This

is a confidential draft submission to the U.S. Securities and Exchange Commission pursuant to Section

106(a) of the Jumpstart Our Business Startups Act of 2012 on November 15, 2019 and is not being filed

publicly under the Securities Act of 1933, as amended.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Elite Education Group International Limited

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | Not applicable | |||

| (State or Other Jurisdiction

of Incorporation or Organization) |

(Primary Standard

Industrial Classification Code Number) |

(I.R.S. Employer

Identification Number) |

1209 N. University Blvd, Middletown, OH 45042

Tel: +1 (513) 835-5394

(Address, including zip code, and telephone number, including area code, of principal executive offices)

[_]

Telephone: [_]

(Name, address, including zip code, and telephone number, including areas code, of agent for service)

Copies to:

F. Alec Orudjev, Esq. Schiff Hardin LLP 901 K Street, NW, Suite 700 Washington, DC 20001 Tel: 202-724-6848 |

Richard I. Anslow, Esq. Jonathan Delinger, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas, 11th Floor New York, NY 10105 Tel: 212-370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(2) | Proposed

Maximum Aggregate Price Per Share |

Proposed

Maximum Price(1) |

Amount of

Registration Fee |

||||||||||||

| Shares, $0.001 par value per share to be sold by Registrant | [_] | $ | [_] | $ | [_] | $ | [_] | |||||||||

| Underwriter’s share purchase warrants (3) | - | - | - | - | ||||||||||||

| Shares underlying underwriter’s warrants (3)(4) | [_] | $ | [_] | $ | [_] | $ | [_] | |||||||||

| Total | [_] | $ | [_] | $ | [_] | $ | [_] |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (2) | Includes [●] ordinary shares which may be issued on exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | We have agreed to issue to the underwriter, upon closing of this offering, warrants exercisable for a period of five years from the effective date of this registration statement representing 10% of the aggregate number of ordinary shares issued in this offering. In accordance with Rule 457(g) under the Securities Act, because the Company’s shares underlying the warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

| (4) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. We have calculated the proposed maximum aggregate offering price of the ordinary shares underlying the underwriter’s warrants by assuming that such warrants are exercisable at a price per share equal to 110% of the price per share sold in this offering.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement is filed with the Securities and Exchange Commission is effective.

| PRELIMINARY PROSPECTUS (Subject to Completion) | DATED [_], 2019 |

Elite Education Group International Limited

[●] shares

This is the initial public offering of Elite Education Group International Limited. We are offering [●] common shares on a firm commitment basis. We expect that the initial public offering price will be between $[●] and $[●] per ordinary share.

Prior to this offering, there has been no public market for our ordinary shares. We plan to apply to have our ordinary shares listed on the NASDAQ Capital Market under the symbol “EEIQ” for the ordinary shares we are offering. We cannot guarantee that we will be successful in listing our ordinary shares on the Nasdaq; however, we will not complete this offering unless we are so listed.

We anticipate that following the completion of this initial public offering of our securities, our Chief Executive Officer and our Chief Financial Officer together will beneficially own approximately [●]% of the Company’s then outstanding securities. While under NASDAQ Marketplace Rules 5615(c), it may be deemed a “controlled company,” the Company does not intend to avail itself of the corporate governance exemptions afforded to a “controlled company” under the NASDAQ Marketplace Rules.

We are an “emerging growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be subject to reduced public company reporting requirements.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 11 of this prospectus.

| Per share | Total | |||||||

| Initial public offering price | $ | [●] | $ | [●] | ||||

| Underwriting discounts and commissions (1) | $ | [●] | $ | [●] | ||||

| Proceeds to us, before expenses | $ | [●] | $ | [●] | ||||

| (1) | We have agreed to issue upon the closing of this offering, compensation warrants to ViewTrade Securities, Inc., as representative of the underwriters, entitling them to purchase up to 10% of the number of shares sold in this offering. We have also agreed to pay a non-accountable expense allowance to the underwriters of 0.5% of the gross proceeds received in this offering and to reimburse the underwriters for other out-of-pocket expenses related to the offering. For a description of other terms of the compensation warrants and a description of the other compensation to be received by the underwriters, see “Underwriting.” |

We have granted the representatives an option, exercisable for 45 days from the date of this prospectus, to purchase up to an additional [●] ordinary shares on the same terms as the other shares being purchased by the underwriters from us.

The underwriters expect to deliver the ordinary shares against payment in U.S. dollars on or about [_].

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

VIEWTRADE SECURITIES, INC.

The date of this prospectus is , 2019

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters have authorized anyone to provide you with different information. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

For investors outside the United States: Neither we, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside the United States.

i

This summary highlights information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before buying ordinary shares in this offering. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could,” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements.

Our Company

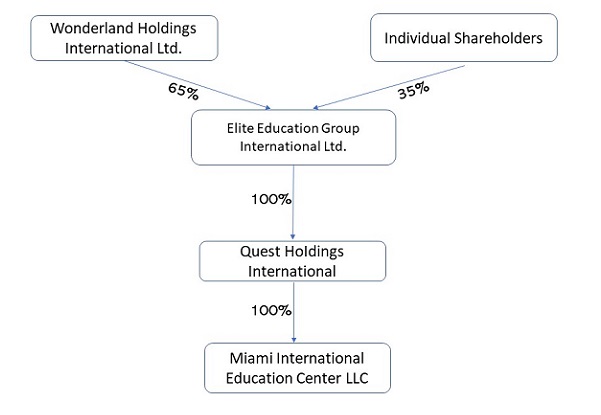

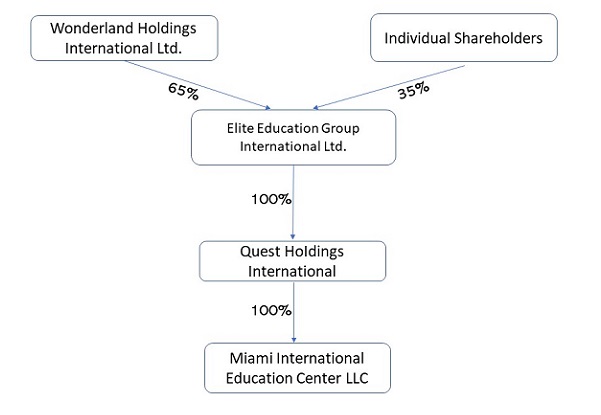

Elite Education Group International Limited (EEI) is a holding company registered and incorporated in the British Virgin Islands (BVI) on December 13, 2017 by Jianbo Zhang. As a wholly-owned subsidiary of EEI, Quest Holding International LLC (QHI) was incorporated in 2012 in Middletown, Ohio to facilitate study abroad and post-study services for Chinese students in the United States. Miami International Education Center LLC (MIE) was set up on January 13, 2017 in Ohio, and is a wholly-owned subsidiary of QHI. We partner with Miami University of Ohio, one of the oldest public universities in the country, to offer our services to Chinese students interested in studying in the US. Located in southwestern Ohio and established in 1809, Miami University has 7 colleges, 5 different campuses, and the campus population of approximately 30,000. Known as “public Ivy,” the university offers more than 120 undergraduate, 60 graduate and 13 Ph.D. degrees. Currently, our partnership with the University extends to Middletown and Hamilton campuses, and will extend to the main campus of Miami University in Oxford starting the 2019-20 fiscal year.

We develop specific education goals and plan for each student enrolled in its program, and provide a safe and structured environment and support services so that students can focus most of their attention on academic studies.

Our mission is to provide our students with a reliable and comprehensive support system to fulfill their dreams of studying abroad. We strive to accomplish that by offering students and parents a one-stop destination for the US study needs, with potential expansion to other destinations as discussed below. We maintain an office in the United States and work with a business partner in the PRC. Our US Office is mainly responsible for providing study abroad and post-study services which include, among others, student dormitory management, academic guidance, international student services, student catering services, student transfer application services, internship and employment guidance. QHI’s business partner in China is Renda Financial Education Technology Co., Ltd. (Renda), located in Beijing. Its main business includes development and cooperation of the Chinese study market, language testing, student application, visa service, pre-departure training, pick-up arrangements, or any other accommodation arrangements as may be required.

QHI focuses on all stages of the study process and aims to provide the best services available to ensure that every student successfully completes university application, travel and settlement processes. It accomplishes this by offering a one-stop solution to these needs.

The PRC office coordinates the pre-attendance service needs of our customers while our United States office coordinates or provides the actual study abroad and post-study services.

Such pre-attendance services coordinated by our PRC office at no charge include information support and counseling services for students and parents:

| ● | Language test training counseling – we provide International English Proficiency Test (ITEP) counseling, registration, and test placement for students with no or poor language skills |

| ● | Admission application – our professional personnel reviews and provides feedback on student application materials |

| ● | Visa counseling - our personnel provide visa counseling and guidance services for the student applicants |

| ● | Pre-departure guidance – we offer logistical and organizational support for the student applicants prior their departure to the educational institutions |

| ● | Accommodation arrangements – we pick up and drop off the students at the point of arrival. |

The services after arrival include, among others:

| ● | Pick-up service with no charge - our US office opens and maintains a 24-hour hotline to coordinate with Miami University for pick-up and ensures that each student arrives at and settles in dormitories safely |

| ● | Welcome service at no charge – we coordinate with Miami University whose staff members offer a two-week orientation |

| ● | Dormitory service - our dormitory administrators are on duty 24 hours per day and 7 days per week |

1

| ● | Catering services – we maintain a Chinese restaurant consisting of Chinese chefs and culinary staff near student dormitories to offer several meals a day to our students |

| ● | Academic guidance – with the help of professionally retained tutors, we offer academic guidance to help students choose and plan their career development |

| ● | Internship services – we arrange for various types of internships and social practice activities throughout the academic calendar to help students with the future employment, educational and social prospects; we believe these services also help developing their problem solving skills, workplace and emotional intelligence training |

| ● | Shuttle bus services – our staff offer shuttle bus services to cater to students’ needs. |

Industry and Market Background

Over the past years, China’s economic and social improvements were followed by increases in spending on education, particularly, for pursuing education on foreign soil. According to the 2018 studies from Ministry of Education in China, the total number of Chinese students studying abroad reached 662,100 in 2018, of whom 596,300 studying there at their own expense, an increase of 8.8% over the previous year. According to the 2019 White Book of Chinese international students (the 2019 Annual Report), students also appear to choose more diverse destinations to pursue their studies. Chinese students remain on top of the list of international students in the United States, Canada, Australia, Japan, South Korea and the United Kingdom, with the United States being the top choice for international students, with the UK being second such choice. The proportion of student respondents who rank the U.S. as their prior choice fell from 49% in 2017 to 44% in 2018 and to 43% in 2019. The U.K. remains the second most popular destination for Chinese students, with 41% of applications, a 6% percent increase from last year.

As students’ parents’ education and income levels improve, the demand for foreign education extends to middle school or even elementary school levels. For most students, preparations for studying abroad starts as early as middle school. Prospective students tend to focus on teacher-student ratios, living conditions, educational experience and professionalization of their fields, among other factors. In addition to improving academic qualifications and enriching academic background, studying abroad now is more about enhancing students’ life experience, self-perception, and communication skill.

The United States, the United Kingdom, Australia, and Canada remain the most desirable destinations for studying abroad. As economic conditions in many countries tighten and educational budgets are reduced, universities tend to absorb more students who pay out-of-state tuition fees, especially Asian students. East Asian countries are the world’s largest origin of international students, followed by South Asia and the Middle East.

In 2018, Chinese students represented the largest portion of all foreign students in the United States. In addition, the overall trend of increased tuition and fees continued at US universities and colleges, public and private alike. For instance, the Ivy League institutions raised their tuition on average by nearly 8%, and Columbia University charges tuition fees of $59,430 per year, higher than any other private colleges. The University of California at Berkeley has the biggest jump on tuition fees percentage wise.

According to Higher Education Statistics Agency in the U.K., the number of British undergraduates at Oxford University and Cambridge University fell by 7% and 5%, respectively, as compared to a decade ago. This drop was replaced with international students. There are 51% more international undergraduates at Oxford and 65% more at Cambridge than a decade ago. The number of international students in Cambridge’s postgraduate programs now exceeds that of British students.

While the number of British students has been decreasing, the number of international students has been on the rise. At the same time, non-EU students will continue paying higher tuition fees, e.g., Oxford University and Cambridge University plan to increase tuition to possibly over 30,000 pounds (about USD43,000) per year. In addition, according to Higher Education Statistics Agency, other top British universities also plan to recruit more undergraduates in 2019, e.g., University College London plans to expand by 65%, the University of Bristol - 41%, and the University of Exeter - 74%. Such expansion primarily targets international students and the tuition fees are expected to increase accordingly.

2

The number of overseas students in Australia and tuition fees increase in parallel on an annual basis. The number of Asian (PRC) international students in Australia tends to exceed the same in the United States. In 2018-2019 academic year, 39% of foreign university students in Australia came from China, an increase of 17%. In a new academic season of 2019, the University of Melbourne and the University of Queensland have announced their plans to expand the enrollment for international students from Asia for following academic years. In November 2018, all Australian universities released their 2019 tuition fees all of which trending upwards, e.g., tuition fees of the University of Sydney are up by approximately RMB 10,000; the University of New South Wales – by RMB 11,000; the University of Melbourne – by RMB 7,500 on average.

An increasing number of international students is targeting Canada for its studies. The number of students from two largest Asian countries, China and India, grow faster than any other country. Nearly three out of every ten international students are Chinese. Such large volume of Chinese international students has resulted in a considerable financial contribution to many Canadian universities. In 2018, for example, the University of Toronto, earned $928 million (RMB 4.7 billion). We anticipate that Canadian universities including, among others, the University of Toronto, McGill University, etc., will continue expanding enrollment of Asian students in 2019 and beyond. Other well-known Canadian universities, such as the University of British Columbia at Vancouver and the University of Montreal, are open to expanding their enrollment of international students. Along with increasing the number of international students, the University of Toronto also plans to increase tuition fees by an average of 6% per year for the next five years starting from 2019; Simon Fraser University plans to increase tuition fees in 2019, including a 4% increase for international students to address its $15 million budget deficit. We view these trends as business opportunities.

With the development of the PRC international study market, the Chinese government and foreign universities have increasingly directed more attention to the PRC education market, with high school students and their parents being the primary target of such interest become the main force in the international study market. Both students and their parents focus on locating high-quality, low risk ways of studying abroad to realize return on their educational investments. While many of our competitors offer quick preparation schemes, many students continue their language studies in foreign language schools for a few months before going abroad to begin their undergraduate studies. Similarly, many preparatory programs also promise that students will graduate after only three years abroad. Most domestic one-year programs only provide courses to learn the language, but lack the study of professional courses. These preparatory programs are situated in public universities, mainly in the form of one-year university preparatory courses, 2 + 2 year cooperation projects and 3 + 2 year undergraduate continuing courses.

EEI’s business partner in China, Renda, has been engaged in operation and management of such cooperative courses at Renmin University of China from 2006 to 2016. Over the past 10 years, Renda has sent more than 1,000 Chinese students to the UK, Canada and the United States for further studies. Consistent with the industry demands, the project types have been changing continuously in the past 10 years, from 3 + 2 to 2 + 3, and then to the final year of university preparatory course. After substantial analysis of the attendance and participation levels, it became apparent that the scale of one-year preparatory course in the market has been too small which made it difficult to recruit students. In fact, it appears that one-year preparatory courses available in the market have not delivered on the cost saving promises; on the contrary, they prolonged the study abroad periods.

Our Strategies and Development Objectives

We strive to continue to improve the quality of our project offerings, provide our customers with the most suitable options to carry on with their studies abroad, and ultimately to establish an internationally recognized education brand. We have designed our management systems to pursue and secure an enduring competitive advantage in the market for education services by improving our research & development capabilities, stable market positioning and channels, and efficient sales system.

3

Specific areas of our focus include:

| ● | Developing unique signature brand, project, talent and internet capabilities, designed to optimize the customer experience and retention structure, and to build an international education and study abroad product chain. |

| ● | Focusing on development and expansion of our medium- and high-end educational products to increase our domestic market share and expand our global market to establish an integrated product as well as maintaining diversification, along with adopting mobile application to facilitate multi-channel operation modes. |

| ● | Enhancing our brand quality by offering higher quality service at all stages, diversifying our services (e.g., pre-departure planning for overseas study, professional visa training, group purchases of air tickets, safety training on abroad study, academic guidance and career guidance), packaging our products, and promoting both online and offline activities to increase brand exposure. |

| ● | Establishing a multi-dimensional education platform that includes global overseas education industry chains, educational training, and mobile application components: |

| ● | Global Overseas Educational Industry Chain Establishment |

| ● | We aim to expand our business in Hong Kong and Southeast Asia markets such as Myanmar, Vietnam, Thailand, to build private international schools, and establish relationships with local prestigious universities to initiate multinational platforms for the local students to have opportunities to study abroad, as well as various universities in the United Kingdom, Britain, the United States, and Australia to attract more Chinese students. We began exploring opportunities in Myanmar in 2018, and intend to explore similar opportunities in Vietnam in 2020 and to roll out this initiative in the 2020/21 academic year. |

| ● | Following recent enrollment volume, Miami University and QHI have agreed to expand their cooperation on the University’s Hamilton campus. QHI serves as a principal for all the recruitment and promotional activities, which are related to these two campuses, in Asia. Currently, we provide dormitory housing and student dining hall services to approximately 30 student residents of the Hamilton campus. We have also reached an agreement with Miami University with respect to expansion onto the University’s main campus in Oxford, and will increase our recruiting to match the Oxford campus expansion in 2020. |

| ● | QHI began explorations of the Canadian market with the intent to replicate the Miami University model in a new setting. QHI will be in charge of the recruitment, pre-departure through post-study services. We anticipate rolling out this initiative in the 2020/21 academic year. |

| ● | QHI has been pursuing a new partner in the UK (particularly, London) with the intention to establish its own UK college and/or university partnership to provide additional options for Chinese students in 2021. |

| ● | Educational Training |

| ● | Early childhood training combined with early childhood education, English, and special training school |

| ● | Overseas language study training and test preparation for the IELTS, TOEFL, GRE and SAT tests |

| ● | Special training including brain development, abacus arithmetic, studies in Chinese history, and technical fields (e.g., engineering fundamentals) |

4

| ● | Mobile Application |

Through years of accumulation of market resources, we have established a comprehensive and diversified internet platform including, but not limited to, overseas study service, education and training, and business cooperation. Study abroad services include access to:

| ● | applications of U.K., U.S., Canadian and Australia universities |

| ● | required and supplemented documents, application guidance, pre-departure Q&A, air ticket reservation, dormitory reservation, overseas high school student guidance, rental assisting, legal aid, learning driving permit training, etc. |

| ● | school information for parents to monitor children performances |

| ● | special skill training program, language training (i.e., IELTS/TOEFL/SAT sprint training), professional teaching training |

| ● | a platform for all agencies for expeditious cooperation |

| ● | online courses, including college preparation, PTE training, and outstanding teacher courses |

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors will continue contributing to our growth and success:

| ● | Low admission requirements and no minimum language requirements. QHI serves as a principal and takes over its recruiting and promotion aspect for the regional campuses, and has reached an agreement to do so for its main campus (Oxford), in China and other Asian countries starting 2020. The application process is extended and can be confusing for the initiated. While most colleges require a GPA of at least 2.5 and/or minimum language proficiency, the Miami project does not maintain such requirements. The English Language Center (ELC) at the Miami University specially set up an Academic Redirection Program (APR) course for students with GPA of 2.0 or lower. Internal testing methods are flexible, and can be taken at any time and any place, without geographical limitations. The Miami University also accepts ITEP test scores as a language standard for admission to the ELC program at the Miami University. ITEP is an online examination system, which offers flexibility and quick scoring; it is most suited for those students who do not have time to take IELTS or TOEFL. |

| ● | Comprehensive service after study. We believe that our post-study services are one of the most important reasons why agents and parents choose us. After students arrive in the United States, QHI provides comprehensive services for students, including pick-up services, student dormitory accommodation arrangements, safety guidance for freshmen, academic guidance, guidance for further education, legal aid, and medical escort. To our knowledge, no other education group offers similar services. |

| ● | High entrance rate. According to US NEWS ranking, the freshman enrollment rate at Miami University is 91%, ranking first among all American universities. Among them, the freshman enrollment rate of ELC students is about 98% with average GPA over 3.0. Such a high enrollment rate is a function of Miami University’s student/teacher ratio. |

| ● | High success rate. The average number of students enrolled in the program is 130-140 per year, and the number of students who are transferred or expelled is less than 5 per year. Our track record shows that virtually all students, irrespective of their background or grades, can progress academically and eventually do transfer to the Oxford campus, which is the main campus. We are so confident in the quality of our services that we offer an investment guarantee with respect to the progress and graduation of our students. |

Corporate Structure and Information

Our main offices are located in Middletown, Ohio at 1209 N. University Blvd., Middletown, OH 45042; our telephone number at those offices is +1 (513) 835-5394. In addition, we maintain offices in Beijing, China at A-1718 Jiatai International Building, 41 Central East 4th Ring Road; our telephone number at those offices is (+86) (10) 8571-0121. The Company’s website is as follows: http://www.eei-global.net. Information contained on, or available through, our website does not constitute part of, and is not deemed incorporated by reference into, this prospectus.

5

The following diagram illustrates our corporate structure as of the date of this prospectus, including our subsidiaries.

Summary of Risks Affecting Our Company

Our business is subject to numerous risks described in the section titled “Risk Factors” and elsewhere in this prospectus. The main risks set forth below and others you should consider are discussed more fully in the section entitled “Risk Factors” beginning on page 11, which you should read in its entirety.

| ● | Our Chairman and Chief Executive Officer has and will continue to exert substantial influence over our company. Under NASDAQ Marketplace Rules 5615(c), it may be deemed a “controlled company”. |

| ● | Our executive officers have no prior experience in operating a U.S. public company, and their inability to operating the public company aspects of our business could harm us. |

| ● | We may not be able to improve our services or offer new services in a timely or cost-effective manner. |

| ● | If we fail to improve existing or offer new services in anticipation of market demand in a timely and cost-effective manner, our competitive position and ability to generate revenues may be materially and adversely affected. |

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. |

| ● | An active trading market for our shares may not develop following this offering, and the trading price of our shares may be volatile, each of which could result in substantial losses to investors. |

| ● | Because we are incorporated under British Virgin Islands law, investors may face difficulties in protecting their interests, and investors’ ability to protect their rights through U.S. courts may be limited. |

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the Securities and Exchange Commission, or the SEC; |

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| ● | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

6

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our ordinary shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Notes on Prospectus Presentation

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus is based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the PRC information technology industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

For the sake of clarity, this prospectus follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English.

Except where the context otherwise requires and for purposes of this prospectus only:

| ● | Depending on the context, the terms “we,” “us,” “our company,” and “our” refer to Elite Education Group International Limited, a British Virgin Islands company, and its subsidiary and affiliated companies: |

| ● | “shares” and “ordinary shares” refer to our shares, $0.001 par value per share; |

| ● | “China” and “PRC” refer to the People’s Republic of China, excluding, for the purposes of this prospectus only, Macau, Taiwan and Hong Kong; and |

| ● | all references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, and all references to “USD,” and “U.S. dollars” are to the legal currency of the United States. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

7

Summary Financial and Operating Data

The following summary consolidated statements of operations and cash flow data for the years ended September 30, 2018 and 2017, and for the six-month periods ended March 31, 2019 and 2018, have been derived from our audited consolidated financial statements and our unaudited interim consolidated financial statements included elsewhere in this prospectus. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP, our consolidated financial statements have been prepared as if the current corporate structure had been in existence throughout the periods presented. Our management believes that the assumptions underlying our financial statements and the above allocations are reasonable. Our financial statements, however, may not necessarily reflect our results of operations, financial position and cash flows as if we had operated as a separate, stand-alone company during the periods presented. You should not view our historical results as an indicator of our future performance.

Selected Consolidated Statement of Comprehensive Income

| For the six months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Revenues | $ | 4,793,300 | $ | 3,385,895 | ||||

| Gross profit | 3,415,939 | 2,117,372 | ||||||

| Operating costs and expenses | (1,933,877 | ) | (1,345,317 | ) | ||||

| Income from operations | 1,482,062 | 772,055 | ||||||

| Net other expense | (35,394 | ) | (25,939 | ) | ||||

| Provision for income taxes | 383,008 | 451,894 | ||||||

| Net income | 1,134,448 | 346,100 | ||||||

| Comprehensive income | 1,134,448 | 346,100 | ||||||

| Net income per share – basic and diluted | 0.09 | 0.03 | ||||||

| Weighted average number of shares - basic and diluted | 12,600,000 | 12,600,000 | ||||||

| For years ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Revenues | $ | 6,285,176 | $ | 5,816,771 | ||||

| Gross profit | 4,642,927 | 4,057,079 | ||||||

| Operating costs and expenses | (2,868,513 | ) | (2,563,606 | ) | ||||

| Income from operations | 1,774,414 | 1,493,473 | ||||||

| Net other expense | (51,879 | ) | (6,868 | ) | ||||

| Provision for income taxes | 669,937 | 510,116 | ||||||

| Net income | 1,156,356 | 990,225 | ||||||

| Comprehensive income | 1,156,356 | 990,225 | ||||||

| Net income per share – basic and diluted | 0.09 | 0.08 | ||||||

| Weighted average number of shares - basic and diluted | 12,600,000 | 12,600,000 | ||||||

Summary Consolidated Balance Sheet Data, Statements of Financial Position

| As of March 31 | As of September 30, | |||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| Cash and cash equivalents | $ | 3,724,291 | $ | 4,017,950 | $ | 1,905,606 | ||||||

| Total current assets | 5,792,466 | 6,698,979 | 3,695,632 | |||||||||

| Total assets | 9,899,434 | 11,412,044 | 7,765,334 | |||||||||

| Total current liabilities | 3,507,333 | 6,373,788 | 4,322,229 | |||||||||

| Total non-current liabilities | - | - | - | |||||||||

| Total liabilities | 3,507,333 | 6,373,788 | 4,322,229 | |||||||||

| Total equity | 6,392,102 | 5,038,256 | 3,443,105 | |||||||||

| Total liabilities and equity | 9,899,434 | 11,412,044 | 7,765,334 | |||||||||

8

Summary Consolidated Statements of Cash Flow Data

| For the six months ended March 31, 2019 | For the six months ended March 31, 2018 | |||||||

| Net cash provided by (used in) operating activities | (585,904 | ) | (1,332,018 | ) | ||||

| Net cash provided by investing activities | 72,847 | 4,575 | ||||||

| Net cash provided by financing activities | 219,398 | 219,396 | ||||||

| Net increase (decrease) in cash | (293,659 | ) | (1,108,047 | ) | ||||

| Cash and cash equivalents at beginning of period | 4,017,950 | 1,905,606 | ||||||

| Cash and cash equivalents at end of period | 3,724,291 | 797,559 | ||||||

| For years ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Net cash provided by (used in) operating activities | $ | 2,165,141 | $ | (491,957 | ) | |||

| Net cash used in investing activities | (491,593 | ) | (561,925 | ) | ||||

| Net cash provided by financing activities | 438,796 | 429,191 | ||||||

| Net increase (decrease) in cash, cash equivalents | 2,112,344 | (624,691 | ) | |||||

| Cash and cash equivalents at beginning of period | 1,905,606 | 2,530,297 | ||||||

| Cash and cash equivalents at end of period | 4,017,950 | 1,905,606 | ||||||

9

The Offering

| Shares Offered | [●] ordinary shares | |

| Over-allotment Option | We have granted the underwriters 45 days from the date of this prospectus, to purchase up to an additional [●] shares on the same terms as the other shares being purchased by the underwriters from us. | |

| Shares outstanding before this offering | 12,600,000 ordinary shares | |

| Shares outstanding after this offering | [●] ordinary shares | |

Use of Proceeds

Indemnification Escrow

Lockups |

We estimate that our net proceeds from this offering will be approximately $[●] million, based on an assumed initial public offering price of $[●] per share, which is the midpoint of the range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses and assuming no exercise of the over-allotment option granted to the underwriters. We intend to use the net proceeds from this offering for expansion of our facilities at additional campuses of Miami University of Ohio, expansion into the Canadian and Southeast Asian markets, entry into the UK educational markets, and working capital and general corporate purposes. See “Use of Proceeds” for more information.

Net proceeds of this offering in the amount of $600,000 shall be used to fund an escrow account for a period of 18 months following the closing date of this offering, which account shall be used in the event we have to indemnify the underwriters pursuant to the terms of an underwriting agreement with the underwriters.

Certain of our executive officers, directors, and stockholders have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for a period of 12 months following the closing of this offering.

We have agreed, for a period of 180 days after the closing of this offering, not to sell, transfer or dispose of any shares or similar securities, subject to certain exceptions.

See “Shares Eligible for Future Sale” and “Underwriting.”

| |

| Underwriters’ Warrants | Upon the closing of this offering, we will issue to ViewTrade Securities, Inc., as representatives of the underwriters, warrants entitling the representative to purchase 10% of the aggregate number of shares issued in this offering. The warrants shall be exercisable for a period of five years from the effective date of the Registration Statement on Form F-1 of which this prospectus forms a part. | |

| NASDAQ Trading symbol | We intend to apply for listing of our ordinary shares on the NASDAQ Capital Market under the symbol “EEIQ.” | |

| Risk Factors | Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our ordinary shares. |

10

Investment in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision. The risks and uncertainties described below represent our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment. You should not invest in this offering unless you can afford to lose your entire investment.

Risks Related to Our Business

Although historically we have generated net income, we cannot assure you that we will continue on the profitability path going forward.

We have generated revenues of $6,285,176 and $5,816,771, and had net income of $1,156,356 and $990,225 for the fiscal years ended September 30, 2018 and 2017, respectively. We expect that our operating expenses will continue to increase as we expand our business. If we are not able to increase revenue and/or manage operating expenses in line with revenue forecasts, we may not be able to achieve profitability. Any significant failure to realize anticipated revenue growth from our new and existing lines of business and/or manage operating expenses in line with revenue forecasts, could result in continued operating losses. As such, we cannot assure you that we will maintain profitability.

If we are not able to continue to attract students to retain our services, our business and prospects will be materially and adversely affected.

The success of our business depends primarily on the number of student members enrolled. Therefore, our ability to continue to attract students is critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to develop new services and enhance existing ones to respond to changes in market trends and student demands, manage our growth while maintaining consistent and high education quality, broaden our relationships with strategic partners and market our services effectively to a broader base of prospective students. If we are unable to continue to attract students, our net revenues may decline, which may have a material adverse effect on our business, financial condition and results of operations.

11

Our results of operations may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our results of operations, including our operating revenue, expenses and other key metrics, may vary significantly in the future and period-to-period comparisons of our operating results may not be meaningful. Accordingly, the results for any one quarter are not necessarily an indication of future performance. Our financial results may fluctuate due to a variety of factors, some of which are outside of our control and, as a result, may not fully reflect the underlying performance of our business. Fluctuation in our operating results may adversely affect the price of our shares. Factors that may cause fluctuations in our quarterly results include:

| ● | our ability to attract new customers, maintain relationships with existing customers, and expand into new markets; |

| ● | the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

| ● | general economic, industry and market conditions in China; and |

| ● | our emphasis on customer experience instead of near-term growth. |

If we fail to attract more students to participate in our activities, our operations and financial condition will be materially adversely affected.

The success of our business line depends primarily on the number of students who participate each year. Therefore, our ability to continue to attract students is critical to our continued success and growth. We rely heavily on our relationships with provincial and local governments, schools, principals and teachers to promote and encourage participation in our programs to parents, teachers and students. We must create an innovative theme to attract the interest of the participants. In addition, parental support is critical for student participation. If we are unable to continue to attract parents and students to participate, not only will our revenues decline in this business line, but our brand will be harmed, which may have a material adverse effect on our business, financial condition and results of operations.

China regulates education services extensively and we may be subject to government actions if our programs do not comply with PRC laws.

Violation of PRC laws, rules or regulations pertaining to education and related activities may result in penalties, including fines. We endeavor to comply with such requirements by requesting relevant documents from our program participants. However, we cannot assure you that violations or alleged violations of such requirements will not occur with respect to our operations. If the relevant PRC governmental agencies determine that our programs violate any applicable laws, rules or regulations, we could be subject to penalties. Violations or alleged violations of the content requirements could also harm our reputation and impair our ability to conduct and expand our business. While we have and continue to engage in strategies to mitigate this risk by diversifying our marketing efforts and focusing on Southeast Asian markets, there is no assurance that such efforts will be successful in mitigating such risks faced by the Company.

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

Our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally and by continued economic growth in China as a whole. China’s economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures since the late 1970’s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, which are generally viewed as a positive development for foreign business investment, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over the PRC economic growth through allocating resources, controlling payments of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies. For example, as a result of China’s current nationwide anti-corruption campaign, public school spending has become strictly regulated. To comply with the expenditure control policies of the Chinese government, many public universities, including our clients, temporarily reduced their self-taught education spending in 2017. This caused the demand for our courses in 2017 to decrease. If our clients continue to reduce their demand for our services due to the policies of the Chinese government, this could adversely impact our business, financial condition and operating results.

While China’s economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy, and the rate of growth has been slowing. Some of the governmental measures may benefit the overall Chinese economy but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. Any stimulus measures designed to boost the Chinese economy may contribute to higher inflation, which could adversely affect our results of operations and financial condition. For example, certain operating costs and expenses, such as employee compensation and office operating expenses, may increase as a result of higher inflation. In addition, the PRC government has implemented in the past certain measures to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our businesses, financial condition and results of operations.

12

Our business, financial condition and results of operations may be adversely affected by a downturn in the global or Chinese economy.

Because our student enrollment may depend on our students’ and potential students’ levels of disposable income, perceived job prospects and willingness to spend, as well as the level of hiring demand of positions in the areas of our training, our business and prospects may be affected by economic conditions in China or globally. The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession. The recovery from the lows of 2008 and 2009 was uneven and is continuously facing new challenges, including the escalation of the European sovereign debt crisis since 2011 and the slowdown of the Chinese economy in 2012. Economic conditions in China are sensitive to global economic conditions, as well as changes in domestic economic and political policies and the expected or perceived overall economic growth rate in China. A decline in the economic prospects in the mechanics and other industries could alter current or prospective students’ spending priorities and the recruiting demand from workers in these areas. We cannot assure you that education spending in general or with respect to our course offerings in particular will increase, or not decrease, from current levels. Therefore, a slowdown in China’s economy or the global economy may lead to a reduction in demand for mechanics or other training covered by our courses, which could materially and adversely affect our financial condition and results of operations.

The Company’s operations and performance depend significantly on global and regional economic and geopolitical conditions. Changes in U.S.-China trade policies, and a number of other economic and geopolitical factors both in China and abroad could have a material adverse effect on the Company’s business, financial condition, results of operations or cash flows. Such factors may include, without limitation:

| ● | instability in political or economic conditions, including but not limited to inflation, recession, foreign currency exchange restrictions and devaluations, restrictive governmental controls on the movement and repatriation of earnings and capital, and actual or anticipated military or political conflicts, particularly in emerging markets; |

| ● | intergovernmental conflicts or actions, including but not limited to armed conflict, trade wars, retaliatory tariffs, and acts of terrorism or war; and |

| ● | interruptions to the Company’s business with its largest customers, distributors and suppliers resulting from but not limited to, strikes, financial instabilities, computer malfunctions or cybersecurity incidents, inventory excesses, natural disasters or other disasters such as fires, floods, earthquakes, hurricanes or explosions. |

Some students may decide not to continue engaging our courses for a number of reasons, including a perceived lack of improvement in their performance in specific courses, a change in requirements or general dissatisfaction with our programs, which may adversely affect our business, financial condition, results of operations and reputation.

The success of our business depends in large part on our ability to retain our students by delivering a satisfactory learning experience and improving their performance. If students feel that we are not providing them the experience they are seeking, they may choose not to renew. Student satisfaction with our programs may decline for a number of reasons, many of which may not reflect the effectiveness and efficiency of our services. If students’ performances decline as a result of their own study habits, they may not refer other students to us, which could materially adversely affect our business.

Failure to protect the confidential information of our customers against security breaches could damage our reputation and brand and substantially harm our business and results of operations.

Maintaining security for the storage and transmission of confidential information on our system, such as student names, personal information and billing addresses, is essential to maintaining student confidence. We have adopted security policies and measures to protect our proprietary data and student information. However, advances in technology, the expertise of hackers, new discoveries in the field of cryptography or other events or developments could result in a compromise or breach of the technology that we use to protect confidential information. We may not be able to prevent third parties, especially hackers or other individuals or entities engaging in similar activities, from illegally obtaining such confidential or private information. Such individuals or entities obtaining our clients’ confidential or private information may further engage in various other illegal activities using such information. Any negative publicity regarding our safety or privacy protection mechanisms and policies, and any claims asserted against us or fines imposed upon us as a result of actual or perceived failures, could have a material and adverse effect on our public image, reputation, financial condition and results of operations.

13

If we fail to strengthen and protect our brands, our operations and the financial situation will be materially affected.

We believe that our brand is synonymous with achievement, creativity, self-esteem and accomplishment throughout the PRC and has contributed significantly to our success in our other lines of business. It is critical that we maintain and protect our brand and our image, as we continue to launch new programs, projects and acquire new businesses. As we launch new business lines, and seek to increase visibility in our current business lines, the use of several marketing tools, sponsorship and support from traditional advertisers, schools and government officials will be important to our success. A number of factors could prevent us from successfully promoting our brand, including student and parent dissatisfaction with our services, the failure of our marketing tools and strategies to attract new students. If we are unable to maintain and enhance the brand or utilize marketing tools in a cost-effective manner, our revenues and profitability may suffer. If we are unable to further enhance our brand recognition and increase awareness of our services, or if we incur excessive sales and marketing expenses, our business and results of operations may be materially and adversely affected.

We may not be able to implement our growth strategy and future plans successfully.

Our growth strategy includes increasing sales, leveraging our brand, and acquiring companies that have services, products or technologies that extend or complement our existing business. The process to undertake a growth strategy like ours, is time-consuming and costly. We expect to expend significant resources and there is no guarantee that we will successfully execute our plans. Failure to manage expansion effectively may affect our success in executing our business plan and may adversely affect our business, financial condition and results of operations. We may not realize the anticipated benefits of any or all of our strategies, or may not realize them in the time frame expected. In addition, future acquisitions may require us to issue additional equity securities, spend our cash, or incur debt, and amortization expenses related to intangible assets or write-offs of goodwill, any of which could adversely affect our results of operations.

We face significant competition and if we fail to compete effectively, we may lose our market share and our profitability may be adversely affected.

The education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We face competition in each of our business lines and competition is particularly intense in some of the key geographic markets in which we operate. We also face competition from companies that focus on one area of our business and are able to devote all of their resources to that business line. These companies may be able to more quickly adapt to changing technology, student preferences and market conditions in these markets than we can. These companies may, therefore, have a competitive advantage over us with respect to these business areas. The increasing use of the Internet and advances in Internet and computer-related technologies are eliminating geographic and cost-entry barriers to providing educational services and products. As a result, many international companies that offer online test preparation and language training courses may decide to expand their presence in China or to try to penetrate the Chinese market. Many of these international companies have strong education brands, and students and parents in China may be attracted to the offerings based in the country that the student wishes to study in or in which the selected language is widely spoken. In addition, many Chinese and smaller companies are able to use the Internet to quickly and cost-effectively offer their services and products to a large number of students with less capital expenditure than previously required. Competition could result in loss of market share and revenues, lower profit margins and limit our future growth. A number of our current and potential future competitors may have greater financial and other resources than we have. In addition, top 100 US universities and colleges marketing in China also represent our competition. These competitors may be able to devote greater resources than we can to the development, promotion and sale of their services and products, and respond more quickly than we can to changes in student needs, market needs or new technologies. As a result, our net revenues and profitability may decrease. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share and our profitability may be materially adversely affected.

14

Our success depends, to a large extent, on the skill and experience of our management in the education business. If any member of our senior management leaves, or if we fail to recruit suitable replacements, our operation and financial situation will be adversely affected.

Our success depends in large part on the continued employment of our senior management and key personnel who can effectively operate our business, as well as our ability to attract and retain skilled employees. Competition for highly skilled management, technical, research and development and other employees is intense in the education industry in the PRC and we may not be able to attract or retain highly qualified personnel in the future. If any of our employees leave, and we fail to effectively manage a transition to new personnel, or if we fail to attract and retain qualified and experienced professionals on acceptable terms, our business, financial conditions and results of operations could be adversely affected. Our success also depends on our having highly trained sales and marketing personnel to support and promote our current products as well as new service and product launches. We will need to continue to hire additional personnel as our business grows. A shortage in the number of people with these skills or our failure to attract them to our company could impede our ability to increase revenues from our existing products and services, ensure full compliance with applicable federal and state regulations, launch new product offerings and would have an adverse effect on our business and financial results.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

Our trademarks, trade names, and other intellectual property rights are important to our success. In connection with our business, we have registered one domain name in the PRC. We maintain confidentiality of applicant information by encrypting all such information and storing it on third-party servers, with controlled access to any such confidential information by our personnel. Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on trade secrets and confidentiality agreements with our employees, consultants and others to protect our intellectual property rights. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization, or use logos or trade names similar to ours. The unauthorized use of intellectual property is widespread in China, and enforcement of intellectual property rights by Chinese regulatory agencies is inconsistent. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our management’s attention and resources and could disrupt our business. If we are unable to enforce our intellectual property rights, it could have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, we may be unable to halt the unauthorized use of our intellectual property through litigation. Failure to adequately protect our intellectual property could materially adversely affect our competitive position, our ability to attract students and our results of operations.

Our operations are subject to seasonality.

Our programs, which are our primary source of revenues, are seasonal. We tend to experience an increase in revenue from these lines in the second half of the year. As a result, we generally record higher revenue in the second half as compared to the first half of each calendar year. Any adverse change in the trends in spending patterns and other factors, conditions or events in the PRC, may affect our operational results.

15

We may need additional capital, and financing may not be available on terms acceptable to us, or at all.

Although our current cash and cash equivalents, anticipated cash flows from operating activities will be sufficient to meet our anticipated working capital requirements and capital expenditures in the ordinary course of business for at least 12 months following this offering, there is a risk that we may need additional cash resources in the future to fund our growth plans or if we experience adverse changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for new investments, acquisitions, capital expenditures or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. The issuance and sale of additional equity would result in further dilution to our shareholders.

| ● | default and foreclosure on our assets if our operating revenue is insufficient to repay debt obligations; |

| ● | acceleration of obligations to repay the indebtedness (or other outstanding indebtedness), even if we make all principal and interest payments when due, if we breach any covenants that require the maintenance of certain financial ratios or reserves without a waiver or renegotiation of that covenant; |

| ● | our inability to obtain necessary additional financing if the debt security contains covenants restricting our ability to obtain such financing while the debt security is outstanding; |

| ● | diverting a substantial portion of cash flow to pay principal and interest on such debt, which would reduce the funds available for expenses, capital expenditures, acquisitions and other general corporate purposes; and |

| ● | creating potential limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate. |

The occurrence of any of these risks could adversely affect our operations or financial condition.

We will be subject to changing laws, rules and regulations in the U.S. and other jurisdictions regarding regulatory matters, corporate governance and public disclosure that will increase both our costs and the risks associated with non-compliance.

Following this offering, we will be subject to rules and regulations by various governing bodies, including, for example, the Securities and Exchange Commission, which are charged with the protection of investors and the oversight of companies whose securities are publicly traded, and to new and evolving regulatory measures under applicable law. Our efforts to comply with new and changing laws and regulations have resulted in and are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Moreover, because these laws, regulations and standards are subject to varying interpretations, their application in practice may evolve over time as new guidance becomes available. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices. If we fail to address and comply with these regulations and any subsequent changes, we may be subject to penalty and our business may be harmed.

Our business is subject to risks related to lawsuits and other claims brought by our clients or business partners. If the outcomes of these proceedings are adverse to us, it could have a material adverse effect on our business, results of operations and financial condition.

We are subject to lawsuits and other claims in the ordinary course of our business. We are currently not involved in any lawsuits with our customers. However, claims arising out of actual or alleged violations of law could be asserted against us by individuals, companies, governmental or other entities in civil, administrative or criminal investigations and proceedings. These claims could be asserted under a variety of laws and regulations, including but not limited to contract laws, consumer protection laws or regulations, intellectual property laws, environmental laws, and labor and employment laws. These actions could expose us to adverse publicity and to monetary damages, fines and penalties, as well as suspension or revocation of licenses or permits to conduct business. Even if we eventually prevail in these matters, we could incur significant legal fees or suffer reputational harm, which could have a material adverse effect on our business and results of operations as well as our future growth and prospects.

16

Our management team members, individually and together, own a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

Our Chairman and CEO, Jianbo Zhang, indirectly and directly, owns 83.99% of our issued and outstanding ordinary shares, and Zhenyu Wu, our Chief Financial Officer owns 5% of our issued and outstanding ordinary shares. As a result, together, and individually they will be able to exercise significant influence over all matters that require us to obtain shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or its assets. This concentration of ownership in our shares by such individual or their affiliates will limit the other shareholders’ ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price of our shares.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP.