Table of Contents

As confidentially submitted to the Securities and Exchange Commission on August 6, 2019.

This draft registration statement has not been publicly filed with the

Securities and Exchange Commission and all information herein remains strictly confidential.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CPG Newco LLC

to be converted as described herein to a corporation named

The AZEK Company Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3089 | 90-1017663 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1330 W Fulton Street #350

Chicago, IL 60607

877-275-2935

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jesse Singh

Chief Executive Officer

CPG Newco LLC

1330 W Fulton Street, #350

Chicago, IL 60607

877-275-2935

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| John L. Savva, Esq. Rita-Anne O’Neill, Esq. Sullivan & Cromwell LLP 1870 Embarcadero Road Palo Alto, CA 94303 650-461-5600 |

Rachel Sheridan, Esq. Samuel D. Rettew, Esq. Latham & Watkins LLP Washington, D.C. 20004 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ☒ | Smaller Reporting Company ☐ | |||

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Class A Common Stock, par value $0.001 per share |

||||

|

| ||||

|

| ||||

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933.

(2) Includes the aggregate offering price of additional shares that the underwriters have the option to purchase.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

CPG Newco LLC, the registrant whose name appears on the cover of this registration statement, is a Delaware limited liability company. Prior to the effectiveness of this registration statement, CPG Newco LLC intends to convert into a Delaware corporation pursuant to a statutory conversion and change its name to The AZEK Company Inc. as described in the section “Corporate Conversion” of the accompanying prospectus. In addition, a special purpose entity, CPG Holdco LLC, which was formed at the time of the acquisition of CPG Newco LLC solely for the purpose of holding membership interests in CPG Newco LLC and that will continue to hold such interests until the Corporate Conversion, will be merged with and into us. In the accompanying prospectus, we refer to all of the transactions related to our conversion to a corporation and the merger described above as the Corporate Conversion. As a result of the Corporate Conversion, the members of CPG Newco LLC will become holders of shares of Class A common stock and Class B common stock of The AZEK Company Inc. Except as disclosed in the prospectus, the Consolidated Financial Statements and selected historical consolidated financial data and other financial information included in this registration statement are those of CPG Newco LLC and its subsidiaries and do not give effect to the Corporate Conversion. Shares of Class A common stock of The AZEK Company Inc. are being offered by the prospectus.

Pursuant to the applicable provisions of the Fixing America’s Surface Transportation Act, we are omitting from this draft registration statement our interim financial statements as of and for the six months ended March 31, 2018 and 2019, because they relate to historical periods that we believe will not be required to be included in the prospectus at the time of the contemplated offering. We intend to amend this registration statement to include all financial information required by Regulation S-X at the date of such amendment before distributing a preliminary prospectus to investors.

Table of Contents

This information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, and it is not soliciting an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2019.

PROSPECTUS

Shares

Class A Common Stock

This is the initial public offering of shares of Class A common stock of The AZEK Company Inc. We are offering shares of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We anticipate that the initial public offering price for our Class A common stock will be between $ and $ per share. We intend to apply to list our Class A common stock on under the symbol “ ”.

After giving effect to this offering and the Corporate Conversion (as defined in this prospectus), entities affiliated with Ares Management Corporation, or Ares, and Ontario Teachers’ Pension Plan Board, or OTPP, will hold and shares of our Class A common stock, respectively. OTPP will hold all of our outstanding Class B common stock. After giving effect to this offering and the Corporate Conversion, Ares and OTPP will hold approximately % and %, respectively, of our aggregate common stock. Accordingly, we expect to be a “controlled company” as defined in the corporate governance rules of and will be exempt from certain corporate governance requirements of the rules. We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 19.

| Per Share | Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us(1) |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

We have granted the underwriters a 30-day option to purchase up to additional shares at the initial public offering price, less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2019.

Barclays

Prospectus dated , 2019.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 19 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 60 | ||||

| 62 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

67 | |||

| 90 | ||||

| 115 | ||||

| 124 | ||||

| 135 | ||||

| 139 | ||||

| 141 | ||||

| 145 | ||||

| 151 | ||||

| Material U.S. Tax Consequences to Non-U.S. Holders of Common Stock |

154 | |||

| 157 | ||||

| 164 | ||||

| 165 | ||||

| 166 | ||||

| F-1 | ||||

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of Class A common stock only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of Class A common stock.

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering of Class A common stock and the distribution of this prospectus outside the United States.

Until (25 days after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Table of Contents

The following summary contains selected information about us and about this offering. It does not contain all of the information that is important to you and your investment decision. Before you make an investment decision, you should review this prospectus in its entirety, including matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our Consolidated Financial Statements and the related notes included elsewhere in this prospectus. Some of the statements in the following summary constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements.” Our fiscal year ends on September 30. Any references to fiscal years in this prospectus are to the 12 months ended September 30 of that year and any references to fiscal quarters in this prospectus are to the applicable quarter or quarters within a fiscal year. Certain percentages and other figures provided and used in this prospectus may not add up to 100.0% due to the rounding of individual components. Unless the context otherwise requires, all references in this prospectus to “The AZEK Company,” “AZEK,” “CPG Newco LLC,” the “company,” “we,” “us,” “our” or similar terms refer to CPG Newco LLC and its consolidated subsidiaries, and after the Corporate Conversion, The AZEK Company Inc. and its consolidated subsidiaries.

COMPANY OVERVIEW

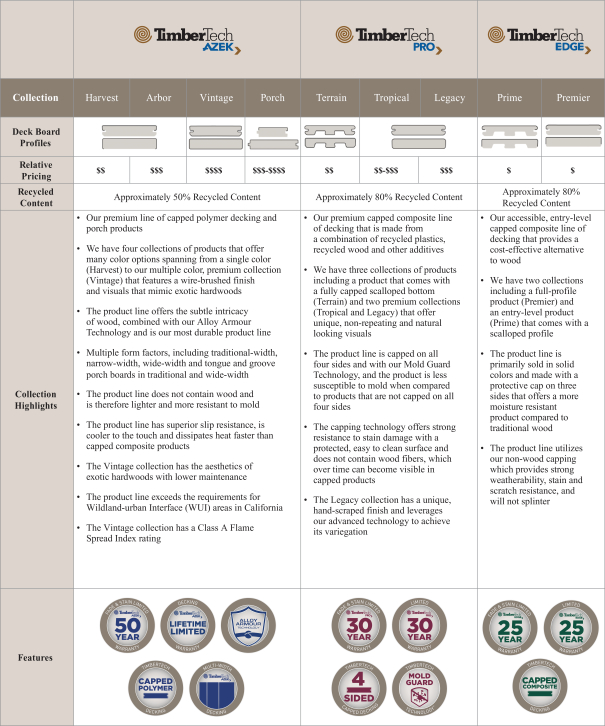

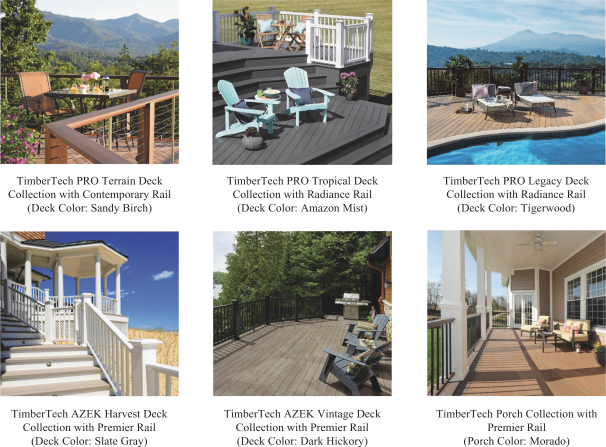

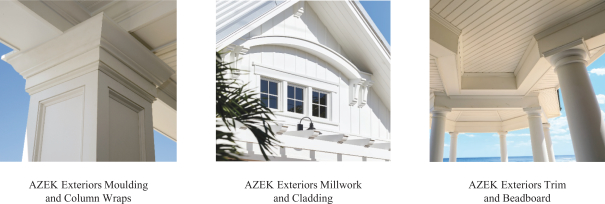

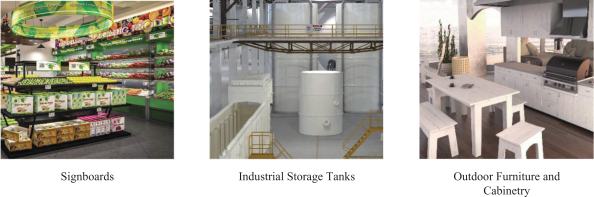

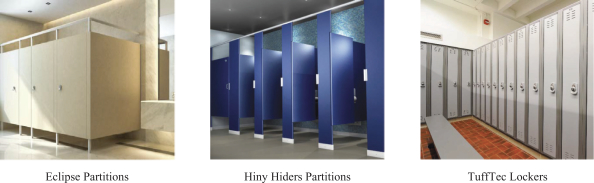

We are an industry-leading designer and manufacturer of beautiful, low-maintenance and sustainable products focused on the highly attractive, fast-growing Outdoor Living market. Homeowners are continuing to invest in their outdoor spaces and are increasingly recognizing the advantages of our long-lasting products. Our products transform those outdoor spaces by combining highly appealing aesthetics with significantly lower maintenance costs compared to traditional materials. Our innovative portfolio of Outdoor Living products, including deck, rail, trim and accessories, inspires consumers to design outdoor spaces tailored to their unique lifestyle needs. We are well known in the industry, and we are generally one of the top two recognized brands in our product categories. In addition to our leading suite of Outdoor Living products, we sell a broad range of highly engineered products that are sold in commercial markets, including partitions, lockers and storage solutions. Our businesses leverage a shared material technology and manufacturing platform to create products that shift demand from traditional materials to those that are long lasting and low maintenance, fulfilling our brand commitment to deliver products that are “Beautifully Engineered to Last”. In our Residential segment, our primary consumer brands, TimberTech and AZEK, are recognized by contractors and consumers for their premium aesthetics, uncompromising quality and performance and for their diversity of style and design options. In our Commercial segment, we manufacture engineered sheet products and high quality bathroom partitions and lockers. Over our history, we have developed a reputation as a leading innovator in our markets by leveraging our differentiated manufacturing capabilities, material science expertise and product management proficiency to consistently introduce new products into the market. This long-standing commitment to innovation has been critical to our ability to stay at the forefront of evolving industry trends and consumer demands, which in turn has allowed us to become a market leader across our core product categories.

Our focus on new product development, material science and research and development, or R&D, enables us to drive material conversion from traditional materials such as wood, to low-maintenance engineered materials and expand our markets. We believe our core competency of consistently launching new products into the market, combined with our recent investments in sales, marketing, R&D and manufacturing, will continue to accelerate our growth. Over our 30-year history, we have introduced numerous disruptive products and demonstrated our ability to extend our portfolio, addressing consumer needs across a wide range of price segments. In fiscal 2015, we introduced our Vintage premium decking collection, and through fiscal 2018, sales for these products, including recently introduced new colors, have increased at a compound annual growth rate, or CAGR, of more than 45.0% per year. We have leveraged the strong consumer response to Vintage to expand

-1-

Table of Contents

the platform with the introduction of new designs that address evolving industry trends and consumer demands. Our material science expertise and differentiated R&D capabilities enable us to create award-winning products and back them with some of the industry’s longest warranties, such as the 50-year fade & stain warranty that we offer on our TimberTech AZEK product line. Most of our product categories are in the early growth stage of their life cycles, and we anticipate that they will continue to benefit from substantial material conversion over the long term.

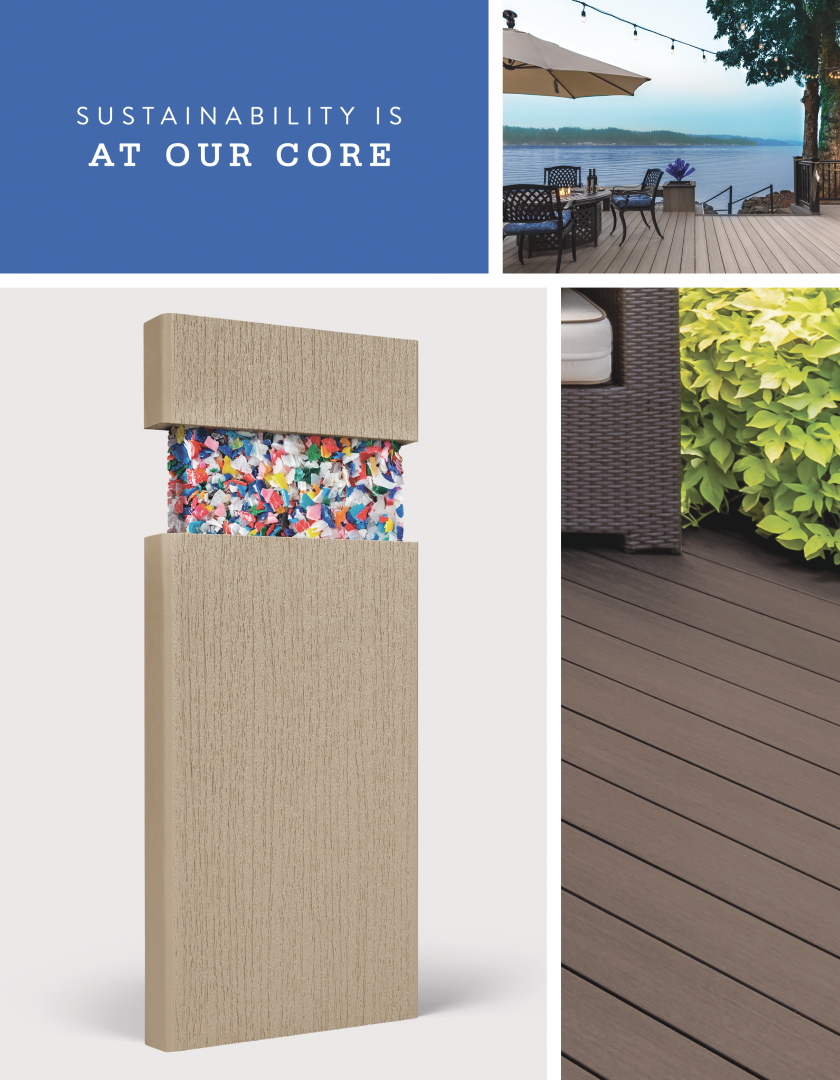

We have created an operating platform that is centered around sustainability, one of our core strategic pillars, which extends across our value chain from product design to raw material sourcing and manufacturing, and we increasingly utilize plastic waste, recycled wood and scrap in our products. We have also made significant recent investments in our recycling capabilities, which further enhance the sustainability of our manufacturing operations and reduce our costs. In fiscal 2018, we utilized more than 170 million pounds of recycled materials in our deck boards, and we expect to increase the amount of recycled materials used in our deck boards by over 15% in fiscal 2019. In addition, we believe we have the opportunity to further increase the amount of recycled material used in our products. In fiscal 2019, we opened a new 100,000 square foot recycling facility that utilizes advanced technologies to transform a broad range of plastic waste into raw material used in our products. Today, our TimberTech PRO and EDGE decking lines offer high quality products made from approximately 80% recycled material, and we believe we have an opportunity to further increase this percentage.

Within our Residential segment, we sell our products through a national network of more than 4,000 dealers, more than 30 distributors and multiple home improvement retailers providing extensive geographic coverage, enabling us to effectively serve contractors across the United States and Canada. Our geographic breadth, combined with our extensive market knowledge and broad product portfolio, positions us to continue to accelerate our growth within the industry. Our customer-focused sales organization generates pull-through demand for our products by driving increased downstream engagement with consumers and key influencers such as architects, builders and contractors, and by focusing on strengthening our position with dealers and growing our presence in retail. We have been investing in our consumer brands, marketing campaigns and digital tools in order to strengthen our relationships with consumers and key influencers, many of whom serve as advocates of our brands. Within our Commercial segment, we sell our products through a broad distribution network as well as directly to original equipment manufacturers, or OEMs.

Through our Residential and Commercial segments, we deliver market-focused product solutions that drive material conversion. We have experienced strong growth over our history, and over the last several years we have made significant investments in our business to further accelerate our growth and increase our profitability.

| (1) | 10-Year Net Sales CAGR refers to the CAGR for the ten years ended March 31, 2019, on a trailing twelve-month basis. |

| (2) | We define Five Year New Product Vitality as the percentage of gross sales in fiscal 2018 derived from products first introduced in fiscal 2018 and the four preceding years, excluding gross sales from Versatex and Ultralox. |

-2-

Table of Contents

In fiscal 2018, our net sales, net income and Adjusted EBITDA were $682.7 million, $7.2 million and $164.9 million, respectively. We intend to continue developing new products, building the leading consumer brand in Outdoor Living and growing our downstream-focused sales force, and we believe the demand for our products will benefit from continued material conversion and growth of the Outdoor Living market. Adjusted EBITDA is a non-GAAP financial measure used by management as a measure of our core operating results and the effectiveness of our business strategy. For more information on Adjusted EBITDA and for a reconciliation to net income, its most comparable financial measure calculated in accordance with GAAP, see “Selected Consolidated Financial Data—Non-GAAP Financial Measures.”

INDUSTRY OVERVIEW

Our products are widely used across several large, attractive markets, including residential and commercial end markets. We primarily serve the Outdoor Living market, which we define as the market for decks, rail, trim, wood-look siding, porches, pavers, outdoor furniture, outdoor cabinetry and outdoor lighting designed to enhance the utility and improve the aesthetics of outdoor living spaces. The Outdoor Living market is benefitting from continued growth in homeowner investment and repair and remodel activity, and we expect the Outdoor Living market will continue to benefit from increased investment as homeowners choose to spend more leisure time outdoors. The primary products that we sell into the Outdoor Living market are deck, rail and trim. Based on data provided by Principia Consulting, LLC, a third-party industry research and consulting firm, or Principia, the total U.S. market sales of these products were $6.7 billion in 2017 and grew at a 6.6% CAGR from 2014 to 2017 on a linear foot basis. Decking, our single largest product category, represents a significant opportunity for homeowners to extend the total livable space of their home and to design a unique space for relaxation and entertainment. Through our portfolio of Outdoor Living products, we provide a broad range of material and design options to homeowners as they tailor their outdoor living space to their unique lifestyle. In addition, we believe that we have significant opportunities to leverage our material science expertise, brand awareness and channel relationships to expand into additional segments of the Outdoor Living market.

-3-

Table of Contents

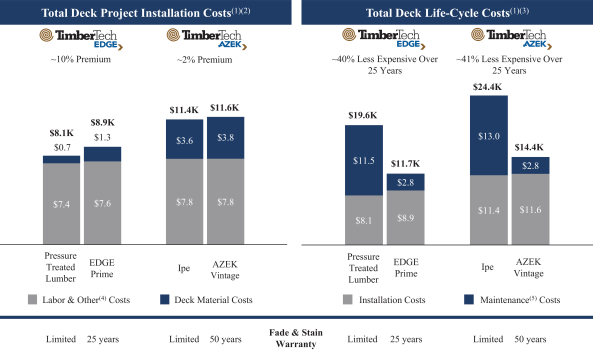

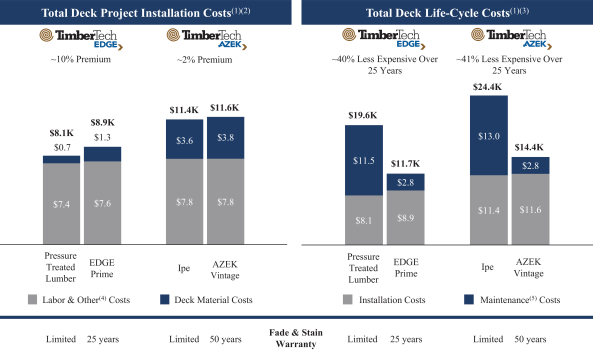

We believe our products offer a compelling value proposition due to their enhanced durability, quality, attractive aesthetics and lower life-cycle costs relative to traditional materials such as wood. For example, we estimate the total lifecycle cost of our new TimberTech EDGE Prime decking, including materials, labor and annual maintenance, is approximately 40% less expensive over its 25-year warranty period than the cost of a comparable pressure treated lumber deck.

Total Deck Project Installation Costs(1) Total Deck Life-Cycle Costs(2)

| (1) | These assumptions and estimates are based on AZEK market knowledge and feedback from decking-focused contractors with experience installing TimberTech and wood decking products. Actual costs for any particular installation can vary significantly. |

| (2) | Total Deck Project Installation Costs represent the total aggregate costs of an initial deck installation for a 16’ x 20’ elevated deck and exclude costs associated with the installation of rail or stairs. |

| (3) | Total Deck Life-Cycle Costs represent both the aggregate costs of an initial deck installation and the estimated maintenance costs over a 25-year period for a 16’ x 20’ elevated deck excluding potential replacement costs. |

| (4) | Other costs include substructure installation costs and the cost of top down fasteners for EDGE Prime and pressure treated lumber and hidden fasteners for ipe and AZEK Vintage. |

| (5) | Estimated maintenance costs include an assumed annual cleaning of TimberTech products and an assumed maintenance requirement of annual pressure washing and sanding, staining and sealing a pressure treated lumber deck every three years and an ipe deck every two years to maintain aesthetics. |

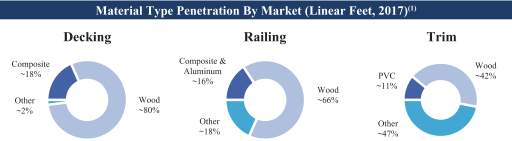

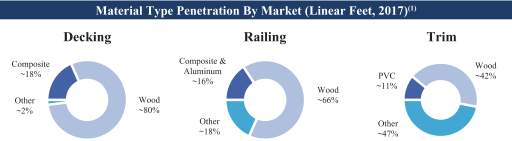

Composite deck (which includes wood composite and PVC decking), rail and trim products have continued to increase market share relative to other materials, due to their superior product qualities. Based on data provided by Principia, between 2014 and 2017, composite deck, composite and aluminum rail and PVC trim products collectively grew at a CAGR of 8.2% as compared to deck, rail and trim manufactured from wood, which grew at a CAGR of 6.0%, in each case measured in terms of linear feet. We believe the market for composite products will continue to increase at an above-market growth rate as it benefits from material conversion. Based on data provided by Principia, wood represented approximately 65% of the total U.S. deck, rail and trim markets based on 2017 linear feet sold. With respect to the individual components of these markets, based on this data, composite deck represented approximately 18% of the decking market, composite and aluminum rail represented approximately 16% of the rail market and PVC trim products represented approximately 11% of the trim market, each in terms of linear feet.

-4-

Table of Contents

Material Type Penetration By Market (Linear Feet, 2017)(1)

| (1) | Based on data provided by Principia. Other includes (A) hollow vinyl, plastic lumber and metal for decking, (B) iron, stainless steel, hollow vinyl and other plastic for railing and (C) engineered wood, fiber cement, vinyl, other polymer composite and other for trim. |

We believe there is a significant opportunity for further market penetration by composite products as continued advances in material science and manufacturing improve the range of colors and textures available. We offer products that reduce the relative premium between composite and other materials to increase the affordability and further improve the lifetime value advantages of composite products. In addition, we believe our products are well positioned to benefit from growth across economic cycles given their low market penetration and improving cost and value proposition. We believe that we have been, and will continue to be, a driving force behind the growth of low-maintenance products in our markets.

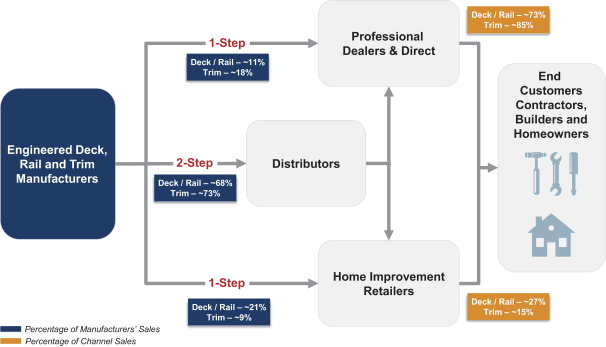

Our engineered deck, trim, rail and accessory products are sold through both one-step and two-step distribution channels. Within our Residential segment, we sell our products to distributors, professional dealers and home improvement retailers, who in turn sell our products to builders, contractors and homeowners. Based on data provided by Principia, the relative industry volumes of composite deck, composite and aluminum rail and PVC trim products sold by distribution channel and by end user channel are as follows:

Residential Channel Summary Sales by Manufacturers Residential Channel Summary Sales to End Users

| (1) | Rail includes composite and aluminum rail. |

-5-

Table of Contents

We are a leader within the professional dealer channel due to our depth across product categories, brand reputation and the superior quality of our products. Although less than 10% of our Residential segment sales were directly through home improvement retailers, we have seen substantial year-over-year growth in special order sales through such retailers, resulting in a CAGR of such gross sales of over 20% between fiscal 2015 and fiscal 2018. We believe we have an opportunity for significant expansion within retail and that this channel represents a key area of potential growth for us in the future. Our Commercial segment sells its products to OEMs and through distribution channels that reach a number of end markets including education, industrial, commercial and marine.

THE AZEK DIFFERENCE

An Industry Leader in the Outdoor Living Market

We are a leader in a number of large and growing segments of the Outdoor Living market and are benefiting from the early stages of material conversion and secular growth trends. Our significant scale, vertically-integrated manufacturing capabilities and extensive material science expertise enable our leadership position. We have leveraged these capabilities to establish a track record of innovation across a broad range of products with superior quality, aesthetics and performance that has been recognized by respected industry sources. In Hanley Wood’s 2019 BUILDER brand use study of U.S. builders, developers and contractors, TimberTech AZEK decking ranked #1 for quality within the deck category, and AZEK trim ranked #1 for quality within the decorative mouldings, trim and columns category. Additionally, our engineered bathroom partitions are a leading product specified by architects, and our Aria partitions won a Product Innovation Award from Architectural Products Magazine in 2018. These strengths, combined with our downstream focus and expanding marketing and digital strategy, have generated strong brand awareness and preference among contractors and consumers.

Serving Large, High-Growth and Resilient Markets That Are Benefitting from Material Conversion

We believe that the Outdoor Living market is benefiting from material conversion from traditional wood materials to low-maintenance, engineered materials. Based on data provided by Principia, wood represented approximately 65% of the total U.S. deck, rail and trim markets as measured by linear feet sold in 2017. As a result, we believe that these markets present substantial opportunities for conversion-driven growth over the coming years. We believe that the residential repair and remodel market, which is the primary market served by our core products, is significantly more resilient through economic cycles than the home building industry. Within our Residential segment, we estimate that over 85% of our net sales are attributable to repair and remodel activity. Our markets are also experiencing favorable secular trends. For example, within our Residential segment, consumers increasingly spend their leisure time outdoors and demand products that expand the usable living space of their home and enhance their outdoor lifestyle. As a result, we believe our business will continue to benefit from strong material conversion, continued repair and remodel activity and favorable secular trends.

Premium Brands Known for Service, Quality, Aesthetics and a Broad Range of Styles and Designs

We achieved our premium brand reputation through our unwavering commitment to developing innovative new products that combine the latest style and design trends with our differentiated material science expertise and proprietary production technologies. For example, we have launched products that take premium flooring trends, such as wire-brushed and hand-scraped finishes and multiple widths, into the decking market. In addition, we have deployed significant direct sales and service resources that have helped us develop strong brand awareness and loyalty among dealers, home improvement retailers and contractors. Over the last several years, we have made substantial investments to further enhance and strengthen our brands, including launching a variety of innovative new products with superior aesthetics, initiating cutting edge marketing campaigns,

-6-

Table of Contents

expanding our digital footprint and capabilities and unveiling a new set of tools focused on enhancing the consumer experience. We are well known in the industry, and we are generally one of the top two recognized brands in our product categories.

Highly Versatile Manufacturing Platform with Differentiated Capabilities

We are a vertically-integrated manufacturer, delivering superior quality products with a competitive cost position. Our versatile, process-oriented manufacturing operations are built on a foundation of extensive material development and processing capabilities. Our proprietary production technologies, material blending proficiency and range of extrusion methods enable innovation and facilitate expansion into new markets. We have deep experience working with multiple technologies that enable us to provide some of the industry’s most attractive visuals through advanced streaking and multi-color technologies. Our manufacturing footprint has been consolidated into six facilities over four geographic locations totaling over 1.6 million square feet, and we have made significant investments in people, processes and systems to increase our manufacturing scale and productivity. We continue to invest in expanding our vertical manufacturing capabilities, including recent investments in our new 100,000 square foot recycling facility. In 2017, we introduced our AZEK Integrated Management System, or AIMS, to manage and monitor operations, and in 2018, we implemented Lean Six Sigma, or LSS, tools and techniques at our manufacturing facilities to reduce material waste and improve manufacturing efficiency. We believe these initiatives create an opportunity for continued expansion of our margins.

Leader in Product Development and Innovation with a Robust New Product Pipeline

Over the past 30 years, we have built an R&D organization with significant expertise in material science and production process technologies. We leverage our R&D and manufacturing capabilities to deliver innovative new products to market that address evolving customer needs while expanding our use of recycled materials. Our product managers and marketing team actively analyze proprietary consumer research and work with architects, contractors and consumers to identify and develop new products that incorporate consumer feedback, expand our portfolio and extend the range of style and design options we offer. Our R&D team then designs, prototypes and tests these new products prior to full scale production. Our rigorous R&D process incorporates in-house analytical capabilities and comprehensive product testing with more than 260 distinct tests, such as accelerated weathering. During the three years ended September 30, 2018, our team successfully led over 10 significant new product introductions, and, for the twelve-month period ended September 30, 2018, our Five Year New Product Vitality for our Residential segment was approximately 51%. We have developed a robust pipeline of new products and technologies that we intend to launch over the next several years, which we believe will help us continue to maintain our strong product vitality.

Extensive Network of Contractors, Dealers and Distributors

Throughout our history, we have developed an extensive network in the United States and Canada of loyal contractors, dealers and distributors, many of whom are brand advocates for our products. Our extensive network consists of more than 4,000 dealers, over 100 distributor branch locations and thousands of contractors throughout the United States and Canada. We believe our strong relationships with dealers and contractors are driven by the trust and reliability that we have generated through product innovation, superior quality and performance, and the continuing service and support that we offer. Such support includes specialized training opportunities such as AZEK University and sales support initiatives such as digital lead generation, joint marketing funds, new sample kits, display kiosks, enhanced product literature, print, TV and radio advertising and social media initiatives. AZEK University provides hands-on training for contractors and customers using TimberTech and AZEK Exteriors products and our AZEK Pro Rewards program leverages our new website and digital capabilities to share curated digital leads with our contractors. In our Commercial segment, we sell

-7-

Table of Contents

our highly engineered polymer sheeting products through a network of approximately 130 engineered product distributors across the United States, Canada and Latin America, who sell primarily to OEMs, and we sell our low-maintenance bathroom partitions, shower and dressing stalls, lockers and other storage solutions through a network of approximately 900 dealers who sell to institutional and commercial customers across the United States and in Canada.

Strong Margin Profile with Significant Opportunity for Expansion

Our business has a strong margin profile driven by our differentiated premium branded products, vertically-integrated manufacturing capabilities and strong customer relationships. We continue to invest in new innovations in current and adjacent markets that we believe will support our long-term growth. Our Residential segment generated Adjusted EBITDA Margin of 31.1% in the year ended September 30, 2018, and we are well positioned to continue to execute on our operational excellence initiatives, including recycling and continuous manufacturing efficiency improvement. We have made significant recent capital investments, and as these investments mature, we believe there is a significant opportunity for us to expand our margins.

Execution-focused Management Team

We have assembled a team of highly experienced and accomplished executives with a proven track record of leading global consumer and industrial organizations and driving profitable growth, product innovation, cost reduction and manufacturing efficiency. Our Chief Executive Officer, Jesse Singh, joined our team in 2016, after serving in numerous leadership roles at 3M, including Chief Commercial Officer, President of 3M’s Health Information Systems business and VP of the Stationery and Office supplies business, which included the iconic Post-it and Scotch Brands. Our Chief Financial Officer, Ralph Nicoletti, joined our team in 2019 after serving as Executive Vice President and Chief Financial Officer of Newell Brands and has more than 35 years of finance experience. Collectively, our team has extensive experience at leading companies, including 3M, Newell Brands, Owens Corning, Eaton, Armstrong, Grainger and Emerson. Our management team has executed key strategic initiatives across the platform to drive accelerated growth and profitability, including upgrading operational capabilities, implementing productivity tools, and investing in new products, sales force expansion, marketing, M&A and internal recycling capabilities.

OUR GROWTH STRATEGY

We believe our multi-faceted growth strategy positions us to drive profitable above-market growth in the markets we serve.

Introduce Innovative New Products That Expand Our Markets

We have a proven track record of developing innovative new products that accelerate material conversion, increase the use of recycled materials and expand our markets. Our strong manufacturing capabilities, proprietary production technologies, detailed consumer research and extensive material science expertise allow us to rapidly introduce differentiated products. In our Residential segment, our new products are driving conversion away from traditional wood materials across all pricing segments, from various forms of pressure treated wood at the entry level to more exotic woods such as cedar and ipe at the premium level. In 2019, our Residential segment launched three new product platforms: TimberTech EDGE, Multi-Width decking and PaintPro trim. We believe that TimberTech EDGE will accelerate conversion of low-cost traditional pressure treated wood materials by offering superior aesthetics and performance at an accessible price point. Our entry-level decking category volume, which includes our TimberTech PRO Terrain collection in addition to our TimberTech EDGE Prime and Premier collections, has increased over 30% on a linear foot basis for the nine months ended June 30, 2019 as compared to the comparable period in the prior year. Multi-Width decking, which extends the technological

-8-

Table of Contents

advancements available in our highly successful Vintage platform, expands the range of style and design options available to consumers seeking premium decking solutions and provides a unique combination of superior performance and a natural wood-look and feel. PaintPro expands the addressable market for our trim products and accelerates wood conversion by delivering the same high quality, low-maintenance performance of traditional white PVC trim across a full spectrum of colors. Each year, we continue to launch new products across our business, and as of the year ended September 30, 2018, our blended Five Year New Product Vitality across our Residential segment and Commercial segment was approximately 44%. We will continue to leverage our material technology capabilities and commission detailed consumer research to regularly introduce new products that set us apart from our competition and accelerate future growth.

Accelerate Market Conversion by Capitalizing on Downstream Investments

Over the three years ended September 30, 2018, we have increased our R&D, sales and marketing expenses by approximately 17% in the aggregate, and we are continuing to make additional investments during fiscal 2019 that we believe will accelerate material conversion and growth in our markets. We expanded our marketing organization and sales force with new talent, enabling us to generate greater awareness of our products and enhance our sales growth in underpenetrated markets and geographies. We invested in new premium and traditional merchandising displays for our dealers and special order merchandising and training for pro desk support associates for our home improvement retailers to increase consumer awareness of our products and to accelerate sales growth. Starting in 2018, we have added new trim and retail focused sales teams and have also established a dedicated sales team to enhance our dealer sales in underpenetrated geographies. We believe these initiatives are helping to accelerate our growth. For example, we believe our new trim-focused sales team has helped increase our AZEK Exteriors trim net sales by more than 15% over the nine month period ended June 30, 2019 as compared to the comparable period in the prior year. In addition to expanding our sales force, we realigned the compensation framework for our sales teams to increase downstream engagement with consumers and key influencers such as architects, builders and contractors, to drive increased pull-through demand for our products. We recently opened our third AZEK University location in Chicago, and we are hosting regular contractor training events to encourage contractors to use our products. We believe we can continue to leverage our downstream investments to accelerate material conversion in our markets, strengthen our position in the pro channel and enhance our retail presence.

Build the Leading Consumer Brand in Outdoor Living

We are well-known for quality, innovation and delivering a broad range of on-trend style and design options to customers. We have made significant investments in sales and marketing and R&D over the past two years to differentiate and strengthen our brands and to simplify and transform the consumer experience for purchasing our products. In 2019, we unified our decking and railing product portfolio under our leading TimberTech brand with a differentiated “Go Against the Grain” marketing campaign. We continue to invest in our marketing organization and alongside our channel partners to increase consumer awareness and preference for our products. Our focused digital strategy, enhanced media presence and differentiated marketing campaigns drive increased engagement with consumers and homeowners as well as key influencers such as architects, builders and contractors. Our new digital platform facilitates the consumer journey from inspiration and design through installation. The experience educates consumers on the features and benefits of our products versus traditional materials, utilizes digital visualization tools to allow consumers to re-imagine their outdoor living spaces and directly connects them to a pre-qualified local contractor. During the first nine months of fiscal 2019, website traffic to our outdoor living branded websites has increased by over 45% and sample orders for our decking products have increased at a double-digit rate, in each case when compared to the prior year period. We enjoy strong preference for our products among contractors, who typically purchase our products at dealers, and we are investing to increase our presence within home improvement retailers as the majority of consumers include visits to home improvement retailers in their research of deck products. These consumer engagement strategies are focused on creating additional pull-through demand and accelerating our growth.

-9-

Table of Contents

Expand Margins Through Enhanced Recycling Capabilities and Productivity Initiatives

Our broad range of manufacturing capabilities, proprietary production technologies and extensive material science expertise position us as a leading innovator in the Outdoor Living market, and our brands command premium prices and afford us a strong margin profile. However, we believe there is an opportunity for significant improvement in our margins as we continue to invest in and expand our recycling capabilities and focus on operational excellence. Since fiscal 2017, we have invested over $25 million in developing our recycling capabilities to substantially reduce our material cost and increase our utilization of recycled materials. For example, for the nine month period ending June 30, 2019, we increased the recycled material content used in the core of our deck boards by approximately 20%, as compared to the recycled material content in fiscal 2017. This increase in recycled material content has allowed us to substantially reduce the utilization of virgin HDPE in the production of the core of our TimberTech PRO and EDGE products, representing over $4 million in cost savings on an annualized basis. We are still in the early stages of material substitution across our manufacturing network and realizing the benefits of our investments in recycling, and we expect to drive additional cost savings as we ramp up internal processing of recycled materials used in the manufacturing of our deck products. In addition to enhancing our recycling capabilities, we have also implemented various LSS initiatives across our manufacturing operations to reduce waste and enhance productivity. We utilize a systematic approach, AIMS, to drive continuous improvement throughout our organization. In fiscal 2018, we realized approximately $14 million of cost savings related to net manufacturing productivity improvements, representing savings of approximately 3.5% of cost of goods sold. We define net manufacturing productivity as the year-over-year change in net manufacturing expenses required to achieve a given level of manufacturing output, assuming constant raw material and other manufacturing input prices and excluding the effect of freight expense and unusual items. We identified and have begun to implement additional projects that we expect will provide incremental net manufacturing productivity in the coming years. We believe AIMS, our investments in people, processes and equipment and our investments in recycling, productivity and operational excellence will enable us to expand our margins through reduced material cost, improved net manufacturing productivity and enhanced business operations.

Execute Strategic Acquisitions That Broaden Our Platform

Our markets are large and highly fragmented, and they provide a wide range of opportunities for us to execute acquisitions to augment our growth independent of end-market demand. We have completed several strategic acquisitions since our company was founded, and we have proven to be a highly effective consolidation platform. For example, the acquisition of Versatex strengthened our position in the exterior trim and moulding market, enhanced our product capabilities and generated attractive cost savings, and the acquisition of Ultralox extended our rail portfolio to include aluminum solutions with proprietary interlocking technology and expanded our ability to address the high-growth aluminum railing market. We intend to continue to execute strategic acquisitions and utilize our disciplined process to identify, evaluate, execute and integrate acquired businesses. We actively monitor a pipeline of attractive consolidation opportunities across multiple product categories and geographies. We target opportunities that enhance our market positions, fill product and technology gaps and increase our business diversity. In addition, the acquisitions we pursue must also provide opportunities for us to leverage our strong manufacturing capabilities, material formulation proficiency and extensive dealer and distributor network to meaningfully enhance their scale, growth, profitability and cash flow.

-10-

Table of Contents

Risk Factors

Investing in our Class A common stock involves risks, which are discussed more fully under “Risk Factors.” You should carefully consider all the information in this prospectus, including under “Risk Factors,” before making an investment decision. These risks include, but are not limited to, the following:

| • | demand for our products is significantly influenced by general economic conditions and trends in consumer spending on outdoor living and home exteriors, and adverse trends in, among other things, the health of the economy, repair and remodel and new construction activity, industrial production and institutional funding constraints; |

| • | we compete against other manufacturers of (i) engineered and composite products; and (ii) products made from wood, metal and other traditional materials; |

| • | the seasonal nature of certain of our products and the impact that changes in weather conditions and product mix may have on our sales; |

| • | our ability to develop new and improved products and effectively manage the introduction of new products; |

| • | our ability to effectively manage changes in our manufacturing process resulting from cost savings and integration initiatives and the introduction of new products; |

| • | risks related to our ability to accurately predict demand for our products and risks related to our ability to maintain our relationships with key distributors or other customers; |

| • | risks related to shortages in supply, price increases or deviations in the quality of raw materials; |

| • | our ability to retain management; |

| • | risks related to acquisitions or joint ventures we may pursue; |

| • | our ability to maintain product quality and product performance at an acceptable cost, and potential exposures resulting from our product warranties; |

| • | our ability to ensure that our products comply with local building codes and ordinances; |

| • | risks arising from the material weaknesses we have identified in our internal control over financial reporting and any failure to remediate these material weaknesses; |

| • | our ability to maintain an effective system of internal controls and produce timely and accurate financial statements or comply with applicable regulations; |

| • | our ability to protect our intellectual property rights; |

| • | the increased expenses associated with being a public company; |

| • | risks associated with our substantial indebtedness and debt service; |

| • | our reliance on dividends, distributions and other payments from our subsidiaries to meet our obligations; |

| • | the continuing control after this offering of our company by our Sponsors, whose interests may conflict with our interests and those of other stockholders; |

| • | risks related to the Tax Receivable Agreement; |

| • | our status as a “controlled company” within the meaning of the rules, and our exemption from certain corporate governance requirements; and |

| • | certain provisions in our certificate of incorporation and our bylaws that may delay or prevent a change of control. |

-11-

Table of Contents

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | reduced obligations with respect to financial data, including presenting only two years of audited financial statements and only two years of selected financial data; |

| • | an exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| • | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements, and registration statements; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements. |

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies or that have opted out of using such extended transition period, which may make comparison of our financial statements with those of other public companies more difficult. We may take advantage of these reporting exemptions until we no longer qualify as an emerging growth company, or, with respect to adoption of certain new or revised accounting standards, until we irrevocably elect to opt out of using the extended transition period.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced reporting burdens.

Our Sponsors

Prior to this offering, entities affiliated with Ares and OTPP, and, together with Ares, the Sponsors, indirectly owned substantially all of our limited liability company interests. After giving effect to this offering and the Corporate Conversion, Ares and OTPP will hold and shares of our Class A common stock, respectively. OTPP will hold all of our Class B common stock. After giving effect to this offering and the Corporate Conversion, Ares and OTPP will hold approximately % and %, respectively, of our aggregate common stock. Our Sponsors will have significant power to control our affairs and policies, including with respect to the election of directors (and through the election of directors, the appointment of management). For a description of certain potential conflicts between the Sponsors and our other stockholders, see “Risk Factors—We continue to be controlled by the Sponsors, and the Sponsors’ interests may conflict with our interests and the interests of other stockholders.” For a description of the Sponsors’ ownership interests in us and their rights with respect to such ownership interests, see “Principal Stockholders” and “Description of Capital Stock.”

-12-

Table of Contents

Corporate Conversion

We currently operate as a Delaware limited liability company under the name CPG Newco LLC. CPG Newco LLC is a holding company which holds all of the limited liability company interests in CPG International LLC, the entity which directly and indirectly holds all of the equity interests in our operating subsidiaries. Prior to the effectiveness of the registration statement of which this prospectus forms a part, CPG Newco LLC will convert into a Delaware corporation pursuant to a statutory conversion and will change its name to The AZEK Company Inc. In addition, a special purpose entity, CPG Holdco LLC, which was formed at the time of the acquisition of CPG Newco LLC solely for the purpose of holding membership interests in CPG Newco LLC and that will continue to hold such interests until the Corporate Conversion, will be merged with and into us. In this prospectus, we refer to all of the transactions related to our conversion into a corporation and the merger described above as the Corporate Conversion. For more information, see “Corporate Structure” and “Corporate Conversion.”

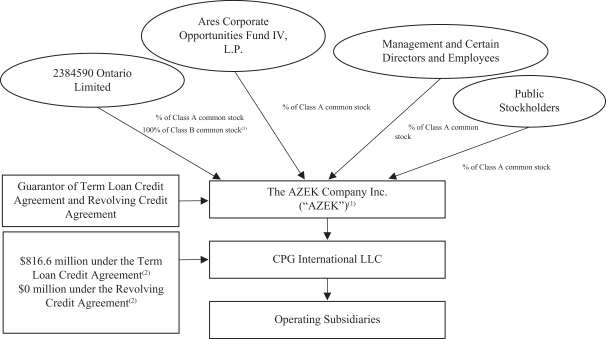

Corporate Structure

The following diagram sets forth a simplified view of our corporate structure and our principal indebtedness as of , 2019 after the consummation of the Corporate Conversion and the consummation of this offering and giving effect to the use of proceeds therefrom, including the redemption of our 8.000% senior notes due 2021, or the Senior Notes, with such proceeds; for more information, see “Description of Certain Indebtedness.” This chart is for illustrative purposes only and does not represent all legal entities affiliated with, or all obligations of, the entities depicted. Our indirect subsidiaries are omitted.

| (1) | Prior to the Corporate Conversion, AZEK was named CPG Newco LLC. |

| (2) | Amounts reflect amounts outstanding as of September 30, 2018 under the Term Loan Credit Agreement and the Revolving Credit Agreement. The Revolving Credit Agreement provides for commitments, as of September 30, 2018, of up to $150.0 million, subject to our option to increase the commitments by up to $100.0 million, subject to certain conditions. |

| (3) | The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. See “Description of Capital Stock.” |

-13-

Table of Contents

Tax Receivable Agreement

We will enter into a tax receivable agreement, or the Tax Receivable Agreement, that will provide for the payment by us to the holders of equity interests in CPG Newco LLC immediately prior to the consummation of this offering, or the TRA Parties, of 85% of the amount of cash savings, if any, in U.S. federal, state, local and non-U.S. income tax that we realize (or in some circumstances are deemed to realize) as a result of the utilization of our and our subsidiaries’ (i) depreciation and amortization deductions, and any offset to taxable income and gain or increase to taxable loss, resulting from the tax basis we have in our assets at the consummation of this offering, (ii) net operating losses as of the consummation of this offering, (iii) carry-forwards of interest deductions that were disallowed prior to consummation of this offering as a result of the limitations on deduction of interest contained in the Tax Cuts and Jobs Act, or the Tax Act and (iv) certain other tax attributes, including tax benefits attributable to payments under the Tax Receivable Agreement. We currently estimate that such payments will aggregate between $ and $ million, and we expect all payments to be made within 15 years of this offering. Because we will be a holding company with no operations of our own, our ability to make payments will depend on the ability of our subsidiaries to make distributions to us in an amount sufficient to cover our obligations under the Tax Receivable Agreement. For more information, see “Risk Factors” and “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.”

Corporate Information

CPG Newco LLC (formerly known as AOT Building Products Newco LLC) was formed on August 15, 2013 in connection with the Sponsors’ acquisition of CPG International LLC. Upon completion of this offering, we will be a Delaware corporation, and we will change our name to The AZEK Company Inc. Our principal executive offices are located at 1330 W Fulton Street, Suite 350, Chicago, Illinois 60607, and our telephone number is 877-275-2935. Our website address is www.AzekCo.com. Information contained on, or that can be accessed through, our website is not part of and is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

“The AZEK Company,” “AZEK,” “TimberTech,” “TimberTech EDGE,” “TimberTech PRO,” “TimberTech AZEK,” “PaintPro,” “Harvest Collection,” “Arbor Collection,” “Vintage Collection,” “ULTRALOX,” “VERSATEX,” “Vycom,” “Impression Rail Express,” “Scranton Products,” the AZEK logo, the TimberTech logo, the ULTRALOX logo, the VERSATEX Logo, the Vycom logo, the Scranton Products logo and other trademarks or service marks of The AZEK Company and its direct and indirect subsidiaries appearing in this prospectus are the property of The AZEK Company. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus generally appear without the ® or ™ symbols.

-14-

Table of Contents

The Offering

| Class A common stock offered by us |

shares |

| Class A common stock to be outstanding after this offering |

shares |

| Class B common stock to be outstanding after this offering |

shares |

| Total Class A common stock and Class B common stock to be outstanding after this offering |

shares |

| Option to purchase additional shares of Class A common stock offered by us |

shares |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional shares of Class A common stock from us in full), based on an assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us. |

| We intend to use net proceeds received by us from this offering to redeem the Senior Notes, plus accrued and unpaid interest thereon. As of September 30, 2018, $315.0 million of aggregate principal amount of Senior Notes was outstanding. |

| We will use any additional net proceeds raised in this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. We may also use a portion of any additional net proceeds we receive from this offering for acquisitions or other strategic investments, although we do not currently have any specific plans to do so. See “Use of Proceeds.” |

| Voting and conversion rights |

Following this offering, we will have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. |

| Each share of our Class A common stock entitles its holder to one vote per share on all matters to be voted upon by the stockholders. Each share of our Class B common stock entitles its holder to one vote per share on all matters to be voted upon by stockholders, except with respect to the election, removal or replacement of directors. Holders of Class A common stock and Class B common stock will generally vote together as a single class on all matters other than with respect to the election, removal or replacement of directors. |

-15-

Table of Contents

| Holders of our shares of Class B common stock may convert their shares of Class B common stock into shares of our Class A common stock on a one-for-one basis, in whole or in part, at any time and from time to time at their option. Additionally, each share of Class A common stock is convertible into one share of Class B common stock at any time and from time to time at the option of the holder so long as such holder holds one or more shares of Class B common stock at the time of conversion. See “Description of Capital Stock.” |

| Dividend policy |

We currently do not anticipate paying any cash dividends after this offering and for the foreseeable future. Any future determination relating to dividend policy will be made at the discretion of our board of directors and will depend on a number of factors, including restrictions in our current and future debt instruments, our future earnings, capital requirements, financial condition, future prospects, and applicable Delaware law, which provides that dividends are only payable out of surplus or current net profits. See “Dividend Policy.” |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

| Controlled company |

Following this offering, affiliates of the Sponsors will continue to control a majority of the voting power of our outstanding voting stock, and as a result we will be a controlled company within the meaning of the corporate governance standards. |

| Proposed symbol |

“ ” |

The numbers of shares of Class A common stock and Class B common stock that will be outstanding following this offering do not include shares of Class A common stock reserved for future issuance under our Equity Incentive Plan, as well as any future increases, including annual automatic increases, in the number of shares of Class A common stock reserved for issuance thereunder. See “Executive Compensation—Treatment of Awards on IPO; Post-IPO Compensation Programs.”

All references to common stock that are not qualified by reference to a particular class refer to our Class A common stock and our Class B common stock collectively.

In addition, unless otherwise expressly stated or the context otherwise requires, the information in this prospectus assumes:

| • | the completion of the Corporate Conversion; |

| • | no exercise of the underwriters’ option to purchase additional shares of our common stock; |

| • | the effectiveness of our certificate of incorporation and bylaws in connection with the completion of this offering; and |

| • | the entry into the Tax Receivable Agreement. |

-16-

Table of Contents

Summary Consolidated Financial Data

The summary consolidated statements of income data and summary consolidated statements of cash flow data for fiscal years 2018 and 2017 and the consolidated balance sheet data as of September 30, 2018 have been derived from our Consolidated Financial Statements included elsewhere in this prospectus.

Our historical results are not necessarily indicative of future operating results. Because this table is a summary and does not provide all of the data contained in our Consolidated Financial Statements, it should be read together with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Capitalization” and our Consolidated Financial Statements and related notes included elsewhere in this prospectus.

| Years Ended September 30, | ||||||||

| (In thousands, except unit/share and per unit/share data) | 2018 | 2017 | ||||||

| Consolidated Statements of Income Data: |

||||||||

| Net sales |

$ | 682,666 | $ | 632,631 | ||||

| Cost of sales |

(479,325 | ) | (463,643 | ) | ||||

|

|

|

|

|

|||||

| Gross profit |

203,341 | 168,988 | ||||||

| Selling, general and administrative expenses |

(145,549 | ) | (147,003 | ) | ||||

| Impairment of goodwill |

— | (32,200 | ) | |||||

| Impairment of property, plant and equipment |

— | (11,380 | ) | |||||

| Other general expenses |

(4,182 | ) | — | |||||

| Loss on disposal of property, plant and equipment |

(791 | ) | (4,288 | ) | ||||

|

|

|

|

|

|||||

| Operating income (loss) |

52,819 | (25,883 | ) | |||||

| Interest expense |

(68,742 | ) | (61,577 | ) | ||||

| Loss before income taxes |

(15,923 | ) | (87,460 | ) | ||||

| Income tax benefit |

23,112 | 20,049 | ||||||

|

|

|

|

|

|||||

| Net income (loss) |

7,189 | (67,411 | ) | |||||

|

|

|

|

|

|||||

| Basic and diluted earnings (loss) per unit attributable to the member: |

$ | 7,189 | $ | (67,411 | ) | |||

|

|

|

|

|

|||||

| Basic and diluted weighted-average units outstanding: |

1 | 1 | ||||||

|

|

|

|

|

|||||

| Basic and diluted pro forma earnings (loss) per share attributable to common stockholders(1): |

||||||||

|

|

|

|

|

|||||

| Basic and diluted pro forma weighted-average common shares outstanding(1): |

||||||||

|

|

|

|

|

|||||

| Consolidated Statements of Cash Flow Data: |

||||||||

| Net cash provided by operating activities |

$ | 67,302 | $ | 57,368 | ||||

| Net cash used in investing activities |

(335,682 | ) | (22,511 | ) | ||||

| Net cash provided by (used in) financing activities |

248,742 | (12,104 | ) | |||||

| Purchases of property, plant and equipment |

(42,758 | ) | (22,511 | ) | ||||

| Other Financial Data: |

||||||||

| Adjusted Gross Profit(2) |

$ | 269,729 | $ | 236,379 | ||||

| Adjusted Net Income(3) |

92,464 | 62,898 | ||||||

| Adjusted EBITDA(4) |

164,858 | 143,129 | ||||||

| Adjusted EBITDA Margin(5) |

24.1 | % | 22.6 | % | ||||

| (1) | Pro forma to reflect the Corporate Conversion, without giving effect to the issuance of shares of Class A common stock in this offering. |

| (2) | We define Adjusted Gross Profit as gross profit before depreciation and amortization, certain non-cash costs, business transformation costs, acquisition costs and certain other costs. See “Selected Consolidated Financial Data—Non-GAAP Financial Measures.” |

| (3) | We define Adjusted Net Income as net income (loss) before depreciation and amortization, certain non-cash costs, business transformation costs, acquisition costs, initial public offering costs, capital structure transaction costs and certain other costs. In addition, |

-17-

Table of Contents

| Adjusted Net Income for fiscal 2018 excludes the net benefit related to the remeasurement of our deferred tax assets and deferred tax liabilities as a result of the Tax Act. See “Selected Consolidated Financial Data—Non-GAAP Financial Measures.” |

| (4) | We define Adjusted EBITDA as net income (loss) before interest expense, net, income tax (benefit) expense and depreciation and amortization and by adding to or subtracting therefrom certain items of expense and income. See “Selected Consolidated Financial Data—Non-GAAP Financial Measures.” |

| (5) | Adjusted EBITDA Margin is equal to Adjusted EBITDA divided by net sales. See “Selected Consolidated Financial Data—Non-GAAP Financial Measures.” |

| As of September 30, 2018 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| (In thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 82,283 | ||||||||||

| Working capital(4) |

139,314 | |||||||||||

| Total assets |

1,774,347 | |||||||||||

| Total current liabilities |

110,327 | |||||||||||

| Total long-term debt – less current portion |

1,107,989 | |||||||||||

| Tax Receivable Agreement liability |

||||||||||||

| Total member’s/stockholders’ equity |

505,997 | |||||||||||

| (1) | Pro forma consolidated balance sheet data gives effect to (i) the Corporate Conversion and (ii) our entry into the Tax Receivable Agreement prior to the consummation of this offering, which will result in an additional liability and a reduction of additional paid-in capital. We currently estimate that liability to be between $ million and $ million. See “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Tax Receivable Agreement” and “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.” |

| (2) | Pro forma as adjusted consolidated balance sheet data additionally gives effect to (i) the sale of shares of our Class A common stock in this offering, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the application of the estimated net proceeds from this offering as described under “Use of Proceeds.” |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share of Class A common stock (the midpoint of the estimated price range set forth on the cover page of this prospectus) would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $ million and would decrease (increase) total long-term debt—less current portion by $ million, assuming that the number of shares of Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares of Class A common stock offered by us would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $ million and would decrease (increase) total long-term debt—less current portion by $ million, assuming the assumed initial public offering price of $ per share remains the same, and after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us. |

| (4) | Working capital represents current assets less current liabilities. |

-18-

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties, together with all of the other information contained in this prospectus, including our Consolidated Financial Statements and related notes included elsewhere in this prospectus, before making an investment decision. The occurrence of any of the following risks, or additional risks not presently known to us or that we currently believe to be immaterial, could materially and adversely affect our business, financial condition, results of operations and prospects. In such case, the trading price of our Class A common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

Demand for our products is significantly influenced by general economic conditions and trends in consumer spending on outdoor living and home exteriors, and adverse trends in, among other things, the health of the economy, repair and remodel and new construction activity, industrial production, consumer confidence and discretionary spending and institutional funding constraints could have a material adverse effect on our business.

Demand for our products is significantly influenced by a number of economic factors affecting our customers, including distributors, dealers, contractors, architects, builders, homeowners and institutional and commercial consumers. Demand for our products depends on the level of residential and commercial improvement and renovation and new construction activity, and, in particular, the amount of spending on outdoor living spaces and home exteriors. Home and commercial renovation and improvement and new construction activity are affected by, among other things, interest rates, consumer confidence and spending habits, demographic trends, housing affordability levels, unemployment rates, institutional funding constraints, industrial production levels, tariffs and general economic conditions.

For example, in our Residential segment, sales of our products depend primarily on the level of repair and remodel activity and, to a lesser extent, new construction activity. Accordingly, increases in interest rates or the reduced availability of financing can reduce the level of home improvement and new construction activity and the demand for our products. In addition, the residential repair and remodel market depends in part on home equity financing, and accordingly, the level of equity in homes will affect consumers’ ability to obtain a home equity line of credit and engage in renovations that would result in purchases of our products. Accordingly, a weakness in home prices may result in a decreased demand for our residential products.

Many of our residential products are impacted by consumer demand for, and spending on, outdoor living spaces and home exteriors. For example, sales of our deck and rail products depend on lifestyle and architectural trends and the extent to which consumers prioritize spending to enhance outdoor living spaces for their homes. While we believe consumer preferences have increased spending on outdoor living and home exteriors in recent years, the level of spending could decrease in the future. Decreased spending on outdoor living spaces and home exteriors generally or as a percentage of home improvement activity may decrease demand for our deck, railing and trim products.