Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2019

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-5828

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 23-0458500 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1735 Market Street, 15th Floor Philadelphia, Pennsylvania | | 19103 |

(Address of principal executive offices) | | (Zip Code) |

|

|

610-208-2000 |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Common Stock, $5 Par Value | | CRS | | New York Stock Exchange |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Securities registered pursuant to 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at least the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to post such files)

Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer x | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

| | | | | | |

Emerging growth company o | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

The aggregate market value of the registrants’ voting common stock held by non-affiliates at December 31, 2018 was $1,687,208,892, based on the closing price per share of the registrant’s common stock on that date of $35.61 as reported on the New York Stock Exchange.

As of August 15, 2019, 47,664,249 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the Company’s fiscal year 2019 definitive Proxy Statement are incorporated by reference into Part III of this Report.

TABLE OF CONTENTS

PART I

Item 1. Business

(a) General Development of Business:

Carpenter Technology Corporation, founded in 1889, is engaged in the manufacturing, fabrication and distribution of specialty metals. As used throughout this report, unless the context requires otherwise, the terms “Carpenter”, “Company”, “Registrant”, “Issuer”, “we” and “our” refer to Carpenter Technology Corporation.

(b) Financial Information About Segments:

We are organized in two reportable business segments: Specialty Alloys Operations (“SAO”) and Performance Engineered Products (“PEP”). See Note 19 to our consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data” for additional segment reporting information.

(c) Narrative Description of Business:

(1) General:

We are a recognized leader in high-performance specialty alloy-based materials and process solutions for critical applications in the aerospace, defense, transportation, energy, industrial, medical and consumer end-use markets. We have evolved to become a pioneer in premium specialty alloys, including titanium, nickel, and cobalt, as well as alloys specifically engineered for additive manufacturing processes and soft magnetics applications. We have expanded our additive manufacturing capabilities to provide a complete “end-to-end” solution to accelerate materials innovation and streamline parts production.

Reportable Segments

The SAO segment is comprised of the Company’s major premium alloy and stainless steel manufacturing operations. This includes operations performed at mills primarily in Reading and Latrobe, Pennsylvania and surrounding areas as well as South Carolina and Alabama. The combined assets of the SAO segment are managed in an integrated manner to optimize efficiency and profitability across the total system.

The PEP segment is comprised of the Company’s differentiated operations. This segment includes the Dynamet titanium business, the Carpenter Powder Products business, the Amega West business, the CalRAM business, the LPW Technology Ltd. business and the Latrobe and Mexico distribution businesses. The businesses in the PEP segment are managed with an entrepreneurial structure to promote speed and flexibility and drive overall revenue and profit growth.

(2) Raw Materials:

Our business depends on continued receipt of critical raw materials for our day to day operations. These raw materials include nickel, cobalt, chromium, manganese, molybdenum, titanium, iron and scrap containing the named alloys. Some of the sources of these raw materials, many of which are international, could be subject to potential interruptions of supply as a result of political events, labor unrest or other reasons. These potential interruptions could cause material shortages and affect availability and price. We have arrangements with certain vendors to provide consigned materials at our manufacturing facilities available for our consumption as necessary.

We have long-term relationships with major suppliers who provide availability of material at competitive prices. Purchase prices of certain raw materials have historically been volatile. We use pricing surcharges, indexing mechanisms, base price adjustments and raw material forward contracts to reduce the impact on our business of increased costs for the most significant of these materials. There can be delays between the time of the increase in the price of raw materials and the realization of the benefits of such mechanisms or actions that could have a short-term impact on our results and could affect the comparability of our results from period to period.

(3) Patents and Licenses:

We own a number of United States and international patents and have granted licenses under some of them. In addition, certain products that we produce are covered by patents held or owned by other companies from whom licenses have been obtained. The duration of a patent issued in the United States is between 14 and 20 years from the date of filing a patent application or issuance of the patents. The durations of patents issued outside of the United States varies from country to country. Generally, patent licenses are structured to match the duration of the underlying patent. Although these patents and licenses are believed to be of value, we do not consider our business to be materially dependent upon any single such item or related group of such items.

(4) Seasonality of Business:

Our sales are normally influenced by seasonal factors. Historically, our sales in the first two fiscal quarters (the respective three months ending September 30 and December 31) are typically the lowest, principally because of annual plant vacation and maintenance shutdowns by us, as well as by many of our customers. However, the timing of major changes in the general economy or the markets for certain products can alter this historical pattern.

The chart below summarizes the percent of net sales by quarter for the past three fiscal years:

|

| | | | | | | | | |

Quarter Ended | | 2019 | | 2018 | | 2017 |

September 30, | | 24 | % | | 22 | % | | 22 | % |

December 31, | | 23 |

| | 22 |

| | 24 |

|

March 31, | | 26 |

| | 27 |

| | 26 |

|

June 30, | | 27 |

| | 29 |

| | 28 |

|

| | 100 | % | | 100 | % | | 100 | % |

(5) Customers:

On a consolidated basis, we are not dependent upon a single customer, or very few customers, such that the loss of any one or more particular customers would have a materially adverse effect on our consolidated statement of income. One customer, Arconic Inc., accounted for approximately 11 percent, 12 percent and 11 percent of net sales for the years ended June 30, 2019, 2018 and 2017, respectively. Approximately 12 percent of the accounts receivable outstanding at June 30, 2019 is due from one customer, Arconic Inc. No single customer accounted for 10 percent or more of the accounts receivable outstanding at June 30, 2018. See Note 19 to our consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data” for additional information.

(6) Backlog:

As of June 30, 2019, we had a sales backlog of orders excluding surcharge, believed to be firm, of approximately $800 million, substantially all of which is expected to be shipped within fiscal year 2020. Our backlog of orders excluding surcharge as of June 30, 2018 was approximately $568 million.

(7) Competition:

We are leaders in specialty materials for critical applications with 130 years of metallurgical and manufacturing expertise. Our business is highly competitive. We manufacture and supply materials to a variety of end-use market sectors and compete with various companies depending on the end-use market, product or geography. A significant portion of the products we produce are highly engineered materials for demanding applications. There are less than ten companies producing one or more similar products that we consider our major competitors for our high-value products used in demanding applications, particularly in our Aerospace and Defense and Energy end-use markets. These products are generally required to meet complex customer product specifications and often require the materials to be qualified prior to supplying the customer. Our experience, technical capabilities, product offerings and research and development efforts represent barriers to existing and potential competitors.

For other products, there are several dozen smaller producing companies and converting companies that are also competitors, as well as several hundred independent distributors of products similar to those distributed by us. Additionally, numerous foreign companies produce various specialty metal products similar to those produced by us. Furthermore, a number of different products may, in certain instances, be substituted for our finished products.

(8) Research, Product and Process Development:

Our expenditures for company-sponsored research and development were $23.3 million, $19.3 million and $16.9 million in fiscal years 2019, 2018 and 2017, respectively. We believe that our ability to be an innovator in special material development and manufacturing processes has been and will continue to be an important factor in the success of the Company. Our worldwide staff of expert metallurgists, research and development scientists, engineers and service professionals work closely with our customers to identify and provide innovative solutions to specific product requirements.

(9) Environmental Regulations:

We are subject to various stringent federal, state, local and international environmental laws and regulations relating to pollution, protection of public health and the environment, natural resource damages and occupational safety and health. Management evaluates the liability for future environmental remediation costs on a quarterly basis. We accrue amounts for environmental remediation costs representing management’s best estimate of the probable and reasonably estimable costs relating to environmental remediation. For further information on environmental remediation, see the Contingencies section included in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the notes to our consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data”.

Our costs of maintaining and operating environmental control equipment were $15.6 million, $13.0 million and $12.4 million for fiscal years 2019, 2018 and 2017, respectively. The capital expenditures for environmental control equipment were $1.7 million, $1.2 million and $0.8 million for fiscal years 2019, 2018 and 2017, respectively. We anticipate spending approximately $4 million on major domestic environmental capital projects over the next five fiscal years. This includes approximately $1 million in fiscal year 2020. Due to the possibility of future regulatory developments, the amount of future capital expenditures may vary from these estimates.

(10) Employees:

As of June 30, 2019, our total workforce consisted of approximately 5,100 employees, which included approximately 150 production employees in Washington, Pennsylvania, who are covered under a collective bargaining agreement which expires on August 31, 2019, and approximately 500 employees in Latrobe, Pennsylvania who are covered under a collective bargaining agreement which expires August 1, 2020. We believe our relations with our employees are generally good.

(d) Financial information about foreign and domestic operations and export sales:

Sales outside of the United States, including export sales, were $773.5 million, $728.3 million and $599.3 million in fiscal years 2019, 2018 and 2017, respectively. Long-lived assets held outside of the United States were $30.6 million and $27.0 million as of June 30, 2019 and 2018, respectively. For further information on domestic and international sales, see Note 19 to our consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data”.

(e) Available Information:

Our Board of Directors has adopted a Code of Ethics for the Chief Executive Officer and Chief Financial Officer of Carpenter Technology Corporation, which is also applicable to our other executive officers. There were no waivers of the Code of Ethics in fiscal year 2019. The Code of Ethics and any information regarding any waivers of the Code of Ethics are disclosed on Carpenter’s website at www.carpentertechnology.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). Our website and the content contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

The SEC maintains an Internet site that contains reports, proxy and other information regarding issuers that file electronically. Such information can be accessed through the Internet at www.sec.gov.

Item 1A. Risk Factors

There are inherent risks and uncertainties associated with all businesses that could adversely affect operating performances or financial conditions. The following discussion outlines the risks and uncertainties that management believes are the most material to our business. However, these are not the only risks or uncertainties that could affect our business. Certain risks are associated specifically with our business, industry or customer base, while others have a broader effect.

The demand for certain products we produce may be cyclical.

Demand in our end-use markets can be cyclical in nature and sensitive to general economic conditions, competitive influences and fluctuations in inventory levels throughout the supply chain. As such, our results of operations, financial condition, cash flows and availability of credit could fluctuate significantly from period to period.

A significant portion of our sales represents products sold to customers in the commercial aerospace and defense and energy markets. The cyclicality of those markets can adversely affect our current business and our expansion objectives.

The commercial aerospace and defense market is historically cyclical due to both external and internal market factors. These factors include general economic conditions, airline profitability, consumer demand for air travel, varying fuel and labor costs, price competition and international and domestic political conditions such as military conflict and the threat of terrorism. The length and degree of cyclical fluctuation can be influenced by any one or combination of these factors and therefore are difficult to predict with certainty. A downturn in the commercial aerospace and defense industry would adversely affect the demand for our products and/or the prices at which we are able to sell our products; our results of operations and financial condition could be materially adversely affected.

The energy market has also been historically cyclical, principally as a result of volatile oil prices that impact demand for our products. Our future success requires us to, among other things, expand in key international energy markets by successfully adding to our customer base, distribution channels and product portfolio. The volatility of oil prices and other factors that contribute to the cyclicality of the energy market will impact our ability to expand successfully in this area and may adversely affect our results of operations and financial condition.

Any significant delay or inability to successfully expand our operations in a timely and cost-effective manner could materially adversely affect our business, financial condition and results of operations.

Over the last few years, we have undertaken capital projects associated with expanding our production capacity and capability. These projects place a significant demand on management and operational resources. Our success in expanding our operations in a cost-effective manner depends upon numerous factors including the ability of management to ensure the necessary resources are in place to properly execute these projects, our ability to obtain the necessary internal and customer qualifications to produce material from the facilities and our ability to operate the facilities to maximize the potential opportunities with minimal impacts to our existing operations. If we are not able to achieve the anticipated results from our capital expansion projects, or if we incur unanticipated excess costs, our results of operations and financial position may be materially adversely affected.

Periods of reduced demand and excess supply as well as the availability of substitute lower cost materials can adversely affect our ability to price and sell our products at the profitability levels we require to be successful.

Additional worldwide capacity and reduced demand for our products could significantly impact future worldwide pricing which would adversely impact our results of operations and financial condition. In addition, continued availability of lower cost, substitute materials may cause significant fluctuations in future results as our customers opt for a lower cost alternative.

We change prices on our products as we deem necessary. In addition to the above general competitive impact, other market conditions and various economic factors beyond our control can adversely affect the timing of our pricing actions. The effects of any pricing actions may be delayed due to long manufacturing lead times or the terms of existing contracts. There is no guarantee that the pricing actions we implement will be effective in maintaining the Company’s profit margin levels.

We rely on third parties to supply certain raw materials and supplies that are critical to the manufacture of our products and we may not be able to access alternative sources of these raw materials if the suppliers are unwilling or unable to meet our demand.

Costs of certain critical raw materials, such as nickel, cobalt, chromium, manganese, molybdenum, titanium, iron and scrap containing these alloys have been volatile due to factors beyond our control. We expect to mitigate most of the adverse impact of rising raw material costs through raw material surcharges, indices to customers and raw material forward contracts, but changes in business conditions could adversely affect our ability to recover rapid increases in raw material costs and may adversely affect our results of operations.

In addition, the availability of critical raw materials and supplies is subject to factors that are not in our control. In some cases, these critical raw materials and supplies are purchased from suppliers operating in countries that may be subject to unstable political and economic conditions. At any given time, we may be unable to obtain an adequate supply of these critical raw materials and supplies on a timely basis, at prices and other terms acceptable to us, or at all.

If suppliers increase the price of critical raw materials or are unwilling or unable to meet our demand, we may not have alternative sources of supply. In addition, to the extent that we have quoted prices to customers and accepted customer orders for products prior to purchasing necessary raw materials, or have existing contracts, we may be unable to raise the price of products to cover all or part of the increased cost of the raw materials to our customers.

The manufacture of some of our products is a complex process and requires long lead times. As a result, we may experience delays or shortages in the supply of raw materials. If unable to obtain adequate and timely receipts of required raw materials, we may be unable to timely manufacture sufficient quantities of products. This could cause us to lose sales, incur additional costs, delay new product introductions or suffer harm to our reputation.

We provide benefits to active and retired employees throughout most of our Company, most of which are not covered by insurance; and thus, our financial condition can be adversely affected if our investment returns are insufficient to meet these obligations.

We have obligations to provide substantial benefits to active and retired employees, and most of the associated costs are paid by the Company and are not covered by insurance. In addition, certain employees are covered by defined benefit pension plans, with the majority of our plans covering employees in the United States. Benefits accrued to eligible participants of our largest qualified defined benefit pension plan and certain non-qualified pension plans were frozen effective December 31, 2016. Many domestic and international competitors do not provide defined benefit plans and/or retiree health care plans, and other international competitors operate in jurisdictions with government sponsored health care plans that may offer them a cost advantage. A decline in the value of plan investments in the future, an increase in costs or liabilities or unfavorable changes in laws or regulations that govern pension plan funding could materially change the timing and amount of required pension funding. A requirement to accelerate or increase pension contributions in the future could have a material adverse effect on our results of operations, cash flows and financial condition.

The extensive environmental, health and safety regulatory regimes applicable to our manufacturing operations create potential exposure to significant liabilities.

The nature of our manufacturing business subjects our operations to numerous and varied federal, state, local and international laws and regulations relating to pollution, protection of public health and the environment, natural resource damages and occupational safety and health. We have used, and currently use and manufacture, substantial quantities of substances that are considered hazardous, extremely hazardous or toxic under worker safety and health laws and regulations. Although we implement controls and procedures designed to reduce continuing risk of adverse impacts and health and safety issues, we could incur substantial cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims as a result of violations, non-compliance or liabilities under these regulatory regimes required at our facilities.

We have environmental remediation liabilities at some of our owned operating facilities and have been designated as a potentially responsible party (“PRP”) with respect to certain third party Superfund or similar waste disposal sites and other third party owned sites. Additionally, we have been notified that we may be a PRP with respect to other Superfund sites as to which no proceedings have been instituted against us. From time to time, we are a party to lawsuits and other proceedings involving alleged violations of, or liabilities arising from, environmental laws.

When our liability is probable and we can reasonably estimate our costs, we record environmental liabilities in our financial statements. However, in many cases, we are not able to determine whether we are liable, or if liability is probable, in order to reasonably estimate the loss or range of loss which could result from such environmental liabilities. Estimates of our liability remain subject to additional uncertainties, including the nature and extent of site contamination, available remediation alternatives, the extent of corrective actions that may be required, and the number and financial condition of other PRPs, as well as the extent of their responsibility for the remediation. We adjust our accruals to reflect new information as appropriate. Future adjustments could have a material adverse effect on our results of operations in a given period, but we cannot reliably predict the amounts of such future adjustments. Future developments, administrative actions or liabilities relating to environmental matters could have a material adverse effect on our financial condition, cash flows or results of operations.

Our manufacturing processes, and the manufacturing processes of many of our suppliers and customers, are energy intensive and generate carbon dioxide and other “Greenhouse Gases”, and pending legislation or regulation of Greenhouse Gases, if enacted or adopted in an onerous form, could have a material adverse impact on our results of operations, financial condition and cash flows.

Political and scientific debates related to the impacts of greenhouse gas emissions on the global climate are prevalent. Regulation or some form of legislation aimed at reducing the greenhouse gas emissions is currently being considered both in the United States and globally. As a specialty alloy manufacturer, we will be affected, both directly and indirectly, if climate change legislation, such as use of a “cap and trade” system, is enacted and implemented. Such legislation could have a material adverse impact on our results of operations, financial condition and cash flows.

Product liability and product quality claims could adversely affect our operating results.

We produce ultra-high strength, high temperature and corrosion-resistant alloys designed for our customers’ demanding applications particularly in our Aerospace and Defense, Energy and Medical end-use markets. Failure of the materials that are included in our customers’ applications could give rise to substantial product liability claims. There can be no assurance that our insurance coverage will be adequate or continue to be available on terms acceptable to us. We have a complex manufacturing process necessary to meet our customers’ stringent product specifications. We are also required to adhere to various third party quality certifications and perform sufficient internal quality reviews to ensure compliance with established standards. If we fail to meet the customer specifications for their products, we may be subject to product quality costs and claims. These costs are generally not insured. The impacts of product liability and quality claims could have a material adverse impact on the results of our operations, financial condition and cash flows.

Our business subjects us to risks of litigation claims, as a routine matter, and this risk increases the potential for a loss that might not be covered by insurance.

Litigation claims relate to the conduct of our currently and formerly owned businesses, including claims pertaining to product liability, commercial disputes, employment actions, employee benefits, compliance with domestic and international laws and regulations, personal injury, patent infringement and tax issues. Due to the uncertainties of litigation, we can give no assurance that we will prevail on claims made against us in the lawsuits that we currently face or that additional claims will not be made against us in the future. The outcome of litigation cannot be predicted with certainty, and some of these lawsuits, claims or proceedings may be determined adversely to us. The resolution in any reporting period of one or more of these matters could have a material adverse effect on our results of operations for that period. We can give no assurance that any other matters brought in the future will not have a material effect on our results of operations, financial condition and cash flows.

A portion of our workforce is covered by collective bargaining agreements and union attempts to organize our other employees may cause work interruptions or stoppages.

Approximately 150 production employees at our Dynamet business unit located in Washington, Pennsylvania are covered by a collective bargaining agreement. This agreement expires in August 2019. Approximately 500 production employees at our Latrobe business unit located in Latrobe, Pennsylvania are covered by a collective bargaining agreement. This agreement expires in August 2020. There can be no assurance that we will succeed in concluding collective bargaining agreements with the unions to replace those that expire which could result in work interruptions and stoppages. From time to time, the employees at our manufacturing facility in Reading, Pennsylvania, participate in election campaigns or union organizing attempts. There is no guarantee that future organization attempts will not result in union representation.

Our manufacturing processes are complex and depend upon critical, high cost equipment for which there may be only limited or no production alternatives.

It is possible that we could experience prolonged periods of reduced production due to unplanned equipment failures, and we could incur significant repair or replacement costs in the event of those failures. It is also possible that operations could be disrupted due to other unforeseen circumstances such as power outages, explosions, fires, floods, accidents and severe weather conditions. We must make regular, substantial capital investments and changes to our manufacturing processes to lower production costs, improve productivity, manufacture new or improved products and remain competitive. We may not be in a position to take advantage of business opportunities or respond to competitive pressures if we fail to update, replace or make additions to our equipment or our manufacturing processes in a timely manner. The cost to repair or replace much of our equipment or facilities would be significant. We cannot be certain that we will have sufficient internally generated cash or acceptable external financing to make necessary capital expenditures in the future.

A significant portion of our manufacturing and production facilities are located in Reading and Latrobe, Pennsylvania and Athens, Alabama, which increases our exposure to significant disruption to our business as a result of unforeseeable developments in these geographic areas.

It is possible that we could experience prolonged periods of reduced production due to unforeseen catastrophic events occurring in or around our manufacturing facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama. As a result, we may be unable to shift manufacturing capabilities to alternate locations, accept materials from suppliers, meet customer shipment needs or address other severe consequences that may be encountered. Our financial condition, cash flows and results of operations could be materially adversely affected.

We rely on third parties to supply energy consumed at each of our energy-intensive production facilities.

The prices for and availability of electricity, natural gas, oil and other energy resources are subject to volatile market conditions. These market conditions often are affected by political and economic factors beyond our control. Disruptions or lack of availability in the supply of energy resources could temporarily impair the ability to operate our production facilities. Further, increases in energy costs, or changes in costs relative to energy costs paid by competitors, have affected and may continue to adversely affect our profitability. To the extent that these uncertainties cause suppliers and customers to be more cost sensitive, increased energy prices may have an adverse effect on our results of operations, financial condition and cash flows.

We consider acquisitions, joint ventures and other business combination opportunities, as well as possible business unit dispositions, as part of our overall business strategy, that involve uncertainties and potential risks that we cannot predict or anticipate fully.

From time to time, management holds discussions with management of other companies to explore such aforementioned opportunities. As a result, the relative makeup of the businesses comprising our Company is subject to change. Acquisitions, joint ventures and other business combinations involve various inherent risks. Such risks include difficulties in integrating the operations, technologies, products and personnel of the acquired companies, diversion of management’s attention from existing operations, difficulties in entering markets in which we have limited or no direct prior experience, dependence on unfamiliar supply chains, insufficient revenues to offset increased expenses associated with acquisitions, loss of key employees of the acquired companies, inaccurate assessment of undisclosed liabilities, difficulties in realizing projected efficiencies, synergies and cost savings, and increases in our debt or limitation on our ability to access additional capital when needed.

Regulations related to conflict minerals could adversely impact our business.

The SEC has promulgated final rules mandated by the Dodd-Frank Act regarding disclosure of the use of tin, tantalum, tungsten and gold, known as conflict minerals, in products manufactured by public companies. These rules require due diligence to determine whether such minerals originated from the Democratic Republic of Congo (the “DRC”) or an adjoining country and whether such minerals helped finance the armed conflict in the DRC. The Company timely filed its latest annual conflict minerals report required by the rules on May 2, 2019. There are costs associated with complying with these disclosure requirements going forward, including costs to determine the origin of conflict minerals used in our products. In addition, the implementation of these rules could adversely affect the sourcing, supply and pricing of materials used in our products. Also, we may face disqualification as a supplier for customers and reputational challenges if the due diligence procedures we continue to implement do not enable us to verify the origins for all conflict minerals or to determine that such minerals are DRC conflict-free.

Our business may be impacted by external factors that we may not be able to control.

War, civil conflict, terrorism, natural disasters and public health issues including domestic or international pandemic have caused and could cause damage or disruption to domestic or international commerce by creating economic or political uncertainties. Additionally, the volatility in the financial markets could negatively impact our business. These events could result in a decrease in demand for our products, affect the availability of credit facilities to us, our customers or other members of the supply chain necessary to transact business, make it difficult or impossible to deliver orders to customers or receive materials from suppliers, affect the availability or pricing of energy sources or result in other severe consequences that may or may not be predictable. As a result, our business, financial condition and results of operations could be materially adversely affected.

Our international operations and global sales expose us to various risks including the impact of tariffs, which may adversely affect our business.

Risks associated with international operations include without limitation: political and economic instability, including weak conditions in the world’s economies; difficulty in collecting accounts receivable; unstable or unenforced export controls; changes in legal and regulatory requirements; policy changes affecting the markets for our products; changes in duties, quotas, tariffs and taxes; changes in taxation including the ability to repatriate earnings; and exchange rate fluctuations (which may affect sales to international customers and the value of profits earned on international sales when converted into U.S. dollars). In addition, we will need to invest in building our capabilities and infrastructure to meet our international growth goals. Any of these factors could materially adversely affect our results for the period in which they occur.

Significant changes to United States and international trade policies continue to emerge and activity levels have increased with regard to new import and export tariffs, retaliatory tariffs, and quotas; modifications to international trade policy; the withdrawal from or renegotiation of certain trade agreements; and other changes. These changes could materially adversely impact our business or require us to make changes to our current business practices or supply chain. We also continue to evaluate the potential effect of Brexit, the United Kingdom’s planned departure from the European Union, on our business operations and financial results.

We value most of our inventory using the LIFO method, which could be repealed resulting in adverse effects on our cash flows and financial condition.

The cost of our inventories is primarily determined using the Last-In, First-Out (“LIFO”) method. Under the LIFO inventory valuation method, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period even though these materials and other costs may have been incurred at significantly different values due to the length of time of our production cycle. Generally, in a period of rising prices, LIFO recognizes higher costs of goods sold, which both reduces current income and assigns a lower value to the year-end inventory. From time to time, there have been proposals aimed at repealing the election to use the LIFO method for income tax purposes. According to these proposals, generally taxpayers that currently use the LIFO method would be required to revalue their LIFO inventory to its First-In, First-Out (“FIFO”) value. As of June 30, 2019, if the FIFO method of inventory had been used instead of the LIFO method, our inventories would have been approximately $178 million higher. This increase in inventory would result in a one-time increase in taxable income which may be taken into account over the following several taxable years. The repeal of the LIFO method could result in a substantial tax liability which could adversely impact our cash flows and financial condition.

We depend on the retention of key personnel.

Much of our future success depends on the continued service and availability of skilled personnel, including members of our executive management team, management, metallurgists and production positions. The loss of key personnel could adversely affect our ability to perform until suitable replacements are found.

Cybersecurity attacks and other security breaches or failures in functionality of our information technology (“IT”) and computer systems could adversely impact our financial condition and results of operations and compromise the integrity of confidential data.

Management relies extensively on IT infrastructure, including hardware, network, software, people and processes, to provide useful information to conduct our business and support assessments and conclusions about operating performance. Our inability to produce relevant and/or reliable measures of operating performance in an efficient, cost-effective and well-controlled fashion may have significant negative impacts on our future operations. In addition, any material failure, interruption of service, or compromised data security could adversely affect our operations. Security breaches in our information technology could result in theft, destruction, loss, misappropriation or release of confidential data or intellectual property which could adversely impact our future results.

We are regularly the target of attempted cyber and other security threats and must continuously monitor and develop our IT networks and infrastructure to prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have a security impact. Cybersecurity attacks are evolving in both frequency and sophistication and could be made by both internal and external individuals or groups with an extensive range of motives. If we are unable to prevent cybersecurity attacks and other information security breaches, we may encounter significant disruptions in our operations which could adversely impact our business, financial condition and results of operations or result in the unauthorized disclosure of confidential information. Such breaches may also harm our reputation, result in financial losses or subject us to litigation or other costs or penalties.

We are in the process of implementing a new enterprise resource planning system and problems with the design or implementation of this system could interfere with our business and operations.

We are engaged in a multi-year implementation of a global enterprise resource planning ("ERP") system which is planned to be deployed in phases. The new ERP system will replace multiple current business systems and is being designed to improve manufacturing planning, development and processes, accurately maintain books and records, record transactions and provide important information of the operations of our business to our management. The implementation of the new ERP system has required, and will continue to require, the investment of significant financial resources as well as a considerable allocation of personnel for the project. While we have invested, and continue to invest, significant resources in planning and project management, implementation issues may arise during the course of implementing the ERP system, and it is possible that we may experience significant delays, increased costs and other difficulties that are not presently contemplated. Any disruptions, delays or deficiencies in the design and implementation of the new ERP system could adversely affect our financial condition and results of operations.

The carrying value of goodwill and other long-lived assets may not be recoverable.

Goodwill and other long-lived assets including property, plant and equipment and other intangible assets are recorded at fair value on the date of acquisition. We review these assets at least annually for impairment. Impairment may result from, among other things, deterioration in performance, adverse market conditions, adverse changes in applicable laws or regulations and a variety of other factors. Any future impairment of goodwill or other long-lived assets could have a material adverse effect on our results of operations.

Our ability to produce timely and accurate financial statements may be impacted if we fail to maintain an effective system of disclosure controls and internal controls over financial reporting.

We are subject to the reporting requirements of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Sarbanes-Oxley requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. We are also required to make a formal assessment and provide an annual management report on the effectiveness of our internal control over financial reporting, which must be attested to by our independent registered public accounting firm. In order to maintain the effectiveness of our disclosure controls and procedures and internal control over financial reporting, we have expended, and anticipate that we will continue to expend, resources, including accounting-related costs and management oversight.

As disclosed in Item 8. of this Annual Report on Form 10-K under the caption “Management’s Report on Internal Control Over Financial Reporting”, we identified a material weakness related to the accuracy and completeness of the data inputs for price, quantity and related customer data during the billing process. There were no misstatements identified in our annual or interim consolidated financial statements. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. We are in the process of implementing changes to our internal control over financial reporting to remediate the material weakness. We cannot assure, however, that remediation efforts will be effective, and the enhanced controls and procedures could require increased management time, attention, and resources.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The principal locations of our primary domestic integrated mills in our SAO segment are located in Reading and Latrobe, Pennsylvania and Athens, Alabama. In addition, SAO manufactures large diameter hollow bar in Orwigsburg, Pennsylvania and Elyria, Ohio and operates a mini mill manufacturing stainless steel bar and wire in Hartsville, South Carolina. The principal locations for PEP businesses include titanium alloy production facilities located in Washington, Pennsylvania and Clearwater, Florida, powder products manufacturing facilities in Bridgeville, Pennsylvania, Athens, Alabama, Woonsocket, Rhode Island and Bruceton Mills, West Virginia, additive manufacturing facilities in Camarillo, California and Liverpool, United Kingdom and a facility in Houston, Texas for manufacturing of machined components used in the drilling, exploration and production of oil and gas. The PEP segment includes one owned service center in White House, Tennessee. Properties also include domestic leased warehouses and service centers located in Houston, Texas; San Antonio, Texas; Midland, Texas; Oklahoma City, Oklahoma; Casper, Wyoming; Lafayette, Louisiana; Washington, West Alexander and Imperial, Pennsylvania; Vienna, Ohio and Chicago, Illinois.

The Reading, Hartsville, Washington, Bridgeville, Orwigsburg, Elyria, Woonsocket, Latrobe, Houston and Athens facilities are owned. The Clearwater facility is owned, but the land is leased.

We also own or lease manufacturing facilities, distribution centers, service centers and sales offices in a number of foreign countries, including Belgium, Canada, China, Mexico, Singapore, Sweden, Taiwan, the United Arab Emirates and the United Kingdom.

Our corporate offices, located in Philadelphia, Pennsylvania, are leased.

Our plants, customer service centers and distribution centers were acquired or leased at various times over several years. There is an active maintenance program to ensure a safe operating environment and to keep facilities in good condition. In addition, we have an active capital spending program to replace equipment as needed to keep it technologically competitive on a worldwide basis. We believe our facilities are in good condition and suitable for our business needs.

Item 3. Legal Proceedings

From time to time, we are a party to lawsuits and other proceedings involving alleged violations of, or liabilities arising from, environmental laws. We have environmental remediation liabilities at some of our owned operating facilities and have been designated as a PRP with respect to certain third party Superfund or similar waste disposal sites and other third party owned sites. Additionally, we have been notified that we may be a PRP with respect to other Superfund sites as to which no proceedings have been instituted against us. Estimates of the amount and timing of future costs of environmental remediation requirements are inherently imprecise because of the continuing evolution of environmental laws and regulatory requirements, the availability and application of technology, the identification of currently unknown remediation sites and the allocation of costs among the PRPs. Based upon information currently available, such future costs are not expected to have a material effect on our financial position, results of operations or cash flows over the long-term. However, such costs could be material to our financial position, results of operations or cash flows in a particular future quarter or year.

In addition, from time to time, we are a party to certain routine claims and legal actions and other contingent liabilities incident to the normal course of business which pertain to litigation, product claims, commercial disputes, employment actions, employee benefits, compliance with domestic and foreign laws and regulations, personal injury claims, patent infringement and tax issues. Based on information currently available, the ultimate resolution of our known contingencies, individually or in the aggregate and including the matters described in Note 12 to the consolidated financial statements in this Form 10-K, is not expected to have a material adverse effect on our financial position, cash flows or results of operations. However, there can be no assurance that an increase in the scope of pending matters or that any future lawsuits, claims, proceedings or investigations will not be material to our financial position, results of operations or cash flows in a particular future quarter or year.

See the “Contingencies” section included in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation”, and the “Contingencies and Commitments” section included in Note 12 to our consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data”, included in this Form 10-K, the contents of which are incorporated by reference to this Item 3.

Item 4. Mine Safety Disclosures

Not applicable.

Item 4A. Executive Officers of the Registrant

Listed below are the names of our corporate executive officers, including those required to be listed as executive officers for SEC purposes, each of whom assumes office after the annual organization meeting of the Board of Directors which immediately follows the Annual Meeting of Stockholders.

Tony R. Thene was appointed President and Chief Executive Officer effective July 1, 2015. Mr. Thene joined Carpenter in January 2013 and served as the Senior Vice President and Chief Financial Officer. Prior to joining Carpenter, Mr. Thene was employed for 23 years by Alcoa Inc., a leading producer of primary and fabricated aluminum, holding various management positions.

Timothy Lain was appointed Vice President and Chief Financial Officer effective September 14, 2018. Mr. Lain joined Carpenter in June 2007 and since June 2013 served as the Vice President-Controller and Chief Accounting Officer. Prior to joining the Company, Mr. Lain served as Audit Director at McGladrey & Pullen LLP, a certified public accounting firm.

James D. Dee was appointed Vice President, General Counsel and Secretary effective September 13, 2010. Mr. Dee joined Carpenter from C&D Technologies where he last served as Senior Vice President, General Counsel, Secretary and Chief Administrative Officer. Prior to his tenure at C&D Technologies, Mr. Dee was employed by the law firm of Montgomery, McCracken, Walker & Rhodes, LLP. Mr. Dee also worked 16 years at SPS Technologies, Inc., where he last served as Vice President, General Counsel and Secretary.

Brian J. Malloy was appointed Vice President and Chief Commercial Officer effective March 11, 2016. Mr. Malloy joined Carpenter in August 2015 as Vice President, Sales & Customer Service for SAO. Prior to joining Carpenter, Mr. Malloy worked for Global Precision Tubes where he was the Senior Vice President & Chief Strategy Officer. During Mr. Malloy's two years in this role, he was responsible for business development, strategy and the commercial organizations. Mr. Malloy's previous experience includes key roles at Alcoa, Inc., where his last position was Vice President, Commercial for Industrial Gas Turbines in the Power and Propulsion business unit.

Michael Murtagh was appointed Vice President and Group President, Specialty Alloys Operations effective July 1, 2018. Mr. Murtagh joined Carpenter in October 2016 and served as Vice President and Chief Technology Officer. Prior to Carpenter, Mr. Murtagh was employed by Unifrax where he was responsible for corporate research and development, and innovation, process and capital engineering, new business development and intellectual property. Prior to Unifrax, Mr. Murtagh was with James Hardie, a global building materials company, as Vice President – Research, Development & Central Operations. Mr. Murtagh began his career with Corning in 1999, where he spent more than ten years as a research scientist and plant operations manager for one of the world’s leaders in glass, ceramics, and advanced materials.

|

| | | | | | |

| | | | | | Assumed Present Position |

Name | | Age | | Position | |

Tony R. Thene | | 58 | | President and Chief Executive Officer | | July 2015 |

| | | | | | |

Timothy Lain | | 47 | | Vice President and Chief Financial Officer | | September 2018 |

| | | | | | |

James D. Dee | | 62 | | Vice President, General Counsel and Secretary | | September 2010 |

| | | | | | |

Brian J. Malloy | | 52 | | Vice President and Chief Commercial Officer | | March 2016 |

| | | | | | |

Michael Murtagh | | 47 | | Vice President and Group President, Specialty Alloys Operations | | July 2018 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange (“NYSE”) and traded under the symbol “CRS”. The following table sets forth, for the periods indicated, the high and low prices for our common stock as reported by the NYSE:

|

| | | | | | | | | | | | | | | | |

| | Fiscal Year 2019 | | Fiscal Year 2018 |

Period Ended: | | High | | Low | | High | | Low |

September 30, | | $ | 60.78 |

| | $ | 51.52 |

| | $ | 48.19 |

| | $ | 36.20 |

|

| | | | | | | | |

December 31, | | $ | 60.11 |

| | $ | 32.77 |

| | $ | 53.61 |

| | $ | 44.08 |

|

| | | | | | | | |

March 31, | | $ | 48.88 |

| | $ | 34.40 |

| | $ | 54.61 |

| | $ | 42.44 |

|

| | | | | | | | |

June 30, | | $ | 53.00 |

| | $ | 40.04 |

| | $ | 61.49 |

| | $ | 41.75 |

|

| | | | | | | | |

Annual June 30, | | $ | 60.78 |

| | $ | 32.77 |

| | $ | 61.49 |

| | $ | 36.20 |

|

The range of our common stock price on the NYSE from July 1, 2019 to August 15, 2019 was $44.13 to $49.27. The closing price of the common stock was $44.13 on August 15, 2019.

We have paid quarterly cash dividends on our common stock since 1906. We paid a quarterly dividend of $0.20 and $0.18 per share of common stock during each quarter of fiscal years 2019 and 2018, respectively.

As of August 15, 2019, there were 1,971 common stockholders of record.

Information regarding Securities Authorized for Issuance under Equity Compensation Plans is set forth in Item 12 hereto “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”.

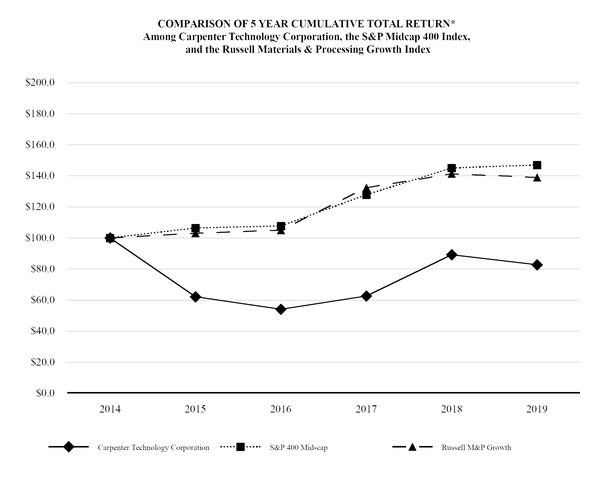

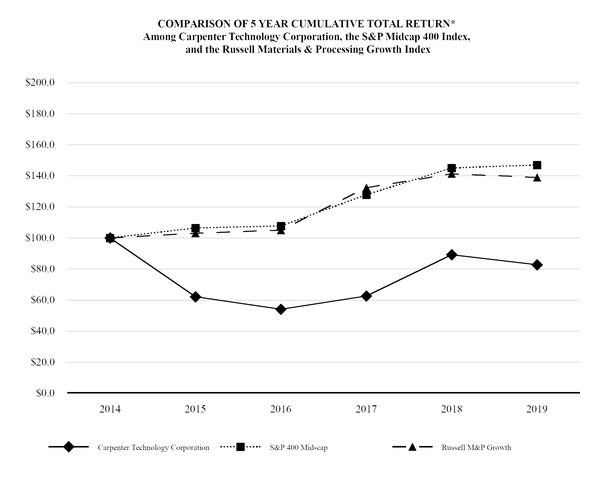

Cumulative Total Stockholder Return

The graph below compares the cumulative total stockholder return on our common stock to the cumulative total return of the S&P MidCap 400 Index, the most widely used index for mid-sized companies, and our Peer Group for fiscal year ended June 30, 2019, and prior four fiscal years. The cumulative total return assumes an investment of $100 on June 30, 2014 and the reinvestment of any dividends during the period. Our Peer Group consists of the companies in the Russell RSCC Materials & Processing Growth Index. We believe the companies included in our Peer Group, taken as a whole, provide a more meaningful comparison in terms of product offerings, markets served, competition and other relevant factors. The total stockholder return for the peer group is weighted according to the respective issuer’s stock market capitalization at the beginning of each period.

|

|

* $100 invested on June 30, 2014 in stock or index, including reinvestment of dividends. Fiscal years ending June 30. |

Data Sourced from Bloomberg |

Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global |

Copyright © 2019 Russell Investments |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 |

Carpenter Technology Corporation | | $ | 100.00 |

| | $ | 62.10 |

| | $ | 54.10 |

| | $ | 62.60 |

| | $ | 89.20 |

| | $ | 82.70 |

|

S&P Midcap 400 | | $ | 100.00 |

| | $ | 106.40 |

| | $ | 107.80 |

| | $ | 127.80 |

| | $ | 145.00 |

| | $ | 147.00 |

|

Russell Materials & Processing Growth | | $ | 100.00 |

| | $ | 103.10 |

| | $ | 105.00 |

| | $ | 132.40 |

| | $ | 141.30 |

| | $ | 139.00 |

|

Issuer Purchases of Equity Securities

Employees surrendered 31,860 shares to the Company, at an average purchase price of $47.90, during the fourth quarter of fiscal year 2019, for the payment of the minimum tax liability withholding obligations upon the vesting of shares of restricted stock and the exercise of options. We do not consider this a share buyback program.

Item 6. Selected Financial Data

Five-Year Financial Summary

in millions, except per share data

(Fiscal years ended June 30,)

|

| | | | | | | | | | | | | | | | | | | | |

| | 2019 (a) | | 2018(b) | | 2017(c) | | 2016(d)(f) | | 2015 (e)(f) |

Summary of Operations: | | |

| | |

| | |

| | |

| | |

|

Net sales | | $ | 2,380.2 |

| | $ | 2,157.7 |

| | $ | 1,797.6 |

| | $ | 1,813.4 |

| | $ | 2,226.7 |

|

Operating income | | $ | 241.4 |

| | $ | 189.3 |

| | $ | 121.5 |

| | $ | 70.8 |

| | $ | 119.3 |

|

Net income | | $ | 167.0 |

| | $ | 188.5 |

| | $ | 47.0 |

| | $ | 11.3 |

| | $ | 58.7 |

|

Financial Position at Year-End: | | |

| | |

| | |

| | |

| | |

|

Cash and cash equivalents | | $ | 27.0 |

| | $ | 56.2 |

| | $ | 66.3 |

| | $ | 82.0 |

| | $ | 70.0 |

|

Total assets | | $ | 3,187.8 |

| | $ | 3,007.0 |

| | $ | 2,878.1 |

| | $ | 2,794.3 |

| | $ | 2,902.6 |

|

Long-term debt, net of current portion | | $ | 550.6 |

| | $ | 545.7 |

| | $ | 550.0 |

| | $ | 611.3 |

| | $ | 603.8 |

|

Per Common Share: | | |

| | |

| | |

| | |

| | |

|

Net earnings: | | |

| | |

| | |

| | |

| | |

|

Basic | | $ | 3.46 |

| | $ | 3.96 |

| | $ | 0.99 |

| | $ | 0.23 |

| | $ | 1.11 |

|

Diluted | | $ | 3.43 |

| | $ | 3.92 |

| | $ | 0.99 |

| | $ | 0.23 |

| | $ | 1.11 |

|

Cash dividend-common | | $ | 0.80 |

| | $ | 0.72 |

| | $ | 0.72 |

| | $ | 0.72 |

| | $ | 0.72 |

|

Weighted Average Common Shares Outstanding: | | |

| | |

| | |

| | |

| | |

|

Basic | | 47.7 |

| | 47.2 |

| | 47.0 |

| | 48.1 |

| | 52.6 |

|

Diluted | | 48.1 |

| | 47.6 |

| | 47.1 |

| | 48.2 |

| | 52.7 |

|

(a) Fiscal year 2019 included $1.2 million of acquisition-related costs related to LPW Technology Ltd. See Note 4 in the Notes to the Consolidated Financial Statements included in Item 8. “Financial Statements and Supplementary Data” of this report.

(b) Fiscal year 2018 included $68.3 million of discrete income tax net benefits related to the U.S. tax reform and other legislative changes. See Note 17 in the Notes to the Consolidated Financial Statements included in Item 8. “Financial Statements and Supplementary Data” of this report.

(c) Fiscal year 2017 included $3.2 million of loss on divestiture of business. See Note 4 in the Notes to the Consolidated Financial Statements included in Item 8. "Financial Statements and Supplementary Data" of this report.

(d) Fiscal year 2016 included $22.5 million of excess inventory write-down charges, $12.5 million of goodwill impairment charges and $18.0 million of restructuring and impairment charges including $7.6 million of impairment of intangible assets and property, plant and equipment and $10.4 million of restructuring costs related primarily to an early retirement incentive and other severance related costs.

(e) Fiscal year 2015 included $29.1 million of restructuring costs related principally to workforce reduction, facility closures and write-down of certain assets.

(f) The weighted average common shares outstanding for fiscal years 2016 and 2015 included 5.5 million and 0.9 million less shares, respectively, related to the share repurchase program authorized in October 2014. During the fiscal years ended June 30, 2016 and 2015, we repurchased 3,762,200 shares and 2,995,272 shares, respectively, of common stock for $123.9 million and $124.5 million, respectively.

See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for discussion of factors that affect the comparability of the “Selected Financial Data”.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Background and General

Our discussions below in this Item 7 should be read in conjunction with our consolidated financial statements, including the notes thereto, included in this annual report on Form 10-K.

We are a producer and distributor of premium specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels as well as drilling tools. We are a recognized leader in high-performance specialty alloy-based materials and process solutions for critical applications in the aerospace, defense, transportation, energy, medical, industrial and consumer markets. We have evolved to become a pioneer in premium specialty alloys, including titanium, nickel, and cobalt, as well as alloys specifically engineered for additive manufacturing ("AM") processes and soft magnetics applications. We have expanded our AM capabilities to provide a complete “end-to-end” solution to accelerate materials innovation and streamline parts production. We primarily process basic raw materials such as nickel, cobalt, titanium, manganese, chromium, molybdenum, iron scrap and other metal alloying elements through various melting, hot forming and cold working facilities to produce finished products in the form of billet, bar, rod, wire and narrow strip in many sizes and finishes. We also produce certain metal powders and parts. Our sales are distributed directly from our production plants and distribution network as well as through independent distributors. Unlike many other specialty steel producers, we operate our own worldwide network of service and distribution centers. These service centers, located in the United States, Canada, Mexico, Europe and Asia allow us to work more closely with customers and to offer various just-in-time stocking programs.

As part of our overall business strategy, we have sought out and considered opportunities related to strategic acquisitions and joint collaborations as well as possible business unit dispositions aimed at broadening our offering to the marketplace. We have participated with other companies to explore potential terms and structures of such opportunities and expect that we will continue to evaluate these opportunities.

While we prepare our financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), we also utilize and present certain financial measures that are not based on or included in U.S. GAAP (we refer to these as “Non-GAAP financial measures”). Please see the section “Non-GAAP Financial Measures” below for further discussion of these financial measures, including the reasons why we use such financial measures and reconciliations of such financial measures to the nearest U.S. GAAP financial measures.

Business Trends

Selected financial results for the past three fiscal years are summarized below:

|

| | | | | | | | | | | | |

| | Years Ended June 30, |

($ in millions, except per share data) | | 2019 | | 2018 | | 2017 |

Net sales | | $ | 2,380.2 |

| | $ | 2,157.7 |

| | $ | 1,797.6 |

|

| | | | | | |

Net sales excluding surcharge revenue (1) | | $ | 1,942.1 |

| | $ | 1,792.3 |

| | $ | 1,558.4 |

|

| | | | | | |

Operating income | | $ | 241.4 |

| | $ | 189.3 |

| | $ | 121.5 |

|

| | | | | | |

Net income | | $ | 167.0 |

| | $ | 188.5 |

| | $ | 47.0 |

|

| | | | | | |

Diluted earnings per share | | $ | 3.43 |

| | $ | 3.92 |

| | $ | 0.99 |

|

| | | | | | |

Purchases of property, plant, equipment and software | | $ | 180.3 |

| | $ | 135.0 |

| | $ | 98.5 |

|

| | | | | | |

Free cash flow (1) | | $ | (53.7 | ) | | $ | 34.7 |

| | $ | (16.8 | ) |

| | | | | | |

Pounds sold (in thousands) (2) | | 267,536 |

| | 265,620 |

| | 236,346 |

|

(1) See the section “Non-GAAP Financial Measures” below for further discussion of these financial measures.

(2) Includes pounds from Specialty Alloys Operations segment, and certain Performance Engineered Products segment businesses including Dynamet, Carpenter Powder Products and LPW Technology Ltd.

Our sales are across diverse end-use markets. The table below summarizes our sales by end-use market over the past three fiscal years:

|

| | | | | | | | | | | | | | | | | | | | | |

| | Years Ended June 30, |

| | 2019 | | 2018 | | 2017 |

($ in millions) | | Dollars | | % of

Total | | Dollars | | % of

Total | | Dollars | | % of

Total |

Aerospace and Defense | | $ | 1,327.9 |

| | 56 | % | | $ | 1,182.3 |

| | 55 | % | | $ | 973.3 |

| | 54 | % |

Medical | | 205.0 |

| | 8 |

| | 175.3 |

| | 8 |

| | 125.5 |

| | 7 |

|

Energy | | 181.7 |

| | 8 |

| | 146.5 |

| | 7 |

| | 138.0 |

| | 8 |

|

Transportation | | 157.7 |

| | 6 |

| | 157.0 |

| | 7 |

| | 143.9 |

| | 8 |

|

Industrial and Consumer | | 371.5 |

| | 16 |

| | 364.9 |

| | 17 |

| | 298.2 |

| | 17 |

|

Distribution | | 136.4 |

| | 6 |

| | 131.7 |

| | 6 |

| | 118.7 |

| | 6 |

|

Total net sales | | $ | 2,380.2 |

| | 100 | % | | $ | 2,157.7 |

| | 100 | % | | $ | 1,797.6 |

| | 100 | % |

Impact of Raw Material Prices and Product Mix

We value most of our inventory utilizing the LIFO inventory costing methodology. Under the LIFO inventory costing method, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period even though these materials may have been acquired at potentially significantly different values due to the length of time from the acquisition of the raw materials to the sale of the processed finished goods to the customers. In a period of rising raw material costs, the LIFO inventory valuation normally results in higher cost of sales. Conversely, in a period of decreasing raw material costs, the LIFO inventory valuation normally results in lower cost of sales.

The volatility of the costs of raw materials has impacted our operations over the past several years. We, and others in our industry, generally have been able to pass cost increases on major raw materials through to our customers using surcharges that are structured to recover increases in raw material costs. Generally, the formula used to calculate a surcharge is based on published prices of the respective raw materials for the previous month which correlates to the prices we pay for our raw material purchases. However, a portion of our surcharges to customers may be calculated using a different surcharge formula or may be based on the raw material prices at the time of order, which creates a lag between surcharge revenue and corresponding raw material costs recognized in cost of sales. The surcharge mechanism protects our net income on such sales except for the lag effect discussed above. However, surcharges have had a dilutive effect on our gross margin and operating margin percentages as described later in this report.

Approximately 25 percent of our net sales are sales to customers under firm price sales arrangements. Firm price sales arrangements involve a risk of profit margin fluctuations, particularly when raw material prices are volatile. In order to reduce the risk of fluctuating profit margins on these sales, we enter into commodity forward contracts to purchase certain critical raw materials necessary to produce the related products sold. Firm price sales arrangements generally include certain annual purchasing commitments and consumption schedules agreed to by the customers at selling prices based on raw material prices at the time the arrangements are established. If a customer fails to meet the volume commitments (or the consumption schedule deviates from the agreed-upon terms of the firm price sales arrangements), the Company may need to absorb the gains or losses associated with the commodity forward contracts on a temporary basis. Gains or losses associated with commodity forward contracts are reclassified to earnings/loss when earnings are impacted by the hedged transaction. Because we value most of our inventory under the LIFO costing methodology, changes in the cost of raw materials and production activities are recognized in cost of sales in the current period attempting to match the most recently incurred costs with revenues. Gains and/or losses on the commodity forward contracts are reclassified from other comprehensive income together with the actual purchase price of the underlying commodities when the underlying commodities are purchased and recorded in inventory. To the extent that the total purchase price of the commodities, inclusive of the gains or losses on the commodity forward contracts, are higher or lower relative to the beginning of year costs, our cost of goods sold reflects such amounts. Accordingly, the gains and/or losses associated with commodity forward contracts may not impact the same period that the firm price sales arrangements revenue is recognized, and comparisons of gross profit from period to period may be impacted. These firm price sales arrangements are expected to continue as we look to strengthen our long-term customer relationships by expanding, renewing and, in certain cases, extending to a longer term, our customer long-term arrangements.

We produce hundreds of grades of materials, with a wide range of pricing and profit levels depending on the grade. In addition, our product mix within a period is subject to the fluctuating order patterns of our customers as well as decisions we may make on participation in certain products based on available capacity including the impacts of capacity commitments we may have under existing customer agreements. While we expect to see positive contribution from a more favorable product mix in our margin performance over time, the impact by period may fluctuate, and period to period comparisons may vary.

Net Pension Expense

Net pension expense, as we define it below, includes the net periodic benefit costs related to both our pension and other postretirement plans. The net periodic benefit costs are determined annually based on beginning of year balances and are recorded ratably throughout the fiscal year, unless a significant re-measurement event occurs. The following is a summary of the net periodic benefit costs for the years ended June 30, 2019, 2018 and 2017:

|

| | | | | | | | | | | | |

| | Years Ended June 30, |

($ in millions) | | 2019 | | 2018 | | 2017 |

Pension plans | | $ | 9.8 |

| | $ | 11.3 |

| | $ | 45.8 |

|

Other postretirement plans | | 1.8 |

| | 2.9 |

| | 2.6 |

|

Net periodic benefit costs | | $ | 11.6 |

| | $ | 14.2 |

| | $ | 48.4 |

|

In September 2016, we announced changes to retirement plans we offer to certain employees. Benefits accrued to eligible participants of our largest qualified defined benefit pension plan and certain non-qualified pension plans were frozen effective December 31, 2016. Approximately 1,900 affected employees were transitioned to the Company’s 401(k) plan that has been in effect for eligible employees since 2012, when the pension plan was closed to new entrants. We recognized the plan freeze during fiscal year 2017 as a curtailment, since it eliminated the accrual for a significant number of participants for all of their future services. We also made a voluntary pension contribution of $100.0 million to the affected plan in October 2016.

The service cost component of net pension expense represents the estimated cost of future pension liabilities earned associated with active employees. The pension earnings, interest and deferrals (“pension EID”) is comprised of the expected return on plan assets, interest costs on the projected benefit obligations of the plans and amortization of actuarial gains and losses and prior service costs.

Net pension expense is recorded in accounts that are included in both the cost of sales and selling, general and administrative expenses based on the function of the associated employees and in other income (expense), net. The following is a summary of the classification of net pension expense for the years ended June 30, 2019, 2018 and 2017:

|

| | | | | | | | | | | | |

| | Years Ended June 30, |

($ in millions) | | 2019 | | 2018 | | 2017 |

Cost of sales | | |

| | |

| | |

|

Service cost | | $ | 10.0 |

| | $ | 10.5 |

| | $ | 20.2 |

|

Total cost of sales | | 10.0 |

| | 10.5 |

| | 20.2 |

|

Selling, general and administrative expenses | | |

| | |

| | |

|

Service cost | | 1.5 |

| | 1.6 |

| | 3.9 |

|

Total selling, general and administrative expenses | | 1.5 |

| | 1.6 |

| | 3.9 |

|

Other expense | | | | | | |

Pension earnings, interest and deferrals | | 0.1 |

| | 2.1 |

| | 23.8 |

|

Curtailment charge | | — |

| | — |

| | 0.5 |

|

Total other expense | | 0.1 |

| | 2.1 |

| | 24.3 |

|

Net pension expense | | $ | 11.6 |

| | $ | 14.2 |

| | $ | 48.4 |

|

As of June 30, 2019 and 2018, amounts capitalized in gross inventory were $1.7 million and $1.7 million, respectively.

Operating Performance Overview

We believe fiscal year 2019 was a successful year as strong execution of our commercial and manufacturing strategies combined with growing market demand across most markets resulted in our best operating income performance since fiscal year 2013. We made significant progress in the following areas:

| |

• | We expanded customer relationships through market share gains with new and existing customers based on the strength of our solutions focused customer approach. |

| |

• | Through the ongoing implementation of the Carpenter Operating Model, we have unlocked incremental capacity through efficiency and productivity improvements across our SAO and PEP businesses. |

| |

• | Our Athens, Alabama facility continues to gain qualifications of submitted Aerospace Vendor Approved Processes contributing to increased capacity. |

| |

• | We expanded our leading additive manufacturing platform with the acquisition of LPW Technology Ltd. |

| |

• | We increased our focus and investment in core growth areas such as additive manufacturing and soft magnetics. |

Results of Operations — Fiscal Year 2019 Compared to Fiscal Year 2018