UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year

ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission

file number:

(Exact Name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

People’s Republic

of

(Address of principal executive offices)

Telephone:

E-mail:

People’s Republic

of

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| American depositary shares, each representing three Class A ordinary shares, par value US$0.00001 per share | New York Stock Exchange | |||

| | |

* Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

| None | ||

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

| None | ||

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Class A ordinary shares, par value US$0.00001 each | ||

| Class B ordinary shares, par value US$0.00001 each |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Non-accelerated filer ☐ | |

| Emerging growth company |

If an emerging

growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant

to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark

whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

i

INTRODUCTION

Unless we indicate otherwise and for the purpose of this annual report only:

| ● | “ADRs” refers to the American depositary receipts which, if issued, evidence the ADSs; |

| ● | “ADSs” refers to American depositary shares, each of which represents three Class A ordinary shares; |

| ● | “Affected Entities” refers to the middle schools that are affected by the Implementation Rules, and entities holding such middle school institutions or middle school programs, which are listed in “Item 4. Information on the Company—C. Organizational Structure”; |

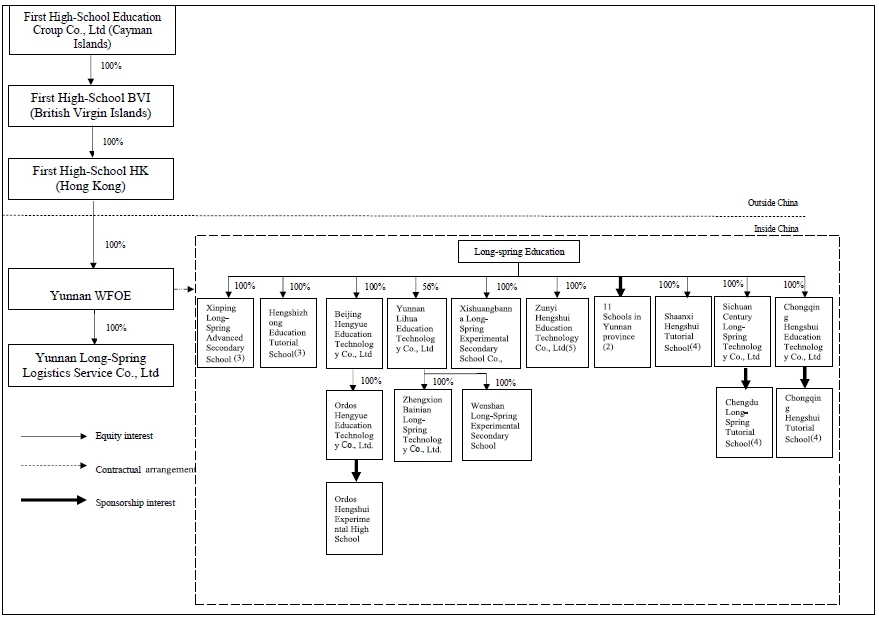

| ● | “affiliated entities” refers to the entities that First High-School Education Group Co., Ltd. controls and consolidates through contractual arrangements, as the context requires, including, collectively, Long-Spring Education Holding Group Limited, or Long-Spring Education, its subsidiaries and our schools; |

| ● | “CAGR” refers to compound annual growth rate; |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| ● | “Class A ordinary shares” refers to our Class A ordinary shares, par value US$0.00001 per share; |

| ● | “Class B ordinary shares” refers to our Class B ordinary shares, par value US$0.00001 per share; |

| ● | “Double First Class University Plan” refers to a tertiary education development initiative designed by the PRC government in 2015, which aims to comprehensively develop elite Chinese universities into world-class institutions by the end of 2050 through developing and strengthening their individual faculty departments; |

| ● | “first-tier universities” refers to the first batch of universities that enroll students after Gaokao. First-tier universities generally have stronger comprehensive strengths, such as school facilities, academic resources and research capabilities, among other things, and frequently gain special support from the PRC central and local governments. To be admitted into a first-tier university, interested high school graduates must achieve certain high scores set by the relevant PRC provincial education authorities and select such university in their general university applications; |

| ● | “Gaokao” refers to the university entrance examinations administered in China; |

| ● | “Gaokao repeaters” refers to the high school graduates who fail to achieve satisfying results in Gaokao or be admitted to the universities of their choosing, and elect to repeat the last year of high school and retake Gaokao in the following year; |

| ● | “high school(s)” refers to, for the purpose of this annual report, high school institutions or high school programs provided in our schools; |

| ● | “Implementation Rules” refers to the Implementation Rules for Private Education Laws, which was issued by the PRC State Council on May 14, 2021 and became effective on September 1, 2021; |

ii

| ● | “middle school(s)” refer to, for the purpose of this annual report, middle school institutions or middle school programs provided in our schools that also provide high school programs; |

| ● | “ordinary shares” refers to our ordinary shares, par value US$0.00001 per share and our Class A ordinary shares and Class B ordinary shares, par value US$0.00001 per share; |

| ● | “our schools” refers to Kunming Xishan Long-Spring Experimental Secondary School (formerly known as Resort District Hengshui Experimental Secondary School), Kunming Chenggong Long-Spring Experimental Secondary School (formerly known as Yunnan Hengshui Chenggong Experimental Secondary School), Yiliang Long-Spring Experimental Secondary School (formerly known as Yunnan Hengshui Yiliang Experimental Secondary School), Yunnan Hengshui Experimental Secondary School—Xishan School, Qujing Hengshui Experimental Secondary School, Yunnan Yuxi Hengshui Experimental High School, Ordos Hengshui Experimental High School, Yunnan Long-Spring Foreign Language Secondary School, Xinping Long-Spring Advanced Secondary School (formerly known as Xinping Hengshui Experimental High School), Xishuangbanna Long-Spring Experimental Secondary School (formerly known as Xishuangbanna Hengshui Experimental High School), Qiubei Long-Spring Experimental Secondary School (formerly known as Yunnan Hengshui Qiubei Experimental High School), Wenshan Long-Spring Experimental Secondary School (formerly known as Yunnan Hengshui Wenshan Experimental High School), Zhenxiong Long-Spring Advanced Secondary School (formerly known as Yunnan Hengshui Zhenxiong High School), Mengla Long-Spring Experimental Secondary School (formerly known as Mengla Hengshui Experimental High School), Yunnan Zhongchuang Education Tutorial School, Hengshizhong Education Tutorial School, Guizhou Zunyi Tutorial School, Chongqing Hengshi Tutorial School, Chengdu Long-Spring Tutorial School, Shaanxi Hengshi Tutorial School, Xinping Hengshui Experimental Middle School, and Shaanxi Hengshui Experimental Middle School, unless otherwise specified, before the deconsolidation of the Affected Entities, and Kunming Xishan Long-Spring Experimental Secondary School, Kunming Chenggong Long-Spring Experimental Secondary School, Yiliang Long-Spring Experimental Secondary School, Yunnan Hengshui Experimental Secondary School—Xishan School, Qujing Hengshui Experimental Secondary School, Yunnan Yuxi Hengshui Experimental High School, Ordos Hengshui Experimental High School, Yunnan Long-Spring Foreign Language Secondary School, Xinping Long-Spring Advanced Secondary School, Xishuangbanna Long-Spring Experimental Secondary School, Qiubei Long-Spring Experimental Secondary School, Wenshan Long-Spring Experimental Secondary School, Zhenxiong Long-Spring Advanced Secondary School, Mengla Long-Spring Experimental Secondary School, Yunnan Zhongchuang Education Tutorial School, Hengshizhong Education Tutorial School, Guizhou Zunyi Tutorial School, Chongqing Hengshi Tutorial School, Chengdu Long-Spring Tutorial School, and Shaanxi Hengshi Tutorial School, unless otherwise specified, after the deconsolidation of the Affected Entities, as the context requires; |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “tutorial school(s)” refers to, for the purpose of this annual report, tutorial school programs for Gaokao repeaters, unless otherwise specified; |

| ● | “US$,” “U.S. dollars,” “$” or “dollars” refers to the legal currency of the United States of America; |

| ● | “VIE” refers to Long-Spring Education Holding Group Limited; |

| ● | “Western China” refers to Sichuan, Guizhou, Yunnan, Shaanxi, Gansu and Qinghai provinces, Inner Mongolia Autonomous Region, Tibet Autonomous Region, Xinjiang Autonomous Region and Ningxia Autonomous Region and Chongqing municipality; |

| ● | “we,” “us,” “our” or “our company” refers to First High-School Education Group Co., Ltd., its subsidiaries and its affiliated entities; and |

| ● | “Zhongkao” refers to the high school entrance examinations administered in China. |

iii

We have made rounding adjustments to reach some of the figures included in this annual report. Consequently, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

First High-School Education Group Co., Ltd., our ultimate Cayman Islands holding company, does not have any substantive operations other than indirectly controlling Long-Spring Education, the VIE which controls and holds our schools, collectively as the affiliated entities, through certain contractual arrangements. Investors in the ADSs are purchasing equity securities of our ultimate Cayman Islands holding company rather than purchasing equity securities of the affiliated entities. We conduct our business operations through both our subsidiaries and the affiliated entities, which we effectively control through certain contractual arrangements. We, together with the affiliated entities, are subject to PRC laws relating to, among others, restrictions over foreign investments in education services set out in the Negative List (2021 Version) promulgated by the Ministry of Commerce (“MOFCOM”), and the National Development and Reform Commission (“NDRC”). As a result, we have to control over the affiliated entities through contractual arrangements. The VIE structure is used to replicate foreign investment in China-based companies where the PRC law prohibits direct foreign investment in the operating companies. Neither we nor our subsidiaries own any share in the affiliated entities. Instead, we control and receive the economic benefits of the affiliated entities’ business operation through a series of contractual agreements with the affiliated entities. The contractual agreements with the affiliated entities are designed to provide Yunnan Century Long-Spring Technology Co., Ltd. (“Yunnan WFOE”) with the power, rights, and obligations equivalent in all material respects to those it would possess as the principal equity holder of the affiliated entities, including absolute control rights and the rights to the assets, property, and revenue of the affiliated entities. As a result of our direct ownership in Yunnan WFOE and the contractual agreements with the affiliated entities, we are regarded as the primary beneficiary of the affiliated entities. Because of our corporate structure, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on foreign ownership of private education entities, and regulatory review of oversea listing and offering of securities of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our contractual agreements may not be effective in providing control over the affiliated entities. We may also subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission if we fail to comply with their rules and regulations.

We and the affiliated entities face various legal and operational risks and uncertainties related to being based in and having significant operations in China. The PRC government has significant authority to exert influence on the ability of a China-based company, such as us and the affiliated entities, to conduct its business, accept foreign investments or list on U.S. or other foreign exchanges. For example, we and the affiliated entities face risks associated with regulatory approvals of offshore offerings, oversight on cybersecurity and data privacy, as well as the lack of PCAOB inspection on our independent registered public accounting firm. Such risks could result in a material change in our operations and/or the value of the ADSs or could significantly limit or completely hinder our ability to offer ADSs and/or other securities to investors and cause the value of such securities to significantly decline or be worthless. The PRC government also has significant discretion over the conduct of the business of us and the affiliated entities and may intervene with or influence our operations or the development of the private education industry as it deems appropriate to further regulatory, political and societal goals. Furthermore, the PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and foreign investment in China-based companies like us. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. For relevant risks, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Recent joint statement by the SEC and the PCAOB, proposed rule changes submitted by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.”

Our financial statements contained in the annual report on Form 20-F for the years ended December 31, 2019, 2020 and 2021 have been audited by an independent registered public accounting firm that is headquartered in Singapore and has been inspected by the PCAOB on a regular basis, which was not included in the list of PCAOB Identified Firms of having been unable to be inspected or investigated completely by the PCAOB in the PCAOB Determination Report issued in December 2021. We have not been identified by the U.S. Securities and Exchange Commission (the “SEC”) as a non-inspection registrant under the Holding Foreign Company Accountable Act (the “HFCAA”), as of the date of this annual report. If, in the future, we have been identified by the SEC for three consecutive years as a non-inspection registrant whose registered public accounting firm is determined by the PCAOB that it is unable to inspect or investigate completely because of a position taken by one or more authorities in China, the SEC may prohibit our shares or ADSs from being traded on a national securities exchange or in the over the counter trading market in the United States. Additionally, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. If we fail to meet the new listing standards specified in the HFCAA, we could face possible delisting from the NYSE, cessation of trading in over the counter market, deregistration from the SEC and/or other risks, which may materially and adversely affect, or effectively terminate, the ADSs trading in the United States. For more details about the risk on the HFCAA and its impact on us, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Recent joint statement by the SEC and the PCAOB, proposed rule changes submitted by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.”

Our reporting currency is Renminbi. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Renminbi into U.S. dollars were made at RMB6.3726 to US$1.00, the noon buying rate on December 30, 2021 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi at any particular rate or at all.

iv

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements about our current expectations and views of future events. These forward looking statements are made under the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to events that involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from those expressed or implied by these statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “could,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “propose,” “potential,” “should,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. The forward-looking statements included in this annual report relate to, among other things:

| ● | our mission, goals and strategies; |

| ● | our ability to retain and grow customer base; |

| ● | our future business development, financial condition and results of operations; |

| ● | expected changes in our revenue, costs or expenditures; |

| ● | our ability to manage and expand the sales network and other aspects of our operations; |

| ● | our projected markets and growth in markets; |

| ● | our potential need for additional capital and the availability of such capital; |

| ● | competition in our industry; |

| ● | relevant government policies and regulations relating to our industry; |

| ● | general economic and business conditions globally and in China; and |

| ● | assumptions underlying or related to any of the foregoing. |

You should read this annual report and the documents that we refer to in this annual report completely and with the understanding that our actual future results may be materially different from and worse than what we expect. Moreover, new risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

This annual report also contains certain data and information that we obtained from various government and private publications. Statistical data in these publications include projections based on a number of assumptions. Failure of the market to grow at the projected rate may have a material adverse effect on our business and the market price of the ADSs. In addition, projections or estimates about our business and financial prospects involve significant risks and uncertainties. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

v

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks related to our business and industry

| ● | our efforts to be in compliance with the Implementation Rules materially and adversely affecting our business, financial condition, results of operations and prospect in the future; |

| ● | our limited operating history, which makes it difficult to predict our prospects and our business and financial performance; |

| ● | potential contractual disputes in relation to the sponsorship in the schools that local governments may claim to have sponsor interests, which could cause us to lose control of the affected schools if any such contractual dispute were to judicially determined against us; |

| ● | new legislation or proposed changes in the PRC regulatory requirements regarding private education, which may cast doubt on the legality of our contractual arrangements and our revenue derived from the running of schools pursuant to our contractual arrangements; |

| ● | our ability to execute our growth strategies, continue to grow rapidly or manage our growth effectively, which may negatively affect our prospects and our business and financial performance; |

| ● | our ability to charge tuition and boarding fees at sufficient levels to be profitable or increase our fee level, which may negatively affect our profitability; |

| ● | our ability to enroll and retain a sufficient number of students, which may negatively affect our profitability; |

| ● | potential unfavorable changes in our cooperative relationships with local governments or favorable government policy treatment, which could negatively affect our current business model and/or result in disputes with the relevant local governments; |

| ● | our ability to obtain all required approvals, licenses and make all required registrations for our education services and business operations, which could subject us to fines and penalties and order to cease operation in the case of non-compliance; |

| ● | our ability to integrate businesses we acquired or plan to acquire in the future, which may negatively affect our expansion; |

| ● | our ability to attract and retain a sufficient number of qualified teachers and principals, which could negatively affect our business if we experience a shortage of high-quality teachers and principals; |

1

| ● | our ability to maintain the market recognition of our brand and our reputation; and |

| ● | accidents, injuries or other harm at our school premises or otherwise arising from or in connection with our education services, which could subject us to tort liabilities. |

Risks related to our corporate structure

| ● | compliance of the contractual arrangements that establish our corporate structure for operating our business, which could subject us to penalties if the PRC government finds that our corporate structure and contractual arrangements does not comply with applicable PRC laws and regulations; |

| ● | uncertainties in the interpretation of newly issued rules, regulatory actions and statements related to VIE and private schools, under which we may be unable to assert our contractual rights over the assets of the affiliated entities; |

| ● | failure by the VIE or its shareholders to perform their obligations under our contractual arrangements with them, which could force us to rely on legal remedies under PRC laws to enforce the contractual arrangements, which may not be effective; |

| ● | uncertainties with respect to the interpretation and implementation of the newly enacted Foreign Investment Law and its impact on the viability of our current corporate structure, which could require us to take additional actions with respect to, or modify or unwind, our current contractual arrangements to the extent required by any unfavorable interpretation or implementation; and |

| ● | actual or potential conflicts of interest of shareholders of the VIE with us, which could cause such shareholders not to act in the best interests of our company. |

Risks related to doing business in China

| ● | changes in China’s economic, political or social conditions or government policies, laws and regulations, which could adversely affect the education services market and harm our business; |

| ● | uncertainties with respect to the PRC legal system, which may affect our decisions on the policies and actions to be taken to comply with PRC laws and regulations; |

| ● | any actions by the Chinese government may cause us to make material changes to the operation of our PRC subsidiaries or the affiliated entities; |

| ● | significant uncertainties in the application and interpretation of the Law on Promoting Private Education, the Implementation Rules and their detailed implementation rules and regulations; |

| ● | increased regulatory scrutiny focus on U.S.-listed companies with operations in China, which could add uncertainties to our business operations, share price and reputation; and |

| ● | difficulty for overseas regulators to conduct investigations or collect evidence within China, which could increase difficulties you face in protecting your interests. |

Risks related to the ADS

| ● | volatility of the trading price of the ADSs; and |

| ● | the sale or availability for sale of substantial amounts of the ADSs. |

| ● | impact of our dual-class share structure on the ability of holders of our Class A ordinary shares and ADSs to influence corporate matters, which, among other things, will limit your ability to influence corporate matters and could discourage others from pursuing any favorable change of control transactions. |

2

Risks Related to Our Business and Industry

Our efforts to be in compliance with the Implementation Rules has materially and adversely affected and may continue to materially and adversely affect our business, financial condition, results of operations and prospect in the future.

On May 14, 2021, the PRC State Council promulgated the amended Implementation Rules for Private Education Laws (the “Implementation Rules”), which became effective on September 1, 2021. Pursuant to the Implementation Rules, (1) foreign-invested enterprises established in China and social organizations whose actual controllers are foreign parties shall not sponsor, participate in or actually control private schools that provide compulsory education, (2) social organizations or individuals shall not control any private school that provides compulsory education or any non-profit private school that provides pre-school education by means of, among others, merger, acquisition and contractual arrangements, and (3) private schools providing compulsory education shall not conduct any transaction with any related party, and any other private school conducting any transaction with any related party shall follow the principles of openness, fairness and impartiality, fix the price reasonably and regulate the decision-making, and shall not damage the interests of the state and the school or the rights and interests of the teachers and students, which may impose restrictions on the above-mentioned related party transactions. Such prohibition has significantly affected the enforceability of the exclusive management services and business cooperation agreements with affiliated entities providing compulsory education.

The Implementation Rules have had significant impacts on our business operations and our results of operations. As a result of the effectiveness of the Implementation Rules, we have lost control over the Affected Entities as from September 1, 2021, which primarily include the middle schools providing compulsory education and the sponsor entities within China that are affected by the Implementation Rules. Consequently, we classified the operation for the Affected Entities as discontinued operations. We have determined that, in substance, we had ceased to recognize revenues for all activities related to the Affected Entities and had discontinued all business activities with such entities by September 1, 2021 while continuing to provide essential services to keep these schools in normal operations. Such discontinuation has had a material and adverse impact on our business, financial condition and results of operations. Our ability to engage in the compulsory education in China has been materially and adversely affected, and we cannot assure you that we will be able to restore such ability, which could materially and adversely affect our business, prospects, results of operations and financial condition.

We have limited operating history, which makes it difficult to predict our prospects and our business and financial performance.

We have a limited operating history of nine years, with our first school established in 2012. Our limited operating history may not serve as an adequate basis for evaluating our prospect and results of operations, including revenues, cash flows and operating margins. We have encountered, and may continue to encounter in the future, risks, challenges and uncertainties associated with operating a private education business, such as addressing regulatory compliance and uncertainty, engaging, training and retaining high-quality teachers, and expanding our school network. If we do not manage these risks successfully, our operating and financial results may differ materially from our expectations and our business and financial performance may suffer.

In addition, as some of our schools commenced operations recently, they have not yet reached their full capacity. For newly established schools, we only admit students for the entry classes, such as the tenth grade for high schools, but not higher grades, upon the establishment of a new school, which leads to a relatively lower utilization rate for such schools. With our existing students progressing into the next grades in school and as we fill up new entry classes, the utilization rates of our newly established schools will increase accordingly. We cannot assure you that we will be able to successfully increase the utilization rate for the schools that are in the ramp-up stage, which may materially and adversely affect our business growth and profitability.

If local governments claim to have sponsor interests in certain of our schools, we could be subject to contractual disputes in relation to the sponsorship in those schools or the entry into contractual arrangements over those schools.

We primarily collaborate with local governments to establish and operate our schools. The cooperative arrangements for a total of seven schools provide that the local governments retain ownership in the affected schools’ “ownership assets” without defining what constitutes such assets. It is possible that “ownership assets” could be interpreted in a way to include sponsor interest, in which case, the local governments may have a claim over the sponsor interest in the affected schools. We have obtained written statements from local governments for all of the seven schools confirming our understanding that “ownership assets” refer to real estate and tangible assets that local governments provided.

In addition, the school operation permits for Yunnan Hengshui Experimental Secondary School—Xishan School and Yunnan Yuxi Hengshui Experimental High School provide that the local governments and Long-Spring Education are co-sponsors of such schools. We have obtained written statements for Yunnan Hengshui Experimental Secondary School—Xishan School and Yunnan Yuxi Hengshui Experimental High School from the local governments confirming our understanding that the sponsor interests of such schools belong to Long-Spring Education. As of the date of this annual report, we are in the process of amending these permits to designate Long-Spring Education as the sole sponsor.

Furthermore, according to the list released by People's Government of Xishan District on March 30, 2022, Yunnan Hengshui Experimental Secondary School—Xishan School may be turned into a public school from September 2022. As of the date of this annual report, we are in the process of communicating with the competent authorities on such matter.

3

To the extent that any local government has a claim over the sponsor interest in or control over any of our schools, we could be subject to contractual disputes. For example, the government claimants could argue that they have de facto sponsor interest in the affected schools per our cooperative arrangements and that the entry into the contractual arrangements in relation to the affected schools have infringed their interests. If the government claimants successfully persuaded the court to rule in their favor, we could lose control over the affected schools and may be unable to receive the full rights and economic benefits of any or all of those schools, in which case we would no longer be able to include the operating results of those schools in our consolidated financial statements, which in turn would materially and adversely affect business, results of operation and financial condition.

Uncertainties exist in relation to new legislation or proposed changes in the PRC regulatory requirements regarding private education, which may materially and adversely affect our group structure, our business, financial condition and results of operation

Pursuant to the Law on Promoting Private Education of the PRC (the “Private Education Law”), last amended and becoming effective on December 29, 2018, sponsors of private schools may choose to establish schools in China as either non-profit or for-profit schools. Sponsors are not permitted to establish for-profit schools that provide compulsory education services, which cover grades one to nine. Sponsors of for-profit private schools are entitled to retain the profits from their schools and the operating surplus may be allocated to the sponsors pursuant to the PRC Company Law and other relevant laws and regulations. Sponsors of non-profit private schools are not entitled to any distribution of profits from their schools and all revenues must be used for the operation of the schools. For further details, see “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations on Private Education in the PRC—The Law on Promoting Private Education.” Our school sponsors have registered Hengshizhong Education Tutorial School, Xinping Long-Spring Advanced Secondary School, and Xishuangbanna Long-Spring Experimental Secondary School as for-profit private schools and have registered Qujing Hengshui Experimental Secondary School, Xinping Hengshui Experimental Middle School, Qiubei Long-Spring Experimental Secondary School, Wenshan Long-Spring Experimental Secondary School, and Mengla Long-Spring Experimental Secondary School as non-profit private schools, while have not submitted classified registration materials for the rest of our schools as for-profit or non-profit educational institutions. We cannot assure you that our current intention to register some of our schools as non-profit educational institutions will not materially and adversely affect our business, financial condition and results of operations. As a holding company, our ability to generate profits, pay dividends and other cash distributions to our shareholders under the Private Education Law is affected by many factors, including but not limited to the characterizations of our schools as for-profit or non-profit schools, the profitability of our schools and other affiliated entities, and our ability to receive dividends and other distributions from our wholly-owned PRC subsidiary, Yunnan WFOE, which in turn depends on the service fees paid to Yunnan WFOE from our schools and other affiliated entities. If our schools are unable to be registered as for-profit private education entities, the approval of which is subject to the discretion of government authorities, our contractual arrangements with such schools may be subject to more stringent scrutiny. Furthermore, pursuant to the Private Education Law, sponsors are not permitted to establish for-profit schools if such schools provide compulsory education services, which cover grades one to nine. Nevertheless, during the reporting period, compulsory education services accounted for a significant portion of our student base as well as revenue.

In addition, the Opinions on Further Strengthening and Regulating the Administration of Education Fees (the “Opinions”), which were issued on August 17, 2020 by the MOE, the National Development and Reform Commission, the Ministry of Finance, the State Administration of Market Regulation and the National Press and Publication Administration, reiterate the provision from the decision that the sponsors of non-profit privately-run schools may not obtain proceeds from the running of schools. The Opinions further provide that the sponsors of non-profit privately-run schools and non-profit sino-foreign cooperative educators may not obtain proceeds from the running of schools such as tuition income, distributing school balances (residual assets) or transferring proceeds from the running of schools through related-party transactions or affiliated parties or other means. The Opinions have not specified (1) whether the contractual arrangements fall within the activities of transferring the proceeds from the running of schools through profit privately-run schools and non-profit sino-foreign cooperative educators may not obtain proceeds from the running of schools such as tuition income, distributing school balances (residual assets) or transferring proceeds from the running of schools through related-party transactions or affiliated parties or other means, (2) the relevant legal consequences of engaging in activities through contractual arrangements, or (3) the scope of proceeds from the running of schools by listing other possible income sources such as meal and accommodation services.

4

We are entitled to the tuition and boarding fees to be paid by our schools that are largely derived from the proceeds from the running of schools pursuant to our contractual arrangements. See “Item 4. Information on the Company—C. Organizational Structure—Our Contractual Arrangements.” If any law and regulation that may be promulgated in the future further defines the contractual arrangements, including ours, as related-party transactions transferring proceeds from the running of schools, we may not obtain the part of the tuition and boarding fees under our contractual arrangements that is funded by proceeds from the running of schools. As advised by our PRC legal counsel, Jingtian & Gongcheng, the Opinions do not affect the legality of our contractual arrangements in accordance with applicable PRC laws and regulations, as the provisions under the Opinions did not render the contractual arrangements invalid under the Civil Code of the PRC. As of the date of this annual report, however, we have not sought declaration from the relevant government authorities as to the legality of our contractual agreements under the Opinions, and we are not aware of any official administrative or judicial declaration on, or interpretation of, the Opinions, especially as applied to contractual or other similar arrangements under which we operate. We are also not aware of when official administrative or judicial declaration or interpretation on that matter will be released, if at all, and we cannot assure you that the Opinions will not be interpreted, or further laws and regulations will not be promulgated, in a way that would affect or impair our ability to retain the tuition and boarding fees under the contractual arrangements in the future. Our business, financial condition and results of operations would be materially and adversely affected if we are unable to obtain any or all of the tuition and boarding fees to be paid by our schools under the contractual arrangements.

We may not be able to execute our growth strategies, continue to grow rapidly or manage our growth effectively.

We have experienced steady growth and expansion since the establishment of our first secondary school in 2014. We plan to continue to expand our operations in different geographic locations in China primarily by (1) entering into partnerships with local governments and independent third parties; (2) establishing new self-owned schools; and (3) acquiring additional schools if there are suitable targets.

However, we may not be able to continue to grow as we did in the past due to uncertainties involved in the process as follows:

| ● | we may not be able to attract and retain a sufficient number of students for our existing and new schools; |

| ● | we may not be able to hire, retain and train qualified teachers, and attract and retain management, administrative and marketing personnel for our existing and new schools; |

| ● | we may be unable to optimize our student’s academic performance as expected; |

| ● | we may be unable to adequately update our operational, administrative and technological systems and strengthen our financial and management controls to support our future expansion; |

| ● | we may be unable to keep strengthening our operational, administrative and technological systems, our financial and management controls; |

| ● | the development and acquisitions of new schools may be delayed or affected as a result of many factors, such as delays in obtaining government approvals or licenses, and changes in applicable laws and regulations, some of which are beyond our control; |

| ● | we may not be able to maintain and enhance our brand name and reputation; |

| ● | we may be unable to successfully execute new growth strategies; and |

| ● | we may be unable to successfully integrate entities we have established or acquired into our operations. |

These risks may increase significantly as we expand into new geographical areas. We may find it difficult to manage our financial resources, implement uniform education standard and operational policies and maintain consistency across our network. There are no guarantees that we will be able to effectively manage any future growth in an efficient, cost-effective and timely manner, or at all. Our growth in a relatively short period of time is not necessarily indicative of results that we may achieve in the future. In addition, local governments and cooperative partners may have interests which are not entirely in line with ours and may consider their own interests or the interests of other stakeholders of schools in making cooperation decisions, and as a result, we may be unable to execute our expansion plan and growth strategies in a cost-effective or timely manner, or at all. Any failure in our management and execution of our expansion plan may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our business, financial condition and results of operations.

5

These risks may increase significantly as we expand into new geographical areas. We may find it difficult to manage our financial resources, implement uniform education standard and operational policies and maintain consistency across our network. There are no guarantees that we will be able to effectively manage any future growth in an efficient, cost-effective and timely manner, or at all. Our growth in a relatively short period of time is not necessarily indicative of results that we may achieve in the future. In addition, local governments and cooperative partners may have interests which are not entirely in line with ours and may consider their own interests or the interests of other stakeholders of schools in making cooperation decisions, and as a result, we may be unable to execute our expansion plan and growth strategies in a cost-effective or timely manner, or at all. Any failure in our management and execution of our expansion plan may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our business, financial condition and results of operations.

We may be unable to charge tuition and boarding fees at sufficient levels to be profitable or increase our fee level.

Our revenues are primarily driven by our tuition and boarding fees. For 2019, 2020 and 2021, tuition income accounted for 78.1%, 78.4% and 81.0% of our total revenues, respectively, and our boarding fees accounted for 4.7%, 4.6% and 4.8% of our total revenues, respectively, for the same periods. Subject to applicable regulatory requirements, we determine our tuition and boarding fee rates based on many factors, including market supply and demands for our education, our cost of operations, the quality of education services we provide, the geographic area we operate in, and general economic conditions of the PRC. Although we have been able to increase the tuition and boarding fees we charge our students at certain schools in the past, we cannot guarantee that we will be able to maintain or increase our tuition in the future without adversely affecting the demand for our education services. Our competitive advantage might be adversely affected if we fail to implement the optimal pricing strategy to maintain our profitability, which could adversely affect our student enrollments and consequently our revenues and cash flow.

As part of our cooperation with local governments, we admit a certain number of local students on behalf of the government as publicly-sponsored students. These students pay us tuition typically at the level of public schools, which are usually lower than the normal tuition we charge, and under our cooperative arrangements with local governments for certain of our schools, we may receive government subsidies to make up for the tuition difference. As of December 31, 2019, 2020 and 2021, the number of publicly-sponsored students in our schools was 4,607, 6,755 and 7,993, respectively, accounting for 33.7%, 39.2% and 42.8% of our total students for our continuing operations as of the same dates. We have limited discretion in increasing the tuition for publicly-sponsored students, and the government subsidies have an upper limit which we may gradually use up over a number of years. We intend to re-negotiate with the local governments to obtain additional government subsidies to cover the tuition difference for the publicly-sponsored students after we use up the upper limit or our cooperative arrangements with local governments expire. If our re-negotiation efforts fail, or if we cannot collect the outstanding amount of government subsidies on time, we would be unable to make up for the price difference for publicly-sponsored students, which would materially and adversely affect our profitability.

The tuition and boarding fees we charge are subject to regulatory restrictions. While we are not required to obtain pre-approval from relevant authorities before raising our tuition and boarding fees in Yunnan province, China where most of our schools are located, we are generally required to file and record our price increase with local governments, who in turn still maintain certain level of control and oversight of our operation. We might also be inspected by relevant pricing authorities in the future, which could result in negative adjustments in our tuition and boarding fees and material disruption of our operations.

Furthermore, the tuition we may charge is subject to a number of other factors, such as the perception of our brand, the academic results achieved by our students, our ability to hire qualified teachers, and local economic conditions. Any significant deterioration in these factors could have a material adverse effect on our ability to charge tuition at levels for us to remain profitable.

6

If we fail to enroll and retain a sufficient number of students, our business could be materially and adversely affected.

Our ability to continue to enroll and retain students for our schools is critical to the continued success and growth of our business. The success of our efforts to enroll and retain students will depend on several factors, including our ability to:

| ● | enhance existing education programs and services to respond to market changes and student demands; |

| ● | develop new programs and services that appeal to our students and their parents; |

| ● | maintain and enhance our reputation and brand recognition as a leading school operator; |

| ● | expand our school network and geographic reach; |

| ● | effectively market our schools and programs to a broader base of prospective students; |

| ● | manage our growth while maintaining consistency of our teaching quality; |

| ● | maintain cooperative relationships with local governments; and |

| ● | respond to increasing competition in the market. |

In addition, local and provincial government authorities may impose restrictions on the number of students we can enroll. Our business, financial condition and results of operations could be materially and adversely affected if we cannot maintain or increase our student base as we expand our school network.

Our ability to maintain sufficient cash to fund our operations depends on our financing activities.

Our ability to maintain sufficient cash to fund our operations depends on our financing activities. In April 2019, August 2020 and November 2021, we entered into sale and leaseback arrangements with certain financing leasing companies for net financing proceeds of RMB28.7 million, RMB93.5 million and RMB50.0 million (US$7.8 million), respectively. Under the sale and leaseback arrangements, Yunnan WFOE, Long-Spring Education, Yunnan Long-Spring Logistics Service Co., Ltd. and ten of our schools, or collectively the lessees, sold certain equipment, including computers, projectors and printers, to the lessors. Concurrent with the sale of the leased equipment, the lessees lease back all of the leased equipment sold to the lessor for a lease term of two or three years. We consider the substance of the transaction to be debt financing in nature and no gain or loss is recognized upon the sale of these assets. If the lessees fail to make lease payments in full and timely or there be any material adverse change in our business, the lessor has the right to immediately collect the total lease payments, request for penalty on late payment, and/or retrieve the leased equipment. As a result, our ability to maintain sufficient cash to fund our operations could be diminished, which may materially and adversely affect our business, financial condition and results of operations.

Any unfavorable changes in our cooperative relationships with third parties or favorable government policy treatment may adversely affect our business.

Our asset-light business model, under which we form mutually beneficial cooperative arrangements with third parties, including local governments and real estate developers, has allowed us to grow rapidly and expand with light capital commitments and have more flexibility in our allocation of financial resources. Under such arrangements, our partners contributed or leased to us land and/or school facilities, and our government partners also granted to us favorable tax treatments or other forms of favorable government policies or support, while we contributed our expertise in operating private schools, teachers, as well as operating expenses of the schools and capital expenditures to construct and renovate school facilities.

If our relationship with our partners deteriorates or favorable government policies and support cease to be available, we may incur substantial amount of expenses in connection with our infrastructure, promotion, and other matters relating to school establishment and operations, which may materially and adversely affect our business, financial condition and results of operations. We may also be unable to form cooperative relationship with third parties in the geographic areas we plan to enter and expand into, which would materially and adversely affect our ability to grow as quickly as planned or maintain historical growth rates.

The cooperative arrangements for five schools within our network have provided that the local government has the right to appoint a majority of a school’s board of supervisors, which shall be the supreme decision-making body in school management. As of the date of this annual report, we obtained written statements from local governments for four of such schools confirming that the school council or board of director should be the decision-making body for such schools. To the extent any of these local governments changes their view toward our collaborative relationships and claims to have control in these schools, we could be subject to contractual disputes with the local governments in relation to the management of such schools.

7

In September 2018, we entered into certain cooperation agreements with local governments in Inner Mongolia Autonomous Region, China, pursuant to which we provide school operation and management services and receive service fees. See “Item 4. Information on the Company—B. Business Overview—Our Schools and Programs” We are also required to meet certain academic performance targets pursuant to such agreements. If we fail to meet such performance targets, we may be found in breach of the agreements and be unable to continue our cooperation with the relevant governments, which may materially and adversely affect our relationship with the relevant governments, as well as our business, financial condition and results of operations. We may also be unable to enter into similar cooperation agreements with third parties in the future, which may materially and adversely affect our business, financial condition and results of operations

We may be unable to obtain all required approvals, licenses and make all required registrations for our education services and business operations, and may be subject to fines and penalties if the operations of our business do not comply with applicable PRC laws and regulation.

In order to conduct our business and operate our schools in China, we are required to obtain and maintain various approvals, licenses and permits and fulfill registration and filing requirements. For example, to establish and operate a school in the PRC, we are required to obtain a private school operation permit from the local education bureau and register with the local civil affairs bureau to obtain a certificate of registration for a privately-run non-enterprise unit for a non-profit school, or register with the local market supervision and administration department to obtain a business license for a for-profit school. Such local regulatory authorities may also conduct annual inspection of our schools. We currently hold valid private school operation permits for all of our operating schools except for Chengdu Long-Spring Tutorial School, Shaanxi Hengshi Tutorial School and Chongqing Hengshi Tutorial School, which are still in the process of obtaining a private school operation permit and registering with the local market supervision and administration department or the local civil affairs bureau, and Hengshizhong Education Tutorial School for which the private school operation permit has been cancelled. For such schools which conduct business before we can obtain a private school operation permit, we may be subject to order to cease our operation, refund the income we collected and a fine ranging from one to five times of the income the sponsor collected. Ordos Hengshui Experimental High School is still in the process of applying for the renewal of such permit. We cannot guarantee that all of our existing schools will be able to renew their permits, or that all of our newly opened schools will be able to receive operation permits in a timely manner or at all, which may materially and adversely affect our business and results of operations.

A total of 17 of our schools have not set up their own on-site medical clinics, all of such schools are in the process of engaging third-party hospitals and/or medical clinics with valid practice license to provide healthcare services on campus, and recruiting a sufficient number of medical care personnel. However, we cannot assure you that we may be able to obtain all relevant practice licenses, retain third-party licensed medical care providers or otherwise fully comply with the relevant laws and regulations relating to on-site medical clinics at all of our current locations in a timely manner or at all, and we may be subject to orders to rectify within a specified period of time.

While we intend to obtain all requisite permits, approvals and complete the necessary filings, renewals and registrations on a timely basis for our schools, there is no assurance that we will be able to obtain all required permits given the significant amount of discretion the local PRC authorities may have in interpreting, implementing and enforcing relevant rules and regulations, as well as other factors that are beyond our control and anticipation. If we fail to receive required permits in a timely manner or obtain or renew any permits and certificates, we may be subject to fines, confiscation of the gains derived from our non-compliant operations, the suspension of our non-compliant operations or disgorgement of our profits to compensate for any economic loss suffered by our students or other relevant parties, which may materially and adversely affect our business and results of operations.

We may not be able to successfully integrate businesses we acquired or plan to acquire in the future, which may adversely affect our business growth.

We have expanded rapidly primarily through organic growth. We have, in the past, acquired an underperforming high school and successfully turned it into a high-quality high school with solid academic results. We may attempt to make similar acquisitions in the future. The integration of acquired schools is complicated and time-consuming and requires significant resource commitment, standardized integration process, and adequate planning and implementation. We may not successfully integrate the schools we acquire in a timely manner and may not effectively and efficiently manage our expansion, which would have a material adverse effect on our financial condition and results of operations. In addition, as advised by our PRC legal counsel, our plan to pursue further expansion through acquisitions could be affected by regulatory uncertainty in connection with the Private Education Law and related implementation rules.

8

We may be unable to engage with the Affected Entities to provide education services as we expected.

Following the effectiveness of the Implementation Rules, we have been engaging with the relevant government authorities and external advisors to seek full compliance with the Implementation Rules and other applicable PRC laws and regulations. However, we are exploring the possibility of continuing to engage with the Affected Entities in future cooperation on mutually acceptable terms and in full compliance with the Implementation Rules and other applicable PRC laws and regulations. The future cooperation may involve our provision of management services to the Affected Entities, such as consultation for school operation, catering and accommodation, property management and maintenance, administrative management, student admission and school branding. However, the future cooperation with the Affected Entities, if any, will be arm’s length transactions on mutually acceptable terms, and we cannot assure you that the cooperation under contemplation will be specifically permitted by competent government authorities or that we will be able to agree on commercial terms satisfactory to us, and as such, we may be unable to effect the cooperation with the Affected Entities as we expect.

We may not be able to attract and retain a sufficient number of qualified teachers and principals.

As an education service provider, our ability to recruit and retain qualified teachers and principals is crucial to the quality of our education and services and our brand and reputation. To ensure our successful operation and growth, we need to retain and continue to hire high-quality teachers specialized in specific subjects that are able to teach the courses we offer or plan to offer to our students, as well as high-quality principals who are able to effectively manage the operation of our schools. We must provide competitive compensation and benefits packages to attract and retain qualified candidates. However, there is no guarantee that we would be able to keep recruiting teachers and principals meeting the high standards in the future, or retain our current, high-quality teachers and principals, especially when we seek a more rapid expansion plan to meet the growing demands for our services. Furthermore, under our business model, we may not be able to provide extensive training to our newly hired teachers for them to familiarize with our teaching methods and to retain existing teachers who can provide such trainings. A shortage of high-quality teachers and principals, a decrease in the quality of our teachers’ and principals’ performance, whether actual or perceived, or a significant increase in the cost to engage or retain high-quality teachers and principals would have a material adverse effect on our business, financial condition and results of operations.

We may not be able to maintain the market recognition of our brand and our reputation.

Our success depends heavily on our reputation. We might face potential difficulties in maintaining our reputation and brand recognition, which could adversely affect our student enrollments and results of operations. Our ability to maintain our brand and reputation could be affected by many factors, some of which are beyond our control, including: our ability to deliver satisfactory academic results, the teaching quality of our teachers, the academic quality and achievements of our students, news report about our company, our schools or our partners, results of government inspections or compliance with relevant regulations, unauthorized use or other infringement of our copyright and brand by third party, campus incidents, especially safety incidents, and any kind of disruption of our education services.

We have developed our student base mainly through word-of-mouth referrals. Our other promotion efforts include participating in education fairs organized by local governments and distributing relevant promotional materials in connection with such fairs. However, we cannot guarantee that our promotional efforts will be enough to maintain or enhance our reputation in the marketplace to remain competitive. Our promotional efforts may be insufficient to enhance our brand recognition and reputation and we may incur excessive expenses for our promotions, which may adversely affect our business.

9

Accidents, injuries or other harm at our school premises or otherwise arising from or in connection with our education services may adversely affect our reputation and subject us to liabilities.

We may be subject to liabilities arising from accidents or injuries or other harm to students or other people on our school premises, including those caused by or otherwise arising in connection with our school facilities, employees or education services. We could also face claims alleging that we were negligent, provided inadequate maintenance to our school facilities or supervision of our employees and therefore may be held liable for accidents or injuries suffered by our students or other people at our schools. In addition, if any of our students or our employees or contractors commits unlawful acts or displays seriously inappropriate behavior, we could face allegations that we failed to provide adequate security, supervision or were otherwise responsible for his or her actions, even if such acts or behavior may occur off our school premises. As an education services provider, we may be held liable for other accidents, injuries or other harm in relation to our education services and students, such as commuting to our schools and extracurricular activities. We may also be subject to liabilities arising from out-of-school activities or events which we organize or involve in. As a result, our schools may be perceived to be unsafe, which may discourage prospective students from applying to or attending our schools.

Our schools have also outsourced the operation of all of our meal catering services to third parties since September 2017. We cannot assure you that we will be able to maintain the quality of food or monitor the meal preparation process to ensure its quality, that service providers adhere to food quality standards, or that no incidents resulted from food quality will occur in the future. In the event of incidents arising from poor quality food that result in any serious health violations or medical emergencies, such as mass food poisonings, our business and reputation could be materially and adversely affected.

Furthermore, although we maintain certain liability insurance, the insurance coverage may not be adequate to fully protect us from these kinds of claims and liabilities. In addition, we may not be able to obtain liability insurance in the future at reasonable prices or at all. A liability claim against us or any of our employees could adversely affect our reputation, student enrollment and retention, and teacher recruitment and retention. Such a claim, even if unsuccessful, could create unfavorable publicity, incur substantial expenses for us and divert the time and resources of our management, all of which may have a material and adverse effect on our business, prospects, financial condition and results of operations.

Failure to adequately and promptly respond to changes in examination systems, admission standards, test materials, teaching methods and regulation changes in the PRC could render our education services less attractive to students.

Our reputation, student enrollment, and results of operations depend in part on our ability to prepare our students for various tests and examinations, such as Gaokao. Admission and assessment processes undergo continuous changes, in terms of subject and skill focus, question type, examination format and the manner in which the processes are administered. We are therefore required to continually update and enhance our curricula, course materials and teaching methods. Any failure to respond to the changes in a timely and cost-effective manner will adversely impact our students’ academic performance and the marketability of our education services, which would have a material adverse effect on our business, financial condition and results of operations.

Regulations and policies that decrease the weight of scholastic competition achievements in the admissions process mandated by government authorities or adopted by schools or affect the number of students participating in Gaokao or Zhongkao may have an impact on our student enrollments and teaching methods. For example, the Ministry of Education of the PRC (the “MOE”), issued certain implementing opinions in January 2014 to clarify that local educational administrative departments at all levels, public schools and private schools are not allowed to use examinations to select their students for admission to middle schools from primary schools. As a result, we may need to adjust our teaching methods to accommodate a student body of a potentially wide competency range. Failure to track and respond to these changes in a timely and cost-effective manner would render our courses, services and products less attractive to students, which may materially and adversely affect our reputation and ability to continue to attract students.

If we fail to help our students achieve their academic goals, student and parent satisfaction with our education services may decline.

The success of our business depends on our ability to deliver quality school experiences and help our students achieve their academic goals. Our schools may not be able to meet the expectations of our students and their parents in terms of students’ academic performance. A student may not be able to attain the level of academic improvement that he or she seeks and his or her performance may otherwise not progress or decline due to reasons beyond our control. We may not be able to provide education that is satisfactory to all of our students and their parents, and student and parent satisfaction with our services may decline. In addition, we cannot guarantee that our students will be admitted to higher levels of education institutions of their choice. Any of the foregoing could result in a student’s withdrawal from our schools, and dissatisfied students or their parents may attempt to persuade other students or prospective students not to attend our schools. If our ability to retain students decreases significantly or if we otherwise fail to continue to enroll and retain new students, our business, financial condition and results of operations may be materially and adversely affected.

10

We face intense competition in the PRC education industry and we may fail to compete effectively.

The private education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We compete with public schools and other private schools that offer similar programs in each geographic market where we operate our schools. In particular, we face significant competition from public schools and other private schools in Yunnan province, China. Although our business model and cooperative relationship with local governments helped us receive favorable regulatory treatments, we may fail to compete effectively with public schools that may enjoy more substantial financial and policy support from the local governments. Additionally, our competitors may adopt similar curriculums, school management approaches and marketing strategies, with different pricing and service packages that may be more appealing than ours to students and parents in the relevant regions. Some of our competitors might be able to dedicate more resources than we can to the development and improvement of their schools and respond more quickly than we can to the changes in student demands, testing materials, admission standards, market needs and new technologies. As such, we may be required to lower our tuition and boarding fees or increase our spending in order to maintain our competitiveness and retain or attract students and qualified teachers or pursue new market opportunities. If we are unable to successfully compete for new students, attract and retain competent teachers or other key personnel, maintain or increase our tuition level, enhance the quality of our education services or maintain our operations in a cost-effective manner, our business and/or results of operations may be materially and adversely affected.

Our business may be disrupted if we lose the services of our senior management and other key personnel.

Our continued success depends in part on the expertise and dedication of our senior management team and other key personnel. We rely on our senior management and school administrators for the efficient and effective operation of our schools and the execution of our business plans, which is vital for us to compete in the education industry. We may experience changes in our senior management in the future for reasons beyond our control. We may not be able to retain our directors, senior management, or other key management personnel, who might either join our competitors or start their own businesses that directly compete with us. If we lose one or more of our directors, senior management, or other key management personnel, we might not be able to hire qualified candidates to fill the gap in a timely manner and our business could be materially disrupted or otherwise adversely affected.

Our school premises and facilities are subject to extensive governmental approvals and compliance requirements.

The construction and usage of our school premises requires various permits, certificates and approvals, including, for example, land use rights certificates, construction permits, public health permits and certificates for passing fire control assessments. As of the date of this annual report, we leased six business premises for our schools and were provided with 13 business premises by governments pursuant to our cooperative arrangements with them. For premises we leased from or were provided for use by local governments or entities associated with local governments, the lessors or premise providers failed to obtain the relevant land use rights certificates, construction planning approvals or construction permits, or failed to pass the relevant environmental protection verification, fire control assessment or inspection for completion of construction, or failed to provide us with the authorization to lease the premises. If the government authorities suspend the use of such premises or require measures to be taken to rectify the defects or any of our lease agreements is invalidated due to the defects of such premises, or if any third party successfully challenges our use of the affected premises, the operation of the affected schools could be interrupted and we may need to relocate those schools, which would incur additional expenses and our business and results of operations may be materially and adversely affected.