UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ___________ to ___________

Commission File Number: 001-41060

(Exact Name of Registrant as Specified in its Charter)

State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. | |||||||

| Address of Principal Executive Offices | Zip Code | |||||||

(408 ) 899-4443

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | ||||

Smaller reporting company | |||||

Emerging growth company | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2022, there were 7,982,008 shares of the registrant’s common stock, par value $0.0001 per share, issued and outstanding, of these, 6,423,852 shares were held by non-affiliates of the registrant. The market value of securities held by non-affiliates was $8,286,769 as of June 30, 2022, based on the closing price of $1.29 for the registrant’s common stock on June 30, 2022.

As of March 14, 2023, there was 8,227,074 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

2

HEARTBEAM, INC.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, statements contained in this Annual Report on Form 10-K, including but not limited to, statements regarding the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities; our future results of operations and financial position, business strategy and plan prospects, or costs and objectives of management for future acquisitions, are forward looking statements. These forward looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “seeks,” “goals,” “estimates,” “predicts,” “potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item lA. “Risk Factors” and elsewhere in this. Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward looking statements for any reason.

The Company will continue to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Forward-looking statements speak only as of the dates specified in such filings. Except as expressly required under federal securities laws and the rules and regulations of the SEC, we do not undertake any obligation to update any forward-looking statements to reflect events or circumstances arising after any such date, whether as a result of new information or future events or otherwise. You should not place undue reliance on the forward-looking statements included in this report or that may be made elsewhere from time to time by us, or on our behalf. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

NOTE REGARDING COMPANY REFERENCES

Throughout this Annual Report on Form 10-K, “HeartBeam,” the “Company,” “we,” “us” and “our” refer to HeartBeam, Inc.

3

Table of Contents

4

Part I

Item 1. Business

Overview

We are a medical technology company primarily focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease both inside and outside a healthcare facility setting. Our ability to develop higher resolution ECG solutions is achieved through the development of our proprietary and patented Vector Electrocardiography (“VECG”) technology platform. Our VECG is capable of developing three-dimensional (“3D”) vector images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital-based ECG systems.

Our aim is to deliver innovative, ambulatory cardiac health monitoring technologies that can be used for patients anywhere, especially where critical cardiac care decisions need to be made on a more timely basis. Our products (hereinafter “Product” or “Products”) require Food and Drug Administration (“FDA”) clearance and have not been cleared for marketing.

We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. We are developing our telehealth Product (“HeartBeam AIMIGoTM”), to address the rapidly growing telehealth market. HeartBeam AIMIGo is comprised of a credit card sized electrocardiogram device and powerful cloud-based diagnostic expert software systems. We intend to show that our easy to use device (without external electrodes) provides signals equivalent to a standard 12L device, and therefore will have a number of applications for ambulatory use. We believe that we are uniquely positioned to play a central role in cardiac remote monitoring including high-risk coronary artery disease patients, because the initial studies have shown that our ischemia detection system may be more accurate than existing ambulatory monitoring solutions. Coronary artery disease (“CAD”) patients are at increased risk for a heart attack or Myocardial Infarction (“MI”).

5

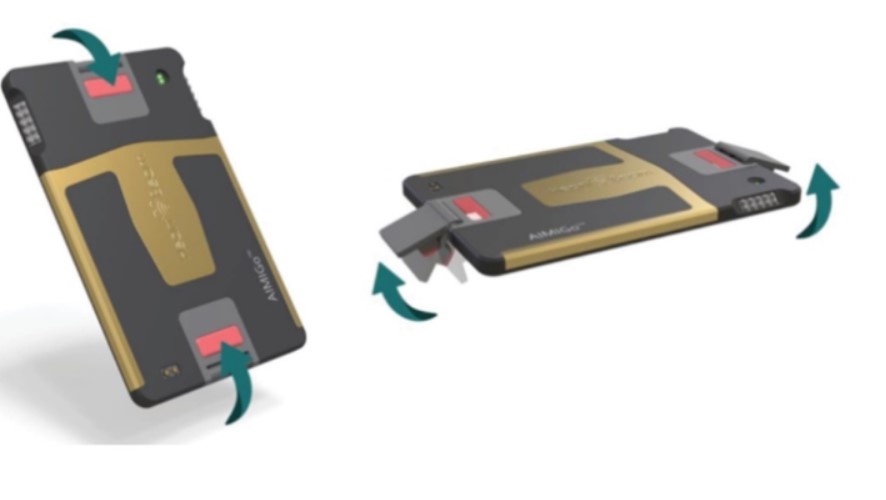

HeartBeam AIMIGo device in planar and ready position

We are also applying our software platform to create a tool for detecting heart attacks in the Emergency Department (“ED”) environment using standard 12-lead ECG recordings. The software tool, (“HeartBeam AIMITM”) is designed to enable emergency physicians diagnose heart attacks more accurately and quickly than currently available tools. Market clearance of this Product is planned to precede HeartBeam AIMIGo.

To date, we have developed working prototypes for both HeartBeam AIMIGo and HeartBeam AIMI. HeartBeam AIMI has been submitted for FDA 510(k) clearance and we have received questions from the FDA within the statutory 30-day review deadline, discussed the questions via teleconference with the FDA review team and provided written responses addressing the questions to the primary reviewer.

The custom software and hardware of our Products, we believe, are classified as Class II medical devices by the FDA, running on an FDA approved Class I registered software platform. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k) or 510(k) de-novo premarket notification process.

HeartBeam has nine issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963, U.S. 11,529,085, U.S. 10,980,433, U.S. 11,412,972 and U.S. 11,234,658), and six pending U.S. applications. Four of the pending applications have been published, the remaining two pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands and United Kingdom and seven pending applications in Canada, China, the European Union, Japan and Australia. HeartBeam has three pending PCT applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

Market Overview

Chronic diseases are the number one burden on the healthcare system, driving up costs each year, and cardiovascular illnesses are one of the top contributors. Regulators, payors, and providers are focused on shifting the diagnosis and management of these conditions to drive better outcomes at lower cost. Connected medical solutions are expanding rapidly and are projected to reach $155 billion by 2026, a compound annual growth rate (“CAGR”) of 17%. These solutions are

6

socio-technical models for healthcare management and delivery using technology to provide healthcare services remotely and aim to maximize healthcare resources and provide increased, flexible capabilities for patients to engage with clinicians and better self-manage their care, using readily available consumer-facing technologies to deliver patient care outside the hospital or doctor’s office.

The market for Remote Patient Monitoring (“RPM”) is projected to reach $31.3 billion by 2023. In 2019, 1,800 hospitals in the US were using mobile applications to improve risk management and quality of care. The number in 2020 was likely larger as the onset of the COVID-19 pandemic greatly accelerated use and acceptance of telehealth by both patients and healthcare providers.

Cardiovascular disease is the number one cost to the healthcare system and is estimated to be responsible for 1 in every 6 healthcare dollars spent in the US. As cardiovascular disease is the leading cause of death worldwide, early detection, diagnosis, and management of chronic cardiac conditions are necessary to relieve the increasing burden on the healthcare infrastructure. Diagnostic tests such as ECGs are used to detect, diagnose, and track numerous cardiovascular conditions. With advances in mobile communications, diagnostic monitoring of cardiac conditions is increasingly occurring outside the hospital.

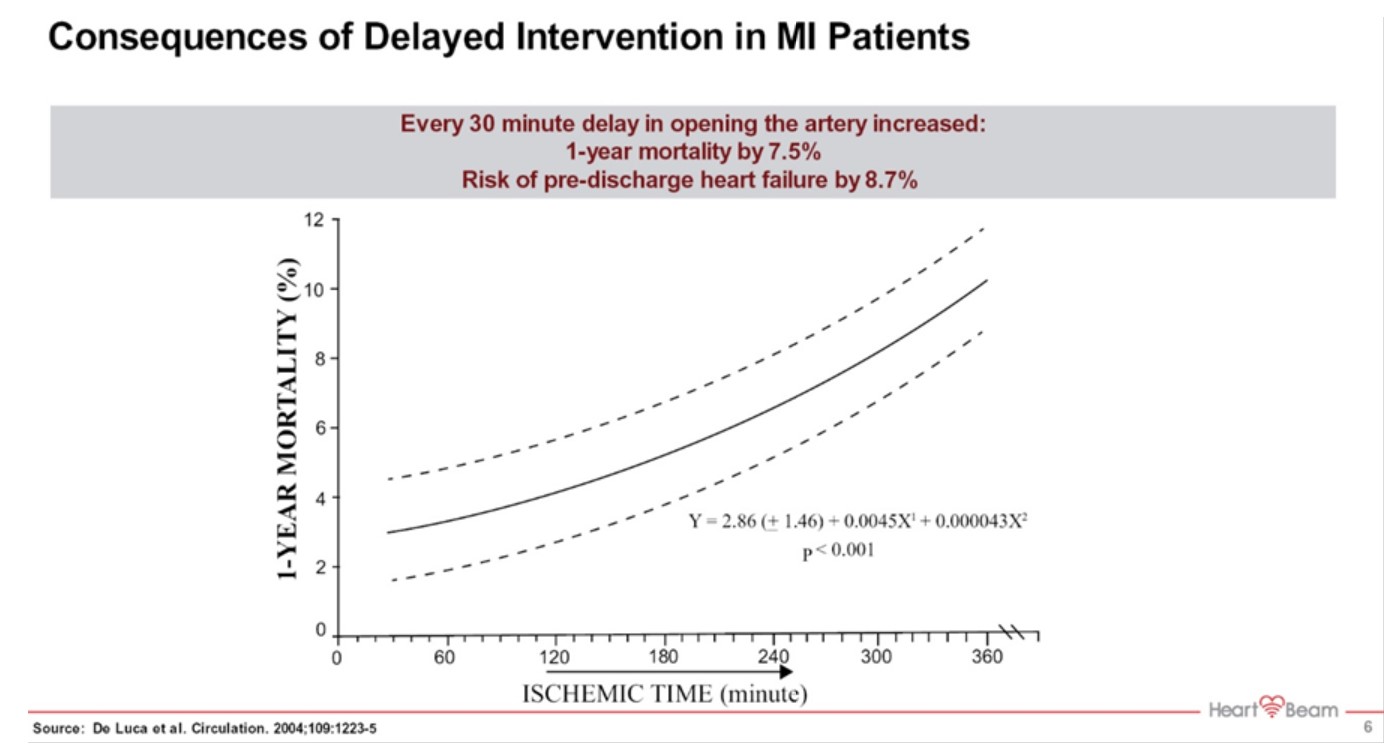

We intend to show that our easy to use device (without external electrodes) provides signals equivalent to a standard 12L device, and therefore will have a number of applications for ambulatory use. Our initial telemedicine technology Product HeartBeam AIMIGo will first address the heart attack detection market as well as the market to monitor CAD patients who are typically at high risk for a heart attack. Additionally, we expect to cater to patients across different risk profiles interested in our cardiac monitoring solutions for different heart conditions. Currently there are no products on the market that are user friendly, easy to carry, and always with the patient to provide physicians and patients with timely and highly accurate information about all heart conditions that could be detected with a 12L ECG, including potential ischemic events. A tool that is always with the patient, that decreases time to intervention, and that decreases the number of unnecessary ED visits by chest pain patients would have a significant effect on saving lives and healthcare dollars. We believe our technology will address this problem and will provide a convenient, cost-effective, integrated telehealth solution, including software and hardware for physicians and their patients. There are approximately 20 million people in the US who are considered at high risk for a heart attack, including 8 million who already have had prior intervention for MI’s and are therefore considered to be at extreme risk.

In the US, mobile cardiac tests are primarily conducted through outsourced Independent Diagnostic Testing Facilities (“IDTFs”) or as part of an RPM/telehealth system. Reimbursement rates vary depending on the use case and generally are based on the value a technology offers to patients and healthcare providers. Actual reimbursed pricing is set by the Centers

7

for Medicare & Medicaid Services (“CMS”). Reimbursement rates for private insurers typically provide for similar or higher reimbursement rates when compared to those set by the government for Medicare and Medicaid.

In the ED environment, early and accurate diagnosis of a chest pain patient who is potentially having a heart attack is of immense importance. Guidelines state that every chest pain patient in an ED must receive an ECG within 10 minutes of presentation. The accuracy of these initial ECGs, interpreted by physicians, is only approximately 75%. The need for increased ECG accuracy in detecting a heart attack in the ED is well defined, and an improved solution could result in saved lives and healthcare dollars. A 510(k) for our ED Product, HeartBeam AIMI, was submitted for review on August 15, 2022 to the FDA. We believe this Product will offer an increase in the accuracy of heart attack detection in EDs. There are approximately 5,000 Emergency Departments in the US.

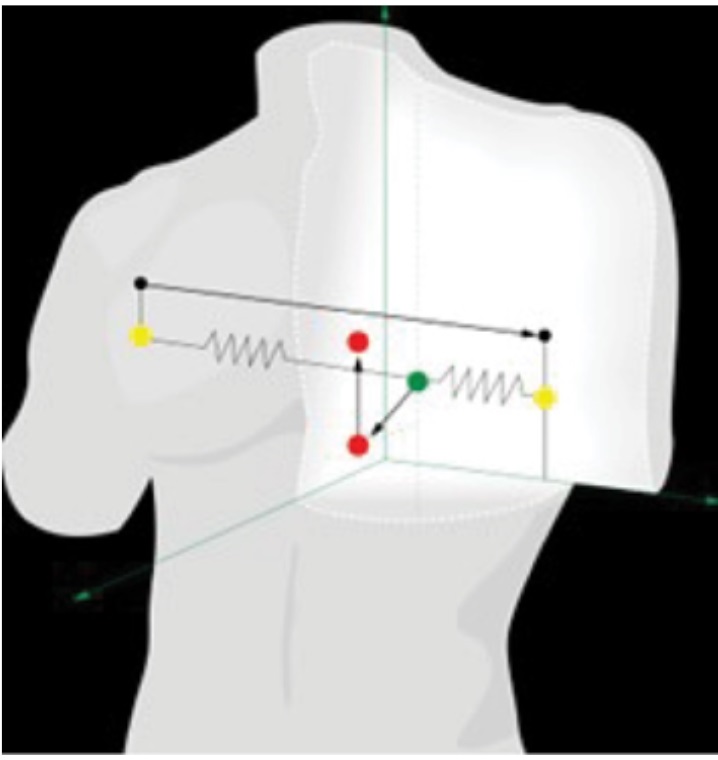

Products and Technology

The foundation of our novel technology is the concept of VECG, a technology that has long been seen as superior to ECGs in detecting MIs but is no longer used clinically because of the difficulty experienced by physicians interpreting the output. We solved the crucial problem of recording three orthogonal (x, y and z) projections of the heart vector with a device that is sized like a credit card. The thickness of our credit card sized ECG signal collection device is about 1/8 inch (4 mm), and it weighs about 1 ounce (28 grams). The core technology consists of a series of patented inventions and associated algorithms. In addition to using VECG to get a more complete 3D characterization of cardiac activity, we use the concept of a baseline. Our MI marker is a differential marker that measures the change in cardiac parameters between an asymptomatic (baseline) recording and the symptomatic recording. It is personalized for every patient as every patient has a unique baseline. Our increase in diagnostic performance in detecting MIs, when compared to a panel of cardiologists, is attributed to a richer cardiac information set offered by VECG and the fact that our MI marker compares the baseline and symptomatic recordings and does that in the 3D space of VECG.

This novel technology has resulted in two key Products to date: a telehealth Product for cardiovascular patients (HeartBeam AIMIGo) and a powerful cloud-based ECG interpretation based on a quantitative comparison of the patients 3D VECG baseline and symptomatic recordings for EDs (HeartBeam AIMI). Our telehealth ECG collection device is the size of a credit card and records cardiac signals with integrated electrodes rather than wires or self-adhesive electrodes. Unlike a standard 12-lead ECG machine that records signals in empirically determined locations on a human body, our approach is focused on recording three projections of the heart vector. The successful recording of the projections of the heart vector enables the synthesis, via a patented method, of a 12-lead signal set and internal algorithmic diagnostic work in the space of 3D heart vectors.

There are obvious ease of use advantages when comparing our handheld device that fits in a wallet and can be instantly self-applied versus the current 12-lead ECG machine that requires a trained professional to apply. In addition, there are diagnostic performance advantages, including, based on our initial study, increased accuracy in diagnosing MIs. The system is used by patients at home or elsewhere, and collected data is sent to a physician to assess whether the patient’s chest pain is truly the result of an MI.

Our telehealth HeartBeam AIMIGo system will be a prescription-only mobile health system intended for individuals with known or suspected heart disease, especially CAD. It helps guide physicians in choosing the best course of action for their patients who experience chest pain outside of a medical facility. HeartBeam AIMIGo will bring a medical grade ECG to patients and will enable them to receive a plan of action from a physician in a timely manner. At the time of onboarding and at regularly scheduled time intervals, patients record a baseline 30 second cardiac reading using our device. When a patient experiences symptoms, such as irregular heartbeats or chest pain, the patient can simply open the smartphone application and press the credit card sized device against the chest to collect signals that can be converted to a synthesized 12-lead ECG. This synthesized 12-lead ECG is sent to the physician overlayed with the patient’s synthesized baseline ECG recording. In addition, the patient provides input on their symptoms that is sent, along with the ECG data, to the cloud for interpretation by a physician. A cloud-based algorithm processes the signals and displays the symptom description and patient history to a physician to analyze and prescribe an action plan. From start to finish, the process takes just a few minutes.

The telehealth HeartBeam AIMIGo system consists of a number of capabilities that will be productized in an incremental fashion. These are:

8

1.A credit card sized cardiac electrical signal collection device. The device captures cardiac signals that represent x, y and z projections of the heart vector and transmits them via Bluetooth connection to a smartphone. It is always with the patient as it easily fits in a wallet. It is easy to use as all that is required of the patient is that the device be pressed against the chest.

2.A smartphone application that receives the cardiac signals from the HeartBeam signal collection device. The application has several functions: guiding the patient through the signal collection, asking about symptoms, displaying the status of the data collection including real time signal quality check, and notifying the patient of the plan of action as determined by a physician. In addition, the application will contain HIPAA-compliant video conferencing or text capabilities for the healthcare provider to communicate directly with the patient.

3.A cloud-based software system that serves four basic functions: (1) Performing a final check of the ECG signal quality, (2) Synthesizing a 12-lead ECG from the measured (recorded) 3 vector leads, (3) Creating a diagnostic suggestion based on 3D VECG interpretation, risk factors and symptoms and (4) Preparing a summary report for the physician. These software functions will be introduced to the HeartBeam AIMIGo product in a sequential manner. To facilitate a more accurate physician interpretation of the data, the software overlays the patient’s synthesized baseline 12 lead ECG waveform on the synthesized 12 lead ECG waveform from the current event. To ensure high signal quality, the system checks for noise levels in the recorded signals. Those signals that can be effectively filtered are accepted and those that have a noise level above an empirically established threshold are rejected. If a recorded signal is rejected, the user is asked to repeat the recording.

4.A web-based physician portal capable of displaying the following relevant information for the physician to analyze: diagnostic suggestion, patient history, symptoms, baseline and current, synthesized 12-lead ECG, and recorded 3 vector leads. Our physician portal assists physicians with their diagnostic interpretation by providing both the baseline 12-lead synthesized ECG and the 12-lead synthesized ECG that is under evaluation.

5.A dedicated ECG monitoring and reading team of medical professionals to offer 24/7/365 services in order to assist symptomatic patients when making a decision of whether they should go to the Emergency Department. This capability will be developed in-house or outsourced through a contracted third-party organization.

The market release of our telehealth Product will be in multiple versions.

The initial Product will have a limited feature set and introduce a 3-lead 3D VECG credit card-sized device, the HeartBeam AIMIGo 3L, that records the X,Y,Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(k) submission to the FDA is planned for early 2023.

Following this we will offer to the physician a pair of baseline and symptomatic 12-lead ECGs, both synthesized from 3-lead 3D VECG signals recorded by the HeartBeam AIMIGo device, and a symptoms report. It leverages recently issued patents for a personalized system for synthesizing 12-lead ECG waveforms. The 510(k) submission to the FDA is planned for late 2023.

Future versions may include our proprietary ECG interpretation MI marker and our overall MI diagnostic suggestion in addition to all features of the earlier Products and may as well offer an automated atrial fibrillation detection algorithm.

The same core technology built into the telehealth Product HeartBeam AIMIGo is used in the ED Product HeartBeam AIMI. In this application, the increased accuracy of detecting MIs by the ECG is of utmost importance. An ECG is the first diagnostic test a chest pain patient receives in the ED and it has a major impact on the patient’s subsequent clinical path. The ED Product has no hardware and introduces minimal change to the standard of care chest pain diagnostic path. It uses a baseline standard 12-lead ECG from the patient’s Electronic Medical Record (“EMR”) and the standard 12-lead ECG that is being evaluated. It converts the two ECGs to a VECG representation and utilizes our proprietary 3D VECG differential marker to generate an ECG interpretation suggestion to be used by the ED physician. The importance of increased accuracy of the first ECG interpretation for a chest pain patient presenting to an ED is significant, potentially leading to faster intervention or avoiding unnecessary activation of the cardiac catheterization lab.

9

FDA Regulatory Path

We have defined the FDA 510(k) clearance paths for both Products and have contracted with regulatory consultants to help us clear both products with the FDA.

The initial Product will have a limited feature set and introduce a 3-lead 3D VECG credit card-sized device, the HeartBeam AIMIGo 3L, that records the X, Y, Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(k) submission to the FDA is planned for early Q2 2023.

We are planning a subsequent 510(k) submission, in Q4 2023, for the Product, which will include the ability to generate synthesized 12L ECG recordings. The submission is planned to contain results of a validation study comparing our synthesized 12-lead ECG recordings to standard 12-lead ECG recordings.

HeartBeam’s ED software product, HeartBeam AIMI, is hosted on LIVMOR’s Class I registered software platform and a predicate device for the cloud-based diagnostic engine for the ED product was identified. The predicate device is widely used as part of a software package produced by a leading ECG machine manufacturer. The predicate device software makes a diagnostic suggestion regarding a potential MI diagnosis. HeartBeam AIMI will also make a diagnostic suggestion to the ED physician. In the HIDES pilot study, we showed improved performance in detecting ischemia over a panel of cardiologists.

For the FDA 510(k) regulatory submission, a retrospective study was performed comparing patients’ baseline and asymptomatic ECG recordings and providing a diagnostic suggestion from the HeartBeam AIMI software. The diagnostic suggestion of the predicate device software, that was already recorded in the patient’s EMR, was compared to the diagnostic suggestion of our Product. The 510(k) regulatory submission for market clearance was filed with the FDA on August 15, 2022.

Market Opportunity

ECGs are key diagnostic tests utilized in the diagnosis and monitoring of cardiovascular disease, the number one cause of death worldwide. In the US in 2016, there were approximately 120 million adults living with cardiovascular disease and approximately 20 million adults with diagnosed coronary artery disease. The prevalence of these cardiac conditions and thus the market size is increasing, due to an aging population and lifestyle choices.

Every 40 seconds someone in the US has a heart attack, or MI. Unfortunately, there is no way for patients to tell whether the symptoms they are experiencing are due to an MI, or some other more benign condition such as indigestion. As a result, patients often ignore symptoms and delay seeking care, which leads to worse outcomes and increased mortality. On the other hand, many patients who go to the ED with chest pain are not experiencing an MI. Chest pain is the second most common reason for an ED visit in patients over 45, yet fewer than 20% of chest pain ED visits result in a diagnosis of a life-threatening condition. These unnecessary ED visits lead to well over $10 billion in unnecessary healthcare expenditures.

Most ECGs are conducted in a healthcare facility setting using a 12-lead ECG machine, the gold standard. ECGs taken outside of healthcare facilities are expected to grow more quickly than in-hospital ECGs. Monitoring cardiac patients outside of a hospital is a fast-growing trend, as it is less expensive and provides a better patient experience. However, while ambulatory cardiac monitoring devices are often much easier for patients to use, they have fewer leads than the gold standard and therefore cannot offer as comprehensive a picture of cardiac health.

While a standard 12-lead ECG readout is of great medical value, it is simply impractical to have a standard 12-lead machine next to patients when they experience symptoms outside the clinical setting, since recording the event requires attaching multiple electrodes to the patient’s body with professional assistance. While existing technologies use predominantly single lead ECG devices to monitor arrhythmias, these technologies do not provide information to the physician on the presence of life-threatening conditions of acute coronary syndrome (“ACS”) or heart attacks.

We believe our telehealth technology addresses these market needs and has several key attributes that make it a good fit for these patients. Our telehealth Product is generally used when symptoms occur and offers the potential for lifelong patient usage. The device is practically always near the patient and ready to be used for recording a cardiac event. It enables very

10

nearly real-time cardiac data transmission during a telemedicine visit. It offers a recorded 3 vector lead set of signals and a synthesized 12-lead ECG set of signals. We believe physicians will typically prescribe our solution to chronic cardiovascular patients for long term monitoring, thereby enabling prolonged data collection and delivering a more complete picture for diagnosis. This will also enable the use of artificial intelligence on our future database that will have a unique set of longitudinal synthesized 12-lead ECGs for patients.

As our VECG platform demonstrates 12-Lead equivalence and clinical & cost-effectiveness advantages, coupled with a patent protected technology, we believe this might open multiple licensing and/or partnering opportunities with players in the ECG, cardiac monitoring patch and smart watch verticals.

Market Strategy

Our goal is to establish our products as key solutions for cardiology practices and hospital EDs. Our efforts to enter the market involve establishing clinical evidence and demonstrating the cost-effectiveness of adopting our products. For both the telehealth (HeartBeam AIMIGo) and the ED Products (HeartBeam AIMI), the initial geographic market is the United States.

We believe that both the telehealth and ED Products will be subject to the US FDA’s 510(k) review process. A 510(k) for our HeartBeam AIMI was submitted to the FDA on August 15, 2022, for review and we are in the process of preparing a 510(k) submission for HeartBeam AIMIGo.

For HeartBeam AIMIGo, the primary customers are cardiology practices and the cardiology departments of hospitals. Healthcare insurers are another important customer, as they will potentially benefit from the reduced costs to the healthcare system. We are working to develop new clinical studies and publish results of completed clinical studies and plan to demonstrate real world cost-effectiveness of the use of the solution.

Our initial targets for HeartBeam AIMIGo are market segments that see value in an easy-to-use device that can generate synthesized 12L ECG recordings. These will be segments in which payment for the device will be outside of the established reimbursement system. These target segments include concierge practices, hospital-at-home segment and clinical trials. As we establish clinical data on the clinical and cost-effectiveness of HeartBeam AIMIGo, we will target at-risk cardiology practices, including high risk patients being discharged from hospitals after experiencing an MI.

Our long-term strategy is to generate sufficient evidence of clinical efficacy and cost-effectiveness to generate reimbursement coverage and payment specifically for the HeartBeam AIMIGo solution. We expect to be able to demonstrate significant clinical benefits for patients and savings to the healthcare system, justifying appropriate reimbursement levels.

For the telehealth Product, our primary marketing strategy will focus on the medical community with continued validation of clinical efficacy and cost-effectiveness and the establishment of reference sites. We will also create educational materials and provide other support to help educate our customers’ patients.

We will explore other business models. For example, hospitals face CMS penalties if their 30-day readmission rates for patients who are discharged after an MI exceed certain thresholds. These CMS penalties are levied on all hospital CMS payments, so the impact can be significant. Our telehealth Product can be a tool to help hospitals manage these patients after discharge. We will explore models in which hospitals pay for the device and for the initial 30 days of service. In addition, we will explore models for value-based care, in which the use of the telehealth Product reduces overall costs.

We are currently speaking with hospitals in large healthcare systems to educate them about our first two products. These are sophisticated customers, and we plan to use technical presentations, peer reviewed clinical data, and demonstration projects to achieve penetration of this market. We plan to continue to expand our medical advisory board, conduct clinical trials with leading cardiologists to increase the body of evidence, and establish reference sites among these customers.

For the ED Product, the primary customers are acute care facilities. As with the telehealth Product, we plan to publish clinical studies on the effectiveness of the Product. In addition, we plan to develop financial models demonstrating the cost-effectiveness of the approach and establish reference sites who are using the Product. We do not expect to obtain specific reimbursement for the ED Product but intend to demonstrate that the purchase of the software would result in clinical and economic benefits and potentially reduced malpractice legal exposure for ED provider institutions.

11

We expect our value proposition will be progressively increased as we gradually add additional functionality to our monitoring solutions and drive down the cost of continuous monitoring by increasing scale and automation. We expect our HeartBeam AIMIGo device and AIMI software to gradually incorporate internally developed algorithms with the capabilities of detecting heart conditions that can be exposed via a standard 12-L ECG device. Additionally, as we collect rich longitudinal data sets from our patients, we expect to train AI and ML algorithms that could potentially have predictive capabilities regarding different heart conditions. Over time and with scale we expect our costs to decrease and provide more and better services to our patients by improving our capabilities.

We plan to establish a direct sales network with relationships and experience selling to our target markets.

Clinical Data

HeartBeam has performed three clinical studies to assess performance of our technologies.

1. HIDES — Included 66 patients whose coronary arteries were occluded during a Percutaneous Coronary Intervention (“PCI”) and had electrical signals simultaneously collected by both a traditional 12-lead ECG and our vector signal-based device.

ECG recordings:

66 baseline recordings for each patient were taken during patient enrollment and prior to the balloon inflation. These were ischemia negative recordings. 120 recordings were taken during balloon occlusions in various arteries. These were ischemia positive recordings. There were a total of 186 diagnostic recordings: 66 ischemia negative recordings and 120 ischemia positive recordings.

Study design:

The HeartBeam automated ischemia marker is based on the vector difference between ST vectors of the symptomatic and baseline recordings. Human reading results were obtained by averaging results from three expert readers (two electrophysiologists and one invasive cardiologist) who were presented with the 186 standard 12-lead ECG recordings. These readings were performed in two sessions four weeks apart. A total of six readings were averaged to arrive at human readers’ ischemia detection performance.

Study results:

The automated HeartBeam ischemia marker was superior to human expert reading for detecting acute ischemia (66 patients, 120 balloon occlusions: 186 total recordings) using ECG signals only:

| SENSITIVITY [%] | SPECIFICITY [%] | ACCURACY [%] | ||||||||||||||||||

| Human readings | 71.94 | 70.96 | 71.59 | |||||||||||||||||

| HeartBeam ischemia marker | 91.7 | 95.5 | 93 | |||||||||||||||||

| p<0.01 | p<0.01 | p<0.01 | ||||||||||||||||||

The ischemia marker showed an area under the curve (“AUC”) in the receiver operating characteristic (“ROC”) curve of 93.6%. HeartBeam’s marker accuracy was consistent across the three culprit arteries (LAD, LCX, RCA), p=1.00. There was no statistically significant difference in accuracy between three human readers (p=1.00).

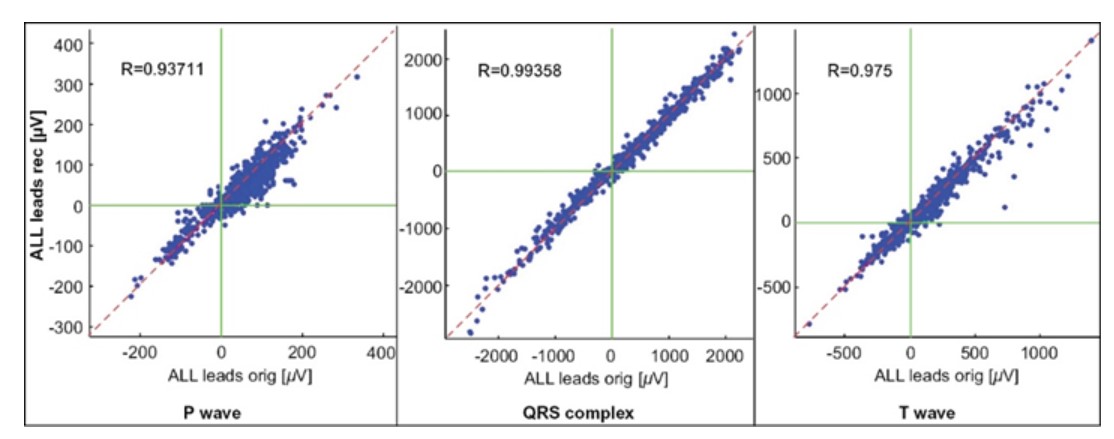

Synthetized vs, standard 12 lead ECG:

The synthesized 12 lead ECG was obtained using an individual transformation matrix obtained from standard 12 lead signals. Comparison of the standard 12 lead and synthetized 12 lead ECGs were performed with standard correlation analyses. Results for Pearson’s correlation coefficient R between standard 12 lead and synthetized 12 lead ECGs were:

P wave: R = 0.937;

QRS complex: R = 0.994;

T wave: R = 0.975

12

They are shown in the graphical form for all 186 pairs of signals (standard and synthesized 12-lead):

Pearson’s correlation coefficient is the test statistic that measures the statistical relationship between two continuous variables A value of 1 implies that a linear equation describes the relationship perfectly; value of 0 implies that there is no linear correlation between the variables

2. B Score — Evaluation of sensitivity and specificity of the HeartBeam diagnostic algorithm in diagnosing patients with ACS in the ED setting.

Study design and enrollment:

Enrolled were all patients presenting to an ED with chest pain or other symptoms suggestive of ACS who a) answered questions about risk factors and chest pain characteristics and b) had standard 12-lead ECG and HeartBeam ECG recorded 3 times with 10-15 minutes intervals between recordings. The final decision whether a patient was having ACS was determined by 3 cardiology experts (gold standard panel) based on discharge diagnosis and one week follow up data.

An additional HeartBeam ECG recording was taken between 9 and 12 months after the initial visit, when ST resolution was completed in most cases, and this recording was used as the baseline ECG in HeartBeam’s diagnostic algorithm. The same set of data — risk factors, chest pain characteristics and three recordings — were used for evaluation of the HeartBeam algorithm and presented to three expert cardiologists (evaluation panel) for a blinded evaluation.

Study results:

110 ER patients presenting with chest pain of which 29 (26%) with ACS (per gold standard panel), underwent HeartBeam assessment as well as assessment by the evaluation cardiologist panel. Sensitivity of the HeartBeam algorithm was 97% (27/28) and specificity was 56% (45/81). The only positive patient missed by the algorithm had known coronary disease with typical anginal episode resulting in a troponin leak. The average sensitivity and specificity of the evaluation cardiologists panel was 94% and 54%, respectively. The diagnostic performance of the HeartBeam algorithm in determining presence of the ACS in these patients was statistically indifferent from the performance of the evaluation cardiologist panel (p>0.42).

This result indicates that the quality of the advice produced by our expert system will be extremely valuable to the physician who is assessing the condition of a patient in a telehealth environment.

3. ISPEC — evaluation of the ECG signal quality and specificity of the ACS detection (false positive rate) in real-life use of the HeartBeam device by non-symptomatic patients.

Study design and enrollment:

The study included 30 participants, healthy volunteers, and patients with different cardiac disturbances. The participants recorded three HeartBeam recordings three times daily, for 3 to 7 days. The ECG signal quality was evaluated as the percentage of recordings rejected by the HeartBeam cloud-based software due to insufficient signal quality. The specificity of HeartBeam in classification of non-ischemic recordings was performed by application of HeartBeam’s ACS detection

13

algorithm. It was assumed that none of the patients was ischemic during the study period, as none reported chest pain symptoms.

Study results:

The study generated a total of 1845 recordings; 19.5% (360/1845) of the recordings were rejected by HeartBeam due to insufficient signal quality and had to be repeated. The false positive rate of the HeartBeam algorithm in classification of non-ischemic recordings was zero. In other words, the specificity was 100% in real-life use of our system in asymptomatic patients.

Competition

The cardiac monitoring and detection market is characterized by rapid technological change and strong competition. There are numerous companies developing technologies that are competitive, in a broad sense, to our products, and many of these companies have significantly greater resources than HeartBeam.

In the category of ambulatory (telehealth) cardiac monitors — devices that are intended to be used outside of a health facility setting — there are two major segments: consumer devices and devices prescribed for ACS.

Consumer Devices

The consumer device segment consists of devices that are FDA cleared but are sold directly to patients, without a prescription. Generally, these devices are single lead ECG devices intended to recognize heart rhythm abnormalities, such as atrial fibrillation, but are not intended for ischemia detection or for life threatening conditions such as heart attack.

•Apple Inc, a public company located in Cupertino, CA, produces the Apple Watch, which includes ECG functionality. The Apple Watch is a single lead ECG with two electrodes that contact the wrist and the finger and is intended to detect some common cardiac arrhythmias, such as Atrial Fibrillation.

•AliveCor Inc, a private company located in Mountain View, CA, produces the KardiaMobile, KardiaMobile Card and KardiaMobile 6L devices. These devices are intended to detect some common cardiac arrhythmias, such as Atrial Fibrillation.

•Google Inc, a public company located in Mountain View, CA, produces the Fitbit Sense smartwatch and ECG app. The Fitbit Sense watch is a single lead ECG with two electrodes that contact the fingers and is intended to detect some common cardiac arrhythmias, such as Atrial Fibrillation.

•Samsung Electronics Co., Ltd, based in Seoul, South Korea, is publicly traded in Korea. It produces the Galaxy Watch3 and Galaxy Watch Active2 smartwatches with ECG functionality, intended to detect some common cardiac arrhythmias, such as Atrial Fibrillation.

Devices prescribed for ischemia detection

There are a small number of devices that have been cleared by FDA to be used outside of healthcare facilities that provide information for patients with potential ischemic events such as MIs.

•Angel Medical Systems, Inc. is a private company based in Eatontown, NJ. The AngelMed Guardian is an implantable cardiac monitor for patients who are deemed to be extremely high risk for an MI. Physicians implant the AngelMed Guardian in patients. We believe that the HeartBeam AIMIGo device will be a viable alternative to the AngelMed Guardian, as it does not require an implant and does not have a high up-front cost.

•SHL Telemedicine Ltd., is based in Tel Aviv, Israel and is publicly traded. It produces Smartheart Pro, a 12 lead ECG indicated for patient use at home. Smartheart Pro is larger and more complex than our telehealth solution, requiring the placement of an electrode belt, two underarm electrodes and a waist electrode, and moistening the areas before use. Most patients would find this technology impractical to be carried with them at all times because of the large size and complex lead attachment procedure.

There are several competitors in the category of software that automatically analyzes 12 lead ECGs performed in healthcare facilities, specifically in an ED. Major competitors in this market include the following:

14

•General Electric, a publicly traded company based in Chicago, IL produces a line of ECG equipment. The Company also has developed the GE Marquette 12SL ECG analysis program, which analyzes the ST segment of the ECG to detect potential cardiac ischemia. It does not use the 3D vector approach in deriving a diagnostic suggestion.

•Koninklijke Philips N.V., a publicly traded company based in Amsterdam, NL, produces a range of ECG products, including products that feature the DXL algorithm for resting ECGs. The Philips DXL algorithm monitors the ST segment to detect STEMI. It does use the 3D vector approach in deriving a diagnostic suggestion.

Intellectual Property

We believe our intellectual property (“IP”) protects our innovations, and our goal is to become a leader in the ambulatory VECG sector. For some aspects of our proprietary technology, we rely on trade secret protection. It is our view that the combination of these two methods of IP protection maximizes our chances for success.

HeartBeam has nine issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963, U.S. 11,529,085, U.S. 10,980,433, U.S. 11,412,972 and U.S. 11,234,658), and six pending U.S applications. Four of the pending applications have been published, the remaining two pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands, and United Kingdom and seven pending applications in Canada, China, the European Union (“EU”), Japan and Australia. HeartBeam has three pending PCT applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

Our issued and pending U.S. patent applications cover compact VECG systems for remote detection and/or diagnosis of acute myocardial infarction (“AMI”). Outside of the U.S., the pending EU, Australian (“AU”), Japanese (“JP”) and Chinese (“CN”) patent applications correspond to the pending and issued US cases. The pending PCT applications cover methods and apparatuses for automatic cardiac diagnosis as well as compact systems including retractable electrodes.

15

The following table sets forth a brief description of issued and pending patents, including their respective titles:

| Patent Type | Application No. Pat. No. | Status | Predicted Expiration | Title Summary | ||||||||||||||||||||||

| Utility (US) | 15/096,159 US 10,433,744 | Issued | Sep 15, 2036 | MOBILE THREE-LEAD CARDIAC MONITORING DEVICE AND METHOD FOR AUTOMATED DIAGNOSTICS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (US) | 15/632,155 US 10,117,592 | Issued | Apr 11, 2036 | MOBILE THREE-LEAD CARDIAC MONITORING DEVICE AND METHOD FOR AUTOMATED DIAGNOSTICS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (US) | 17/092,152 | Published | Apr 11, 2036 | MOBILE THREE-LEAD CARDIAC MONITORING DEVICE AND METHOD FOR AUTOMATED DIAGNOSTICS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (US) | 17/202,299 US 11,071,490 | Issued | Apr 11, 2036 | ELECTROCARDIOGRAM PATCH DEVICES AND METHODS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (CN) | 201680030550.5 | Published | Apr 11, 2036 | MOBILE THREE-LEAD CARDIAC MONITORING DEVICE AND METHOD FOR AUTOMATED DIAGNOSTICS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (EU) | 16777474.4 | Allowed | Apr 11, 2036 | MOBILE THREE-LEAD CARDIAC MONITORING DEVICE AND METHOD FOR AUTOMATED DIAGNOSTICS Methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (EU) | 198948150 | Pending | Nov 18, 2039 | HAND HELD DEVICE FOR AUTOMATIC CARDIAC RISK AND DIAGNOSTIC ASSESSMENT Method and apparatus for performing automatic cardiac diagnosis. | ||||||||||||||||||||||

| Utility (US) | 17/296,669 | Pending | Nov 18, 2039 | HAND HELD DEVICE FOR AUTOMATIC CARDIAC RISK AND DIAGNOSTIC ASSESSMENT Method and apparatus for performing automatic cardiac diagnosis. | ||||||||||||||||||||||

| Utility (US) | 17/443,456 | Pending | Apr 11, 2036 | ELECTROCARDIOGRAM PATCH DEVICES AND METHODS Adhesive patch methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (US) | 17/570,368 US 11,419,538 | Issued | Apr 11, 2036 | ELECTROCARDIOGRAM PATCH DEVICES AND METHODS Adhesive patch methods and apparatuses for remote and detection and/or diagnosis of acute myocardial infarction (AMI). | ||||||||||||||||||||||

| Utility (US) | 17/609,014 | Pending | May 20, 2040 | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

16

| Patent Type | Application No. Pat. No. | Status | Predicted Expiration | Title Summary | ||||||||||||||||||||||

| Utility (AU) | 2020275409 | Pending | May 20, 2040 | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

| Utility (CA) | 3137669 | Pending | May 20, 2040 | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

| Utility (EU) | 208063123 | Pending | May 20, 2040 | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

| Utility (JP) | 2021568329 | Pending | May 20, 2040 | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

| Utility (PCT) | PCTUS2021 059271 | Pending | N/A | COMPACT MOBILE THREE-LEAD CARDIAC MONITORING DEVICE WITH HYBRID ELECTRODE Compact, mobile three-lead cardiac monitoring devices for remote detection and/or diagnosis of cardiac events. | ||||||||||||||||||||||

| Utility (PCT) | PCTUS2022 011075 | Pending | N/A | AMBULATORY ELECTROCARDIOGRAM PATCH DEVICES AND METHODS Cardiac monitoring patch devices (e.g., an ECG patch for 12-lead detection) for remote detection and/or diagnosis of cardiac events (e.g., acute myocardial infarction). | ||||||||||||||||||||||

| Utility (US) | 17/494,806 US 11,445,963 | Issued | Oct 5, 2041 | METHOD AND APPARATUS FOR RECONSTRUCTING ELECTROCARDIOGRAM (ECG) DATA Synthesizing (generating) 12-lead ECG dataset from 3-lead ECG data. | ||||||||||||||||||||||

| Utility (US) | 17/726,497 US 11,529,085 | Issued | Oct 5, 2041 | APPARATUS FOR GENERATING AN ELECTROCARDIOGRAM Wrist-worn device can be taken off of the wrist and held against the chest to detect three orthogonal cardiac leads, and methods of using a wrist-worn device to detect the three orthogonal cardiac leads. | ||||||||||||||||||||||

| Utility (US) | 16/362,527 US 10,980,433 | Issued | Nov 22, 2038 | HEALTH MONITORING AND GUIDANCE Methods, systems and software for the determination of stress states utilizing PPG sensors. | ||||||||||||||||||||||

| Utility (US) | 16/368,568 US 11,412,972 | Issued | Apr 19, 2040 | DETECTION OF ATRIAL FIBRILLATION Methods and software for determining atrial fibrillation utilizing PPG sensors. | ||||||||||||||||||||||

| Utility (US) | 16/368,571 US 11,234,658 | Issued | Apr 5, 2039 | PHOTOPLETHYSMOGRAM DATA ANALYSIS AND PRESENTATION Methods, systems and software for the creation of ECG-type waveforms from PPG sensor data. | ||||||||||||||||||||||

We have entered, and generally plan to continue to enter into, non-disclosure, confidentiality and intellectual property assignment agreements with all new employees as a condition of employment. In addition, we intend to generally enter into confidentiality and non-disclosure agreements with consultants, manufacturers’ representatives, distributors, suppliers, and others to attempt to limit access to, use and disclosure of our proprietary information. There can be no assurance, however, that these agreements will provide meaningful protection or adequate remedies for our trade secrets in the event of unauthorized use or disclosure of such information.

The ownership of all filed patents is assigned to HeartBeam, Inc.

17

Research and Development

The primary objective of our research and development program is to provide innovative, user-friendly, ambulatory VECG solutions with high medical value. To date, we have been highly successful in developing our initial products. The emphasis has been on developing a user-friendly solution that is always with the patient and assists physicians in diagnosing heart attacks in chest pain patients.

Our Research team is largely based in Belgrade, Serbia as well as in California, USA. We have assembled a highly capable Belgrade team currently consisting of seven PhD level contributors who are credited with developing our key inventions and patents. The diverse group includes:

•Two nuclear physicists.

•Two Biomedical Engineers experienced in developed digital health applications.

•Two highly experienced Healthcare IT development professionals.

•Two Electrical Engineers (M.S.E.E) with strong signal processing and ECG analysis algorithm expertise from the medical device industry.

•An Electrical Engineer (M.S.E.E) with exceptional implantable medical device development and power optimization expertise.

•A Software Engineer, (PhD Computer Science), with deep expertise in developing mobile applications for medical devices.

Future research and development efforts will focus on the application of signal processing and artificial intelligence to address a range of cardiac conditions.

During 2022 we also added 3 development engineers led by our recently hired Chief Technology Officer Kenneth Persen. This is an experienced development team that worked together previously and was successful in delivering FDA cleared products.

Future Products

Our core technology — the heart vector approach adopted and invented by our research team — is a platform technology that can provide diagnostic solutions to a variety of cardiovascular patients. Our plans call for expanding solutions that diagnose all major cardiac conditions that are diagnosed by ECGs.

Future plans include the development of a VECG-based, synthesized 12-lead capable patch ECG monitor that will provide advantages over existing single-lead ECG patch products such as the Zio-XT from iRhythm Technologies, Inc. Our approach will offer a synthesized 12-lead ECG with a patch that is very similar, in dimensions and look and feel, to the currently available single lead ECG patches. We believe providing standard of care 12-lead ECG capabilities will have significant diagnostic advantages over a single lead patch.

We also plan to develop a synthesized 12-lead ECG smartwatch-based monitor intended for detection of heart attacks and complex cardiac arrhythmias. This invention eliminates the need for a dedicated ECG device while offering a synthesized 12-lead ECG capability enabling heart attack and complex arrhythmia detection.

While our initial telehealth Product is powered by a software expert system that serves as a diagnostic aid to a physician, we will develop an AI based diagnostic system that will supplement our diagnostic expert system.

We are committed to continue advancing the full potential inherent in our synthesized 12-lead 3D VECG technology as demonstrated in recently issued and allowed patents with potentially disruptive market impacts.

Government Regulation

General

Our proposed products are subject to regulation by the FDA and various other federal and state agencies, as well as by foreign governmental agencies. These agencies enforce laws and regulations that govern the development, testing, manufacturing, labeling, advertising, marketing and distribution, and market surveillance of our products.

18

In addition to those indicated below, the only other regulations we encounter are regulations that are common to all businesses, such as employment legislation, implied warranty laws, and environmental, health and safety standards, to the extent applicable. In the future we will be subject to industry-specific government regulations that govern our products when developed for commercial use. It is possible that other regulatory approvals will be required for the design and manufacture of our products and proposed products.

U.S. Regulation

The FDA governs the following activities that HeartBeam performs, and will perform, upon the clearance or approval of its Product, or that are performed on its behalf, to ensure that medical products distributed domestically or exported internationally are safe and effective for their intended uses:

•product design, and development

•product safety, testing, labeling and storage

•record keeping procedures; and

•product marketing.

There are numerous FDA regulatory requirements governing the approval or clearance and subsequent commercial marketing of our products. These include:

•the timely submission of product listing and establishment registration information, along with associated establishment user fees;

•continued compliance with the Quality System Regulation, or QSR, which require specification developers and manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process;

•labeling regulations and FDA prohibitions against the promotion of products for uncleared, unapproved or off-label use or indication;

•clearance or approval of product modifications that could significantly affect the safety or effectiveness of the device or that would constitute a major change in intended use;

•Medical Device Reporting regulations (“MDR”), which require that manufacturers keep detailed records of investigations or complaints against their devices and to report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur;

•adequate use of the Corrective and Preventive Actions process to identify and correct or prevent significant systemic failures of products or processes or in trends which suggest same;

•post-approval restrictions or conditions, including post-approval study commitments;

•post-market surveillance regulations, which apply when necessary, to protect the public health or to provide additional safety and effectiveness data for the device; and

•notices of correction or removal and recall regulations.

Depending on the classification of the device, before HeartBeam can commercially distribute medical devices in the United States, it must obtain, either prior 510(k) clearance, 510(k) de-novo clearance or premarket approval (“PMA”), from the FDA unless a respective exemption applies to the device under review by the FDA.

The FDA classifies medical devices into one of three classes based on the degree of risk associated with each medical device and the extent of regulatory controls needed to ensure the device’s safety and effectiveness:

•Class I medical devices, which are low risk and subject to only general controls (e.g., registration and listing, medical device labeling compliance, MDRs, Quality System Regulations, and prohibitions against adulteration and misbranding) and, in some cases, to the 510(k) premarket clearance requirements;

19

•Class II medical devices, which are moderate risk and generally require 510(k) or 510(k) de-novo premarket clearance before they may be commercially marketed in the United States as well as general controls and potentially special controls like performance standards or specific labeling requirements; and

•Class III medical devices, which are devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a predicate device. Class III medical devices generally require the submission and approval of a PMA supported by clinical trial data.

The custom software and hardware of our products, we believe, are classified as Class II that will run on a Class I platform. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k). As part of the 510(k), the FDA may have required the following:

•Development of comprehensive product description and indications for use;

•Completion of extensive preclinical tests and preclinical animal studies, performed in accordance with the FDA’s Good Laboratory Practice (“GLP”) regulations;

•Comprehensive review of predicate devices and development of data supporting the new product’s substantial equivalence to one or more predicate devices; and

•If appropriate and required, certain types of clinical trials (IDE submission and approval may be required for conducting a clinical trial in the US).

Clinical trials involve use of the medical device on human subjects under the supervision of qualified investigators in accordance with current Good Clinical Practices (“GCPs”), including the requirement that all research subjects provide informed consent for their participation in the clinical study. A written protocol with predefined end points, an appropriate sample size and pre-determined patient inclusion and exclusion criteria, is required before initiating and conducting a clinical trial. All clinical investigations of devices to determine safety and effectiveness must be conducted in accordance with the FDA’s Investigational Device Exemption, or IDE, regulations that among other things, govern investigational device labeling, prohibit promotion of the investigational device, and specify recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. If the device presents a “significant risk,” as defined by the FDA, the agency requires the device sponsor to submit an IDE application, which must become effective prior to commencing human clinical trials. The IDE will automatically become effective 30 days after receipt by the FDA, unless the FDA denies the application or notifies the Company that the investigation is on hold and may not begin. If the FDA determines that there are deficiencies or other concerns with an IDE that requires modification, the FDA may permit a clinical trial to proceed under a conditional approval. In addition, the study must be approved by, and conducted under the oversight of, an Institutional Review Board (“IRB”) for each clinical site. If the device presents a non-significant risk to the patient, a sponsor may begin the clinical trial after obtaining approval for the trial by one or more IRBs without separate approval from the FDA, but it must still follow abbreviated IDE requirements, such as monitoring the investigation, ensuring that the investigators obtain informed consent, and labeling and record-keeping requirements.

Given successful completion of all required testing, a detailed 510(k) premarket notification or 510(k) de-novo will be submitted to the FDA requesting clearance to market the product. This notification will include all relevant data from pertinent preclinical and clinical trials, together with detailed information relating to the product’s manufacturing controls and proposed labeling, and other relevant documentation.

A 510(k)-clearance letter from the FDA authorizes commercial marketing of the device for one or more specific indications of use.

After 510(k) clearance, HeartBeam is required to comply with several post-clearance requirements, including, but not limited to, Medical Device Reporting and complaint handling, and, if applicable, reporting of corrective actions. Also, quality control and manufacturing procedures must continue to conform to Quality System Regulations (“QSR”). The FDA periodically inspects manufacturing facilities to assess compliance with FDA’s QSR, which impose extensive procedural, substantive, and record keeping requirements on medical device manufacturers. In addition, changes to the manufacturing process are strictly regulated, and, depending on the change, validation activities may need to be performed. Accordingly,

20

manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with QSR and other types of regulatory controls.

After a device receives 510(k) clearance from the FDA, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use or technological characteristics, requires a new 510(k) clearance or could require a PMA. The FDA requires each manufacturer to make the determination of whether a modification requires a new 510(k) notification or PMA in the first instance, but the FDA can review any such decision. If the FDA disagrees with a manufacturer’s decision not to seek a new 510(k) clearance or PMA for a particular change, the FDA may retroactively require the manufacturer to seek 510(k) clearance or PMA. The FDA can also require the manufacturer to cease U.S. marketing and/or recall the modified device until additional 510(k) clearance or PMA approval is obtained.

The FDA and the Federal Trade Commission (“FTC”), will also regulate the advertising claims of HeartBeam’s products to ensure that the claims it makes are consistent with its regulatory clearances, that there is scientific data to substantiate the claims and that product advertising is neither false nor misleading.

We will apply for 510(k) clearance for both our cloud-based diagnostic engine for the ED product and the cloud-based diagnostic engine and hardware components of our telehealth Product. To obtain 510(k) clearance, a company must submit a notification to the FDA demonstrating that its proposed device is substantially equivalent to a predicate device (i.e., a device that was in commercial distribution before May 28, 1976, a device that has been reclassified from Class III to Class I or Class II, or a 510(k)-cleared device). The FDA’s 510(k) clearance process generally takes from three to 12 months from the date the application is submitted but also can take significantly longer. If the FDA determines that the device or its intended use is not substantially equivalent to a predicate device, the device is automatically placed into Class III, requiring the submission of a PMA. Once the information is submitted, there is no guarantee that the FDA will grant a company 510(k) clearance for its pipeline products, and failure to obtain the necessary clearances for its products would adversely affect its ability to grow its business. Delays in receipt or failure to receive the necessary clearances, or the failure to comply with existing or future regulatory requirements, could reduce its business prospects.

Devices that cannot be cleared through the 510(k)-process due to lack of a predicate device but would be considered low or moderate risk may be eligible for the 510(k) de-novo process. In 1997, the Food and Drug Administration Modernization Act (“FDAMA”) added the de novo classification pathway now codified in section 513(f)(2) of the FD&C Act. This law established an alternate pathway to classify new devices into Class I or II that had automatically been placed in Class III after receiving a Not Substantially Equivalent (“NSE”), determination in response to a 510(k) submission. Through this regulatory process, a sponsor who receives an NSE determination may, within 30 days of receipt, request FDA to make a risk-based classification of the device through what is called a “de novo request.” In 2012, section 513(f)(2) of the FD&C Act was amended by section 607 of the Food and Drug Administration Safety and Innovation Act (“FDASIA”), to provide a second option for de novo classification. Under this second pathway, a sponsor who determines that there is no legally marketed device upon which to base a determination of substantial equivalence can submit a de novo request to FDA without first submitting a 510(k).

If a company receives a Not Substantially Equivalent determination in response to a 510(k) submission, the device may still be eligible for the 510(k) de novo classification process.

Devices that cannot be cleared through the 510(k) or 510(k) de novo classification process require the submission of a PMA. The PMA process is much more time consuming and demanding than the 510(k)-notification process. A PMA must be supported by extensive data, including but not limited to data obtained from preclinical and/or clinical studies and data relating to manufacturing and labeling, to demonstrate to the FDA’s satisfaction the safety and effectiveness of the device. After a PMA application is submitted, the FDA’s in-depth review of the information generally takes between one and three years and may take significantly longer.

We also need to establish a suitable and effective quality management system, which establishes controlled processes for our product design, manufacturing, and distribution. We plan to do this in compliance with the internationally recognized standard ISO 13485:2013 Medical Devices — Quality Management Systems — Requirements for Regulatory Purposes. Following the introduction of a product, the FDA and foreign agencies engage in periodic reviews of our quality systems, as well as product performance and advertising and promotional materials. These regulatory controls, as well as any changes in FDA policies, can affect the time and cost associated with the development, introduction, and continued availability of new products. Where possible, we anticipate these factors in our product development processes. These

21

agencies possess the authority to take various administrative and legal actions against us, such as product recalls, product seizures and other civil and criminal sanctions.

To reduce time and minimize the need to hire permanent technical and regulatory staffing in pursuing our FDA clearances we have contracted with a service provider to prepare our Products for FDA submission. This is the most efficient way to maximize our chances for timely FDA clearances.

Based on all available data and opinions from our well qualified external consultants who specialize in FDA submissions, we believe that both our initial products and the follow-on products qualify for the 510(k)-clearance path.

Foreign Regulation

As we plan to market our products in the EU and other foreign markets, in addition to regulations in the United States, we will be subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution of our products in foreign countries. Whether or not we obtain FDA approval for a product, we must obtain approval of a product by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

Preparations for FDA Clearance Submissions and Design for Manufacturing

To date, we focused primarily on research and development of our first two Products. We have fully functional, pre-production versions of our first two Products which we were used in most of our medical studies. Production versions on the products will go through the required design control processes, and all required verification and validation testing, including all safety testing to the applicable standards. These documents will be provided in the 510(k) regulatory submission to the FDA for market clearance. We are not yet at a stage to commence volume production of our products.

We contracted with LIVMOR to prepare HeartBeam AIMI for clearance via a 510(k) submission to the FDA. The principal terms of this contract were to incorporate the product requirements, user needs, and 3D vector algorithm plugin developed by HeartBeam into this ED MI software Product. Our contract with Triple Ring, Inc., a US-based medical device and design engineering organization (“TRIPLE RING”) as the development partner is to turn the ECG Hardware prototype into a commercially ready product cleared by the FDA. The principal terms of the agreement require TRIPLE RING to perform the design, development, and testing of the ECG device and interface with the user application. With oversight from and in partnership with HeartBeam, TRIPLE RING will define all requirements, testing, detailed design, verification protocols, and test cases for all subsystems included in the ECG device product. Once the subsystems are complete, the service provider will perform system-level software testing. Once completed, the product will be provided to HeartBeam to perform system validation testing using clinical data from post-MI patients.

We plan to have a scalable manufacturing strategy. With initial HeartBeam AIMIGo devices we are working on a time and material basis with Evolve Manufacturing Technologies (“Evolve”), a contract medical device manufacturing company that provides end-to-end contract manufacturing for medical device and life sciences instrument companies. As manufacturing operations become more automated we plan to invest in appropriate tooling (e.g. molds) and we plan to enter into a separate manufacturing agreement to leverage Evolve’s manufacturing and packaging expertise to support commercialization of the HeartBeam AIMIGo device in anticipation of early market testing and FDA Clearance. Evolve has previously collaborated with TRIPLE RING, HeartBeam’s co-developer of the AIMIGo device, creating additional synergies as the device moves into manufacturing technology transfer. Evolve uses Design for Excellence (“DFX”) methodologies and its quality processes are integrated with TRIPLE RING. They offer turnkey contract manufacturing for our initial needs with low to medium production volumes, from first article builds to prototypes and clinical units.

We plan to consider other manufacturers, inside and outside the US, for our high-volume manufacturing.

Employees

As of December 31, 2022, we had 15 full-time employees. We have budgeted to hire additional full-time employees (including additional consultants or independent contractors) in the near future to execute our growth plans.

22

We consider our employee relations to be good.

Corporate Information

Our principal executive offices are located at 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050. Our telephone number is (408) 899-4443 and our web address is www.heartbeam.com. Financial and other information can be accessed on the “Investors” section of our website. We make available through our website, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the Securities and Exchange Commission (the “SEC”). Also posted on our website are certain corporate governance documents, including our Code of Business Conduct and Ethics. The reference to our website is textual in reference only, and the information included or referred to on, or accessible through, our website does not constitute part of, and is not incorporated by reference into, this report or any other filing.

We also file periodic reports, proxy statements and other information with the SEC. Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at (800) SEC-0330. In addition, the SEC maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements and other information.

Item 1A. Risk Factors.

You should consider carefully the risks, uncertainties and other factors described below, in addition to the other information set forth in this Form 10-K, before making an investment decision. Any of these risks, uncertainties and other factors could materially and adversely affect our business, financial condition, results of operations, cash flows or prospects. In that case, the market price of our common stock could decline, and you may lose all or part of your investment in our common stock. See also “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business