UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ___________.

Commission file number:

AvePoint, Inc.

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report).

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||

| | | The | ||

| | | The |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of November 14, 2022, there were

AVEPOINT, INC.

FORM 10-Q

For the Fiscal Quarter Ended September 30, 2022

TABLE OF CONTENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements, as well as descriptions of the risks and uncertainties that could cause actual results and events to differ materially, may appear throughout this Quarterly Report, including in the following sections: “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (Part I, Item 2 of this Quarterly Report), “Quantitative and Qualitative Disclosures about Market Risk” (Part I, Item 3 of this Quarterly Report), and “Risk Factors” (Part II, Item 1A of this Quarterly Report),.

These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events, or developments that we expect or anticipate will occur in the future — including statements relating to volume growth, sales, earnings, and statements expressing general views about future operating results — are forward-looking statements. These forward-looking statements are, by their nature, subject to significant risks and uncertainties, and are based on the beliefs of, as well as assumptions made by and information currently available to, our management. Our management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Readers should evaluate all forward-looking statements made in the context of these risks and uncertainties. The important factors referenced above may not contain all of the factors that are important to investors.

These forward-looking statements speak only as of the date of this Quarterly Report and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements include, without limitation, statements about:

| • |

our ability to recognize the anticipated benefits of the Business Combination (as defined in this Quarterly Report), which may be affected by, among other things, competition and the ability of the combined business to grow and manage growth profitably; |

|

| • |

our future operating or financial results; |

|

| • |

future acquisitions, business strategy and expected capital spending; |

|

| • |

changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

|

| • |

the implementation, market acceptance and success of our business model and growth strategy; |

|

| • |

expectations and forecasts with respect to the size and growth of the cloud industry and digital transformation in general and Microsoft’s products and services in particular; |

|

| • |

the ability of our products and services to meet customers’ compliance and regulatory needs; |

|

| • |

our ability to compete with others in the digital transformation industry; |

|

| • |

our ability to grow our market share; |

|

| • |

our ability to attract and retain qualified employees and management; |

|

| • |

our ability to adapt to changes in consumer preferences, perception and spending habits and develop and expand our product offerings and gain market acceptance of our products, including in new geographies; |

|

| • |

developments and projections relating to our competitors and industry; |

|

| • |

our ability to develop and maintain our brand and reputation; |

|

| • |

developments and projections relating to our competitors and industry; |

|

| • |

unforeseen business disruptions or other impacts due to political instability, civil disobedience, terrorism, armed hostilities (including the ongoing hostilities between Russia and Ukraine), extreme weather conditions, natural disasters, other pandemics or other calamities. |

|

| • |

our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

|

| • |

expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

|

| • |

our future capital requirements and sources and uses of cash; |

|

| • |

our ability to obtain funding for our operations and future growth; |

|

| • |

the effects of inflation both with our industry and the macro-economy; and |

|

| • |

the effects of foreign currency exchange. |

The foregoing list of risks is not exhaustive. Other sections of this Quarterly Report may include additional factors that could harm our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as required by law.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Quarterly Report, the events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. You should refer to the ‘‘Risk Factors’’ section of this Quarterly Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements.

You should read this Quarterly Report and the documents that we reference in this Quarterly Report and have filed as exhibits to the Quarterly Report, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

Item 1

PART I. FINANCIAL INFORMATION.

Item 1. Financial Statements.

AvePoint, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

As of September 30, 2022 and December 31, 2021

(In thousands, except par value)

(Unaudited)

| September 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Short-term investments | ||||||||

| Accounts receivable, net of allowance of $ and $ at September 30, 2022 and December 31, 2021, respectively | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Goodwill | ||||||||

| Other intangible assets, net | ||||||||

| Operating lease right-of-use assets | ||||||||

| Deferred contract costs | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities, mezzanine equity, and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses and other liabilities | ||||||||

| Current portion of deferred revenue | ||||||||

| Total current liabilities | ||||||||

| Long-term operating lease liabilities | ||||||||

| Long-term portion of deferred revenue | ||||||||

| Earn-out shares liabilities | ||||||||

| Other non-current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies | ||||||||

| Mezzanine equity | ||||||||

| Redeemable noncontrolling interest | ||||||||

| Total mezzanine equity | ||||||||

| Stockholders’ equity | ||||||||

| Common stock, $ par value; shares authorized, and shares issued and outstanding, at September 30, 2022 and December 31, 2021, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Treasury stock | ( | ) | ( | ) | ||||

| Accumulated other comprehensive income | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities, mezzanine equity, and stockholders’ equity | $ | $ | ||||||

See accompanying notes.

AvePoint, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

For the Three and Nine Months Ended September 30, 2022 and 2021

(In thousands, except per share amounts)

(Unaudited)

| Three Months Ended |

Nine Months Ended |

|||||||||||||||

| September 30, |

September 30, |

|||||||||||||||

| 2022 |

2021 |

2022 |

2021 |

|||||||||||||

| Revenue: |

||||||||||||||||

| SaaS |

$ | $ | $ | $ | ||||||||||||

| Term license and support |

||||||||||||||||

| Services |

||||||||||||||||

| Maintenance |

||||||||||||||||

| Perpetual license |

||||||||||||||||

| Total revenue |

||||||||||||||||

| Cost of revenue: |

||||||||||||||||

| SaaS |

||||||||||||||||

| Term license and support |

||||||||||||||||

| Services |

||||||||||||||||

| Maintenance |

||||||||||||||||

| Total cost of revenue |

||||||||||||||||

| Gross profit |

||||||||||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing |

||||||||||||||||

| General and administrative |

||||||||||||||||

| Research and development |

||||||||||||||||

| Depreciation and amortization |

||||||||||||||||

| Total operating expenses |

||||||||||||||||

| Loss from operations |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Gain on earn-out and warrant liabilities |

||||||||||||||||

| Interest income, net |

||||||||||||||||

| Other income (expense), net |

( |

) | ( |

) | ( |

) | ||||||||||

| Loss before income taxes |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Income tax expense (benefit) |

( |

) | ( |

) | ||||||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Net income attributable to and accretion of redeemable noncontrolling interest |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Net loss attributable to AvePoint, Inc. |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Deemed dividends on preferred stock |

( |

) | ||||||||||||||

| Net loss available to common shareholders |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Basic and diluted loss per share |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Basic and diluted shares used in computing loss per share |

||||||||||||||||

See accompanying notes.

AvePoint, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Loss

For the Three and Nine Months Ended September 30, 2022 and 2021

(In thousands)

(Unaudited)

| Three Months Ended |

Nine Months Ended |

|||||||||||||||

| September 30, |

September 30, |

|||||||||||||||

| 2022 |

2021 |

2022 |

2021 |

|||||||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Other comprehensive income (loss) net of taxes |

||||||||||||||||

| Unrealized loss on available-for-sale |

( |

) | ||||||||||||||

| Foreign currency translation adjustments |

( |

) | ||||||||||||||

| Total other comprehensive income (loss) |

( |

) | ||||||||||||||

| Total comprehensive loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Comprehensive income attributable to redeemable noncontrolling interests |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Total comprehensive loss attributable to AvePoint, Inc |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

See accompanying notes.

AvePoint, Inc. and Subsidiaries

Condensed Consolidated Statements of Mezzanine Equity and Stockholders’ Equity

For the Three Months Ended September 30, 2022 and 2021

(In thousands, except share amounts)

(Unaudited)

| Redeemable |

Total |

Accumulated |

||||||||||||||||||||||||||||||||||||||

| noncontrolling |

mezzanine |

Additional |

Other |

Total |

||||||||||||||||||||||||||||||||||||

| interest |

equity |

Common Stock (1) |

Paid-In |

Treasury Stock |

Accumulated |

Comprehensive |

Stockholders’ |

|||||||||||||||||||||||||||||||||

| Amount |

Amount |

Shares |

Amount |

Capital |

Shares |

Amount |

Deficit |

Income |

Equity |

|||||||||||||||||||||||||||||||

| Balance, June 30, 2022 |

$ | $ | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||||||||||||

| Proceeds from exercise of options |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued upon vesting of restricted stock units |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued upon acquisition |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued for canceled officer awards |

— | — | ( |

) | ||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense |

— | — | — | — | ||||||||||||||||||||||||||||||||||||

| Reclassification of earn-out RSUs to earn-out shares |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||||||||||||||||||

| Repurchase of common stock |

— | — | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||

| Comprehensive income (loss): |

||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||

| Net income attributable to and accretion of redeemable noncontrolling interest |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||

| Total other comprehensive income (loss) |

( |

) | ( |

) | — | — | ||||||||||||||||||||||||||||||||||

| Balance, September 30, 2022 |

$ | $ | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||||||||||||

| Redeemable | Share | Redeemable | Total | Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||

| Convertible | Common | Based | noncontrolling | mezzanine | Additional | Other | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock (1) | Shares | Awards | interest | equity | Common Stock (1) | Paid-In | Treasury Stock | Accumulated | Comprehensive | Stockholders’ | ||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Amount | Amount | Amount | Amount | Shares | Amount | Capital | Amount | Deficit | Income | Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | |||||||||||||||||||||||||||||||||||||

| Reclassification of common shares to mezzanine equity | — | ( | ) | ( | ) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Remeasurement of redemption value of common shares | — | ( | ) | ( | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from exercise of options | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Remeasurement of redemption value of convertible preferred stock | — | ( | ) | ( | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of redeemable common shares from mezzanine to permanent entity | — | ( | ) | ( | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of share-based awards from liabilities and mezzanine equity to permanent equity | — | ( | ) | ( | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Merger and recapitalization, net of transaction costs | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of earn-out RSUs to earn-out shares | — | — | — | — | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||||||||

| Reclassification of Apex shares purchased prior to the Business Combination | — | — | — | — | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||||||||

| Net income attributable to and accretion of redeemable noncontrolling interest | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other comprehensive income (loss) | — | ( | ) | ( | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | |||||||||||||||||||||||||||||||||||||

(1) As part of the Business Combination (as disclosed in “Note 3 — Business Combination”), all per share information has been retroactively adjusted using an exchange ratio of 8.69144 per share.

See accompanying notes.

| Redeemable |

Total |

Accumulated |

||||||||||||||||||||||||||||||||||||||

| noncontrolling |

mezzanine |

Additional |

Other |

Total |

||||||||||||||||||||||||||||||||||||

| interest |

equity |

Common Stock (1) |

Paid-In |

Treasury Stock |

Accumulated |

Comprehensive |

Stockholders’ |

|||||||||||||||||||||||||||||||||

| Amount |

Amount |

Shares |

Amount |

Capital |

Shares |

Amount |

Deficit |

Income |

Equity |

|||||||||||||||||||||||||||||||

| Balance, December 31, 2021 |

$ | $ | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||||||||||||

| Proceeds from exercise of options |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued upon vesting of restricted stock units |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued upon acquisition |

— | — | ||||||||||||||||||||||||||||||||||||||

| Common stock issued for canceled officer awards |

— | — | ( |

) | ||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense |

— | — | — | — | ||||||||||||||||||||||||||||||||||||

| Issuance of redeemable noncontrolling interest in EduTech |

— | — | ||||||||||||||||||||||||||||||||||||||

| Reclassification of earn-out RSUs to earn-out shares |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||||||||||||||||||

| Repurchase of common stock |

— | — | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||

| Comprehensive income (loss): |

||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||

| Net income attributable to and accretion of redeemable noncontrolling interest |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||

| Total other comprehensive loss |

( |

) | ( |

) | — | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||

| Balance, September 30, 2022 |

$ | $ | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||||||||||||

| Redeemable |

Share |

Redeemable |

Total |

Accumulated |

||||||||||||||||||||||||||||||||||||||||||||||||

| Convertible |

Common |

Based |

noncontrolling |

mezzanine |

Additional |

Other |

Total |

|||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock (1) |

Shares |

Awards |

interest |

equity |

Common Stock (1) |

Paid-In |

Treasury Stock |

Accumulated |

Comprehensive |

Stockholders’ |

||||||||||||||||||||||||||||||||||||||||||

| Shares |

Amount |

Amount |

Amount |

Amount |

Amount |

Shares |

Amount |

Capital |

Amount |

Deficit |

Income |

Equity |

||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2020 |

$ | $ | $ | $ | $ | $ | $ | $ | $ | ( |

) | $ | $ | ( |

) | |||||||||||||||||||||||||||||||||||||

| Reclassification of share-based awards to mezzanine equity |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of common shares to mezzanine equity |

— | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Remeasurement of redemption value of common shares |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from exercise of options |

— | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense |

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Remeasurement of redemption value of preferred stock |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of redeemable noncontrolling interest in EduTech |

— | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of redeemable common shares from mezzanine to permanent entity |

— | ( |

) | ( |

) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of share-based awards from liabilities and mezzanine equity to permanent equity |

— | ( |

) | ( |

) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Merger and recapitalization, net of transaction costs |

— | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of earn-out RSUs to earn-out shares |

— | — | — | — | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||||||||||

| Reclassification of Apex shares purchased prior to the Business Combination |

— | — | — | — | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||||||||||

| Net income attributable to and accretion of redeemable noncontrolling interest |

— | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other comprehensive income (loss) |

— | ( |

) | ( |

) | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2021 |

$ | $ | $ | $ | $ | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | |||||||||||||||||||||||||||||||||||||

AvePoint, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 2022 and 2021

(In thousands)

(Unaudited)

| Nine Months Ended |

||||||||

| September 30, |

||||||||

| 2022 |

2021 |

|||||||

| Operating activities |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

||||||||

| Operating lease right-of-use assets expense |

||||||||

| Foreign currency remeasurement loss (gain) |

( |

) | ||||||

| Provision for doubtful accounts |

( |

) | ||||||

| Stock-based compensation |

||||||||

| Gain on disposal of property and equipment |

( |

) | ( |

) | ||||

| Deferred income taxes |

( |

) | ( |

) | ||||

| Change in value of earn-out and warrant liabilities |

( |

) | ( |

) | ||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable and long-term unbilled receivables |

( |

) | ( |

) | ||||

| Prepaid expenses and other current assets |

( |

) | ( |

) | ||||

| Deferred contract costs and other assets |

( |

) | ( |

) | ||||

| Accounts payable, accrued expenses and other liabilities |

( |

) | ||||||

| Deferred revenue |

||||||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| Investing activities |

||||||||

| Maturities of investments |

||||||||

| Purchases of investments |

( |

) | ( |

) | ||||

| Net assets acquired from business combinations and asset acquisitions, net of cash acquired |

( |

) | ||||||

| Capitalization of internal use software |

( |

) | ||||||

| Purchase of property and equipment |

( |

) | ( |

) | ||||

| Net cash used in investing activities |

( |

) | ( |

) | ||||

| Financing activities |

||||||||

| Proceeds from recapitalization of Apex shares |

||||||||

| Redemption of redeemable convertible preferred stock |

( |

) | ||||||

| Redemption of Legacy AvePoint common stock |

( |

) | ||||||

| Payments of transaction fees by Legacy AvePoint |

( |

) | ||||||

| Purchase of common stock |

( |

) | ( |

) | ||||

| Payment of net cash settlement for management options |

( |

) | ||||||

| Proceeds from stock option exercises |

||||||||

| Proceeds from sale of common shares of subsidiary |

||||||||

| Repayments of finance leases |

( |

) | ( |

) | ||||

| Net cash (used in) provided by financing activities |

( |

) | ||||||

| Effect of exchange rates on cash |

( |

) | ||||||

| Net (decrease) increase in cash and cash equivalents |

( |

) | ||||||

| Cash and cash equivalents at beginning of period |

||||||||

| Cash and cash equivalents at end of period |

$ | $ | ||||||

| Supplemental disclosures of cash flow information |

||||||||

| Income taxes paid |

$ | $ | ||||||

| Noncash acquisition |

$ | $ | ||||||

See accompanying notes.

1. Nature of Business and Organization

AvePoint, Inc. was incorporated as a New Jersey corporation on July 24, 2001 and redomiciled as Delaware corporation in 2006. On July 1, 2021 AvePoint, Inc. (hereinafter referred to as “AvePoint,” the “Company,” “we,” “us,” or “our”) became a publicly traded company, as further described in “Note 3 - Business Combination” (Part I, Item 1 of this Quarterly Report on Form 10-Q).

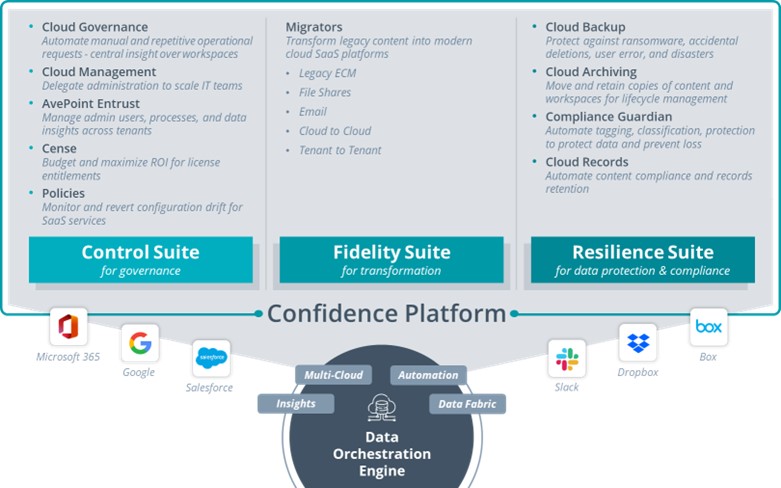

We are a leading provider of enterprise collaboration and productivity software solutions. We develop, market, and sell our suite of software solutions and services, primarily in North America, Europe, Australia, and Asia. We provide our customers with high-performance infrastructure management, compliance, data governance, mobility and productivity, online services and software solutions consulting. We do this through our Confidence Platform, a software as a service (“SaaS”) platform that assists organizations who use the latest cloud services like Microsoft 365, Google, Salesforce, and more than a half dozen additional cloud collaboration utilities. Our Confidence Platform, built on AvePoint Online Services, contains our suites of software solutions: our Control Suite, for data governance enabling collaboration services at scale, with automation and repeatable business templates; our Fidelity Suite, for the preservation of data integrity as organizations undergo digital transformation projects to streamline the way they work from one collaboration system to the next; and our Resilience Suite, to help organizations comply with data governance regulations, preserve business records for compliance, and ensure business continuity.

Our principal executive headquarters are located in Jersey City, New Jersey, with our operating headquarters in Richmond, Virginia and additional offices in North America, Europe, Asia, Australia and the Middle East.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated balance sheet as of December 31, 2021, which has been derived from audited financial statements, and the unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for interim financial information and include the accounts of the Company. Certain information and disclosures normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) have been condensed or omitted.

In the opinion of management, these financial statements contain all material adjustments, consisting of normal recurring accruals, necessary to present fairly the financial position, results of operations and cash flows for the periods indicated. Operating results for the nine months ended September 30, 2022 are not necessarily indicative of results that may be expected for any other interim period or for the year ending December 31, 2022.

These unaudited interim condensed consolidated financial statements should be read in conjunction with our audited consolidated financial statements as of December 31, 2021 and 2020 and for the years ended December 31, 2021, 2020 and 2019 and the related notes included in our most recent Annual Report on Form 10-K for the year ended December 31, 2021, which was filed with the SEC on March 31, 2022 (“Annual Report”).

Recently Adopted Accounting Guidance

In February 2016, the Financial Account Standard Board (the “FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases (Accounting Standards Codification (“ASC”)) and subsequently issued amendments to the initial guidance: ASU 2017-13, ASU 2018-10, ASU 2018-11, ASU 2018-20, ASU 2019-01, ASU 2019-10, ASU 2020-02, ASU 2020-05 and ASU 2021-05 (collectively, “ASC 842”). The Company adopted ASC 842 on January 1, 2022 using the modified retrospective approach and has elected not to restate comparative periods and record a cumulative-effect adjustment as of the effective date. ASC 842 requires companies to generally recognize on the balance sheet operating and finance lease liabilities and corresponding right-of-use (“ROU”) assets.

The Company elected the package of practical expedients permitted under the transition guidance within the new standard, which allowed the Company to carry forward its historical assessments of whether a contract contains a lease, lease classification and initial direct costs. The Company elected not to use hindsight in determining the lease term. The Company made the following other transition considerations and elections under ASC 842: (i) not to separate non-lease components for all classes of underlying assets, including under Leases (“ASC 840”) for the purpose of transition measurement; (ii) apply accounting similar to ASC 840 for operating lease with term of 12 months or less at the commencement date; (iii) consider remaining lease term as of the date of initial application in determining the incremental borrowing rate to be used to discount minimum rental payments for operating leases in transition.

The adoption of the new standard resulted in the recognition of ROU assets of $

In October 2021, the FASB issued ASU No. 2021-08, Business Combinations (“ASC 805”), Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which requires contract assets and contract liabilities acquired in a business combination to be recognized and measured by the acquirer on the acquisition date in accordance with Revenue from contracts with customers (“ASC 606”). Generally, this new guidance will result in the acquirer recognizing contract assets and contract liabilities at the same amounts recorded by the acquiree. The new guidance should be applied prospectively to acquisitions occurring on or after the effective date. The standard is effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early adoption is permitted, including in interim periods, for any financial statements that have not been issued. The Company early adopted the new standard on January 1, 2022. We applied the new guidance to the current year acquisitions. The adoption of the standard did not have any impact on the Company’s condensed consolidated financial statements.

Comparative Data

Certain amounts from prior periods which have been presented separately have been grouped to conform to the current period presentation, including:

| • | The reclassification of long-term unbilled receivables to be included in other assets on the condensed consolidated balance sheets as of December 31, 2021; and |

| • | The payments of transaction fees to be included in proceeds from recapitalization of Apex shares on the condensed consolidated statements of cash flows for the nine months ended September 30, 2021. |

|

Business Combination

When we consummate a business combination, the assets acquired, and the liabilities assumed are recognized separately from goodwill at their acquisition date fair values. Goodwill as of the acquisition date is measured as the excess of the fair value of consideration transferred over the acquisition date fair value of the net identifiable assets acquired. While best estimates and assumptions are used to accurately value assets acquired and liabilities assumed at the acquisition date as well as contingent consideration, where applicable, our estimates are inherently uncertain and subject to refinement. As a result, during the measurement period, which may be up to one year from the acquisition date, we record adjustments to the assets acquired and liabilities assumed with the corresponding offset to goodwill as we obtain new information about facts and circumstances that existed as of the acquisition date that, if known, would have affected the measurement of the amounts recognized as of that date. Upon the earlier of the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, any subsequent adjustments are recorded in the consolidated statements of income.

Goodwill

Goodwill represents the excess of the fair value of consideration transferred over the fair value of net identifiable assets acquired.

We will test goodwill for impairment at least annually by performing qualitative and quantitative assessments of whether the fair value of each reporting unit or asset exceeds its carrying amount. We have reporting unit. Goodwill is tested at this reporting unit level. This requires us to assess and make judgments regarding a variety of factors which impact the fair value of the reporting unit or asset being tested, including business plans, anticipated future cash flows, economic projections and other market data.

No other events or circumstances changed since the acquisitions that would indicate that the fair value of our reporting unit is below its carrying amount. During the nine months ended September 30, 2022, the goodwill had been impaired. There was goodwill as of December 31, 2021.

Other Intangible Assets, net

Other intangible assets consist of customer related assets and acquired software and technology. Typical customer related assets include order backlogs and customer relationships. Intangible assets that have finite useful lives are amortized over their useful lives on a straight-line basis, which range from year to years. We evaluate the recoverability of intangible assets periodically by considering events or circumstances that may warrant revised estimates of useful lives or that indicate the asset may be impaired.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in our condensed consolidated financial statements and accompanying notes. We base our estimates and assumptions on historical experience and on various other assumptions that we believe are reasonable under the circumstances. The amounts of assets and liabilities reported in our condensed consolidated balance sheets and the amounts of revenue and expenses reported for each of its periods presented are affected by estimates and assumptions, which are used for, but not limited to, the accounting for revenue recognition, allowance for doubtful accounts, deferred contract costs, valuation of goodwill and other intangible assets, income taxes and related reserves, stock-based compensation, purchase price in a business combination, and earn-out liabilities. Actual results and outcomes may differ from management’s estimates and assumptions due to risks and uncertainties, including uncertainty in the current economic environment.

Foreign Currency

The Company has foreign operations where the functional currency has been determined to be the local currency, in accordance with FASB ASC 830, Foreign Currency Matters. Adjustments resulting from translating such foreign functional currency assets and liabilities into U.S. dollars, based on current exchange rates, are recorded as a separate component of stockholders’ equity (deficiency) under the caption, accumulated other comprehensive income. Revenue and expenses are translated using average rates prevailing during the period. Transaction gains and losses arising from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in other income (expense), net in the Company’s condensed consolidated statements of operations. Transaction losses totaled $

Cash and Cash Equivalents

The Company maintains cash with several high credit-quality financial institutions. The Company considers all investments available with original maturities of three months or less to be cash equivalents. These investments are not subject to significant market risk. The Company maintains its cash and cash equivalents in bank accounts which, at times, exceed the federally insured limits. The Company has not experienced any losses in such accounts. The Company maintains cash balances used in operations at entities based in countries which imposes regulations that limit the ability to transfer cash out of the country. As of September 30, 2022 and December 31, 2021, the Company’s cash balances at these entities were $

Short-Term Investments

Short-term investments consist mainly of U.S. treasury bills and certificates of deposit held by financial institutions which have an initial maturity of greater than three months but less than or equal to one year at period end.

Based on our intentions regarding these investments, we classify substantially all of our investments as available-for-sale. We carry these securities at fair value, and report the unrealized gains and losses, net of taxes, as a component of stockholders’ equity, except for any unrealized losses determined to be related to credit losses, which we record within non-operating income, net in the accompanying consolidated statements of operations. Substantially all of our investments are classified as current based on the nature of the investments and their availability for use in current operations.

Allowance for Doubtful Accounts

The Company evaluates the collectability of its accounts receivable based on a combination of factors. Where we are aware of circumstances that may impair a specific customer’s ability to meet its financial obligations, we record a specific allowance against amounts due. For all other customers, we recognize allowances for doubtful accounts based on the length of time the receivables are outstanding, the current business environment and its historical experience. Accounts are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received. As such, we present trade receivables at their net estimated realizable value through use of the allowance for doubtful accounts.

Deferred Contract Costs

We defer sales commissions earned by our sales force that are considered to be incremental and recoverable costs of obtaining SaaS, term license and support, service, perpetual license and maintenance contracts. We have structured commissions plans such that the commission rate paid on renewal contracts are less than those paid on the initial contract; therefore, it is determined that the renewal commissions are not commensurate with the initial commission that are deferred and amortized. We determine the estimated average customer relationship period and average renewal term utilizing a portfolio approach. Deferred costs are periodically reviewed for impairment.

Amortization of deferred contract costs of $

Revenue Recognition

The Company derives revenue from four primary sources: SaaS, term license and support, services, and maintenance. Services include installation services, training and other consulting services. The following table presents our revenue by source:

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Revenue: | ||||||||||||||||

| SaaS | $ | $ | $ | $ | ||||||||||||

| Term license and support | ||||||||||||||||

| Services | ||||||||||||||||

| Maintenance | ||||||||||||||||

| Perpetual license | ||||||||||||||||

| Total revenue | $ | $ | $ | $ | ||||||||||||

Term license and perpetual license revenue recognized at point in time was $

We use judgement in determining the relative standalone selling price (“SSP") for products and services. For substantially all performance obligations except term licenses, we are able to establish the SSP based on the observable prices of products or services sold separately in comparable circumstances to similar customers. We typically establish an SSP range for our products and services which is reassessed on a periodic basis or when facts and circumstances change. Term licenses are sold only as a bundled arrangement that includes the rights to a term license and support. In determining the SSP of license and support in a term license arrangement, we apply observable inputs using the value relationship between support and term licenses, the value relationship between support and perpetual licenses, the average economic life of our products, software renewal rates and the price of the bundled arrangement in relation to the perpetual licensing approach. Using a combination of the relative fair value method or the residual value method, the SSP of the performance obligations in an arrangement is allocated to each performance obligation within a sales arrangement.

In rare cases when the software and the related when-and-if available updates are critical to the combined utility of the software, the Company has determined this to be one performance obligation and revenue is recognized ratably over the license term.

Deferred revenue as of September 30, 2022 and December 31, 2021 was $

The opening and closing balances of the Company’s accounts receivable, net, deferred revenue and deferred contract costs are as follows:

| Accounts | Deferred | |||||||||||

| receivable, | Deferred | contract | ||||||||||

| net (1) | revenue | costs | ||||||||||

| (in thousands) | ||||||||||||

| Opening (January 1, 2021) | $ | $ | $ | |||||||||

| Closing (December 31, 2021) | ||||||||||||

| Increase/(decrease) | ||||||||||||

| Opening (January 1, 2022) | $ | $ | $ | |||||||||

| Closing (September 30, 2022) | ||||||||||||

| Increase/(decrease) | ||||||||||||

(1) Accounts receivable, net is inclusive of accounts receivable, net of allowance for doubtful accounts, current unbilled receivables and long-term unbilled receivables.

There were no significant changes to the Company’s contract assets or liabilities during the year ended December 31, 2021 and the nine months ended September 30, 2022 outside of its sales activities.

As of September 30, 2022, transaction price allocated to remaining performance obligations, which includes deferred revenue and amounts that will be invoiced and recognized as revenue in future periods, was $

As of December 31, 2021, transaction price allocated to remaining performance obligations, which includes deferred revenue and amounts that will be invoiced and recognized as revenue in future periods, was $

Stock-Based Compensation

Stock-based compensation represents the cost related to stock-based awards granted to employees. To date, we have issued both stock options and restricted stock units (“RSUs”). With respect to equity-classified awards, the Company measures stock-based compensation cost at the grant date based on the estimated fair value of the award and recognizes the cost as expense ratably (net of estimated forfeitures) over the requisite service period. With respect to liability-classified awards, the Company measures stock-based compensation cost at the grant date and at each reporting period based on the estimated fair value of the award. Stock-based compensation cost is recognized ratably over the requisite service period, net of actual forfeitures in the period.

We estimate the fair value of stock options using the Black-Scholes valuation model. The Black-Scholes model requires highly subjective assumptions in order to derive the inputs necessary to calculate the fair value of stock options. To estimate the expected term of stock options, the Company considers the contractual terms of the options, including the vesting and expiration periods, as well as historical option exercise data and current market conditions to determine an estimated expected term. The Company’s historical experience is too limited to be able to reasonably estimate the expected term. Expected volatility is based on historical volatility of a group of peer entities. Dividend yields are based upon historical dividend yields. Risk-free interest rates are based on the implied yields currently available on U.S. Treasury zero coupon issues with a remaining term equal to the expected term.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to difference between financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to be applied to taxable income in the years in which those temporary differences are expected to be recovered or settled.

We recognize liabilities for uncertain tax positions taken or expected to be taken in income tax returns. Accrued interest and penalties related to unrecognized tax benefits are recognized as part of the provision for income taxes. Judgment is required in determining the provision for income taxes, deferred tax assets and liabilities and unrecognize tax benefits. In determining the need for a valuation allowance, the historical and projected financial performance of the operation that is recording a net deferred tax asset is considered along with any other pertinent information.

We file income tax returns in the U.S. federal, various states and foreign jurisdictions. The tax years

Redeemable Noncontrolling Interest

At September 30, 2022 and December 31, 2021, the Company owned

AEPL Pte. Ltd. (“AEPL”)

As part of AEPL’s investment in EduTech, the Company granted AEPL a put option which allows AEPL to cause the Company to repurchase AEPL’s shares in EduTech at any time between December 24, 2022 and December 24, 2023 at a price equal to AEPL’s initial investment of approximately $

I-Access Solutions Pte. Ltd. (“I-Access”)

On February 18, 2022 (the “I-Access Closing Date”), EduTech consummated its acquisition of all of the ordinary shares of I-Access, a Singapore limited company. As a result, I-Access became a wholly-owned subsidiary of EduTech. The acquisition was made pursuant to a share purchase agreement, dated as of January 31, 2022 (the “Share Purchase Agreement”), by and among EduTech and the former I-Access shareholders. At September 30, 2022, former I-Access shareholders owned

Emerging Growth Company

The Company is considered an emerging growth company. Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies, but any such election to opt out is irrevocable. The Company elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard.

Recent Accounting Pronouncements

In August 2020, the FASB issued ASU 2020-06, Debt — Debt with Conversion and Other Options (“ASC 470-20”) and Derivatives and Hedging — Contracts in Entity’s Own Equity (“ASC 815-40”) (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The ASU is part of the FASB’s simplification initiative, which aims to reduce unnecessary complexity in U.S. GAAP. The amendments in this ASU are effective for entities eligible to be smaller reporting companies for fiscal years beginning after December 15, 2023. The Company is currently evaluating the impact ASU 2020-06 will have on its consolidated financial statements.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (“ASC 740”): Simplifying the Accounting for Income Taxes (ASU 2019-12), which is intended to simplify various areas related to the accounting for income taxes and improve consistent application of ASC 740. The amendments in this ASU are effective for EGC entities, which elected to take advantage of the extended transition period, for fiscal years beginning after December 15, 2021. Early adoption of the amendments is permitted, including adoption in any interim period for public business entities for periods for which financial statements have not yet been issued and all other entities for periods for which financial statements have not yet been made available for issuance. The Company is currently evaluating the impact of its pending adoption of ASU 2019-12 on its consolidated financial statements.

In January 2016, the FASB issued ASU 2016-13, Financial Instruments — Credit Losses on Financial Instruments (“ASC 326”) which replaces incurred loss methodology to estimate credit losses on financial instruments with a methodology that reflects expected credit losses. This amendment affects entities holding financial assets that are not accounted for at fair value through net income including trade receivables. Subsequently FASB issued ASU 2020-02 which deferred the adoption date. The amendments in this ASU are effective for EGC entities, which elected to take advantage of the extended transition period, for fiscal years beginning after December 15, 2022. Early application of the amendments is permitted. The Company is currently evaluating the impact of adoption of this ASU on its consolidated financial statements.

While the Company generally expects the financial records to be impacted by the requirements highlighted above, the Company cannot reasonably estimate the impact that adoption of the ASUs referenced in this announcement is expected to have on the financial statements at this time.

3. Business Combination

Apex Technology Acquisition Corporation

On November 23, 2020, AvePoint, Inc. ("Legacy AvePoint") and certain members of Apex (as defined below) entered into the Apex Business Combination Agreement. The Apex Business Combination by and among Legacy AvePoint and certain members of Apex was affected on July 1, 2021 and through a series of merger transactions, which were finalized on July 26, 2021, Apex Technology Acquisition Corporation ("Apex") was the surviving entity and changed its name to AvePoint.

The Apex Business Combination was accounted for as a reverse recapitalization as Legacy AvePoint was determined to be the accounting acquirer under ASC 805. This determination was primarily based on Legacy AvePoint comprising the ongoing operations of the combined entity, Legacy AvePoint’s senior management comprising the majority of the senior management of the combined company and the prior shareholders of Legacy AvePoint having a majority of the voting power of the combined entity. In connection with the Apex Business Combination, the outstanding shares of Legacy AvePoint's preferred stock were redeemed for cash and shares of AvePoint’s Common Stock and the outstanding shares of Legacy AvePoint's common stock were converted into AvePoint's Common Stock, representing a recapitalization, and the net assets of the Company were acquired at historical cost, with no goodwill or intangible assets recorded. Operations and assets and liabilities of the Company prior to the Apex Business Combination in these financial statements are those of Legacy AvePoint. As a result, these financial statements represent the continuation of Legacy AvePoint and the historical shareholders’ deficiency. Common stock, preferred stock and loss per share of Legacy AvePoint prior to the Apex Business Combination have been retrospectively adjusted for the Apex Business Combination using an exchange ratio of

I-Access Acquisition

On the I-Access Closing Date, EduTech consummated its acquisition of all of the ordinary shares of I-Access. As a result, I-Access became a wholly-owned subsidiary of EduTech. The acquisition was made pursuant to the Share Purchase Agreement, by and among EduTech and the former I-Access shareholders. The Company, through its subsidiary EduTech, completed the acquisition of I-Access to further expand its SaaS solutions for corporate learning and development. The fair value of the transaction considerations totaled approximately $

(i)

(ii) a put option which allows sellers to cause EduTech to repurchase the shares of EduTech for approximately $

(iii) earnout in EduTech shares held in escrow at a fair value equal to revenue surplus above the agreed guaranteed minimum revenue amount, of up to approximately $

On April 15, 2022, the Company implemented a management changeover. As a result, pursuant to the terms of the Share Purchase Agreement, the Adjustment for Guaranteed Minimum Revenue was cancelled and the

The acquisition-related costs totaled $

Prior to being reclassified to mezzanine equity, the contingent consideration was liability classified and was measured at fair value on the I-Access Closing Date and remeasured on the date the Adjustment for Guaranteed Minimum Revenue was cancelled. The fair value of the contingent consideration was estimated using a combination of multiple valuation methods, including discounted cash flows method, guideline public company method, and the Black-Scholes option-pricing model with the following weighted-average assumptions at February 18, 2022 and April 15, 2022:

| February 18, | April 15, | |||||||

| 2022 | 2022 | |||||||

| Expected life (in years) | ||||||||

| Expected volatility | % | % | ||||||

| Risk-free rate | % | % | ||||||

| Dividend | % | % | ||||||

The contingent consideration fair value estimated on the I-Access Closing Date and the date the Adjustment for Guaranteed Minimum Revenue was cancelled was $

The valuation of assets acquired and liabilities assumed has not yet been finalized as of September 30, 2022. During the nine months ended September 30, 2022, goodwill in the purchase price allocation changed by $

The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date:

| Preliminary Allocation | ||||

| (in thousands) | ||||

| Accounts receivable, net | $ | |||

| Prepaid expenses and other current assets | ||||

| Property and equipment | ||||

| Goodwill | ||||

| Technology and software | ||||

| Customer related assets | ||||

| Other assets | ||||

| Accrued expenses and other liabilities | ( | ) | ||

| Current portion of deferred revenue | ( | ) | ||

| Other non-current liabilities | ( | ) | ||

| Total purchase consideration | $ | |||

The goodwill, which is generally not tax-deductible, is attributed to intangible assets that do not qualify for separate recognition, including the assembled workforce of the acquired business and the synergies expected to arise as a result of the acquisitions.

Intangible assets primarily relate to acquired technology and software and customer related assets. The acquired definite-lived intangible assets are being amortized over an estimated useful life of: (i)

tyGraph Companies Acquisition

On September 12, 2022, AvePoint consummated its acquisition of all of the outstanding shares of tyGraph Incorporated (“tyGraph US”), and AvePoint Ontario Ltd. (“AvePoint Ontario”, a wholly-owned subsidiary of AvePoint) consummated its acquisition of all of the outstanding shares of tyGraph Ltd. (“tyGraph Canada” and, collectively with tyGraph US, the “tyGraph Companies”). On September 12, 2022, tyGraph Canada was merged with and into AvePoint Ontario, with AvePoint Ontario surviving. As a result, the tyGraph Companies became wholly-owned subsidiaries of AvePoint. The acquisition was made pursuant to the Share Purchase Agreement, by and among AvePoint, AvePoint Ontario and the former tyGraph Companies shareholders. The Company completed the acquisition of the tyGraph Companies to further expand its SaaS solutions for providing robust analytics capabilities that enable organizations to uncover workplace engagement. The fair value of the transaction considerations totaled approximately $

(i) the cash purchase price of $

(ii) the entire outstanding principal and interest of the loans made to certain tyGraph Companies shareholders which was approximately $

(iii) unpaid transaction costs incurred by the tyGraph Companies as of the open of business on the closing date which was less than approximately $

The acquisition-related costs incurred by the Company totaled $

The financial results of the tyGraph Companies have been included in our condensed consolidated financial statements since the date of the acquisitions. The tyGraph Companies businesses are reported within our reportable segment. In accordance with ASC 805-740, the Company established a deferred tax liability with an offset to goodwill in connection with the accounting for the opening balance sheet of the tyGraph Companies acquisitions as a result of book-to-tax differences primarily related to the technology and software intangibles and customer related assets.

The valuation of assets acquired and liabilities assumed has not yet been finalized as of September 30, 2022. The purchase price allocation is preliminary and subject to change, including the valuation of intangible assets, income taxes, and goodwill, among other items. The amounts recognized will be finalized as the information necessary to complete the analysis is obtained, but no later than one year after the acquisition date. Finalization of the valuation during the measurement period could result in a change in the amounts recorded for the acquisition date fair value.

The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date:

| Preliminary Allocation | ||||

| (in thousands) | ||||

| Accounts receivable, net | $ | |||

| Prepaid expenses and other current assets | ||||

| Property and equipment | ||||

| Goodwill | ||||

| Customer related assets | ||||

| Technology and software | ||||

| Other assets | ||||

| Accounts payable | ( | ) | ||

| Accrued expenses and other liabilities | ( | ) | ||

| Current portion of deferred revenue | ( | ) | ||

| Other non-current liabilities | ( | ) | ||

| Total purchase consideration | $ | |||

The goodwill, which is generally not tax-deductible, is attributed to intangible assets that do not qualify for separate recognition, including the assembled workforce of the acquired business and the synergies expected to arise as a result of the acquisition.

Intangible assets primarily relate to acquired technology and software and customer related assets. The acquired definite-lived intangible assets are being amortized over an estimated useful life of: (i)

Essential Acquisition

On August 25, 2022, AvePoint acquired all of the issued and outstanding equity interest in Essential Co. Ltd. (“Essential”), a South Korea-based software solutions provider that will advance the Company’s ability to enable organizations to accelerate data-driven digital transformation, for a total valuation of $

4. Goodwill

The changes in the carrying amounts of goodwill were as follows:

| Goodwill | ||||

| (in thousands) | ||||

| Balance as of December 31, 2021 | $ | |||

| Acquisitions | ||||

| Effect of foreign currency translation | ( | ) | ||

| Balance as of September 30, 2022 | $ | |||

The goodwill is assigned to the single reporting unit.

5. Other intangible assets, net

Amortization expense for intangible assets was $

As of September 30, 2022, estimated future amortization expense for the intangible assets reflected above was as follows:

| Year Ending December 31: | ||||

| (in thousands) | ||||

| 2022 (three months) | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total intangible assets subject to amortization | $ | |||

A summary of the balances of the Company's intangible assets as of September 30, 2022 and December 31, 2021 is presented below:

| Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Weighted Average | ||||||||||||||||||||||

| September 30, | December 31, | Life | ||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||

| (in thousands) | (in years) | |||||||||||||||||||||||||||

| Technology and software, net | ( | ) | ||||||||||||||||||||||||||

| Customer related assets, net | ( | ) | ||||||||||||||||||||||||||

| Content, net | ( | ) | ||||||||||||||||||||||||||

| Total | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||

6. Concentration of Credit Risk

The Company deposits its cash with financial institutions and, at times, such balances may exceed federally insured limits.

7. Accounts Receivable, Net

Accounts receivable, net, consists of the following components:

| September 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| (in thousands) | ||||||||

| Trade receivables | $ | $ | ||||||

| Current unbilled receivables | ||||||||

| Allowance for doubtful accounts | ( | ) | ( | ) | ||||

| $ | $ | |||||||

8. Line of Credit

The Company maintains a loan and security agreement with HSBC Venture Bank USA Inc. (“HSBC”) as lender for a revolving line of credit of up to $

To date, the Company is in compliance with all covenants under the Second Amended Loan Agreement. The Company has not at any time, including as of September 30, 2022 and for the fiscal year ended December 31, 2021, borrowed under the Second Amended Loan Agreement. The descriptions of the Loan Agreement, the First Amendment, the Second Amendment, the First Amended Loan Agreement, the Second Amended Loan Agreement, the First Assignment and Assumption Agreement, the Second Assignment and Assumption Agreement, the Limited Consent, the Pledge Agreement, and the Limited Guaranty, are qualified in their entirety by the full text of the forms of such agreements, copies of which are attached as exhibits to the Company's Annual Report.

9. Income Taxes

The Company had an effective tax rate of ()% and

The change in effective tax rates for the three-month period ended September 30, 2022 as compared to the three-month period ended September 30, 2021 was primarily due to the mix of pre-tax income (loss) results by jurisdictions taxed at different rates, and stock-based compensation.

The change in effective tax rates for the nine-month period ended September 30, 2022 as compared to the nine-month period ended September 30, 2021 was primarily due to the mix of pre-tax income (loss) results by jurisdictions taxed at different rates, changes in valuation allowance at various jurisdictions, and stock-based compensation.

The Company continues to evaluate the realizability of its deferred tax assets on a quarterly basis and will adjust such amounts in light of changing facts and circumstances. In making such an assessment, management would consider all available positive and negative evidence, including the level of historical taxable income, future reversals of existing temporary differences, tax planning strategies, and projected future taxable income.

10. Leases

The Company is obligated under various non-cancelable operating leases primarily for office space. The initial terms of the leases expire on various dates through 2030. We determine if an arrangement is a lease at inception.

Leases are classified as either operating or finance leases based on certain criteria. This classification determines the timing and presentation of expenses on the income statement, as well as the presentation of the related cash flows and balance sheet. Operating leases are recorded on the balance sheet beginning January 1, 2022 as operating lease right-of-use assets, accrued expenses and other liabilities, and long-term operating lease liabilities. The Company currently has no significant finance leases.

ROU assets and related liabilities are recorded at lease commencement based on the present value of the lease payments over the expected lease term. Lease payments include future increases unless the increases are based on changes in an index or rate. As the Company's leases do not provide an implicit rate, the Company’s incremental borrowing rate is used to calculate ROU assets and related liabilities. The incremental borrowing rate is determined based on the Company’s estimated credit rating, the term of the lease, the economic environment where the asset resides and full collateralization. Lease terms include periods under options to extend or terminate the lease when it is reasonably certain that we will exercise that option. We generally use the base, non-cancelable, lease term when determining the lease assets and liabilities. Operating lease expense is recognized on a straight-line basis over the lease term and is allocated within operating expenses in the condensed consolidated statements of operations.

The components of the Company's operating lease expense are reflected in the condensed consolidated statements of income for the three and nine months ended September 30, 2022 are as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||

| 2022 | 2022 | |||||||

| (in thousands) | ||||||||

| Lease liability cost | $ | $ | ||||||

| Short-term lease expenses (1) | ||||||||

| Variable lease cost not included in the lease liability (2) | ||||||||

| Total lease cost | $ | $ | ||||||

(1) Short-term lease expenses include rent expenses from leases of 12 months or less on the transition date or lease commencement.

(2) Variable lease cost includes common area maintenance, property taxes, and fluctuations in rent due to a change in an index or rate.

Our lease agreements generally contain lease and non-lease components. Non-lease components primarily include payments for maintenance and utilities. We elected to combine fixed payments for non-lease components, for all classes of underlying assets, with our lease payments and account for them together as a single lease component which increases the amount of our lease assets and liabilities.

During the three and nine months ended September 30, 2022, ROU assets obtained in exchange for new operating lease liabilities amounted to $

Other information related to operating leases for the three and nine months ended September 30, 2022 is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||

| 2022 | 2022 | |||||||

| (in thousands) | ||||||||

| Cash paid for amounts included in the measurement of the lease liability: | ||||||||

| Operating cash flows from operating leases | $ | $ | ||||||

As of September 30, 2022, our operating leases had a weighted average remaining lease term of

| Year Ending December 31: | ||||

| (in thousands) | ||||

| 2022 (three months) | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total future lease payments | $ | |||

| Less: Present value adjustment | ( | ) | ||

| Present value of future lease payments (1) | $ | |||

(1) Includes the current portion of operating lease liabilities of $

During the three and nine months ended September 30, 2021, total rent expenses amounted to $

The future minimum rental payments under ASC 840 for all long-term non-cancelable property leases at December 31, 2021 were as follows:

| Year Ending December 31: | ||||

| (in thousands) | ||||

| 2022 | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| $ | ||||

11. Commitments and Contingencies

Legal Proceedings

In the normal course of its business, the Company may be involved in various claims, negotiations and legal actions. Except for such claims that arise in the normal course of business, as of September 30, 2022, the Company was not a party to any other litigation for which a material claim is reasonably possible, probable or estimable.

Guarantees

In the normal course of business, we are seldomly required to enter into service agreements that require contingency agreements with customers in highly regulated sectors. These agreements are secured by certificates of deposit. As of September 30, 2022, letters of credit have been issued in the amount of $

12. Earn-Out and Warrant Liabilities

Company Earn-Out Agreement

As a result of the Apex Business Combination, the holders of Legacy AvePoint Preferred Stock, Legacy AvePoint common stock and Legacy AvePoint Options shall be issued additional shares of AvePoint's Common Stock, as follows:

| • | | |

| • | | |

| • | |