As of June 30, 2023, we had a total of 2,521 employees working

across three offices in the U.S.: San Jose, CA, Houston, TX, and Draper, UT; one office in Sydney, Australia; and others working remotely. We also employ individuals on a temporary basis and use the services of contractors as necessary.

We know our success is tied to recruiting, developing, and retaining

our employees. Our Chief People Officer is responsible for creating and implementing our initiatives around our employees and our Board has ultimate oversight and receives updates on these initiatives periodically.

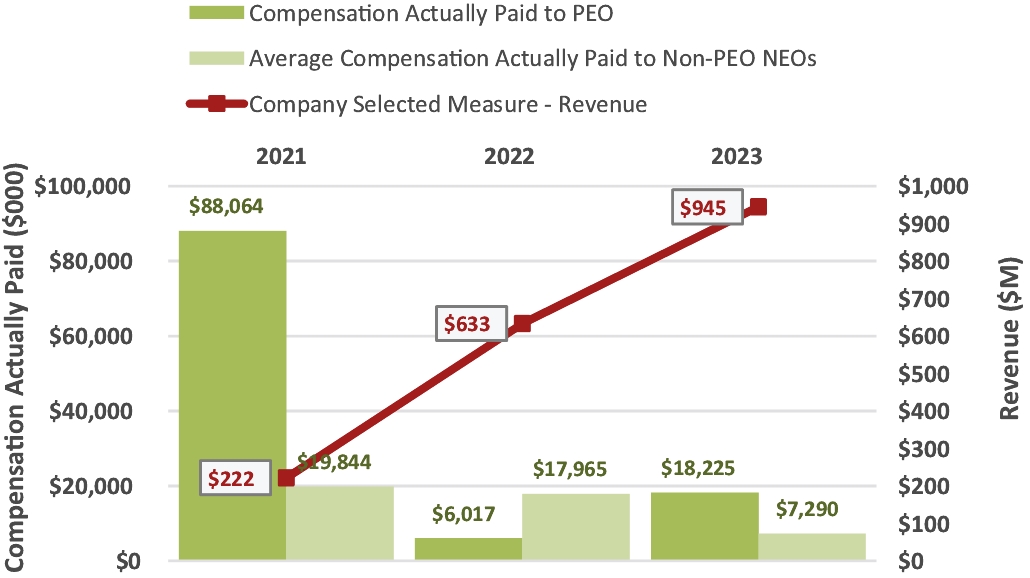

We leverage data and analytics to align the recruiting function to

business growth and revenue drivers. We are committed to providing a fair and equitable compensation and benefits program that supports our diverse workforce. BILL offers market-competitive base salaries, semi-annual bonuses, and sales

incentives. The majority of our employees are awarded equity at the time of hire and through annual equity refresh grants. We also offer an employee stock purchase plan to foster a strong sense of ownership and engage our employees in our

long-term success. Our full-time employees are eligible to receive, subject to the satisfaction of certain eligibility requirements, our comprehensive benefits package, including medical, dental, and vision insurance, family planning support

and fertility treatments, and life and income protection plans. In addition, we provide generous paid time-off policies, access to free mental health services, and offer a tax-qualified 401(k) retirement plan. Through the self-directed

brokerage features of the plan, participants in the 401(k) plan can choose to invest their contributions in funds tailored to their particular goals and preferences, including ESG-focused funds.

We develop our leaders and high-potential employees through

intensive, cohort-based, key talent programs. We offer training for new people managers. To facilitate ongoing learning and development, we provide employees with an online curriculum of study, linked to business needs, leveraging a third-party

platform. The curriculum includes coursework in inclusion, change management, and decision-making. All employees are eligible and participate in developmental reviews with their managers. We conduct performance review cycles twice a year.

To keep a pulse on engagement, we survey our employees semi-annually.

Employees respond anonymously, and we take action on the areas flagged for improvement, reporting back to the employee base on progress against stated improvement goals. We closely monitor employee turnover, conducting exit interviews and

surveys to alert us to any issues, as well as to make improvements to the employee experience.

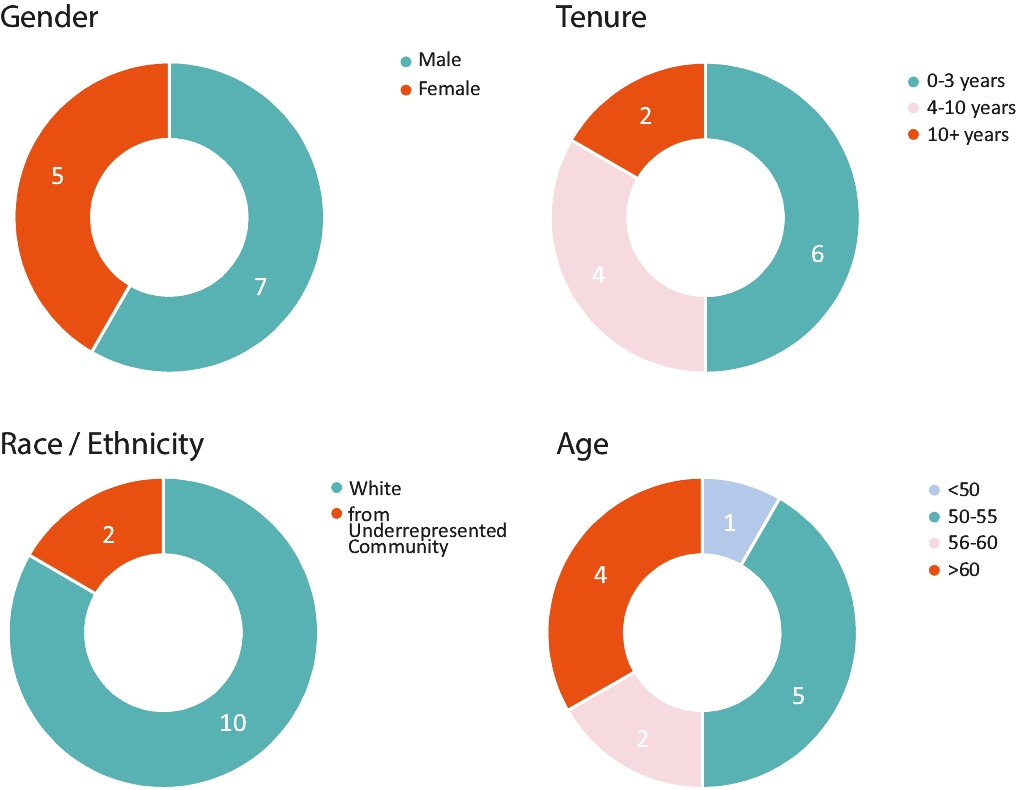

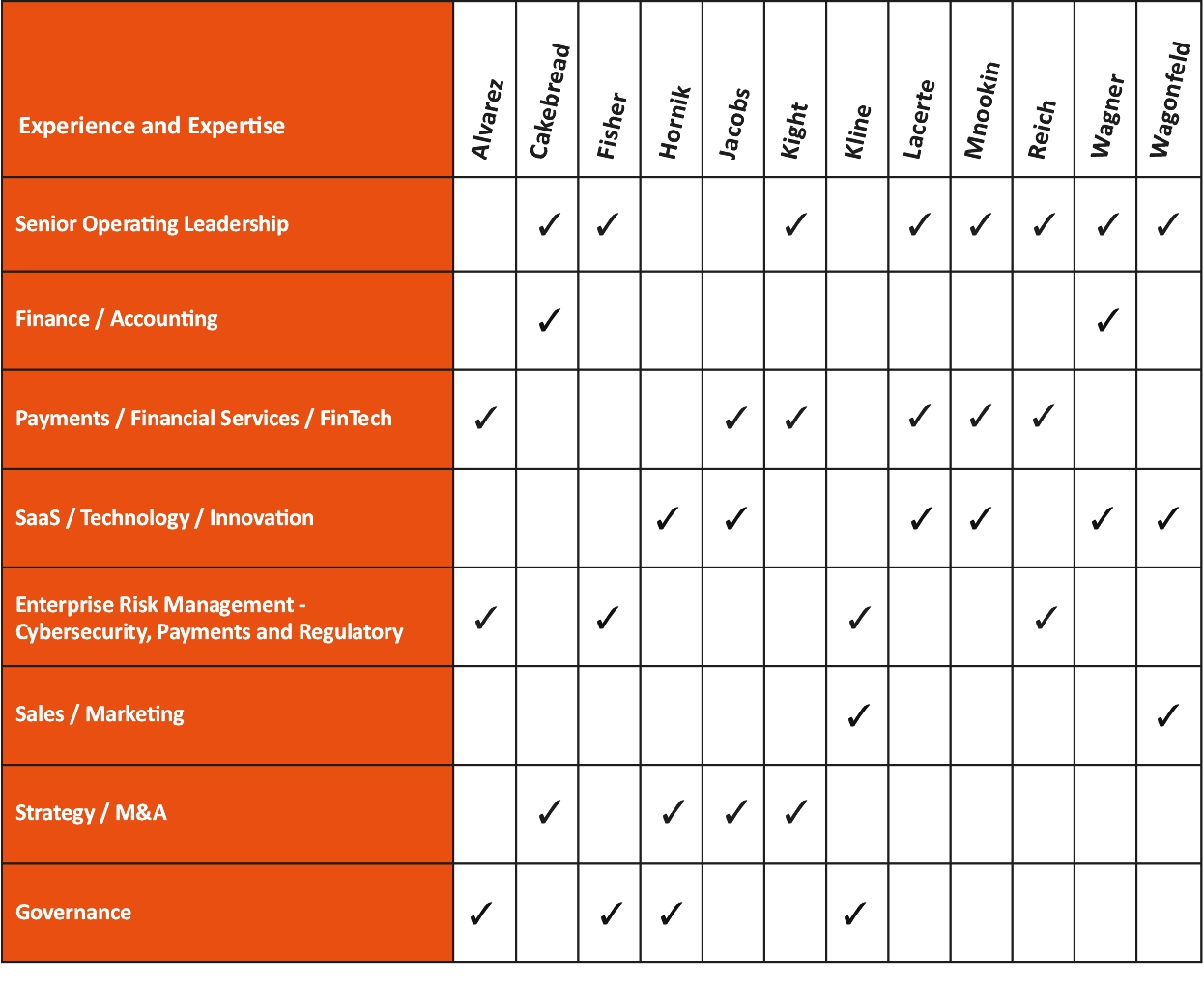

Diversity, Equity and Inclusion

Through an equitable approach to hiring, compensation, and career

growth, we have built a company that fosters inclusivity, authenticity, and action. We seek to embed a sense of inclusion and social responsibility into our culture and how we serve the businesses using our solutions. Our Vice President of DEI

is building a strategy that helps us accelerate our progress across four key pillars:

|

•

|

Cultivating a respectful and accessible workplace where every employee feels they belong;

|

|

•

|

Increasing diverse representation at all levels and functions of the company;

|

|

•

|

Supporting our diverse customers’ needs through our products and services; and

|

|

•

|

Engaging with our communities to promote diverse businesses and entrepreneurs.

|

One of the ways we strengthen our workplace culture of DEI is by

supporting employee resource groups (ERGs). ERGs are self-organized communities that bring employees together to raise awareness and belonging for under-represented groups. Through a grassroots effort, BILL employees have established seven ERGs

focused upon the following dimensions of identity: women, Latinx, Black, LGBTQIA+, disabilities and mental health, veterans, and Pan Asian and Pacific Islanders. These ERGs, which are open to all employees, have established strong employee

mentorship programs to support the career development of their members.

We also offer employees learning opportunities to increase awareness

of DEI issues. Unconscious bias training is available through our e-learning platform, we regularly host speakers from diverse backgrounds to share their lived experiences, and our ERGs host safe-space discussions on issues important to their

members. We also lead by example, with a diverse leadership team, including three women and one officer from an underrepresented community (44% of our leadership team).

We partner with organizations like Codepath.org and ColorStack to

support Black, Latinx, and Indigenous students interested in technical careers. Through Codepath’s Internship Connection Program, we have placed underrepresented students majoring in computer science into technical internships at BILL. Last

year, we also