Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS 3

As filed with the Securities and Exchange Commission on February 25, 2020

Registration No. 333-232731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 9

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GFL Environmental Holdings Inc.

(Exact Name of Registrant as Specified in its Charter)

| Ontario, Canada (State or other jurisdiction of incorporation or organization) |

4953 (Primary Standard Industrial Classification Code Number) |

N/A (I.R.S. Employer Identification Number) |

100 New Park Place, Suite 500

Vaughan, Ontario, Canada L4K 0H9

Telephone: (905) 326-0101

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Patrick Dovigi

Founder and Chief Executive Officer

100 New Park Place, Suite 500

Vaughan, Ontario, Canada L4K 0H9

Telephone: (905) 326-0101

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Corporate Creations Network Inc.

3411 Silverside Road, Tatnall Building, Suite 104

Wilmington, DE 19810

(302) 351-3367

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||||

| Ryan Bekkerus, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Jeffrey Singer, Esq. Jeffrey Hershenfield, Esq. Stikeman Elliott LLP 5300 Commerce Court West 199 Bay Street Toronto, Ontario, Canada M5L 1B9 (416) 869-5500 |

Deanna L. Kirkpatrick, Esq. Shane Tintle, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Shawn McReynolds, Esq. Jennifer Grossklaus, Esq. Davies Ward Phillips & Vineberg LLP 155 Wellington Street West Toronto, Ontario, Canada M5V 3J7 (416) 863-0900 |

|||

Approximate date of commencement of the proposed sale of the securities to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Aggregate Offering Price Per Share or Unit |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Subordinate voting shares, no par value |

84,146,342(1) | $21.00(2) | $1,767,073,182 | $229,366.10 | ||||

Tangible Equity Units(4)(5) |

16,100,000 | $50.00 | $805,000,000 | $104,489 | ||||

Stock Purchase Contracts |

||||||||

Amortizing Notes |

||||||||

Total |

$2,572,073,182 | $333,855.10 | ||||||

|

||||||||

- (1)

- Includes

shares to be sold upon exercise of the underwriters' option to purchase to cover over-allotments, if any. See "Underwriting (Conflicts of Interest)".

- (2)

- Estimated

solely for the purpose of calculating the registration fee under Rule 457(a) of the Securities Act of 1933, as amended.

- (3)

- Previously

paid $313,726.73 of such fee.

- (4)

- Includes

2,100,000 Tangible Equity Units that are subject to the underwriters' option to purchase additional Tangible Equity Units. Each Tangible Equity Unit is

composed of a stock purchase contract and an amortizing note. This registration statement also registers an estimated 39,268,293 of the Registrant's subordinate voting shares that are issuable upon

settlement of the purchase contracts that are a component of the Tangible Equity Units registered hereby, at the initial rate of 2.4390 subordinate voting shares per purchase contract, based on the

assumed initial public offering price of $20.50 per subordinate voting share, which is the midpoint of the estimated price range set forth on the cover page of the subordinate voting shares prospectus

which forms a part of this registration statement and assuming the maximum number of shares issuable upon automatic settlement of such purchase contracts. Under Rule 457(i), there is no

additional filing fee payable with respect to the subordinate voting shares issuable upon settlement of the purchase contracts because no additional consideration will be received in connection with

the settlement. The number of the Registrant's subordinate voting shares issuable upon such settlement will vary based on the public offering price of the subordinate voting shares registered hereby.

- (5)

- The number of the Registrant's subordinate voting shares issuable upon settlement of the purchase contracts is subject to anti-dilution adjustments upon the occurrence of certain events described herein. Pursuant to Rule 416 under the Securities Act, the number of the Registrant's subordinate voting shares to be registered includes an indeterminable number of subordinate voting shares that may become issuable upon settlement of the purchase contracts as a result of such anti-dilution adjustment, solely to the extent permitted by Rule 416.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

GFL Environmental Holdings Inc., a Canadian corporation formed by amalgamation on May 31, 2018 that is the registrant whose name appears on the cover of this registration statement, will amalgamate with its subsidiary, GFL Environmental Inc. and will continue as GFL Environmental Inc. The amalgamation will be accounted for as a transaction between entities under common control and the net assets will be recorded at the historical cost basis retrospectively. Upon the amalgamation, GFL Environmental Inc. will become the financial reporting entity.

This Registration Statement contains a prospectus relating to an offering of GFL Environmental Inc.'s subordinate voting shares (for purposes of this Explanatory Note, the "Subordinate Voting Shares Prospectus"), together with separate prospectus pages relating to an offering of GFL Environmental Inc.'s Tangible Equity Units (the "Unit Offering") (for purposes of this Explanatory Note, the "Tangible Equity Units Prospectus"). The complete Subordinate Voting Shares Prospectus follows immediately. Following the Subordinate Voting Shares Prospectus are the following alternative and additional pages for the Tangible Equity Units Prospectus:

- •

- front and back cover pages, which will replace the front and back cover pages of the Subordinate Voting Shares Prospectus;

- •

- pages for the "The Offering" section, which will replace the "Prospectus Summary—The Offering" section of the Subordinate Voting

Shares Prospectus;

- •

- pages for the "Risk Factors—Risks Related to the Units, the Separate Purchase Contracts and the Separate Amortizing Notes" and

"Risk Factors—Risks Related to Ownership of our Subordinate Voting Shares and Multiple Voting Shares" sections, which will replace the "Risk Factors—Risks Related to this

Offering and Ownership of Our Subordinate Voting Shares and Multiple Voting Shares" section of the Subordinate Voting Shares Prospectus;

- •

- pages for the "Description of the Units", "Description of the Purchase Contracts" and "Description of the Amortizing Notes" sections, which

will replace the "Tangible Equity Units Offering" section of the Subordinate Voting Shares Prospectus;

- •

- pages for the "Material United States Federal Income Tax Consequences to U.S. Holders" section, which will replace the "Material United States

Federal Income Consequences to U.S. Holders" section of the Subordinate Voting Shares Prospectus;

- •

- pages for the "Material Canadian Federal Income Tax Consequences" section, which will replace the "Material Canadian Federal Income Tax

Considerations" section of the Subordinate Voting Shares Prospectus;

- •

- pages for the "Certain ERISA Considerations" and "Book-Entry Procedures and Settlement" sections, which will be added to the Tangible Equity

Units Prospectus;

- •

- pages for the "Underwriting (Conflicts of Interest)" section, which will replace the "Underwriting (Conflicts of Interest)" section of the

Subordinate Voting Shares Prospectus; and

- •

- pages for the "Legal Matters" section, which will replace the "Legal Matters" section of the Subordinate Voting Shares Prospectus.

The following disclosures and references contained within the Subordinate Voting Shares Prospectus will be replaced or removed in the Tangible Equity Units Prospectus:

- •

- references to "subordinate voting shares" contained in the first paragraph under "Prospectus Summary", the first paragraph of "Prospectus

Summary—Risk Factors" and the first paragraph under "Risk Factors" will be replaced with references to "the Units" in the Tangible Equity Units Prospectus;

- •

- the reference to "—Risks Related to this Offering and Ownership of Our Subordinate Voting Shares and Multiple Voting Shares—A significant portion of our total outstanding subordinate voting shares may be sold into the public market in the near future, which could cause the

- •

- the disclosure under "Prospectus Summary—Unit Offering" will be replaced in its entirety with a section entitled "Prospectus

Summary—Concurrent Offering" and the following disclosure: "Concurrently with this offering, we are offering, by means of a separate prospectus, 71,652,440 subordinate voting shares

(and up to an additional 10,975,609 subordinate voting shares that the underwriters in the Concurrent Offering have the option to purchase from us). In addition, the selling shareholder is offering

1,518,293 subordinate voting shares. We estimate that the net proceeds to us from the sale of subordinate voting shares in the Concurrent Offering will be approximately US$1,408.9 million (or

$1,878.5 million) (or approximately US$1,626.6 million (or $2,168.7 million) if the underwriters exercise their option to purchase additional subordinate voting shares in full),

assuming an initial public offering price of US$20.50 per share (which is the midpoint of the estimated price range set forth on the cover page of the prospectus relating to the Concurrent Offering),

in each case after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of subordinate voting shares

by the selling shareholder in the Concurrent Offering. The closing of this offering is conditioned upon the closing of the Concurrent Offering, but the closing of the Concurrent Offering is not

conditioned upon the closing of this offering." in the Tangible Equity Units Prospectus;

- •

- the first sentence of the first paragraph under "Dilution" will be replaced in its entirety with "If you invest in subordinate voting shares in

the Concurrent Offering, your investment will be immediately diluted to the extent of the difference between the initial public offering price per subordinate voting share in the Concurrent Offering

and the as adjusted net tangible book value (deficit) per subordinate voting share after this offering and the Concurrent Offering." in the Tangible Units Prospectus;

- •

- references to "this offering" contained in "Basis of Presentation", "Prospectus Summary—Risk Factors", "Risk

Factors—Risks Related to our Business and Industry", "Cautionary Note Regarding Forward-Looking Statements", "Use of Proceeds", "Dividend Policy", "Capitalization", "Dilution",

"Management's Discussion and Analysis of Financial Condition and Results of Operations", "Management", "Executive Compensation", "Certain Relationships and Related Person Transactions", "Principal and

Selling Shareholders", "Description of Material Indebtedness", "Description of Share Capital", "Shares Eligible for Future Sale" and "Where You Can Find More Information" will be replaced with

references to "the Concurrent Offering" in the Tangible Equity Units Prospectus;

- •

- references to "the Unit Offering" contained in "Cautionary Note Regarding Forward-Looking Statements", "Use of Proceeds", "Capitalization",

"Dilution" and "Shares Eligible for Future Sale" will be replaced with references to "this offering" in the Tangible Equity Units Prospectus;

- •

- references to "the selling shareholder" on pages i and ii shall be deleted in the Tangible Equity Units Prospectus;

- •

- references to the "concurrent issuance" contained in "Capitalization" will be replaced with references to "issuance in this offering of" in the

Tangible Equity Units Prospectus;

- •

- references to "midpoint of the estimated price range set forth on the cover page of this prospectus" will be replaced with "midpoint of the estimated price range set forth on the cover page of the prospectus relating to the Concurrent Offering" in the Tangible Equity Units Prospectus;

market price of our subordinate voting shares to drop significantly" contained in "Shares Eligible For Future Sale" will be replaced with a reference to "—Risks Related to the Units, the Separate Purchase Contracts and the Separate Amortizing Notes—A significant portion of our total outstanding subordinate voting shares may be sold into the public market in the near future, which could cause the market price of the Units, the purchase contracts and/or the subordinate voting shares to drop significantly" in the Tangible Equity Units Prospectus;

- •

- references to "assuming the number of subordinate voting shares offered by us remains the same as set forth on the cover page of this

prospectus" contained in "Use of Proceeds" will be replaced with "assuming the number of subordinate voting shares offered by us, shown on the cover page of the prospectus relating to the Concurrent

Offering, remains the same" in the Tangible Equity Units Prospectus;

- •

- the third paragraph under "Use of Proceeds" will be moved as the first paragraph under the section in the Tangible Equity Units Prospectus;

- •

- references to "this prospectus" contained in "Certain Relationships and Related Person Transactions—Directed Share Program" will be

replaced with references to "the prospectus relating to the Concurrent Offering" in the Tangible Equity Units Prospectus;

- •

- the reference to "See "Underwriting (Conflicts of Interest)" for more information" in "Certain Relationships and Related Person

Transactions—Directed Share Program" will be removed in the Tangible Equity Units Prospectus; and

- •

- the references to "subordinate voting shares" in "Where You Can Find More Information" will be replaced with references to "the Units, purchase contracts and amortizing notes" in the Tangible Equity Units Prospectus.

All words and phrases similar to those specified above that appear throughout the Subordinate Voting Shares Prospectus will be revised accordingly to make appropriate references in the Tangible Equity Units Prospectus.

Each of the complete Subordinate Voting Shares Prospectus and Tangible Equity Units Prospectus will be filed with the Securities and Exchange Commission in accordance with Rule 424 under the Securities Act of 1933, as amended. The closing of the offering of subordinate voting shares is not conditioned upon the closing of the offering of Tangible Equity Units, but the closing of the offering of Tangible Equity Units is conditioned upon the closing of the offering of subordinate voting shares.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion. Dated February 25, 2020

73,170,733 Shares

GFL Environmental Inc.

Subordinate Voting Shares

This is an initial public offering of subordinate voting shares of GFL Environmental Inc. We are offering 71,652,440 subordinate voting shares. Josaud II Holdings Inc. (the "selling shareholder"), an entity owned and controlled by Patrick Dovigi, is offering 1,518,293 subordinate voting shares. We will not receive any proceeds from the subordinate voting shares sold by the selling shareholder.

Concurrently with this offering, we are also making a public offering of 14,000,000 % tangible equity units (the "Tangible Equity Units" or the "Units"), which is being made by means of a separate prospectus and not by means of this prospectus. In the Unit Offering, we have granted the underwriters of the Unit Offering an option to purchase, within 13 days beginning on, and including, the date of the initial issuance of the Units, up to an additional 2,100,000 Units. The closing of this offering is not conditioned upon the closing of the Unit Offering, but the closing of the Unit Offering is conditioned upon the closing of this offering.

Prior to this offering, there has been no public market for our subordinate voting shares. It is currently estimated that the initial public offering price per subordinate voting share will be between US$20.00 and US$21.00 (or $26.66 and $28.00 based on an exchange rate of US$1.00 = $1.3333). Our subordinate voting shares have been approved for listing on the New York Stock Exchange ("NYSE") under the symbol "GFL" and our subordinate voting shares have been conditionally approved for listing on the Toronto Stock Exchange ("TSX") under the symbol "GFL".

Following this offering, we will have two classes of shares outstanding: subordinate voting shares and multiple voting shares. The rights of the holders of our subordinate voting shares and multiple voting shares are substantially identical, except with respect to voting and conversion. The subordinate voting shares will have one vote per share and the multiple voting shares will have 10 votes per share. The subordinate voting shares are "restricted securities" within the meaning of such term under applicable Canadian securities law. The subordinate voting shares are not convertible into any other class of shares, while the multiple voting shares are convertible into subordinate voting shares on a one-for-one basis at the option of the holder and under certain other circumstances set forth in our Articles (as defined herein). See "Description of Share Capital". After giving effect to this offering, the subordinate voting shares will collectively represent 96.3% of our total issued and outstanding shares and 72.2% of the voting power attached to all of our issued and outstanding shares (96.4% and 72.9%, respectively, if the underwriters' option to purchase additional subordinate voting shares is exercised in full) and the multiple voting shares will collectively represent 3.7% of our total issued and outstanding shares and 27.8% of the voting power attached to all of our issued and outstanding shares (3.6% and 27.1%, respectively, if the underwriters' option to purchase additional subordinate voting shares is exercised in full). See "Description of Share Capital—Share Capital upon Completion of the Offering".

Upon completion of this offering, 100% of our multiple voting shares will be held by the Dovigi Group (as defined herein). For so long as BC Partners (as defined herein) holds at least 15% of the issued and outstanding shares, the Dovigi Group will only be permitted to vote the multiple voting shares that it holds in a manner consistent with the recommendations of the director nominees of BC Partners on our board of directors. See "Certain Relationships and Related Party Transactions" and "Principal and Selling Shareholders".

See "Risk Factors" beginning on page 33 to read about factors you should consider before buying our subordinate voting shares.

Neither the Securities and Exchange Commission (the "SEC") nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

||||

| |

Per subordinate voting share |

Total |

||

|---|---|---|---|---|

Initial public offering price |

US$ ($ ) | US$ ($ ) | ||

Underwriting discounts and commissions(1) |

US$ ($ ) | US$ ($ ) | ||

Proceeds to us, before expenses |

US$ ($ ) | US$ ($ ) | ||

Proceeds, before expenses, to the selling shareholder |

US$ ($ ) | US$ ($ ) | ||

|

||||

- (1)

- See "Underwriting (Conflicts of Interest)" for additional information regarding underwriting compensation.

To the extent that the underwriters sell more than 73,170,733 subordinate voting shares, the underwriters have the option to purchase up to an additional 10,975,609 subordinate voting shares from us to cover over-allotments at the initial public offering price less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

The underwriters expect to deliver the subordinate voting shares against payment in Toronto, Ontario on or about , 2020.

| J.P. Morgan | BMO Capital Markets |

Goldman Sachs & Co. LLC |

RBC Capital Markets |

Scotiabank |

| Barclays | BC Partners | Raymond James | Stifel | TD Securities Inc. |

| BofA Securities | CIBC Capital Markets | HSBC | National Bank Financial Inc. |

Prospectus dated , 2020.

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. None of us, the selling shareholder or the underwriters have authorized anyone to provide you with different information, and none of us, the selling shareholder or the underwriters take responsibility for any other information others may give you. We are not, and

i

the selling shareholder and underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is only accurate as of the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Market and industry data presented throughout this prospectus was obtained from third-party sources, industry reports and publications, websites and other publicly available information, including data supplied to us from the Environmental Business Journal ("EBJ") in mid 2019, as well as industry and other data prepared by us or on our behalf on the basis of our knowledge of the markets in which we operate, including information provided by suppliers, customers and other industry participants. The EBJ data contained in this prospectus represents EBJ's estimates and does not represent facts. We believe that the market and economic data presented throughout this prospectus is accurate and, with respect to data prepared by us or on our behalf, that our estimates and assumptions are currently appropriate and reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data presented throughout this prospectus are not guaranteed and neither we nor any of the underwriters make any representation as to the accuracy of such data. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Although we believe it to be reliable, neither we nor any of the underwriters have independently verified any of the data from third-party sources referred to in this prospectus, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying market, economic and other assumptions relied upon by such sources. Market and economic data are subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus. Neither we nor the underwriters can guarantee the accuracy or completeness of such information contained in this prospectus.

This prospectus includes certain trademarks, such as "GFL Green For Life", "Green Today, Green For Life", "GFL Environmental" and "GFL" which are protected under applicable intellectual property laws and are our property. Solely for convenience, our trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and trade names.

In connection with and prior to the closing of this offering, GFL Environmental Inc. will amalgamate with its parent company, GFL Environmental Holdings Inc. ("Holdings") and will continue as GFL Environmental Inc. In connection with such amalgamation, we will, among other things, amend our share capital such that it will be composed of an unlimited number of subordinate voting shares, an unlimited number of multiple voting shares, and an unlimited number of preferred shares. In addition, all of the issued and outstanding shares of the amalgamating corporations will be exchanged for subordinate voting shares and multiple voting shares of the Company. See "Description of Share Capital—Pre-Closing Capital Changes". The subordinate voting shares to be sold by the selling shareholder as part of this offering will be converted from multiple voting shares prior to the closing of

ii

this offering. Unless otherwise indicated, all references in this prospectus to "GFL", "we", "our", "us", "the Company" or similar terms refer to GFL Environmental Inc. and its consolidated subsidiaries assuming the completion of the Pre-Closing Capital Changes (as defined herein and which includes the amalgamation of Holdings and GFL Environmental Inc.).

Holdings amalgamated with Hulk Acquisition Corp. on May 31, 2018 in connection with the investment in Holdings by certain funds and other entities managed, advised or controlled by or affiliated with BC Partners Advisors L.P. ("BC Partners"), or an entity affiliated with Ontario Teachers' Pension Plan Board (collectively with the funds, partnerships, investment vehicles or other entities affiliated therewith or managed, advised or controlled thereby, "Ontario Teachers") and affiliates of Patrick Dovigi, our Founder, Chairman, President and Chief Executive Officer. We refer to these investments and the amalgamation as the "Recapitalization". Accordingly, the consolidated financial statements for Holdings presented elsewhere in this prospectus as of December 31, 2019 and 2018, and for the year ended December 31, 2019, the periods ended December 31, 2018 and May 31, 2018, and for the year ended December 31, 2017, reflect the periods both prior and subsequent to the Recapitalization. Our fiscal year ends on December 31 of each calendar year. Our fiscal year ended December 31, 2018, which we refer to as "Fiscal 2018", is presented separately for (i) the predecessor period from January 1, 2018 through May 31, 2018, which we refer to as the "Predecessor 2018 Period", and (ii) the successor period from June 1, 2018 through December 31, 2018, which we refer to as the "Successor 2018 Period", with the periods prior to the Recapitalization being labeled as "Predecessor" and the periods subsequent to the Recapitalization being labeled as "Successor". We refer to the years ended December 31, 2019 and December 31, 2017 as "Fiscal 2019" and "Fiscal 2017", respectively.

We report under International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (the "IASB"). The consolidated financial statements of Wrangler Super Holdco Corp. and its subsidiaries (dba Waste Industries USA) ("Waste Industries") were prepared in accordance with generally accepted accounting principles in the United States ("U.S. GAAP"). U.S. GAAP differs in certain material respects from IFRS and, as such, consolidated financial statements of Waste Industries are not comparable to financial statements of the Company prepared in accordance with IFRS. We refer to our merger with Waste Industries in November 2018 as the "Waste Industries Merger".

We publish our consolidated financial statements in Canadian dollars. In this prospectus, unless otherwise specified, all monetary amounts are in Canadian dollars, all references to "$", "C$", "CDN$", "CAD$" and "dollars" mean Canadian dollars and all references to "US$" and "USD" mean U.S. dollars.

iii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in the subordinate voting shares. You should read this entire prospectus carefully, including the sections entitled "Risk Factors", "Selected Historical Consolidated Financial Information", "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Cautionary Note Regarding Forward-Looking Statements" and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision.

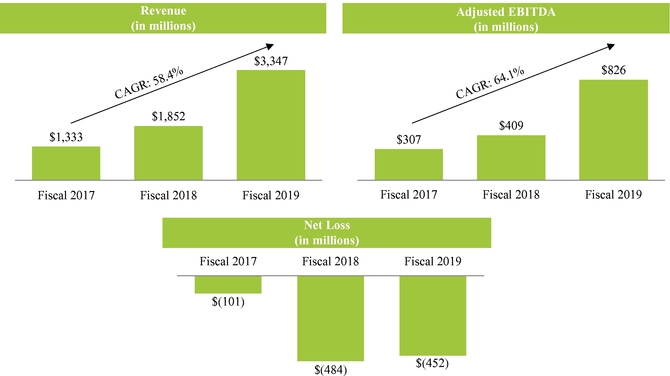

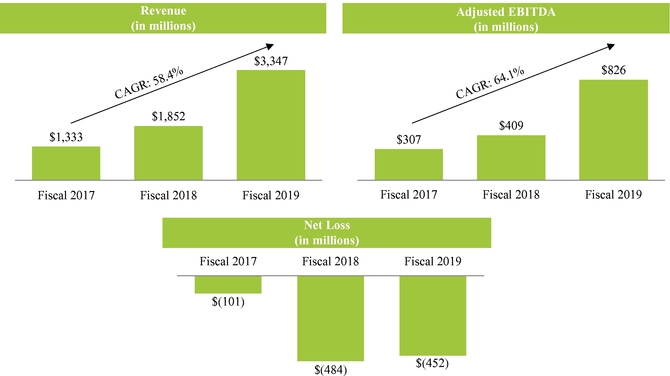

GFL is the fourth largest diversified environmental services company in North America, as measured by revenue and North American operating footprint. From 2017 to 2019, we have grown revenue in excess of, and our Compound Annual Growth Rate ("CAGR") for revenue has grown at a higher rate than, our publicly traded environmental services peers. We have an extensive geographic footprint, operating throughout Canada and in 23 states in the United States. Our diversified business model and competitive positioning in the stable environmental services industry have allowed us to maintain strong revenue growth across macroeconomic cycles. Between Fiscal 2017 and Fiscal 2019, we grew revenue from $1,333 million to $3,347 million. Over the same period, our net loss increased from $(101) million to $(452) million and our Adjusted EBITDA grew from $307 million to $826 million. For a discussion of Adjusted EBITDA, which is a measure that is not presented in accordance with IFRS, and a reconciliation to the most directly comparable financial measure calculated and presented in accordance with IFRS, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Measures" and "—Summary Historical Consolidated Financial Information".

Our diversified offerings include non-hazardous solid waste management, infrastructure & soil remediation and liquid waste management services. Our solid waste management business line includes the collection, transportation, transfer, recycling and disposal of non-hazardous solid waste for municipal, residential, and commercial and industrial customers. Our infrastructure & soil remediation business line provides remediation of contaminated soils as well as complementary services, including civil, demolition, excavation and shoring services. In our liquid waste management business line, we collect, transport, process, recycle and/or dispose of a wide range of liquid wastes from commercial and industrial customers.

As of December 31, 2019:

- •

- In our solid waste operations, we had more than 100 collection operations, over 70 transfer stations, 45 landfills, over

20 material recovery facilities ("MRF") and 11 organics facilities;

- •

- In our infrastructure & soil remediation operations, we had 14 soil remediation facilities;

- •

- In our liquid waste operations, we had more than 50 liquid waste collection, processing or storage facilities; and

- •

- Across our operations, we had more than 11,500 employees.

1

The table below summarizes our three business lines as at December 31, 2019.

- (1)

- See "—Summary Historical Consolidated Financial Information".

Our comprehensive service offerings across our business lines position us to be a "one-stop" provider of environmental services to our customers and differentiate us from our competitors that do not offer the same breadth of services. Our locally-based regional managers and sales representatives are best suited to identify and service our customers' needs, supported by our centralized back office functions. As a result, we believe that we are well-positioned to further unlock cross-selling opportunities to support new customer environmental services needs and to convert existing customers into customers for our other business lines.

Our network of facilities and route collection assets position us to realize operational efficiencies and obtain procurement and cost synergies, including from the significant volume of waste that we control across our operations. In each of our geographic markets, our strong competitive position is supported by the significant capital investment that would be required to replicate our network infrastructure and asset base, our productivity from route density that we have developed to date, as well as the stringent permitting and regulatory compliance required to operate a platform of our size.

2

The map below shows our strategically-located facility network.

We have a large and diverse customer base. In our solid waste management business, we currently serve over 4 million households, including those covered by more than 650 municipal collection contracts, and over 135,000 commercial and industrial customers. Our infrastructure & soil remediation business is currently concentrated in Southern Ontario and services many of the major Canadian infrastructure customers in that market. We are selectively expanding the geographic presence of our operations in this line of business, prioritizing other major metropolitan centres in Canada, such as the British Columbia and Quebec markets, where we have complementary solid and liquid waste assets and where existing and new customers have sought our infrastructure & soil remediation services in support of their major complex projects. Our liquid waste management line of business currently serves over 13,000 customers. Our top 10 customers accounted for approximately 9.6% of Fiscal 2019 revenue, and no single customer represented more than approximately 3.0% of Fiscal 2019 revenue.

3

For Fiscal 2019, our revenue by line of business, geography and source was as follows:

The revenue generated from both our solid and liquid waste management operations is predictable and recurring in nature as a result of the stability of waste generation and the contractual nature of these business lines. In many of our markets, we are able to successfully adjust pricing to reflect increases in our operating costs such as labour, fuel, logistics and other environmental expenses to broadly ensure that we continue to secure appropriate returns on capital. Our municipal solid waste customer relationships are supported by contracts with initial terms of three to 10 years, with one to five year renewal terms at the option of the municipality, and typically contain annual consumer price index ("CPI") and periodic fuel adjustments. Similarly, our solid waste contracts with commercial and industrial customers typically have three to five year terms with automatic renewals, volume-based pricing and CPI, fuel and other adjustments. Many of the businesses we have acquired have never implemented pricing growth strategies in their markets. As a result, we believe that we have the ability to continue to grow our revenue through the implementation of consistent pricing optimization strategies across our platform. In addition, many of our municipal and commercial contracts are only in their first or second renewal or extension term. When our municipal contracts are renewed or extended, we focus on marketing additional or upgraded services, such as automated carts or the collection of additional waste streams, that support further price increases.

We have historically demonstrated a strong track record of winning renewals or extensions of existing contracts with our municipal customers. For example, we successfully rebid our municipal contract with the City of Detroit for a five-year term that commenced on June 1, 2019. We also have a track record of winning repeat business with our major infrastructure & soil remediation and liquid waste customers. In our infrastructure & soil remediation business, our work is project based, often on large multi-year infrastructure projects, such as subway or other large-scale transit expansion projects, with a set term and three to four month lead times from contract to start of work. In our liquid waste business, we provide both regularly scheduled and on-call industrial waste management services, including emergency response services, for municipal, industrial and commercial customers. Furthermore, we have long-term relationships with many of our liquid waste customers who rely on our expertise to service their various waste streams. We believe there are numerous opportunities for us to continue to win new contracts and increase our market share in our current markets, as well as in new or adjacent markets.

We have generated strong, stable organic growth by leveraging our diversified business model and scalable network of facilities to increase the breadth and depth of services provided to our existing customers, realizing cross-selling opportunities between our complementary service capabilities, winning new contracts and renewals or extensions of existing contracts, and expanding into new or adjacent markets. We have a proven track record of successfully implementing this strategy, most notably to date in Southern Ontario, where we have built meaningful liquid waste and infrastructure & soil remediation

4

businesses alongside our solid waste management operations. We also see attractive opportunities to continue to expand our solid waste and infrastructure & soil remediation offerings in parts of Western Canada and the Midwestern United States, where we have an established asset and employee base servicing our liquid waste operations. We will continue to seek to replicate this model in other markets where we do not currently operate all three lines of our business. In our infrastructure & soil remediation business line, we are leveraging our existing expertise and reputation to expand into other large metropolitan centres in Canada with projects for existing customers or for which we are qualified to bid. With our acquisition of a liquid waste platform in the Midwestern United States in the fourth quarter of Fiscal 2018, we expect to begin to cross-sell liquid and solid waste management services to our customers in those markets in the United States where we have both a solid and liquid waste presence.

In addition to strong organic growth, we have completed over 100 acquisitions since 2007, generally at an average adjusted EBITDA multiple of 7.0x, excluding platform acquisitions. We focus on selectively acquiring premier independent regional operators, like Waste Industries, to create platforms to enter and expand into new markets across each of our business lines. We then seek to build scale by utilizing our broader infrastructure and platform acquisitions to make and effectively integrate smaller tuck-in acquisitions. We have a track record of sourcing and executing acquisitions of leading, high quality and complementary businesses by leveraging the relationships that our senior and regional leadership have built with potential vendors over time. We believe that this proven strategy minimizes integration risk and allows us to grow the top line revenue and profitability of acquired businesses under the GFL banner, while maintaining their same high service standards. This approach to acquisitions creates meaningful cost synergies by increasing route density and collection volumes, and drives margin expansion by leveraging our scalable infrastructure and centralized administrative capabilities. While we expect we will be able to fund some of our acquisitions and capital expenditures with our existing resources, we will likely require additional financing, including debt, to pursue certain acquisitions.

The North American environmental services industry remains highly fragmented with many regional, independent operators across all three of our business lines. We believe that many of these independent operators may wish to sell their businesses to provide succession for their family members or employees or as part of their estate planning. We believe our relationship-based approach and track record of executing on the terms and the timeline we commit to make us an acquirer-of-choice in the highly fragmented environmental services industry.

Since December 31, 2019, we have closed the Interim Acquisitions (as defined herein), representing aggregate annualized revenue of approximately $442.0 million.

5

We operate in the large and stable North American environmental services industry, which EBJ estimates totaled approximately US$434 billion in 2018 based on annual revenue. Key characteristics of our industry include relative recession resistance, high visibility of waste volumes, a stringent regulatory framework, high capital intensity to achieve scale and significant fragmentation which, in turn, has led to strong consolidation activity.

The North American environmental services industry has benefitted from an attractive macroeconomic and demographic backdrop. From 2012 to 2018, both Canada and the United States experienced strong nominal Gross Domestic Product ("GDP") CAGRs of 3.3% and 4.0%, respectively, and population growth of 1.0% and 0.7%, respectively. In particular, population growth has driven strong increases in housing starts and infrastructure spending, which underpin growth across the solid waste, infrastructure & soil remediation, and liquid waste segments of the environmental services industry.

North American Environmental Services Industry

Estimated based on annual revenue. Canadian dollar amounts have been converted to U.S. dollars using the exchange rate on May 29, 2019 of C$1.00 = US$0.7433.

Source: EBJ.

North American Solid Waste Industry

EBJ estimates that the North American solid waste industry market generated approximately US$73 billion of revenue in 2018 (US$8 billion in Canada and US$65 billion in the United States) and expects it to grow at an approximately 2.3% CAGR to reach approximately US$82 billion by 2023. We believe that our geographic presence in Canada and the United States will position us well to capitalize on favourable demographic and macroeconomic trends in the markets that we serve.

6

North American Solid Waste Industry

Estimated based on annual revenue. Canadian dollar amounts have been converted to U.S. dollars using the exchange rate on May 29, 2019 of C$1.00 = US$0.7433.

Source: EBJ.

Proper waste collection and disposal is essential for public health and safety, making the solid waste industry highly defensive and relatively recession-resistant. The industry benefits from a number of sectoral attributes, including: (i) high visibility of revenue due to stable and predictable waste generation by residential and commercial customers, including, with certain customers, multi-year contracts with annual CPI and periodic fuel adjustments; (ii) stable organic growth of waste volumes correlated to population and GDP growth, with collection and disposal pricing rates largely inelastic to economic downturns; (iii) the ongoing trend of municipalities and local governments privatizing public services, including waste management services; (iv) the absence of cost-effective substitutes for collection and landfill disposal; and (v) limited opportunities for new market entrants due to the geographical, regulatory, environmental and significant capital costs of landfill and asset development. These competitive dynamics are amplified through route density of collection operations and vertical integration where companies control the waste stream from collection to disposal. Due to the factors described above and the predictability of operating and capital costs, solid waste management companies have historically generated strong, recurring cash flows.

The North American solid waste industry is highly fragmented which presents attractive consolidation opportunities. EBJ estimates that in 2018, the top five providers in Canada and the United States controlled approximately 31% and 48% of their respective markets and were generally large, national companies. The remaining market participants were smaller private companies as well as municipalities that continue to own and operate waste collection and disposal operations.

North American Infrastructure & Soil Remediation Industry

According to EBJ, the North American infrastructure & soil remediation industry generated approximately US$49 billion of revenue in 2018 and is expected to grow at an approximately 2.9% CAGR to reach approximately US$56 billion by 2023. Key growth drivers include infrastructure investment, commercial and residential construction, and demolition performed to facilitate new construction. Growth is also expected to be driven by greater recognition of remediation of contaminated soil as a more environmentally sustainable alternative than disposal at landfills.

7

North American Infrastructure & Soil Remediation Industry

Estimated based on annual revenue. Canadian dollar amounts have been converted to U.S. dollars using the exchange rate on May 29, 2019 of C$1.00 = US$0.7433.

Source: EBJ.

The infrastructure & soil remediation industry includes treatment of contaminated soil and sediment as well as complementary infrastructure services, including shoring, excavation, and civil and demolition services. Soil remediation businesses operate by using on-site, commonly referred to as in-situ, or off-site, commonly referred to as ex-situ, remediation techniques or by accepting contaminated soils for transportation to and disposal at landfills. In-situ treatments involve containment treatment at the origin of contaminated soil, while ex-situ treatments involve the excavation and removal from the originating site of contaminated soils for processing and disposal. In many cases, soil remediation is a critical path item for project development. General contractors seek out service providers who can complete soil remediation on a timely, cost-effective basis to avoid overall project delays and related penalties.

The North American infrastructure & soil remediation industry is highly specialized with only a few significant players operating in each region in which we have relevant operations. In order to operate soil remediation or disposal facilities, service providers must obtain government permits through a costly and time-consuming permitting process. In addition, federal, provincial and state governments in the Canadian and United States markets in which we operate have adopted increasingly stringent standards regulating soil contaminants in recent years. As of 2018, EBJ estimates that in Canada, approximately 14% of the market was held by the five largest companies, each generating greater than $100 million of revenue annually. Approximately 25% of the market consisted of participants with annual revenue between $50 million and $100 million with the balance comprised of smaller players, each generating less than $50 million in annual revenue. In the United States, EBJ estimates that, as of 2018, approximately 8% of the market was held by companies with annual revenues greater than US$100 million with another approximately 20% of the market consisting of participants with annual revenue between US$50 million and US$100 million. The remaining 72% of the market was comprised of smaller local or regional constituents that each generated less than US$50 million in annual revenue.

North American Liquid Waste Industry

EBJ estimates that the North American liquid waste industry generated approximately US$36 billion of revenue in 2018, and expects it to grow at an approximately 3.0% CAGR to reach approximately US$42 billion by 2023.

8

North American Liquid Waste Industry

Estimated based on annual revenue. Canadian dollar amounts have been converted to U.S. dollars using the exchange rate on May 29, 2019 of C$1.00 = US$0.7433.

Source: EBJ.

This industry is broad in scope, offering services including waste water collection and processing; UMO collection, processing and resale; hydro vacuum services; waste packaging; lab packing; and on-site industrial services, such as parts and tank cleaning and waste removal. Similar to solid waste, and infrastructure & soil remediation, the liquid waste industry is highly regulated by municipal, provincial, and federal authorities that require permitting and ongoing operational supervision. Key drivers of the business include industrial production, oil prices, infrastructure investment and vehicle population. According to EBJ, in 2018, the top five players in Canada and the United States accounted for approximately 33% and 6% of their respective markets with the balance held by small- and mid-sized operators.

9

Leading, High Growth Environmental Services Platform

Through a combination of organic growth and acquisitions, we have grown revenue in excess of our publicly-traded environmental services peers. From 2017 to 2019, our CAGR for revenue has grown at a higher rate than our publicly traded environmental services peers. Between Fiscal 2017 and Fiscal 2019, we grew revenue from $1,333 million to $3,347 million. Over the same period, our net loss increased from $(101) million to $(452) million and our Adjusted EBITDA grew from $307 million to $826 million. For a discussion of Adjusted EBITDA, which is a measure that is not presented in accordance with IFRS, and a reconciliation to the most directly comparable financial measure calculated and presented in accordance with IFRS, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Measures" and "—Summary Historical Consolidated Financial Information".

We have generated strong, stable organic growth by leveraging our diversified business model and scalable network of facilities to increase the breadth and depth of services provided to our existing customers, realizing cross-selling opportunities between our complementary service capabilities, winning new contracts and renewals or extensions of existing contracts, and expanding into new or adjacent markets. We have a proven track record of successfully implementing this strategy, most notably to date in Southern Ontario, where we have built meaningful liquid waste and infrastructure & soil remediation businesses alongside our solid waste management operations. We will continue to seek to replicate this model in other markets where we do not currently operate all three lines of our business. In our infrastructure & soil remediation business line, we are leveraging our existing expertise and reputation to expand into other large metropolitan centres in Canada with projects for customers for which our integrated service model is particularly well-suited, or for which we are qualified to bid. With our acquisition of a liquid waste platform in the Midwestern United States in the fourth quarter of Fiscal 2018, we expect to begin to cross-sell liquid and solid waste management services to our customers in those markets in the United States where we have both a solid and liquid waste presence.

10

Our scalable capabilities and diverse service offerings also allow us to be responsive to changing customer needs and regulatory demands. For example, we believe we are well-positioned to service the increasing rates of waste diversion from landfills in Canada as well as the growing customer demand for sustainability solutions through our soil remediation facilities in Ontario, Manitoba and Saskatchewan, and our organics facilities in British Columbia, Saskatchewan, Alberta and Ontario. As a result of the Waste Industries Merger, we have added to our platform a network of collection operations, transfer stations and landfills primarily in the Southeastern United States, through which we manage our customers' solid waste streams from collection to transfer to disposal. In addition, Lonnie C. Poole, III (Ven Poole), the former Chief Executive Officer of Waste Industries, is now an investor in GFL as a result of the Waste Industries Merger.

Our ability to identify, execute and integrate value-enhancing acquisitions has also been a key driver of our growth strategy. The North American environmental services industry remains highly fragmented and we continue to see attractive acquisition opportunities in all three of our business lines.

Industry-Leading Financial Growth Profile

We believe that our financial performance is predictable and stable. Solid and liquid waste environmental services are largely non-discretionary in nature, which makes them relatively less sensitive to cyclical economic trends. The solid waste markets in which we compete are also characterized by longstanding customer relationships, supported by long-term contracts with municipalities, many with annual CPI and periodic fuel adjustments, and for our commercial and industrial customers, automatic term extensions with pricing that is based on volume as well as periodic adjustments (including customary surcharges) which reflect increases in operating costs such as fuel, labour, regulatory compliance and other factors.

Our growth has been driven by the execution of our organic growth and acquisition strategies. Our "one-stop" strategy enables us to grow the breadth and depth of services we provide to our customers, and to further unlock cross-selling opportunities to support customer needs for more than one business line and convert customer relationships from our first-on-site offerings into contracts for our other environmental services. We also focus on leveraging our expertise and service capabilities across our entire platform to drive efficiencies, which further supports our growth. We will continue to focus on accretive acquisitions, such as the margin-accretive acquisition of our first liquid waste platform in the United States in the fourth quarter of Fiscal 2018 and the Waste Industries Merger. We believe this approach, combined with our flexible disposal strategy, allows us to generate strong free cash flow and allocate more capital towards the execution of our growth initiatives.

Diversified Business Model Across Business Lines, Geographies and Customers

Since inception, we have expanded our footprint from Ontario to across Canada and into the United States. Today, our business is well-diversified across business lines, geographies and customers.

In Fiscal 2019, approximately 74%, 16% and 10% of our revenue was generated from our solid waste management, infrastructure & soil remediation and liquid waste management business lines, respectively. Our revenue is also well-distributed by geography, with approximately 53% and 47% of Fiscal 2019 revenue generated by our operations in Canada and the United States, respectively. We expect further geographic diversification as we continue to execute on our organic and acquisition growth strategies.

We have a large and diverse customer base. In our solid waste management business, we currently serve over 4 million households, including those covered by more than 650 municipal collection contracts, and over 135,000 commercial and industrial customers. Our infrastructure & soil remediation business is currently concentrated in Southern Ontario and services many of the major Canadian infrastructure customers in that market. We are expanding these operations into other major

11

metropolitan centres in Canada where our customers have infrastructure projects, including in British Columbia and Québec. Our liquid waste management line of business currently serves over 13,000 customers. Our top 10 customers accounted for approximately 9.6% of Fiscal 2019 revenue, and although we service large, flagship municipal contracts for cities like Toronto and Detroit, no single customer represented more than approximately 3.0% of Fiscal 2019 revenue. As we continue to build out our underpenetrated business lines in new markets, win new contracts and grow our customer base, we expect the diversification of our business by customer to continue.

We believe that our diversified business model affords us several advantages. In addition to providing stability across macroeconomic cycles and greater predictability to our organic growth, our ability to act as a one-stop provider for all of our customers' environmental services needs provides us with significant opportunities to unlock cross-selling opportunities across our business lines. For example, liquid waste customers typically also need solid waste management services. In addition, our infrastructure & soil remediation business allows customers to source all of their infrastructure project needs from us, as well as on-site hydro vacuum services offered by our liquid waste business line. Infrastructure projects also drive volumes into our soil remediation facilities. We have the ability to expand our infrastructure & soil remediation business with our existing customers as they undertake new projects in the markets that we serve. We believe that being first on-site with customers through our infrastructure offerings allows us to use our relationships with general contractors to also offer them solid and liquid waste services during the life of the relevant project as well as following its completion. We believe that the breadth of services that we offer our customers in our infrastructure operations uniquely positions us to compete on our service capabilities as well as on price. As we continue to build our customer base in all of our lines of business, we expect to be able to realize on additional cross-selling opportunities.

Our diversified business model also complements our acquisition strategy, which is an important component of our growth. With multiple business lines, we are able to source acquisitions from a broader pool of potential targets. This allows us to continue to seek out accretive acquisition opportunities and helps to reduce execution and business risk inherent in single-market and single-service offering strategies.

Scalable, Strategic Network of Facilities that would be Difficult to Replicate

We provide our services through a strategically-located network of facilities in all major metropolitan centres. We have an extensive geographic footprint, operating throughout Canada and in 23 states in the United States. As of December 31, 2019, our network included more than 100 collection operations, more than 70 owned or managed transfer stations, 45 owned or managed landfills, more than 20 owned or managed MRFs, 11 organics facilities, 14 soil remediation facilities and more than 50 liquid waste collection, processing or storage facilities. In each of our markets, our strong competitive position is supported by the significant capital investment that would be required to replicate our valuable network infrastructure and asset base, our productivity from route density that we have developed to date, as well as by the stringent permitting and regulatory compliance requirements to operate a platform of our size. We believe that our size and scale are difficult to replicate and present a distinctive and significant competitive advantage versus both smaller, traditional competitors and asset-light technology-focused waste competitors.

Our broad network of solid waste facilities underpins our ability to compete in markets with different disposal dynamics and profitably manage the solid waste volumes that we control. In some markets, we create and maintain vertically-integrated operations through which we manage our customers' waste streams from collection to transfer to disposal, a process we refer to as internalization. By internalizing waste in those markets where we have vertically-integrated operations, we are able to deliver high quality customer service and benefit from a stable and predictable revenue stream while maximizing profitability and cash flow from our operations. In disposal-neutral markets, or

12

markets with excess landfill capacity, we leverage our control of the substantial solid waste volumes from our collection and transfer stations to negotiate competitive disposal and pricing terms with third party disposal facilities. Revenue from our landfill operations represented approximately 5% of Fiscal 2019 revenue, which is below that of many of our peers. This has allowed us to generate strong free cash flow due to the lower capital intensity typically associated with our operations mix, which is less reliant on developing owned landfills. Overall, we believe we have an attractive network of environmental services facilities with the most relevant assets in markets where they are best-suited to efficiently meet our operational needs.

Proven Ability to Identify, Execute and Integrate Acquisitions

Our disciplined ability to identify, execute and integrate value-enhancing acquisitions has been a key driver of our growth to date. We focus on selectively acquiring premier independent regional operators to create platforms in new markets. We then seek to build scale by making and effectively integrating tuck-in acquisitions that generate meaningful cost synergies by increasing route density, and drive margin expansion by leveraging our scalable infrastructure and centralized administrative capabilities. We have a deep and multi-disciplinary team that executes our acquisitions. Such team includes, among others, our Vice President of Corporate Development, our Vice President of Integration, our legal group, corporate development associates, IT professionals, environmental professionals and other support resources.

Since commencing operations in 2007, we have completed over 100 acquisitions, including the Waste Industries Merger and the acquisition of a liquid waste platform operating primarily in the Midwestern United States, both of which significantly expanded our geographic footprint in the United States. Prior to its merger with us, Waste Industries was a leading independent, vertically-integrated solid waste management company, based in the Southeastern United States. In connection with our acquisitions, such as the Waste Industries Merger, we have incurred additional indebtedness. As of December 31, 2019, we had approximately $7,684.0 million of indebtedness outstanding. While we expect we will be able to fund some of our acquisitions and capital expenditures with our existing resources, we will likely require additional financing, including debt, to pursue certain acquisitions.

We have experience in executing large-scale platform acquisitions, as demonstrated by our completion of the Waste Industries Merger, which valued Waste Industries at a total enterprise value of US$2.8 billion, and our acquisitions in 2016 of solid waste operations in Eastern Canada and Michigan for approximately $775 million and approximately $400 million, respectively. These large-scale platform acquisitions have opened new markets to us, provided us with new opportunities to realize cross-selling opportunities, and are expected to drive procurement and cost synergies across our operations. We also have experience successfully integrating acquired regional businesses into our existing network, expanding their top line revenue and profitability under the GFL banner while maintaining their same high service standards.

While our senior management team is responsible for executing and integrating acquisitions, our decentralized management structure allows us to maintain a robust acquisition pipeline by identifying attractive opportunities at the local market level. We focus on developing relationships with potential vendors over time. Our typical approach to transactions involves engaging internal and/or external specialists and advisors, conducting due diligence, entering into a definitive agreement, closing the transaction and then integrating the acquired business, assets, systems and personnel into our broader operations. We are committed to delivering on the indicative transaction terms we propose to vendors in our letters of intent, including providing a definitive timeline to close. We believe that these core acquisition principles resonate with potential vendors and have enabled us to develop a reputation as an acquirer-of-choice. Additionally, we believe that our entrepreneurial and returns-driven culture is highly attractive to vendors who wish to remain involved in the business after an acquisition has been completed. Our historical number of acquisitions is highlighted below.

13

- (1)

- YTD 2020 includes transactions we closed from January 1, 2020 up to the date of this prospectus.

Well-Invested Fleet and Operating Infrastructure

We have made substantial investments in our facilities, fleet, technology and processes which we believe will support our future growth. As of December 31, 2019, we had approximately 4,861 routed solid waste collection vehicles with an average age of approximately 7.1 years, compared to an estimated useful life of 10 years, and approximately 455 routed liquid waste collection vehicles with an average age of approximately 9.7 years, compared to an estimated useful life of 15 years. In addition to enhancing our operating performance, our young, well-invested fleet supports a safer working environment for all of our field employees. In our solid waste operations, we have invested in compressed natural gas ("CNG") fueling stations and highly-efficient CNG-fueled collection vehicles, which currently comprise approximately 14.2% of our solid waste collection fleet. These investments have resulted in lower fuel and near-term maintenance expenditures, leading to higher operating margins. As we replace and add new vehicles to our fleet, we intend to increase our CNG vehicle count where we have existing CNG facilities and service select new municipal contract wins with new CNG vehicles. We have also invested in new technologies such as the addition of side-arm loaders to our fleet which we believe will maximize the utilization of our fleet and further support a safer working environment. Fleet standardization initiatives have improved purchasing efficiency, reduced capital expenditure variability and maintenance turnaround time, and minimized parts inventory while also enhancing the overall customer experience. We are also evaluating the potential benefits associated with other technologies, including the use of electric vehicles more broadly within our operations.

We intend to continue to implement our strategy of centralizing our administrative function to reduce our corporate costs and improve efficiency of our growing platform. In addition, we have implemented comprehensive enterprise resource planning systems, and back-office and information-technology infrastructure, which we believe will continue to improve our asset productivity, strengthen our customer engagement, further enhance employee safety and increase the efficiency of our business operations.

Best-in-Class, Founder-led Management Team

We are led by a team of highly experienced and entrepreneurial executives. Patrick Dovigi, our Founder, Chairman, President and Chief Executive Officer, has led our operations since inception in 2007 and has approximately 16 years of industry experience. Mr. Dovigi and our senior leadership team have instilled a results-oriented, entrepreneurial culture that emphasizes operational excellence and the importance of safety for our employees and customers.

14

Our senior leadership team has an average of approximately 18 years of environmental services experience. Our solid waste regional leadership team has an average of approximately 21 years of relevant experience and includes Area or Regional Vice Presidents for Michigan, Colorado, Canada West, Canada East and the U.S. Southeast. In addition, our liquid waste regional leadership team has an average of approximately 20 years of relevant experience and includes Area Vice Presidents of Canada and the U.S. We have adopted a decentralized operating structure, giving operational oversight to our regional business leaders. We believe this model is advantageous given the regional and fragmented nature of the markets in which we operate and the relationship-based approach to our acquisition strategy. Furthermore, we believe that our operating structure provides our employees with a greater sense of ownership, which drives the efficiency and profitability of our business. Since inception, our management team has driven strong revenue growth across our business in excess of our publicly-traded environmental services peers, and has built a platform that we believe positions us well for continued growth, margin expansion and strong free cash flow generation.

Long-Term Focus on Environmental Responsibility and Sustainability

Sustainability is fundamental to GFL. We strive to provide accessible, cost-effective environmental solutions to our customers and the communities we service to be Green for Life. Aligned with this purpose, we have made significant investments in new technology and in the innovation of existing management and operating processes, including a robust environmental management system that tracks regulatory compliance and various performance measures. These investments reflect our commitment to providing sustainable environmental solutions and are also value-enhancing initiatives for our business. Examples of these investments include:

- •

- Organics facilities that recycle organic waste to produce a high-quality compost product, fertilizers and other soil supplements. By providing

a commercially-viable environmental solution, communities are able to help reduce their overall greenhouse gas footprint by keeping organic waste out of landfills.

- •

- Landfill gas-to-energy facilities that capture landfill gas and convert it into a renewable source of electricity for households and commercial

establishments.

- •

- Incorporation of CNG vehicles into a portion of our solid waste collection fleet. CNG emits less greenhouse gas and contaminants per kilometre

than traditional diesel fuel.

- •

- Soil remediation facilities that remediate contaminated soils otherwise destined for landfill disposal for reuse in construction and

development projects. The use of soil remediation facilities not only reduces construction costs but also reduces greenhouse gas emissions from trucking by supporting the beneficial reuse

of soils.

- •

- A re-refinery which will recycle UMO from passenger and commercial vehicles into marine diesel fuels. By displacing virgin fuels, environmental impacts from resource extraction are avoided.

We have the goal of being recognized as a leader in driving sustainable solutions for the industry. In support of this initiative, GFL is developing a three-year plan to further identify and embed sustainable management initiatives into our operations. We strive to continuously enhance our environmental management systems, re-evaluate our processes, and strengthen our team with individuals who have the task of actively identifying and implementing sustainable environmental solutions that enhance our return on capital and result in growth. Certain of our current corporate social responsibility measures include: a Safe for Life commitment, which focuses all employees and contractors on a clear path to achieving a best in industry total recordable incident rate; a Women in Waste program, which is a diversity strategy aimed at increasing participation of women in GFL's hourly workforce; and the Full Circle Project, which allows GFL's customers to identify charitable

15

categories for GFL's annual giving commitment and encourages employee participation to support local charities in customer-identified categories.

As individuals and communities have a desire to be more environmentally-conscious, we believe that we are in a strong position to benefit from this trend as we have a range of service offerings, including organics processing and commercial recycling. Additionally, we believe we are well-positioned to adapt to environmental regulatory changes given our scale and operating sophistication.

We believe that we are well-positioned to continue capitalizing on the attractive growth opportunities in the North American environmental services industry. We expect to achieve our future growth through a three-pronged strategy of (i) generating strong, stable organic revenue growth, (ii) executing strategic, accretive acquisitions and (iii) driving operating cost efficiencies across our platform.

Generating Strong, Stable Organic Revenue Growth

We are focused on generating strong, stable organic growth by serving our existing customers' demand for all of the environmental services that we offer, renewing contracts and winning new customers, and expanding our service offerings into new geographic markets.

Driving Market Share with Existing Customers and Realizing Cross-Selling Opportunities

Within and across our business lines, many of our customers currently rely on more than one service provider to meet their environmental service needs. We intend to deepen our relationships with our existing customers, win business that is currently being serviced by third parties and thereby improve our customer penetration.

By positioning ourselves as a "one-stop" environmental services provider, we plan to leverage our diverse service offerings to unlock potential cross-selling opportunities across our business lines. For example, infrastructure & soil remediation customers typically also have a solid and liquid waste service requirement. We believe that being first on-site with customers through our infrastructure & soil remediation offerings allows us to use our relationships with general contractors to also offer them solid and liquid waste services in those markets. In addition, we believe that the breadth of the services we offer through our infrastructure & soil remediation operations uniquely positions us to compete on our service capabilities as well as on price. We also intend to place a greater focus on cross-selling our solid waste services to liquid waste customers across markets where we maintain both a solid and liquid waste management presence. We expect that by driving additional cross-selling, we will be able to generate additional revenue per customer and realize operating cost benefits across our platform.

Renewing Contracts and Winning New Customers

We have a proven track record of renewing contracts with our existing customers, often on more favourable terms, as well as winning new customers and contracts.

We serve over 4 million households, including those covered by more than 650 municipal collection contracts, more than 135,000 commercial and industrial customers in our solid waste management business line, and over 13,000 customers in our liquid waste management business line.

16