Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Dec. 31, 2022 |

Dec. 31, 2021 |

| Pay vs Performance Disclosure [Table] |

|

|

| Pay vs Performance [Table Text Block] |

PAY VERSUS PERFORMANCE

As required by Section 953(a) of the Dodd-Frank Act and Item 402(v) of Regulation

S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of the Company. Also as required by the SEC, this section compares compensation actually paid

to various measures used to gauge performance at the Company. Accordingly, the table below includes the following “Company-Selected Measure” as defined in Item 402(v) of Regulation S-K: Revenue. For further information regarding our

compensation philosophy and how we seek to align executive compensation with the Company’s performance, refer to “Executive Compensation—Compensation Discussion and Analysis.”

|

2022

|

|

|

263,058

|

|

|

2,136,675

|

|

|

(2,043)

|

|

|

(4,133,509)

|

|

|

743,179

|

|

|

(3,393,261)

|

|

|

$4.91

|

|

|

$77.63

|

|

|

$(82.7)

|

|

|

$215.5

|

|

2021

|

|

|

N/A

|

|

|

10,614,467

|

|

|

N/A

|

|

|

9,985,561

|

|

|

6,099,502

|

|

|

678,800

|

|

|

$29.10

|

|

|

$97.57

|

|

|

$152.2

|

|

|

$193.1

|

|

(1)

|

The dollar amounts reported are total compensation reported for Messrs. Francis (our Executive Chair and Principal Executive Officer) and Beals

(our former Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Summary Compensation Table.”

|

|

(2)

|

The dollar amounts reported represent “compensation actually paid” to Messrs. Francis and Beals as computed in accordance with

Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Messrs. Francis and Beals during the applicable year. In accordance with the requirements of Item 402(v) of

Regulation S-K, the following adjustments were made to Mr. Francis’ total compensation for each year to determine the compensation actually paid:

|

|

Summary Compensation Table total

|

|

|

263,058

|

|

Less: Grant Date Fair Value of Stock Awards Granted in Fiscal Year(a)

|

|

|

(193,357)

|

|

± Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in

Fiscal Year(b)(i)

|

|

|

41,908

|

|

± Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior

Fiscal Years(b)(ii)

|

|

|

(100,329)

|

|

± Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested

During Fiscal Year(b)(iii)

|

|

|

0

|

|

± Change in Fair Value as of Vesting Date of Stock Awards

Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(b)(iv)

|

|

|

(13,323)

|

|

- Fair Value as of Prior Fiscal Year-End of Stock Awards

Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

|

0

|

|

Compensation Actually Paid

|

|

|

(2,043)

|

In accordance with the requirements of Item 402(v) of Regulation S-K, the following

adjustments were made to Mr. Beals’ total compensation for each year to determine the compensation actually paid:

|

Summary Compensation Table total

|

|

|

2,136,675

|

|

|

10,614,467

|

|

Less: Grant Date Fair Value of Stock Awards Granted in Fiscal Year(a)

|

|

|

(565,430)

|

|

|

(10,000,000)

|

|

± Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in

Fiscal Year(b)(i)

|

|

|

0

|

|

|

8,954,422

|

|

± Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior

Fiscal Years(b)(ii)

|

|

|

0

|

|

|

0

|

|

± Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested

During Fiscal Year(b)(iii)

|

|

|

565,430

|

|

|

416,672

|

|

± Change in Fair Value as of Vesting Date of Stock Awards

Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(b)(iv)

|

|

|

(235,676)

|

|

|

0

|

|

- Fair Value as of Prior Fiscal Year-End of Stock Awards

Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year(b)(v)

|

|

|

(6,034,508)

|

|

|

0

|

|

Compensation Actually Paid

|

|

|

(4,133,509)

|

|

|

9,985,561

|

|

(a)

|

The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” and “Option

Awards” columns in the Summary Compensation Table for the applicable year.

|

|

(b)

|

The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following:

(i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior

fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same

|

applicable year, the fair value as of the vesting date; (iv) for awards granted

in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; and (v) for awards granted in prior years that are determined to fail to meet the

applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year.

|

(3)

|

The dollar amounts reported represent the average of the amounts reported for the NEOs as a group (excluding our PEO) in the

“Total” column of the Summary Compensation Table in each applicable year. The NEOs (excluding our PEO) included for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2022, Arden Lee, Chief

Financial Officer; Brian Camire, General Counsel; Duncan Grazier, Chief Technology Officer; Juanjo Feijoo, former Chief Operating Officer and Justin Dean, former Chief Technology Officer and Chief Information Officer; and (ii) for 2021,

Messrs. Lee, Camire, Dean and Feijoo.

|

|

(4)

|

The dollar amounts reported represent the average amount of “compensation actually paid” to the NEOs as a group (excluding our

PEO), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (excluding our PEO) during the applicable year. In

accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the NEOs as a group (excluding our PEO) for each year to determine the compensation actually paid,

using the same methodology described above in Note (2):

|

|

2022

|

|

|

743,179

|

|

|

(59,999)

|

|

|

(4,076,441)

|

|

|

(3,393,261)

|

|

2021

|

|

|

6,099,502

|

|

|

(5,300,000)

|

|

|

(120,702)

|

|

|

678,800

|

|

(a)

|

The amounts deducted or added in calculating the total average equity award adjustments are as follows:

|

|

2022

|

|

|

8,563

|

|

|

(1,747,161)

|

|

|

6,598

|

|

|

(692,857)

|

|

|

(1,651,584)

|

|

|

(4,076,441)

|

|

2021

|

|

|

4,687,447

|

|

|

(4,238,985)

|

|

|

283,334

|

|

|

(852,498)

|

|

|

0

|

|

|

(120,702)

|

|

(5)

|

Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming

dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. We use the Closing Date of the

Business Combination as the “measurement point” for purposes of calculating TSR.

|

|

(6)

|

Represents the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the

beginning of each period for which a return is indicated. The peer group used for this purpose is Russell 2000 Index, the same peer group identified in our stock performance graph in our Annual Report on Form 10-K for the year ended

December 31, 2022.

|

|

(7)

|

The dollar amounts for Net (Loss) Income and Revenue reported represent the amount reflected in the Company’s audited

financial statements for the applicable year.

|

|

|

| Company Selected Measure Name |

Revenue

|

|

| Named Executive Officers, Footnote [Text Block] |

|

(3)

|

The dollar amounts reported represent the average of the amounts reported for the NEOs as a group (excluding our PEO) in the

“Total” column of the Summary Compensation Table in each applicable year. The NEOs (excluding our PEO) included for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2022, Arden Lee, Chief

Financial Officer; Brian Camire, General Counsel; Duncan Grazier, Chief Technology Officer; Juanjo Feijoo, former Chief Operating Officer and Justin Dean, former Chief Technology Officer and Chief Information Officer; and (ii) for 2021,

Messrs. Lee, Camire, Dean and Feijoo.

|

|

|

| Peer Group Issuers, Footnote [Text Block] |

|

(6)

|

Represents the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the

beginning of each period for which a return is indicated. The peer group used for this purpose is Russell 2000 Index, the same peer group identified in our stock performance graph in our Annual Report on Form 10-K for the year ended

December 31, 2022.

|

|

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

|

(2)

|

The dollar amounts reported represent “compensation actually paid” to Messrs. Francis and Beals as computed in accordance with

Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Messrs. Francis and Beals during the applicable year. In accordance with the requirements of Item 402(v) of

Regulation S-K, the following adjustments were made to Mr. Francis’ total compensation for each year to determine the compensation actually paid:

|

|

Summary Compensation Table total

|

|

|

263,058

|

|

Less: Grant Date Fair Value of Stock Awards Granted in Fiscal Year(a)

|

|

|

(193,357)

|

|

± Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in

Fiscal Year(b)(i)

|

|

|

41,908

|

|

± Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior

Fiscal Years(b)(ii)

|

|

|

(100,329)

|

|

± Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested

During Fiscal Year(b)(iii)

|

|

|

0

|

|

± Change in Fair Value as of Vesting Date of Stock Awards

Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(b)(iv)

|

|

|

(13,323)

|

|

- Fair Value as of Prior Fiscal Year-End of Stock Awards

Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year

|

|

|

0

|

|

Compensation Actually Paid

|

|

|

(2,043)

|

In accordance with the requirements of Item 402(v) of Regulation S-K, the following

adjustments were made to Mr. Beals’ total compensation for each year to determine the compensation actually paid:

|

Summary Compensation Table total

|

|

|

2,136,675

|

|

|

10,614,467

|

|

Less: Grant Date Fair Value of Stock Awards Granted in Fiscal Year(a)

|

|

|

(565,430)

|

|

|

(10,000,000)

|

|

± Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in

Fiscal Year(b)(i)

|

|

|

0

|

|

|

8,954,422

|

|

± Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior

Fiscal Years(b)(ii)

|

|

|

0

|

|

|

0

|

|

± Fair Value at Vesting of Stock Awards Granted in Fiscal Year That Vested

During Fiscal Year(b)(iii)

|

|

|

565,430

|

|

|

416,672

|

|

± Change in Fair Value as of Vesting Date of Stock Awards

Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year(b)(iv)

|

|

|

(235,676)

|

|

|

0

|

|

- Fair Value as of Prior Fiscal Year-End of Stock Awards

Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year(b)(v)

|

|

|

(6,034,508)

|

|

|

0

|

|

Compensation Actually Paid

|

|

|

(4,133,509)

|

|

|

9,985,561

|

|

(a)

|

The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” and “Option

Awards” columns in the Summary Compensation Table for the applicable year.

|

|

(b)

|

The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following:

(i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior

fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same

|

applicable year, the fair value as of the vesting date; (iv) for awards granted

in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; and (v) for awards granted in prior years that are determined to fail to meet the

applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year.

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 743,179

|

$ 6,099,502

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ (3,393,261)

|

678,800

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

|

(4)

|

The dollar amounts reported represent the average amount of “compensation actually paid” to the NEOs as a group (excluding our

PEO), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (excluding our PEO) during the applicable year. In

accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the NEOs as a group (excluding our PEO) for each year to determine the compensation actually paid,

using the same methodology described above in Note (2):

|

|

2022

|

|

|

743,179

|

|

|

(59,999)

|

|

|

(4,076,441)

|

|

|

(3,393,261)

|

|

2021

|

|

|

6,099,502

|

|

|

(5,300,000)

|

|

|

(120,702)

|

|

|

678,800

|

|

(a)

|

The amounts deducted or added in calculating the total average equity award adjustments are as follows:

|

|

2022

|

|

|

8,563

|

|

|

(1,747,161)

|

|

|

6,598

|

|

|

(692,857)

|

|

|

(1,651,584)

|

|

|

(4,076,441)

|

|

2021

|

|

|

4,687,447

|

|

|

(4,238,985)

|

|

|

283,334

|

|

|

(852,498)

|

|

|

0

|

|

|

(120,702)

|

|

|

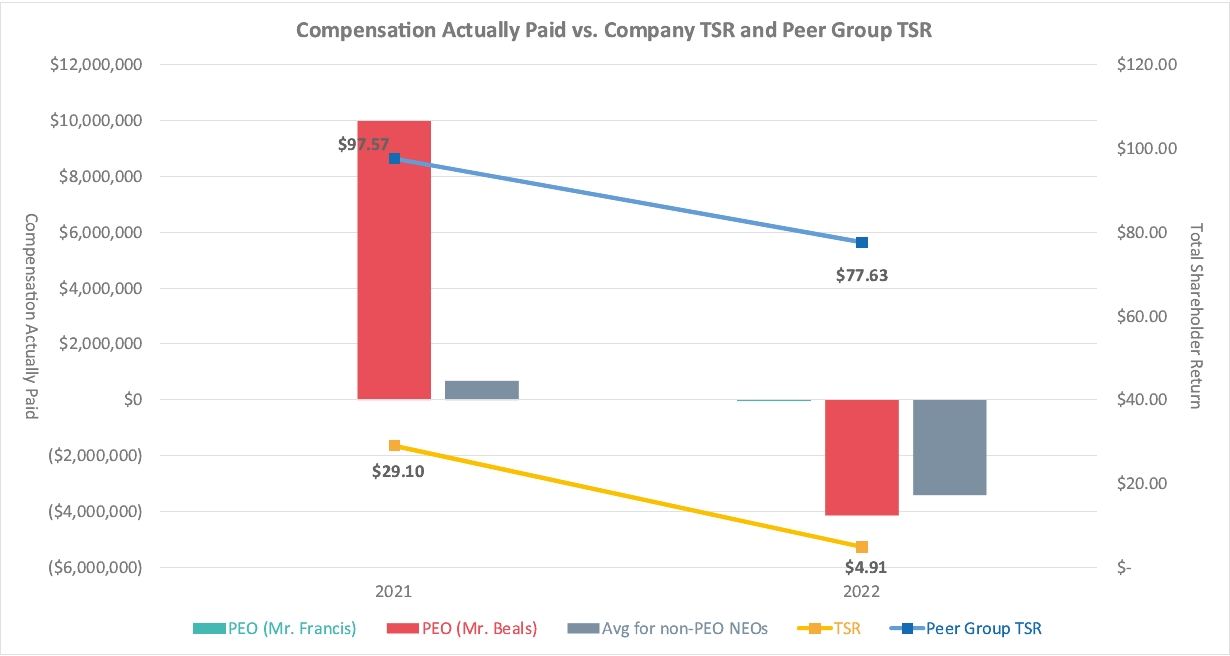

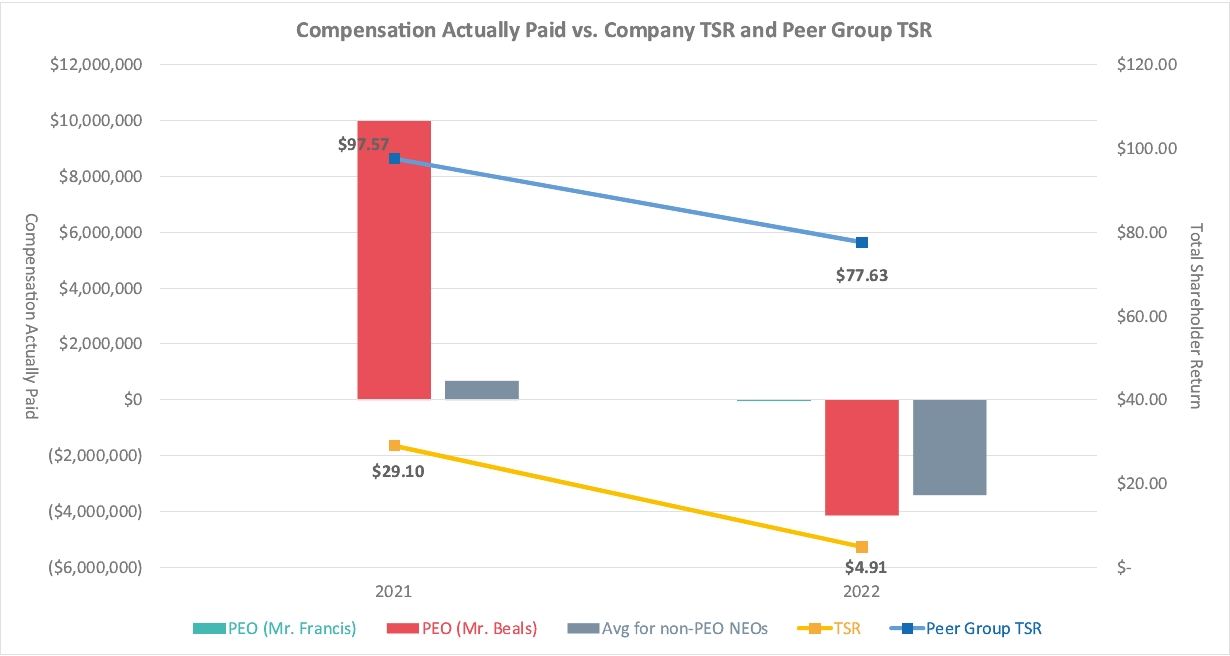

| Compensation Actually Paid vs. Total Shareholder Return [Text Block] |

Required Disclosure of the Relationship Between Compensation Actually

Paid and Financial Performance Measures

As required by Item 402(v) of Regulation S-K, we are providing the following graphs

to illustrate the relationship between the pay and performance figures that are included in the pay versus performance tabular disclosure above. As noted above, “compensation actually paid” for purposes of the tabular disclosure and the

following graphs was calculated in accordance with SEC rules and does not fully represent the actual final amount of compensation earned by or actually paid to our NEOs during the applicable years.

The graph below illustrates the relationship between Company TSR and that of the

designated peer group and the PEO “compensation actually paid” and Average Non-PEO NEOs “compensation actually paid”. TSR amounts reported in the graph assume an initial fixed investment of $100 and use the Closing Date of the Business

Combination as the “measurement point” for purposes of calculating TSR.

|

|

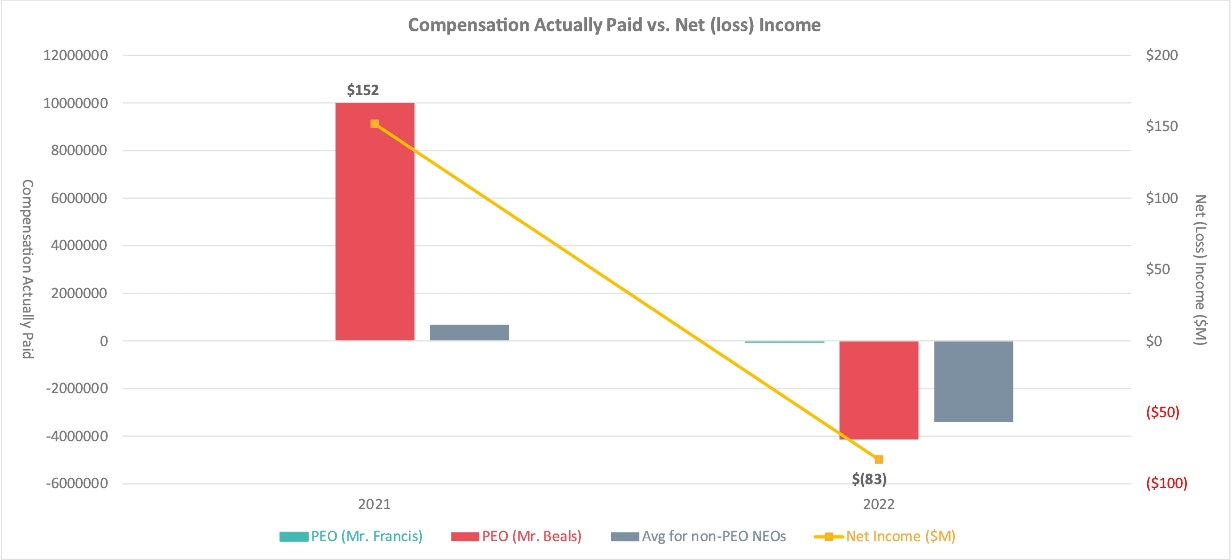

| Compensation Actually Paid vs. Net Income [Text Block] |

Required Disclosure of the Relationship Between Compensation Actually

Paid and Financial Performance Measures

As required by Item 402(v) of Regulation S-K, we are providing the following graphs

to illustrate the relationship between the pay and performance figures that are included in the pay versus performance tabular disclosure above. As noted above, “compensation actually paid” for purposes of the tabular disclosure and the

following graphs was calculated in accordance with SEC rules and does not fully represent the actual final amount of compensation earned by or actually paid to our NEOs during the applicable years.

The graph below illustrates the relationship between Net (loss) Income and PEO

“compensation actually paid” and Average Non-PEO NEOs “compensation actually paid”.

|

|

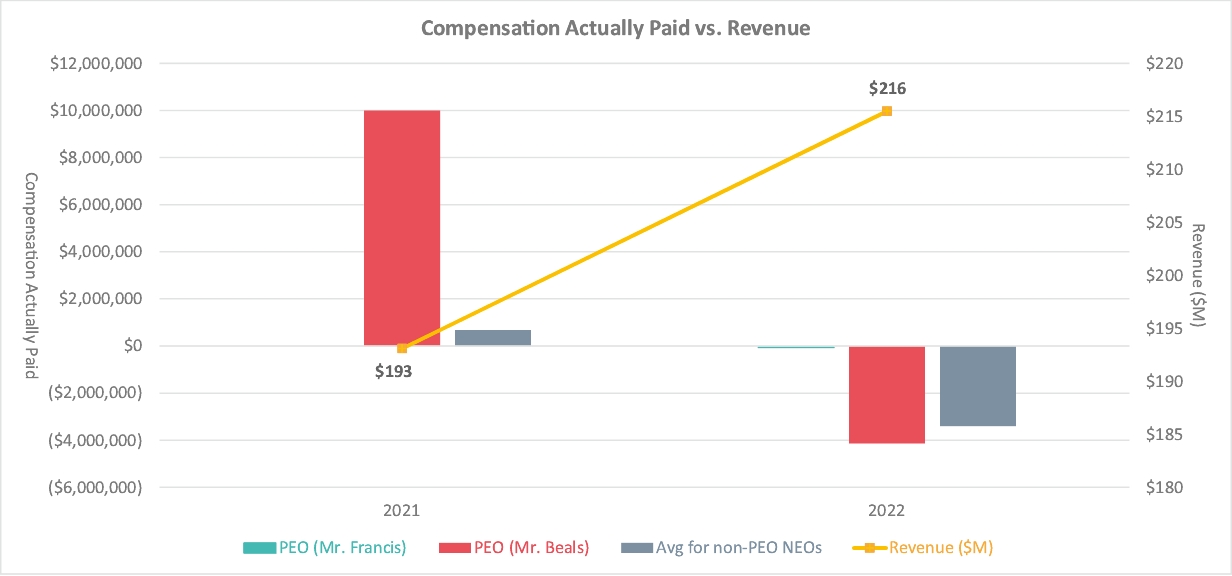

| Compensation Actually Paid vs. Company Selected Measure [Text Block] |

Required Disclosure of the Relationship Between Compensation Actually

Paid and Financial Performance Measures

As required by Item 402(v) of Regulation S-K, we are providing the following graphs

to illustrate the relationship between the pay and performance figures that are included in the pay versus performance tabular disclosure above. As noted above, “compensation actually paid” for purposes of the tabular disclosure and the

following graphs was calculated in accordance with SEC rules and does not fully represent the actual final amount of compensation earned by or actually paid to our NEOs during the applicable years.

The graph below illustrates the relationship between Revenue and PEO “compensation

actually paid” and Average Non- PEO NEOs “compensation actually paid”.

|

|

| Total Shareholder Return Vs Peer Group [Text Block] |

Required Disclosure of the Relationship Between Compensation Actually

Paid and Financial Performance Measures

As required by Item 402(v) of Regulation S-K, we are providing the following graphs

to illustrate the relationship between the pay and performance figures that are included in the pay versus performance tabular disclosure above. As noted above, “compensation actually paid” for purposes of the tabular disclosure and the

following graphs was calculated in accordance with SEC rules and does not fully represent the actual final amount of compensation earned by or actually paid to our NEOs during the applicable years.

The graph below illustrates the relationship between Company TSR and that of the

designated peer group and the PEO “compensation actually paid” and Average Non-PEO NEOs “compensation actually paid”. TSR amounts reported in the graph assume an initial fixed investment of $100 and use the Closing Date of the Business

Combination as the “measurement point” for purposes of calculating TSR.

|

|

| Tabular List [Table Text Block] |

Tabular List of Financial Performance Measures

The Company’s Compensation Committee believes in a holistic evaluation of our NEOs’

and the Company’s performance and uses a mix of performance measures throughout our annual focal and long-term incentive compensation programs to align executive pay with Company performance. As required by SEC rules, the performance measures

identified as the most important used to link the “compensation actually paid” to our NEOs’ for fiscal 2022 compensation to the Company’s performance are listed in the table below, each of which is described in more detail in the section

entitled Executive Compensation – Compensation Discussion and Analysis.

|

Financial Performance Measures

|

|

Revenue

|

|

|

|

|

Adjusted EBITDA

|

|

|

|

|

|

| Total Shareholder Return Amount |

$ 4.91

|

29.1

|

| Peer Group Total Shareholder Return Amount |

77.63

|

97.57

|

| Net Income (Loss) |

$ (82,700,000)

|

$ 152,200,000

|

| Company Selected Measure Amount |

215,500,000

|

193,100,000

|

| Measure [Axis]: 1 |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Measure Name |

Revenue

|

|

| Measure [Axis]: 2 |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Measure Name |

Adjusted EBITDA

|

|

| Messrs. Francis [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| PEO Total Compensation Amount |

$ 263,058

|

|

| PEO Actually Paid Compensation Amount |

$ (2,043)

|

|

| PEO Name |

Messrs. Francis

|

|

| Beals [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| PEO Total Compensation Amount |

$ 2,136,675

|

$ 10,614,467

|

| PEO Actually Paid Compensation Amount |

$ (4,133,509)

|

$ 9,985,561

|

| PEO Name |

Beals

|

Beals

|

| PEO [Member] | Messrs. Francis [Member] | Grant Date Fair Value of Stock Awards Granted in Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

$ (193,357)

|

|

| PEO [Member] | Messrs. Francis [Member] | Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

41,908

|

|

| PEO [Member] | Messrs. Francis [Member] | Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(100,329)

|

|

| PEO [Member] | Messrs. Francis [Member] | Fair Value at Vesting of Stock Awards Granted in Fiscal Year that Vested During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

0

|

|

| PEO [Member] | Messrs. Francis [Member] | Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for which Applicable Vesting Conditions were Satisfied During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(13,323)

|

|

| PEO [Member] | Messrs. Francis [Member] | Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

0

|

|

| PEO [Member] | Beals [Member] | Grant Date Fair Value of Stock Awards Granted in Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(565,430)

|

$ (10,000,000)

|

| PEO [Member] | Beals [Member] | Fair Value at Fiscal Year-End of Outstanding Unvested Stock Awards Granted in Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

0

|

8,954,422

|

| PEO [Member] | Beals [Member] | Change in Fair Value of Outstanding Unvested Stock Awards Granted in Prior Fiscal Years [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

0

|

0

|

| PEO [Member] | Beals [Member] | Fair Value at Vesting of Stock Awards Granted in Fiscal Year that Vested During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

565,430

|

416,672

|

| PEO [Member] | Beals [Member] | Change in Fair Value as of Vesting Date of Stock Awards Granted in Prior Fiscal Years for which Applicable Vesting Conditions were Satisfied During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(235,676)

|

0

|

| PEO [Member] | Beals [Member] | Fair Value as of Prior Fiscal Year-End of Stock Awards Granted in Prior Fiscal Years that Failed to Meet Applicable Vesting Conditions During Fiscal Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(6,034,508)

|

0

|

| Non-PEO NEO [Member] | Reported Value of Equity Awards [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(59,999)

|

(5,300,000)

|

| Non-PEO NEO [Member] | Equity Award Adjustments [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(4,076,441)

|

(120,702)

|

| Non-PEO NEO [Member] | Average Year End Fair Value of Equity Awards [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

8,563

|

4,687,447

|

| Non-PEO NEO [Member] | Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(1,747,161)

|

(4,238,985)

|

| Non-PEO NEO [Member] | Average Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

6,598

|

283,334

|

| Non-PEO NEO [Member] | Year over Year Average Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

(692,857)

|

(852,498)

|

| Non-PEO NEO [Member] | Average Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year [Member] |

|

|

| Pay vs Performance Disclosure [Table] |

|

|

| Adjustment to Compensation Amount |

$ (1,651,584)

|

$ 0

|