As filed with the Securities and Exchange Commission on September 3, 2024

Registration No. 333-257774

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 5

ON

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WM Technology, Inc.

(Exact Name of Registrant as Specified

in its Charter)

|

Delaware

|

| |

7372

|

| |

98-1605615

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

| |

(Primary Standard Industrial

Classification Code No.)

|

| |

(I.R.S. Employer

Identification No.)

|

41 Discovery

Irvine, California 92618

Tel: (844) 933-3627

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Brian Camire

General Counsel

WM Technology, Inc.

41 Discovery

Irvine, California 92618

Tel: (844) 933-3627

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Dave Peinsipp

Kristin VanderPas

Peter Byrne

Cooley LLP

3 Embarcadero Center, 20th Floor

San Francisco, California 94111

Tel: (415) 693-2000

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. ☒

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in

Rule 12b-2 under the Securities Exchange Act of 1934:

|

Large accelerated filer

|

| |

☐

|

| |

Accelerated filer

|

| |

☒

|

|

Non-accelerated filer

|

| |

☐

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

Emerging growth company

|

| |

☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date

or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

WM Technology, Inc., a Delaware corporation (the “Company”), filed a Registration

Statement on Form S-1 on July 8, 2021, which was declared effective on July 20, 2021, as amended by (i) Post-Effective Amendment No. 1 to Form S-1, which was filed on March 7, 2022, as further amended by (ii) Post-Effective Amendment No. 2 to

Form S-1, which was filed on March 11, 2022, and subsequently declared effective by the Securities and Exchange Commission (the “SEC”) on March 15, 2022 (as amended and supplemented, the “Form S-1 Registration Statement”). On October 5, 2022,

the Company filed Post-Effective Amendment No. 3 to the Form S-1 Registration Statement on Form S-3 to convert the Form S-1 Registration Statement into a registration statement on Form S-3, which was subsequently declared effective by the SEC

on October 19, 2022 (the “Form S-3 Registration Statement”).

Post-Effective Amendment No. 4 to the Form S-3 Registration Statement on Form S-1

was filed by the Company on July 29, 2024 to convert the Form S-3 Registration Statement into a registration statement on Form S-1 (“Post-Effective Amendment No. 4”). This Post-Effective Amendment No. 5 (“Post-Effective Amendment No. 5”) is

being filed to include our unaudited condensed consolidated financial statements as of and for the three and six months ended June 30, 2024.

The information included in this filing amends the Form S-3 Registration

Statement and the prospectus contained therein. No additional securities are being registered under this Post-Effective Amendment No. 5. All applicable registration fees were paid at the time of the original filing of the Form S-1

Registration Statement.

On May 24, 2024, the Company filed its Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, as amended on August 30, 2024 (the “Annual Report on Form 10-K”) and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 (the “Q1 Quarterly Report on Form 10-Q”), and on August 8, 2024, the

Company filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (the “Q2 Quarterly Report on Form 10-Q” and together with the Q1 Quarterly Report on Form 10-Q, the “Quarterly Reports on Form 10-Q”). Interested parties

should refer to such Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q for more information.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling

securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

| |

SUBJECT TO COMPLETION — DATED SEPTEMBER 3, 2024

|

Up to 110,898,382 Shares of Class A Common Stock

and

Up to 105,014,011 Shares of Class A Common Stock

Up to 7,000,000 Warrants

Offered by the Selling Securityholders

This prospectus relates to the issuance by us of an aggregate of up to 110,898,382

shares of our Class A Common Stock, $0.0001 par value per share (“Class A Common Stock”), consisting of (i) 7,000,000 shares of Class A Common Stock issuable upon exercise of warrants originally issued in a private placement (the “Private

Placement Warrants”) in connection with the initial public offering of Silver Spike Acquisition Corp. (“Silver Spike”) by the holders thereof, (ii) 12,499,993 shares of Class A Common Stock issuable upon exercise of the public warrants

originally issued in the initial public offering of Silver Spike (the “Public Warrants” and together with the Private Placement Warrants, the “Warrants”) by the holders thereof, (iii) 65,502,347 shares of Class A Common Stock issuable upon

exchange of Class A units representing limited liability company interests of WM Holding Company, LLC (“WMH LLC” and such units, the “Class A Units”) combined with an equivalent number of shares of Class V Common Stock, par value $0.0001 per

share (together with the Class A Units, the “Paired Interests”) and (iv) 25,896,042 shares of Class A Common Stock issuable upon exchange of Class P units representing limited liability company interests WMH LLC (“Class P Units” and together

with the Class A Units, the “Units”). We will receive the proceeds from any exercise of any Warrants for cash.

This prospectus also relates to the offer and sale from time to time by the selling

securityholders named in this prospectus (the “Selling Securityholders”) of up to (a) 105,014,011 shares of Class A Common Stock, consisting of (i) 38,750,000 issued and outstanding shares of Class A Common Stock, (ii) 59,264,011 shares of

Class A Common Stock issuable upon exchange of such Selling Securityholder’s Paired Interests or Class P Units, and (iii) 7,000,000 shares of Class A Common Stock issuable upon exercise of the Private Placement Warrants and (b) 7,000,000

Private Placement Warrants. We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus. However, we will pay the expenses, other than underwriting

discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the

sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that the

Selling Securityholders will offer or sell any of the shares of Class A Common Stock or Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock or Warrants publicly or through

private transactions at prevailing market prices or at negotiated prices. We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus. We provide more

information about how the Selling Securityholders may sell the shares or Warrants in the section entitled “Plan of Distribution.”

Our Class A Common Stock and Public Warrants are listed on The Nasdaq Global

Select Market (“Nasdaq”) under the symbols “MAPS” and “MAPSW,” respectively. On August 29, 2024, the closing price of our Class A Common Stock was $0.9889 and the closing price for our Public Warrants was $0.037.

See the section entitled “Risk Factors” beginning on page 5 of

this prospectus to read about certain risks and uncertainties you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 3, 2024.

TABLE OF CONTENTS

|

|

| |

Page

|

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

You should rely only on the information provided in this

prospectus and any applicable prospectus supplement. Neither we nor the Selling Securityholders have authorized anyone to provide you with different information. Neither we nor the Selling Securityholders are making an offer of these securities

in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the

date of this prospectus our business, financial condition, results of operations and prospects may have changed.

i

This prospectus is part of a registration statement that we filed with the SEC using

the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by

such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A Common Stock issuable upon exercise of any Warrants, Paired Interests and

Class P Units. We will not receive any proceeds from the sale of shares of Class A Common Stock issuable upon exercise of the Warrants, or upon exchange of the Paired Interests or the Class P Units pursuant to this prospectus, except with

respect to amounts received by us upon exercise of the Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you

with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither

we nor the Selling Securityholders take responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the

registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement

together with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.”

On June 16, 2021 (the “Closing Date”), Silver Spike, our predecessor company,

consummated the Business Combination, which was previously announced, pursuant to that certain Agreement and Plan of Merger, dated December 10, 2020 (the “Merger Agreement”), by and among Silver Spike, Silver Spike Merger Sub LLC, a Delaware

limited liability company and a wholly owned direct subsidiary of Silver Spike (“Merger Sub”), WM Holding Company, LLC, a Delaware limited liability company (when referred to in its pre-Business Combination (as defined below) capacity, “Legacy

WMH”), and Ghost Media Group, LLC, a Nevada limited liability company, solely in its capacity as the initial holder representative (the “Holder Representative”). Pursuant to the Merger Agreement, Merger Sub merged with and into WMH, whereupon

the separate limited liability company existence of Merger Sub ceased and WMH became the surviving company and continued in existence as a subsidiary of Silver Spike (the transactions contemplated by the Merger Agreement, the “Business

Combination”). On the Closing Date, and in connection with the closing of the Business Combination (the “Closing”), Silver Spike changed its name to WM Technology, Inc.

Unless the context indicates otherwise, references in this prospectus to the

“Company,” “WMH,” “we,” “us,” “our” and similar terms refer to WM Technology, Inc. (f/k/a Silver Spike Acquisition Corp.) and its consolidated subsidiaries (including Legacy WMH). References to “Silver Spike” refer to our predecessor company

prior to the consummation of the Business Combination.

ii

This prospectus contains forward-looking statements within the meaning of

Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act.”). We have based these forward-looking statements on our current expectations and projections about future events. All

statements, other than statements of present or historical fact included in this prospectus, our future financial performance, strategy, expansion plans, future operations, future operating results, estimated revenues, losses, projected costs,

prospects, plans and objectives of management are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are

forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our

actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Except as otherwise

required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus. We caution

you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

Forward-looking statements in this prospectus may include, for example, statements

about:

|

•

|

our financial and business performance, including key business metrics and any underlying assumptions thereunder;

|

|

•

|

our market opportunity and our ability to acquire new clients and retain existing clients;

|

|

•

|

our expectations and timing related to commercial product launches;

|

|

•

|

the success of our go-to-market strategy;

|

|

•

|

our ability to scale our business and expand our offerings;

|

|

•

|

our competitive advantages and growth strategies;

|

|

•

|

our future capital requirements and sources and uses of cash;

|

|

•

|

our ability to obtain funding for our future operations;

|

|

•

|

the impact of material weaknesses in our internal controls and our ability to remediate any such material weakness on the

timing we anticipate, or at all;

|

|

•

|

the impact of the restatement on our reputation and investor confidence in us and the increased possibility of legal

proceedings and regulatory inquiries;

|

|

•

|

the outcome of any known and unknown litigation and regulatory proceedings;

|

|

•

|

changes in domestic and foreign business, market, financial, political and legal conditions;

|

|

•

|

the effect of macroeconomic conditions, including but not limited to inflation, uncertain credit and global financial

markets, recent and potential future disruptions in access to bank deposits or lending commitments due to bank failures; recent and potential future geopolitical events, including the military conflicts between Russia and Ukraine and

Israel and Hamas; and the occurrence of a catastrophic event, including but not limited to severe weather, war, or terrorist attack;

|

|

•

|

future global, regional or local economic and market conditions affecting the cannabis industry;

|

|

•

|

the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis

industry;

|

|

•

|

our ability to successfully capitalize on new and existing cannabis markets, including our ability to successfully monetize

our solutions in those markets;

|

|

•

|

our ability to manage future growth;

|

|

•

|

our ability to effectively anticipate and address changes in the end-user market in the cannabis industry;

|

iii

|

•

|

our ability to develop new products and solutions, bring them to market in a timely manner and make enhancements to our

platform and our ability to maintain and grow our two-sided marketplace, including our ability to acquire and retain paying clients;

|

|

•

|

the effects of competition on our future business;

|

|

•

|

our success in retaining or recruiting, or changes required in, officers, key employees or directors;

|

|

•

|

cyber-attacks and security vulnerabilities; and

|

|

•

|

the possibility that we may be adversely affected by other economic, business or competitive factors.

|

Given these risks and uncertainties, you should not place undue reliance on these

forward-looking statements. Additional cautionary statements or discussions of risks and uncertainties that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in any

accompanying prospectus supplement.

Should one or more of the risks or uncertainties described in this prospectus

actually occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact

the operations and projections discussed herein can be found in the section entitled “Risk Factors” and in our periodic filings with the SEC. Our SEC filings are available publicly on the SEC’s website at www.sec.gov.

You should read this prospectus and any accompanying prospectus supplement

completely and with the understanding that our actual future results, levels of activity and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements

by these cautionary statements.

iv

This summary highlights selected information appearing in this prospectus. Because

it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set forth in the sections entitled “Risk

Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and the consolidated financial statements and related notes included elsewhere in this prospectus before making an investment

decision.

The Company

Founded in 2008, and headquartered in Irvine, California, WM Technology, Inc.

operates a leading online cannabis marketplace for consumers together with a comprehensive set of eCommerce and compliance software solutions for cannabis businesses, which are sold to both storefront locations and delivery operators

(“retailers”) and brands in the legalized cannabis markets in states and territories of the United States. Our comprehensive business-to-consumer and business-to-business suite of products afford cannabis retailers and brands of all sizes

integrated tools to compliantly run their businesses and to reach, convert, and retain consumers.

WM Technology, Inc. was initially incorporated in the Cayman Islands on June 7,

2019 under the name “Silver Spike Acquisition Corp” (“Silver Spike”). Silver Spike was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business

combination with one or more businesses. On June 16, 2021 (the “Closing Date”), Silver Spike consummated the business combination (the “Business Combination”), pursuant to that certain Agreement and Plan of Merger, dated December 10, 2020, by

and among Silver Spike, Silver Spike Merger Sub LLC, a Delaware limited liability company and a wholly owned direct subsidiary of Silver Spike Acquisition Corp., WM Holding Company, LLC, a Delaware limited liability company (when referred to

in its pre-Business Combination capacity, “Legacy WMH” and following the Business Combination, “WMH LLC”), and Ghost Media Group, LLC, a Nevada limited liability company. On the Closing Date, and in connection with the closing of the Business

Combination, Silver Spike was domesticated and continues as a Delaware corporation, and changed its name to WM Technology, Inc.

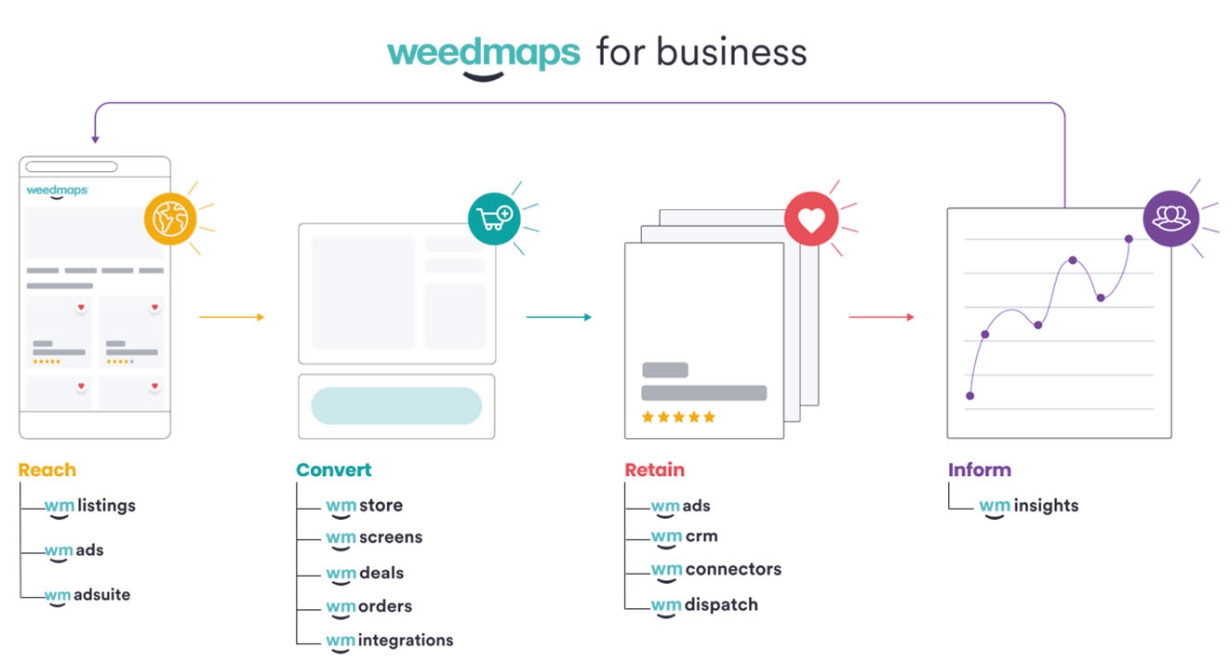

Our business primarily consists of our commerce-driven marketplace (“Weedmaps”),

and our fully integrated suite of end-to-end Software-as-a-Service (“SaaS”) solutions software offering (“Weedmaps for Business”). The Weedmaps marketplace provides cannabis consumers with information regarding cannabis retailers and brands.

In addition, the Weedmaps marketplace aggregates data from a variety of sources, including retailer point-of-sale (“POS”) solutions, to provide consumers with the ability to browse by strain, price, cannabinoids and other information

regarding locally available cannabis products, through our website and mobile apps. The marketplace provides consumers with product discovery, access to deals and discounts, and reservation of products for pickup by consumers or delivery to

consumers by participating retailers (retailers complete orders and process payments outside of the Weedmaps marketplace as Weedmaps serves only as a portal, passing a consumer’s inquiry to the dispensary). The marketplace also provides

education and learning information to help newer consumers learn about the types of products to purchase. We believe the size, loyalty and engagement of our user base and the frequency of consumption of cannabis by our user base makes the

Weedmaps marketplace highly valuable to our clients.

Risks Associated with Our Business

Our ability to implement our business strategy is subject to numerous risks that

you should be aware of before making an investment decision. These risks are described more fully in the section entitled “Risk Factors,” immediately following this prospectus summary. These risks include the following, among others:

|

•

|

As our costs increase, we may not be able to generate sufficient revenue to achieve profitability in the future.

|

|

•

|

If we fail to retain our existing clients and consumers or to acquire new clients and consumers in a cost-effective manner,

our revenue may decrease and our business may be harmed.

|

|

•

|

We may fail to offer the optimal pricing of our products and solutions.

|

|

•

|

If we fail to expand effectively into new markets, our revenue and business will be adversely affected.

|

|

•

|

Competition from the illicit cannabis market could impact our ability to succeed.

|

1

|

•

|

Our business is concentrated in California, and, as a result, our performance may be affected by factors unique to the

California market.

|

|

•

|

Federal law enforcement may deem our clients to be in violation of U.S. federal law, and, in particular the Controlled

Substances Act (“CSA”). A change in U.S. federal policy on cannabis enforcement and strict enforcement of federal cannabis laws against our clients would undermine our business model and materially affect our business and operations.

|

|

•

|

Some of our clients or their listings currently and in the future may not be in compliance with licensing and related

requirements under applicable laws and regulations. Allowing unlicensed or noncompliant businesses to access our products, or allowing businesses to use our solutions in a noncompliant manner, may subject us to legal or regulatory

enforcement and negative publicity, which could adversely impact our business, operating results, financial condition, brand and reputation. In addition, allowing businesses that engage in false or deceptive advertising practices to

use our solutions may subject us to negative publicity, which could have similar adverse impacts on us.

|

|

•

|

We generally do not, and cannot, ensure that our clients will conduct their business activities in a manner compliant with

such regulations and requirements, despite providing features to help support our clients’ compliance with the complex, disparate and constantly evolving regulations and other legal requirements applicable to the cannabis industry. As

a result, federal, state, provincial or local government authorities may seek to bring criminal, administrative or regulatory enforcement actions against our clients, which could have a material adverse effect on our business,

operating results or financial conditions, or could force us to cease operations.

|

|

•

|

Our business is dependent on U.S. state laws and regulations.

|

|

•

|

The rapid changes in the cannabis industry and applicable laws and regulations make predicting and evaluating our future

prospects difficult, and may increase the risk that we will not be successful.

|

|

•

|

Because our business is dependent, in part, upon continued market acceptance of cannabis by consumers, any negative trends

could adversely affect our business operations.

|

|

•

|

Expansion of our business is dependent on the continued legalization of cannabis.

|

|

•

|

Our clients face challenges unique to the cannabis industry that can impact their financial health and long-term viability.

If our clients struggle financially or do not remain viable, it can negatively impact our ability to generate new revenue, maintain existing revenue or collect on outstanding receivables.

|

|

•

|

If clients and consumers using our platform fail to provide high-quality content that attracts consumers, we may not be

able to generate sufficient consumer traffic to remain competitive.

|

|

•

|

Our business is highly dependent upon our brand recognition and reputation, and the erosion or degradation of our brand

recognition or reputation would likely adversely affect our business and operating results.

|

|

•

|

We currently face intense competition in the cannabis information market, and we expect competition to further intensify as

the cannabis industry continues to evolve.

|

|

•

|

If we fail to manage our employee operations and organization effectively, our brand, business and operating results could

be harmed.

|

|

•

|

If we are unable to recruit, train, retain and motivate key personnel, we may not achieve our business objectives.

|

|

•

|

We rely on search engine placement, syndicated content, paid digital advertising and social media marketing to attract a

meaningful portion of our clients and consumers. If we are not able to generate traffic to our website through search engines and paid digital advertising, or increase the profile of our company brand through social media engagement,

our ability to attract new clients may be impaired.

|

|

•

|

If our current marketing model is not effective in attracting new clients, we may need to employ higher-cost sales and

marketing methods to attract and retain clients, which could adversely affect our profitability.

|

2

|

•

|

If the Google Play Store or Apple iTunes App Store limit the functionality or availability of our mobile application

platform, including as a result of changes or violations of terms and conditions, access to and utilization of our platform may suffer.

|

|

•

|

We may be unable to scale and adapt our existing technology and network infrastructure in a timely or effective manner to

ensure that our platform is accessible, which would harm our reputation, business and operating results.

|

|

•

|

Our payment system and the payment systems of our clients depend on third-party providers and are subject to evolving laws

and regulations.

|

|

•

|

We are dependent on our banking relations, and we may have difficulty accessing or consistently maintaining banking or

other financial services due to our connection with the cannabis industry.

|

|

•

|

We track certain performance metrics with internal tools and do not independently verify such metrics. Certain of our

performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

|

|

•

|

Our ability to successfully drive engagement on our platform, as well as changes to our user engagement and advertising

strategy and practices, pose risks to our business.

|

|

•

|

Any security incident, including a distributed denial of service attack, ransomware attack, security breach or unauthorized

data access could impair or incapacitate our information technology systems and delay or interrupt service to our clients and consumers, harm our reputation, or subject us to significant liability.

|

|

•

|

Governmental regulation of the internet continues to develop, and unfavorable changes could substantially harm our business

and operating results.

|

|

•

|

We have identified material weaknesses in our internal control over financial reporting as of December 31, 2023. If we are

unable to remediate these material weaknesses or to develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may

adversely affect investor confidence in us and materially and adversely affect our business and operating results.

|

|

•

|

The restatement of our prior quarterly financial statements may affect investor confidence and raise reputational issues

and may subject us to additional risks and uncertainties, including increased professional costs and the increased possibility of legal proceedings and regulatory inquiries.

|

|

•

|

The trading price of our Class A Common Stock and certain of our Public Warrants have been, and may continue to be,

volatile, and the value of our Class A Common Stock and such Warrants may decline.

|

Corporate Information

Silver Spike, which was incorporated on June 7, 2019 as a Cayman Islands exempted

company and formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. Silver Spike completed its initial public

offering in August 2019. In June 2021, Merger Sub merged with and into Legacy WMH, whereupon the separate limited liability company existence of Merger Sub ceased and Legacy WMH became the surviving company and continued in existence as a

subsidiary of Silver Spike. Prior to the Closing Date, Silver Spike changed its jurisdiction of incorporation from the Cayman Islands to the State of Delaware by deregistering as an exempted company in the Cayman Islands and domesticating and

continuing as a corporation formed under the laws of the State of Delaware (the “Domestication”). On the Closing Date, and in connection with the Closing, Silver Spike changed its name to WM Technology.

The mailing address of our principal executive office is 41 Discovery, Irvine,

California 92618. Our telephone number is (844) 933-3627.

3

Issuer

WM Technology, Inc. (f/k/a Silver Spike Acquisition Corp.).

Issuance of Class A Common Stock

Shares of Class A Common Stock Offered by us

Up to 110,898,382 shares of our Class A Common Stock consisting of (i)

7,000,000 shares of Class A Common Stock issuable upon exercise of the Private Placement Warrants by the holders thereof, (ii) 12,499,993 shares of Class A Common Stock issuable upon exercise of the Public Warrants by the holders thereof,

(iii) 65,502,347 shares of Class A Common Stock issuable upon exchange of Paired Interests and (iv) 25,896,042 shares of Class A Common Stock issuable upon exchange of Class P Units.

Shares of Class A Common Stock

Outstanding Prior to Exercise of All Warrants and Exchange of Paired Interests and Class P Units

97,376,026 shares (as of August 26, 2024).

Shares of Class A Common Stock

Outstanding Assuming Exercise of All Warrants and Exchange of Paired Interests and Class P Units

187,041,867 shares (based on total shares outstanding as of August 26,

2024).

Exercise Price of Warrants

$11.50 per share, subject to adjustment as described herein.

Use of Proceeds

We will receive up to an aggregate of approximately $224.3 million from the

exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. See the section entitled “Use of Proceeds.”

Resale of Class A Common Stock

and Warrants Shares of Class A Common Stock Offered by the Selling Securityholders

Up to (i) 105,014,011 shares of Class A Common Stock, consisting of (i)

38,750,000 issued and outstanding shares of Class A Common Stock, (ii) 59,264,011 shares of Class A Common Stock issuable upon exchange of such Selling Securityholder’s Paired Interests or Class P Units and (iii) 7,000,000 shares of Class A

Common Stock issuable upon exercise of the Private Placement Warrants.

Warrants Offered by the Selling Securityholders

7,000,000 Private Placement Warrants.

Redemption

The Warrants are redeemable in certain circumstances. See the section entitled

“Description of Securities—Warrants” for further discussion.

Market for Class A Common Stock and Warrants

Our Class A Common Stock and Public Warrants are currently traded on Nasdaq

under the symbols “MAPS” and “MAPSW,” respectively.

Risk Factors

See the section entitled “Risk Factors” and other information included in this

prospectus, and under similar headings in any amendments or supplements to this prospectus, for a discussion of factors you should consider before investing in our securities.

4

Investing in our securities involves risks. Before you make a decision to buy our

securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may

materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties

described in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and

adversely affect our business.

Risks Related to our Business and Industry

As our costs increase, we may not be able to

generate sufficient revenue to achieve profitability in the future.

Our revenue declined in 2023 compared with 2022 and remained relatively flat when

compared with 2021. Our revenue may continue to decline due to a number of factors including, but not limited to, slowdowns in the pace of issuance of new licenses to cannabis retailers and brands, and the decline in the number of new major

geographic markets in which the sale of cannabis is permitted and to which we have not already expanded. Accordingly, we may not be able to generate sufficient revenue to offset potential cost increases and our ability to achieve and sustain

profitability may be impacted. Additionally, we expect our costs to increase in future periods as we expend substantial financial and other resources on, among other things:

|

•

|

sales and marketing, including continued investment in our current marketing efforts and future marketing initiatives;

|

|

•

|

hiring of additional employees, including in our product and engineering teams;

|

|

•

|

expansion domestically and internationally in an effort to increase our consumer and client usage, client base and our sales

to our clients;

|

|

•

|

development of new products, and increased investment in the ongoing development of our existing products;

|

|

•

|

integrating any acquired companies into our operations; and

|

|

•

|

general administration, including continued compliance with various regulations applicable to public companies and cannabis

industry businesses and other work arising from the growth and maturity of our company.

|

These expenditures may not result in additional revenue or the growth of our

business. If we fail to continue to grow revenue or to achieve profitability, the market price of our securities could decline, and our business, operating results and financial condition could be adversely affected.

If we fail to retain our existing clients

and consumers or to acquire new clients and consumers in a cost-effective manner, our revenue may decrease and our business may be harmed.

We compete in a dynamic, innovative market, which we expect will continue to evolve

rapidly. We believe that our success is dependent on our ability to continue identifying and anticipating the needs of our clients and consumers and growing our two-sided marketplace by retaining our existing clients and consumers and adding

new clients and consumers. This two-sided marketplace may grow more slowly than we expect or than it has grown in the past. As we have become larger through organic growth, the number of paying clients and monthly revenue per client have at

times slowed or declined and may similarly slow or decline in the future, even if we continue to add clients and consumers on an absolute basis. Although we expect that our growth rates will continue to slow during certain periods as our

business increases in size, if we fail to retain either our existing clients or consumers, the value of our two-sided marketplace will be diminished.

In addition, the costs associated with client and consumer retention are

substantially lower than costs associated with the acquisition of new clients or consumers. We have incurred significant costs to attract clients and consumers to our platform and expect to incur significant additional costs to attract and

retain clients and consumers for the foreseeable future. Because expenditures on our platform can represent a significant financial investment for our clients, our ability to retain clients depends in part on our ability to create and maintain

high levels of client and

5

consumer satisfaction, which we may not always be capable of providing, including

for reasons outside of our control. Additionally, in order to retain our clients, we may be required to identify ways to help our clients convert consumers more effectively. Our clients generally do not have long-term obligations to purchase

our products and solutions and generally may cancel their use of our products and solutions at any time without penalty. Thus, any decrease in client satisfaction or other change negatively affecting our ability to retain existing clients or

consumers, even if such losses are offset by an increase in revenue resulting from the acquisition of new clients or consumers, could have rapid, concentrated and adverse effect on our business and operating results.

We may fail to offer the optimal pricing of our

products and solutions.

We have limited experience in determining the optimal pricing of our products and

solutions, and we have in the past changed and may in the future change our pricing model. We also have historically priced our add-on premium offerings in a bid-auction format. Our ability to continue growing depends on our ability to maintain

and expand our client base. If our clients do not believe the incremental additional cost we are charging for Weedmaps for Business is justified by the additional components included in our software bundles or that our add-on offerings do not

generate proper return on investment, such clients may decline to continue using our services, and our revenue and other financial results may be adversely impacted.

If we fail to expand effectively into new

markets, our revenue and business will be adversely affected.

While a key part of our business strategy is to add clients and consumers in our

existing geographic markets, we also intend to expand our operations into new markets if and as cannabis continues to be legalized. Any such expansion places us in competitive markets with which we may be unfamiliar, requires us to invest

significant time and resources, including to analyze the potential applicability of new and complicated regulations regarding the usage, sale and marketing of cannabis in such markets, and involves various risks, including the possibility that

returns on such investments will not be achieved for several years, if at all. As a result of new market expansions, we may incur losses or otherwise fail to enter new markets successfully. In attempting to establish a presence in new markets,

we expect to incur significant expenses and face various other challenges, such as expanding our compliance efforts to cover those new markets. These efforts may prove more expensive than we currently anticipate, and we may not succeed in

increasing our revenues sufficiently to offset these expenses. Our current and any future expansion plans will require significant resources and management attention.

Competition from the illicit cannabis market

could impact our ability to succeed.

Our clients face competition from illegal market operators that are unlicensed and

unregulated including illegal dispensaries and illicit market suppliers selling cannabis and cannabis-based products, particularly in states like California. Because these illegal market participants do not comply with the regulations governing

the cannabis industry, their operations may have significantly lower costs. The perpetuation of the illegal market for cannabis may have a material adverse effect on our clients and our business, results of operations, as well as the perception

of cannabis use. Furthermore, given the restrictions on regulated cannabis retail, it is possible that legal cannabis consumers revert to the illicit market as a matter of convenience. In particular, we rely on licensed cannabis businesses to

drive the growth of our revenue and the use of our products, and the failure of the licensed cannabis markets to sufficiently overtake or eliminate the illegal market may have an adverse effect on our ability to grow our revenue, particularly

if the slow pace of licensing allows the illegal market to gain a foothold, which may be more likely to occur in jurisdictions with an extended period of time between the authorization of consumer possession and the time at which licensed

retailers become operational. In such jurisdictions, the timeline for licensed cannabis businesses overtaking the illegal market may be extended.

Our business is concentrated in California,

and, as a result, our performance may be affected by factors unique to the California market.

California represents one of the largest state legal cannabis markets in the United

States, and approximately 52%, 56% and 61% of our revenue for the years ended December 31, 2023, 2022 and 2021, were generated in California. As new markets develop and our current markets expand, we anticipate that there will be a further

reduction in the percentage of our revenue generated in California, but we do not know with any certainty when and to what degree, if ever, this would occur. Moreover, the cannabis market in California is rapidly evolving, and we expect our

growth in California to continue as the cannabis industry continues to develop, which could further concentrate our client base. As a result, our business and results of operations are particularly susceptible to, and may be disproportionately

impacted by, trends in the California cannabis market, as well as adverse economic, regulatory, political and other conditions in California.

6

Litigation or legal proceedings could

expose us to significant liabilities and have a negative impact on our reputation or business.

From time to time, we may be party to various claims and legal proceedings. For

example, in August 2022, our board of directors determined to voluntarily report an internal complaint and subsequent internal investigation to the SEC. Since that date, we have responded to subpoenas from the SEC’s Division of Enforcement

and on July 22, 2024, we reached an agreement in principle with the SEC staff to resolve the SEC staff’s investigation with respect to the Company, which remains subject to approval by the SEC. Regardless of the outcome, such proceedings can

have an adverse impact on us because of legal costs, penalties and other sanctions, diversion of management resources, negative publicity and reputational harm and other factors. See the section titled “Business—Legal Proceedings” for more

information.

Even when not merited, the defense of any lawsuits or legal proceedings, including

potential securities litigation, is expensive and may divert management’s attention, and we may incur significant expenses in defending any lawsuits or legal proceedings. The results of litigation and other legal proceedings are inherently

uncertain, and adverse judgments or settlements in some of these legal disputes may result in adverse monetary damages, penalties or injunctive relief against us, which could negatively impact our financial position, cash flows or results of

operations. We evaluate all claims and proceedings to assess the likelihood of unfavorable outcomes and to estimate, if probable and estimable, the amount of potential losses. Based on these assessments and estimates, we may establish reserves,

as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from our assessments and

estimates.

Furthermore, while we maintain insurance for certain potential liabilities, such

insurance does not cover all types and amounts of potential liabilities and is subject to various exclusions as well as caps on amounts recoverable. Even if we believe a claim is covered by insurance, insurers may dispute our entitlement to

recovery for a variety of potential reasons, which may affect the timing and, if the insurers prevail, the amount of our recovery. In addition, any claims or litigation, even if fully indemnified or insured, could damage our reputation and make

it more difficult to compete effectively or to obtain adequate insurance in the future.

Federal law enforcement may deem our clients

to be in violation of U.S. federal law, and, in particular the Controlled Substances Act (“CSA”). A change in U.S. federal policy on cannabis enforcement and strict enforcement of federal cannabis laws against our clients would undermine our

business model and materially affect our business and operations.

U.S. federal law, and more specifically the CSA, proscribes the cultivation,

processing, distribution, sale, advertisement and possession of cannabis. As a result, U.S. federal law enforcement authorities, in their attempt to regulate the illegal or unauthorized production, distribution, promotion, sale, possession, or

use of cannabis, may seek to bring criminal actions against our clients under the CSA. On August 4, 2021, the U.S. Attorney’s Office for the Eastern District of California withdrew a subpoena served on us in September 2019, and informed us that

it had no present plan to exercise its discretion to proceed further in the matter. The U.S. Attorney’s Office for the Eastern District of California also stated that its decision was not a grant of immunity, however, and there can be no

assurance that the U.S. Attorney’s Office for the Eastern District of California — either the U.S. Attorney’s Office for the Eastern District of California or another Department of Justice (“DOJ”) entity — will not initiate another

investigation in the future. If our clients are found to be violating U.S. federal law relating to cannabis, they may be subject not only to criminal charges and convictions, but also to forfeiture of property, significant fines and penalties,

disgorgement of profits, administrative sanctions, cessation of business activities, or civil liabilities arising from proceedings initiated by either the U.S. government or private citizens. Any of these actions or consequences on our clients

could have a material adverse effect on our business, operating results or financial condition, or could force us to cease operations, and as a result, our investors could lose their entire investment.

Further, to the extent any law enforcement actions require us to respond to

subpoenas, or undergo search warrants, for client records, cannabis businesses could elect to cease using our products. Until the U.S. federal government changes the laws with respect to cannabis, and particularly if the U.S. Congress does not

extend the Omnibus Spending Bill’s protection of state medical cannabis programs, described below, to apply to all state cannabis programs, U.S. federal authorities could more strictly enforce current federal prohibitions and restrictions. An

increase in federal enforcement against companies licensed under state cannabis laws could negatively impact the state cannabis industries and, in turn, our business, operating results, financial condition, brand and reputation.

7

Some of our clients or their listings

currently and in the future may not be in compliance with licensing and related requirements under applicable laws and regulations. Allowing unlicensed or noncompliant businesses to access our products, or allowing businesses to use our

solutions in a noncompliant manner, may subject us to legal or regulatory enforcement and negative publicity, which could adversely impact our business, operating results, financial condition, brand and reputation. In addition, allowing

businesses that engage in false or deceptive advertising practices to use our solutions may subject us to negative publicity, which could have similar adverse impacts on us.

Our clients are contractually required to represent, warrant and covenant to us that

they conduct their business in compliance with applicable state law, which includes any applicable licensing requirements and the regulatory framework enacted by each state or province in which they do business. Clients further contractually

agree to indemnify us for any damages we may suffer as a result of their noncompliance. We rely on our clients’ contractual representations, and generally do not verify them, other than with respect to the licensing information of our clients

operating cannabis retail businesses, where we currently require such clients to provide evidence of a valid state or provincial cannabis license prior to their initial access and from time to time during the term of their use of such products.

We require all operational cannabis retailer clients, including storefronts and delivery services, to display on their listing a valid, unexpired state-issued license number. We also currently require cannabis brand clients to provide evidence

of a valid state or provincial license in order to get access to our listings and premium placement products. Additionally, many states do not require a license to sell CBD products at retail, and the illicit market could fraudulently attempt

to use our CBD listings product to sell products containing THC. While we periodically audit and respond to reports related to our CBD listings, it is difficult to monitor the individual products listed, and marketing claims contained, in the

listings of our CBD clients. As a result, some of our clients or their listings currently and in the future may not be in compliance with licensing and related requirements under applicable state or provincial laws and regulations. There could

be legal enforcement actions against unlicensed or insufficiently licensed entities selling cannabis or CBD, which could negatively impact us.

Any legal or regulatory enforcement against us based on the business solutions that

we offer, the third-party content available on our platform or noncompliance by our clients with licensing and other legal requirements, could subject us to various risks, including monetary penalties and the risk that we elect or are compelled

to remove content from our platform and would likely cause us to experience negative publicity. Any of these developments could materially and adversely impact our business, operating results, financial condition, brand and reputation.

We generally do not, and cannot, ensure that

our clients will conduct their business activities in a manner compliant with such regulations and requirements, despite providing features to help support our clients’ compliance with the complex, disparate and constantly evolving regulations

and other legal requirements applicable to the cannabis industry. As a result, federal, state, provincial or local government authorities may seek to bring criminal, administrative or regulatory enforcement actions against our clients, which

could have a material adverse effect on our business, operating results or financial conditions, or could force us to cease operations.

We generally do not, and cannot, ensure that our clients will conduct their business

activities in a manner compliant with certain regulations and other legal requirements applicable to the cannabis industry, in whole or in part, even if our solutions provide features to support our clients’ compliance with such regulations and

requirements. Their legal noncompliance could result in regulatory and even criminal actions against them, which could have a material adverse impact on our business and operating results or financial condition. For additional information, see

the other risk factors in this section entitled “Risk Factors—Risks Related to our Business and Industry,” including “Some of our clients or their listings currently and in the future may not be in compliance with licensing and related

requirements under applicable laws and regulations. Allowing unlicensed or noncompliant businesses to access our products, or allowing businesses to use our solutions in a noncompliant manner, may subject us to legal or regulatory enforcement

and negative publicity, which could adversely impact our business, operating results, financial condition, brand and reputation. In addition, allowing businesses who engage in false or deceptive advertising practices to use our solutions may

subject us to negative publicity, which could have similar adverse impacts on us.”

Our business is dependent on U.S. state laws

and regulations.

Although cannabis is a restricted controlled substance under the federal CSA, U.S.

states have legalized cannabis to varying degrees through state-specific regulatory frameworks.

Laws and regulations affecting the cannabis industry in states and territories of

the United States are continually changing. Any change or even the speed of changes could require us to incur substantial costs associated with

8

compliance or alter our business plan, and could detrimentally affect our

operations, revenue and profitability. Similarly, if the pace of issuance of new cannabis licenses is slower than expected, our ability to acquire new clients and grow our revenue could be harmed. The commercial cannabis industry is still a

young industry, and we cannot predict the impact of the compliance regime to which it may be subject. We will incur ongoing costs and obligations related to regulatory compliance, and such costs may prove to be material. Failure to comply with

regulations may result in additional costs for corrective measures, penalties or restrictions on our operations. In addition, changes in regulations, more vigorous enforcement thereof, or other unanticipated events could require extensive

changes to our operations or increased compliance costs or give rise to material liabilities, which could have a material adverse effect on us.

Given the concentration of our revenue from the sale of listing products, any

increase in the stringency of any applicable laws, including U.S. state, or Canadian federal laws and regulations relating to cannabis, or any escalation in the enforcement of such existing laws and regulations against the current or putative

cannabis industry within any jurisdiction, could negatively impact the profitability or viability of cannabis businesses in such affected jurisdictions, which in turn could materially adversely affect our business and operating results.

In addition, although we have not yet been required to obtain any cannabis license

as a result of existing cannabis regulations, it is possible that cannabis regulations may be enacted in the future that will require us to obtain such a cannabis license or otherwise seek to substantially regulate our business. Additionally,

in some jurisdictions we may be required to seek and obtain a blanket approval of our platform in order to enable potential clients to access our services, and such approval may be subject to significant regulatory discretion. U.S. state, or

Canadian federal and other non-U.S. jurisdictions’ cannabis laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter our business

plan. Our failure to adequately manage the risk associated with future regulations and adequately manage future compliance requirements may adversely affect our business, our status as a reporting company and our public listing. Further, any

adverse pronouncements from political leaders or regulators about businesses related to the legal cannabis industry could adversely affect the price of our securities.

The rapid changes in the cannabis industry

and applicable laws and regulations make predicting and evaluating our future prospects difficult, and may increase the risk that we will not be successful.

The cannabis industry, and the complex regulatory regime applicable to it, is

evolving rapidly and may develop in ways that we cannot anticipate. The pace of dramatic change in the cannabis industry makes it difficult to assess our future prospects, and you should evaluate our business in light of the risks and

difficulties we may encounter as the industry continues to evolve. These risks and difficulties include:

|

•

|

managing complex, disparate and rapidly evolving regulatory regimes imposed by U.S. federal, state and local and other

non-U.S. governments around the world applicable to cannabis and cannabis-related businesses;

|

|

•

|

adapting to rapidly evolving trends in the cannabis industry and the way consumers and cannabis industry businesses interact

with technology;

|

|

•

|

maintaining and increasing our base of clients and consumers;

|

|

•

|

continuing to preserve and build our brand while upgrading our existing offerings;

|

|

•

|

successfully attracting, hiring and retaining qualified personnel to manage operations;

|

|

•

|

adapting to changes in the cannabis industry if sales of cannabis expand significantly beyond a regulated model;

|

|

•

|

commodification of the cannabis industry;

|

|

•

|

successfully implementing and executing our business and marketing strategies; and

|

|

•

|

successfully expanding our business into new and existing cannabis markets.

|

If the demand for our platform and software solutions does not develop as we expect,

or if we fail to address the needs of our clients or consumers, our business will be harmed. We may not be able to successfully address these risks and difficulties, which could harm our business and operating results.

9

Because our business is dependent, in

part, upon continued market acceptance of cannabis by consumers, any negative trends could adversely affect our business operations.

We are dependent on public support, continued market acceptance and the

proliferation of consumers in the legalized cannabis markets in states and territories of the United States. While we believe that the market and opportunities in the space will continue to grow, we cannot predict the future growth rate or size

of the market. Any downturns in, or negative outlooks on, the cannabis industry may adversely affect our business and financial condition.

Expansion of our business is dependent on the

continued legalization of cannabis.

Expansion of our business is in part dependent upon continued legislative

authorization, including by voter initiatives and referendums, of cannabis in various jurisdictions worldwide. Any number of factors could slow, halt, or even reverse progress in this area. For example, in 2023, ballot measures to allow for

adult use succeeded in Ohio, but failed in Oklahoma. In addition, implementation of state laws is often a multi-year process following a ballot initiative or legislation. Further, progress for the industry, while encouraging, is not assured.

While there may be ample public support for legislative action in a particular jurisdiction, numerous factors could impact the legislative process, including lobbying efforts by opposing stakeholders as well as legislators’ disagreements about

how to legalize cannabis as well as the interpretation, implementation, and enforcement of applicable laws or regulations. Any one of these factors could slow or halt the legalization of cannabis, which would negatively impact our ability to

expand our business.

Additionally, the expansion of our business also depends on jurisdictions in which

cannabis is currently legalized not narrowing, limiting or repealing existing laws legalizing and regulating cannabis, or altering the regulatory landscape in a way that diminishes the viability of cannabis businesses in those jurisdictions.

For example, in April 2019, a lawsuit was filed in the Fresno County Superior Court challenging the California Bureau of Cannabis Control1 regulation that allowed cannabis businesses to deliver products in local jurisdictions which

had prohibited the sale of cannabis. In November 2020, in a mixed result, the Fresno County Superior Court upheld the state regulation that allows licensed cannabis delivery companies to offer services anywhere in the state, while also

affirming that cities and counties can forbid those operations, though enforcement of the bans is also up to the local governments. While a recent amendment (S.B. 1186), which became effective in January 2024, prevents local governments from

banning the delivery of medical cannabis to patients, adult-use cannabis storefront retail and delivery operations may continue to be restricted by some cities and counties. The imposition or potential enforcement of local jurisdiction delivery

bans may negatively impact the viability and attractiveness of our offerings in California going forward. We generated approximately 52%, 56% and 61% of our revenue for the years ended December 31, 2023, 2022 and 2021 in California, and such

developments may in turn have a material adverse effect on our business, operating results and financial condition. For more information, see “—Our business is concentrated in California, and, as a result, our performance may be affected by

factors unique to the California market.” Additionally, if such challenges are successful in any other jurisdictions that have legalized or are in the process of legalizing cannabis, our ability to expand our business would be negatively

impacted.

Our clients face challenges unique to the

cannabis industry that can impact their financial health and long-term viability. If our clients struggle financially or do not remain viable, it can negatively impact our ability to generate new revenue, maintain existing revenue or collect on

outstanding receivables.

Our paying clients face challenges including, among other factors, limited access

to capital (relative to other industries) and the impact of Section 280E of the Code (which, as applied to certain cannabis businesses, disallows the deduction of “ordinary and necessary” business expenses, such as below-the-line deductions,

essentially resulting in federal income tax liability calculated based on gross income), limiting cash flow and liquidity of many industry participants. Additionally, the cannabis industry faced price deflation in 2023 and 2022 further

pressuring many of our paying clients. This resulted in financial hardship for certain cannabis companies, including some of our paying clients which caused elevated churn and bad debt expense in 2023 and 2022. If our clients struggle

financially or do not remain viable, it can negatively impact our ability to generate new revenue, maintain existing revenue or collect on outstanding receivables. We have customers with past due balances and our failure to collect a

significant portion of such balances could adversely affect our cash and provision for doubtful accounts. See “Accounts Receivable, Net” of Note 2, “Summary of Significant Accounting Policies” to the audited consolidated financial statements

included in this prospectus for additional information.

|

1

|

In 2021, the Bureau of Cannabis Control merged with two other state agencies regulating

California cannabis to form the Department of Cannabis Control, which presently regulates all California commercial cannabis businesses.

|

10

If clients and consumers using our

platform fail to provide high-quality content that attracts consumers, we may not be able to generate sufficient consumer traffic to remain competitive.

Our success depends on our platform providing consumers with useful information

about our clients and their products, which in turn depends on the content provided by consumers and clients. For example, the platform will not provide useful information about cannabis brands or products if clients or consumers do not

contribute content that is helpful and reliable, or if they remove previously submitted content.

Additionally, if we filter out helpful content or fail to filter out unhelpful

content, clients and consumers alike may stop or reduce their use of our platform and products, which could negatively impact our business. Allegations made against us, whether or not accurate, can materially harm our reputation and operating

results. While we are continually seeking to improve our ability to identify and remove offensive, biased, unreliable, inauthentic, duplicative, fraudulent or otherwise unhelpful content, and have implemented safeguards on the platform to

facilitate those efforts, we cannot guarantee that those efforts or safeguards will be effective or adequate. If our website is not perceived as providing useful, accurate and current information about our clients and their products, consumers

may stop or reduce their use of our platform, which could suppress the demand for our advertising placements and adversely affect our business and operating results.

Our business is highly dependent upon our

brand recognition and reputation, and the erosion or degradation of our brand recognition or reputation would likely adversely affect our business and operating results.

We believe that our business is highly dependent on our brand identity and our

reputation, which is critical to our ability to attract and retain clients and consumers. We also believe that the importance of our brand recognition and reputation will continue to increase as competition in the markets in which we operate

continues to develop. Our success in this area will depend on a wide range of factors, some of which are within our control and some of which are not. The factors affecting our brand recognition and reputation that are within our control

include the following:

|

•

|

the efficacy of our marketing efforts;

|

|

•

|

our ability to maintain a high-quality, innovative and error- and bug-free platform;

|

|

•

|

our ability to maintain high satisfaction among clients and consumers;

|

|

•

|

the quality and perceived value of our platform;

|

|

•

|

successfully implementing and developing new features, including alternative revenue streams;

|

|

•

|

our ability to obtain, maintain and enforce trademarks and other indicia of origin that are valuable to our brand;

|

|

•

|

our ability to successfully differentiate our platform from competitors’ products;

|

|

•

|

our compliance with laws and regulations, including those applicable to any political action committees affiliated with us

and to our registered lobbying activities;

|

|

•

|

our ability to provide client support; and

|

|

•

|

any actual or perceived data breach or data loss, or misuse or perceived misuse of our platform.

|

In addition, our brand recognition and reputation may be affected by factors that are

outside our control, such as:

|

•

|

actions of competitors or other third parties;

|

|

•

|

the quality and timeliness of our clients’ delivery businesses;

|

|

•

|

consumers’ experiences with clients or products identified through our platform;

|

|

•

|

negative publicity regarding our company or operations, as well as with respect to events or activities attributed to us, our

employees, partners, including celebrities who endorse or promote our brand, or others associated with any of these parties;

|

|

•

|

interruptions, delays or attacks on our platform; and

|

|

•

|

litigation or regulatory developments.

|

11

Damage to our reputation and loss of brand equity from one or more of the factors

listed above may reduce demand for our platform and have an adverse effect on our business, operating results and financial condition. Moreover, any attempts to rebuild our reputation and restore the value of our brand may be costly and

time-consuming, and such efforts may not ultimately be successful.

We currently face intense competition in the

cannabis information market, and we expect competition to further intensify as the cannabis industry continues to evolve.

The cannabis information market is rapidly evolving and is currently characterized

by intense competition, due in part to relatively low barriers to entry. We expect competition to further intensify in the future as cannabis continues to be legalized and regulated, new technologies are developed and new participants enter the

cannabis information market. Our direct competitors for individual components or parts of our platform include cannabis-focused, two-sided networks like Leafly (for retailer listing pages) and Dutchie and Jane Technologies (for menu embed and

orders functionality). In addition, our platform also may compete with current or potential products and solutions offered by internet search engines and advertising networks, like Google, general two-sided networks like Yelp, various other