pwp-20220113S-1/A0001777835TRUEAmendment no. 10.00070730.000828060.00086790940.0010203869P3YP3YP1YP3Y00017778352021-01-012021-09-3000017778352020-12-31iso4217:USD00017778352019-12-3100017778352020-01-012020-12-3100017778352019-01-012019-12-3100017778352018-01-012018-12-310001777835pwp:PartnerCapitalMember2017-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-3100017778352017-12-310001777835pwp:PartnerCapitalMember2018-01-012018-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001777835pwp:PartnerCapitalMember2018-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100017778352018-12-310001777835pwp:PartnerCapitalMember2019-01-012019-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001777835pwp:PartnerCapitalMember2019-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001777835pwp:PartnerCapitalMember2020-01-012020-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001777835pwp:PartnerCapitalMember2020-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001777835pwp:FinTechAcquisitionCorpIVMembersrt:ScenarioForecastMember2020-12-302020-12-300001777835pwp:FinTechAcquisitionCorpIVMembersrt:ScenarioForecastMemberus-gaap:PrivatePlacementMember2020-12-30iso4217:USDxbrli:shares0001777835srt:ScenarioForecastMemberpwp:PerellaWeinbergPartnersMember2020-12-30xbrli:pure0001777835us-gaap:LetterOfCreditMember2019-12-310001777835us-gaap:LetterOfCreditMember2020-12-310001777835us-gaap:CustomerConcentrationRiskMember2020-12-310001777835us-gaap:CustomerConcentrationRiskMember2019-12-310001777835us-gaap:CustomerConcentrationRiskMember2019-01-012019-12-31pwp:client0001777835pwp:FurnitureFixturesAndEquipmentMember2020-01-012020-12-310001777835pwp:SoftwareMember2020-01-012020-12-3100017778352020-05-012020-05-310001777835us-gaap:AccountingStandardsUpdate201409Member2017-12-310001777835us-gaap:AccountingStandardsUpdate201409Member2018-01-012018-12-310001777835us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001777835us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001777835us-gaap:AccountingStandardsUpdate201613Member2019-12-310001777835us-gaap:TransferredOverTimeMember2020-01-012020-12-310001777835us-gaap:TransferredOverTimeMember2019-01-012019-12-310001777835us-gaap:TransferredOverTimeMember2018-01-012018-12-310001777835us-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310001777835us-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310001777835us-gaap:TransferredAtPointInTimeMember2018-01-012018-12-3100017778352021-01-012020-12-310001777835srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccountingStandardsUpdate201613Member2019-12-310001777835srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-012020-12-310001777835srt:MinimumMemberus-gaap:BuildingMember2020-12-310001777835srt:MaximumMemberus-gaap:BuildingMember2020-12-310001777835srt:MinimumMemberus-gaap:OfficeEquipmentMember2020-12-310001777835srt:MaximumMemberus-gaap:OfficeEquipmentMember2020-12-310001777835pwp:NewYorkOfficeMember2020-07-012020-07-310001777835pwp:TudorPickeringHoltCoLLCMember2016-11-302016-11-300001777835us-gaap:CustomerRelationshipsMember2020-12-310001777835us-gaap:TrademarksAndTradeNamesMember2020-12-310001777835us-gaap:CustomerRelationshipsMember2019-12-310001777835us-gaap:TrademarksAndTradeNamesMember2019-12-310001777835pwp:PerellaWeinbergPartnersLPTPHSecuritiesTudorAndPickeringHoltCoAdvisorsLPMember2020-12-310001777835pwp:PerellaWeinbergPartnersLPTPHSecuritiesTudorAndPickeringHoltCoAdvisorsLPMember2019-12-310001777835pwp:PerellaWeinbergPartnersUKLLPMember2020-12-31iso4217:GBP0001777835pwp:PerellaWeinbergPartnersUKLLPMember2019-12-310001777835pwp:TudorPickeringHoltCoSecuritiesCanadaULCMember2020-12-31iso4217:CAD0001777835pwp:TudorPickeringHoltCoSecuritiesCanadaULCMember2019-12-310001777835pwp:PerellaWeinbergPartnersFranceSASMember2020-12-31iso4217:EUR0001777835us-gaap:LeaseholdImprovementsMember2020-12-310001777835us-gaap:LeaseholdImprovementsMember2019-12-310001777835us-gaap:FurnitureAndFixturesMember2020-12-310001777835us-gaap:FurnitureAndFixturesMember2019-12-310001777835us-gaap:EquipmentMember2020-12-310001777835us-gaap:EquipmentMember2019-12-310001777835pwp:SoftwareMember2020-12-310001777835pwp:SoftwareMember2019-12-310001777835us-gaap:SoftwareDevelopmentMember2020-01-012020-12-310001777835us-gaap:SoftwareDevelopmentMember2019-01-012019-12-310001777835us-gaap:SoftwareDevelopmentMember2018-01-012018-12-310001777835us-gaap:ConvertibleDebtMember2020-12-310001777835us-gaap:ConvertibleDebtMember2019-12-310001777835us-gaap:RevolvingCreditFacilityMember2020-12-310001777835us-gaap:RevolvingCreditFacilityMember2019-12-310001777835us-gaap:ConvertibleDebtMember2016-11-300001777835us-gaap:ConvertibleDebtMember2016-11-302016-11-300001777835us-gaap:ConvertibleDebtMember2020-01-012020-12-310001777835us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2016-11-300001777835us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2016-11-300001777835us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2019-02-280001777835us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2019-02-280001777835us-gaap:ConvertibleDebtMember2019-02-280001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2020-01-012020-12-310001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2019-01-012019-12-310001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2018-01-012018-12-310001777835us-gaap:ConvertibleDebtMember2019-01-012019-12-310001777835us-gaap:ConvertibleDebtMember2018-01-012018-12-310001777835us-gaap:SeniorNotesMember2016-11-300001777835us-gaap:RevolvingCreditFacilityMember2018-12-310001777835us-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001777835us-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310001777835us-gaap:RevolvingCreditFacilityMember2018-01-012018-12-310001777835us-gaap:EurodollarMember2016-12-012018-12-310001777835us-gaap:BaseRateMember2016-12-012018-12-310001777835us-gaap:EurodollarMember2019-01-012020-12-310001777835us-gaap:BaseRateMember2019-01-012020-12-310001777835pwp:WeightedAverageInterestRateMemberus-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001777835pwp:WeightedAverageInterestRateMemberus-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310001777835pwp:WeightedAverageInterestRateMemberus-gaap:RevolvingCreditFacilityMember2018-01-012018-12-310001777835us-gaap:RevolvingCreditFacilityMember2016-11-300001777835us-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2020-01-012020-12-310001777835us-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2019-01-012019-12-310001777835us-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2018-01-012018-12-310001777835us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2016-11-302016-11-300001777835us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2016-11-302016-11-300001777835us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2019-02-012019-02-280001777835us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2019-02-012019-02-280001777835pwp:SLPAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2016-11-302016-11-300001777835pwp:SLPAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2020-01-012020-12-310001777835pwp:SLPAwardsMember2018-01-012018-12-310001777835us-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2018-01-012018-12-310001777835srt:MaximumMemberus-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMember2018-01-012018-12-310001777835us-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2017-01-012017-12-310001777835srt:MaximumMemberus-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMember2017-01-012017-12-310001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMemberpwp:MeasurementInputIncomeMultipleMember2018-01-012018-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputIncomeMultipleMember2018-01-012018-12-310001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMemberpwp:MeasurementInputIncomeMultipleMember2017-01-012017-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputIncomeMultipleMember2017-01-012017-12-310001777835pwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMember2018-01-012018-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMember2018-01-012018-12-310001777835pwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMember2017-01-012017-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMember2017-01-012017-12-310001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMembersrt:MinimumMember2018-01-012018-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMember2018-01-012018-12-310001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMembersrt:MinimumMember2017-01-012017-12-310001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMember2017-01-012017-12-310001777835pwp:SLPAwardsMember2018-10-012018-10-010001777835us-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2018-10-012018-10-010001777835srt:MaximumMemberus-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMember2018-10-012018-10-010001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMemberpwp:MeasurementInputIncomeMultipleMember2018-10-012018-10-010001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputIncomeMultipleMember2018-10-012018-10-010001777835pwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMember2018-10-012018-10-010001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputRevenueMultipleMemberus-gaap:MarketApproachValuationTechniqueMember2018-10-012018-10-010001777835pwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMembersrt:MinimumMember2018-10-012018-10-010001777835srt:MaximumMemberpwp:SLPAwardsMemberus-gaap:MarketApproachValuationTechniqueMemberpwp:MeasurementInputGrowthRateMember2018-10-012018-10-010001777835pwp:SLPAwardsMember2019-01-012019-12-310001777835us-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2019-01-012019-12-310001777835srt:MaximumMemberus-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMember2019-01-012019-12-310001777835pwp:SLPAwardsMember2020-01-012020-12-310001777835us-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2020-01-012020-12-310001777835srt:MaximumMemberus-gaap:IncomeApproachValuationTechniqueMemberpwp:SLPAwardsMemberus-gaap:MeasurementInputDiscountRateMember2020-01-012020-12-310001777835pwp:SLPAwardsMember2020-12-310001777835us-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-01-012019-12-310001777835us-gaap:DeferredProfitSharingMemberpwp:PerellaWeinbergPartnersUKLLPMember2019-01-012019-12-310001777835us-gaap:DeferredProfitSharingMemberpwp:PerellaWeinbergPartnersUKLLPMember2018-01-012018-12-310001777835srt:MaximumMember2020-01-012020-12-310001777835us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001777835us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001777835us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001777835us-gaap:FairValueMeasurementsRecurringMember2020-12-310001777835us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001777835us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001777835us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001777835us-gaap:FairValueMeasurementsRecurringMember2019-12-310001777835pwp:PWPCapitalHoldingsLPMember2020-12-310001777835pwp:TSACompensationRelatedMember2020-01-012020-12-310001777835pwp:TSACompensationRelatedMember2019-01-012019-12-310001777835pwp:TSACompensationRelatedMember2018-01-012018-12-310001777835pwp:TSANonCompensationRelatedMember2020-01-012020-12-310001777835pwp:TSANonCompensationRelatedMember2019-01-012019-12-310001777835pwp:TSANonCompensationRelatedMember2018-01-012018-12-310001777835pwp:TsaMember2020-01-012020-12-310001777835pwp:TsaMember2019-01-012019-12-310001777835pwp:TsaMember2018-01-012018-12-310001777835us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberpwp:PWPCapitalHoldingsLPMember2019-02-280001777835pwp:PartnerPromissoryNotesMember2019-01-012019-12-310001777835pwp:PartnerPromissoryNotesMember2018-01-012018-12-310001777835pwp:PartnerPromissoryNotesMember2020-01-012020-12-310001777835pwp:PartnerPromissoryNotesMember2019-12-310001777835pwp:PartnerPromissoryNotesMember2020-12-310001777835pwp:PartnerPromissoryNotesMember2018-12-310001777835pwp:AffiliatesMemberus-gaap:ConvertibleDebtMember2020-12-310001777835pwp:AffiliatesMemberus-gaap:ConvertibleDebtMember2019-12-310001777835us-gaap:GuaranteeOfIndebtednessOfOthersMember2020-12-310001777835us-gaap:GuaranteeOfIndebtednessOfOthersMember2019-12-310001777835us-gaap:IndemnificationGuaranteeMember2020-12-310001777835us-gaap:IndemnificationGuaranteeMember2019-12-310001777835us-gaap:PendingLitigationMember2020-03-20pwp:claim0001777835pwp:PendingDismissalMember2020-03-200001777835pwp:PendingLitigationAfterPendingDismissalMember2020-03-20pwp:Segment0001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001777835country:US2020-01-012020-12-310001777835country:US2019-01-012019-12-310001777835country:US2018-01-012018-12-310001777835us-gaap:NonUsMember2020-01-012020-12-310001777835us-gaap:NonUsMember2019-01-012019-12-310001777835us-gaap:NonUsMember2018-01-012018-12-310001777835country:US2020-12-310001777835country:US2019-12-310001777835us-gaap:NonUsMember2020-12-310001777835us-gaap:NonUsMember2019-12-310001777835us-gaap:SubsequentEventMemberpwp:InvestorLimitedPartnersAndSpecialLimitedPartnerMember2021-01-012021-01-0100017778352021-09-300001777835us-gaap:CommonClassAMember2021-09-30xbrli:shares0001777835us-gaap:CommonClassAMember2020-12-310001777835us-gaap:CommonClassBMember2021-09-300001777835us-gaap:CommonClassBMember2020-12-3100017778352021-07-012021-09-3000017778352020-07-012020-09-3000017778352020-01-012020-09-300001777835us-gaap:LimitedPartnerMember2019-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001777835us-gaap:LimitedPartnerMember2020-01-012020-03-3100017778352020-01-012020-03-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001777835us-gaap:LimitedPartnerMember2020-03-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-3100017778352020-03-310001777835us-gaap:LimitedPartnerMember2020-04-012020-06-3000017778352020-04-012020-06-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001777835us-gaap:LimitedPartnerMember2020-06-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-3000017778352020-06-300001777835us-gaap:LimitedPartnerMember2020-07-012020-09-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300001777835us-gaap:LimitedPartnerMember2020-09-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-3000017778352020-09-300001777835us-gaap:LimitedPartnerMember2020-12-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001777835us-gaap:LimitedPartnerMember2021-01-012021-03-3100017778352021-01-012021-03-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001777835us-gaap:LimitedPartnerMember2021-03-310001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-3100017778352021-03-310001777835us-gaap:LimitedPartnerMember2021-04-012021-06-3000017778352021-04-012021-06-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001777835us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-04-012021-06-300001777835us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-04-012021-06-300001777835us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001777835us-gaap:NoncontrollingInterestMember2021-04-012021-06-300001777835us-gaap:RetainedEarningsMember2021-04-012021-06-300001777835us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-06-300001777835us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-06-300001777835us-gaap:AdditionalPaidInCapitalMember2021-06-300001777835us-gaap:RetainedEarningsMember2021-06-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001777835us-gaap:NoncontrollingInterestMember2021-06-3000017778352021-06-300001777835us-gaap:RetainedEarningsMember2021-07-012021-09-300001777835us-gaap:NoncontrollingInterestMember2021-07-012021-09-300001777835us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300001777835us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-07-012021-09-300001777835us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-08-032021-08-030001777835us-gaap:TreasuryStockMember2021-07-012021-09-300001777835us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-09-300001777835us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-09-300001777835us-gaap:TreasuryStockMember2021-09-300001777835us-gaap:AdditionalPaidInCapitalMember2021-09-300001777835us-gaap:RetainedEarningsMember2021-09-300001777835us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001777835us-gaap:NoncontrollingInterestMember2021-09-300001777835us-gaap:CustomerConcentrationRiskMember2021-09-300001777835us-gaap:CustomerConcentrationRiskMember2021-01-012021-09-300001777835pwp:PWPOpCoMember2021-09-300001777835pwp:PWPOpCoMember2020-12-310001777835pwp:PipeInvestorsMemberus-gaap:CommonClassAMember2020-12-290001777835pwp:SponsorRelatedPipeInvestorsMemberus-gaap:CommonClassAMember2020-12-290001777835us-gaap:CommonClassBMemberpwp:SponsorMember2021-06-240001777835pwp:FtivAndOtherPartiesMemberus-gaap:CommonClassAMember2021-06-242021-06-240001777835pwp:CommonClassB1Member2021-06-242021-06-240001777835pwp:ClassB2CommonStockMember2021-06-242021-06-240001777835us-gaap:ConvertibleDebtMember2021-06-242021-06-240001777835us-gaap:RevolvingCreditFacilityMember2021-06-242021-06-2400017778352021-06-242021-06-240001777835pwp:ElectingIlpsMember2021-06-242021-06-240001777835pwp:ElectingFormerWorkingPartnersMember2021-06-242021-06-240001777835pwp:PublicWarrantMember2021-06-240001777835pwp:PrivateWarrantMember2021-06-2400017778352021-06-240001777835us-gaap:CommonClassAMember2021-06-240001777835us-gaap:CommonClassBMember2021-06-240001777835us-gaap:TransferredOverTimeMember2021-07-012021-09-300001777835us-gaap:TransferredOverTimeMember2020-07-012020-09-300001777835us-gaap:TransferredOverTimeMember2021-01-012021-09-300001777835us-gaap:TransferredOverTimeMember2020-01-012020-09-300001777835us-gaap:TransferredAtPointInTimeMember2021-07-012021-09-300001777835us-gaap:TransferredAtPointInTimeMember2020-07-012020-09-300001777835us-gaap:TransferredAtPointInTimeMember2021-01-012021-09-300001777835us-gaap:TransferredAtPointInTimeMember2020-01-012020-09-3000017778352021-10-012021-09-300001777835us-gaap:AccountingStandardsUpdate201613Member2020-01-012020-09-300001777835pwp:NewYorkOfficeMember2021-05-310001777835pwp:NewYorkOfficeMember2021-05-012021-05-310001777835pwp:HoustonOfficeMember2021-07-260001777835pwp:HoustonOfficeMember2021-07-262021-07-260001777835pwp:ParisOfficeMember2021-08-030001777835pwp:ParisOfficeMember2021-08-032021-08-030001777835us-gaap:CustomerRelationshipsMember2021-09-300001777835us-gaap:TrademarksAndTradeNamesMember2021-09-300001777835us-gaap:LeaseholdImprovementsMember2021-09-300001777835us-gaap:FurnitureAndFixturesMember2021-09-300001777835us-gaap:EquipmentMember2021-09-300001777835pwp:SoftwareMember2021-09-300001777835us-gaap:SoftwareDevelopmentMember2021-07-012021-09-300001777835us-gaap:SoftwareDevelopmentMember2021-01-012021-09-300001777835us-gaap:SoftwareDevelopmentMember2020-07-012020-09-300001777835us-gaap:SoftwareDevelopmentMember2020-01-012020-09-300001777835us-gaap:ConvertibleDebtMember2021-09-300001777835us-gaap:RevolvingCreditFacilityMember2021-09-300001777835us-gaap:ConvertibleDebtMember2016-11-012016-11-300001777835us-gaap:ConvertibleDebtMember2021-06-240001777835us-gaap:ConvertibleDebtMember2021-06-242021-06-240001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2020-07-012020-09-300001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2020-01-012020-09-300001777835us-gaap:ConvertibleDebtMemberpwp:EffectiveInterestRateMember2021-01-012021-06-240001777835us-gaap:ConvertibleDebtMember2021-01-012021-06-240001777835us-gaap:ConvertibleDebtMember2020-07-012020-09-300001777835us-gaap:ConvertibleDebtMember2020-01-012020-09-300001777835us-gaap:RevolvingCreditFacilityMember2020-01-012020-09-300001777835pwp:FixedRateMemberus-gaap:RevolvingCreditFacilityMember2021-06-242021-06-240001777835srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMember2021-06-242021-06-240001777835pwp:ReductionToCadenceBankPrimeRateMemberus-gaap:RevolvingCreditFacilityMember2021-06-242021-06-240001777835pwp:FixedRateMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2021-06-242021-06-240001777835us-gaap:RevolvingCreditFacilityMember2021-01-012021-09-300001777835pwp:WeightedAverageInterestRateMemberpwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-06-240001777835pwp:WeightedAverageInterestRateMemberpwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMember2020-07-012020-09-300001777835pwp:WeightedAverageInterestRateMemberpwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMember2020-01-012020-09-300001777835pwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2021-01-012021-06-240001777835pwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2020-07-012020-09-300001777835pwp:PriorToBusinessCombinationMemberus-gaap:RevolvingCreditFacilityMemberpwp:EffectiveInterestRateMember2020-01-012020-09-300001777835us-gaap:RevolvingCreditFacilityMember2021-07-012021-09-300001777835us-gaap:RevolvingCreditFacilityMember2020-07-012020-09-300001777835pwp:ClassB1CommonStockMember2021-09-300001777835pwp:ClassB2CommonStockMember2021-09-300001777835us-gaap:CommonClassAMember2021-01-012021-09-300001777835pwp:ClassB1CommonStockMember2021-01-012021-09-300001777835pwp:ClassB2CommonStockMember2021-01-012021-09-300001777835us-gaap:CommonClassAMember2021-08-032021-08-0300017778352021-08-032021-08-030001777835pwp:ProfessionalPartnersAndIlpsMember2021-09-300001777835pwp:DollarTwelvePriceMemberpwp:FounderSharePurchaseOptionMember2021-09-300001777835pwp:FounderSharePurchaseOptionMemberpwp:DollarFifteenPriceMember2021-09-300001777835pwp:FounderSharePurchaseOptionMember2021-01-012021-09-30utr:D0001777835pwp:FounderSharePurchaseOptionMember2021-08-092021-08-090001777835pwp:FormerWorkingPartnersMember2021-01-012021-09-300001777835pwp:WorkingPartnersMembersrt:MinimumMember2021-01-012021-09-300001777835srt:MaximumMemberpwp:WorkingPartnersMember2021-01-012021-09-300001777835pwp:ExistingInvestorLimitedPartnersMember2021-01-012021-09-300001777835pwp:OthersMember2021-01-012021-09-300001777835pwp:PublicWarrantsMember2021-09-300001777835pwp:PublicWarrantsMember2021-01-012021-09-300001777835pwp:PrivatePlacementWarrantsMember2021-09-300001777835pwp:PwpIncentivePlanMemberpwp:GeneralShareReserveMember2021-09-300001777835pwp:PwpIncentivePlanMember2021-01-012021-09-300001777835pwp:TransactionPoolShareReserveMemberpwp:PwpIncentivePlanMember2021-09-300001777835pwp:TransactionPoolRsusReserveMemberpwp:PwpIncentivePlanMember2021-09-300001777835pwp:PwpIncentivePlanMemberpwp:TransactionPoolPsusReserveMember2021-09-300001777835pwp:PwpIncentivePlanMember2021-09-300001777835srt:MinimumMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835srt:MaximumMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:FiftyFourMonthsTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:FourtyEightMonthsTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:FourtyTwoMonthsTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:ThirtySixMonthsTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:SixtyMonthsTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:OneTwoPriceTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:OneSevenPriceTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:OneThreePointFiveZeroPriceTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:OneFivePriceTrancheMemberpwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:TransactionPoolPsusMember2021-01-012021-09-300001777835pwp:OneTwoPriceTrancheMemberpwp:TransactionPoolPsusMember2021-09-300001777835pwp:OneThreePointFiveZeroPriceTrancheMemberpwp:TransactionPoolPsusMember2021-09-300001777835pwp:TransactionPoolPsusMember2020-12-310001777835pwp:TransactionPoolPsusMember2021-09-300001777835pwp:TransactionPoolPsusMember2021-07-012021-09-300001777835pwp:TransactionPoolRsusMember2021-01-012021-09-300001777835pwp:TransactionPoolRsusMember2021-07-012021-09-300001777835pwp:TransactionPoolRsusMember2021-09-300001777835pwp:TransactionPoolRsusMember2020-12-310001777835pwp:TrancheOneMemberpwp:ManagementPsusMember2021-09-300001777835pwp:ManagementPsusMemberpwp:TrancheTwoMember2021-09-300001777835pwp:ManagementPsusMemberpwp:TrancheThreeMember2021-09-300001777835pwp:ManagementPsusMemberpwp:TrancheFourMember2021-09-300001777835pwp:ManagementPsusMember2021-01-012021-09-300001777835pwp:ManagementPsusMember2020-12-310001777835pwp:ManagementPsusMember2021-09-300001777835pwp:ManagementPsusMember2021-07-012021-09-300001777835pwp:GeneralRsusMembersrt:MinimumMember2021-01-012021-09-300001777835srt:MaximumMemberpwp:GeneralRsusMember2021-01-012021-09-300001777835pwp:GeneralRsusMember2021-01-012021-09-300001777835pwp:GeneralRsusMember2021-07-012021-09-300001777835pwp:GeneralRsusMember2021-09-300001777835pwp:GeneralRsusMember2020-12-310001777835pwp:LegacyAwardsMember2020-01-012020-01-310001777835pwp:LegacyAwardsMembersrt:MinimumMember2020-01-012020-01-310001777835srt:MaximumMemberpwp:LegacyAwardsMember2020-01-012020-01-310001777835pwp:LegacyAwardsMember2021-01-012021-01-310001777835pwp:LegacyAwardsMembersrt:MinimumMember2021-01-012021-01-310001777835srt:MaximumMemberpwp:LegacyAwardsMember2021-01-012021-01-310001777835pwp:ProfessionalPartnersAwardMembersrt:MinimumMember2021-01-012021-09-300001777835srt:MaximumMemberpwp:ProfessionalPartnersAwardMember2021-01-012021-09-300001777835pwp:ProfessionalPartnersAwardMember2021-06-242021-06-240001777835pwp:TransactionPoolPsusMember2021-08-310001777835pwp:LegacyAwardsMember2021-09-300001777835pwp:LegacyAwardsMember2021-01-012021-09-300001777835pwp:ProfessionalPartnersAwardMember2021-09-300001777835pwp:ProfessionalPartnersAwardMember2021-01-012021-09-300001777835pwp:IncentivePlanAwardsMember2021-07-012021-09-300001777835pwp:IncentivePlanAwardsMember2020-07-012020-09-300001777835pwp:IncentivePlanAwardsMember2021-01-012021-09-300001777835pwp:IncentivePlanAwardsMember2020-01-012020-09-300001777835pwp:LegacyAwardsMember2021-07-012021-09-300001777835pwp:LegacyAwardsMember2020-07-012020-09-300001777835pwp:LegacyAwardsMember2020-01-012020-09-300001777835pwp:LegacyAwardsAndProfessionalPartnersAwardsMember2021-07-012021-09-300001777835pwp:LegacyAwardsAndProfessionalPartnersAwardsMember2020-07-012020-09-300001777835pwp:LegacyAwardsAndProfessionalPartnersAwardsMember2021-01-012021-09-300001777835pwp:LegacyAwardsAndProfessionalPartnersAwardsMember2020-01-012020-09-3000017778352021-06-252021-09-300001777835us-gaap:WarrantMember2021-07-012021-09-300001777835us-gaap:WarrantMember2021-06-252021-09-300001777835pwp:PwpOpCoClassAPartnershipUnitsMember2021-07-012021-09-300001777835pwp:PwpOpCoClassAPartnershipUnitsMember2021-06-252021-09-300001777835us-gaap:RestrictedStockMember2021-07-012021-09-300001777835us-gaap:RestrictedStockMember2021-06-252021-09-300001777835us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-09-300001777835us-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835pwp:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835us-gaap:FairValueInputsLevel2Memberpwp:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835pwp:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-09-300001777835pwp:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-09-300001777835us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberpwp:PrivateWarrantsMember2021-09-300001777835us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberpwp:PrivateWarrantsMember2021-09-300001777835us-gaap:FairValueMeasurementsRecurringMemberpwp:PrivateWarrantsMemberus-gaap:FairValueInputsLevel3Member2021-09-300001777835us-gaap:FairValueMeasurementsRecurringMemberpwp:PrivateWarrantsMember2021-09-300001777835pwp:PrivateWarrantsMember2021-01-012021-09-300001777835pwp:PrivateWarrantsMember2021-09-300001777835us-gaap:FairValueInputsLevel3Member2021-06-240001777835us-gaap:FairValueInputsLevel3Member2021-06-252021-09-300001777835us-gaap:FairValueInputsLevel3Member2021-09-300001777835pwp:TSACompensationRelatedMember2021-07-012021-09-300001777835pwp:TSACompensationRelatedMember2020-07-012020-09-300001777835pwp:TSACompensationRelatedMember2021-01-012021-09-300001777835pwp:TSACompensationRelatedMember2020-01-012020-09-300001777835pwp:TSANonCompensationRelatedMember2021-07-012021-09-300001777835pwp:TSANonCompensationRelatedMember2020-07-012020-09-300001777835pwp:TSANonCompensationRelatedMember2021-01-012021-09-300001777835pwp:TSANonCompensationRelatedMember2020-01-012020-09-300001777835pwp:TsaMember2021-07-012021-09-300001777835pwp:TsaMember2020-07-012020-09-300001777835pwp:TsaMember2021-01-012021-09-300001777835pwp:TsaMember2020-01-012020-09-300001777835pwp:AffiliatesMemberus-gaap:ConvertibleDebtMember2020-12-310001777835pwp:PFACHoldingsMember2021-01-012021-09-300001777835pwp:PFACHoldingsMember2021-09-012021-09-300001777835srt:DirectorMember2021-01-012021-09-300001777835pwp:PartnersMemberus-gaap:GuaranteeOfIndebtednessOfOthersMember2021-09-300001777835pwp:PartnersMemberus-gaap:GuaranteeOfIndebtednessOfOthersMember2020-12-310001777835us-gaap:IndemnificationGuaranteeMember2021-09-3000017778352015-11-090001777835us-gaap:CustomerConcentrationRiskMember2021-07-012021-09-300001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-07-012021-09-300001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-09-300001777835us-gaap:CustomerConcentrationRiskMember2020-07-012020-09-300001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-07-012020-09-300001777835us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-09-300001777835country:US2021-07-012021-09-300001777835country:US2020-07-012020-09-300001777835country:US2021-01-012021-09-300001777835country:US2020-01-012020-09-300001777835us-gaap:NonUsMember2021-07-012021-09-300001777835us-gaap:NonUsMember2020-07-012020-09-300001777835us-gaap:NonUsMember2021-01-012021-09-300001777835us-gaap:NonUsMember2020-01-012020-09-300001777835country:US2021-09-300001777835us-gaap:NonUsMember2021-09-300001777835us-gaap:SubsequentEventMember2021-11-300001777835us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2021-11-030001777835us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2021-11-032021-11-03

As filed with the Securities and Exchange Commission on January 13, 2022.

Registration No. 333-261785

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Perella Weinberg Partners

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | 6199

(Primary Standard Industrial

Classification Code Number) | 84-1770732

(I.R.S. Employer

Identification Number) |

767 Fifth Avenue

New York, New York 10153

(212) 287-3200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Vladimir Shendelman, Esq.

General Counsel

Perella Weinberg Partners

767 Fifth Avenue

New York, New York 10153

(212) 287-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| | | | | |

Joseph A. Coco, Esq.

Michael J. Schwartz, Esq.

Blair T. Thetford, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, NY 10001

(212) 735-3000 | Richard D. Truesdell, Jr., Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4000 |

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | x | Smaller reporting company | x |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

| | | | | | | | | | | | | | |

| CALCULATION OF REGISTRATION FEE |

Title of Each Class of

Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee |

Class A common stock, par value $0.0001 per share | 3,502,033 | $12.44 | $43,565,290.52 | $4,038.50 (2) |

(1)Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, on the basis of the average high and low sales price of the Registrant's Class A common stock as reported by the Nasdaq Global Select Market on December 15, 2021.

(2)The registration fee was previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell or distribute the securities described herein until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 13, 2022

PRELIMINARY PROSPECTUS

| | | | | | | | |

| | |

| |

| |

| Perella Weinberg Partners |

| 3,502,033 Shares of Class A Common Stock |

| | |

We are offering 3,502,033 shares of Class A common stock (as defined below) in this offering. Our Class A common stock is listed on The Nasdaq Global Select Market under the symbol “PWP.” On January 11, 2022, the last reported closing sale price of our Class A common stock on The Nasdaq Global Select Market was $12.99 per share.

We intend to use the proceeds from this offering to purchase from certain non-employee holders (i) outstanding PWP OpCo Class A partnership units (as defined below) and (ii) outstanding shares of our Class B common stock (as defined below). See “Use of Proceeds.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. See “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 37 of this prospectus. | | | | | | | | | | | |

| Per share | | Total |

Public offering price | $ | | $ |

Underwriting discounts and commissions(1) | $ | | $ |

Proceeds to us before expenses | $ | | $ |

_______________(1)We have agreed to reimburse the underwriter for certain FINRA-related expenses. See “Underwriting” for additional information regarding underwriting compensation.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of our Class A common stock to purchasers on or about , 2022.

Book Running Manager

| | | | | |

| JMP Securities |

| A CITIZENS COMPANY |

The date of this prospectus is , 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Neither we nor the underwriter have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourself about and to observe any restrictions relating as to this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

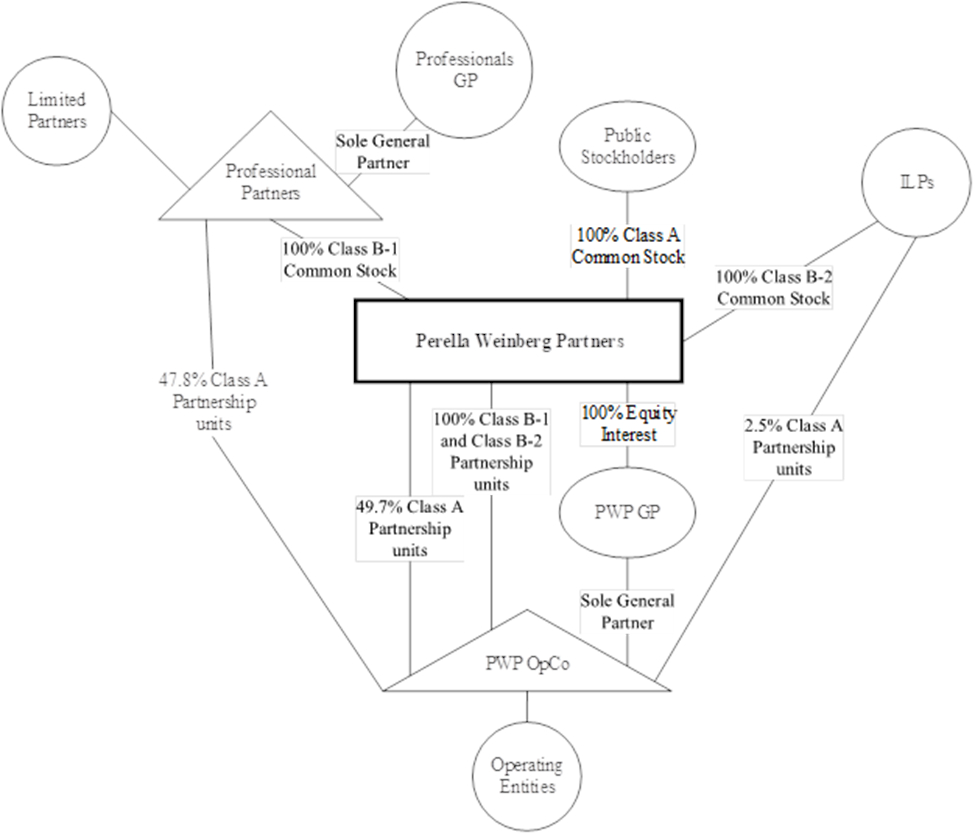

On June 24, 2021 (the “Closing Date”), Perella Weinberg Partners (formerly known as FinTech Acquisition Corp. IV (“FTIV”)), consummated its previously announced business combination pursuant to that certain Business Combination Agreement, dated as of December 29, 2020, by and among FTIV, FinTech Investor Holdings IV, LLC, a Delaware limited liability company, FinTech Masala Advisors, LLC, a Delaware limited liability company (together with FinTech Investor Holdings IV, LLC, “Sponsor”), PWP Holdings LP, a Delaware limited partnership (“PWP OpCo”), PWP GP LLC, a Delaware limited liability company and the general partner of PWP OpCo (“PWP GP”), PWP Professional Partners LP, a Delaware limited partnership and a limited partner of PWP OpCo (“Professional Partners”), and Perella Weinberg Partners LLC, a Delaware limited liability company and the general partner of Professional Partners (“Professionals GP”). As contemplated by the Business Combination Agreement, (i) FTIV acquired certain partnership interests in PWP OpCo, (ii) PWP OpCo became jointly-owned by the Company (as defined below), Professional Partners and certain existing partners of PWP OpCo, and (iii) PWP OpCo serves as the Company's operating partnership as part of an umbrella limited partnership C-corporation (Up-C) structure (collectively with the other transactions contemplated by the Business Combination Agreement, the “Business Combination”).

Unless the context indicates otherwise, references to the “Company,” “we,” “us” and “our” refer, prior to the Business Combination, to FTIV or PWP OpCo, as the context suggests, and, following the Business Combination, to Perella Weinberg Partners, a Delaware corporation, and its consolidated subsidiaries.

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain market, ranking and industry data included in this prospectus, including the size of certain markets and our size or position and the positions of our competitors within these markets, including our products and services relative to our competitors, are based on estimates by our management. These estimates have been derived from our management's knowledge and experience in the markets in which we operate, as well as information based on research, industry and general publications, including surveys and studies conducted by third parties. Industry publications, surveys and studies generally state that they have been obtained from sources believed to be reliable.

We are responsible for all of the disclosure in this prospectus and while we believe the data from these sources to be accurate and complete, we have not independently verified all data from these sources or obtained third-party verification of market share data and this information may not be reliable. In addition, these sources may use different definitions of the relevant markets. Data regarding our industry is intended to provide general guidance, but is inherently imprecise. Market share data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. In addition, customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be reliable. References herein to us being a leader in a market or product category refers to our belief that we have a leading market share, expertise or thought leadership position in each specified market, unless the context otherwise requires. In addition, the discussion herein regarding our various markets is based on how we define the markets for our products or services, which products or services may be either part of larger overall markets or markets that include other types of products and services. Assumptions and estimates regarding our current and future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors—Risks Related to Our Business.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

In this prospectus, we use the term “independent advisory firms” to refer to independent investment banks that offer advisory services. We consider the independent advisory firms to be our publicly traded peers, Evercore Partners Inc.; Greenhill & Co., Inc.; Houlihan Lokey, Inc.; Lazard Ltd; Moelis & Company; PJT Partners, Inc., as well as our non-publicly traded peers, Centerview Partners; Guggenheim Partners; and NM Rothschild & Sons Limited. The mergers and acquisitions (“M&A”) market data for announced and completed transactions and estimated fee data referenced throughout this prospectus were obtained from Dealogic, LLC.

NON-GAAP FINANCIAL MEASURES

In addition to financial measures presented in accordance with United States generally accepted accounting principles (“GAAP”), we present certain non-GAAP financial measures in this prospectus, including Adjusted total compensation and benefits, Adjusted non-compensation expense, Adjusted operating income (loss), Adjusted non-operating income (expenses), Adjusted income (loss) before income taxes and Adjusted net income (loss), which we monitor to manage our business, make planning decisions, evaluate our performance and allocate resources.

We believe that these non-GAAP financial measures are key financial indicators of our business performance over the long term and provide useful information regarding whether cash provided by operating activities is sufficient to maintain and grow our business. We believe that the methodology for determining these non-GAAP financial measures can provide useful supplemental information to help investors better understand the economics of our platform.

These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or as a substitute for, the analysis of other GAAP financial measures, including total compensation and benefits, non-compensation expense, operating income (loss), non-operating income (expenses), income (loss) before taxes and net income (loss). These non-GAAP financial measures are not universally consistent calculations, limiting their usefulness as comparative measures. Other companies may calculate similarly titled financial measures differently. Additionally, these non-GAAP financial measures are not measurements of financial performance or liquidity under GAAP. In order to facilitate a clear understanding of our consolidated historical operating results, you should examine our non-GAAP financial measures in conjunction with our historical consolidated financial statements and notes thereto included elsewhere in this prospectus.

Management compensates for the inherent limitations associated with using these non-GAAP financial measures through disclosure of such limitations, presentation of our financial statements in accordance with GAAP and reconciliation of such non-GAAP financial measures to the most directly comparable GAAP financial measure. For additional information regarding see “Summary Historical Financial and Other Information of PWP.”

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus may contain some trademarks, service marks and trade names of the Company or of third parties. Each one of these trademarks, service marks or trade names is either (1) our registered trademark, (2) a trademark for which we have a pending application, or (3) a trade name or service mark for which we claim common law rights. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our respective rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

SELECTED DEFINITIONS

Unless stated in this prospectus or the context otherwise requires, references to:

•“Business Combination” are to the transactions contemplated by the Business Combination Agreement;

•“Business Combination Agreement” are to the Business Combination Agreement, dated as of December 29, 2020, by and among FTIV, the Sponsor, PWP OpCo, PWP GP, Professional Partners and Professionals GP, as it may be amended from time to time;

•“Class A common stock” are to Class A common stock, par value $0.0001 per share, of FTIV prior to the Business Combination, and of the Company immediately following the consummation of the Business Combination;

•“Class B common stock” are to Class B common stock, par value $0.0001 per share, of FTIV prior to the Business Combination and, collectively to Class B-1 common stock, par value $0.0001 per share, and Class B-2 common stock, par value $0.0001 per share, of the Company immediately following the consummation of the Business Combination;

•“Class B Condition” are to the condition that Professional Partners or its limited partners as of the date of the Closing or its or their respective successors or assigns maintain, directly or indirectly, ownership of PWP OpCo Class A partnership units that represent at least ten percent (10%) of our issued and outstanding Class A common stock (calculated, without duplication, on the basis that all issued and outstanding PWP OpCo Class A partnership units not held by us or our subsidiaries had been exchanged for our Class A common stock);

•“Closing” are to the consummation of the transactions contemplated by the Business Combination Agreement;

•“Closing Date” are to June 24, 2021, the date of the closing of the Business Combination;

•“Common Stock” are to the Class A common stock and the Class B common stock, together;

•“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

•“Founder Shares” are to the 7,870,000 shares of Class B common stock held by the Sponsor prior to the Business Combination, 1,023,333 of which were forfeited and 6,846,667 of which were converted into shares of our Class A common stock at the closing of the Business Combination. All but 1,000,000 of the Founder Shares held by the Sponsor were distributed to the Sponsor’s members pursuant to the Sponsor Distribution (as defined below);

•“Group LP” are to Perella Weinberg Partners Group LP, a Delaware limited partnership and a wholly owned subsidiary of PWP OpCo;

•“ILPs” are to certain existing investor limited partners of PWP OpCo who hold interests in PWP OpCo, alongside Professional Partners;

•“Incentive Plan” are to the Perella Weinberg Partners 2021 Omnibus Incentive Plan approved in connection with the Business Combination;

•“IPO” are to FTIV's initial public offering on September 29, 2020 in which it sold 23,000,000 units;

•“JOBS Act” are to the Jumpstart Our Business Startups Act of 2012;

•“Legacy Partners” are to former working Limited Partners whose tenure was terminated prior to November 1, 2020;

•“Limited Partners” are to limited partners of Professional Partners;

•“PIPE Shares” are to the 12,500,000 shares of Class A common stock issued to the private investment in public equity investors (the “PIPE Investors”) pursuant to the Subscription Agreements (as defined below);

•“Placement Shares” are to the 610,000 shares of Class A common stock underlying the 610,000 units that were initially issued to the Sponsor in a private placement simultaneously with the closing of the IPO and which were distributed to the Sponsor’s members pursuant to the Sponsor Distribution;

•“Private Placement Warrants” are to the 203,333 Warrants underlying the 610,000 units that were initially issued to Sponsor in a private placement simultaneously with the closing of the IPO and which were distributed to the Sponsor’s members pursuant to the Sponsor Distribution;

•“Professional Partners” are to PWP Professional Partners LP, a Delaware limited partnership;

•“Public Warrants” are to the redeemable Warrants underlying the units that were initially offered and sold by FTIV in its IPO;

•“PWP” (i) prior to the Business Combination are to PWP OpCo and its consolidated subsidiaries and (ii) following the consummation of the Business Combination are to Perella Weinberg Partners and its consolidated subsidiaries;

•“PWP GP” are to PWP GP LLC, the general partner of PWP OpCo;

•“PWP OpCo” (i) prior to the PWP Separation, are to PWP Holdings LP as the holding company for both the advisory business and asset management business of PWP and (ii) following the PWP Separation, are to PWP Holdings LP as the holding company solely for the advisory business of PWP;

•“PWP OpCo Class A partnership unit” are to a Class A common unit of PWP Holdings LP, a Delaware limited partnership, that is issued by PWP Holdings LP pursuant to the PWP OpCo LPA;

•“PWP OpCo LPA” are to the Amended and Restated Agreement of Limited Partnership of PWP OpCo, as amended, restated, modified or supplemented from time to time;

•“PWP Separation” are to the separation of the advisory business from the asset management business of PWP OpCo pursuant to a master separation agreement, dated as of February 28, 2019;

•“RRA Parties” are to the Sponsor, Professional Partners, the ILPs and others party to the Amended and Restated Registration Rights Agreement (as defined below), including certain parties affiliated with the Sponsor who became a party to the Amended and Restated Registration Rights Agreement in connection with the Sponsor Distribution;

•“Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002;

•“Secondary Class B Condition” are to the condition that Professional Partners or its limited partners as of the date of Closing or its or their respective successors or assigns maintain, directly or indirectly, ownership of PWP OpCo Class A partnership units that represent at least five percent (5%) of our issued and outstanding Class A common stock (calculated, without duplication, on the basis that all issued and outstanding PWP OpCo Class A partnership units not held by us or our subsidiaries had been exchanged for our Class A common stock);

•“Securities Act” are to the Securities Act of 1933, as amended;

•“Sponsor” are collectively to FinTech Investor Holdings IV, LLC, a Delaware limited liability company, and Fintech Masala Advisors, LLC, a Delaware limited liability company;

•“Subscription Agreements” are to the subscription agreements with the PIPE Investors, pursuant to, and on the terms and subject to the conditions of, which the PIPE Investors collectively subscribed for 12,500,000 shares of the Company’s Class A common stock for an aggregate purchase price equal to $125 million (the “PIPE Investment”);

•“Warrants” are to Public Warrants and Private Placement Warrants, as the case may be; and

•“Working Partners” are to working Limited Partners whose tenure was not terminated prior to November 1, 2020.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus are “forward looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. Statements regarding the expectations regarding the combined business are “forward-looking statements.” In addition, words such as “estimates,” “projected,” “expects,” “estimated,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of the parties, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include:

•any projected financial information, anticipated growth rate, and market opportunity of the Company;

•the ability to maintain the listing of the Company's Class A common stock and Warrants on Nasdaq following the Business Combination;

•our public securities' potential liquidity and trading;

•our success in retaining or recruiting partners and other employees, or changes related to, our officers, key employees or directors following the completion of the Business Combination;

•members of our management team allocating their time to other businesses and potentially having conflicts of interest with our business;

•factors relating to the business, operations and financial performance of the Company, including:

◦whether the Company realizes all or any of the anticipated benefits from the Business Combination;

◦whether the Business Combination results in any increased or unforeseen costs or has an impact on the Company's ability to retain or compete for professional talent or investor capital;

◦global economic, business, market and geopolitical conditions, including the impact of public health crises, such as the ongoing rapid, worldwide spread of a novel strain of coronavirus and the pandemic caused thereby (collectively, “COVID-19”);

◦the Company's dependence on and ability to retain working partners and other key employees;

◦the Company's ability to successfully identify, recruit and develop talent;

◦risks associated with strategic transactions, such as joint ventures, strategic investments, acquisitions and dispositions;

◦conditions impacting the corporate advisory industry;

◦the Company's dependence on its fee-paying clients and fluctuating revenues from its non-exclusive, engagement-by-engagement business model;

◦the high volatility of the Company's revenue as a result of its reliance on advisory fees that are largely contingent on the completion of events which may be out of its control;

◦the ability of the Company's clients to pay for its services, including its restructuring clients;

◦the Company's ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to the Company's business, including actual, potential or perceived conflicts of interest and other factors that may damage its business and reputation;

◦strong competition from other financial advisory and investment banking firms;

◦potential impairment of goodwill and other intangible assets, which represent a significant portion of the Company's assets;

◦the Company's successful formulation and execution of its business and growth strategies;

◦the outcome of third-party litigation involving the Company;

◦substantial litigation risks in the financial services industry;

◦cybersecurity and other operational risks;

◦the Company's ability to expand into new markets and lines of businesses for the advisory business;

◦exposure to fluctuations in foreign currency exchange rates;

◦assumptions relating to the Company's operations, financial results, financial condition, business prospects, growth strategy and liquidity;

◦extensive regulation of the corporate advisory industry and U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy and laws (including the treatment of carried interest);

◦the impact of the global COVID-19 pandemic on any of the foregoing risks; and

◦other risks and uncertainties described under the section entitled “Risk Factors.”

The forward-looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will be those that the Company has anticipated. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PROSPECTUS SUMMARY

This summary highlights certain significant aspects of our business and is a summary of information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements,” “PWP's Management's Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information,” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus before making an investment decision. The definition of some of the other terms used in this prospectus are set forth under the section “Selected Definitions.”

Business Summary

We are a leading global independent advisory firm that provides strategic and financial advice to clients across a range of the most active industry sectors and international markets. We provide advisory services to a wide range of clients globally, including large public multinational corporations, mid-sized public and private companies, individual entrepreneurs, private and institutional investors, creditor committees and government institutions.

We were founded in June 2006 with the opening of offices in New York and London, led by a team of ten seasoned advisory partners who previously held senior management positions at large global investment banks. The foundation of our Company was rooted in a belief, among other considerations, that clients would increasingly seek out deeply experienced advisors who offer independent strategic thinking and who are not burdened by the complicated conflicts that large investment banking institutions may face due to their various businesses. The 2008 global financial crisis reinforced this hypothesis and contributed to the early growth of our firm. Today, we believe that our independence is even more important. For clients and for us, independence means freedom from the distractions that dilute strategic thinking and a willingness and candor to share an honest opinion, even if at times it is contrary to our clients' point of view. We believe that our clients choose to engage us because they value our unbiased perspective and expert advice regarding complex financial and strategic matters.

Our business provides services to multiple industry sectors, geographic markets and advisory service offerings. We believe that our collaborative partnership and integrated approach combining deep industry insights, significant technical, product and transactional expertise, and rigorous work ethic create a significant opportunity for our Company to realize sustainable growth. We seek to advise clients throughout their evolution, with the full range of our advisory capabilities including, among other things, advice related to mission-critical strategic and financial decisions, M&A execution, shareholder and defense advisory, capital raising, capital structure and restructuring, capital markets advisory, specialized underwriting and research services for the energy industry.

Since our inception, we have experienced significant growth in our business, driven by hiring professionals who are highly regarded in their fields of expertise, expanding the scope and geographic reach of our advisory services, deepening and expanding our client relationships and maintaining a firm culture that attracts, develops and retains talented people. In addition to our hiring and internal development of individual professionals, in November 2016, we completed a business combination with Tudor, Pickering, Holt & Co., LLC (“TPH”), an independent advisory firm, focused on the energy industry, that shares our culture and strategic vision, which increased our footprint in this sector. As of December 31, 2021, we serve our clients with 422 advisory professionals, including 60 advisory partners (which numbers include two advisory partners who retired from the firm in January 2022), based in ten offices, located in five countries around the world.

We have demonstrated robust financial performance, achieving revenues of $602.7 million, operating income of $67.2 million and Adjusted operating income of $129.4 million for the nine months ended September 30, 2021, revenues of $519.0 million, operating loss of $14.6 million and Adjusted operating income of $40.3 million for the year ended December 31, 2020, revenues of $533.3 million, operating loss of $155.1 million and Adjusted operating income of $49.5 million for the year ended December 31, 2019, revenues of $702.0 million, operating loss of $107.4 million and Adjusted operating income of $107.7 million for the year ended December 31, 2018 and revenues of $418.4 million, operating loss of $173.9 million and Adjusted operating income of $40.1 million for the year ended

December 31, 2017. GAAP operating losses in these historical periods have been largely due to the equity-based compensation awards granted by Professional Partners, which have no economic impact on PWP or PWP OpCo. The vesting of equity awards granted in connection with the Business Combination was recorded as an equity-based compensation expense at PWP OpCo for GAAP accounting purposes. As a result (or due to other factors), we may continue to experience operating losses in future periods. We believe we have established leading franchises in each of our areas of focus, as evidenced by the lead role we often command among advisors, the complexity of the situations in which we advise clients and our clients' reputation as leaders in their respective industries.

Our Market Opportunity

We founded our firm with the objective of providing strategic and financial advice to business leaders that is critical to the success of their businesses throughout their corporate evolution. The decisions that business leaders confront often transcend traditional transaction-related questions, focusing instead on the core risks and opportunities facing their businesses. We believe that clients are increasingly looking for an independent advisor who can serve as an unbiased sounding board, work with them in genuine partnership and be by their side as they navigate mission-critical and complex issues.

We believe many factors drive the demand for such advice, including, but not limited to:

Sector-Specific Transformation and Disruption: The sectors on which we focus are all experiencing change at an accelerating pace. Such change within a sector may be driven by new regulation, new competition, business model innovation and transformation and the increasing impact of technology, among other factors. Business leaders are highly focused on the effect of such change on their marketplace and the implications for their businesses.

Business Growth: Business leaders all share a desire to grow their business and improve their position relative to their peers and the market overall. This focus on growth often can lead to organic and inorganic initiatives such as business or business model transformation, expansion through acquisitions, rationalization of certain low-growth, non-core elements of their businesses or the selection of technologies that can alter the trajectory of their businesses.

Challenges for Leadership: Business leaders have to be vigilant in how they confront specific immediate and potential future challenges. These challenges can range from traditional business execution risk, to increased competitive risks, to funding and balance sheet constraints to shareholder initiatives or governance-related matters. These challenges are often highly complex and can be mission-critical to the success or survival of a company.

Rapidly Changing Political and Regulatory Landscape: Changes in political regimes, regulation, monetary policies, tariff policies, tax policies, environmental laws, regulations and policies, migration policies and economic stability, among others, can have a significant impact on the decisions that business leaders make to drive the success of their businesses.

The above issues are among the most important topics faced by business leaders every day, regardless of the size or the global nature of their business. In a business environment that is increasingly competitive, global, and undergoing significant transformation, we believe that business leaders will increasingly seek to partner with advisors who provide independent thought and advice to holistically navigate these opportunities and challenges and drive the long-term success of their businesses.

We believe that our collaborative partnership and integrated approach positions us well to stand by our clients and support them with independent thinking, expertise and knowledge, and that this can lead to an expanded demand for our advisory services. The principal drivers of this opportunity include:

Growing Demand for Independent Advice: We believe the momentum driving demand for independent advice remains strong. When we founded our firm in 2006, this dynamic was driven largely by growing client concern about conflicts at the large financial conglomerates and a growing desire by bankers to join a pure play advisory platform, all of which became increasingly apparent during the 2008 global financial crisis. In our experience, our clients value a broad approach to independence—advisors who deliver deep industry, product and technical expertise rather than offer a wide array of financial products while also acting as transaction counterparty. Since 2005, the year before our founding, the demand for independent advice has increased significantly. On average, our

peer independent advisory firms advised on 66% of volume from the top 25 announced M&A transactions in the five-year period ended December 31, 2021, up from 47% on average during the five-year period ended December 31, 2005. Similarly, according to Dealogic, the estimated M&A fee pool of our peer independent advisory firms averaged $5.4 billion in the five-year period ended December 31, 2021, up from an average of $1.2 billion in the five-year period ended December 31, 2005. We expect the trend toward independent advice to continue as business leaders become increasingly experienced with the independent advisory model and believe our firm is well positioned to continue to capitalize on this trend.

Dynamic Mergers & Acquisitions Activity: We believe the M&A environment will remain active over the medium term based on a variety of economic, regulatory and strategic factors, including a stabilizing global macroeconomic environment, strong corporate balance sheets, significant undeployed venture and private equity capital, attractive financing markets, a rapidly accelerating trend toward global consolidation and business model transformation. In 2021 and 2020, globally announced M&A volume reached $3.7 trillion and $5.8 trillion, respectively, with approximately 71% occurring in North America and in Europe, the markets in which we are primarily focused. Dealogic estimates that the global M&A fee pool averaged approximately $30 billion in the five-year period ended December 31, 2021, which illustrates the large market opportunity that exists today. We believe that our Company is well positioned to further capitalize on these robust fundamentals and M&A trends, which we expect will continue to drive global growth of the financial advisory market.

Growing Demand in Liability Management (Restructuring and Capital Markets) Advisory Services: We believe that, due to large debt issuances by companies in recent years, a steady liability management (including restructuring and capital markets) advisory market will continue to exist as interest rates rise and/or credit markets become more difficult to access, even with a stable macroeconomic environment and robust M&A activity. According to Dealogic, the past nine years represented record years in volume of corporate bond issuance in the United States, as companies took advantage of historically low borrowing costs to add leverage to their capital structures. Additionally, beyond typical capital structure-related issues, we believe that the pace of business model transformation driven by a changing regulatory backdrop, and technology innovation and unanticipated shock resulting from the COVID-19 pandemic, among other factors, will lead to an entirely different wave of restructuring activity as companies consider their readiness for such change and the requirements to fund their growth and success in such an environment. We believe our integrated industry and geographic approach positions us to provide solutions to clients in both robust and challenging economic environments. We also believe that our broad industry coverage is an attractive complement to our restructuring and capital markets advisory practices due to the often uncorrelated industry-specific challenges that can lead to disruption for companies in distressed situations. Our strong positioning in each of our primary areas of industry focus and our restructuring and capital markets advisory practices diversifies our revenues and differentiates us from our peers.

Our Principles Define Our Strategy

Since our founding in 2006, we have focused on building a trust-based, focused, and high-intensity advisory business that we believe is well positioned to deliver significant value to our clients, our shareholders, and our employees.

Five key principles drive our approach:

Relationships are Everything to Us: We cultivate deep, long-term relationships, which transcend traditional transactional dialogue. Our clients often rely on us to assist them in assessing opportunities and challenges throughout their corporate evolution.

Partnership is at Our Core: We operate as a highly collaborative and integrated partnership defined by a culture of integrity, humility, rigor, and intensity. Working together is a critical ingredient of our success.

Focused Internationally: Since its founding, our organization has been integrated globally and is deliberately focused on the most active advisory markets worldwide. Our closely integrated partnership approach enables us to efficiently leverage our deep industry expertise with clients across geographies.

We Thrive in Complexity: We excel in complex, mission-critical situations where we can utilize our insights, experience, deep strategic thinking and personalized approach to partner with our clients to achieve their objectives.

Independence is Core to Our Character: We strive to be viewed as independent thinkers and our goal is to attract people to the firm with innovative, independent views and a willingness to speak with candor. We are not afraid to voice our perspective and are not afraid for “no” to be the right answer.

We believe these principles capture the essence of who we are and how we seek to be thought of in our markets. If we remain focused on these principles, we believe clients will continue to have the confidence to put their trust in us.

Our Key Competitive Strengths