maps-2023033112/3100017794742023Q1false00017794742023-01-012023-03-310001779474us-gaap:CommonClassAMember2023-01-012023-03-310001779474us-gaap:WarrantMember2023-01-012023-03-310001779474us-gaap:CommonClassAMember2023-05-05xbrli:shares0001779474maps:CommonClassVMember2023-05-0500017794742023-03-31iso4217:USD00017794742022-12-31iso4217:USDxbrli:shares0001779474us-gaap:CommonClassAMember2023-03-310001779474us-gaap:CommonClassAMember2022-12-310001779474maps:CommonClassVMember2023-03-310001779474maps:CommonClassVMember2022-12-3100017794742022-01-012022-03-310001779474us-gaap:CommonClassAMember2022-01-012022-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001779474maps:CommonClassVMemberus-gaap:CommonStockMember2022-12-310001779474us-gaap:AdditionalPaidInCapitalMember2022-12-310001779474us-gaap:RetainedEarningsMember2022-12-310001779474us-gaap:ParentMember2022-12-310001779474us-gaap:NoncontrollingInterestMember2022-12-310001779474us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001779474us-gaap:ParentMember2023-01-012023-03-310001779474us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001779474maps:ClassPUnitsMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001779474us-gaap:AdditionalPaidInCapitalMembermaps:ClassPUnitsMember2023-01-012023-03-310001779474maps:ClassPUnitsMemberus-gaap:ParentMember2023-01-012023-03-310001779474maps:ClassPUnitsMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-310001779474maps:ClassPUnitsMember2023-01-012023-03-310001779474us-gaap:RetainedEarningsMember2023-01-012023-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001779474maps:CommonClassVMemberus-gaap:CommonStockMember2023-03-310001779474us-gaap:AdditionalPaidInCapitalMember2023-03-310001779474us-gaap:RetainedEarningsMember2023-03-310001779474us-gaap:ParentMember2023-03-310001779474us-gaap:NoncontrollingInterestMember2023-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001779474maps:CommonClassVMemberus-gaap:CommonStockMember2021-12-310001779474us-gaap:AdditionalPaidInCapitalMember2021-12-310001779474us-gaap:RetainedEarningsMember2021-12-310001779474us-gaap:ParentMember2021-12-310001779474us-gaap:NoncontrollingInterestMember2021-12-3100017794742021-12-310001779474us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001779474us-gaap:ParentMember2022-01-012022-03-310001779474us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-03-310001779474maps:ClassAUnitsMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-03-310001779474maps:ClassAUnitsMembermaps:CommonClassVMemberus-gaap:CommonStockMember2022-01-012022-03-310001779474maps:ClassAUnitsMemberus-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001779474maps:ClassAUnitsMemberus-gaap:ParentMember2022-01-012022-03-310001779474maps:ClassAUnitsMemberus-gaap:NoncontrollingInterestMember2022-01-012022-03-310001779474maps:ClassAUnitsMember2022-01-012022-03-310001779474maps:ClassPUnitsMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-03-310001779474us-gaap:AdditionalPaidInCapitalMembermaps:ClassPUnitsMember2022-01-012022-03-310001779474maps:ClassPUnitsMemberus-gaap:ParentMember2022-01-012022-03-310001779474maps:ClassPUnitsMemberus-gaap:NoncontrollingInterestMember2022-01-012022-03-310001779474maps:ClassPUnitsMember2022-01-012022-03-310001779474us-gaap:RetainedEarningsMember2022-01-012022-03-310001779474us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-03-310001779474maps:CommonClassVMemberus-gaap:CommonStockMember2022-03-310001779474us-gaap:AdditionalPaidInCapitalMember2022-03-310001779474us-gaap:RetainedEarningsMember2022-03-310001779474us-gaap:ParentMember2022-03-310001779474us-gaap:NoncontrollingInterestMember2022-03-3100017794742022-03-310001779474srt:MinimumMember2023-03-31maps:state0001779474stpr:CAus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2023-01-012023-03-31xbrli:pure0001779474us-gaap:AccountsReceivableMembermaps:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001779474us-gaap:ComputerEquipmentMember2023-01-012023-03-310001779474us-gaap:FurnitureAndFixturesMember2023-01-012023-03-310001779474us-gaap:LeaseholdImprovementsMember2023-01-012023-03-310001779474us-gaap:SoftwareDevelopmentMember2023-01-012023-03-310001779474maps:EnhancementsMember2023-01-012023-03-31maps:segment0001779474maps:PublicWarrantsMember2021-06-160001779474maps:PrivatePlacementWarrantMember2021-06-160001779474us-gaap:CommonClassAMember2021-06-160001779474maps:PublicWarrantsMember2023-03-310001779474maps:PrivatePlacementWarrantMember2023-03-310001779474maps:BusinessSubscriptionAndOtherSolutionsMember2023-01-012023-03-310001779474maps:BusinessSubscriptionAndOtherSolutionsMember2022-01-012022-03-310001779474maps:FeaturedListingMember2023-01-012023-03-310001779474maps:FeaturedListingMember2022-01-012022-03-310001779474us-gaap:ServiceMember2023-01-012023-03-310001779474us-gaap:ServiceMember2022-01-012022-03-310001779474us-gaap:ProductAndServiceOtherMember2023-01-012023-03-310001779474us-gaap:ProductAndServiceOtherMember2022-01-012022-03-310001779474country:US2023-01-012023-03-310001779474country:US2022-01-012022-03-310001779474country:CA2023-01-012023-03-310001779474country:CA2022-01-012022-03-310001779474srt:MaximumMember2023-01-012023-03-31maps:institution0001779474us-gaap:EmployeeSeveranceMember2022-12-310001779474us-gaap:EmployeeSeveranceMember2023-03-310001779474us-gaap:FairValueInputsLevel1Membermaps:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001779474us-gaap:FairValueInputsLevel1Membermaps:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001779474us-gaap:FairValueMeasurementsRecurringMember2023-03-310001779474us-gaap:FairValueMeasurementsRecurringMember2022-12-310001779474maps:PublicWarrantsMember2022-12-310001779474maps:PrivatePlacementWarrantMember2022-12-310001779474maps:PublicWarrantsMember2023-01-012023-03-310001779474maps:PrivatePlacementWarrantMember2023-01-012023-03-310001779474maps:PublicWarrantsMember2021-12-310001779474maps:PrivatePlacementWarrantMember2021-12-310001779474maps:PublicWarrantsMember2022-01-012022-03-310001779474maps:PrivatePlacementWarrantMember2022-01-012022-03-310001779474maps:PublicWarrantsMember2022-03-310001779474maps:PrivatePlacementWarrantMember2022-03-310001779474us-gaap:WarrantMember2021-06-162021-06-160001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputExercisePriceMember2023-03-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputExercisePriceMember2022-12-310001779474us-gaap:MeasurementInputSharePriceMemberus-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMember2023-03-310001779474us-gaap:MeasurementInputSharePriceMemberus-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMember2022-12-310001779474us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMember2023-03-310001779474us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMember2022-12-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputExpectedTermMember2023-03-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputExpectedTermMember2022-12-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-03-310001779474us-gaap:FairValueInputsLevel3Membermaps:PrivatePlacementWarrantMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001779474maps:EyechronicLLCMember2022-01-142022-01-140001779474maps:EyechronicLLCMember2022-01-140001779474us-gaap:SoftwareDevelopmentMembermaps:EyechronicLLCMember2022-01-140001779474us-gaap:TradeNamesMembermaps:EyechronicLLCMember2022-01-140001779474us-gaap:CustomerRelatedIntangibleAssetsMembermaps:EyechronicLLCMember2022-01-140001779474us-gaap:OrderOrProductionBacklogMembermaps:EyechronicLLCMember2022-01-140001779474us-gaap:TradeNamesMember2023-01-012023-03-310001779474us-gaap:TradeNamesMember2023-03-310001779474us-gaap:SoftwareDevelopmentMember2023-01-012023-03-310001779474us-gaap:SoftwareDevelopmentMember2023-03-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2023-01-012023-03-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2023-03-310001779474us-gaap:OrderOrProductionBacklogMember2023-01-012023-03-310001779474us-gaap:OrderOrProductionBacklogMember2023-03-310001779474us-gaap:TradeNamesMember2022-01-012022-12-310001779474us-gaap:TradeNamesMember2022-12-310001779474us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001779474us-gaap:SoftwareDevelopmentMember2022-12-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2022-01-012022-12-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310001779474us-gaap:OrderOrProductionBacklogMember2022-01-012022-12-310001779474us-gaap:OrderOrProductionBacklogMember2022-12-3100017794742022-01-012022-12-310001779474maps:PublicWarrantsMember2021-07-1600017794742021-07-162021-07-160001779474us-gaap:CommonStockMember2021-07-160001779474maps:PrivatePlacementWarrantMember2021-07-162021-07-160001779474maps:PrivatePlacementWarrantMember2021-07-160001779474us-gaap:CommonClassAMember2021-07-16maps:vote0001779474maps:CommonClassVMember2023-01-012023-03-3100017794742021-06-150001779474maps:WMHUnitsMember2023-03-310001779474maps:CommonClassVMember2021-06-1600017794742021-06-162021-06-160001779474maps:ClassPUnitsMember2022-12-310001779474maps:ClassPUnitsMember2023-03-310001779474maps:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2023-03-310001779474maps:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2023-01-012023-03-310001779474us-gaap:RestrictedStockUnitsRSUMember2022-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-03-310001779474us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310001779474us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-01-052023-01-050001779474us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-01-05maps:increment0001779474us-gaap:PerformanceSharesMembersrt:MinimumMember2023-01-012023-03-310001779474srt:MaximumMemberus-gaap:PerformanceSharesMember2023-01-012023-03-310001779474us-gaap:PerformanceSharesMember2023-03-310001779474us-gaap:PerformanceSharesMember2023-01-012023-03-310001779474us-gaap:PerformanceSharesMember2022-01-012022-03-310001779474us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001779474us-gaap:SellingAndMarketingExpenseMember2022-01-012022-03-310001779474us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001779474us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-03-310001779474us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001779474us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-03-310001779474maps:ClassAUnitsMember2023-01-012023-03-310001779474maps:ClassAUnitsMember2022-01-012022-03-310001779474maps:ClassPUnitsMember2023-01-012023-03-310001779474maps:ClassPUnitsMember2022-01-012022-03-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001779474us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310001779474us-gaap:PerformanceSharesMember2023-01-012023-03-310001779474us-gaap:PerformanceSharesMember2022-01-012022-03-310001779474maps:PublicWarrantsMember2023-01-012023-03-310001779474maps:PublicWarrantsMember2022-01-012022-03-310001779474maps:PrivateWarrantsMember2023-01-012023-03-310001779474maps:PrivateWarrantsMember2022-01-012022-03-310001779474maps:AcquisitionHoldbackSharesMember2023-01-012023-03-310001779474maps:AcquisitionHoldbackSharesMember2022-01-012022-03-310001779474maps:SubleaseAgreementMember2022-06-012023-03-310001779474maps:SubleaseAgreementMember2023-03-310001779474us-gaap:OtherCurrentAssetsMember2023-03-310001779474us-gaap:OtherCurrentAssetsMember2022-12-310001779474maps:SubleaseAgreementMember2023-01-012023-03-310001779474maps:SilverSpikeSponsorMember2023-03-162023-03-160001779474maps:SilverSpikeSponsorMember2023-03-160001779474maps:SilverSpikeSponsorMember2023-03-310001779474maps:SilverSpikeSponsorMember2022-12-310001779474maps:SilverSpikeSponsorMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001779474maps:SilverSpikeSponsorMemberus-gaap:OtherAssetsMember2023-03-310001779474maps:SilverSpikeSponsorMemberus-gaap:OtherAssetsMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________

FORM 10-Q

_______________________________________________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 001-39021

_______________________________________________________________________________

WM TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________

| | | | | | | | |

| Delaware | | 98-1605615 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

41 Discovery Irvine, California |

| 92618 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(844) 933-3627

(Registrant’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | MAPS | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | MAPSW | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of May 5, 2023, there were 92,573,466 shares of the registrant’s Class A common stock outstanding and 55,486,361 shares of Class V common stock outstanding.

WM TECHNOLOGY, INC.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this report, including statements regarding our future results of operations and financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, forward-looking statements may be identified by words such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

•our financial and business performance, including key business metrics and any underlying assumptions thereunder;

•our market opportunity and our ability to acquire new clients and retain existing clients;

•our expectations and timing related to commercial product launches;

•the success of our go-to-market strategy;

•our ability to scale our business and expand our offerings;

•our competitive advantages and growth strategies;

•our future capital requirements and sources and uses of cash;

•our ability to obtain funding for our future operations;

•the impact of the material weakness in our internal controls and our ability to remediate this material weakness on the timing we anticipate, or at all;

•the outcome of any known and unknown litigation and regulatory proceedings;

•changes in domestic and foreign business, market, financial, political and legal conditions;

•the effect of macroeconomic conditions, including but not limited to the COVID-19 pandemic, inflation, uncertain credit and global financial markets, recent and potential future disruptions in access to bank deposits or lending commitments due to bank failures and geopolitical events, including the military conflict between Russia and Ukraine;

•future global, regional or local economic and market conditions affecting the cannabis industry;

•the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis industry;

•our ability to successfully capitalize on new and existing cannabis markets, including our ability to successfully monetize our solutions in those markets;

•our ability to manage future growth;

•our ability to effectively anticipate and address changes in the end-user market in the cannabis industry;

•our ability to develop new products and solutions, bring them to market in a timely manner and make enhancements to our platform and our ability to maintain and grow our two-sided digital network, including our ability to acquire and retain paying clients;

•the effects of competition on our future business;

•our success in retaining or recruiting, or changes required in, officers, key employees or directors

•cyber-attacks and security vulnerabilities; and

•the possibility that we may be adversely affected by other economic, business or competitive factors.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in the section titled “Risk Factors” and included in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 16, 2023. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. The results, events, and circumstances reflected

in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe,” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10-Q. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report on Form 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

Part I - Financial Information

Item 1. Financial Statements

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except for share data)

| | | | | | | | | | | | | | |

| | March 31, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets | | | | |

| Cash | | $ | 25,902 | | | $ | 28,583 | |

| Accounts receivable, net | | 15,401 | | | 17,438 | |

| Prepaid expenses and other current assets | | 6,866 | | | 8,962 | |

| Total current assets | | 48,169 | | | 54,983 | |

| Property and equipment, net | | 25,556 | | | 24,928 | |

| Goodwill | | 68,368 | | | 68,368 | |

| Intangible assets, net | | 9,784 | | | 10,339 | |

| Right-of-use assets | | 30,245 | | | 31,447 | |

| | | | |

| Other assets | | 8,504 | | | 8,970 | |

| Total assets | | $ | 190,626 | | | $ | 199,035 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued expenses | | $ | 26,170 | | | $ | 33,635 | |

| Deferred revenue | | 6,366 | | | 6,256 | |

| Operating lease liabilities, current | | 6,574 | | | 6,334 | |

| Tax receivable agreement liability, current | | 500 | | | — | |

| Other current liabilities | | 98 | | | 98 | |

| Total current liabilities | | 39,708 | | | 46,323 | |

| Operating lease liabilities, non-current | | 31,314 | | | 33,043 | |

| Tax receivable agreement liability, non-current | | 100 | | | 500 | |

| Warrant liability | | 1,365 | | | 2,090 | |

| Other long-term liabilities | | 2,900 | | | 2,302 | |

| Total liabilities | | 75,387 | | | 84,258 | |

| | | | |

| Commitments and contingencies (Note 3) | | | | |

| | | | |

| Stockholders’ equity | | | | |

Preferred Stock - $0.0001 par value; 75,000,000 shares authorized; no shares issued and outstanding at March 31, 2023 and December 31, 2022 | | — | | | — | |

Class A Common Stock - $0.0001 par value; 1,500,000,000 shares authorized; 92,573,466 shares issued and outstanding at March 31, 2023 and 92,062,468 shares issued and outstanding at December 31, 2022 | | 9 | | | 9 | |

Class V Common Stock - $0.0001 par value; 500,000,000 shares authorized, 55,486,361 shares issued and outstanding at March 31, 2023 and December 31, 2022 | | 5 | | | 5 | |

| Additional paid-in capital | | 72,444 | | | 67,986 | |

| Accumulated deficit | | (57,095) | | | (54,620) | |

| Total WM Technology, Inc. stockholders’ equity | | 15,363 | | | 13,380 | |

| Noncontrolling interests | | 99,876 | | | 101,397 | |

| | | | |

| Total stockholders’ equity | | 115,239 | | | 114,777 | |

| Total liabilities and stockholders’ equity | | $ | 190,626 | | | $ | 199,035 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except for share data)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| Revenues | $ | 48,007 | | | $ | 57,452 | |

| | | |

| Operating expenses | | | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | 3,494 | | | 3,740 | |

| Sales and marketing | 12,060 | | | 21,882 | |

| Product development | 10,934 | | | 13,090 | |

| General and administrative | 22,500 | | | 29,055 | |

| Depreciation and amortization | 3,167 | | | 3,945 | |

| Total operating expenses | 52,155 | | | 71,712 | |

| Operating loss | (4,148) | | | (14,260) | |

| Other income (expenses) | | | |

| Change in fair value of warrant liability | 725 | | | (18,219) | |

| Change in tax receivable agreement liability | (100) | | | — | |

| Other expense, net | (446) | | | (502) | |

| Loss before income taxes | (3,969) | | | (32,981) | |

| Benefit from income taxes | — | | | (1,748) | |

| Net loss | (3,969) | | | (31,233) | |

| Net loss attributable to noncontrolling interests | (1,494) | | | (17,340) | |

| Net loss attributable to WM Technology, Inc. | $ | (2,475) | | | $ | (13,893) | |

| | | |

| Class A Common Stock: | | | |

| Basic and diluted loss per share | $ | (0.03) | | | $ | (0.19) | |

| | | |

| | | |

| Class A Common Stock: | | | |

| Weighted average basic and diluted shares outstanding | 92,323,757 | | | 72,450,204 | |

| | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands, except for share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Common Stock

Class A | | Common Stock

Class V | | Additional Paid-in Capital | | Accumulated Deficit | | Total WM Technology, Inc. Stockholders’ Equity | | Non-controlling Interests | | | | Total Equity |

| Shares | Par Value | | Shares | Par Value | | | | | | |

As of December 31, 2022 | 92,062,468 | $ | 9 | | | 55,486,361 | $ | 5 | | | $ | 67,986 | | | $ | (54,620) | | | $ | 13,380 | | | $ | 101,397 | | | | | $ | 114,777 | |

| Stock-based compensation | — | — | | | — | | — | | | 4,396 | | | — | | | 4,396 | | | 285 | | | | | 4,681 | |

| Issuance of common stock - vesting of restricted stock units, net of shares withheld for taxes | 475,510 | — | | | — | | — | | | — | | | — | | | — | | | — | | | | | — | |

| Distributions | — | — | | | — | | — | | | — | | | — | | | — | | | (250) | | | | | (250) | |

| | | | | | | | | | | | | | | | | |

| Issuance of common stock - Class P Unit exchange | 35,488 | — | | | — | | — | | | 62 | | | — | | | 62 | | | (62) | | | | | — | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | — | | | — | | — | | | — | | | (2,475) | | | (2,475) | | | (1,494) | | | | | (3,969) | |

As of March 31, 2023 | 92,573,466 | $ | 9 | | | 55,486,361 | $ | 5 | | | $ | 72,444 | | | $ | (57,095) | | | $ | 15,363 | | | $ | 99,876 | | | | | $ | 115,239 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| Common Stock

Class A | | Common Stock

Class V | | Additional Paid-in Capital | | Retained Earnings | | Total WM Technology, Inc. Stockholders’ Equity | | Non-controlling Interests | | | | Total Equity |

| Shares | Par Value | | Shares | Par Value | | | | | | |

As of December 31, 2021 | 65,677,361 | $ | 7 | | | 65,502,347 | | $ | 7 | | | $ | 2,173 | | | $ | 61,369 | | | $ | 63,556 | | | $ | 68,384 | | | | | $ | 131,940 | |

| Stock-based compensation | — | — | | | — | | — | | | 7,246 | | | — | | | 7,246 | | | 681 | | | | | 7,927 | |

| Issuance of common stock - vesting of restricted stock units, net of shares withheld for taxes | 879,284 | — | | | — | | — | | | (6) | | | — | | | (6) | | | (7) | | | | | (13) | |

| Issuance of common stock for acquisitions | 4,721,706 | — | | | — | | — | | | 12,836 | | | — | | | 12,836 | | | 15,889 | | | | | 28,725 | |

| Issuance of common stock - Class A Unit exchange | 4,295,574 | 1 | | | (4,295,574) | | (1) | | | 3,669 | | | — | | | 3,669 | | | (3,669) | | | | | — | |

| Issuance of common stock - Class P Unit exchange | 7,525,045 | — | | | — | | — | | | 6,427 | | | — | | | 6,427 | | | (6,427) | | | | | — | |

| Issuance of common stock - warrants exercised | 20 | — | | | — | | — | | | — | | | — | | | — | | | — | | | | | — | |

Impact of Tax Receivable Agreement due

to exchanges of Units | — | — | | | — | | — | | | 11,625 | | | — | | | 11,625 | | | — | | | | | 11,625 | |

| Net loss | — | — | | | — | | — | | | — | | | (13,893) | | | (13,893) | | | (17,340) | | | | | (31,233) | |

As of March 31, 2022 | 83,098,990 | $ | 8 | | | 61,206,773 | $ | 6 | | | $ | 43,970 | | | $ | 47,476 | | | $ | 91,460 | | | $ | 57,511 | | | | | $ | 148,971 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (3,969) | | | $ | (31,233) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 3,167 | | | 3,945 | |

| Change in fair value of warrant liability | (725) | | | 18,219 | |

| Change in tax receivable agreement liability | 100 | | | — | |

| | | |

| Stock-based compensation | 4,383 | | | 7,517 | |

| Deferred tax asset | — | | | (1,748) | |

| Provision for doubtful accounts | 1,951 | | | 2,759 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 86 | | | (7,802) | |

| Prepaid expenses and other current assets | 2,447 | | | 1,617 | |

| Other assets | 25 | | | — | |

| Accounts payable and accrued expenses | (5,417) | | | 3,132 | |

| Deferred revenue | 109 | | | (256) | |

| Net cash provided by (used in) operating activities | 2,157 | | | (3,850) | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (3,226) | | | (4,201) | |

| Cash paid for acquisitions, net of cash acquired | — | | | (713) | |

| | | |

| | | |

| Net cash used in investing activities | (3,226) | | | (4,914) | |

| | | |

| Cash flows from financing activities | | | |

| Repayments of insurance premium financing | (1,450) | | | (3,143) | |

| Distributions | (250) | | | — | |

| Proceeds from repayment of related party note | 88 | | | — | |

| Taxes paid related to net share settlement of equity awards | — | | | (13) | |

| Net cash used in financing activities | (1,612) | | | (3,156) | |

| | | |

| Net decrease in cash | (2,681) | | | (11,920) | |

| Cash – beginning of period | 28,583 | | | 67,777 | |

| Cash – end of period | $ | 25,902 | | | $ | 55,857 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

(Continued)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| | | |

| | | |

| | | |

| | | |

| Supplemental disclosures of noncash investing and financing activities | | | |

| Stock-based compensation capitalized for software development | $ | 298 | | | $ | 410 | |

| Insurance premium financing | $ | — | | | $ | 248 | |

| Issuance of equity for acquisitions | $ | — | | | $ | 28,725 | |

| Holdback liability recognized in connection with the acquisition | $ | — | | | $ | 98 | |

| Accrued liabilities assumed in connection with acquisition | $ | — | | | $ | 586 | |

| | | |

| | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Organization

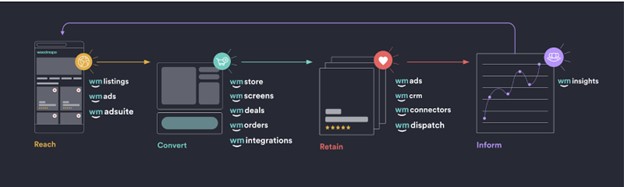

Founded in 2008, and headquartered in Irvine, California, WM Technology, Inc. (the “Company”) operates a leading online cannabis marketplace for consumers together with a comprehensive set of eCommerce and compliance software solutions for cannabis businesses, which are sold to both storefront locations and delivery operators (“retailers”) and brands in the U.S. states, U.S. territories and Canadian legalized cannabis markets. The Company’s comprehensive business-to-consumer (“B2C”) and business-to-business (“B2B”) suite of products afford cannabis retailers and brands of all sizes integrated tools to compliantly run their businesses and to reach, convert, and retain consumers.

The Company’s business primarily consists of its commerce-driven marketplace (“Weedmaps”), and its fully integrated suite of end-to-end Software-as-a-Service (“SaaS”) solutions software offering (“Weedmaps for Business”). The Weedmaps marketplace provides cannabis consumers with information regarding cannabis retailers and brands. In addition, the Weedmaps marketplace aggregates data from a variety of sources including retailer point-of-sale solutions to provide consumers with the ability to browse by strain, price, cannabinoids and other information regarding locally available cannabis products, through the Company’s website and mobile apps. The marketplace provides consumers with product discovery, access to deals and discounts, and reservation of products for pickup by consumers or delivery to consumers by participating retailers (retailers complete orders and process payments outside of the Weedmaps marketplace as Weedmaps serves only as a portal, passing a consumer’s inquiry to the dispensary). The marketplace also provides education and learning information to help newer consumers learn about the types of products to purchase. The Company believes the size, loyalty and engagement of its user base and the frequency of consumption of cannabis of its user base is highly valuable to the Company’s clients and results in clients paying for its services.

Weedmaps for Business, the Company’s SaaS offering, is a comprehensive set of eCommerce and compliance software solutions catered towards cannabis retailers, delivery services and brands that streamline front and back-end operations and help manage compliance needs. These tools support cannabis businesses at every stage in the consumer funnel, enabling them to:

•Strategically reach prospective cannabis consumers;

•Manage pickup, delivery and inventory in compliance with local regulations;

•Help improve the customer experience by creating online browsing and ordering functionality on a brand or retailer (including delivery) operator’s website and by extending that functionality in-store with kiosks;

•Foster customer loyalty and re-engage with segments of consumers;

•Leverage the Weedmaps for Business products in conjunction with any other preferred software solutions via integrations and application programming interfaces (“APIs”); and

•Make informed marketing and merchandising decisions using performance analytics and consumer and brand insights to promote products to specific consumer groups.

The Company’s solutions are designed to address these challenges facing cannabis consumers and businesses. The Weedmaps marketplace allows cannabis users to search for and browse cannabis products from retailers and brands, and ultimately reserve products from certain local retailers, in a manner similar to other technology platforms with breadth and depth of product, brand and retailer selection. With the development of Weedmaps for Business, the Company offers an end-to-end platform for licensed cannabis retailers to comply with state law. The Company sells a monthly subscription offering to storefront, delivery and brand clients as well as upsell and add-on offerings to licensed clients. The Company’s current subscription package includes:

•WM Listings: A listing page with product menu for a retailer or brand on the Weedmaps marketplace, enabling the Company’s clients to be discovered by the marketplace’s users. This also allows clients to disclose their license information, hours of operation, contact information, discount policies and other information that may be required under applicable state law;

•WM Orders: Software for retailers to receive pickup and delivery orders directly from a Weedmaps listing and connect orders directly with a client’s POS system (for certain POS systems). The marketplace also enables brands to route customer purchase interest to a retailer that carries the brand’s product. After a dispensary receives the order request from the consumer, the dispensary and the consumer can continue to communicate, adjust items in the request, and handle any stock issues, prior to and while the dispensary processes and fulfills the order;

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

•WM Store: Customizable online store which allows retailers and brands to import their Weedmaps listing menu or product reservation functionality to their own white-labeled WM Store website or separately owned website. WM Store facilitates customer pickup or delivery orders and enables retailers to reach more customers by bringing the breadth of the Weedmaps marketplace to a client’s own website;

•WM Connectors: A centralized integration platform, including API tools, for easier menu management, automatic inventory updates and streamlined order fulfillment to enable clients to save time and more easily integrate into the WM Technology ecosystem and integrate with disparate software systems. This creates business efficiencies and improves the accuracy and timeliness of information across Weedmaps, creating a more positive experience for consumers and businesses; and

•WM Insights: An insights and analytics platform for clients leveraging data across the Weedmaps marketplace and software solutions. WM Insights provides data and analytics on user engagement and traffic trends to a client’s listing page. For Brand clients, WM Insights allows them to monitor their brand and product rankings, identify retailers not carrying products and keep track of top brands and products by category and state.

The Company also offers other add-on products for additional fees, including:

•WM Ads: Ad solutions on the Weedmaps marketplace designed for clients to amplify their businesses and reach more highly engaged cannabis consumers throughout their buying journey including:

◦Featured Listings: Premium placement ad solutions on high visibility locations on the Weedmaps marketplace (desktop and mobile) to amplify the Company’s clients’ businesses and maximize clients’ listings and deal presence.

◦WM Deals: Discount and promotion pricing tools that let clients strategically reach prospective price-conscious cannabis customers with deals or discounts to drive conversion. In some jurisdictions, it is required by applicable law to showcase discounts.

◦Other WM Ads solutions: Includes banner ads and promotion tiles on our marketplace as well as banner ads that can be tied to keyword searches. These products provide clients with targeted ad solutions in highly visible slots across our digital surfaces.

•WM AdSuite: Omni-channel (on and off platform) marketing solution with access to the Weedmaps marketplace and cannabis-friendly off marketplace outlets including certain publishers, out-of-home units in addition to other media solutions. These campaigns leverage proprietary first-party Weedmaps data to target verified cannabis consumers.

•WM CRM: Customer relationship management software allowing clients to reach new consumers, build loyalty, and grow revenue with our compliant app, text and marketing tools. The tools also allow for retargeting and re-engagement of cannabis consumers.

•WM Dispatch: Compliant, automated and optimized logistics and fulfillment last-mile delivery software (including driver apps) that helps clients manage their delivery fleets. This product streamlines the delivery experience from in-store to front-door.

•WM Screens: In-store digital menu signage and kiosk solution and media management tool enabling clients to enhance the in-store experience, impact omnichannel retail and centralize operations with revenue-driving and customizable digital signage.

The Company charges a monthly fee to retailer, delivery and brand clients for access to its subscription package, which includes WM Listings, WM Orders, WM Store, WM Connectors and WM Insights. Depending on the market, the other add-on products are available for additional fees.

The Company sells its Weedmaps for Business suite in the United States, and currently offers some of its Weedmaps for Business solutions in Canada and has a limited number of non-monetized listings in several other countries including Austria, Germany, the Netherlands, Spain and Switzerland. The Company operates in the United States, Canada and other foreign jurisdictions where medical and/or adult cannabis use is legal under state or national law. As of March 31, 2023, the Company

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

actively operated in over 30 U.S. states and territories that have adult-use and/or medical-use regulations in place. The Company defines actively operated markets as those U.S. states or territories with greater than $1,000 monthly revenue.

The Company’s mission is to power a transparent and inclusive global cannabis economy. The Company’s technology addresses the challenges facing both consumers seeking to understand cannabis products and businesses who serve cannabis users in a legally compliant fashion. Over the past 14 years, Weedmaps has become a premier destination for cannabis consumers to discover and browse information regarding cannabis and cannabis products, permitting product discovery and order-ahead for pickup or delivery by participating retailers. Weedmaps for Business is a set of eCommerce-enablement tools designed to help retailers and brands get the best out of the Weedmaps’ consumer experience, create labor efficiencies and manage compliance needs.

The Company holds a strong belief in the importance of enabling safe, legal access to cannabis for consumers worldwide. The Company believes it offers the only comprehensive software platform that allows cannabis retailers to reach their target audience, quickly and cost effectively, addressing a wide range of needs. The Company is committed to building the software solutions that power cannabis businesses compliantly in the industry, to advocating for legalization, licensing and social equity of cannabis and to facilitating further learning through partnership with subject matter experts to provide detailed, accurate information about cannabis.

WM Technology, Inc. was initially incorporated in the Cayman Islands on June 7, 2019 under the name “Silver Spike Acquisition Corp” (“Silver Spike”). Silver Spike was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On June 16, 2021 (the “Closing Date”), Silver Spike consummated the business combination (the “Business Combination”), pursuant to that certain Agreement and Plan of Merger, dated December 10, 2020 (the “Merger Agreement”), by and among Silver Spike, Silver Spike Merger Sub LLC, a Delaware limited liability company and a wholly owned direct subsidiary of Silver Spike Acquisition Corp. (“Merger Sub”), WM Holding Company, LLC, a Delaware limited liability company (when referred to in its pre-Business Combination capacity, “Legacy WMH” and following the Business Combination, “WMH LLC”), and Ghost Media Group, LLC, a Nevada limited liability company, solely in its capacity as the initial holder representative (the “Holder Representative”). On the Closing Date, and in connection with the closing of the Business Combination (the “Closing”), Silver Spike was domesticated and continues as a Delaware corporation, changing its name to WM Technology, Inc.

On the Closing Date, the Company was reorganized into an Up-C structure, in which substantially all of the assets and business of the Company are held by WMH LLC and continue to operate through WMH LLC and its subsidiaries, and WM Technology, Inc.’s material assets are the equity interests of WMH LLC indirectly held by it. Legacy WMH was determined to be the accounting acquirer in the Business Combination, which was accounted for as a reverse recapitalization in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

2. Summary of Significant Accounting Policies

The summary of significant accounting policies presented below is designed to assist in understanding the Company’s condensed consolidated financial statements. Such condensed consolidated financial statements and accompanying notes are the representations of the Company’s management, who is responsible for their integrity and objectivity. Management believes that these accounting policies conform to GAAP in all material respects, and have been consistently applied in preparing the accompanying condensed consolidated financial statements.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with GAAP and applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for quarterly reports on Form 10-Q and Article 10-1 of Regulation S-X. Accordingly, certain information and footnotes required by GAAP in annual financial statements have been omitted or condensed and these interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 16, 2023. The condensed financial statements of the Company include all adjustments of a normal recurring nature which, in the opinion of management, are necessary for a fair statement of the Company’s financial position as of March 31, 2023, and results of its operations and its cash flows for the interim periods presented. The results of operations for the three months ended March 31, 2023 are not necessarily indicative of the results to be expected for the entire year. There have been no significant changes in the Company’s accounting policies from those described in the Company’s audited consolidated financial statements and the related notes to those statements.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of WM Technology, Inc. and WM Holding Company, LLC, including their wholly and majority owned subsidiaries. In conformity with GAAP, all significant intercompany accounts and transactions have been eliminated.

Foreign Currency

Assets and liabilities denominated in a foreign currency are translated into U.S. dollars using the exchange rates in effect at the balance sheet date. Revenue and expense accounts are translated at the average exchange rates during the periods. The impact of exchange rate fluctuations from translation of assets and liabilities is insignificant for the three months ended March 31, 2023 and 2022.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the interim condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant estimates made by management include, among others, the allowance for expected credit losses, the useful lives of long-lived assets, income taxes, website and internal-use software development costs, leases, valuation of goodwill and other intangible assets, valuation of warrant liability, deferred tax assets and the related valuation allowance, tax receivable agreement liability, revenue recognition, stock-based compensation and the recognition and disclosure of contingent liabilities.

Risks and Uncertainties

The Company operates in a relatively new industry where laws and regulations vary significantly by jurisdiction. Currently, thirty-nine states, the District of Columbia, Puerto Rico, the Virgin Islands, and Guam have legalized some form of cannabis use for certain medical purposes. Twenty-two of those states, the District of Columbia, Guam, and Northern Mariana have legalized cannabis for adults for non-medical purposes as well (sometimes referred to as adult or recreational use). Eight additional states have legalized forms of low-potency cannabis, for select medical conditions. Only three states continue to prohibit cannabis entirely.. Additionally, while a number of U.S. legislators have introduced various bills to legalize cannabis at the federal level, none of these bills has become law. Currently, under federal law, cannabis, other than hemp (defined by the U.S. government as Cannabis sativa L. with a THC concentration of not more than 0.3% on a dry weight basis), is still a Schedule I controlled substance under the Controlled Substances Act (“CSA”). Even in states or territories that have legalized

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

cannabis to some extent, the cultivation, possession, and sale of cannabis all violate the CSA and are punishable by imprisonment, substantial fines, and forfeiture. Moreover, individuals and entities may violate federal law if they aid and abet another in violating the CSA, or conspire with another to violate the law, and violating the CSA is a predicate for certain other crimes, including money laundering laws and the Racketeer Influenced and Corrupt Organizations Act. If any of the states that permit use of cannabis were to change their laws or the federal government was to actively enforce the CSA or other laws related to the federal prohibition on cannabis, the Company’s business could be adversely affected.

In addition, the Company’s ability to grow and meet its operating objectives depends largely on the continued legalization and regulation of cannabis on a widespread basis. There can be no assurance that such legalization will occur on a timely basis, or at all.

The geographic concentration of the Company’s clients makes the Company vulnerable to a downturn in the local market area. Historically, the Company’s business operations have been located primarily in the State of California, and for the three months ended March 31, 2023, approximately 55% of the Company’s revenue originated in California.

Fair Value Measurements

The Company follows the guidance in Accounting Standards Codification (“ASC”) 820 - Fair Value Measurements for its financial assets and liabilities that are re-measured and reported at fair value at each reporting period. See Note 4 for additional information on liabilities measured at fair value.

The fair value of the Company’s financial assets and liabilities reflects management’s estimate of amounts that the Company would have received in connection with the sale of the assets or paid in connection with the transfer of the liabilities in an orderly transaction between market participants at the measurement date. In connection with measuring the fair value of its assets and liabilities, the Company seeks to maximize the use of observable inputs (market data obtained from independent sources) and to minimize the use of unobservable inputs (internal assumptions about how market participants would price assets and liabilities). The following fair value hierarchy is used to classify assets and liabilities based on the observable inputs and unobservable inputs used in order to value the assets and liabilities:

•Level 1: Quoted prices in active markets for identical assets or liabilities. An active market for an asset or liability is a market in which transactions for the asset or liability occur with sufficient frequency and volume to provide pricing information on an ongoing basis.

•Level 2: Observable inputs other than Level 1 inputs. Examples of Level 2 inputs include quoted prices in active markets for similar assets or liabilities and quoted prices for identical assets or liabilities in markets that are not active.

•Level 3: Unobservable inputs based on the Company assessment of the assumptions that market participants would use in pricing the asset or liability.

Accounts Receivable

Accounts receivable is recorded at the invoiced amount and does not bear interest.

Effective January 1, 2021, the Company adopted the new accounting guidance on measuring credit losses on its trade accounts receivable using the modified retrospective approach. The new credit loss guidance replaces the old model for measuring the allowance for credit losses with a model that is based on the expected losses rather than incurred losses. Under the new accounting guidance, the Company measures credit losses on its trade accounts receivable using the current expected credit loss model under ASC 326 Financial Instruments – Credit Losses.

The Company calculates the expected credit losses on a pool basis for those trade receivables that have similar risk characteristics. For those trade receivables that do not share similar risk characteristics, the allowance for doubtful accounts is calculated on an individual basis. Risk characteristics relevant to the Company’s accounts receivable include balance of customer account and aging status.

Account balances are written off against the allowance when it is determined that it is probable that the receivable will not be recovered. The Company had allowance for doubtful account balances of $13.4 million and $12.2 million as of March 31, 2023 and December 31, 2022, respectively.

As of March 31, 2023, a receivable due from one single customer accounted for approximately 11% of the total gross accounts receivable outstanding.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The following table summarizes the changes in the allowance for doubtful accounts:

| | | | | | | | | | | | |

| Three Months Ended March 31, | |

| 2023 | | 2022 | |

| Allowance, beginning of period | $ | 12,232 | | | $ | 5,169 | | |

| Addition to allowance | 1,951 | | | 2,759 | | |

| Write-off, net of recoveries | (770) | | | (686) | | |

| Allowance, end of period | $ | 13,413 | | | $ | 7,242 | | |

Investments in Equity Securities

Investments in equity securities that do not have a readily determinable fair value and qualify for the measurement alternative for equity investments provided in ASC 321, Investments – Equity Securities are accounted for at cost, less any impairment, plus or minus changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer. As of March 31, 2023 and December 31, 2022, the carrying value of the Company’s investments in equity securities without a readily determinable fair value was $3.5 million, which is recorded within other assets on the Company’s condensed consolidated balance sheets.

The Company performs a qualitative assessment at each reporting date to evaluate whether the investments in equity securities are impaired. When a qualitative assessment indicates that an investment is impaired, the investment is written down to its fair value and the impairment charge is included in general and administrative expenses in the accompanying condensed consolidated statements of operations. No impairments to investments in equity securities were recorded during the three months ended March 31, 2023 and 2022.

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation, and consist of internally developed software, computer equipment, furniture and fixtures and leasehold improvements. Depreciation is computed using the straight-line method over the estimated useful lives of the assets and generally over three years for computer equipment, seven years for furniture and fixtures and five years for leasehold improvements. Maintenance and repairs are expensed as incurred. When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the Company’s condensed consolidated statements of operations.

Capitalized website and internal-use software development costs are included in property and equipment in the accompanying balance sheets. The Company capitalizes certain costs related to the development and enhancement of the Weedmaps platform and SaaS solutions. The Company began to capitalize these costs when preliminary development efforts were successfully completed, management has authorized and committed project funding, and it was probable that the project would be completed and the software would be used as intended. Capitalization ceases upon completion of all substantial testing. Maintenance and training costs are expensed as incurred. Such costs are amortized when placed in service, on a straight-line basis over the estimated useful life of the related asset, generally estimated to be three years. Costs incurred for enhancements that were expected to result in additional features or functionality are capitalized and expensed over the estimated useful life of the enhancements, generally three years. Product development costs that do not meet the criteria for capitalization are expensed as incurred.

The Company assess impairment of property and equipment when an event and change in circumstance indicates that the carrying value of such assets may not be recoverable. If an event and a change in circumstance indicates that the carrying amount of an asset (or asset group) may not be recoverable and the expected undiscounted cash flows attributable to the asset are less than its carrying value, an impairment loss equals to the excess of the asset’s carrying value over its fair value is recognized. No impairments to property and equipment were recorded during the three months ended March 31, 2023 and 2022.

Goodwill and Intangible Assets

Goodwill consists of the excess of the purchase price over the fair value of identifiable net assets of businesses acquired. Goodwill is reviewed for impairment each year using a qualitative or quantitative process that is performed at least annually or

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

whenever events or circumstances indicate a likely reduction in the fair value of a reporting unit below its carrying amount. The Company has concluded that it has one reporting unit.

The Company performs the annual impairment analysis on December 31 in order to provide management time to complete the analysis prior to year-end. Prior to performing the quantitative evaluation, an assessment of qualitative factors may be performed to determine whether it is more likely than not that the fair value of a reporting unit exceeds the carrying value. If it is determined that it is unlikely that the carrying value exceeds the fair value, the Company is not required to complete the quantitative goodwill impairment evaluation. If it is determined that the carrying value may exceed fair value when considering qualitative factors, a quantitative goodwill impairment evaluation is performed. When performing the quantitative evaluation, if the carrying value of the reporting unit exceeds its fair value, an impairment loss equal to the difference will be recorded.

Intangible assets are recorded at cost less accumulated amortization. Intangible assets are reviewed for impairment whenever events or changes in circumstances may affect the recoverability of the net assets. Such reviews may include an analysis of current results and take into consideration the undiscounted value of projected operating cash flows. No goodwill or intangible asset impairment charges were recorded for the three months ended March 31, 2023 and 2022.

Leases

The Company classifies arrangements meeting the definition of a lease as operating or financing leases, and leases are recorded on the condensed consolidated balance sheets as both a right-of-use asset (“ROU”) and lease liability, calculated by discounting fixed lease payments over the lease term at the rate implicit in the lease or the Company’s incremental borrowing rate. Lease liabilities are increased by interest and reduced by payments each period, and the right-of-use asset is amortized over the lease term. For operating leases, interest on the lease liability and the amortization of the right-of-use asset result in straight-line rent expense over the lease term. For finance leases, interest on the lease liability and the amortization of the right-of-use asset results in front-loaded expense over the lease term. Variable lease expenses are recorded when incurred.

In calculating the right-of-use asset and lease liability, the Company elects to combine lease and non-lease components for all classes of assets. The Company excludes short-term leases having initial terms of 12 months or less from the new guidance as an accounting policy election, and instead recognizes rent expense on a straight-line basis over the lease term.

The Company assesses impairment of ROU assets when an event and change in circumstance indicates that the carrying value of such ROU assets may not be recoverable. If an event and a change in circumstance indicates that the carrying value of an ROU asset may not be recoverable and the estimated fair value attributable to the ROU asset is less than its carrying value, an impairment loss equals to the excess of the ROU asset’s carrying value over its fair value is recognized.

Total lease costs, net for the three months ended March 31, 2023 and 2022 were $2.2 million and $2.5 million, respectively. Sublease rental income is recognized as a reduction to the related lease expense on a straight-line basis over the sublease term. For the three months ended March 31, 2023 and 2022, the Company recorded contra rent expense related to its subleases of $0.5 million and $0.4 million, respectively.

Warrant Liability

The Company assumed 12,499,993 Public Warrants originally issued in the initial public offering of Silver Spike (the “Public Warrants”) and 7,000,000 Private Placement Warrants that were originally issued in a private placement by Silver Spike (the “Private Placement Warrants” and together with the Public Warrants, the “Warrants”) upon the Closing, all of which were issued in connection with Silver Spike’s initial public offering and entitle the holder to purchase one share of Class A Common Stock at an exercise price of at $11.50 per share. As of March 31, 2023, 12,499,973 Public Warrants and 7,000,000 Private Placement Warrants remained outstanding. The Public Warrants are publicly traded and are exercisable for cash unless certain conditions occur, such as the failure to have an effective registration statement related to the shares issuable upon exercise or redemption by the Company under certain conditions, at which time the warrants may be cashless exercised. The Private Placement Warrants are transferable, assignable or salable in certain limited exceptions. The Private Placement Warrants are exercisable for cash or on a cashless basis, at the holder’s option, and are non-redeemable so long as they are held by the initial purchasers or their permitted transferees. If the Private Placement Warrants are held by someone other than the initial purchasers or their permitted transferees, the Private Placement Warrants will cease to be Private Placement Warrants, and become Public Warrants and be redeemable by the Company and exercisable by such holders on the same basis as the other Public Warrants.

The Company evaluated the Warrants under ASC 815-40 - Derivatives and Hedging - Contracts in Entity’s Own Equity, and concluded they do not meet the criteria to be classified in stockholders’ equity. Specifically, the exercise of the Warrants

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

may be settled in cash upon the occurrence of a tender offer or exchange that involves 50% or more of our Class A equity holders. Because not all of the voting stockholders need to participate in such tender offer or exchange to trigger the potential cash settlement and the Company does not control the occurrence of such an event, the Company concluded that the Warrants do not meet the conditions to be classified in equity. Since the Warrants meet the definition of a derivative under ASC 815, the Company recorded these warrants as liabilities on the condensed consolidated balance sheets at fair value, with subsequent changes in their respective fair values recognized in change in fair value of warrant liabilities within the condensed consolidated statements of operations at each reporting date.

Tax Receivable Agreement

In connection with the Business Combination, the Company entered into a tax receivable agreement (the “TRA”) with continuing members that provides for a payment to the continuing Class A Unit holders of 85% of the amount of tax benefits, if any, that the Company realizes, or is deemed to realize, as a result of redemptions or exchanges of Units. In connection with such potential future tax benefits resulting from the Business Combination, the Company has established a deferred tax asset for the additional tax basis and a corresponding TRA liability of 85% of the expected benefit. The remaining 15% is recorded to additional paid-in capital.

The TRA liability is subject to remeasurement each reporting period, due to various factors, including changes in federal and state income tax rates and assessment of the probability of payment. As these remeasurement changes are subsequent to the initial measurement, the impact of the remeasurement is recorded in other income (loss) on the condensed consolidated statements of operations. As of March 31, 2023, tax receivable agreement liability was $0.6 million. During the three months ended March 31, 2023, the Company recognized a loss of $0.1 million related to the remeasurement of its TRA liability. See Income Taxes below for information related to the Company’s allowance against its net deferred tax assets.

Revenue Recognition

The Company’s revenues are derived primarily from monthly subscriptions and additional offerings for access to the Company’s Weedmaps marketplace and SaaS solutions. The Company recognizes revenue when the fundamental criteria for revenue recognition are met. The Company recognizes revenue by applying the following steps: the contract with the customer is identified; the performance obligations in the contract are identified; the transaction price is determined; the transaction price is allocated to the performance obligations in the contract; and revenue is recognized when (or as) the Company satisfies these performance obligations in an amount that reflects the consideration it expects to be entitled to in exchange for those services. The Company excludes sales taxes and other similar taxes from the measurement of the transaction price. For clients that pay in advance for listing and other services, the Company records deferred revenue and recognizes revenue over the applicable subscription term.

The Company offers Weedmaps for Business subscriptions, which include access to the Weedmaps marketplace and certain SaaS solutions. As add-ons for additional fees, the Company offers other products, including featured listings, placements, promoted deals, nearby listings, other display advertising, client relationship management, digital menu, and delivery and logistics services. The Company’s Weedmaps for Business subscriptions generally have one-month terms that automatically renew unless notice of cancellation is provided in advance. The Company has a fixed inventory of featured listing and display advertising in each market, and price is generally determined through a competitive auction process that reflects local market demand. Revenues for these arrangements are recognized over-time, generally during a month-to-month subscription period as the products are provided. The Company rarely needs to allocate the transaction price to separate performance obligations. In the rare case that allocation of the transaction price is needed, the Company recognizes revenue in proportion to the standalone selling prices of the underlying services at contract inception.

Revenue for service contracts that the Company assesses are not probable of collection is not recognized until the contract is completed and payment is received. Collectability is reassessed when there is a significant change in facts or circumstances. The assessment of collectability considers whether the Company may limit its exposure to credit risk through its right to stop transferring additional service in the event the customer is delinquent.

Disaggregation of revenue

Weedmaps for Business and other SaaS subscriptions include the Company's WM Pages subscription package as well as subscriptions to the Company's other SaaS products. The WM Pages subscription package includes access to WM Listings, WM Orders, WM Store, WM Connectors and WM Insights. Additional SaaS subscriptions include WM CRM, WM Dispatch and WM Screens. These subscriptions are typically monthly in nature. Featured and deal listings include the Featured Listings

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

and WM Deals products. Other ad solutions include certain advertising products on and off the Weedmaps marketplace, including WM AdSuite. For a description of these solutions, see the "Business and Organization" section.

The following table summarizes the Company’s disaggregated net revenues information (in thousands):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| |

| | | |

| | | |

| | | |

| Weedmaps for Business and other SaaS solutions | $ | 11,684 | | | $ | 12,737 | |

| Featured and deal listings | 33,494 | | | 41,470 | |

| Subtotal | 45,178 | | | 54,207 | |

| | | |

| Other ad solutions | 2,829 | | | 3,245 | |

| Total revenues | $ | 48,007 | | | $ | 57,452 | |

Deferred revenue primarily consists of billings or payments received in advance of revenue recognition from subscription offerings, as described above, and is recognized as the revenue recognition criteria are met. Deferred revenue balance as of March 31, 2023 and December 31, 2022 were $6.4 million and $6.3 million, respectively, and the balance is expected to be fully recognized within the next twelve months. The Company generally invoices customers and receives payment on an upfront basis and payments do not include significant financing components or variable consideration and there are generally no rights of return or refunds after the subscription period has passed.

All revenues during the periods presented were recognized over time, as opposed to at a point in time.

The following table summarizes the Company’s U.S. and foreign revenues (in thousands):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| |

| | | |

| | | |

| | | |

| U.S. revenues | $ | 47,982 | | | $ | 57,436 | |

| Foreign revenues | 25 | | | 16 | |

| Total revenues | 48,007 | | | 57,452 | |

Cost of Revenues (Exclusive of Depreciation and Amortization)

The Company’s cost of revenue primarily consists of web hosting, internet service costs, credit card processing costs and inventory costs related to multi-media offerings.

Product Development Costs

Product development costs include salaries and benefits for employees, including engineering and technical teams who are responsible for building new products, as well as maintaining and improving existing products. Product development costs that do not meet the criteria for capitalization are expensed as incurred.

Advertising

The Company expenses the cost of advertising in the period incurred. Advertising expense totaled $1.0 million and $4.9 million for the three months ended March 31, 2023 and 2022, respectively, and are included in sales and marketing expense in the accompanying condensed consolidated statements of operations.

Stock-Based Compensation

The Company measures fair value of employee stock-based compensation awards on the date of grant and allocates the related expense over the requisite service period. The fair value of restricted stock units and performance-based restricted stock units is equal to the market price of the Company’s common stock on the date of grant. The fair value of the Class P Units is measured using the Black-Scholes-Merton valuation model. The expected volatility is based on the historical volatility and

WM TECHNOLOGY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

implied volatilities for comparable companies, the expected life of the award is based on the simplified method. When awards include a performance condition that impacts the vesting of the award, the Company records compensation cost when it becomes probable that the performance condition will be met and the expense will be attributed over the performance period.

The Company accounts for non-employee stock-based transactions using the fair value of the consideration received (i.e., the value of the goods or services) or the fair value of the equity instruments issued, whichever is more reliably measurable.

Employee Benefit Plan

The Company’s 401(k) saving plan is a tax-qualified deferred compensation arrangement under Section 401(k) of the Internal Revenue Code. Under the 401(k) Plan, participating U.S. employees may contribute a portion of their eligible earnings, subject to applicable U.S. Internal Revenue Service and plan limits. The Company matches up to 3.5% of the employee’s eligible compensation, vested upon two years of service. For the three months ended March 31, 2023 and 2022, the Company recognized $0.6 million of expenses in each period related to employer contributions for the 401(k) saving plan.

Other Income (Expense)

Other income (expense) consists primarily of change in fair value of warrant liability and tax receivable agreement liability remeasurement. Other expense, net consists primarily of political contributions, interest expense, financing fees and other tax related expenses.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes under ASC 740 - Income Taxes. Under the guidance, deferred tax assets and liabilities are recognized for the future tax consequences of (i) temporary differences between the financial statement carrying amounts and the tax basis of existing assets and liabilities and (ii) operating loss and tax credit carryforwards. Deferred income tax assets and liabilities are based on enacted tax rates applicable to the future period when those temporary differences are expected to be recovered or settled. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period the rate change is enacted.