UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

For the fiscal year ended

OR

For the transition period from to .

OR

Date of event requiring this shell company report

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

People’s Republic of

(Address of principal executive offices)

Chief Executive Officer

Tel: +

E-mail:

At the address of the set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

|

|

| The | |

|

| N/A |

| The |

*Not for trading, but only in connection with the listing on the Nasdaq Global Market of American depositary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

457,743,530 ordinary shares, par value US$0.00002 per share, as of December 31, 2022.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Non-accelerated Filer | ☐ | ||

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

| |

| Other ☐ | |

| by the International Accounting Standards Board ☒ |

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

TABLE OF CONTENTS

i

INTRODUCTION

Except where the context otherwise indicates and for the purpose of this annual report only:

| ● | “ADSs” refers to the American depositary shares, each representing five of our ordinary shares; |

| ● | “China” or “PRC” refers to the People’s Republic of China; and only in the context of describing PRC rules, laws, regulations, regulatory authority, and any PRC entities or citizens under such rules, laws and regulations and other legal or tax matters in this annual report, excludes Taiwan, Hong Kong, and Macau; |

| ● | “Greater China,” with respect to our collaboration with CStone Pharmaceuticals (Suzhou) Co., Ltd. (“CStone”), refer to Mainland China, Taiwan, Hong Kong and Macau; |

| ● | “Genetron” refers to Genetron Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability; |

| ● | “IVD” refers to in vitro diagnostics products, including platforms and assays; |

| ● | “LDT” refers to laboratory developed tests which examine samples taken from the human body, such as body fluids (blood, urine, cerebrospinal fluid, etc.) and tissue, and are conducted in our laboratories. |

| ● | “ordinary shares” refers to our ordinary shares of par value US$0.00002 per share; |

| ● | “PRC Subsidiaries” refers to Genetron (Tianjian) Co., Ltd. and Genetron (Wuxi) Business Management Co., Ltd., which has power over and ability to receive substantially all the economic benefits from the respective VIE s which results in consolidation for accounting purposes,, in the context of describing of their activities; |

| ● | “RMB” or “Renminbi” refers to the legal currency of the People’s Republic of China; |

| ● | “US$,” “dollars” or “U.S. dollars” refers to the legal currency of the United States; |

| ● | “we,” “us,” “our Company,” or “our” refers to Genetron Holdings Limited and its subsidiaries, and, in the context of describing our consolidated financial information, business operations and operating data, its consolidated VIEs and their subsidiaries; and |

| ● | “variable interest entities,” or “VIEs,” refers to Genetron Health (Beijing) Co., Ltd. and Genetron (Wuxi) Biotech Co., Ltd. in the context of describing their activities and contractual arrangements with us. |

We present our financial results in RMB. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Renminbi into U.S. dollars were made at the rate at RMB6.8972 to US$1.00, the exchange rate as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System in effect as of December 30, 2022.

1

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, you can identify these forward-looking statements by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to:

| ● | our goals and growth strategies; |

| ● | our future business development, results of operations and financial condition; |

| ● | relevant government policies and regulations relating to our business and industry; |

| ● | our expectations regarding demand for and market acceptance of our diagnosis services and products, cancer early screening services and our IVD products and our ability to expand our customer base; |

| ● | our ability to obtain and maintain regulatory approvals from the NMPA, the NCCL and have our laboratory certified or accredited by authorities including the CLIA and the CAP; |

| ● | our ability to obtain and maintain intellectual property protections for our technologies and our continued research and development to keep pace with technology developments; |

| ● | impacts of the COVID-19 pandemic; |

| ● | general economic and business condition in China; and |

| ● | assumptions underlying or related to any of the foregoing. |

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3. Key Information—3. D. Risk Factors” of this annual report and other risks outlined in our other filings with the Securities and Exchange Commission, or the SEC. Those risks are not exhaustive. We operate in an evolving environment. New risks emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law. You should read this annual report and the documents that we reference in this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

2

EXPLANATORY NOTE

Investing in our securities involves a high degree of risk. Please carefully consider the risks discussed under the section entitled “Item 3. Key Information—D. Risk Factors” in this annual report. We provide the following disclosure to help investors better understand our corporate structure, operations in China and the associated risks.

As used in this annual report, (i) “we,” “us,” “our Company,” or “our” refers to Genetron Holdings Limited and its subsidiaries, and, in the context of describing the Group’s consolidated financial information, business operations and operating data, the consolidated VIEs and their subsidiaries; (ii) “Genetron” refers to Genetron Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability; (iii) “PRC Subsidiaries” refers to Genetron (Tianjin) Co., Ltd., which has power over and ability to receive substantially all the economic benefits from Genetron Health (Beijing) Co., Ltd. which results in consolidation for accounting purposes, and Genetron (Wuxi) Business Management Co., Ltd., which has power over and ability to receive substantially all the economic benefits from Genetron (Wuxi) Biotech Co., Ltd., which results in consolidation for accounting purposes, in the context of describing of their activities; and (iv) “variable interest entities,” or “VIEs,” refers to Genetron Health (Beijing) Co., Ltd. and Genetron (Wuxi) Biotech Co., Ltd. in the context of describing their activities and contractual arrangements with us. The VIEs primarily conduct operations in China, and the VIEs are consolidated for accounting purposes but are not entities in which we own equity.

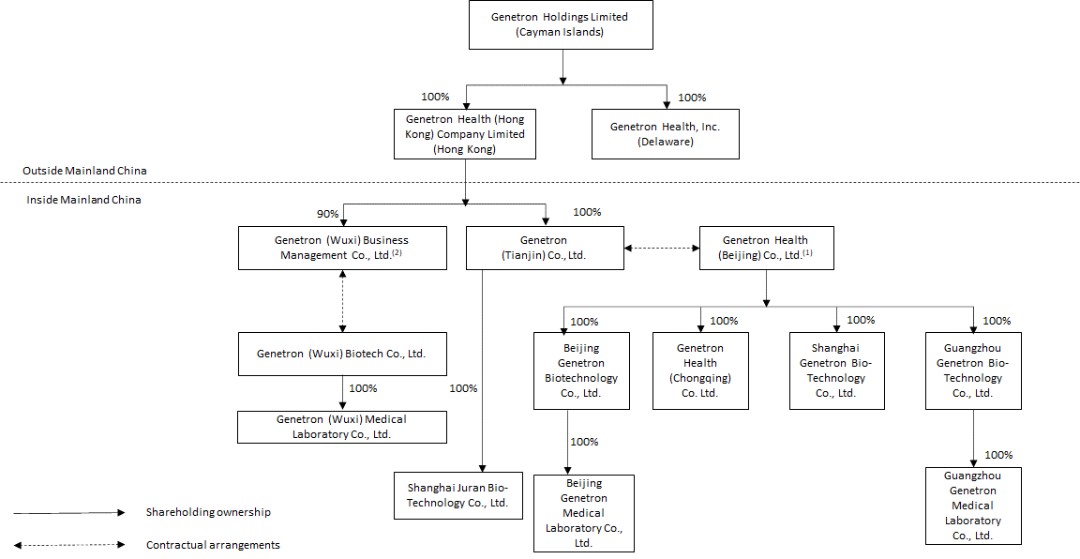

Our Corporate Structure and Operation in China

Genetron Holdings Limited is a Cayman Islands holding company. It conducts its operations in China through its PRC subsidiaries, the VIEs, and subsidiaries of the VIEs. To comply with PRC laws and regulations, we established the VIEs, Genetron Health (Beijing) Co., Ltd. (“Genetron Health”) and Genetron (Wuxi) Biotech Co., Ltd., to conduct precision oncology services business activities.

However, we and our direct and indirect subsidiaries do not, and it is virtually impossible for them to, have any equity interests in the VIEs in practice as current PRC laws and regulations impose certain restrictions or prohibitions on foreign ownership of companies that engage in the field of technology development and applications relating to human stem cells and genomic diagnosis and treatment. Therefore, we have power over and receive substantially all the economic benefits of Genetron Health through contractual arrangements among Genetron (Tianjin) Co., Ltd., Genetron Health and shareholders of Genetron Health; and we have power over and receive substantially all the economic benefits of Genetron (Wuxi) Biotech Co., Ltd. through contractual arrangements among Genetron (Wuxi) Business Management Co., Ltd, Genetron (Wuxi) Biotech Co., Ltd. and its shareholders. As a result of these contractual arrangements, we have consolidated the financial results of the VIEs and their subsidiaries in our consolidated financial statements in accordance with IFRS. For a detailed description about such structure and the relevant contractual arrangements, see “Item 4. Information on the Company—4.C. Organizational Structure.”

The VIEs are owned by certain nominee shareholders, not us. All of these nominee shareholders are also beneficial owners of the Company. Such structure involves unique risks to investors in the ADSs and ordinary shares. Investors in our ADSs are purchasing equity securities of a Cayman Islands holding company rather than equity securities issued by our subsidiaries and the VIEs. Our contractual arrangements with the VIEs and their respective shareholders have not been tested in a court of law in the PRC, and investors who are non-PRC residents may not directly hold equity interests in the VIEs under current PRC laws and regulations. If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to material penalties or be forced to relinquish our interests in those operations or otherwise significantly change our corporate structure. We and our investors face significant uncertainty about potential future actions by the PRC government that could affect the legality and enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect our ability to consolidate the financial results of the VIEs and the financial performance of our Company as a whole. Our ADSs may decline in value or become worthless if we are unable to effectively enforce our contractual rights over the assets and operations of the VIE that conduct a significant portion of our business in China. These risks could result in a material change in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. See “Item 3. Key Information—3.D. Risk Factor—Risks Related to Our Corporate Structure” for detailed discussion.

3

We face various legal and operational risks and uncertainties as a company based in and primarily operating in China. The PRC government has significant authority to exert influence on the ability of a China-based company, like us, to conduct its business, accept foreign investments or be listed on a U.S. stock exchange. For example, we face risks associated with the use of variable interest entities, anti-monopoly regulatory actions, cybersecurity and data privacy, as well as the uncertainties associated with potential lack of inspection from the U.S. Public Company Accounting Oversight Board, or PCAOB, on our auditor in the future. The PRC government has recently published new policies and made statements, such as those related to regulatory approvals of offshore offerings and data security or anti-monopoly concerns, that may have significantly affected us and our industry as a whole and we cannot rule out the possibility that it will in the future further release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Any such action, once taken by the PRC government, could impact our ability to conduct our business, accept foreign investments, or maintain list on Nasdaq or list on other foreign exchange, and cause the value of our securities to significantly decline or in extreme cases, become worthless.

Implication of the Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor. In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of this annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the Securities and Exchange Commission, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. See “Item 3. Key Information––3.D. Risk Factors––Risks Related to Doing Business in the PRC–– The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections.” And “Item 3. Key Information––3.D. Risk Factors––Risks Related to Doing Business in the PRC–– Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

4

Corporate Structure

The following diagram illustrates our corporate structure as of the date of this annual report, including our material subsidiaries and the consolidated VIEs.

Notes:

(1) | Shareholders of Genetron Health (Beijing) Co., Ltd., or Genetron Health, are (a) Wang-Acting-in-Concert Group (as defined below), collectively holding 58.0% equity interests of Genetron Health, and (b) a diversified group of unrelated PRC-based institutional investors that are also shareholders of Genetron Holdings Limited, collectively holding 42.0% of equity interests of Genetron Health, among which Shenzhen Jiadao Gongcheng Equity Investment Funds (Limited Partnership) and Shenzhen Haixia Life Science Investment Partnership (Limited Partnership) owns 8.9% and 8.0% of equity interests of Genetron Health, respectively. |

On October 10, 2017, Mr. Sizhen Wang, the immediate family members of executive officer and co-founder (Dr. Yan Hai and Mr. Weiwu He), Beijing Jinchuang Junmeng Investment Management Center (Limited Partnership), Zhuhai Jinchuang Junhe Investment Management Center (Limited Partnership) and Beijing Jinchuang Junlian Investment Management Center (Limited Partnership) (such persons collectively, the “Wang-Acting-in-Concert Group”), entered into a concert party agreement pursuant to which the parties agree to (i) always be acting in concert in respect of their respective direct or indirect voting rights at Genetron Health’s shareholders’ general meetings and Genetron Health’s board meetings, (ii) recognize the controlling position of Mr. Sizhen Wang, CEO of the Company and Chairman of the Board; and (iii) act in concert in accordance with Mr. Sizhen Wang’s opinions in respect of the daily operations and management and the major decision-making of Genetron Health.

(2) | Shareholders of Genetron (Wuxi) Biotech Co., Ltd. are Sizhen Wang and Yuchen Jiao, our Chief Technology Officer of the Company, each holding 90% and 10%, respectively, equity interests of Genetron (Wuxi) Biotech Co., Ltd. |

5

Disaggregated Financial Information relating to the VIEs

In 2020, 2021 and 2022, external revenues contributed by the VIEs and their subsidiaries accounted for 100.0%, 99.98% and 98.28%, respectively, of our total revenues. As of December 31, 2021 and 2022, total assets of the VIEs, excluding amounts due from other companies in our group, equaled to 48.9% and 71.9% of our consolidated total assets as of the same dates, respectively.

Set forth below are the condensed consolidating schedule showing the financial position as of December 31, 2021 and 2022, and results of operations and cash flows for the years ended December 31, 2020, 2021 and 2022 for (i) Genetron Holdings Limited (the “Parent”); (ii) the PRC Subsidiaries, which have power over and ability to receive substantially all the economic benefits from the VIEs and their subsidiaries which results in consolidation for accounting purposes; (iii) other subsidiaries (excluding the PRC Subsidiaries); (iv) the VIEs and their subsidiaries; (v) eliminating adjustments; and (vi) consolidated totals.

6

As of December 31, 2021 | As of December 31, 2022 | |||||||||||||||||||||||

Other | PRC | VIEs and their | Eliminating | Consolidated | Other | PRC | VIEs and their | Eliminating | Consolidated | |||||||||||||||

Parent | Subsidiaries | Subsidiaries | subsidiaries | Adjustments | Totals | Parent | Subsidiaries | Subsidiaries | subsidiaries | Adjustments | Totals | |||||||||||||

Condensed Consolidating Schedule of Financial Position | (RMB in thousands) | (RMB in thousands) | ||||||||||||||||||||||

Property, plant and equipment(1) |

| — |

| 7,619 |

| 5,499 |

| 100,622 |

| (3,455) |

| 110,285 |

| — |

| 11,138 |

| 5,535 |

| 123,232 |

| (1,152) |

| 138,753 |

Right-of-use assets |

| — |

| 11,091 |

| 738 |

| 40,245 |

| — |

| 52,074 |

| — |

| 9,980 |

| — |

| 28,904 |

| — |

| 38,884 |

Intangible assets |

| — |

| 2,501 |

| 1,669 |

| 16,525 |

| — |

| 20,695 |

| — |

| 6,647 |

| 5,273 |

| 20,148 |

| — |

| 32,068 |

Financial assets at fair value through profit or loss |

| 25,503 |

| — |

| — |

| 24,277 |

| — |

| 49,780 |

| 27,859 |

| — |

| — |

| 22,637 |

| — |

| 50,496 |

Prepayments |

| 19,766 |

| 4,208 |

| 5,912 |

| 7,724 |

| — |

| 37,610 |

| — |

| 2,285 |

| — |

| 3,888 |

| — |

| 6,173 |

Amounts due from Group companies(2) |

| — |

| 1,360,431 |

| 1,168,130 |

| — |

| (2,528,561) |

| — |

| — |

| 1,590,661 |

| 1,430,703 |

| — |

| (3,021,364) |

| — |

Investments in subsidiaries and VIEs(3) |

| 1,138,922 |

| — |

| 210,000 |

| — |

| (1,348,922) |

| — |

| 558,800 |

| — |

| 210,000 |

| — |

| (768,800) |

| — |

Total non-current assets |

| 1,184,191 |

| 1,385,850 |

| 1,391,948 |

| 189,393 |

| (3,880,938) |

| 270,444 |

| 586,659 |

| 1,620,711 |

| 1,651,511 |

| 198,809 |

| (3,791,316) |

| 266,374 |

Inventories(1) |

| — |

| — |

| 477 |

| 35,700 |

| (574) |

| 35,603 |

| — |

| 1,045 |

| 609 |

| 41,355 |

| (582) |

| 42,427 |

Trade receivables |

| — |

| — |

| — |

| 282,113 |

| — |

| 282,113 |

| — |

| — |

| 809 |

| 242,314 |

| — |

| 243,123 |

Other receivables and prepayments |

| 7,170 |

| 2,037 |

| 16,455 |

| 72,233 |

| — |

| 97,895 |

| 16,765 |

| 1,525 |

| 14,640 |

| 32,501 |

| — |

| 65,431 |

Amounts due from Group companies(2) |

| 6,713 |

| — |

| 65,056 |

| 3,890 |

| (75,659) |

| — |

| 735 |

| — |

| 202,675 |

| 5,646 |

| (209,056) |

| — |

Amounts due from other related parties |

| — |

| — |

| — |

| 597 |

| — |

| 597 |

| — |

| — |

| — |

| 110 |

| — |

| 110 |

Financial assets at fair value through profit or loss |

| 91,562 |

| — |

| 9,924 |

| 49,957 |

| — |

| 151,443 |

| 83,207 |

| 3,168 |

| 401 |

| 70,650 |

| — |

| 157,426 |

Cash and cash equivalents |

| 44,691 |

| 243,756 |

| 273,949 |

| 76,646 |

| — |

| 639,042 |

| 4,211 |

| 9,490 |

| 70,488 |

| 92,077 |

| — |

| 176,266 |

Other current assets |

| — |

| — |

| 5,091 |

| 35,391 |

| — |

| 40,482 |

| — |

| — |

| 929 |

| 23,240 |

| — |

| 24,169 |

Total current assets |

| 150,136 |

| 245,793 |

| 370,952 |

| 556,527 |

| (76,233) |

| 1,247,175 |

| 104,918 |

| 15,228 |

| 290,551 |

| 507,893 |

| (209,638) |

| 708,952 |

Total assets |

| 1,334,327 |

| 1,631,643 |

| 1,762,900 |

| 745,920 |

| (3,957,171) |

| 1,517,619 |

| 691,577 |

| 1,635,939 |

| 1,942,062 |

| 706,702 |

| (4,000,954) |

| 975,326 |

Borrowings |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 7,098 |

| — |

| 7,098 |

Lease liabilities |

| — |

| 9,587 |

| — |

| 24,278 |

| — |

| 33,865 |

| — |

| 8,505 |

| — |

| 11,740 |

| — |

| 20,245 |

Deficit in subsidiaries and VIEs(3) |

| — |

| 269,229 |

| 924,376 |

| — |

| (1,193,605) |

| — |

| — |

| 843,168 |

| 1,455,786 |

| — |

| (2,298,954) |

| — |

Amounts due to Group companies(2) |

| 75,457 |

| — |

| 1,074,974 |

| 1,378,130 |

| (2,528,561) |

| — |

| 106,688 |

| 9,340 |

| 1,273,974 |

| 1,631,362 |

| (3,021,364) |

| — |

Other non-current liabilities |

| — |

| — |

| 8,612 |

| — |

| — |

| 8,612 |

| — |

| — |

| 9,760 |

| — |

| — |

| 9,760 |

Total non-current liabilities |

| 75,457 |

| 278,816 |

| 2,007,962 |

| 1,402,408 |

| (3,722,166) |

| 42,477 |

| 106,688 |

| 861,013 |

| 2,739,520 |

| 1,650,200 |

| (5,320,318) |

| 37,103 |

Trade payables |

| — |

| — |

| 8,016 |

| 47,751 |

| — |

| 55,767 |

| — |

| — |

| 23,317 |

| 39,731 |

| — |

| 63,048 |

Other payables and accruals |

| 51,837 |

| 1,655 |

| 4,041 |

| 99,699 |

| — |

| 157,232 |

| 36,260 |

| 2,455 |

| 11,315 |

| 135,976 |

| — |

| 186,006 |

Amounts due to Group companies(2) |

| 1,442 |

| — |

| 2,448 |

| 71,680 |

| (75,570) |

| — |

| 2,507 |

| 1,047 |

| 2,110 |

| 203,269 |

| (208,933) |

| — |

Borrowings |

| — |

| — |

| — |

| 19,554 |

| — |

| 19,554 |

| — |

| — |

| 5,000 |

| 104,734 |

| — |

| 109,734 |

Lease liabilities |

| — |

| 2,161 |

| 711 |

| 17,700 |

| — |

| 20,572 |

| — |

| 2,501 |

| — |

| 18,989 |

| — |

| 21,490 |

Other current liabilities |

| — |

| — |

| 461 |

| 11,504 |

| — |

| 11,965 |

| — |

| — |

| — |

| 9,589 |

| — |

| 9,589 |

Total current liabilities |

| 53,279 |

| 3,816 |

| 15,677 |

| 267,888 |

| (75,570) |

| 265,090 |

| 38,767 |

| 6,003 |

| 41,742 |

| 512,288 |

| (208,933) |

| 389,867 |

Total liabilities |

| 128,736 |

| 282,632 |

| 2,023,639 |

| 1,670,296 |

| (3,797,736) |

| 307,567 |

| 145,455 |

| 867,016 |

| 2,781,262 |

| 2,162,488 |

| (5,529,251) |

| 426,970 |

Total shareholders’ equity/(deficit) |

| 1,205,591 |

| 1,349,011 |

| (260,739) |

| (924,376) |

| (163,896) |

| 1,205,591 |

| 546,122 |

| 768,923 |

| (839,200) |

| (1,455,786) |

| 1,526,063 |

| 546,122 |

Non-controlling interests |

| — |

| — |

| — |

| — |

| 4,461 |

| 4,461 |

| — |

| — |

| — |

| — |

| 2,234 |

| 2,234 |

Total equity and liabilities |

| 1,334,327 |

| 1,631,643 |

| 1,762,900 |

| 745,920 |

| (3,957,171) |

| 1,517,619 |

| 691,577 |

| 1,635,939 |

| 1,942,062 |

| 706,702 |

| (4,000,954) |

| 975,326 |

7

For the year ended December 31, 2020 | For the year ended December 31, 2021 | For the year ended December 31, 2022 | ||||||||||||||||||||||||||||||||||

VIEs and | VIEs and | VIEs and | ||||||||||||||||||||||||||||||||||

Other | PRC | their | Eliminating | Consolidated | Other | PRC | their | Eliminating | Consolidated | Other | PRC | their | Eliminating | Consolidated | ||||||||||||||||||||||

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals |

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals |

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals | |

Condensed Consolidating Schedule of Results of Operations | (RMB in thousands) | (RMB in thousands) | (RMB in thousands) | |||||||||||||||||||||||||||||||||

Total revenue(1) |

| — |

| — |

| 45,034 |

| 424,485 |

| (45,034) |

| 424,485 |

| — |

| — |

| 46,228 |

| 534,111 |

| (48,389) |

| 531,950 |

| — |

| 47 |

| 183,651 |

| 641,190 |

| (174,182) |

| 650,706 |

Total cost of revenue and expenses |

| (19,480) |

| (5,357) |

| (60,641) |

| (647,255) |

| 46,189 |

| (686,544) |

| (51,124) |

| (26,089) |

| (73,290) |

| (918,859) |

| 51,267 |

| (1,018,095) |

| (48,689) |

| (39,643) |

| (247,252) |

| (1,131,789) |

| 176,337 |

| (1,291,036) |

Equity method on loss of subsidiaries(3) |

| (225,796) |

| (258,868) |

| (236,102) |

| — |

| 720,766 |

| — |

| (445,020) |

| (445,998) |

| (425,411) |

| — |

| 1,316,429 |

| — |

| (747,430) |

| (592,958) |

| (550,429) |

| — |

| 1,890,817 |

| — |

Fair value loss of financial instruments with preferred rights | (2,823,370) | — | — | — | — | (2,823,370) | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||

Others-net |

| (397) |

| 38,429 |

| (8,314) |

| (13,332) |

| — |

| 16,386 |

| (94) |

| 27,067 |

| (2,763) |

| (40,663) |

| — |

| (16,453) |

| (12,284) |

| (114,876) |

| 16,550 |

| (59,830) |

| 140 |

| (170,300) |

Loss before income tax |

| (3,069,043) |

| (225,796) |

| (260,023) |

| (236,102) |

| 721,921 |

| (3,069,043) |

| (496,238) |

| (445,020) |

| (455,236) |

| (425,411) |

| 1,319,307 |

| (502,598) |

| (808,403) |

| (747,430) |

| (597,480) |

| (550,429) |

| 1,893,112 |

| (810,630) |

Income tax expense |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

Loss for the year |

| (3,069,043) |

| (225,796) |

| (260,023) |

| (236,102) |

| 721,921 |

| (3,069,043) |

| (496,238) |

| (445,020) |

| (455,236) |

| (425,411) |

| 1,319,307 |

| (502,598) |

| (808,403) |

| (747,430) |

| (597,480) |

| (550,429) |

| 1,893,112 |

| (810,630) |

Owners of the Company |

| (3,069,043) |

| (225,796) |

| (260,023) |

| (236,102) |

| 721,921 |

| (3,069,043) |

| (496,238) |

| (445,020) |

| (455,236) |

| (425,411) |

| 1,325,667 |

| (496,238) |

| (808,403) |

| (747,430) |

| (597,480) |

| (550,429) |

| 1,895,339 |

| (808,403) |

Non-controlling interests |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (6,360) |

| (6,360) |

| — |

| — |

| — |

| — |

| (2,227) |

| (2,227) |

8

For the year ended December 31, 2020 | For the year ended December 31, 2021 | For the year ended December 31, 2022 | ||||||||||||||||||||||||||||||||||

VIEs and | VIEs and | VIEs and | ||||||||||||||||||||||||||||||||||

Other | PRC | their | Eliminating | Consolidated | Other | PRC | their | Eliminating | Consolidated | Other | PRC | their | Eliminating | Consolidated | ||||||||||||||||||||||

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals |

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals |

| Parent |

| Subsidiaries |

| Subsidiaries |

| subsidiaries |

| Adjustments |

| Totals | |

Condensed Consolidating Schedule of Cash Flows | (RMB in thousands) | (RMB in thousands) | (RMB in thousands) | |||||||||||||||||||||||||||||||||

Net cash used in operating activities | (36,241) | (12,459) | (55,603) | (196,594) | — | (300,897) | (35,706) | (18,256) | (64,272) | (405,910) | — | (524,144) | (36,359) | (31,307) | (165,297) | (227,234) | — | (460,197) | ||||||||||||||||||

Investment in subsidiaries(3) |

| (1,006,010) |

| (438,036) |

| — |

| — |

| 1,444,046 |

| — |

| (886,610) |

| (258,607) |

| (210,000) |

| — |

| 1,355,217 |

| — |

| (24,302) |

| — |

| — |

| — |

| 24,302 |

| — |

Loans to Group companies(4) |

| — |

| (546,384) |

| (499,424) |

| — |

| 1,045,808 |

| — |

| — |

| (1,371,357) |

| (718,600) |

| — |

| 2,089,957 |

| — |

| — |

| (249,000) |

| (404,080) |

| — |

| 653,080 |

| — |

Repayments of loans from Group companies(4) |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 770,000 |

| 282,480 |

| — |

| (1,052,480) |

| — |

| — |

| 25,000 |

| 141,507 |

| — |

| (166,507) |

| — |

Other investing activities |

| (34,323) |

| (9,489) |

| (31,614) |

| (9,223) |

| — |

| (84,649) |

| (91,931) |

| (5,154) |

| 13,509 |

| (52,699) |

| — |

| (136,275) |

| (7,106) |

| (11,415) |

| 9,879 |

| (79,190) |

| — |

| (87,832) |

Net cash (used in)/ generated from investing activities |

| (1,040,333) |

| (993,909) |

| (531,038) |

| (9,223) |

| 2,489,854 |

| (84,649) |

| (978,541) |

| (865,118) |

| (632,611) |

| (52,699) |

| 2,392,694 |

| (136,275) |

| (31,408) |

| (235,415) |

| (252,694) |

| (79,190) |

| 510,875 |

| (87,832) |

Capital contribution from Group companies(3) |

| — |

| 1,006,010 |

| 438,036 |

| — |

| (1,444,046) |

| — |

| — |

| 1,096,610 |

| 258,607 |

| — |

| (1,355,217) |

| — |

| — |

| 24,302 |

| — |

| — |

| (24,302) |

| — |

Proceeds from loans from Group companies(4) |

| — |

| — |

| 546,384 |

| 499,424 |

| (1,045,808) |

| — |

| 75,457 |

| — |

| 1,085,900 |

| 928,600 |

| (2,089,957) |

| — |

| 25,000 |

| 9,340 |

| 224,000 |

| 394,740 |

| (653,080) |

| — |

Repayments of loans from Group companies(4) |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (770,000) |

| (282,480) |

| 1,052,480 |

| — |

| — |

| — |

| (25,000) |

| (141,507) |

| 166,507 |

| — |

Proceeds from issuance of ordinary shares and financial instruments with preferred rights |

| 1,746,842 |

| — |

| — |

| — |

| — |

| 1,746,842 |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

Repurchase of ordinary shares and financial instruments with preferred rights |

| (4,102) |

| — |

| — |

| — |

| — |

| (4,102) |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

Other financing activities |

| 300,429 |

| — |

| — |

| (298,657) |

| — |

| 1,772 |

| 50,786 |

| (1,277) |

| 8,936 |

| (116,850) |

| — |

| (58,405) |

| 843 |

| (2,390) |

| 4,277 |

| 68,637 |

| — |

| 71,367 |

Net cash generated from /(used in) financing activities |

| 2,043,169 |

| 1,006,010 |

| 984,420 |

| 200,767 |

| (2,489,854) |

| 1,744,512 |

| 126,243 |

| 1,095,333 |

| 583,443 |

| 529,270 |

| (2,392,694) |

| (58,405) |

| 25,843 |

| 31,252 |

| 203,277 |

| 321,870 |

| (510,875) |

| 71,367 |

Net increase/(decrease) in cash and cash equivalents |

| 966,595 |

| (358) |

| 397,779 |

| (5,050) |

| — |

| 1,358,966 |

| (888,004) |

| 211,959 |

| (113,440) |

| 70,661 |

| — |

| (718,824) |

| (41,924) |

| (235,470) |

| (214,714) |

| 15,446 |

| — |

| (476,662) |

Exchange differences on cash and cash equivalents |

| (147,158) |

| 33,406 |

| (9,213) |

| (189) |

| — |

| (123,154) |

| (8,846) |

| (1,318) |

| (7,666) |

| (70) |

| — |

| (17,900) |

| 1,444 |

| 1,204 |

| 11,253 |

| (15) |

| — |

| 13,886 |

Cash and cash equivalents at beginning of year |

| 122,104 |

| 67 |

| 6,489 |

| 11,294 |

| — |

| 139,954 |

| 941,541 |

| 33,115 |

| 395,055 |

| 6,055 |

| — |

| 1,375,766 |

| 44,691 |

| 243,756 |

| 273,949 |

| 76,646 |

| — |

| 639,042 |

Cash and cash equivalents at end of year |

| 941,541 |

| 33,115 |

| 395,055 |

| 6,055 |

| — |

| 1,375,766 |

| 44,691 |

| 243,756 |

| 273,949 |

| 76,646 |

| — |

| 639,042 |

| 4,211 |

| 9,490 |

| 70,488 |

| 92,077 |

| — |

| 176,266 |

Notes:

9

| (1) | It includes intercompany sales of equipment and reagents, among others, between PRC Subsidiaries and VIEs and their subsidiaries, which were eliminated at the consolidation level. For the years ended December 31, 2020, 2021 and 2022, the PRC Subsidiaries did not charge any service fees from VIEs and their subsidiaries. |

| (2) | It represents the intercompany balances eliminated at the consolidation level. |

| (3) | It represents the elimination of the investment in PRC Subsidiaries and other subsidiaries at the consolidation level. |

| (4) | It represents the elimination of the intercompany advances and repayments among companies within our group. |

10

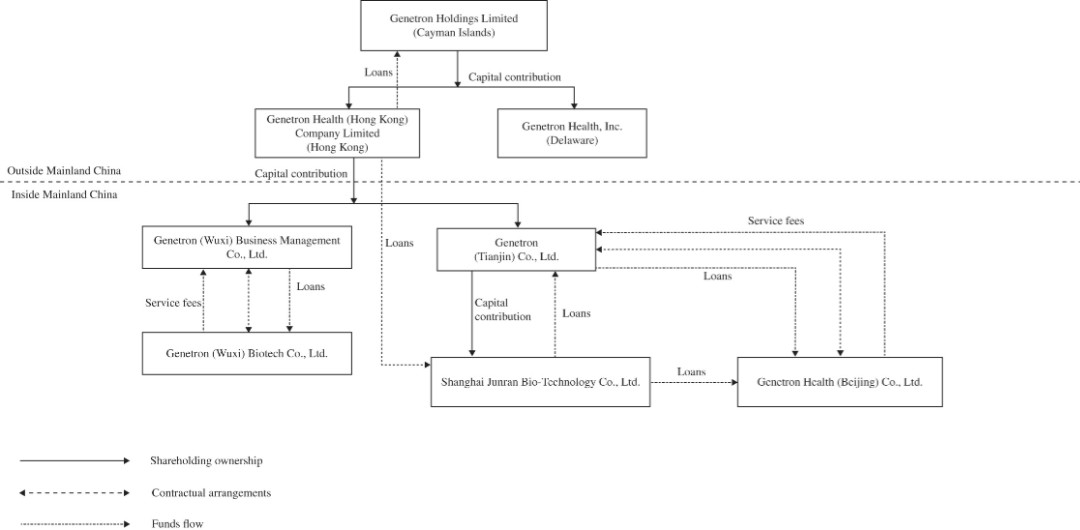

Transfer of Funds and Other Assets

The following diagram summarizes how funds were transferred among Genetron Holdings Limited, our subsidiaries, and the VIEs.

Under PRC law, Genetron Holdings Limited may provide funding to our PRC Subsidiaries only through capital contributions or loans, and to the VIEs only through loans, subject to satisfaction of applicable government registration and approval requirements.

In 2020, 2021 and 2022, Genetron Holdings Limited made aggregate capital contributions of RMB438.0 million, RMB258.6 million and nil, respectively to Genetron (Tianjin) Co., Ltd. and Genetron (Wuxi) Business Management Co., Ltd., collectively.

In 2020, 2021 and 2022, there were no payment or prepayment of service fees from the VIEs to our PRC subsidiaries.

Our PRC Subsidiaries, maintained certain personnel to support the operations of the VIEs. There were no other assets transferred between the VIEs and other entities in 2020, 2021 and 2022.

Genetron Holdings Limited has not previously declared or paid any cash dividend or dividend in kind, and has no plan to declare or pay any dividends in the near future on our shares or the ADSs representing our ordinary shares to investors, including U.S. investors. In addition, none of our subsidiaries have made any dividends or distribution to Genetron Holdings Limited. As such, no such transfers, dividends, or distributions have been made to date. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business and intend to settle amounts owed under the VIE agreements in accordance with the terms of such agreements to the extent permitted under the PRC laws and regulations. As advised by our PRC legal counsel, for any amounts owed by the VIEs to our PRC subsidiaries under the VIE agreements, unless otherwise required by PRC tax authorities, we are able to settle such amounts under the current effective PRC laws and regulations, provided that the VIEs have sufficient funds to do so. See “Item 8. Financial Information—8.A. Consolidated Statements and Other Financial Information—Dividend Policy.”

11

For the purpose of illustration, the below table reflects the hypothetical taxes that might be required to be paid within China, assuming that (i) we have taxable earnings and (ii) we determine to pay a dividend in the future:

| Taxation Scenario(1) |

| |

Statutory Tax and Standard Rates |

| ||

Hypothetical pre-tax earnings(2) |

| 100 | % |

Tax on earnings at statutory rate of 25%(3) | (25) | % | |

Net earnings available for distribution |

| 75 | % |

Withholding tax at standard rate of 10%(4) | (7.5) | % | |

Net distribution to Parent/Shareholders |

| 67.5 | % |

Notes:

| (1) | For purposes of this hypothetical example, the tax calculation has been simplified. The hypothetical book pre-tax earnings amount, not considering timing differences, is assumed to equal Chinese taxable income. |

| (2) | Under the terms of VIE agreements, our PRC Subsidiaries may charge the VIEs for services provided to VIEs. These fees shall be recognized as expenses of the VIEs, with a corresponding amount as service income by our PRC Subsidiaries and eliminated in consolidation. For income tax purposes, our PRC Subsidiaries and VIEs file income tax returns on a separate company basis. The fees paid are recognized as a tax deduction by the VIEs and as income by our PRC Subsidiaries and are tax neutral. |

| (3) | Certain of our subsidiaries and VIEs qualifies for a 15% preferential income tax rate in China. However, such rate is subject to qualification, is temporary in nature, and may not be available in a future period when distributions are paid. For purposes of this hypothetical example, the table above reflects a maximum tax scenario under which the full statutory rate would be effective. |

| (4) | China’s Enterprise Income Tax Law imposes a withholding income tax of 10% on dividends distributed by a Foreign Invested Enterprises (“FIE”) to its immediate holding company outside of China. A lower withholding income tax rate of 5% will be applied if the FIE’s immediate holding company is registered in Hong Kong or other jurisdictions that have a tax treaty arrangement with China, subject to a qualification review at the time of the distribution. For purposes of this hypothetical example, the table above assumes a maximum tax scenario under which the full withholding tax would be applied. |

The table above has been prepared under the assumption that all profits of the VIEs will be distributed as fees to our PRC Subsidiaries under tax neutral contractual arrangements. If in the future, the accumulated earnings of the VIEs exceed the fees paid to our PRC Subsidiaries, or if the current and contemplated fee structure between the intercompany entities is determined to be non-substantive and disallowed by Chinese tax authorities, we have other tax-planning strategies that can be deployed on a tax neutral basis.

Should all tax planning strategies fail, the VIEs could, as a matter of last resort, make a non-deductible transfer to our PRC Subsidiaries for the amounts of the stranded cash in the VIEs. This would result in the double taxation of earnings: one at the VIEs level (for non-deductible expenses) and one at the PRC Subsidiaries level (for presumptive earnings on the transfer). Such a transfer and the related tax burdens would increase our after-tax loss to approximately 50.6% of the pre-tax loss. Our management is of the view that the likelihood that this scenario would happen is remote.

Restrictions on Foreign Exchange and the Ability to Transfer Cash between Entities, Across Borders and to U.S. Investors

Under our current corporate structure, Genetron Holdings Limited’s ability to pay dividends, if any, to its shareholders and ADS holders, including U.S. Investors, and to fund any cash and financing requirements it may have will depend upon dividends paid by our PRC Subsidiaries.

12

Our PRC subsidiaries are permitted to pay dividends to their shareholders, and eventually to Genetron Holdings Limited and our shareholders, including U.S. investors, only out of their distributable profits, if any, as determined in accordance with PRC accounting standards and regulations. Such payment of dividends by entities registered in China is subject to limitations, which could result in limitations on the availability of cash to fund dividends or make distributions to shareholders of our securities. Under PRC laws and regulations, our PRC Subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets offshore to Genetron Holdings Limited. In particular, under the current effective PRC laws and regulations, dividends may be paid only out of distributable profits. Distributable profits are the net profit as determined under PRC GAAP, less any recovery of accumulated losses and appropriations to statutory and other reserves required to be made. Each of our PRC Subsidiaries is required to set aside at least 10% of its after-tax profits each year, after making up previous years’ accumulated losses, if any, to fund certain statutory reserve funds, until the aggregate amount of such a fund reaches 50% of its registered capital. As a result, our PRC Subsidiaries may not have sufficient distributable profits to pay dividends to us in the near future.

Furthermore, the PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural requirements. Therefore, our wholly foreign-owned subsidiaries in China are able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulation, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents. But approval from or registration with appropriate government authorities or delegated banks is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our ADSs and U.S. Investors. As a result, the funds in our PRC subsidiaries or the VIEs in mainland China may not be available to fund operations or for other use outside of mainland China due to interventions in, or the imposition of restrictions and limitations on, the ability of our holding company, our subsidiaries, or the VIEs by the PRC government on currency conversion.

For PRC and United States federal income tax consideration of an investment in the ADSs, see “Item 10. Additional Information—10.E. Taxation.”

13

Permissions Required from the PRC Authorities for Our Operations

We conduct our business primarily through our PRC subsidiaries, the VIEs, and subsidiaries of the VIEs in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, the VIEs and subsidiaries of the VIEs in China have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company, our PRC subsidiaries, the VIEs and subsidiaries of the VIEs in China, which are listed below and no such permissions or approvals have been denied.

License/Permit |

| Holder |

| Grant Date |

| Expiration Date |

Medical Device Manufacturing Permit | Genetron Health (Beijing) Co., Ltd. | June 24, 2020 | February 8, 2023 | |||

Medical Device Manufacturing Permit | Genetron Health (Chongqing) Co., Ltd. | December 13 , 2022 | December 27, 2027 | |||

Medical Device Operation Permit | Genetron Health (Beijing) Co., Ltd. | June 29, 2020 | June 28, 2025 | |||

Medical Device Operation Permit | Genetron Health (Chongqing) Co., Ltd. | May 22, 2020 | May 29, 2023 | |||

National High-tech Enterprise Certificate | Genetron Health (Beijing) Co., Ltd. | November 28, 2022 | November 27, 2025 | |||

Medical Institution Practice License | Guangzhou Genetron Medical Laboratory Co., Ltd. | December 17, 2019 | December 17, 2024 | |||

Medical Institution Practice License | Beijing Genetron Medical Laboratory Co., Ltd. | August 23, 2022 | May 10, 2026 | |||

Medical Institution Practice License | Tianjin Genetron Clinic Co., Ltd. | August 4, 2021 | April 11, 2026 | |||

Filing Receipt of Pathogenic Microbe Bio-Safety Lab (BSL-2) | Guangzhou Genetron Medical Laboratory Co., Ltd. | May 25, 2020 | - | |||

Record-Filing Notice of Pathogenic Microbe Lab and Activities Conducted Therein in Beijing | Beijing Genetron Medical Laboratory Co., Ltd. | May 9, 2020 | - | |||

Acceptance Certificate of Technique Used by Clinical Gene Amplification Testing Lab | Guangzhou Genetron Medical Laboratory Co., Ltd. | February 1, 2021 | January 31, 2026 | |||

Medical Device Registration Certificate (Human 8 Gene Mutation Comprehensive Detection Kit (Semiconductor Sequencing Method)) Registration No.: Guoxiezhuzhun 2020340072 | Genetron Health (Beijing) Co., Ltd. | January 22, 2020 | January 21, 2025 | |||

Medical Device Registration Certificate(Biochip Reader) Registration No.: Yuxiezhuzhun 20172400136 | Genetron Health (Chongqing) Co., Ltd. | October 31, 2022 | October 30, 2027 | |||

Medical Device Registration Certificate (Fully-automated Sampling System) Registration No.: Yuxiezhuzhun 20192220364 | Genetron Health (Chongqing) Co., Ltd. | November 25, 2019 | November 24, 2024 | |||

Medical Device Registration Certificate (Gene Sequencing Instrument) Registration No.: Guoxiezhuzhun 20193220820 | Genetron Health (Chongqing) Co., Ltd. | November 1, 2019 | October 31, 2024 | |||

Medical Device Registration Certificate (Gene Sequencing Instrument) Registration No.: Guoxiezhuzhun 2020032220081 | Genetron Health (Chongqing) Co., Ltd. | January 22, 2020 | January 21, 2025 |

Furthermore, in connection with the VIEs’ operations and our previous issuance of ordinary shares represented by the ADSs to foreign investors, under current PRC laws, regulations and regulatory rules, as of the date of this annual report, we, our PRC subsidiaries, the VIEs and the subsidiaries of the VIEs, (i) are not required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, (ii) are not required to file an application for cybersecurity review by the Cyberspace Administration of China, or the CAC, as advised by Shihui Partners, our PRC legal counsel, and (iii) have not been asked to obtain or were denied such permissions by any PRC authority.

14

However, the PRC government has promulgated certain regulations and rules to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines (the “Listing Guidelines”), which came into effect on March 31, 2023. According to the Trial Measures, domestic companies in the Chinese mainland that directly or indirectly offer or list their securities in an overseas market are required to file with the CSRC. In addition, an overseas-listed company must also submit the filing with respect to its follow-on offerings, issuance of convertible corporate bonds and exchangeable bonds, and other equivalent offering activities, within a specific time frame requested under the Trial Measures. Therefore, we will be required to file with the CSRC for our overseas offering of equity and equity linked securities in the future within the applicable scope of the Trial Measures.

Furthermore, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by government authorities, we cannot assure you that we have obtained all the permits or licenses required for conducting our business in China. For example, despite the rapid development of LDTs in China in recent years, due to the relatively short history of the LDT industry in China, a comprehensive regulatory framework governing the LDT industry has not been established. There are certain risks associated with the regulatory uncertainties of the provision of our LDT services in China. For details of such risks and regulatory uncertainties, see “Item 3. Key Information—3.D. Risk Factor—Risks Related to Our Business and Industry—We may be adversely affected by the uncertainties and changes in the regulation of cancer genomic testing service industry or LDT industry in general in the PRC, and any lack of requisite approvals, permits, registrations or filings in relation to our business may have a material adverse effect on our business, results of operations and prospects, and “Item 3. Key Information—3.D. Risk Factor—Risks Related to Our Business and Industry—If we fail to obtain applicable licenses or registrations for our IVD medical products, we will unable to commercially manufacture, distribute and market our products, and our commercialization of IVD medical products might be substantially harmed.” If we, our PRC subsidiaries, the VIEs or the VIEs’ subsidiaries (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, we may be subject to government enforcement actions, investigations, penalties, sanctions and fines imposed by the CSRC, the CAC and relevant departments of the State Council. In severe circumstances, the business of our PRC subsidiaries, the VIEs or the VIEs’ subsidiaries may be ordered to suspend and its business qualifications and licenses may be revoked.

15

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

3.A. Reserved

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reason for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

Summary of Risk Factors

Genetron Holdings Limited. is a Cayman Islands holding company. It conducts its operations in China through its PRC subsidiaries and through contractual arrangements with the consolidated VIEs and the subsidiaries of the VIEs. However, we and our direct and indirect subsidiaries do not have and it is virtually impossible for them to have, any equity interests in the VIEs in practice as current PRC laws and regulations restrict foreign investment in companies that engage in precision oncology services, which fall within the scope of the field of technology development and applications relating to human stem cells and genomic diagnosis and treatment, a prohibited category for foreign investment in the PRC. As a result, we depend on the contractual arrangements with the VIEs to have power over and receive substantially all the economic benefits of the business and operations of the VIEs and their subsidiaries. This structure allows us to consolidate the VIEs and their subsidiaries for accounting purposes. This structure also provides contractual exposure to foreign investment in such companies. The VIEs are owned by their respective shareholders, not by us. All of these shareholders are also affiliated with our Company or affiliated with certain shareholders of the Company. Investors in our ADSs are purchasing equity securities of a Cayman Islands holding company rather than equity securities issued by our subsidiaries and the VIE. Investors who are non-PRC residents may not directly hold equity interests in the VIEs under current PRC laws and regulations. As used in this annual report, (i) “we,” “us,” “our Company,” or “our” refers to Genetron Holdings Limited and its subsidiaries, and, in the context of describing the group’s consolidated financial information, business operations and operating data, the consolidated VIEs and their subsidiaries; (ii) Genetron” refers to Genetron Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability; (iii) “PRC Subsidiaries” refers to Genetron (Tianjin) Co., Ltd., which has power over and ability to receive substantially all the economic benefits from Genetron Health (Beijing) Co., Ltd. which results in consolidation for accounting purposes, and Genetron (Wuxi) Business Management Co., Ltd., which has power over and ability to receive substantially all the economic benefits from Genetron (Wuxi) Biotech Co., Ltd. which results in consolidation for accounting purposes, in the context of describing of their activities; and (iv) “variable interest entities,” or “VIEs,” refers to Genetron Health (Beijing) Co., Ltd. and Genetron (Wuxi) Biotech Co., Ltd. in the context of describing their activities and contractual arrangements with us.

16

Our corporate structure involves unique risks to investors in the ADSs. In 2020, 2021 and 2022, external revenues contributed by the VIEs and their subsidiaries accounted for 100.0%, 99.98% and 98.28%, respectively, of our total revenues. As of December 31, 2021 and 2022, total assets of the VIEs and their subsidiaries, excluding amounts due from other companies in our group, equaled to 48.9% and 71.9% of our consolidated total assets as of the same dates, respectively. Our executive officers and directors reside in China for a significant portion of time and it may be difficult for investors to bring any actions against, or to enforce any judgments obtained from foreign courts against, our Company or our officers and directors in China. In addition, as of the date of this annual report, to the best knowledge of our directors and management, our VIE agreements have not been tested in a court of law in the PRC. If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to material penalties or be forced to relinquish our interests in those operations or otherwise significantly change our corporate structure. We and our investors face significant uncertainty about potential future actions by the PRC government that could affect the legality and enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect our ability to consolidate the financial results of the VIEs and the financial performance of our company as a whole. Our ADSs may decline significantly in value or become worthless if we are unable to effectively enforce our contractual rights over the assets and operations of the VIEs that conducts a significant portion of our business in China.

We face various significant regulatory, liquidity and enforcement risks and uncertainties as a company based in and primarily operating in China. The PRC government has significant authority to exert influence on the ability of a China-based company, like us, to conduct its business, accept foreign investments or be listed on a U.S. stock exchange. In particular, we face risks arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice. We also face risks associated with regulatory approvals of offshore offerings, anti-monopoly regulatory actions, cybersecurity and data privacy, as well as uncertainties associated with potential lack of inspection from the U.S. Public Company Accounting Oversight Board, or PCAOB, on our auditor in the future.

The PRC government may also intervene with or influence our operations at any time by adopting new laws and regulations as the government deems appropriate to further regulatory, political and societal goals, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of the securities we have previously registered for sale. The PRC government has published new policies and made statements, such as those related to regulatory approvals of offshore offerings and data security or anti-monopoly concerns, that although did not target on our company specifically, nevertheless have significantly affected certain industries and other PRC-based issuers as a whole, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to conduct our business, accept foreign investments, or maintain list on Nasdaq or list on other foreign exchange, and offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless.

You should carefully consider all of the information in this annual report before making an investment in the ordinary shares or ADSs. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. The operational risks associated with being based in and having operations in mainland China also apply to operations in Hong Kong and Macau. While entities and businesses in Hong Kong and Macau operate under different sets of laws from mainland China, the legal risks associated with being based in and having operations in mainland China could apply to a company’s operations in Hong Kong and Macau, if the laws applicable to mainland China become applicable to entities and business in Hong Kong and Macau in the future. As of the date of this Annual Report, we do not have operations in Hong Kong or Macau. In particular, as we are a China-based company incorporated in the Cayman Islands, you should pay special attention to subsections headed “Item 3. Key Information—3.D. Risk Factors—Risks Related to Doing Business in China” and “Item 3. Key Information—3.D. Risk Factors—Risks Related to Our Corporate Structure.”

Below please find a summary of the principal risks we face, organized under relevant headings.

17

Risks Related to Doing Business in China

We are a China-based company and we may face risks and uncertainties in doing business in China, including:

| ● | We may be required to obtain approval or complete filing or other requirements of the CSRC or other PRC government authorities in connection with our issuances of securities overseas, and, if required, we cannot predict whether we will be able to obtain such approval or complete such governmental procedure. For details, see page 57 to 59 of this annual report. |

| ● | Uncertainties with respect to the PRC legal system, including uncertainties regarding the enforcement of laws, and changes in laws, regulations and policies in China could adversely affect us. For details, see page 59 of this annual report. |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the annual report based on foreign laws. For details, see page 60 of this annual report. |

| ● | Our current corporate structure, corporate governance and business operations may be affected by Foreign Investment Law. For details, see pages 60 and 61 of this annual report. |

| ● | The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections. For details, see page 68 of this annual report. |

| ● | Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. For details, see page 68 and 69 of this annual report; |

| ● | The enactment of the Accelerating Holding Foreign Companies Accountable Act decreases the number of non-inspection years from three years to two, thus reducing the time period before our ADSs will be prohibited from trading on the Nasdaq Stock Market or OTC or delisted. For details, see page 69 of this annual report. |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may restrict or delay us from using the proceeds of our financing activities to make loans or additional capital contributions to our PRC subsidiaries and making loans to the VIE or its subsidiaries, which could adversely affect our liquidity and our ability to fund and expand our business. For details, see page 66 of this annual report. |

Risks Related to Our Corporate Structure

We face risks and uncertainties related to our corporate structure, including:

| ● | There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules relating to our contractual arrangements, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements and, consequently, significantly affect our financial condition and results of operation. If the PRC government finds our contractual arrangements noncompliant with relevant PRC laws, regulations and rules, or if these laws, regulations and rules or the interpretation thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIEs. For details, see pages 52 and 53 of this annual report. |

| ● | Any failure by the VIEs or their shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business. For details, see pages 53 and 54 of this annual report. |

| ● | We rely on contractual arrangements with the VIEs and their shareholders for our business operations, which may not be as effective as direct ownership. For details, see page 53 of this annual report. |

| ● | The shareholders of the VIEs may have actual or potential conflicts of interest with us, which may materially and adversely affect our business, results of operations and financial condition. For details, see page 54 of this annual report. |

18

| ● | Our exercise of the option to acquire equity ownership and assets of the VIEs may subject us to certain limitation and substantial costs. For details, see page 54 of this annual report. and |

| ● | We may lose the ability to use and enjoy licenses, approvals and assets held by the VIEs that are material to the operation of certain portions of our business if the VIEs go bankrupt or become subject to a dissolution or liquidation proceeding. For details, see page 55 of this annual report. |

Risks Related to Our Limited Operating History, Our Financial Prospectus and Need for Additional Capital

We face risks and uncertainties with respect to our limited operating history, our financial prospectus and need for additional capital, including:

| ● | Our audit report and related financial statements include a reference of substantial doubt about our ability to continue as a going concern. We will require substantial additional financing to achieve our goals, and a failure to obtain this capital when needed and on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product development, commercialization efforts or other operations. For details, see page 22 of this annual report. |

| ● | We recorded negative cash flows from operating activities historically and may have a net current liabilities position in the future. For details, see page 23 of this annual report. |

| ● | We will need to obtain substantial additional financing to fund our growth and operations. For details, see pages 23 and 24 of this annual report. |

| ● | As of the date of this annual report, our revenue was primarily generated from diagnosis and monitoring services and products and we are highly dependent on it for our success. For details, see page 24 of this annual report. |

Risks Related to Our Business and Industry

We face risks and uncertainties related to our business and industry, including:

| ● | Our business and financial prospects depend substantially upon obtaining regulatory approval and the successful commercialization of our services and products in the future, which may fail or experience significant delays. For details, see page 25 of this annual report. |

| ● | We may be adversely affected by the uncertainties and changes in the regulation of cancer genomic testing service industry or LDT industry in general in the PRC, and any lack of requisite approvals, permits, registrations or filings in relation to our business may have a material adverse effect on our business, results of operations and prospects. For details, see pages 26 to 27 of this annual report. |

| ● | Failure to comply with existing or future laws and regulations related to privacy or data security could lead to government enforcement actions, which could include civil or criminal fines or penalties, investigation or sanction by regulatory authorities, private litigation, other liabilities, and/or adverse publicity. Non-compliance or failure to comply with such laws could increase the costs of our products and services, could limit their use or adoption, and could otherwise negatively affect our operating results and business. For details, see pages 29 and 30 of this annual report. |

| ● | Even though we have received breakthrough device designation for our HCCscreenTM for hepatocellular carcinoma, this designation may not expedite the development or review of HCCscreenTM and does not provide assurance ultimately of premarket approval submission or approval by the FDA. For details, see page 31 and 32 of this annual report. |

| ● | If we fail to comply with United States federal and state healthcare laws and regulations in connection with our activities in the United States, we could face substantial penalties and our business, operations and financial condition could be adversely affected. For details, see pages 33 to 35 of this annual report. |

19

| ● | We may face intense competition and our competitors may develop similar, but more advanced services and products than ours, which may adversely affect our business and financial conditions. For details, see pages 35 and 36 of this annual report. |

Risks Related to Our Operations