Exhibit 99.3

RECENT DEVELOPMENTS

The following section sets forth our key recent developments since the filing of our annual report on Form 20-F for the fiscal year ended December 31, 2021, which updates and supplements the disclosure contained therein, and should be read in conjunction with such annual report, our Registration Statement on Form F-3 filed with the SEC on February 5, 2021 and the related prospectus supplements filed with the SEC.

Recent Business Developments

Updated Pipeline Development Highlights and Upcoming Milestones

Our drug pipeline has a number of critical features: (1) The pipeline is innovative and globally competitive, comprised of three generations of products with first-in-class and best-in-class potential. This is exemplified by the first generation of differentiated drug assets, such as felzartamab and eftansomatropin alfa, which are in registrational trial or at a pre-BLA stage, as well as novel monoclonal antibodies such as lemzoparlimab and uliledlimab, which are in phase 2 clinical trials or preparation for phase 3. The second generation of even more innovative bi-specific antibody assets, including TJ-CD4B and TJ-L14B, are in phase 1 clinical trials, followed by additional bi-specific antibody assets progressing towards an IND enabling stage. The new discovery initiatives for the third-generation innovation are on the way for high-risk and high-value drug candidates enabled by transformative technologies. (2) The pipeline is focused on immuno-oncology and biologics, leveraging our unique R&D and CMC strengths. (3) The pipeline is advanced with three assets are either in phase 3 or registrational studies or planned for phase 3. We expect to achieve two potential BLA submissions or market launches between 2023 and 2025.

The chart below summarizes the development status of our clinical stage pipeline (pre-clinical programs are not shown).

(1) | Clinical Assets |

Lemzoparlimab: Lemzoparlimab, a novel CD47 antibody developed by us, is being investigated through a comprehensive clinical development plan for hematologic malignancies and solid tumors.

| ● | Update on AbbVie partnership: On August 15, 2022, we and AbbVie Global Enterprises Ltd. (as assignee of AbbVie Ireland Unlimited Company) (“AbbVie”) entered into an amendment to the original license and collaboration agreement dated September 3, 2020 among I-Mab Biopharma (Shanghai) Co., Ltd. and I-Mab Biopharma US Limited, each a wholly-owned subsidiary of our company, and AbbVie (as amended, the “Agreement”). Both parties will continue to collaborate on the global development of anti-CD47 antibody therapy under the Agreement. We will be eligible to receive, and AbbVie will pay, up to US$1.295 billion in the development, regulatory and sales milestone payments, and the tiered royalties at rates from mid-to-high single digit percentages on global net sales outside of Greater China for certain new anti-CD47 antibodies currently in development, or the original milestone payments and tiered royalties previously disclosed in our annual report on Form 20-F for the fiscal year ended December 31, 2021 for other licensed products. We have the exclusive right to develop and commercialize all licensed products under the Agreement in Greater China. |

As a part of the amendment, AbbVie has discontinued the global Phase 1b study of lemzoparlimab combination therapy with azacitidine (“AZA”) and venetoclax, in patients with myelodysplastic syndromes (“MDS”) and acute myeloid leukemia (“AML”), which was not based on any specific or unexpected safety concerns. This event would lead to the noncompletion of a key milestone in the original licensing and collaboration agreement, which is expected to result in a loss of no more than US$50.0 million in the second half of 2022.

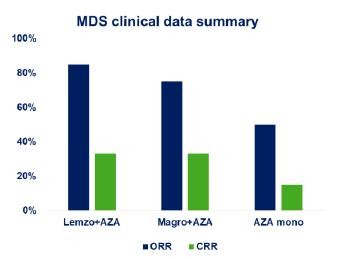

| ● | Lemzoparlimab in combination with AZA for AML and MDS: We continue our commitment on lemzoparlimab development. Over 90 patients with newly diagnosed MDS or acute myeloid leukemia (AML) have been dosed with lemzoparlimab at 30 mg/kg in combination with AZA in China. This patient cohort had a more severe disease at baseline due to disease conditions and clinical practice patterns in China. I-Mab’s recent data analysis of the MDS cohort, including over 50 patients who received the combination treatment, showed that without a priming dose, lemzoparlimab was well tolerated. We observed significant clinical responses as defined by the overall response and complete response rates, which improved over time (Figure 1). Detailed safety and efficacy data, along with gene mutation analysis, was presented in a proffered paper at the European Society for Medical Oncology (ESMO) Congress 2022. |

Figure 1. Clinical efficacy of lemzoparlimab and AZA combination in MDS patients who received initial dose over six months

2

| o | Phase 3 clinical trial of lemzoparlimab in combination with AZA as a 1L treatment for MDS: In September 2022, we have successfully completed an End-of-Phase 2 (EoP2) meeting with the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA), and obtained approval from the CDE to initiate a Phase 3 registrational trial evaluating lemzoparlimab, a novel CD47 antibody, in combination with azacitidine (AZA) for the first-line treatment of patients with newly diagnosed higher-risk myelodysplastic syndrome (HR-MDS). The outcome of the EoP2 meeting supports the advancement of lemzoparlimab into Phase 3 study for a potential biologic license application (BLA) submission. We are on track to initiate the study as planned. |

The EoP2 meeting was supported by encouraging results from the Phase 2 clinical trial evaluating lemzoparlimab in combination with AZA in patients with newly diagnosed HR-MDS (NCT04202003). A total of 53 patients were enrolled as of March 31, 2022, receiving lemzoparlimab at a weekly dose of 30 mg/kg intravenously (IV) and AZA at 75 mg/m2 subcutaneously (SC) on Days 1–7 in a 28-day cycle. Top-line data showed that for patients who began treatments 6 months or longer prior to the analysis (n=15), the overall response rate (ORR) and complete response rate (CRR) was 86.7% and 40% respectively. For patients who began treatment 4 months or longer prior to the analysis (n=29), the ORR and CRR was 86.2% and 31% respectively. While the study enrolled more patients with worse baseline conditions due to underlying disease (74% of patients had grade ≥3 anemia and 51% of patients had grade ≥3 thrombocytopenia), the results showed that lemzoparlimab combined with AZA was well-tolerated and the safety profile was consistent with AZA monotherapy.

Decreased red blood cells, measured as hemoglobin, and decreased platelets are major causes of morbidity for patients with HR-MDS and the median hemoglobin and platelet levels for patients on study increased in response to treatment. Of the 29 patients who were dependent upon blood transfusions at baseline, 9 patients (31%) became transfusion independent at the time of analysis. Furthermore, the majority of CR patients showed reduction in variant allele frequency (VAF) of MDS-related gene mutation including TP53, TET2 and RUNX1, with 56% achieving minimal residual disease negativity (≤10-4) by flow cytometry. These data are consistent with the anti-leukemic activities and expected drug safety of lemzoparlimab.

Uliledlimab: A highly differentiated CD73 antibody being developed for solid tumor indications. We are currently advancing uliledlimab in two Phase 2 clinical trials in the U.S. and China in selected tumor types for clinical proof-of-concept. The current development focus is on non-small cell lung cancer (NSCLC) as a combination therapy with a PD-1 antibody to aim for the potential initiation of a pivotal clinical study in 2023.

| ● | Phase 2 clinical study of uliledlimab in combination with PD-1 antibody (toripalimab) in advanced NSCLC: In May 2022, we presented the preliminary clinical results of an ongoing phase 2 clinical study of uliledlimab in combination with toripalimab (TUOYI®) in patients with NSCLC at the 2022 American Society of Clinical Oncology (ASCO) Annual Meeting. The results are largely consistent with those observed in phase 1 clinical trial in relation to favorable safety, pharmacokinetics (PK), and pharmacodynamic (PD) profile of uliledlimab. Uliledlimab appears safe and well-tolerated up to the highest doses tested at 30 mg/kg Q3W, as a monotherapy and as a combination therapy with toripalimab with no dose limiting toxicity (DLT). Uliledlimab exhibited a linear PK profile at doses ≥ 5mg/kg and a dose-dependent receptor occupancy with no “hook effect” where the antibody loses its effectiveness at high concentrations. |

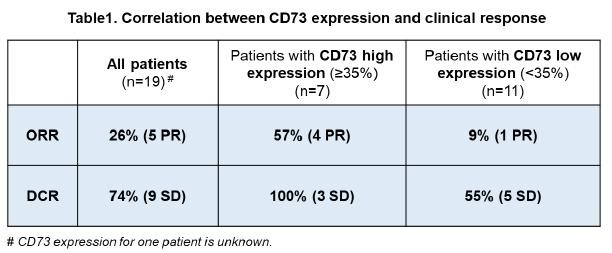

The phase 2 preliminary efficacy data as of March 29, 2022, are summarized as follows. Among the three NSCLC patient cohorts who were under different treatment settings, clinical responses varied. The highest clinical response rate was observed in the patient cohort with advanced NSCLC (mostly stage 4 disease) who were previously ineligible for standard of care treatment. Among 19 efficacy evaluable patients from this cohort, 5 partial responses (5 PR, overall response rate [ORR]=26%) and 9 stable disease (9 SD, disease control rate [DCR] =74%) were observed. Approximately 80% of patients in this cohort showed low PD-L1 expression in baseline tumor samples (tumor proportion score [TPS] 1-49% or TPS<1%) who were considered less responsive to a checkpoint inhibitor therapy as demonstrated in KEYNOTE-042 (ORR=16.9% for patients with PD-L1 TPS 1-49%). Notably, the clinical response observed in this patient cohort correlated with tumor CD73 expression. In a subgroup of 7 patients with high CD73 expression (≥35% expression level in tumor cells or immune cells), ORR (4 PR) was 57% with 100% DCR (3 SD) (Table 1). While the other two heavily treated NSCLC cohorts showed a lower clinical response.

3

Based on the preliminary data mentioned above, the phase 2 clinical trial was expanded to focus on enrolling the selected patient cohort with advanced NSCLC who were previously ineligible for standard of care treatment for further evaluation of treatment efficacy as well as the role of CD73 as a potential predictive biomarker. As of August 2022, 47 patients have been enrolled in this expanded cohort, and more data are being collected. Our goal is to speed up the expanded phase 2 study and complete the target enrollment of 60 patients within the next two months. A more complete dataset is expected by the fourth quarter of 2022. We are seeking a suitable opportunity to present the new dataset either by the end of 2022 or early 2023.

| ● | Development of companion diagnostic (CDx) kit of CD73: Based on the correlation data between clinical response and tumor CD73 expression, I-Mab is collaborating with WuXi Diagnostics to develop a standardized companion diagnostic kit of CD73 to be employed in the planned pivotal clinical trial in 2023. |

Eftansomatropin alfa: A differentiated long-acting growth hormone for pediatric growth hormone deficiency (PGHD). Eftansomatropin alfa is the only rhGH in its proprietary fusion protein format (pure protein-based molecule) without chemically linking with PEG or other moieties. Its safety, tolerability, and efficacy have been well demonstrated in a phase 2 clinical trial in the EU. We have the rights for the development, manufacturing, and commercialization of eftansomatropin alfa in China from Genexine.

| ● | Phase 3 clinical trial for PGHD: This phase 3 registrational trial (TALLER) of eftansomatropin alfa as a weekly treatment for PGHD patients is ongoing in China. On May 31, 2022, we announced the completion of patient enrollment in the TALLER study for treatment of PGHD. TALLER is a multi-center, randomized, open-label, active-controlled phase 3 clinical study (NCT04633057) that has enrolled 168 patients in China. The study aims to evaluate the efficacy, safety, and pharmacokinetics (PK) of eftansomatropin alfa in PGHD, as compared to Norditropin®, a daily rhGH marketed in China. Following the completion of the enrollment in May 2022, the final dataset from the TALLER study is anticipated in the third quarter of 2023, which is expected to be followed by a BLA submission in the fourth quarter of 2023 or the first quarter of 2024. |

TJ-CD4B/ABL111 (Phase 1): A novel Claudin 18.2 and 4-1BB bi-specific antibody is composed of a highly potent Claudin18.2 IgG with high binding affinity even in Claudin18.2 low-expressing tumors and a unique 4-1BB scFv which could stimulate T cells only upon tumor cell engagement to avoid systemic and liver toxicity. TJ-CD4B is designed to treat patients with Claudin18.2 positive gastric and pancreatic cancer. In March 2022, we received FDA Orphan Drug Designation for TJ-CD4B for the treatment of gastric cancer, including cancer of the gastroesophageal junction.

| ● | Phase 1 clinical trial of TJ-CD4B in patients with advanced or metastatic solid tumors: The dose escalation part of the study reached 8 mg/kg without encountering dose limiting toxicity. More data are being generated as the trial progresses. As of the second quarter of 2022, five dose cohorts had been completed, with 16 subjects dosed. Regarding safety, no grade 2 treatment-related adverse events (TRAEs) or dose-limiting toxicities (DLTs) were reported. There is a dose-dependent increase of drug exposure and soluble 4-1BB in serum, suggestive of a favorable PK/PD profile and potentially a longer dosing interval with durable T cell activation. Preliminary clinical activity was also observed, with one confirmed PR of a metastatic esophageal adenocarcinoma patient who failed three lines of prior therapies, including PD-1 therapy, and three cases of stable disease (SD). The study is currently at 8 mg/kg without significant toxicities. Additional clinical sites in China joined this phase 1 international multi-center clinical trial, with the first patient dosed at 5 mg/kg in July 2022. |

Efineptakin alfa (Phase 2): The world’s first and only long-acting recombinant human interleukin-7 (“rhIL-7”) and is designed as a monotherapy for the treatment of cancer patients with lymphopenia because of its unique properties of increasing tumor-attacking T

4

cells and as a combination with a PD-1 or PD-L1 antibody because of its potential synergism with PD-1/PD-L1 therapy. We have the rights for the development, manufacturing, and commercialization of efineptakin alfa in Greater China from Genexine.

| ● | Phase 2 Clinical Trial: the first patient was dosed in a phase 2 study of efineptakin alfa (also known as TJ107) in combination with pembrolizumab (Keytruda®) in patients with advanced solid tumors in January 2022. The study follows a “basket” trial design to include selected tumor types, including triple-negative breast cancer (TNBC) and squamous cell cancer of the head and neck (SCCHN). |

| ● | Clinical data published by Genexine/NeoImmuneTech: (1) According to the data from the NIT-110 dose-escalation trial presented at ASCO 2021, the combination of efineptakin alfa and pembrolizumab is safe and well-tolerated in patients with advanced solid tumors. It significantly increased T cell numbers in both tumor specimens and the peripheral blood in patients treated with efineptakin alfa. (2) Data from phase 1b/2 Keynote-899 study, presented at ASCO 2022, showed that combination treatment of efineptakin alfa with pembrolizumab (Keytruda®) induced ORR of 15.7% (8/51) for phase 1b and 21.2% (7/33) for phase 2 study in patients with metastatic TNBC. Notably, the ORR in patients with PD-L1 CPS ≥ 10 was 60% (6/10) compared to 0% (0/15) in patients with PD-L1 CPS < 10, which warrants a further study of a combination regimen for patients with PD-L1 CPS ≥ 10. |

Plonmarlimab (TJM2): a monoclonal antibody targeting human granulocyte-macrophage colony-stimulating factor (GM-CSF), a cytokine that plays a critical role in acute and chronic inflammation and cytokine release syndrome (CRS) associated with CAR-T and severe COVID-19.

| ● | CRS associated with severe COVID-19: In August 2021, we reported positive interim analysis from the phase 2/3 trial of plonmarlimab to treat patients with severe COVID-19. Plonmarlimab treatment resulted in a higher mechanical ventilation free (MVF) rate (83.6% vs. 76.7%), a lower mortality rate (4.9% vs. 13.3%) by day 30, higher recovery rates (68.9% vs. 56.7% at day 14 and 80.3% vs. 70.0% at day 30), as well as reduced time to recovery and hospitalization duration, as compared to placebo. Biomarker results were consistent with the observed clinical outcome and indicated patients treated with plonmarlimab had a reduction in plasma levels of pro-inflammatory cytokines and chemokines critically involved in CRS, including TARC, IP10, GCSF, IL10, IL6, MCP1, IL1RA, TNF-alpha but not interferon-gamma. A transient increase in Neutrophil to Lymphocyte Ratio (NLR) that is commonly associated with disease exacerbation was only observed in placebo. Plonmarlimab was well tolerated in all patients with no significant safety concerns. The clinical data obtained so far have validated the effect of plonmarlimab on CRS, paving the way to continue exploring the therapeutic indications where CRS is a critical element of the diseases. Additional clinical data are being analyzed to determine the next step development plan. The last patient out was in February 2022, and the final clinical study report is expected in the second half of 2022. Currently, no active clinical study is ongoing. |

Enoblituzumab (TJ271): A humanized B7-H3 antibody as an immuno-oncology treatment agent. Enoblituzumab works through a dual mechanism to attack tumor cells, i.e., ADCC and immune activation. We licensed the rights for the development and commercialization of enoblituzumab in Greater China from MacroGenics, Inc. (“MacroGenics”) under a collaboration agreement (as amended from time to time, the “MacroGenics Agreement”). We originally planned a phase 2 clinical trial of enoblituzumab in combination with pembrolizumab (Keytruda®) in patients with selected solid tumors, including NSCLC, bladder cancer and melanoma, in China, but has not enrolled any patient in the trial. In July 2022, due to an unexpected high incidence of fatal bleeding, MacroGenics terminated a phase 2 study of enoblituzumab as a combination therapy with PD-1 antibody or PD-1/LAG3 bispecific antibody in patients with head and neck cancers. We exercised our right to terminate the MacroGenics Agreement by serving a termination notice on August 29, 2022, which termination will take effect in 180 days after the date of the notice.

TJ210/MOR210: A novel monoclonal antibody targeting C5aR1 to treat solid tumors through the suppression of myeloid-derived suppressor cells and modulation of tumor microenvironment in favor of enhanced anti-tumor immune response as a novel mechanism of action. The in vitro and in vivo pre-clinical studies are ongoing to explore and validate the most effective combination partner(s) of TJ210 in addition to the PD-(L)1 antibody. I-Mab has the rights for the development, manufacturing and commercialization of TJ210 from MorphoSys in Greater China and South Korea, and co-develops the asset globally with MorphoSys.

| ● | Phase 1 clinical trial in patients with advanced solid tumors: The phase 1 study is ongoing in the U.S., and patient recruitment for dose escalation was completed in the second quarter of 2022. In addition, the clinical study report of this phase 1 study is expected in the second quarter of 2023. The phase 1 clinical trial in Chinese patients has been approved by China NMPA. Currently, no active clinical study is ongoing. |

5

(2) | Preclinical assets and programs |

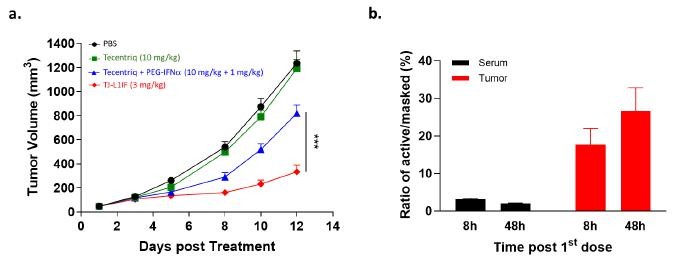

TJ-L1IF: A novel PD-L1/IFN-α antibody-cytokine fusion protein, which is specifically designed for the treatment of PD-1/PD-L1 resistant tumors through the addition of a strong immune adjuvant (interferon-alpha, IFN-α) to potentially convert “cold” tumor to “hot” tumor on top of a PD-L1 antibody to achieve superior anti-tumor activity than PD-(L)1 antibody monotherapy. Novel drug molecules with such design is badly needed to address the current clinical challenges where a majority of cancer patients do not or poorly respond to PD-1/PDL-1 therapies.

IFN-α was the first cytokine approved for cancer treatment, but its clinical use is highly limited due to considerable systemic toxicity. TJ-L1IF is composed of a PD-L1 VHH nanobody linked with the Fc of human IgG with an engineered IFN-α2b fused at the C-terminus. It is a prodrug in that the IFN-α2b moiety is masked by a PEG group through a protease-cleavable linker rendering the drug inactive in the systemic circulation, thus strongly reducing systemic toxicity. Once the drug accumulates at the tumor site by PD-L1 antibody targeting, the linker is cleaved by proteases that are highly expressed in the tumor environment to achieve specific activation only at the tumor site. This unique property of TJ-L1IF has been confirmed in a series of in vitro and in vivo studies, in which TJ-L1IF demonstrated plasma stability, good safety in cynomolgus monkeys, and superior anti-tumor activity in the PD-1/PD-L1 resistant tumor models, than that achieved by PD-L1 antibody or IFN-α used either alone or in combination. After the first dose of treatment, the active format of the drug was quickly detected and accumulated in the tumor but not in the periphery, confirming the local delivery and conversion to an active form of IFN-α at the tumor site (Figure 2). TJ-L1IF was developed using Affinity’s TMEA technology and is now under pre-clinical development.

Figure 2. In vivo anti-tumor activity of TJ-L1IF in PD-L1 resistant tumor model. (a) NSG mice transplanted subcutaneously with colon cancer cell line were treated with Tecentriq (10 mg/kg) alone, Tecentriq (10 mg/kg) and PEG-IFNa (1 mg/kg) combination and TJ-L1IF (3 mg/kg) twice a week. (b) The concentration of PEG cleaved active and PEG masked L1IF was measured in tumor and serum, respectively at 8h and 48h post the first dosing. The ratio of the level of active to that of masked L1IF was calculated.

TJ-C64B: Our third bispecific molecule being developed by leveraging a conditional 4-1BB platform which has the advantage of minimizing liver toxicity with an increased therapeutic window. It is specifically designed to simultaneously target Claudin 6 (CLDN6), uniquely expressed in specific cancer types, including ovarian cancer cells, and 4-1BB expressed by T cells to mediate the T cell killing of CLDN6+ tumor cells. CLDN6 is hardly detectable in normal adult tissues to ensure treatment specificity for ovarian cancers. We have achieved candidate selection and is actively progressing the pre-clinical development of the candidate molecule.

TJ-C64B activates T cells through 4-1BB stimulation only upon CLDN6 engagement, providing a localized immune activation in tumors with expected efficacy and reduced systemic toxicity. Owing to a competent Fc, TJ-C64B has an added advantage of specifically depleting CLDN6-expressing tumor cells and intra-tumor regulatory T cells highly expressing 4-1BB, which differentiates it from other 4-1BB bispecific antibodies under clinical development. As published in AACR 2022, pre-clinical data showed that TJ-C64B enhances CLDN6-dependent T cell activation upon the engagement of cancer cell lines with different CLDN6 expression levels. In a syngeneic mouse model, TJ-C64B treatment induces strong anti-tumor activity with complete tumor regression in all tested mice at the dose of 4.5 mg/kg and long-term protection from tumor re-challenge through the immunological memory response. Further, ex vivo analysis confirms localized immune activation by TJ-C64B as evident by the increased CD8+ T cells, specifically those residing in tumors (Figure 3). TJ-C64B is now under pre-clinical development and we plan to submit an IND in the U.S. around mid-2023.

6

Figure 3. In vivo anti-tumor activity of different doses of TJ-C64B treatment. (a) Humanized 4-1BB mice transplanted MC38 tumor cells were treated with different doses of TJ-C64B once a week. After the stop of the treatment, the mice with complete tumor regression were injected with new tumor cells for tumor re-challenge. (b) The percentage of CD8+ T cells in tumor-infiltrating lymphocytes from different treatment groups was analyzed by flow cytometry.

Recent Corporate Developments

We strengthened our corporate governance and made changes to senior management team:

| ● | On September 30, 2022, Dr. Jingwu Zang, Founder and Chairman, transferred Acting Chief Executive Officer with business operational duties to Dr. Andrew Zhu, President of I-Mab. Dr. Zhu will also serve on the Environmental, Social and Governance committee (“ESG Committee”) of the board. Dr. Zang will continue overseeing corporate strategy, global business partnerships and the development of the next generation innovation. |

| ● | On April 28, 2022, I-Mab appointed Mr. Richard Yeh as Chief Operating Officer. He was also appointed to join I-Mab’s Board. Mr. Yeh is based in Shanghai, China. As the Chief Operating Officer, Mr. Yeh leads I-Mab’s investor relations, global alliance management, and major facilities across the world. On September 30, 2022, Mr. Yeh, with an extensive track record in banking and working as a Chief Financial Officer (“CFO”) for biotech companies, assumed the interim CFO. Mr. John Long stepped down as CFO, board director and member of the ESG Committee to pursue other interests. |

| ● | On April 28, 2022, I-Mab appointed Dr. John Hayslip as Chief Medical Officer. Dr. Hayslip is based in the United States. As I-Mab's Chief Medical Officer, Dr. Hayslip leads our pipeline development, addressing the key challenges in clinical sciences to increase the probability of success and the speed of clinical development for I-Mab’s innovative assets. |

| ● | I-Mab appointed Dr. Lin Li, Ph.D. nominated by Hony Capital, as a member of our board of directors and a member of the Audit Committee, effective from August 31, 2022, replacing Ms. Xi Liu of Hony Capital, who resigned on the same day. Dr. Li served as our director from July 2018 to April 2020. Dr. Li has served as a partner since March 2021 and an investment director from December 2016 to March 2021 at Hony Capital. Dr. Li worked as an associate at Snow Lake Capital (HK) Limited from November 2014 to November 2016. Dr. Li served as a senior investment manager in the cross-border investment group at Hony Capital from April 2012 to October 2014. Prior to that, he worked as an associate in the corporate finance department of Goldman Sachs Gao Hua Securities Company Limited in Beijing from July 2010 to April 2012. Dr. Li received his bachelor’s degree in biology from Peking University in July 2000, Ph.D. in biology from Boston University in 2006, and a Master’s degree in business administration from Harvard Business School in 2010. |

| ● | Dr. Zheru Zhang resigned from his position as our President and a director of the board effective from August 31, 2022 and was appointed as the President for I-Mab Hangzhou, an investee of our company with a comprehensive biologics manufacturing facility in Hangzhou, China. Mr. Jielun Zhu resigned from his position as our Chief Strategy Officer on July 31, 2022 to pursue other interests. |

We and our senior management implemented share purchase plans:

| ● | We announced on August 23, 2022, that we plan to implement share repurchases pursuant to the share repurchase program previously authorized by our board of directors. On the same day, we were informed by Dr. Jingwu Zang, Founder and Chairman, and other members of senior management of their intention to use personal funds to purchase our American Depositary Shares (the “ADSs”) on the open market. Under the share purchase plans, we and the senior management may |

7

| purchase up to US$40 million of ADSs in aggregate. The timing and dollar amount of share repurchase and share purchase transactions will be subject to the applicable U.S. Securities and Exchange Commission rule requirements. Our board of directors will review the implementation of share repurchases periodically and may authorize adjustment of its terms and size. |

We invested in I-Mab Hangzhou in 2020 as a part of our overall strategic plan. On July 16, 2022, I-Mab Hangzhou entered into a definitive financing agreement with a group of domestic investors in China to raise approximately US$46 million in RMB equivalent. To date, the closing of the financing is in progress. Upon closing, we, through our wholly-owned subsidiary, remains the largest shareholder. Upon the occurrence of certain triggering events as specified in the shareholders agreement among I-Mab Hangzhou, I-Mab (through its wholly-owned subsidiary) and other domestic investors, including but not limited to I-Mab Hangzhou's failure to accomplish certain public offering condition, I-Mab may be obligated to repurchase the equity held by other domestic investors in cash or in I-Mab’s stocks within certain time period.

Updates Regarding Holding Foreign Companies Accountable Act (HFCAA)

In May 2022, the SEC conclusively listed I-Mab as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 20-F for the fiscal year ended December 31, 2021. On August 26, 2022, the Public Company Accounting Oversight Board (the “PCAOB”) signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. We have noted this positive progress and will closely follow the development under the Statement of Protocol, which is expected to be executed in steps and may ultimately mitigate delisting risks under the HFCAA. In parallel, we will continue working on and is prepared to effect, as a contingency plan, the change to a selected U.S.-based public accounting firm in the event that the progress of Statement of Protocol does not meet the deadline for us to mitigate the delisting risk upon filing of the 2022 consolidated financial statements in our annual report.

8