UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Otis Worldwide Corporation

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

We are Otis

We are the world’s

leading company for elevator and escalator

manufacturing, installation and service.

You’ll find us in the

world’s most iconic structures, as well as residential and commercial buildings,

transportation hubs and everywhere people

are on the move.

Our Vision

We give people freedom to connect and thrive in a taller, faster, smarter world.

The Otis Absolutes

In realizing our vision, our employees are guided by our commitment to The Otis Absolutes:

Safety

We are in the safety business.

The well-being of

our colleagues, our customers and the riding public

is paramount.

EVERYTHING DEPENDS ON MOVING

PEOPLE SAFELY.

Ethics

We strive to be a trusted

company, and the employer

and supplier of choice. Doing business the ethical,

lawful and honest way is who we are and our

reputation

depends on it.

DOING BUSINESS THE RIGHT

WAY – IT’S WHO

WE ARE.

Quality

We stand for delivering quality

results in everything we

do – from engineering, manufacturing, installation and

service, to selling, marketing and financial

reporting.

WE DELIVER QUALITY RESULTS IN

EVERYTHING WE DO.

Creating value in 2020

In 2020, Otis Worldwide Corporation (“Otis”) became an independent public company trading on the New York Stock Exchange (“NYSE”), following the spinoff from United Technologies Corporation (“UTC”). In our first independent year, we grew stronger, showed our resilience and accelerated our innovation – thriving through change.

Our reach is global, our people are local

|

We maintain approximately 2.1 million customer units worldwide |

|

We serve customers in more than 200 countries and territories | |

|

We have more than 69,000 employees, including 40,000 field professionals |

|

We have over 1,400

branches and offices and a direct physical presence in approximately 80 countries |

Executing on our strategy

As an independent company, we are focused on optimizing our business model and driving returns for shareholders. A foundation of our strategy is balanced capital allocation that supports a sustainable dividend, debt reduction, share repurchase and acquisitions. Our strategy is growth-oriented, and our business is focused on executing against our strategic pillars.

| STRATEGIC PILLARS | 2020 RESULTS | |

| Sustain new equipment growth |  |

• Grew new equipment share by approximately 60 basis points(1) • Expanded sales force and networks in key markets and improved effectiveness through digitalization • Expanded product offerings by launching new Gen2 Prime in key markets to address unique customer needs • Launched new LINK commercial and public escalator products in China and India |

| Accelerate service portfolio growth |  |

• Leveraged digital tools to improve productivity and customer satisfaction and retention • Used targeted initiatives to improve new equipment conversion, reduce cancellations and bring Otis units back to the portfolio • Enhanced service model in key regions to train and develop more specialized maintenance and callback service mechanics to improve response times and maintenance completion • Expanded service portfolio through targeted acquisitions |

| Advance digitalization |  |

• Accelerated deployment of Otis ONE, our IoT offering, driving service productivity for our field mechanics and value for our customers • Opened an Industry 4.0 escalator factory in China, upgrading our smart manufacturing capabilities • Introduced 16th generation of Compass destination dispatching software, continuing to help improve traffic flow • Moved network infrastructure to global cloud-based solutions to improve collaboration, efficiency and security for our teams |

| Focus and empower our workforce |  |

• Strengthened our culture as a standalone Otis, reinforcing our commitment to The Otis Absolutes and diversity, equity and inclusion • Continued to develop process discipline around safety, our First Absolute, with an emphasis on ownership through global safety stand-downs, stop-work authority and speak-up culture that empowers our workforce to continuously improve outcomes for colleagues and customers |

| (1) | Based on Otis internal estimates. |

| 1 // 83 | |

| 2021 Proxy Statement |

CREATING VALUE IN 2020

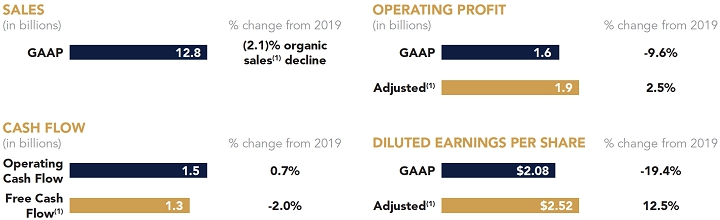

Financial highlights

Otis delivered solid financial results in 2020. On an adjusted basis, we were able to grow operating profit and expand operating profit margins with our continuous, multiyear focus on productivity and swift and concerted focus on cost containment amid a challenging environment due to the impact of COVID-19. Organic sales(1) were down due to COVID-19, but our contractual maintenance business proved resilient. Against this backdrop, we also executed on our capital deployment initiatives, returning $260 million in dividends to our shareholders, about 38% of net income, and paid down $350 million in debt, $100 million more than we planned at the beginning of the year due to our strong cash flow.

| (1) | As defined more fully in Appendix A on pages 80-82, the company refers to non-GAAP sales as organic sales, non-GAAP operating profit as adjusted operating profit, non-GAAP cash flow as free cash flow and non-GAAP diluted earnings per share as adjusted EPS. Appendix A also provides a reconciliation of these non-GAAP financial measures to the corresponding GAAP financial measures |

Our pandemic response

As a global company, the impact of the COVID-19 pandemic on Otis and its customers differed regionally. The services we provide, however, were deemed essential. We worked swiftly to protect our employees, liquidity and supply chain to minimize disruptions.

|

PROTECTING

Secured critical personal protective equipment that enabled field professionals to safely continue their essential work at job sites, customer locations and our manufacturing operations

|

EXPANDING REMOTE

Expanded our systems and network capabilities to maximize our employees’ ability to securely and efficiently perform their work remotely

|

PROTECTING

Implemented stepped plan to rationalize expenses across the organization, while maintaining investments in our workforce, research and development, and innovation

| ||

|

PROMOTING WORKFORCE

Provided employees with additional benefits, support and assistance programs to promote workforce health and wellness

|

CONTRIBUTING

Contributed to the World Health Organization’s COVID-19 Response Fund

Expanded our platform to match employee giving for select COVID-19 causes |

MOBILIZING

Mobilized global supply chain to minimize disruptions in meeting global customer demand

|

| 2 // 83 | |

|

CREATING VALUE IN 2020

Commitment to our people and our communities

With customers in more than 200 countries and territories, and more than 1,400 branches and offices around the world, Otis is a true global citizen. Everywhere we do business, we operate on the belief that financial performance and corporate responsibility go hand in hand. Our vision – to give people freedom to connect and thrive in a taller, faster, smarter world – depends on us doing well by doing good for the people and places we impact. It’s why we uphold the highest standards of safety, ethics and quality; nurture a workplace culture of diversity, equity and inclusion; invest in our local communities; encourage employee volunteerism; and aim to minimize our environmental footprint.

A few of our initiatives are highlighted below. Read more at www.otis.com/en/us/our-company/social-impact.

Protecting our people

We will not be satisfied until every Otis employee and subcontractor returns home safely at the end of every day. We are actively working to ensure our workplaces are safe and our employees and subcontractors have the tools, training and support to create an injury-free environment. Our fundamental work-safety principles, which we call the Cardinal Rules, are designed to deal with the hazards in our industry – from fall protection in the hoistway to controlling elevator movement during service to electrical safety procedures on the jobsite. Our deep commitment to the health and safety of our employees and subcontractors expanded in 2020 as we developed comprehensive safety measures to allow our teams to work safely during the COVID-19 pandemic.

Globally, the Otis total recordable incident rate (“TRIR”) and lost time incident rate (“LTIR”) have been reduced by 13% and 35%, respectively, between 2015 and 2020. TRIR and LTIR are lagging indicators used by industries of all sizes to measure safety performance by comparing significant injuries to the number of hours worked by all employees. Otis’ safety rates are best-in-class compared to the latest reported metrics across our industry, the result of focused initiatives aimed at strengthening our safety culture, demonstrating safety leadership at all levels of our organization and significantly increasing employee engagement and empowerment.

Our key safety initiatives in 2020 included the following:

| Speak Up and Stop Work Policy | We continue to empower all of our employees and subcontractors with stop work authority to use when they perceive an unsafe condition or behavior that may cause a risk of injury. In 2020, employees and subcontractors participated in training to reinforce the need to recognize and take immediate action to stop work where conditions threaten anyone’s safety. Actual stop work examples were shared and recognized as they occurred. | |

| The Season of Safety 2020 | This global program focused on strengthening our safety culture by promoting strong employee engagement through gamification, sharing lessons learned and best practices, and encouraging meaningful conversations at various levels of our management team. We emphasized our Cardinal Rules and stop work programs, outlining their importance in keeping all employees safe on jobsites and in the workplace. We achieved a high-level of engagement, further developing our progress toward creating a true culture of care where employees take care of and look out for one another. | |

| Subcontractor risk management | We completed field safety risk assessments with our active installation and modernization subcontractors to strengthen our partnerships with them and to promote keeping their employees safe. In 2020, we ensured that risk assessments were completed for all of these subcontractor partners and that action plans were developed and executed for certain subcontractors based on the results of their assessments. | |

| COVID-19 pandemic | As we adjusted to new ways of working in the midst of a global health crisis, we took actions to ensure our workforce remained safe, including: | |

| • Employee protection measures. We took significant measures to protect the health and well-being of our field professionals, factory and office employees, and contractors. Our robust, multilayered approach to prevent the spread of COVID-19 – which will continue as long as COVID-19 transmission remains a threat – uses advanced risk assessment and control techniques. It is focused on four key areas: safe workplace measures, such as increased air filtration, field, factory and office jobsite evaluations and temperature screening capabilities; sanitization and personal protective equipment, including enhanced cleaning and disinfection techniques, touch-free fixtures and use of face masks; social distancing and workspace improvements, including modified work stations and large gathering prohibitions; and exposure and confirmed case reporting procedures. | ||

| • Our New Workplace: A Guide to Protecting Your Health. We created a comprehensive manual for our employees to assist them in navigating the work environment during the COVID-19 pandemic. The guide provides information on resources and benefits available to employees and describes procedures for creating and maintaining a safe and healthy work environment. |

| 3 // 83 | |

| 2021 Proxy Statement |

CREATING VALUE IN 2020

Prioritizing diversity, equity and inclusion

Our Commitment to Change initiative outlines actions we have taken or will take to ensure that Otis is a place where every voice feels safe, welcome and heard. It advances these goals by building transparency and accountability into the process. Specifically, we commit to:

|

|

| ||

| Conduct an independent review of Otis to uncover and eliminate biases affecting any of our colleagues in our hiring, compensation, professional development and other business practices | Accelerate anti-racism, unconscious bias and inclusion learning for employees at all levels of the organization and throughout their Otis careers | Create an advisory group to ensure transparency and hold us accountable for achieving measurable progress toward a diverse, inclusive culture | ||

|

|

| ||

| Amplify our ongoing commitment to STEM and vocational education, as we join with community and business partners to invest in and build a diverse talent pipeline | Make social justice and racial equity an integral part of our community giving, volunteerism and external reporting programs | Promote and expand mental health and well-being benefits, policies and practices to support our colleagues | ||

In support of Our Commitment to Change, we have already:

| • | Completed the first commitment, an independent review of Otis to uncover and eliminate biases, with key findings related to: accelerating gender diversity, increasing focus on career growth for field professionals, expanding diversity measurements, modifying existing talent lifecycle practices to ensure equity and inclusion throughout all touch points and building accountability at all management levels |

| • | Finalized the design and implementation plan to launch unconscious bias training globally during 2021 |

| • | Invested in our talent and culture, providing underrepresented talent throughout our organization increased opportunities to attend professional development events |

| • | Launched a series of webinars to support our employees during these times of crisis, with topics focused on mental health, managing stress, resiliency and thriving during the COVID-19 pandemic |

| • | Forged new, meaningful relationships with a diverse set of nonprofits and non-governmental organizations, including the Thurgood Marshall Scholarship Fund, the Urban League, UNICEF, The Asia Foundation, the China Women’s Development Foundation and Serving People with Disabilities in Singapore |

We encourage our employees to join Employee Resource Groups (“ERGs”), which provide mentoring, career guidance, allyship and mutual support for colleagues who share the concerns and affinities of race, ethnicity, gender, gender identity, sexual orientation, disability, generation, veteran status and more.

For example, in 2020, the North America ERGs hosted a series of programs for Otis employees, called Breaking Bread & Breaking Barriers, that focused on and encouraged more dialogue about diversity, equity and inclusion. To support the goal of developing relationships with people from a variety of backgrounds and groups to discuss these topics, our employees organized and gathered in small groups that included a wide range of seniority (including executives), work roles, geographies and other characteristics.

| 4 // 83 | |

|

CREATING VALUE IN 2020

Preparing tomorrow’s leaders

We are committed to providing education and training resources to develop tomorrow’s diverse leaders.

Made to Move Communities

Made to Move Communities, the cornerstone of our Corporate Social Responsibility strategy, focuses on two issues that are vital both to Otis and to the communities where we live and work: STEM education and inclusive mobility. This program features an annual global student challenge for student teams from around the world to develop and apply creative, technology-based solutions for eliminating the barriers to mobility that our neighbors in underrepresented communities often encounter. Students in the program’s first year focused their research on mobility solutions for those communities most affected by the COVID-19 pandemic.

Our Employee Scholar Program

We support a culture of lifelong learning in which our employees are encouraged to expand their knowledge and capabilities to maintain their competitive skills in an ever-changing world. We aspire to maintain a highly educated workforce capable of the innovation required of our technology-driven company.

Our Employee Scholar Program is one of the most comprehensive company-sponsored employee education programs in the world. Otis provides financial and program support to participating employees attending classes at universities around the world.

|

UP TO 100% SUBSIDIZED EDUCATION

We pay for our eligible employees to attend credit-bearing classes in approved degree or certificate programs, and tuition, fees and books are covered up to a maximum amount per year and per degree. |

BROAD ELIGIBILITY

All employees worldwide, full-time or part-time, are eligible once they have worked at Otis for one year or are on military leave of absence.

|

APPLIES TO ANY FIELD OF STUDY APPLICABLE TO OTIS

Employees can pursue degrees or certificates in their current field or learn an entirely new field that applies to Otis’ business or operations.

|

PAID STUDY TIME

We provide eligible employees up to three hours per week of paid time off to study.

|

Closing the gender gap

We are committed to ensuring that women are equally represented throughout our workforce. We believe that gender should not be a barrier to success in any role, and we are taking action to increase engagement of women in all roles. To encourage more women to consider field positions, we have:

| • | Advanced the efforts of FORWARD, our first global ERG, to support women in field operations |

| • | Re-evaluated the criteria for these field positions to ensure we draw upon a diverse applicant field |

Paradigm for Parity

We are the first in our industry to join the Paradigm for Parity coalition, pledging our commitment to establish gender parity across our executive ranks by 2030. We have committed to implement Paradigm for Parity’s 5-point Action Plan, a set of specific actions that when concurrently implemented, aim to catalyze change and enable companies to more effectively increase the number of women of all races, cultures and backgrounds in leadership positions.

PARADIGM FOR PARITY’S 5-POINT ACTION PLAN

| 1 |

Eliminating, or minimizing, unconscious bias in the workplace | 2 |

Significantly increasing the number of women in senior operating roles | 3 |

Measuring targets and maintaining accountability through regular progress reports | 4 |

Basing career progress on business results and performance, rather than physical presence in the office | 5 |

Providing sponsors, not just mentors, to women well-positioned for long-term success |

We have already begun putting our commitment into action. In 2020, we:

| • | Defined clear representation goals in our executive ranks and in the non-executive grades to sustain progress |

| • | Participated in the benchmark survey study offered by Paradigm for Parity to identify gaps and opportunities and to contribute to strengthening the coalition to improve gender parity overall |

| 5 // 83 | |

| 2021 Proxy Statement |

CREATING VALUE IN 2020

Strengthening sustainability

We are committed to reducing the impact of our environmental footprint and to developing the sustainable solutions the world needs. We are using our resources judiciously and are relying more on renewable energy. We also are innovating products and services that reduce energy consumption and that are made with recycled and recyclable material.

|

ENVIRONMENTALLY SUSTAINABLE FOOTPRINT |

|

RESOURCE EFFICIENCY |  |

SUSTAINABLE PRODUCTS |

|

Our factory greenhouse gas emissions were reduced by over 30% between 2015 and 2020 through measures such as using solar fields at a number of our facilities to reduce our reliance on fossil fuels.

Otis was a pioneer in the construction of green elevator production facilities. We now have two Gold LEED-certified production factories in Asia. In addition, nearly 85% of our factories are certified to the environmental management standard ISO 14001; and in Europe, six of our factories are certified to energy management standard ISO 50001.

|

Measured globally, we reduced our factory water use by over 40% between 2015 and 2020 by implementing practices that promote a more efficient use of this valuable natural resource. An example is at our factory in São Bernardo do Campo, Brazil, where we installed separate rainwater collection and wastewater reuse systems that allow us to use the reclaimed water for non-potable water sources. This project allowed us to reduce freshwater use by over 2 million gallons annually.

Between 2015 and 2020, we have recycled over 99% of all waste products generated by factory operations and reduced generation of hazardous waste, less than 1% of our total waste generation, worldwide by over 30%. |

Our Gen2 elevator with ReGen technology is smaller and capable of reducing energy consumption by 75% under normal operating conditions compared to conventional systems without regenerative technology.

Our ReGen drive captures energy that would otherwise be wasted as heat and converts it into reusable energy for use by other building systems.

Our CompassPlus destination dispatching technology saves energy by putting some elevators on standby mode when traffic is light.

| |||

| 6 // 83 | |

|

Independent lead director letter

|

TO OUR SHAREHOLDERS:

In 2020, we returned to our roots as an independent company, 100 years after Otis’ initial listing on the New York Stock Exchange. Even before the listing, our Board came together to ensure that we had the background, foundation and relationships to enable us to operate effectively. From financial expertise, global experience, innovation leadership and risk management to gender and ethnic diversity, we have the right combination of experience and variety of perspectives to guide Otis on the path to continued industry leadership and long-term growth. These attributes were instrumental as we navigated the year’s unique challenges, including a global pandemic and social unrest. Fueled by these challenges, our Board worked closely with our management team to execute our strategies and deliver on our commitments. |

DIVERSE, EXPERIENCED BOARD OF DIRECTORS |

| SOLID EXECUTION OF OUR STRATEGIES |

I am pleased to report that we performed well in 2020, as demonstrated by our solid results and strong financial position. Our results validate our key strategies to sustain new equipment growth, accelerate portfolio growth, advance digitalization, and focus and empower our workforce. These strategic pillars are part of a broader operational framework to optimize our business model and implement balanced, shareholder-friendly capital allocation. |

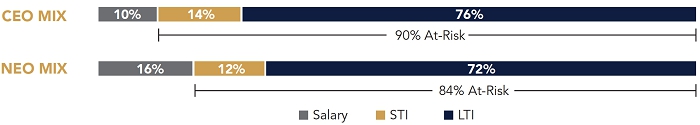

| We also are aligning compensation with strategy execution. Our Compensation Committee introduced new performance goals in the annual incentive plan for executives. Previously, Otis’ annual incentive plan was tied to achievement of free cash flow and EBIT (earnings before interest and taxes) results. Although these are important objectives for any business, and we have retained them, our Compensation Committee added performance goals for sales and new equipment orders. These additional goals support our strategic priority of growing the business. | COMPENSATION METRICS TIED TO GROWING THE BUSINESS |

| THE

OTIS ABSOLUTES |

Beyond financial performance, we continue to shape our standalone culture. The Otis Absolutes, our code of ethics, are the foundation of that culture and are based on the pillars of Safety, Ethics and Quality. They apply across our enterprise, represent how we operate as a company and contribute to realizing our vision to give people freedom to connect and thrive in a taller, faster, smarter world. |

| The culture we have put in place demands that we advance diversity, equity and inclusion, and I am proud of the progress we have made. Our Commitment to Change establishes the Otis roadmap to a more diverse, equitable and inclusive future. Our Made to Move Communities program expands upon our commitment to STEM and vocational education, joining with community and business partners to invest in and build a diverse talent pipeline. Otis joined the Paradigm of Parity coalition as well, pledging to achieve gender parity in executive roles by 2030. | ACTIVE COMMITMENT TO DIVERSITY, EQUITY AND INCLUSION |

2020 represented a strong start for the newly independent Otis. I am confident this Board, working with senior management, can achieve long-term growth and expand Otis’ iconic leadership in the industry we helped create. I also look forward to engaging with you, our shareholders, and to creating the framework for continued dialogue as Otis continues its journey. As such, I request your support for the board-recommended proposals contained in this Proxy Statement.

Yours truly,

JOHN H. WALKER

INDEPENDENT LEAD DIRECTOR AND

CHAIR OF THE COMPENSATION COMMITTEE

| 7 // 83 | |

| 2021 Proxy Statement |

Notice of 2021 Annual Meeting of Shareholders

Meeting information

|

| |

|

DATE AND TIME: April 27, 2021 9:00 a.m. Eastern time |

LOCATION: We will be holding our 2021 Annual Meeting of Shareholders (“Annual Meeting”) virtually via live webcast. To attend, vote or submit questions during the Annual Meeting, please see “How to attend” below. You will not be able to attend the meeting in person. For more information, see “Virtual Annual Meeting.” | |

| Your vote is important. Please submit your proxy or voting instructions as soon as possible. | ||

Agenda

| 1. | Election of the Nine Director Nominees Listed in the Proxy Statement |

| 2. | Advisory Vote to Approve Executive Compensation |

| 3. | Advisory Vote on Frequency of Advisory Vote to Approve Executive Compensation |

| 4. | Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2021 |

| 5. | Other Business, if Properly Presented |

Who may vote:

If you owned shares of Otis common stock at the close of business on March 3, 2021, you are entitled to receive this Notice of the 2021 Annual Meeting of Shareholders and to vote at the meeting, either online or by proxy.

How to attend:

To attend the meeting, please go to www.virtualshareholdermeeting.com/OTIS2021. To participate by voting or submitting questions during the Annual Meeting, you will need to log in to www.virtualshareholdermeeting.com/OTIS2021 using the control number located on your Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”), proxy card or voting instruction form. You will not be able to attend the Annual Meeting in person.

Please review your 2021 proxy statement (“Proxy Statement”) and vote using one of the methods described on the following page.

By Order of the Board of Directors.

NORA E. LAFRENIERE

EXECUTIVE VICE PRESIDENT, GENERAL COUNSEL & CORPORATE SECRETARY

| 8 // 83 | |

|

How to Vote

|

|

| ||

INTERNET Online during the Annual Meeting: Go to www.virtualshareholdermeeting.com/OTIS2021 and follow the instructions on the website. Online in advance of the Virtual Annual Meeting: Up until 11:59 p.m. Eastern time on April 26, 2021, go to www.proxyvote.com and follow the instructions on the website. |

TELEPHONE Up until 11:59 p.m. |

Sign, date and return your proxy card or voting instruction form in the enclosed postage-paid enclosed envelope. |

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on April 27, 2021. This Notice of the 2021 Annual Meeting of Shareholders and Proxy Statement and our 2020 Annual Report to Shareholders (“2020 Annual Report”) are available free of charge at www.proxyvote.com. References in either document to our website or any third-party website are for the convenience of readers, and information available at or through these websites is not a part of nor is it incorporated by reference in the Proxy Statement or 2020 Annual Report.

The Board of Directors is soliciting proxies to be voted at our Annual Meeting on April 27, 2021, and at any postponed or reconvened meeting. We expect that the proxy materials or a Notice of Internet Availability will be mailed and made available to shareholders beginning on or about March 12, 2021. At the Annual Meeting, votes will be taken on the matters listed in this Notice of 2021 Annual Meeting of Shareholders.

| 9 // 83 | |

| 2021 Proxy Statement |

Virtual Annual Meeting

For our Annual Meeting, we have adopted a virtual meeting format. This format enables shareholders to participate regardless of geographic location or physical or resource constraints, and also safeguards the health and safety of our shareholders, employees and members of our Board of Directors (“Board”) as the COVID-19 pandemic continues. All that is required is an internet-connected device.

How will the Annual Meeting be held?

The Annual Meeting will be held via live webcast through an online virtual meeting platform that allows shareholders around the globe to listen to the entire meeting on their computer or other device and submit questions. Members of management, our Board and a representative of our independent auditor will be in virtual attendance.

How can shareholders attend and participate in the Annual Meeting?

Only shareholders of record and beneficial owners as of March 3, 2021, the record date, may attend or participate in the meeting by voting or submitting questions. To attend and participate, go to www.virtualshareholdermeeting.com/OTIS2021 and log in using the 16-digit control number included on your Notice of Internet Availability, Proxy Card or voting instruction form.

On the day of the Annual Meeting, April 27, 2021, shareholders may begin to log in to the online Virtual Meeting platform beginning at 8:45 a.m. Eastern time. The meeting will begin promptly at 9:00 a.m. Eastern time. Please allow ample time to log in.

How can shareholders receive technical assistance in connection with the Annual Meeting?

Beginning at 8:45 a.m. Eastern time on the day of the meeting, we will have technicians ready to assist you with any technical difficulties you may have logging in to or accessing the Annual Meeting. For technical support, you may call 844-986-0822 (U.S.) or 303-562-9302 (International). These technical support numbers also will be displayed on the login page of the online virtual meeting platform.

How can shareholders submit questions at the Annual Meeting?

Once logged in to the virtual meeting platform as instructed above, shareholders may submit questions directly by following the instructions on the website. We will answer as many shareholder-submitted questions that are pertinent to the meeting matters and appropriate as time permits during the Annual Meeting. Substantially similar questions may be answered as a group.

YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON.

| 10 // 83 | |

|

| 11 // 83 | |

| 2021 Proxy Statement |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Proxy voting roadmap

| PROPOSAL 1 |

Election

of directors BOARD RECOMMENDATION: FOR EACH DIRECTOR NOMINEE |

PAGE 16 | ||

| PROPOSAL 2 |

Advisory

vote to approve executive compensation BOARD RECOMMENDATION: FOR |

PAGE 38 | ||

| PROPOSAL 3 |

Advisory

vote on frequency of advisory vote to approve executive compensation BOARD RECOMMENDATION: ONE YEAR |

PAGE 66 | ||

| PROPOSAL 4 |

Appoint

an independent auditor for 2021 BOARD RECOMMENDATION: FOR |

PAGE 68 |

Governance and Board highlights

In 2018, UTC announced its intention to spin off its Otis reportable segment into a separate publicly traded company (the “Separation”). We became an independent, public company as of April 3, 2020. The Separation is further described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (“2020 Annual Report on Form 10-K”), available on our website at www.otisinvestors.com/financials/sec-filings.

Otis is committed to best corporate governance practices. Our governance structure reflects processes from across industries that we believe provide the basis for effective board oversight. Our governance is dynamic, reflecting the Board’s continuous review of best practices and goal of maintaining optimum effectiveness.

| 12 // 83 | |

|

PROXY STATEMENT SUMMARY

Below are Otis’ key corporate governance practices, together with where in this Proxy Statement and/or other publicly available documents you may find further information on these practices. Publicly available documents such as our Corporate Governance Guidelines, Certificate of Incorporation, Bylaws, Committee Charters and The Otis Absolutes are available on our website at www.otisinvestors.com/governance/governance-documents.

| Board independence and composition | For more information |

| Fresh perspectives – the tenure of eight of our nine directors on the Otis Board or its predecessor, UTC, is less than three years | page 15 |

| 7 of 9 director nominees are independent | page 29 |

| All committees are comprised of independent directors only | pages 31-33 |

| Independent Lead Director has expansive responsibilities | page 30 Corporate Governance Guidelines (“CGG”) |

| Private sessions of independent directors are held following each regularly scheduled Board and committee meeting without management present; presided by the Lead Director or committee chair | CGG |

| All directors are elected annually | page 20 Bylaws and Certificate of Incorporation |

| Overboarding is prevented – all directors are restricted in the number of other boards on which they may serve | page 20 CGG |

| Majority voting standard applies for uncontested elections; resignation policy is in place if a director fails to receive the majority of votes cast | CGG |

| Director engagement | |

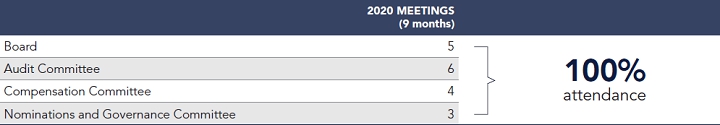

| 5 Board meetings and 13 committee meetings in 2020 | page 33 |

| 100% director attendance at Board and committee meetings in 2020 | page 33 |

| Robust onboarding education program for all directors | page 23 CGG |

| Annual self-evaluations completed by all directors | page 22 CGG |

| Environmental, social and governance (“ESG”) matters | |

| Strong commitment to diversity, equity and inclusion | page 4 |

| The Otis Absolutes, our code of ethics, applies to all employees globally as well as the Board | The Otis Absolutes and CGG |

| Extensive ESG program and active Board and committee oversight of ESG matters in place | page 18 |

| Shareholder rights | |

| Nomination of director candidates available through the proxy access process; properly made shareholder nominations considered by the Nominations and Governance Committee | Bylaws |

| Request for a special meeting of shareholders can be made by shareholders holding at least 15% of outstanding shares of Otis common stock | Bylaws |

| No dual class or cumulative voting structure – one vote per share | Certificate of Incorporation |

| No supermajority shareholder vote requirements or poison pill plan | Bylaws and Certificate of Incorporation |

| Stock ownership requirements | |

| Robust stock ownership requirements for directors and executive officers | pages 36 and

49 CGG |

| Prohibition on hedging and pledging of our common stock by directors and employees (including officers) | page 49 |

| 13 // 83 | |

| 2021 Proxy Statement |

PROXY STATEMENT SUMMARY

The Board has nominated nine individuals for election to the Otis Board upon recommendation of the Nominations and Governance Committee. These nominees are deeply experienced executives with the highest integrity and represent a highly diverse collection of backgrounds, experience, skills and perspectives. The nominees have led companies as chief executive officers, presidents, chairmen, and managing or lead partners in a wide range of sectors, including high-tech manufacturing, asset management, consumer products, professional services and transportation. Each of the nominees is a current Otis director, appointed in connection with the Separation. During this past year of unpredictability and change, the nominees have proven that they work well together with respect, agility and dedication.

| INDEPENDENT | |||

|

Jeffrey H. Black, 66 Former Senior Partner and Vice Chairman, |

|

Kathy Hopinkah Hannan, 59 Former Global Lead Partner, National |

|

Shailesh G. Jejurikar, 54 CEO and Executive Sponsor, Corporate |

|

Harold W. McGraw III, 72 Former Chairman, President & CEO, |

|

Margaret M. V. Preston, 63 Former Managing Director, |

|

Shelley Stewart, Jr., 67 Former Chief Procurement Officer, |

|

John H. Walker, 63 Former Chairman and CEO, |

||

| NON-INDEPENDENT | |||

|

Christopher J. Kearney, 65 Executive Chairman, |

|

Judith F. Marks, 57 President & CEO, |

| 14 // 83 | |

|

PROXY STATEMENT SUMMARY

Focus on Board diversity

Otis places great emphasis on diversity in its workplace and beyond, and the Board is no exception. The Nominations and Governance Committee actively considers diversity in recruitment and nominations of directors and assesses its effectiveness in this regard when reviewing the composition of the Board. The current composition of our Board reflects those efforts and the importance of diversity to the Board. Further, the Nominations and Governance Committee itself is specifically composed of a diverse group of directors, which gives it a strong foundation for considering diversity in Board leadership and governance matters.

| NOMINEES | NOMINATIONS AND GOVERNANCE COMMITTEE |

Independent, focused board with fresh perspectives

| * | Harold W. McGraw III served as a UTC director from September 2003 until the Separation. |

Board qualifications

Our Board values the varying perspectives that individuals of differing backgrounds and experiences bring. Each of our nominees meets the fundamental criteria required to be an Otis Board member:

| • | Objectivity and independence | • | Broad senior-level experience | • | Professional and personal ethics |

| • | Loyalty | • | Diversity | • | Alignment on corporate purpose |

| • | Commitment to enhancing long-term shareholder value | • | Capacity to devote time required |

Our nominees as a group also possess the following highly valuable skills that the Board has identified as most relevant and desirable to support and guide Otis in excelling now and into the future:

| 15 // 83 | |

| 2021 Proxy Statement |

|

Election of directors |

| • | We are seeking your support for the election of the nine individuals that the Board has nominated to serve on the Board for a one-year term beginning on the date of the Annual Meeting. |

| • | All the nominees are current directors of Otis, first appointed in connection with the Separation in April 2020. |

| • | The Board believes that the nominees have the qualifications consistent with our position as a global leader in the elevator and escalator manufacture, installation and service industry with operations worldwide. |

| THE BOARD RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE: |

|

Jeffrey H. Black |  |

Christopher J. Kearney |  |

Margaret M. V. Preston | |||

|

Kathy Hopinkah Hannan |  |

Judith F. Marks |  |

Shelley Stewart, Jr. | |||

|

Shailesh G. Jejurikar |  |

Harold W. McGraw III |  |

John H. Walker |

Board responsibilities and oversight

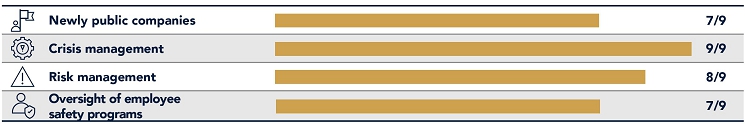

2020 was a year of tremendous change for Otis. Most significantly, we became an independent public company, pursuing our strategies that we expect will lead to long-term value creation for our shareholders. At the same time, the world was being transformed by a pandemic unseen in our lifetimes. Workplaces, residences and public spaces took on new meanings and functions. Health and safety, already paramount concerns, took on expanded importance. Moreover, our commitment to diversity, equity and inclusion was made more urgent by widespread social unrest rooted in the basic human need for equality and dignity. Through it all, our strong financial position, agile operations and a steadfast adherence to our values enabled us to succeed.

Our Board led strongly, soundly and with unwavering commitment as we pursued our strategies and supported our colleagues, customers and communities. The Board was deeply engaged as Otis quickly adapted to the rapidly changing business environment, ensuring that the company continued to provide critical and essential services while protecting its liquidity and its employees. The Board never lost focus on The Otis Absolutes and the need for inclusion and empowerment to remain a constant through uncertainty. The Board’s collective breadth and depth of experience and expertise proved invaluable.

|

OVERSEEING CHANGE Members of the Otis Board bring with them experiences that are helpful in overseeing a company undergoing change. They have experience with: |

| 16 // 83 | |

|

CORPORATE GOVERNANCE

The Board is responsible for overseeing Otis business and activities. Board oversight is divided into several key areas, with oversight responsibility delegated in some instances from the Board as a whole to one or more of its committees. Key areas of Board oversight are set forth below. More information about committee oversight and responsibilities is set forth in “Our leadership and Board structure – Board committees.”

STRATEGY

While management is responsible for executing Otis’ strategy, the Board actively engages with management to guide, inform and advise on that strategy in order to support and promote long-term shareholder value.

| • | The Board receives updates from management on status of company performance, key strategic initiatives, global socioeconomic conditions, competitive trends, capital markets and other developments. | ||

| • | The Board, primarily through the Audit Committee’s review and advice, has oversight responsibility over capital allocation policy, including financings, dividends, share repurchases, and significant investments and capital appropriations. | ||

| • | Throughout the year, the Board, through its committees, is briefed on strategies for issues falling under the oversight of those committees, such as corporate social responsibility and diversity, equity and inclusion. | ||

| • | The Board’s varied experiences and perspectives allow it to probe and, if appropriate, challenge management’s assumptions and conclusions on strategies and their implementation. | ||

| • | Engagement by the entire Board is supported and promoted through discussions at private sessions of the independent members of the Board following every Board meeting led by the independent Lead Director, and following every Board committee meeting led by its committee chair. |

RISK MANAGEMENT

Successful execution of a robust and innovative growth strategy involves accepting a certain measure of risk. Otis identifies, assesses, monitors and manages risks through its comprehensive enterprise risk management (“ERM”) program that conforms to the Enterprise Risk – Management Integrated Framework established by the Committee of Sponsoring Organizations of the Treadway Commission. The Board works with management to develop appropriate risk tolerances, and oversees and monitors the management of risks that could significantly affect the company’s operations or growth. The Board, its committees and management work together on risk management as follows:

Board of Directors

The full Board has oversight responsibility for the following areas of risk and risk management: |

|||||

| • | Overall risk management program and structure; risk tolerance levels | • | Management succession planning and development | ||

| • | Selection and evaluation of senior executive management | • • |

Business objectives and major strategies Risks deemed significant |

||

|

The Board delegates certain risk management responsibilities to committees upon recommendation from the Audit Committee.

Risk oversight delegated to committees includes: |

|||||||

|

Audit Committee • Enterprise risk management policies and practices • Financial statements, reporting and controls • Legal, ethical and regulatory compliance • Financial and capital • Operational • Reputational • Cybersecurity |

Compensation Committee • Executive incentive plan performance metrics and goals • Compensation levels for senior leaders • CEO and Executive Chairman performance goals • Stock ownership requirements |

Nominations and • Director qualifications and nomination • Director independence • Assessment of Board effectiveness • Board refreshment • Corporate governance • Corporate social responsibility • Safety and environment • Diversity, equity and inclusion • Public policy issues |

|||||

| 17 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

ESG PROGRAMS

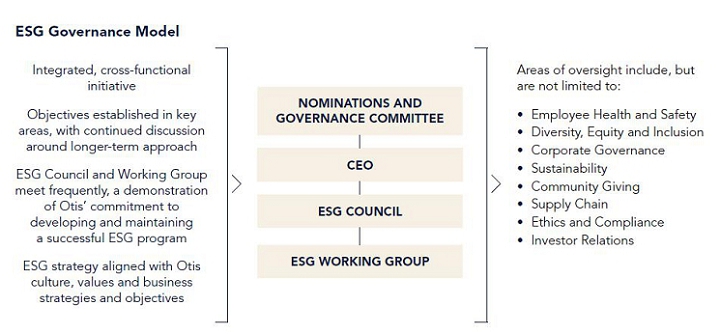

For Otis, being a good corporate citizen is fundamental to everything that we do. Underscoring that importance, the Nominations and Governance Committee engages in extensive review and oversight of issues falling under the ESG umbrella.

Otis has developed an ESG Governance Model that supports its ESG efforts. ESG matters impact every corner of the business, and, accordingly, ESG governance is cross-functional, involving team members from multiple functional and business areas. The ESG Council – composed of the Executive Vice President, General Counsel & Corporate Secretary; Executive Vice President & Chief People Officer; Executive Vice President, Operations; and Vice President, Financial Planning & Analysis & Investor Relations – works closely with an internal ESG Working Group and reports regularly to the CEO.

In 2020, the Nominations and Governance Committee received information from management at every meeting concerning progress on key ESG objectives. The Committee engaged in reviews of issues including: employee health and safety; corporate social responsibility and giving; sustainability; diversity, equity and inclusion, including Our Commitment to Change and the Made to Move Communities initiative. More information about the Committee’s oversight of ESG can be found in “Our leadership and Board structure – Board committees.”

Our code of ethics – The Otis Absolutes

Otis’ code of ethics is called The Otis Absolutes. This code, which applies to all directors and employees, including all executive officers, is based on The Three Absolutes of Safety, Ethics and Quality. These core values establish standards of conduct and ethical principles that guide every employee and Board member across the globe in their day-to-day decisions. The Board, through its Audit Committee, receives reports from management, the Chief Compliance Officer and Otis’ internal auditor on any significant issues regarding compliance with The Otis Absolutes.

| 18 // 83 | |

|

CORPORATE GOVERNANCE

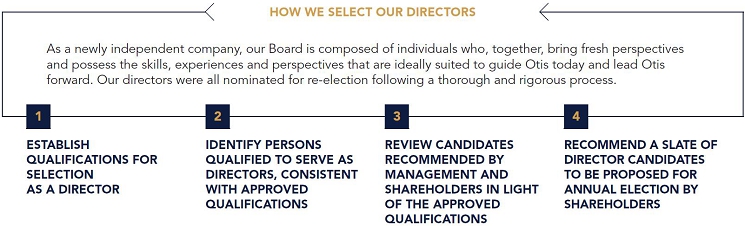

Creating and maintaining an effective Board

|

STEP 1 Establish qualifications for selection as a director |

|

The Board, upon recommendation by the Nominations and Governance Committee, has established fundamental criteria that any prospective director must possess. Additionally, recognizing that Otis and its strategy must continuously adapt to ever-changing business, social, environmental and other global dynamics, the Board considers which skills, attributes and experiences are necessary to support Otis in executing its current strategy as well as to guide the company in the future.

The qualifications used by the Board in selecting the nominees for directors are described under “Criteria for Board membership” and “Director skills and attributes.” |

|

|

STEP 2 Identify persons qualified to serve as directors, consistent with approved qualifications |

| The CEO, in consultation with the Executive Chairman and the Nominations and Governance Committee, is responsible for identifying candidates for the Board. The Board has delegated the screening and evaluation process for director candidates to the Nominations and Governance Committee. The Nominations and Governance Committee also may engage search firms to assist in identifying and evaluating qualified candidates and to ensure that a large and diverse pool of potential candidates is being considered. |

|

| 19 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

STEP 3 Review candidates recommended by management and shareholders in light of the approved qualifications |

||

|

The Nominations and Governance Committee will consider candidates recommended by directors, management and shareholders who meet the qualifications Otis seeks in its directors. Each candidate is reviewed to ensure that he or she meets the criteria for Board membership established by the Board. While objectivity and independence of thought is a critical attribute for any nominee, the Board also considers whether the candidate satisfies the independence and other requirements for service on the Board and its committees in accordance with the rules of the NYSE and Securities and Exchange Commission (“SEC”).

Shareholder nominations. Shareholders may recommend nominees for consideration by the Committee by advance notice or proxy access, pursuant to the procedures set forth in Otis’ Bylaws. See “Frequently Asked Questions About the Meeting – How do I submit proposals and nominations for the 2022 Annual Meeting of Shareholders?” for more information on shareholder nominations of directors for the 2022 Annual Meeting of Shareholders.

Conflicts of interest. Directors must be loyal to and act in the best interests of Otis and promote shareholder value, thus avoiding conflicts of interest and any appearance thereof, as defined by applicable laws and as set forth in The Otis Absolutes. Candidates for Board membership must disclose all situations that could reasonably represent a conflict of interest. |

||

Additional considerations for renomination

Change in principal responsibilities. If a director’s principal employment or principal responsibilities outside of Otis change substantially, the director must offer to resign from the Board. The Committee will recommend to the Board whether the resignation should be accepted.

Service on other boards. A director may not serve on the boards of more than four other public companies in addition to the Otis Board. Additionally, the Committee will review the appropriateness of a director’s continuing Board service if a director joins the board of a public company or for-profit company where a relationship between Otis and such other entity may affect the independence of the director, require disclosure or conflict with other legal requirements.

Retirement policy. Our Corporate Governance Guidelines require that directors will not stand for re-election and will retire from the Board as of the Annual Meeting of Shareholders following their attainment of age seventy-five (75). The Board retains the authority to approve exceptions to this policy based upon special circumstances. There are no fixed term limits for members of the Board since such a policy could deprive Otis of the benefit of the experience and insight into Otis’ operations that develop and strengthen over time. |

||

|

||

STEP 4 Recommend a slate of director candidates to be proposed for annual election by shareholders |

||

The individuals nominated for re-election to the Board at the Annual Meeting have served diligently, capably and vigorously in 2020. Each has been determined by the Nominations and Governance Committee and the Board to possess the skills, experiences and attributes necessary to lead Otis strongly into the future. While the world has experienced much change since the nominees were initially elected to the Board in April 2020, their skills, experience and agility have proven to be invaluable in guiding the company. |

| 20 // 83 | |

|

CORPORATE GOVERNANCE

The Board, upon recommendation by the Nominations and Governance Committee, has established fundamental criteria that a prospective director must possess:

| • | Objectivity and independence in making informed business decisions |

| • | Broad, senior-level experience to be able to offer insight and practical wisdom |

| • | The highest professional and personal ethics and values in accordance with The Otis Absolutes |

| • | Loyalty to the interests of Otis |

| • | A commitment to enhancing long-term shareholder value |

| • | A capacity to devote the time required to successfully fulfill a director’s duties |

| • | The ability to contribute to the diversity of the Board, consistent with Otis’ diversity, equity and inclusion initiatives |

| • | Alignment on the corporation’s goal to positively impact employees, communities, the environment and other stakeholders |

Recognizing that Otis and its strategy must continuously adapt to ever-changing business, social, environmental and other global dynamics, the Board also considered which skills and attributes were necessary to support Otis in executing its current strategy and navigating through change. As a result, the Board, upon recommendation from the Committee, determined that the Board should be composed of individuals possessing one or more of the following skills and attributes, so that each crucial skill and attribute is adequately represented on the Board:

Director skills and attributes

|

Senior industry leadership Industry knowledge through service as a senior leader or as a director | |

|

Environmental, social and governance Experience managing or overseeing matters related to environmental, health and safety, and social and governance initiatives | |

|

Innovation and optimization Executive experience overseeing product development, operations and/or technological innovation translating into an understanding of how to adapt to rapid change and generate optimized solutions | |

|

Financial Proficiency in complex financial management, financial reporting processes, capital allocation, capital markets, and M&A | |

|

Risk management Experience in overseeing and understanding major risk exposures, including significant financial, operational, compliance, reputational, strategic, regulatory, global, trade and cybersecurity risks | |

|

Global Extensive leadership experience with a significant, global enterprise providing relevant business and cultural perspectives | |

|

Diversity Contributes to the diversity of the Board consistent with Otis’ diversity, equity and inclusion initiatives |

| 21 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

A strong and effective Board is the foundation of Otis’ governance. The Board monitors and maintains its effectiveness through its interrelated Board governance practices. The Board’s self-evaluation process allows it to improve its practices and policies in order to increase effectiveness. Continuous improvement includes understanding and staying current on industry, global, financial and other trends impacting the business. Otis’ governance practices include robust onboarding and continuing education opportunities.

| 22 // 83 | |

|

CORPORATE GOVERNANCE

Director onboarding

As required by the Corporate Governance Guidelines, all Otis directors participated in a comprehensive onboarding program in 2020. The multiday onboarding program, which took place over the course of two months, included:

| • | Sessions familiarizing directors with the roles and responsibilities of the Board, including topics tailored to each director’s committee assignments |

| • | Meetings with senior leaders reviewing the company’s strategy; the business; financial statements; significant financial, accounting and risk management issues; compliance programs and The Otis Absolutes; and the internal audit function and the independent auditor |

| • | Attendance at Otis Investor Day |

| • | Meetings with key executives, including regional and functional area leaders |

| • | Visit to the Otis Bristol Test Tower facility in Connecticut to view the 13 test elevator shafts and the testing labs for quality-control products and digital tools for field professionals |

| • | Visit to a customer site to understand modernization and service practices and to see demonstrations of Otis’ digital products |

The extensive onboarding program also gave the directors the opportunity to meet each other and establish their working relationships – an essential component of a healthy, effective and respectful board.

Director continuing education

We encourage our Board members to visit our branches, service centers and other facilities. However, apart from the director onboarding program, these in-person visits were postponed in 2020 due to the COVID-19 pandemic. Going forward, it is the Board’s intention to conduct at least one annual on-site visit to an Otis operating unit, factory or construction or customer site, giving directors a firsthand understanding of Otis operations and providing an opportunity for employees and directors to interact. Directors also are encouraged to attend outside continuing education programs. Several times throughout the year, management and/or external advisors may provide presentations and materials to directors at Board and committee meetings, at the request of a director or as deemed relevant and beneficial.

| 23 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

The Board, upon the recommendation of the Nominations and Governance Committee, has nominated for election the nine individuals below. All are current directors of Otis who were appointed to the Otis Board in connection with the Separation. Six of the nine directors are new to Otis, while three bring continuity and an understanding of Otis’ pre-Separation business and the UTC governance model in which Otis operated – Ms. Marks, Otis President & CEO, and Messrs. Kearney and McGraw, who served as UTC directors prior to the Separation.

Each nominee’s biography highlights the key skills and attributes upon which the Board particularly relies, in addition to describing each director’s significant work experience and service.

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Audit (Chair)

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

None

| JEFFREY H. BLACK | 66 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Risk management | • Director, Vantage Airport Group, LTD (non-public) • Director, Basin Holdings LLC (non-public) • Board Chair, The Research Foundation for the State University of New York • Treasurer and Director, The University at Albany Foundation | ||

|

Environmental, social and governance |  |

Global | |||

|

Financial | |||||

| EXPERIENCE: | ||||||

• Senior Partner and Vice Chairman, Deloitte LLP, 2002-2016; Member of Board of Directors, 2004-2011 • Partner-in-Charge of Metro New York audit practice, Arthur Andersen LLP, 1988-2002 |

||||||

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Audit, Nominations and Governance

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

Annaly Capital Management, Inc.

| KATHY HOPINKAH HANNAN | 59 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Environmental, social and governance |  |

Risk management | • Director, Blue Trail Software (non-public) • Board Chair and National President, Girl Scouts of the United States of America • Board Chair, Smithsonian National Museum of the American Indian • Trustee of the Committee for Economic Development • President George W. Bush’s National Advisory Council on Indian Education | ||

|

Financial |  |

Diversity | |||

| EXPERIENCE: | ||||||

• Global Lead Partner, Senior Advisor for Board Leadership Center and National Leader Total Impact Strategy, KPMG LLP, 2015-2018 • National Managing Partner of Diversity and Corporate Responsibility, KPMG LLP, 2009-2015 • Midwest Area Managing Partner, Tax Services, KPMG LLP, 2004-2009 • Vice Chairman, Human Resources, KPMG LLP, 2000-2004 |

||||||

| 24 // 83 | |

|

CORPORATE GOVERNANCE

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Audit, Compensation

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

None

| SHAILESH G. JEJURIKAR | 54 | BIRTHPLACE INDIA | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Risk management | • Member, Nanyang Technological University, Singapore Business Advisory Board, 2008-2018 • Vice Chairman, ACI-American Cleaning Institute, 2014-2017 | ||

|

Environmental, social and governance |  |

Global | |||

|

Innovation and optimization |  |

Diversity | |||

|

Financial | |||||

| EXPERIENCE: | ||||||

• Chief Executive Officer, Fabric & Home Care, The Procter & Gamble Company, since 2019 • Executive Sponsor, Corporate Sustainability, The Procter & Gamble Company, since 2016 • President, Global Fabric Care & Home Care Sector, The Proctor & Gamble Company, 2018-2019 • President, Global Fabric Care & Brand Building Organization, The Proctor & Gamble Company, 2015-2018 • President, Fabric Care, North America, The Proctor & Gamble Company, 2014-2015 |

||||||

EXECUTIVE CHAIRMAN

BOARD COMMITTEES:

None

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

Nucor Corporation

| CHRISTOPHER J. KEARNEY | 65 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Financial | • Director, United Technologies Corporation, 2018-2020 • Director, Polypore International, Inc., 2012-2015 | ||

|

Environmental, social and governance |  |

Risk management | |||

|

Innovation and optimization |  |

Global | |||

| EXPERIENCE: | ||||||

• Executive Chairman, Otis Worldwide Corporation, since 2020 • Non-Executive Chairman of SPX FLOW, Inc., 2016-2017 • Chairman, President and Chief Executive Officer, SPX FLOW, Inc., October-December 2015 • Chairman, President and Chief Executive Officer, SPX Corporation, 2007-2015 • President and Chief Executive Officer, SPX Corporation, 2004-2007 • Managing Partner, Eagle Marsh Holdings, LLC, since 2016 |

||||||

| 25 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

PRESIDENT & CEO

BOARD COMMITTEES:

None

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

None

| JUDITH F. MARKS | 57 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Financial | Director, Hubbell, Inc., 2016-2020 | ||

|

Environmental, social and governance |  |

Global | |||

|

Innovation and optimization |  |

Diversity | |||

| EXPERIENCE: | ||||||

• President & Chief Executive Officer, Otis Worldwide Corporation, since 2020 • President (since 2017) & Chief Executive Officer (since 2019), Otis Elevator Company • Chief Executive Officer, Siemens USA and Dresser Rand, a Siemens business, 2016-2017 • Executive Vice President, New Equipment Solutions, Dresser Rand, 2015-2016 • President & Chief Executive Officer, Siemens Government Technologies, 2011-2015 |

||||||

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Compensation, Nominations and Governance

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

Phillips 66 Company

| HAROLD W. MCGRAW III | 72 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE AND SERVICE: | |||||

|

Senior industry leadership |  |

Global | • Chairman, U.S. Council for International Business • Member, U.S. Trade Representatives’ Advisory Committee for Trade Policy and Negotiations • Honorary Chairman, International Chamber of Commerce • Director, ConocoPhillips, 2005-2012 • Director, United Technologies Corporation, 2003-2020 | ||

|

Environmental, social and governance | |||||

| EXPERIENCE: | ||||||

• Chairman, McGraw-Hill Companies, 1999-2015 • President &

CEO, McGraw-Hill Companies, 1998-2013 |

||||||

| 26 // 83 | |

|

CORPORATE GOVERNANCE

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Compensation, Nominations and Governance (Chair)

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

McCormick & Company

| MARGARET M. V. PRESTON | 63 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE AND SERVICE: | |||||

|

Environmental, social and governance |  |

Global | • Board Member, Lincoln Center, Women’s Leadership Council • Board Member, United Way of New York City Women’s Leadership Council | ||

|

Financial |  |

Diversity | |||

|

Risk management | |||||

| EXPERIENCE: | ||||||

• Managing Director, North Region Leader, U.S. Wealth Management, TD Bank, N.A., 2014-2019 • Managing Director and Regional Executive for U.S. Trust, Bank of America Private Wealth Management, 2006-2014 • Executive Vice President, Wealth Management and Investments, PNC Bank (formerly Mercantile-Safe Deposit & Trust Co.), 2002-2006 |

||||||

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Audit, Nominations and Governance

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

Kontoor Brands, Inc.

| SHELLEY STEWART, JR. | 67 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Risk management | • Director, Cleco Corporation, 2010-2016 • Board of Trustees, Howard University • Chair, Board of Visitors, Howard University School of Business • Board of Governors, University of New Haven | ||

|

Environmental, social and governance |  |

Global | |||

|

Innovation and optimization |  |

Diversity | |||

|

Financial | |||||

| EXPERIENCE: | ||||||

• Vice President, Sourcing and Logistics, and Chief Procurement Officer, E. I. du Pont de Nemours and Company, 2012-2018 • Senior Vice President, Operational Excellence, Chief Procurement Officer, Tyco International plc, 2005-2012 • Vice President, Supply Chain Management, Tyco International plc, 2003-2005 • Senior Vice President, Supply Chain, Invensys PLC, 2001-2003 • Managing Partner, Bottom Line Advisory LLC, since 2018 |

||||||

| 27 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

LEAD DIRECTOR

INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Compensation (Chair)

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

Nucor Corporation O-I Glass, Inc.

| JOHN H. WALKER | 63 | BIRTHPLACE UNITED STATES | ||||||

| SKILLS AND ATTRIBUTES: | OTHER LEADERSHIP EXPERIENCE: | |||||

|

Senior industry leadership |  |

Financial | • Director, United Continental Holdings, Inc., 2002-2016 • Director, Delphi Corporation, 2005-2009 • Executive Director, Weirton Steel Corporation, 2000-2003 | ||

|

Environmental, social and governance |  |

Risk management | |||

|

Innovation and optimization | |||||

| EXPERIENCE: | ||||||

• Non-Executive Chairman, Nucor Corporation, since 2020 • Non-Executive Chairman, Global Brass and Copper Holdings, Inc., 2014-2019 • Executive Chairman, Global Brass and Copper Holdings, Inc., 2013-2014 • Chief Executive Officer, Global Brass and Copper Holdings, Inc., 2007-2014 • President and Chief Executive Officer, The Boler Company, 2003-2006 |

||||||

Nominee skills and attributes matrix

We are proud of the breadth, depth and diversity of skills and expertise that our Board possesses. No one skill is more important than the other, and the strength of our Board comes from its collective perspectives. The chart below and the biographical information for each director nominee above illustrate the diverse set of key skills, attributes and areas of expertise represented on our Board. The absence of a “l” for a particular skill or attribute does not mean the director is unable to contribute to the decision-making process in that area.

| Jeffrey H. Black | Kathy Hopinkah Hannan |

Shailesh G. Jejurikar |

Christopher J. Kearney |

Judith F. Marks |

Harold W. McGraw III |

Margaret M. V. Preston |

Shelley Stewart, Jr. |

John H. Walker | ||

|

Senior industry leadership | l | l | l | l | l | l | l | ||

|

Environmental, social and governance | l | l | l | l | l | l | l | l | l |

|

Innovation and optimization | l | l | l | l | l | ||||

|

Financial | l | l | l | l | l | l | l | l | |

|

Risk management | l | l | l | l | l | l | l | ||

|

Global | l | l | l | l | l | l | l | ||

|

Diversity | l | l | l | l | l |

| 28 // 83 | |

|

CORPORATE GOVERNANCE

Objectivity and independence of thought are critical attributes for all our Board members, enabling our Board as a whole to respect and consider the broad range of viewpoints offered by our diverse directors. To further ensure that our directors are guided by independent thought and interest, the Board, under the Corporate Governance Guidelines, requires that a substantial majority of directors be independent in accordance with applicable law and the listing standards of the NYSE.

Independence determinations by the Board are further guided by the Board’s Director Independence Policy (available at www.otisinvestors.com/governance/governance-documents), pursuant to which a director is considered independent if the Board makes an affirmative determination, after consideration of all relevant facts and circumstances, that the director does not have a material relationship with Otis (other than as a director) either directly or as a partner, shareholder or executive officer of another entity that has a relationship with Otis. When assessing the materiality of a director’s relationship with Otis, the Board will consider the issue both from the director’s standpoint and from that of persons or organizations affiliated with the director.

Before joining the Board and annually thereafter, the Nominations and Governance Committee conducts an assessment for each nominee and director that considers all known relevant facts and circumstances about relationships bearing on the independence of the nominee/director. This assessment is based on a questionnaire completed by the nominee/director, as well as company information about sales and purchases of products and services in the ordinary course of business, as well as other transactions, between Otis (including its subsidiaries) and other companies or charitable organizations, where directors and nominees (and their immediate family members) may have relationships pertinent to the independence determination. The assessment also examines relationships that may affect heightened independence standards that apply to members of the Audit Committee and Compensation Committee.

| Following its assessments in connection with the nomination of the nine incumbent directors to the Board at the Annual Meeting, the Nominations and Governance Committee has concluded, and the Board affirmatively determined, that all of the directors other than Christopher J. Kearney and Judith F. Marks, who are employed by Otis, are independent under Otis’ Director Independence Policy and the NYSE listing standards because none of the directors, other than Mr. Kearney and Ms. Marks, has a business, financial, family or other relationship with Otis that is considered material. |

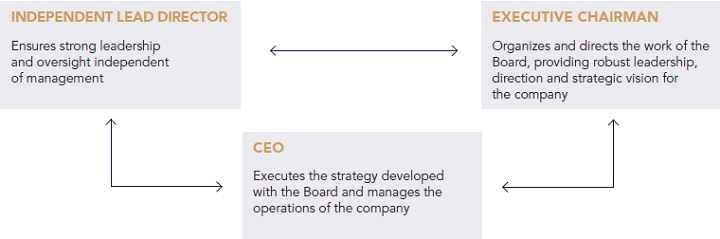

Our leadership and Board structure

The Otis Board is led by an Executive Chairman and an independent Lead Director, with the CEO as a vital member of the Board. As a newly public company, Otis’ Board leadership structure reflects the desire for both continuity of leadership and fresh, independent oversight. Otis has no fixed policy on whether the roles of Executive Chairman and CEO should be separate or combined, but rather allows the Board to determine the best structure based on the circumstances. The Otis Board believes that the current structure continues to serve the best interests of Otis at this time.

| 29 // 83 | |

| 2021 Proxy Statement |

CORPORATE GOVERNANCE

The roles of CEO, Executive Chairman and Lead Director are separate and distinct, but function together and support each other. The separate roles of CEO and Executive Chairman allow CEO Judith F. Marks to focus on leading and growing our newly independent business and operations. At the same time, Executive Chairman Christopher J. Kearney can focus on strong Board governance and leadership, while working collaboratively with senior management. Mr. Kearney, who served on the UTC board of directors prior to the Separation, is well-suited for this role since he brings an understanding of Otis’ pre-Separation business and the UTC governance model in which Otis operated. Additionally, Mr. Kearney has recent, extensive and highly relevant experience leading a Fortune 500 manufacturing company as Chairman, President and Chief Executive Officer of SPX Corporation and overseeing the spinoff of a large segment into a standalone public company (SPX FLOW, Inc.), following which he served as Chairman, President and Chief Executive Officer, and subsequently Non-Executive Chairman of SPX FLOW, Inc.

Since the Executive Chairman is not independent, the Corporate Governance Guidelines require the independent directors to annually select an independent member to serve as Lead Director to act in an advisory capacity to the CEO and Executive Chairman and to management in matters concerning the interests of the organization and the Board and relationships between management and the Board. The independent directors selected John H. Walker to fill this role in light of his extensive executive and board leadership experience.

In electing the individuals to serve as Executive Chairman and independent Lead Director, the Board considers skills and experiences as well as personal characteristics that will best support a strong and collaborative working relationship among them and the CEO. The key roles and responsibilities of the Executive Chairman and the Lead Director are described below.

| Executive Chairman | Lead Director | |