00017838752023FYfalsehttp://fasb.org/us-gaap/2023#GoodwillAndIntangibleAssetImpairmentP9M0.0833http://fasb.org/us-gaap/2023#GainLossOnDerivativeInstrumentsNetPretaxhttp://fasb.org/us-gaap/2023#GainLossOnDerivativeInstrumentsNetPretax2500017838752023-01-012023-12-3100017838752023-06-30iso4217:USD00017838752024-04-10xbrli:shares00017838752023-12-3100017838752022-12-3100017838752022-01-012022-12-31iso4217:USDxbrli:shares0001783875us-gaap:CommonStockMember2021-12-310001783875us-gaap:AdditionalPaidInCapitalMember2021-12-310001783875us-gaap:RetainedEarningsMember2021-12-310001783875us-gaap:ParentMember2021-12-310001783875us-gaap:NoncontrollingInterestMember2021-12-3100017838752021-12-310001783875us-gaap:CommonStockMemberffntf:IslandGlobalHoldingsInc.Member2022-01-012022-12-310001783875ffntf:IslandGlobalHoldingsInc.Memberus-gaap:ParentMember2022-01-012022-12-310001783875ffntf:IslandGlobalHoldingsInc.Member2022-01-012022-12-310001783875ffntf:NewEnglandCannabisCorporationMemberus-gaap:CommonStockMember2022-01-012022-12-310001783875ffntf:NewEnglandCannabisCorporationMemberus-gaap:ParentMember2022-01-012022-12-310001783875ffntf:NewEnglandCannabisCorporationMember2022-01-012022-12-310001783875ffntf:BloomFarmsMemberus-gaap:CommonStockMember2022-01-012022-12-310001783875ffntf:BloomFarmsMemberus-gaap:ParentMember2022-01-012022-12-310001783875ffntf:BloomFarmsMember2022-01-012022-12-310001783875us-gaap:CommonStockMember2022-01-012022-12-310001783875us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001783875us-gaap:ParentMember2022-01-012022-12-310001783875us-gaap:RetainedEarningsMember2022-01-012022-12-310001783875us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001783875us-gaap:CommonStockMember2022-12-310001783875us-gaap:AdditionalPaidInCapitalMember2022-12-310001783875us-gaap:RetainedEarningsMember2022-12-310001783875us-gaap:ParentMember2022-12-310001783875us-gaap:NoncontrollingInterestMember2022-12-310001783875us-gaap:CommonStockMember2023-01-012023-12-310001783875us-gaap:ParentMember2023-01-012023-12-310001783875us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001783875us-gaap:RetainedEarningsMember2023-01-012023-12-310001783875us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001783875us-gaap:CommonStockMember2023-12-310001783875us-gaap:AdditionalPaidInCapitalMember2023-12-310001783875us-gaap:RetainedEarningsMember2023-12-310001783875us-gaap:ParentMember2023-12-310001783875us-gaap:NoncontrollingInterestMember2023-12-31ffntf:Segment0001783875ffntf:THCCannabisSegmentMember2023-01-012023-12-31ffntf:Dispensaryffntf:facility0001783875srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001783875srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001783875us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310001783875srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001783875us-gaap:EquipmentMember2023-12-310001783875us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001783875us-gaap:CustomerRelationshipsMember2023-12-310001783875srt:MinimumMemberus-gaap:TrademarksAndTradeNamesMember2023-12-310001783875srt:MaximumMemberus-gaap:TrademarksAndTradeNamesMember2023-12-310001783875us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2023-12-310001783875srt:MaximumMemberus-gaap:NoncompeteAgreementsMember2023-12-310001783875us-gaap:TradeSecretsMember2023-12-310001783875us-gaap:RetailMember2023-01-012023-12-310001783875us-gaap:RetailMember2022-01-012022-12-310001783875ffntf:WholesaleMember2023-01-012023-12-310001783875ffntf:WholesaleMember2022-01-012022-12-310001783875ffntf:RealEstateSalesMember2023-01-012023-12-310001783875ffntf:RealEstateSalesMember2022-01-012022-12-310001783875ffntf:UnharvestedCannabisMember2023-12-310001783875ffntf:UnharvestedCannabisMember2022-12-310001783875ffntf:HarvestedAndPurchasedCannabisMember2023-12-310001783875ffntf:HarvestedAndPurchasedCannabisMember2022-12-310001783875us-gaap:LandMember2023-12-310001783875us-gaap:LandMember2022-12-310001783875us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001783875us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001783875us-gaap:ConstructionInProgressMember2023-12-310001783875us-gaap:ConstructionInProgressMember2022-12-310001783875ffntf:FurnitureEquipmentAndOtherMember2023-12-310001783875ffntf:FurnitureEquipmentAndOtherMember2022-12-310001783875us-gaap:LeaseholdImprovementsMember2023-12-310001783875us-gaap:LeaseholdImprovementsMember2022-12-310001783875ffntf:ILGrownMedicineLLCMember2022-11-012022-11-3000017838752023-11-1700017838752023-11-172023-11-170001783875us-gaap:LicensingAgreementsMember2021-12-310001783875us-gaap:CustomerRelationshipsMember2021-12-310001783875us-gaap:NoncompeteAgreementsMember2021-12-310001783875us-gaap:TrademarksAndTradeNamesMember2021-12-310001783875us-gaap:TradeSecretsMember2021-12-310001783875us-gaap:LicensingAgreementsMember2022-01-012022-12-310001783875us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001783875us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310001783875us-gaap:TrademarksAndTradeNamesMember2022-01-012022-12-310001783875us-gaap:TradeSecretsMember2022-01-012022-12-310001783875us-gaap:LicensingAgreementsMember2022-12-310001783875us-gaap:CustomerRelationshipsMember2022-12-310001783875us-gaap:NoncompeteAgreementsMember2022-12-310001783875us-gaap:TrademarksAndTradeNamesMember2022-12-310001783875us-gaap:TradeSecretsMember2022-12-310001783875us-gaap:LicensingAgreementsMember2023-01-012023-12-310001783875us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001783875us-gaap:NoncompeteAgreementsMember2023-01-012023-12-310001783875us-gaap:TrademarksAndTradeNamesMember2023-01-012023-12-310001783875us-gaap:TradeSecretsMember2023-01-012023-12-310001783875us-gaap:LicensingAgreementsMember2023-12-310001783875us-gaap:NoncompeteAgreementsMember2023-12-310001783875us-gaap:TrademarksAndTradeNamesMember2023-12-3100017838752023-10-312023-10-310001783875ffntf:THCCannabisSegmentMember2023-12-310001783875ffntf:CBDWellnessSegmentMember2023-12-310001783875ffntf:NewEnglandCannabisCorporationAndIslandGlobalHoldingsIncMember2022-01-012022-12-310001783875ffntf:NewEnglandCannabisCorporationMember2022-12-310001783875ffntf:IslandGlobalHoldingsInc.Member2022-12-310001783875ffntf:NewEnglandCannabisCorporationAndIslandGlobalHoldingsIncMember2022-12-310001783875ffntf:NewEnglandCannabisCorporationMember2022-01-28xbrli:pure0001783875ffntf:NewEnglandCannabisCorporationMember2022-01-282022-01-280001783875ffntf:NewEnglandCannabisCorporationMemberffntf:SubordinateVotingShareMember2022-01-282022-01-280001783875ffntf:A29EverettStreetLLCMember2022-01-280001783875ffntf:A29EverettStreetLLCMember2022-01-282022-01-280001783875ffntf:IslandGlobalHoldingsInc.Member2022-04-250001783875ffntf:SubordinateVotingShareMemberffntf:IslandGlobalHoldingsInc.Member2022-04-252022-04-250001783875ffntf:IslandGlobalHoldingsInc.Member2022-04-252022-04-250001783875ffntf:IslandGlobalHoldingsInc.Memberffntf:IslandAcquisitionWarrantsMember2022-04-250001783875ffntf:IslandGlobalHoldingsInc.Memberus-gaap:TrademarksAndTradeNamesMember2022-04-252022-04-250001783875ffntf:SubordinateVotingShareMemberffntf:BloomFarmsMember2022-08-192022-08-190001783875ffntf:BloomFarmsMember2022-08-192022-08-190001783875ffntf:BloomFarmsMember2022-08-190001783875srt:MaximumMemberffntf:BloomFarmsMember2022-08-190001783875ffntf:EuphoriaLLCMember2023-03-270001783875ffntf:EuphoriaLLCMember2023-03-272023-03-270001783875ffntf:EuphoriaLLCMember2023-03-282023-12-310001783875ffntf:WestsideMember2023-11-170001783875ffntf:WestsideMember2023-11-172023-11-170001783875ffntf:WestsideMember2023-12-310001783875ffntf:OmOfMedicineMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-01-012023-12-310001783875ffntf:OmOfMedicineMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-12-310001783875srt:MinimumMemberffntf:ILGrownMedicineLLCMember2022-10-270001783875srt:MaximumMemberffntf:ILGrownMedicineLLCMember2022-10-270001783875ffntf:ILGrownMedicineLLCMember2022-11-102022-11-100001783875ffntf:ILGrownMedicineLLCMember2022-11-100001783875ffntf:LeaseAgreementForCultivationAndProductionFacilityInMattesonIllinoisMember2023-07-070001783875ffntf:LeaseAgreementForTheThirdDispensaryLocationInIllinoisMember2023-08-232023-08-230001783875ffntf:LeaseAgreementForTheThirdDispensaryLocationInIllinoisMember2023-12-310001783875us-gaap:BuildingMember2023-12-310001783875us-gaap:BuildingMember2022-12-3100017838752023-07-070001783875ffntf:CapitalUnitsOneMemberus-gaap:PrivatePlacementMember2020-11-232020-11-230001783875ffntf:CapitalUnitsOneMemberus-gaap:PrivatePlacementMember2020-11-23iso4217:CADxbrli:shares0001783875us-gaap:PrivatePlacementMember2020-11-232020-11-230001783875us-gaap:PrivatePlacementMember2020-11-230001783875us-gaap:MeasurementInputExercisePriceMemberus-gaap:PrivatePlacementMember2020-11-230001783875ffntf:WarrantsExercisableThroughMay12026Memberus-gaap:RelatedPartyMember2023-08-100001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMember2023-08-102023-08-100001783875ffntf:WarrantsExercisableThroughMay12026Member2023-08-090001783875ffntf:WarrantsExercisableThroughMay12026Member2023-08-100001783875ffntf:DebtInstrumentRefinanceTermOneMember2023-08-100001783875ffntf:DebtInstrumentRefinanceTermOneMemberffntf:WarrantsExercisableThroughMay12026Member2023-08-100001783875ffntf:DebtInstrumentRefinanceTermTwoMember2023-08-100001783875ffntf:DebtInstrumentRefinanceTermTwoMemberffntf:WarrantsExercisableThroughMay12026Member2023-08-100001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2020-11-230001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2023-12-310001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2020-11-230001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2023-12-310001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2020-11-23utr:Y0001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2023-12-310001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2020-11-230001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-11-230001783875us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001783875us-gaap:RestrictedStockUnitsRSUMember2023-11-132023-11-130001783875us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310001783875us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310001783875ffntf:WarrantLiabilitiesMember2023-01-012023-12-310001783875ffntf:WarrantLiabilitiesMember2022-01-012022-12-310001783875us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-01-012023-12-310001783875us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-01-012022-12-310001783875us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-12-310001783875ffntf:InterestRatePeriodOneMemberffntf:SecuredPromissoryNoteDatedMay102019Member2023-12-310001783875ffntf:InterestRatePeriodTwoMemberffntf:SecuredPromissoryNoteDatedMay102019Member2023-12-310001783875ffntf:SecuredPromissoryNoteDatedMay102019Member2023-12-310001783875ffntf:SecuredPromissoryNoteDatedMay102019Member2022-12-310001783875ffntf:PromissoryNoteDatedOctober132023Member2023-12-310001783875ffntf:PromissoryNoteDatedOctober132023Member2022-12-310001783875ffntf:ConvertiblePromissoryNoteDatedOctober62021Member2023-12-310001783875ffntf:ConvertiblePromissoryNoteDatedOctober62021Member2022-12-310001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2023-12-310001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2023-10-022023-10-020001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2022-12-310001783875ffntf:PromissoryNoteIssuedForNECCAcquisitionMember2022-12-310001783875ffntf:PromissoryNoteIssuedForNECCAcquisitionMember2023-12-310001783875ffntf:PromissoryNoteIssuedForIslandAcquisitionMember2023-12-310001783875ffntf:PromissoryNoteIssuedForIslandAcquisitionMember2022-12-310001783875ffntf:InterestRatePeriodOneMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2023-12-310001783875ffntf:InterestRatePeriodTwoMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2023-12-310001783875ffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2023-12-310001783875ffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-12-310001783875ffntf:InterestRatePeriodOneMemberffntf:UnsecuredPromissoryNoteDueNovember302024Member2023-12-310001783875ffntf:InterestRatePeriodTwoMemberffntf:UnsecuredPromissoryNoteDueNovember302024Member2023-12-310001783875ffntf:UnsecuredPromissoryNoteDueNovember302024Member2023-12-310001783875ffntf:UnsecuredPromissoryNoteDueNovember302024Member2022-12-310001783875ffntf:VariousMember2023-12-310001783875ffntf:VariousMember2022-12-310001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2023-10-020001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001783875ffntf:UnsecuredConvertiblePromissoryNoteWithHealthyPharmsIncMemberus-gaap:UnsecuredDebtMember2023-11-012023-11-300001783875ffntf:PromissoryNoteIssuedForNECCAcquisitionMember2022-07-280001783875ffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-300001783875ffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-302022-08-300001783875ffntf:InterestRatePeriodOneMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-300001783875ffntf:InterestRatePeriodOneMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-302022-08-300001783875ffntf:InterestRatePeriodTwoMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-300001783875ffntf:InterestRatePeriodTwoMemberffntf:PromissoryNoteDueFebruary2023At15PerMonthMember2022-08-302022-08-300001783875ffntf:PromissoryNotePurchaseAgreementWithHI4FrontLLCAndNavyCapitalGreenFundLPMember2023-10-102023-10-10iso4217:CAD0001783875ffntf:PromissoryNotePurchaseAgreementWithHI4FrontLLCAndNavyCapitalGreenFundLPMemberffntf:WarrantsForExtensionFeeMember2023-10-100001783875ffntf:InterestRatePeriodOneMemberffntf:UnsecuredPromissoryNoteDueNovember302024Member2022-09-160001783875ffntf:InterestRatePeriodTwoMemberffntf:UnsecuredPromissoryNoteDueNovember302024Member2022-09-160001783875ffntf:LILendingLLCLoanAgreementMember2019-05-100001783875ffntf:LILendingLLCLoanAgreementMember2023-12-31ffntf:draw0001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawOneMember2023-12-310001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawTwoMember2023-12-310001783875ffntf:LILendingLLCLoanAgreementMember2023-01-012023-12-310001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawOneMember2020-04-302020-04-300001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawOneMember2020-04-300001783875ffntf:LILendingLLCLoanAgreementMember2020-12-012020-12-310001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawOneMember2022-01-010001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawOneMember2020-12-310001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LILendingFacilityDrawTwoMember2022-01-010001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMember2023-07-310001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMemberus-gaap:RelatedPartyMember2023-07-012023-07-310001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMemberus-gaap:RelatedPartyMember2023-07-310001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMember2023-07-012023-07-310001783875ffntf:FirstAmendmentToLILendingLLCLoanAgreementMember2023-07-012023-12-310001783875ffntf:LILendingLLCLoanAgreementMember2022-12-310001783875ffntf:LILendingLLCLoanAgreementMember2022-01-012022-12-310001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2021-10-060001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2023-10-060001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2023-01-012023-12-310001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2022-01-012022-12-310001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2023-12-310001783875us-gaap:ConvertibleDebtMemberffntf:October2021ConvertibleNoteMember2022-12-310001783875ffntf:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-130001783875ffntf:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-132023-10-130001783875ffntf:SeniorSecuredCreditFacilityMemberus-gaap:PrimeRateMemberus-gaap:LineOfCreditMember2023-10-132023-10-1300017838752022-01-282022-01-28ffntf:extensionOption00017838752022-01-280001783875ffntf:PromissoryNoteIssuedForNECCAcquisitionMember2022-11-250001783875ffntf:ClassASubordinateVotingSharesMember2021-12-310001783875ffntf:ClassCMultipleVotingSharesMember2021-12-310001783875ffntf:ClassASubordinateVotingSharesMember2022-01-012022-12-310001783875ffntf:ClassCMultipleVotingSharesMember2022-01-012022-12-310001783875ffntf:ClassASubordinateVotingSharesMember2022-12-310001783875ffntf:ClassCMultipleVotingSharesMember2022-12-310001783875ffntf:ClassASubordinateVotingSharesMember2023-01-012023-12-310001783875ffntf:ClassCMultipleVotingSharesMember2023-01-012023-12-310001783875ffntf:ClassASubordinateVotingSharesMember2023-12-310001783875ffntf:ClassCMultipleVotingSharesMember2023-12-31ffntf:vote0001783875us-gaap:CommonClassAMember2023-12-310001783875us-gaap:CommonClassCMember2023-12-310001783875ffntf:WarrantOneMember2023-12-310001783875ffntf:WarrantTwoMember2023-12-310001783875ffntf:WarrantThreeMember2023-12-310001783875ffntf:WarrantFourMember2023-12-310001783875ffntf:WarrantFiveMember2023-12-310001783875ffntf:WarrantSixMember2023-12-310001783875us-gaap:NoncontrollingInterestMemberus-gaap:RelatedPartyMemberffntf:MmaCapitalLlcMember2023-12-310001783875us-gaap:NoncontrollingInterestMemberus-gaap:RelatedPartyMemberffntf:MmaCapitalLlcMember2022-12-310001783875ffntf:MmaCapitalLlcMemberus-gaap:RelatedPartyMember2021-12-310001783875ffntf:MmaCapitalLlcMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001783875ffntf:MmaCapitalLlcMemberus-gaap:RelatedPartyMember2022-12-310001783875ffntf:MmaCapitalLlcMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001783875ffntf:MmaCapitalLlcMemberus-gaap:RelatedPartyMember2023-12-31ffntf:plan0001783875ffntf:EquityIncentivePlanMember2023-01-012023-12-310001783875srt:MinimumMember2023-12-310001783875srt:MaximumMember2023-12-3100017838752021-01-012021-12-310001783875ffntf:EquityIncentivePlanMember2022-01-012022-12-310001783875us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001783875us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001783875us-gaap:CommonClassAMember2022-01-012022-12-310001783875ffntf:EquityIncentivePlanMemberffntf:CashlessExercisesOptionMember2022-01-012022-12-310001783875us-gaap:RestrictedStockUnitsRSUMember2023-07-272023-07-270001783875us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001783875ffntf:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMember2023-11-130001783875us-gaap:RestrictedStockUnitsRSUMember2023-11-130001783875us-gaap:StateAndLocalJurisdictionMember2023-12-310001783875us-gaap:DomesticCountryMember2023-12-310001783875us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleAbandonmentMemberffntf:CaliforniaOperationsMember2023-01-012023-12-310001783875us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleAbandonmentMemberffntf:CaliforniaOperationsMember2023-12-310001783875us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleAbandonmentMemberffntf:CaliforniaOperationsMember2022-01-012022-12-310001783875us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleAbandonmentMemberffntf:CaliforniaOperationsMember2022-12-310001783875us-gaap:RelatedPartyMemberffntf:SecuredPromissoryNoteDatedMay102019Member2019-05-100001783875us-gaap:RelatedPartyMemberffntf:SecuredPromissoryNoteDatedMay102019Member2023-12-310001783875ffntf:LILendingLLCMemberus-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMember2023-12-310001783875ffntf:LILendingLLCMembersrt:DirectorMemberus-gaap:RelatedPartyMember2023-12-310001783875srt:MinimumMember2023-01-012023-12-310001783875srt:MaximumMember2023-01-012023-12-310001783875ffntf:OmOfMedicineMember2021-12-310001783875ffntf:OmOfMedicineMember2022-01-012022-12-310001783875ffntf:OmOfMedicineMember2022-12-310001783875ffntf:OmOfMedicineMember2023-01-012023-12-310001783875ffntf:OmOfMedicineMember2023-12-310001783875ffntf:OmOfMedicineMember2020-12-310001783875srt:MaximumMemberffntf:OmOfMedicineMember2022-12-310001783875ffntf:OmOfMedicineMember2021-01-012021-12-310001783875ffntf:LitigationSuedByFlorivalMember2023-05-092023-05-090001783875ffntf:LitigationSuedByFlorivalMember2023-12-310001783875ffntf:LitigationSuedByTeichmanSeptember142023Member2023-09-142023-09-140001783875ffntf:LitigationSuedByTeichmanSeptember292023Member2023-09-292023-09-290001783875ffntf:LitigationSuedByTeichmanSeptember292023Member2023-09-290001783875ffntf:LitigationSuedByTeichmanSeptember292023Member2023-12-3100017838752022-10-13ffntf:defendant0001783875us-gaap:FairValueInputsLevel1Member2023-12-310001783875us-gaap:FairValueInputsLevel2Member2023-12-310001783875us-gaap:FairValueInputsLevel3Member2023-12-310001783875us-gaap:FairValueInputsLevel1Member2022-12-310001783875us-gaap:FairValueInputsLevel2Member2022-12-310001783875us-gaap:FairValueInputsLevel3Member2022-12-310001783875us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310001783875ffntf:ConvertibleNotesNotesPayableAndAccruedInterestMember2023-12-310001783875ffntf:ConstructionFinanceLiabilityMember2023-12-310001783875ffntf:THCCannabisSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001783875ffntf:THCCannabisSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001783875us-gaap:OperatingSegmentsMemberffntf:CBDWellnessSegmentMember2023-01-012023-12-310001783875us-gaap:OperatingSegmentsMemberffntf:CBDWellnessSegmentMember2022-01-012022-12-310001783875us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001783875us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001783875ffntf:THCCannabisSegmentMemberus-gaap:OperatingSegmentsMember2023-12-310001783875ffntf:THCCannabisSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001783875us-gaap:OperatingSegmentsMemberffntf:CBDWellnessSegmentMember2023-12-310001783875us-gaap:OperatingSegmentsMemberffntf:CBDWellnessSegmentMember2022-12-310001783875us-gaap:CorporateNonSegmentMember2023-12-310001783875us-gaap:CorporateNonSegmentMember2022-12-310001783875ffntf:LILendingLLCLoanAgreementMemberus-gaap:SubsequentEventMember2024-01-290001783875ffntf:LILendingLLCLoanAgreementMemberus-gaap:SubsequentEventMember2024-01-292024-01-290001783875ffntf:LILendingLLCLoanAgreementMemberffntf:LoanConversionWarrantsMemberus-gaap:SubsequentEventMember2024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 000-56075

| | |

4Front Ventures Corp. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| British Columbia | | 83-4168417 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | |

7010 E. Chauncey Lane, Suite 235 Phoenix, Arizona 85054 |

(Address of principal executive offices and zip code) |

Registrant’s telephone number, including area code: (602) 633-3067

Securities registered pursuant to Section 12(b) of the Act:

None.

Securities registered pursuant to Section 12(g) of the Act:

| | |

Class A Subordinate Voting Shares, no par value |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2023 was approximately $88,955,560, based on the closing sale price reported for such date on the OTCQX. Common stock held by each executive officer, director and holder of more than 5% of the registrant’s common stock have been excluded based on the assumption that such persons may be deemed to be affiliates. These assumptions should not be deemed to constitute an admission that such persons are affiliates, or that there are not other persons who may be deemed to be affiliates, of the registrant.

As of April 10, 2024, there were 912,923,993 shares of the registrant’s Class A Subordinate Voting Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

4Front Ventures Corp.

FORM 10-K

For the Annual Period Ended December 31, 2023

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| PART I. | | |

| Item 1. | | 5 |

| Item 1A. | | 28 |

| Item 1B. | | 28 |

| Item 1C. | | 28 |

| Item 2. | | 28 |

| Item 3. | | 29 |

| Item 4. | | 30 |

| | |

| PART II. | | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 31 |

| Item 6. | | 32 |

| Item 7. | | 33 |

| Item 7A. | | 43 |

| Item 8. | | 43 |

| Item 9. | | 43 |

| Item 9A. | | 43 |

| Item 9B. | | 45 |

| Item 9C | | 45 |

| | |

| PART III. | | |

| Item 10. | | 46 |

| Item 11. | | 51 |

| Item 12. | | 54 |

| Item 13. | | 59 |

| Item 14. | | 59 |

| | |

| PART IV. | | |

| Item 15. | | 61 |

| Item 16. | | 61 |

| | | |

| | | 65 |

Use of Market and Industry Data

This Annual Report on Form 10-K (this “annual report”) includes market and industry data that 4Front Ventures Corp. (together with its subsidiaries, “4Front,” the “Company,” “we,” “us,” or “our”) has obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of, and experience in, the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this annual report are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates only and there will usually be differences between the prospective and actual results, because events and circumstances frequently do not occur as expected, and those differences may be material. Also, references in this annual report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this annual report .

Trademarks, Trade Names and Service Marks

“4Front,” “4Front Ventures,” “Mission” and other trademarks or service marks of 4Front appearing in this annual report are the property of 4Front Ventures Corp. or its subsidiaries. The other trademarks, trade names and service marks appearing in this annual report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this annual report are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Other Pertinent Information

As of April 10, 2024, the Company has two classes of stock: (i) Class A Subordinate Voting Shares (“SVS”), and (ii) Class C Multiple Voting Shares (“MVS”), both with no par value. The Company is authorized to issue an unlimited number of SVS and an unlimited number of MVS. Holders of SVS are entitled to one vote in respect of each SVS. Holders of MVS are entitled to 800 votes in respect of each MVS and have certain conversion rights as further described in Note 12 of the Company’s audited consolidated financial statements appearing elsewhere in this annual report.

As of April 10, 2024, 912,923,993 SVS and 1,276,208 MVS were issued and outstanding.

Dollar amounts in this annual report are denominated in United States dollars unless otherwise indicated. References to $ are to the lawful currency of the United States and references to C$ are to the lawful currency of Canada.

Forward-Looking Statements

This annual report contains forward-looking statements within the meaning of the United States and Canadian securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. All statements that do not relate strictly to historical or factual matters included in this annual report, including those regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. These forward-looking statements are based on management’s current beliefs, based on currently available information, as to the outcome and timing of future events. Forward-looking statements contained in this report include, but are not limited to, statements about:

•the performance of our business and operations;

•our product offerings;

•the competitive conditions of the cannabis industry;

•our competitive and business strategies;

•the sufficiency of capital including our ability to obtain capital to develop our business;

•our operations in the United States, the characterization and consequences of those operations under United States federal law and applicable state law, and the framework for the enforcement of applicable laws in the United States;

•implications of the war in Ukraine;

•the impact of macroeconomic trends, such as the rate of unemployment, interest rates, the rate of inflation and the availability of credit;

•statements relating to the business and future activities of, and developments related to, us, including such things as future business strategy, competitive strengths, goals, expansion and growth of our business, operations and plans;

•expectations that licenses applied for will be obtained, and that the Company will be able to maintain all of the licenses that it currently holds;

•expectations regarding future cash flows from operations;

•potential future legalization of adult-use and/or medical cannabis under U.S. state and federal law;

•expectations of market size and growth in the U.S. and the states in which we operate;

•expectations for other economic, business, financial market, political, regulatory and/or competitive factors related to us or the cannabis industry generally; and

•other events or conditions that may occur in the future.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this report.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described elsewhere in this report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this report. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements made in this report will be achieved or occur, and actual results, events or circumstances could differ materially from those described in such forward-looking statements.

PART I

Item 1. Business.

4Front Ventures Corp. (“4Front” or the “Company”) is a vertically integrated, multi-state cannabis operator and retailer, with a market advantage in mass-produced, low-cost, quality branded cannabis products. The Company manufactures and distributes a portfolio of over 25 cannabis brands including Mission, the Hunt, Marmas, Crystal Clear, Legends, and Island. The Company distributes its products through third party retail outlets, as well as the Company’s chain of branded dispensaries. From plant genetics to automated manufacturing, to the cannabis retail experience – 4Front’s team applies expertise across the entire cannabis value chain.

Overview

The Company exists pursuant to the provisions of the British Columbia Corporations Act. On July 31, 2019, 4Front Holdings LLC (“Holdings”) completed a Reverse Takeover Transaction (“RTO”) with Cannex Capital Holdings, Inc. (“Cannex”) whereby Holdings acquired Cannex and the shareholders of Holdings became the controlling shareholders of the Company. Following the RTO, the Company’s SVS are listed on the Canadian Securities Exchange (“CSE”) under the ticker “FFNT” and are quoted on the OTCQX under the ticker “FFNTF”.

The Company has two primary operating segments: THC Cannabis and CBD Wellness. With regard to its THC Cannabis segment, as of December 31, 2023, the Company operated five cannabis dispensaries in Massachusetts and Illinois under the “MISSION” brand name, three cultivation and production facilities in Massachusetts, and one cultivation and production facility in Illinois. The Company produces the majority of the products that are sold at its Massachusetts and Illinois MISSION dispensaries.

The Company’s CBD Wellness segment is focused upon its ownership and operation of its wholly owned subsidiary, Pure Ratios Holdings, Inc. (“Pure Ratios”), a CBD-focused wellness company, that sells non-THC products throughout the United States.

While marijuana is legal under the laws of several U.S. states (with varying restrictions), the United States Federal Controlled Substances Act classifies all “marijuana” as a Schedule I drug, whether for medical or recreational use. Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of safety data for the use of the drug under medical supervision.

Recent Developments

Asset Acquisition of Euphoria, LLC

On March 27, 2023, the Company entered into a Membership Interest Purchase Agreement to acquire 100% of the issued and outstanding equity interests in Euphoria, LLC, which holds a conditional adult use dispensary license in the state of Illinois. The transfer of the license is subject to regulatory approval. Please see Note 7 of the consolidated financial statements for a full description of the transaction.

Asset Acquisition of Westside Visionaries, LLC

On November 17, 2023, the Company entered into a Membership Interest Purchase Agreement to acquire 100% of the issued and outstanding equity interests in Westside Visionaries, LLC ("Westside") for a total purchase price of $2.4 million to be paid in cash, a promissory note, and Class A Subordinate Voting Shares. In addition, Westside has issued a $2.0 million secured promissory note to fund the permitted expansion for the dispensary build-out with a maturity date of the earlier of the second anniversary of closing (license approval) or the third anniversary of the date on which the note was executed. Westside holds a conditional adult use dispensary license in the state of Illinois

which shall convert to a state license upon regulatory approval. The transfer of the license is subject to regulatory approval.

Discontinued THC Operations in California

During the fiscal quarter ended September 30, 2023, the Company ceased its THC cannabis cultivation and production operations in the state of California (together, the "California operations"). Each of the Company’s California subsidiaries filed an intent to wind up and dissolve with the Secretary of State of California in January 2024. The Company's abandonment of its California operations represented a strategic shift, and thus all assets and liabilities related to the operations within the state of California were classified as discontinued operations. Revenue and expenses, gains and losses relating to the discontinuation of its California operations were eliminated from the Company's profit and loss from continuing operations, and are shown as a single line item in the consolidated statements of operations for all periods presented.

Closure of Michigan Location

On May 19, 2023, the Company entered into an Asset Purchase Agreement to sell its retail dispensary located in Ann Arbor, Michigan, which was subsequently amended in January 2024. On November 8, 2023, the Company shuttered operations at the dispensary. The transaction is subject to close upon regulatory approval which is expected in the first half of 2024.

Construction of the Matteson Facility

On July 7, 2023, the Company amended its lease agreement for the cultivation and production facility in Matteson, Illinois (the "Matteson Facility"), to apply its security deposit mainly to the monthly base rent for the four month period ended November 30, 2023; to defer payment of the $2.2 million increase in security deposit, to be funded as draws on the tenant improvement allowance through November 30, 2023; and to make pro-rata payments of such deferred payments equal to 1/12 of the aggregate amount, concurrently with monthly base rent installments, for the twelve month period commencing January 1, 2024.

On December 6, 2023, the Company amended its lease agreement for the Matteson Facility, making an encroachment agreement and the dumpster enclosure agreement part of its lease.

On January 1, 2024, the Company amended its lease agreement for the Matteson Facility to reduce the rent for the property through October 2024, applying the security deposit to be made to certain reimbursements owed to the landlord, and extending the term of the lease for the facility and the other properties leased by the Company from Innovative Industrial Properties through December 31, 2044.

On February 5, 2024, the Company completed construction of the Matteson Facility, with operations expected to commence in the second quarter of fiscal 2024. The state-of-the-art Matteson Facility, now one of the largest cultivation and manufacturing centers in Illinois, spans approximately 250,000 square feet of production space, and includes the use of innovative and energy efficient technologies such DLC-certified LED lighting, HVAC systems utilizing cutting edge compressor wall technology, and fully automated irrigation and fertigation systems.

Extension of Secured Debt

On July 31, 2023, the Company entered into a definitive agreement with the Company’s secured lender, LI Lending, LLC (“LI”), a related party, to extend the maturity date to May 1, 2026, reduce the interest rate to 12.0% per annum beginning May 1, 2024, and expand the amount of third-party financings allowed under the December 17, 2020 Amended and Restated Loan and Security Agreement (“Loan”) between 4Front and LI.

The Company agreed to pay an extension fee of $0.5 million payable in cash on May 1, 2024. In addition, the Company issued warrants to purchase a variable number of subordinate voting shares to LI wherein each warrant

shall be exercisable into one (1) Subordinate Voting Share of the Company at an exercise price of $0.17 through May 1, 2026. Because 4Front obtained permitted secured debt senior to the Loan in excess of $8.0 million (up to the $10.0 million maximum) as described below, 100% of the warrants became exercisable by cashless exercise.

On January 29, 2024, the Company agreed with LI to convert $23.0 million of the Company’s secured debt to Class A Subordinate Voting Shares at market price and issued LI a warrant for 36,702,127 shares of Class A Subordinate Voting Shares at a price of $0.11, as well as a restricted stock unit agreement providing that, in the event of a financing by the Company at less than C$0.125 per share of Class A Subordinate Voting Shares, LI shall be entitled to receive the number of shares necessary to restore it to 18.43% of the voting interests of the Company.

Debt Amendments

On September 28, 2023, the Company amended the unsecured promissory note dated September 20, 2019 wherein the interest rate was reduced to 11% per annum through March 15, 2024, and the maturity date was extended to November 30, 2024. By March 15, 2024, the parties intend to agree to an interest rate on the promissory note through maturity. The Company shall make monthly payments of $25,000 through December 2023 and monthly interest payments thereafter.

On October 2, 2023, the Company amended the unsecured convertible promissory note with Healthy Pharms Inc., wherein the interest rate was amended to 12.0% per annum and the maturity date was extended to December 18, 2024. Beginning January 15, 2024, the Company shall make monthly cash payments of $50,000 through the maturity date. In November 2023, the Company issued 10,359,372 Class A Subordinate Voting Shares to the note holder at an exercise price of C$0.26 per share to settle $1,992,187 of the promissory note.

On October 6, 2023, the Company amended the October 2021 Convertible Note wherein payment of interest shall be deferred and become due and payable upon the earlier of the maturity date, a change of control, or event of default under the existing agreement terms. In addition, the outstanding balance, including any deferred interest payments, shall accrue interest at a rate of 10.0% per annum through maturity. The conversion price was amended to $0.23 per share.

On October 10, 2023, the Company amended the Promissory Note Purchase Agreement with HI 4Front, LLC and Navy Capital Green Fund, LP, wherein the maturity date was extended to January 1, 2024. As consideration for the amendment, the Company paid an extension fee of C$65,000 in the form of 1,283,425 share purchase warrants, wherein each warrant is exercisable into one (1) Subordinate Voting Share at an exercise price of US$0.20 and expire on October 17, 2027.

$10 Million Senior Secured Credit Facility

On October 13, 2023, the Company entered into a senior secured credit facility with ALT Debt II, LP for an aggregate principal of up to $10.0 million (the "Credit Facility"). A term loan in the amount of $6.0 million was drawn on the closing date and a second tranche of $4.0 million is available to be drawn through July 13, 2024 (together the “Term Loans”). The Term Loans accrue interest, paid monthly in arrears, at a rate equal to the greater of (a) the sum of the prime rate and 7.0% and (b) 15.5% per annum. The Term Loans initially matured on December 1, 2023, and included extension terms under certain circumstances to no further than September 30, 2026. For each term loan, the Company shall pay an origination fee equal to 7.0% of the principal amount of the term loan upon issuance. In addition, the Company shall pay a commitment fee on the undrawn second tranche, which shall accrue at a rate per annum of 2.0% through the earlier of July 13, 2024 and the date on which the maximum facility amount is drawn. The Company may prepay the term loans, in whole or in part, at any time subject to the prepayment fee based on the date of the prepayment. Further, the Company shall pay an exit fee of $1.4 million upon the earlier of the maturity date or the date on which the obligations are paid in full. The funds are committed to building out the Company’s retail operations in Illinois in connection with the launch of the Matteson Facility. Refer to Note 11 of the financial statements for further information.

In connection with the Credit Facility, on November 13, 2023, the Company entered into a restricted stock unit ("RSU") agreement with ALT Debt II, LP to issue a total of 15,900,000 RSU's, wherein each RSU is exercisable into one (1) Class A Subordinate Voting Share upon the earliest of certain specified conditions, at an issue price of C$0.31 per RSU. If at the time of the distribution event the number of SVS underlying the RSUs is less than 2.12% of the fully diluted SVS of the Company (calculated in accordance with the terms of the RSU Agreement), an additional number of RSUs will be issuable to ALT Debt II, LP by the Company with respect to the deficiency, each issuable at the closing market price on the Canadian Securities Exchange on the trading day prior to issuance.

Equipment Sale

On November 17, 2023, the Company entered into an agreement with a third party to purchase a significant piece of equipment for a purchase price of $1.4 million. $0.95 million of the purchase price was paid in cash with the remaining $0.5 million contemplated in a promissory note. This equipment was classified as assets related to discontinued operations as of December 31, 2023.

Management Changes

Effective March 14, 2023, the Board of Directors appointed Kristopher Krane as an interim member of the Board. Mr. Krane has continued to serve as a strategic advisor to the Company since stepping down as 4Front Co-Founder and President of Mission Dispensaries after more than a decade with the business.

Effective May 16, 2023, Amit Patel resigned as a director and the Chair of the Audit Committee of the Company.

Effective July 31, 2023, Keith Adams resigned as Chief Financial Officer of the Company. Effective August 4, 2023, Nicole Frederick was named Interim Chief Financial Officer.Effective November 30, 2023, Nicole Frederick resigned as Chief Financial Officer of the Company. Effective December 1, 2023, Peter Kampian was appointed as Chief Financial Officer. A description of Mr. Kampian's business experience and executive compensation is included in "Item 10. Directors, Executive Officers and Corporate Governance" and "Item 11. Executive Compensation" in this Form 10-K.

Effective January 8, 2024, Leonid Gontmakher resigned as Chief Executive Officer. Mr. Gontmakher will remain on the board of directors of the Company as a director and will continue to serve as a consultant to the Company.

Effective January 8, 2024, Andrew Thut was appointed as Chief Executive Officer. Mr. Thut resigned as Chief Investment Officer at that time.

Business

As of December 31, 2023, the Company had two business segments:

•THC Cannabis – Encompassing the cultivation, production, manufacturing, and distribution of THC cannabis products to owned dispensaries and third-party retailers, providing ancillary services for the support of wholesale operations, and retail sales direct to end consumers

•CBD Wellness – Pure Ratios encompasses the production and sale of CBD products to third-party customers via a national direct-to-consumer e-commerce platform

THC Cannabis - Retail

As part of its THC Cannabis segment, the Company owns and operates three dispensaries in Massachusetts, and two dispensaries in Illinois. The Company leases the real estate of all three Massachusetts dispensaries and the Calument City, Illinois dispensary. The Company owns the real estate at its South Shore, Illinois dispensary. The Company has entered into two conditional management service agreements to manage the operations of the Euphoria, LLC

and Westside Visionaries, LLC dispensaries, both of which are still under construction until the dispensaries receive final licenses.

The Company’s dispensaries are branded under the “MISSION” retail brand. The dispensaries sell products which are either: (1) purchased from licensed cannabis producers in the state in which they operate, if allowed under state law and regulation; or, (2) transferred from the Company’s owned production operations within the relevant state market as in the case of markets where “vertical integration” is allowed (i.e. jurisdictions in which the Company can and does own both retail and production cannabis assets such as Illinois or Massachusetts). Product availability varies depending on conditions in the Company’s key retail markets, and the performance of the Company’s own production assets. Interstate commerce of cannabis is illegal under state and federal law, and therefore the Company currently cannot transfer inventory between key markets.

The Company is focused on expanding its own production assets in order to provide better product availability for the retail segments, especially focusing on increasing supply of high-quality dried cannabis flower including markets where such product is in relatively short supply, such as Illinois and Massachusetts.

Generally, the Company sells cannabis packaged goods in accordance with applicable state law and regulation through retail dispensaries (i.e. in store). The Company has also expanded its services in certain markets to accommodate online ordering, curbside pickup, and delivery where such activities are permitted by applicable state law and regulation.

The Company operates age-gated online platforms (https://4frontventures.com/ and https://missiondispensaries.com/) for patients and customers of its dispensaries (the “Online Platform”). The content of such websites is not deemed to be incorporated by reference in this report or filed with the SEC. Prior to launching the Online Platform, the Company’s compliance team and internal and external counsel undertook a review of the applicable federal and state privacy, advertising and cannabis laws and launched the Online Platform in a manner intended to ensure compliance with such laws. The Online Platform allows patients and customers to understand the cannabis products that the Company offers, and view real-time pricing and product availability at the Company’s dispensaries, and as a repository of miscellaneous corporate and investor information. The Online Platform does not provide any education, information or any other functionalities with respect to any third-party dispensaries.

No purchase or sale transactions occur on the Online Platform. A patient or customer may reserve products using the Online Platform, but the patient or customer must be physically present at one of the Company’s dispensaries to consummate the purchase and sale of products. This requirement allows the Company and dispensary staff to ensure that the Company’s standard operating procedures (including its compliance program(s)) are applied to all patients and customers in connection with the purchase and sale of products.

In jurisdictions where medical cannabis is legal, once a patient arrives at the applicable dispensary, dispensary staff must verify the patient’s identity and accreditation (such as a state-issued medical cannabis card), and confirm the patient’s allotment to ensure the user is not exceeding the state’s allotment limits. Once the foregoing is verified, the patient must pay for the product(s) to complete the purchase. If the customer does not have valid identification and accreditation, the customer will not be able to purchase medical cannabis at the applicable Company dispensary, irrespective of any reservation(s) made on the Online Platform.

In jurisdictions where recreational cannabis is legal, once a customer arrives at the applicable dispensary, dispensary staff must verify that the customer is at least 21 years of age by verifying the customer’s government-issued identification. Once the identification is verified, the customer must pay for the product(s) to complete the transaction. If the customer does not have valid identification, the customer will not be able to purchase recreational cannabis at the applicable Company dispensary, irrespective of any reservation(s) made on the Online Platform.

THC Cannabis - Cultivation & Production

As part of its THC Cannabis segment, the Company operates three facilities in Massachusetts and one facility in Illinois. The Company leases all of these facilities. The Company produces dried cannabis flower and trim, extracted cannabis products such as wax and distillate, and cannabis infused edible products in its production facilities.

The production segment utilizes certain raw materials to produce cannabis flowers and other extracted products. To produce and dry cannabis flower, the Company utilizes growing medium, nutrients, water, electrical power, soil adjuvants, and certain beneficial pests as part of its integrated pest management efforts. There are many sources for such products (except for water and power, which are provided by the local utility), and prices are reflective of commodity pricing worldwide. Some of these raw material inputs are sourced internationally, so changes in import laws or duties are a potential risk. The prices of power and water are generally stable and set through processes that involve governmental approvals over any increases, but the prices of growing medium, nutrients, etc. are all at least somewhat exposed to underlying commodity price volatility.

For extract products, an additional input is butane or propane for use as a solvent. These gases are largely a commodity, with their pricing being reflective of worldwide conditions, and they are supplied to the Company’s operations by local suppliers of industrial gases and materials in the relevant jurisdictions. Prices for such inputs may be volatile, as with any other commodity.

The Company employs certain state registered and unregistered trademarks in association with its cannabis goods, including the dried cannabis flower brands “Island”, “Legends” and “The Hunt,” the edibles brands “Chewee’s”, “Hi-Burst,” “Marmas” and “KOKO Gemz,” and the extracts brands “Evergreen Cannabis”, “Dabl” and “Crystal Clear”.

CBD Wellness

The Company’s CBD Wellness segment is focused upon its ownership and operation of its wholly owned subsidiary, Pure Ratios. Pure Ratios is a cannabidiol (“CBD”) products company that sells a variety of CBD products, both directly to consumer, business to business, and through third party fulfillment vendors. The products include CBD patches, salves, roll-ons, and tablets containing CBD with apoptogenic mushroom ingredients. Pure Ratios produces certain base ingredients, such as the CBD plus proprietary ingredient mixtures which are then injected into the finished patches by contract manufacturers. The Company also sells its Pure Ratios branded products through its CBD e-commerce platform www.pureratios.com. The content of such websites is not deemed to be incorporated by reference in this report or filed with the SEC.

The Pure Ratios segment utilizes certain raw materials to produce its CBD source materials, as do its contract manufacturers. These products include CBD source material, and certain herbs and other ayurvedic ingredients which are part of Pure Ratios’ formulations. These raw materials are generally commodities and their prices are reflective of worldwide commodity prices and volatility.

Pure Ratios utilizes reservoir patch technology, trade secrets and other intangible know-how in the creation and formulation of the proprietary blend of herbs and other ingredients which are combined with CBD in its products.

Pure Ratios creates certain of its CBD source materials through its proprietary processes and techniques, but creation and assembly of finished goods (e.g. salves, patches, etc.) is contracted to third party contract manufacturers. Additionally, Pure Ratios contracts with an internet sales organization which advertises Pure Ratios products, and then fulfills those products as well. Pure Ratios is therefore economically dependent on such third party manufacturers, and the third party advertising/fulfillment company.

Beginning in 2020, the market experienced a significant decrease in pricing across CBD products as additional suppliers entered the market. However, if federal and state policies change in favor of the industry, and if the FDA begins to test and regulate the quality of related consumer products, the downward trend in pricing could reverse. Please see the “Description of the U.S. Legal Cannabis Industry” section for further information on the regulatory landscape in which the Company operates.

Corporate Structure

4Front Ventures Corp. is a corporation existing under the provisions of the Business Corporations Act (British Columbia). The Company currently owns or manages licensed cannabis facilities in state-licensed markets in the United States. On July 31, 2019, 4Front Holdings LLC (“Holdings”) and Cannex Capital Holdings Inc. (“Cannex”) completed a business combination which resulted in the business of each of Holdings and Cannex becoming the business of the Company (the “Business Combination”).

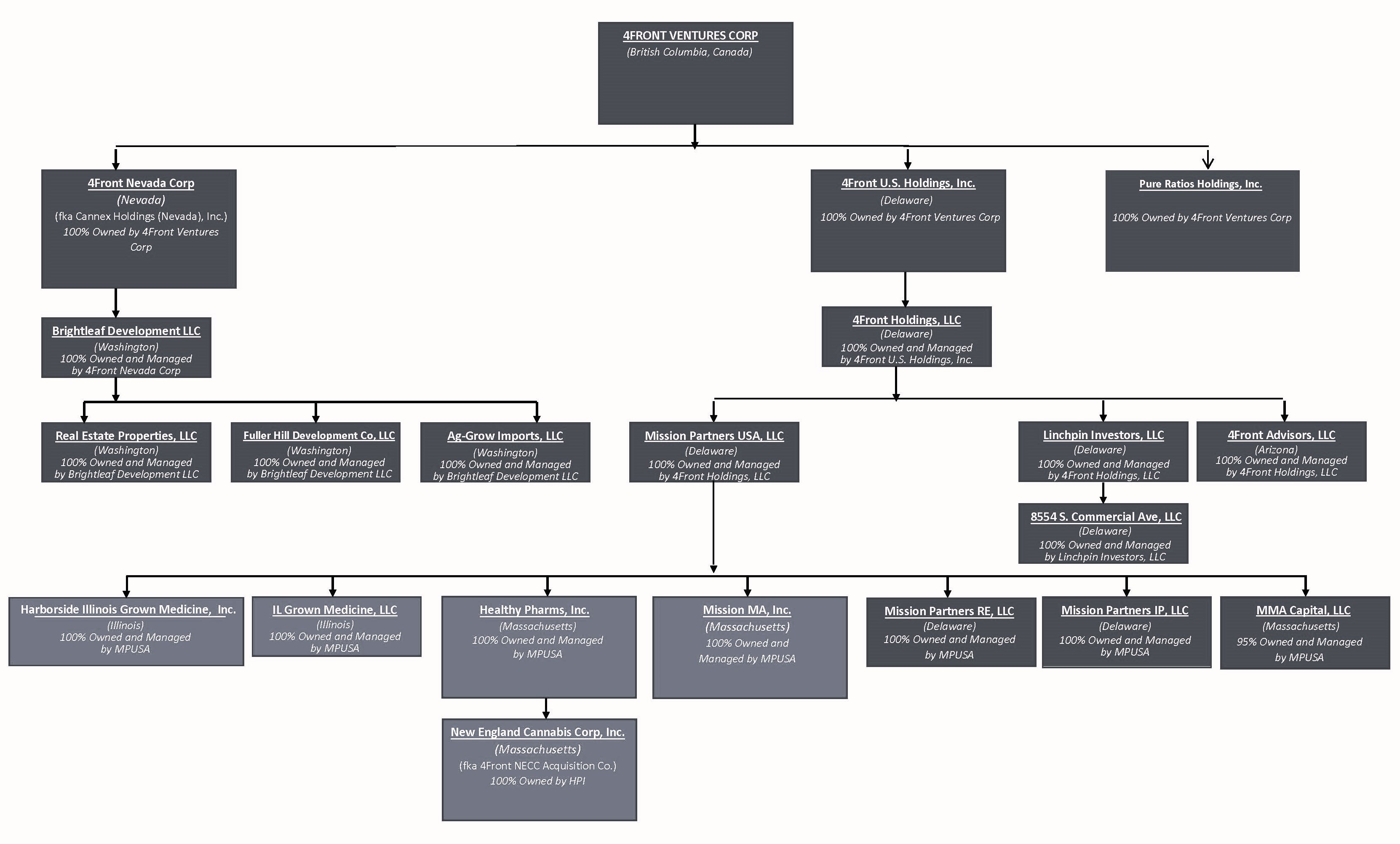

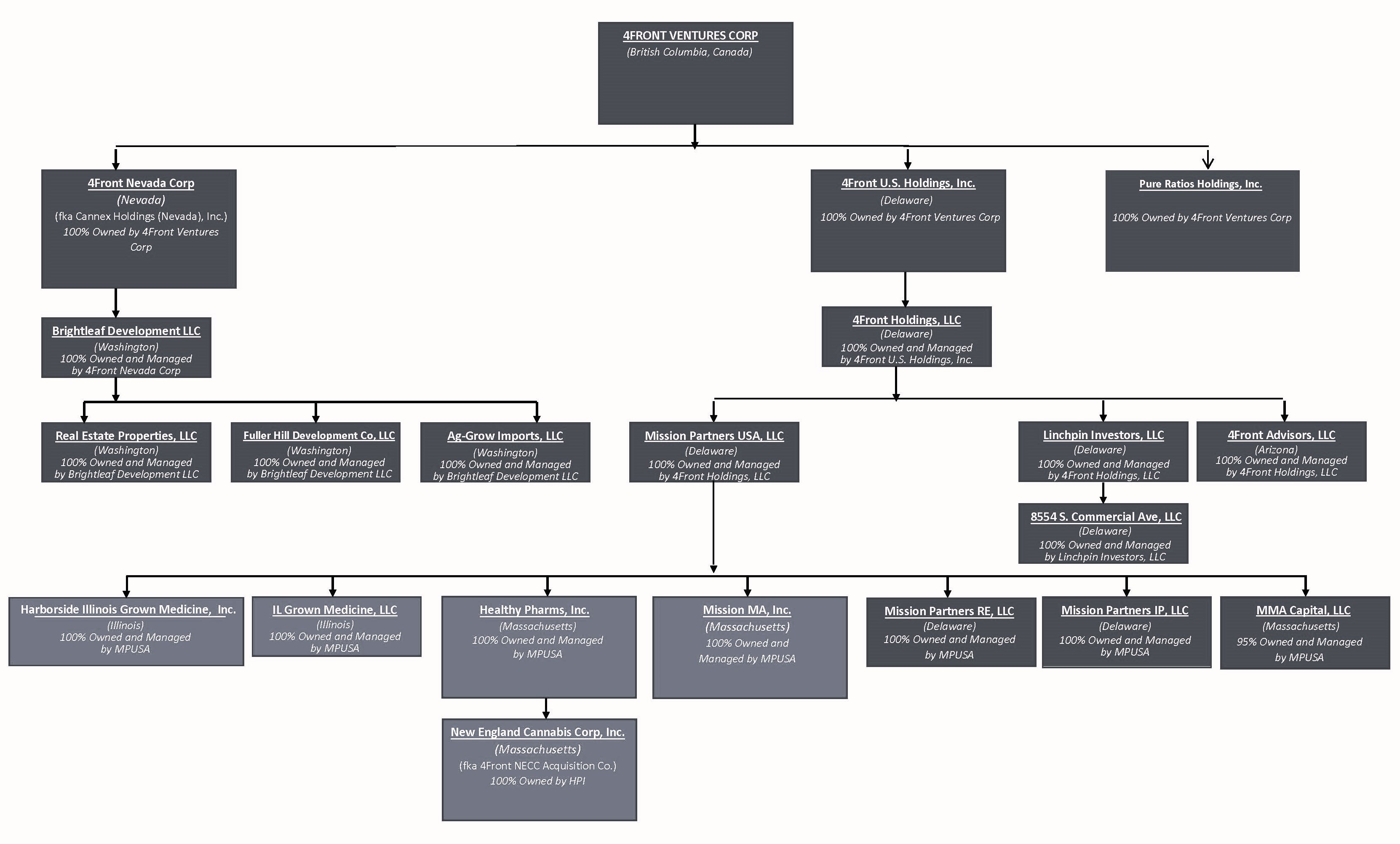

The following is an organizational chart that represents the current intercorporate relationships among the Company and its subsidiaries.

We are and intend to be, directly or indirectly through certain of our subsidiaries and proposed acquisition targets, engaged in the cultivation, processing, sale and distribution of cannabis in the cannabis marketplaces in Illinois, and Massachusetts, and engaged in leasing cannabis cultivation and production facilities and the supply of packaging in Washington. Although we believe that all of our business activities are compliant with applicable U.S. state and local law, strict compliance with state and local laws with respect to cannabis may neither absolve the Company of liability under U.S. federal law, nor may it provide a defense to any federal proceeding which may be brought against the Company.

We directly or indirectly own and control the voting equity of all the subsidiaries in the percentages set forth in the table below.

| | | | | | | | | | | | | | | | | |

| Holding Entity | % Owned | State | License Number | Expiry Date | Description |

| Healthy Pharms Inc. | 100% | MA | MTC285

MR281754

MC281631

MP281450

| October 25, 2024

August 06, 2024

August 06, 2024

August 06, 2024

| Co-located Cultivation / Production / Dispensary |

| Mission MA, Inc. | 100% | MA | MTC1125

MC281288

MR281259

LIC202074

B-17-2919

MR282028

| January 15, 2025

December 19, 2024

December 19, 2024

May 31, 2024

December 31, 2023 (1)

December 22, 2024

| Co-located Cultivation / Production / Dispensary

Adult-use Dispensary |

| New England Cannabis Corporation, Inc. | 100% | MA | MC281251

MP281466

| April 11, 2025 (1)

April 11, 2025 (1) | Adult-use Cultivation & Production |

| MMA Capital, LLC | 95% | MA | N/A | N/A | Finance Company |

| Harborside Illinois Grown Medicine, Inc. | 100% | IL | DISP.000053

284.000341-DISP

284.000342-DISP

2529888

5516

| June 8, 2024

March 31, 2026

March 31, 2026

May 15, 2025

December 31, 2023 (1)

| Dispensary (allowing for the operation of 2 dispensaries)

Adult use/Dispensary

Adult use/Dispensary |

| IL Grown Medicine, LLC | 100% | IL | 1504160768- AU

1504160768

1504160768-TR | March 31, 2025

April 16, 2024 (1)

July 14, 2024

| Cultivation and Transportation |

| Real Estate Properties LLC | 100% | WA | N/A | N/A | Real Estate Holding |

| Ag-Grow Imports LLC | 100% | WA | N/A | N/A | Importer of Equipment |

| Brightleaf Development LLC | 100% | WA | N/A | N/A | Holding Company |

| Fuller Hill Development Co, LLC | 100% | WA | N/A | N/A | Real Estate Holding |

| Pure Ratios Holdings, Inc. | 100% | DE | N/A | N/A | Online CBD Retail |

| 4Front US Holdings, Inc. | 100% | DE | N/A | N/A | Holding Company |

| 4Front Holdings, LLC | 100% | DE | N/A | N/A | Holding Company |

| Mission Partners IP, LLC | 100% | DE | N/A | N/A | IP Holding Company |

| Mission Partners USA, LLC | 100% | DE | N/A | N/A | Investment Company |

| Linchpin Investors, LLC | 100% | DE | N/A | N/A | Finance Company |

| 4Front Advisors, LLC | 100% | AZ | N/A | N/A | Consulting Company |

| 4Front Nevada Corp. | 100% | NV | N/A | N/A | Holding Company |

(1) Renewal application has been submitted and is in process.

DESCRIPTION OF THE U.S. LEGAL CANNABIS INDUSTRY

In accordance with Canadian Securities Administrators Staff Notice 51-352 – Issuers with U.S. Marijuana-Related Activities (“Staff Notice 51-352”), below is a discussion of the federal and state-level U.S. regulatory regimes in those jurisdictions where the Company is directly involved through certain subsidiaries and investees and expects to be involved in the U.S. legal cannabis industry. The Company is, through certain subsidiaries, and intends to be, directly or indirectly, through additional subsidiaries and proposed acquisition targets, directly engaged in the cultivation, processing, sale and distribution of cannabis in Illinois and Massachusetts, and in the leasing of cannabis cultivation and production facilities, sale of equipment and supplies, and licensing of intellectual property in Washington.

In accordance with the licenses outlined below, the Company has approximately $0.275 million in surety bonds with states, where required. The surety bonds carry no further liability but provide a financial assurance that the Company will perform according to the laws and regulations governing the license.

The following table is intended to assist readers in identifying those parts of this Form 10-K that address the disclosure expectations outlined in Staff Notice 51-352.

| | | | | | | | |

| Industry Involvement | Specific Disclosure Necessary to Fairly Present all Material Facts, Risks and Uncertainties | Cross Reference |

| All issuers with U.S. Marijuana-Related Activities | Describe the nature of the Corporation’s involvement in the U.S. marijuana industry and include the disclosures indicated for at least one of the direct, indirect and ancillary industry involvement types noted in this table. | •Item 1. Business – Description of the U.S. Legal Cannabis Industry |

| Prominently state that marijuana is illegal under U.S. federal law and that enforcement of relevant laws is a significant risk. | •Item 1. Business - Description of the U.S. Legal Cannabis Industry – Legal and Regulatory Matters |

| Discuss any statements and other available guidance made by federal authorities or prosecutors regarding the risk of enforcement action in any jurisdiction where the Corporation conducts U.S. marijuana-related activities. | •Item 1. Business - Description of the U.S. Legal Cannabis Industry – Legal and Regulatory Matters |

| Outline related risks including, among others, the risk that third-party service providers could suspend or withdraw services and the risk that regulatory bodies could impose certain restrictions on the Corporation’s ability to operate in the U.S. | •Item 1. Business - Description of the U.S. Legal Cannabis Industry – Legal and Regulatory Matters |

| Given the illegality of marijuana under U.S. federal law, discuss the Corporation’s ability to access both public and private capital and indicate what financing options are/are not available in order to support continuing operations. | •Item 1. Business - Description of the U.S. Legal Cannabis Industry – Legal and Regulatory Matters |

| Quantify the Corporation’s balance sheet and operating statement exposure to U.S. marijuana related activities. | • Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Disclose if legal advice has not been obtained, either in the form of a legal opinion or otherwise, regarding (a) compliance with applicable state regulatory frameworks and (b) potential exposure and implications arising from U.S. federal law. | •Item 1. Business – Description of the U.S. Legal Cannabis Industry and - Compliance |

| | | | | | | | |

| U.S. Marijuana Issuers with direct involvement in cultivation or distribution | Outline the regulations for U.S. states in which the Corporation operates and confirm how the Corporation complies with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. | •Item 1. Business – Description of the U.S. Legal Cannabis Industry - The Regulatory Landscape on a U.S. State Level |

| Discuss the Corporation’s program for monitoring compliance with U.S. state law on an ongoing basis, outline internal compliance procedures and provide a positive statement indicating that the Corporation is in compliance with U.S. state law and the related licensing framework. Promptly disclose any non-compliance, citations or notices of violation which may have an impact on the Corporation’s license, business activities or operations. | • Item 1. Business - Compliance |

| U.S. Marijuana Issuers with indirect involvement in cultivation or distribution | Outline the regulations for U.S. states in which the Corporation’s investee(s) operate. | •Not applicable |

| Provide reasonable assurance, through either positive or negative statements, that the investee’s business is in compliance with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. Promptly disclose any non- compliance, citations or notices of violation, of which the Corporation is aware, that may have an impact on the investee’s license, business activities or operations. | •Not applicable |

|

| U.S. Marijuana Issuers with material ancillary involvement | Provide reasonable assurance, through either positive or negative statements, that the applicable customer’s or investee’s business is in compliance with applicable licensing requirements and the regulatory framework enacted by the applicable U.S. state. | •Item 1. Business - Description of the U.S. Legal Cannabis Industry - The Regulatory Landscape on a U.S. State Level and Compliance |

As of the date hereof, 100% of the Company’s business is derived from direct or ancillary U.S. cannabis-related activities. The following chart sets out, the U.S. state(s) in which the Company and its subsidiaries operates in, as more specifically described below.

| | | | | | | | | | | | | | |

| State | Primary Cannabis Regulator(s) | Direct, Indirect, or Ancillary Involvement in the U.S. Cannabis Industry (1) | Currently Operational? | Brief Description of |

| IL | Dispensary: Illinois Department of Financial and Professional Regulation (IDFPR). Cultivation Center: Illinois Department of Agriculture (DOA) | Direct | Yes | Owner of 3 dispensary licenses (allowing for the operation of 2 dispensaries, one with adult use and medical, one with adult use only) and 1 cultivation/production license. Manager of 2 additional not-yet operational adult use dispensaries. |

| MA | Massachusetts Cannabis Control Commission (CCC) | Direct | Yes | Owner of 2 medical treatment center licenses for retail, cultivation and processing, 3 adult use retail licenses, and 5 adult use cultivation and processing licenses. |

| WA | Washington State Liquor and Cannabis Board | Ancillary | Yes | Landlord and packaging supplier to cultivation and production licensees. |

Regulatory Matters

United States Federal Regulation of the Cannabis Market

Marijuana (the dried flowers, leaves, stems, and seeds of the cannabis plant) is illegal under U.S. federal law, and enforcement of relevant laws governing marijuana-related activities is a significant risk for the Company. The U.S. federal government regulates drugs through, among other things, the Controlled Substances Act (“CSA”), 21 U.S.C. § 801 et seq., which places controlled substances, including marijuana, in a schedule. Marijuana is a Schedule I drug. A Schedule I controlled substance is defined as having no currently accepted medical use, a high potential for abuse and a lack of accepted safety for use under medical supervision. With the limited exception of the U.S. Food and Drug Administration (“FDA”) approving Epidiolex (cannabidiol) (CBD) oral solution for the treatment of seizures associated with two rare and severe forms of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome, the FDA has not approved any other cannabis or cannabis-derived compound as a safe and effective drug for any indication. The FDA has approved Marinol and Syndros for therapeutic uses in the U.S., including for the treatment of anorexia associated with weight loss in AIDS patients. Marinol and Syndros include the active ingredient dronabinol, a synthetic delta-9-tetrahydrocannabinol (“THC”). Another FDA-approved drug, Cesamet, contains the active ingredient nabilone, which has a chemical structure similar to THC and is synthetically derived.

Unlike in Canada, which has federal legislation governing the cultivation, distribution, sale, and possession of medical and adult-use cannabis, cannabis is largely regulated at the state level in the United States.

State laws regulating cannabis are in direct conflict with the federal CSA, which makes cannabis use and possession federally illegal. As of December 31, 2023, 38 states, the District of Columbia, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, and the U.S. Virgin Islands have legalized cannabis for medical use, and 24 of those states and the District of Columbia, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, and Guam have legalized adult use of cannabis for recreational purposes. Although many states and territories have and continue to legalize cannabis production and distribution by licensed entities, under U.S. federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia remains illegal under any and all circumstances.

On January 4, 2018, former U.S. Attorney General Jeff Sessions issued a memorandum to all U.S. Attorneys in which he rescinded previous guidance from the U.S. Department of Justice (“DOJ”) specific to cannabis enforcement in the United States, including a memorandum drafted by former Deputy Attorney General James Michael Cole in 2013 (the “Cole Memorandum”). With the Cole Memorandum rescinded, U.S. federal prosecutors have been given discretion in determining whether to prosecute cannabis related violations of U.S. federal law.

On November 7, 2018, Mr. Sessions resigned and William Barr was sworn in as United States Attorney General. During his confirmation hearing on January 15, 2019, Mr. Barr pledged not to pursue marijuana companies that comply with state law. This pledge was made in writing, when responding to written questions from Senators: “As discussed in my hearing, I do not intend to go after parties who have complied with the state law in reliance on the Cole Memorandum.” During William Barr’s tenure as Attorney General, DOJ did not pursue marijuana companies that comply with state law.

On March 10, 2021, the U.S. Senate confirmed President Biden’s nominee for Attorney General, Merrick Garland. During his confirmation hearing on February 22, 2021, Garland said, among other things, that “It does not seem to me a useful use of limited resources that we have, to be pursuing prosecutions in states that have legalized and that are regulating the use of marijuana, either medically or otherwise. I don’t think that’s a useful use. I do think we need to be sure there are no end-runs around the state laws that criminal enterprises are doing. So that kind of enforcement should be continued. But I don’t think it’s a good use of our resources, where states have already authorized. That only confuses people, obviously, within the state.” To date, there have been no new federal cannabis memorandums issued by the DOJ or any published change in federal enforcement policy.

On October 6, 2022, President Biden directed the Secretary of Health and Human Services and the Attorney General to initiate the administrative process to review expeditiously how marijuana is scheduled under U.S. federal law. Simultaneously, Biden also announced a pardon of all prior federal simple possession of marijuana offenses and urged state governors to do the same with regard to state level offenses.

On August 29, 2023, the U.S. Department of Health and Human Services (HHS) issued a recommendation to the U.S. Drug Enforcement Administration (DEA) that cannabis be reclassified from Schedule I to Schedule III under the Controlled Substances Act (CSA).1 In January, a review detailing the scientific findings underpinning this recommendation was provided to a Texas lawyer, Matthew Zorn, who had sued HHS for its release. While HHS Secretary Xavier Becerra previously confirmed that his agency had made a recommendation in light of President Biden’s October 2022 Executive Order, neither the text of the recommendation nor any accompanying documentation had been made public.

For fiscal years 2015 through 2018, Congress adopted budget riders to the Consolidated Appropriations Acts (sometimes referred to as the Rohrabacher-Farr or Rohrabacher-Blumenauer Amendment after its original lead sponsor, and now referred to as the Joyce Amendment after its current lead sponsor) to prevent the federal government from using appropriated funds to enforce federal marijuana laws against regulated medical cannabis actors operating in compliance with state and local law. The Rohrabacher-Blumenauer Amendment was included in the fiscal year 2018 budget passed on March 23, 2018.

On September 27, 2019, the Joyce Amendment was renewed as part of a stopgap spending bill, in effect through November 21, 2019. On December 27, 2020, the Joyce Amendment was approved as part of the omnibus spending bill for fiscal year 2021, effective through September 30, 2021. Congress has renewed the amendment several times, on September 30, 2021, December 3, 2021, February 18, 2022, and March 11, 2022. On March 15, 2022 the amendment was renewed through the signing of the fiscal year 2022 omnibus spending bill, effective through September 30, 2022. As of March 21, 2024, the Joyce Amendment is effective through September 30, 2024.

United States Federal Regulation of Industrial Hemp

On December 20, 2018, the Agricultural Improvement Act of 2018 (commonly known as the “2018 Farm Bill”) was signed into law. The 2018 Farm Bill, among other things, removes industrial hemp and its derivatives, including cannabidiol (“CBD”), from the CSA and amends the Agricultural Marketing Act of 1946 to allow for industrial hemp production and sale in the United States. Under the Farm Bill, industrial hemp is defined as “the plant Cannabis sativa L. and any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with a delta-9-tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis.”