uwmc-20211231FYfalse202100017833980.25P0Y8M18DP0Y9M1DP7M00017833982021-01-012021-12-310001783398us-gaap:CommonClassAMember2021-01-012021-12-310001783398us-gaap:WarrantMember2021-01-012021-12-3100017833982021-06-30iso4217:USD0001783398us-gaap:CommonClassAMember2022-02-24xbrli:shares0001783398uwmc:CommonClassDMember2022-02-2400017833982019-01-012019-12-3100017833982021-12-3100017833982020-12-31iso4217:USDxbrli:shares0001783398us-gaap:CommonClassAMember2021-12-310001783398us-gaap:CommonClassBMember2021-12-310001783398us-gaap:CommonClassCMember2021-12-310001783398uwmc:CommonClassDMember2021-12-3100017833982020-01-012020-12-310001783398us-gaap:AdditionalPaidInCapitalMember2018-12-310001783398us-gaap:RetainedEarningsMember2018-12-3100017833982018-12-310001783398us-gaap:RetainedEarningsMember2019-01-012019-12-310001783398us-gaap:AdditionalPaidInCapitalMember2019-12-310001783398us-gaap:RetainedEarningsMember2019-12-3100017833982019-12-310001783398us-gaap:RetainedEarningsMember2020-01-012020-12-310001783398us-gaap:AdditionalPaidInCapitalMember2020-12-310001783398us-gaap:RetainedEarningsMember2020-12-310001783398us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001783398srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001783398us-gaap:RetainedEarningsMember2021-01-012021-01-2000017833982021-01-012021-01-200001783398us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-210001783398uwmc:CommonClassDMemberus-gaap:CommonStockMember2021-01-210001783398us-gaap:AdditionalPaidInCapitalMember2021-01-210001783398us-gaap:RetainedEarningsMember2021-01-210001783398us-gaap:NoncontrollingInterestMember2021-01-2100017833982021-01-210001783398us-gaap:RetainedEarningsMember2021-01-222021-12-3100017833982021-01-222021-12-310001783398us-gaap:NoncontrollingInterestMember2021-01-222021-12-310001783398us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-222021-12-310001783398us-gaap:AdditionalPaidInCapitalMember2021-01-222021-12-310001783398us-gaap:RetainedEarningsMembersrt:RevisionOfPriorPeriodReclassificationAdjustmentMember2021-01-210001783398srt:RevisionOfPriorPeriodReclassificationAdjustmentMemberus-gaap:NoncontrollingInterestMember2021-01-210001783398srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2021-01-210001783398us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001783398uwmc:CommonClassDMemberus-gaap:CommonStockMember2021-12-310001783398us-gaap:AdditionalPaidInCapitalMember2021-12-310001783398us-gaap:RetainedEarningsMember2021-12-310001783398us-gaap:NoncontrollingInterestMember2021-12-310001783398uwmc:UWMLLCMember2021-01-200001783398uwmc:SFSCorpMember2021-01-21xbrli:pure0001783398uwmc:UwmHoldingsCorporationMember2021-01-21uwmc:vote0001783398us-gaap:CommonClassAMember2021-01-210001783398uwmc:CommonClassDMember2021-01-210001783398us-gaap:CommonClassCMember2021-01-210001783398us-gaap:CommonClassBMember2021-01-210001783398us-gaap:CommonClassBMember2021-01-012021-12-310001783398uwmc:ClassBAndClassDMemberuwmc:UwmHoldingsCorporationMemberuwmc:SFSCorpMember2021-01-212021-01-210001783398us-gaap:CommonClassAMembersrt:MinimumMember2021-01-210001783398us-gaap:CommonClassAMembersrt:MaximumMember2021-01-210001783398uwmc:GoreHoldingsIVIncMember2021-01-212021-01-210001783398uwmc:GoresHoldingsIVIncMember2021-01-2100017833982021-01-212021-12-310001783398us-gaap:CommonClassAMember2021-10-012021-12-31uwmc:Segment0001783398us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-01-010001783398srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-01-010001783398us-gaap:GovernmentNationalMortgageAssociationGnmaInsuredLoansMember2021-12-310001783398us-gaap:GovernmentNationalMortgageAssociationGnmaInsuredLoansMember2020-12-310001783398us-gaap:GovernmentNationalMortgageAssociationGnmaInsuredLoansMember2021-01-012021-12-310001783398us-gaap:GovernmentNationalMortgageAssociationGnmaInsuredLoansMember2020-01-012020-12-310001783398us-gaap:IPOMemberuwmc:GoresHoldingsIVIncMember2020-01-012020-01-310001783398us-gaap:CommonClassAMemberus-gaap:IPOMemberuwmc:GoresHoldingsIVIncMember2020-01-310001783398us-gaap:IPOMemberuwmc:GoresHoldingsIVIncMember2020-01-31iso4217:USDuwmc:unit0001783398us-gaap:CommonClassAMemberuwmc:PublicWarrantsMemberuwmc:GoresHoldingsIVIncMember2020-01-310001783398uwmc:PublicWarrantsMemberuwmc:GoresHoldingsIVIncMember2020-01-310001783398uwmc:PrivateWarrantsMemberuwmc:GoresHoldingsIVIncMember2020-01-31iso4217:USDuwmc:warrant0001783398uwmc:PublicWarrantsMember2021-01-210001783398uwmc:PrivateWarrantsMember2021-01-210001783398us-gaap:InterestRateLockCommitmentsMember2021-12-310001783398us-gaap:InterestRateLockCommitmentsMember2020-12-310001783398uwmc:ForwardLoanSaleCommitmentsMember2021-12-310001783398uwmc:ForwardLoanSaleCommitmentsMember2020-12-310001783398uwmc:MortgageServicingRightsMember2021-12-310001783398uwmc:MortgageServicingRightsMember2020-12-310001783398uwmc:MortgageServicingRightsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001783398uwmc:MortgageServicingRightsMember2021-01-012021-12-310001783398uwmc:MortgageServicingRightsMember2021-09-300001783398uwmc:MortgageServicingRightsMember2021-07-012021-09-300001783398uwmc:MortgageServicingRightsMember2019-12-310001783398uwmc:MortgageServicingRightsMember2018-12-310001783398uwmc:MortgageServicingRightsMember2020-01-012020-12-310001783398uwmc:MortgageServicingRightsMember2019-01-012019-12-310001783398uwmc:MortgageServicingRightsMembersrt:MinimumMember2021-01-012021-12-310001783398uwmc:MortgageServicingRightsMembersrt:MaximumMember2021-01-012021-12-310001783398uwmc:MortgageServicingRightsMembersrt:WeightedAverageMember2021-01-012021-12-310001783398uwmc:MortgageServicingRightsMembersrt:MinimumMember2020-01-012020-12-310001783398uwmc:MortgageServicingRightsMembersrt:MaximumMember2020-01-012020-12-310001783398uwmc:MortgageServicingRightsMembersrt:WeightedAverageMember2020-01-012020-12-310001783398srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001783398us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MinimumMember2021-01-012021-12-310001783398srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001783398us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2021-01-012021-12-310001783398us-gaap:LeaseholdImprovementsMember2021-12-310001783398us-gaap:LeaseholdImprovementsMember2020-12-310001783398us-gaap:FurnitureAndFixturesMember2021-12-310001783398us-gaap:FurnitureAndFixturesMember2020-12-310001783398us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310001783398us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310001783398us-gaap:ConstructionInProgressMember2021-12-310001783398us-gaap:ConstructionInProgressMember2020-12-310001783398srt:MinimumMember2021-12-310001783398srt:MaximumMember2021-12-310001783398uwmc:RelatedPartyFinanceLeaseMember2021-01-012021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueMay242022Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueMay242022Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly62022Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly62022Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueOctober202022Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueOctober202022Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueNovember92022Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueNovember92022Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueDecember222022Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueDecember222022Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJanuary92023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJanuary92023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueFebruary2220231Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueFebruary2220231Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueFebruary2220232Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueFebruary2220232Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueApril232023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueApril232023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueMay262023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueMay262023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly282023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly282023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueAugust302023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueAugust302023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueSeptember182023Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueSeptember182023Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJune232021Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJune232021Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly12021Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueJuly12021Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueSeptember192021Member2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditDueSeptember192021Member2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditWithEarlyFundingASAPMember2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditWithEarlyFundingASAPMember2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditWithEarlyFundingEFMember2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditWithEarlyFundingEFMember2020-12-310001783398uwmc:WarehouseLineOfCreditMember2021-12-310001783398uwmc:WarehouseLineOfCreditMember2020-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditThroughEarlyFundingProgramMember2021-12-310001783398uwmc:WarehouseLineOfCreditMemberuwmc:LineOfCreditWithNoExpirationGestationLineMember2021-12-310001783398uwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2021-12-310001783398uwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-12-310001783398uwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-12-310001783398uwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-12-310001783398us-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2020-12-310001783398uwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-11-030001783398srt:ScenarioForecastMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2022-11-152025-11-150001783398us-gaap:DebtInstrumentRedemptionPeriodTwoMembersrt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2022-11-152025-11-150001783398srt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2022-11-152025-11-150001783398srt:ScenarioForecastMembersrt:MaximumMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-11-032022-11-140001783398srt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-11-032022-11-140001783398us-gaap:DebtInstrumentRedemptionPeriodThreeMembersrt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-11-032022-11-140001783398uwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-04-070001783398uwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2020-11-030001783398srt:ScenarioForecastMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2024-04-152029-04-150001783398us-gaap:DebtInstrumentRedemptionPeriodTwoMembersrt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2024-04-152029-04-150001783398srt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2024-04-152029-04-150001783398srt:ScenarioForecastMembersrt:MaximumMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-04-072024-04-140001783398srt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-04-072024-04-140001783398us-gaap:DebtInstrumentRedemptionPeriodThreeMembersrt:ScenarioForecastMemberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-04-072024-04-140001783398us-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-11-220001783398srt:ScenarioForecastMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2024-06-152027-06-150001783398us-gaap:DebtInstrumentRedemptionPeriodTwoMembersrt:ScenarioForecastMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2024-06-152027-06-150001783398srt:ScenarioForecastMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2024-06-152027-06-150001783398srt:ScenarioForecastMembersrt:MaximumMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-11-222024-06-140001783398srt:ScenarioForecastMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-11-222024-06-140001783398us-gaap:DebtInstrumentRedemptionPeriodThreeMembersrt:ScenarioForecastMemberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-11-222024-06-140001783398uwmc:HoldingsLLCMember2021-01-012021-12-310001783398us-gaap:SecuredDebtMembersrt:MinimumMember2021-01-012021-12-310001783398srt:MaximumMemberus-gaap:SecuredDebtMember2021-01-012021-12-310001783398uwmc:HoldingsLLCMemberus-gaap:CommonClassAMember2021-12-310001783398uwmc:HoldingsLLCMemberus-gaap:CommonClassBMemberuwmc:SFSCorpMember2021-12-310001783398uwmc:HoldingsLLCMember2021-12-310001783398uwmc:FNMAFHLMCAndGNMAMember2021-12-310001783398us-gaap:FairValueInputsLevel1Member2021-12-310001783398us-gaap:FairValueInputsLevel2Member2021-12-310001783398us-gaap:FairValueInputsLevel3Member2021-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001783398us-gaap:FairValueInputsLevel1Memberuwmc:ForwardLoanSaleCommitmentsMember2021-12-310001783398uwmc:ForwardLoanSaleCommitmentsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001783398uwmc:ForwardLoanSaleCommitmentsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001783398uwmc:MortgageServicingRightsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001783398uwmc:MortgageServicingRightsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001783398uwmc:MortgageServicingRightsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001783398us-gaap:FairValueInputsLevel1Member2020-12-310001783398us-gaap:FairValueInputsLevel2Member2020-12-310001783398us-gaap:FairValueInputsLevel3Member2020-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001783398us-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001783398us-gaap:FairValueInputsLevel1Memberuwmc:ForwardLoanSaleCommitmentsMember2020-12-310001783398uwmc:ForwardLoanSaleCommitmentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001783398uwmc:ForwardLoanSaleCommitmentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001783398srt:WeightedAverageMemberus-gaap:InterestRateLockCommitmentsMemberuwmc:MeasurementInputPullThroughRateMember2021-12-310001783398srt:WeightedAverageMemberus-gaap:InterestRateLockCommitmentsMemberuwmc:MeasurementInputPullThroughRateMember2020-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueNovember152025Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberuwmc:SeniorUnsecuredNotesDueApril152029Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2021-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2020-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberuwmc:SeniorUnsecuredNotesDueJune152027Member2020-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2021-12-310001783398us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2020-12-310001783398us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2020-12-310001783398srt:ChiefExecutiveOfficerMember2021-01-012021-12-31uwmc:aircraft0001783398srt:ManagementMember2021-01-012021-12-310001783398srt:AffiliatedEntityMember2021-01-012021-12-310001783398srt:AffiliatedEntityMember2020-01-012020-12-310001783398srt:AffiliatedEntityMember2019-01-012019-12-310001783398uwmc:A2020UWMHoldingsCorporationOmnibusIncentivePlanMember2021-12-310001783398us-gaap:RestrictedStockUnitsRSUMember2020-12-310001783398us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001783398us-gaap:RestrictedStockUnitsRSUMember2021-12-310001783398us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001783398us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-01-012021-12-310001783398uwmc:MortgageServicingRightsMemberus-gaap:SubsequentEventMember2022-01-310001783398us-gaap:SubsequentEventMember2022-01-012022-01-310001783398uwmc:MortgageServicingRightsMemberus-gaap:SubsequentEventMember2022-03-010001783398us-gaap:SubsequentEventMember2022-03-012022-03-010001783398us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2022-02-282022-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number 001-39189

UWM HOLDINGS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | | 84-2124167 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

585 South Boulevard E. | Pontiac, | MI | 48341 |

(Address of Principal Executive Offices) | | (Zip Code) |

(800) 981-8898

Registrant's telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | UWMC | New York Stock Exchange |

| Warrants, each warrant exercisable for one share of Class A Common Stock | UWMCWS | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

Non-accelerated filer | o | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the registrant's voting stock held by non-affiliates on June 30, 2021 was $774,077,257, based on the closing price on the New York Stock Exchange on that date of $8.45. (Does not include shares issuable upon exercise of warrants).

As of February 24, 2022, the registrant had 92,529,679 shares of Class A common stock outstanding and 1,502,069,787 shares of Class D common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its 2022 Annual Meeting of Stockholders, which is to be filed no later than 120 days after December 31, 2021, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| | | | | |

| Section Name | Page |

| |

| |

| |

| PART I | |

| |

| |

| |

| |

| |

| |

| PART II | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART III | |

| |

| |

| |

| |

| |

| PART IV | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

GLOSSARY OF TERMS

| | | | | | | | |

Terms | | Definitions |

“Fannie Mae” | | The Federal National Mortgage Association is a government-sponsored enterprise that purchases qualifying mortgage loans from mortgage lenders, packages them together, and sells them as a mortgage-backed security to investors on the secondary market. |

| | |

“FHA” | | The Federal Housing Administration is a governmental agency that provides mortgage insurance on loans made by FHA-approved lenders. |

| | |

“Forward-settling Loan Sale Commitment” or “FLSC” or “TBA” | | A forward-settling Loan Sale Commitment (also referred to as a FLSC or a TBA) is a forward derivative that requires a mortgage lender to commit to deliver at a specific future date a mortgage-backed security issued by Fannie Mae, Freddie Mac or guaranteed by Ginnie Mae which is collateralized by an undesignated pool of mortgage loans. |

| | |

“Freddie Mac” | | The Federal Home Loan Mortgage Corporation is a government-sponsored enterprise that purchases qualifying mortgage loans from mortgage lenders, packages them together, and sells them as a mortgage-backed security to investors on the secondary market. |

| | |

“Ginnie Mae” | | Government National Mortgage Association is a government-owned corporation that guarantees mortgage-backed securities that have been guaranteed by a government agency, mainly the Federal Housing Administration and the Veterans Administration. |

| | |

“GSE” | | Government-sponsored enterprises, such as Fannie Mae and Freddie Mac. |

| | |

“interest rate lock commitment” or “IRLC” | | An interest rate lock commitment is a binding agreement by a mortgage lender with a borrower to extend a mortgage loan at a specified interest rate and term within a specified period of time. |

| | |

“loan officers” | | We use the term loan officers to refer to the individual employees of our clients. Each loan officer is licensed, or exempt from licensure, in the state or states in which he or she operates. |

| | |

“mortgage-backed security” or “MBS” | | Mortgage-backed securities, or MBSs, are securities that are secured by a pool of mortgage loans, which does not include the MSRs which are separated from the mortgage loan prior to the mortgage loan being placed in the pool and are therefore not part of the collateral. |

| | |

“mortgage servicing rights” or “MSRs” | | Mortgage servicing rights, or MSRs, are the right to service a mortgage loan for a fee, which rights are separated from the mortgage loan once the mortgage loan is sold in the secondary market. |

| | |

“To Be Announced market” | | The To Be Announced market is a secondary market where FLSCs or TBAs are sold by lenders seeking to hedge the risk that market interest rates may change and lock in a price for the mortgages they are in the process of originating. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. Specifically, forward-looking statements in this report may include statements relating to:

• the future financial performance of our business;

• changes in the market for our services;

• expansion plans and opportunities;

• our future growth, including our pace of loan originations;

• our ability to implement our corporate strategy, including retaining our leading position in the wholesale lending channel, and the impact of such strategy on our future operations and financial and operational results;

• our strategic advantages and the impact that those advantages will have on future financial and operational results;

• the advantages of the wholesale mortgage market;

• industry growth and trends in the wholesale mortgage market and in the mortgage industry generally;

• our approach and goals with respect to technology;

• our current infrastructure, client-based business strategies, strategic initiatives and product pipeline;

• the impact of various interest rate environments and changes in LIBOR on our future financial results of operations;

• our evaluation of competition in our markets and our relative position;

• our accounting policies;

• macroeconomic conditions that may affect our business and the mortgage industry in general;

• political and geopolitical conditions that may affect our business and the mortgage industry in general;

• the impact of the COVID-19 pandemic, or any other similar pandemic or public health situation, on our

business and the mortgage industry in general; and

• other statements preceded by, followed by or that include the words “may,” “can,” “should,” “will,”

“estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or

similar expressions.

These forward-looking statements involve estimates and assumptions which may be affected by risks and uncertainties in the Company’s business, as well as other external factors, which could cause future results to materially differ from those expressed or implied in any forward-looking statement including those risks set forth below in Risk Factor Summary and the other risks and uncertainties indicated in this report, including those set forth under the section entitled “Risk Factors.”

All forward-looking statements speak only as of the date of this report and should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

RISK FACTOR SUMMARY

An investment in our securities involves substantial risk. Our ability to execute on our strategy also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following the Summary below may cause us not to realize the full benefits of our competitive strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks we face include the following:

•our dependence on macroeconomic and U.S. residential real estate market conditions, including changes in U.S. monetary policies that affect interest rates;

•our reliance on our warehouse facilities to fund mortgage loans and otherwise operate our business, leveraging of assets under these facilities and the risk of a decrease in the value of the collateral underlying certain of our facilities causing an unanticipated margin call;

•our ability to sell loans in the secondary market, including to government sponsored enterprises, and to securitize our loans into mortgage-backed securities through the GSEs and Ginnie Mae;

•our dependence on the GSEs and the risk of changes to these entities and their roles, including, as a result of GSE reform, termination of conservatorship or efforts to increase the capital levels of the GSEs;

•changes in the GSEs’, FHA, USDA and VA guidelines or GSE and Ginnie Mae guarantees;

•our dependence on licensed residential mortgage officers or entities, including brokers that arrange for funding of mortgage loans, or banks, credit unions or other entities that use their own funds or warehouse facilities to fund mortgage loans, but in any case do not underwrite or otherwise make the credit decision with regard to such mortgage loans to originate mortgage loans;

•the unique challenges posed to our business by the COVID-19 pandemic and the impact of governmental actions taken in response to the pandemic on our ability to originate mortgages, our servicing operations, our liquidity and our team members;

•the risk that an increase in the value of the MBSs we sell in forward markets to hedge our pipeline may result in an unanticipated margin call;

•our inability to continue to grow, or to effectively manage the growth of, our loan origination volume;

•our ability to continue to attract and retain our Independent Mortgage Broker relationships;

•the occurrence of a data breach or other failure of our cybersecurity;

•loss of key management;

•reliance on third-party software and services;

•reliance on third-party sub-servicers to service our mortgage loans or our mortgage servicing rights;

•intense competition in the mortgage industry;

•our ability to implement technological innovation;

•our ability to continue to comply with the complex state and federal laws, regulations or practices applicable to mortgage loan origination and servicing in general, including maintaining the appropriate state licenses, managing the costs and operational risk associated with material changes to such laws;

•fines or other penalties associated with the conduct of Independent Mortgage Brokers;

•errors or the ineffectiveness of internal and external models or data we rely on to manage risk and make business decisions;

•loss or inability to enforce intellectual property rights or contractual rights;

•risk of counterparty terminating servicing rights and contracts;

•the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and

•the requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members and team members.

PART I

Item 1. Business

Unless otherwise indicated or the context otherwise requires, when used in this Annual Report, the term “UWMC” means UWM Holdings Corporation, “UWM” means United Wholesale Mortgage, LLC and "the Company," “we,” “our” and “us” refer to UWM Holdings Corporation and our subsidiaries.

Overview

We are the publicly traded indirect parent of United Wholesale Mortgage, LLC (“UWM”). UWM is the second largest direct residential mortgage lender and the largest wholesale mortgage lender in the U.S., originating mortgage loans exclusively through the wholesale channel. With approximately 8,000 team members, as of December 31, 2021, and a culture of continuous innovation of technology and enhanced client experience, UWM leads the market by building upon its proprietary and exclusively licensed technology platforms, superior service and focused partnership with the independent mortgage broker community. We originate primarily conforming and government loans across all 50 states and the District of Columbia.

For the last seven years including the year ended December 31, 2021, we have been the largest Wholesale Mortgage Lender in the U.S. by closed loan volume. For the year ended December 31, 2021, we originated $226.5 billion in residential mortgage loans, which was an increase of $44.0 billion, or 24%, from the prior year. We generated $1.57 billion of net income during the year ended December 31, 2021, which was a decrease of $1.81 billion, or 53.6%, compared to net income of $3.38 billion for the year ended December 31, 2020. For the year ended December 31, 2020, we originated $182.5 billion in residential mortgage loans, an increase of 69% from the prior year. We generated $3.38 billion of net income for the year ended December 31, 2020, a 714.9% increase from 2019. Our 2021 mortgage production of $226.5 billion represented a 4.7% market share of all residential mortgage loans originated in the U.S.

Founded in 1986 and headquartered in Pontiac, Michigan, we have built a client-focused, team-oriented culture that strives to bring superior customer service, efficiency and operational stability to our clients, the Independent Mortgage Brokers. We were named as a "Best Places to Work in Financial Services and Insurance" by Fortune and a Top Work Place in Metro Detroit by the Detroit Free Press in 2021. We were ranked the #1 training team in the nation by Training Magazine in 2021.

On January 21, 2021 (the “Closing Date”), Gores Holdings IV, Inc. (“Gores IV”), our predecessor company, consummated the previously announced business combination (the “Business Combination”) pursuant to the terms of the Business Combination Agreement, dated September 22, 2020 (as amended by Amendment No. 1 thereto, dated December 14, 2020, the “Business Combination Agreement”) with SFS Holding Corp. (“SFS Corp.”), a Michigan corporation, UWM (f/k/a United Shore Financial Services, LLC), a Michigan limited liability company, and UWM Holdings, LLC (“Holdings LLC”), a Delaware limited liability company. Immediately upon the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement (the “Transactions,” and such completion, the “Closing”), UWM became an indirect subsidiary of Gores IV. In connection with the Transactions, Gores IV changed its name to UWM Holdings Corporation. We began trading on the New York Stock Exchange on January 22, 2021 under the ticker symbol UWMC.

Strategy

Our principal strategy that has driven our substantial growth over the past years, is our strategic decision to operate solely as a Wholesale Mortgage Lender—thereby avoiding conflict with our partners, the Independent Mortgage Brokers and their direct relationship with borrowers. We believe that by not competing for the borrower connection and relationship, we are able to generate significantly higher loyalty and satisfaction from our clients (i.e., Independent Mortgage Brokers) who, in turn, armed with our partnership tools are positioned to direct a growing share of the residential mortgage volume nationwide.

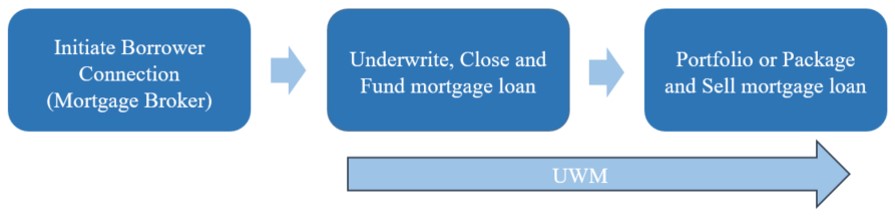

The residential mortgage loan financing process typically involves three stages:

•Initiate Borrower Connection. A broker or other party is approached by a potential borrower for a mortgage loan. This party advises the borrower on loan options, runs the initial credit check, gathers the borrower’s information for the loan application and submits the loan application.

•Underwrite, Close and Fund. The borrower’s loan application is reviewed, the mortgage loan is underwritten, the borrower is approved, the closing is arranged and the loan is funded, collectively referred to as loan origination.

•Portfolio or Package and Sell mortgage loan into Secondary Market Sales. The loan is either placed into an investment portfolio (in the case of banks and typically only for certain loans tied to shorter term interest rates) or packaged together with other loans and sold as MBS to investors in the secondary market.

We refer to a “Retail Mortgage Lender” as a lender that both offers its mortgage loans directly to individual borrowers and underwrites the mortgage loans. Certain Retail Mortgage Lenders also portfolio or package the mortgage loans for sale in the secondary market.

By comparison, a “Wholesale Mortgage Lender” is a lender that originates, underwrites and closes a mortgage loan arranged by an Independent Mortgage Broker.

We operate exclusively as a Wholesale Mortgage Lender and focus only on the wholesale channel so that we can be a true partner to our clients (all of which are Independent Mortgage Brokers). We do not work directly with the borrower during the mortgage loan financing process.

Many, if not all, of our competitors are primarily Retail Mortgage Lenders that also compete in the wholesale channel as Wholesale Mortgage Lenders. We believe that by competing in both channels, our competitors have an inherent conflict that makes them a less attractive option for Independent Mortgage Brokers when deciding which lender to work with when originating a mortgage loan. We further believe that this competitive advantage is a major reason that has and will continue to drive market share growth and loan production as the wholesale channel grows.

Integral components of our strategy are (1) continuing our leadership position in the growing wholesale channel by investing in technology and partnership tools designed to meet the needs of Independent Mortgage Brokers and their customers, (2) capitalizing on our strategic advantages which include a singular focus on the wholesale channel, a family-controlled business that can quickly adapt to market conditions and opportunities, and ample capital and liquidity, (3) employing our six pillars (see below) to drive a unique culture that we believe results in a durable competitive advantage and (4) originating high quality loans, the vast majority of which are backed directly or indirectly by the federal government, to minimize market risks and to maximize opportunity in different macroeconomic environments.

Leading in the Growing Wholesale Channel

Following the recession of 2008 and the resulting adoption of significant banking regulations, the percentage of residential mortgage loans originated by non-banks has grown significantly. Our business has represented a large percentage of that growth, but with a singular focus on the wholesale channel since 2014.

According to the Nationwide Multistate Licensing System ("NMLS"), as of September 30, 2021, there were approximately 390,000 federally registered mortgage loan officers in the U.S. Our exclusive focus on the wholesale channel has resulted in relationships with over 11,000 independent broker businesses throughout the U.S., with over 45,000 associated loan officers—of which approximately 35,000 have submitted a loan to us during the year 2021. As the wholesale channel continues to grow, especially in a rising rate environment, we see a significant opportunity for these mortgage loan officers to join the wholesale channel.

Benefits to Borrower

•Provides Trusted Advisor in Complex Financial Instruments. Independent Mortgage Brokers serve as advisors to borrowers, leveraging their deep knowledge base of complex financial products to help borrowers make informed decisions. Independent Mortgage Brokers assist prospective borrowers in analyzing their financial situation, assessing his or her credit history and current mortgage and making an informed decision based on their personal circumstances.

•Maximizes Optionality. Independent Mortgage Brokers are able to provide borrowers with multiple options on product structure and pricing rather than being rooted in a single platform offering, which we believe

empowers borrowers and enhances their borrowing experience. We believe that Independent Mortgage Brokers are able to deliver borrowers access to better rates than their Retail Mortgage Lender counterparts. As a partner to our clients, we continually strive to provide a range of residential loan options, so that our clients can match the needs of their borrowers with our product offerings.

•Streamlines and Enhances the Experience. Independent Mortgage Brokers are best positioned to be the single personalized point-of-contact for the loan process and provide borrowers a superior customer service experience.

•Aligns Interest. In the wholesale channel, the interests of the Independent Mortgage Broker and the borrower are aligned to achieve the best outcome for the borrower—which increases borrower loyalty to the Independent Mortgage Broker and provides a greater likelihood that the borrower will retain the advisor for future transactions.

Benefits to Independent Mortgage Broker

•Drives Brand Recognition and Loyalty. We believe that allowing Independent Mortgage Brokers to “own” the relationship with the borrower drives client brand recognition and loyalty. When borrowers view their Independent Mortgage Brokers as the person who delivered the superior results, rather than just as a conduit to funding, they are more likely to return to that Independent Mortgage Broker for their next residential mortgage loan, whether it is a new purchase or a refinance. Our technology provides Independent Mortgage Brokers with advanced personalized marketing tools to establish and maintain their borrower relationships.

•Offers Flexibility. We believe that Independent Mortgage Brokers and their loan officers are better served by the wholesale channel as it provides them the flexibility of matching their borrowers’ needs with the most applicable lender and lender program. A Wholesale Mortgage Lender needs to earn business every day. If the Wholesale Mortgage Lender is not faster, easier and more affordable, it will not be successful in earning that business. For example, if speed to close is the most important factor to a borrower because a purchase contract is going to expire, and a particular lender is backed up in underwriting, a loan officer that works as an Independent Mortgage Broker can select the lender that is best positioned to meet the borrower’s requirements, whereas a “captive” loan officer cannot. Similarly, if a particular lender does not offer a product type (e.g., non-Qualified Mortgage loans which we do not offer), the needs of the borrower can still be met by arranging the loan with a different lender—that flexibility may not available for a captive loan officer.

• Protects Relationship with Borrower. Utilizing the wholesale channel with a true Wholesale Mortgage Lender allows Independent Mortgage Brokers to maintain their relationships with borrowers throughout the mortgage lending process and beyond with less risk of being replaced by the lender in the next new purchase or a refinance. Retail Mortgage Lenders that dabble in the wholesale channel do not afford this protected relationship.

•Ability to Provide Superior Sophisticated and Personalized Service. The wholesale channel allows Independent Mortgage Brokers to offer a diverse set of product options and capitalize on the benefits of scale to offer superior service, such as turn times and pull through rates, with the focus on personal service. Our suite of full-service technology platforms positions Independent Mortgage Brokers to effectively compete with banks and other non-bank loan originators by delivering a closely managed end-to-end experience for the borrower from origination through closing.

Benefits to UWM

•Access to Extensive Network. The wholesale channel offers us access to a broad network of Independent Mortgage Brokers, reducing reliance on any one entity or any geographic region.

•Volume Levels Supports Significant Automation. Our volume allows for significant investment in automating each step of the residential loan process, which in turn reduces error rates, improves customer service and enhances efficiency.

•Distribute Fixed Cost Across Wider Network. Our exclusive focus on the wholesale channel reduces our fixed costs by allowing us to distribute costs across a wider network of clients. We invest in the personnel and technology resources to underwrite, close, fund and sell residential mortgage loans, which are variable based on loan origination volume. This results in a minimal fixed cost base for origination and high marginal profitability.

•Supports Scalability. We believe that our exclusive focus on the wholesale channel coupled with our efficient and centralized processes, cost structure and technology platform has resulted in a business that is highly scalable with minimal incremental investment.

Capitalizing on our Strategic Advantages

We believe that our exclusive focus on the wholesale channel along with our business model, team members, technologies and competitive position provide us with some significant strategic advantages.

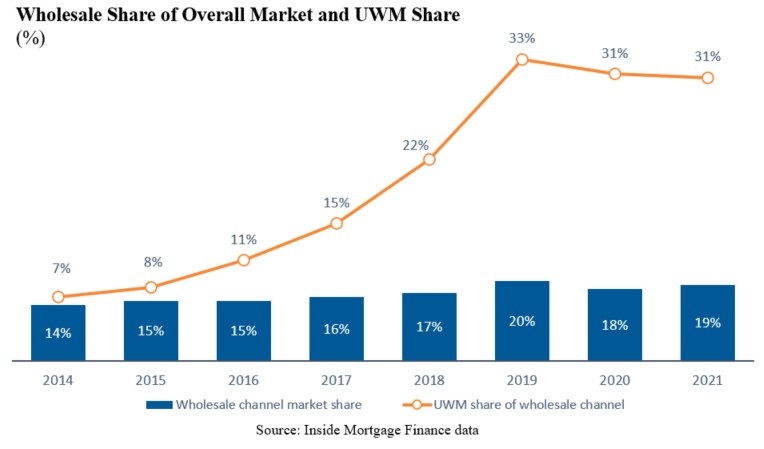

•Strong Brand Recognition. Our leading position as a Wholesale Mortgage Lender and ability to deliver superior client service provides us strong brand recognition with Independent Mortgage Brokers. As of December 31, 2021, we were the second largest residential mortgage lender in the U.S. and were the largest Wholesale Mortgage Lender. For the year ended December 31, 2021, we had approximately 31% market share in the wholesale channel (based on data released by Inside Mortgage Finance ("IMF")). Our high degree of operating leverage enables us to invest in, and deliver to our clients, a full suite of technology and workflow solutions that allow for industry-leading closing times for our clients, which contributes to long-term brand recognition with clients. Furthermore, by focusing exclusively on the wholesale mortgage market we are able to differentiate ourselves with clients as a partner in their success rather than a potential competitor.

•Operational Excellence. We believe our exclusive focus on the wholesale channel provides us with a differentiated, client-centric business model that allows for scaled, efficient and centralized processes and the ability to focus on high quality loans. For the year ended December 31, 2021, we originated approximately 654,000 loans, up from approximately 561,000 loans for the year ended December 31, 2020. For the year ended December 31, 2021, our average application to clear to close time was 18 business days, compared to management's estimate of the industry average of 46 days for 2021 (per the December 2021 ICE Mortgage Technology Origination Insight Report). During 2021, we closed an average of 8.3 loans per month per production team member, as compared to an average of 9.9 loans per month per production team member during 2020, well above the industry average of 3.6 during the nine months ended September 30, 2021 (based on a Mortgage Bankers Association report). We consistently receive positive client feedback and received an 87% average monthly client Net Promoter Score ("NPS") for the year ended December 31, 2021, as well as an 86% average monthly client NPS for the the past five years, evidencing the effectiveness of our business model.

•Innovative Technology Platforms. Leveraging our culture of continuous technological innovation, we have built proprietary technology platforms and exclusively license technology that support our clients and borrowers to provide what we believe to be a best-in-class client experience. We believe that our technology platforms provide us with a competitive advantage, driving client retention and offering the ability to efficiently and quickly achieve closings on loan originations. We offer our clients a complete platform with a highly efficient, external-facing interface that includes required regulatory and compliance mechanisms. We seek to continuously improve and innovate our technology platforms and have a team of over 1,100 full time team members as of December 31, 2021 committed to our information systems and technologies.

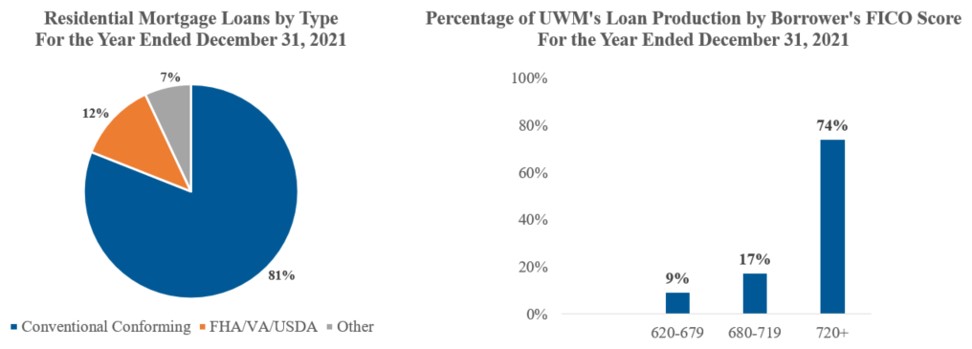

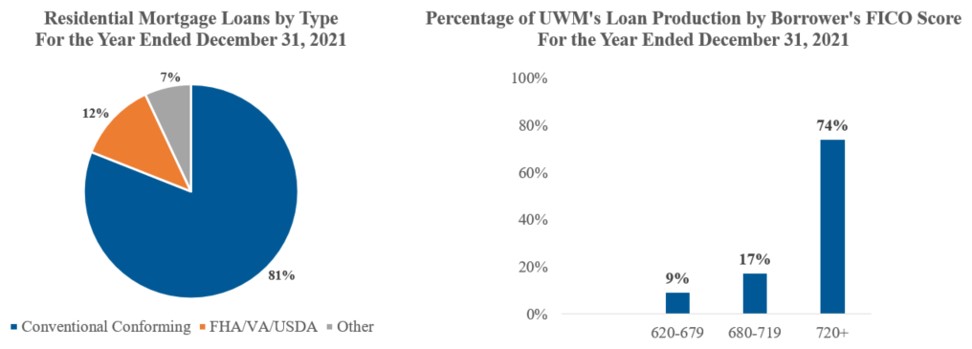

•Focus on High Quality, Agency Loans. We focus on the underlying credit quality of mortgage loans that we originate, with a vast majority of loans representing conforming, agency production. For the year ended December 31, 2021, our borrowers had a weighted average FICO score of approximately 750; and for the year ended December 31, 2020, our borrowers had a weighted average FICO score of 758.

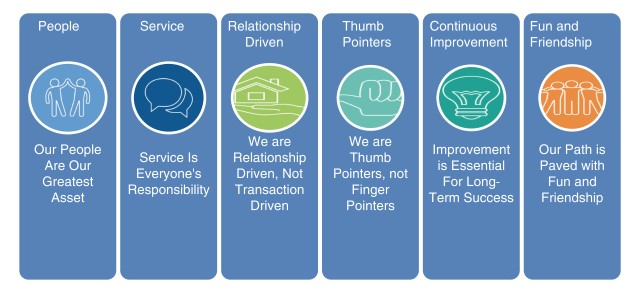

Employing Our Six Pillars to Drive a Durable Competitive Advantage

We were founded with a simple goal in mind: attract great people, to a great workplace, and give them the tools they need to do great work. Our culture is based on six pillars:

•People—our people are the secret to our success. We invest in our team members with continuous and real-time training so they can continue to set the standard. Team members are given a path to succeed and are rewarded for that success.

•Service—We pride ourselves on creating a memorable service experience for every partner. Internal service among team members is critical.

•Relationship driven—Our long-term reputation is more important than short-term gains. We place a premium on creating lasting relationships with our clients and counterparties, such as our Independent Mortgage Brokers, warehouse banks, vendors, regulators and other agencies.

•Thumb pointers—Team members are focused on accountability and personal responsibility. Our team members concentrate on taking ownership, improving and delivering results.

•Continuous improvement—We develop and introduce cutting-edge, industry leading technology and information processes.

•Fun and friendship—We are a big believer that work can (and should) be fun. It’s about finding your passion and purpose—but always leaving time for friendship and camaraderie. We were named as a "Best Places to Work in Financial Services and Insurance" by Fortune and a Top Work Place in Metro Detroit by the Detroit Free Press in 2021. We were ranked the #1 training team in the nation by Training Magazine in 2021.

These core principles influence everything we do and form the basis of our client-focused culture. In addition to providing superior customer service to our clients, we also take business actions to support our clients.

Originating High Quality Loans Backed Directly or Indirectly by the Federal Government to Minimize Risks and to Maximize Opportunity in Different Macroeconomic Environments

An integral component to our strategy is to originate high quality loans throughout the U.S. For the year ended December 31, 2021, our borrowers had a weighted average FICO score of approximately 750 as compared to a weighted average FICO score of 758 for the year ended December 31, 2020. The following charts illustrate our loan originations portfolio by type and FICO score mix for the year ended December 31, 2021:

We seek to have a balanced loan origination business model, with relatively higher purchase over refinancing mix which we believe has provided us the ability to deliver strong, stable and consistent growth in mortgage loan origination volume and profitability through both high and low interest rate cycles. Our model is focused on the origination business, with a specific focus on purchase loans; this area of the market has grown consistently over the last several years and, we believe, is more durable with respect to interest rate fluctuations than the refinance market. Historically, residential purchase mortgage loan origination volume has experienced less volatility in response to interest rate movements than the refinancing mortgage loan origination volume. Consequently, we believe that by focusing on the purchase business we will be better positioned to deliver more consistent volume in increasing and decreasing rate environments. In rising interest rate environments, we believe that our demonstrated reputation for excellent client service and short loan closing times will drive continued purchase mortgage volume, our broad client base will allow us to capitalize on lead generation and our cost structure will allow us to be more competitive on margins.

We currently retain the majority of the mortgage servicing rights ("MSRs") associated with our production, but we have, and intend to continue to opportunistically sell MSRs depending on market conditions. This nimble approach has provided us funding flexibility, and reduced legacy MSR asset exposure. In addition, our wholesale only business is uniquely positioned to capture a greater share of purchase originations and, we believe, provides a competitive advantage relative to correspondent or various retail origination models.

Market Opportunity

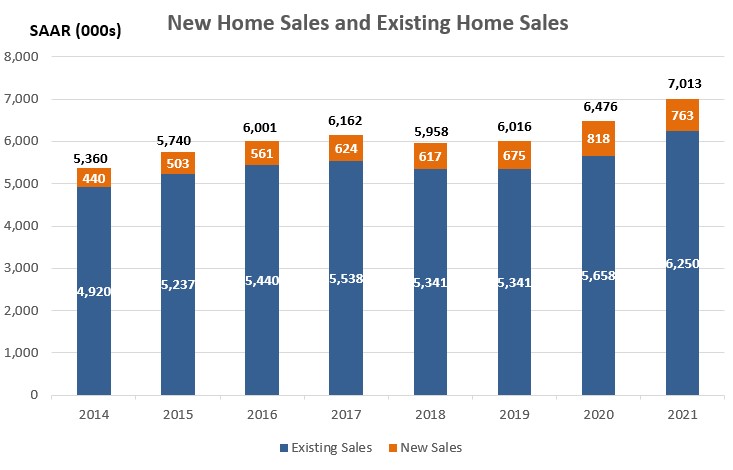

Residential Mortgage Loan Originations Continue to Grow. According to the Federal Reserve, residential mortgages represent the largest segment of the broader U.S. consumer finance market.

In 2021, annual residential mortgage origination volume reached $2.5 trillion, with an average volume of $2.4 trillion over the last five years. According to the Mortgage Bankers Association, there was approximately $4.05 trillion of residential mortgage debt outstanding in the U.S. as of September 30, 2021.

Despite rising home prices, shifting demographics have driven new and existing home sales which is driving increasing purchase volume (Sources: National Association of Realtors and U.S. Census Bureau; SAAR refers to seasonally adjusted annual rate):

As a percentage of the overall mortgage market, the wholesale channel has grown and is expected to continue to grow exponentially, providing us with an opportunity to capitalize on that growth:

Over the last several years, “online mortgage lenders” have become an increasing force within the industry. The mortgage industry has reached a critical inflection point where new technology and the growing use of digital mortgage applications has made it possible for the origination process to move more quickly. We believe we are well-positioned to capture and capitalize on this trend, as we develop and provide Independent Mortgage Brokers, that have the local and personal connection on a nationwide basis to consumers, with access to our proprietary and exclusively licensed technology platforms to enable our clients to succeed in this changing environment.

Our Loan Programs

Over the past 10 years we have developed technologies and processes that allow us to quickly introduce and market new loan programs or to adjust for existing loan programs and to adapt services and offerings to ever-changing markets for home financing. These technologies allow us to quickly and efficiently build guidelines, rules, pricing, and controls into our loan origination platforms and workflows; generate new loan documents, disclosures and program descriptions from our systems; and efficiently distribute internal communications. By having nimble and flexible systems that are controlled

internally, we believe we are better positioned to take advantage of market opportunities when they present themselves and change the direction of loan programs when the market dictates.

Conventional agency-conforming mortgage loans

Since 2012, we have been primarily focused on originating conventional, agency-eligible loans that can be sold to Fannie Mae, Freddie Mac or transferred to Ginnie Mae pools for sale in the secondary market. Our conventional agency-conforming loans meet the general underwriting guidelines established by Fannie Mae and Freddie Mac. Loans that are written under the FHA program, the VA program or the USDA program are guaranteed by the governmental agencies and then transferred to Ginnie Mae pools for sale in the secondary market. All of our mortgage loans are underwritten to the “Qualified Mortgage” underwriting standards established by the Consumer Financial Protection Bureau ("CFPB"). For the year ended December 31, 2021, 90% of loans originated were sold to Fannie Mae or Freddie Mac, or were transferred to Ginnie Mae pools in the secondary market, while the remainder were primarily jumbo loans that are underwritten to the same “Qualified Mortgage" underwriting standards and have a similar risk profile but are sold to third party investors purely due to loan size.

The following table summarizes our loan production by loan type for the periods indicated.

| | | | | | | | | | | | | | | | | |

($ in thousands)

Loan Type | For the year ended December 31, 2021 | | For the year ended December 31, 2020 | | For the year ended December 31, 2019 |

| Conventional Conforming | $ | 183,178,860 | | | $ | 153,525,586 | | | $ | 76,207,713 | |

| FHA/VA/USDA | 26,868,391 | | | 27,541,347 | | | 25,563,260 | |

Non-Agency1 | 16,456,442 | | | 1,480,708 | | | 5,996,199 | |

| Total Loan Production | $ | 226,503,693 | | | $ | 182,547,641 | | | $ | 107,767,172 | |

| Production volume (closest '000) | 654,000 | | | 561,000 | | | 339,000 | |

| Average initial loan balance | $ | 346 | | | $ | 325 | | | $ | 318 | |

1 Represents jumbo products.

Our Mortgage Lending Process

We believe that our highly scaled, efficient and centralized mortgage lending processes are key to our success. Utilizing our proprietary system, “Easiest Application System Ever” (EASETM), and our dedicated team members we focus on client service, and loan quality throughout the entire loan origination, underwriting and closing processes. EASETM automates the process and, based on the jurisdictional requirements of the client and borrower, automatically generates the necessary documents required by us and by the clients for applications. The entire origination, underwriting and preparation of closing documents takes place in our centralized, paperless work environment where documents and data are entered into EASETM and are reviewed, processed and analyzed based on a set of pre-determined, rules-based workflows. We focus on speed to close as it is one of the primary metrics for client satisfaction. We believe our closing process is the most efficient in the industry and results in shorter application to clear-to-close times than any of the other major Retail Mortgage Lenders or Wholesale Mortgage Lenders. For the years ended December 31, 2021 and December 31, 2020, we delivered an average of 18 and 17 business days, respectively, from loan application to clear to close, as compared to management's estimates of the industry averages of 46 and 44 days, respectively.

Our rules-based mortgage loan origination system, or LOS allows multiple teams to work on the same loan at the same time, to track and be alerted to missing or incomplete items, to flag items in order to alert other team members of possible deficiencies and to have visibility into the history, status and progress of loans in process. We use advanced technologies and workflow systems to assist all underwriting and operations team members in prioritizing which loans require their immediate attention and to monitor each team’s progress so workload-balancing decisions can be made among the operation teams in real time and avoid bottlenecks.

Underwriting

Our underwriting process is one of our key strategic advantages as our extensive training program and technology platforms allow us to produce a portfolio of high-quality loans, with an industry-leading time from application to clear to close and maintain the superior level of client service that allows it to attract and retain our clients. All mortgage loans that we originate are underwritten in-house by our underwriting team. We invest significant time and resources in our underwriters through our robust training process to help them and us succeed. Regardless of their background or level of experience, each

underwriter who joins us attends an in-house, intensive training session taught by our knowledgeable underwriting trainers. Following this initial training, each underwriter is assigned a mentor to supervise them. This commitment to training continues throughout an underwriter’s career with us. In addition, we hold daily meetings and weekly webcasts to keep our underwriters informed and knowledgeable about industry developments. We believe that our intensive training program is an integral component of our scalability as we are able to materially increase our underwriting resources, at a consistent quality, with less labor constraints and complications than our competitors.

Our clients, the Independent Mortgage Brokers, have the initial communication with a potential borrower and they receive from the borrower the relevant financial and property information to run a credit check and obtain a pre-approval through one of the automated underwriting systems. Once a pre-approval has been received, an Independent Mortgage Broker is able to seamlessly import the borrower’s information and documentation into our EASETM LOS without the need for extra data entry. One of our senior underwriters then reviews the file and, based on the loan product and the financial and other information provided, makes an underwriting decision. If the mortgage loan is approved, our system generates a “conditions to close” list based on the specifics of the borrower, the property and the loan product and a junior underwriter who generally takes ownership of the file ensuring that each of these conditions is met prior to granting a “clear-to-close.” Our underwriters will typically focus on one product line, but many are cross-trained in other loan products.

We utilize technology and automated processes throughout the underwriting process, to provide our underwriters “guard rails” and allow us to efficiently and effectively underwrite high-quality loans while mitigating risk. For example, if a loan product requires an 80% loan-to-value or a family gift is providing the portion of a deposit, our systems are programmed to automatically populate the appropriate conditions and not permit the loan to move on to the next step in the underwriting process until the appropriate documents are uploaded into the system. Another component of our check and balance processes is our loan quality review team who review multiple files for every underwriter every month. This permits us to provide real-time feedback and process improvement. We believe these systems and processes serve as guard rails to support our ability to produce high-quality loans and minimize risk in the underwriting process.

Loan closings

UWM UCloseTM, our document closing tool, allows clients to facilitate and easily control the closing process, including document generation, title company interaction and the timing of closing. In addition, we structure our closing process such that all conditions are satisfied prior to the generation of closing documents and therefore are able to provide clients and borrowers automatic funding for all closings. Once a title agent uploads the executed documents into UCloseTM, the funds are automatically wired to the appropriate parties. We believe that eliminating the hours of waiting in a title office leads to more satisfied borrowers and repeat business for us and our clients.

We believe we have achieved industry leading close times through the use of proprietary technology and process innovations such as DocHub, UClose and BOLT. Additionally, in 2021, we recognized that one of the pain points in timely closings were the delays in obtaining appraisals. Consequently, we launched UWM Appraisal Direct. Appraisal Direct provides mortgage brokers a streamlined, transparent process for the scheduling, execution and delivery of an appraisal that they can easily track, which we believe will deliver faster appraisals to offer a better experience and relieve a key pain point in the mortgage industry.

Capital Markets and Secondary Marketing

Our capital markets team is dedicated to maximizing loan sale profitability while at the same time minimizing operational, interest rate and market risks. This team manages the interest rate risk for the business and is responsible for interest rate lock management policies and procedures, hedging the pipeline, managing warehouse facilities and associated facility utilization and managing risk and sales of mortgage servicing rights on the balance sheet. We aggregate our loan production into pools that are (i) sold to Fannie Mae or Freddie Mac or securitized through the issuance of Fannie Mae or Freddie Mac bonds, (ii) transferred into Ginnie Mae pools and securitized by us into government-insured mortgage-backed securities, or (iii) sold outright or securitized to investors in the secondary mortgage market. Our primary access to the secondary market comes from pooling and selling eligible loans that we originate through Fannie Mae, Freddie Mac, and Ginnie Mae’s securitization programs. The goal of the capital markets team is to protect margin at origination, and to maximize execution at sale. We believe that our technologies, automated workflow and experienced capital markets team allow us to quickly aggregate and sell the pools of loans in order to make efficient use of our capital and warehouse facilities. Our focus on agency deliverable originations and speed to sale reduces our exposure to market volatility, liquidity risk and credit risk.

When we have identified a pool of mortgage loans to sell to the agencies, non-governmental entities, or through our private label securitization transactions (which commenced during the second quarter of 2021), we repurchase such loans from

our warehouse lender and sell the pool of mortgage loans into the secondary market, but generally retain the mortgage servicing rights, or MSRs, associated with those loans. To the extent we generate non-agency loans, these loans are typically sold under an incentive-based servicing structure which permits us to retain servicing and control the borrower experience. We retain MSRs for a period of time depending on business and liquidity considerations. When we sell MSRs, we typically sell them in the bulk MSR secondary market.

Our hedging strategy

Our origination pipeline is exposed to interest rate volatility. During the origination, pooling, and delivery process, the pipeline value rises and falls with changes in interest rates. In addition to the value changes associated with interest rate risk, borrowers have an option to close or not close their rate lock based upon how interest rate changes impact their situations. Rising interest rates, relative to the borrower’s locked rate, create a greater incentive to close, while falling interest rates create a disincentive to close. This option to close is termed fallout risk and can be costly if not properly modeled.

We manage our interest rate exposure to maintain a near-zero exposure. Because substantially all of our production is deliverable to Fannie Mae, Freddie Mac, and Ginnie Mae, we predominately utilize forward agency or Ginnie Mae To Be Announced ("TBA") securities as our primary hedge instrument. The TBA market is a secondary market where forward loan sale commitments ("FLSCs") or TBAs are sold by lenders seeking to hedge the risk that market interest rates may change and lock in a price for the mortgages they are in the process of originating.

We use a third-party platform to model our interest rate risk positions and provide baseline historical fallout models that we supplement with advanced modeling techniques and monitoring programs. We regularly validate the rate lock pull-through factor and evaluate the factor with every market and portfolio change. Sophisticated loan level models score the pipeline throughout the day ensuring our hedge ratios are in sync with market changes. Daily monitoring is intended to ensure the model attributes and results remain within our standards.

Repurchase and indemnification risks

Although we do not retain credit risk on the loans we sell into the secondary market, we do have repurchase and indemnification obligations to purchasers of mortgage loans for breaches under our loan sale agreements. Such agreements, including Fannie Mae and Freddie Mac master agreements, require us to make certain representations and warranties related to, among other things, the quality of the loans, underwriting of the loans in conformity with the applicable agency, FHA or VA guidelines, and origination in compliance with applicable federal, state and local laws and regulations. If we were to breach these representations and warranties, we may be required to repurchase the loan, and may be subject to other indemnification obligations.

Under the Fannie Mae and Freddie Mac framework, lenders are, under certain conditions, relieved of seller representations and warranties that relate to the underwriting of the borrower, the property, or the project for loans delivered to Fannie Mae or Freddie Mac. Currently, to obtain such relief, loans must achieve an acceptable payment history or a successful full-file quality control review by Fannie Mae or Freddie Mac. Under the current framework, lenders are not relieved from representations and warranties with respect to the following matters:

•charter matters;

•misstatements, misrepresentations, and omissions;

•data inaccuracies;

•clear title/first-lien enforceability;

•compliance with laws and responsible lending practices; and

•single-family mortgage product eligibility.

While some of the representations and warranties in our loan sale agreements may extend over the life of the loan, most of our historical repurchase activity has involved loans which defaulted within the first few years after origination. Generally, liability only arises if there is a breach of the representations and warranties in a material respect based on standards set forth under the terms of the related loan sale agreement. We attempt to limit the risk of repurchase and indemnification by structuring our operations to ensure that we originate high-quality mortgages that are compliant with the representations and warranties given in the loan sale agreements. Additionally, in certain instances we are contractually obligated to refund to the investor certain premiums paid to us on the sale if the mortgagor prepays the loan within a specified period of time specified in the loan sale agreements.

Infrastructure, Systems and Technologies

Advanced technologies and systems

We are a technology driven company that continuously seeks to innovate and provide superior systems to our clients, with over 1,100 highly trained team members dedicated to our technology and information systems located in our Pontiac, Michigan headquarters as of December 31, 2021.

We focus on automating and providing sophisticated tools for loan origination functions, but also with respect to automating the infrastructure that supports those core operations, such as training, capital markets, human resources and facilities functions. Our integrated technology platforms create an automated, scalable, standardized and controlled end-to-end loan origination process that incorporates government/agency guidelines and loan program requirements into rules-based workflows, to ensure loans progress to closing only as conditions, guidelines and requirements are met and required information is provided and verified, and accounts for variations in state laws, loan programs and property type, among other variables.

Our client facing systems are generally proprietary (other than Blink+TM), developed in-house and were built to be scalable and readily modified, which allows us to quickly introduce enhanced features and to change loan program guidelines in response to market, industry and regulatory changes without excessive complex programming or dependency on outside entities. Our client facing systems (and their respective roll out dates) are as follows:

•BOLT (September 2021) – Allows mortgage brokers to obtain initial underwriting approval for qualified borrowers in as little as 15 minutes, which will enable brokers to close loans faster. We also believe that BOLT will unlock underwriter capacity and ultimately drive down our cost-per-loan.

•DocHubTM (November 2020) – Our custom-built document management system that allows team members to control the way they view, interact with, and deliver the documents required to close and fund loans. The program allows us to scale business without increasing costs associated with document storage, and processes can be designed in conjunction with the document management system for maximum efficiency.

•Blink+TM (September 2020) – A client facing point of sale (POS) system white-labeled for our clients. Blink+TM allows clients to access our products and pricing, automated underwriting system and fee templates. This solution syncs loan application data, including fees, with our EASETM program, and replaces a client’s costly existing system free of charge while encouraging lead conversion. Blink+TM integrates with Brand 360TM to convert leads into applications.

•InTouch Mobile App (September 2020) – A mobile app that allows our clients to handle virtually every aspect of the lending process, from underwriting through clear-to-close, without need for a desktop computer.

•Brand 360TM (October 2019) – Our all-encompassing marketing platform supports our clients’ growth and brand building capabilities. It provides useful communications tools to help our clients stay connected to borrowers and monitors home equity, new home listings, and rates to provide relevant market updates to ensure clients stay connected with potential new or repeat borrowers.

•UCloseTM (August 2015) – Our tool that allows clients to facilitate and easily control the closing process, notably timing, document generation, and title company interaction and the autonomous nature of the tool promotes more timely and efficient closings.

•EASETM (January 2015) – Our “Easiest Application System Ever” is our primary LOS that allows clients to interact with us and to select products, lock rates and run the Automated Underwriting System (AUS).

Our Blink+TM (POS) system was developed by a third party and has been white-labeled for our clients and integrated into our technology suite to provide Independent Mortgage Brokers a direct online method for communicating with us the information required for residential loan applications. We pay the Blink+TM developer per unit transaction fees, subject to a minimum monthly fee. Pursuant to our agreement with the Blink+TM developer, the developer has agreed to not make its online platform available to other wholesale lenders for a term that extends until November 2023 (or November 2024 to the extent that we have closed at least 25,000 loans using the platform during 2023), subject to a de minimis exception that includes our prior written consent for new participants.

In addition, we have internally developed enterprise level systems that: