UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

MediaCo Holding Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

MEDIACO HOLDING INC. 48 W. 25th Street, Floor 3 New York, New York 10010 | | |  |

May 30, 2024

Dear Shareholder:

The directors and officers of MediaCo Holding Inc. join me in inviting you to attend the virtual annual meeting of our shareholders on Tuesday, July 9, 2024, at 9:00 a.m. Eastern time, via virtual conference using www.virtualshareholdermeeting.com/MDIA2024. As in recent years, in order to prioritize the health and safety of our shareholders and maximize efficiency, we have decided to hold the meeting solely by means of remote communication (i.e., a virtual-only meeting).

The formal notice of this annual meeting and the proxy statement appear on the following pages and are accompanied by a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2023. After reading the proxy statement and other materials, please submit your proxy promptly by telephone or via the Internet in accordance with the instructions on the enclosed proxy card, or by marking, signing and returning a physical proxy card by mail, to ensure that your votes on the business matters of the meeting will be recorded.

We hope that you will dial in to attend this meeting. Whether or not you attend, we urge you to submit your proxy promptly. In light of the meeting being held virtually, we strongly recommend that you vote your shares in advance of the annual meeting even if you plan to attend. Instructions on how to vote or change your vote are found in the sections entitled “Questions and Answers About this Annual Meeting—How do I vote my shares before the annual meeting?” and “Questions and Answers About this Annual Meeting—How can I change my vote?”

We look forward to talking to you on Tuesday, July 9, 2024.

Sincerely,

/s/ Jacqueline Hernandez

Jacqueline Hernandez

Interim Chief Executive Officer

This proxy statement is dated May 30, 2024, and we mailed to our shareholders of record as of May 10, 2024 (other than those who previously requested electronic or paper delivery of our proxy materials) a notice of internet availability of proxy materials on or about that date.

MEDIACO HOLDING INC. 48 W. 25th Street, Floor 3 New York, New York 10010 | | |  |

Notice of Annual

Meeting of Shareholders

| | | Time and Date: Tuesday, July 9, 2024, at 9:00 a.m. Eastern time | | |  | | | Location: via virtual conference using www.virtualshareholder meeting.com/MDIA2024. | | |  | | | Record Date: Only shareholders of record at the close of business on May 10, 2024, are entitled to notice of and to vote at this meeting and any adjournments or postponements of this meeting. |

The annual meeting of the shareholders of MediaCo Holding Inc. will be held on Tuesday, July 9, 2024, at 9:00 a.m. Eastern time, via virtual conference using www.virtualshareholdermeeting.com/MDIA2024. As in recent years, in order to prioritize the health and safety of our shareholders and maximize efficiency, we have decided to hold the meeting solely by means of remote communication (i.e., a virtual-only meeting).

Holders of Common Shares of MediaCo will be asked to consider and vote on the following matters:

| | 1 | | | Election of three directors to our board of directors for terms of three years; | |

| | 2 | | | An advisory vote to approve the compensation of our named executive officers; | |

| | 3 | | | Ratification of the selection of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2024; and | |

| | 4 | | | Transaction of any other business that may properly come before the meeting and any adjournments or postponements. | |

We describe each of these proposals in more detail in the accompanying proxy statement, which you should read in its entirety before voting.

Only shareholders of record at the close of business on May 10, 2024, are entitled to notice of and to vote at this meeting and any adjournments or postponements of this meeting.

By order of the Board of Directors,

/s/ Ann Beemish

Ann Beemish

Secretary

New York, New York

May 30, 2024

| | Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on July 9, 2024. The proxy statement and annual report are available, free of charge, at www.proxyvote.com. Also available on the website are the MediaCo proxy card, as well as additional voting information. | |

PROXY STATEMENT

In this proxy statement, MediaCo Holding Inc. is referred to as “we,” “us,” “our,” “our company,” “the company” or “MediaCo.”

Q: Why did I receive this proxy statement?

As a MediaCo shareholder, you received this proxy statement because our board of directors is soliciting your proxy to vote at the annual meeting of shareholders. The annual meeting will be held on Tuesday, July 9, 2024, at 9:00 a.m. Eastern time, via virtual conference using www.virtualshareholdermeeting.com/MDIA2024.

This proxy statement summarizes the information you need to know to vote on an informed basis at the annual meeting; however, you do not need to attend the annual meeting to vote your shares. For information regarding how to vote your shares, see “How do I vote my shares before the annual meeting?” We expect to begin sending or otherwise making available this proxy statement, the annual report, notice of annual meeting and the proxy card(s) on or about May 30, 2024, to all shareholders entitled to vote.

Q: What am I voting on?

You are being asked to consider and vote on the following:

• | election of three directors to our board of directors for terms of three years; |

• | an advisory vote to approve the compensation of our named executive officers; and |

• | ratification of the selection of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2024. |

Q: Who is entitled to vote?

Holders of outstanding shares of MediaCo’s Class A Common Stock, par value $0.01 per share (“Class A Shares”) and holders of outstanding shares of MediaCo’s Class B Common Stock, par value $0.01 per share (“Class B Shares” and together with the Class A Shares, “Common Shares”) as of the close of business on May 10, 2024, the record date, are entitled to vote at the annual meeting. As of May 10, 2024, 41,291,540 Class A Shares and 5,413,197 Class B Shares were issued and outstanding. As of May 10, 2024, there were no shares of MediaCo’s Class C Common Stock, par value $0.01 per share, issued or outstanding.

Q: Has the board of directors made any recommendation with respect to each proposal?

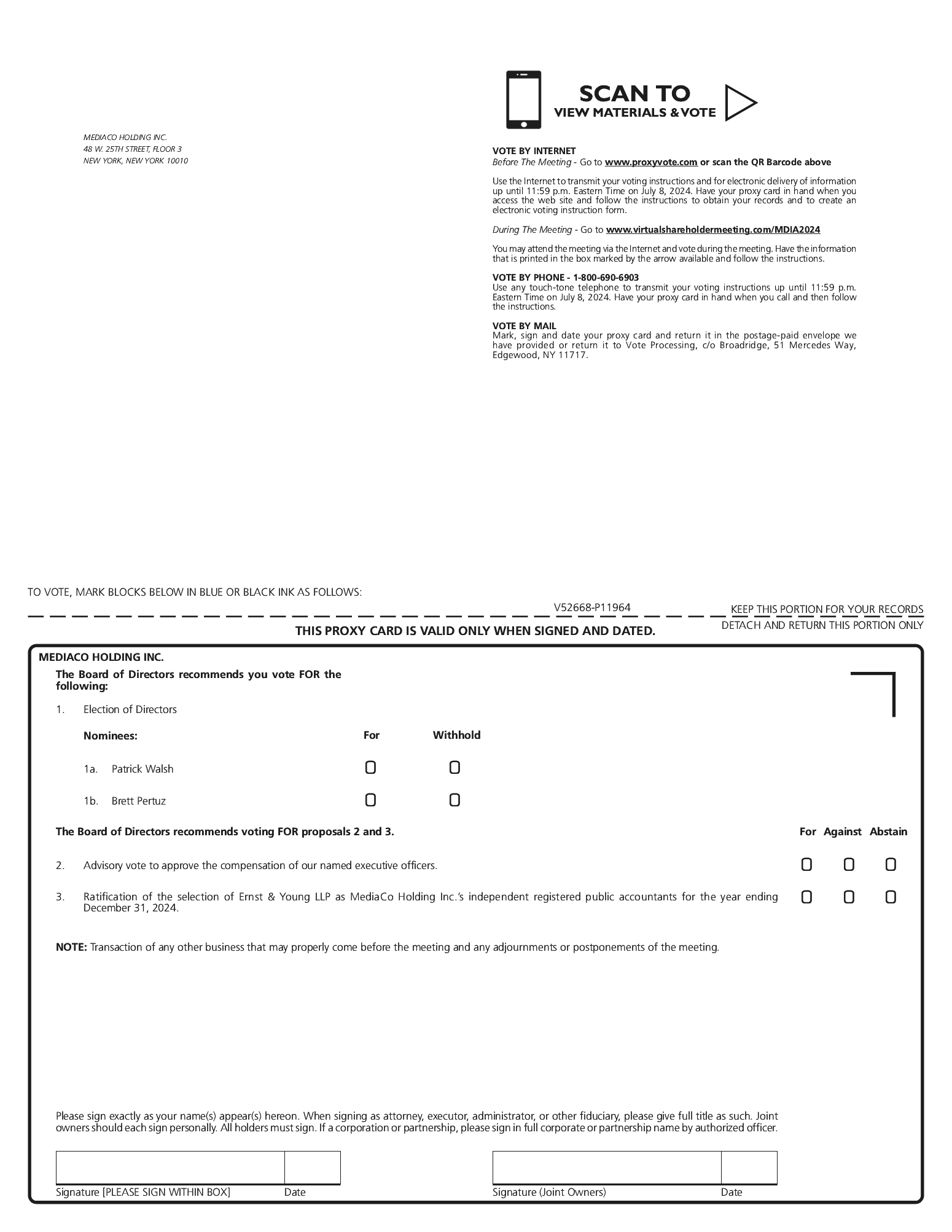

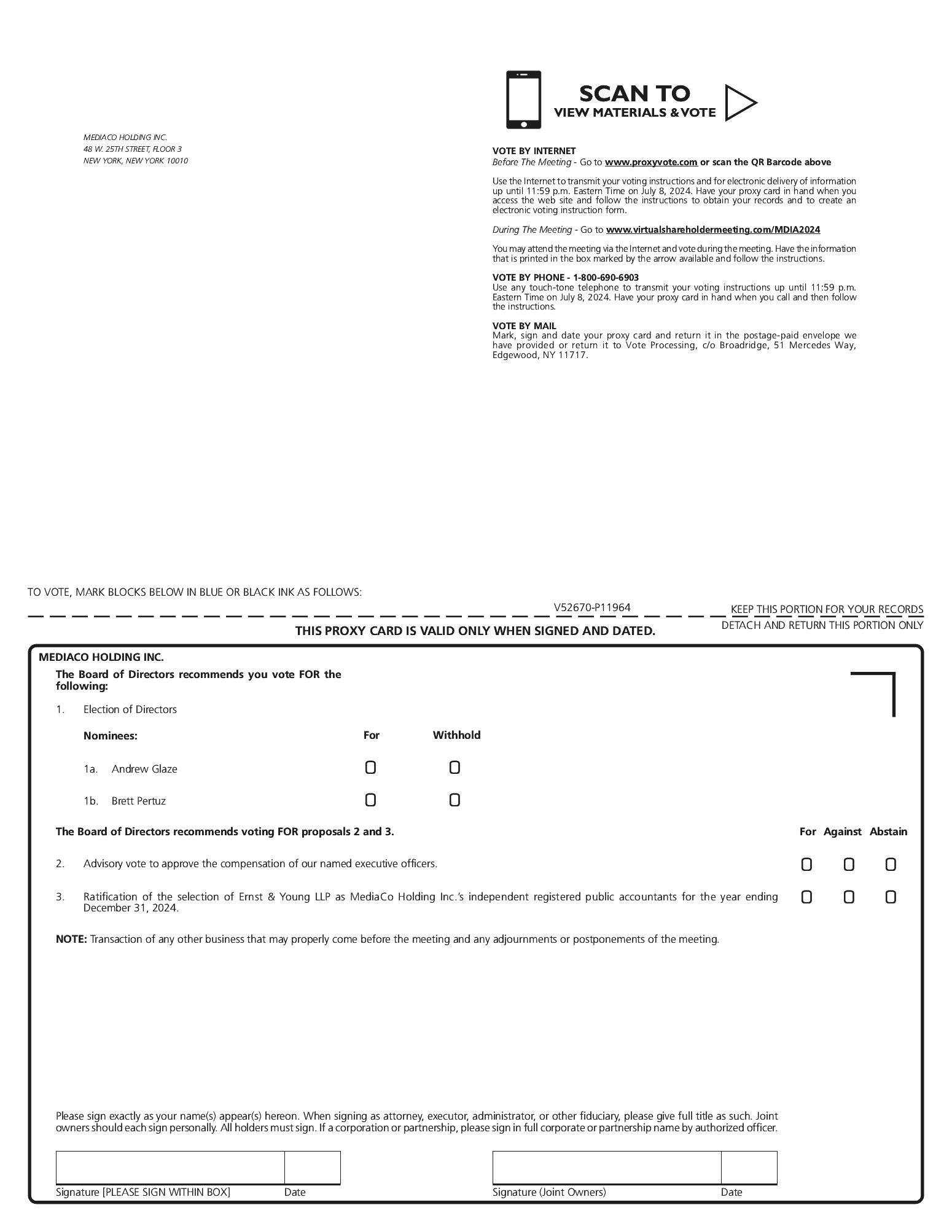

The board of directors recommends that holders of Class A Shares vote FOR Patrick Walsh, that the holders of Class B Shares vote FOR Andrew Glaze and that the holders of all Common Shares vote FOR Brett Pertuz, the persons nominated by the board to be elected as directors for terms of three years. The board of directors also recommends that holders of Common Shares vote FOR approval of an advisory resolution approving the compensation of our named executive officers, and FOR ratification of Ernst & Young LLP as our independent registered public accountants.

Q: What does it mean if I get more than one proxy card?

If you receive more than one proxy card, it means you hold Common Shares registered in more than one account. Sign and return ALL proxy cards to ensure that all your Common Shares are voted.

MediaCo Holding Inc. 1 2024 Proxy Statement

Q: What are the voting rights of the Common Shares?

Each Class A Share is entitled to one vote and each Class B Share is entitled to ten votes. Generally, the holders of Class A and Class B Shares vote together as a single group. However, the two classes vote separately in connection with the election of certain directors, certain “going private” transactions and other matters as provided by law.

At this annual meeting, the Class A and Class B Shares, respectively, will vote separately on the election of two of the director candidates, Patrick Walsh and Andrew Glaze (a director elected by the Class A Shares, a “Class A Director” and a director elected by the Class B Shares, a “Class B Director”), and will vote together on election of the third director candidate, Brett Pertuz, the advisory resolution approving the compensation of our named executive officers and the ratification of Ernst & Young LLP as our registered public accountants. The Company knows of no other business to be presented for consideration at the annual meeting other than the items indicated herein. If other matters are properly presented at the annual meeting, the persons designated as authorized proxies on your proxy card may vote on such matters in their discretion.

Q: How do I vote my shares before the annual meeting?

If you hold your shares in your own name, you may submit a proxy by telephone, via the Internet or by mail.

| | | Submitting a Proxy by Telephone: You can submit a proxy for your shares by telephone until 11:59 p.m. Eastern time on July 8, 2024, by calling the toll-free telephone number on the enclosed proxy card, (800) 690-6903. Telephone proxy submission is available 24 hours a day. Voice prompts allow you to submit a proxy for your shares and confirm that your instructions have been properly recorded. Our telephone proxy submission procedures are designed to authenticate shareholders by using individual control numbers. | | |  | | | Submitting a Proxy via the Internet: You can submit a proxy via the Internet until 11:59 p.m. Eastern time on July 8, 2024, by accessing the website listed on your proxy card, www.proxyvote.com, and following the instructions you will find on the website. Internet proxy submission is available 24 hours a day. As with telephone proxy submission, you will be given the opportunity to confirm that your instructions have been properly recorded. | | |  | | | Submitting a Proxy by Mail: If you choose to submit a proxy by mail, simply mark the appropriate proxy card, date and sign it, and return it in the postage paid envelope provided or to the address shown on the proxy card. Your proxy card must be received by the Secretary before the start of the meeting in order for your vote to be counted. | |

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions. You may also attend the annual meeting and vote in person.

If your shares are held in the name of a bank, broker or other holder of record, then you are the beneficial owner of shares held in “street name.” The notice of annual meeting, proxy statement, and accompanying materials have been forwarded to you by your broker, bank, or other holder of record that is considered the “holder of record” of those shares. As the beneficial owner, you have the right to direct your broker, bank, or other holder of record in voting your shares and you will receive instructions from the holder of record that you must follow for your shares to be voted. The availability of telephonic or Internet voting will depend on the bank’s or broker’s voting process. Please check with your bank or broker and follow the voting procedures your bank or broker provides to vote your shares.

Q: If I am the beneficial owner of shares held in “street name” by my broker, will my broker automatically vote my shares for me?

Stock exchange rules applicable to brokers grant your broker discretionary authority to vote your shares without receiving your instructions on certain matters. Your broker has discretionary voting authority under these rules to vote your shares on the ratification of Ernst & Young LLP as our independent registered public accountants. However, unless you provide voting instructions to your broker, your broker does not have discretionary authority to vote on the election of directors or the advisory resolution approving the compensation of our named executive officers. Therefore, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

MediaCo Holding Inc. 2 2024 Proxy Statement

Q: How will my shares be voted if I give my proxy but do not specify how my shares should be voted?

If you provide specific voting instructions, your shares will be voted at the annual meeting in accordance with your instructions. If you return your signed proxy card but do not indicate your voting preferences, we will vote on your behalf FOR each of the nominees for whom you are entitled to vote, FOR approval of an advisory resolution approving the compensation of our named executive officers and FOR the ratification of Ernst & Young LLP as our independent registered public accountants.

Q: What is an “abstention” or a broker “non-vote” and how do they affect the vote?

An “abstention” occurs when a shareholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. An abstention with respect to the election of directors is neither a vote cast “for” a nominee nor a vote cast “against” the nominee and, therefore, will have no effect on the outcome of the vote. Abstentions with respect to the advisory resolution approving the compensation of our named executive officers and the ratification of Ernst & Young LLP as our independent registered public accountants will also have no effect on the outcome of the vote.

A broker “non-vote” occurs when a broker or other nominee who holds shares for the beneficial owner is unable to vote those shares for the beneficial owner because the broker or other nominee does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner of the shares. Brokers will have discretionary voting power to vote Common Shares for which no voting instructions have been provided by the beneficial owner only with respect to the ratification of Ernst & Young LLP as our independent registered public accountants. Brokers will not have discretionary voting power to vote Common Shares with respect to the election of directors or the advisory resolution approving the compensation of our named executive officers. Common Shares that are the subject of a broker non-vote are included for quorum purposes, but a broker non-vote with respect to a proposal will not be counted as a vote represented at the meeting and entitled to vote and, consequently, as a general matter, will have no effect on the outcome of the vote.

Q: How can I change my vote?

You may revoke your proxy at any time before it is exercised by:

• | Delivering to the Secretary a written notice of revocation, dated later than the proxy, before the vote is taken at the annual meeting; |

• | Delivering to the Secretary an executed proxy bearing a later date, before the vote is taken at the annual meeting; or |

• | Submitting a proxy on a later date by telephone or via the Internet (only your last telephone or Internet proxy will be counted), before 11:59 p.m. Eastern time on July 8, 2024. |

Any written notice of revocation, or later dated proxy, should be delivered to:

MediaCo Holding Inc.

48 W. 25th Street, Floor 3

New York, New York 10010

Attention: Ann Beemish, Secretary

Alternatively, you may hand deliver a written revocation notice, or a later dated proxy, to the Secretary before we begin voting at the annual meeting.

If your shares are held by a bank, broker or other nominee, you must follow the instructions provided by the bank, broker or other nominee if you wish to change your vote.

Q: Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will count the votes.

MediaCo Holding Inc. 3 2024 Proxy Statement

Q: What constitutes a quorum?

A majority of the combined voting power of the outstanding Class A and Class B Shares entitled to vote at the meeting constitutes a quorum for the items to be voted on by the Common Shares at the annual meeting (i.e., counting one vote for each share of outstanding Class A Shares and ten votes for each share of outstanding Class B Shares, present in person or represented by proxy), except that a majority of the outstanding Class A Shares entitled to vote at the meeting constitutes a quorum for the election of the Class A Director and a majority of the outstanding Class B Shares entitled to vote at the meeting constitutes a quorum for the election of the Class B Directors.

Q: How many votes are needed for approval of each proposal?

The Class A Director will be elected by a plurality of the votes cast by the holders of outstanding Class A Shares entitled to vote in the election who are present, in person or by proxy, at the meeting. Consequently, the director nominee receiving the most votes of the holders of Class A Shares will be elected to fill the Class A Director position. Only votes cast FOR a nominee will be counted.

The Class B Directors will be elected by a plurality of the votes cast by the holders of outstanding Class B Shares entitled to vote in the election who are present, in person or by proxy, at the meeting. Consequently, the director nominees receiving the most votes of the holders of Class B Shares will be elected to fill the Class B Director positions. Only votes cast FOR a nominee will be counted.

The third candidate for director, Brett Pertuz, will be elected by a plurality of the votes cast by the holders of our outstanding Class A Shares and Class B Shares, voting together, entitled to vote in the election who are present, in person or by proxy, at the meeting. Consequently, the director nominee receiving the most votes of the holders of Class A Shares and Class B Shares, voting together, will be elected to fill this position. Only votes cast FOR a nominee will be counted.

The approval of the advisory resolution approving the compensation of our named executive officers and the ratification of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2024, require that the number of votes cast in favor of that proposal by holders of our outstanding Class A Shares and Class B Shares entitled to vote thereon, voting together, exceed the number of votes cast against the proposal by such holders of our outstanding Class A Shares and Class B Shares.

Q: What percentage of stock does our largest individual shareholder own and how does it intend to vote? What about executive officers and directors?

SG Broadcasting LLC (“SG Broadcasting”), is our largest single shareholder, beneficially owning approximately 92.0% of our Class A Shares and 100% of our Class B Shares as of May 10, 2024. Representatives of SG Broadcasting have informed us that they intend to vote for the nominee for election as Class B Director and for the election of Mr. Pertuz, for approval of the advisory resolution approving the compensation of our named executive officers and for the proposal regarding the ratification of the selection of Ernst & Young LLP as our independent registered public accountants. If SG Broadcasting does so, the election of Class B Director nominee Mr. Andrew Glaze, the election of Mr. Pertuz, approval of the advisory resolution approving the compensation of our named executive officers and ratification of the selection of Ernst & Young LLP as our independent registered public accountants are expected to be approved because SG Broadcasting controls approximately 96.1% of the combined voting power of our outstanding Common Shares.

All directors and executive officers together own outstanding Class A Shares and Class B Shares representing less than 1% of the combined voting power of our outstanding Common Shares.

Q: Does MediaCo offer an opportunity to receive future proxy materials electronically?

Yes. If you are a shareholder of record, you may, if you wish, receive future proxy statements and annual reports online. If you elect this feature, you will receive either a proxy card or an e-mail message notifying you when the materials are available, along with a web address for viewing the materials. You may sign up for electronic delivery by marking and signing the appropriate spaces on your proxy card or by contacting our Investor Relations Department by e-mail at ir@MediaCoHolding.com or toll-free by phone at (866) 366-4703. If you received these materials electronically, you do not need to do anything to continue receiving materials electronically in the future.

If you hold your shares in a brokerage account, you may also have the opportunity to receive proxy materials electronically. Please follow the instructions of your broker.

MediaCo Holding Inc. 4 2024 Proxy Statement

Electronic delivery saves MediaCo money by reducing printing and mailing costs. It will also make it convenient for you to receive your proxy materials online. MediaCo charges nothing for electronic delivery. You may, of course, incur the usual expenses associated with Internet access, such as telephone charges or charges from your Internet service provider.

You may discontinue electronic delivery at any time. For more information, contact our Investor Relations Department by e-mail at ir@MediaCoHolding.com or toll-free by phone at (866) 366-4703.

Q: Who can attend the annual meeting?

All shareholders of record as of May 10, 2024, as well as holders of shares held in street name, may attend by dialing into [•].

Q: Where will the meeting take place?

We intend to hold our annual meeting via virtual conference using www.virtualshareholdermeeting.com/MDIA2024. As in recent years, in order to prioritize the health and safety of our shareholders and maximize efficiency, we have decided to hold the meeting solely by means of remote communication (i.e., a virtual-only meeting).

Q: What do I do if I have additional questions?

If you have any questions prior to the annual meeting, please contact our Investor Relations Department by e-mail at ir@MediaCoHolding.com or toll-free by phone at (866) 366-4703.

MediaCo Holding Inc. 5 2024 Proxy Statement

This proxy statement (this “proxy statement”) includes or incorporates forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are based upon management's assumptions, expectations, projections, intentions and beliefs about future events. In some cases, predictive, future-tense or forward-looking words such as “intend,” “plan,” “may,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity,” “forecast,” “should” and similar expressions, whether in the negative or affirmative, are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Factors that could cause actual results to difference materially from the results anticipated in these forward-looking statements are contained in MediaCo Holding Inc.’s (the “Company”) periodic reports filed with the U.S. Securities and Exchange Commission (the “SEC”) under the heading “Risk Factors” and elsewhere, and other filings that the Company may make with the SEC. The Company cautions readers that the forward-looking statements included in this proxy statement represent our estimates and assumptions only as of the date of this proxy statement and are not intended to give any assurance as to future results. These forward-looking statements are not statements of historical fact and represent only our management's beliefs and expectations as of the date hereof, and involve risks and uncertainties that could cause actual results to differ materially and inversely from expectations expressed in or indicated by the forward-looking statements. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, the Company cannot assess the effect of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement. Accordingly, you should not unduly rely on any forward-looking statements.

The Company undertakes no obligation to update or revise any forward-looking statements contained in this proxy statement, whether as a result of new information, future events, a change in our views or expectations or otherwise except as required by the federal securities laws.

MediaCo Holding Inc. 6 2024 Proxy Statement

Election of Directors

Three directors are to be elected by the holders of Common Shares. Patrick Walsh, Andrew Glaze and Brett Pertuz have each been nominated for a term of three years and until their respective successors have been elected and qualified. Mr. Walsh, the Class A Director, will be elected by the Class A Shares voting separately as a single class. Mr. Glaze, the Class B Director, will be elected by the holder of the Class B Shares voting separately as a single class. Mr. Pertuz will be elected by the holders of all Common Shares voting together. All nominees are currently members of the board of directors.

If, at the time of the annual meeting, any nominee is unable or declines to serve, the discretionary authority provided in the proxy may be exercised to vote for a substitute or substitutes. The board of directors has no reason to believe that any substitute nominee or nominees will be required.

Name, Age, Principal Occupation(s) and Business Experience

Nominees for terms expiring in 2027:

Andrew P. Glaze | Age 45 | Class B Director (Director since November 2019) | |

Andrew Glaze is the founder and has served as the Chief Investment Officer of Shiro Capital since 2019. Prior to Shiro Capital, Mr. Glaze served as a Research Analyst at Standard General L.P. (“Standard General”) from 2016 to June 2019. Before joining Standard General, Mr. Glaze was a Managing Director at Claar Advisors, LLC, which he joined in 2014. Mr. Glaze was the founder, and, from 2009 through 2014, the Chief Investment Officer of Emys Capital, LLC. Prior to May 2009 he was an investment banking associate on the Consumer and Leveraged Finance teams at Merrill Lynch. Mr. Glaze began his career in the United States Army where he served as an officer for five years in the 1st Cavalry Division. As part of his service, Mr. Glaze deployed to Baghdad, Iraq for one year where he served with distinction as a Captain and Aviation Brigade Fire Support Officer. Mr. Glaze is a service-disabled veteran. He holds a B.S. from the United States Military Academy at West Point and an MBA from Columbia Business School, where he participated in the highly selective Value Investing Program. Mr. Glaze is a Chartered Financial Analyst. | | |

Mr. Glaze is an experienced investment professional, with substantial expertise in making and supervising investments at all levels of the capital structure. His investment banking experience and investment experience allows Mr. Glaze to provide valuable insights to the board on capital structure and prospective acquisition opportunities. | |

MediaCo Holding Inc. 7 2024 Proxy Statement

Patrick M. Walsh | Age 56 | Class A Director (Director since November 2019) | |

Patrick Walsh serves as President, Chief Operating Officer and a director of Emmis Corporation (“Emmis”), positions he has held since August 2015. Previously, he was Executive Vice President, Chief Financial Officer and Chief Operating Officer of Emmis, having joined Emmis in September 2006. Mr Walsh also previously served as our President (June 2019 to June 2021) and Chief Operating Officer (June 2019 to August 2020). With Emmis’ launch of a special purpose acquisition corporation in January 2021, Mr. Walsh served as President, Chief Operating Officer and a director of Monument Circle Acquisition Corp. until December 2023. Mr. Walsh joined Emmis from iBiquity Digital Corporation (now Xperi Corporation), the developer and licensor of HD Radio technology, where he served as Chief Financial Officer from 2002 to 2006. Mr. Walsh previously served as a management consultant for McKinsey & Company, and worked in various sales, marketing, finance and accounting roles at General Motors and Deloitte. Mr. Walsh also serves as a director of video game ad tech company Anzu Virtual Reality, Ltd. and Center for Leadership Development. He recently completed serving on the Alumni Board of Governors at the Ross School of Business Administration at the University of Michigan, serving as Vice Chairman and Director of National Association of Broadcasters, and a director at Radio Music License Committee and Radio Advertising Bureau. Mr. Walsh has a BBA from the University of Michigan and an MBA from Harvard Business School. Mr. Walsh is a Certified Public Accountant. | | |

Mr. Walsh was recommended by Emmis Operating Company (“EOC”) and, as such, pursuant to MediaCo’s Amended and Restated Articles of Incorporation, our board is currently required to nominate him as a Class A Director. In addition to his background in finance and radio, television, and digital media operations, Mr. Walsh has experience as a management consultant and has served in financial and operational capacities in a business that sold technology to the radio industry. | |

Brett Pertuz | Age 50 | (Director since April 2024) | |

Brett Pertuz is a Managing Director at HPS. Prior to joining HPS in 2018, Mr. Pertuz worked in private equity as a Managing Director first with Bruckmann, Rosser, Sherrill & Co. and later with Altpoint Capital Partners. Mr. Pertuz began his career at Bain & Company in management consulting. Mr. Pertuz holds a BS from the University of Virginia and an MBA from Harvard Business School. | | |

Mr. Pertuz was designated by Aggregator pursuant to the Stockholders Agreement and as such elected to the Board effective April 17, 2024. Mr. Pertuz brings to the board substantial experience in the financial industry and in private equity and finance transactions. He has served on the boards of several private companies in a variety of industries. | |

MediaCo Holding Inc. 8 2024 Proxy Statement

Directors whose terms expire in 2025:

Colbert Cannon | Age 48 | (Director since April 2024) | |

Colbert Cannon is a Managing Director at HPS. Prior to joining HPS in 2017, Mr. Cannon was a Partner and Director of Research at Wingspan Investment Management, a distressed credit investment firm launched in 2013. Prior to Wingspan, Mr. Cannon was a Managing Director at Glenview Capital, where he led the Credit Investment effort from 2009 to 2012. Prior to joining Glenview, Mr. Cannon was a Principal at Audax Group, a Boston-based Private Equity firm. Mr. Cannon began his career in Mergers and Acquisitions Investment Banking at Goldman Sachs. Mr. Cannon holds an AB in Social Studies from Harvard College. | | |

Mr. Cannon was designated by Aggregator pursuant to the Stockholders Agreement and as such elected to the Board effective April 17, 2024. Mr. Cannon brings to the board an extensive background in financial analysis, operational oversight, and has served on the board of several media companies. | |

Robert L. Greene | Age 56 | Class B Director (Director since January 2023) | |

Robert Greene has been the President and Chief Executive Officer of the National Association of Investment Companies, the industry trade association and largest network of diverse-owned alternative asset class investment firms, since February 2013. He was the Head of Investor Relations of Syndicated Communications Venture Partners, a venture capital firm, from June 2007 to December 2013. Mr. Greene currently serves on the board of directors of the Boy Scouts of America National Executive Board, the board of directors of Transworld Systems Inc., a privately held, private equity-backed company that provides debt collection services for Fortune 500 companies on a global basis, and the board of directors of Synergy Infrastructure Holdings, a privately held, private equity-backed company that is a leading provider of compact, heavy and pump equipment rentals. Previously, he also served on the board of directors and audit committee of Starboard Value Acquisition Corporation, a blank check company, which in July 2021 merged with Cyxtera Technologies, Inc. (Nasdaq: CYXT), a global leader in colocation and interconnection services. | | |

Mr. Greene’s broad level of investment and board experience provides MediaCo with a diversified view into best practices across the operations, accounting, systems and fund raising. | |

Deborah A. McDermott | Age 69 | Class B Director (Director since November 2019) | |

Deb McDermott serves as CEO of Standard Media Group LLC. She has a 25-plus year career leading broadcast groups- including COO of Media General and CEO-President of Young Broadcasting. As CEO, she spearheaded Young’s successful mergers with Media General and LIN Media. Ultimately, overseeing the combined company’s more than 70 television stations. Deb currently serves as Chair of the Board of Directors of MediaCo Holding Inc. | | |

Among her many accomplishments, Ms. McDermott was inducted into the Broadcasting & Cable Hall of Fame in 2013 and the Library of American Broadcasting Foundation’s Giants of Broadcasting and Electronics Arts award in 2022. She currently serves on the ABC Board of Governors, the Board of Directors for Television Bureau of Advertising, National Association of Broadcasters and the International Radio and Television Society. She is also a member of C200 and CEO.org. Previously, Ms. McDermott served on the Board of Directors for the Country Music Association and Chair of the National Association of Television Program Executives (NATPE). | |

MediaCo Holding Inc. 9 2024 Proxy Statement

Jeffrey H. Smulyan | Age 77 | Class A Director (Director since June 2019) | |

Jeff Smulyan founded Emmis in 1979 and serves as its Chairman of the board of directors and Chief Executive Officer. At Emmis, he has held the positions of Chairman of the board of directors and Chief Executive Officer since 1981 and was President until August 2015. Mr. Smulyan was also appointed Chairman of the board of directors and Chief Executive Officer of Monument Circle Acquisition Corp., a special purpose acquisition corporation, from January 2021 through December 2023. Mr. Smulyan began working in radio in 1973 and has owned one or more radio stations since then. Formerly, he served as our Chief Executive Officer from June 2019 through June 2021, and he was also the owner and chief executive officer of the Seattle Mariners Major League Baseball team. He is former Chairman of the Radio Advertising Bureau; a former director of The Finish Line, a sports apparel manufacturer; and serves as a Trustee of his alma mater, the University of Southern California. Among other awards, Mr. Smulyan has received the National Radio Award, been inducted into the Broadcasting and Cable Hall of Fame, been named a “Giant of Broadcasting” by the Library of American Broadcasting and been honored as an Indiana Living Legend. | | |

Mr. Smulyan was recommended by EOC, and, as such, pursuant to MediaCo’s Amended and Restated Articles of Incorporation, our board is currently required to nominate him as a Class A Director. Mr. Smulyan’s experience ranges from running an individual radio station to chairing significant broadcast industry groups, providing the board with strategic insights into the broadcast industry and future trends that will likely affect the company’s radio broadcasting operations. | |

Directors whose terms expire in 2026:

J. Scott Enright | Age 61 | Class A Director (Director since November 2019) | |

Scott Enright serves as Executive Vice President, General Counsel and Secretary of Emmis, a position he has held since March 2009. He also served as Executive Vice President, General Counsel and Secretary of Monument Circle Acquisition Corp., a special purpose acquisition corporation, from January 2021 through December 2023, and as Executive Vice President, General Counsel and Secretary of MediaCo from June 2019 through November 25, 2021. Mr. Enright joined Emmis in October 1998, previously being a partner at the law firm Bose McKinney & Evans. He serves on the board of Broadcaster Traffic Consortium, LLC (an aggregator of radio broadcast spectrum used to distribute traffic data to in-dash and handheld mapping devices), as well as on the boards of charitable organizations such as Goodwill of Central and Southern Indiana, Inc., EdChoice, Inc. (formerly the Milton and Rose D. Friedman Foundation) and the Endowment of the Second Presbyterian Church of Indianapolis. | | |

Mr. Enright was recommended by EOC and, as such, pursuant to MediaCo’s Amended and Restated Articles of Incorporation, our board is currently required to nominate him as a Class A Director. Mr. Enright is a lawyer with extensive experience in a wide range of legal issues facing publicly traded media companies, including corporate governance and regulatory matters. | |

MediaCo Holding Inc. 10 2024 Proxy Statement

Jacqueline Hernández | Age 58 | (Director since April 2024) | |

Jacqueline Hernández was appointed as MediaCo’s Interim Chief Executive Officer effective April 17, 2024, and also joined the Board at such time. Ms. Hernández is a media executive who most recently was Founder and CEO of New Majority Ready, a marketing strategy and content development firm. Prior to starting her own company, she was President of Combate Americas, a leading Hispanic sports franchise. Prior to Combate Americas, Ms. Hernández was Chief Marketing Officer of NBC Universal Hispanic Enterprises and Content and Chief Operation Officer of NBC Universal’s Telemundo Enterprises. Prior to joining NBC Universal, Ms. Hernández was Publisher of People en Español and TEEN People. Prior to joining People en Español, she was Vice President Turner International Advertising. Prior to Turner, Ms. Hernández was Director of Marketing of TIME International. Prior to TIME, Ms. Hernández was Director of Targeted Advertising Sales for the Village Voice. Ms. Hernández began her career in advertising at the Boston Globe. Ms. Hernández currently sits on the board of Victoria’s Secret & Co., and previously served on the board of Estrella Media, Inc. She holds a BA from Tufts University and an MBA from Baruch College. | | |

Ms. Hernandez was designated by Aggregator pursuant to the Stockholders Agreement and as such elected to the Board effective April 17, 2024. Ms. Hernandez brings business expertise in transforming business models for growth as well as a rich cultural fluency in understanding and connecting with multicultural consumers. | |

Mary Beth McAdaragh | Age 60 | Class B Director (Director since November 2019) | |

Mary Beth McAdaragh has over 30 years of media production, distribution and marketing experience having been involved with the branding and marketing of some of the most recognizable television franchises in domestic and international syndication. She most recently served as Executive Vice President, Marketing/Affiliate Relations for CBS Media Ventures (a division of ViacomCBS). She was responsible for the Marketing and Affiliate Relations for the industry’s leading roster of first-run and off-network syndicated product including: Judge Judy, Dr. Phil, Wheel of Fortune, Jeopardy!, Entertainment Tonight, The Drew Barrymore Show, Rachael Ray and Inside Edition. In 2000, she was named Vice President, Marketing for NBC Enterprises, the then newly formed syndication division of NBC. There she developed domestic and international marketing campaigns for The Weakest Link, Fear Factor, and Access Hollywood. In 2006, upon the inception of 20th Century Fox’s new broadcast network, MyNetworkTV, McAdaragh produced a six-week, 30 city marketing and promotional tour across the United States to launch the new venture. She was then named Senior Vice President of Affiliate Relations where she was the key liaison between the Network and their 180+ broadcast station affiliates around the country. Ms. McAdaragh created and executive produced The Surreal Gourmet, a traveling cooking show which aired for five seasons on Food Network, and she has served as a business development and marketing consultant for both traditional media and new technology ventures. | | |

Ms. McAdaragh graduated from South Dakota State University with a BA in Broadcast Journalism and is a member of the university’s Mass Communications Department Advisory Council. She is the recipient of numerous creative awards including two Daytime Emmy® Awards and PROMAX Gold Medallions. She is active in many trade and civic organizations and resides in Beverly Hills, California. | |

MediaCo Holding Inc. 11 2024 Proxy Statement

Amit Thakrar | Age 36 | (Director since August 2023) | |

Amit Thakrar has over 15 years of experience investing in private equity, public equity and special situations strategies across a broad range of industries including most recently as a Partner at Standard General LP beginning in 2019. Between 2010 and 2019, he worked at Davidson Kempner Capital Management, OMERS Private Equity, and CIBC World Markets. In addition, he has extensive operating experience, including serving as Executive Vice President of Standard Media Group LLC, a diversified national media company. | | |

Mr. Thakrar received his MBA from Columbia Business School and a Bachelor of Commerce (Honors) from Queen's University. Mr. Thakrar brings to the Board a strong investment, financial management and operational background in the media space. | |

Recommendation of the Board of Directors

| | Our board of directors unanimously recommends that holders of Class A Shares vote FOR Patrick Walsh, that holders of Class B Shares vote FOR Andrew Glaze and that holders of all Common Shares votes FOR Brett Pertuz, the persons nominated by the board to be elected as directors. | |

Under the terms of the Company’s Amended and Restated Articles of Incorporation, Mr. Walsh’s nomination as a Class A Director is based upon the recommendation of Emmis Operating Company (“EOC”). EOC, a wholly owned subsidiary of Emmis, is entitled to nominate each of the three Class A Directors so long as either that certain Management Agreement, dated November 25, 2019, between MediaCo and EOC (the “Management Agreement”) remains in effect, or that certain Unsecured Promissory Note, dated November 25, 2019, from MediaCo to Emmis Communications Corporation (the “Emmis Promissory Note”) remains outstanding. While the Management Agreement terminated in November 2021, the Emmis Promissory Note currently remains outstanding.

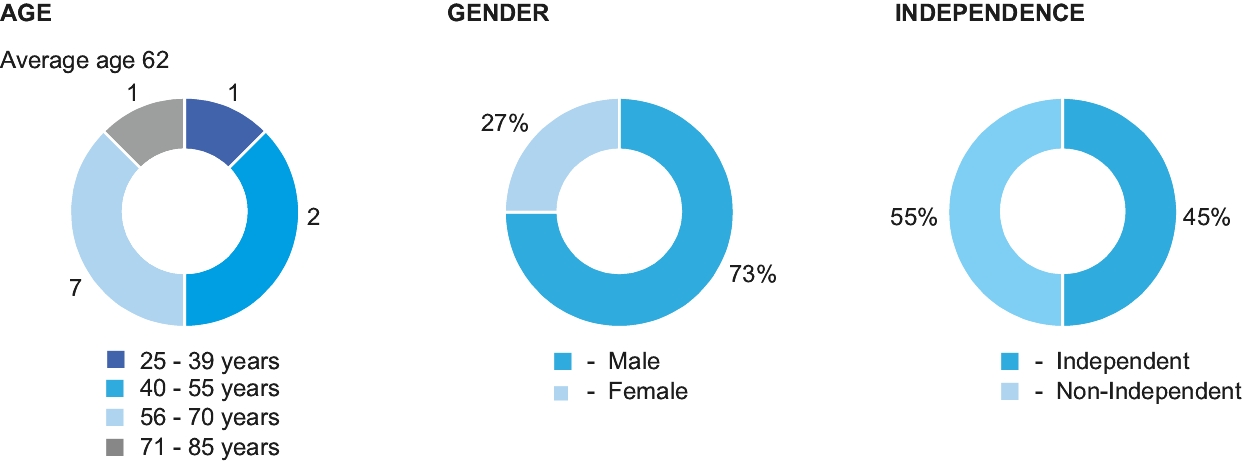

The board believes that well-functioning boards consist of a diverse collection of individuals that bring a variety of complementary skills. Although the board of directors does not have a formal policy with regard to the consideration of diversity in identifying directors, diversity is one of the factors that the board may, pursuant to its charter, take into account in identifying director candidates. Subject to any contractual commitments, the board generally considers each director eligible for nomination in the broad context of the overall composition of our board of directors with a view toward constituting a board that, as a body, possesses the appropriate mix of skills and experience to oversee our business. The board of directors may actively seek candidates that embody elements of diversity in skills, ability, industry knowledge, experience, gender, race and ethnicity. The experience, qualifications, attributes, or skills that led the board to conclude that each of the members of the board of directors should serve on the board are generally described below:

MediaCo Holding Inc. 12 2024 Proxy Statement

As of May 10, 2024, there were 41,291,540 Class A Shares and 5,413,197 Class B Shares issued and outstanding. The Class A Shares are entitled to an aggregate of 41,291,540 votes and the Class B Shares are entitled to an aggregate of 54,131,970 votes. The following table shows, as of May 10, 2024, the number of shares and percentage of our Class A Shares and Class B Shares held by each person known to us to own beneficially more than five percent of the issued and outstanding Class A Shares or Class B Shares, by our named executive officers and our directors, and by our named executive officers and directors as a group. Unless otherwise specified, the address of each person listed is: c/o MediaCo Holding Inc., 48 W. 25th Street, Floor 3, New York, NY 10010.

| | | | Class A Shares | | | Class B Shares | | | Total Beneficial Ownership of Outstanding MediaCo Interests(2) | | | | ||||||||

| | Five Percent Shareholders, Directors, Nominees and Certain Executive Officers | | | Amount and Nature of Beneficial Ownership Class A Shares(1) | | | Percent of Class | | | Amount and Nature of Beneficial Ownership Class B Shares(1) | | | Percent of Class | | | Percent of Total Voting Power of Outstanding MediaCo Interests | | |||

| | Standard General, L.P. | | | 42,945,193(3) | | | 91.95% | | | 5,413,197 | | | 100.00% | | | 42,945,193 | | | 96.06% | |

| | Andrew P. Glaze | | | 73,023 | | | 0.18% | | | — | | | —% | | | 73,023 | | | * | |

| | Mary Beth McAdaragh | | | 34,342 | | | 0.08% | | | — | | | —% | | | 34,342 | | | * | |

| | Deborah A. McDermott | | | 40,453 | | | 0.10% | | | — | | | —% | | | 40,453 | | | * | |

| | Jeffrey H. Smulyan | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Patrick M. Walsh | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Ann C. Beemish | | | 123,811 | | | 0.30% | | | — | | | —% | | | 123,811 | | | * | |

| | Robert L. Greene | | | 20,849 | | | 0.05% | | | — | | | —% | | | 20,849 | | | * | |

| | Amit Thakrar | | | 12,856 | | | 0.03% | | | — | | | —% | | | 12,856 | | | * | |

| | Kudjo Sogadzi | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | J. Scott Enright | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Jacqueline Hernández | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Colbert Cannon | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Brett Pertuz | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | Rahsan-Rahsan Lindsay | | | 10,117 | | | 0.02% | | | — | | | —% | | | 10,117 | | | * | |

| | Bradford A. Tobin | | | — | | | —% | | | — | | | —% | | | — | | | * | |

| | All Named Executive Officers and Directors as a Group (13 persons) | | | 315,451 | | | 0.76% | | | — | | | —% | | | 315,451 | | | 0.33% | |

| | Other 5% Shareholders: | | | | | | | | | | | | | | ||||||

| | HPS Group GP, LLC | | | 9,300,650(4) | | | 18.38% | | | — | | | —% | | | 9,300,650 | | | 8.88% | |

| | Emmis Corporation | | | 4,332,394(5) | | | 9.57% | | | — | | | —% | | | 4,332,394 | | | 4.36% | |

* | Less than 1%. |

1. | Unless otherwise indicated, each of the shareholders has sole voting and investment power with respect to the securities shown to be owned by such shareholder. The inclusion herein of securities listed as beneficially owned does not constitute an admission of beneficial ownership. |

MediaCo Holding Inc. 13 2024 Proxy Statement

2. | As Class B Shares are convertible into Class A Shares at the election of the holder, the beneficial ownership reported herein assumes that the beneficial owner (and no other shareholder) elected to convert all Class B Shares beneficially owned by such beneficial owner into Class A Shares. |

3. | Includes 5,413,197 Class B Shares. All Common Shares beneficially owned by Standard General are held by SG Broadcasting and certain funds. Soohyung Kim is the managing member and Standard General serves as investment manager for SG Broadcasting and such funds. Mr. Kim is the managing partner and chief investment officer of Standard General and a director of the general partner of Standard General. By virtue of the foregoing, Standard General and Mr. Kim may be deemed to beneficially own these shares. Each of Mr. Kim and Standard General disclaims beneficial ownership of the shares reported except to the extent of its or his pecuniary interest in such shares. Each of SG Broadcasting, Standard General and Mr. Kim have an address of 767 Fifth Avenue, 12th Floor, New York, NY 10153. |

4. | Represents 9,300,650 Class A Shares currently issuable upon the exercise of the Class A Common Stock Purchase Warrant (the “Warrant”) issued by the Company to SLF LBI Aggregator, LLC (“Aggregator”) on April 17, 2024, which Warrant relates in total to 28,206,152 Class A Shares. The percentage ownership interest is based on (i) 41,291,540 outstanding Class A and (ii) 9,300,650 Class A Shares issuable upon exercise of the Warrant. Scott Kapnick is chief executive officer of HPS Investment Partners, LLC, which is a registered investment adviser and is affiliated with HPS Group GP, LLC (collectively with HPS Group GP, LLC, “HPS”) and Aggregator. The principal business address of each of these persons is 40 West 57th Street, 33rd Floor, New York, New York 10019. |

5. | Includes 3,970,295 Class A Shares that would have been issued had the Emmis Promissory Note been converted into Common Shares on May 10, 2024. Emmis has an address of 40 Monument Circle, Suite 700, Indianapolis, IN 46204. |

In addition, as of May 10, 2024, there were 60,000 shares of Series B Preferred Stock issued and outstanding. Holders of Series B Preferred Stock have one vote per share on any matter on which holders of Series B Preferred Stock are entitled to vote separately as a class, whether at a meeting or by written consent, pursuant to the express terms of the Company’s Amended & Restated Articles of Incorporation, as amended, or as applicable law, including the Indiana Business Corporation Law, may expressly require a separate class vote of the holders of Series B Preferred Stock. Except as set forth in the immediately preceding sentence, the holders of Series B Preferred Stock are not entitled to vote on any matter submitted to the Company’s stockholders. See Footnote 4 to the preceding table for information regarding HPS Group GP, LLC, currently the sole holder of the Series B Preferred Stock.

| | Holder | | | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP SERIES B PREFERRED STOCK | | | PERCENT OF CLASS | |

| | HPS Group GP, LLC | | | 60,000 | | | 100.0% | |

MediaCo Holding Inc. 14 2024 Proxy Statement

Section 16(a) of the Exchange Act requires our directors and executive officers and any beneficial owner of more than 10% of any class of our equity securities to file with the SEC initial reports of beneficial ownership and reports of changes in ownership of any of our securities. These reports are made on documents referred to as Forms 3, 4 and 5. Our directors and executive officers must also provide us with copies of these reports. We have reviewed the copies of the reports that we have received and any written representations that no Form 5 was required from the individuals required to file the reports that we have received, as well as reviewed Forms 3, 4 and 5 filed with the SEC. Based on this review, we believe that during the year ended December 31, 2023, each of our directors and executive officers and beneficial owners of more than 10% of any class of our equity securities timely complied with applicable reporting requirements for transactions in our equity securities, except (i) Mr. Lindsay was late in filing Form 4s in connection with two withholdings of shares in order to pay taxes associated with the grant of shares or vesting of restricted shares, (ii) Ms. Beemish was late in filing Form 4s in connection with two withholdings of shares in order to pay taxes associated with the grant of shares or vesting of restricted shares and one grant of shares as employment compensation, (iii) Mr. Tobin was late in filing Form 4s in connection with one withholding of shares in order to pay taxes associated with the grant of shares or vesting of restricted shares and one grant of shares as employment compensation, (iv) Emmis Corporation was late in filing one Form 4 in connection with the sale of 300 shares of the Class A common stock, (v) Mr. Sogadzi and Mr. Thakrar were late in filing their Form 3s in connection with their service as an executive officer and a Board member, respectively, and (vi) each of Mss. McDermott and Riggio, and Messrs. Greene and Glaze, was late in filing a Form 4 in connection with a grant of shares as compensation for service on the Board in August 2023.

MediaCo Holding Inc. 15 2024 Proxy Statement

General

MediaCo aspires to the highest ethical standards for our employees, officers and directors, and remains committed to the interests of our shareholders and other constituents. We believe we can achieve these objectives only with a plan for corporate governance that clearly defines responsibilities, sets high standards of conduct and promotes compliance with the law. The board of directors has adopted formal corporate governance guidelines, as well as policies and procedures designed to foster the appropriate level of corporate governance. Some of these guidelines and procedures are discussed below. For further information, including electronic versions of our Code of Business Conduct and Ethics, our Corporate Governance Guidelines, our Audit Committee Charter, our Compensation Committee Charter, and our Complaint Procedure for Accounting and Auditing Matters, please visit the Corporate Governance section of our website (www.MediaCoHolding.com) located under the Investors heading.

Independent Directors

Our board of directors currently consists of eleven members. Of these, our board has determined that five (Mses. McAdaragh and McDermott, and Messrs. Glaze, Thakrar and Greene) qualify as “independent directors” under the listing standards of The Nasdaq Stock Market, Inc. (“Nasdaq”). In addition, MediaCo is a “Controlled Company” as defined in the Nasdaq listing standards. The company is, therefore, pursuant to Nasdaq Marketplace Rule 5615(c)(2), exempt from certain aspects of Nasdaq’s listing standards relating to independent directors.

MediaCo Holding Inc. 16 2024 Proxy Statement

Board Diversity

Pursuant to the Nasdaq’s Board Diversity Rules, below is the Board Diversity Matrix outlining diversity statistics regarding our Board. In addition to gender and demographic diversity, we also recognize the value of other diverse attributes that directors may bring to our Board, including veterans of the U.S. Military. We are proud to report that of our eight current directors, one is also a military veteran.

Board Diversity Matrix (as of May 10, 2024)

| | Total Number of Directors | | | 11 | | |||

| | | | Female | | | Male | | |

| | Part I: Gender Identity | | | | | | ||

| | Directors | | | 3 | | | 8 | |

| | Part II: Demographic Background | | | | | | ||

| | African American or Black | | | 0 | | | 2 | |

| | Alaskan Native or Native American | | | 0 | | | 0 | |

| | Asian | | | 0 | | | 1 | |

| | Hispanic or Latinx | | | 1 | | | 1 | |

| | Native Hawaiian or Pacific Islander | | | 0 | | | 0 | |

| | White | | | 2 | | | 3 | |

| | Two or More Races or Ethnicities | | | 0 | | | 1 | |

| | LGBTQ+ | | | 0 | | | 0 | |

| | Did Not Disclose Demographic Background | | | 0 | | | 0 | |

Code of Ethics

MediaCo has adopted a Code of Business Conduct and Ethics to document the ethical principles and conduct we expect from our employees, officers and directors. A copy of our Code of Business Conduct and Ethics is available in the Corporate Governance section of our website (www.MediaCoHolding.com) located under the Investors heading.

Leadership Structure and Risk Oversight

MediaCo’s Corporate Governance Guidelines provide that the chair of the board is to meet the independence requirements under the applicable Nasdaq listing standards. Our board has determined that our board chair, Deborah McDermott, is an “independent director” under Nasdaq rules. As Chair, Ms. McDermott is responsible for, among other matters: (i) setting the agenda for and leading executive sessions of the independent directors, unless a lead director is otherwise appointed by the Chair; (ii) briefing the CEO on issues arising in the executive sessions; (iii) coordinating and developing the agenda for meetings of the board, in collaboration with the CEO; (iv) convening meetings of the independent directors as necessary or appropriate; and (v) if requested and appropriate, being available for consultation with major shareholders. The board believes that this structure provides strong independent leadership and oversight for our Company and our board.

The board of directors expects the Company’s management to take primary responsibility for identifying material risks the company faces and communicating them to the board, developing and implementing appropriate risk management strategies responsive to those risks with oversight from the board, and integrating risk management into the Company’s decision-making processes. The board, through the Audit Committee on a quarterly basis and as a full board at least annually, regularly reviews information regarding the company’s credit, liquidity and operational risks, as well as strategies for addressing and managing such risks. In addition, the Compensation Committee monitors the Company’s compensation programs so that such programs do not encourage excessive risk-taking by Company employees.

MediaCo Holding Inc. 17 2024 Proxy Statement

Communications with Independent Directors

Any employee, officer, shareholder or other interested party who has an interest in communicating with the Chair or any other MediaCo independent directors regarding any matter may do so by directing communication to Ms. McDermott addressed to Board Chair, c/o Corporate Secretary, MediaCo Holding Inc., 48 W. 25th Street, Floor 3, New York, New York 10010, by e-mail message to Chair@MediaCoHolding.com. The communication will be delivered to the independent directors as appropriate. For matters related to finance or auditing, a communication should specify that it is directed to the Audit Committee. For matters related to compensation, a communication should specify that it is directed to the Compensation Committee. Messages for any director or the board of directors as a whole may be delivered through the Board Chair as well.

Consideration of Candidates for Nomination as Director

The board of directors will consider and evaluate potential nominees submitted by holders of our Class A Shares to our corporate secretary on or before the date for shareholder nominations specified in the “Shareholder Proposals” section of this proxy statement. These potential nominees will be considered and evaluated using the same criteria as potential nominees obtained by the board of directors from other sources, subject to the requirement to only nominate persons recommended by EOC so long as the Emmis Promissory Note is outstanding and to Aggregator’s rights to designate up to three individuals for election to the Board in accordance with the terms of the Stockholders Agreement.

In its assessment of each potential candidate, including those recommended by shareholders, the board of directors takes into account all factors it considers appropriate, which may include (a) ensuring that the board of directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as an “audit committee financial expert,” as that term is defined by the rules of the SEC), local or community ties, (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and related industries, independence of thought and an ability to work collegially, and (c) contractual and other obligations to nominate individuals recommended by EOC or SG Broadcasting. The board also may consider the extent to which the candidate would fill a present need on the board of directors. After conducting an initial evaluation of a candidate, the board of directors would be expected interview that candidate if it believes the candidate might be suitable to be a director and may ask the candidate to meet with certain directors and management. If the board believes a candidate would be a valuable addition to the board of directors, it would expect to nominate that candidate as a director.

Certain Committees of the Board of Directors

The standing committees of our board of directors are the Audit Committee and the Compensation Committee. MediaCo is a “controlled company” within the meaning of the Nasdaq listing standards. As such, we are exempt from Nasdaq’s requirement that director nominees be selected exclusively by independent directors constituting a majority of the independent directors of the board of directors or that MediaCo have a nominations committee comprised solely of independent directors. Accordingly, MediaCo does not have a separate standing nomination and corporate governance committee comprised of independent directors. The responsibilities and functions normally associated with such committee are instead carried out by the full board of directors.

Audit Committee. The Audit Committee’s primary responsibility is to engage our independent auditors and otherwise to monitor and oversee the audit process. The Audit Committee also undertakes other related responsibilities as summarized in the Report of the Audit Committee below and detailed in the Audit Committee Charter, which is available in the Corporate Governance section of our website (www.MediaCoHolding.com) located under the Investors heading. The board of directors has determined that the members of the Audit Committee, Robert L. Greene (chair), Deborah McDermott, Amit Thakrar and Mary Beth McAdaragh, are independent directors under the Exchange Act and the Nasdaq listing standards. The Audit Committee held four meetings during the last fiscal year.

Compensation Committee. The Compensation Committee reviews our compensation and benefit plans for executive officers to ensure that our corporate objectives are met, establishes compensation arrangements and approves compensation payments to members of our board of directors and our executive officers, and generally administers our equity incentive plans. The Compensation Committee’s charter is available in the Corporate Governance section of our website (www.MediaCoHolding.com) located under the Investors heading. The members of the Compensation Committee are Deborah McDermott (chair), Amit Thakrar and Mary Beth McAdaragh, all of whom are independent directors under Nasdaq standards. The Compensation Committee held three meetings during the last fiscal year.

MediaCo Holding Inc. 18 2024 Proxy Statement

Additional Committees. The Company also has a Diversity, Equity and Inclusion Committee. The members of the Diversity, Equity and Inclusion Committee are Andrew Glaze, who is independent under Nasdaq standards, and Jacqueline Hernandez. The Diversity, Equity and Inclusion Committee held one (1) meeting during the last fiscal year.

Meeting Attendance

In 2023, our board of directors held four meetings, either in person or by telephone. Each director attended at least 75% of the aggregate of (1) the total number of meetings of our board of directors held while he or she was a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served on the committee.

We believe that communication between our shareholders and the members of our board of directors is enhanced by the opportunity for personal interaction at our annual meeting of shareholders. Accordingly, we encourage the members of our board of directors to attend our annual meeting of shareholders whenever possible. Each of our directors then in office, other than Mr. Enright, attended the Company’s annual meeting of shareholders in 2023, which was held in a virtual-only format.

Compensation of Directors

During 2021, the Compensation Committee authorized annual retainers of $75,000 for each director who is not an officer of Emmis, as well as the following retainers for certain committee chairs: $50,000 for Board Chair, $50,000 for Audit Committee Chair, $50,000 for Acquisition Committee Chair, $50,000 for Digital Committee Chair, $50,000 for COVID Committee Chair, and $100,000 for Diversity Committee Chair. However, these amounts remained subject to the previous decision by the directors, made in the summer of 2020, that each of the directors elected to would reduce their annual $75,000 retainers by twenty percent for the remainder of the year, with Ms. McDermott reducing her retainer by forty percent. This reduction has remained in effect since that time and remains in effect for 2024, except that for 2024, the amount of the reduction is expected to be paid in Class A Shares. Ms. Hernandez receives no additional compensation for her service on the Board. Additionally, Mr. Cannon and Mr. Pertuz receive no compensation for their services on the Board.

| | Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards(1) ($) | | | All Other Compensation ($) | | | Total ($) | |

| | J. Scott Enright | | | — | | | — | | | — | | | — | | | — | |

| | Andrew P. Glaze | | | 85,000 | | | 15,000 | | | — | | | — | | | 100,000 | |

| | Robert L. Greene | | | 110,000 | | | 15,000 | | | — | | | — | | | 125,000 | |

| | Mary Beth McAdaragh | | | 60,000 | | | 15,000 | | | — | | | — | | | 75,000 | |

| | Deborah A. McDermott | | | 95,000 | | | 30,000 | | | — | | | — | | | 125,000 | |

| | Jeffrey H. Smulyan | | | — | | | — | | | — | | | — | | | — | |

| | Patrick M. Walsh | | | — | | | — | | | — | | | — | | | — | |

| | Amit Thakrar | | | 23,571 | | | 15,000 | | | — | | | — | | | 38,571 | |

MediaCo Holding Inc. 19 2024 Proxy Statement

Relationship and Agreements with Estrella Media

Asset Purchase Agreement

On April 17, 2024, MediaCo and its wholly-owned subsidiary MediaCo Operations LLC (“Purchaser”), entered into the Asset Purchase Agreement, pursuant to which Purchaser purchased substantially all of the assets of Estrella and its subsidiaries (other than certain broadcast assets owned by Estrella and its subsidiaries (the “Estrella Broadcast Assets”)) (the “Purchased Assets”), and assumed substantially all of the liabilities (the “Assumed Liabilities”) of Estrella and its subsidiaries.

MediaCo provided the following consideration for the Purchased Assets:

i. | A warrant (the “Warrant”) to purchase up to 28,206,152 shares of MediaCo’s Class A Common Stock, par value $0.01 per share (“Class A Common Stock”); |

ii. | 60,000 shares of a newly designated series of MediaCo’s preferred stock designated as “Series B Preferred Stock” (the “Series B Preferred Stock”), the terms of which are described in Item 3.03 of this Current Report on Form 8-K; |

iii. | A term loan in the principal amount of $30.0 million under the Second Lien Credit Agreement (as defined below) (the “Second Lien Term Loan”); and |

iv. | An aggregate cash payment in the amount of approximately $30.0 million to be used, in part, for the repayment of certain indebtedness of Estrella and payment of certain Estrella transaction expenses. |

The shares of Class A Common Stock issuable upon the exercise of the Warrant and the shares of Class A Common Stock issuable upon the exercise of the Option Agreement (as defined below) represent approximately 43% of the outstanding shares of Class A Common Stock on a fully diluted basis (assuming the full exercise of the Warrant and the Option Agreement).

The Warrant, the shares of Series B Preferred Stock and the Second Lien Term Loan will initially be held by an affiliate of HPS.

The Asset Purchase Agreement requires MediaCo to prepare and file with the Commission a proxy statement to be sent to MediaCo stockholders relating to a special meeting of MediaCo stockholders (the “Stockholders Meeting”) to be held to consider approval of the issuance of shares of Class A Common Stock upon exercise of the Warrant and the issuance of shares of Class A Common Stock pursuant to the Option Agreement (the “Proposal”). The board of directors of MediaCo (the “Board”) has directed that the Proposal be submitted to a vote at the Stockholders Meeting and recommended that MediaCo’s stockholders vote in favor of approval of the Proposal.

The Asset Purchase Agreement includes representations, warranties and covenants of the parties customary for a transaction of this nature.

Option Agreement

On April 17, 2024, in connection with the Transactions contemplated by the Asset Purchase Agreement (the “Transactions”), MediaCo and Purchaser entered into an Option Agreement (the “Option Agreement”) with Estrella and certain subsidiaries of Estrella pursuant to which (i) Purchaser was granted the option to purchase 100% of the equity interests of certain subsidiaries of Estrella holding the Estrella Broadcast Assets (the “Option Subsidiaries Equity”) in exchange for 7,051,538 shares of Class A Common Stock, and (ii) Estrella was granted the right to put the Option Subsidiaries Equity to Purchaser for the same consideration beginning six months after the date of the closing of the Transactions (the “Closing Date”).

MediaCo Holding Inc. 20 2024 Proxy Statement

Voting and Support Agreement

On April 17, 2024, in connection with the Transactions, SG Broadcasting LLC (“SG Broadcasting”), the holder of shares of Class A Common Stock and Class B Common Stock, par value $0.01 per share (“Class B Common Stock”) representing a majority of the voting power of the shares of MediaCo, entered into a Voting and Support Agreement with MediaCo and Estrella (the “Voting and Support Agreement”), pursuant to which SG Broadcasting agreed to, among other things, and subject to the terms and conditions set forth therein, at any meeting of MediaCo stockholders (including the Stockholders Meeting), or at any adjournment or postponement thereof, vote in favor of the Proposal and against any action or proposal that would reasonably be expected to prevent or materially delay consummation of the Proposal. The Voting Agreement also includes certain customary restrictions on SG Broadcasting’s ability to transfer its shares of MediaCo stock. The Voting Agreement will automatically terminate upon the date on which the Proposal is approved.

Warrant

On April 17, 2024, in connection with the Transactions, MediaCo issued the Warrant, which provides for the purchase of up to 28,206,152 shares of Class A Common Stock (the “Warrant Shares”), subject to customary adjustments as set forth in the Warrant, at an exercise price per share of $0.00001. Subject to certain limitations, the Warrant also provides that the Warrant holder has the right to participate in distributions on Class A Common Stock on an as-exercised basis. The Warrant further provides that in no event shall the aggregate number of Warrant Shares issuable to the Warrant holder upon exercise of the Warrant exceed 19.9% of the aggregate number of shares of common stock of MediaCo outstanding, or the voting power of such outstanding shares of common stock, on the business day immediately preceding the issue date for such Warrant Shares, calculated in accordance with the applicable rules of the Nasdaq Capital Market (“Nasdaq”), unless and until the Proposal has been approved.

First Lien Term Loan

In order to finance the Transactions, MediaCo and its direct and indirect subsidiaries entered into a maximum $45.0 million first lien term loan credit facility, dated April 17, 2024 (the “First Lien Credit Agreement”), with White Hawk Capital Partners, LP, as term agent thereunder, and the lenders party thereto. Under the terms of the First Lien Credit Agreement, MediaCo received an initial term loan of $35.0 million on April 17, 2024 (the “Initial Loan”) and was provided with a subsequent delayed draw facility of up to $10.0 million that may be provided for additional working capital purposes under certain conditions (the “Delayed Draw” and the loans thereunder, the “Delayed Draw Term Loans”). The Initial Loan and Delayed Draw Term Loans are collectively referred to as the “First Lien Term Loans.” The proceeds of the Initial Loan were used to finance the Transactions, pay off certain existing indebtedness in connection therewith and pay related fees and transaction costs. The Initial Loan will mature on April 17, 2029, and each Delayed Draw Term Loan will mature on the date that is two years after the drawing of such Delayed Draw Term Loan. First Lien Term Loans will be subject to monthly amortization payments equal to 0.8333% of the initial principal amount of the First Lien Term Loans, and monthly interest payments at a rate of SOFR + 6.00%. The First Lien Term Loans are subject to a borrowing base in accordance with the terms of the First Lien Credit Agreement.

Second Lien Term Loan

In addition, MediaCo and its direct and indirect subsidiaries entered into a $30.0 million second lien term loan credit facility, dated April 17, 2024 (the “Second Lien Credit Agreement”), with HPS as term agent, and the lenders party thereto. Under the terms of the Second Lien Credit Agreement, MediaCo was deemed to receive the Second Lien Term Loan of $30.0 million on April 17, 2024 in exchange for the Transactions. The Second Lien Term Loan will mature on April 17, 2029 and will be subject to monthly interest payments at a rate of SOFR + 6.00%. The Second Lien Term Loans are subject to a borrowing base in accordance with the terms of the Second Lien Credit Agreement.

Stockholders Agreement

On April 17, 2024, in connection with the Transactions, MediaCo entered into a stockholders’ agreement with SG Broadcasting and Aggregator (the “Stockholders Agreement”). The Stockholders’ Agreement provides Aggregator (i) the right to designate up to three individuals for election to the Board (each such designee, an “Investor Director Designee”), subject to reduction and termination based on certain MediaCo stock ownership requirements (including that such designation right falls away upon Aggregator ceasing to beneficially own at least ten percent (10%) of the fully diluted MediaCo common stock for ten consecutive days), and (ii) certain consent rights over material actions taken by MediaCo.

MediaCo Holding Inc. 21 2024 Proxy Statement

Registration Rights Agreement

On April 17, 2024, in connection with the Transactions, MediaCo entered into a registration rights agreement with SG Broadcasting and Aggregator (the “Registration Rights Agreement”), pursuant to which MediaCo has granted each of SG Broadcasting and Aggregator customary underwritten shelf takedown and piggyback rights with respect to the registration of shares of Class A Common Stock with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). In addition, MediaCo has agreed to prepare and file within three months of the Closing Date a registration statement covering the sale or distribution of shares of Class A Common Stock held by SG Broadcasting and Aggregator.

Network Affiliation and Supply Agreements

On April 17, 2024, in connection with the Transactions, Purchaser entered into a Network Program Supply Agreement (the “Network Program Supply Agreement”) with certain subsidiaries of Estrella that operate radio broadcast stations (the “Radio Stations”). Pursuant to the Network Program Supply Agreement, Purchaser has agreed to license certain programs and other material to the Radio Stations for distribution on the Radio Stations’ broadcast channels.

On April 17, 2024, in connection with the Transactions, Purchaser entered into a Network Affiliation Agreement (the “Network Affiliation Agreement”) with certain subsidiaries of Estrella that operate television broadcast stations (the “TV Stations”). Pursuant to the Network Affiliation Agreement, Purchaser has agreed to license certain programs and other material to the TV Stations for distribution on the TV Stations’ broadcast channels.

Relationship and Agreements with Emmis

MediaCo was formed by Emmis in connection with a transaction (the “Transactions”) with SG Broadcasting that involved, among other things, Emmis conveying the assets of radio stations WBLS-FM and WQHT-FM (the “New York Radio Stations”) to MediaCo (the “Separation”) and distributing (the “Distribution”) all of MediaCo’s Class A Shares to all of Emmis’ shareholders pro rata. Emmis and the Company operate separately, each as an independent public company. In connection with the Separation, we and Emmis entered into certain agreements to affect the separation of our business from Emmis and govern our relationship with Emmis after the Separation. The following is a summary of the terms of the material agreements that we have entered into with Emmis. These summaries set forth the terms of the agreements that we believe are material and are qualified in their entirety by reference to the full text of such agreements.

Transaction Agreement