UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Tel:

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| * | Not for trading, but only in connection with the listing on the |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s class the period covered by the annual report:

As of December 31, 2022, there were

83,109,689 ordinary shares in issue1, being the sum of (i)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company | ||

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes

This Annual Report on Form 20-F is incorporated by reference into the Registrant’s Registration Statements on Form F-3 (File No. 333-256630) filed with SEC on May 28, 2021, Form S-8 (File No. 333-238679) filed with SEC on May 26, 2020, Form S-8 (File No. 333-259748) filed with SEC on September 23, 2021, and Form S-8 (File No. 333-265413) filed with SEC on June 3, 2022.

TABLE OF CONTENTS

i

| PART II | 153 | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 153 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 153 |

| ITEM 15. | CONTROLS AND PROCEDURES | 153 |

| ITEM 16 | [RESERVED] | 155 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 155 |

| ITEM 16B. | CODE OF ETHICS | 155 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 155 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 155 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 155 |

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 155 |

| ITEM 16G. | CORPORATE GOVERNANCE | 156 |

| ITEM 16H. | MINE SAFETY DISCLOSURE | 156 |

| ITEM 16I. | DISCLOSURE REGARDING FOREIGN JURISDICATION THAT PREVENT INSPECTIONS | 156 |

| PART III | 157 | |

| ITEM 17. | FINANCIAL STATEMENTS | 157 |

| ITEM 18. | FINANCIAL STATEMENTS | 157 |

| ITEM 19. | EXHIBITS | 157 |

ii

INTRODUCTION

We began our operations by incorporating AnPac Bio-Medical Science Co., Ltd., or AnPac Bio, in January 2010 as a British Virgin Islands, or BVI, business company limited by shares under the BVI Business Companies Act. On May 9, 2023, we changed our name to Fresh2 Group Limited to reflect our entry into the Asian e-commerce food business in the U.S.

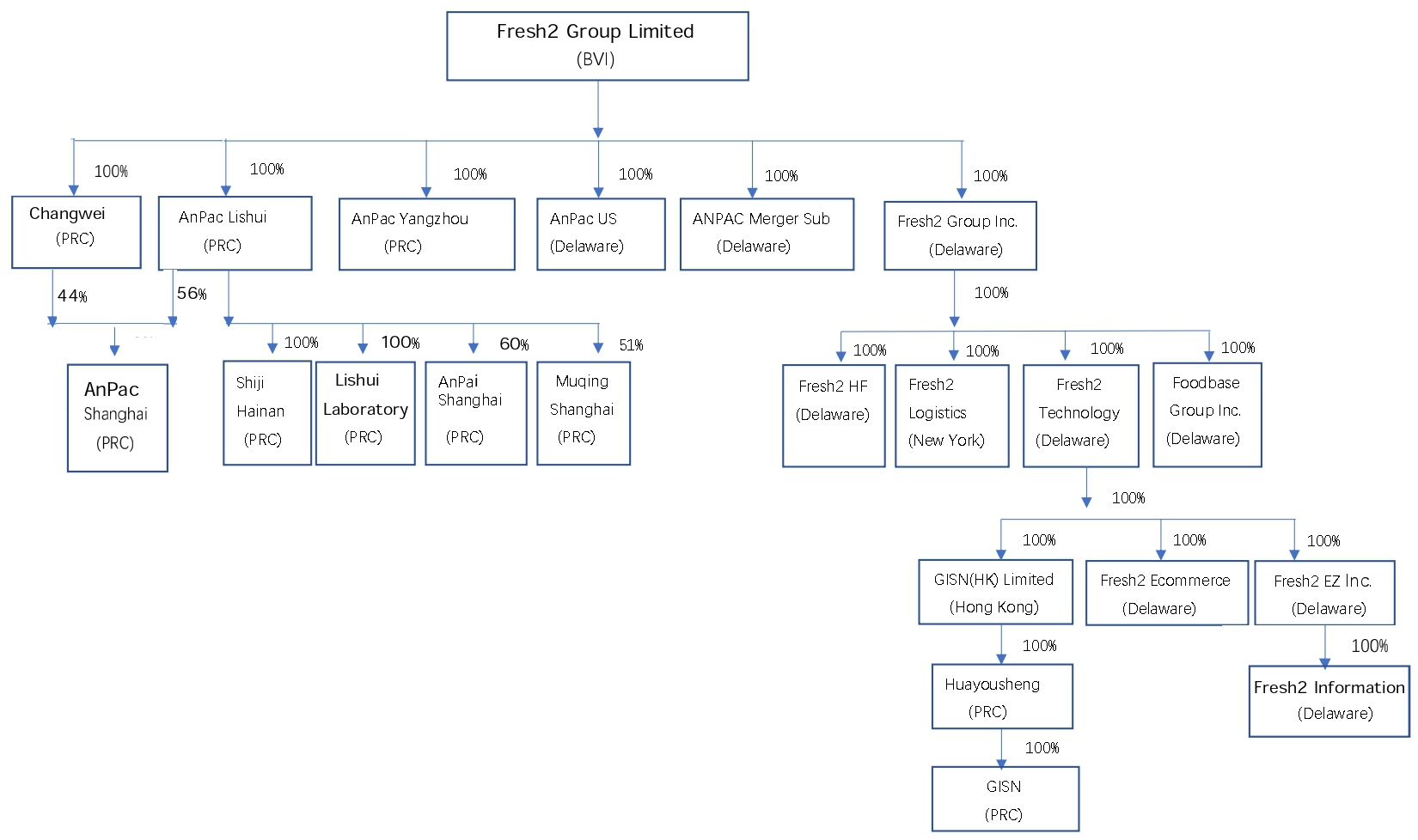

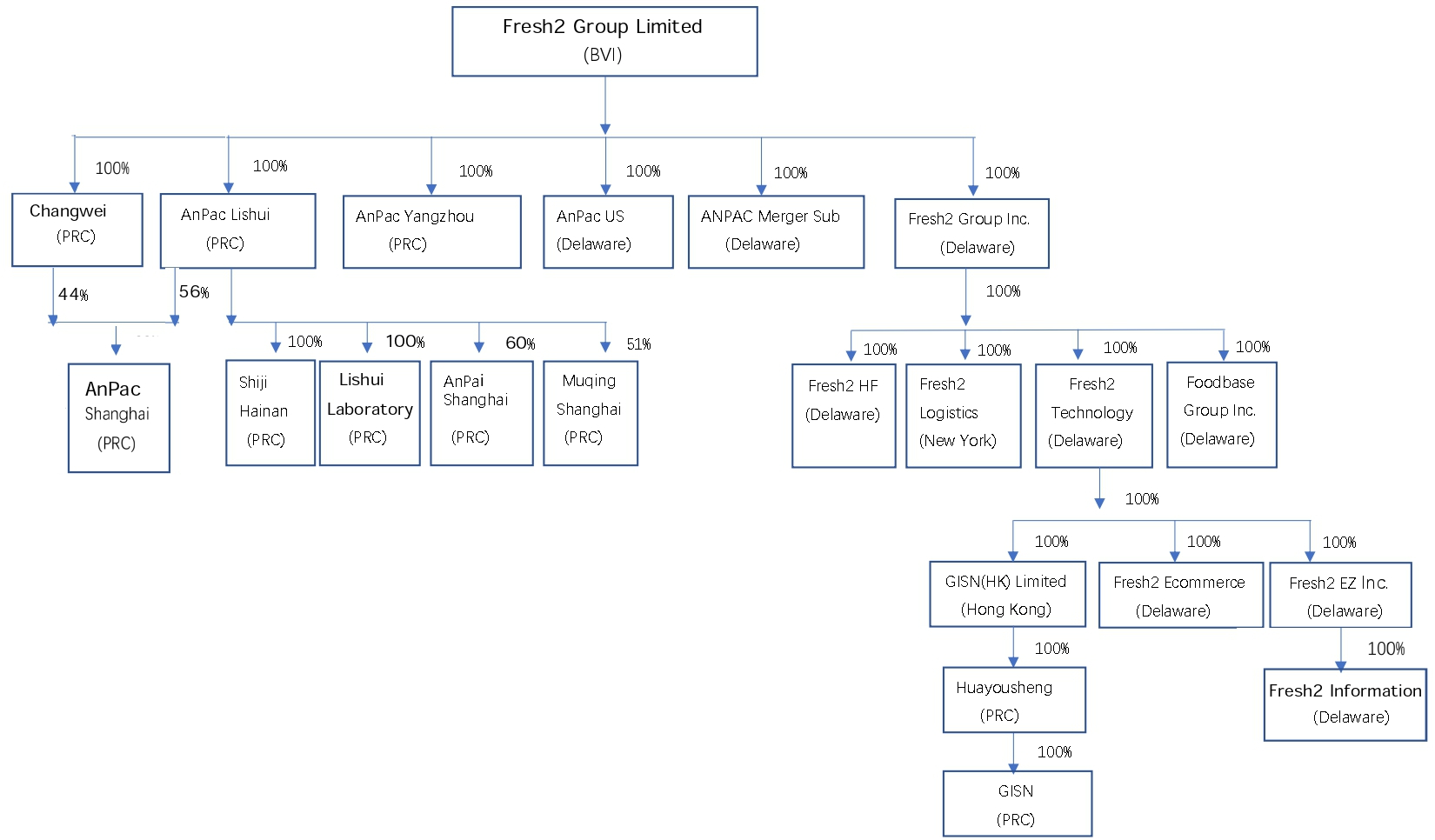

The chart below summarizes our corporate structure and identifies our principal subsidiaries as of the date of this report. operating subsidiaries in the People’s Republic of China (the “PRC” or “China”) and the United States. Our corporate structure contains no variable interest entities. We are not a Chinese operating company and our structure involves unique risks to investors. As used herein the terms “we,” “us,” “our,” “Fresh2” and the” Company” means Fresh2 Group Limited. a BVI business company and its subsidiaries.

iii

Fresh2 Group Limited is the public company in which investors hold our American Depositary Shares (‘ADSs”) and as a holding company does not conduct any of our operations. All of our subsidiaries are wholly-owned. A listing identifying the place of incorporation, type of legal entity, principal activity and the ownership interest in our Company and each of its subsidiaries follows:

| Entity Name | Place of Incorporation |

Type of legal entity |

Ownership Percentage |

Shareholder(s) | Principal activities |

|||||||

| Fresh2 Group Limited | BVI | Public company | 100% | Public company | Holding Company | |||||||

| Fresh2 Group Inc | Delaware | Corporation | 100% | Fresh2 Group Limited | Holding Company | |||||||

| Fresh2 HF Inc | Delaware | Corporation | 100% | Fresh2 Group Inc | Holding Company | |||||||

| Fresh2 Logistics Inc | New York | Corporation | 100% | Fresh2 Group Inc | Distribution of products | |||||||

| Fresh2 Technology Inc | Delaware | Corporation | 100% | Fresh2 Group Inc | Operating company | |||||||

| Foodbase Group Inc | Delaware | Corporation | 100% | Fresh2 Group Inc | Holding Company | |||||||

| ANPC Merger Sub Inc. | Delaware | Corporation | 100% | Fresh2 Group Limited | No activity yet | |||||||

| GISN(HK) Limited | Hong Kong | Limited liability company | 100% | Fresh2 Technology Inc | Holding Company | |||||||

| Hua You Sheng Future (Beijing) Technology Co., LTD | PRC | Limited liability company | 100% | GISN(HK) Limited | Technology development | |||||||

| GuanShi Technology ( Beijing) Co. , Ltd | PRC | Limited liability company | 100% | GISN(HK) Limited | Technology development | |||||||

| Fresh2 Ecommerce Inc | Delaware | Corporation | 100% | Fresh2 Technology Inc | Operating company | |||||||

| Fresh2 EZ Inc | Delaware | Corporation | 100% | Fresh2 Technology Inc | Owner of core technology platform | |||||||

| Fresh2 Information Inc | Delaware | Corporation | 100% | Fresh2 EZ Inc | No activity yet | |||||||

| Anpac Technology USA CO., LTD (“AnPac US”) | Delaware | Corporation | 100% | Fresh2 Group Limited | Clinical trials for research on cancer screening and detection tests | |||||||

| AnPac Bio-Medical Technology (Lishui) Co., Ltd. (“AnPac Lishui”) | PRC | Limited liability company | 100% | Fresh2 Group Limited | Cancer screening detection tests and device manufacturing | |||||||

| Changhe Bio-Medical Technology (Yangzhou) Co., Ltd. | PRC | Limited liability company | 100% | Fresh2 Group Limited | Cancer screening and detection tests | |||||||

| Changwei System Technology (Shanghai) Co., Ltd. (“Changwei”) | PRC | Limited liability company | 100% | Fresh2 Group Limited | Research and development | |||||||

| AnPac Bio-Medical Technology (Shanghai) Co., Ltd. | PRC | Limited liability company | 100% | AnPac Lishui (56%); Changwei (44%) | Cancer screening and detection tests | |||||||

| Lishui AnPac Medical Laboratory Co., Ltd. | PRC | Limited liability company | 100% | AnPac Lishui | Cancer screening and detection tests | |||||||

| Shiji (Hainan) Medical Technology Ltd. | PRC | Limited liability company | 100% | AnPac Lishui | Cancer screening and detection tests | |||||||

| Anpai (Shanghai) Healthcare Management and Consulting Co., Ltd. | PRC | Limited liability company | 60% | AnPac Lishui | Cancer screening and detection tests | |||||||

| Shanghai Muqing AnPac Health Technology Co., Ltd. (“AnPac Muqing”) | PRC | Limited liability company | 51% | AnPac Lishui | Cancer screening and detection tests | |||||||

iv

Significant Factors Relating to PRC Government Oversight of Our Operating Businesses.

Due to our operations in China, our business, results of operations, financial condition and prospects may be influenced to a significant degree by economic, political, legal and social conditions in the PRC or changes in government relations between China and the United States or other governments. There is significant uncertainty about the future relationship between the United States and China with respect to trade policies, treaties, government regulations and tariffs. China’s economy differs from the economies of other countries in many respects, including with respect to the level of development, growth rate, amount of government involvement, control of foreign exchange and allocation of resources. While China’s economy has experienced significant growth over the past four decades, growth has been uneven across different regions and among various economic sectors. The Chinese government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are currently applicable to us. In addition, in the past the Chinese government implemented certain measures, including interest rate increases, to manage the pace of economic growth and prevent the economy from overheating. These measures may cause decreased economic activity in China, which may adversely affect our business and results of operations.

Status under Holding Foreign Companies Accountable Act

In December 2021, the SEC adopted rules (the “Final Rules”) to implement the Holding Foreign Companies Accountable Act (the “HFCAA”). The HFCAA includes requirements for the SEC to identify issuers who file annual reports with audit reports issued by independent registered public accounting firms located in foreign jurisdictions that the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect or investigate completely because of a position taken by a non-U.S. authority in the accounting firm’s jurisdiction (“Commission-Identified Issuers”). The HFCAA also requires that, to the extent that the PCAOB has been unable to inspect an issuer’s independent registered public accounting firm for three consecutive years since 2021, the SEC shall prohibit the issuer’s securities registered in the United States from being traded on any national securities exchange or over-the-counter markets in the United States. In December 2022, the Accelerating Holding Foreign Companies Accountable Act amended the HFCAA to shorten the three-year period to two years.

Under the Final Rules, the SEC adopted submission and disclosure requirements by amending Form 10-K and other annual reporting forms and established procedures to identify issuers and prohibit the trading of the securities of certain registrants as required by the HFCAA. Specifically, the Final Rules require each Commission-Identified Issuer to submit documentation to the SEC annually on or before its annual report due date that establishes that it is not owned or controlled by a government entity in its public accounting firm’s foreign jurisdiction and require additional specified disclosures by “foreign issuers” as defined in Rule 3b-4 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The SEC identifies an issuer as a Commission-Identified Issuer after the issuer files its annual report and on a rolling basis, and will impose an initial trading prohibition on an issuer as soon as practicable after it has been conclusively identified as a Commission-Identified Issuer for two consecutive years. To end an initial or subsequent trading prohibition, a Commission-Identified Issuer must certify that it has retained a registered public accounting firm that the PCAOB has determined it is able to inspect or investigate. To make that certification, the Commission-Identified Issuer must file financial statements that include an audit report signed by such a registered public accounting firm.

In August 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of the People’s Republic of China, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. PCAOB staff members conducted on-site inspections and investigations from September to November 2022, and in December 2022, the PCAOB announced that it has secured complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and confirmed that until such time as the PCAOB issues any new determination, there are no Commission-Identified Issuers at risk of having their securities subject to a trading prohibition under the HFCAA.

Given that Marcum Asia CPAs LLP, a New York based independent accounting firm, serves as the principal accountant to audit our consolidated financial statements to be filed with the SEC, we believe we are compliant with the HFCAA, which should preclude a finding by the SEC that we are a Commission-Identified Issuer and therefore the delisting of our ADSs from the Nasdaq Capital Market. For a detailed description of risks related to our doing business in China and status under the HFCAA, see “Item 1A. Risk Factors - Risks Related to Our Doing Business in the PRC”.

Recent Regulatory Developments in China

The PRC government has recently indicated an intent to exert more oversight and control over securities offerings and other capital markets activities that are conducted outside of China and over foreign investment in China-based companies. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including enforcement actions against illegal activities in the securities market, enhancing supervision over China-based companies listed outside of China using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, in July 2021, the relevant PRC government authorities made public the Opinions on Intensifying Crack-Down on Illegal Securities Activities (the “Securities Opinions”) which emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. In November 2021, the Cyberspace Administration of China (the “CAC”) released the draft Administrative Regulations on Cyber Data Security for public comments, which requires, among others, that a prior cybersecurity review should be required for listing abroad of data processors which process over one million users’ personal information, and the listing of data processors in Hong Kong which affects or may affect national security. On February 17, 2023, the CSRC released the Overseas Listing Trial Measures, and five relevant guidelines, which became effective on March 31, 2023, requiring the Chinese domestic companies’ overseas offerings and listings of equity securities be filed with the CSRC.

v

The Chinese government may further promulgate relevant laws, rules and regulations that may impose additional and significant obligations and liabilities on overseas listed PRC companies regarding data security, cross-border data flow, anti-monopoly and unfair competition, and compliance with China’s securities laws. It is uncertain whether or how these new laws, rules and regulations and the interpretation and implementation thereof may affect us, but among other things, our ability to obtain external financing through the issuance of equity securities in the United States, Hong Kong or other markets could be negatively affected, and as a result, the trading prices of our Common Stock could significantly decline or become worthless. For a detailed description of risks related to our doing business in China, please see the section of this Annual Report titled “Item 1A. Risk Factors—Risks Related to Our Doing Business in the PRC.”

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. For more details, see “Item 1A. Risk Factors—Risks Related to Doing Business in China— Uncertainties with respect to the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us or result in a material adverse change to our subsidiaries’ business operations, and damage our and our subsidiaries’ reputation, which would materially and adversely affect our financial condition and results of operations and cause our Common Stock to significantly decline in value or become worthless.”

In light of such developments, the SEC has imposed enhanced disclosure requirements on China-based companies seeking to register securities with the SEC. Any future PRC, U.S. or other rules and regulations that place restrictions on capital raising or other activities by companies with extensive operations in China could adversely affect our business and results of operations. Any such action, once taken by the Chinese government, could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, and could cause the value of our Common Stock to significantly decline or become worthless. If the business environment in China deteriorates from the perspective of domestic or international investment, or if relations between China and the United States or other governments deteriorate, our business in China and United States may also be adversely affected. For more details, see “Item 1A. Risk Factors—Risks Related to Doing Business in China— Uncertainties with respect to the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us or result in a material adverse change to our subsidiaries’ business operations, and damage our and our subsidiaries’ reputation, which would materially and adversely affect our financial condition and results of operations and cause our ADSs to significantly decline in value or become worthless.”

Except where the context otherwise requires:

| ● | “ADME test” refers to our immunology test named AnPac Defense Medical Examination; |

| ● | “ADRs” refers to the American depositary receipts that evidence our ADSs; |

| ● | “ADSs” refers to our American depositary shares, each of which represents one Class A ordinary share; |

| ● | “CDA test” refers to our cancer screening and detection test using the CDA technology; |

| ● | “CDA-based tests” refers to either or both of our CDA tests and combination tests; |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Hong Kong, Macau and Taiwan; |

| ● | “Class A ordinary shares” refers to our Class A ordinary shares of par value US$0.01 per share; |

| ● | “Class B ordinary shares” refers to our Class B ordinary shares of par value US$0.01 per share; |

| ● | “combination test” refers to a test that combines our CDA test with an auxiliary test based on another cancer screening and detection technology, such as biomarker-based test (which have historically been our primary combination test) and the ct-DNA test (which we refer to as the APCS (AnPac Pan Cancer Screening) test), using our proprietary algorithm; |

| ● | “detection” of cancers by our CDA-based device or tests refers to the detection of the risk of whether cancer may occur or has occurred, not to cancer diagnosis, and “detect” has the corresponding meaning; |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “shares” or “ordinary shares” refers to our ordinary shares, including Class A and Class B ordinary shares, par value US$0.01 per share; |

| ● | “US$,” “U.S. dollars,” “$” or “dollars” refers to the legal currency of the United States; and |

| ● | “we,” “us,” “our company,” “our” or “Fresh 2 Group” refers to Fresh2 Group Limited and its subsidiaries; |

Our reporting currency is the Renminbi. Certain of our financial data in this annual report on Form 20-F are translated into U.S. dollars solely for the reader’s convenience. Unless otherwise noted, all convenience translations from Renminbi to U.S. dollars in this annual report on Form 20-F were made at a rate of RMB 6.8972 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System on December 31, 2022. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, at the rate stated above, or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

vi

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “projects,” “intends,” “potential,” “target,” “aim,” “predict,” “outlook,” “seek,” “goal” “objective,” “assume,” “contemplate,” “continue,” “positioned,” “forecast,” “likely,” “may,” “could,” “might,” “will,” “should,” “approximately” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

| ● | the implementation of our new business model and growth strategies; | |

| ● | our future business development, financial condition and results of operations and our ability to obtain financing cost-effectively; | |

| ● | potential changes of government regulations; |

| ● | trends and competition in the cancer screening and detection market; |

| ● | our expectations regarding demand for and market acceptance of our cancer screening and detection tests and our ability to expand our customer base; |

| ● | the duration of COVID-19 and its impact on our business and financial performance; |

| ● | our ability to obtain and maintain intellectual property protections for our CDA technology and our continued research and development to keep pace with technology developments; |

| ● | our ability to obtain and maintain regulatory approvals from the PRC National Medical Products Administration (the “NMPA”), U.S. Food and Drug Administration (the “FDA”) and the relevant U.S. states and to have our laboratories certified or accredited by authorities including under CLIA; |

| ● | general economic and business conditions in China and elsewhere; |

| ● | our ability to hire and maintain key personnel; and |

| ● | our relationship with our major business partners and customers. |

This annual report on Form 20-F also contains estimates, projections and statistical data obtained from various government and private publications. This market data speaks as of the date it was published and includes projections that are based on a number of assumptions and are not representations of facts. The cancer screening and detection market may not grow at the rates projected by market data, or at all. The failure of this market to grow at the projected rate may have a material adverse effect on our business and the market price of our ADSs. If any one or more of the assumptions underlying the market data proves to be incorrect, actual results may differ from the projections based on these assumptions. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this annual report. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by U.S. federal securities law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we reference in this annual report and have filed as exhibits to this annual report, completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

vii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to Our Business

Risks Related to Our CDA E-Commerce Food Businesses

There are doubts about our company’s ability to continue as a going concern.

Our company’s independent auditors have raised doubts about our ability to continue as a going concern. There can be no assurance that sufficient funds that will be required during the next year or thereafter will be generated from operations or that funds will be available from external sources, such as securities, debt or equity financing or other potential sources. We intend to overcome the circumstances that impact our ability to remain a going concern through a combination of new sources of revenues, with interim cash flow deficiencies being addressed through additional financing. We anticipate raising additional funds through public or private financing, securities financing and/or strategic relationships or other arrangements in the near future to support our business operations; however, we may not have commitments from third parties for a sufficient amount of additional capital. We cannot be certain that any such financing will be available to us on acceptable terms, or at all, and our failure to raise capital when needed could limit our ability to continue our operations. Our ability to obtain additional funding will determine if we can continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on our financial performance, results of operations and share price and require us to curtail or cease operations, sell off assets, seek protection from creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of our shares, and debt financing, if available, may have onerous terms. including restrictive covenants. Any additional financing could have a negative effect on our shareholders.

We have incurred losses each year since our inception, we expect to continue to incur losses for the foreseeable future, and we may not be able to achieve or maintain profitability.

We have incurred losses each year since our inception. For the years ended December 31, 2020, 2021 and 2022, we incurred net losses of RMB80.6 million, RMB120.1 million and RMB103.6 million (US$15.0 million), respectively. As of December 31, 2022, we had an accumulated deficit of RMB 577.5 million (US$ 83.7 million). To the date of this annual report, we have financed our operations primarily with proceeds from equity and debt offerings, borrowings, and loans from related parties. We have devoted and expect to continue to devote substantially all of our resources to the research, development and commercialization of our CDA technology, device and test. We expect to continue to incur losses for the foreseeable future. We cannot predict the extent of these future losses, or when we may achieve profitability, if at all. If we are unable to generate sufficient revenue from our business and control our costs and expenses to achieve and maintain profitability, the value of your investment in us could be negatively affected.

1

We require substantial funding for our operations. If we cannot raise sufficient capital on acceptable terms, our business, financial condition and prospects may be materially and adversely affected.

We require substantial capital to expand our business, pursue strategic investments and for other reasons, including to:

| ● | increase our sales and marketing efforts to drive market adoption of our cancer screening and detection tests and address competitive developments; |

| ● | expand our technologies into other types of cancer screening and detection products, such as our CDA test’s application in assistance in diagnosis, prognosis and recurrence; |

| ● | acquire or invest in technologies or other food service businesses; |

| ● | seek regulatory and marketing approvals for our cancer screening and detection tests and devices; |

| ● | conduct research studies for our CDA test and any additional cancer screening and detection tests; |

| ● | maintain, expand and protect our intellectual property portfolio; |

| ● | hire and retain additional personnel; |

| ● | develop, acquire and improve operational, financial and management information systems, including personnel to support our business activities and help us comply with our obligations as a public company; |

| ● | add equipment and physical infrastructure to support our businesses; and |

| ● | finance general and administrative expenses. |

We will be required to obtain further funding through public or private equity offerings, debt financings or other sources. Accordingly, our shareholders’ ownership interest will be diluted, Further financing may not be available to us on acceptable terms, or at all. If we fail to raise capital as and when needed it would have a negative impact on our financial condition and our ability to pursue our business strategy. To the extent that we raise additional capital through the sale of equity or convertible debt, and the terms of such securities may include liquidation or other preferences that adversely affect shareholder rights. Debt financing and equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making acquisitions or capital expenditures.

Our principal sources of liquidity have been cash generated from financing and operating activities. As of December 31, 2022, we had RMB1.9 million (US$0.3 million) of cash and cash equivalents and a working capital deficit of RMB28.6 million (US$4.1 million). For the years ended December 31, 2020, 2021 and 2022, we incurred losses of RMB 80.6 million, RMB120.1 million and RMB103.6 million (US$15.0 million), respectively. For the year ended December 31, 2022, we incurred RMB55.1 million (US$8.0 million) of negative cash flows from operations. The recent resurgence of COVID-19 and lockdown policies in Shanghai, China also has negative impact on our operation. The above-mentioned facts raise substantial doubt about the Group’s ability to continue as a going concern.

In assessing our liquidity, we monitor and analyze our cash on-hand, our ability to generate sufficient revenue sources in the future, and our operating and capital expenditure commitments. With respect to capital funding requirements, we budgeted capital spending based on ongoing assessments of needs to maintain adequate cash. We intend to finance our future working capital requirements and capital expenditures from financing activities until our operating activities generate positive cash flows, if ever. We expect to engage in continuous capital financing through debt or equity issuances to support our working capital requirements.

In December 2022 and January 2023, the Company signed definitive investment agreements with several third-party investors. The investors agreed to purchase 33,171,421 newly issued Class A ordinary shares of the Company at a price of US$0.175 per ordinary share or, for a total purchase price of approximately US$5.8 million (RMB40.0 million). The Company received approximately US$5.1 million (RMB 35.3 million) by April 22, 2023.

In March 2023, the Company signed definitive investment agreements with several shareholders, whereby the investors agreed to purchase an aggregate of 16,666,665 Class A ordinary shares at a price of US$0.30 per ordinary share for a total purchase price of $5,000,000 (RMB34,486,000). The Company has not received any proceeds from these agreements.

2

On April 6, 2023, the Company completed its sale to institutional investors a total of 12,500,000 Class A ordinary shares, pre-funded warrants exercisable for 2,500,000 Class A ordinary shares, issuable to investors whose purchase of American Depositary Shares and warrants exercisable for 750,000 ADSs. The purchase price of each pre-funded warrant is equal to the price per one ADS, minus $0.0001, and the exercise price of each pre-funded warrant will equal $0.0001 per share. The pre-funded warrants are immediately exercisable and may be exercised at any time until exercised in full. The warrants are immediately exercisable, will expire five (5) years from the original issuance date and have an exercise price of $4.00 per ADS. The Company also issued warrants exercisable for 37,500 ADSs to the sole placement agent with the placement agent, with an exercise price of $4.80 per ADS (the “Placement Agent Warrants”), pursuant to a placement agency agreement (the “Placement Agency Agreement”) dated March 31, 2023. Other than in respect of the exercise price, the Placement Agent Warrants have terms identical to the pre-funded warrants. The Company received of approximately US$3.0 million from this investment.

As of December 31, 2022, we had short-term debt of RMB5.0 million (US$0.7 million). However, our estimate as to how long we expect these financial resources to be sufficient to fund our operations is based on assumptions that may prove to be wrong. Further, changing circumstances, some of which may be beyond our control, could cause us to consume capital significantly faster than we currently anticipate. Going forward, we expect to need additional fundraising if our cash flows generated from operations do not increase substantially. Our present and future funding requirements will depend on many factors, including:

| ● | the scope, progress, timing, costs and results of the development of our CDA technology and our other products; |

| ● | the costs of expanding our e-commerce business; |

| ● | our rate of progress in, and costs of the sales and marketing activities associated with, encouraging adoption of our cancer screening and detection tests; |

| ● | our rate of progress in, and cost of research and development activities associated with, our CDA test, any additional cancer screening and detection tests and other tests; |

| ● | the impact of competing technological and market developments; |

| ● | costs related to entering the U.S. market; |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights and defending against intellectual property related claims; |

| ● | the costs, timing and outcome of obtaining regulatory approvals and changes in regulatory policies or laws that may affect our operations; and |

| ● | the costs of operating as a public company. |

3

Material weaknesses in our internal control over financial reporting have been identified, and if we fail to implement and maintain an effective system of internal controls over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud.

As a result of the initial public offering we have become subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act of 2002 and the rules and regulations of the Nasdaq Stock Market. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls over financial reporting. Commencing with our year ended December 31, 2021, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting in our Form 20-F filing for that year, as required by Section 404 of the Sarbanes-Oxley Act. In addition, when we cease to be an “emerging growth company” as the term is defined in the Jumpstart Our Business Startups Act, our independent registered public accounting firm may be required to attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. This will require that we incur substantial additional professional fees and internal costs to expand our accounting and finance functions and that we expend significant management efforts. We may experience difficulty in meeting these reporting requirements in a timely manner.

In the course of preparing and auditing our consolidated financial statements for the year ended December 31, 2022, we identified three material weaknesses in our internal control over financial reporting, the material weaknesses identified were (i) lack of accounting staff and resources with appropriate knowledge of U.S. GAAP and SEC reporting and compliance requirements; (ii) lack of financial reporting policies and procedures to establish formal risk assessment process and internal control framework; and (iii) deficiencies noted in (a) IT policy; (b) risk and vulnerability assessment. (c) program change and security patch management; (d) backup and recovery management; (e) audit trail and separation of duty management; (f) password management. For details, see “Item 15. Controls and Procedures—Internal Control Over Financial Reporting.” However, we cannot assure you that all these measures will be sufficient to remediate our material weakness in time, or at all.

To remedy our identified material weaknesses, we have started to undertake steps to strengthen our internal control over financial reporting, including: (i) hiring additional qualified accounting and financial reporting personnel with U.S. GAAP and SEC reporting experience, (ii) obtaining advisory services from professional consultants with experience in the requirements of the Sarbanes Oxley Act of 2002 and internal audit guidance on SEC reporting, (iii) expanding the capabilities of our existing accounting and financial reporting personnel through continuous training and education in the accounting and reporting requirements under U.S. GAAP, and SEC rules and regulations, (iv) developing, communicating and implementing an accounting policy manual for our accounting and financial reporting personnel for our recurring transactions and period-end closing processes, and (v) establishing effective monitoring and oversight controls for non-recurring and complex transactions to ensure the accuracy and completeness of our company’s consolidated financial statements and related disclosures. However, these measures have not been fully implemented and we concluded that the material weakness in our internal control over financial reporting has not been remediated as of December 31, 2022. We will continue to implement measures to remediate the material weaknesses.

In addition, our internal control over financial reporting will not prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud will be detected.

4

Impairment charges for goodwill, indefinite-lived intangible assets or other long-lived assets could adversely affect our financial condition and results of operation.

We review our amortizable intangible assets for impairment whenever events or changes in circumstances indicate the carrying value may not be recoverable. We test goodwill and other indefinite-lived intangible assets for impairment at least annually, or more frequently if events or changes in circumstances indicate an asset may be impaired. Relevant factors, events and circumstances that affect the fair value of goodwill and indefinite-lived intangible assets may include external factors such as macroeconomic, industry, and market conditions, as well as cost factors, overall financial performance, other relevant entity-specific events, specific events affecting the reporting unit, or sustained decrease in share price. We may be required to record a significant charge in our consolidated financial statements during the period in which any impairment of our goodwill or intangible assets is determined, which would negatively affect our results of operations.

Impairment analysis requires significant judgment by management and the fair value of goodwill, indefinite-lived intangible assets or other long-lived assets are sensitive to changes in key assumptions used in the projected cash flows, which include forecasted revenues and perpetual growth rates, among others, as well as current market conditions in both the United States and globally, all of which were unfavorably impacted by the COVID-19 pandemic. To the extent that business conditions deteriorate further, or if changes in key assumptions and estimates differ significantly from management’s expectations, it may be necessary to record additional future impairment charges, which could be material. For more information on our goodwill impairment assessment and related impairment charge, see Note 9 - Goodwill and Acquired Intangible Assets in our consolidated financial statements of this Annual Report.

We face risks related to natural disasters, health epidemics, civil and social disruption and other outbreaks, which could significantly disrupt our operations.

We are vulnerable to social and natural catastrophic events that are beyond our control, such as natural disasters, health epidemics, and other catastrophes, which may materially and adversely affect our business. Since December 2019, there has been an outbreak of a novel strain of coronavirus (COVID-19) in China and around the world. COVID-19 is considered to be highly contagious and poses a serious public health threat. The World Health Organization labeled the coronavirus a pandemic on March 11, 2020, given its threat beyond a public health emergency of international concern that the organization had declared on January 30, 2020. In response to this pandemic, China, the United States and many other countries and jurisdictions have taken, and may continue to adopt, additional restrictive measures to contain the virus’ spread, such as quarantines, travel restrictions and work from home policies. These measures have slowed down the development of the Chinese economy and the U.S. economy and adversely affected the global economic conditions and financial markets. We currently derive all our revenues in China and we have one laboratory in the United States. The outbreak of this virus caused wide-ranging business disruptions and traffic restrictions in China and the United States in 2020, and with its continued spread globally, the virus’ adverse impact on business activities, travels and overall GDP in China, the United States and other parts of the world has been unprecedented and is expected to continue in the foreseeable future. While the Chinese government’s efforts have slowed down the virus’ spread, there has been resurgences in China from time to time, particularly in winter and spring. As the pandemic expands globally, the world economy is suffering a noticeable slowdown. Commercial activities throughout the world have been and could continue to be curtailed with decreased consumer spending, business operation disruptions, interrupted supply chains, difficulties in travel, and reduced workforces.

As a result of the pandemic of COVID-19 in China, the United States and the world, our operations have been, and may continue to be, adversely impacted by disruptions in business activities, commercial transactions and general uncertainties surrounding the duration of the outbreaks and the various governments’ business, travel and other restrictions. These adverse effects could include our ability to market and conduct our tests in China, commercialize our tests in the United States and carry out research studies and activities in China and the United States. In addition, our business operations could be disrupted if any of our employees is suspected of contracting the coronavirus or any other epidemic disease, since our employees could be quarantined and/or our offices be shut down for disinfection. Although we have validated a COVID-19 antibody test using Roche’s FDA authorized equipment, we have not begun to commercialize our offering of this test and we cannot guarantee the market acceptance of and demand for this test. We have no control over the development of the COVID-19 situations in China, the United States or around the world and therefore cannot assure you that we will be able to maintain a revenue growth in future periods.

Resurgence of COVID-19 and followed lock-down policies in some cities could cut the demand and revenue depending on length of lock-down. Starting March 27, 2022, the lockdown policy in Shanghai has forced us to temporarily halt operations in our Shanghai office. Most of the CDA tests are performed in our subsidiary located in Lishui, Zhejiang, which is not impacted by the resurgence of COVID-19. However, the close of our Shanghai office caused delay in the issuance and delivery of test reports to our customers, which will delay our revenue recognition in such period. The downturn brought by and the duration of the coronavirus pandemic is difficult to assess or predict and the actual effects will depend on many factors beyond our control, including the increased world-wide spread of COVID-19 and the relevant governments’ actions to contain COVID-19 or treat its impact. While China, the U.S. and many other countries have been administering COVID-19 vaccines, it remains uncertain whether and when the vaccines will be able to effectively contain the pandemic. The extent to which COVID-19 continues to impact our results remains uncertain, and we are closely monitoring its impact on us. Our business, results of operations, financial condition and prospects could be adversely affected directly, as well as to the extent that the coronavirus or any other epidemic harms the Chinese and the United States’ economies in general.

5

Our businesses may be affected by the impacts of unfavorable geopolitical events or other market disruptions on consumer confidence and spending patterns.

Our net sales, profit, cash flows and future growth may be affected by negative local, regional, national or international political or economic trends or developments that reduce consumers’ ability or willingness to spend, including the effects of national and international security concerns such as war, terrorism or the threat thereof. The Russian invasion of Ukraine in February 2022 and the financial and economic sanctions and other measures imposed by the European Union, the United States, and other countries and organizations in response thereto is creating, and may continue to create, market disruption and volatility and instability in the geopolitical environment. The extent to which this conflict escalates to other countries and the resulting impact on the global market remains uncertain. We are monitoring the conflict, but do not, and cannot, know if this situation will result in broader economic and security concerns or in material implications for our business. These events could have a material adverse effect on our customers, our business partners and our third-party suppliers.

We have a limited amount of financial resources and our ability to make additional acquisitions without securing additional financing from outside sources is limited.

In order to continue to pursue our acquisition strategy, we may be required to obtain additional financing. We may obtain such financing through a combination of traditional debt financing and/or the placement of debt and equity securities. We may finance some portion of our future acquisitions by either issuing equity or by using shares of our common stock for all or a portion of the purchase price for such businesses. In the event that our common stock does not attain or maintain a sufficient market value, or potential acquisition candidates are otherwise unwilling to accept our common stock as part of the purchase price for the sale of their businesses, we may be required to use more of our cash resources, if available, in order to maintain our acquisition program. If we do not have sufficient cash resources, we will not be able to complete acquisitions and our growth could be limited unless we are able to obtain additional capital through debt or equity financings. The terms of our credit facility require that we obtain the consent of our lenders prior to securing additional debt financing. There could be circumstances in which our ability to obtain additional debt financing could be constrained if we are unable to secure such consent.

To the extent we make any material acquisitions, our earnings may be adversely affected by non-cash charges relating to the amortization of intangible assets.

Under applicable accounting standards, purchasers are required to allocate the total consideration paid in a business combination to the identified acquired assets and liabilities based on their fair values at the time of acquisition. The excess of the consideration paid to acquire a business over the fair value of the identifiable tangible assets acquired must be allocated among identifiable intangible assets including goodwill. The amount allocated to goodwill is not subject to amortization. However, it is tested at least annually for impairment. The amount allocated to identifiable intangible assets, such as customer relationships and the like, is amortized over the life of these intangible assets. We expect that this will subject us to periodic charges against our earnings to the extent of the amortization incurred for that period. Because our business strategy focuses, in part, on growth through acquisitions, our future earnings may be subject to greater non-cash amortization charges than a company whose earnings are derived solely from organic growth. As a result, we may experience an increase in non-cash charges related to the amortization of intangible assets acquired in our acquisitions. Our financial statements will show that our intangible assets are diminishing in value, even if the acquired businesses are increasing (or not diminishing) in value.

6

We have granted, and may continue to grant, stock incentive awards, which may result in increased share-based compensation expenses.

As of December 31, 2022, options to purchase 4,986,606 Class A ordinary shares were outstanding, consisting of (i) options to purchase 2,334,906 Class A ordinary shares held by our directors, officers and employees, and (ii) options to purchase 2,651,700 Class A ordinary shares held by non-employees. In March 2023, our broad of directors approved our 2023 Share Incentive Plan (the "2023 Plan"). The maximum number of ordinary shares that may be issued under the 2023 Plan is 13,000,000 Class A ordinary shares to our directors, officers, employees and consultants to incentivize their performance and align their interests with ours. Any future grants will result in more stock-based compensation expense and additional dilution.

We believe the granting of stock incentive awards is of significant importance to our ability to attract and retain our management, employees and consultants, and we will continue to grant stock incentive awards to our management, employees and consultants in the future. As a result, our expenses associated with share-based compensation may increase, which may have an adverse effect on our results of operations. In addition, the granting, vesting and exercise of the awards under these stock incentive plans will have a dilutive effect on your shareholding in our company.

We rely on technology in our businesses and any cybersecurity incident, other technology disruption or delay in implementing new technology could negatively affect our business and our relationships with customers.

We use technology in our business operations, and our ability to serve customers most effectively depends on the reliability of our technology systems. Our Clients use our software to place orders and we use software and other technology systems, among other things, to process clients’ orders, to make purchases, to manage warehouses and to monitor and manage our business on a day-to-day basis. Further, our business involves the storage and transmission of numerous classes of sensitive and/or confidential information and intellectual property, including customers’ and suppliers’ personal information, private information about employees, and financial and strategic information about us and our business partners.

These technology systems are vulnerable to disruption from circumstances beyond our control, including fire, natural disasters, power outages, systems failures, security breaches, espionage, cyber-attacks, viruses, theft and inadvertent releases of information. Any such disruption to these software and other technology systems, or the technology systems of third parties on which we rely, the failure of these systems to otherwise perform as anticipated, or the theft, destruction, loss, misappropriation, or release of sensitive and/or confidential information or intellectual property, could result in business disruption, negative publicity, brand damage, violation of privacy laws, loss of customers, potential liability and competitive disadvantage, any or all of which could potentially adversely affect our customer service, decrease the volume of our business and/or result in increased costs and lower profits.

A significant breach of our cybersecurity infrastructure may result from actions by our employees, suppliers, third-party administrators, or unknown third parties or through cyber-attacks. The risk of a breach can exist whether software services are in our technology systems or are in cloud-based software services. Breaches have occurred, and may occur again, in our systems and in the systems of our suppliers and third-party administrators. Any such breach could result in operational impairments, significant harm to our reputation and financial losses.

A significant breach could affect our data framework or cause a failure to protect the personal information of our customers, suppliers or employees, or sensitive and confidential information regarding our business and could give rise to legal liability and regulatory action under data protection and privacy laws. Any such breach of our or our suppliers’ cybersecurity infrastructure could have a material adverse effect on our business, results of operations and financial condition.

7

Further, as we pursue our strategy to grow through acquisitions and to pursue new initiatives that improve our operations and cost structure, we are also expanding and improving our information technology, resulting in a larger technological presence and corresponding exposure to cybersecurity risk. If we fail to assess and identify cybersecurity risks associated with acquisitions and new initiatives, we may become increasingly vulnerable to such risks. Information technology systems continue to evolve and, in order to remain competitive, we need to implement new technologies in a timely and efficient manner. Investments will continue to be made in attracting, retaining, and training our human capital to remain current on the ever-changing industry best practices related to information security. If our competitors implement new technologies more quickly or successfully than we do, such competitors may be able to provide lower cost or enhanced services of superior quality compared to those we provide, which could have an adverse effect on our results of operations.

We may be subject to litigation and other claims and legal proceedings, and may not always be successful in defending ourselves against these claims or proceedings.

We are subject to lawsuits and other claims in the ordinary course of our business. We have been, and may in the future be, subject to lawsuits and other legal proceedings brought by our customers, competitors, employees, business partners, investors, other shareholders of the companies we invest in, or other entities against us, in matters relating to intellectual property rights, contractual disputes, competition claims and employment disputes, among others. We may also be subject to regulatory proceedings, such as any non-compliance with licensing requirements, advertising practices, and protection of data privacy of the tested individuals. We may not be successful in defending ourselves, and the outcomes of these lawsuits and proceedings may be unfavorable to us. Lawsuits and regulatory proceedings against us may also generate negative publicity that significantly harms our reputation, which may adversely affect our customer base, market position and our relationships with our research partners and other business partners. In addition to the related costs, managing and defending litigation and other legal proceedings and related indemnity obligations can significantly divert our management’s attention from operating our business. We may also need to pay damages or settle lawsuits or other claims with a substantial amount of cash, negatively affecting our liquidity. As a result, our business, financial condition and results of operations could be adversely affected.

We have limited business insurance coverage.

Our business insurance is limited, and we do not carry business interruption insurance to cover our operations. We have determined that the costs of insuring for related risks and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical. Any uninsured damage to our facilities or technology infrastructures or disruption of our business operations could require us to incur substantial costs and divert our resources, which could have an adverse effect on our business, financial condition and results of operations.

Our business has been affected and may in the future be affected by steps taken by the Chinese government to address the COVID-19 pandemic.

We purchase a portion of our inventory directly or indirectly from Chinese suppliers. In addition, our R&D center is located in China. Beginning with the outbreak of the COVID-19 pandemic in 2020, quarantines, travel restrictions, and the closure of stores and business facilities have been imposed in China as part of the government’s “zero-COVID” policy to limit the impact of the pandemic, and these measures were not relaxed until the beginning of 2023. If the PRC government reinstitutes policies that have been relaxed, or institutes new restrictive policies, we may not be able to procure certain inventory items from our suppliers, we may experience further supply chain bottlenecks and price increases, or we could have temporary disruptions in the function of our R&D center, any of which could adversely impact our business.

8

Risks Related to Our CDA Business

We are a development-stage biotechnology company with a limited operating history, which makes it difficult to evaluate our prospects and may increase the probability that we will not be successful.

We commenced our operations in 2010. We achieved commercialization of our CDA test and started generating revenue in China in 2015; we currently do not have commercial operations in the U.S. We are a development-stage biotechnology company with a limited operating history, and our history may not provide a meaningful basis for you to evaluate our business, financial performance and prospects. Furthermore, we may not have sufficient experience or resources to address the risks frequently encountered by development-stage biotechnology companies, which include our potential failure to:

| ● | achieve and maintain profitability; |

| ● | acquire and retain customers and increase adoption of our cancer screening and detection tests—including primarily our CDA test and combination tests (namely a combination of our CDA test and, on an auxiliary basis, biomarker-based or ct-DNA cancer screening and detection tests)—by physicians, key opinion leaders, or KOLs (including research scientists and doctors in the U.S. who are willing to validate our tests after research), patients, hospitals, medical institutions, healthcare payers and others in the medical community; |

| ● | commercialize and/or increase the market adoption for our other products, such as a COVID-19 antibody test and our ADME (AnPac Defense Medical Examination) immunology test, and extend the use of our CDA technology to screen pre-cancer diseases and increase its adoption by the medical community; |

| ● | respond to competitive market conditions; |

| ● | attract, train, motivate and retain qualified personnel; |

| ● | protect our proprietary technologies and intellectual property rights; |

| ● | secure a stable supply of blood samples to support our research and clinical studies; |

| ● | keep up with evolving industry standards and market developments; |

| ● | obtain and maintain the regulatory licenses, certifications, and approvals required for us to further market our cancer screening and detection tests and commercialize our CDA device in China and to commercialize our tests and CDA device in the United States; |

| ● | increase the awareness of our tests and protect our reputation; |

| ● | maintain adequate control of our operational costs; and |

| ● | manage our relationships with our research partners. |

If we are unsuccessful in addressing any one or more of these risks, they could adversely affect our business, financial condition and results of operations and increase the probability that we will not be successful.

9

Our success depends heavily on the success of our CDA technology and related cancer screening and detection test.

We derive our revenue primarily from our CDA-based tests, which depend on our CDA technology. If we obtain relevant approvals from the NMPA to sell our CDA device, we also anticipate generating revenue from the sales of our CDA device. We believe that our commercial success will depend upon our ability to achieve and maintain market acceptance of our current and future cancer screening and detection tests, which will depend on a number of factors, including:

| ● | our ability to further validate and improve the clinical utility and superiority of our CDA technology by increasing its sensitivity and specificity and through research studies and accompanying publications; |

| ● | the timing and scope of additional approvals from the NMPA for our CDA device and test and our ability to maintain these approvals; |

| ● | acceptance of our CDA test by physicians, KOLs, patients, hospitals, medical institutions, healthcare payers and others in the medical community; |

| ● | our ability to obtain the Class III medical device registration certificate from the NMPA for our CDA device and enter and develop the China hospital market for our CDA device and test; |

| ● | sufficient coverage and reimbursement by third-party payers for our services, which may depend on multiple factors such as the enforceability of relevant laws that mandate the coverage of cancer or pre-cancer disease screening; |

| ● | our ability to maintain and expand our customer base in China, especially among insurance companies, corporate customers and the hospital market; |

| ● | our sales and marketing capabilities, including our success in expanding our sales and marketing team and establishing our own sales network in China; |

| ● | the amount and nature of competition from other early cancer screening and detection products and procedures; |

| ● | our ability to obtain regulatory approvals for our U.S. laboratories to conduct commercial tests and successfully penetrate the U.S. market; and |

| ● | negative publicity regarding our or our competitors’ tests and technologies resulting from defects or errors. |

If we are unsuccessful in addressing these or other factors that might affect the market acceptance of our tests, our business and results of operations will suffer.

10

Our ability to grow our CDA business is substantially dependent on our ability to penetrate the Chinese hospital market.

In China, we currently can only conduct our cancer screening and detection tests on our devices in our own certified laboratories. Given these restrictions, our customer base is primarily direct customers such as corporations and life insurance companies, as well as sales agents such as health management companies and medical device dealers. China’s largest market for cancer screening and detection tests is the hospital market, in which patients go to Chinese hospitals for cancer screening and other medical tests. Currently we cannot conduct our tests in hospitals. We have applied for an NMPA Class III medical device registration certificate for our CDA devices to assist in multi-cancer diagnosis. If we receive this certificate, together with an updated medical device manufacture license, we would be permitted to place our devices within Chinese hospitals’ laboratories to conduct commercial tests there or sell our devices to the hospitals for the purposes of assisting in physicians’ diagnosis of specified multiple cancers. We expect to receive the Class III license by the end of the first quarter of 2024. Even if we obtain the certificate and license, we will need to successfully market our CDA device and test to Chinese hospitals. Our ability to grow our China business depends substantially on our ability successfully to penetrate the Chinese hospital market, and we cannot assure you as to when or whether we will be able to do so.

Our plans to enter the U.S. market with our CDA technology may not be successful.

Currently, we conduct commercial operations only in China with respect to our CDA technology, and the substantial majority of our business, assets, management and employees are located in China. We have been making efforts to enter the U.S. market. We commenced operations of our new laboratory in Philadelphia, Pennsylvania with the completion of our facility renovation and first phase equipment installation in July 2020. We obtained a CLIA Certificate of Registration for this laboratory in August 2020, and accreditation by the College of American Pathologists, or CAP, and a Certificate of Accreditation under the Clinical Laboratory Improvement Amendments of 1988, or CLIA for this new laboratory. Our U.S. operations currently include collaborating with U.S. health organizations to conduct research tests of our CDA technology, planning to commercialize our CDA tests.

Although our strategy is to expand our U.S. operations and eventually commence commercial sales of our CDA-based tests and other tests (such as COVID-19 antibody tests) in the United States, this strategy is subject to a number of risks and uncertainties, including:

| ● | our ability to secure research agreements with reputable U.S. hospitals, medical institutions and other health organizations to conduct research studies for our test; |

| ● | our ability to obtain sufficient blood samples for our planned research tests; |

| ● | the substantial costs and time required for U.S. research tests and clinical studies; |

| ● | positive outcomes of our U.S. research tests sufficient to support the clinical validity, safety, and effectiveness of our tests in the U.S. market; |

| ● | U.S. federal and state regulatory risks, including our ability to commence marketing of our CDA test as a laboratory developed test, or LDT, without premarket clearance, market authorization or approval from the United States Food and Drug Administration, or the FDA, our ability to comply with all applicable laws and other regulations, and costs and timing of obtaining relevant approvals; |

| ● | development of a U.S. infrastructure, including sales and marketing resources, sufficient to commercialize our test; |

| ● | substantial competition in the U.S. cancer screening and detection market, including from companies with substantially greater resources than we have; and |

| ● | market acceptance of our test in the U.S. |

Our ability to successfully address these factors and penetrate the U.S. market, as well as the costs and timing of these efforts, are highly uncertain. We expect that our commercial activities and revenues will continue to be derived solely from China for the foreseeable future.

11

The cancer detection business is subject to rapid change, and other companies or institutions may develop and market novel or improved early cancer screening and detection methods, which may make our CDA technology less competitive or obsolete.

Our CDA-based tests depend on the effectiveness of our CDA technology, and we may be unable to maintain the competitiveness of this technology. Our industry is characterized by rapid changes, including technological and scientific breakthroughs, frequent new product introductions and enhancements and evolving industry standards, all of which could make our current CDA-based test obsolete. In recent years, there have been numerous advances in technologies relating to the diagnosis and treatment of cancer. We must continuously enhance our CDA technology and develop new tests to keep abreast of evolving standards of early cancer screening and detection. Other companies and institutions may possess significantly greater financial and other resources and research and development capabilities than we do. These other companies and institutions may devote significant resources to develop new methods of detecting cancers and pre-cancer symptoms, and these methods and related tests could represent significant competition for our CDA technology and cancer screening and detection test, or even render our CDA technology obsolete.

We may be unable to compete effectively against our competitors because their products and services may be superior. They may also have more expertise, experience, financial resources or stronger business relationships in developing and marketing their products and services, more mature technologies and products, greater market adoption and greater brand recognition than we do. Further, even if we do develop new marketable tests or services, our current and future competitors may develop tests and services that are more commercially attractive than ours and they may bring those tests and services to market sooner than we are able to.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide.

Our operating results may fluctuate significantly, which makes it difficult for us to predict our future operating results. These fluctuations may occur due to a variety of factors, many of which are outside of our control, including:

| ● | the level of demand for our cancer screening and detection tests, which may vary significantly; |

| ● | our entry into the e-commerce food distribution business; |

| ● | the timing and cost of, and level of investment in, research, development, regulatory approval and commercialization activities relating to our CDA technology and our cancer screening and detection tests and device, which may change from time to time; |

| ● | the volume, customer mix and product mix for our cancer screening and detection tests and e-commerce revenues; |

| ● | the introduction of new cancer screening and detection tests and services by us or others in our industry; |

| ● | expenditures that we may incur to acquire, develop or commercialize our e-commerc business and additional tests, devices and technologies; |

| ● | coverage and reimbursement policies with respect to our cancer screening and detection tests and tests that compete with our tests; |