Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-253759

PROSPECTUS

ChargePoint Holdings, Inc.

Up to 246,020,583 Shares of

Common Stock

6,521,568 Warrants to Purchase

Common Stock

This prospectus relates to the issuance by us of up to an aggregate of up to 10,470,562 shares of our common stock, $0.0001 par value per share (“Common Stock”) that are issuable upon the exercise of our publicly-traded warrants (the “Public Warrants”), up to 6,521,568 shares of our Common Stock issuable upon exercise of private placement warrants issued to NGP Switchback, LLC (the “Private Warrants”) at an exercise price of $11.50 per share, and warrants to purchase up to 8,266,681 shares of our Common Stock at a weighted average exercise price of $6.92 per share (the “Other Warrants”) and, together with the Public Warrants and the Private Warrants, the “Warrants”). This prospectus also relates to the resale from time to time, upon the expiration of lock-up agreements, by (i) the selling stockholders named in this prospectus or their permitted transferees (the “Selling Stockholders”) of up to 220,761,772 shares of our Common Stock and (ii) the selling holders of Private Warrants (the “Selling Warrantholders,” together with the Selling Stockholders, the “Selling Securityholders”).

The Selling Securityholders may offer, sell or distribute all or a portion of the shares of Common Stock and Private Warrants registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices or as distributions in kind to their members, partners or stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. We provide more information about how the Selling Securityholders may sell the securities in the section entitled “Plan of Distribution.”

We will pay certain offering fees and expenses and fees in connection with the registration of the Common Stock and Private Warrants and will not receive proceeds from the sale of the shares of Common Stock or Private Warrants by the Selling Securityholders. We will receive the proceeds from any exercise of any Warrants for cash.

Our Common Stock and Public Warrants are listed on the NYSE under the symbols “CHPT” and “CHPT WS,” respectively. On June 4, 2021, the closing price of our Common Stock was $28.11 and the closing price for our Public Warrants was $16.50.

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 10 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 7, 2021.

Table of Contents

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 38 | ||||

| 39 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

41 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

56 | |||

| 77 | ||||

| 89 | ||||

| 96 | ||||

| 107 | ||||

| 118 | ||||

| 121 | ||||

| 131 | ||||

| 137 | ||||

| 142 | ||||

| 147 | ||||

| 147 | ||||

| 147 | ||||

| 148 | ||||

| F-1 |

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

On February 26, 2021 (the “Closing Date”), Switchback Energy Acquisition Corporation, our predecessor company (“Switchback”), consummated the previously announced merger pursuant to that certain Business Combination Agreement and Plan of Reorganization, dated as of September 23, 2020 (the “Business Combination Agreement”), by and among Switchback, Lightning Merger Sub Inc., a wholly owned subsidiary of Switchback incorporated in the State of Delaware (“Merger Sub”) and ChargePoint, Inc., a Delaware corporation (“Legacy ChargePoint”). Pursuant to the terms of the Business Combination Agreement, a business combination between the Company and Legacy ChargePoint was effected through the merger of Merger Sub with and into Legacy ChargePoint, with Legacy ChargePoint surviving as the surviving company and as a wholly-owned subsidiary of the Company (the “Merger” and, collectively with the other transactions described in the Business Combination Agreement, the “Business Combination”). On the Closing Date, and in connection with the closing of the Business Combination (the “Closing”), Switchback Energy Acquisition Corporation changed its name to ChargePoint Holdings, Inc.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “ChargePoint,” “we,” “us,” “our” and similar terms refer to ChargePoint Holdings, Inc. (f/k/a Switchback Energy Acquisition Corporation) and its consolidated subsidiaries (including Legacy ChargePoint). References to “Switchback” refer to our predecessor company prior to the consummation of the Business Combination.

1

Table of Contents

TERMS

Unless otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” “Company” and

“ChargePoint” refer to ChargePoint Holdings, Inc., a Delaware corporation:

| • | “Board” or “Board of Directors” means the board of directors of ChargePoint. |

| • | “Business Combination” means the transactions described in the Business Combination Agreement. |

| • | “Business Combination Agreement” means that certain Business Combination Agreement and Plan of Reorganization, dated as of September 23, 2020, by and among Switchback, Merger Sub and Legacy ChargePoint. |

| • | “ChargePoint” means ChargePoint Holdings, Inc., a Delaware corporation. |

| • | “Code” means the Internal Revenue Code of 1986, as amended. |

| • | “DGCL” means the General Corporation Law of the State of Delaware. |

| • | “ESPP” means the ChargePoint Holdings, Inc. 2021 Employee Stock Purchase Plan. |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| • | “Founder Shares” means 6,868,235 shares of Common Stock that currently are owned by the Initial Stockholders, The Founder Shares were shares of Class B Common Stock, par value $0.0001 per share, of Switchback that automatically converted into shares of Common Stock upon the closing of the Business Combination. |

| • | “Initial Stockholders” means the Sponsor together with Joseph Armes, Zane Arrott and Ray Kubis. |

| • | “Investment Company Act” means the Investment Company Act of 1940, as amended. |

| • | “IPO” means Switchback’s initial public offering, consummated on July 30, 2019, of 31,411,763 units (including 1,411,763 units that were subsequently issued to the underwriters in connection with their partial exercise of their overallotment option) at $10.00 per unit. |

| • | “leader,” “leading,” “industry leadership,” “industry leading,” and other similar statements included in this prospectus regarding ChargePoint and its services are based on beliefs regarding its market position in its sector. ChargePoint bases its beliefs regarding these matters, including its estimates of its market share in its sector, on its collective institutional knowledge and expertise regarding its industries, markets and technology, which are based on, among other things, publicly available information, reports of government agencies, RFPs and the results of contract bids and awards, and industry research firms, as well as ChargePoint’s internal research, calculations and assumptions based on its analysis of such information and data. ChargePoint believes these assertions to be reasonable and accurate as of the date of this prospectus. |

| • | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012. |

| • | “Legacy ChargePoint” means ChargePoint, Inc., a Delaware corporation. |

| • | “Legacy ChargePoint Warrants” means warrants issued by Legacy ChargePoint that were assumed in the Business Combination. |

| • | “Merger Sub” means Lightning Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Switchback. |

| • | “NYSE” means the New York Stock Exchange. |

| • | “public shares” means shares of Common Stock included in the public units. |

2

Table of Contents

| • | “public stockholders” means holders of public shares, including the Initial Stockholders to the extent the Initial Stockholders hold public shares; provided, that the Initial Stockholders are considered a “public stockholder” only with respect to any public shares held by them. |

| • | “public units” means the units sold in the IPO, consisting of one share of Common Stock and one-third of one Public Warrant. |

| • | “SEC” means the U.S. Securities and Exchange Commission. |

| • | “Second A&R Bylaws” means our second amended and restated bylaws, dated February 26, 2021. |

| • | “Second A&R Charter” means our second amended and restated certificate of incorporation, dated February 26, 2021. |

| • | “Securities Act” means the Securities Act of 1933, as amended. |

| • | “SOX” means the Sarbanes-Oxley Act of 2002. |

| • | “Sponsor” means NGP Switchback, LLC, a Delaware limited liability company. |

| • | “Switchback” means Switchback Energy Acquisition Corporation, a Delaware corporation, prior to the completion of the Business Combination. |

| • | “Transfer Agent” means Continental Stock Transfer & Trust Company. |

| • | “U.S. GAAP” means U.S. generally accepted accounting principles. |

| • | “Warrants” means the Public Warrants, Private Warrants and Other Warrants. |

3

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company makes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act in this Prospectus. All statements, other than statements of present or historical fact included in this Prospectus, regarding the Company’s future financial performance, as well as the Company’s strategy, future operations, future operating results, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” “project” or the negative of such terms and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of, fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company. These forward- looking statements are subject to known and unknown risks, uncertainties and assumptions about the Company that may cause the actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. If any of these risks materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward- looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, except as otherwise required by applicable law, the Company specifically disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Prospectus. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date hereof. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company cautions you that these forward-looking statements are subject to numerous risk and uncertainties, most of which are all difficult to predict and many of which are beyond the control of the Company.

The following factors, among others, could cause actual results to differ materially from forward-looking statements:

| • | ChargePoint’s success in retaining or recruiting, or changes in, its officers, key employees or directors; |

| • | changes in applicable laws or regulations; |

| • | the possibility that COVID-19 may adversely affect the results of operations, financial position and cash flows of ChargePoint; |

| • | ChargePoint’s ability to expand its business in Europe; |

| • | the EV market may not continue to grow as expected; |

| • | ChargePoint may not attract a sufficient number of fleet owners as customers; |

| • | incentives from governments or utilities may be reduced, which could reduce demand for EVs; |

| • | the impact of competing technologies that could reduce the demand for EVs; |

| • | technological changes; |

4

Table of Contents

| • | data security breaches or other network outages; |

| • | ChargePoint’s ability to remediate its material weaknesses in internal control over financial reporting; |

| • | the possibility that ChargePoint may be adversely affected by other economic, business or competitive factors; and |

| • | any further changes to our financial statements that may be required due to SEC comments to the Form 10-K/A or further guidance regarding the accounting treatment of the Warrants, and the restatement’s quantitative effects. |

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other risk factors included herein. Forward-looking statements reflect current views about ChargePoint’s plans, strategies and prospects, which are based on information available as of the date of this prospectus. Except to the extent required by applicable law, ChargePoint undertakes no obligation (and expressly disclaims any such obligation) to update or revise the forward-looking statements whether as a result of new information, future events or otherwise.

Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not place undue reliance on those statements.

5

Table of Contents

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements included elsewhere in this prospectus.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “our,” “us” and other similar terms refer to ChargePoint.

ChargePoint

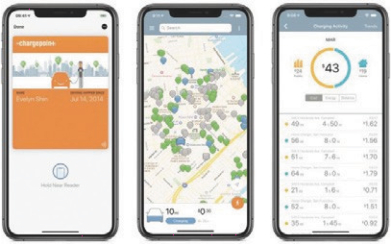

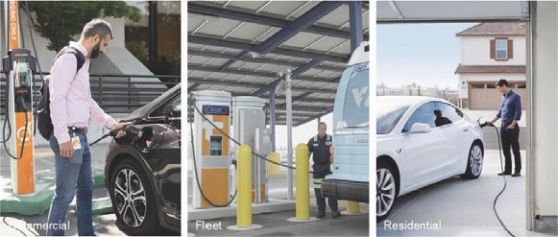

ChargePoint is a leading EV charging network provider committed to enabling the electrification of mobility for all people and goods. Years before EVs were widely available, ChargePoint envisioned a new way of fueling, conveniently located where drivers live, work and play. By pioneering networked EV charging, ChargePoint has helped make electrified mobility a reality, with consumers and fleets rapidly adopting EVs. With 13 years of focused development, over 4,000 existing commercial customers and over $1.1 billion of capital raised from a diversified set of high-profile investors from automotive, energy, manufacturing and venture funding, ChargePoint is driving the shift to electric mobility by providing charging solutions in North America and Europe for all segments, including commercial (e.g., retail, workplace, parking, recreation, education and highway fast charge), fleet (e.g., delivery, logistics, motorpool, transit and shared mobility) and residential (e.g., homes, apartments and condos).

The mailing address of ChargePoint’s principal executive office is 240 East Hacienda Avenue, Campbell, CA 95008, and its telephone number is (408)-841-4500.

For more information about ChargePoint, see the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of ChargePoint,” “Risk Factors” and the financial statements of ChargePoint included herein.

The Business Combination

On February 26, 2021 (the “Closing Date”), ChargePoint consummated the previously announced business combination (the “Closing”) pursuant to the Business Combination Agreement. At the Closing, Merger Sub merged with and into Legacy ChargePoint, with Legacy ChargePoint surviving the merger as a wholly owned subsidiary of ChargePoint (the “Merger”). As a result of the Business Combination, Legacy ChargePoint became a wholly-owned subsidiary of the Company.

Pursuant to the terms of the Business Combination Agreement, each stockholder of Legacy ChargePoint received 0.9966 shares of Common Stock and the contingent right to receive certain Earnout Shares (as defined below), for each share of Legacy ChargePoint common stock, par value $0.0001 per share, owned by such Legacy ChargePoint stockholder that was outstanding immediately prior to the Closing (other than any shares of Legacy ChargePoint restricted stock). In addition, certain investors purchased an aggregate of 22,500,000 shares of Common Stock (such investors, the “PIPE Investors”) concurrently with the Closing for an aggregate purchase price of $225 million. Additionally, at the Closing, after giving effect to the forfeiture contemplated by the Founders Stock Letter (as defined below), each outstanding Founder Share was converted into a share of Common Stock on a one-for-one basis and the Founder Shares ceased to exist.

6

Table of Contents

Also at the Closing, the Sponsor exercised its right to convert a portion of the working capital loans made by the Sponsor to the Company into an additional 1,000,000 Private Warrants at a price of $1.50 per warrant in satisfaction of $1.5 million principal amount of such loans.

In addition, pursuant to the terms of the Business Combination Agreement, at the effective time of the Merger (the “Effective Time”), (1) warrants to purchase shares of capital stock of Legacy ChargePoint were converted into warrants to purchase an aggregate of 38,761,031 shares of Common Stock and the contingent right to receive certain Earnout Shares, (2) options to purchase shares of common stock of Legacy ChargePoint were converted into options to purchase an aggregate of 30,135,695 shares of Common Stock and, with respect to vested options, the contingent right to receive certain Earnout Shares and (3) unvested restricted shares of common stock of Legacy ChargePoint that were outstanding pursuant to the “early exercise” of ChargePoint options were converted into an aggregate of 345,689 restricted shares of ChargePoint.

During the time period between the Closing Date and the five-year anniversary of the Closing Date, eligible former equityholders of Legacy ChargePoint may receive up to 27,000,000 additional shares of Common Stock (the “Earnout Shares”) in the aggregate in three equal tranches if certain earnout conditions (as further described in the Business Combination Agreement) are fully satisfied. The first two triggering events for up to 18,000,000 of the Earnout Shares occurred on March 12, 2021 and, after the withholding of some of these Earnout Shares for tax withholding, 17,539,667 Earnout Shares were issued on March 19, 2021. The Earnout Shares are not subject to a lock-up agreement and may be sold publicly following receipt.

Risk Factors

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 10 before making a decision to invest in our Common Stock. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. Set forth below is a summary of some of the principal risks we face:

| • | ChargePoint is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the near term. |

| • | ChargePoint has experienced rapid growth and expects to invest in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected. |

| • | ChargePoint currently faces competition from a number of companies, particularly in Europe, and expects to face significant competition in the future as the market for EV charging develops. |

| • | Failure to effectively expand ChargePoint’s sales and marketing capabilities could harm its ability to increase its customer base and achieve broader market acceptance of its solutions. |

| • | ChargePoint faces risks related to health pandemics, including the recent coronavirus (“COVID-19”) pandemic, which could have a material adverse effect on its business and results of operations. |

| • | ChargePoint relies on a limited number of suppliers and manufacturers for its charging stations. A loss of any of these partners could negatively affect its business. |

| • | ChargePoint’s business is subject to risks associated with construction, cost overruns and delays, and other contingencies that may arise in the course of completing installations, and such risks may increase in the future as ChargePoint expands the scope of such services with other parties. |

| • | While ChargePoint to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions. |

7

Table of Contents

| • | If ChargePoint is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed. |

| • | ChargePoint is expanding operations internationally, which will expose it to additional tax, compliance, market and other risks. |

| • | Some members of ChargePoint’s management have limited experience in operating a public company. |

| • | ChargePoint may need to raise additional funds and these funds may not be available when needed. |

| • | ChargePoint’s future revenue growth will depend in significant part on its ability to increase sales of its products and services to fleet operators. |

| • | Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm ChargePoint’s business. |

| • | ChargePoint’s headquarters and other facilities are located in an active earthquake zone; an earthquake or other types of natural disasters or resource shortages, including public safety power shut-offs that have occurred and will continue to occur in California, could disrupt and harm its operations and those of ChargePoint’s customers. |

| • | ChargePoint’s stock price will be volatile. |

| • | ChargePoint has never paid cash dividends on its capital stock, and does not anticipate paying dividends in the foreseeable future. |

| • | Concentration of ownership among ChargePoint’s existing executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions. |

| • | ChargePoint’s future growth and success is highly correlated with and thus dependent upon the continuing rapid adoption of EVs for passenger and fleet applications. |

| • | The EV market currently benefits from the availability of rebates, tax credits and other financial incentives from governments, utilities and others to offset the purchase or operating cost of EVs and EV charging stations. |

| • | ChargePoint’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third parties. |

| • | ChargePoint has identified material weaknesses in its internal control over financial reporting. If ChargePoint is unable to remediate these material weaknesses, or if ChargePoint identifies additional material weaknesses in the future or otherwise fails to maintain an effective system of internal control over financial reporting, this may result in material misstatements of ChargePoint’s consolidated financial statements or cause ChargePoint to fail to meet its periodic reporting obligations. |

| • | ChargePoint’s Warrants are being accounted for as a warrant liability and are being recorded at fair value upon issuance with changes in fair value each period reported in earnings, which may have an adverse effect on the market price of its Common Stock. |

8

Table of Contents

| Issuer |

ChargePoint Holdings, Inc. |

Issuance of Common Stock

| Shares of Common Stock Offered by Us |

25,258,811 shares of common stock issuable upon exercise of the Warrants |

| Shares of Common Stock Outstanding |

277,768,357 shares |

| Shares of Common Stock Outstanding Assuming Exercise of the Warrants |

303,027,168 shares |

| Exercise Price of Public Warrants and |

$11.50 per share, subject to adjustment as described herein |

| Weighted Average Exercise Price of Other Warrants |

$6.92 per share, subject to adjustment as described herein |

| Use of Proceeds |

We will receive proceeds equal to the aggregate exercise price from any exercises of the Warrants, assuming the exercise of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. See “Use of Proceeds.” |

Resale of Common Stock and Private Warrants

| Common Stock Offered by the Selling Stockholders |

Up to 220,761,772 shares. |

| Private Warrants to be sold by the Selling Warrantholders |

6,521,568 warrants |

| Use of Proceeds |

We will not receive any of the proceeds from the sale of the shares of Common Stock or Private Warrants by the Selling Securityholders. |

| Market for Our Shares of Common Stock and |

Our Common Stock and Public Warrants are listed on the NYSE under the symbol “CHPT” and “CHPT WS,” respectively. |

| Risk Factors |

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

9

Table of Contents

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to us or that we consider immaterial as of the date of this prospectus. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Summary of Principal Risks Associated with ChargePoint’s Business

| • | ChargePoint is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the near term. |

| • | ChargePoint has experienced rapid growth and expects to invest in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected. |

| • | ChargePoint currently faces competition from a number of companies, particularly in Europe, and expects to face significant competition in the future as the market for EV charging develops. |

| • | ChargePoint faces risks related to health pandemics, including the recent coronavirus pandemic, which could have a material adverse effect on its business and results of operations. |

| • | ChargePoint faces risks related to health pandemics, including the recent coronavirus pandemic, which could have a material adverse effect on its business and results of operations. |

| • | ChargePoint relies on a limited number of suppliers and manufacturers for its charging stations. A loss of any of these partners could negatively affect its business. |

| • | ChargePoint’s business is subject to risks associated with construction, cost overruns and delays, and other contingencies that may arise in the course of completing installations, and such risks may increase in the future as ChargePoint expands the scope of such services with other parties. |

| • | While ChargePoint to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions. |

| • | If ChargePoint is unable to attract and retain key employees and hire qualified management, technical engineering and sale personnel, its ability to compete and successfully grow its business would be harmed. |

| • | ChargePoint is expanding operations internationally, which will expose it to additional tax, compliance, market and other risks. |

| • | Some members of ChargePoint’s management have limited experience in operating a public company. |

| • | ChargePoint may need to raise additional funds and these funds may not be available when needed. |

| • | ChargePoint’s future revenue growth will depend in significant part on its ability to increase sales of its products and services to fleet operators. |

| • | Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm ChargePoint’s business. |

| • | ChargePoint’s headquarters and other facilities are located in an active earthquake zone; an earthquake or other types of natural disasters or resource shortages, including public safety power shut-offs that have occurred and will continue to occur in California, could disrupt and harm its operations and those of ChargePoint’s customers. |

| • | ChargePoint’s stock price will be volatile, and you may not be able to sell shares at or above the price at the Closing. |

10

Table of Contents

| • | ChargePoint has never paid cash dividends on its capital stock, and does not anticipate paying dividends in the foreseeable future. |

| • | Concentration of ownership among ChargePoint’s existing executive officers, directors and their affiliate may prevent new investors from influencing significant corporate decisions. |

| • | ChargePoint’s future growth and success is highly correlated with and thus dependent upon the continuing rapid adoption of EVs for passenger and fleet applications. |

| • | The EV market currently benefits from the availability of rebates, tax credits and other financial incentives from governments, utilities and others to offset the purchase or operating cost of EVs and EV charging stations. |

| • | ChargePoint’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third parties. |

| • | ChargePoint has identified material weaknesses in its internal control over financial reporting. If ChargePoint is unable to remediate these material weaknesses, or if ChargePoint identifies additional material weaknesses in the future or otherwise fails to maintain an effective system of internal control over financial reporting, this may result in material misstatements of ChargePoint’s consolidated financial statements or cause ChargePoint to fail to meet its periodic reporting obligations. |

| • | ChargePoint’s Warrants are being accounted for as a warrant liability and are being recorded at fair value upon issuance with changes in fair value each period reported in earnings, which may have an adverse effect on the market price of its Common Stock. |

Risks Related to ChargePoint’s Business

ChargePoint is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the near term.

ChargePoint incurred a net loss of $197.0 million for the year ended January 31, 2021 and as of January 31, 2021, ChargePoint had an accumulated deficit of approximately $679.4 million. ChargePoint believes it will continue to incur operating and net losses each quarter for the near term. Even if it achieves profitability, there can be no assurance that it will be able to maintain profitability in the future. ChargePoint’s potential profitability is particularly dependent upon the continued adoption of EVs by consumers and fleet operators, the widespread adoption of electric trucks and other vehicles and other electric transportation modalities, which may not occur.

ChargePoint has experienced rapid growth and expects to invest in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected.

ChargePoint has experienced rapid growth in recent periods. For example, the number of employees has grown from 743 as of January 31, 2020 to 834 as of January 31, 2021, including 77 employees in Europe as of January 31, 2020 to 101 as of January 31, 2021. The growth and expansion of its business has placed and continues to place a significant strain on management, operations, financial infrastructure and corporate culture. In the event of further growth, ChargePoint’s information technology systems and ChargePoint’s internal control over financial reporting and procedures may not be adequate to support its operations and may introduce opportunities for data security incidents that may interrupt business operations and permit bad actors to obtain unauthorized access to business information or misappropriate funds. ChargePoint may also face risks to the extent such bad actors infiltrate the information technology infrastructure of its contractors.

To manage growth in operations and personnel, ChargePoint will need to continue to improve its operational, financial and management controls and reporting systems and procedures. Failure to manage growth effectively could result in difficulty or delays in attracting new customers, declines in quality or customer

11

Table of Contents

satisfaction, increases in costs, difficulties in introducing new products and services or enhancing existing products and services, loss of customers, information security vulnerabilities or other operational difficulties, any of which could adversely affect its business performance and operating results.

ChargePoint currently faces competition from a number of companies, particularly in Europe, and expects to face significant competition in the future as the market for EV charging develops.

The EV charging market is relatively new and competition is still developing. ChargePoint primarily competes with smaller providers of EV charging station networks for installations, particularly in Europe. Large early stage markets, such as Europe, require early engagement across verticals and customers to gain market share, and ongoing effort to scale channels, installers, teams and processes. Some European customers require solutions not yet available and ChargePoint’s recent entrance into Europe requires establishing itself against existing competitors. In addition, there are multiple competitors in Europe with limited funding, which could cause poor experiences, hampering overall EV adoption or trust in any particular provider.

In addition, there are other means for charging EVs, which could affect the level of demand for onsite charging capabilities at businesses. For example, Tesla Inc. continues to build out its supercharger network across the United States for its vehicles, which could reduce overall demand for EV charging at other sites. Also, third-party contractors can provide basic electric charging capabilities to potential customers seeking to have on premise EV charging capability as well as for home charging. In addition, many EV charging manufacturers, including ChargePoint, are offering home charging equipment, which could reduce demand for on premise charging capabilities of potential customers and reduce the demand for onsite charging capabilities if EV owners find charging at home to be sufficient.

Further, ChargePoint’s current or potential competitors may be acquired by third parties with greater available resources. As a result, competitors may be able to respond more quickly and effectively than ChargePoint to new or changing opportunities, technologies, standards or customer requirements and may have the ability to initiate or withstand substantial price competition. In addition, competitors may in the future establish cooperative relationships with vendors of complementary products, technologies or services to increase the availability of their solutions in the marketplace. This competition may also materialize in the form of costly intellectual property disputes or litigation.

New competitors or alliances may emerge in the future that have greater market share, more widely adopted proprietary technologies, greater marketing expertise and greater financial resources, which could put ChargePoint at a competitive disadvantage. Future competitors could also be better positioned to serve certain segments of ChargePoint’s current or future target markets, which could create price pressure. In light of these factors, even if ChargePoint’s offerings are more effective and higher quality than those of its competitors, current or potential customers may accept competitive solutions. If ChargePoint fails to adapt to changing market conditions or continue to compete successfully with current charging providers or new competitors, its growth will be limited which would adversely affect its business and results of operations.

Failure to effectively expand ChargePoint’s sales and marketing capabilities could harm its ability to increase its customer base and achieve broader market acceptance of its solutions.

ChargePoint’s ability to grow its customer base, achieve broader market acceptance, grow revenue, and achieve and sustain profitability will depend, to a significant extent, on its ability to effectively expand its sales and marketing operations and activities. Sales and marketing expenses represent a significant percentage of its total revenue, and its operating results will suffer if sales and marketing expenditures do not contribute significantly to increasing revenue.

ChargePoint is substantially dependent on its direct sales force to obtain new customers. ChargePoint plans to continue to expand its direct sales force both domestically and internationally but it may not be able to recruit

12

Table of Contents

and hire a sufficient number of sales personnel, which may adversely affect its ability to expand its sales capabilities. New hires require significant training and time before they achieve full productivity, particularly in new sales territories. Recent hires and planned hires may not become as productive as quickly as anticipated, and ChargePoint may be unable to hire or retain sufficient numbers of qualified individuals. Furthermore, hiring sales personnel in new countries can be costly, complex and time-consuming, and requires additional set up and upfront costs that may be disproportionate to the initial revenue expected from those countries. There is significant competition for direct sales personnel with strong sales skills and technical knowledge. ChargePoint’s ability to achieve significant revenue growth in the future will depend, in large part, on its success in recruiting, training, incentivizing and retaining a sufficient number of qualified direct sales personnel and on such personnel attaining desired productivity levels within a reasonable amount of time. ChargePoint’s business will be harmed if continuing investment in its sales and marketing capabilities does not generate a significant increase in revenue.

ChargePoint faces risks related to health pandemics, including the recent coronavirus (“COVID-19”) pandemic, which could have a material adverse effect on its business and results of operations.

The impact of COVID-19, including changes in consumer and business behavior, pandemic fears and market downturns, and restrictions on business and individual activities, has created significant volatility in the global economy and has led to reduced economic activity. The spread of COVID-19 has also created a disruption in the manufacturing, delivery and overall supply chain of vehicle manufacturers and suppliers, and has led to a decrease in EV sales in markets around the world. Any sustained downturn in demand for EVs would harm ChargePoint’s business.

The pandemic has resulted in government authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, stay-at-home or shelter-in-place orders and business shutdowns. These measures may adversely impact ChargePoint’s employees and operations and the operations of its customers, suppliers, vendors and business partners, and may negatively impact demand for EV charging stations, particularly at workplaces. These measures by government authorities may remain in place for a significant period of time and may adversely affect manufacturing and building plans, sales and marketing activities, business and results of operations.

ChargePoint has modified its business practices by recommending that all non-essential personnel work from home and cancelling or reducing physical participation in sales activities, meetings, events and conferences. ChargePoint has also implemented additional safety protocols for essential workers, has implemented cost cutting measures in order to reduce its operating costs, and may take further actions as may be required by government authorities or that it determines are in the best interests of its employees, customers, suppliers, vendors and business partners. There is no certainty that such actions will be sufficient to mitigate the risks posed by the virus or otherwise be satisfactory to government authorities. If significant portions of ChargePoint’s workforce are unable to work effectively, including due to illness, quarantines, social distancing, government actions or other restrictions in connection with the COVID-19 pandemic, its operations will be negatively impacted. Furthermore, if significant portions of its customers’ or potential customers’ workforces are subject to stay-at-home orders or otherwise have substantial numbers of their employees working remotely for sustained periods of time, user demand for charging stations and services will decline.

The extent to which the COVID-19 pandemic impacts ChargePoint’s business, prospects and results of operations will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the pandemic, its severity, the actions to contain the virus or treat its impact, and when and to what extent normal economic and operating activities can resume. The COVID-19 pandemic could limit the ability of customers, suppliers, vendors and business partners to perform, including third-party suppliers’ ability to provide components and materials used in charging stations or in providing installation or maintenance services. Even after the COVID-19 pandemic has subsided, ChargePoint may continue to experience an adverse impact to its business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

13

Table of Contents

Specifically, difficult macroeconomic conditions, such as decreases in per capita income and level of disposable income, increased and prolonged unemployment or a decline in consumer confidence as a result of the COVID-19 pandemic, as well as reduced spending by businesses, could each have a material adverse effect on the demand for ChargePoint’s products and services.

ChargePoint relies on a limited number of suppliers and manufacturers for its charging stations. A loss of any of these partners could negatively affect its business.

ChargePoint relies on a limited number of suppliers to manufacture its charging stations, including in some cases only a single supplier for some products and components. This reliance on a limited number of manufacturers increases ChargePoint’s risks, since it does not currently have proven reliable alternatives or replacement manufacturers beyond these key parties. In the event of interruption, it may not be able to increase capacity from other sources or develop alternate or secondary sources without incurring material additional costs and substantial delays. Thus, ChargePoint’s business could be adversely affected if one or more of its suppliers is impacted by any interruption at a particular location.

If ChargePoint experiences a significant increase in demand for its charging stations, or if it needs to replace an existing supplier, it may not be possible to supplement or replace them on acceptable terms, which may undermine its ability to deliver products to customers in a timely manner. For example, it may take a significant amount of time to identify a manufacturer that has the capability and resources to build charging stations in sufficient volume. Identifying suitable suppliers and manufacturers could be an extensive process that requires ChargePoint to become satisfied with their quality control, technical capabilities, responsiveness and service, financial stability, regulatory compliance, and labor and other ethical practices. Accordingly, a loss of any significant suppliers or manufacturers could have an adverse effect on ChargePoint’s business, financial condition and operating results.

In addition, as a result of the Business Combination, ChargePoint became subject to requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) to diligence, disclose, and report whether or not its products contain minerals originating from the Democratic Republic of the Congo and adjoining countries, or conflict minerals. ChargePoint will incur additional costs to comply with these disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. These requirements could adversely affect the sourcing, availability, and pricing of minerals used in the components used in its products. It is also possible that ChargePoint’s reputation may be adversely affected if it determines that certain of its products contain minerals not determined to be conflict-free or if it is unable to alter its products, processes or sources of supply to avoid use of such materials. ChargePoint may also encounter end-customers who require that all of the components of the products be certified as conflict free. If ChargePoint is not able to meet this requirement, such end-customers may choose to purchase products from a different company.

ChargePoint’s business is subject to risks associated with construction, cost overruns and delays, and other contingencies that may arise in the course of completing installations, and such risks may increase in the future as ChargePoint expands the scope of such services with other parties.

ChargePoint does not typically install charging stations at customer sites. These installations are typically performed by ChargePoint partners or electrical contractors with an existing relationship with the customer and/ or knowledge of the site. The installation of charging stations at a particular site is generally subject to oversight and regulation in accordance with state and local laws and ordinances relating to building codes, safety, environmental protection and related matters, and typically requires various local and other governmental approvals and permits that may vary by jurisdiction. In addition, building codes, accessibility requirements or regulations may hinder EV charger installation because they end up costing the developer or installer more in order to meet the code requirements. Meaningful delays or cost overruns may impact ChargePoint’s recognition of revenue in certain cases and/or impact customer relationships, either of which could impact ChargePoint’s business and profitability.

14

Table of Contents

Furthermore, ChargePoint may in the future elect to install charging stations at customer sites or manage contractors, likely as part of offering customers a turnkey solution. Working with contractors may require ChargePoint to obtain licenses or require it or its customers to comply with additional rules, working conditions and other union requirements, which can add costs and complexity to an installation project. In addition, if these contractors are unable to provide timely, thorough and quality installation-related services, customers could fall behind their construction schedules leading to liability to ChargePoint or cause customers to become dissatisfied with the solutions ChargePoint offers.

While ChargePoint to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions.

ChargePoint may acquire additional assets, products, technologies or businesses that are complementary to its existing business. The process of identifying and consummating acquisitions and the subsequent integration of new assets and businesses into ChargePoint’s own business would require attention from management and could result in a diversion of resources from its existing business, which in turn could have an adverse effect on its operations. Acquired assets or businesses may not generate the expected financial results. Acquisitions could also result in the use of cash, potentially dilutive issuances of equity securities, the occurrence of goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business.

If ChargePoint completes future acquisitions, it may not ultimately strengthen its competitive position or achieve its goals and business strategy; ChargePoint may be subject to claims or liabilities assumed from an acquired company, product, or technology; acquisitions ChargePoint completes could be viewed negatively by its customers, investors, and securities analysts; and ChargePoint may incur costs and expenses necessary to address an acquired company’s failure to comply with laws and governmental rules and regulations. Additionally, ChargePoint may be subject to litigation or other claims in connection with the acquired company, including claims from terminated employees, former stockholders or other third parties, which may differ from or be more significant than the risks ChargePoint’s business faces. If ChargePoint is unsuccessful at integrating future acquisitions in a timely manner, or the technologies and operations associated with such acquisitions, the revenue and operating results of the combined company could be adversely affected. Any integration process may require significant time and resources, which may disrupt ChargePoint’s ongoing business and divert management’s attention, and ChargePoint may not be able to manage the integration process successfully or in a timely manner. ChargePoint may not successfully evaluate or utilize the acquired technology or personnel, realize anticipated synergies from the acquisition, or accurately forecast the financial impact of an acquisition transaction and integration of such acquisition, including accounting charges and any potential impairment of goodwill and intangible assets recognized in connection with such acquisitions. ChargePoint may have to pay cash, incur debt, or issue equity or equity-linked securities to pay for any future acquisitions, each of which could adversely affect its financial condition or the market price of its Common Stock. Furthermore, the sale of equity or issuance of equity-linked debt to finance any future acquisitions could result in dilution to ChargePoint’s stockholders. The occurrence of any of these risks could harm ChargePoint’s business, operating results, and financial condition.

If ChargePoint is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed.

ChargePoint’s success depends, in part, on its continuing ability to identify, hire, attract, train and develop and retain highly qualified personnel. The inability to do so effectively would adversely affect its business. ChargePoint’s future performance also depends on the continued services and continuing contributions of its senior management to execute on its business plan and to identify and pursue new opportunities and product innovations. The loss of services of senior management, or the ineffective management of any leadership transitions, especially within ChargePoint’s sales organization, could significantly delay or prevent the achievement of its development and strategic objectives, which could adversely affect its business, financial condition, and operating results.

15

Table of Contents

Competition for employees can be intense, particularly in Silicon Valley where ChargePoint is headquartered, and the ability to attract, hire and retain them depends on ChargePoint’s ability to provide competitive compensation. ChargePoint may not be able to attract, assimilate, develop or retain qualified personnel in the future, and failure to do so could adversely affect its business, including the execution of its global business strategy.

ChargePoint is expanding operations internationally, which will expose it to additional tax, compliance, market and other risks.

ChargePoint’s primary operations are in the United States and it maintains contractual relationships with parts and manufacturing suppliers in Asia, Mexico and other locations. Also, ChargePoint is continuing to invest to increase its presence in Europe and to expand a primarily software development team in India. Managing this expansion requires additional resources and controls, and could subject ChargePoint to risks associated with international operations, including:

| • | conformity with applicable business customs, including translation into foreign languages and associated expenses; |

| • | lack of availability of government incentives and subsidies; |

| • | challenges in arranging, and availability of, financing for customers; |

| • | potential changes to its established business model; |

| • | cost of alternative power sources, which could vary meaningfully outside the United States; |

| • | difficulties in staffing and managing foreign operations in an environment of diverse culture, laws, and customers, and the increased travel, infrastructure, and legal and compliance costs associated with international operations; |

| • | installation challenges; |

| • | differing driving habits and transportation modalities in other markets; |

| • | different levels of demand among commercial, fleet and residential customers; |

| • | compliance with multiple, potentially conflicting and changing governmental laws, regulations, certifications, and permitting processes including environmental, banking, employment, tax, information security, privacy, and data protection laws and regulations such as the European Union (the “EU”) General Data Protection Regulation (“GDPR”), national legislation implementing the same and changing requirements for legally transferring data out of the European Economic Area; |

| • | compliance with U.S. and foreign anti-bribery laws including the Foreign Corrupt Practices Act (“FCPA”) and the United Kingdom Anti-Bribery Act; |

| • | conforming products to various international regulatory and safety requirements as well as charging and other electric infrastructures; |

| • | difficulty in establishing, staffing and managing foreign operations; |

| • | difficulties in collecting payments in foreign currencies and associated foreign currency exposure; |

| • | restrictions on repatriation of earnings; |

| • | compliance with potentially conflicting and changing laws of taxing jurisdictions and compliance with applicable U.S. tax laws as they relate to international operations, the complexity and adverse consequences of such tax laws, and potentially adverse tax consequences due to changes in such tax laws; and |

| • | regional economic and political conditions. |

16

Table of Contents

As a result of these risks, ChargePoint’s current expansion efforts and any potential future international expansion efforts may not be successful.

Some members of ChargePoint’s management have limited experience in operating a public company.

Some of ChargePoint’s executive officers have limited experience in the management of a publicly-traded company. The management team may not successfully or effectively manage the transition to a public company that will be subject to significant regulatory oversight and reporting obligations under federal securities laws. Their limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage in that it is likely that an increasing amount of their time may be devoted to these activities, which will result in less time being devoted to the management and growth of our company. ChargePoint may not have adequate personnel with the appropriate level of knowledge, experience and training in the accounting policies, practices or internal control over financial reporting required of public companies. The development and implementation of the standards and controls and the hiring of experienced personnel necessary to achieve the level of accounting standards required of a public company may require costs greater than expected.

ChargePoint may need to raise additional funds and these funds may not be available when needed.

ChargePoint may need to raise additional capital in the future to further scale its business and expand to additional markets. ChargePoint may raise additional funds through the issuance of equity, equity-related or debt securities, or through obtaining credit from government or financial institutions. ChargePoint cannot be certain that additional funds will be available on favorable terms when required, or at all. If ChargePoint cannot raise additional funds when needed, its financial condition, results of operations, business and prospects could be materially and adversely affected. If ChargePoint raises funds through the issuance of debt securities or through loan arrangements, the terms of which could require significant interest payments, contain covenants that restrict ChargePoint’s business, or other unfavorable terms. In addition, to the extent ChargePoint raises funds through the sale of additional equity securities, ChargePoint stockholders would experience additional dilution.

ChargePoint’s future revenue growth will depend in significant part on its ability to increase sales of its products and services to fleet operators.

ChargePoint’s future revenue growth will depend in significant part on its ability to increase sales of its products and services to fleet operators. The electrification of fleets is an emerging market, and fleet operators may not adopt EVs on a widespread basis and on the timelines ChargePoint anticipates. In addition to the factors affecting the growth of the EV market generally, transitioning to an EV fleet can be costly and capital intensive, which could result in slower than anticipated adoption. The sales cycle could also be longer for sales to fleet operators, as they are often larger organizations, with more formal procurement processes than smaller commercial site hosts. Fleet operators may also require significant additional services and support, and if ChargePoint is unable to provide such services and support, it may adversely affect its ability to attract additional fleet operators as customers. Any failure to attract and retain fleet operators as customers in the future would adversely affect ChargePoint’s business and results of operations.

Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruption in service, which could harm ChargePoint’s business.

Computer malware, viruses, physical or electronic break-ins and similar disruptions could lead to interruption and delays in ChargePoint’s services and operations and loss, misuse or theft of data. Computer malware, viruses, ransomware, hacking and phishing attacks against online networks have become more prevalent and may occur on ChargePoint’s systems in the future. Any attempts by cyber attackers to disrupt ChargePoint’s services or systems, if successful, could harm its business, introduce liability to data subjects, result in the misappropriation of funds, be expensive to remedy and damage its reputation or brand. Insurance

17

Table of Contents

may not be sufficient to cover significant expenses and losses related to cyber-attacks. Efforts to prevent cyber attackers from entering computer systems are expensive to implement, and ChargePoint may not be able to cause the implementation or enforcement of such preventions with respect to its third-party vendors. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security and availability of systems and technical infrastructure may, in addition to other losses, harm ChargePoint’s reputation, brand and ability to attract customers.

ChargePoint has previously experienced, and may in the future experience, service disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, third-party service providers, human or software errors and capacity constraints. If ChargePoint’s services are unavailable when users attempt to access them, they may seek other services, which could reduce demand for its solutions from target customers.

ChargePoint has processes and procedures in place designed to enable it to quickly recover from a disaster or catastrophe and continue business operations and has tested this capability under controlled circumstances. However, there are several factors ranging from human error to data corruption that could materially impact the efficacy of such processes and procedures, including by lengthening the time services are partially or fully unavailable to customers and users. It may be difficult or impossible to perform some or all recovery steps and continue normal business operations due to the nature of a particular disaster or catastrophe, especially during peak periods, which could cause additional reputational damages, or loss of revenues, any of which could adversely affect its business and financial results.

ChargePoint’s headquarters and other facilities are located in an active earthquake zone; an earthquake or other types of natural disasters or resource shortages, including public safety power shut-offs that have occurred and will continue to occur in California, could disrupt and harm its operations and those of ChargePoint’s customers.

ChargePoint conducts a majority of its operations in the San Francisco Bay area in an active earthquake zone. The occurrence of a natural disaster such as an earthquake, drought, flood, fire (such as the recent extensive wildfires in California), localized extended outages of critical utilities (such as California’s public safety power shut-offs) or transportation systems, or any critical resource shortages could cause a significant interruption in its business, damage or destroy its facilities or inventory, and cause it to incur significant costs, any of which could harm its business, financial condition and results of operations. The insurance ChargePoint maintains against fires, earthquakes and other natural disasters may not be adequate to cover losses in any particular case.

In addition, rolling public safety power shut offs in California or other states can affect user acceptance of EVs, as charging may be unavailable at the desired times, or at all during these events. These shut offs could also affect the ability of fleet operators to charge their EVs, which, for example, could adversely affect transportation schedules or any service level agreements to which either ChargePoint or the fleet operator may be a party. If these events persist, the demand for EVs could decline, which would result in reduced demand for charging solutions.

Risks Related to the EV Market

Changes to fuel economy standards or the success of alternative fuels may negatively impact the EV market and thus the demand for ChargePoint’s products and services.

As regulatory initiatives have required an increase in the mileage capabilities of cars, consumption of renewable transportation fuels, such as ethanol and biodiesel, and consumer acceptance of EVs and other alternative vehicles has been increasing. If fuel efficiency of non-electric vehicles continues to rise, whether as the result of regulations or otherwise, and affordability of vehicles using renewable transportation fuels improves, the demand for electric and high energy vehicles could diminish. In addition, the EV fueling model is different than gas or other fuel models, requiring behavior change and education of influencers, consumers and others such

18

Table of Contents

as regulatory bodies. Developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect demand for EVs and EV charging stations. For example, fuel which is abundant and relatively inexpensive in the United States, such as compressed natural gas, may emerge as preferred alternative to petroleum-based propulsion. Regulatory bodies may also adopt rules that substantially favor certain alternatives to petroleum-based propulsion over others, which may not necessarily be EVs. This may impose additional obstacles to the purchase of EVs or the development of a more ubiquitous EV market. Finally, the current litigation between the state of California and the National Highway Traffic Safety Administration (“NHTSA”) could impact California’s ability to set fuel economy standards that encourage the adoption of EVs, and could be followed by many other states. If any of the above cause or contribute to consumers or businesses to no longer purchase EVs or purchase them at a lower rate, it would materially and adversely affect ChargePoint’s business, operating results, financial condition and prospects.

ChargePoint’s future growth and success is highly correlated with and thus dependent upon the continuing rapid adoption of EVs for passenger and fleet applications.

ChargePoint’s future growth is highly dependent upon the adoption of EVs by businesses and consumers. The market for EVs is still rapidly evolving, characterized by rapidly changing technologies, competitive pricing and competitive factors, evolving government regulation and industry standards and changing consumer demands and behaviors, changing levels of concern related to environmental issues and governmental initiatives related to climate change and the environment generally. Although demand for EVs has grown in recent years, there is no guarantee of continuing future demand. If the market for EVs develops more slowly than expected, or if demand for EVs decreases, ChargePoint’s business, prospects, financial condition and operating results would be harmed. The market for EVs could be affected by numerous factors, such as:

| • | perceptions about EV features, quality, safety, performance and cost; |

| • | perceptions about the limited range over which EVs may be driven on a single battery charge; |

| • | competition, including from other types of alternative fuel vehicles, plug-in hybrid electric vehicles and high fuel-economy internal combustion engine vehicles; |

| • | volatility in the cost of oil and gasoline; |

| • | concerns regarding the stability of the electrical grid; |

| • | the decline of an EV battery’s ability to hold a charge over time; |

| • | availability of service for EVs; |

| • | consumers’ perception about the convenience and cost of charging EVs; |

| • | increases in fuel efficiency; |

| • | government regulations and economic incentives, including adverse changes in, or expiration of, favorable tax incentives related to EVs, EV charging stations or decarbonization generally; |

| • | relaxation of government mandates or quotas regarding the sale of EVs; and |

| • | concerns about the future viability of EV manufacturers. |

In addition, sales of vehicles in the automotive industry can be cyclical, which may affect growth in acceptance of EVs. It is uncertain how macroeconomic factors will impact demand for EVs, particularly since they can be more expensive than traditional gasoline-powered vehicles, when the automotive industry globally has been experiencing a recent decline in sales. Furthermore, because fleet operators often make large purchases of EVs, this cyclicality and volatility in the automotive industry may be more pronounced with commercial purchasers, and any significant decline in demand from these customers could reduce demand for EV charging and ChargePoint’s products and services in particular.

19

Table of Contents

Demand for EVs may also be affected by factors directly impacting automobile prices or the cost of purchasing and operating automobiles, such as sales and financing incentives, prices of raw materials and parts and components, cost of fuel and governmental regulations, including tariffs, import regulation and other taxes. Volatility in demand may lead to lower vehicle unit sales, which may result in reduced demand for EV charging solutions and therefore adversely affect ChargePoint’s business, financial condition and operating results.

The EV market currently benefits from the availability of rebates, tax credits and other financial incentives from governments, utilities and others to offset the purchase or operating cost of EVs and EV charging stations. In particular, ChargePoint’s marketing efforts have heavily relied upon federal tax credits available to purchasers of its EV charging stations that effectively provide purchasers with a significantly discounted purchase price. The reduction, modification, or elimination of such benefits could cause reduced demand for EVs and EV charging stations, which would adversely affect ChargePoint’s financial results.

The U.S. federal government, foreign governments and some state and local governments provide incentives to end users and purchasers of EVs and EV charging stations in the form of rebates, tax credits and other financial incentives, such as payments for regulatory credits. The EV market relies on these governmental rebates, tax credits and other financial incentives to significantly lower the effective price of EVs and EV charging stations to customers. However, these incentives may expire on a particular date, end when the allocated funding is exhausted, or be reduced or terminated as a matter of regulatory or legislative policy. In particular, ChargePoint has heavily relied upon the availability of federal tax credits to purchasers under Section 30C of the Code to market its EV charging stations, which can effectively provide such purchasers with up to a 30% discount off the purchase price of ChargePoint’s EV charging stations. The credits under Section 30C of the Code are set to expire on December 31, 2021 and thus would not be available to ChargePoint’s customers unless extended. There can be no assurance that the credits under Section 30C of the Code will be extended, or if extended, will not be otherwise reduced. Any reduction in rebates, tax credits or other financial incentives, including the credit under Section 30C of the Code, could materially reduce the demand for EVs and ChargePoint’s solutions and, as a result, may adversely impact ChargePoint’s business and expansion potential.

ChargePoint also derives other revenue from regulatory credits. If government support of these credits declines, ChargePoint’s ability to generate this other revenue in the future would be adversely affected. Recently, ChargePoint has derived a slight majority of its other revenue from regulatory credits, and ChargePoint expects revenue from this source will decline as a percentage of other and total revenue over time. Further, the availability of such credits may decline even with general governmental support of the transition to EV infrastructure. For example, in September 2020, California Governor Gavin Newsom issued Executive Order N-79-20 (the “EO”), announcing a target for all in-state sales of new passenger cars and trucks to be zero-emission by 2035. While the EO calls for the support of EV infrastructure, the form of this support is unclear. If California or other jurisdictions choose to adopt regulatory mandates instead of establishing or continuing green energy credit regimes for EV infrastructure, ChargePoint’s revenue from these credits would be adversely impacted.

The EV charging market is characterized by rapid technological change, which requires ChargePoint to continue to develop new products and product innovations. Any delays in such development could adversely affect market adoption of its products and ChargePoint’s financial results.

Continuing technological changes in battery and other EV technologies could adversely affect adoption of current EV charging technology and/or ChargePoint’s products. ChargePoint’s future success will depend upon its ability to develop and introduce a variety of new capabilities and innovations to its existing product offerings, as well as introduce a variety of new product offerings, to address the changing needs of the EV charging market. As new products are introduced, gross margins tend to decline in the near term and improves as the product become more mature and with a more efficient manufacturing process.

As EV technologies change, ChargePoint may need to upgrade or adapt its charging station technology and introduce new products and services in order to serve vehicles that have the latest technology, in particular