (ARQ-151)

Our lead product candidate, roflumilast cream, has the potential to offer symptomatic improvement in psoriasis patients similar to the combination of a high potency steroid and calcipotriene, a favorable tolerability profile, the ability to be used chronically, and little to none of the application site reactions associated with many existing topical treatments. Roflumilast cream is designed for simple once-a-day application for chronic use, does not burn or sting on application, and can be used on any part of the body, including sensitive or difficult-to-treat areas, such as the face and intertriginous regions. It quickly and easily rubs into the skin without leaving a greasy residue, does not stain clothing or bedding, or have an unpleasant smell. Roflumilast is a highly potent and selective PDE4 inhibitor that was approved by the FDA for systemic treatment to reduce the risk of exacerbations of chronic obstructive pulmonary disease (COPD) in 2011. Roflumilast has demonstrated a potency advantage of approximately 25x to in excess of 300x compared to the active ingredients in the two other FDA-approved PDE4 inhibitors, Eucrisa and Otezla.

We are currently developing roflumilast cream for plaque psoriasis, including intertriginous psoriasis, as well as atopic dermatitis. We have successfully completed pivotal Phase 3 clinical trials, as well as a long-term safety study, in plaque psoriasis. We have submitted an NDA to the FDA, and the FDA has set a PDUFA action date of July 29, 2022. In atopic dermatitis, we completed our Phase 2 proof of concept study and initiated our Phase 3 clinical program. The atopic dermatitis Phase 3 program includes 4 studies: two identical studies with approximately 650 subjects each, ages 6 and above (INTEGUMENT-1 and -2); a study with approximately 650 subjects ages 2-5 (INTEGUMENT-PED); and an open label extension study with up to 1,500 subjects (INTEGUMENT-OLE). We expect to provide topline data from each of INTEGUMENT-1 and -2 by the end of 2022. We intend to submit an sNDA for topical roflumilast cream for the treatment of atopic dermatitis patients aged six years or older in 2023 based on the results of INTEGUMENT-1 and -2. We expect to provide topline data from INTEGUMENT-PED in 2023 and submit a subsequent sNDA for the younger age cohort following the potential initial atopic dermatitis approval in patients aged six years or older.

In July 2018, we executed a licensing agreement with AstraZeneca AB (AstraZeneca) for exclusive worldwide rights to roflumilast as a topical product in humans solely for dermatological indications. We have built our own intellectual property portfolio around topical uses of roflumilast, with issued and pending formulation, pharmacokinetic, and method-of-use patents in the United States and other jurisdictions from several distinct patent families, which should provide us with exclusivity for our product at least into 2037.

9

Plaque Psoriasis

Psoriasis Background

Psoriasis is an immune disease that occurs in about 3% of the U.S. population, representing approximately 8.6 million patients. About 90% of cases are plaque psoriasis, which is characterized by “plaques”, or raised, red areas of skin covered with a silver or white layer of dead skin cells referred to as “scale” (see figures below). Psoriatic plaques can appear on any area of the body, but most often appear on the scalp, knees, elbows, trunk, and limbs, and the plaques are often itchy and sometimes painful. At least 40% of plaque psoriasis patients have plaques on their scalp, about 15% have plaques in their intertriginous regions, approximately 10% have plaques on their face, and one in three has plaques on their elbows and knees. Each of these areas present a variety of treatment challenges which may be well suited to treatment with topical roflumilast.

Psoriasis patients are generally characterized as mild, moderate, or severe, with approximately 75% experiencing a mild to moderate form of the disease and 25% experiencing a moderate-to-severe form of the disease. Pruritus (itching) is a particularly common and bothersome symptom for patients, which can be severe and impact sleep patterns. In addition, patients with plaque psoriasis can suffer substantial psychosocial impacts from their disease and have a 50% greater chance of depression than the general population.

Figures: Plaque Psoriasis

Source: DermNet (right)

Current Psoriasis Treatment Landscape

The vast majority of psoriasis patients are treated with topical therapies, of which there have been no novel treatments approved in over 20 years. Despite their widespread use, existing topical therapies all possess substantial shortcomings:

•Topical steroids are associated with a number of side effects, including, among others, hypothalamic-pituitary-adrenal (HPA) axis suppression, skin atrophy (thinning), striae (stretch marks), and telangiectasia (spider veins). Some of these side effects are irreversible. Consequently, high potency topical steroids are not recommended for chronic use, and physicians generally will not prescribe them for treatment on the face or in the intertriginous regions.

10

Figures: Steroid-induced striae (left) and Steroid-induced skin atrophy (right)

Source: DermNet (right)

•Vitamin D3 analogs provide substantially less symptomatic improvement than high potency steroids, and are frequently irritating. While they can be used chronically, tolerability issues with their use can be a challenge, and physicians generally will not prescribe them for use on the face or in the intertriginous regions.

•Vitamin D3/steroid combinations offer better symptomatic improvement than either of the two individual components alone, but still carry a risk of HPA axis suppression, and are limited in their duration of use.

Because high potency steroids and combinations containing high potency steroids provide robust symptomatic improvement for psoriasis patients, most physicians initiate treatment for nearly all patients with them. However, due to the limitations on duration of treatment to between two and eight weeks, most physicians will switch the patient to a low- to mid-potency steroid or to a vitamin D analog to manage the patient’s psoriasis chronically. These “step down” options provide less symptomatic improvement and are often irritating. Also, rebound is a known challenge with steroids, where psoriasis returns even worse than before steroid treatment. As a result, patients are constantly cycling between effective short courses of high potency steroids and less effective “step down” maintenance treatments.

Treatment with biologics remains highly restricted. In the United States, less than 20% of moderate-to-severe psoriasis patients (equivalent to 6% of all psoriasis patients) are on biologic therapy. The uptake of biologics has remained limited due to multiple factors, including the fact that they are indicated only for use in moderate-to-severe patients, their high cost and patient co-payments, reimbursement and access restrictions, perceived risk of side effects, and patient fear of injection.

Treatment with non-biologic systemic therapy, such as methotrexate or Otezla is also limited. According to Decision Resources Group, non-biologic systemic therapy represents approximately 8% of patients worldwide and 11% of patients in the United States. The use of methotrexate has declined due to concerns about side effects and mandatory routine monitoring. Otezla has a limited U.S. market share in part due to its high annual price relative to topical treatments, modest symptomatic improvement, and frequent adverse events.

Atopic Dermatitis

Atopic Dermatitis Background

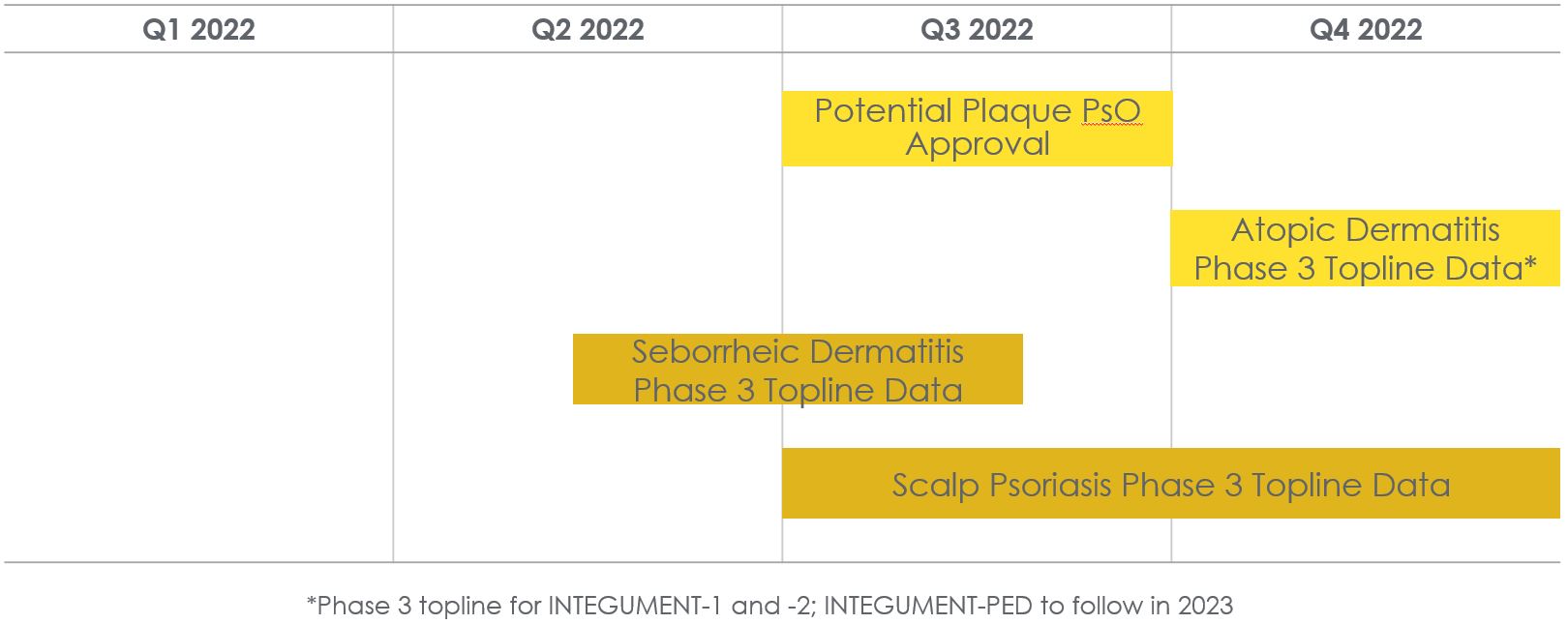

Atopic dermatitis is the most common type of eczema, affecting approximately 26 million people in the United States. Atopic dermatitis is the most common skin disease among children, with prevalence steadily increasing from 8% to 12% in the last two decades. Atopic dermatitis is characterized by a defect in the skin barrier, which allows allergens and other irritants to enter the skin, leading to an immune reaction and inflammation. This reaction produces a red, itchy rash, most frequently occurring on the face, arms and legs, and the rash can cover significant areas of the body (see figures below). The rash causes significant pruritus (itching), which can lead to damage caused by scratching or rubbing and perpetuating an ‘itch-scratch’ cycle.

11

Figures: Atopic Dermatitis Lesions

Source: DermNet

Given the high proportion of pediatric patients, safety and tolerability of atopic dermatitis treatments is paramount. Atopic dermatitis imposes a substantial burden on the patient, parents, and family. Pediatric patients with atopic dermatitis can suffer from sleep disturbances, behavioral problems, irritability, crying, interference with normal childhood activities, and social functioning. Adults with atopic dermatitis also frequently suffer from sleep disturbances, emotional impacts, and impaired social functioning. Adults with atopic dermatitis also appear to be at a significantly increased risk of anxiety, depression, and suicidal ideation compared to the general population.

Current Atopic Dermatitis Treatment Landscape

The vast majority of atopic dermatitis patients are being treated with topical therapies, particularly low- to mid-potency topical steroids and TCIs, and these two classes of drugs constituted nearly all atopic dermatitis prescriptions in 2021. Despite their widespread use, existing topical therapies all possess substantial shortcomings:

•Topical steroids pose a particular concern in pediatric patients due to the risk of systemic absorption, and the consequent risk of HPA axis suppression, and potential developmental problems. Chronic use of topical steroids in atopic dermatitis patients is generally avoided. Many physicians are also reluctant to use steroids to treat atopic dermatitis on the face due to the increased risk of glaucoma and cataracts, or the diaper/groin region due to risk of skin thinning. There is also considerable concern among many parents about treating their children with steroids.

•Topical calcineurin inhibitors are generally seen as providing less symptomatic improvement than topical steroids and are also associated with some application site burning. In 2005 the FDA placed a boxed warning on the labels of both TCIs regarding a potential increased risk of cancers, especially lymphomas, associated with their use, which often creates significant parental resistance to their use.

•Eucrisa is a topical non-steroidal PDE4 inhibitor approved by the FDA in 2016. Despite initial interest among the physician community to adopt the product, its growth has been hampered by modest symptomatic improvement, frequent occurrences of application site burning and stinging, and disadvantaged reimbursement status compared to other atopic dermatitis treatments.

•Opzelura is a topical JAK inhibitor approved in September 2021 for the treatment of mild to moderate atopic dermatitis. The label carries an extensive boxed warning for serious infections, all-cause mortality, malignancy, major adverse cardiovascular events and thrombosis, and the product is limited to short-term, non-continuous use after failure of other treatments.

Treatment with biologics like Dupixent remains highly restricted. In the United States, less than 2% of all atopic dermatitis patients are on biologic therapy. The uptake of biologics has remained limited due to multiple factors, including the fact that they are indicated only for use in moderate-to-severe patients, their high cost and patient co-payments, reimbursement and access restrictions, and patient fear of injection.

12

Roflumilast Cream Clinical Development

Plaque Psoriasis

We have successfully completed the pivotal clinical studies of roflumilast cream in plaque psoriasis, and submitted an NDA to the FDA. The FDA has set a PDUFA action date of July 29, 2022. Our NDA submission is supported by the positive data from the pivotal Phase 3 clinical studies, DERMIS-1 and DERMIS-2, and our long-term Phase 2b open label study. In all trials, roflumilast cream was generally well-tolerated with a favorable safety and tolerability profile.

Key Completed Trials

ARQ-151-301 and 302 (DERMIS-1 and DERMIS-2 pivotal Phase 3 studies)

The DERMIS-1 and DERMIS-2 studies were identical pivotal Phase 3 randomized, parallel, double-blind, vehicle-controlled, multi-national, multi-center studies in which subjects age 2 years and above with mild, moderate, or severe chronic plaque psoriasis involving between 2% and 20% body surface area received 8 weeks of (i) roflumilast cream 0.3% once daily or (ii) matching vehicle once daily. DERMIS-1 enrolled 439 subjects and DERMIS-2 enrolled 442 subjects.

Results from the eight-week treatment period demonstrated statistically significant improvement compared to the matching vehicle on key efficacy endpoints. On the studies’ primary efficacy endpoint of percentage of subjects achieving Investigator Global Assessment (IGA) success, which was defined as a score of “clear” or “almost clear” plus a 2-grade improvement from baseline at week 8, 42.4% of subjects treated with roflumilast cream achieved IGA Success, compared to 6.1% of subjects treated with vehicle (p < 0.0001) in DERMIS-1, and 37.5% of subjects treated with roflumilast cream achieved IGA Success, compared to 6.9% of subjects treated with vehicle (p<0.0001) in DERMIS-2. Roflumilast cream also demonstrated statistically significant improvements over vehicle on key secondary endpoints, including on Intertriginous IGA Success, Psoriasis Area Severity Index-75, reductions in itch as measured by the Worst Itch-Numerical Rating Scale, and patient perceptions of symptoms as measured by the Psoriasis Symptoms Diary (PSD).

Roflumilast cream was well-tolerated by the patient populations, with rates of treatment-emergent adverse events (“TEAEs”) low and similar to vehicle, with most TEAEs assessed as mild to moderate in severity. Of the subjects treated with roflumilast cream, five subjects (1.7% of subjects) in DERMIS-1 and one subject (0.3% of subjects) in DERMIS-2 discontinued the study due to a TEAE. There were no treatment-related serious adverse events.

ARQ-151-202 (Long-Term Safety Study)

The long-term safety study was a Phase 2, multi-center, open label study of the long-term safety and efficacy of roflumilast cream 0.3% in adult subjects with chronic plaque psoriasis involving up to 25% total body surface area (BSA), evaluated in two cohorts: subjects who completed the ARQ-151-201 Phase 2b, randomized, controlled trial; and previously untreated subjects. All subjects applied roflumilast cream 0.3% once daily for 52 weeks at home. Approximately half (164 out of 332) of the subjects entered this long-term study after completing treatment with roflumilast cream 0.3% or 0.15% in the randomized Phase 2b study (ARQ-151-201) and therefore received up to 64 weeks of total treatment with roflumilast cream (12 weeks in the randomized Phase 2b study and 52 weeks in the long-term safety study). Periodic clinic visits included assessments for clinical safety, application site reactions, and disease improvement or progression. The primary outcome measures of this long-term safety study were the occurrence of TEAEs and the occurrence of serious adverse events.

13

In this open label study, roflumilast cream 0.3% applied once daily for up to 52 weeks demonstrated favorable safety and tolerability over the long-term treatment period, consistent with what was seen in the randomized Phase 2b study, with only 3.6% of subjects experiencing a treatment-related adverse event during 52 weeks of treatment. Additionally, a durable treatment effect was maintained through 52 to 64 weeks. At week 52 of the long-term safety study, 44.8% of all subjects attained an IGA Success of clear or almost clear, with 34.8% of subjects in Cohort 1 and 39.5% of subjects in Cohort 2 achieving IGA Success, defined as a score of clear or almost clear plus a 2-grade improvement from baseline. Additionally, of the subjects in the 12-week randomized Phase 2b study who were treated with roflumilast cream 0.3%, and who attained an IGA of clear or almost clear at 12 weeks in the first study, then continued on treatment in the long-term safety study, 66.7% had an IGA of clear or almost clear at the end of 64 weeks of treatment or their last visit. Of the 332 subjects in this study, 73.5% completed the full 52 weeks of open label treatment, with only 3.9% of subjects discontinuing the study due to an adverse event and less than 1% of subjects discontinuing due to lack of efficacy. There were no treatment related serious adverse events reported.

Atopic Dermatitis

Key Completed Trials

ARQ-151-212

The most recent study completed with roflumilast cream in atopic dermatitis was a multi-center, double-blind, vehicle-controlled proof of concept Phase 2 study, in which 136 adolescents (ages 12 and above) and adults with mild to moderate atopic dermatitis involving between 1.5% and 35% BSA were randomized across three arms to receive once daily topical applications for 4 weeks of: (1) roflumilast cream 0.15%, or (2) roflumilast cream 0.05%, or (3) vehicle. The goals of this small proof of concept study were to establish whether roflumilast cream provides a signal of potential symptomatic improvement in atopic dermatitis subjects, as well as to gain an understanding of its tolerability. Completion rates for the study were 98% in the roflumilast cream 0.15% arm, 91% in the roflumilast cream 0.05% arm, and 93% in the vehicle arm.

On the study's primary endpoint, the absolute change from baseline in the Eczema Area and Severity Index (EASI) Total Score after 4 weeks of once daily treatment, neither dose reached statistical significance versus vehicle, although roflumilast cream 0.15% showed a trend towards significance, with a mean improvement of 6.4 in subjects treated with roflumilast cream 0.15% compared to 4.8 in subjects treated with vehicle (p = 0.097). On the secondary endpoint of mean percent change from baseline on EASI, roflumilast cream 0.15% demonstrated a statistically significant improvement versus vehicle (72.3% versus 55.8%, p = 0.049). Efficacy was also observed at both doses as measured by EASI-75 (roflumilast cream 0.05%: 59.1% versus vehicle: 31.1%, p = 0.009 and roflumilast cream 0.15%: 52.3% versus vehicle: 31.1%, p = 0.045). On the Validated Investigator Global Assessment - Atopic Dermatitis (vIGA-AD), roflumilast cream 0.15% also demonstrated a statistically significant improvement versus vehicle in the percentage of subjects achieving clear or almost clear (roflumilast cream 0.15%: 52.3% versus vehicle: 31.1%, p = 0.040).

In this study, both doses of roflumilast cream were well-tolerated. 95% of subjects on active treatment completed the full study. The incidence of treatment-related TEAEs and application site reactions were low (< 5%) and similar between active treatment and vehicle. All TEAEs were mild to moderate in severity. Among subjects receiving roflumilast cream, there was only one serious adverse event (SAE), which was unrelated to treatment, and only one discontinuation due to a TEAE.

We believe the consistent evidence of improvement in atopic dermatitis signs and symptoms demonstrated by both strengths of roflumilast cream across multiple endpoints, as well as the magnitude of improvement demonstrated on both doses in this small proof-of-concept study, demonstrate the ability of roflumilast cream to effectively treat atopic dermatitis. Additionally, this study provided valuable insights into the safety and tolerability of roflumilast cream in this population, an especially important consideration because the majority of atopic dermatitis sufferers are young children. While the study did not reach statistical significance on every endpoint, the consistency of evidence for improvement in atopic dermatitis, coupled with favorable tolerability data, provides us with the confidence to continue the development of roflumilast cream in atopic dermatitis.

14

Key Ongoing Trials

The atopic dermatitis Phase 3 program includes four studies. INTEGUMENT-1 and -2 are multi-center, double-blind, vehicle-controlled Phase 3 studies, in approximately 650 subjects in each study, ages 6 and above with mild to moderate atopic dermatitis. Subjects have been randomized to receive once daily topical applications for 4 weeks of roflumilast cream 0.15%, or vehicle. The primary endpoint is the proportion of all randomized subjects who attain IGA Success, defined as a vIGA-AD score of ‘clear’ or ‘almost clear’ plus a 2-grade improvement from Baseline at week 4. Sharing a similar overall design, INTEGUMENT-PED is a multi-center, double-blind, vehicle-controlled Phase 3 study in approximately 650 subjects ages 2-5 with mild to moderate atopic dermatitis. Subjects have been randomized to receive once daily topical application for 4 weeks of roflumilast cream 0.05%, or vehicle and the primary endpoint is also the proportion of all randomized subjects who attain IGA Success at week 4. INTEGUMENT-OLE is an open label extension study that is enrolling up to 1,500 subjects who have completed INTEGUMENT-1, -2, or -PED. Subjects are to be treated for up to 52 weeks and the primary endpoints are the occurrence of TEAEs and SAEs. We expect to provide topline data from each of INTEGUMENT-1 and -2 by the end of 2022, and from INTEGUMENT-PED in 2023.

Roflumilast Foam (ARQ-154)

We are also developing a foam formulation of topical roflumilast for the treatment of scalp psoriasis and seborrheic dermatitis. Roflumilast foam contains the same highly potent and selective PDE4 inhibitor in roflumilast cream, and is nearly identical to roflumilast cream, with all ingredients in the foam being the same as those in the cream, other than reduced oil content and the addition of a propellant in the can to create the foam. Roflumilast foam is a light foam, similar to hair mousse, that has been designed to deliver the drug to the scalp while not leaving a greasy residue or disturbing hair style. The foam breaks easily upon agitation, creating a thin solution that can be rubbed easily into the scalp. Additionally, the product does not melt on the fingers prior to application. Roflumilast foam will not stain clothing or bedding, and does not have an unpleasant smell. Roflumilast foam is designed for simple once-a-day application and neither burns nor stings on application.

We have successfully completed Phase 2 studies of roflumilast foam in seborrheic dermatitis and scalp and body psoriasis, demonstrating promising efficacy and tolerability in both diseases, and are currently conducting pivotal Phase 3 studies in both indications. We believe that roflumilast foam may offer physicians and patients a highly differentiated clinical profile that is ideally suited to address unmet needs in the topical treatment of seborrheic dermatitis and scalp psoriasis.

Seborrheic Dermatitis

Seborrheic Dermatitis Background

Seborrheic dermatitis is a common skin disease that is estimated to occur in more than 10 million people in the United States. The disease causes red patches covered with large, greasy, flaking yellow-gray scales, and is frequently itchy. It appears most often on the scalp, face (especially on the nose, eyebrows, ears, and eyelids), upper chest, and back as depicted in the figure below. A milder variant of the disease is dandruff. While the pathogenesis of seborrheic dermatitis is not well understood, some experts believe a contributor is an over-abundance of Malassezia, a naturally occurring yeast found on normal skin but found in excess numbers on skin with seborrheic dermatitis. There also is an immunological or inflammatory component, possibly as a result of the proliferation of the Malassezia yeast and its elaboration of substances that irritate the skin. Seborrheic dermatitis can occur in both adults and infants, and in infants is commonly referred to as “cradle cap”.

Figures: Seborrheic Dermatitis

15

Current Seborrheic Dermatitis Treatment Landscape

There are a number of widely used treatments for seborrheic dermatitis, including antifungal agents, lower potency steroids, and immunomodulators.

•Antifungal agents, particularly azoles such as ketoconazole, are the cornerstone of therapy for seborrheic dermatitis. These agents are available in a variety of topical formulations, and oral antifungals are occasionally used in very severe cases. Antifungals in the treatment of seborrheic dermatitis are generally well-tolerated, although some patients experience irritant contact dermatitis, a burning or itching sensation, or dryness.

•Topical steroids, mostly low- to mid-potency, are often prescribed for patients suffering from seborrheic dermatitis because of the inflammatory component of the disease. Due to the risks associated with steroid use, particularly on the face, physicians try to limit duration or avoid steroid therapy.

•TCIs are also sometimes used off-label for the treatment of seborrheic dermatitis. These agents appear to provide symptomatic improvement in seborrheic dermatitis due to their anti-inflammatory effects. As previously noted, TCIs carry a boxed warning for the potential increased risk of cancers, especially lymphomas, associated with their use, and physicians generally try to avoid long-term use in patients suffering from seborrheic dermatitis. Additionally, TCIs only provide symptomatic improvement in seborrheic dermatitis in areas of skin that are very thin and where the drug can penetrate (i.e., largely the periocular areas only).

While physicians have a number of relatively inexpensive treatment options that provide symptomatic improvement for seborrheic dermatitis, the greatest unmet need relates to inadequate response to existing therapies in some patients, particularly in patients with more severe disease. Physicians report that up to one-third of severe patients suffering from seborrheic dermatitis, and a smaller percentage of mild- and moderate-severity patients, have an inadequate response to current seborrheic dermatitis treatments. Additionally, physicians are wary of using steroids on the face due to the risk of skin thinning, spider veins, folliculitis, and unnatural hair growth. Physicians are especially wary of using steroids near the eyes due to the potential increased risk of cataracts and glaucoma. Finally, many physicians are reluctant to treat chronically with steroids and TCIs, the main anti-inflammatory agents used in treatment of seborrheic dermatitis.

We believe roflumilast foam may present a unique dual mechanism of action to treat patients with seborrheic dermatitis. Based on clinical data to date across indications, topical roflumilast has demonstrated strong anti-inflammatory properties. In addition, a recent nonclinical study demonstrated that roflumilast foam may also possess anti-fungal effects, specifically against Malassezia, the fungus implicated in seborrheic dermatitis. Because the pathogenesis of seborrheic dermatitis potentially includes both a fungal overgrowth component and an inflammatory component, roflumilast foam’s putative dual mechanism of action may provide symptomatic improvement for patients not achieving suitable responses from currently available therapies. In addition to the opportunity in treatment resistant patients, we believe roflumilast foam may be an option for some patients as a first-line therapy, especially patients with involvement of the face where other therapies are contraindicated.

Scalp Psoriasis

Scalp Psoriasis Background

Scalp psoriasis is a manifestation of plaque psoriasis that occurs in nearly half of all psoriasis patients, characterized by plaques in the hair-bearing area of the scalp and sometimes extending to the forehead, back of the neck, or behind or inside the ears as depicted in the figures below. These psoriatic plaques are identical to plaques on other body areas, however topical treatment of these plaques is complicated by the difficulty of delivering topical drugs under hair-bearing areas. As with psoriatic plaques on other parts of the body, psoriasis on the scalp is often itchy and is sometimes painful. Scalp psoriasis can also be associated with hair loss, likely due to damage to the hair from excessive scratching, rubbing, or combing of the affected area.

16

Figures: Scalp Psoriasis

Source: DermNet (left)

Current Scalp Psoriasis Treatment Landscape

Scalp psoriasis treatments are similar to plaque psoriasis treatments, given that the plaques are identical to the plaques in other body areas. Topical treatments for scalp psoriasis include TCS, vitamin D analogs, or the combination, in a topical formulation suitable for hair-bearing areas, such as shampoos, solutions, or foams. However, many of the current topical formulations for hair-bearing areas are poorly formulated and are not well-received by patients. Existing topical treatments for the scalp also suffer from the same efficacy, safety, tolerability, and patient acceptability issues as existing creams and ointments. While both biologics and systemic treatments will improve scalp psoriasis, they suffer from the same limitations on their use as in plaque psoriasis.

Roflumilast Foam Clinical Development

We have successfully completed Phase 2 studies of roflumilast foam in seborrheic dermatitis and scalp psoriasis. In seborrheic dermatitis, we initiated a single pivotal Phase 3 clinical trial, with topline data anticipated in mid-year 2022. We also initiated a single pivotal Phase 3 clinical trial in scalp and body psoriasis, with topline data anticipated in the second half of 2022. If these pivotal Phase 3 trials for roflumilast foam are positive, we expect the data to be sufficient basis for an NDA submission to the FDA for each indication.

Seborrheic Dermatitis

Key Completed Trials

ARQ-154-203 (Phase 2 Study)

Study ARQ-154-203 enrolled 226 adult subjects with moderate-to-severe seborrheic dermatitis. This 8-week, multi-center, multi-national, double-blind, vehicle-controlled study evaluated the safety and efficacy of roflumilast foam 0.3% administered once daily to affected areas on the scalp, face, and body.

Roflumilast foam 0.3% administered once daily for 8 weeks demonstrated statistically significant improvement compared to a matching vehicle foam on key efficacy endpoints in subjects with moderate-to-severe seborrheic dermatitis. On the study’s primary endpoint assessed at week 8, roflumilast foam 0.3% achieved an IGA Success rate of 73.8% compared to a vehicle rate of 40.9% (p<0.0001). IGA Success is defined as the achievement of an IGA score of ‘clear’ or ‘almost clear’ on a 5-grade scale plus at least a two-point change from baseline. The onset of effect was rapid, with roflumilast foam statistically separating from vehicle as early as week 2, the first visit after baseline, on IGA Success as well as multiple secondary endpoints. For example, at week 8, 64.6% of subjects treated with roflumilast foam who had a baseline WI-NRS score of 4 achieved an itch reduction of at least 4 points compared to 34.0% of vehicle treated subjects (p=0.0007). Other secondary endpoints included overall assessment of erythema and overall assessment of scaling, which also had positive outcomes.

Importantly, roflumilast foam was well-tolerated, with rates of application site adverse events, treatment-related adverse events, and discontinuations due to adverse events low and similar to vehicle. Only 2 out of 154 subjects (1.3%) treated with roflumilast foam discontinued the study due to an adverse event, compared to 1 out of 72 subjects (1.4%) treated with the vehicle.

17

Key Ongoing and Upcoming Trials

ARQ-154-304 (Phase 3 Study)

The "STudy of Roflumilast foam Applied Topically for the redUction of seborrheic derMatitis" (STRATUM) is a Phase 3, parallel group, double blind, vehicle-controlled study of the safety and efficacy of roflumilast 0.3% foam administered once-daily in approximately 450 subjects ages nine and older with moderate to severe seborrheic dermatitis. The primary endpoint of the study is the proportion of subjects achieving IGA Success, defined as an IGA score of “clear” or “almost clear” plus a 2-point improvement at eight weeks.

ARQ-154-214 (Long-Term Safety)

Study ARQ-154-214 is an ongoing multi-center, open label Phase 2 long-term safety study of roflumilast foam 0.3% applied once daily in subjects with seborrheic dermatitis. This study includes subjects who were treated previously in the Phase 2 trial (ARQ-154-203), as well as subjects naive to treatment with roflumilast foam. Periodic clinic visits will include assessments for clinical safety, application site reactions, and disease improvement, or progression.

Scalp Psoriasis

Key Completed Trials

ARQ-154-204 (Phase 2b Study)

Study ARQ-154-204 was a multi-center, multi-national, double-blind, vehicle-controlled Phase 2b study, in which 304 adolescents (ages 12 and above) and adults with scalp psoriasis covering at least 10% of the total scalp involvement and up to 25% of total psoriasis involvement in all body areas were randomized to receive 8 weeks of (1) roflumilast foam 0.3% once daily, or (2) matching vehicle once daily. Randomization was 2:1, active to vehicle. The primary endpoint of the trial was achievement of a Scalp IGA (S-IGA) scale score of “clear” or “almost clear” plus a 2-grade improvement from baseline, or S-IGA, at week 8. Multiple secondary endpoints were also evaluated.

Roflumilast foam demonstrated statistically significant improvements compared to a matching vehicle foam on key efficacy endpoints. On the study’s primary endpoint of S-IGA Success assessed at week 8, roflumilast foam 0.3% achieved a rate of 59.1% compared to a vehicle rate of 11.4% (p<0.0001). Onset was rapid, with significantly higher rates of S-IGA Success noted as early as 2 weeks.

Multiple secondary endpoints were also met. On the key secondary endpoint of Body Investigator Global Assessment (B-IGA) success assessed at week 8, roflumilast foam 0.3% achieved a rate of 40.3% compared to a vehicle rate of 6.8% (p<0.0001), with separation from vehicle on B-IGA Success as early as 2 weeks. Symptomatic improvement was also demonstrated, with 71.0% of subjects treated with roflumilast foam 0.3% who had a baseline Scalp Itch Numeric Rating Scale score of 4 or greater achieving an itch reduction of at least 4 points at week 8 compared to 18.5% of vehicle treated subjects (p<0.0001).

Consistent with other clinical trials of topical roflumilast, roflumilast foam was well-tolerated, as evidenced by subject-reported local tolerability and rates of application site adverse events, treatment-related adverse events, and discontinuations due to adverse events low and similar to vehicle. Only 5 out of 200 subjects (2.5%) in the roflumilast foam treated group discontinued the study due to an adverse event, compared to 2 out of 104 subjects (1.9%) treated with the vehicle.

Key Ongoing and Upcoming Trials

ARQ-154-309 (Phase 3 Study)

The “A Randomized tRial Employing topiCal roflumilasT foam to treat scalp psORiasis” (ARRECTOR) study is a parallel group, double blind, vehicle-controlled pivotal Phase 3 study of the safety and efficacy of roflumilast 0.3% foam or a matching vehicle administered once-daily in approximately 420 subjects with scalp and body psoriasis ages 12 and older. The co-primary endpoints of the study include the proportion of subjects achieving S-IGA success and the proportion of subjects achieving B-IGA success, with IGA success defined as an IGA score of ‘clear’ or ‘almost clear’ plus a 2-point improvement from baseline after eight weeks.

18

ARQ-252

ARQ-252 is topical cream formulation of a potent and highly selective small molecule inhibitor of JAK1 that we are developing for chronic hand eczema and vitiligo. In a nonclinical study, ARQ-252 proved to be highly selective to JAK1 over JAK2. We believe that due to its high selectivity for JAK1 over JAK2, ARQ-252 has the potential to treat inflammatory diseases without causing the hematopoietic adverse effects associated with JAK2 inhibition. As the only JAK1-selective topical in development, we believe that ARQ-252 could offer a best-in-class topical JAK inhibitor, with a more favorable safety and tolerability profile than other topical JAK inhibitors due to its selectivity to JAK1 over JAK2, robust symptomatic improvement due to its high potency against JAK1, and a convenient and patient-friendly cream formulation.

In May 2021, we announced that the Phase 1/2b study of ARQ-252 in chronic hand eczema did not meet its primary endpoint, with further analyses of the study pointing to inadequate local drug delivery to the skin. Importantly, there were no safety or tolerability issues seen in that study. Given these analyses, we also elected to terminate the Phase 2a clinical trial evaluating ARQ-252 as a potential treatment in vitiligo, as we began reformulation efforts to develop an enhanced formulation of ARQ-252 that delivers more active drug to targets in the skin. Additionally, we have formulation and nonclinical efforts continuing for ARQ-255, an alternative deep-penetrating topical formulation of ARQ-252 designed to reach deeper into the skin in order to potentially treat alopecia areata. The ARQ-255 formulation is separate and distinct from ARQ-252, and thus there are no implications to ARQ-255 from ARQ-252.

In December 2019, we exercised our exclusive option under our Hengrui License Agreement to exclusively license the active pharmaceutical ingredient in ARQ-252 for all topical dermatological uses in the United States, Canada, Europe, and Japan. Jiangsu Hengrui Medicine Co., Ltd. (Hengrui) is developing SHR-0302, the active ingredient in ARQ-252, for the oral treatment of various inflammatory and immunological disorders, including rheumatoid arthritis, Crohn’s disease, and ulcerative colitis, and has completed a Phase 2b study in rheumatoid arthritis. Under our agreement, we have the right to reference their safety data, along with the systemic toxicology data supporting their program. Hengrui has built strong intellectual property protection around the active ingredient in ARQ-252, and holds U.S. composition of matter patents, including patents for the bisulfate form of the active ingredient that do not begin to expire until 2033. We believe there is the potential for additional intellectual property protection of ARQ-252 through possible future formulation and other patents.

Chronic Hand Eczema

Eczema is a term used to describe a group of different diseases that cause the skin to become red, itchy and inflamed. There are multiple forms of eczema, including atopic dermatitis, contact dermatitis, hand eczema, dyshidrotic eczema, and seborrheic dermatitis. Eczema is very common, with some estimates that up to 30 million people in the United States may have some form of eczema.

Hand eczema is a common, predominantly inflammatory, skin disease characterized variously by redness, fluid filled blisters or bumps, scaling, cracking, itching and pain occurring on the hands, especially the palms (see figures below). It is the most common skin disease affecting the hands, with prevalence estimated at up to 2.5% of the population. The impact of hand eczema on patients can be significant, leading to work absences or disability, social stigmatization, and psychosocial distress.

Figures: Hand Eczema

19

Current Hand Eczema Treatment Landscape

Hand eczema is a difficult disease to treat. The palms of the hand have skin that can be up to ten times thicker than skin from other body areas, which inhibits drug absorption and the ability to deliver drugs topically. Hand eczema is typically treated with high potency topical steroids, mostly due to the aforementioned skin barrier challenges. In some cases, physicians also will incorporate barrier creams to aid in hydration and to prevent the irritant effect caused by occupational exposure, a common cause of hand eczema. There are currently no FDA-approved treatments specifically for the indication of hand eczema. However, LEO Pharma has demonstrated proof of concept for their topical JAK inhibitor, delgocitinib, in Phase 2 studies. Physicians report that a significant percentage of patients, including up to 40% of patients with severe dyshidrotic eczema (one type of hand eczema), have an inadequate response to currently available treatments. In those who respond to high potency topical steroids, skin atrophy becomes a problem with chronic use, even on the thick skin of the palms.

Vitiligo

Vitiligo is a chronic and disfiguring autoimmune disease that causes the complete loss of skin color in blotches or patches, frequently in a symmetrical distribution, and has a significant impact on the patient's quality of life. The disease is caused by the localized destruction by the immune system of melanocytes, the skin cells that produce the skin pigment melanin, resulting in complete depigmentation in the affected area.

Vitiligo can have profound psychological impact on patients, particularly those with skin of color. Patients may feel loss of self-esteem and experience stigmatization. At this point in time, there are no FDA-approved treatments for vitiligo, so patients are often treated with off-label combinations of steroids, TCIs, ultraviolet light, and lasers. As such, there is great unmet need for therapies that are more effective and less limiting than currently available treatment modalities.

ARQ-252 Clinical Development

Chronic Hand Eczema

ARQ-252-205 Study (Phase 2b Study)

In May 2021, we announced that the Phase 1/2b study of ARQ-252 in chronic hand eczema did not meet its primary endpoint of IGA clear or almost clear at week 12, with further analyses of the study pointing to inadequate local drug delivery to the skin. Importantly, there were no safety or tolerability issues seen in that study. We are currently working on re-formulating ARQ-252 to develop an enhanced formulation that delivers more active drug to targets in the skin.

Vitiligo

ARQ-252-213 Study (Phase 2a Study)

Given the failure of the Phase 1/2b study of ARQ-252 in chronic hand eczema, and the data pointing towards inadequate drug delivery, we elected to terminate the Phase 2a clinical trial evaluating ARQ-252 as a potential treatment in vitiligo. We are currently working on re-formulating ARQ-252 to develop an enhanced formulation that delivers more active drug to targets in the skin.

20

ARQ-255

We are also developing ARQ-255, an alternative topical formulation of ARQ-252 designed to reach deeper into the skin in order to potentially treat alopecia areata. Alopecia areata is an autoimmune disorder that causes the immune system to incorrectly attack the body’s own cells, specifically the hair follicles, leading to loss of hair—usually in patches—on the scalp, face or sometimes other areas of the body. While oral JAK inhibitors have shown symptomatic improvement in the treatment of alopecia areata, multiple topically applied JAK inhibitors have failed to demonstrate symptomatic improvement in alopecia areata. It is our belief that this discrepancy is due to the site of inflammation driving alopecia areata, deep in the skin at the base (bulb) of the hair follicle. While oral JAK inhibitor administration can achieve required levels of drug at the site of inflammation, conventional topical applications are unlikely to deliver concentrations of JAK inhibitors to the site of inflammation adequate to treat alopecia areata. We have undertaken a formulation effort we refer to as Deep Dermal Drug Delivery (“4D” technology), that leverages some of the unique physical properties of the active pharmaceutical ingredient in ARQ-255, and which we believe may allow us to topically deliver sufficient concentrations of the drug to potentially treat alopecia areata via topical administration. Formulation and nonclinical efforts are continuing for ARQ-255.

Competition

The biotechnology and pharmaceutical industry is highly competitive, and is characterized by rapid and significant changes, intense competition and a bias towards proprietary products. We will face competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, and generic drug companies. Any product candidate that we successfully develop and commercialize will compete with existing treatments, including those that may have achieved broad market acceptance, and any new treatment that may become available in the future.

Many of our competitors have greater financial, technical, and human resources than we have. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Our commercial opportunity could be reduced or eliminated if our competitors develop or market products or other novel therapies that offer more symptomatic improvement, have a lower risk of side effects, or are less costly than our current or future product candidates.

Our success will be based in part on our ability to identify, develop and commercialize a portfolio of product candidates that have a lower risk of side effects and/or provide more symptomatic improvement than competing products.