Table of Contents

As filed with the Securities and Exchange Commission on January 27, 2020

Registration No. 333-235698

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 2

TO

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

NEXPOINT REAL ESTATE FINANCE, INC.

(Exact name of Registrant as Specified in Governing Instruments)

300 Crescent Court

Suite 700

Dallas, Texas 75201

(972) 628-4100

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Brian Mitts

President

300 Crescent Court

Suite 700

Dallas, Texas 75201

(972) 628-4100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Charles T. Haag Justin S. Reinus Winston & Strawn LLP 2121 N. Pearl Street Suite 900 Dallas, Texas 75201 (214) 453-6500 |

Robert K. Smith James V. Davidson Hunton Andrews Kurth LLP 2200 Pennsylvania Avenue NW Washington, D.C. 20037 (202) 955-1500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☑ | Smaller reporting company ☑ | Emerging growth company ☑ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum |

Proposed Maximum Aggregate |

Amount of Registration Fee (3) | ||||

| Common Stock, par value $0.01 per share |

5,750,000 |

$21.00 |

$120,750,000 | $15,674 | ||||

|

| ||||||||

| (1) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

| (2) | Estimated pursuant to Rule 457(a) under the Securities Act of 1933 solely for the purpose of determining the registration fee. |

| (3) | Of this amount, $14,927 was previously paid in connection with prior filings of this registration statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated January 27, 2020

5,000,000 Shares

| PRELIMINARY PROSPECTUS | ||||

|

||||

NEXPOINT REAL ESTATE FINANCE, INC.

Common Stock

NexPoint Real Estate Finance, Inc., or we, us or our, is a newly formed commercial real estate finance company. Our strategy is to originate, structure and invest in first mortgage loans, mezzanine loans, preferred equity and alternative structured financings in commercial real estate properties, as well as multifamily commercial mortgage backed securities, or CMBS, securitizations. Upon completion of this offering, we will be externally managed by NexPoint Real Estate Advisors VII, L.P., or our Manager, a subsidiary of NexPoint Advisors, L.P., or our Sponsor.

We are offering 5,000,000 shares of our common stock in this offering. We expect the public offering price of our common stock to be between $19.00 and $21.00 per share. This is our initial public offering and no public market currently exists for our common stock. Our common stock has been approved for listing, subject to official notice of issuance, on the New York Stock Exchange, or NYSE, under the symbol “NREF.”

At our request, the underwriters have reserved for sale, at the public offering price, up to 250,000 shares, or the Reserved Shares, offered by this prospectus for sale to our Sponsor and its affiliates. No underwriting discounts or commissions will be applied to the Reserved Shares.

We intend to elect to be treated as a mortgage real estate investment trust, or REIT, for U.S. federal income tax purposes commencing with our taxable year ending December 31, 2020. Shares of our common stock are subject to ownership limitations that are primarily intended to assist us in maintaining our qualification as a REIT. Our charter contains certain restrictions relating to the ownership and transfer of our common stock, including, subject to certain exceptions, a 6.2% ownership limit of common stock by value or number of shares, whichever is more restrictive. Our board of directors may grant waivers from this ownership limit to stockholders and, in connection with this offering, intends to grant our Sponsor and its affiliates a waiver allowing them to own up to 25% of our common stock. See “Description of Capital Stock—Restrictions on Ownership and Transfer.”

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and are subject to reduced public company reporting requirements. Investing in our shares of common stock involves a high degree of risk. See “Risk Factors” beginning on page 32 of this prospectus. The most significant risks relating to your investment in our common stock include the following:

| • | Our loans and investments expose us to risks similar to and associated with debt-oriented real estate investments generally. |

| • | Commercial real estate-related investments that are secured, directly or indirectly, by real property are subject to delinquency, foreclosure and loss, which could result in losses to us. |

| • | Fluctuations in interest rate and credit spreads, which may not be adequately protected or protected at all, by our hedging strategies, could reduce our ability to generate income on our loans and other investments, which could lead to a significant decrease in our results of operations, cash flows and the market value of our investments. |

| • | Our loans and investments will be concentrated in terms of geography, asset types and sponsors upon completion of the formation transaction and may continue to be so in the future. |

| • | Upon the completion of the formation transaction, we will have a substantial amount of indebtedness which may limit our financial and operating activities and may adversely affect our ability to incur additional debt to fund future needs. |

| • | We have limited operating history as a standalone company and may not be able to operate our business successfully, find suitable investments, or generate sufficient revenue to make or sustain distributions to our stockholders. |

| • | We are dependent upon our Manager and its affiliates to conduct our day-to-day operations; thus, adverse changes in their financial health or our relationship with them could cause our operations to suffer. |

| • | We may not replicate the historical results achieved by other entities managed or sponsored by affiliates of our Manager, members of our Manager’s management team or by our Sponsor or its affiliates. |

| • | Our Manager and its affiliates will face conflicts of interest, including significant conflicts created by our Manager’s compensation arrangements with us, including compensation which may be required to be paid to our Manager if our management agreement is terminated, which could result in decisions that are not in the best interests of our stockholders. |

| • | We will pay substantial fees and expenses to our Manager and its affiliates, which payments increase the risk that you will not earn a profit on your investment. |

| • | If we fail to qualify as a REIT for U.S. federal income tax purposes, cash available for distributions to be paid to you could decrease materially, which would limit our ability to make distributions to our stockholders. |

| Per Share | Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions (1)(2) |

$ | $ | ||||||

| Proceeds, before expenses, to us (2) |

$ | $ | ||||||

| (1) | Includes a structuring fee payable to Raymond James & Associates, Inc. equal to 1.0% of the gross proceeds of this offering (excluding any proceeds from sale of the Reserved Shares). Excludes certain compensation payable to the underwriters. See “Underwriting” for a detailed description of compensation payable to the underwriters. |

| (2) | Reflects that no underwriting discounts or commissions will be applied to the Reserved Shares. |

We have granted the underwriters an option to purchase up to an additional 750,000 shares of our common stock on the same terms and conditions set forth above within 30 days of the date of this prospectus solely to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2020.

| RAYMOND JAMES | KEEFE, BRUYETTE & WOODS A STIFEL COMPANY |

BAIRD |

The date of this prospectus is , 2020

Table of Contents

| 1 | ||||

| 30 | ||||

| 32 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| SELECTED HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA |

85 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

87 | |||

| 101 | ||||

| 129 | ||||

| 145 | ||||

| 148 | ||||

| 149 | ||||

| 155 | ||||

| 181 | ||||

| 186 | ||||

| CERTAIN PROVISIONS OF MARYLAND LAW AND OUR CHARTER AND BYLAWS |

193 | |||

| 200 | ||||

| 204 | ||||

| 207 | ||||

| 212 | ||||

| 212 | ||||

| 212 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. We and the underwriters are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales thereof are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

i

Table of Contents

This prospectus summary highlights material information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section, before making a decision to invest in our common stock. Except where the context suggests otherwise, the terms:

| • | “we,” “us,” “our,” “NREF” and the “Company” refer to NexPoint Real Estate Finance, Inc., a Maryland corporation; |

| • | “Manager” refers to NexPoint Real Estate Advisors VII, L.P., a Delaware limited partnership; |

| • | “Sponsor” refers to NexPoint Advisors, L.P., a Delaware limited partnership; and |

| • | “OP” refers to NexPoint Real Estate Finance Operating Partnership, L.P., a Delaware limited partnership. |

Our Company

We are a newly formed commercial real estate finance company. Our strategy is to originate, structure and invest in first mortgage loans, mezzanine loans, preferred equity and alternative structured financings in commercial real estate properties, as well as multifamily commercial mortgage backed securities, or CMBS, securitizations, or collectively our target assets. We will primarily focus on investments in real estate sectors where our senior management team has operating expertise, including in the multifamily, single-family rental, or SFR, self-storage, hospitality and office sectors predominantly in the top 50 metropolitan statistical areas, or MSAs. In addition, we will primarily focus on lending or investing in properties that are stabilized or have a “light-transitional” business plan, meaning a property that requires limited deferred funding primarily to support leasing or ramp-up of operations and for which most capital expenditures are for value-add improvements.

Our primary investment objective is to generate attractive, risk-adjusted returns for stockholders over the long term, primarily through dividends and secondarily through capital appreciation. We will seek to employ a flexible and relative value focused investment strategy and expect to re-allocate capital periodically among our target investment classes. We believe this flexibility will enable us to efficiently manage risk and deliver attractive risk-adjusted returns under a variety of market conditions and economic cycles.

We will be externally managed by our Manager, a subsidiary of our Sponsor, an SEC-registered investment advisor, which has extensive real estate experience, having completed as of September 30, 2019 approximately $9.0 billion of gross real estate transactions since the beginning of 2012. In addition, our Sponsor, together with its affiliates, including NexBank, is one of the most experienced global alternative credit managers managing approximately $13.3 billion of loans and debt or credit related investments as of September 30, 2019 and has managed credit investments for over 25 years. We believe our relationship with our Sponsor benefits us by providing access to resources including research capabilities, an extensive relationship network, other proprietary information, scalability, a vast wealth of information on real estate in our target assets and sectors and sourcing of investments by NexBank.

1

Table of Contents

Substantially all of our assets will be owned directly or indirectly through our OP. Upon the completion of this offering, we will hold all of the limited partnership interests in our OP.

We intend to elect to be treated as a real estate investment trust, or REIT, for U.S. federal income tax purposes beginning with our taxable year ending December 31, 2020. We also intend to operate our business in a manner that will permit us and our subsidiaries to maintain one or more exclusions or exemptions from registration under the Investment Company Act of 1940, or the Investment Company Act.

The Formation Transaction

Prior to the closing of this offering, we plan to engage in a series of transactions, or the Formation Transaction, through which we will acquire an initial portfolio consisting of senior pooled mortgage loans backed by SFR properties, the junior most bonds of multifamily CMBS securitizations, or CMBS B-Pieces, mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments within the multifamily, SFR and self-storage asset classes, or collectively, the Initial Portfolio. We will acquire the Initial Portfolio from affiliates of our Sponsor, or the Contribution Group, pursuant to a contribution agreement with the Contribution Group in exchange for limited partnership interests in subsidiary partnerships of our OP. The limited partnership units of the subsidiary partnerships issued to the Contribution Group in connection with the Formation Transaction will be redeemable for an aggregate of approximately 12,635,047 OP units (assuming the Contribution Group contributes $252.7 million of net value and based on $20.00 per share, the midpoint of the range set forth on the cover of this prospectus) or cash in an amount equal to the number of OP units multiplied by the per share price of our common stock (at the discretion of the OP); provided that such subsidiary partnership units have been outstanding for at least one year or earlier at the discretion of the OP following the direction and approval of our board of directors. At the closing of the Formation Transaction, the number of OP units for which subsidiary partnership units may be redeemed is subject to change based on changes in the subsidiary partnerships’ working capital balances. See “Use of Proceeds” and “Our Operating Partnership and the Partnership Agreement” for additional information.

Upon completion of the Formation Transaction, our Initial Portfolio based on total unpaid principal balance, excluding the consolidation of the CMBS B-Pieces as described further below, is expected to be approximately 82% senior pooled mortgage loans backed by SFR properties, approximately 13% multifamily CMBS B-Pieces and approximately 6% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments. Total liabilities, excluding the consolidation of the CMBS B-Pieces, with respect to each of the aforementioned investment structures in our Initial Portfolio are expected to be approximately $788.9 million, $0 and $0, respectively, upon completion of the Formation Transaction. Our CMBS B-Piece investments as a percentage of total assets, excluding the consolidation of the CMBS B-Pieces, reflects the assets that we will actually own following the Formation Transaction. However, in accordance with the applicable accounting standards, we expect to consolidate all of the assets of the trusts that issued the CMBS B-Pieces that we will own following the Formation Transaction.

Upon completion of the Formation Transaction, our Initial Portfolio based on total unpaid principal balance, including the consolidation of the CMBS B-Pieces, is expected to be approximately 32% senior pooled mortgage loans backed by SFR properties, approximately 66% multifamily CMBS B-Pieces and approximately 2% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments. Total liabilities, including the consolidation of the CMBS B-Pieces, with respect to each of the aforementioned investment structures in our Initial Portfolio are expected to be approximately $788.9 million, $1.7 billion and $0, respectively, upon completion of the Formation Transaction.

2

Table of Contents

See the table in “—Our Financing Strategy—Freddie Mac Credit Facility” for additional information.

Upon completion of the Formation Transaction, our Initial Portfolio based on net equity is expected to be approximately 43% senior pooled mortgage loans backed by SFR properties, approximately 39% multifamily CMBS B-Pieces and approximately 18% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments. Net equity represents the carrying value less our leverage on the asset.

Our Manager

Upon completion of this offering, we will be externally managed by our Manager pursuant to a management agreement that we will enter into with our Manager, or the Management Agreement. Our Manager is a recently formed indirect subsidiary of our Sponsor. All our investment decisions will be made by our Manager, subject to general oversight by the Manager’s investment committee and our board of directors. The members of the Manager’s investment committee are James Dondero, Matthew Goetz, Brian Mitts and Matt McGraner.

Our senior management team will be provided by our Manager and includes James Dondero, Matthew Goetz, Brian Mitts and Matt McGraner. Paul Richards and David Willmore are also key members of the management team, with Mr. Richards focusing on underwriting, originations and investments and Mr. Willmore focusing on accounting and financial reporting. The senior management team has significant experience across real estate investing and private lending. See “Management” for biographical information regarding these individuals.

We will pay our Manager an annual management fee but will not pay management fees to our Manager based on the equity portion of the Initial Portfolio contributed to us in the Formation Transaction. We will not pay any incentive fees to our Manager. We will also reimburse our Manager for expenses it incurs on our behalf. However, our Manager is responsible, and we will not reimburse our Manager or its affiliates, for the salaries or benefits to be paid to personnel of our Manager or its affiliates who serve as our officers, except that we may grant equity awards to our officers under a long-term incentive plan adopted by us and approved by our stockholders. Direct payment of operating expenses by us, which includes compensation expense relating to equity awards granted under our long-term incentive plan, together with reimbursement of operating expenses to our Manager, plus the Annual Fee (as defined in “—Our Management Agreement”), may not exceed 2.5% of equity book value determined in accordance with accounting principles generally accepted in the United States, or GAAP, for any calendar year or portion thereof, provided, however, that this limitation will not apply to offering expenses, legal, accounting, financial, due diligence and other service fees incurred in connection with extraordinary litigation and mergers and acquisitions and other events outside the ordinary course of our business or any out-of-pocket acquisition or due diligence expenses incurred in connection with the acquisition or disposition of certain real estate-related investments. To the extent total corporate G&A expenses would otherwise exceed 2.5% of equity book value, our Manager will waive all or a portion of its annual management fee to keep our total corporate general and administrative expenses at or below 2.5% of equity book value. For additional information regarding our Management Agreement and the conflicts of interest that the Management Agreement poses, see “—Our Management Agreement,” “—Conflicts of Interest and Related Policies” and “Risk Factors”.

Our Sponsor

Our Sponsor and its subsidiaries have extensive experience managing real estate investment activities. Our Sponsor’s real estate team includes 15 individuals and as of September 30, 2019 has

3

Table of Contents

completed over 160 transactions totaling approximately $9.0 billion of gross real estate value since 2012. The members of our Sponsor’s real estate team have extensive experience investing in commercial real estate and debt related to real estate properties both at our Sponsor and in previous positions.

Our Sponsor is affiliated through common control with Highland Capital Management, L.P., or Highland, an SEC-registered investment adviser. This common control is a result of the general partners of each of our Sponsor and Highland being wholly owned by Mr. Dondero, who will be our President and a director upon completion of this offering. Highland and its affiliates oversee approximately $10.0 billion in assets as of October 31, 2019. While Highland oversees institutional products, such as private equity funds, hedge funds and collateralized loan obligations, our Sponsor oversees real estate investments and registered investment company products. Our Sponsor is a party to a shared services arrangement with Highland. Under this arrangement, our Manager may utilize employees from Highland in connection with various services such as human resources, accounting, tax, valuation, information technology services, office space, employees, compliance and legal. We do not expect Highland’s bankruptcy filing, discussed below, to impact its provision of services to our Manager. Other than Mr. Dondero, none of our directors or executive officers is a director, executive officer or employee of Highland or any of its controlled affiliates. Mr. Mitts and Mr. McGraner are executive officers of our Manager, the general partner of which is wholly owned by our Sponsor.

On October 16, 2019, Highland filed for Chapter 11 bankruptcy protection with the United States Bankruptcy Court for the District of Delaware, or the Highland Bankruptcy. The Highland Bankruptcy stems from a potential judgment being sought against Highland relating to a financial crisis-era fund previously managed by Highland. The fund has been in liquidation since 2011. The liquidation plan, which was finalized and approved by investors and Highland in 2011, established a committee of fund investor representatives, or the Redeemer Committee, to coordinate the liquidation process. Between 2011 and 2016, Highland distributed over $1.55 billion of the approximately $1.70 billion amount to be liquidated. Then, on July 5, 2016, the Redeemer Committee filed a complaint against Highland resulting from a contract dispute over the timing of management fees and other related claims. Highland believes it acted in the interest of investors and disputes the Redeemer Committee’s claims. However, in consideration of its liquidity profile, Highland determined that it was necessary to commence the voluntary Chapter 11 proceedings. Although Highland disputes the underlying claims, entry of the judgment in its maximum potential amount could result in a judgment against Highland in an amount greater than Highland’s liquid assets. Neither our Manager nor our Sponsor are parties to Highland’s bankruptcy filing. For additional information, see “Risk Factors—Risks Related to Our Corporate Structure”.

Our Strategic Relationship with Our Sponsor

Significant Stockholder Alignment—Investor as well as Manager

Our Sponsor and our Manager believe in taking proactive measures intended to align themselves with investors by holding substantial stakes in the investment vehicles they manage as well as implementing investor friendly governance provisions further supporting the alignment among our Sponsor, our Manager and investors.

The underwriters have at our request reserved for sale, at the public offering price, up to 250,000 shares, or the Reserved Shares, offered by this prospectus for sale to our Sponsor and its affiliates. No underwriting discounts or commissions will be applied to the Reserved Shares. Additionally, affiliates

4

Table of Contents

of our Sponsor are contributing approximately $252.7 million of net value, of which our management team owns approximately $21.1 million, to subsidiary partnerships of our OP as part of the Formation Transaction. Pro forma for the Formation Transaction and the offering, our management team will have invested approximately $26.1 million in us on a consolidated basis, and will own approximately 7.4% of our common shares outstanding on a fully diluted basis after giving effect to the Formation Transaction and the offering (assuming our Sponsor and its affiliates purchase all 250,000 Reserved Shares and all subsidiary partnership units are redeemed for shares of our common stock). The Contribution Group will receive limited partnership units of the subsidiary partnerships in exchange for their contribution of assets in the Formation Transaction that will be redeemable for an aggregate of approximately 12,635,047 OP units (assuming the Contribution Group contributes $252.7 million of net value and based on $20.00 per share, the midpoint of the range set forth on the cover of this prospectus) or cash in an amount equal to the number of OP units multiplied by the per share price of our common stock (at the discretion of the OP); provided that such subsidiary partnership units have been outstanding for at least one year or earlier at the discretion of the OP following the direction and approval of our board of directors. At the closing of the Formation Transaction, the number of OP units for which subsidiary partnership units may be redeemed is subject to change based on changes in the subsidiary partnerships’ working capital balances. See “Use of Proceeds” and “Our Operating Partnership and the Partnership Agreement” for additional information. We believe our Sponsor, our Manager, their affiliates and our Manager’s management team will be highly aligned with our stockholders as a result of these investments.

Leveraging Our Sponsor’s Platforms

We expect to benefit from our Sponsor’s platform, which provides access to resources including research capabilities, an extensive relationship network, other proprietary information, scalability, a vast wealth of information on real estate in our target assets and sectors and sourcing of investments by NexBank. We believe this access and the network, resources and core competencies developed by our Sponsor can allow our Manager to research, source, and evaluate opportunities on our behalf that may not be available to our competitors.

Leading Credit Focused Platform

Our Sponsor, together with its affiliates, including NexBank, is one of the most experienced global alternative credit managers managing approximately $13.3 billion of loans and debt or credit related investments as of September 30, 2019 and has managed credit investments for over 25 years. Our Sponsor and its affiliates’ debt and credit related investments are primarily managed through the following entities:

NexBank is a financial services company with total assets of approximately $10.2 billion, including real estate related assets of approximately $5.7 billion as of September 30, 2019, and whose primary subsidiary is a commercial bank. NexBank provides commercial banking, mortgage banking, investment banking and corporate advisory services to institutional clients and financial institutions throughout the U.S. We expect to have access to the resources of NexBank to help source and execute investments, provide servicing infrastructure and asset management. NexBank’s credit and underwriting team has extensive experience in real estate and asset based lending and underwriting.

Highland Income Fund, or HFRO (NYSE: HFRO), is a closed-end fund managed by Highland Capital Management Fund Advisors, L.P., an affiliate of our Sponsor. As of September 30, 2019, HFRO had $1.3 billion of assets under management. HFRO seeks to provide a high level of current income consistent with preservation of capital. HFRO pursues its investment objectives by investing primarily in floating-rate loans and other securities deemed to be floating-rate investments.

5

Table of Contents

NexPoint Strategic Opportunities Fund, or NHF (NYSE: NHF), is a closed-end fund managed by our Sponsor. As of September 30, 2019, NHF had $1.3 billion in assets under management. NHF’s investment objectives are to provide both current income and capital appreciation. NHF is invested primarily in (i) secured and unsecured floating and fixed rate loans; (ii) bonds and other debt obligations; (iii) debt obligations of stressed, distressed and bankrupt issuers; (iv) structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; (v) equities; (vi) other investment companies, including business development companies; and (vii) REITs.

Leading Real Estate Focused Platform

Our Sponsor is an experienced manager of real estate. Our Sponsor and its affiliates manage approximately $7.3 billion of gross value in real estate related investments as of September 30, 2019. Our Sponsor and its affiliates’ real estate related investments are primarily managed through the following entities:

NexPoint Residential Trust, Inc., or NXRT (NYSE: NXRT), is a publicly traded REIT. NXRT is primarily focused on acquiring, renovating, owning and operating well-located, middle-income multifamily properties with “value-add” potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States. As of September 30, 2019, NXRT owned 37 properties encompassing 13,757 units.

VineBrook Homes Trust, Inc., or VineBrook, is a privately held REIT and is a leading owner and operator of workforce SFR properties. VineBrook acquires, renovates, owns and manages SFR properties that management deems to be in the “affordable” or “workforce” category with a focus on “value-add” potential. As of September 30, 2019, VineBrook owned and operated 6,392 homes in primarily Midwestern cities and had 269 homes under contract.

NexPoint Hospitality Trust, Inc., or NHT (TSXV: NHT-U), is a publicly traded REIT. NHT is primarily focused on acquiring, owning, renovating, and operating select-service, extended-stay and efficient full-service hotels located in attractive U.S. markets. As of September 30, 2019, NHT owned 11 hotel properties encompassing 1,607 rooms across the United States. On July 21, 2019, NHT entered into an agreement to acquire Condor Hospitality Trust, Inc. (NYSE: CDOR), which owned 15 select service and extended stay properties, encompassing 1,908 rooms as of September 30, 2019.

Affiliates of our Sponsor manage multiple privately held REITs that are wholly owned by funds managed by affiliates of our Sponsor, including (1) NexPoint Real Estate Opportunities, or NREO, (2) NexPoint Real Estate Capital, or NREC, (3) NFRO REIT Sub, LLC, (4) NexPoint Capital REIT, LLC, (5) NRESF REIT Sub, LLC and (6) GAF REIT, LLC, and manage multiple Delaware Statutory Trusts, or DSTs.

Experience in Target Property Sectors

Our Sponsor and its affiliates have extensive experience in our target property sectors and as of September 30, 2019 have completed approximately $9.0 billion in gross real estate transactions since 2012. These transactions include activity in the following sectors:

Multifamily

Affiliates of our Sponsor have been active in the multifamily sector since 2013 and have invested or loaned approximately $5.7 billion in the multifamily sector, including in NXRT, six separate multifamily CMBS B-Piece securitizations totaling approximately $292.3 million as of September 30, 2019, preferred equity investments in 28 multifamily properties with approximately

6

Table of Contents

$1.0 billion of gross real estate value as of September 30, 2019, 14 multifamily properties in DSTs with $668.3 million in gross real estate value as of September 30, 2019 and NexBank’s outstanding loans in the multifamily sector as of September 30, 2019.

Single-Family Rental

Affiliates of our Sponsor have been active in the SFR sector, investing or loaning approximately $2.1 billion as a continuation of our Sponsor’s affordable housing investment thesis, including approximately $1.2 billion in SFR mortgages, an investment in VineBrook, which owns SFR assets directly, and NexBank’s outstanding loans in the SFR sector as of September 30, 2019. VineBrook is externally managed by an affiliate of our Sponsor and our Sponsor plays an integral role in the expansion of VineBrook’s business.

Self-Storage

Affiliates of our Sponsor have invested or loaned approximately $211 million in the self-storage sector, including a $125 million preferred equity investment in Jernigan Capital, Inc., or JCAP (NYSE: JCAP), a publicly traded REIT that provides capital to private developers, owners and operators of self-storage facilities, approximately $77.4 million of equity invested directly into self-storage developments and NexBank’s outstanding loans in the self-storage sector as of September 30, 2019.

Hospitality

Affiliates of our Sponsor have invested or loaned approximately $477 million in the hospitality sector since 2014, including in NHT and NexBank’s outstanding loans in the hospitality sector as of September 30, 2019. NHT is externally managed by an affiliate of our Manager.

Office

Affiliates of our Sponsor have invested or loaned approximately $521 million in the office sector since 2012, including NexBank’s outstanding loans in the office sector as of September 30, 2019, and have primarily focused on opportunistic repositioning investments.

Other

Affiliates of our Sponsor have also made investments and loans in alternative real estate sectors, including timber, triple net retail, strip malls and single family residential totaling $6.0 billion, which includes NexBank’s outstanding loans in other sectors as of September 30, 2019.

Our Competitive Strengths

Credit Strength of Initial Portfolio

As a whole, we believe our Initial Portfolio investments have a relatively low risk profile: 99.7% of the underlying properties in the Initial Portfolio are stabilized and have a weighted average occupancy of 92%; the portfolio-wide weighted average debt service coverage ratio, or DSCR, a metric used to assess the performance and credit worthiness of an investment, is 1.8x; the weighted average loan-to-value, or LTV, of our investments is 66.9%; and the weighted average maturity is 8.1 years as of December 31, 2019. These metrics do not reflect our alternative structured financing investment. The Initial Portfolio has associated leverage that is matched in term and structure to provide stable contractual spreads and net interest income, which we believe in the long-term will help protect us from fluctuations in market interest rates that may occur over the life of the portfolio investments.

7

Table of Contents

Public Company REIT Experience

Our Manager’s management team took NXRT public in 2015 through a spin-off of 38 multifamily properties owned by NHF. NXRT is primarily focused on acquiring, renovating, owning and operating well-located, middle-income multifamily properties with “value-add” potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States. As of September 30, 2019, NXRT owned 13,757 rental units across 37 properties.

Network of Existing Partners Provides Us An Immediately Available Investment Pipeline

We also believe that one of our key competitive strengths is the network of local, regional and national operating partners with which our Sponsor and its affiliates do business. Our Sponsor and its affiliates work closely with high quality sponsors to forge long-standing relationships so that our Sponsor is viewed as an “investment partner of choice” when partners are seeking investment in new transactions. Our Sponsor has made investments with over 75 real estate sponsors.

Scalability, Strength and Experience in Target Sectors

We expect to deploy a significant amount of our capital in investments in the multifamily, SFR, self-storage, hospitality and office property sectors in which our Sponsor and its affiliates have a large network of relationships and extensive experience. As of September 30, 2019, our Sponsor and its affiliates have completed approximately $5.7 billion of multifamily investments, $2.1 billion of SFR investments, $211 million of self-storage investments, $477 million of hospitality investments, $521 million of office investments and $6.0 billion of other investments since 2012, which includes NexBank’s outstanding loans in these sectors as of September 30, 2019.

Our Sponsor’s Financing Solutions are Pre-Approved and Comply with Freddie Mac and Fannie Mae Standards

Our Sponsor is a select sponsor with Freddie Mac and has experience structuring financing solutions behind first mortgage lenders, including banks, life insurance companies, Freddie Mac and The Federal National Mortgage Association, or Fannie Mae, including mezzanine loans and preferred equity investments. Our Sponsor and its affiliates have successfully tailored financing solutions to property owners in creative ways but also highly symbiotic with a typical Freddie Mac or Fannie Mae first mortgage. Our multifamily loan and investment platform complies with current Freddie Mac and Fannie Mae standards, giving us a unique opportunity to invest alongside quality sponsors and the largest multifamily lenders in the U.S.

Access to Our Sponsor’s Real Estate Platform

Our Sponsor and its subsidiaries have extensive experience managing real estate investment activities. Our Sponsor’s real estate team includes 15 individuals and as of September 30, 2019 has completed over 160 transactions totaling approximately $9.0 billion of gross real estate value since 2012. The members of our Sponsor’s investment team have on average 15 years of investment experience with leading institutions and investors in the following asset classes: real estate, private equity, alternatives, credit and equity. In addition, we expect to have access to the resources of NexBank to help source and execute investments, provide servicing and infrastructure and asset management.

8

Table of Contents

Our Investment Strategy

Primary Investment Objective

Our primary investment objective is to generate attractive, risk-adjusted returns for stockholders over the long term, primarily through dividends and secondarily through capital appreciation. We intend to achieve this objective primarily by originating, structuring and investing in first mortgage loans, mezzanine loans, preferred equity and alternative structured financings in commercial real estate properties, as well as multifamily CMBS securitizations. We intend to primarily focus on lending or investing in properties that are stabilized or have a light transitional business plan with positive DSCRs and high quality sponsors.

Through active portfolio management we will seek to take advantage of market opportunities to achieve a superior portfolio risk-mix, while delivering attractive total return. Our Manager will regularly monitor and stress-test each investment and the portfolio as a whole under various scenarios, enabling us to make informed and proactive investment decisions.

Target Investments

We intend to invest primarily in first mortgage loans, mezzanine loans, preferred equity and alternative structured financings in commercial real estate properties, as well as multifamily CMBS securitizations, with a focus on lending or investing in properties that are stabilized or have a light transitional business plan primarily in the multifamily, SFR, self-storage, hospitality and office real estate sectors predominantly in the top 50 MSAs, including, but not limited to, the following:

| • | First Mortgage Loans: We intend to make investments in senior loans that are secured by first priority mortgage liens on real estate properties. The loans may vary in duration, bear interest at a fixed or floating rate and amortize, typically with a balloon payment of principal at maturity. These investments may include whole loans or pari passu participations within such senior loans. |

| • | Mezzanine Loans: We may originate or acquire mezzanine loans. These loans are subordinate to the first mortgage loan on a property, but senior to the equity of the borrower. These loans are not secured by the underlying real estate, but generally can be converted into preferred equity of the mortgage borrower or owner of a mortgage borrower, as applicable. |

| • | Preferred Equity: We may make investments that are subordinate to any mortgage or mezzanine loan, but senior to the common equity of the borrower. Preferred equity investments typically receive a preferred return from the issuer’s cash flow rather than interest payments and often have the right for such preferred return to accrue if there is insufficient cash flow for current payment. These investments are not secured by the underlying real estate, but upon the occurrence of a default, the preferred equity provider typically has the right to effect a change of control with respect to the ownership of the property. |

| • | Alternative Structured Financing: We may also look to construct innovative financing solutions that are symbiotic for both parties. We expect to provide flexibility and structured financings that enable counterparties to strategically draw capital when needed or “match funded” commitments. Terms may entail a maximum commitment over a certain period with monthly minimums in exchange for a preferred equity investment with a stated cash coupon and a back-end payment-in-kind component that is in the form of additional preferred equity or common equity, which provides an additional avenue for value accretion to us. |

9

Table of Contents

| • | CMBS B-Pieces: We intend to make investments in the junior-most bonds comprising some or all of the BB-rated, B-rated and unrated tranches of CMBS securitization pools. In the CMBS structure, underlying commercial real estate loans are typically aggregated into a pool with the pool issuing and selling different tranches of bonds and securities to different investors. Under the pooling and servicing agreements that govern these securitization pools, the loans are administered by a trustee and servicers, who act on behalf of all CMBS investors, distribute the underlying cash flows to the different classes of securities in accordance with their seniority. Historically, a single investor acquires all of the below-investment grade securities that comprise each CMBS B-Piece. CMBS B-Pieces have been a successful and sought-after securitization program offering a wide-range of residential and multifamily products. As of September 30, 2019, there have been 307 Freddie Mac K-deal issuances for a combined $334 billion and 16,790 loans originated and securitized since 2009. |

Market Opportunity

Strong Demand for Commercial Real Estate Debt Capital

Borrower demand for commercial real estate debt capital remains at historically high levels. This demand is expected to be sustained by the significant upcoming maturities of commercial real estate debt originated during the credit boom preceding the economic recession in 2008 and 2009. According to the Mortgage Bankers Association $130 billion to more than $150 billion of non-bank-held mortgages are set to mature each year from 2020 to 2024.

Large, Addressable Market Opportunity

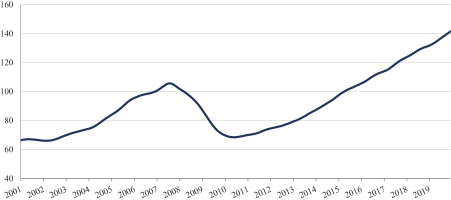

The U.S. commercial real estate market has current total outstanding loan balances of more than $4.5 trillion as reported by the U.S. Federal Reserve Bank as of September 30, 2019. Financing opportunities are created by strong commercial real estate transaction volumes, which totaled $537 billion in 2018, the second-largest year on record for commercial real estate sales in the U.S., according to Ten-X. In addition, commercial real estate transaction volumes are expected to continue at these levels due to the large amount of “dry powder” of real estate funds and appreciation of commercial real estate property values, as illustrated by the charts below.

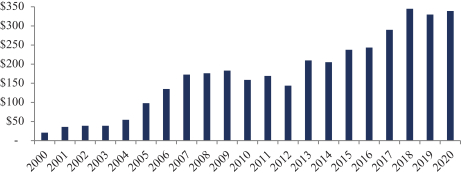

Dry Powder of Real Estate Funds ($ in Billions)

Source: Preqin, data for 2020 as of January 2020

10

Table of Contents

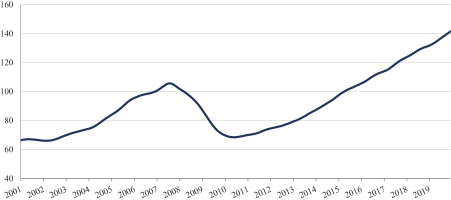

National All-Property Price Index

Source: Real Capital Analytics, data through December 2019

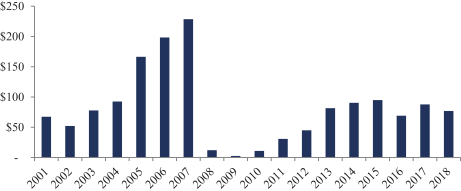

Traditional Lenders Have Been Constrained

Traditional lenders have been scaling back from both the new construction and refinancing market due in large part to more onerous underwriting standards and an increase in banking regulations such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, which has called for stricter liquidity and capital requirements. As a result, this has led to sweeping changes to the banking sector’s conventional lending practices and has created a strong demand for “gap” financing from experienced and trusted non-bank conduit lenders. Gap financing refers to the financing needed to bridge the “gap” between the lending bank’s first mortgage and a sponsor’s equity investment due to a lending bank’s unwillingness and limitation to lend beyond a certain LTV ratio. Over the years, banks have shortened interest only periods and lowered average LTV ratios leaving a large void across the lending landscape. Historically, a significant amount of commercial real estate mortgage loans have been financed through the CMBS markets. CMBS issuance has been significantly lower than before the financial crisis, resulting in a need for alternative lenders to meet debt capital demand, as illustrated by the chart below.

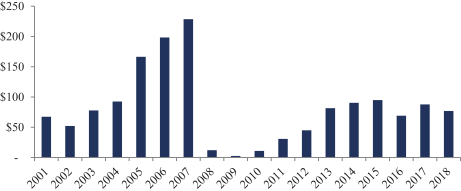

CMBS Issuance ($ in Billions)

Source: Commercial Mortgage Alert

11

Table of Contents

Due to the increased regulatory environment, commercial real estate mortgage REITs and other lenders have captured 10% of the U.S. commercial real estate debt market at September 30, 2019, steadily increasing from their 8.1% share at the beginning of the financial crisis.

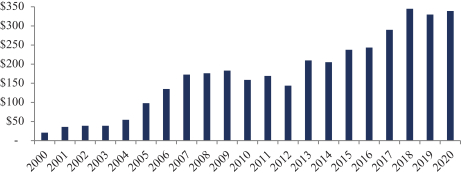

Commercial Real Estate Debt Market Share

Source: Federal Reserve

Our Initial Portfolio

Our Initial Portfolio will consist of senior pooled mortgage loans backed by SFR properties, multifamily CMBS B-Pieces, mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments within the multifamily, SFR and self-storage asset classes.

Upon completion of the Formation Transaction, our Initial Portfolio based on total unpaid principal balance, excluding the consolidation of the CMBS B-Pieces as described further below, is expected to be approximately 82% senior pooled mortgage loans backed by SFR properties, approximately 13% multifamily CMBS B-Pieces and approximately 6% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments. Total liabilities, excluding the consolidation of the CMBS B-Pieces, with respect to each of the aforementioned investment structures in our Initial Portfolio are expected to be approximately $788.9 million, $0 and $0, respectively, upon completion of the Formation Transaction. Our CMBS B-Piece investments as a percentage of total assets, excluding the consolidation of the CMBS B-Pieces, reflects the assets that we will actually own following the Formation Transaction. However, in accordance with the applicable accounting standards, we expect to consolidate all of the assets of the trusts that issued the CMBS B-Pieces that we will own following the Formation Transaction.

Upon completion of the Formation Transaction, our Initial Portfolio based on total unpaid principal balance, including the consolidation of the CMBS B-Pieces, is expected to be approximately 32% senior pooled mortgage loans backed by SFR properties, approximately 66% multifamily CMBS B-Pieces and approximately 2% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments.

12

Table of Contents

Total liabilities, including the consolidation of the CMBS B-Pieces, with respect to each of the aforementioned investment structures in our Initial Portfolio are expected to be approximately $788.9 million, $1.7 billion and $0, respectively, upon completion of the Formation Transaction. See the table in “—Our Financing Strategy—Freddie Mac Credit Facility” for additional information.

Upon completion of the Formation Transaction, our Initial Portfolio based on net equity is expected to be approximately 43% senior pooled mortgage loans backed by SFR properties, approximately 39% multifamily CMBS B-Pieces and approximately 18% mezzanine loan and preferred equity investments in real estate companies and properties and other structured real estate investments. Net equity represents the carrying value less our leverage on the asset.

13

Table of Contents

As a whole, we believe our Initial Portfolio investments have a relatively low risk profile: 99.7% of the underlying properties in the Initial Portfolio are stabilized and have a weighted average occupancy of 92%; the portfolio-wide weighted average DSCR is 1.8x; the weighted average LTV of our investments is 66.9%; and the weighted average maturity is 8.1 years as of December 31, 2019. These metrics do not reflect our alternative structured financing investment. For additional information related to the diversification of the collateral associated with the Initial Portfolio, including with respect to interest rate category, underlying property type, investment structure and geography, see the charts on the following page.

| # |

Investment |

Origination Date |

UPB (1) | Carrying Value |

Net Equity | Interest Rate |

PIK / Other Rate |

All-in Rate (2) |

Fixed / Floating |

Maturity Date (3) |

City, State | Property Type (4) |

LTV (5) | Stabilized (6) | ||||||||||||||||||||||||||||||||||||||||

| SENIOR LOANS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Senior Loan | 8/8/18 | $ | 508,700,000 | $ | 550,828,126 | $ | 85,138,711 | 4.7 | % | — | 4.7 | % | Fixed | 9/1/28 | Multiple | SFR | 68.1 | % | Yes | ||||||||||||||||||||||||||||||||||

| 2 | Senior Loan | 2/15/19 | 62,023,000 | 67,159,451 | 11,171,289 | 5.0 | % | — | 5.0 | % | Fixed | 3/1/29 | Multiple | SFR | 65.0 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 3 | Senior Loan | 9/28/18 | 51,362,000 | 55,615,558 | 9,469,369 | 4.7 | % | — | 4.7 | % | Fixed | 10/1/25 | Multiple | SFR | 54.2 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 4 | Senior Loan | 10/16/18 | 38,637,060 | 41,836,799 | 5,546,940 | 5.6 | % | — | 5.6 | % | Fixed | 11/1/28 | Multiple | SFR | 73.8 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 5 | Senior Loan | 1/28/19 | 17,439,248 | 18,883,484 | 2,651,904 | 5.6 | % | — | 5.6 | % | Fixed | 2/1/29 | Multiple | SFR | 65.2 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 6 | Senior Loan | 10/17/18 | 15,300,000 | 16,567,074 | 2,963,844 | 5.5 | % | — | 5.5 | % | Fixed | 11/1/23 | Multiple | SFR | 55.8 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 7 | Senior Loan | 9/14/18 | 12,414,407 | 13,442,509 | 2,077,741 | 5.5 | % | — | 5.5 | % | Fixed | 10/1/28 | Multiple | SFR | 67.5 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 8 | Senior Loan | 11/15/18 | 10,739,777 | 11,629,194 | 1,560,117 | 5.6 | % | — | 5.6 | % | Fixed | 12/1/28 | Multiple | SFR | 74.1 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 9 | Senior Loan | 8/15/18 | 10,664,870 | 11,548,084 | 1,812,124 | 5.3 | % | — | 5.3 | % | Fixed | 9/1/28 | Multiple | SFR | 70.5 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 10 | Senior Loan | 11/28/18 | 10,316,356 | 11,170,708 | 1,577,528 | 5.7 | % | — | 5.7 | % | Fixed | 12/1/28 | Multiple | SFR | 66.1 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 11 | Senior Loan | 1/4/18 | 10,726,883 | 11,615,233 | 2,278,554 | 5.4 | % | — | 5.4 | % | Fixed | 2/1/28 | Multiple | SFR | 72.7 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 12 | Senior Loan | 2/11/19 | 10,523,000 | 11,394,465 | 2,110,022 | 4.7 | % | — | 4.7 | % | Fixed | 3/1/26 | Multiple | SFR | 63.2 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 13 | Senior Loan | 9/28/18 | 9,875,000 | 10,692,801 | 1,535,220 | 6.1 | % | — | 6.1 | % | Fixed | 10/1/28 | Multiple | SFR | 74.3 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 14 | Senior Loan | 12/18/18 | 9,313,105 | 10,084,372 | 1,590,355 | 5.9 | % | — | 5.9 | % | Fixed | 1/1/29 | Multiple | SFR | 56.9 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 15 | Senior Loan | 10/10/18 | 8,334,194 | 9,024,392 | 1,288,594 | 5.9 | % | — | 5.9 | % | Fixed | 11/1/28 | Multiple | SFR | 72.5 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 16 | Senior Loan | 1/31/19 | 7,948,371 | 8,606,618 | 1,235,696 | 5.5 | % | — | 5.5 | % | Fixed | 2/1/29 | Multiple | SFR | 56.8 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 17 | Senior Loan | 1/18/19 | 7,823,472 | 8,471,375 | 1,382,527 | 5.3 | % | — | 5.3 | % | Fixed | 2/1/29 | Multiple | SFR | 74.2 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 18 | Senior Loan | 6/29/18 | 7,676,055 | 8,311,750 | 1,330,378 | 5.1 | % | — | 5.1 | % | Fixed | 7/1/28 | Multiple | SFR | 57.1 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 19 | Senior Loan | 2/5/19 | 6,874,210 | 7,443,499 | 1,232,307 | 5.5 | % | — | 5.5 | % | Fixed | 3/1/29 | Multiple | SFR | 72.2 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 20 | Senior Loan | 10/26/18 | 6,421,247 | 6,953,024 | 960,074 | 5.5 | % | — | 5.5 | % | Fixed | 11/1/28 | Multiple | SFR | 74.0 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 21 | Senior Loan | 1/3/19 | 6,752,435 | 7,311,639 | 1,411,362 | 4.8 | % | — | 4.8 | % | Fixed | 2/1/24 | Multiple | SFR | 69.1 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 22 | Senior Loan | 8/9/18 | 6,618,588 | 7,166,708 | 1,315,876 | 5.8 | % | — | 5.8 | % | Fixed | 9/1/23 | Multiple | SFR | 57.9 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 23 | Senior Loan | 11/30/18 | 5,760,000 | 6,237,016 | 890,584 | 6.0 | % | — | 6.0 | % | Fixed | 12/1/28 | Multiple | SFR | 70.0 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 24 | Senior Loan | 9/14/18 | 5,719,004 | 6,192,625 | 937,718 | 5.2 | % | — | 5.2 | % | Fixed | 10/1/28 | Multiple | SFR | 57.8 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 25 | Senior Loan | 7/27/18 | 5,653,308 | 6,121,488 | 1,123,964 | 5.3 | % | — | 5.3 | % | Fixed | 8/1/23 | Multiple | SFR | 67.4 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 26 | Senior Loan | 12/14/18 | 5,410,402 | 5,858,466 | 910,112 | 5.5 | % | — | 5.5 | % | Fixed | 1/1/29 | Multiple | SFR | 74.1 | % | Yes | |||||||||||||||||||||||||||||||||||||

| 27 | Senior Loan | 1/11/19 | 4,736,000 | 5,128,213 | 849,000 | 5.4 | % | — | 5.4 | % | Fixed | 2/1/29 | Multiple | SFR | 74.0 | % | Yes | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Senior Loans - Total / Wtd. Avg. |

$ | 863,761,992 | $ | 935,294,671 | $ | 146,351,910 | 4.9 | % | — | 4.9 | % | 8.4 | 67.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| CMBS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28 | CMBS |

3/28/19 | $ | 75,617,792 | $ | 75,466,556 | $ | 75,466,556 | 7.8 | % | — | 7.8 | % | Floating | 2/25/26 | Multiple | MF | 65.4 | % | Yes | ||||||||||||||||||||||||||||||||||

| 29 | CMBS |

11/26/19 | 58,661,484 | 58,368,177 | 58,368,177 | 7.8 | % | — | 7.8 | % | Floating | 11/25/26 | Multiple | MF | 64.8 | % | Yes | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| CMBS - Total / Wtd. Avg. |

$ | 134,279,276 | $ | 133,834,733 | $ | 133,834,733 | 7.8 | % | — | 7.8 | % | 6.5 | 65.1 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| MEZZANINE LOANS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 | Mezzanine Loan |

2/5/18 | $ | 3,250,000 | $ | 3,221,343 | $ | 3,221,343 | 8.0 | % | 5.8 | %(7) | 13.8 | % | Floating | 1/31/22 | |

North Charleston, SC |

|

MF | 73.4 | % | No | |||||||||||||||||||||||||||||||

| PREFERRED EQUITY |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 31 | Preferred Equity |

8/31/15 | $ | 10,000,000 | $ | 9,746,231 | $ | 9,746,231 | 8.5 | % | 3.0 | % | 11.5 | % | Fixed | 7/1/25 | |

Columbus, GA |

|

MF | 85.8 | % | Yes | |||||||||||||||||||||||||||||||

| 32 | Preferred Equity |

3/22/19 | 5,056,000 | 5,056,000 | 5,056,000 | 8.5 | % | 4.0 | % | 12.5 | % | Fixed | 12/1/27 | |

Jackson, MS |

|

MF | 75.6 | % | Yes | ||||||||||||||||||||||||||||||||||

| 33 | Preferred Equity |

7/14/14 | 3,821,000 | 3,821,000 | 3,821,000 | 10.3 | % | 5.0 | % | 15.3 | % | Fixed | 8/1/22 | |

Corpus Christi, TX |

|

MF | 57.0 | % | Yes | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Preferred Equity - Total / Wtd. Avg. |

$ | 18,877,000 | $ | 18,623,231 | $ | 18,623,231 | 8.9 | % | 3.7 | % | 12.5 | % | 5.6 | 77.1 | % | 100.0 | % | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| ALTERNATIVE STRUCTURED FINANCING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 34 | Alternative Structured Financing |

7/27/16 | $ | 40,000,000 | $ | 40,507,265 | $ | 40,507,265 | 7.0 | % | 6.4 | %(8) | 13.4 | % | Fixed | NA | Multiple | SS | NA | NA | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Total Portfolio - Total / Wtd. Avg. |

$ | 1,060,168,268 | $ | 1,131,481,243 | $ | 342,538,482 | 5.4 | % | 0.3 | % | 5.7 | % | 8.1 | 66.9 | % | 99.7 | % | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

14

Table of Contents

| (1) | UPB as of December 31, 2019. |

| (2) | All-in Rate is calculated as the Interest Rate plus the PIK / Other Rate. The All-in Rates for the CMBS investments numbered 28 and 29 are based on one-month LIBOR of 1.8% as of December 31, 2019 plus a spread over the index of 6.0%. |

| (3) | Weighted average years to maturity as of December 31, 2019. |

| (4) | SFR is single-family rental, MF is multifamily and SS is self-storage properties. |

| (5) | LTV is generally based on the initial first mortgage loan amount plus the preferred equity or mezzanine loan investment, if any, divided by the as-is appraised value as of the date the investment was originated or by the current principal amount as of the date of the most recent as-is appraised value. |

| (6) | We consider stabilized investments to be those with an in-place debt service coverage ratio (DSCR), including the current pay of preferred equity or mezzanine loan, if applicable, of 1.2x or greater. Weighted average is the percentage of the total Carrying Value that is Stabilized. |

| (7) | Interest income for the Mezzanine Loan numbered 30 is calculated using the December 31, 2019 WSJ Prime of 4.8% plus a spread over the index of 9.0%. A fixed minimum rate of 8.0% is paid in cash on a monthly basis. The difference between the 8.0% minimum monthly payment and the 13.8% stated rate is accrued as paid-in-kind (PIK) interest and is compounded on a monthly basis. Accrued PIK is to be paid at maturity. |

| (8) | The preferred stock pays a fixed quarterly dividend of $2.125 million payable pro rata to the holders of the preferred stock for the first three quarters of 2018, 2019 and 2020 and for the first fiscal quarter of 2021. For the last fiscal quarter of each of 2018, 2019 and 2020 and for the second fiscal quarter of 2021, the stock dividend varies based on the underlying company’s book value and past aggregate dividends among other things, but will be no lower than $2.125 million. Given that the stock dividend for the last fiscal quarter of 2020 cannot be predicted, the Company assumes a dividend of $2.125 million as a conservative estimate. It is expected that the company will own 40,000 shares of $1,000 par value preferred stock out of a total 133,500 shares outstanding as of December 31, 2019. |

Loan 1 has a total unpaid principal balance of $508.7 million at December 31, 2019, which equates to 48.0% of the total unpaid principal balance of our Initial Portfolio, and net equity of $85.1 million, which equates to 24.8% of the total net equity of our Initial Portfolio. Loan 1 is collateralized by a diversified portfolio of 4,812 SFR workforce housing properties with values that average approximately $155,202 per home and rents that average $1,206 per month. The portfolio is stabilized with a weighted average occupancy of 90.0% and a DSCR of 1.7x. The portfolio’s underlying tenants are diverse with over 4,800 unique leases or tenants and the portfolio is located in 32 MSAs in 12 states. The guarantor of Loan 1 is a well-capitalized and publicly traded company.

The following charts illustrate our Initial Portfolio based on interest rate category, underlying property type, investment structure, and geography:

Note: The charts above do not reflect the GAAP consolidation of the trusts that issued the CMBS B-Pieces in our financial statements. In addition, the geography charts do not reflect our alternative structured financing investment.

15

Table of Contents

Our Financing Strategy

While we do not have any formal restrictions or policy with respect to our debt-to-equity leverage ratio, we currently expect that our initial leverage will not exceed a ratio of 3-to-1. We believe this leverage ratio is prudent given that leverage typically exists at the asset level. The amount of leverage we may employ for particular assets will depend upon the availability of particular types of financing and our Manager’s assessment of the credit, liquidity, price volatility and other risks of those assets and financing counterparties. Our decision to use leverage to finance our assets will be at the discretion of our Manager, subject to review by our board of directors, and will not be subject to the approval of our stockholders. We generally intend to match leverage terms and interest rate type to that of the underlying investment financed.

Sources of Liquidity

Our primary source of cash will generally consist of cash generated from our operating results. From time to time, we may enter into repurchase agreements to finance the acquisition of a portion of our target assets.

Bridge Facility

In connection with the Formation Transaction, we, through our subsidiaries, will enter into a $95 million bridge facility with Key Bank, National Association, as lender, and the entities that will contribute the CMBS B-Pieces to us in the Formation Transaction, as co-borrowers (the “Bridge Facility”). We will guarantee the Bridge Facility and the obligations under the Bridge Facility will be secured by the CMBS B-Pieces that we will own following the Formation Transaction. The co-borrowers will use the proceeds from the Bridge Facility to repay the indebtedness outstanding on the CMBS B-Pieces that they will contribute to us in the Formation Transaction.

Freddie Mac Credit Facility

Following the Formation Transaction, two of our subsidiaries will be a party to a loan and security agreement that was entered into on July 12, 2019 with Freddie Mac, or the Credit Facility. Under the Credit Facility, these entities borrowed approximately $788.9 million in connection with their acquisition of senior pooled mortgage loans backed by SFR properties, or the Underlying Loans, that will be part of our Initial Portfolio following the Formation Transaction. No additional borrowings can be made under the Credit Facility. Our obligations under the Credit Facility will be secured by the Underlying Loans. Our borrowings under the Credit Facility will mature on July 12, 2029.

16

Table of Contents

The leverage utilized on all senior loans in our Initial Portfolio are matched in duration and structure, with a weighted average spread of 2.5% between the asset interest rate and the liability interest rate.

| Asset Metrics | Debt Metrics | |||||||||||||||||||||||||

| # |

Investment |

Fixed / Floating Rate |

Interest Rate |

Maturity Date (1) |

Fixed / Floating Rate |

Interest Rate |

Maturity Date (1) |

|||||||||||||||||||

| SENIOR LOANS |

||||||||||||||||||||||||||

| 1 | Senior Loan | Fixed | 4.7 | % | 9/1/2028 | Fixed | 2.2 | % | 9/1/2028 | |||||||||||||||||

| 2 | Senior Loan | Fixed | 5.0 | % | 3/1/2029 | Fixed | 2.7 | % | 3/1/2029 | |||||||||||||||||

| 3 | Senior Loan | Fixed | 4.7 | % | 10/1/2025 | Fixed | 2.1 | % | 10/1/2025 | |||||||||||||||||

| 4 | Senior Loan | Fixed | 5.6 | % | 11/1/2028 | Fixed | 2.7 | % | 11/1/2028 | |||||||||||||||||

| 5 | Senior Loan | Fixed | 5.6 | % | 2/1/2029 | Fixed | 2.9 | % | 2/1/2029 | |||||||||||||||||

| 6 | Senior Loan | Fixed | 5.5 | % | 11/1/2023 | Fixed | 2.6 | % | 11/1/2023 | |||||||||||||||||

| 7 | Senior Loan | Fixed | 5.5 | % | 10/1/2028 | Fixed | 3.0 | % | 10/1/2028 | |||||||||||||||||

| 8 | Senior Loan | Fixed | 5.6 | % | 12/1/2028 | Fixed | 2.8 | % | 12/1/2028 | |||||||||||||||||

| 9 | Senior Loan | Fixed | 5.3 | % | 9/1/2028 | Fixed | 2.8 | % | 9/1/2028 | |||||||||||||||||

| 10 | Senior Loan | Fixed | 5.7 | % | 12/1/2028 | Fixed | 3.0 | % | 12/1/2028 | |||||||||||||||||

| 11 | Senior Loan | Fixed | 5.4 | % | 2/1/2028 | Fixed | 3.5 | % | 2/1/2028 | |||||||||||||||||

| 12 | Senior Loan | Fixed | 4.7 | % | 3/1/2026 | Fixed | 2.5 | % | 3/1/2026 | |||||||||||||||||

| 13 | Senior Loan | Fixed | 6.1 | % | 10/1/2028 | Fixed | 3.3 | % | 10/1/2028 | |||||||||||||||||

| 14 | Senior Loan | Fixed | 5.9 | % | 1/1/2029 | Fixed | 3.1 | % | 1/1/2029 | |||||||||||||||||

| 15 | Senior Loan | Fixed | 5.9 | % | 11/1/2028 | Fixed | 3.0 | % | 11/1/2028 | |||||||||||||||||

| 16 | Senior Loan | Fixed | 5.5 | % | 2/1/2029 | Fixed | 2.8 | % | 2/1/2029 | |||||||||||||||||

| 17 | Senior Loan | Fixed | 5.3 | % | 2/1/2029 | Fixed | 3.0 | % | 2/1/2029 | |||||||||||||||||

| 18 | Senior Loan | Fixed | 5.1 | % | 7/1/2028 | Fixed | 2.7 | % | 7/1/2028 | |||||||||||||||||

| 19 | Senior Loan | Fixed | 5.5 | % | 3/1/2029 | Fixed | 3.0 | % | 3/1/2029 | |||||||||||||||||

| 20 | Senior Loan | Fixed | 5.5 | % | 11/1/2028 | Fixed | 2.7 | % | 11/1/2028 | |||||||||||||||||

| 21 | Senior Loan | Fixed | 4.8 | % | 2/1/2024 | Fixed | 2.4 | % | 2/1/2024 | |||||||||||||||||

| 22 | Senior Loan | Fixed | 5.8 | % | 9/1/2023 | Fixed | 2.9 | % | 9/1/2023 | |||||||||||||||||

| 23 | Senior Loan | Fixed | 6.0 | % | 12/1/2028 | Fixed | 3.1 | % | 12/1/2028 | |||||||||||||||||

| 24 | Senior Loan | Fixed | 5.2 | % | 10/1/2028 | Fixed | 2.6 | % | 10/1/2028 | |||||||||||||||||

| 25 | Senior Loan | Fixed | 5.3 | % | 8/1/2023 | Fixed | 2.5 | % | 8/1/2023 | |||||||||||||||||

| 26 | Senior Loan | Fixed | 5.5 | % | 1/1/2029 | Fixed | 3.0 | % | 1/1/2029 | |||||||||||||||||

| 27 | Senior Loan | Fixed | 5.4 | % | 2/1/2029 | Fixed | 3.1 | % | 2/1/2029 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Senior Loans—Total / Wtd. Avg. |

100% Fixed | 4.9 | % | 8.4 | 100% Fixed | 2.4 | % | 8.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (1) | Weighted average years to maturity as of December 31, 2019. |

17

Table of Contents

Investment Process

We expect to benefit from the tested method of capital allocation and on-going investment monitoring developed by our Sponsor. The primary objectives of the investment process are for it to be repeatable, dependable, and produce attractive risk-adjusted returns. The primary components of the investment process are as follows:

Investment Guidelines

Upon completion of this offering, we expect our board of directors will approve the following investment guidelines:

| • | No investment will be made that would cause us to fail to qualify or maintain our qualification as a REIT under the Code; |

| • | No investment will be made that would cause us or any of our subsidiaries to be required to be registered as an investment company under the Investment Company Act; |

| • | Our Manager will seek to invest our capital in our target assets; |

| • | Prior to the deployment of our capital into our target assets, our Manager may cause our capital to be invested in any short-term investments in money market funds, bank accounts, overnight repurchase agreements with primary Federal Reserve Bank dealers collateralized by direct U.S. government obligations and other instruments or investments determined by our Manager to be of high quality and consistent with our qualification as a REIT under the Code; and |

| • | Without the approval of a majority of our independent directors, no more than 25% of our Equity (as defined in our Management Agreement) may be invested in any individual investment (it being understood, however, that for purposes of the foregoing concentration limit, in the case of any investment that is comprised (whether through a structured investment vehicle or other arrangement) of securities, instruments or assets of multiple portfolio issuers, such investment will be deemed to be multiple investments in such underlying securities, instruments and assets and not the particular vehicle, product or other arrangement in which they are aggregated). |

18

Table of Contents

These investment guidelines may be amended, supplemented or waived by our board of directors (which must include a majority of our independent directors) from time to time, but without the approval of our stockholders.

Summary Risk Factors

An investment in shares of our common stock involves various risks. You should consider carefully the following risks and those under the heading “Risk Factors” before purchasing our common stock:

| • | Our loans and investments expose us to risks similar to and associated with debt-oriented real estate investments generally. |

| • | Commercial real estate-related investments that are secured, directly or indirectly, by real property are subject to delinquency, foreclosure and loss, which could result in losses to us. |

| • | Fluctuations in interest rate and credit spreads, which may not be adequately protected or protected at all, by our hedging strategies, could reduce our ability to generate income on our loans and other investments, which could lead to a significant decrease in our results of operations, cash flows and the market value of our investments. |

| • | Our loans and investments will be concentrated in terms of geography, asset types and sponsors upon completion of the formation transaction and may continue to be so in the future. |

| • | Upon the completion of the formation transaction, we will have a substantial amount of indebtedness which may limit our financial and operating activities and may adversely affect our ability to incur additional debt to fund future needs. |

| • | We have limited operating history as a standalone company and may not be able to operate our business successfully, find suitable investments, or generate sufficient revenue to make or sustain distributions to our stockholders. |

| • | We are dependent upon our Manager and its affiliates to conduct our day-to-day operations; thus, adverse changes in their financial health or our relationship with them could cause our operations to suffer. |

| • | We may not replicate the historical results achieved by other entities managed or sponsored by affiliates of our Manager, members of our Manager’s management team or by our Sponsor or its affiliates. |

| • | Our Manager and its affiliates will face conflicts of interest, including significant conflicts created by our Manager’s compensation arrangements with us, including compensation which may be required to be paid to our Manager if our management agreement is terminated, which could result in decisions that are not in the best interests of our stockholders. |

| • | We will pay substantial fees and expenses to our Manager and its affiliates, which payments increase the risk that you will not earn a profit on your investment. |

19

Table of Contents

| • | If we fail to qualify as a REIT for U.S. federal income tax purposes, cash available for distributions to be paid to you could decrease materially, which would limit our ability to make distributions to our stockholders. |