DEF 14AFALSE0001777393iso4217:USD00017773932023-02-012024-01-310001777393chpt:RickWilmerMember2023-02-012024-01-310001777393chpt:PasqualeRomanoMember2023-02-012024-01-3100017773932022-02-012023-01-3100017773932021-02-012022-01-3100017773932020-02-012021-01-310001777393chpt:PasqualeRomanoMember2020-02-012021-01-310001777393chpt:PasqualeRomanoMember2021-02-012022-01-310001777393chpt:PasqualeRomanoMember2022-02-012023-01-310001777393ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2020-02-012021-01-310001777393ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2021-02-012022-01-310001777393ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2022-02-012023-01-310001777393ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2023-02-012024-01-310001777393chpt:RickWilmerMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-02-012024-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberchpt:PasqualeRomanoMember2020-02-012021-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberchpt:PasqualeRomanoMember2021-02-012022-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberchpt:PasqualeRomanoMember2022-02-012023-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberchpt:PasqualeRomanoMember2023-02-012024-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberchpt:RickWilmerMemberecd:PeoMember2023-02-012024-01-310001777393ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2020-02-012021-01-310001777393ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2021-02-012022-01-310001777393ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2022-02-012023-01-310001777393ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberchpt:PasqualeRomanoMember2023-02-012024-01-310001777393ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberchpt:RickWilmerMemberecd:PeoMember2023-02-012024-01-310001777393ecd:PeoMemberchpt:PasqualeRomanoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-02-012021-01-310001777393ecd:PeoMemberchpt:PasqualeRomanoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-02-012022-01-310001777393ecd:PeoMemberchpt:PasqualeRomanoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-02-012023-01-310001777393ecd:PeoMemberchpt:PasqualeRomanoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-02-012024-01-310001777393chpt:RickWilmerMemberecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-02-012024-01-310001777393ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberchpt:PasqualeRomanoMember2020-02-012021-01-310001777393ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberchpt:PasqualeRomanoMember2021-02-012022-01-310001777393ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberchpt:PasqualeRomanoMember2022-02-012023-01-310001777393ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberchpt:PasqualeRomanoMember2023-02-012024-01-310001777393chpt:RickWilmerMemberecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-02-012024-01-310001777393ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-02-012021-01-310001777393ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-02-012022-01-310001777393ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-02-012023-01-310001777393ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-02-012024-01-310001777393ecd:NonPeoNeoMemberchpt:YearEndFairValueOfForfeitedEquityAwardsInFiscalYearMember2020-02-012021-01-310001777393ecd:NonPeoNeoMemberchpt:YearEndFairValueOfForfeitedEquityAwardsInFiscalYearMember2021-02-012022-01-310001777393ecd:NonPeoNeoMemberchpt:YearEndFairValueOfForfeitedEquityAwardsInFiscalYearMember2022-02-012023-01-310001777393ecd:NonPeoNeoMemberchpt:YearEndFairValueOfForfeitedEquityAwardsInFiscalYearMember2023-02-012024-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-02-012021-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-02-012022-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-02-012023-01-310001777393ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-02-012024-01-310001777393ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-02-012021-01-310001777393ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-02-012022-01-310001777393ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-02-012023-01-310001777393ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-02-012024-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-02-012021-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-02-012022-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-02-012023-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-02-012024-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-02-012021-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-02-012022-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-02-012023-01-310001777393ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-02-012024-01-31000177739312023-02-012024-01-31000177739322023-02-012024-01-31000177739332023-02-012024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

______________________

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to Section 240.14a-12 |

ChargePoint Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

240 East Hacienda Avenue

Campbell, CA 95008

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 1:00 p.m. Pacific Time on Tuesday, July 9, 2024

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of ChargePoint Holdings, Inc., a Delaware corporation ("ChargePoint" or the “Company”), which will be held on Tuesday, July 9, 2024 at 1:00 p.m. Pacific Time. The Annual Meeting will be a virtual meeting of stockholders, which will be conducted via a live audio webcast. You will be able to attend the Annual Meeting, submit your questions and vote online during the meeting by visiting www.virtualshareholdermeeting.com/CHPT2024. We believe a virtual meeting provides expanded access, improves communication, enables increased stockholder attendance and participation and provides cost savings for our stockholders and the Company.

The Annual Meeting is being held for the following purposes:

1.To elect the four Class I directors named in this proxy to the Board of Directors (the “Board”), each to hold office until the 2027 Annual Meeting of Stockholders;

2.To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending January 31, 2025;

3.To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the Proxy Statement; and

4.To transact such other business as may properly come before the Annual Meeting or any continuation or adjournment thereof.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is May 17, 2024. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

On or about May 24, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended January 31, 2024 (“2024 Annual Report”). The Notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying Proxy Statement and our 2024 Annual Report can be accessed directly at the following Internet address: http://www.proxyvote.com. All you have to do is enter the control number located on your proxy card.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the meeting chair or secretary of the Annual Meeting will convene the meeting at 4:00 p.m. Pacific Time on the date specified above and at the Company’s address specified above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of the Company’s website at www.chargepoint.com.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on Tuesday, July 9, 2024 at 1:00 p.m. Pacific Time online at www.virtualshareholdermeeting.com/CHPT2024.

The Proxy Statement and 2024 Annual Report are available at www.ProxyVote.com.

The Board recommends that you vote “FOR” the election of all nominees for director in Proposal No. 1, “FOR” Proposal No. 2, and “FOR” Proposal No. 3.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented.

We appreciate your continued support of ChargePoint Holdings, Inc. and look forward to receiving your proxy.

| | | | | |

| By Order of the Board |

| |

| /s/ Rick Wilmer |

| |

| Rick Wilmer President and Chief Executive Officer |

Campbell, California

May 24, 2024

You are cordially invited to attend the Annual Meeting, which will be held virtually via the Internet. Whether or not you expect to attend the Annual Meeting, please vote as promptly as possible in order to ensure your representation at the meeting. You may vote your shares by telephone or over the Internet as instructed in these materials. If you received a proxy card or voting instruction card by mail, you may submit your proxy card or voting instruction card by completing, signing, dating and mailing your proxy card or voting instruction card in the envelope provided. Even if you have voted by proxy, you may still attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

240 East Hacienda Avenue

Campbell, CA 95008

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 1:00 p.m. Pacific Time on Tuesday, July 9, 2024

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

We are providing you with these proxy materials because the Board of Directors of ChargePoint Holdings, Inc. (the “Board”) is soliciting your proxy to vote at ChargePoint’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements thereof, to be held via a live audio webcast on Tuesday, July 9, 2024 at 1:00 p.m. Pacific Time. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/CHPT2024 where you will be able to listen to the meeting live, submit questions and vote online.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy.

The proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended January 31, 2024 (“2024 Annual Report”), are being distributed and made available on or about May 24, 2024. As used in this Proxy Statement, references to “we,” “us,” “our,” “ChargePoint” and the “Company” refer to ChargePoint Holdings, Inc. and its subsidiaries. ChargePoint was a special purpose acquisition company called Switchback Energy Acquisition Corporation (“Switchback”) prior to the closing of the Business Combination on February 26, 2021. As used in this Proxy Statement, the term “Business Combination” represents the transactions contemplated by an agreement and plan of reorganization whereby the entities that previously comprised the business of ChargePoint, Inc. (“Legacy ChargePoint”) merged with and into a subsidiary of the Company. For further information on the Business Combination, please refer to our Current Report on Form 8-K as filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2021. Our SEC filings are available to the public on a website maintained by the SEC located at www.sec.gov. We also maintain a website at https://investors.chargepoint.com under the "Financials" heading with our prior SEC filings.

Why are you holding a virtual meeting and how can stockholders attend?

We have adopted a virtual meeting format for our Annual Meeting. We believe a virtual meeting format will provide a consistent experience to all stockholders regardless of geographic location and enhance stockholder access and engagement. To participate in our virtual Annual Meeting, including to vote, ask questions and to view the list of registered stockholders as of the record date during the meeting, visit www.virtualshareholdermeeting.com/CHPT2024 with your 16-digit control number included in the Notice (as defined below), on your proxy card, or in the instructions that accompanied your proxy materials. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, follow the instructions from your broker or bank.

What can I do if I need technical assistance during the Annual Meeting?

If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting log-in page.

How can stockholders submit questions during the Annual Meeting

If you are logged in as a stockholder at the virtual Annual Meeting, you will have an opportunity to submit questions live at www.virtualshareholdermeeting.com/CHPT2024 during a designated portion of the virtual Annual Meeting. Once you are logged in, type your question into the question box and click “submit.” Subject to time constraints, we intend to answer questions pertinent to the Company and meeting matters submitted by stockholders during the Annual Meeting that comply with our rules of conduct for the Annual Meeting, which will be posted on the meeting website during the meeting.

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

On or about May 24, 2024, the proxy materials are being distributed to all stockholders of record entitled to vote at the Annual Meeting.

What proxy materials are available on the internet?

The 2024 Proxy Statement and 2024 Annual Report are available at www.ProxyVote.com.

Who can vote at the Annual Meeting?

If you are a stockholder of record as of the record date, you may vote your shares at the Annual Meeting by following the instructions provided on the Notice to log in to www.virtualshareholdermeeting.com/CHPT2024. You will be asked to provide the control number from your Notice.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must obtain a valid proxy from your broker, bank or other agent to vote online during the Annual Meeting. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

The webcast of the Annual Meeting will begin promptly at 1:00 p.m. Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m. Pacific Time, and you should allow reasonable time for the check-in procedures.

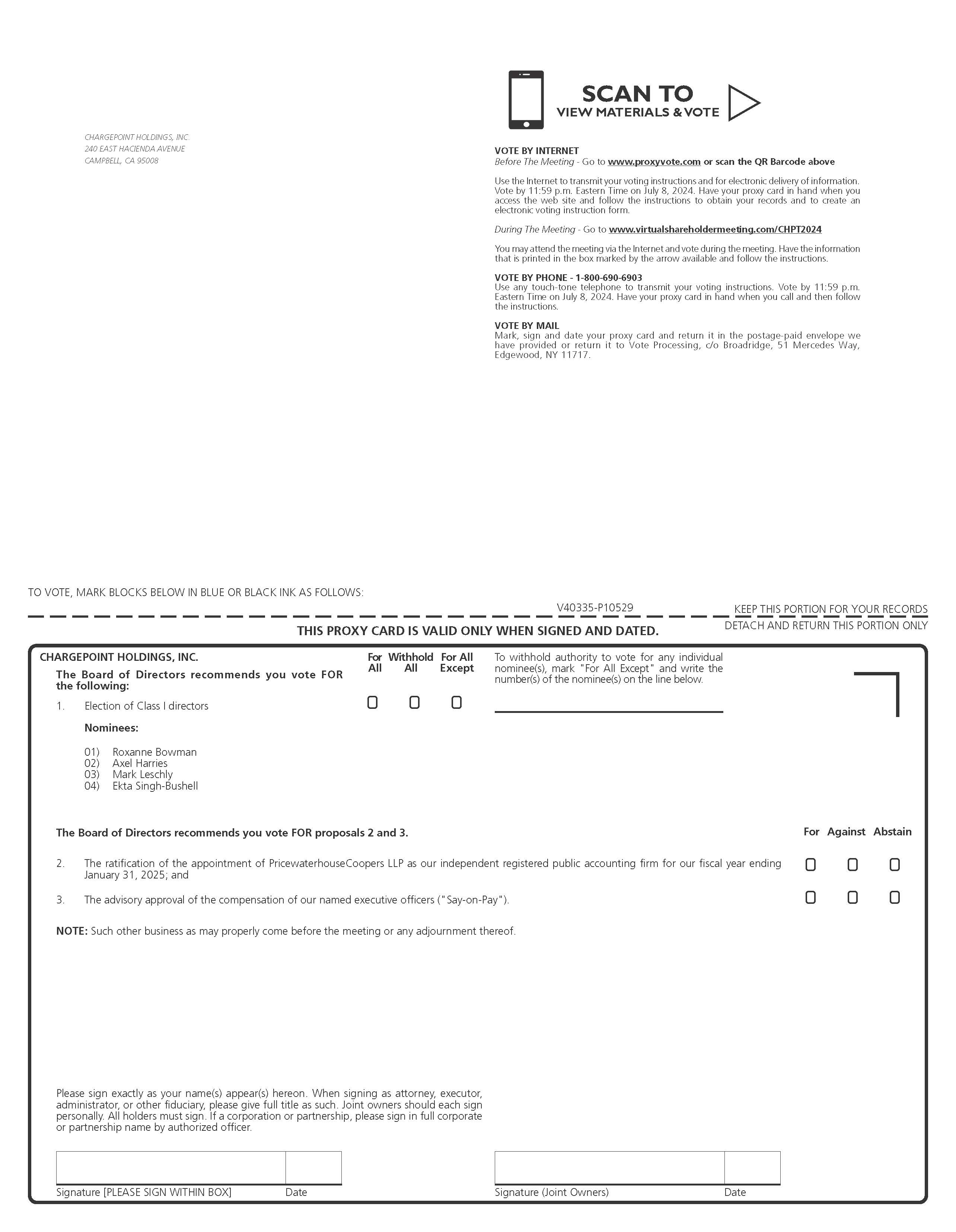

Vote by Proxy

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote at the Annual Meeting even if you have already voted by proxy.

If you are a stockholder of record, you may vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time:

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the Notice. Your vote must be received by 11:59 p.m. Eastern Time on July 8, 2024 to be counted.

•To vote through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the control number from your Notice. Your vote must be received by 11:59 p.m. Eastern Time on July 8, 2024 to be counted.

•To vote using the printed proxy card that may be delivered to you, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, the proxyholders will vote your shares as you instruct. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted.

We are holding the Annual Meeting online and providing internet voting to provide expanded access and to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your voting instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

Stockholder of Record: Shares Registered in Your Name

If on May 17, 2024 your shares were registered directly in your name with ChargePoint’s transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote at the

meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on May 17, 2024 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

•Election of the four Class I directors named in this proxy and nominated by the Board, each to serve until the 2027 Annual Meeting of Stockholders;

•Ratification of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending January 31, 2025; and

•Advisory approval of the compensation of our named executive officers.

How does the Board recommend I vote on these proposals?

Our Board recommends a vote:

•“FOR” the election of Roxanne Bowman, Axel Harries, Mark Leschly and Ekta Singh-Bushell as Class I directors;

•“FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2025; and

•“FOR” the advisory approval of the compensation of our named executive officers.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of May 17, 2024. On this record date, there were 425,289,679 shares of our common stock outstanding.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or online at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Nominee

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each of the four Class I director nominees, “For” the ratification of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending January 31, 2025, and “For” the approval, on an advisory basis, of the compensation of our named executive officers. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Are guests permitted to attend the Annual Meeting

Guests may attend the Annual Meeting in “listen-only” mode by entering the Annual Meeting at www.virtualshareholdermeeting.com/CHPT2024 and entering the information requested in the “Guest Login” section. Guests will not have the ability to vote or ask questions during the virtual Annual Meeting.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies online, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We have retained Saratoga Proxy Consulting LLC to assist us in soliciting proxies for a fee of approximately $10,000, plus reasonable out-of-pocket expenses incurred in the process of soliciting proxies.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting.

Stockholder of Record: Shares Registered in Your Name

If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to ChargePoint’s Secretary at 240 East Hacienda Avenue, Campbell, CA 95008.

•You may attend the Annual Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by January 24, 2025 to ChargePoint’s Secretary at 240 East Hacienda Avenue, Campbell, CA 95008 and comply with the requirements in the Company’s Amended and Restated Bylaws (the “Bylaws”) and all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). If you wish to submit a proposal for next year’s annual meeting that is not to be included in next year’s proxy materials or nominate a director, you must do so no later than April 10, 2025 and not earlier than March 11, 2025, provided, however, that if our 2025 annual

meeting of stockholders is held before June 9, 2025 or after September 7, 2025, then your proposal must be received no earlier than the close of business on the 120th day prior to such meeting and not later than the close of business on the later of the 90th day prior to such meeting or the 10th day following the day on which notice or public announcement of the date of such meeting is first made. You are also advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than May 12, 2025.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and with respect to Proposals No. 2 and 3, votes “For,” “Against,” abstentions and, if applicable, broker non-votes. A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal.

•Proposal No. 1: The election of directors is a matter considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore ChargePoint expects broker non-votes on Proposal No. 1. Thus, if you do not instruct your broker how to vote with respect to Proposal No. 1, your broker may not vote with respect to that proposal.

•Proposal No. 2: Ratification of the selection of PricewaterhouseCoopers LLP is considered to be a routine matter and, accordingly, if you do not instruct your broker or other nominee on how to vote the shares in your account for Proposal No. 2, brokers will be permitted to exercise their discretionary authority to vote for the ratification of the selection of PricewaterhouseCoopers LLP. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted with respect to that proposal.

•Proposal No. 3: The approval, on an advisory basis, of the compensation of our named executive officers is a matter considered non-routine under applicable rules. As described in Proposal 1 above, a broker or other nominee cannot vote without instructions on non-routine matters, and therefore ChargePoint expects broker non-votes on Proposal No. 3. Thus, if you do not instruct your broker how to vote with respect to Proposal No. 3, your broker may not vote with respect to that proposal.

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. Broker non-votes will not be counted for purposes of determining the number of shares present online during the meeting or represented by proxy and entitled to vote with respect to Proposals No. 1 or 3. Thus, a broker non-vote will not affect the outcome of the vote on Proposals No. 1 or 3.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares with respect to such matters. These unvoted shares are considered “broker non-votes” with respect to such matters. In the absence of timely directions, your broker will have discretion to vote your shares on Proposal No. 2, our sole “routine” matter, but brokers and nominees cannot use their discretion to vote “uninstructed” shares with respect to matters that are considered “non-routine.” “Non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as executive compensation (including any advisory stockholder votes to approve executive compensation) and certain corporate governance proposals, even if such proposals are supported by management. Accordingly, your broker or nominee may not vote your shares on Proposals No. 1 or 3 without your instructions, but may vote your shares on Proposal No. 2.

How many votes are needed to approve each proposal?

•Proposal No. 1: The election of directors requires a plurality vote of the shares of our common stock present virtually or by proxy at the virtual Annual Meeting and entitled to vote thereon to be approved. “Plurality”

means that the nominees who receive the largest number of votes cast “for” such nominees are elected as directors. Only votes “For” will affect the outcome.

•Proposal No. 2: The ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year ending January 31, 2025 requires the affirmative vote of a majority of the votes cast by the holders of shares of our common stock present virtually or by proxy at the virtual Annual Meeting and voting affirmatively or negatively on such matter to be approved. You may vote “for,” “against,” or “abstain” with respect to this proposal. Broker non-votes and abstentions will have no effect on the outcome of this proposal.

•Proposal No. 3: The approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of votes cast by the holders of shares of our common stock present virtually or by proxy at the virtual Annual Meeting and voting affirmatively or negatively on such matter to be approved. You may vote “for,” “against,” or “abstain” with respect to this proposal. Broker non-votes and abstentions will have no effect on the outcome of this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present online at the meeting, by remote communication, if applicable, or represented by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the meeting’s chairperson or holders of a majority of shares represented at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

ChargePoint Holdings, Inc.’s Board of Directors (the “Board”) is divided into three classes, designated Class I, Class II and Class III. Each class consists, as nearly as may be possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled solely by the affirmative vote of a majority of the directors then in office, even if less than a quorum, or by a sole remaining director. Any director elected to fill a vacancy or newly created directorship shall hold office until the next election of the class to which such director shall have been appointed or assigned, and until his or her successor is duly elected and qualified, subject to his or her earlier death, disqualification, resignation or removal.

The Board presently has eleven members. There are four directors in the class whose term of office expires in 2024, Roxanne Bowman, Axel Harries, Mark Leschly and Ekta Singh-Bushell. The Board has proposed that each of Roxanne Bowman, Axel Harries, Mark Leschly and Ekta Singh-Bushell be elected as a Class I director at the Annual Meeting.

The nominees listed below are currently directors of the Company and were each recommended for election by the Nominating and Corporate Governance Committee of the Board. Ms. Bowman, Mr. Harries and Mr. Leschly were previously elected by our stockholders and Ms. Singh-Bushell was appointed to the Board in April 2022 following a search process in which nominees were evaluated by existing members of our Board. If elected at the Annual Meeting, each nominee would serve for a three-year term expiring at our 2027 annual meeting and until the election and qualification of her or his successor or, if sooner, her or his death, disqualification, resignation or removal. The Company encourages but does not require its directors to attend its annual meetings. Ten of our eleven directors at the time of our 2023 annual meeting attended our annual meeting of stockholders in 2023.

Vote Required

Directors are elected by a plurality of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Proxies cannot be voted for more than one person. Each nominee nominated by the Board to serve as Class I director must receive the most “For” votes (among votes properly cast online during the meeting or by proxy) of nominees for the vacancies in such director class in order to be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, “For” the election of the nominees named below. Only votes “For” will affect the outcome.

The brief biographies below include information, as of the date of this Proxy Statement, regarding the specific and particular experience, qualifications, attributes or skills of each of our Class I, Class II and Class III directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class | | Age | | Position | | Director

Since** | | Current

Term

Expires | | Expiration of Term for which Nominated |

Class I Nominees | | | | | | | | | | | |

Roxanne Bowman(1) | I | | 57 | | Director | | 2019 | | 2024 | | 2027 |

| Axel Harries | I | | 59 | | Director | | 2016 | | 2024 | | 2027 |

Mark Leschly(1*)(3) | I | | 55 | | Director | | 2009 | | 2024 | | 2027 |

Ekta Singh-Bushell(2) | I | | 52 | | Director | | 2022 | | 2024 | | 2027 |

Class II and Class III Continuing Directors | | | | | | | | | | | |

Jeffrey Harris(2*) | II | | 68 | | Director | | 2018 | | 2025 | | — |

Susan Heystee(2) | II | | 62 | | Director | | 2021 | | 2025 | | — |

G. Richard Wagoner, Jr.(2) | II | | 71 | | Director | | 2017 | | 2025 | | — |

Rick Wilmer | III | | 62 | | President and Chief Executive Officer, Director | | 2023 | | 2026 | | — |

| Elaine L. Chao | III | | 71 | | Director | | 2021 | | 2026 | | — |

Bruce Chizen(1)(3) | III | | 68 | | Chairman of the Board | | 2014 | | 2026 | | — |

Michael Linse(3*) | III | | 49 | | Director | | 2012 | | 2026 | | — |

________________

*Signifies Chair of the Committee

**Based on service on the boards of ChargePoint and Legacy ChargePoint

(1)Member of the Nominating and Corporate Governance Committee

(2)Member of the Audit Committee

(3)Member of the Compensation and Organizational Development Committee

CLASS I NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2027 ANNUAL MEETING

Roxanne Bowman has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since August 2019. Ms. Bowman has served as Operating Executive at NMS Capital, a private investment firm, since March 2019. From September 2013 to November 2018, Ms. Bowman served as Chief Executive Officer of PowerTeam Services, LLC, a gas and electric utility service provider. Ms. Bowman holds a B.S. in Electrical Engineering from Clemson University and an M.B.A. from the Pamplin College of Business at Virginia Polytechnic Institute and State University. We believe Ms. Bowman is qualified to serve as a member of our Board based on her wide-ranging experience in management, sales, marketing and strategic planning within the utilities industry.

Axel Harries has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since October 2016. Mr. Harries has served as Head of Global Customer Service and Parts for Mercedes-Benz AG, an automotive manufacturing and supply company, since May 2023. Prior to this, since June 1993, Mr. Harries held several roles at Mercedes-Benz AG, including Vice President of Product Management and Sales from June 2017 until May 2023, leading the Connected, Autonomous, Shared & Services and Electric Drive unit, which is responsible for all-electric vehicle architecture from July 2016 to June 2017, leading Quality Management of Mercedes-Benz Cars from July 2014 until July 2016 and Head of the G-Wagon Business Unit at Mercedes-Benz Cars from July 2008 until June 2014. Mr. Harries studied product engineering with finance and management accounting at Furtwangen University, Germany. We believe Mr. Harries is qualified to serve as a member of our Board based on his extensive management experience in the automotive industry and knowledge of Europe’s auto charging market.

Mark Leschly has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since December 2009. Since July 1999, Mr. Leschly has served as a managing partner of Rho Capital Partners, Inc., an investment and venture capital management company. Since 2017, Mr. Leschly has been the chairman and chief executive officer of Universal Tennis, LLC, which is the developer of a software platform for tennis analytics and tournament management. Since 2014, Mr. Leschly has also been the owner and managing member of Iconica LLC, which primarily focuses on investments at the intersection of sports, media and technology. Mr. Leschly served as a director of NGM Biopharmaceuticals, Inc. from January 2008 to May 2022. Mr. Leschly holds an M.B.A. from Stanford Graduate School of Business and a B.A. from Harvard University. We believe Mr. Leschly is qualified to serve as a member of our Board based on his extensive experience in corporate finance and investing in energy companies.

Ekta Singh-Bushell has served as a member of ChargePoint’s Board since April 2022. From May 2016 to June 2017, Ms. Singh-Bushell served as deputy to the first vice president, chief operating officer executive office, at the Federal Reserve Bank of New York. Prior to 2016, Ms. Singh-Bushell worked at Ernst & Young, serving in various roles including global IT Effectiveness leader, U.S. innovation & digital strategy leader, and chief information security officer. Ms. Singh-Bushell has served as a director for numerous public companies including, TTEC Holdings, Inc., since May 2017, Lesaka Technologies Inc., since October 2018, and Huron Consulting Group, since May 2019. Ms. Singh-Bushell previously served as director of Designer Brands, Inc. from September 2018 until May 2022. Ms. Singh-Bushell received her Master of Science in Electrical Engineering & Computer Science from the University of California, Berkeley and her undergraduate degree in engineering from the University of Poona, India. We believe that Ms. Singh-Bushell is qualified to serve as a member of our Board based on her operational experiences with finance, audit, technology and cybersecurity matters and her prior public company board service.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” EACH OF THE NAMED NOMINEES IN CLASS I

BOARD AND CORPORATE GOVERNANCE

Continuing Directors

In addition to the director nominees, ChargePoint has seven other directors who will continue in office after the Annual Meeting with terms expiring in 2025 and 2026. The following includes a brief biography of each director composing the remainder of the Board with terms expiring as shown, with each biography including information regarding the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the applicable director should serve as a member of our Board.

Class II Directors Continuing in Office Until the 2025 Annual Meeting

Jeffrey Harris has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since December 2018. In 2012, Mr. Harris founded Global Reserve Group LLC, a financial advisory and investment firm focused primarily on the energy and technology industries. In addition, he has been a Venture Partner of Quantum Energy Partners, a private equity firm focused on the energy industry, since 2012. Previously, Mr. Harris was a managing director of Warburg Pincus LLC, a private equity firm, from 1983 until 2011. Mr. Harris served as a director of Knoll, Inc., until July 2021 and of InterPrivate II Acquisition Corp., until December 2022. Mr. Harris holds a B.S. in Economics from the Wharton School of the University of Pennsylvania and an M.B.A. from Harvard Business School. We believe Mr. Harris is qualified to serve as a member of our Board based on his extensive financial expertise and knowledge of the energy industry and clean technology.

Susan Heystee has served as a member of ChargePoint’s Board since May 26, 2021. From January 2017 to June 2018, Ms. Heystee was Senior Vice President of Global Automotive Business at Verizon Connect, a fleet management solutions software company. Prior to Verizon Connect, Ms. Heystee served as Executive Vice President of Global Sales and OEM Business at Telogis, Inc., which was acquired by Verizon in July 2016, from February 2010 to December 2016. Ms. Heystee has served as a director of Ouster, Inc., since September 2018. Ms. Heystee holds Bachelor’s degrees in mathematics and business from the University of Waterloo and has completed the Advanced Management Program at Harvard Business School. We believe that Ms. Heystee is qualified to serve as a member of our Board of Directors due to her extensive experience in the technology sector and knowledge of market driven strategies.

G. Richard Wagoner, Jr. has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since February 2017. From 1977 to 2009, Mr. Wagoner held numerous senior positions at General Motors Corporation, including Chairman and Chief Executive Officer from 2003 to 2009. Mr. Wagoner currently serves as a director of Invesco Ltd., since October 2013, and Graham Holdings Inc., since June 2010. Mr. Wagoner previously served as a director of Aleris Corporation from August 2010 until April 2020. Mr. Wagoner holds a bachelor’s degree from Duke University and an M.B.A. from Harvard Business School. We believe Mr. Wagoner is qualified to serve as a member of our Board based on his extensive experience in the automobile industry, general management experience and public company board service.

Class III Directors Continuing in Office Until the 2026 Annual Meeting

Rick Wilmer has served as President and Chief Executive Officer and a member of the Board of Directors for ChargePoint since November 2023. Prior to November 2023, Mr. Wilmer served as Chief Operating Officer from December 2022 until November 2023 and as Chief Customer and Operations Officer after joining ChargePoint in July 2022. Prior to joining ChargePoint, Mr. Wilmer served as the Head of Chowbotics at DoorDash, Inc., a company that operates an online food ordering and food delivery platform, from February 2021 until July 2022. Previously, Mr. Wilmer served as Chief Executive Officer of Chowbotics, Inc., a manufacturer of a fresh food robot, from September 2019 until February 2021. Prior to Chowbotics, Inc., Mr. Wilmer served as Chief Executive Officer of Mojo Networks, a provider of cloud-managed wireless networking, from December 2014 until the acquisition of Mojo Network, Inc. by Arista Networks in August 2018, and following such acquisition, as the General Manager of Arista Networks, Inc.’s Wi-Fi business until September 2019. With more than 30 years of global technology, operations and customer support experience, Mr. Wilmer has global operations experience across North America, Europe and Asia and industry knowledge across multiple technology segments as well as overseas manufacturing and supply chain management. Mr. Wilmer holds a Bachelor of Science in Chemistry from the University of California, Berkeley. We believe Mr. Wilmer is qualified to serve as a member of our Board based on his wide-ranging experience in global operations and manufacturing, management, sales, customer support, executive leadership and strategic planning.

Elaine L. Chao has served as a member of the ChargePoint Board since November 2021. Ms. Chao served as the U.S. Secretary of Transportation from January 2017 to January 2021 and the U.S. Secretary of Labor from January 2001 to January 2009. Ms. Chao has served as a director for numerous public companies and currently serves as a director for The Kroger Co., since August 2021. Ms. Chao served as a director for Hyliion Holdings Corp from August 2021 to March 2023 and for Embark Technology, Inc. from March 2021 to August 2023. Ms. Chao holds a bachelor’s degree in economics from Mount Holyoke College and a Master in Business Administration from the Harvard Business School. We believe that Ms. Chao is qualified to serve as a member of our Board based on her experiences in the public, private and nonprofit sectors, extensive public policy experience and her extensive public company board service.

Bruce Chizen has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since December 2014. Mr. Chizen is currently an independent consultant and has served as Senior Adviser to Permira Advisers LLP, a private equity fund, since July 2008, and as a Venture Partner at Voyager Capital, a venture capital firm, since August 2009 through May 2023. He has also served as an Operating Partner for Permira Growth Opportunities, a private equity fund since June 2018. From 1994 until 2008, Mr. Chizen served in a number of positions at Adobe Systems Incorporated, a provider of design, imaging and publishing software, including as its Chief Executive Officer from 2000 until 2007, President from 2000 until 2005, acting Chief Financial Officer from 2006 until 2007 and Strategic Advisor from 2007 until 2008. Mr. Chizen currently serves as a director of Synopsys, Inc. since April 2001, Oracle Corporation since July 2008, and Informatica Inc. since August 2015. Mr. Chizen holds a bachelor’s degree from Brooklyn College, City University of New York. We believe Mr. Chizen is qualified to serve as a member of our Board based on his extensive executive leadership experience in digital media and software.

Michael Linse has served as a member of ChargePoint’s Board since February 26, 2021 and previously served as a director of Legacy ChargePoint since April 2012. Mr. Linse has served as the Founder and Managing Director of Linse Capital LLC since October 2015, a growth equity firm investing in late-stage technology companies, and Levitate Capital, a venture capital firm, since March 2017. Prior to founding Linse Capital, Mr. Linse served as a partner at Kleiner Perkins Caufield & Byers (“KPCB”) from 2008 until March 2016. Prior to joining KPCB, Mr. Linse worked at Goldman Sachs for over a decade, most recently as Managing Director of the alternative energy investing team. Mr. Linse currently serves as a director of Valens Semiconductor Ltd. Mr. Linse holds a B.A. in Economics from Harvard University and an M.B.A. from Harvard Business School. We believe Mr. Linse is qualified to serve as a member of our Board based on his extensive experience in corporate finance and investing in the alternative energy space.

Independence of the Board of Directors

As required under the New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NYSE, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, the Board has affirmatively determined that the following ten directors are independent directors within the meaning of the applicable NYSE listing standards: Mses. Bowman, Chao, Heystee and Singh-Bushell, and Messrs. Chizen, Harries, Harris, Leschly, Linse and Wagoner. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. Wilmer, our President and Chief Executive Officer, is not an independent director by virtue of his current employment with ChargePoint.

Family Relationships

There are no familial relationships among the ChargePoint directors and executive officers.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board may separate or combine the roles of Chairman of the Board and Chief Executive Officer when and if it deems it advisable and in the best interests of the Company and its stockholders to do so. Currently, the roles are separated, with Rick Wilmer serving as President and Chief Executive Officer and Bruce Chizen serving as the independent Chairman of the Board. The Chairman of the Board presides over all executive sessions of the Board. While the Board does not have a policy requiring the separation of the positions of

Chairman and Chief Executive Officer, at this time, the Company believes that separating these positions aligns the Chairman role with our independent directors and further enhances the independence of our Board from management.

Role of the Board in Risk Oversight

The Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to ChargePoint and its stockholders. While the executive team is responsible for the day-to-day management of risk, one of the Board’s key functions is informed oversight of the Company’s risk management process and regular review and discussion with members of management regarding potential and identified risks, and responses to significant threats or risk events. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that identify, categorize and address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure over the short-term, intermediate-term and long-term, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Such risk oversight also includes reviewing the Company’s cybersecurity and other information technology risks, controls and procedures, including the Company’s plans to mitigate cybersecurity risks and to respond to data breaches. For more information, please refer to Part I, Item 1C, “Cybersecurity,” in our 2024 Annual Report.

The Audit Committee also reviews with management when appropriate any significant regulatory and legal developments that may have a material impact on ChargePoint’s financial statements, compliance programs and policies, and the effectiveness of ChargePoint’s related disclosure controls and procedures. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation and Organizational Development Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Meetings of the Board

During our fiscal year ended January 31, 2024, our Board held thirteen meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our Board on which he or she served during the periods that he or she served.

Information Regarding Committees of the Board

ChargePoint’s Board has established three committees: an Audit Committee; a Compensation and Organizational Development Committee; and a Nominating and Corporate Governance Committee. During the fiscal year ended January 31, 2024, the Audit Committee met ten times, the Compensation and Organizational Development Committee met ten times and the Nominating and Corporate Governance Committee met eight times.

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable NYSE rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee is comprised of four directors: Mses. Heystee and Singh-Bushell and Messrs. Harris and Wagoner.

The composition of our Audit Committee meets the requirements for independence for audit committee members under the listing standards of the NYSE and the rules and regulations of the SEC. In determining that Mr. Harris is independent, our board of directors considered his role as partner of Quantum Energy Group, which beneficially holds approximately 8% of our outstanding stock, and the ”safe harbor” of Rule 10A-3 under the Exchange Act, which provides that an audit committee member who may be deemed to beneficially own less than 10% of a company’s voting stock is not considered an “affiliated person” of such company. Mr. Harris disclaims any beneficial ownership of the shares of our

common stock held by Quantum Energy Group. Each member of our Audit Committee also meets the financial literacy requirements of the listing standards of the NYSE. In addition, our Board has determined that Mr. Harris qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the NYSE.

The Audit Committee has direct responsibility for oversight of the following:

•evaluating the qualifications, independence and performance of the independent registered public accounting firm, including leading the review and selection of the lead audit engagement partner;

•overseeing and reviewing the integrity of the Company’s accounting and financial reporting process and the audit of the Company’s financial statements;

•overseeing the Company’s compliance with legal and regulatory requirements;

•overseeing the design, implementation and performance of our internal audit function and risk assessment and risk management;

•reviewing the Company’s cybersecurity and other information technology risks, controls and procedures at least annually, including the Company’s plans to mitigate cybersecurity risks and to respond to data breaches and steps management has taken to monitor and control cybersecurity risk exposures;

•reviewing and discussing with management the adequacy and effectiveness of our disclosure controls and procedures;

•discussing with the Company’s management and independent registered public accounting firm the annual audit plan and scope of audit activities, scope and timing of the annual audit of the Company’s financial statements, and the results of the audit, quarterly reviews of our financial statements and, as appropriate, initiates inquiries into certain aspects of the Company’s financial affairs;

•establishing and overseeing procedures for the receipt, retention and treatment of any complaints regarding accounting, internal accounting controls or auditing matters, as well as for the confidential and anonymous submissions by the Company’s employees of concerns regarding questionable accounting or auditing matters; and

•reviewing and overseeing all related person transactions in accordance with the Company’s policies and procedures.

The Audit Committee has sole authority to approve the hiring and discharging of the Company’s independent registered public accounting firm, all audit engagement terms and fees and all permissible non-audit engagements with the independent auditor.

The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at https://investors.chargepoint.com under “Governance.”

Compensation and Organizational Development Committee

The Compensation and Organizational Development Committee is comprised of three directors: Messrs. Chizen, Leschly, and Linse.

The Compensation and Organizational Development Committee meets the requirements for independence for compensation committee members under the listing standards of the NYSE and the rules and regulations of the SEC. Each member of our Compensation and Organizational Development Committee is also a “non-employee director,” as defined pursuant to Rule 16b-3 promulgated under the Exchange Act.

The Compensation and Organizational Development Committee assists the Board in discharging certain of the responsibilities with respect to compensating our executive officers, and the administration and review of the incentive plans for employees and other service providers, including our equity incentive plans, and certain other matters related to our compensation programs. The Compensation and Organizational Development Committee reviews, modifies and approves the overall compensation strategy and policies for the Company, including:

•reviewing annually and recommending to the Board for approval all compensation to be paid or awarded to the Chief Executive Officer. In consultation with the Chief Executive Officer, review annually and determine and approve all compensation to be paid or awarded to all other executive “officers,” as defined in the rules promulgated under Section 16 of the Exchange Act, of the Company, in each case including any severance or change in control agreements, and special or supplemental benefits applicable to such executive officers,

evaluating and approving the compensation plans and programs advisable for the Company, as well as evaluating and approving the modification or termination of existing plans and programs. The Chief Executive Officer may not be present during voting or deliberations on his or her compensation;

•establishing annually corporate performance goals and objectives relevant to compensation, in consultation with the Chief Executive Officer, for other executive officers, and evaluating annually, in consultation with the Chief Executive Officer, other executive officer performance against any corporate goals and objectives relevant to such officers’ compensation;

•reviewing periodically and making recommendations to the Board with respect to adoption and approval of, or amendments to, the Company’s equity incentive plans;

•overseeing the management of risks associated with the Company’s compensation policies and programs, including to determine whether any such program encourages undue or inappropriate risk-taking by Company personnel that is reasonably likely to have a material adverse effect on the Company;

•reviewing and providing feedback on Company’s recruitment strategies, diversity and inclusion initiatives, and talent development; and

•preparing the compensation committee report that the SEC requires to accompany the Compensation Discussion and Analysis contained in this Proxy Statement.

The Board has adopted a written Compensation and Organizational Development Committee charter that is available to stockholders on the Company’s website at https://investors.chargepoint.com under “Governance.”

Compensation and Organizational Development Committee Processes and Procedures

The Compensation and Organizational Development Committee plans to meet at least twice each year and may otherwise meet at such times and places as the committee determines. The agenda for each meeting is usually developed by the Chair of the Compensation and Organizational Development Committee, in consultation with the Chief Executive Officer, Chief Legal Officer, Chief People Officer or functional equivalent. The Compensation and Organizational Development Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation and Organizational Development Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation and Organizational Development Committee meetings. The Chief Executive Officer may not be present during voting or deliberations of the Compensation and Organizational Development Committee regarding his compensation.

The charter of the Compensation and Organizational Development Committee grants the committee full access to all books, records, facilities and personnel of the Company. In addition, the Compensation and Organizational Development Committee has the authority, in its sole discretion, to retain or obtain the advice of compensation consultants, independent legal counsel, or other advisors of its choosing, and the Company must provide for appropriate funding for payment of reasonable fees to any such advisor retained by the committee. The Compensation and Organizational Development Committee has direct responsibility for the appointment, compensation, termination and oversight of the work of any such advisors engaged for the purpose of advising the committee. Under the charter, the Compensation and Organizational Development Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation and Organizational Development Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration the factors, prescribed by the SEC and NYSE, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

In the Company’s fiscal year 2024, the Compensation and Organizational Development Committee engaged Frederic W. Cook & Co., Inc. (“FW Cook”), a national compensation consulting firm, to advise the Compensation and Organizational Development Committee regarding the amount and types of compensation provided to our executive officers and non-employee directors. FW Cook does not provide any services to us other than the services provided to the Compensation and Organizational Development Committee. The Compensation and Organizational Development Committee assessed the independence of FW Cook pursuant to SEC and NYSE rules and concluded that no conflict of interest exists that would prevent FW Cook from independently representing the committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is comprised of three directors: Ms. Bowman and Messrs. Chizen and Leschly.

The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under the listing standards of the NYSE and the rules and regulations of the SEC. The Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying individuals qualified to become members of the Board and the Board’s committees, consistent with criteria approved by the Board, including diversity of race, ethnicity, national origin, gender and sexual orientation;

•selecting, or recommending that the Board select, the director nominees for the next annual meeting of stockholders;

•developing, evaluating, and recommending to the Board a set of corporate governance guidelines applicable to the Company; and

•leading the periodic performance review of the Board, its committees and management; and any related matters required by the federal securities laws.

The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Company’s website at https://investors.chargepoint.com under “Governance.”

Considerations in Evaluating Director Nominees

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, and high personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of ChargePoint, having demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity (including race, ethnicity, national origin, gender and sexual orientation), age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, consistent with our Corporate Governance Guidelines and the Board’s belief that directors should not have “unlimited tenure,” the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NYSE purposes, which determination is based upon applicable NYSE listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, including direct inquiry from the then appointed members of the Board, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote of those present at a meeting at which a quorum is present.

Stockholder Recommendations for Nominations to the Board

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. However, the Nominating and Corporate Governance Committee has the power and authority to establish procedures for submission of director nominees to the Board, including stockholder nominees, as approved by the Board in the Company’s policies and procedures for director candidates and to review and evaluate any stockholder nominees for director submitted in accordance with the Company’s Bylaws and any candidates for the Board recommended by stockholders in accordance with the Company’s policies and procedures for director candidates.

Subject to advance notice provisions contained in our Bylaws, a stockholder may propose the nomination of someone for election as a director at our annual meeting of stockholders by timely written notice to our Secretary. Stockholders who

wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written notice to ChargePoint’s Corporate Secretary at 240 East Hacienda Avenue Campbell, CA 95008 not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting. Stockholders may not nominate more candidates than are up for election. As discussed in the Company’s Bylaws, the notice must set forth: (A) certain information as to each nominee such stockholder proposes to nominate at the meeting as set forth in the Company’s Bylaws, including such person’s written consent to being named in the Proxy Statement as a nominee and to serving as a director if elected, and (B) certain information as to, and certain representations and certifications from, the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is being made, as set forth in the Company’s Bylaws. In accordance with our Bylaws and Rule 14a-19 of the Exchange Act, a nominating stockholder must also represent that he or she intends to solicit proxies in accordance with Rule 14a-19. Nominations will be disregarded if the nominating stockholder gives notice of its intent to solicit proxies using a universal proxy but subsequently fails to meet the requirements of Rule 14a-19 to file a Proxy Statement or solicit at least 67% of the shares entitled to vote.

Investor Outreach

During fiscal 2024, we conducted targeted investor outreach in advance of our 2023 Annual Meeting. We engaged with institutional investors representing, at the time, approximately 22% of our outstanding stock ownership. Our Chairman participated in our outreach efforts, along with a member of our senior management team and investor relations team. In addition to our investor outreach prior to our 2023 Annual Meeting, our senior management and investor relations team routinely engages with investors and analysts through our investor relation function at quarterly earnings calls, industry presentations, conferences and "roadshow" meetings.

Communicating with the Board

Stockholders and any interested party may communicate directly with the independent directors either by writing to the Board, a Board committee, or an individual director at the Company’s principal executive offices at 240 East Hacienda Avenue, Campbell, CA 95008 or by emailing investors@chargepoint.com. Management receives all letters and emails sent and forwards proper communications to the Board, a Board committee, or an individual director, who facilitates an appropriate response. Management generally will not forward communications that are primarily solicitations for products or services, matters of a personal nature that are not relevant for stockholders, matters that are of a type that render them improper or irrelevant to the functioning of the Board, or requests for general information about the Company.

Compensation and Organizational Development Committee Interlocks and Insider Participation

None of the members of the Compensation and Organizational Development Committee has ever been a member of the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of the Board or Compensation and Organizational Development Committee.

Environmental, Social and Governance Initiatives

In keeping with our values, we are committed to improving our management of Environmental, Social and Governance (“ESG”) matters and their impact on our business. Since 2021 we have taken several steps to align our approach to ESG matters with the interests of our stakeholders, including our stockholders, such as the following:

Environmental

We believe the availability and use of the charging stations in our charging network reduces fossil fuel reliance by our customers. We measure the reduction in greenhouse gas (“GHG”) emissions from our customers’ use of the charging stations in our charging network. Since 2007 through January 31, 2024, we estimate we’ve powered over 9 billion electric miles driven which is:

•Equivalent to avoiding use of more than 360 million gallons of gasoline; and

•Equivalent to 1.9 million metric tons of GHG avoided because of avoiding such gasoline consumption.

We further believe in the merit of reducing GHG through measures aimed at reducing our energy consumption and carbon output, including the following efforts: