As filed with the Securities and Exchange Commission on January 15, 2021

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

| WETRADE GROUP INC |

| (Exact name of registrant as specified in its charter) |

| Wyoming |

| 7389 |

| N/A |

| (State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

No 1 Gaobei South Coast, Yi An Men 111 Block 37, Chao Yang District,

Beijing City, People Republic of China 100020

+86-135-011-76409

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Wyoming Registered Agent

1621 Central Ave Cheyenne, Wyoming 82001

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| William S. Rosenstadt, Esq. Mengyi “Jason” Ye, Esq. Yarona L. Yieh, Esq. Ortoli Rosenstadt LLP 366 Madison Avenue, 3rd Floor New York, NY 10017 212-588-0022 |

|

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered |

| Proposed |

|

| Amount of |

| ||

| Common Stock, no par value (2) |

| $ | 115,000,000 |

|

| $ | 12,546.50 |

|

| Underwriter Warrants(3) |

|

| — |

|

|

| — |

|

| Common Stock, no par value, underlying Underwriter Warrants(3) |

| $ | 5,500,000 |

|

| $ | 600.05 |

|

| Total |

| $ | 120,500,000 |

|

| $ | 13,146.55 |

|

| (1) | The registration fee for securities is based on an estimate of the Proposed Maximum Aggregate Offering Price of the securities, assuming the sale of the maximum number of shares at the highest expected offering price, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

| (2) | We have granted the underwriter an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of the common stock to be offered by us pursuant to this offering (excluding common stock subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discounts. In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional shares of common stock that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (3) | The Registrant will issue to the representative of the underwriters, , warrants to purchase a number shares of common stock equal to an aggregate of five percent (5%) of the shares of common stock (the “Underwriter’s Warrants”) sold in the offering. The exercise price of the Underwriter’s Warrants is equal to 110% of the offering price of the common stock offered hereby. Assuming an exercise price of $ per share, we would receive, in the aggregate, $ upon exercise of the Underwriter’s Warrants. The Underwriter’s Warrants are exercisable within 5 years commencing 180 days from the effective date of the offering at any time, and from time to time, in whole or in part. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We will not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION JANUARY 15, 2021 |

WETRADE GROUP INC.

Shares of Common Stock

WeTrade Group Inc. is offering up to an aggregate of shares of its common stock with no par value. Prior to this offering, our common stock is quoted on the OTC Market under the symbol “WETG”. As of January 15, 2021, our stock price on the OTC Market is $6.40. We expect the offering price to be $ per share. We intend to apply to list our shares of common stock on the Nasdaq Capital Market. This offering is contingent upon us listing our common stock on Nasdaq or another national exchange. There is no guarantee or assurance that our common stock will be approved for listing on the Nasdaq Capital Market or another national exchange.

This offering is being made on a firm commitment basis by the underwriter. We have agreed to grant the underwriter an option exercisable for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of the shares offered in this offering for the purpose of covering over-allotments, if any, at the offering price less the underwriting discounts (the “Over-Allotment Option”). The underwriter expects to deliver the shares of common stock against payment as set forth under “Underwriting” on page 51.

We are a “controlled company” within the meaning of the Nasdaq Stock Market Rules due to the fact that our directors and officers, will beneficially own approximately % of the total outstanding shares of common stock after the offering, or % of the total outstanding shares of common stock if the underwriter exercises the Over-Allotment Option in full. As a “controlled company” as defined under the Nasdaq Stock Market Rules, we are permitted to elect to rely on certain exemptions from corporate governance rules. We do not plan to rely on these exemptions, but we may elect to do so after we complete this offering.

Investing in our common stock involves a high degree of risk. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6.

We are an “emerging growth company” and a “smaller reporting company” as defined under federal securities laws and, as such, have elected to comply with certain reduced public company disclosure requirements in this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

|

|

| Per Share |

|

| Total Without |

|

| Total With Full |

| |||

| Offering Price |

| $ |

|

|

| $ |

|

|

| $ |

|

|

| Underwriting Discounts and Commissions(1) |

| $ |

|

|

| $ |

|

|

| $ |

|

|

| Proceeds to Us, Before Expenses(2) |

| $ |

|

|

| $ |

|

|

| $ |

|

|

| (1) | We have agreed to give our representative of the underwriters, , a discount equal to six percent (6%) of offering price as well as warrants equal to five percent (5%) of the shares of common stock issued in the Offering (the “Underwriter’s Warrants”). The Underwriter’s Warrants will be exercisable at any time, and from time to time, in whole or in part, during the period commencing 180 days from the effective date of the registration statement of which this prospectus is a part, which period shall not extend further than five years from the effective date of the Registration Statement in compliance with FINRA Rule 5110(g)(8)(A). The Underwriter’s Warrants are exercisable at a per share price of $ , which is 110% of the offering price. The Underwriter’s Warrants are also exercisable on a cashless basis. We also have agreed to reimburse the underwriter for certain of their out-of-pocket expenses. See “Underwriting” for a description of these arrangements. |

|

|

|

| (2) | The total estimated expenses related to this offering are set forth in the section entitled “Expenses Related to This Offering.” |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

[UNDERWRITER]

The date of this prospectus is , 2021.

|

| 1 |

| |

|

| 6 |

| |

|

| 18 |

| |

|

| 19 |

| |

|

| 20 |

| |

|

| 21 |

| |

|

| 22 |

| |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 23 |

|

|

| 28 |

| |

|

| 35 |

| |

|

| 41 |

| |

|

| 47 |

| |

| Security Ownership of Certain Beneficial Owners and Management |

| 48 |

|

|

| 49 |

| |

|

| 50 |

| |

|

| 51 |

| |

|

| 54 |

| |

|

| 54 |

| |

|

| 54 |

| |

|

| 54 |

| |

|

| F-1 |

|

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission (the “SEC”). Neither we, the selling stockholders, nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared. Neither we, the selling stockholders, nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, results of operations, financial condition, and prospects may have changed since such date.

For investors outside of the United States: Neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus and any free writing prospectus must inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

| i |

| Table of Contents |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read the entire prospectus, including our financial statements and the related notes and management’s discussion and analysis incorporated herein by reference. You should also consider, among other things, the matters described under “Risk Factors” in each case appearing elsewhere in this prospectus.

Overview

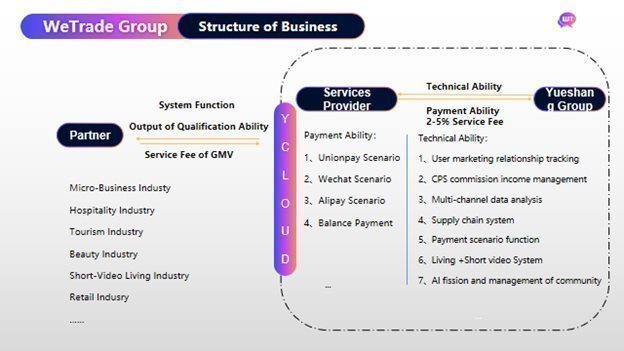

WeTrade Group, Inc. was incorporated in the State of Wyoming on March 28, 2019 and is in the business of providing technical services and solutions via its membership-based social e-commerce platform. We are committed to providing an international cloud-based intelligence system and independently developed a microbusiness cloud intelligence system (the “YCloud”). Our goal is to provide technical and auto-billing management services for 100 million micro-business online stores in China through big data analytics, machine learning mechanism, social network recommendations, and multi-channel data analysis.

We formed a strategic alliance with service providers. We, together with service providers provide services to both individual and corporate clients. We are serving microbusiness owners at various platforms with a 360-million potential market basis for the individual side. We are serving enterprises in multiple industries for the corporate side, including Yuetao Group, JD Zhiding, Lvyue, Yuebei, Yuedian, Coke GO, China Tobacco Shangyue, etc. We have conducted business operations in mainland China and trial operations in Hong Kong, the Philippines, and Singapore. We expect to utilize the YCloud system to establish a global strategic cooperation with various social media platforms, including Kakao Talk, Line, Whatsapp, Ohho, and Bluechat, etc. We have also formed a long-term technical collaboration with Yuetao App, Daren App, Yuebei App, JDZhiding App, Yuedian App, and Lvyue App.

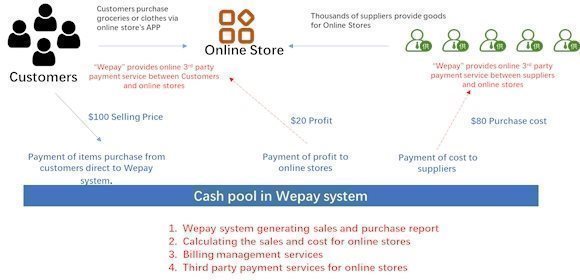

In January 2020, we appointed 3rd party software company to develop an auto-billing management system (“WeTrade System”), the early stage of YCloud system, at the cost of RMB 400,000 to provide online payment services for its online store customers in PRC. The main functions of YCloud System are users’ marketing relationship, CPS commission profit management, multi-channel data statistics, AI fission and management, improved supply chain system. Business applications cover the micro business industry, tourism industry, hospitality industry, livestreaming and short video industry, medical beauty industry and traditional retail industry.

Our products are currently serving the e-commerce industry, tourism industry, hospitality industry, and live-streaming/short video industry.

Our Products and Technology

We have utilized digitalization, electronic management, electronic data exchange, big data analysis, AI fission technology, revenue management and other technologies to form a strong coordination effect. We believe that our cloud technology enables us to develop a platform with better functionality for microbusiness users in China. We have optimized our product using the tools and platforms best suited to serve our customers. Performance, functional depth and usability of our product drive our technology decisions and product development direction, which leads to our successful development of our YCloud.

YCloud is the first global micro-business cloud intelligent internationalization system. It conducts multi-channel data analysis through the learning of big data and social recommendation relationships. It also provides users with independent research and development of community AI fission and management systems and supply chain systems. It focuses on solving the problem of new maintenance, supply chain CPS integration output, and enrich the functional needs of users. YCloud has four main functions and competitive advantages as follows:

Payment scenario function: the YCloud system provides partners with multiple payment methods such as Alipay, WeChat, and UnionPay. The total order amount is directly entered into the platform to collect funds in separate accounts. The payment scenarios’ actual application can be divided into the single scenario payment function and the multi-scenario payment function. Dividing by income, the payment scenario function reduces the labor cost and error rate, thus significantly improving the efficiency of generating intelligent data analysis.

| 1 |

| Table of Contents |

Team management: the YCloud system utilizes user marketing relationship tracking and CPS commission revenue management tools.

AI fission and management: with the application of intelligent robots with user behavior, sharing data, sharing purchase, and other data, the YCloud system provides tailored recommendations and displays. For example, the YCloud system connects users’ behavior in multiple apps and platforms and makes automatic recommendations based on the analysis.

Supply chain system integration: the YCloud system applies cross-platform resource integration technology. The integration allows the multi-channel output of high-quality products and a seamless connection between suppliers and customers. The YCloud provides a complete supply chain system integrating supply, sales, finance, and service.

Revenue Model

In the business of providing technical services and solutions via a membership-based social e-commerce platform, we are committed to providing an international cloud-based intelligence system and independently developed the “YCloud” system. We aim to provide technical and auto-billing management services for 100 million micro-business online stores in China through big data analytics, machine learning mechanism, social network recommendations, and multi-channel data analysis.

We derive our revenue from service fees charged for transactions conducted on its e-commerce platform-based SaaS products. We receive 2%-3.5% of the total Gross Merchandise Volume generated in the platform as a service fee through our agreements with various platforms, depending on the type of service and industry. We generally settle the service fee with its customers within the first ten days of each calendar month.

Other Pertinent Information

Except where the context otherwise requires and for purposes of this prospectus only, “we,” “us,” “our,” the “Company” and similar designations refer to:

|

| ● | WeTrade Group Inc. (“WeTrade Group” when individually referenced), a Wyoming corporation; |

|

| ● | Utour Pte Ltd. (“Utour” when individually referenced), a Singapore company and a wholly-owned subsidiary of WeTrade Group; |

|

| ● | WeTrade Information Technology Limited (“WeTrade Technology” when individually referenced), a Hong Kong company and a wholly-owned subsidiary of WeTrade Group; |

|

| ● | Yueshang information technology (Beijing)Limited (“Yueshang Beijing” when individually referenced), a PRC company and a wholly-owned subsidiary of WeTrade Technology; |

|

|

|

|

|

| ● | Yueshang Group Network (Hunan) Co., Limited, (“Yueshang Hunan” when individually referenced), a PRC company that wholly-owned by subsidiary of Yueshang Beijing, which was incorporated on November 13, 2020. |

|

|

|

|

|

| ● | Yueshang Technology Group (Hainan Special Economic Zone) Co. Limited (“Yueshang Hainan” when individually referenced),a PRC company that wholly-owned by subsidiary of Yueshang Beijing, which was incorporated on October 27, 2020. |

| 2 |

| Table of Contents |

Corporate Information

We were incorporated on March 28, 2019 as WeTrade Group, Inc., a Wyoming corporation. Our principal executive offices are located at No 1 Gaobei South Coast, Yi An Men 111 Block 37, Chao Yang District, Beijing City, People Republic of China 100020, and our telephone number is +86-135-011-76409. Our registered agent for service of process is Wyoming Registered Agent, 1621 Central Ave, Cheyenne, WY 82001. Our website address is http://www.wetradegroup.net/. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only. Investors should not rely on any such information in deciding whether to purchase our common stock.

Foreign Currency Translation

The Company’s principal country of operations is the PRC. The accompanying consolidated financial statements are presented in US$. The functional currency of the Company is US$, and the functional currency of the Company’s subsidiaries is RMB. The consolidated financial statements are translated into US$ from RMB at year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. The resulting translation adjustments are recorded as a component of shareholders’ equity included in other comprehensive income. Gains and losses from foreign currency transactions are included in profit or loss.

|

|

| As of |

| |||||

|

|

| For the period ended September 30, 2020 |

|

| December 31, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| RMB: US$ exchange rate |

|

| 6.79 |

|

|

| 7.00 |

|

|

|

| Nine months ended September 30, |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

|

|

|

|

|

|

|

| ||

| RMB: US$ exchange rate |

|

| 6.81 |

|

|

| 7.05 |

|

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation.

The balance sheet amounts, with the exception of equity, September 30, 2020 and December 31, 2019 were translated at 6.79 RMB and 7.00 RMB to $1.00, respectively. The equity accounts were stated at their historical rates. The average translation rates applied to statements of operations and comprehensive income (loss) accounts for the period ended September 30, 2020 and year ended December 31, 2019 were 6.81 RMB and 7.05 RMB to $1.00, respectively. Cash flows were also translated at average translation rates for the periods and, therefore, amounts reported on the statement of cash flows would not necessarily agree with changes in the corresponding balances on the consolidated balance sheet. The transactions dominated in SGD are immaterial.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, we:

|

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; |

| 3 |

| Table of Contents |

|

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

|

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

|

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); |

|

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

|

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

|

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 10-K following the effectiveness of our initial public offering. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a prospectus declared effective under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Implication of Being a Controlled Company

We are and will remain, following this offering, to be a “controlled company” within the meaning of the Nasdaq Stock Market Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.

We are and will be a “controlled company” as defined under the Nasdaq Stock Market Rules as our directors and officers own and hold more than 50% of the voting right represented by our outstanding shares of common stock. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

|

| ● | an exemption from the rule that a majority of our board of directors must be independent directors; |

|

| ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and |

|

| ● | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption after we complete this offering. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors after we complete this offering. (See “Risk Factors –As a “controlled company” under the rules of the Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders.”)

Additionally, pursuant to Nasdaq’s phase-in rules for newly listed companies, we have one year from the date on which we are first listed on Nasdaq to comply fully with the Nasdaq listing standards. We do not plan to rely on the phase-in rules for newly listed companies and will comply fully with the Nasdaq listing standards at the time of listing.

| 4 |

| Table of Contents |

The Offering

| Issuer: |

| WeTrade Group Inc. |

|

|

|

|

| Common Stock to be Offered: |

| shares of common stock (excluding the Over-Allotment Option discussed below) |

|

|

|

|

| Price per Share: |

| $ |

|

|

|

|

| Over-Allotment Option: |

| We have granted to the underwriter the option, exercisable for 45 days from the date this registration statement is declared effective by the SEC, to purchase up to an additional 15% of the total number of shares of common stock to be offered by the Company in this offering.

|

| Common Stock to be Outstanding after the Offering: |

| shares of common stock, or shares of common stock if the underwriter exercises the Over-Allotment Option in full.

The numbers do not include any of the up to shares of common stock underlying the Underwriter’s Warrants. See “Description of Share Capital.” |

|

|

|

|

| Gross Proceeds: |

| $ , or $ if the underwriter exercises the Over-Allotment Option in full, less underwriter discounts, non-expense allowance and estimated offering expenses. See “Underwriting.” |

|

|

|

|

| Risk Factors: |

| Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus starting on page 6 before deciding to invest in our common stock. |

|

|

|

|

| Use of Proceeds: |

| We intend to use the proceeds from this offering for software research and development and business expansion. See “Use of Proceeds” for more information. |

|

|

|

|

| Dividend Policy: |

| We have no present plans to declare dividends and plan to retain our earnings to continue to grow our business. |

|

|

|

|

| Transfer Agent: |

| Globex Transfer LLC |

|

|

|

|

| Exchange: |

| We plan to apply to list our common stock on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing on Nasdaq; however, we will not complete this offering unless we receive conditional approval letter. |

|

|

|

|

| Trading Symbol: |

| WETG |

| 5 |

| Table of Contents |

Before you decide to purchase our common stock, you should understand the high degree of risk involved. You should consider carefully the following risks and other information in this prospectus, including our consolidated financial statements and related notes. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our common stock could decline, perhaps significantly.

Risks Relating to Our Business and Our Financial Condition

Our independent auditors have issued an audit opinion for the Company which includes a statement describing our going concern status. Our financial status creates a doubt whether we will continue as a going concern.

As described in our accompanying financial statements, our auditors have issued a going concern opinion regarding the Company. This means there is substantial doubt we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty regarding our ability to continue in business. As such, we may have to cease operations and investors could lose part or all of their investment in the Company.

Our success depends on our ability to develop products and services to address the rapidly evolving market for SaaS and E-Commerce, financial, and marketing services, and, if we are not able to implement successful enhancements and new features for our products and services, our business could be materially and adversely affected.

We expect that new services and technologies applicable to the industries in which we operate will continue to emerge and evolve. Rapid and significant technological changes continue to confront the industries in which we operate, including developments in WeChat business, ecommerce, mobile commerce, and payment integration services. Other potential changes are on the horizon as well, such as developments in secure data privacy. Similarly, there is rapid innovation in the provision of other products and services to businesses, including in financial services and marketing services.

These new services and technologies may be superior to, impair, or render obsolete the products and services we currently offer or the technologies we currently use to provide them. Incorporating new technologies into our products and services may require substantial expenditures and take considerable time, and we may not be successful in realizing a return on these development efforts in a timely manner or at all. There can be no assurance that any new products or services we develop and offer to our sellers will achieve significant commercial acceptance. Our ability to develop new products and services may be inhibited by industry-wide standards, ecommerce payment networks, laws and regulations, resistance to change from buyers or sellers, or third parties’ intellectual property rights. Our success will depend on our ability to develop new technologies and to adapt to technological changes and evolving industry standards. If we are unable to provide enhancements and new features for our products and services or to develop new products and services that achieve market acceptance or that keep pace with rapid technological developments and evolving industry standards, our business would be materially and adversely affected.

In addition, because our products and services are designed to operate with a variety of systems, infrastructures, and devices, we need to continuously modify and enhance our products and services to keep pace with changes in mobile, software, communication, and database technologies. We may not be successful in either developing these modifications and enhancements or in bringing them to market in a timely and cost-effective manner. Any failure of our products and services to continue to operate effectively with third-party infrastructures and technologies could reduce the demand for our products and services, result in dissatisfaction of our sellers or their customers, and materially and adversely affect our business.

| 6 |

| Table of Contents |

Our services must integrate with a variety of operating systems. If we are unable to ensure that our services or hardware interoperate with such operating systems, our business may be materially and adversely affected.

We are dependent on the ability of our products and services to integrate with a variety of operating systems, as well as web browsers that we do not control. Any changes in these systems that degrade the functionality of our products and services, impose additional costs or requirements on us, or give preferential treatment to competitive services, could materially and adversely affect usage of our products and services. In addition, we rely on ecommerce platforms and marketplaces, such as the WeChat, Meituan, Vipshop for SaaS uses and strategic cooperation. Apple, Google, or other operators of app marketplaces regularly make changes to their marketplaces, and those changes may make access to our products and services more difficult. In the event that it is difficult for our sellers to access and use our products and services, our business may be materially and adversely affected.

Our chief executive officer, chief financial officer and principal accounting officer, and directors have no significant experience managing a public company and no meaningful financial reporting experience as it relates to public companies. Accordingly, our ability to meet Exchange Act reporting requirements on a timely basis will be dependent to a significant degree upon others.

Our officers and directors have no significant experience managing a public company and no meaningful financial reporting experience as it relates to public companies, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934, which is necessary to maintain our public company status. If we were to fail to fulfill obligations, our ability to continue as a public company would be in jeopardy, in which event you could lose your entire investment in our Company.

We face risks related to natural disasters, terrorist acts or acts of war, social unrest, health epidemics or other public safety concerns or hostile events, which could significantly disrupt our operations.

Our business could be materially and adversely affected by natural disasters, terrorist acts or acts of war, social unrest, health epidemics or other public safety concerns or hostile events. Natural disasters may give rise to server interruptions, breakdowns, system or technology platform failures, or internet failures, which would adversely affect our ability to operate our platform and provide our services. In addition, our results of operations could be adversely affected to the extent that any such event affects the economic condition in general and the travel industry in particular.

Since early 2020, the disease caused by a novel strain of coronavirus, later named COVID-19, has severely impacted China and the rest of the world. On March 11, 2020, the World Health Organization declared COVID-19 a pandemic. The COVID-19 pandemic has led governments and other authorities around the world to impose measures intended to control its spread, including restrictions on freedom of movement, gatherings of large numbers of people, and business operations such as travel bans, border closings, business closures, quarantines, shelter-in-place orders and social distancing measures. As a result, the COVID-19 pandemic and its consequences have caused a severe decline in global travel.

The impact of the COVID-19 pandemic is rapidly evolving, and the continuation or a future resurgence of the pandemic could precipitate or aggravate the other risk factors that we face, which in turn could further materially and adversely affect our business, financial condition, liquidity, results of operations and profitability, including in ways that are not currently known to us or that we do not currently consider to present significant risks. The extent of the impact of the COVID-19 on our operational and financial performance in the longer term will depend on future developments, including the duration of the outbreak and related travel advisories and restrictions and the impact of the COVID-19 on overall demand for travel, all of which are highly uncertain and beyond our control. In addition to COVID-19, our business could also be adversely affected by the outbreak of Ebola virus disease, H1N1 flu, H7N9 flu, avian flu, SARS, or other epidemics.

| 7 |

| Table of Contents |

Interruption or failure of our own technology systems or those provided by third-party service providers we rely upon could impair our ability to provide products and services, which could damage our reputation and harm our results of operations.

Our ability to provide products and services depends on the continuing operation of our technology systems or those provided by third-party service providers, such as cloud service providers. Any damage to or failure of such systems could interrupt our services. Service interruptions could reduce our revenue and profit and damage our brand if our systems are perceived to be unreliable. Our systems are vulnerable to damage or interruption as a result of terrorist attacks, wars, earthquakes, floods, fires, power loss, telecommunications failures, undetected errors or “bugs” in our software, malware, computer viruses, interruptions in access to our platform through the use of “denial of service” or similar attacks, hacking or other attempts to harm our systems, and similar events. Some of our systems are not fully redundant, and our disaster recovery planning does not account for all possible scenarios. If we cannot continue to retain third-party services on acceptable terms, our services may be interrupted. If we experience frequent or persistent system failures on our platform, whether due to interruptions and failures of our own technology and or those provided by third-party service providers that we rely upon, our reputation and brand could be severely harmed.

We are in the process of developing and optimizing our billing system, which will place a key role in our existing and planned business initiatives. Any error in the billing system could disrupt our operations and impact our ability to provide or bill for our services, retain customers, attract new customers, or negatively impact overall customer experience. Any occurrence of the foregoing could cause material adverse effects on our operations and financial condition, material weaknesses in our internal control over financial reporting, and reputational damage.

Any actual or perceived security or privacy breach could interrupt our operations, harm our brand and adversely affect our reputation, brand, business, financial condition and results of operations.

Our business involves the collection, storage, processing and transmission of our users’ personal data and other sensitive data. An increasing number of organizations, including large online and off-line merchants and businesses, other large Internet companies, financial institutions and government institutions, have disclosed breaches of their information security systems and other information security incidents, some of which have involved sophisticated and highly targeted attacks. Because techniques used to obtain unauthorized access to or to sabotage information systems change frequently and may not be known until launched against us, we may be unable to anticipate or prevent these attacks. In addition, users on our platform could have vulnerabilities on their own mobile devices that are entirely unrelated to our systems and platform, but could mistakenly attribute their own vulnerabilities to us. Further, breaches experienced by other companies may also be leveraged against us. For example, credential stuffing attacks are becoming increasingly common and sophisticated actors can mask their attacks, making them increasingly difficult to identify and prevent. Certain efforts may be state-sponsored or supported by significant financial and technological resources, making them even more difficult to detect.

Although we intend to develop, contract or purchase systems and processes that are designed to protect our users’ data, prevent data loss and prevent other security breaches, these security measures cannot guarantee security. Our information technology and infrastructure may be vulnerable to cyberattacks or security breaches, and third parties may be able to access our users’ personal information and limited payment card data that are accessible through those systems. Employee error, malfeasance or other errors in the storage, use or transmission of personal information could result in an actual or perceived privacy or security breach or other security incident. Although we have policies restricting the access to the personal information we store, our employees have been accused in the past of violating these policies and we may be subject to these types of accusations in the future.

Any actual or perceived breach of privacy or security could interrupt our operations, result in our platform being unavailable, resulting in loss or improper disclosure of data, result in fraudulent transfer of funds, harm our reputation and brand, damage our relationships with third-party partners, result in significant legal, regulatory and financial exposure and adversely affect our business, financial condition and results of operations. Any breach of privacy or security impacting any entities with which we share or disclose data (could have similar effects. Further, any cyberattacks, or security and privacy breaches directed at our competitors could reduce confidence in the industry as a whole and, as a result, reduce confidence in us.

Additionally, defending against claims or litigation based on any security breach or incident, regardless of their merit, could be costly and divert management’s attention. We cannot guarantee that we will be able to successfully defending any of such lawsuits which could have an adverse effect on our reputation, brand, business, financial condition and results of operations.

| 8 |

| Table of Contents |

As we expand our platform offerings, we may become subject to additional laws and regulations, and any actual or perceived failure by us to comply with such laws and regulations or manage the increased costs associated with such laws and regulations could adversely affect our business, financial condition and results of operations.

As we continue to expand our platform offerings and user base, we may become subject to additional laws and regulations, which may differ or conflict from one jurisdiction to another. Many of these laws and regulations were adopted prior to the advent of our industry and related technologies and, as a result, do not contemplate or address the unique issues faced by our industry.

Despite our efforts to comply with applicable laws, regulations and other obligations relating to our platform offerings, it is possible that our practices, offerings or platform could be inconsistent with, or fail or be alleged to fail to meet all requirements of such laws, regulations or obligations. Our failure, or the failure by our third-party providers or partners, to comply with applicable laws or regulations or any other obligations relating to our platform offerings, could harm our reputation and brand or result in fines or proceedings by governmental agencies or private claims and litigation, any of which could adversely affect our business, financial condition and results of operations.

Key employees are essential to expanding our business.

Dai Zheng, Pijun Liu, Li Zhuo and Che Kean Tat are essential to our ability to continue to grow and expand our business. They have established relationships within the industry in which we operate. If they were to leave us, our growth strategy might be hindered, which could materially affect our business and limit our ability to increase revenue.

Additional capital, if needed, may not be available on acceptable terms, if at all, and any additional financing may be on terms adverse to your interests.

We may need additional cash to fund our operations. Our capital needs will depend on numerous factors, including market conditions and our profitability. We cannot be certain that we will be able to obtain additional financing on favorable terms, if at all. If additional financing is not available when required or is not available on acceptable terms, we may be unable to fund expansion, successfully promote our brand name, develop or enhance our services, take advantage of business opportunities, or respond to competitive pressures or unanticipated requirements, any of which could seriously harm our business and reduce the value of your investment.

If we are able to raise additional funds if and when needed by issuing additional equity securities, you may experience significant dilution of your ownership interest and holders of these new securities may have rights senior to yours as a holder of our common stock. If we obtain additional financing by issuing debt securities, the terms of those securities could restrict or prevent us from declaring dividends and could limit our flexibility in making business decisions. In this case, the value of your investment could be reduced.

There is no assurance that we will be able to obtain additional funding if it is needed, or that such funding, if available, will be obtainable on terms and conditions favorable to or affordable by us. If we cannot obtain needed funds, we may be forced to curtail our activities.

We face increased competition as the barrier to entry the industry is relatively low and some of our competitors have significantly greater financial and marketing resources than we do.

The global E-commerce SaaS industry is still uprising, and in its early stage of development. The barrier to entry the industry is relatively low. We may compete against businesses in varied sectors, many of which are larger than we are, have a dominant and secure position in other industries, or offer other goods and services to consumers and merchants, which we do not provide. In addition, some of our competitors have significantly greater financial and marketing resources than we do and, therefore, vendors may not negotiate a similar or lower price to our Company than to other competitors with significantly greater assets and a larger budget for advertising. There are no assurances that our efforts to compete in the marketplace will be successful.

| 9 |

| Table of Contents |

Our marketing efforts to help grow our business may not be effective.

Promoting awareness of our offerings is important to our ability to grow our business and to attract new users can be costly. We believe that much of the growth in our user base and the number of users on our platform will be attributable to paid marketing initiatives. Our marketing initiatives may become increasingly expensive and generating a meaningful return on those initiatives may be difficult. Even if we successfully increase revenue as a result of our paid marketing efforts, it may not offset the additional marketing expenses we incur.

If our marketing efforts are not successful in promoting awareness of our offerings or attracting new users and partners, or if we are not able to cost-effectively manage our marketing expenses, our results of operations could be adversely affected. If our marketing efforts are successful in increasing awareness of our offerings, this could also lead to increased public scrutiny of our business and increase the likelihood of third parties bringing legal proceedings against us. Any of the foregoing risks could harm our business, financial condition and results of operations.

Any failure to offer high-quality user support may harm our relationships with users and could adversely affect our reputation, brand, business, financial condition and results of operations.

Our ability to attract and retain qualified users is dependent in part on the ease and reliability of our offerings, including our ability to provide high-quality support. Users on our platform depend on our support organization to resolve any issues relating to our offerings issues with reporting a problem. Our ability to provide effective and timely support is largely dependent on our ability to attract and retain service providers who are qualified to support users and sufficiently knowledgeable regarding our offerings.

Failure to deal effectively with fraud could harm our business.

There is the possibility of losses from various types of fraud, including use of stolen or fraudulent credit card data, claims of unauthorized payments by a user, attempted payments by users with insufficient funds and fraud committed by users in concert with third parties. Criminals use increasingly sophisticated methods to engage in illegal activities involving personal information, such as unauthorized use of another person’s identity, account information or payment information and unauthorized acquisition or use of credit or debit card details, bank account information and mobile phone numbers and accounts. Under current credit card practices, we may be liable for purchases facilitated on our platform with fraudulent credit card data, even if the associated financial institution approved the credit card transaction. Despite measures we have taken to detect and reduce the occurrence of fraudulent or other malicious activity on our platform, we cannot guarantee that any of our measures will be effective or will scale efficiently with our business. Our failure to adequately detect or prevent fraudulent transactions could harm our reputation or brand, result in litigation or regulatory action and lead to expenses that could adversely affect our business, financial condition and results of operations.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could prevent us from producing reliable financial reports or identifying fraud. In addition, stockholders could lose confidence in our financial reporting, which could have an adverse effect on our stock price.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud, and a lack of effective controls could preclude us from accomplishing these critical functions. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of an issuer’s internal controls over financial reporting. Although we intend to augment our internal controls procedures and expand our accounting staff, there is no guarantee that this effort will be adequate.

During the course of our testing, we may identify deficiencies which we may not be able to remediate. In addition, if we fail to maintain the adequacy of our internal accounting controls, as applicable standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain an effective internal control environment could cause us to face regulatory action and, also, cause investors to lose confidence in our reported financial information, either of which could have an adverse effect on our stock price.

| 10 |

| Table of Contents |

As a “smaller reporting company” certain reduced disclosure and other requirements will be available to us after we are no longer an emerging growth company.

We are a “smaller reporting company” pursuant to the Securities Exchange Act of 1934. Some of the reduced disclosure and other requirements available to us as a result of the JOBS Act may continue to be available to us after we are no longer an emerging growth company pursuant to the JOBS Act but remain a “smaller reporting company” pursuant to the Securities Exchange Act of 1934. As a “smaller reporting company” we are not required to:

|

| · | have an auditor report regarding our internal controls of financial reporting pursuant to Section 4(b) of the Sarbanes-Oxley Act; |

|

|

|

|

|

| · | present more than two years audited financial statement in our registration statement and annual reports on Form 10-K and present selected financial data in such registration statements and annual reports; |

|

|

|

|

|

| · | Make risk factor disclosure in our annual reports of Form 10-K; and |

|

|

|

|

|

| · | Make certain otherwise required disclosures in our annual reports on Form 10-K and quarterly reports on Form 10-Q. |

The financial statements included with the registration statement of which this prospectus is a part have been prepared on a going concern basis. We may not be able to generate profitable operations in the future and/or obtain the necessary financing to meet our obligations and repay liabilities arising from normal business operations when they come due. The outcome of these matters cannot be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern. We plan to continue to provide for our capital needs through related party advances. Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

A prolonged downturn in the global economy could materially and adversely affect our business and results of operations.

The current global market and economic conditions are unprecedented, volatile and challenging, with the threat of recessions occurring in most major economies. Continued concerns about the systemic impact of potential long-term and wide-spread recession, energy costs, geopolitical issues, and the availability and cost of credit have contributed to increased market volatility and diminished expectations for economic growth around the world. The difficult economic outlook has negatively affected businesses and consumer confidence and contributed to volatility of unprecedented levels. We cannot provide any assurance that our operations will not be materially and adversely affected by these conditions. If our operations are so affected, we may not be profitable and you could lose your investment in our shares.

Changes in laws or regulations relating to privacy, data protection or the protection or transfer of personal data, or any actual or perceived failure by us to comply with such laws and regulations or any other obligations relating to privacy, data protection or the protection or transfer of personal data, could adversely affect our business.

We receive, transmit and store a large volume of personally identifiable information and other data relating to the users on our platform. Numerous local, municipal, state, federal and international laws and regulations address privacy, data protection and the collection, storing, sharing, use, disclosure and protection of certain types of data, including the California Online Privacy Protection Act, the Personal Information Protection and Electronic Documents Act, the Controlling the Assault of Non-Solicited Pornography and Marketing (CAN-SPAM) Act, Canada’s Anti-Spam Law (CASL), the Telephone Consumer Protection Act of 1991, the U.S. Federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, Section 5(c) of the Federal Trade Commission Act, and, effective as of January 1, 2020 the California Consumer Privacy Act, or CCPA. These laws, rules and regulations evolve frequently and their scope may continually change, through new legislation, amendments to existing legislation and changes in enforcement, and may be inconsistent from one jurisdiction to another. For example, California recently enacted legislation, the CCPA, which will, among other things, require new disclosures to California consumers and afford such consumers new abilities to opt-out of certain sales of personal information when it goes into effect on January 1, 2020. The CCPA provides for fines of up to $7,500 per violation. It presently is unclear how this legislation will be modified or how it will be interpreted. The effects of this legislation potentially are far-reaching, however, and may require us to modify our data processing practices and policies and incur substantial compliance-related costs and expenses. The CCPA and other changes in laws or regulations relating to privacy, data protection and information security, particularly any new or modified laws or regulations that require enhanced protection of certain types of data or new obligations with regard to data retention, transfer or disclosure, could greatly increase the cost of providing our offerings, require significant changes to our operations or even prevent us from providing certain offerings in jurisdictions in which we currently operate and in which we may operate in the future.

| 11 |

| Table of Contents |

Despite our efforts to comply with applicable laws, regulations and other obligations relating to privacy, data protection and information security, it is possible that our practices, offerings or platform could be inconsistent with, or fail or be alleged to fail to meet all requirements of, such laws, regulations or obligations. Our failure, or the failure by our third-party providers or partners, to comply with applicable laws or regulations or any other obligations relating to privacy, data protection or information security, or any compromise of security that results in unauthorized access to, or use or release of personally identifiable information or other user data, or the perception that any of the foregoing types of failure or compromise has occurred, could damage our reputation, discourage new and existing users from using our platform or result in fines or proceedings by governmental agencies and private claims and litigation, any of which could adversely affect our business, financial condition and results of operations. Even if not subject to legal challenge, the perception of privacy concerns, whether or not valid, may harm our reputation and brand and adversely affect our business, financial condition and results of operations.

We may not maintain sufficient insurance coverage for the risks associated with our business operations

Risks associated with our business and operations include, but are not limited to, claims for wrongful acts committed by our officers, directors, and other representatives, the loss of intellectual property rights, the loss of key personnel and risks posed by natural disasters. Any of these risks may result in significant losses. We currently do not carry business interruption insurance and may not do so in the future. In addition, we cannot provide any assurance that our insurance coverage is sufficient to cover any losses that we may sustain, or that we will be able to successfully claim our losses under our insurance policies on a timely basis or at all. If we incur any loss not covered by our insurance policies, or the compensated amount is significantly less than our actual loss or is not timely paid, our business, financial condition and results of operations could be materially and adversely affected.

We do not have “key man” life insurance policies for any of our key personnel. If we were to obtain “key man” insurance for our key personnel, of which there can be no assurance, the amounts of such policies may not be sufficient to pay losses experienced by us as a result of the loss of any of those personnel.

We do not currently have general liability insurance and may not have general liability insurance in the near future until our financial situation improves.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new SEC regulations, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed.

| 12 |

| Table of Contents |

We are a “controlled company” within the meaning of the rules of the NASDAQ Stock Market and as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.

We are a “controlled company” as defined under the NASDAQ Stock Market Rules because our directors and officers beneficially own more than 50% of our total voting power. For so long as we remain a controlled company under that definition, we are permitted to elect to rely, and intend to rely, on certain exemptions from corporate governance rules, including an exemption from the rule that a majority of our board of directors must be independent directors.

Risks Relating to Doing Business in China

As the Company will be targeting the Chinese domestic market as its primary source of revenue; the following risk factors may apply:

Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China, which could materially and adversely affect our business.

We will conduct substantially all of our business operations and sales activities in China and Hong Kong. Accordingly, our business, financial condition, results of operations and prospects depend to a significant degree on economic developments in China. China’s economy differs from the economies of most other countries in many respects, including with respect to the amount of government involvement in the economy, the general level of economic development, growth rates and government control of foreign exchange and the allocation of resources. While the PRC economy has experienced significant growth in the past 30 years, this growth has remained uneven across different periods, regions and among various economic sectors. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Future changes in laws, regulations or enforcement policies in China could adversely affect our business.

We are subject to Chinese laws and regulations relating to data protection, business permits, banking, and money transfer among others. Laws, regulations or enforcement policies in China, including those relating to the travel industry, are evolving and subject to frequent changes. Further, regulatory agencies in China may periodically, and sometimes abruptly, change their enforcement practices. Therefore, prior enforcement activity, or lack of enforcement activity, is not necessarily predictive of future actions. Any enforcement actions against us could have a material and adverse effect on us. In addition, any litigation or governmental investigation or enforcement proceedings in China may be protracted and may result in substantial cost and diversion of resources and management attention, negative publicity, damage to our reputation and viability of our business plans.

We are a holding company, and will rely on dividends paid by our subsidiaries for our cash needs. We do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends.

Any limitation on the ability of our subsidiaries to make dividend payments to us, or any tax implications of making dividend payments to us, could limit our ability to pay our parent company expenses or pay dividends to holders of our common stock. PRC regulations may restrict the ability of our PRC subsidiary to pay dividends to us. The determination of whether to pay dividends on our common stock in the future will depend on several factors, including without limitation, our earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates. We currently intend to retain our future earnings to support operations and to finance expansion and, therefore, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

| 13 |

| Table of Contents |

PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC operating subsidiaries.

We may make loans to our future PRC subsidiaries. Any investments in or foreign loans to our PRC subsidiaries are subject to approval by or registration with relevant governmental authorities in China. We may also decide to finance our subsidiaries by means of capital contributions. According to the relevant PRC regulations on foreign-invested enterprises in China, depending on the total amount of investment and the industries of the investment, capital contributions to our PRC operating subsidiaries may be subject to the approval of the PRC Ministry of Commerce, or MOFCOM, or its local branches. We may not obtain these government approvals on a timely basis, if at all, with respect to future capital contributions by us to our PRC subsidiaries. If we fail to receive such approvals, our ability to use the proceeds of this offering and to capitalize our PRC operations may be negatively affected, which could adversely affect our liquidity and our ability to fund and expand our business.

Fluctuations in the value of the Renminbi may have a material and adverse effect on your investment.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions and China’s foreign exchange policies. The conversion of Renminbi into foreign currencies, including the U.S. dollar, has historically been set by the People’s Bank of China. On July 21, 2005, the PRC government changed its policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy caused the Renminbi to appreciate more than 20% against the U.S. dollar over the following three years. Since reaching a high against the U.S. dollar in July 2008, however, the Renminbi has traded within a narrow band against the U.S. dollar, remaining within 1% of its July 2008 high but never exceeding it. As a consequence, the Renminbi has fluctuated sharply since July 2008 against other freely traded currencies, in tandem with the U.S. dollar. In June 2010, the PRC government indicated that it would again make the foreign exchange rate of the Renminbi more flexible, which increases the possibility of sharp fluctuations in Renminbi’s value in the future as well as the unpredictability associated with Renminbi’s exchange rate. It is difficult to predict how long the current situation may last and when and how it may change again.

There remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against foreign currencies. Our revenues and costs are mostly denominated in the Renminbi, and a significant portion of our financial assets are also denominated in the Renminbi. As we rely entirely on dividends paid to us by our subsidiaries, any significant revaluation of the Renminbi may have a material and adverse effect on our revenues and financial condition, and the value of, and any dividends payable on, our ordinary shares in foreign currency terms. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar would reduce the Renminbi amount we receive from the conversion. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making dividend payments on our ordinary shares or for other business purposes, appreciation of the U.S. dollar against the Renminbi would reduce the U.S. dollar amount available to us. Any fluctuations in the exchange rate between the Renminbi and the U.S. dollar could also result in foreign currency translation losses for financial reporting purposes. The current economic dispute between China and the United States has resulted in a loss in the value of the Renminbi against the U.S. dollar for example thus illustrating the short term risk indicated above.

Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive most of our revenues in Renminbi. Under our current corporate structure, our company may rely on dividend payments from our PRC and Hong Kong subsidiaries to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE by complying with certain procedural requirements. But approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. This could affect the ability of our PRC subsidiaries to obtain foreign exchange through debt or equity financing, including by means of loans or capital contributions from us. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our shares.

| 14 |

| Table of Contents |

Uncertainties with respect to the Chinese legal system could have a material and adverse effect on us.

The PRC legal system is based on written statutes. Unlike under common law systems, decided legal cases have little value as precedents in subsequent legal proceedings. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general, and forms of foreign investment, including wholly foreign-owned enterprises and joint ventures, in particular. These laws, regulations and legal requirements are often changing, and their interpretation and enforcement involve significant uncertainties that could limit the reliability of the legal protections available to us. We cannot predict the effects of future developments in the PRC legal system. We may be required in the future to procure additional permits, authorizations and approvals for our existing and future operations, which may not be obtainable in a timely fashion or at all. An inability to obtain such permits or authorizations may have a material and adverse effect on our business, financial condition and results of operations.

Risks Relating to our Common Stock and this Offering

Our common stock has a limited public trading market.

There is a limited established public trading marketing for our common stock, and there can be no assurance that one will ever develop. Market liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result, holders of our securities may not find purchasers for our securities should they to sell securities held by them. Consequently, our securities should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite period of time.

Our common stock may be subject now and in the future to the SEC’s “Penny Stock” rules.