Exhibit 99.1

BEFORE

THE PUBLIC

SERVICE COMMISSION OF

SOUTH

CAROLINA

DOCKET

NO. 2023-89-E - ORDER NO. 2023-752(A)

OCTOBER

23, 2023

| IN RE: |

Duke Energy Progress, LLC’s Petition for a Financing Order (“Phase II”) |

)

)

)

)

)

)

) |

STORM RECOVERY

FINANCING ORDER

APPROVING

COMPREHENSIVE

SETTLEMENT

AGREEMENT AND

ACCOUNTING ORDER |

After the issuance of Order

No. 2023-752, an inadvertent scrivener’s error was discovered in the definition of “public interest,” as defined

by S.C. Code Ann. section 58-4-10(B) in the Dissent. The error does not change the substantive argument made in the Dissent or the

outcome of the Order. The Office of Regulatory Staff filed a letter noting this error and acknowledged that it does not affect the outcome

or conclusions contained in the Order. The Amended Order amends the Dissent with correction only to the most recent definition S.C. Code

Ann. section 58-4-10(B). There are no other changes to Order No. 2023-752, and this amendment does not change any argument or analysis.

This matter comes before

the Public Service Commission of South Carolina (Commission) on the May 31, 2023, Petition of Duke Energy Progress, LLC (DEP or

the Company) for Issuance of a Storm Recovery Financing Order (the Petition) by the Commission pursuant to S.C. Code Ann. section 58-27-1110.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 2

I. PROCEDURAL

HISTORY AND JURISDICTION

On May 31, 2023, pursuant

to S.C. Code Ann. section 58-27-1110(A) (Supp. 2023), S.C. Code Ann. Regs. 103-825 (2012), and other applicable rules and regulations

of the Commission, DEP filed its Petition requesting that the Commission grant authorization for the financing of the Company’s

storm recovery costs incurred due to storm recovery activities required as a result of the following storms: Pax, Ulysses, Matthew, Florence,

Michael, Dorian, Izzy and Jasper (the Storms). Specifically, DEP seeks the following: (1) authorization to finance its Securitizable

Balance plus up-front Financing Costs incurred in connection with the issuance of the Storm Recovery Bonds1; (2) approval

of the proposed securitization financing structure; (3) approval to issue Storm Recovery Bonds2, secured by the pledge

of Storm Recovery Property, in one or more series in an aggregate principal amount not to exceed the relevant Securitizable Balance plus

up-front Financing Costs; (4) approval of the Financing Costs, including up-front Financing Costs and on-going Financing Costs,

incurred in connection with the issuance of Storm Recovery Bonds; (5) approval to create Storm Recovery Property, including the

right to (i) impose, bill, charge, collect, and receive nonbypassable Storm Recovery Charge; and (ii) obtain periodic formulaic

adjustments to the Storm Recovery Charge as provided in this Financing Order; and (6) approval of the tariff to implement the Storm

Recovery Charge. With regard to the Petition, the Company was represented in this proceeding by Carnal O. Robinson, Esquire; J. Ashley

Cooper, Esquire; Alexandrea Breazeale, Esquire; James H. Jeffries IV, Esquire; and Kristin M. Athens, Esquire.3

1

See Finding of Fact 4 defining Securitizable Balance

2

Capitalized terms not otherwise defined herein shall have the meaning assigned to them in S.C. Code Ann. sections 58-27-1105

through 1180 referred to herein as the “Storm Securitization Statute”.

3

James H. Jeffries IV was admitted pro hac vice pursuant to Commission Order No. 2023-570. Kristin M. Athens was admitted

pro hac vice pursuant to Commission Order No. 2023-499.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 3

In support of its Petition,

DEP filed the Direct Testimony and Exhibits of Thomas J. Heath Jr., Structured Finance Director with Duke Energy Business Services, LLC

(DEBS); Kimberly K. Smith, Rates & Regulatory Strategy Manager with Duke Energy Carolinas, LLC; Jacalyn H. Moore, Rates &

Regulatory Strategy Manager with DEBS; Nicholas G. Speros, Director of Accounting with DEBS; and Katrina T. Niehaus, Managing Director,

Head of the Corporate Asset Backed Securities Finance Group with Goldman Sachs & Co. Tr. pp. 46, 186, 310, 322, & 358.

On July 11, 2023, DEP filed an Errata to the Petition and the Direct Testimony and Exhibits of Witness Kimberly K. Smith. Tr. p.

188. On July 21, 2023, DEP filed Supplemental Direct Testimony and Exhibits of Witness Jacalyn H. Moore. Tr. p. 324. On August 10,

2023, DEP filed Rebuttal Testimony and Exhibits, where applicable, of Thomas J. Heath, Jr., Katrina T. Niehaus, Kimberly K. Smith,

Nicholas G. Speros, and Jacalyn H. Moore. Tr. pp. 48, 190. On August 22, 2023, DEP filed Revised Rebuttal Testimony of Kimberly

K. Smith. Tr. p. 190. On September 8, 2023, DEP submitted Amended Rebuttal Testimony and Exhibit of Thomas J. Heath, Jr.,

Amended Rebuttal Testimony of Katrina T. Niehaus, and Settlement Testimony of Thomas J. Heath Jr. Tr. pp. 48; 360. On September 12,

2023, DEP filed Hearing Exhibit 7 providing the net present value savings calculation for a 10-Year and 15-Year Bond Recovery Period.

Tr. p. 282.

On June 7, 2023, the

South Carolina Department of Consumer Affairs (DCA) petitioned the Commission to intervene, which was granted on June 22, 2023,

by Order No. 2023-70-H. DCA was represented in this proceeding by Carri Grube Lybarker, Esquire, and Roger P. Hall, Esquire. On

July 26, 2023, DCA filed the Direct Testimony of Aaron Rothschild. On August 22, 2023, DCA filed Surrebuttal Testimony of Aaron

Rothschild. On September 8, 2023, DCA filed Testimony of Aaron Rothschild in support of the Settlement Agreement.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 4

On

June 21, 2023, Nucor Steel - South Carolina (Nucor Steel) petitioned the Commission to intervene, which was granted on July 3,

2023, by Order No. 2023-74-H. Nucor Steel was represented in this proceeding by Robert R. Smith II, Esquire, and Michael K.

Lavanga, Esquire.4

The

South Carolina Office of Regulatory Staff (ORS) is a party of record to proceedings before the Commission pursuant to S.C. Code Ann.

Section 58-4-10(B) (Supp. 2023). ORS was represented in this proceeding by Christopher M. Huber, Esquire, Donna L. Rhaney,

Esquire, and Joshua E. Austin, Esquire. On July 26, 2023, ORS filed the Direct Testimony and Exhibit of Michael L. Seaman-

Huynh, Deputy Director of Energy Operations with ORS; Direct Testimony and Exhibits of Jeremy E. Traska, Managing Director of Debt Capital

Markets & Advisory Group with Drexel Hamilton, LLC; Direct Testimony of Mark A. Rhoden, Chief Financial Officer with ORS, and

Direct Testimony and Exhibits of Lane Kollen, Vice President and Principal with J. Kennedy and Associates, Inc. Tr. pp. 239, 251,

529, & 536. On August 22, 2023, ORS filed Surrebuttal Testimony and Exhibit of Mark A. Rhoden and Surrebuttal Testimony

of Lane Kollen. Tr. pp. 241, 253. On September 8, 2023, ORS filed Settlement Testimony of Mark A. Rhoden. Tr. p. 255.

On August 25, 2023,

DCA filed a letter with attachments on behalf of DCA witness Rothschild. On August 28, 2023, DEP filed a motion to strike DCA witness

Rothschild’s direct and surrebuttal testimony. DCA filed its response to the motion on September 1, 2023, and ORS filed a

letter and exhibit this same day. DEP filed a reply to DCA’ s response to the motion to strike on September 5, 2023. The motion

was withdrawn with prejudice during the hearing of this matter.5

4

Michael K. Lavanga was admitted pro hac vice pursuant to Commission Order No. 2023-492.

5

During the hearing of this matter, the pending motion was withdrawn, with prejudice. Each party confirmed that withdrawal

was being freely and voluntarily made, and all parties specifically disclaimed any prejudice associated with the motion. Attorneys on

behalf of each party, confirmed to the Commission that by withdrawal of the motion, the parties knowingly agreed to waive all rights

and other legal remedies available to them by the withdrawal of the motion. As such, the withdrawal of the motion during the proceeding

has the effect of that provision being stricken from the Comprehensive Settlement Agreement, which is reflected in Order Exhibit No.

1. Tr. p. 290:16-301:19.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 5

On September 5, 2023,

DEP filed a Stipulation between DEP, ORS, DCA and Nucor Steel regarding various matters before the Commission. On September 6, 2023,

the Commission convened the hearing on this matter with the Honorable Florence P. Belser presiding. At the commencement of the hearing,

the Commission permitted a delay of the hearing in order to allow the Commission time to review the Stipulation filed on September 5,

2023.

When the hearing reconvened,

counsel for DEP informed the Commission that the Parties had reached a global, comprehensive settlement resolving all issues in the case,

and requested a recess in the proceeding to allow the Parties to memorialize the agreement and for certain Parties to file settlement

testimony supporting the comprehensive settlement agreement. The Commission agreed to stay the proceeding related to DEP’ s Petition

until Monday, September 11, 2023.

On September 8, 2023,

ORS filed a Comprehensive Settlement Agreement6 (Settlement Agreement) between DEP, ORS, DCA and Nucor Steel (the Parties)

attached hereto in this Financing Order as Order Exhibit No. 1. The Commission resumed the hearing on September 11, 2023,

and accepted the Settlement Agreement into evidence.

DEP presented the direct,

supplemental direct, rebuttal, revised or amended rebuttal, and settlement testimonies of witnesses Heath, Smith, Moore, Speros, and

Niehaus. DCA presented the settlement testimony of witness Rothschild. ORS presented the direct, surrebuttal, and settlement testimonies

of witnesses Rhoden, Seaman-Huynh7, Kollen, and Traska. The pre-filed testimonies and exhibits of DEP’s five witnesses,

the settlement testimony of DCA’s witness, and the pre-filed testimony and exhibits of ORS’ s four witnesses were accepted

into the record without objection.

6

The Stipulation filed on September 5, 2023, only addressed certain issues in the proceeding, but the Comprehensive Settlement

Agreement was a proposed resolution of all issues in the proceeding.

7

Witness Seaman-Huynh’s Direct Testimony and Exhibit were entered into the record without him appearing to present

it. An Affidavit verifying his Direct Testimony and Exhibit was filed with the Commission on September 11, 2023.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 6

The Commission also marked

and accepted into evidence late-filed Hearing Exhibit 7 provided on September 12, 2023, which provides the net present value

savings calculations for both a 10- year and 15-year storm bond recovery period, calculated as of May 22, 2023. Tr. p. 282.

II. STATUTORY

STANDARDS AND REQUIRED FINDINGS

The Storm Securitization

Statute establishes the process by which an electrical utility may petition the Commission for a financing order authorizing the electrical

utility to finance storm recovery costs associated with storm recovery activities with the proceeds of storm recovery bonds that are

secured by the storm recovery property. Before granting a financing order, the Commission must find two primary conditions: (1) that

the issuance of the storm recovery bonds and the imposition of a storm recovery charge will provide quantifiable net benefits to customers

on a present value basis as compared to the costs that would have been incurred absent the issuance of storm recovery bonds and (2)that

the structuring, marketing, and pricing of the storm recovery bonds will result in the lowest storm recovery charge consistent with market

conditions at the time the storm recovery bonds are priced and the terms set forth in this Financing Order. S.C. Code Ann. § 58-27-1110(C)(2)(b) and

(c) (Supp. 2023).

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 7

To support this finding, the utility must submit a petition

that includes (a) a description of its storm recovery activities; (b) an estimate of the storm recovery costs; (c) the

proposed level of storm recovery reserve, if any; (d) an indicator of the amount of storm recovery costs to be financed using storm

recovery bonds; (e) an estimate of the financing costs related to the storm recovery bonds; (f) an estimate of the storm recovery

charge necessary to recover storm recovery costs; and (g) a comparison between the net present value of the cost to customers estimated

to result from the issuance of storm recovery bonds and the cost that would result from the application of the traditional method of

financing and recovering storm recovery costs — this comparison must demonstrate that the issuance of storm recovery bonds and

the imposition of a storm recovery charge are expected to provide quantifiable net benefits to customers on a present value basis. S.C.

Code Ann. § 58-27-1110(A) (Supp. 2023).

When issued, in addition

to the findings referenced above required by section 58-27-1110(C)(2)(b) and (c), the financing order must also include all elements

required by section 58-27-1110(C)(2):

(a) except

for changes made pursuant to the formula-based mechanism authorized under this section, the amount of storm recovery costs, including

the level of storm recovery reserves, if any, to be financed using storm recovery bonds. The Commission shall describe and estimate the

amount of financing costs that may be recovered through storm recovery charges and specify the period over which storm recovery costs

and financing costs may be recovered;

(b) a

finding that the proposed issuance of recovery bonds and the imposition and collections of a storm recovery charge will provide quantifiable

net benefits to customers on a present value basis as compared to the costs that would have been incurred absent the issuance of storm

recovery bonds;

(c) a

finding that the structuring, marketing, and pricing of the storm recovery bonds will result in the lowest storm recovery charges consistent

with market conditions at the time the storm recovery bonds are priced and the terms set forth in such financing order. The financing

order must provide detailed findings of fact addressing cost effectiveness and associated rate impacts upon retail customers and retail

customer classes;

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 8

(d) a

requirement that, for so long as the storm recovery bonds are outstanding and until all financing costs have been paid in full, the imposition

and collection of storm recovery charges authorized under a financing order shall be nonbypassable and paid by all existing and future

retail customers receiving transmission or distribution service, or both, from the electrical utility or its successors or assignees

under commission-approved rate schedules or under special contracts, even if a customer elects to purchase electricity from an alternative

electric supplier following a fundamental change in regulation of electrical utilities in this State;

(e) a

determination of what portion, if any, of the storm recovery reserves, if any, must be held in a funded reserve and any limitations on

how the reserve may be held, accessed, or used;

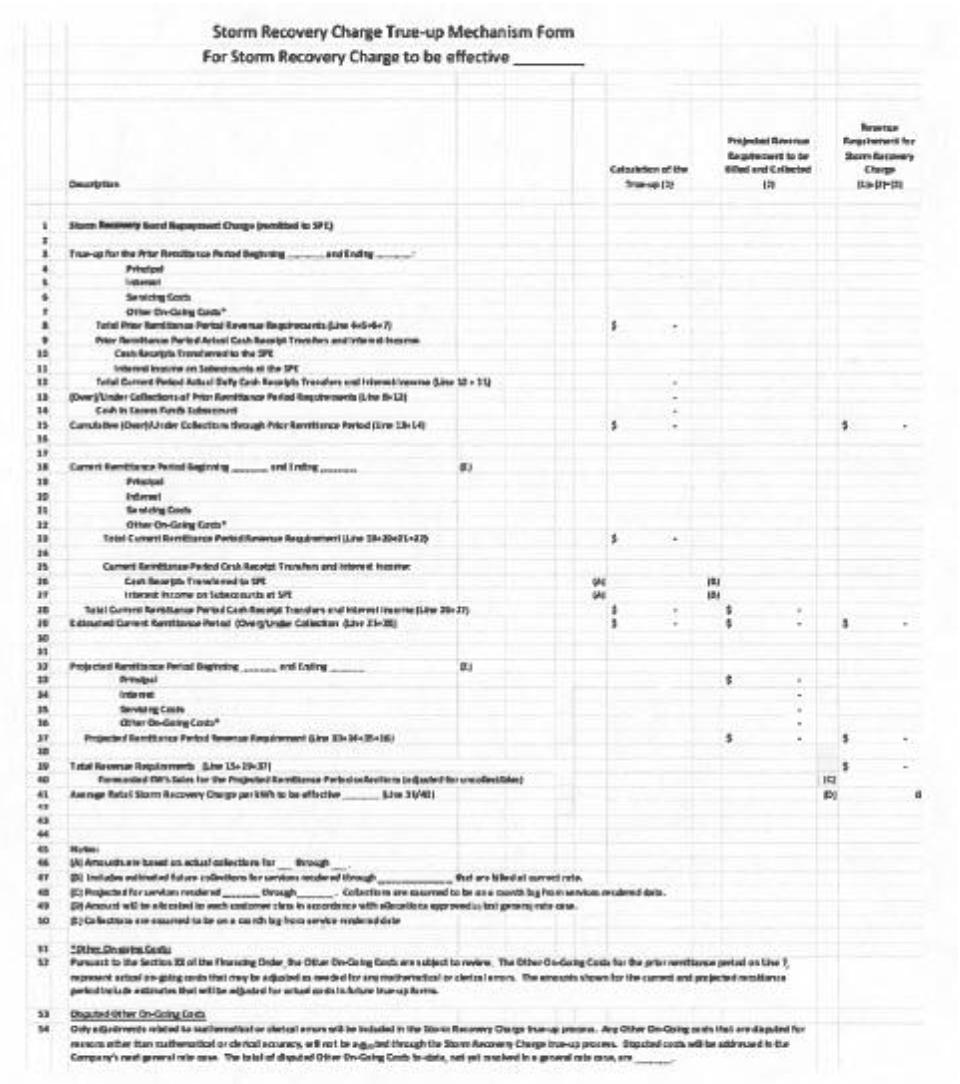

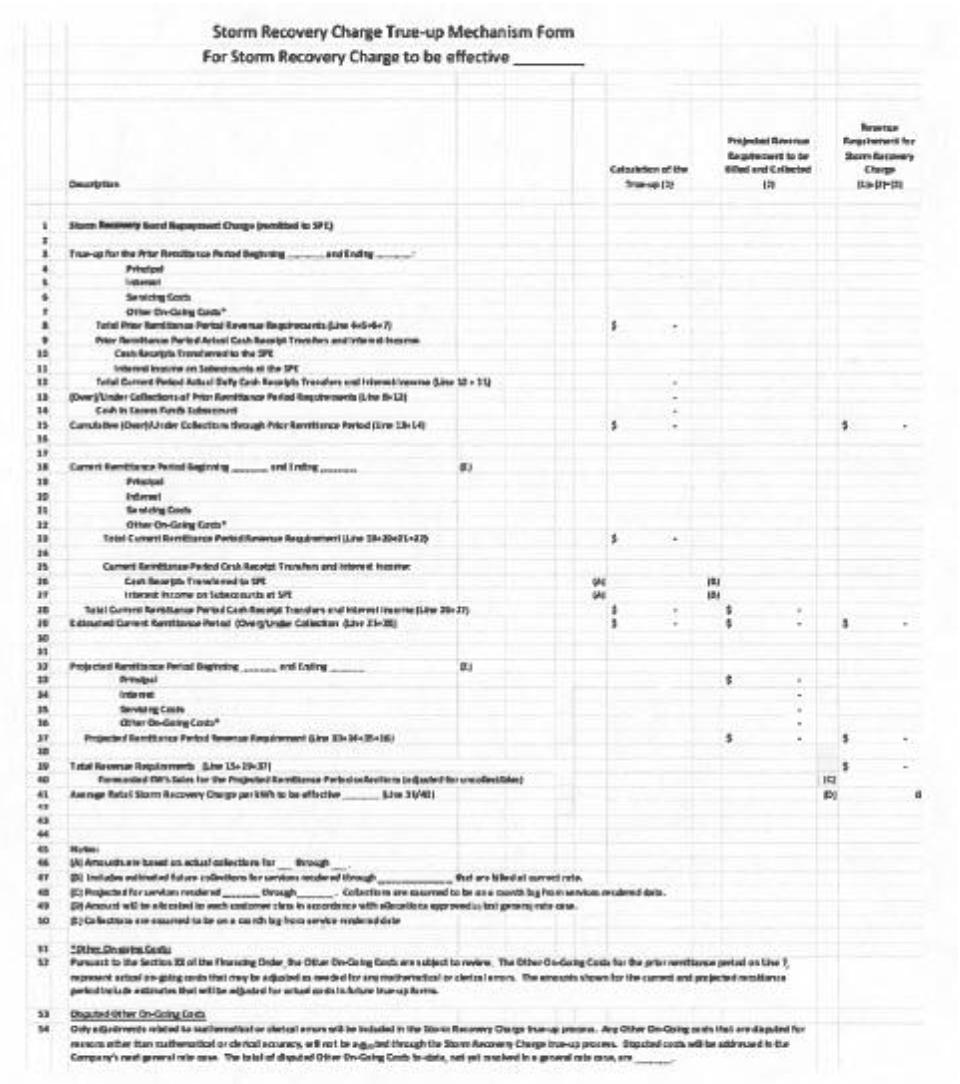

(f) a

formula-based true-up mechanism for making, at least annually, expeditious periodic adjustments in the storm recovery charges that customers

are required to pay pursuant to the financing order and for making any adjustments that are necessary to correct for any overcollection

or undercollection of the charges or to otherwise ensure the timely payment of storm recovery bonds, financing costs, and other required

amounts and charges payable in connection with the storm recovery bonds;

(g) the

storm recovery property that is or shall be created in favor of an electrical utility or its successors or assignees, and that shall

be used to pay or secure storm recovery bonds and all financing costs;

(h) the

degree of flexibility to be afforded to the electrical utility in establishing the terms and conditions of the storm recovery bonds including,

but not limited to, repayment schedules, expected interest rates, and other financing costs, and subject to any conditions in the financing

order, including the pre-bond issuance review process which the commission shall establish;

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 9

(i) how

storm recovery charges will be allocated among customer classes;

(j) a

requirement that, after the final terms of an issuance of storm recovery bonds have been established and before the issuance of storm

recovery bonds, the electrical utility determines the resulting initial storm recovery charge in accordance with the financing order

and that such initial storm recovery charge be final and effective upon the issuance of such storm recovery bonds without further commission

action so long as the recovery charge is consistent with the financing order and the pre-bond issuance review process established by

the commission in the financing order is complete;

(k) a

method of tracing funds collected as storm recovery charges, or other proceeds of storm recovery property, and the determination that

such method shall be deemed the method of tracing such funds and determining the identifiable cash proceeds of any storm recovery property

subject to a financing order under applicable law; and

(l) any

other conditions not otherwise inconsistent with this section that the commission determines are appropriate.

This financing order, as

described in greater detail herein infra, fully satisfies each element required by section 58-27-1110(C)(2).

The Storm Securitization

Statute specifies that the financing order must also include a requirement that the electrical utility file with the Commission at least

annually a letter applying the formula-based mechanism, and request adjustments in the storm recovery charge, if necessary, to a level

sufficient to ensure the bond payment obligations. The Commission’s review of this filing is limited to determining mathematical

and clerical errors in the application of the formula-based mechanism relating to the appropriate amount of any overcollection or undercollection

of storm recovery charges and the amount of an adjustment. S.C. Code Ann. § 58-27-1110(C)(4) (Supp. 2023).

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 10

III. STANDARD

OF REVIEW

With regard to the Petition,

the burden of proof is the preponderance of the evidence standard. See S.C. Code Ann. § 1-23-600(A)(5) (Supp. 2023)

(“Unless otherwise provided by statute, the standard of proof in a contested case is by a preponderance of the evidence.”).

This means that the Commission should grant DEP’s Petition if the Company has demonstrated, by a preponderance of the evidence,

that it has met the requirements of the Storm Securitization Statute, including that the issuance of the storm recovery bonds and the

imposition of a storm recovery charge will provide quantifiable net benefits to customers on a present value basis as compared to the

costs that would have been incurred absent the issuance of storm recovery bonds and that the structuring, marketing, and pricing of the

storm recovery bonds will result in the lowest storm recovery charge consistent with market conditions at the time the storm recovery

bonds are priced and the terms set forth in this Financing Order. S.C. Code Ann. § 58-27-1110(C)(2)(b) and (c) (Supp.

2023).

The record supports the issuance

of a financing order under the terms of the Settlement Agreement.

The Commission’s decision

on the Petition must be based upon substantial evidence in the record. Additionally, pursuant to S.C. Code Ann. section 58-27-1110(2)(1) (Supp.

2023), the Commission may impose any other conditions not otherwise inconsistent with the Securitization statute, that the Commission

determines appropriate. However, in accordance with the non-severable Comprehensive Settlement Agreement presented by the Settling Parties

for approval without exception, modification, or additional provisions, the Commission is not exercising its statutory authority to impose

conditions beyond what has been presented in the Comprehensive Settlement Agreement, nor have the Settling Parties asked that the Commission

exercise such authority. Therefore, the Commission finds that this Financing Order is based upon the substantial evidence in the record

as presented by the Settling Parties.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 11

IV. FINDINGS

OF FACT AND CONCLUSIONS OF LAW

Based upon the Petition,

the Settlement Agreement, the testimony, and exhibits received into evidence at the hearing and the entire record of this proceeding,

the Commission makes the following findings of fact:

1. DEP

is a limited liability company duly organized and existing under the laws of the State of North Carolina. It is a public utility under

the laws of the State of South Carolina and is subject to the jurisdiction of this Commission pursuant to S.C. Code Ann. section 58-3-140(A) (Supp.

2023) and an electrical utility under S.C. Code Ann. section 58-27-10(7) (Supp. 2023). The Company is engaged in the business of

generating, transmitting, distributing, and selling electric power to the public in the northeastern portion of South Carolina, a substantial

portion of the coastal plain of North Carolina extending from the Piedmont to the Atlantic coast and between the Pamlico River and the

South Carolina border, the lower Piedmont section of North Carolina and area in western North Carolina in and around the City of Asheville.

DEP, with its offices and principal places of business in Raleigh, North Carolina, is a wholly owned subsidiary of Duke Energy, with

its offices and principal place of business in Charlotte, North Carolina.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 12

2. The

Commission has jurisdiction over the rates and charges, rate schedules, classifications, and practices of public utilities operating

in South Carolina, including DEP, as generally provided in S.C. Code Ann. sections 58-27-10, et seq (2015 and Supp. 2023).

3. Having

received Commission Order No. 2023-260 in Docket No. 2022-256-E, determining the amount of the Company’s approved principal

costs under S.C. Code Ann. section 58- 27-1110(B) (Supp. 2023), DEP is properly before the Commission requesting authorization to

recover its approved storm recovery costs through the issuance of storm recovery bonds based upon its Petition pursuant to S.C. Code

Ann. section 58-27-1110 (Supp. 2023).

4. On

September 8, 2023, ORS filed the Settlement Agreement, signed by all parties, resolving all issues in dispute.

5. The

Commission, having carefully reviewed the Settlement Agreement, the evidence in the record, and considered the testimony of witnesses

who concluded that the proposal would, in fact, provide quantifiable net benefits to customers on a present value basis as compared to

the costs that would have been incurred absent the issuance of Storm Recovery Bonds and (ii) result in the lowest Storm Recovery

Charge consistent with market conditions at the time the Storm Recovery Bonds are priced and the terms set forth in this Financing Order,

finds and concludes that the provisions of the Settlement Agreement are just and reasonable as to all the Parties and are in the public

interest. Therefore, the Settlement Agreement should be approved in its entirety. The specific terms of the Settlement Agreement are

addressed in the following findings of fact: 7, 9, 11-14, 22, 24-26, 29, 35-36, 38, 41-53 and 55-57.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 13

6. The

complete Settlement Agreement, included hereto as Order Exhibit No. 1, is incorporated by reference.

| D. | Costs Eligible for Recovery Through

Securitization |

Storm Recovery Costs

7. In

accordance with the Commission’s findings of fact and conclusions of law in Order No. 2023-260, the Storm Recovery Costs of

approximately $170.6 million, subject to adjustments including the final amount of carrying costs through the issuance date of the Storm

Recovery Bonds, are eligible for recovery through the issuance of storm recovery bonds (the Securitizable Balance). The Storm Recovery

Costs do not include an amount to pre-fund the Company’s storm recovery reserve through the issuance of Storm Recovery Bonds.

Up-front Financing Costs

8. DEP’s

estimated up-front Financing Costs updated in Heath Rebuttal Exhibit 1 and in Attachment 2, in the form of the proposed Issuance

Advice Letter, Order Exhibit No. 4, are estimated between $5.96 million to $7.09 million, which includes but is not limited

to legal, consulting and accounting fees and expenses, rating agency fees, plus costs of outside consultants and counsel to the Commission

and the ORS, are reasonable and prudent, made in the best interest of DEP’s customers, and eligible for recovery through securitization.

The up-front Financing Costs are subject to adjustment in the Issuance Advice Letter that DEP will file with the Commission after the

Storm Recovery Bonds are priced, as further described in Findings of Fact 48-53.

9. DEP

is permitted to establish a regulatory asset to defer up-front financing costs in excess of final estimates included in the Issuance

Advice Letter, if any; provided, however that the costs subject to deferral would not impact the storm recovery bonds or charges that

are the subject of this proceeding. DEP will accrue carrying costs on the regulatory asset, net of accumulated deferred income taxes

(ADIT), at DEP’s approved pre-tax weighted average cost of capital (WACC) in effect at the time the deferral costs are incurred.

DEP will then request that all such costs are included in base rates during the next base rate proceeding. It is reasonable that all

parties reserve their right to review the reasonableness and prudency of those costs in the next rate proceeding.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 14

On-going Financing Costs

10. The

on-going Financing Costs identified in DEP’s Petition and in Attachment 4 of the form Issuance Advice Letter, Order Exhibit No. 4,

estimated to be approximately $0.4 million annually, subject to update and adjustment in the Issuance Advice Letter as described in this

Financing Orders8, are reasonable and prudent, made in the

best interest of DEP’s customers, and qualify as Financing Costs eligible for recovery pursuant to S.C. Code Ann. section 58-27-1105(7) (Supp.

2023).

Utility Assessment Fee, License Tax and Sales Tax

11. DEP

will seek an opinion from the South Carolina Department of Revenue (the SCDOR) regarding whether (i) License Tax on Utilities under

S.C. Code Ann. section 12-20-100 (2014) and (ii) Sales Tax arising under S.C. Code Title 12 apply to the storm recovery charges.

Until the SCDOR provides an opinion in response to DEP’s request regarding the License Tax under S.C. Code Ann. section 12-20-100,

DEP proposes to collect the License Tax as an initial matter until it receives final clarification from the SCDOR. Until SCDOR provides

an opinion in response to DEP’s request regarding the Sales Tax, DEP proposes to collect Sales Tax as an initial matter on the

storm recovery charges from customers to whom sales of electricity are not otherwise exempt from Sales Tax until it receives final clarification

from the SCDOR. Exempt customers from whom the Company does not propose to collect Sales Tax include but are not limited to all residential

customers.

8

On-Going Financing Costs were updated in Heath’s Amended Rebuttal Exhibit 1-5.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 15

12. If

the License Tax is deemed not to apply, then the Company will file an amended consolidated return and will pass the cash refunded by

the SCDOR back through an invoice from the Company, as the Servicer, to the Special Purpose Entity (SPE). The SPE will credit the License

Taxes paid from customers back to customers through the next applicable true-up filing.

13. If

the Company collects Sales Taxes that are subsequently deemed not to apply, then the Company will credit customers via a miscellaneous

credit on their subsequent electricity bill.

14. The

Settling Parties agreed in the Settlement Agreement that the Commission will determine if DEP should collect a Utility Assessment Fee

arising under Sections 58-27-50, 58-4-60, and 58-3-100 to be included in the calculation of ongoing financing costs. S.C. Code Ann. §§ 58-27-50 &

58-3-100 (2015); S.C. Code Ann. § 58-4-60 (Supp. 2023). The Commission finds that that the SPE is not a utility as defined by South

Carolina law, and no Utility Assessment Fee shall be collected on the basis of storm recovery charges of the SPE.

Capital Contribution

15. DEP’s

capital contribution to the SPE shall earn a return at the interest rate of the longest maturing tranche of the Storm Recovery Bonds,

which is reasonable and prudent.

| E. | Structure of Bond Issuance |

16. DEP’s

proposed financing structure adheres to the requirements of the Storm Securitization Statute.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 16

Special Purpose Entity

17. For

purposes of issuing storm recovery bonds, it is reasonable for DEP to create a SPE, which will be a Delaware limited liability company

(LLC) with DEP as its sole member. The SPE will be an “assignee” as defined in S.C. Code Ann. Section 58-27-1105(2) (Supp.

2023), and when an interest in Storm Recovery Property is transferred, other than as security, to the SPE, the SPE may issue Storm Recovery

Bonds in accordance with this Financing Order.

Storm Recovery Property

18. It

is reasonable for DEP to sell or otherwise transfer Storm Recovery Property to the SPE pursuant to the terms of this Financing Order.

Upon the transfer by DEP of the Storm Recovery Property to the SPE, that SPE will have all of the rights, title, and interest of DEP

with respect to such Storm Recovery Property, including the right to impose, bill, charge, collect, and receive the Storm Recovery Charge

authorized by this Financing Order and to obtain periodic formulaic adjustments to the Storm Recovery Charge. Such Storm Recovery Property

is expected to be pledged by the SPE to, and held and administered by, an indenture trustee as collateral for payment of the Storm Recovery

Bonds to ensure that the proposed issuance of Storm Recovery Bonds and the imposition of the Storm Recovery Charge will: (i) provide

quantifiable net benefits to customers on a present value basis as compared to the costs that would have been incurred absent the issuance

of Storm Recovery Bonds and (ii) result in the lowest Storm Recovery Charge consistent with market conditions at the time the Storm

Recovery Bonds are priced and the terms set forth in this Financing Order (collectively, the Statutory Cost Objectives).

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 17

19. The

Storm Securitization Statute provides that the State of South Carolina and its agencies, including this Commission, pledge and agree

with bondholders, the owners of the Storm Recovery Property, and other financing parties that the State and its agencies, including the

Commission, will not take any of the following actions as to any outstanding Storm Recovery Bonds, Storm Recovery Charge, or Storm Recovery

Property: (i) alter the provisions of the Storm Securitization Statute, which authorize the Commission to create an irrevocable

contract right or chose in action by the issuance of this Financing Order, create Storm Recovery Property and make the Storm Recovery

Charge imposed by this Financing Order an irrevocable, binding or nonbypassable charge; (ii) take or permit any action that impairs

or would impair the value of the Storm Recovery Property or the security for the Storm Recovery Bonds or revise the Storm Recovery Costs

for which storm recovery is authorized; (iii) in any way impair the rights and remedies of the bondholders, assignees, and other

financing parties; or (iv) except for changes made pursuant to the True-Up Mechanism, reduce, alter or impair the Storm Recovery

Charge until any and all principal, interest, premium (if any), Financing Costs and other fees, expenses or charges incurred, and any

contracts to be performed in connection with the Storm Recovery Bonds, have been paid and performed in full, as further described in

S.C. Code Ann. section 58-27-1155(A) (Supp. 2023). This paragraph does not preclude limitation or alteration if full compensation

is made by law for the full protection of the storm recovery charges collected pursuant to a financing order and of the bondholders and

any assignee or financing party entering into a contract with the electrical utility. S.C. Code Ann. § 58-27-1155(A) (Supp.

2023).

Form of Transaction Documents

20. The

forms of the servicing agreement, purchase and sale agreement, administration agreement, limited liability company agreement, and indenture,

originally filed as exhibits to Company witness Thomas J. Heath Jr.’s testimony (collectively, the “Transaction Documents”)

are in the public interest and necessary to facilitate the transaction and are approved, subject to Finding of Fact 22.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 18

21. It

is reasonable and prudent for any modifications to the Transaction Documents to be reviewed and provided input by the Bond Advisory Team,

defined below in Finding of Fact 43, to ensure that the Statutory Cost Objectives are achieved and for compliance with the terms of this

Financing Order.

Offering and Sale of Bonds

22. It

is reasonable for DEP to issue the Storm Recovery Bonds through a negotiated sale or other sales option to achieve the Statutory Cost

Objectives. Furthermore, DEP will have the flexibility to utilize a means of sale other than an SEC-registered sale, such as a Rule 144A

offering, if market volatility or other factors indicate that such a sale would be the best manner to achieve the “Statutory Cost

Objectives” defined herein. DEP agrees to consider the advice and input from the Bond Advisory Team and DCA prior to making such

decision. If a means of sale other than an SEC registered sale is proposed to be utilized, the rationale for the decision shall be explained

in detail in the Issuance Advice Letter submitted to the Commission.

Amortization of Storm Recovery Bonds

23. The

proposed duration of the bond repayment period is reasonable and prudent.

The expected term of the

scheduled final payment date of the last maturing tranche of bonds issued pursuant to the authority granted herein, as determined in

the reasonable discretion of DEP, is to be no later than 20 years, from the issuance of the series of Storm Recovery Bonds. The legal

maturity date of each tranche may be longer than the scheduled final payment date for that tranche.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 19

Cap on Costs of Securitization Financing

24. It

is appropriate for the Storm Recovery Bonds, or each tranche thereof if multiple tranches are issued, to have a fixed interest rate,

determined consistent with current market conditions. Unless otherwise discussed with the Bond Advisory Team (as defined herein), to

ensure the issuance of Storm Recovery Bonds results in quantifiable net benefits, the weighted average interest rate on the Storm Recovery

Bonds will not exceed 7.0%. If the 7.0% cap based on the weighted average interest rate on the bonds is projected to be exceeded, DEP

will discuss with the Bond Team and develop a recommendation, based on the advice and input from the members and participants on the

Bond Advisory Team, for the Commission on whether to proceed with the issuance in accordance with the Statutory Cost Objectives. For

informational purposes, the rationale for the final interest rate decision, whether above or below such cap, shall be explained in the

Issuance Advice Letter submitted to this Commission. This rationale shall include, but not be limited to, the comparisons made to determine

how the interest rate(s) results in the lowest storm recovery charges consistent with market conditions at the time the storm recovery

bonds are priced and the terms set forth in the Financing Order. If market conditions change and it becomes necessary, in order to best

achieve the Statutory Cost Objectives, DEP will have the flexibility to utilize floating-rate securities for one or more tranches of

bonds. DEP shall consider the advice and input of the Bond Advisory Team prior to making its decision to issue any floating rate bonds.

DEP is further authorized to issue such bonds but will be required to execute agreements to swap the floating payments to fixed-rate

payments to ensure that Statutory Cost Objectives are achieved. Tr. pp. 471:7-480:24; 360.8:17-360.9:6. If one or more tranches of bonds

are to be issued as floating-rate bonds, the rationale for the decision shall be explained in the Issuance Advice Letter submitted to

this Commission.

Credit Ratings of Storm Recovery Bonds

25. DEP

should strive for the Storm Recovery Bonds to achieve AAA credit ratings or the highest equivalent credit ratings given for the type

of securities the SPE issues, consistent with its overarching obligation to meet the Statutory Cost Objectives. DEP agrees to necessary

credit enhancements, with recovery of related costs as on-going Financing Costs, only to achieve such ratings, only if and to the extent

such credit enhancements and corresponding credit ratings are warranted to meet the Statutory Cost Objectives. The cost of any such credit

enhancements shall be included in the determination whether the Statutory Cost Objectives are met.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 20

26. If

the ratings from S&P Global Ratings (S&P) and Moody’s Investor Service (Moody’s) result in split bond ratings, the

Company will seek advice and input from the Bond Advisory Team on whether to obtain a third rating from Fitch Ratings, Inc. (Fitch).

If the final credit rating on the proposed bonds is not AAA or Aaa, the rationale for the decision shall be explained in the Issuance

Advice Letter submitted to the Commission.

Security for the Storm Recovery Bonds

27. The

utilization by the SPE of a collection account, including a general subaccount, a capital subaccount, and an excess funds subaccount,

is reasonable and prudent. DEP may include other subaccounts in the collection account, if necessary to obtain the highest possible credit

ratings on the Storm Recovery Bonds.

DEP as Initial Servicer of the Storm Recovery Bonds

28. DEP’s

proposal to act as initial servicer of the Storm Recovery Bonds is reasonable and prudent.9

29. The

on-going annual servicing fee for DEP, acting as the initial servicer, in the amount of 0.05 percent (5 basis points) of the initial

principal amount of the Storm Recovery Bonds plus out-of-pocket expenses provided for in the servicing agreement is necessary to compensate

the servicer adequately and ensure the high credit quality of the Storm Recovery Bonds and is reasonable and prudent.

9 “Rating agencies expect that the Company will be

the servicer but assume that a replacement servicer may require additional compensation to perform these services, without access to

the Company’s existing infrastructure and customer relationships. Illustrative draft forms of both the Servicing and Administration

Agreements are included in the testimony of witness Heath as Heath Exhibits 2b and 2d.” Tr. p. 358.62:21-358.63:3.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 21

DEP as Administrator of the SPE

30. DEP’s

proposal to act as an administrator of the SPE under the proposed financing transaction is reasonable and prudent.

31. The

on-going fee to be paid to the administrator of $50,000 per year plus out-of- pocket expenses included in the administration agreement

is necessary to cover the costs and expenses of administering the SPE and to preserve the integrity of the bankruptcy-remote structure

of the SPE and the high credit quality of the Storm Recovery Bonds and is reasonable and prudent.

Storm Recovery Bonds to be Treated as Debt for Federal

Income Tax Purposes

32. DEP

shall structure the Storm Recovery Bond transactions in a way that meets all requirements for the Internal Revenue Service’s (IRS)

safe harbor treatment provided for in IRS Revenue Procedure 2005-62.

Imposition and Computation of Storm Recovery Charge

33. To

repay the Storm Recovery Bonds and on-going Financing Costs, DEP is authorized to impose the Storm Recovery Charge to be collected on

a per kWh basis from all applicable customer rate classes until the Storm Recovery Bonds and related Financing Costs are paid in full.

34. The

Securitizable Balance plus up-front Financing Costs to be financed using Storm Recovery Bonds shall be the principal amount of Storm Recovery

Bonds shown in Order Exhibit No. 2 to this Financing Order.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 22

35. The

calculation methodology for the Storm Recovery Charge by customer class in Smith Exhibit 3, as clarified and amended by paragraph

13 of the Settlement Agreement, is just and reasonable. It is also just and reasonable that the allocation methodology for the Storm Recovery

Charge be adjusted concurrently with a subsequent true-up adjustment for any changes to the customer class allocation methodology approved

by the Commission in subsequent general rate proceedings for DEP.

36. DEP

will use a weather normalization calculation methodology that matches its most current South Carolina rate case. This calculation will

use 30 years of historical data to determine normal weather heating and cooling degree days in the calculation of the forecast variance

factor. The variance factor will be equal to one standard deviation of the normal weather variation and will be applied by customer class

to DEP’s most current retail spring or fall forecast which includes the upcoming rate period.

37. In

the event of a customer’s partial payment of a bill, after application of late charges such partial payment shall be allocated ratably

among the Storm Recovery Charge, any similar securitization charges, and DEP’s other billed amounts in a manner that is consistent

with DEP’s current process for allocating partial payments.

Treatment of Storm Recovery Charge in Tariff and on

Retail Customer Bills

38. DEP’s

proposed Tariff implementing the Storm Recovery Charge as amended by the Settlement Agreement indicates the Storm Recovery Charge and

the ownership of the charge.

39. DEP

is authorized and directed to include the Storm Recovery Charge on each customer’s bill as a separate line item and include both

the rate and the amount of the charge on each bill as well as a statement that the SPE is the owner of the rights to the Storm Recovery

Charge and that DEP is acting as a servicer for the SPE.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 23

True-up of Storm Recovery

Charges

40. The

formulaic true-up mechanism (True-up Mechanism) and associated procedures described in DEP’s proposed Tariff, are reasonable and

prudent. The True-up Mechanism is attached to this Financing Order as Order Exhibit No. 3.

41. The

ORS and the Commission shall have 60 days to review and inform the Company of any mathematical or clerical errors in its calculation pursuant

to S.C. Code Ann. section 58-27-1110(C)(4) (Supp. 2023). It is reasonable for DEP and ORS to engage in a good faith discussion to

discuss reducing the time period from 60 days to 30 days after the completion of three semi-annual true-up periods.

| G. | Accumulated Deferred Income Taxes |

42. From

the date of the Financing Order, the Company will defer and compound the return on Storm Cost ADIT (Storm ADIT) at its most recently approved

pre-tax WACC to a regulatory liability until base rates are reset in the next base rate case proceeding. At that time, the Storm ADIT

and the deferred return on the Storm ADIT regulatory liability will be included as a reduction to rate base and will be amortized as a

negative expense to return the deferred Storm ADIT benefit to customers.

43. To

ensure that the structuring, marketing, and pricing of the Storm Recovery Bonds will result in the lowest Storm Recovery Charge consistent

with market conditions at the time the Storm Recovery Bonds are priced and the terms set forth in this Financing Order, it is reasonable

to create an advisory body to meet regularly to review and provide input on the structuring, marketing, and pricing of the Storm Recovery

Bonds (the Bond Advisory Team). It is further statutorily compliant for decisions regarding the structuring, marketing, and pricing of

the Storm Recovery Bonds to be made by DEP, with advice and input from the other members and participants on the Bond Advisory Team. It

is also statutorily compliant for the Bond Advisory Team to consist of representatives from DEP and the ORS. In accordance with the Comprehensive

Settlement Agreement proposed by the Settling Parties, DEP and the ORS may designate staff, counsel, and consultants to participate on

the Bond Advisory Team on their behalf. It is further statutorily compliant that designated staff and attorneys of DCA, and the Underwriters

and their counsel be invited to also attend meetings of the Bond Advisory Team as participants, able to provide input just as ORS. DCA

shall be invited to every meeting of the Bond Advisory Team.10

10

Parties assured the Commission the invitation of DCA was a practical consideration, only related to staffing and budgetary

considerations. Otherwise, DCA can provide input just as ORS. Tr. pp. 156:16-157:9; 94: 17-23.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 24

44. The

ORS shall be designated as the Qualified Independent Third Party (QITP) under S.C. Code Ann. section 58-27-1110(C)(6) (Supp. 2023).

ORS is charged by law with the duty to represent the public interest of South Carolina pursuant to S.C. Code Ann. section 58-4-10(B) (Supp.

2023). As QITP, ORS or their representative shall be able to participate in Bond Advisory Team meetings so that it will be able to provide

the certification and any other information it believes this Commission should consider when reviewing the Issuance Advice Letter as contemplated

pursuant to S.C. Code Ann. section 58-27-1110(C)(6)(a) (Supp. 2023). It is appropriate for ORS to follow its statutory charge under

S.C. Code Ann. section 58-4-10(B) (Supp. 2023) in how ORS fulfills the role of QITP. This is a specific provision contained in the

Comprehensive Settlement Agreement, presented by the Settling Parties for approval without exception, modification, or additional provisions.

Order Exhibit No. 1, Paragraph 23. ORS, at its discretion, may designate staff, counsel, and consultants to assist ORS in fulfilling

its role as QITP.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 25

45. DEP

shall provide all members and participants on the Bond Advisory Team, with timely information to allow the members and participants on

the Bond Advisory Team to be informed fully and in advance regarding all aspects of the structuring, marketing, and pricing of the Storm

Recovery Bonds. DEP will invite and allow the Bond Advisory Team and DCA to be present during communications with underwriters, credit

rating agencies, and investors provided customary practices to ensure compliance with securities laws and regulations are followed. DEP

shall invite all members of the Bond Advisory Team and the DCA to join all Bond Advisory Team meetings to review and comment on all aspects

of the structuring, marketing, and pricing of the Storm Recovery Bonds, including without limitation the following: the selection and

retention of underwriters and other transaction participants; the terms of all Transaction Documents; the length of the bond terms; the

interest rates of the bonds (including whether the interest rate is floating or fixed); the capital contribution to the extent the amount

required in the IRS Revenue Procedure 2005-62; the transaction structure; the issuance strategy; appropriate credit enhancements; and

the credit rating process.

46. It

is just and reasonable for DEP to have the sole right to select all counsel and advisors for DEP and the SPE.

47. None

of the ORS, DCA or their designees, consultants or counsel are agents of DEP or the SPE. They are not issuers, sponsors, or depositors

of the Storm Recovery Bonds. Their role on, or as participants with, the Bond Advisory Team is to provide advice and input that is independent

of DEP. Neither ORS nor DCA are granted decision making authority with DEP on the Bond Advisory Team, per the terms of the Comprehensive

Settlement Agreement presented for approval.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 26

48. Because

the actual structure and pricing of the Storm Recovery Bonds are unknown as of the issuance of this Financing Order, the Commission finds

it is reasonable and prudent to adopt the Issuance Advice Letter process prescribed by S.C. Code Ann. section 58-27-1110(C)(6) (Supp.

2023). Accordingly, within one business day after final terms of the Storm Recovery Bonds are determined, DEP shall provide to the Commission

an Issuance Advice Letter as permitted in S.C. Code Ann. section 58-27-1110(C)(6)(a) (Supp. 2023), attached hereto as Order Exhibit No. 4.

49. Such

Issuance Advice Letter shall include the final terms of the Storm Recovery Bonds, up-front Financing Costs and on-going Financing Costs

as well as any explanations or rationales for the final terms required pursuant to the Settlement Agreement. In accordance with S.C. Code

Ann. section 58-27-1110(C)(6)(a) (Supp. 2023), the Issuance Advice Letter shall include certification from DEP, the primary underwriter(s) and

the QITP (provided one business day after the Issuance Advice Letter is filed), as a condition to closing, certifying whether the sale

of Storm Recovery Bonds complies with the requirements of the Storm Securitization Statute and the Financing Order. In the Issuance Advice

Letter, DEP shall certify whether the issuance of Storm Recovery Bonds and the imposition and collection of a Storm Recovery Charge will

in fact provide quantifiable net benefits to customers on a present-value basis as compared to the costs that would have been incurred

absent the issuance of Storm Recovery Bonds. DEP and the primary underwriter(s) shall certify whether the structuring, marketing,

and pricing of the Storm Recovery Bonds will in fact result in the lowest Storm Recovery Charge consistent with market conditions at the

time the Storm Recovery Bonds were priced and the terms set forth in this Financing Order.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 27

50. No

later than one business day after DEP provides the Issuance Advice Letter to the Commission, the QITP shall review the Issuance Advice

Letter and deliver its certification to the Commission along with any other information it believes the Commission should consider as

it decides whether to accept the Issuance Advice Letter. Drafts of the Issuance Advice Letter shall be provided to the Bond Advisory Team

and DCA approximately two weeks prior to the expected date of commencement of marketing the Storm Recovery Bonds. The Bond Advisory Team

and DCA shall provide any comments to the draft Issuance Advice Letter one week after the receipt of the draft Issuance Advice Letter.

The QITP shall certify whether the issuance of Storm Recovery Bonds and the imposition and collection of a Storm Recovery Charge will

in fact provide quantifiable net benefits to customers on a present-value basis as compared to the costs that would have been incurred

absent the issuance of Storm Recovery Bonds and whether the structuring, marketing, and pricing of the Storm Recovery Bonds will in fact

result in the lowest Storm Recovery Charge consistent with market conditions at the time the Storm Recovery Bonds were priced and the

terms set forth in this Financing Order.

51. After

the Issuance Advice Letter has been submitted, but prior to noon on the fourth business day after the final terms of the Storm Recovery

Bonds are determined, DEP will be available to answer any questions from the Commission about the final agreed upon terms of the Storm

Recovery Bonds. The Commission agrees with the Parties that, in connection with the submission of the Issuance Advice Letter, information

designated by DEP or any other party as confidential shall be provided to the Commission under seal or in a closed session.

52. No

later than noon on the fourth business day after pricing, the Commission shall either accept the Issuance Advice Letter or deliver an

order to DEP to prevent the issuance of the Storm Recovery Bonds.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 28

53. If

the actual up-front Financing Costs are less than the amount appearing in the final Issuance Advice Letter filed within one business day

after actual pricing of the Storm Recovery Bonds, such unspent amount will be reflected in the next True-Up Adjustment Letter (as defined

herein). Conversely, to the extent that the actual up-front Financing Costs are in excess of the amount appearing in the final Issuance

Advice Letter filed within one business day after actual pricing of the Storm Recovery Bonds, then DEP shall book such excess amounts

to a regulatory asset, which will accrue carrying costs at the Company’s approved pre-tax WACC in effect at the time the deferral

costs are incurred. DEP will request that all such costs are included in base rates during the next base rate proceeding. The Parties

reserve their right to review the reasonableness and prudency of those costs in the next rate proceeding.

| J. | Commission’s Independent Consultant |

54. In

connection with its responsibilities under the Storm Securitization Statute, the Commission has retained an independent outside consultant

(the Commission’s Consultant) to serve as advisor and counsel to the Commission. In addition, the Commission’s Consultant

engaged outside legal counsel to assist in performing its responsibilities under S.C. Code Ann. section 58-27-1170 (Supp. 2023). Consistent

with the requirements of S.C. Code Ann. section 58-27-1170, the Commission finds the compensation approved by the Commission to be paid

to the Commission’s Consultant and its outside legal counsel does not exceed compensation generally paid by the regulated industry

for such specialists and shall be considered an up-front Financing Cost.

55. It

is reasonable and prudent to allow DEP, with the advice and input from the Bond Advisory Team as described in Findings of Fact Nos. 43-47

and the Issuance Advice Letter and certification procedures described in Findings of Fact Nos. 48-53, flexibility in establishing the

final terms and conditions of the Storm Recovery Bonds and therefore the ability, at its option, to cause one or more series of Storm

Recovery Bonds to be issued, in order to achieve the Statutory Cost Objectives.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 29

| L. | Statutory Cost Objectives |

56. The

issuance of Storm Recovery Bonds and imposition and collection of a Storm Recovery Charge as authorized in this Financing Order will provide

quantifiable net benefits to customers on a present value basis as compared to the costs that would have been incurred absent the issuance

of Storm Recovery Bonds, and will result in the lowest Storm Recovery Charge consistent with market conditions at the time the Storm Recovery

Bonds are priced and the terms set forth in this Financing Order.

57. This

Financing Order adheres to the statutory requirements outlined by the Storm Securitization Statute necessary to issue a financing order

authorizing an electrical utility to finance storm recovery costs.

V. EVIDENCE

AND CONCLUSIONS FOR FINDINGS OF FACT

| A. | Evidence and Conclusions for Findings of Fact Nos. 1-2 |

The evidence supporting these

findings of fact and conclusions of law is contained in the Petition, the testimony and exhibits of the witnesses, and the entire record

in this proceeding. These findings and conclusions are informational, procedural, and jurisdictional in nature.

| B. | Evidence and Conclusions for Finding of Fact No. 3 |

In accordance with the Storm

Securitization Statute, the Petition included a description of DEP’s storm recovery activities, an estimate of the Storm Recovery

Costs, the proposed level of storm recovery reserve (zero), an indicator of the amount of Storm Recovery Costs to be financed using Storm

Recovery Bonds, an estimate of the Financing Costs related to the bonds, an estimate of the Storm Recovery Charge necessary to recover

costs, and a comparison between the net present value of the cost to customers estimated to result from the issuance of Storm Recovery

Bonds and the cost that would result from the application of the traditional method of financing and recovering its Storm Recovery Costs.

As explained in the testimony of Company witness Kimberly K. Smith, DEP demonstrated that issuing Storm Recovery Bonds, and imposing the

Storm Recovery Charge, is expected to result in quantifiable net benefits to customers on a present value basis as compared to the costs

that would have occurred absent the issuance of Storm Recovery Bonds.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 30

The Commission finds and concludes

that the Petition satisfies the requirements of the Storm Securitization Statute, as discussed further herein, by including each of the

necessary items required by S.C. Code Ann. section 58-27-1110(A) (Supp. 2023). Therefore, pursuant to the Storm Securitization Statute,

the Commission has the information necessary to issue a Financing Order as well as any other relief necessary for DEP to finance its Storm

Recovery Costs.

| C. | Evidence and Conclusions for Findings of Fact Nos. 4-6 |

The evidence supporting these

findings and conclusions is contained in the Petition, the Settlement Agreement, the testimony and exhibits of the witnesses, and the

entire record in this proceeding.

The Commission convened and

conducted a hearing in this matter and has considered all issues raised by the Parties and evidence presented. Moreover, the Commission

has carefully considered the terms of the Settlement Agreement, the testimony of witnesses, and specifically considered the question of

whether the terms contained in the Settlement Agreement will result in achievement of Statutory Cost Objectives, would be just, fair,

and reasonable; in the public interest; and would be in accordance with applicable law and sound regulatory policy. For the reasons set

forth below, the Commission adopted the Comprehensive Settlement Agreement on September 20, 2023, during a Special Called Commission

Business Meeting, because the Commission finds the Comprehensive Settlement Agreement will result in achievement of the Statutory Cost

Objectives; is in the public interest; and is otherwise in accordance with applicable law. The Settlement Agreement was accepted into

the record of the hearing as Hearing Exhibit 1 (now Order Exhibit No. 1).

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 31

The Settlement Agreement is

described by the Settling Parties as “comprehensive” and “the result of extensive negotiation and compromise among the

Parties...” Order Exhibit No. 1, Paragraph 2. The Settlement Agreement covers a variety of terms within this Financing

Order including the Incremental Up-front Financing Costs in Excess of the Estimated Up-front Financing Costs; the Utility Assessment Fee,

License Tax and Sales Tax; the True-Up Period pursuant to S.C. Code Ann. section 58-27-1110(C)(4) (Supp. 2023); the Rate Calculations;

the Storm Securitization Tariff Sheet; the Cap on Costs of Securitization Financing; Storm Cost Accumulated Deferred Income Taxes Regulatory

Liability; this Financing Order; the Rating Agencies; the Means of Sale; Floating-Rate Bonds; the Bond Advisory Team; the QITP; and the

Issuance Advice Letter Process.

The complete Settlement Agreement

is attached as Order Exhibit No. 1 and is incorporated by reference.

Based on all the evidence,

the Commission finds and concludes that the Settlement Agreement will result in achieving the Statutory Cost Objectives and is just, reasonable,

and in the public interest.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 32

| D. | Evidence and Conclusions for Finding of Fact No. 7 |

The evidence supporting these

findings and conclusions is contained in the Petition, the Settlement Agreement, the testimony and exhibits of the witnesses, and the

entire record in this proceeding.

Storm Recovery Costs

In Order No. 2023-260,

the Commission approved the February 7,2023, stipulation between DEP, the ORS, and all other parties to the proceeding that resolved

several accounting issues, including a cost of debt return for the Storms during the deferral period. In that Order, the Commission also

granted ORS’ s recommendations and adjustments requiring DEP to (i) subtract Modified Accelerated Cost Recovery Systems (MACRS)

depreciation ADIT from the Company’s quantification of the capital cost rate base for Hurricanes Matthew (D) and Florence (D) and

correct bonus depreciation to account for the update provided to ORS during this proceeding; (ii) calculate DEP’s deferred

carrying costs approved in this proceeding on the capital cost rate base and regulatory asset based on the prior month balances of each

of these components; and (iii) disallow recovery of the non-incremental storm restoration costs associated with work performed by

native contractors as identified by the ORS, along with all deferred carrying costs associated with these non-incremental storm restoration

costs. Specifically, the Commission approved the total Phase I principal costs of approximately $170.6 million consisting of: (a) deferred

incremental O&M; (b) deferred capital costs and (c) estimated carrying costs through February 2024, the aggregate of

such costs is referred to herein as the Securitizable Balance. See Order No. 2023-260.

In its Petition, DEP requested

the authority to finance its Storm Recovery Costs through the issuance of storm recovery bonds of approximately $176.0 million, which

includes the $170.6 million approved in Order No. 2023-260 plus an estimated $5.4 million in up-front Financing Costs. The requested

amount is also premised on a Storm Recovery Bond issuance date on or before March 1, 2024. DEP may update the estimated deferred

carrying cost component of the total amount of approved carrying costs to account for any difference in carrying costs resulting from

the Company’s estimated date of issuance and actual date of issuance, net of ADIT at DEP’s approved cost of debt in effect

at the time the deferred costs are incurred. Tr. p. 46.18:4-10. The Company will report to the Commission the final carrying costs and

up-front Financing Costs so financed in the Issuance Advice Letter as described below. Tr. p. 186.13:15-21.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 33

S.C. Code Ann. section 58-27-1105(16)(c) (Supp.

2023) requires that DEP’s actual Storm Recovery Costs eligible for financing be reasonable and prudently incurred. The Storm Recovery

Costs that were included in the Company’s Petition have been the subject of discovery and audit by ORS and other interested parties

to that proceeding. Commission Order No. 2023-260 determined the amount of Storm Recovery Costs eligible to be financed using storm

recovery bonds. See Order No. 2023-260 at 51. Consistent with that Order, the Commission finds that DEP’s Storm Recovery

Costs are now eligible for recovery through financing. DEP shall reflect the actual amount of Storm Recovery Costs recovered by the issuance

of Storm Recovery Bonds in the Issuance Advice Letter. Tr. p. 186.13:15-21.

The Commission also finds

that DEP’s calculation of estimated carrying costs associated with the Storm Recovery Costs net of ADIT at DEP’s approved

cost of debt in effect at the time the deferred costs are incurred is consistent with Order No. 2023-260. Further, the Commission

finds that DEP’s method of calculating and reflecting its final carrying costs in the Issuance Advice Letter is reasonable and prudent

and in compliance with Ordering Paragraph 8 in Order No. 2023-260. See Order No. 2023-260 at 52. Accordingly, the Commission

finds that DEP should be permitted to finance its Storm Recovery Costs, including carrying costs, as provided in this Financing Order.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 34

| E. | Evidence and Conclusions for Findings of Fact Nos. 8-9 |

The evidence supporting these

findings and conclusions is contained in the Petition, the Settlement Agreement, the testimony and exhibits of the witnesses, and the

entire record in this proceeding.

Up-front Financing Costs

In the Petition, DEP requested

that its up-front Financing Costs associated with the securitization process be included in the principal amount of Storm Recovery Bonds

in accordance with S.C. Code Ann. section 58-27-1105(14) (Supp. 2023). Petition at 21. Company witness Heath testified that such costs

include the fees and expenses to obtain the Financing Order, as well as the fees and expenses associated with the structuring, marketing,

and pricing of the Storm Recovery Bonds, including the following: external and incremental internal legal fees and expenses, structuring

advisory fees and expenses, any interest rate lock or swap fees and costs, underwriting fees and original issue discount, rating agency

and trustee fees (including trustee’s counsel), accounting fees, information technology programming costs, servicer’s set-up

costs, printing and marketing expenses, stock exchange listing fees and compliance fees, filing and registration fees, the costs of the

Commission Consultant and its outside legal counsel, and costs of outside consultants retained by ORS for this proceeding and the costs

of consultants retained by ORS acting as the QITP. Tr. pp. 46.18:15-23; 46.19:1-10. A complete list of all up-front Financing Costs will

be included in Attachment 2 of the Issuance Advice Letter; a form of the Issuance Advice Letter, with preliminary estimates of up-front

Financing Costs, is included in Order Exhibit No. 4 of this Financing Order. Company witness Heath further stated that up-front

Financing Costs include reimbursement to DEP for amounts advanced for payment of such costs. Id. Company witness Heath provided

a range of estimates of the up-front Financing Costs, and explained based on those figures, DEP’s estimated up-front Financing Costs

of between $5.96 million to $7.09 million as reflected in Heath Rebuttal Exhibit 1. Company witness Heath also stated that the estimates

will be updated to actual up-front Financing Costs incurred during the proposed Issuance Advice Letter process. Id.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 35

Company witness Smith testified

that since the final up-front Financing Costs may not be known until after the Commission (i) issues its Financing Order, (ii) accepts

the Issuance Advice Letter and (iii) the Company issues the Storm Recovery Bonds, if the actual up-front Financing Costs are below

the amount reflected in the Issuance Advice Letter provided to the Commission, then the difference will be credited back to customers

in the true-up adjustment letter process described by Company witness Smith. Tr. p. 186.14:8-22. Conversely, if the actual up-front Financing

Costs are more than the amounts appearing in the Issuance Advice Letter, DEP may establish a regulatory asset to defer any prudently incurred

excess amounts of up-front Financing Costs to preserve them for later recovery in its next general rate case proceeding provided, however,

that the costs subject to deferral would not impact the Storm Recovery Bonds or Storm Recovery Charges. The regulatory asset would accrue

carrying costs net of ADIT, at DEP’ s approved pre-tax WACC in effect at the time the deferral costs are incurred. Order Exhibit No. 1,

Paragraph 15. In the Settlement Agreement, DCA, ORS and Nucor Steel reserve their right to review the reasonableness and prudency of the

above costs in the next rate proceeding. Order Exhibit No. 1, Paragraph 6.

The up-front Financing Costs,

such as legal fees and expenses and the costs of outside consultants and counsel, will not be known until after the financing is completed.

Further, other up-front Financing Costs will vary depending on the size of the final issuance of the Storm Recovery Bonds. Specifically,

the Securities and Exchange Commission (SEC) registration fee, underwriters’ fees, and rating agency fee are proportional to the

amount of qualified costs actually financed. Other up-front Financing Costs, such as original issue discount, will be determined at the

time of the sale. The costs approved by the Commission of a Commission Consultant and or outside legal counsel as well as the costs of

any outside consultants or counsel retained by ORS are costs, which are fully recoverable from Storm Recovery Bond proceeds, will not

be final until the bonds are ready to be issued. Accordingly, actual up-front Financing Costs will not be known until after the pricing

of the Storm Recovery Bonds. Tr. pp. 46.18:15-23; 46.19:1-10.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 36

S.C. Code Ann. section 58-27-1105(7) (Supp.

2023) defines Financing Costs. The Commission finds that DEP’s proposed up-front Financing Costs fall within this definition, and

that these issuance costs are therefore Financing Costs eligible for recovery pursuant to the Storm Securitization Statute.

| F. | Evidence and Conclusions for Finding of Fact No. 10 |

The evidence supporting these

findings and conclusions is contained in the Petition, the testimony and exhibits of the witnesses, and the entire record in this proceeding.

On-going Financing Costs

In the Petition, DEP requested

that its on-going Financing Costs be recovered through the Storm Recovery Charge authorized by this Financing Order. Company witness Heath

testified that on-going Financing Costs include servicing fees; return on invested capital; administration fees; accounting and auditing

fees; regulatory assessment fees; legal fees; rating agency surveillance fees; trustee fees (including any indemnity owed to the Trustee);

independent director or manager fees; and other miscellaneous fees associated with the servicing of the Storm Recovery Bonds. Tr. p. 46.28:5-16.

Witness Heath also provided estimates of on-going Financing Costs in Heath Exhibit 1, as updated in Heath Rebuttal Exhibit 1.

Hearing Exhibits 1 and 2. Company witness Heath further testified that because on-going Financing Costs are recovered through the Storm

Recovery Charge, DEP will include the actual amounts in the True- Up Adjustment Letters and any disparities would be resolved through

the True-up Mechanism described in Company witness Nicholas G. Speros’s testimony. Tr. p. 46.33:18-22.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 37

The Commission finds that

the estimates for on-going Financing Costs will result in achieving the Statutory Cost Objectives, are just and reasonable, in the public

interest, and, as further described below, are eligible for recovery under the Storm Securitization Statute.

Servicing Fees and Administrative Fees

According to Company witness

Heath, servicing responsibilities will include billing, monitoring, collecting, and remitting the storm recovery charge; reporting requirements

imposed by the servicing agreement; implementing the True-up Mechanism; procedures required to coordinate required audits related to DEP’s

role as servicer; legal and accounting functions related to the servicing obligation; and communication with rating agencies. Tr. p. 46.29:7-13.

Administration fees cover expenses associated with administrative functions DEP will be providing to the SPE, separate from those of the

servicer, and include maintaining the general accounting records, preparation of quarterly and annual financial statements, arranging

for annual audits of the SPE’s financial statements, preparing all required external financial filings, preparing any required income

or other tax returns, and related support. Tr. p. 46.30:6-14. Company witness Heath provided an estimate of the servicing and administration

fees, an approximate $88,565.00 servicing fee (five basis points) and a $50,000.00 administrative fee. Tr. pp. 148:23-149:5. See also

Hearing Exhibits 1, 2, and corrected Exhibit 3.

DOCKET NO. 2023-89-E – ORDER NO. 2023-752(A)

OCTOBER 23, 2023

PAGE 38

The Servicing and Administration

Fees collected by DEP or any Affiliate of DEP11, acting as either the Servicer or the Administrator under the Servicing Agreement

or Administration Agreement, respectively, will be included in DEP’s cost of service such that DEP will credit back all periodic

servicing fees in excess of DEP’s or an affiliate of DEP’s incremental costs of performing servicing and administration functions.

The expenses incurred by DEP, or such affiliate to perform obligations under the Servicing Agreement or Administration Agreement not otherwise

recovered through the Storm Recovery Charge will likewise be included in DEP’s cost of service, subject to review as to reasonableness

in an appropriate rate proceeding.

Having reviewed the testimony

of the parties, the Commission finds that this treatment of the servicing and administration fees will result in achieving the Statutory

Cost Objectives and is just, reasonable, and in the public interest.

| G. | Evidence and Conclusions for Findings of Fact Nos. 11-14 |

The evidence supporting these

findings and conclusions is contained in the Petition, the Settlement Agreement, the testimony and exhibits of the witnesses and the entire

record in this proceeding.

Utility Assessment Fee, License Tax and Sales Tax

ORS witness Rhoden testified

that the Utility Assessment Fee should not be calculated or collected on storm recovery charges and should not be included as an ongoing

financing cost. Tr. p. 251.11:8-11. Witness Rhoden also recommended that the Company seek “written guidance from SCDOR” as