|

Delaware

|

| |

7372

|

| |

98-1605615

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

| |

(Primary Standard Industrial

Classification Code No.)

|

| |

(I.R.S. Employer

Identification No.)

|

|

Large accelerated filer

|

| |

☐

|

| |

Accelerated filer

|

| |

☒

|

|

Non-accelerated filer

|

| |

☐

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

Emerging growth company

|

| |

☐

|

|

PRELIMINARY PROSPECTUS

|

| |

SUBJECT TO COMPLETION — DATED SEPTEMBER 3, 2024

|

|

|

| |

Page

|

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

|

•

|

our financial and business performance, including key business metrics and any underlying assumptions thereunder;

|

|

•

|

our market opportunity and our ability to acquire new clients and retain existing clients;

|

|

•

|

our expectations and timing related to commercial product launches;

|

|

•

|

the success of our go-to-market strategy;

|

|

•

|

our ability to scale our business and expand our offerings;

|

|

•

|

our competitive advantages and growth strategies;

|

|

•

|

our future capital requirements and sources and uses of cash;

|

|

•

|

our ability to obtain funding for our future operations;

|

|

•

|

the impact of material weaknesses in our internal controls and our ability to remediate any such material weakness on the

timing we anticipate, or at all;

|

|

•

|

the impact of the restatement on our reputation and investor confidence in us and the increased possibility of legal

proceedings and regulatory inquiries;

|

|

•

|

the outcome of any known and unknown litigation and regulatory proceedings;

|

|

•

|

changes in domestic and foreign business, market, financial, political and legal conditions;

|

|

•

|

the effect of macroeconomic conditions, including but not limited to inflation, uncertain credit and global financial

markets, recent and potential future disruptions in access to bank deposits or lending commitments due to bank failures; recent and potential future geopolitical events, including the military conflicts between Russia and Ukraine and

Israel and Hamas; and the occurrence of a catastrophic event, including but not limited to severe weather, war, or terrorist attack;

|

|

•

|

future global, regional or local economic and market conditions affecting the cannabis industry;

|

|

•

|

the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis

industry;

|

|

•

|

our ability to successfully capitalize on new and existing cannabis markets, including our ability to successfully monetize

our solutions in those markets;

|

|

•

|

our ability to manage future growth;

|

|

•

|

our ability to effectively anticipate and address changes in the end-user market in the cannabis industry;

|

|

•

|

our ability to develop new products and solutions, bring them to market in a timely manner and make enhancements to our

platform and our ability to maintain and grow our two-sided marketplace, including our ability to acquire and retain paying clients;

|

|

•

|

the effects of competition on our future business;

|

|

•

|

our success in retaining or recruiting, or changes required in, officers, key employees or directors;

|

|

•

|

cyber-attacks and security vulnerabilities; and

|

|

•

|

the possibility that we may be adversely affected by other economic, business or competitive factors.

|

|

•

|

As our costs increase, we may not be able to generate sufficient revenue to achieve profitability in the future.

|

|

•

|

If we fail to retain our existing clients and consumers or to acquire new clients and consumers in a cost-effective manner,

our revenue may decrease and our business may be harmed.

|

|

•

|

We may fail to offer the optimal pricing of our products and solutions.

|

|

•

|

If we fail to expand effectively into new markets, our revenue and business will be adversely affected.

|

|

•

|

Competition from the illicit cannabis market could impact our ability to succeed.

|

|

•

|

Our business is concentrated in California, and, as a result, our performance may be affected by factors unique to the

California market.

|

|

•

|

Federal law enforcement may deem our clients to be in violation of U.S. federal law, and, in particular the Controlled

Substances Act (“CSA”). A change in U.S. federal policy on cannabis enforcement and strict enforcement of federal cannabis laws against our clients would undermine our business model and materially affect our business and operations.

|

|

•

|

Some of our clients or their listings currently and in the future may not be in compliance with licensing and related

requirements under applicable laws and regulations. Allowing unlicensed or noncompliant businesses to access our products, or allowing businesses to use our solutions in a noncompliant manner, may subject us to legal or regulatory

enforcement and negative publicity, which could adversely impact our business, operating results, financial condition, brand and reputation. In addition, allowing businesses that engage in false or deceptive advertising practices to

use our solutions may subject us to negative publicity, which could have similar adverse impacts on us.

|

|

•

|

We generally do not, and cannot, ensure that our clients will conduct their business activities in a manner compliant with

such regulations and requirements, despite providing features to help support our clients’ compliance with the complex, disparate and constantly evolving regulations and other legal requirements applicable to the cannabis industry. As

a result, federal, state, provincial or local government authorities may seek to bring criminal, administrative or regulatory enforcement actions against our clients, which could have a material adverse effect on our business,

operating results or financial conditions, or could force us to cease operations.

|

|

•

|

Our business is dependent on U.S. state laws and regulations.

|

|

•

|

The rapid changes in the cannabis industry and applicable laws and regulations make predicting and evaluating our future

prospects difficult, and may increase the risk that we will not be successful.

|

|

•

|

Because our business is dependent, in part, upon continued market acceptance of cannabis by consumers, any negative trends

could adversely affect our business operations.

|

|

•

|

Expansion of our business is dependent on the continued legalization of cannabis.

|

|

•

|

Our clients face challenges unique to the cannabis industry that can impact their financial health and long-term viability.

If our clients struggle financially or do not remain viable, it can negatively impact our ability to generate new revenue, maintain existing revenue or collect on outstanding receivables.

|

|

•

|

If clients and consumers using our platform fail to provide high-quality content that attracts consumers, we may not be

able to generate sufficient consumer traffic to remain competitive.

|

|

•

|

Our business is highly dependent upon our brand recognition and reputation, and the erosion or degradation of our brand

recognition or reputation would likely adversely affect our business and operating results.

|

|

•

|

We currently face intense competition in the cannabis information market, and we expect competition to further intensify as

the cannabis industry continues to evolve.

|

|

•

|

If we fail to manage our employee operations and organization effectively, our brand, business and operating results could

be harmed.

|

|

•

|

If we are unable to recruit, train, retain and motivate key personnel, we may not achieve our business objectives.

|

|

•

|

We rely on search engine placement, syndicated content, paid digital advertising and social media marketing to attract a

meaningful portion of our clients and consumers. If we are not able to generate traffic to our website through search engines and paid digital advertising, or increase the profile of our company brand through social media engagement,

our ability to attract new clients may be impaired.

|

|

•

|

If our current marketing model is not effective in attracting new clients, we may need to employ higher-cost sales and

marketing methods to attract and retain clients, which could adversely affect our profitability.

|

|

•

|

If the Google Play Store or Apple iTunes App Store limit the functionality or availability of our mobile application

platform, including as a result of changes or violations of terms and conditions, access to and utilization of our platform may suffer.

|

|

•

|

We may be unable to scale and adapt our existing technology and network infrastructure in a timely or effective manner to

ensure that our platform is accessible, which would harm our reputation, business and operating results.

|

|

•

|

Our payment system and the payment systems of our clients depend on third-party providers and are subject to evolving laws

and regulations.

|

|

•

|

We are dependent on our banking relations, and we may have difficulty accessing or consistently maintaining banking or

other financial services due to our connection with the cannabis industry.

|

|

•

|

We track certain performance metrics with internal tools and do not independently verify such metrics. Certain of our

performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

|

|

•

|

Our ability to successfully drive engagement on our platform, as well as changes to our user engagement and advertising

strategy and practices, pose risks to our business.

|

|

•

|

Any security incident, including a distributed denial of service attack, ransomware attack, security breach or unauthorized

data access could impair or incapacitate our information technology systems and delay or interrupt service to our clients and consumers, harm our reputation, or subject us to significant liability.

|

|

•

|

Governmental regulation of the internet continues to develop, and unfavorable changes could substantially harm our business

and operating results.

|

|

•

|

We have identified material weaknesses in our internal control over financial reporting as of December 31, 2023. If we are

unable to remediate these material weaknesses or to develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may

adversely affect investor confidence in us and materially and adversely affect our business and operating results.

|

|

•

|

The restatement of our prior quarterly financial statements may affect investor confidence and raise reputational issues

and may subject us to additional risks and uncertainties, including increased professional costs and the increased possibility of legal proceedings and regulatory inquiries.

|

|

•

|

The trading price of our Class A Common Stock and certain of our Public Warrants have been, and may continue to be,

volatile, and the value of our Class A Common Stock and such Warrants may decline.

|

|

•

|

sales and marketing, including continued investment in our current marketing efforts and future marketing initiatives;

|

|

•

|

hiring of additional employees, including in our product and engineering teams;

|

|

•

|

expansion domestically and internationally in an effort to increase our consumer and client usage, client base and our sales

to our clients;

|

|

•

|

development of new products, and increased investment in the ongoing development of our existing products;

|

|

•

|

integrating any acquired companies into our operations; and

|

|

•

|

general administration, including continued compliance with various regulations applicable to public companies and cannabis

industry businesses and other work arising from the growth and maturity of our company.

|

|

•

|

managing complex, disparate and rapidly evolving regulatory regimes imposed by U.S. federal, state and local and other

non-U.S. governments around the world applicable to cannabis and cannabis-related businesses;

|

|

•

|

adapting to rapidly evolving trends in the cannabis industry and the way consumers and cannabis industry businesses interact

with technology;

|

|

•

|

maintaining and increasing our base of clients and consumers;

|

|

•

|

continuing to preserve and build our brand while upgrading our existing offerings;

|

|

•

|

successfully attracting, hiring and retaining qualified personnel to manage operations;

|

|

•

|

adapting to changes in the cannabis industry if sales of cannabis expand significantly beyond a regulated model;

|

|

•

|

commodification of the cannabis industry;

|

|

•

|

successfully implementing and executing our business and marketing strategies; and

|

|

•

|

successfully expanding our business into new and existing cannabis markets.

|

|

1

|

In 2021, the Bureau of Cannabis Control merged with two other state agencies regulating

California cannabis to form the Department of Cannabis Control, which presently regulates all California commercial cannabis businesses.

|

|

•

|

the efficacy of our marketing efforts;

|

|

•

|

our ability to maintain a high-quality, innovative and error- and bug-free platform;

|

|

•

|

our ability to maintain high satisfaction among clients and consumers;

|

|

•

|

the quality and perceived value of our platform;

|

|

•

|

successfully implementing and developing new features, including alternative revenue streams;

|

|

•

|

our ability to obtain, maintain and enforce trademarks and other indicia of origin that are valuable to our brand;

|

|

•

|

our ability to successfully differentiate our platform from competitors’ products;

|

|

•

|

our compliance with laws and regulations, including those applicable to any political action committees affiliated with us

and to our registered lobbying activities;

|

|

•

|

our ability to provide client support; and

|

|

•

|

any actual or perceived data breach or data loss, or misuse or perceived misuse of our platform.

|

|

•

|

actions of competitors or other third parties;

|

|

•

|

the quality and timeliness of our clients’ delivery businesses;

|

|

•

|

consumers’ experiences with clients or products identified through our platform;

|

|

•

|

negative publicity regarding our company or operations, as well as with respect to events or activities attributed to us, our

employees, partners, including celebrities who endorse or promote our brand, or others associated with any of these parties;

|

|

•

|

interruptions, delays or attacks on our platform; and

|

|

•

|

litigation or regulatory developments.

|

|

•

|

we do not provide a compelling consumer experience to entice consumers to use our products and services, or our consumers

don’t have the ability to maximize the consumer experience;

|

|

•

|

we are unable to convince consumers and clients of the value and usefulness of our platform and services;

|

|

•

|

we are unable to find cost-effective marketing channels or other strategies to drive traffic to our website, including

replacing any pop-under advertisements that we have decreased our usage of or discontinued;

|

|

•

|

our products fail to operate effectively on the iOS or Android mobile operating systems;

|

|

•

|

we are unable to continue to develop products that work with a variety of mobile operating systems, networks and smartphones;

|

|

•

|

we do not provide a compelling consumer experience because of the decisions we make regarding the type and frequency of

advertisements that we display or the structure and design of our products;

|

|

•

|

consumers engage more with competing platforms or products at the expense of ours or those of our clients;

|

|

•

|

if the manner in which we promote engagement or traffic is seen by consumers or clients as unappealing or harm our brand

image or reputation;

|

|

•

|

there are concerns about the privacy implications, safety, or security of our products;

|

|

•

|

our products are subject to increased regulatory scrutiny or approvals, or there are changes in our products that are

mandated or prompted by legislation, regulatory authorities, executive actions, or litigation, including settlements or consent decrees, that adversely affect the consumer experience;

|

|

•

|

technical or other problems frustrate the consumer experience, including by providers that host our platforms, particularly

if those problems prevent us from delivering our product experience in a fast and reliable manner;

|

|

•

|

we, our partners, or other companies in our industry segment are the subject of adverse media reports or other negative

publicity, some of which may be inaccurate or include confidential information that we are unable to correct or retract; or

|

|

•

|

our current or future products reduce consumer activity on our website or our applications by making it easier for our

consumers to interact directly with our clients.

|

|

•

|

our ability to attract new clients and consumers and retain existing clients and consumers;

|

|

•

|

our ability to accurately forecast revenue and appropriately plan our expenses;

|

|

•

|

the effects of changes in search engine placement and prominence;

|

|

•

|

the effects of increased competition on our business;

|

|

•

|

our ability to successfully expand in existing markets and successfully enter new markets;

|

|

•

|

the impact of global, regional or economic conditions;

|

|

•

|

the ability of licensed cannabis markets to successfully grow and out compete illegal cannabis markets;

|

|

•

|

our ability to protect our intellectual property;

|

|

•

|

our ability to maintain and effectively manage an adequate rate of growth;

|

|

•

|

our ability to maintain and increase traffic to our platform;

|

|

•

|

costs associated with defending claims, including intellectual property infringement claims and related judgments or

settlements;

|

|

•

|

changes in governmental or other regulation affecting our business;

|

|

•

|

interruptions in platform availability and any related impact on our business, reputation or brand;

|

|

•

|

the attraction and retention of qualified personnel;

|

|

•

|

the effects of natural or man-made catastrophic events; and

|

|

•

|

the effectiveness of our internal controls, including the material weakness that we have identified.

|

|

•

|

political, social and economic instability;

|

|

•

|

risks related to the legal and regulatory environment in foreign jurisdictions, including with respect to privacy and data

protection, and unexpected changes in laws, regulatory requirements and enforcement;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

higher levels of credit risk and payment fraud;

|

|

•

|

complying with tax requirements of multiple jurisdictions;

|

|

•

|

enhanced difficulties of integrating any foreign acquisitions;

|

|

•

|

the ability to present our content effectively in foreign languages;

|

|

•

|

complying with a variety of foreign laws, including certain employment laws requiring national collective bargaining

agreements that set minimum salaries, benefits, working conditions and termination requirements;

|

|

•

|

reduced protection for intellectual property rights in some countries;

|

|

•

|

difficulties in staffing and managing global operations and the increased travel, infrastructure and compliance costs

associated with multiple foreign locations;

|

|

•

|

regulations that might add difficulties in repatriating cash earned outside the United States and otherwise preventing us

from freely moving cash;

|

|

•

|

import and export restrictions and changes in trade regulation;

|

|

•

|

complying with statutory equity requirements;

|

|

•

|

complying with the U.S. Foreign Corrupt Practices Act of 1977, as amended, the U.K. Bribery Act 2010, the Corruption of

Public Officials Act (Canada), and similar laws in other jurisdictions; and

|

|

•

|

export controls and economic sanctions administered by the U.S. Department of Commerce Bureau of Industry and Security and

the U.S. Treasury Department’s Office of Foreign Assets Control.

|

|

•

|

an acquisition may negatively affect our operating results, financial condition or cash flows because it may require us to

incur charges or assume substantial debt or other liabilities, may cause adverse tax consequences or unfavorable accounting treatment, may expose us to claims and disputes by third parties, including intellectual property claims and

disputes, or may not generate sufficient financial return to offset additional costs and expenses related to the acquisition;

|

|

•

|

we may encounter difficulties or unforeseen expenditures in integrating the business, technologies, products, personnel or

operations of any company that we acquire, particularly if key personnel of the acquired company decide not to work for us, and potentially across different cultures and languages in the event of a foreign acquisition;

|

|

•

|

an acquisition may disrupt our ongoing business, divert resources, increase our expenses and distract our management;

|

|

•

|

an acquisition may result in a delay or reduction of sales for both us and the company we acquired due to uncertainty about

continuity and effectiveness of products or support from either company;

|

|

•

|

we may encounter difficulties in, or may be unable to, successfully sell any acquired products;

|

|

•

|

an acquisition may involve the entry into geographic or business markets in which we have little or no prior experience or

where competitors have stronger market positions;

|

|

•

|

potential strain on our financial and managerial controls and reporting systems and procedures;

|

|

•

|

potential known and unknown liabilities associated with an acquired company;

|

|

•

|

if we incur debt to fund such acquisitions, such debt may subject us to material restrictions on our ability to conduct our

business as well as financial maintenance covenants;

|

|

•

|

the risk of impairment charges related to potential write-downs of acquired assets or goodwill in future acquisitions;

|

|

•

|

to the extent that we issue a significant amount of equity or convertible debt securities in connection with future

acquisitions, existing equity holders may be diluted and earnings per share may decrease; and

|

|

•

|

managing the varying intellectual property protection strategies and other activities of an acquired company.

|

|

•

|

We did not design and maintain effective information technology (IT) general controls for certain information systems

supporting our key financial reporting processes. Specifically, we did not design, implement and maintain (a) change management controls to ensure that program and data changes affecting financial applications and underlying

accounting records are identified, tested, authorized and implemented appropriately, (b) access controls to ensure appropriate IT segregation of duties are maintained that adequately restrict and segregate privileged access between

environments which support development and production, and (c) controls to monitor on an on-going basis for the proper segregation of privileged access between environments which support development and production. As a result, IT

application controls and business process controls that are dependent on the ineffective IT general controls, or that rely on data produced from systems impacted by the ineffective IT general controls, are also deemed ineffective,

which affects substantially all of our financial statement account balances and disclosures.

|

|

•

|

We did not design and maintain effective information technology (IT) general controls for certain information systems

supporting our key financial reporting processes. Specifically, we did not design, implement and maintain sufficient change management, security, and operations controls for certain in-scope on-premise applications and

vendor-supported applications.

|

|

•

|

We did not design and maintain effective process-level controls related to the order-to-cash cycle (including revenues,

accounts receivables, and deferred revenue), procure-to-pay-cycle (including operating expenses, prepaid expenses and other current assets, accounts payable and accrued expenses), capitalized software, and long-term assets. The

material weakness related to the order-to-cash cycle resulted in an inadequate policy associated with our revenue recognition policies related to the cash collection of a certain subset of our customers that had been placed on a cash

basis and, in turn, the restatement of our unaudited condensed consolidated financial statements in its prior three quarters reported in 2023 as of and for the three months ended March 31, 2023, six months ended June 30, 2023 and nine

months ended September 30, 2023 included in our quarterly reports on Form 10-Q for the corresponding periods. Additionally, this material weakness could result in a misstatement of any account balances or disclosures that would result

in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected.

|

|

•

|

may significantly dilute the equity interests of our investors;

|

|

•

|

may subordinate the rights of holders of Class A Common Stock if preferred stock is issued with rights senior to those

afforded our Class A Common Stock;

|

|

•

|

could cause a change in control if a substantial number of shares of our Class A Common Stock are issued, which may affect,

among other things, our ability to use our net operating loss carry forwards, if any, and could result in the resignation or removal of our present officers and directors; and

|

|

•

|

may adversely affect prevailing market prices for our Class A Common Stock and/or Warrants.

|

|

•

|

actual or anticipated fluctuations in our financial condition and operating results;

|

|

•

|

changes in projected operational and financial results;

|

|

•

|

the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis

industry;

|

|

•

|

the commencement or conclusion of legal proceedings that involve us;

|

|

•

|

actual or anticipated changes in our growth rate relative to our competitors;

|

|

•

|

announcements of new products or services by us or our competitors;

|

|

•

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, or joint ventures;

|

|

•

|

capital-raising activities or commitments;

|

|

•

|

issuance of new or updated research or reports by securities analysts;

|

|

•

|

the use by investors or analysts of third-party data regarding our business that may not reflect our financial performance;

|

|

•

|

fluctuations in the valuation of companies perceived by investors to be comparable to us;

|

|

•

|

sales of our securities, including short selling of our securities;

|

|

•

|

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

|

|

•

|

general economic and market conditions; and

|

|

•

|

other events or factors, including those resulting from civil unrest, war, foreign invasions, terrorism, or public health

crises, or responses to such events.

|

|

•

|

Net revenues were $45.9 million as compared to $48.4 million in the prior year.

|

|

•

|

Average monthly paying clients was 5,045, as compared to 5,609 in the prior year.

|

|

•

|

Average monthly net revenues per paying client was $3,033, as compared to $2,878 in the prior year.

|

|

•

|

Net income was $1.2 million as compared to $2.0 million in the prior year.

|

|

•

|

Adjusted EBITDA was $10.1 million as compared to $10.2 million in the prior year.

|

|

•

|

Net Revenue was $188.0 million as compared to $215.5 million in the prior year.

|

|

•

|

Average monthly paying clients was 5,419, as compared to 5,457 in the prior year.

|

|

•

|

Average monthly net revenue per paying client was $2,891, as compared to $3,291 in the prior year.

|

|

•

|

Net loss was $15.7 million as compared to $82.7 million in the prior year.

|

|

•

|

Adjusted EBITDA was $36.9 million.

|

|

•

|

Cash totaled $34.4 million as of December 31, 2023, with no long-term debt.

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

2024

|

| |

2023

|

|

|

| |

(dollars in thousands, except for net revenues per paying client)

|

|||||||||

|

Net revenues(1)

|

| |

$45,903

|

| |

$48,423

|

| |

$90,292

|

| |

$94,839

|

|

Net income (loss)

|

| |

$1,194

|

| |

$1,983

|

| |

$3,153

|

| |

$(1,986)

|

|

EBITDA(2)

|

| |

$4,383

|

| |

$4,826

|

| |

$9,277

|

| |

$4,024

|

|

Adjusted EBITDA(2)

|

| |

$10,090

|

| |

$10,227

|

| |

$19,689

|

| |

$17,357

|

|

Average monthly net revenues per paying client(1)(3)

|

| |

$3,033

|

| |

$2,878

|

| |

$3,015

|

| |

$2,810

|

|

Average monthly paying clients(4)

|

| |

5,045

|

| |

5,609

|

| |

4,991

|

| |

5,625

|

|

(1)

|

For the three and six ended June 30, 2023, net revenues has been retrospectively adjusted to reflect the restatement of

previously reported revenue. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in this prospectus for further information.

|

|

(2)

|

For further information about how we calculate EBITDA and Adjusted EBITDA as well as limitations of its use and a

reconciliation of EBITDA and Adjusted EBITDA to net income (loss), see “Net Income (Loss) to EBITDA and Adjusted EBITDA” below.

|

|

(3)

|

Average monthly net revenues per paying client is defined as the average monthly net revenues for any particular period

divided by the average monthly paying clients in the same respective period. Average monthly net revenues per paying client is calculated in the same manner as our previously-reported “average monthly revenue per paying client,” and

the description of the metric is being updated solely to clarify that it is calculated using net revenues.

|

|

(4)

|

Average monthly paying clients are defined as the average of the number of paying clients billed in a month across a

particular period (and for which services were provided).

|

|

|

| |

Years Ended December 31,

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

2021

|

|

|

| |

(dollars in thousands, except for revenue per paying client)

|

||||||

|

Net revenues

|

| |

$187,993

|

| |

$215,531

|

| |

$193,146

|

|

Net income (loss)

|

| |

$(15,727)

|

| |

$(82,651)

|

| |

$152,218

|

|

EBITDA(1)

|

| |

$(3,534)

|

| |

$107,924

|

| |

$156,042

|

|

Adjusted EBITDA(1)

|

| |

$36,907

|

| |

$(9,633)

|

| |

$31,698

|

|

Average monthly net revenue per paying client(2)

|

| |

$2,891

|

| |

$3,291

|

| |

$3,711

|

|

Average monthly paying clients(3)

|

| |

5,419

|

| |

5,457

|

| |

4,337

|

|

(1)

|

For further information about how we calculate EBITDA and Adjusted EBITDA as well as limitations of its use and a

reconciliation of EBITDA and Adjusted EBITDA to net income (loss), see “Net Income (Loss) to EBITDA and Adjusted EBITDA” under the heading “Non-GAAP Financial Measures” below.

|

|

(2)

|

Average monthly net revenues per paying client is defined as the average monthly net revenues for any particular period

divided by the average monthly paying clients in the same respective period. Average monthly net revenues per paying client is calculated in the same manner as our previously-reported “average monthly revenue per paying client,” and

the description of the metric is being updated solely to clarify that it is calculated using net revenues.

|

|

(3)

|

Average monthly paying clients are defined as the average of the number of paying clients billed in a month across a

particular period (and for which services were provided).

|

|

•

|

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be

replaced in the future, and EBITDA and Adjusted EBITDA do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

|

|

•

|

EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; and

|

|

•

|

EBITDA and Adjusted EBITDA do not reflect tax payments that may represent a reduction in cash available to us.

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

2024

|

| |

2023

|

|

|

| |

(in thousands)

|

|||||||||

|

Net income (loss)

|

| |

$1,194

|

| |

$1,983

|

| |

$3,153

|

| |

$(1,986)

|

|

Provision for income taxes

|

| |

42

|

| |

—

|

| |

51

|

| |

—

|

|

Depreciation and amortization expenses

|

| |

3,187

|

| |

2,855

|

| |

6,124

|

| |

6,022

|

|

Interest income

|

| |

(40)

|

| |

(12)

|

| |

(51)

|

| |

(12)

|

|

EBITDA

|

| |

4,383

|

| |

4,826

|

| |

9,277

|

| |

4,024

|

|

Stock-based compensation

|

| |

2,752

|

| |

3,709

|

| |

5,571

|

| |

8,092

|

|

Change in fair value of warrant liability

|

| |

(460)

|

| |

1,045

|

| |

390

|

| |

320

|

|

Transaction related bonus (recovery) expense

|

| |

—

|

| |

(275)

|

| |

—

|

| |

2,567

|

|

Legal settlements and other legal costs

|

| |

3,020

|

| |

666

|

| |

3,513

|

| |

1,533

|

|

Reduction in force (recovery) expense

|

| |

—

|

| |

(264)

|

| |

—

|

| |

201

|

|

Change in tax receivable agreement liability

|

| |

395

|

| |

520

|

| |

938

|

| |

620

|

|

Adjusted EBITDA

|

| |

$10,090

|

| |

$10,227

|

| |

$19,689

|

| |

$17,357

|

|

|

| |

Years Ended December 31,

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

2021

|

|

|

| |

(in thousands)

|

||||||

|

Net income (loss)

|

| |

$(15,727)

|

| |

$(82,651)

|

| |

$152,218

|

|

Provision for (benefit from) income taxes

|

| |

93

|

| |

179,077

|

| |

(601)

|

|

Depreciation and amortization expenses

|

| |

12,133

|

| |

11,498

|

| |

4,425

|

|

Interest income

|

| |

(33)

|

| |

—

|

| |

—

|

|

EBITDA

|

| |

(3,534)

|

| |

107,924

|

| |

156,042

|

|

Stock-based compensation

|

| |

13,515

|

| |

23,493

|

| |

29,324

|

|

Change in fair value of warrant liability

|

| |

(1,505)

|

| |

(25,370)

|

| |

(166,518)

|

|

Warrant transaction costs

|

| |

—

|

| |

—

|

| |

5,547

|

|

Asset impairment charges

|

| |

24,403

|

| |

4,317

|

| |

2,372

|

|

Transaction related bonus expense

|

| |

3,089

|

| |

10,119

|

| |

2,200

|

|

Transaction costs

|

| |

—

|

| |

251

|

| |

2,583

|

|

Legal settlements and other legal costs

|

| |

3,194

|

| |

3,909

|

| |

148

|

|

Discharge of holdback obligation related to prior acquisition

|

| |

(3,705)

|

| |

—

|

| |

—

|

|

Change in tax receivable agreement liability

|

| |

1,256

|

| |

(142,352)

|

| |

—

|

|

Reduction in force (recovery) expense

|

| |

194

|

| |

8,076

|

| |

—

|

|

Adjusted EBITDA

|

| |

$36,907

|

| |

$(9,633)

|

| |

$31,698

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

2024

|

| |

2023

|

|

Average monthly net revenues per paying client

|

| |

$3,033

|

| |

$2,878

|

| |

$3,015

|

| |

$2,810

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

2024

|

| |

2023

|

|

Average monthly paying clients

|

| |

5,045

|

| |

5,609

|

| |

4,991

|

| |

5,625

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

2024

|

| |

2023

As Restated1

|

|

|

| |

(in thousands)

|

|||||||||

|

Net revenues

|

| |

$45,903

|

| |

$48,423

|

| |

$90,292

|

| |

$94,839

|

|

Costs and expenses

|

| |

|

| |

|

| |

|

| |

|

|

Cost of revenues (exclusive of depreciation and

amortization)

|

| |

2,245

|

| |

3,239

|

| |

4,547

|

| |

6,733

|

|

Sales and marketing

|

| |

11,069

|

| |

12,567

|

| |

20,703

|

| |

24,627

|

|

Product development

|

| |

9,642

|

| |

9,200

|

| |

18,871

|

| |

20,134

|

|

General and administrative

|

| |

18,529

|

| |

16,779

|

| |

35,055

|

| |

37,688

|

|

Depreciation and amortization

|

| |

3,187

|

| |

2,855

|

| |

6,124

|

| |

6,022

|

|

Total costs and expenses

|

| |

44,672

|

| |

44,640

|

| |

85,300

|

| |

95,204

|

|

Operating income (loss)

|

| |

1,231

|

| |

3,783

|

| |

4,992

|

| |

(365)

|

|

Other income (expense), net:

|

| |

|

| |

|

| |

|

| |

|

|

Change in fair value of warrant liability

|

| |

460

|

| |

(1,045)

|

| |

(390)

|

| |

(320)

|

|

Change in tax receivable agreement liability

|

| |

(395)

|

| |

(520)

|

| |

(938)

|

| |

(620)

|

|

Other income (expense)

|

| |

(60)

|

| |

(235)

|

| |

(460)

|

| |

(681)

|

|

Income (loss) before income taxes

|

| |

1,236

|

| |

1,983

|

| |

3,204

|

| |

(1,986)

|

|

Provision for income taxes

|

| |

42

|

| |

—

|

| |

51

|

| |

—

|

|

Net income (loss)

|

| |

1,194

|

| |

1,983

|

| |

3,153

|

| |

(1,986)

|

|

Net income (loss) attributable to noncontrolling interests

|

| |

478

|

| |

757

|

| |

1,197

|

| |

(737)

|

|

Net income (loss) attributable to WM Technology, Inc.

|

| |

$716

|

| |

$1,226

|

| |

$1,956

|

| |

$(1,249)

|

|

1.

|

For the three and six months ended June 30, 2023, net revenues and general and administrative expenses have been

retrospectively adjusted to reflect the restatement of previously reported revenue and credit losses. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in

this prospectus for further information.

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

2024

|

| |

2023

As Restated1

|

|

Net revenues

|

| |

100%

|

| |

100%

|

| |

100%

|

| |

100%

|

|

Costs and expenses

|

| |

|

| |

|

| |

|

| |

|

|

Cost of revenues (exclusive of depreciation and

amortization)

|

| |

5%

|

| |

7%

|

| |

5%

|

| |

7%

|

|

Sales and marketing

|

| |

24%

|

| |

26%

|

| |

23%

|

| |

26%

|

|

Product development

|

| |

21%

|

| |

19%

|

| |

21%

|

| |

21%

|

|

General and administrative

|

| |

40%

|

| |

35%

|

| |

39%

|

| |

40%

|

|

Depreciation and amortization

|

| |

7%

|

| |

6%

|

| |

7%

|

| |

6%

|

|

Total costs and expenses

|

| |

97%

|

| |

92%

|

| |

94%

|

| |

100%

|

|

Operating income (loss)

|

| |

3%

|

| |

8%

|

| |

6%

|

| |

0%

|

|

Other income (expense), net:

|

| |

|

| |

|

| |

|

| |

|

|

Change in fair value of warrant liability

|

| |

1%

|

| |

(2)%

|

| |

0%

|

| |

0%

|

|

Change in tax receivable agreement liability

|

| |

(1)%

|

| |

(1)%

|

| |

(1)%

|

| |

(1)%

|

|

Other income (expense)

|

| |

0%

|

| |

0%

|

| |

(1)%

|

| |

(1)%

|

|

Income (loss) before income taxes

|

| |

3%

|

| |

4%

|

| |

4%

|

| |

(2)%

|

|

|

| |

Three Months Ended June 30,

|

| |

Six Months Ended June 30,

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

2024

|

| |

2023

As Restated1

|

|

Provision for income taxes

|

| |

0%

|

| |

0%

|

| |

0%

|

| |

0%

|

|

Net income (loss)

|

| |

3%

|

| |

4%

|

| |

3%

|

| |

(2)%

|

|

Net income (loss) attributable to noncontrolling interests

|

| |

1%

|

| |

2%

|

| |

1%

|

| |

(1)%

|

|

Net income (loss) attributable to WM Technology, Inc.

|

| |

2%

|

| |

3%

|

| |

2%

|

| |

(1)%

|

|

1.

|

For the three and six months ended June 30, 2023, net revenues and general and administrative expenses have been

retrospectively adjusted to reflect the restatement of previously reported revenue and credit losses. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in

this prospectus for further information.

|

|

|

| |

Three Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Net revenues

|

| |

$45,903

|

| |

$48,423

|

| |

$(2,520)

|

| |

(5)%

|

|

1.

|

For the three months ended June 30, 2023, net revenues has been retrospectively adjusted to reflect the restatement of

previously reported revenue. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in this prospectus for further information.

|

|

|

| |

Three Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Cost of revenues

|

| |

2,245

|

| |

3,239

|

| |

(994)

|

| |

(31)%

|

|

Sales and marketing

|

| |

11,069

|

| |

12,567

|

| |

(1,498)

|

| |

(12)%

|

|

Product development

|

| |

9,642

|

| |

9,200

|

| |

442

|

| |

5%

|

|

General and administrative

|

| |

18,529

|

| |

16,779

|

| |

1,750

|

| |

10%

|

|

Depreciation and amortization

|

| |

3,187

|

| |

2,855

|

| |

332

|

| |

12%

|

|

Total costs and expenses

|

| |

44,672

|

| |

44,640

|

| |

32

|

| |

(16)%

|

|

1.

|

For the three months ended June 30, 2023, general and administrative expenses have been retrospectively adjusted to reflect

the restatement of previously reported credit losses. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in this prospectus for further information.

|

|

|

| |

Three Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Change in fair value of warrant liability

|

| |

$460

|

| |

$(1,045)

|

| |

$1,505

|

| |

(144)%

|

|

Change in tax receivable agreement liability

|

| |

(395)

|

| |

(520)

|

| |

125

|

| |

(24)%

|

|

Other income (expense)

|

| |

(60)

|

| |

(235)

|

| |

175

|

| |

74%

|

|

Other income (expense), net

|

| |

$5

|

| |

$(1,800)

|

| |

$1,805

|

| |

(100)%

|

|

|

| |

Three Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Provision for income taxes

|

| |

$42

|

| |

$—

|

| |

$42

|

| |

N/M

|

|

|

| |

Six Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Net revenues

|

| |

$90,292

|

| |

$94,839

|

| |

$(4,547)

|

| |

(5)%

|

|

1.

|

For the six months ended June 30, 2023, net revenues has been retrospectively adjusted to reflect the restatement of

previously reported revenue. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in this prospectus for further information.

|

|

|

| |

Six Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

As Restated1

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Cost of revenues

|

| |

$4,547

|

| |

$6,733

|

| |

(2,186)

|

| |

(32)%

|

|

Sales and marketing

|

| |

20,703

|

| |

24,627

|

| |

(3,924)

|

| |

(16)%

|

|

Product development

|

| |

18,871

|

| |

20,134

|

| |

(1,263)

|

| |

(6)%

|

|

General and administrative

|

| |

35,055

|

| |

37,688

|

| |

(2,633)

|

| |

(7)%

|

|

Depreciation and amortization

|

| |

6,124

|

| |

6,022

|

| |

102

|

| |

2%

|

|

Total costs and expenses

|

| |

$85,300

|

| |

$95,204

|

| |

(9,904)

|

| |

(59)%

|

|

1.

|

For the six months ended June 30, 2023, general and administrative expenses have been retrospectively adjusted to reflect

the restatement of previously reported credit losses. See Note 2, “Summary of Significant Accounting Policies,” to our unaudited condensed consolidated financial statements included in this prospectus for further information.

|

|

|

| |

Six Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Change in fair value of warrant liability

|

| |

$(390)

|

| |

$(320)

|

| |

(70)

|

| |

22%

|

|

Change in tax receivable agreement liability

|

| |

(938)

|

| |

(620)

|

| |

(318)

|

| |

51%

|

|

Other income (expense)

|

| |

(460)

|

| |

(681)

|

| |

221

|

| |

(32)%

|

|

Other (expense) income, net

|

| |

$(1,788)

|

| |

$(1,621)

|

| |

$(167)

|

| |

10%

|

|

|

| |

Six Months Ended June 30,

|

| |

Change

|

||||||

|

|

| |

2024

|

| |

2023

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Provision for income taxes

|

| |

$51

|

| |

$—

|

| |

$51

|

| |

N/M

|

|

|

| |

June 30, 2024

|

| |

December 31, 2023

|

|

|

| |

(dollars in thousands)

|

|||

|

Cash

|

| |

$41,292

|

| |

$34,350

|

|

Accounts receivable, net

|

| |

$7,000

|

| |

$11,158

|

|

Working capital

|

| |

$23,506

|

| |

$17,771

|

|

|

| |

Six Months Ended June 30,

|

|||

|

|

| |

2024

|

| |

2023

|

|

|

| |

(dollars in thousands)

|

|||

|

Net cash provided by operating activities

|

| |

$20,054

|

| |

$4,092

|

|

Net cash used in investing activities

|

| |

$(7,140)

|

| |

$(5,806)

|

|

Net cash used in financing activities

|

| |

$(5,972)

|

| |

$(2,266)

|

|

|

| |

Years Ended December 31,

|

|||||||||

|

|

| |

2023

|

| |

2022

|

||||||

|

|

| |

Amount

|

| |

% Revenue

|

| |

Amount

|

| |

% Revenue

|

|

|

| |

(in thousands, except percentages)

|

|||||||||

|

Net revenues

|

| |

$187,993

|

| |

100.0%

|

| |

$215,531

|

| |

100.0%

|

|

Costs and expenses:

|

| |

|

| |

|

| |

|

| |

|

|

Cost of revenues (exclusive of depreciation and

amortization)

|

| |

12,527

|

| |

6.7%

|

| |

15,407

|

| |

7.1%

|

|

Sales and marketing

|

| |

47,073

|

| |

25.0%

|

| |

82,624

|

| |

38.3%

|

|

Product development

|

| |

36,001

|

| |

19.2%

|

| |

50,520

|

| |

23.4%

|

|

General and administrative

|

| |

74,313

|

| |

39.5%

|

| |

120,787

|

| |

56.0%

|

|

Depreciation and amortization

|

| |

12,133

|

| |

6.5%

|

| |

11,498

|

| |

5.3%

|

|

Asset impairment charges

|

| |

24,403

|

| |

13.0%

|

| |

4,317

|

| |

2.0%

|

|

Total costs and expenses

|

| |

206,450

|

| |

109.8%

|

| |

285,153

|

| |

132.3%

|

|

Operating loss

|

| |

(18,457)

|

| |

(9.8)%

|

| |

(69,622)

|

| |

(32.3)%

|

|

Other income (expense), net:

|

| |

|

| |

|

| |

|

| |

|

|

Change in fair value of warrant liability

|

| |

1,505

|

| |

0.8%

|

| |

25,370

|

| |

11.8%

|

|

Change in tax receivable agreement liability

|

| |

(1,256)

|

| |

(0.7)%

|

| |

142,352

|

| |

66.0%

|

|

Other income (expense)

|

| |

2,574

|

| |

1.4%

|

| |

(1,674)

|

| |

(0.8)%

|

|

Income (loss) before income taxes

|

| |

(15,634)

|

| |

(8.3)%

|

| |

96,426

|

| |

44.7%

|

|

|

| |

Years Ended December 31,

|

|||||||||

|

|

| |

2023

|

| |

2022

|

||||||

|

|

| |

Amount

|

| |

% Revenue

|

| |

Amount

|

| |

% Revenue

|

|

|

| |

(in thousands, except percentages)

|

|||||||||

|

Provision for (benefit from) income taxes

|

| |

93

|

| |

—%

|

| |

179,077

|

| |

83.1%

|

|

Net loss

|

| |

(15,727)

|

| |

(8.4)%

|

| |

(82,651)

|

| |

(38.3)%

|

|

Net (loss) income attributable to noncontrolling interests

|

| |

(5,829)

|

| |

(3.1)%

|

| |

33,338

|

| |

15.5%

|

|

Net loss attributable to WM Technology, Inc.

|

| |

$(9,898)

|

| |

(5.3)%

|

| |

$(115,989)

|

| |

(53.8)%

|

|

|

| |

Years Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Net Revenues

|

| |

$187,993

|

| |

$215,531

|

| |

$(27,538)

|

| |

(13)%

|

|

|

| |

Years Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Cost of revenues

|

| |

$12,527

|

| |

$15,407

|

| |

$(2,880)

|

| |

(19)%

|

|

Sales and marketing

|

| |

47,073

|

| |

82,624

|

| |

(35,551)

|

| |

(43)%

|

|

Product development

|

| |

36,001

|

| |

50,520

|

| |

(14,519)

|

| |

(29)%

|

|

General and administrative

|

| |

74,313

|

| |

120,787

|

| |

(46,474)

|

| |

(38)%

|

|

Depreciation and amortization

|

| |

12,133

|

| |

11,498

|

| |

635

|

| |

6%

|

|

Asset impairment charges

|

| |

24,403

|

| |

4,317

|

| |

20,086

|

| |

465%

|

|

Total costs and expenses

|

| |

$206,450

|

| |

$285,153

|

| |

$(78,703)

|

| |

(28)%

|

|

|

| |

Years Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Change in fair value of warrant liability

|

| |

$1,505

|

| |

$25,370

|

| |

$(23,865)

|

| |

(94)%

|

|

Change in tax receivable agreement liability

|

| |

(1,256)

|

| |

142,352

|

| |

(143,608)

|

| |

(101)%

|

|

Other income (expense)

|

| |

2,574

|

| |

(1,674)

|

| |

4,248

|

| |

(254)%

|

|

Other income (expense), net

|

| |

$2,823

|

| |

$166,048

|

| |

$(163,225)

|

| |

(98)%

|

|

|

| |

Years Ended December 31,

|

| |

Change

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

($)

|

| |

(%)

|

|

|

| |

(dollars in thousands)

|

|||||||||

|

Provision for (benefit from) income taxes

|

| |

$93

|

| |

$179,077

|

| |

$(178,984)

|

| |

(100)%

|

|

|

| |

As of December 31,

|

|||

|

|

| |

2023

|

| |

2022

|

|

|

| |

(in thousands)

|

|||

|

Cash

|

| |

$34,350

|

| |

$28,583

|

|

Accounts receivable, net

|

| |

$11,158

|

| |

$17,438

|

|

Working capital

|

| |

$17,771

|

| |

$8,660

|

|

|

| |

Years Ended December 31,

|

||||||

|

|

| |

2023

|

| |

2022

|

| |

2021

|

|

|

| |

(in thousands)

|

||||||

|

Net cash provided by (used in) operating activities

|

| |

$22,928

|

| |

$(11,621)

|

| |

$30,190

|

|

Net cash used in investing activities

|

| |

$(11,871)

|

| |

$(17,768)

|

| |

$(30,435)

|

|

Net cash provided by (used in) financing activities

|

| |

$(5,290)

|

| |

$(9,805)

|

| |

$48,103

|

|

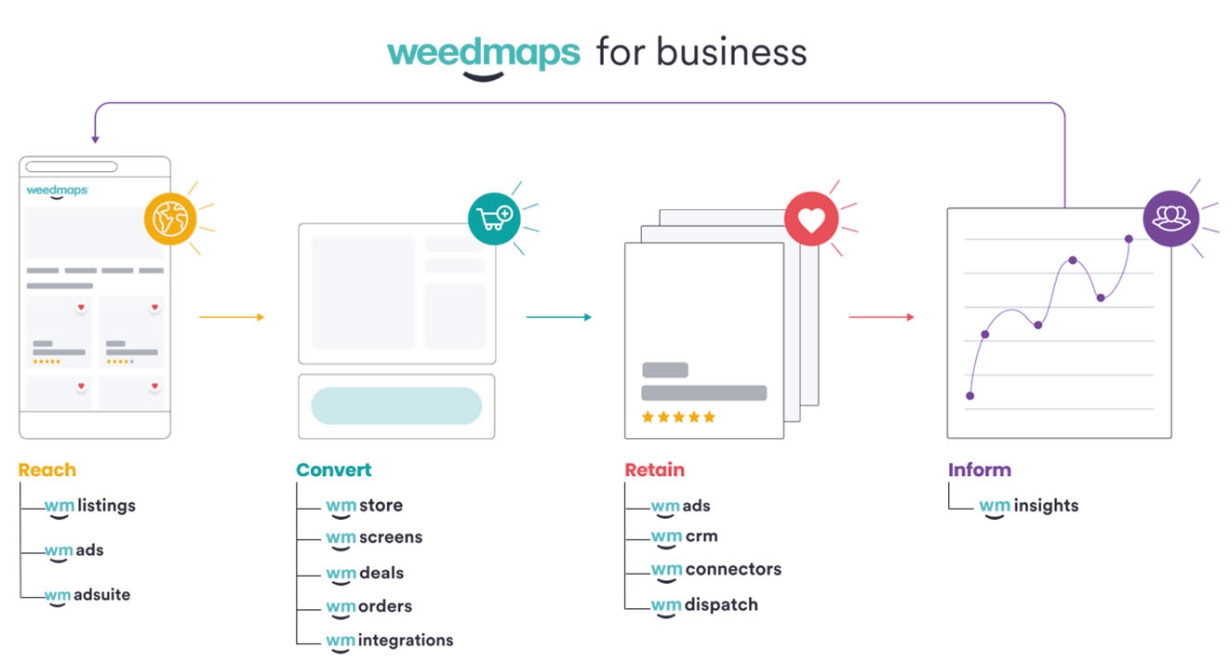

•

|

Strategically reach prospective cannabis consumers.

|

|

•

|

Manage pickup, delivery and inventory in compliance with local regulations.

|

|

•

|

Help improve the customer experience by creating online browsing and ordering functionality on a brand or retailer (including

delivery) operator’s website.

|

|

•

|

Foster customer loyalty and re-engage with segments of consumers.

|

|

•

|

Leverage the Weedmaps for Business products in conjunction with any other preferred software solutions via integrations and

application programming interfaces (“APIs”).

|

|

•

|

Make informed marketing and merchandising decisions using performance analytics and consumer and brand insights to promote

products to specific consumer groups.

|

|

2

|

news.gallup.com - Grassroots Support for Legalizing Marijuana Hits Record 70%

|

|

3

|

Numbers of users aged 21 and older are from the 2022 National Survey on Drug Use and Health,

number of adults in the United States aged 21 and older are from U.S. Census data

|

|

•

|

WM Listings: A listing page with product menu for a retailer or brand on the Weedmaps marketplace, enabling our clients to be

discovered by the marketplace’s users. This also allows clients to disclose their license information, hours of operation, contact information, discount policies and other information that may be required under applicable state law.

|

|

•

|

WM Orders: Software for retailers to receive pickup and delivery orders directly from a Weedmaps listing and connect orders

directly with a client’s POS system (for certain POS systems). The marketplace also enables brands to route customer purchase interest to a retailer that carries the brand’s product. After a dispensary receives the order request from

the consumer, the dispensary and the consumer can continue to communicate, adjust items in the request, and handle any stock issues, prior to and while the dispensary processes and fulfills the order.

|

|

•

|

WM Store: Customizable order and menus embed which allows retailers and brands to import their Weedmaps listing menu or

product reservation functionality to their own white-labeled WM Store website or separately owned website. WM Store facilitates customer pickup or delivery orders and enables retailers to reach more customers by bringing the breadth of

the Weedmaps marketplace to a client’s own website.

|

|

•

|

WM Connectors: A centralized integration platform, including API tools, for easier menu management, automatic inventory

updates and streamlined order fulfillment to enable clients to save time and more easily integrate into the WM Technology ecosystem and integrate with disparate software systems. This creates business efficiencies and improves the

accuracy and timeliness of information across Weedmaps, creating a more positive experience for consumers and businesses.

|

|

•

|

WM Insights: An insights and analytics platform for clients leveraging data across the Weedmaps marketplace and software

solutions. WM Insights provides data and analytics on user engagement and traffic trends to a client’s listing page. For Brand clients, WM Insights allows them to monitor their brand and product rankings, identify retailers not carrying

products and keep track of top brands and products by category and state.

|

|

•

|

WM Ads: Ad solutions on the Weedmaps marketplace designed for clients to amplify their businesses and reach more highly

engaged cannabis consumers throughout their buying journey including:

|

|

○

|

Featured Listings: Premium placement ad solutions on high visibility locations on the Weedmaps

marketplace (desktop and mobile) to amplify our clients’ businesses and maximize clients’ listings and deal presence.

|

|

○

|

WM Deals: Discount and promotion pricing tools that let clients strategically reach prospective

price-conscious cannabis customers with deals or discounts to drive conversion. In some jurisdictions, it is required by applicable law to showcase discounts.

|

|

○

|

Other WM Ads solutions: Includes banner ads and promotion tiles on our marketplace as well as

banner ads that can be tied to keyword searches. These products provide clients with targeted ad solutions in highly visible slots across our digital surfaces.

|

|

•

|

WM Dispatch: Compliant, automated and optimized logistics and fulfillment last-mile delivery software (including driver apps)

that helps clients manage their delivery fleets. This product streamlines the delivery experience from in-store to front-door.

|

|

•

|

Cannabis as a regulated industry is still in a nascent stage of development.

|

|

•

|