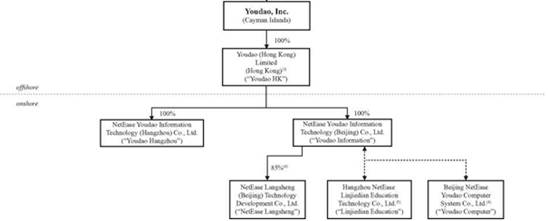

In September 2016, Guangzhou NetEase transferred its interest in Youdao Computer to William Lei Ding, NetEase’s chief executive officer, director and major shareholder. In December 2016, Youdao (Hong Kong) Limited, which was incorporated in July 2016 and wholly owned by Youdao, Inc., acquired the majority interests in Youdao Information. Additionally, Youdao Information, Youdao Computer and all its legal shareholders entered into a series of VIE agreements, through which Youdao Information became the primary beneficiary of Youdao Computer.

In March 2018, the noncontrolling shareholders of Youdao Information withdrew their shareholding interests in Youdao Information in exchange for their historical investment cost, and injected the proceeds received back to Youdao, Inc. for the same shareholding percentage as they previously held in Youdao Information. Youdao Information became wholly owned subsidiary of the Group. As this transaction did not result in a change in control of Youdao Information, it was accounted for as a common control equity transaction, no gain or loss in earnings was recognized.

In May 2019, the Group acquired certain education businesses, including NetEase Cloud Classroom, China University MOOC and NetEase KADA from NetEase Group. Since these businesses were controlled by NetEase both before and after the acquisition, this transaction was accounted for as a business combination under common control. In accordance with ASC 805,

the consolidated financial statements of the Company were retrospectively adjusted to reflect the results of the acquired businesses as if they had been acquired throughout the periods presented.

In December 2020, the Group entered into agreements with NetEase to dispose Youdao Cloudnote business to an investee established by the Company and NetEase. Since the Youdao Cloudnote business was not material to the Group’s operations, the disposal did not represent a strategic shift with a major effect on the Group’s operations and financial results, and did not qualify as discontinued operation in accordance with ASC 205,

Presentation of financial statements

Further, the business was controlled by NetEase both before and after the transaction, this transaction was accounted for as a transaction under common control. Therefore, the transferred assets were accounted for at historical carrying values. Pursuant to the agreements, the Company acquired

37.5% equity interests of the investee with the assets transferred of Youdao Cloudnote. The Company accounted for the investment using the equity method.

Basis of presentation for reorganization

There was no change in the basis of presentation of the financial statement resulting from these reorganization transactions. The assets and liabilities have been stated at historical carrying amounts.

The Group has been operating as separated entities since inception, the allocation from NetEase Group for the expenses incurred by NetEase Group but related to the Group was not material. For the years ended December 31, 2018, 2019 and 2020, the allocation was related to the share-based compensation expenses from award plan of NetEase Group, amounting to RMB6,176, RMB4,356 and RMB2,682, respectively (Note 15).

i) Contracts that give the Company effective control of the VIE

Each shareholder of Youdao Computer, William Lei Ding and Feng Zhou, entered into a loan agreement with Youdao Information under which, Youdao Information provided each of William Lei Ding and Feng Zhou with an interest-free loan in the principal amount of approximately RMB

3.6 million and RMB

1.4 million, respectively. These funds were used by each of William Lei Ding and Feng Zhou to pay the consideration to acquire his respective equity interest in Youdao Computer. Such loans can be repaid by transferring each of William Lei Ding and Feng Zhou’s respective equity interest in Youdao Computer to Youdao Information or its designee or through such other method as Youdao Information shall determine. The term of each of the Loan Agreements is

10 years from the date of loan agreement and will be automatically extended for a further

10-year

term unless otherwise decided by Youdao Information.