UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ________

Commission File Number:

(Exact name of Registrant as specified in its charter)

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of May 16, 2024, the registrant had

TABLE OF CONTENTS

Risk Factor Summary |

|

|

|

Part I. Financial Information |

|

|

|

1 |

|

|

|

Item 2 Management's Discussion and Analysis of Financial Condition and Results of Operations and Business Section |

39 |

|

|

Item 3 Quantitative and Qualitative Disclosures About Market Risk |

94 |

|

|

94 |

|

|

|

Part II. Other Information |

|

|

|

96 |

|

|

|

96 |

|

|

|

96 |

|

|

|

97 |

i

Item 1. Financial Statements

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands, except share and per share amounts)

|

|

March 31, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Accounts receivable, net of allowances |

|

|

|

|

|

|

||

Inventories, net |

|

|

|

|

|

|

||

Vendor deposits |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Right-of-use-assets |

|

|

|

|

|

|

||

Intangible assets, net |

|

|

|

|

|

|

||

Long-term inventories, net |

|

|

|

|

|

|

||

Vendor deposits long term |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total Assets |

|

$ |

|

|

$ |

|

||

Liabilities, preferred stock and stockholders' deficit |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued expenses and other current liabilities |

|

|

|

|

|

|

||

Operating lease liability, current portion |

|

|

|

|

|

|

||

Deferred revenue |

|

|

|

|

|

|

||

Loan payable |

|

|

|

|

|

|

||

Senior secured notes |

|

|

|

|

|

|

||

Income tax payable |

|

|

|

|

|

|

||

Embedded derivatives |

|

|

|

|

|

|

||

Convertible note payable |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Operating lease liability, net of current portion |

|

|

|

|

|

|

||

Warrant liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

$ |

|

|

$ |

|

||

(Note 13) |

|

|

|

|

|

|

||

Series B preferred stock, par value $ |

|

|

|

|

|

|

||

Stockholders' deficit |

|

|

|

|

|

|

||

Series A preferred stock, par value $ |

|

|

|

|

|

|

||

Series A Preferred Stock subscription receivable, |

|

|

( |

) |

|

|

|

|

Common stock, par value $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated other comprehensive income |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders' deficit |

|

|

( |

) |

|

|

( |

) |

Total liabilities, preferred stock and stockholders' deficit |

|

$ |

|

|

$ |

|

||

1

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

(In thousands, except share and per share amounts)

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Revenue: |

|

|

|

|

|

|

||

Fitness product revenue |

|

$ |

|

|

$ |

|

||

Membership revenue |

|

|

|

|

|

|

||

Training revenue |

|

|

|

|

|

|

||

Total revenue |

|

|

|

|

|

|

||

Cost of revenue: |

|

|

|

|

|

|

||

Cost of fitness product revenue |

|

|

( |

) |

|

|

( |

) |

Cost of membership |

|

|

( |

) |

|

|

( |

) |

Cost of training |

|

|

( |

) |

|

|

( |

) |

Total cost of revenue |

|

|

( |

) |

|

|

( |

) |

Gross loss |

|

|

( |

) |

|

|

( |

) |

Operating expenses: |

|

|

|

|

|

|

||

Research and development |

|

|

|

|

|

|

||

Sales and marketing |

|

|

|

|

|

|

||

General and administrative |

|

|

|

|

|

|

||

Total operating expenses |

|

|

|

|

|

|

||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

Other income (expense), net: |

|

|

|

|

|

|

||

Other (expense) income, net |

|

|

( |

) |

|

|

|

|

Interest (expense) income |

|

|

( |

) |

|

|

|

|

Gain upon debt forgiveness |

|

|

|

|

|

|

||

Loss upon extinguishment of debt and accounts payable |

|

|

( |

) |

|

|

|

|

Change in fair value of convertible notes |

|

|

( |

) |

|

|

( |

) |

Change in fair value of warrants |

|

|

|

|

|

|

||

Total other income (expense), net |

|

|

( |

) |

|

|

|

|

Loss before provision for income taxes |

|

|

( |

) |

|

|

( |

) |

Income tax expense |

|

|

|

|

|

|

||

Net loss attributable to common stockholders |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share - basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted average common stock outstanding—basic and diluted |

|

|

|

|

|

|

||

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Other comprehensive loss: |

|

|

|

|

|

|

||

Foreign currency translation gain (loss) |

|

|

|

|

|

( |

) |

|

Total comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

2

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT)

(unaudited)

(In thousands, except share amounts)

|

Convertible Preferred Stock Series B |

|

Convertible Preferred Stock Series A |

|

Common Stock |

|

Class A Common Stock |

|

Class B Common Stock |

|

Subscription Receivable Preferred Stock Series A |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive (Income) Loss |

|

Accumulated Deficit |

|

Total Stockholders' Equity (Deficit) |

|

|||||||||||||||||||||||||

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Balances at December 31, 2022 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

|

|

|

|

|

$ |

— |

|

|

— |

|

|

|

|

|

|

( |

) |

|

( |

) |

|||||

Issuance of Common stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of Common stock upon conversion of Class A Common Stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

( |

) |

|

( |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

||

Issuance of Class B common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

|||

Issuance of Common stock upon conversion of Class B Common Stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||

Net exercise of options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||

Foreign currency translation loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

— |

|

|

( |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

( |

) |

Balances at March 31, 2023 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

|

$ |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

$ |

— |

|

$ |

|

$ |

|

$ |

( |

) |

$ |

|

|||||

|

Convertible Preferred Stock Series B |

|

Convertible Preferred Stock Series A |

|

Common Stock |

|

Class A Common Stock |

|

Class B Common Stock |

|

Subscription Receivable Preferred Stock Series A |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive (Income) Loss |

|

Accumulated Deficit |

|

Total Stockholders' Equity (Deficit) |

|

|||||||||||||||||||||||||

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Balances at December 31, 2023 |

|

— |

|

$ |

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

( |

) |

|

( |

) |

||||

Issuance of preferred stock Series A upon conversion of debt |

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Subscription receivable for issuance of Series A preferred stock |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

Issuance of preferred stock series B upon acquisition of CLMBR, Inc. |

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

||

Issuance of common stock upon acquisition of CLMBR, Inc. |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of Common stock upon waiver to enter into Note Agreement |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of shares upon issuance of convertible notes |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of Common stock from equity line of credit |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of Common stock upon conversion of convertible notes |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||||

Issuance of Common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

|

||

Foreign currency translation loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

|

||

Net loss |

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

( |

) |

|

( |

) |

||

Balances at March 31, 2024 |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

$ |

( |

) |

$ |

|

$ |

|

$ |

( |

) |

$ |

( |

) |

||||||||

3

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited)

(In thousands)

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Cash Flows From Operating Activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Foreign currency |

|

|

( |

) |

|

|

|

|

Depreciation |

|

|

|

|

|

|

||

Amortization |

|

|

|

|

|

|

||

Non-cash lease expense |

|

|

|

|

|

|

||

Inventory valuation loss |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

|

|

|

|

||

Loss on extinguishment of debt and accounts payable |

|

|

|

|

|

|

||

Gain upon debt forgiveness |

|

|

|

|

|

( |

) |

|

Interest expense (income) |

|

|

|

|

|

( |

) |

|

Amortization of debt discount |

|

|

|

|

|

|

||

Common stock issued to lender in connection with entering Equity Line of Credit Agreement |

|

|

|

|

|

|

||

Change in fair value of convertible notes |

|

|

|

|

|

|

||

Warrants issued to service providers and warrant issuance expense |

|

|

|

|

|

|

||

Change in fair value of derivatives |

|

|

( |

) |

|

|

|

|

Change in fair value of warrants |

|

|

( |

) |

|

|

( |

) |

Changes in operating assets and liabilities |

|

|

|

|

|

|

||

Accounts receivable |

|

|

( |

) |

|

|

( |

) |

Inventories |

|

|

( |

) |

|

|

( |

) |

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Vendor deposits |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Accounts payable |

|

|

|

|

|

|

||

Accrued expenses and other current liabilities |

|

|

|

|

|

( |

) |

|

Deferred revenue |

|

|

( |

) |

|

|

|

|

Operating lease liabilities |

|

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Cash Flows From Investing Activities: |

|

|

|

|

|

|

||

Acquisition of business, cash paid, net of cash acquired |

|

|

( |

) |

|

|

|

|

Acquisition of software and content |

|

|

( |

) |

|

|

( |

) |

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Cash Flows From Financing Activities: |

|

|

|

|

|

|

||

Payments of related party loans |

|

|

( |

) |

|

|

( |

) |

Proceeds from senior secured notes |

|

|

|

|

|

|

||

Redemption on convertible notes |

|

|

( |

) |

|

|

|

|

Payment of loans |

|

|

( |

) |

|

|

|

|

Proceeds from issuance of convertible notes, net of issuance costs |

|

|

|

|

|

|

||

Proceeds from the issuance of common stock A |

|

|

|

|

|

|

||

Proceeds from the exercise of common stock options |

|

|

|

|

|

|

||

Proceeds from the issuance of common stock from equity line of credit |

|

|

|

|

|

|

||

Net cash provided by financing activities |

|

|

|

|

|

|

||

Effect of exchange rate on cash |

|

|

|

|

|

( |

) |

|

Net Change In Cash and Cash Equivalents |

|

|

|

|

|

|

||

Cash and restricted cash at beginning of year |

|

|

|

|

|

|

||

Cash and restricted cash at end of year |

|

$ |

|

|

$ |

|

||

Supplemental Disclosure Of Cash Flow Information: |

|

|

|

|

|

|

||

Property & equipment in AP |

|

|

|

|

|

|

||

Inventories in AP and accrued |

|

|

|

|

|

|

||

Capitalized software and content in AP |

|

|

|

|

|

|

||

Issuance of common stock and Series B Preferred Stock for the acquisition of business |

|

|

|

|

|

|

||

Offering costs in AP and accrued |

|

|

|

|

|

|

||

Issuance of Series A Preferred Stock through conversion of debt |

|

|

|

|

|

|

||

Subscription receivable for issuance of Series A Preferred Stock for modification of loan |

|

|

|

|

|

|

||

Conversion of convertible notes into common stock |

|

|

|

|

|

|

||

Decrease in right-of-use asset and operating lease liabilities due to lease termination |

|

|

|

|

|

|

||

Issuance of Common Stock from convertible notes |

|

|

|

|

|

|

||

Issuance of Common Stock from Rights Offering |

|

|

|

|

|

|

||

Net exercise of options |

|

|

|

|

|

|

||

Stock-based compensation capitalized in software |

|

|

|

|

|

|

||

4

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Description and Organization

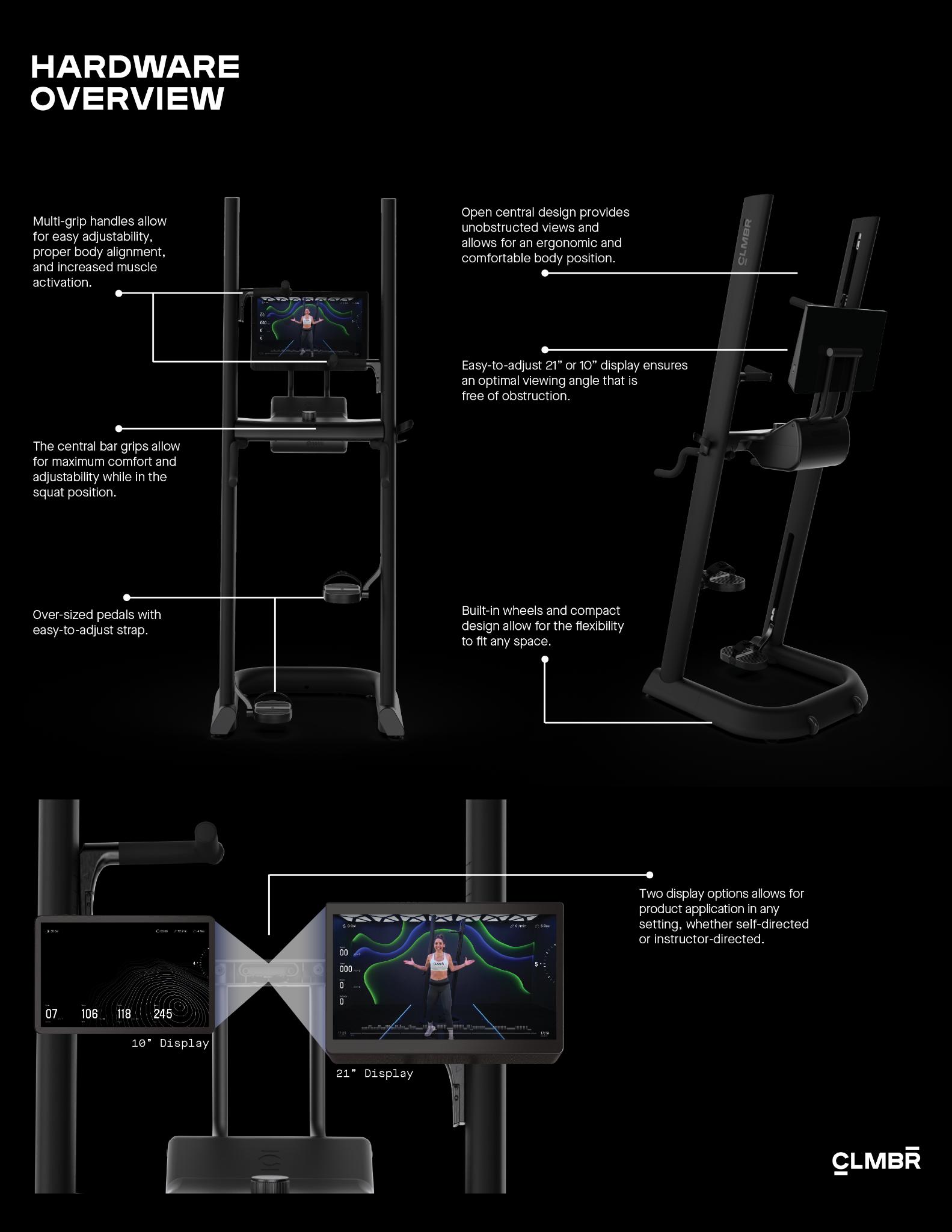

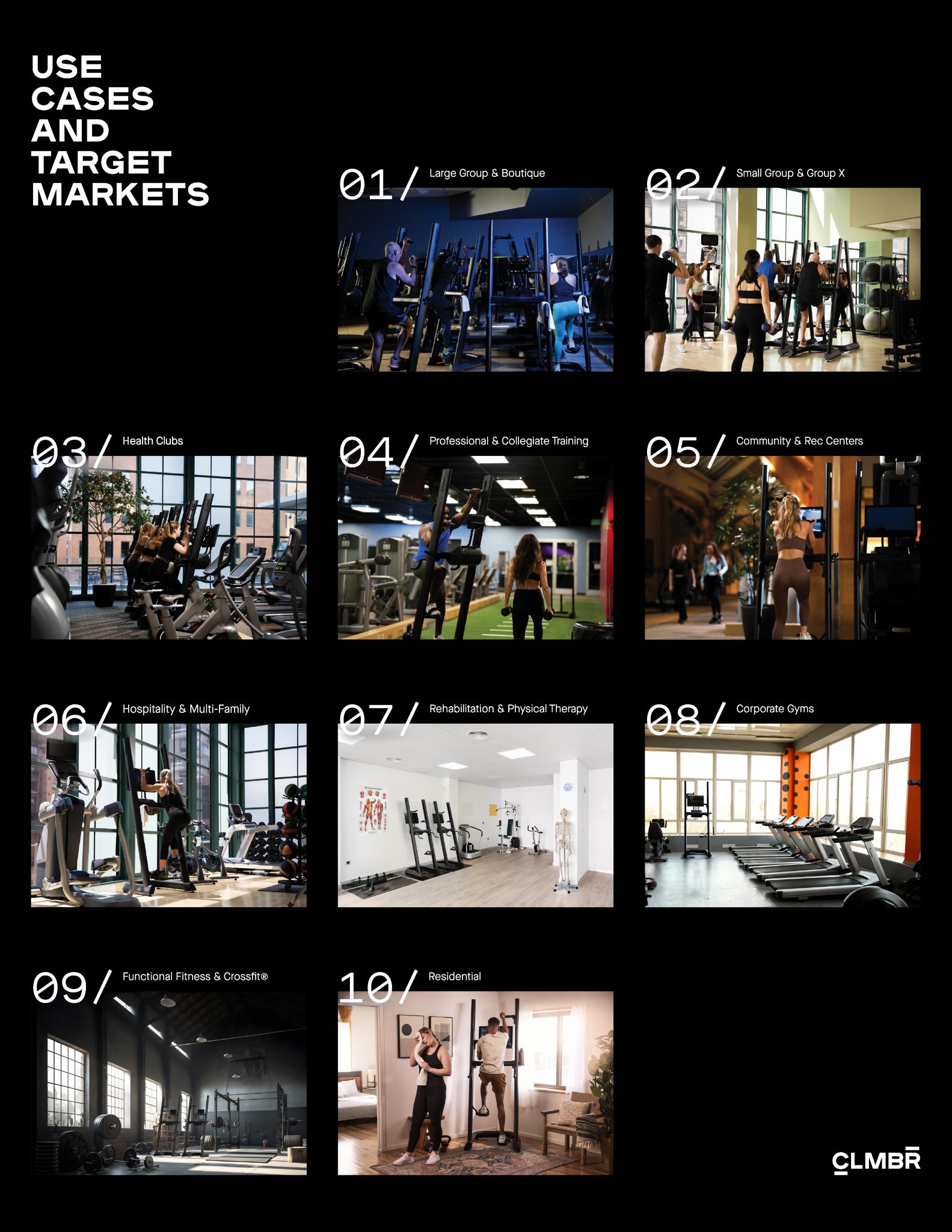

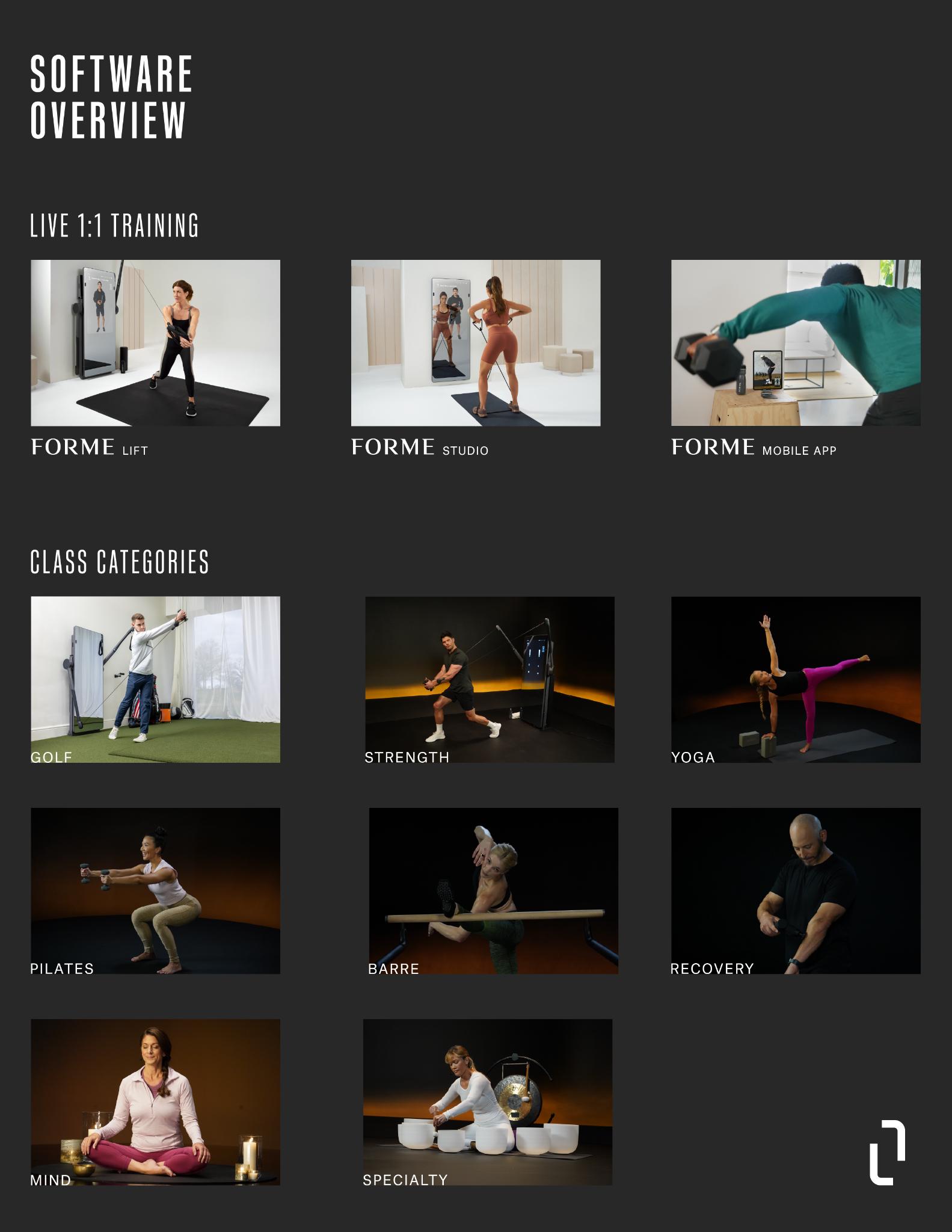

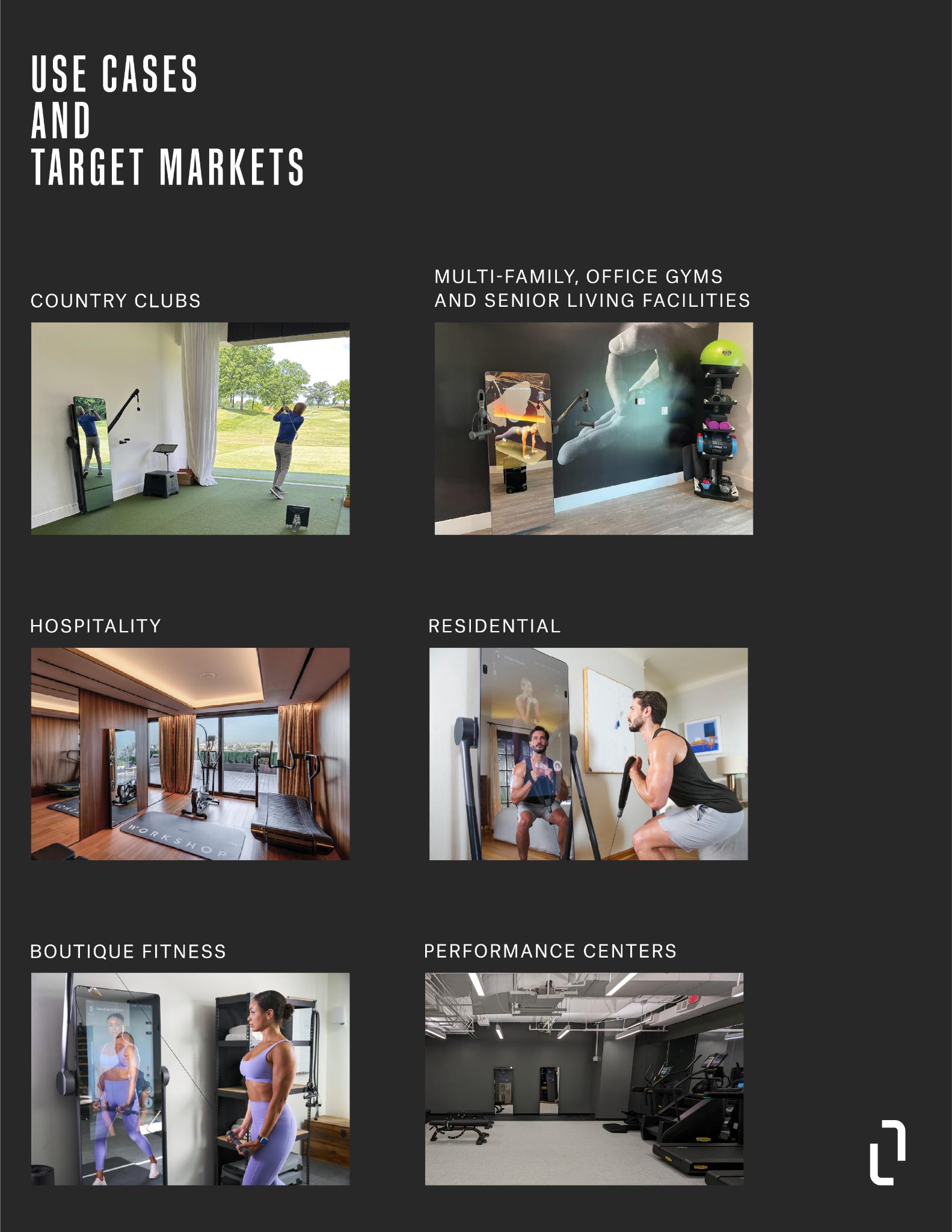

Interactive Strength Inc. is the parent company of two leading brands serving the commercial and at-home markets with specialty fitness equipment and virtual training: CLMBR and FORME. CLMBR manufactures vertical climbing equipment and provides a unique digital and on-demand training platform. FORME is a hardware manufacturer and digital fitness service provider that combines award-winning smart gyms with live 1:1 personal training (from real humans) to deliver an immersive experience. The combination of technology with expert training leads to better outcomes for both consumers and trainers alike. CLMBR and FORME offer unique fitness solutions for both the commercial and at-home markets. Our Members are defined as any individual who has a Forme or CLMBR account through a paid connected fitness membership.

Initial Public Offering

In May 2023, the Company closed its initial public offering ("IPO") in which we issued and sold

Acquisition of CLMBR, Inc.

On October 6, 2023, the Company entered into an asset purchase agreement (the “Asset Purchase Agreement”) with CLMBR and CLMBR1, LLC (collectively, the “Sellers”) to purchase and acquire substantially all of the assets and assume certain liabilities of the Sellers. On January 22, 2024, the Company and the Sellers entered into an amended and restated Asset Purchase Agreement (the “Amended Agreement”). On February 2, 2024, pursuant to the Amended Agreement, the Company completed the acquisition for a total purchase price of approximately $

The Acquisition was accounted for under the acquisition method of accounting under ASC 805, Business Combinations. Assets acquired and liabilities assumed were recorded in the condensed consolidated balance sheet at their estimated fair values as of February 2, 2024, with the remaining unallocated purchase price recorded as goodwill. See Note 21 that outlines the Company’s consideration transferred and the identifiable net assets acquired at their estimated fair value as of February 2, 2024.

Basis of Presentation and Consolidation

The accompanying condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). The condensed consolidated financial statements include the accounts of Interactive Strength Inc. and its subsidiaries in which the Company has a controlling financial interest. All intercompany balances and transactions have been eliminated.

In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, cash flows, and the changes in equity for the interim period.

Liquidity and Capital Resources

In accordance with Accounting Standards Update ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), or ASU 205-40, management evaluated whether there are certain conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date the accompanying condensed consolidated financial statements were issued.

As an emerging growth company, the Company is subject to certain inherent risks and uncertainties associated with the development of an enterprise. In this regard, since the Company’s inception, substantially all of management’s efforts have been devoted to making investments in research and development including the development of revenue generating products and services and the development of a commercial organization, all at the expense of short-term profitability.

5

As of the date the accompanying condensed consolidated financial statements were issued (the “issuance date”), management evaluated the following adverse conditions and events present at the Company in accordance with ASU 205-40:

These uncertainties raise substantial doubt about our ability to continue as a going concern. The accompanying condensed consolidated financial statements have been prepared on the basis that the Company will continue to operate as a going concern, which contemplates that the Company will be able to realize assets and settle liabilities and commitments in the normal course of

6

business for the foreseeable future. Accordingly, the accompanying condensed consolidated financial statements do not include any adjustments that may result from the outcome of these uncertainties.

Unaudited Interim Financial Information

The accompanying unaudited interim condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP, for interim financial reporting and as required by Regulation S-X, Rule 10-01. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited condensed consolidated annual financial statements for the years ended December 31, 2023 and 2022 and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for a fair statement of the Company’s condensed consolidated balance sheet as of March 31, 2024, the condensed consolidated statements of operations and comprehensive loss for the three months ended March 31, 2024 and 2023, the condensed consolidated statement of convertible preferred stock and stockholders' equity (deficit) as of March 31, 2024 and condensed consolidated statements of cash flows for the three months ended March 31, 2024 and 2023. The financial data and other information disclosed in these notes related to the three months ended March 31, 2024 and 2023 are unaudited. The results for the three months ended March 31, 2024, are not necessarily indicative of results to be expected for the year ending December 31, 2024, any other interim periods, or any future year or period.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosures. On an ongoing basis, the Company evaluates its estimates, including, among others, those related to revenue related reserves, the realizability of inventory, fair value measurements, useful lives of long lived assets, including property and equipment and finite lived intangible assets, product warranty, stock-based compensation expense, warrant liabilities, accrual of acquisition earn-outs, estimated legal accruals, valuation of deferred taxes, valuation of embedded derivatives, and commitments and contingencies. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable. Actual results may differ from these estimates.

Segment Information

Operating segments are defined as components of an enterprise for which separate and discrete information is available for evaluation by the chief operating decision-maker (“CODM”) in deciding how to allocate resources and assess performance. The Company has one operating segment, the development and sale of its at-home fitness technology platform. The Company’s chief operating decision maker, its chief executive officer, manages the Company’s operations on a consolidated basis for the purpose of allocating resources. As the Company has one reportable segment, all required segment financial information is presented in the condensed consolidated financial statements. The Company currently operates in the United States, the United Kingdom, and Taiwan. As of March 31, 2024 and 2023, substantially all of the Company’s long-lived assets are held in the United States.

Cash

Cash consists of cash on deposit in banks.

Deferred Offering Costs

The Company complies with the requirements of ASC 340-10-S99-1 and SEC Staff Accounting Bulletin Topic 5A “Expenses of Offering”. Offering costs consist principally of professional and registration fees incurred through the balance sheet date that are related to the IPO. The Company incurred offering costs amounting to $

Property and Equipment

Property and equipment purchased by the Company are stated at cost less accumulated depreciation. Major updates and improvements are capitalized, while charges for repairs and maintenance which do not improve or extend the lives of the respective asset, are expensed as incurred. The Company capitalizes the cost of pre-production tooling which it owns under a supply arrangement. Pre-production tooling, including the related engineering costs the Company will not own or will not use in producing products under long-term supply arrangements, are expensed as incurred.

Depreciation and amortization is computed on a straight-line basis over the following estimated useful lives:

|

|

|

7

Pre-production tooling |

|

|

Machinery and equipment |

|

|

Furniture and fixtures |

|

|

Leasehold improvements |

|

Inventories, net

Inventories, which are comprised of finished goods, are stated at the lower of cost or net realizable value, with cost determined using actual costs. The Company maintains inventory in a third-party warehouse. Reserves are established to reduce the cost of inventories to their estimated net realizable value and are reflected in cost of revenues in the condensed consolidated statement of operations. The Company assessed the obsolescence reserve by evaluating factors such as inventory levels, historical sales, and the remaining life of its products. Inventory losses are written-off against the reserve. Inventory not expected to be sold in the next twelve months is classified as long-term in the accompanying condensed consolidated balance sheets.

Vendor Deposits

Vendor deposits represent prepayments made to the third-party manufacturers of the Company’s inventory. In general, the Company’s manufacturers require that the Company pay a portion of the costs for a manufacturing purchase order in advance, with the remaining cost being invoiced upon delivery of the products. Prior to receipt of the goods, any costs associated with the prepayments made by the Company are reflected as vendor deposits on the Company’s condensed consolidated balance sheet.

Capitalized Studio Content

Capitalized Studio content costs include certain expenditures to develop video and live content for the Company’s customers. The Company capitalizes production costs for recorded content in accordance with ASC 926-20, Entertainment-Films - Other Assets - Film Costs. The Company recognizes capitalized content, net of accumulated amortization, within other non-current assets in the condensed consolidated balance sheets and recognizes the related amortization expense as a component of cost of revenue in the condensed consolidated statements of operations and comprehensive loss. Costs which qualify for capitalization include production costs, development costs, direct costs, labor costs, and production overhead. Expenditures for capitalized content are included within operating activities in the condensed consolidated statements of cash flows. Based on certain factors, including historical and estimated user viewing patterns, the Company amortizes individual titles within the Studio content library on a straight-line basis over a three-year useful life. The Company reviews factors impacting the amortization of the capitalized Studio content on an ongoing basis. Estimates related to these factors require considerable management judgment.

The Company considered certain factors in determining the useful life of the content, including expected periods over which the content will be made available through the platform and related viewership, the lack of “obsolescence” of such content over such period given the nature of its videos (i.e., exercise classes which are not significantly impacted by changes in markets or customer preferences, and/or for which the content is expected to significantly change or evolve over time), and the expected significant growth of its subscriber base which will contribute to substantial increases in viewership over time given the recent launch of its product and membership offerings. Based on these factors, the Company has determined that a three-year (3-year) amortization period is reasonable for the content. The Company will continue to review factors impacting the amortization of the capitalized content on an ongoing basis.

The Company’s business model is membership based as opposed to generating revenues at a specific title level. Therefore, all content assets are monetized as part of a single asset group. The content is assessed at the group level when an event or change in circumstances indicates a change in the expected usefulness of the content or that fair value may be less than unamortized cost. Unamortized costs are assessed for impairment regardless of whether the produced content is completed. To date, the Company has recognized one impairment with regards to the carrying value of its content portfolio. If circumstances in the future suggest that an impairment may exist, these aggregated content assets will be stated at the lower of unamortized cost or fair value. In addition, unamortized costs for assets that have been, or are expected to be, abandoned are written off. The unamortized cost of content is approximately $

Capitalized Software Costs

The Company capitalizes certain eligible software development costs incurred in connection with its internal use software in accordance with ASC 350-40, Internal-use Software and ASC 985, Software. These capitalized costs also relate to the Company’s Studio software that is accessed by its customers on a membership basis as well as certain costs associated with its information systems. Capitalized software costs are amortized over the estimated useful life is three years. Capitalization begins once the

8

application development stage begins, management has authorized and committed to funding the project, it is probable the project will be completed, and the software will be used to perform the function intended. Internal and external costs, if direct and incremental, are capitalized until the software is substantially complete and ready for its intended use. The Company expenses all costs incurred that relate to planning and post-implementation phases of development. Intangible assets are assessed for impairment when events or circumstances indicate the existence of a possible impairment, and

During the three months ended March 31, 2024 and year ended December 31, 2023, the Company capitalized $

During the three months ended March 31, 2024 and year ended December 31, 2023, the Company capitalized $

Amortization is computed on a straight-line basis over the following estimated useful lives:

Capitalized software and internal-use software |

|

Music Royalty Fees

The Company recognizes music royalty fees as these fees are incurred in accordance with the terms of the relevant license agreement with the music rights holder. The incurrence of such royalties is primarily driven by the number of paid subscribers each month and it is classified as cost of membership and training within the Company’s statement of operations. The Company’s license agreements with music rights holders generally include provisions for advance royalties as well as minimum guarantees. When a minimum guarantee is paid in advance, the guarantee is recorded as a prepaid asset and amortized over the shorter of the period consumed or the term of the agreement. As of March 31, 2024 and December 31, 2023 there were no music guarantee-related prepaids, respectively.

Fair Value Measurements

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Subsequent changes in fair value of these financial assets and liabilities are recognized in earnings when they occur. When determining the fair value measurements for assets and liabilities which are required to be recorded at fair value, the Company considers the principal or most advantageous market in which the Company would transact and the market-based risk measurement or assumptions that market participants would use in pricing the assets or liabilities, such as inherent risk, transfer restrictions, and credit risk.

The Company applies the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement:

The Company’s material financial instruments consist primarily of cash and cash equivalents, accounts payable, accrued expenses, convertible notes, and warrants. The carrying amounts of current financial instruments, which include cash, accounts receivable, accounts payable and accrued expenses, contingent consideration, approximate their fair values due to the short-term nature of these instruments.

Impairment of Long-Lived Assets

The Company evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset (or asset group) to the future undiscounted cash flows expected to be generated by the assets (or asset group). If such assets are considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the assets exceeds their fair value.

9

Leases

The Company adopted the Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842) (“ASU 2016-02” or “ASC 842”) as of January 1, 2022, using the modified retrospective method and utilized the effective date as its date of initial application, with prior periods presented in accordance with previous guidance under Accounting Standards Codification (“ASC”) 840, Leases. At the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present in the arrangement. Leases with a term greater than one year are recognized on the balance sheet as right-of-use assets and current and non-current lease liabilities, as applicable.

Bridge Notes

As permitted under ASC Topic 825, Financial Instruments, we have elected the fair value option to account for our November 2023 Bridge Notes. In accordance with ASC Topic 825, we record these bridge notes at fair value with changes in fair value recorded as a component of other (expense) income, net in the condensed consolidated statement of operations and comprehensive loss. As a result of applying the fair value option, direct costs and fees related to the bridge notes were expensed as incurred and were not deferred. In addition, the bridge notes meet other applicable criteria for electing fair value option under ASC Topic 825. The November 2023 Bridge Notes were converted to Series A Preferred Stock in February 2024 and March 2024. As of March 31, 2024 and December 31, 2023, there were $

Convertible Notes

As permitted under ASC Topic 825, Financial Instruments, the Company has elected the fair value option to account for its November 2022 convertible notes. In accordance with ASC Topic 825, the Company records these convertible notes at fair value with changes in fair value recorded as a component of other (expense) income, net in the condensed consolidated statement of operations and comprehensive loss. As a result of applying the fair value option, direct costs and fees related to the convertible notes were expensed as incurred and were not deferred. In addition, the convertible notes meet other applicable criteria for electing fair value option under ASC Topic 825.

In May 2023, upon closing of the Company's IPO, the convertible notes were converted into an aggregate of

In connection with the Company’s issuance of the December 2023 Convertible Notes (the “December 2023 Notes”), the Company bifurcated the embedded conversion option and redemption rights and recorded embedded conversion option and redemption rights as a short term derivative liability in the Company’s balance sheet in accordance with FASB ASC 815, Derivatives and Hedging. The convertible debt and the derivative liability associated with the December 2023 Notes is presented on the condensed consolidated balance sheet as convertible note payable and the embedded derivatives, respectively. The convertible debt is carried at amortized cost. The derivative liability will be remeasured at each reporting period using the lattice model with changes in fair value recorded in the condensed consolidated statements of operations in other expense (income). See Note 10 for further details.

The Company issued Convertible Notes in February 2024 (the “February 2024 Notes”). The convertible debt is presented in on the condensed consolidated balance sheet as convertible note payable. The convertible debt is carried at amortized cost. See Note 10 for further details.

Warrants

The Company account for common stock warrants as either equity-classified instruments or liability-classified instruments based on an assessment of the warrant terms. The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all the requirements for equity classification under ASC 815, including whether the warrants are indexed to our Common Stock, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance, and, for liability-classified warrants, at each reporting period end date while the warrants are outstanding. The warrants are revalued on each subsequent balance sheet date until such instruments are exercised or expire, with any changes in the fair value between reporting periods recorded in the condensed consolidated statements of operations and comprehensive loss.

Commitments and Contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties, and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated. If a loss is reasonably possible and the loss or range of loss can be reasonably estimated, the Company discloses the possible loss or states that such an estimate cannot be made.

10

Revenue Recognition

On January 1, 2020, the Company adopted Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASC 606”) and all subsequent amendments. As the Company had not recognized any revenue prior to the adoption of the new standard, there was no impact on the measurement or timing of revenue recognition as a result of the adoption. Revenue is recognized when control of the promised goods or services is transferred to the Company’s customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. Refer to Note 3 for additional information.

Cost of Fitness Product Revenue

Cost of fitness product revenue relates to the Fitness Product costs, including manufacturing costs, duties and other applicable importing costs, shipping and handling costs, packaging, warranty replacement costs, fulfillment costs, warehousing costs, and certain allocated costs related to management, facilities, and personnel-related expenses associated with supply chain logistics. Cost of fitness product revenue also contains valuation losses related to the Company’s inventory lower of cost or market reserve.

Cost of Membership and Training

Membership costs include costs associated with the creation of content and training, including associated payroll, filming and production costs, other content specific costs, hosting fees, music royalties, amortization of capitalized software development costs, and warranty replacement and servicing costs associated with extended warranty contracts.

Advertising Costs

Advertising and other promotional costs to market the Company’s products are expensed as incurred. Advertising expenses were $

Research and Development Costs

Research and development expenses consist primarily of personnel- and facilities-related expenses, consulting and contractor expenses, tooling and prototype materials software platform expenses, and depreciation of property and equipment. Substantially all of the Company’s research and development expenses are related to developing new products and services and improving existing products and services. Research and development expenses are expensed as incurred.

Stock-Based Compensation

In December 2020, the Board of Directors adopted the 2020 Equity Incentive Plan (“the 2020 Plan”) and in April 2023, our board of directors adopted the 2023 Equity Incentive Plan (the “2023 Plan”). Stock-based awards are measured at the grant date based on the fair value of the award and are recognized as expense, net of actual forfeitures, on a straight-line basis over the requisite service period, which is generally the vesting period of the respective award. The Company estimates the fair value of stock options using the Black-Scholes option pricing model. The determination of the grant date fair value of stock awards issued is affected by a number of variables, including the fair value of the Company’s common stock, the expected common stock price volatility over the expected life of the awards, the expected term of the stock option, risk-free interest rates, and the expected dividend yield of the Company’s common stock. The Company derives its volatility from the average historical stock volatilities of several peer public companies over a period equivalent to the expected term of the awards. The Company estimates the expected term based on the simplified method for employee stock options considered to be “plain vanilla” options, as the Company’s historical share option exercise experience does not provide a reasonable basis upon which to estimate the expected term. The risk-free interest rate is based on the United States Treasury yield curve in effect at the time of grant. Expected dividend yield is

Stock-based compensation expense is classified in the accompanying condensed consolidated statement of operations in the same manner in which the award recipient’s payroll costs are classified or in which the award recipient’s service payments are classified.

Foreign Currency Transactions

The functional currency for the Company’s wholly-owned foreign subsidiaries, Interactive Strength UK and Interactive Strength Taiwan, is the United States dollar. All foreign currency transaction gains and losses are recognized in the condensed consolidated statements of operations and comprehensive loss through other income (expense). The Company recognized material currency transaction gains or losses during the three months ended March 31, 2024 and 2023.

11

Comprehensive Loss

Comprehensive loss includes net loss as well as other changes in stockholders’ deficit that result from transactions and economic events other than those with stockholders. For the three months ended March 31, 2024 and 2023, comprehensive loss included $

Loss Per Share

The Company computes loss per share using the two-class method required for participating securities. The two-class method requires income available to common stockholders for the period to be allocated between common stock and participating securities based upon their respective rights to receive dividends as if all income for the period had been distributed. The Company’s redeemable convertible preferred stock and common stock issued upon early exercise of stock options are participating securities. The Company considers any shares issued upon early exercise of stock options, subject to repurchase, to be participating securities because holders of such shares have non-forfeitable dividend rights in the event a cash dividend is declared on common stock. These participating securities do not contractually require the holders of such shares to participate in the Company’s losses. As such, net losses for the periods presented were not allocated to the Company’s participating securities.

Basic loss per share is computed using the weighted-average number of outstanding shares of common stock during the period. Diluted earnings loss per share is computed using the weighted-average number of outstanding shares of common stock and, when dilutive, potential shares of common stock outstanding during the period. Potential shares of common stock consist of incremental shares issuable upon the assumed exercise of stock options, employee stock purchase plan (“ESPP”) shares to be issued, and vesting of restricted stock awards.

Income Taxes

The Company utilizes the asset and liability method for computing its income tax provision. Deferred tax assets and liabilities reflect the expected future consequences of temporary differences between the financial reporting and tax bases of assets and liabilities as well as operating loss, capital loss, and tax credit carryforwards, using enacted tax rates. Management makes estimates, assumptions, and judgments to determine the Company’s provision for income taxes, deferred tax assets and liabilities, and any valuation allowance recorded against deferred tax assets. The Company assesses the likelihood that its deferred tax assets will be recovered from future taxable income and, to the extent the Company believes recovery is not likely, establishes a valuation allowance.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not the tax position will be sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits recognized from such positions are then measured based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. Interest and penalties related to unrecognized tax benefits, which to date have not been material, are recognized within income tax expense.

Goodwill and Intangible Assets with Indefinite Lives

Goodwill consists of the excess of cost over the fair value of net assets acquired in business combinations. The Company follows the provisions of ASC Topic 350, “Intangibles —Goodwill and Other”, which requires an annual impairment test for goodwill and intangible assets with indefinite lives. The Company may first choose to perform a qualitative evaluation of the likelihood of goodwill and intangible assets impairment. For the goodwill that was the result of current year acquisitions, the Company chose to perform a qualitative evaluation. If the Company determined a quantitative evaluation was necessary, the goodwill at the reporting unit was subject to a two-step impairment test. The first step compares the book value of a reporting unit, including goodwill, with its fair value. If the book value of a reporting unit exceeds its fair value, the Company completes the second step in order to determine the amount of goodwill impairment loss that should be recorded. In the second step, the Company determines an implied fair value of the reporting unit’s goodwill by allocating the fair value of the reporting unit to all of the assets and liabilities other than goodwill. For the periods presented, the Company did not recognize any goodwill impairment as the estimated fair value of its reporting units with goodwill exceeded the book value of these reporting units. For additional information refer to Note 6—Goodwill and Intangible Assets.

The Company estimates the fair value of intangible assets based on an income approach using the relief-from-royalty method. This methodology assumes that, in lieu of ownership, a third party would be willing to pay a royalty in order to exploit the related benefits of these types of assets. This approach is dependent on a number of factors, including estimates of future growth and trends, royalty rates for this category of intellectual property, discount rates and other variables. The Company bases its fair value estimates on assumptions it believes to be reasonable, but which are unpredictable and inherently uncertain. Actual future results may differ from those estimates. The Company recognizes an impairment loss when the estimated fair value of the intangible asset is less than the carrying value. For the periods presented, the Company did not recognize any impairment of intangible assets with indefinite lives as the estimated fair value of its intangible assets with indefinite lives exceeded the book value of these reporting units.

12

Identifiable Intangible Assets

The Company follows the provisions of ASC Topic 360, “Property, Plant and Equipment”, which establishes accounting standards for the impairment of long-lived assets such as property, plant and equipment and intangible assets subject to amortization. The Company reviews long-lived assets to be held and-used for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. If the sum of the undiscounted expected future cash flows over the remaining useful life of a long-lived asset group is less than its carrying amount, the asset is considered to be impaired. Impairment losses are measured as the amount by which the carrying amount of the asset group exceeds the fair value of the asset. The Company estimates fair value using the expected future cash flows discounted at a rate commensurate with the risks associated with the recovery of the asset. During the three months ended March 31, 2024 and 2023, there was

The Company’s intangible assets subject to amortization consist of developed technology, customer related intangibles, trademark and tradenames, and content that are amortized on a straight-line basis over the estimated useful lives of the related intangible asset. The estimated useful lives of the respective intangible assets range from

Business Combinations

The Company accounts for business combinations under the provisions of ASC 805, Business Combinations, which requires that the acquisition method of accounting be used for all business combinations. Assets acquired and liabilities assumed are recorded at the date of acquisition at their respective fair values. ASC 805 also specifies criteria that intangible assets acquired in a business combination must be recognized and reported apart from goodwill. Goodwill represents the excess purchase price over the fair value of the tangible net assets and intangible assets acquired in a business combination. Acquisition-related expenses are recognized separately from the business combinations and are expensed as incurred. If the business combination provides for contingent consideration, the Company records the contingent consideration at fair value at the acquisition date with changes in the fair value recorded through earnings.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”), or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s condensed consolidated financial statements upon adoption. The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and has elected not to “opt out” of the extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company will adopt the new or revised standard at the time public companies adopt the new or revised standard and will do so until such time that the Company either (i) irrevocably elects to “opt out” of such extended transition period or (ii) no longer qualifies as an emerging growth company. As noted below, certain new or revised accounting standards were early adopted.

Accounting Pronouncements Not Yet Adopted

ASU 2020-04 and ASU 2022-06

In March 2020, the FASB issued ASU 2020-04, “Reference rate reform (Topic 848): Facilitation of the effects of reference rate reform on financial reporting.” The ASU provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform. The amendments apply only to contracts and hedging relationships that reference London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued due to reference rate reform. The amendments are elective and are effective upon issuance. In December 2022, the FASB issued ASU 2022-06, “Reference rate reform (Topic 848): Deferral of the sunset date of Topic 848” which defers the expiration date for Topic 848 from December 31, 2022 until December 31, 2024. The Company is currently evaluating the potential impact of adopting this new accounting guidance, but does not expect the adoption of the standard to have a material impact on its consolidated financial statements.

ASU 2023-09

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures.” The ASU modifies income tax disclosures by requiring (i) consistent categories and greater disaggregation of information in the rate reconciliations and (ii) the disclosure of income taxes paid disaggregated by jurisdiction, among other requirements. This ASU is effective for fiscal years beginning after December 31, 2024 and should be applied on a prospective basis, with the option to apply the standard retrospectively. Early adoption is permitted. We are currently evaluating the impact of the new standard, which is limited to financial statement disclosures.

ASU 2023-07d

13

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.” The amendments in the ASU improve reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit and loss, and provide new segment disclosure requirements for entities with a single reportable segment, among other disclosure requirements. This ASU is effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years after December 15, 2024 and should be applied retrospectively to all prior periods presented in the financial statements. Early adoption is permitted. We are currently evaluating the impact of the new standard, which is limited to financial statement disclosures.

The Company’s primary source of revenue is solely derived from the United States from sales of its Connected Fitness Products and related accessories and associated recurring Membership revenue, as well as from sales of personal training services recorded within Training revenue.

The Company determines revenue recognition through the following steps:

Revenue is recognized when control of the promised goods or services is transferred to the Company’s customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. The Company’s revenue is reported net of sales returns, discounts and incentives as a reduction of the transaction price. The Company estimates its liability for product returns and concessions based on historical trends by product category, impact of seasonality, and an evaluation of current economic and market conditions and records the expected customer refund liability as a reduction to revenue, and the expected inventory right of recovery as a reduction of cost of revenue. If actual return costs differ from previous estimates, the amount of the liability and corresponding revenue are adjusted in the period in which such costs occur.

The Company applies the practical expedient as per ASC 606-10-50-14 and does not disclose information related to remaining performance obligations due to their original expected terms being one year or less.

The Company expenses sales commissions on its Connected Fitness Products when incurred because the amortization period would have been less than one year. These costs are recorded in Sales and marketing in the Company’s condensed consolidated statements of operations and comprehensive loss.

Connected Fitness Products

Connected Fitness Products include the Company’s portfolio of Connected Fitness Products and related accessories, delivery and installation services, and extended warranty agreements. The Company recognizes Connected Fitness Product revenue net of sales returns and discounts when the product has been delivered to the customer, except for extended warranty revenue which is recognized over the warranty period. The Company allows customers to return products within thirty days of purchase, as stated in its return policy.

Amounts paid for payment processing fees for credit card sales for Connected Fitness Products are included as a reduction to fitness product revenue in the Company’s condensed consolidated statements of operations and comprehensive loss.

Membership

The Company’s memberships provide unlimited access to content in its library of on-demand fitness classes. The Company’s memberships are offered on a month-to-month basis.

Amounts paid for membership fees are included within deferred revenue on the Company’s condensed consolidated balance sheets and recognized ratably over the membership term. The Company records payment processing fees for its monthly membership charges within cost of membership in the Company’s condensed consolidated statements of operations and comprehensive loss.

Training

14

The Company’s training services are personal training services delivered through the Connected Fitness Products, third-party mobile devices and in-studio classes. Training revenue is recognized at the time the services are delivered.

Standard Product Warranty

The Company offers a standard product warranty that its Connected Fitness Products and related accessories will operate under normal, non-commercial use for a period of one year which covers the touchscreen, frame and all incorporated elements, and related accessories from the date of original delivery. The Company has the obligation, at its option, to either repair or replace the defective product. At the time revenue is recognized, an estimate of future warranty costs are recorded as a component of cost of revenue. Factors that affect the warranty obligation include historical as well as current product failure rates, service delivery costs incurred in correcting product failures, and warranty policies and business practices.

The Company also offers the option for customers in some markets to purchase a third-party extended warranty and service contract that extends or enhances the technical support, parts, and labor coverage offered as part of the base warranty included with the Connected Fitness Product for an additional period of

For third-party extended warranty service sold along with the Company’s Connected Fitness Products, the Company does not obtain control of the warranty before transferring it to the customers. Therefore, the Company accounts for revenue related to the fees paid to the third-party extended warranty provider on a net basis, by recognizing only the net commission it retains. The Company considers multiple factors when determining whether it obtains control of third-party products including, but not limited to, evaluating if it can establish the price of the product, retains inventory risk for tangible products or has the responsibility for ensuring acceptability of the product.

Inventories consist of the following:

|

|

March 31, |

|

|

December 31, |

|

||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Finished products |

|

$ |

|

|

$ |

|

||

Finished products - Long Term |

|

|

|

|

|

|

||

Raw materials - Long Term |

|

|

|

|

|

|

||

Total inventories, net |

|

$ |

|

|

$ |

|

||

Finished products - Long Term represents inventory not expected to be sold in the next twelve months. Raw materials - Long Term represents the components and parts currently being stored in our Taiwan facility that will be shipped to our manufacturing partners.

Total inventory of $

Property and equipment consisted of the following:

|

|

March 31, |

|

|

December 31, |

|

||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Pre-production tooling |

|

$ |

|

|

$ |

|

||

Machinery and equipment |

|

|

|

|

|

|

||

Leasehold improvements |

|

|

|

|

|

|

||

Furniture and fixtures |

|

|

|

|

|

|

||

Software and technology development asset |

|

|

|

|

|

|

||

Total |

|

|

|

|

|

|

||

Less: Accumulated depreciation |

|

|

( |

) |

|

|

( |

) |

Total property and equipment, net |

|

$ |

|

|

$ |

|

||

Depreciation expense amounted to $

Identifiable intangible assets, net consist of the following:

15

|

|

As of March 31, |

|

|

As of December 31, |

|

||||||||||||||||||

|

|

2024 |

|

|

2023 |

|

||||||||||||||||||

(in thousands) |

|