UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from______ to______

Commission File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) |

(Address of principal executive offices and zip code)

(

(Registrant’s telephone number, including area code)

Formerly Columbia Care Inc.

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

☒ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.(1) Yes ☐ No

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). (1) Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a common share of the registrant on June 30, 2023 as reported on the Cboe (Canada) Exchange on that date: USD$

As of March 11, 2024, there were

DOCUMENTS INCORPORATED BY REFERENCE

None.

THE CANNABIST COMPANY HOLDINGS INC.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” regarding The Cannabist Company Holdings Inc. and its subsidiaries (collectively referred to as “The Cannabist Company,” “we,” “us,” “our,” or the “Company”). We make forward-looking statements related to future expectations, estimates, and projections that are uncertain and often contain words such as, but not limited to, “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or other similar words or phrases. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and assumptions that are difficult to predict. Particular risks and uncertainties that could cause our actual results to be materially different from those expressed in our forward-looking statements include those listed below:

The list of factors above is illustrative and by no means exhaustive. Additional information regarding these risks and other risks and uncertainties we face is contained in Part I of this Form 10-K under, Item 1A, “Risk Factors.” Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended.

We urge readers to consider these risks and uncertainties in evaluating our forward-looking statements. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

3

PART I

ITEM 1. BUSINESS

Background

The Company’s common shares are listed on the Cboe Canada (the “Cboe”) under the symbol “CBST” and are quoted on the OTCQX Best Market (the “OTCQX”) under the symbol “CBSTF” and on the Frankfurt Stock Exchange under the symbol “3LP”.

The Company’s principal business activity is the production and sale of cannabis as regulated by the regulatory bodies and authorities of the jurisdictions in which it operates.

The Company, through its subsidiaries, currently owns or manages interests in several state-licensed medical and/or adult use marijuana businesses in Arizona, California, Colorado, Delaware, Florida, Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, Pennsylvania, Utah, Virginia, Washington, D.C. and West Virginia. The Company has exited its prior operations in Missouri, European Union and Puerto Rico markets.

The registered office of the Company is 1700, 666 Burrard St., Vancouver, BC V6C 2X8. The head office is located at 680 5th Ave., 24th Floor, New York, New York 10019. The Company’s telephone number is (212) 634-7100.

History of the Company

The Company was incorporated under the Business Corporations Act (Ontario) (the “OBCA”) on August 13, 2018 under the name “Canaccord Genuity Growth Corp.” as a special purpose acquisition corporation for the purpose of effecting an acquisition of one or more businesses or assets, by way of a merger, amalgamation, arrangement, share exchange, asset acquisition, share purchase, reorganization or any other similar business combination.

On October 17, 2018, the Company announced that it had entered into a letter of intent with Columbia Care LLC (“Old Columbia Care”) to exclusively negotiate a business combination between the two companies. On November 21, 2018, the Company announced that it had entered into a definitive agreement (the “Transaction Agreement”) with Old Columbia Care pursuant to which, among other things, the Company would acquire all of the membership interests of Old Columbia Care by way of a merger between Old Columbia Care and a newly-formed Delaware subsidiary of the Company (the “Business Combination”). The Business Combination constituted the Company’s qualifying transaction.

The Business Combination was completed on April 26, 2019, at which point Old Columbia Care became a 100% wholly-owned subsidiary of the Company. In connection with the closing of the Business Combination, the Company was continued out of the jurisdiction of Ontario under the OBCA and into the jurisdiction of British Columbia under the Business Corporations Act (British Columbia) (“BCBCA”).

Effective September 19, 2023, the Company changed its name from “Columbia Care Inc.” to “The Cannabist Company Holdings Inc.” (the “Name Change”). To effect the Name Change, the Company filed a Notice of Alteration with the British Columbia Registrar of Companies (the “Registrar”), pursuant to which the Registrar issued a new Notice of Articles and a Certificate of Change of Name to the Company. Other than the Name Change, no other changes were made to the Company’s Articles. Copies of the Articles and the Certificate of Change of Name are attached hereto as Exhibits 3.1 and 3.2, respectively.

In connection with the Name Change, on September 21, 2023, the Company’s Common Shares and warrants began trading under the ticker symbols “CBST” and “CBST.WT”, respectively, on the Cboe. The Company’s Common Shares began trading under ticker symbol “CBSTF” on the OTCQX on September 26, 2023.

General Development of the Business

The Cannabist Company has grown primarily by submitting responses to state-issued requests for proposals and obtaining cannabis licenses pursuant to such processes throughout the United States, where such activity is legal at the state-level. In 2020, 2021, and 2022, the Company also grew significantly from acquiring other leading cannabis operations. The Company also provides management services to licensed entities. As of March 11, 2024, The Cannabist Company holds, directly or indirectly, 130 licenses with 117 discrete facilities that are operational or in development.

4

2015-2023 Growth |

|

|||||||||||||||||||||||||||||||||||||||

|

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

|

2024(1) |

|

||||||||||

Employees |

|

|

59 |

|

|

|

219 |

|

|

|

279 |

|

|

|

418 |

|

|

|

697 |

|

|

|

1,775 |

|

|

|

2,586 |

|

|

|

2,505 |

|

|

|

2,191 |

|

|

|

2,221 |

|

Facilities |

|

|

18 |

|

|

|

21 |

|

|

|

25 |

|

|

|

54 |

|

|

|

70 |

|

|

|

107 |

|

|

|

132 |

|

|

|

131 |

|

|

|

126 |

|

|

|

117 |

|

Jurisdictions |

|

|

7 |

|

|

|

10 |

|

|

|

11 |

|

|

|

15 |

|

|

|

16 |

|

|

|

16 |

|

|

|

18 |

|

|

|

17 |

|

|

|

16 |

|

|

|

15 |

|

Notes:

The Cannabist Company’s cannabis license portfolio allows for an aggregate of approximately 2.039 million square feet of cultivation and manufacturing space within its currently leased or owned facilities and the potential to produce over 150,000 kilograms of dry flower annually, based on an assumed 65 grams per square foot of cultivation space and 5.2 harvests per year.

As a vertically-integrated company in the cannabis sector, where there may be material relationships or transactions that involve conflicts of interest, whether actual or perceived, the Company will disclose any commissions, incentives, or other fees earned by The Cannabist Company, its pharmacists or other consultants. The Company will also disclose risks associated with conflicts of interest, including but not limited to situations where The Cannabist Company, its clinics, pharmacists, or other consultants are paid a commission or education grant from a licensed producer or dispensary that is, or is related to, The Cannabist Company. The Cannabist Company does not currently have any material relationships or transactions that involve conflicts of interest, whether actual or perceived.

Recent Events

Development of The Cannabist Company’s Portfolio of Licenses

The following is a summary of the more recent material developments of The Cannabist Company’s growing portfolio of licenses. The Company, through its respective subsidiaries, primarily entered these markets after being selected by state governments through competitive processes. Please refer to prior public filings for details of material licenses since inception. Further details regarding The Cannabist Company’s licenses and regulatory framework are set out under “United States Regulatory Environment.”

Missouri

The Cannabist Company entered the Missouri market in 2020 and operated through a management services arrangement with Columbia Care MO LLC (“Columbia Care MO”). Columbia Care MO is licensed to operate a medical marijuana dispensary and a medical marijuana manufacturing facility. The Company provided management services to both the medical marijuana dispensary and the medical marijuana manufacturing facility of Columbia Care MO for a fee. On March 13, 2023, the Company executed a Definitive Agreement to sell the Missouri assets which are considered non-core. The transaction is pending regulatory approval.

Utah

The Cannabist Company entered the Utah market in 2020 and operates through its wholly-owned subsidiaries, CCUT Pharmacy LLC (“CCUT”) and Columbia Care UT LLC (“Columbia Care UT”). CCUT operates a dispensary in Springville, which opened in the second quarter of 2021. In 2020, CCUT also received an industrial hemp license from the Department of Agriculture and Food.

5

During 2023, the Company signed definitive agreements, subject to closing conditions, to divest CCUT Pharmacy LLC, its Utah license and retail location for $6.5 million. The sale of the Utah assets was completed on March 7, 2024.

West Virginia

Columbia Care Hemp West Virginia LLC was awarded a Research and Marketing Cultivation of Industrial Hemp from the State of West Virginia in 2020. This allows The Cannabist Company to cultivate industrial hemp in the State of West Virginia as well as to perform research.

In 2020, Columbia Care WV LLC (“Columbia Care WV”), a wholly-owned subsidiary of the Company, was awarded a medical cannabis grower license and medical cannabis processor license in West Virginia. Columbia Care WV operates a co-located cultivation and processing facility in Falling Waters. Columbia Care WV received final approval for cultivation operations in July 2021 and received final approval for processing operations in November 2021. In January 2021, Columbia Care WV LLC was awarded 5 dispensary permits in Williamstown, Fayetteville, Morgantown, Beckley and St. Albans. As of December 31, 2022, The Cannabist Company had 4 active dispensaries in the state, located in Beckley, Morgantown, St Albans, and Williamstown.

Colorado

In September 2020, The Cannabist Company acquired The Green Solution (“TGS”), one of the largest vertically integrated cannabis operators in Colorado, through a transaction initially valued at approximately $140 million, excluding certain performance-based milestone payments.

Founded in 2010, TGS operated twenty-three dispensaries, one manufacturing facility and four cultivation locations. In Denver, TGS operated a manufacturing facility, three cultivation facilities and three dispensaries. TGS operates one dispensary and one cultivation facility (consisting of five cultivation licenses) in Trinidad. TGS operates five dispensaries in Aurora, one dispensary in Sheridan and dispensaries in Adams County, Black Hawk, Edgewater, Fort Collins, Glendale, Glenwood Springs, Northglenn, Silver Plume, and Pueblo. In November 2021, The Cannabist Company acquired Futurevision 2020, LLC and Futurevision Holdings, Inc. d/b/a Medicine Man (“Medicine Man”). Medicine Man operated one dispensary and cultivation location in Denver, one dispensary in Aurora, and one dispensary in Thornton. The Cannabist Company also exercised its option to acquire Medicine Man Longmont, LLC and its one dispensary in Longmont.

Recent Development of The Cannabist Company’s Other Business Elements

2021

January 2021 Offering of Common Shares

In January 2021, the Company completed a bought deal public offering of Common Shares (the “January 2021 Offering”) for gross proceeds of C$149,508,625, which included the exercise in full of the over-allotment option granted to the underwriters, before deducting the underwriters’ fees and estimated offering expenses. The January 2021 Offering was conducted in each of the provinces of Canada, other than Québec, pursuant to a prospectus supplement to the Company’s base shelf prospectus dated September 2, 2020, and elsewhere outside of Canada on a private placement basis.

February 2021 Private Placement of Common Shares

In February 2021, the Company completed a bought deal private placement of Common Shares (the “February 2021 Offering”) for gross proceeds of C$28,980,000, which included the exercise in full of the over-allotment option granted to the underwriters, before deducting the underwriters’ fees and estimated offering expenses. The February 2021 Offering was conducted in certain provinces of Canada pursuant to applicable exemptions from the prospectus requirements of Canadian securities laws. The Common Shares were also sold in the United States and in certain jurisdictions outside of Canada and the United States, in each case in accordance with applicable laws.

April 2021 Conversion of June 2020 Convertible Notes

In April 2021, the Company offered an incentive program to the holders of its June 2020 Convertible Notes, pursuant to which, the Company issued to each holder of the June 2020 Convertible Notes that surrendered such June 2020 Convertible Notes for conversion on or before May 28, 2021, 20 Common Shares for each $1,000 aggregate principal amount of June 2020 Convertible Notes surrendered for conversion. The Company issued 4,550,139 Common Shares in connection with the conversion of the June 2020 Convertible Notes.

6

July 2021 Private Placement

In July 2021, the Company completed a private placement (the “July 2021 Convertible Note Private Placement”) of 6.00% secured convertible notes for gross proceeds of US$74,500,000.

2022

February 2022 Private Placement

On February 3, 2022, the Company closed a private placement of US$185,000,000 aggregate principal amount of 9.50% senior-secured first-lien notes due 2026 (the “2026 Notes”). The 2026 Notes are senior secured obligations of the Company and were issued at 100% of face value. The 2026 Notes accrue interest payable semi-annually in arrears and mature on February 3, 2026, unless earlier redeemed or repurchased. The Company may redeem the 2026 Notes at par, in whole or in part, on or after February 3, 2024, as more particularly described in the fourth supplemental trust indenture governing the 2026 Notes. In connection with the offering of the 2026 Notes, the Company received binding commitments to exchange approximately $31,750,000 of the Company’s existing 13% senior secured notes due 2023, pursuant to private agreements in accordance with the trust indenture, for an equivalent amount of 2026 Notes plus accrued but unpaid interest and any negotiated premium thereon. As a result of the note exchanges, the Company received aggregate gross proceeds of $153,250,000 in cash pursuant to the offering of the 2026 Notes.

VentureForth Acquisition and Settlement

On April 18, 2022, in connection with the acquisition and settlement of preexisting relationships, the Company issued 18,755,802 common shares (the “VentureForth Shares”) and, on April 18, 2022 and April 24, 2022 paid approximately $26,000,000 to acquire, by merger, VentureForth Holdings, LLC, which is the owner of VentureForth, LLC (“VentureForth”). VentureForth holds two licenses from the Washington D.C. Alcoholic Beverage Regulation Administration (“ABRA”), specifically, one license to cultivate and manufacture medical cannabis and one license to dispense medical cannabis. The Company previously had a management services agreement with VentureForth. The shares issued and amounts paid also amicably resolved, with no admissions of liability and in exchange for releases, certain direct, indirect, derivative and indemnification claims relating to a confidential arbitration to which VentureForth, a separate subsidiary of the Company and certain members of the Company’s management team were respondent parties.

2023

September 2023 Private Placement

On September 18, 2023, the Company entered into subscription agreements with institutional investors (the “September 2023 Investors”) for the purchase and sale of 22,244,210 units of the Company (the “September 2023 Units”) at a price of C$1.52 per Unit (the “Issue Price”) pursuant to a private placement (the “September 2023 Offering”), for aggregate gross proceeds of approximately C$33.8 million or approximately US$25 million (the “Initial Tranche”). Each Unit consists of one Common Share (or Common Share equivalent) and one half of one warrant that entitles the holder to acquire one Common Share at a price of C$1.96 per Common Share, a 29% premium to issue, for a period of three years following the closing of the Initial Tranche (“September 2023 Warrant”). The Initial Tranche consisted of an aggregate of 21,887,240 Common Shares, 11,122,105 September 2023 Warrants and 356,970 pre-funded warrants that provide the holder the right to purchase one Common Share at an exercise price of C$0.0001 per Common Share (the “September 2023 Pre-Funded Warrants”). The September 2023 Pre-Funded Warrants are exercisable immediately and may be exercised at any time until the September 2023 Pre-Funded Warrants are exercised in full. The September 2023 Offering closed on September 21, 2023. ATB Capital Markets Inc. acted as sole placement agent for the Offering. The Company intends to use the proceeds from the September 2023 Offering to reduce its outstanding indebtedness and for general corporate purposes.

In connection with the transaction, the Company and the Investors entered into a customary registration rights agreement. The September 2023 Units were subject to limited lock-up requirements.

2024

January 2024 Debt Exchange

On January 22, 2024, the Company entered into an exchange agreement (the “Exchange Agreement”) with certain holders (the “Holders”) of the Company’s 6.0% senior secured convertible notes due June 2025 (the “2025 Convertible Notes”), pursuant to which the Company agreed to repurchase (the “Repurchase”) up to $25 million principal amount of the 2025 Convertible Notes in exchange for Common Shares.

7

Pursuant to the terms of the Exchange Agreement, the Holders shall:

In the event the conditions are fulfilled and the Holders fail to Transfer their 2025 Convertible Notes in accordance with the terms of the Exchange Agreement, the Company has the right, but not the obligation, to require the Holders to Transfer some or all of the portion of the $25 million principal amount of 2025 Convertible Notes still held by the Holders. Assuming all of the conditions are fulfilled, and the entire $25 million principal amount of 2025 Convertible Notes are Transferred for Common Shares issued at the minimum prices set out in the Exchange Agreement, a maximum of 68,564,698 Common Shares would be issued in connection with the Repurchase. Through March 11, 2024, $10 million of the potential $25 million exchange has been completed.

Description of the Business

Overview of the Company

The Cannabist Company is a U.S.-based, vertically-integrated consumer product, health and wellness cannabis company with cultivation, product development, production, home delivery and dispensary operations. The Company has built one of the broadest and longest operational records of any licensee in publicly administered medicinal and adult-use cannabis programs in the United States. It has developed proprietary branded products with intellectual property comprised of a variety of medical and adult-use form factors, including but not limited to proprietary formulations, precision manufactured dosing and cannabis flower and flower-derived products. The Company’s mission is to improve lives through product innovation, research and development and outstanding patient and consumer experience. The Cannabist Company’s vision is to address the world’s health and wellness needs through plant-based medicine and products.

The Company is one of the largest and most experienced cultivators, manufacturers and providers of cannabis products and services in the United States.

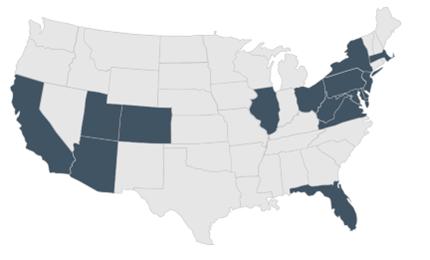

Figure 1: Company Footprint

8

The Cannabist Company actively operates or has under development, cultivation and/or production assets in Arizona, California, Colorado, Delaware, Florida, Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, Pennsylvania, Utah, Virginia, Washington, D.C., and West Virginia. The Company’s existing U.S. license portfolio allows for (i) an aggregate of approximately 2,473,245 square feet of indoor cultivation and production footprint (including operational, in development and optioned space) within its currently leased or owned facilities (including options to expand within such facilities), with the potential to produce more than 150,000 kg of dry flower on an annual basis and (ii) an aggregate of approximately 61.5 acres of outdoor cultivation and production footprint (including operational and optioned space). This capacity does not include the potential yield from the Company’s outdoor marijuana and industrial hemp acreage, which will vary seasonally. Since the Company currently has operating facilities and projects under development across multiple jurisdictions in the United States, it is not substantially dependent on any individual cultivation facility or dispensary.

The table below describes each jurisdiction’s indoor and greenhouse cultivation and/or production operations as of December 31, 2023:

Jurisdiction |

|

Approximate / |

|

|

Status |

|

Approximate Expansion |

|

||

Arizona |

|

28,000 |

|

|

Operational |

|

|

— |

|

|

California |

|

|

45,572 |

|

|

Operational |

|

|

— |

|

Colorado |

|

20,295 |

|

|

Operational |

|

|

— |

|

|

Delaware |

|

20,000 |

|

|

Operational |

|

|

— |

|

|

Florida |

|

13,845 |

|

|

Operational |

|

|

168,000 |

|

|

Illinois |

|

|

32,802 |

|

|

Operational |

|

|

— |

|

Maryland |

|

42,000 |

|

|

Operational |

|

|

— |

|

|

Massachusetts |

|

|

38,890 |

|

|

Operational |

|

|

— |

|

New Jersey |

|

50,274 |

|

|

Operational |

|

|

— |

|

|

New York |

|

58,346 |

|

|

Operational |

|

149,997 |

|

||

Ohio |

|

110,521 |

|

|

Operational |

|

|

— |

|

|

Pennsylvania |

|

|

274,000 |

|

|

Operational |

|

|

— |

|

Virginia |

|

65,765 |

|

|

Operational |

|

|

|

||

Washington, D.C. |

|

7,100 |

|

|

Operational |

|

|

— |

|

|

West Virginia |

|

|

39,293 |

|

|

Operational |

|

|

— |

|

Total |

|

|

2,473,245 |

|

|

|

|

|

517,997 |

|

Notes:

The table below describes each jurisdiction’s outdoor cultivation and/or production operations:

Jurisdiction |

|

Approximate Size |

|

|

Status |

|

Approximate Expansion |

|

||

Colorado |

|

11.5(1) |

|

|

Non-Operational |

|

32.3(3) |

|

||

|

|

50(2) |

|

|

Non-Operational |

|

74.9 |

|

||

Total |

|

|

61.5 |

|

|

|

|

|

107.2 |

|

9

Notes:

The Company’s refined cultivation practices have experienced several iterations since its inception. Its cultivation expertise reflects years of operating experience and specialized input from agricultural, manufacturing, scientific and security experts. The Company has implemented the best practices employed at its nationwide locations in each new facility that it develops and expects to continue to improve and optimize its methods and infrastructure to ensure competitiveness and excellence.

The Company’s production platform is designed to cultivate and manufacture cannabinoid-based products that are used specifically for medical use or consumer wellness, and health and lifestyle products produced to assure consistency and quality. The Company engages national engineering consultants to design bespoke systems that follow industry best practices in order to produce its products. The Company does all of this to optimize product quality, reduce the risk of exposing patients and consumers to potentially harmful contaminants while increasing the effectiveness and consistency of the approved products delivered.

The Company believes that a clean and sanitized growing and processing environment is key to ensuring the integrity of products. These self-imposed disciplines are more resource intensive, but are designed to yield a safe, consistent, contaminant-free product that will lead the market in quality, safety and, where applicable, efficacy.

The Company’s growing process is designed to maximize quality, consistency and yield, while limiting contamination by fungal and bacterial diseases, insect and vertebrate pests, non-organic pesticides and other harmful contaminants. Each step in the Company’s cultivation process, including (i) germination/propagation; (ii) vegetation; (iii) bloom; and (iv) harvest is carefully executed using refined standard operating procedures and training protocols. The Company has standardized nutrient protocols, growing environments, water and irrigation strategies, growing mediums, climate controls, plant tracking, and staffing programs among other components of its cultivation and manufacturing operations. Its ultimate goal is to maximize the biomass output (grams per square foot) across all Company-operated facilities at the lowest cost possible without sacrificing product quality.

Extraction

The Company utilizes a number of well-established, regulatory-approved methods for cannabinoid extraction and performs extraction of the leaves, trimmings and flowers of female cannabis plants to produce an approved cannabinoid product form. Once extracted, the Company’s expert formulation staff formulates proprietary extracts into easily administered consumer products and medications for patient and consumer delivery by following protocol and state regulations.

Dispensaries

The Cannabist Company has, manages or is developing dispensaries in Arizona, California, Colorado, Delaware, Florida, Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, Pennsylvania, Utah, Virginia, Washington, D.C. and West Virginia. All of the Company’s dispensaries have either licensed pharmacists or trained personnel on staff to ensure that customers and patients have access to knowledgeable personnel that can advise on the responsible use of cannabis including delivery formats and dosing schedules as applicable. The table below describes each jurisdiction’s dispensary operations as of December 31, 2023.

Jurisdiction

|

City

|

Status

|

Arizona |

Prescott Tempe |

Operational Operational |

|

|

|

California |

North Hollywood San Diego (2 locations) San Francisco Studio City |

Operational Operational Operational Operational |

|

|

|

Colorado |

Adams County Aspen Aurora (6 locations) Black Hawk Denver (3 locations) Edgewater |

Operational Non-Operational Operational Operational Operational Operational |

10

Jurisdiction

|

City

|

Status

|

|

Englewood Fort Collins Glendale Glenwood Springs Longmont Northglenn Sheridan Silver Plume Pueblo Trinidad Thornton |

Non-Operational Operational Operational Operational Operational Operational Operational Operational Operational Non-Operational Operational |

|

|

|

Delaware |

Rehoboth Beach Smyrna Wilmington |

Operational Operational Operational |

|

|

|

Florida |

Bonita Springs Bradenton Brandon Cape Coral Delray Beach Gainesville Jacksonville Longwood Melbourne Miami Orlando Sarasota St. Augustine Stuart |

Operational Operational Operational Operational Operational Operational Operational Operational Operational Operational Operational Operational Operational Operational |

|

|

|

Illinois |

Chicago Villa Park |

Operational Operational |

|

|

|

Maryland |

Chevy Chase Frederick Rockville(1) Prince George’s County |

Operational Operational Operational Under Development |

Massachusetts |

Boston Greenfield Lowell |

Operational Operational Operational |

|

|

|

Missouri(2) |

Hermann |

Operational |

|

|

|

New Jersey |

Vineland Deptford May’s Landing |

Operational Operational Under development |

|

|

|

New York |

Brooklyn Manhattan Riverhead Rochester |

Operational Operational Operational Operational |

|

|

|

Ohio |

Dayton Logan Marietta Monroe Warren |

Operational Operational Operational Operational Operational |

|

|

|

Pennsylvania |

Allentown Scranton Wilkes-Barre |

Operational Operational Operational |

|

|

|

|

|

|

Utah |

Springville |

Operational |

|

|

|

Virginia |

Portsmouth (co-located with cultivation and manufacturing operations) |

Operational

|

11

Jurisdiction

|

City

|

Status

|

|

Richmond (co-located with cultivation and manufacturing operations) Short Pump Virginia Beach Carytown Williamsburg Colonial Heights Hampton 2 Additional Locations |

Operational

Operational Operational Operational Operational Operational Operational Under development |

|

|

|

Washington, D.C. |

Washington, D.C. |

Operational |

|

|

|

West Virginia |

Beckley Huntington Morgantown St. Albans Williamstown |

Operational Operational Operational Operational Operational |

Notes:

Performance Indicators

As the Company seeks to manage its development, management currently uses key performance indicators (“KPIs”) to assess its rate of growth and performance. These KPIs, which are subject to change, include top-line revenue, growth in gross margin and Adjusted EBITDA margin (non-GAAP measure). These KPIs are further discussed under “Non-GAAP Measures” in Item 2.

Branding and Marketing

The Company employs a diverse and knowledgeable staff of pharmacists and trained personnel for its dispensaries that reflect and embody its brand. The Company has built its reputation on providing trusted, high-quality products to improve patients’ wellness journeys, which are also now available for adult-use consumption. The Company believes that it has become known in the jurisdictions in which it operates as a trusted mark for health and wellness cannabis by constantly innovating to provide the best solutions for its patients and customers.

In 2021, the Company launched its Cannabist retail ecosystem. The Cannabist retail experience is centered on making shopping for cannabis as simple and approachable as possible, accommodating the vast range of experience levels among patients and customers. Merchandising set-ups and store layouts are organized to help patients and customers move through the space with intent and become more comfortable in the process. Additionally, retail spaces are designed to encourage employees and customers to engage in conversations that enhance the shopping experience, whether through product recommendations or general education. To fully realize this goal, Cannabist staff undergo extensive training. Beyond the in-store experience, technology serves as a bridge across the retail ecosystem that enables a seamless shopping experience. Cannabist locations will continue to leverage technology solutions to help customers on their product discovery journey. Several dispensary locations in Utah, Arizona, Illinois, California, Massachusetts, Florida and New York were transformed into Cannabist locations during 2021 and 2022. A number of new store openings in Virginia and West Virginia since 2021 are also Cannabist locations.

Cannabis-based Product Selection and Offerings

The Company has continually been at the forefront of developing and introducing innovative and safe products to serve patients’ and customers' unique needs. The Company offers a competitive product portfolio in the jurisdictions in which it operates. Depending on the jurisdiction, the Company offers a variety of products, including, without limitation, flower, concentrates, edibles and/or accessories. The product mix varies between jurisdictions. As such, the Cannabist Company benefits from its diverse and expanding product portfolio.

The Company’s products have similar characteristics due to the same raw material ingredient (cannabis), similar nature of cultivation process, the type or class of customer and the regulatory nature of our industry. Revenues from transactions with no single external customer exceed 10% of the consolidated revenues. Revenue earned outside of the United States of America is immaterial for the

12

years ended December 31, 2023, 2022, and 2021. Long-lived assets located outside of the United States of America are immaterial as at December 31, 2023, 2022, and 2021.

The Cannabist Company has begun to bring its family of branded products to all jurisdictions where it has manufacturing operations. The Company’s focus is to develop proprietary formulations and delivery technologies that provide patients and adult-use customers with high quality and differentiated products.

In 2016, the Company announced the launch of its line of controlled-dose, solid-fill medicinal cannabinoid capsules. Formulated using the full range of active cannabinoid ingredients from plants grown in its cultivation facilities, these proprietary capsules offered a variety of concentrations in a more accessible and convenient delivery form to patients and customers.

The Company also introduced proprietary, controlled-dose, hard-pressed tablets in New York state. The tablets are manufactured by segregating and formulating precise combinations of active compounds derived from targeted strains of cannabis plants. From the formulation of these tablets, the Company introduced additional products to provide a spectrum of cannabinoid profiles to address the continuum of patient and consumer needs. This precisely engineered diversity of optimized cannabinoids includes the Company’s patent pending Ceed line of medicinal cannabis products, including TheraCeed tablets, EleCeed sublingual tinctures and ClaraCeed vaporization oil.

In 2020, the Company launched Seed & Strain, its first lifestyle cannabis brand. Available in a number of markets, products include flower, pre-rolls and concentrates. Other product and branded categories include but are not limited to confections, chocolate, drink mixes, condiments, kief, shatter, and wax/crumble. The Company launched Classix in five markets simultaneously in October 2021, and has since brought the brand to additional markets. Triple Seven has also been expanded from California to other operational markets.

The Cannabist Company intends to continue launching national brands across its medical and adult-use markets in order to maintain the consistency and quality of products that all patients and customers have come to expect from the Company.

None of the Company’s products have been shown to effectively treat or cure any disease. None of Cannabist Company’s products require approval by the FDA, and none of the Company’s products have been approved, reviewed or cleared by the FDA for any purpose.

Product Pricing

The Cannabist Company’s prices vary based on market conditions and product pricing from non-cannabis suppliers. As a result of different tastes, preferences and customer demographics across its core markets, average dispensary sales differ significantly from state to state.

Caring for The Community We Serve

Having completed well over 10 million sales transactions in multiple medicinal and adult-use cannabis markets since its inception, The Cannabist Company’s team has accumulated significant experience in the treatment of large consumer and specialized patient populations, addressing a wide range of unique combination of qualifying conditions, symptoms and risks. The Company has, at various times, dedicated funding for research collaborations and initiatives with leading academic medical centers across the country to enhance patient care, inform the policy debate and empower healthcare and wellness professionals with data on best practices and safe and efficacious cannabinoid use. Through its public policy efforts, the Company is also at the forefront of ensuring that social equity is a large part of legalization efforts across the United States.

The Cannabist Company has launched extensive patient care initiatives including utilizing anonymized patient data to facilitate product optimization and innovation on behalf of patient and consumer needs. The Company’s proprietary database is an important aspect of the Company’s product development as it invests in branded formulations and administration types that best respond to patient and consumer needs.

The Cannabist Company has distinguished itself over time by establishing research collaborations with renowned medical and research institutions globally. The collaborations are designed to improve product efficacy and assess the medical utility in its products while enhancing patient safety. The Company has developed innovative and collaborative working relationships with a number of leading academic, patient advocacy, research and healthcare organizations as well as partnerships with private, academic, agricultural, policy, sustainability and economic programs at various institutions in the pursuit of expanding the body of scientific knowledge related to cannabis. This focus is one of the principal foundations of The Cannabist Company’s corporate culture and has materially contributed to the Company’s position as one of the most qualified and experienced operators in certain regulated markets

13

in the U.S. Some of the collaboration partners have previously included but are not limited to researchers affiliated with the following institutions: Mount Sinai Hospital, Columbia University, Arizona State University, Brandeis University, The Center for Discovery in New York, The Dana Farber Cancer Institute, New York University, Albert Einstein/Montefiore Medical Center, Stanford University and King’s College London.

Banking and Processing

The Cannabist Company deposits funds from its dispensary operations into bank accounts established with various banking partners. The Company ensures that the banks used are fully aware of the nature of the business and industry in which the Company operates. The Company currently accepts cash, cashless ATMs, and in certain locations the CNC card. The CNC card is the first store credit card in the cannabis industry, providing the Company’s customers an alternative payment method in participating markets, increasing access to the Company’s products. Payment methods currently vary by market.

During the years ended December 31, 2023 and 2022, the Company earned retail revenues of approximately $4.1 million and $4.5 million, respectively, from the CNC program. The Company does not consider the CNC store credit card program to be a material revenue stream.

Real Estate Strategy

In each market that the Company enters, it spends a significant amount of time and resources selecting real estate in highly desirable locations with convenient access to customers, healthcare communities and health and wellness providers and public transit, close proximity to major interstates and other traffic routes, ample parking, and the potential for significant foot traffic. The Company typically targets retail spaces with a footprint of 2,500 to 7,500 square feet and cultivation/manufacturing facilities with a footprint of 20,000 to 65,000+ square feet, depending on the market and available real estate inventory. The Company’s practice is to secure leases with a base term of five to ten years with extension options for renewal terms of five years.

In-Store Pickup and Delivery

The Cannabist Company is currently associated with certain third-party platforms that offer pre-ordering for in-store pickup, online payment processing and home delivery services, where allowed by law. Where required, patients are offered educational material and/or consultations regarding route of administration and dosing format.

Inventory Management

In the jurisdictions where the Company is operational, it has comprehensive inventory management practices that are compliant with applicable state laws and regulations. Such practices ensure control over the Company’s cannabis and cannabis product inventory using seed to sale tracking software. The Company’s practices are designed to avoid contamination and to ensure the safety and quality of the products dispensed.

Information Technology

The Cannabist Company strategically invests in information technology infrastructure. In fiscal year 2023, the Company initiated an effort to consolidate its operational systems, to provide national governance over business process and intelligence across merchandise planning, inventory management, production, costing, order management, accounting, reporting and analysis. These systems will provide the flexibility to support global and multi-channel expansion. The Company has invested in information technology security platforms which are designed to protect patient and customer records and personal information in compliance with applicable laws and regulations.

Research and Development

The Company has been tracking consented patient outcomes since 2013, and now has a research database of more than 20 million sales transactions across all sales locations. It is working with experts to analyze this anonymized data to devise new genetics and new products tailored to individual patient conditions and wellness states.

The Company has operated a product development and process development center in its Rochester, New York cultivation and manufacturing location since 2014, and now also conducts these activities in San Diego, California and Denver, Colorado. At these facilities, unit-dose formulations of proprietary cannabinoid combinations are created, and methods of extraction and separation are scaled. Additional work to add automation to these efforts and commercial manufacturing is ongoing.

14

Employees

As of December 31, 2023, The Cannabist Company had 2,191 employees across its operating jurisdictions, compared to 2,505 employees as of December 31, 2022. As of March 11, 2024, the Company had approximately 2,221 employees.

The Cannabist Company is committed to:

The Cannabist Company is committed to all of the above without regard to race, ethnicity, religion, color, sex, gender, gender identity or expression, sexual orientation, national origin, ancestry, citizenship status, uniform service member and veteran status, marital status, pregnancy, age, protected medical condition, genetic information, disability, or any other protected status in accordance with all applicable federal, state, provincial and local laws.

Company employees are highly talented individuals who have educational achievements ranging from doctorates to masters to undergraduate degrees in a wide range of disciplines, as well as staff who have been trained on the job to uphold the highest standards as set by the Company. It is currently a requirement that all of the Company’s employees pass background checks.

In addition, the safety of the Company’s employees is a priority and the Company is committed to the prevention of illness and injury through the provision and maintenance of a healthy workplace. The Company takes all reasonable steps to ensure staff are appropriately informed and trained to ensure the safety of themselves as well as others around them.

The Company strives to provide an equal opportunity for all its employees to pursue career advancement and to consistently look within its organization for potential job candidates prior to posting employment offerings externally. Importantly, it does not embrace these policies solely out of altruism or an obligation under state requirements, but because it has learned from experience that the organization thrives and becomes more productive by maintaining a culture of inclusion where everyone feels valued and their individual contributions are appreciated and rewarded.

Competition

The Cannabist Company competes with other retail, manufacturing and cultivation license holders across the states in which it operates, as well as additional states. Many of the Company’s competitors are smaller, local operators, as well as an increasing number of operators with a significant presence in multiple states that compete directly with the Company for regional market share. In certain markets, a number of dispensaries and cultivators operate illegally and compete directly with the Company. However, the Company expects that law enforcement will increasingly respond to illicit market operators. In addition to physical dispensaries, the Company also competes with third-party delivery services, which provide direct-to-consumer delivery services.

Further, as more U.S. jurisdictions pass legislation allowing adult-use of cannabis, the Company expects an increased level of competition in the U.S. market. A number of publicly-traded companies are expanding operations to states that have decriminalized cannabis consumption. The increasingly competitive U.S. state markets may adversely affect the financial condition and operations of the Company.

See “United States Regulatory Environment” for additional details as to the regulatory environment in which the Company operates. See Item 1A—“Risk Factors” with respect to competition.

Intellectual Property

The Cannabist Company pursues patent and trademark protection around the world directed to its product and product candidates in an effort to establish intellectual property positions regarding cannabinoid products and devices. Patent prosecution is a lengthy process, during which the scope of the claims initially submitted for examination to the U.S. Patent and Trademark Office or foreign equivalents is often significantly narrowed by the time they are issued, if issued at all. The Company expects this may be the case with

15

respect to its pending patent applications referenced below.

The Company’s intellectual property strategy seeks to provide protection for its product and product candidates, through the prosecution of different types of patent and trademark applications in the U.S. and worldwide.

The Company’s patent portfolio covers a number of its products and product candidates. As of March 3, 2023, this portfolio included 1 issued U.S. patent and at least 8 pending patent applications owned by the Company, filed in one or more of two jurisdictions, including Canada and the U.S., which have strong patent systems. The issued U.S. patent is projected to expire in 2037. The patent applications, if granted, are projected to expire between 2037 and 2040, excluding any extension of patent term that may be available in a particular country.

Our patent portfolio includes:

While the USPTO has granted many patents for cannabis-related technologies, none have yet been successfully enforced in court. Until U.S. courts definitively address the enforceability of cannabis-related patents, or cannabis products are legalized federally in the U.S., we cannot be certain that any of our patents can be effectively enforced against our competitors, even if their products infringe our patents, which could have a material adverse effect on our business.

The USPTO may deny federal trademark registration if the trademark application covers goods or services that violate federal law, including cannabis products. However, certain hemp-derived goods, including some hemp-derived CBD products with a THC concentration of not more than 0.3% on a dry weight basis, as well as ancillary products or services, are considered lawful under federal law and may be eligible for federal trademark registration. Additionally, the USPTO may accept trademark applications for consulting services or goods that do not directly involve the cannabis flower, such as computer software, educational platforms, and brand apparel. Trademarks covering these lawful goods and services are generally enforceable in federal court. Cannabis goods and services that do not meet the USPTO standard for trademark registration may qualify for state trademark registration in states where such goods and services have been legalized, and are generally enforceable in state courts in those states.

No guarantee can be given that the Company will be able to successfully assert its trademark rights, nor can the company guarantee that its trademark registrations will not be invalidated, circumvented or challenged. Any such invalidity, particularly with respect to a product name, or a successful intellectual property challenge or infringement proceeding against the company, could have a material adverse effect on the Company’s business.

In addition to patents and trademarks, the Company relies upon unpatented trade secrets and know-how to develop and maintain its competitive position. The Company has developed numerous proprietary technologies and processes. While actively exploring the patentability of these techniques and processes, the Company relies on non- disclosure/confidentiality arrangements and trade secret

16

protection.

The Company seeks to protect its proprietary information, in part, by executing confidentiality agreements with third parties, its collaborators, and scientific advisors, and as well as non-disclosure and invention assignment agreements with its employees and consultants. The confidentiality agreements it enters into are designed to protect its proprietary information and the agreements or clauses requiring assignment of inventions to the Company are designed to grant it ownership of technologies that are developed through its relationship with the respective counterparty. The Company cannot guarantee, however, that these agreements will afford it adequate protection of its intellectual property and proprietary information rights.

Trade secrets and know-how can be difficult to protect. In particular, some of the Company’s trade secrets and know-how for which it decides to not pursue additional patent protection may, over time, be disseminated within the industry through independent development and public presentations describing the methodology.

UNITED STATES REGULATORY ENVIRONMENT

Federal Regulatory Environment

Controlled Substances Act and “Cole Memorandum”

The United States federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811) (the “CSA”), which places controlled substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I drug. Under United States federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of accepted safety for the use of the drug under medical supervision. The United States Food and Drug Administration (the “FDA”) has approved Epidiolex, which contains a purified form of cannabidiol (“CBD”), a non-psychoactive cannabinoid found in the cannabis plant, for the treatment of seizures associated with two epilepsy conditions. The FDA has not approved cannabis or cannabis derived compounds as a safe and effective drug for any other indication.

In the United States, cannabis is largely regulated at the state level. State laws regulating cannabis are in direct conflict with the federal CSA, which makes cannabis use and possession federally illegal. Although certain states authorize medical or adult-use cannabis production and distribution by licensed or registered entities, under U.S. federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia is illegal, and any such acts are criminal acts under federal law. The Supremacy Clause of the United States Constitution establishes that the United States Constitution and federal laws made pursuant to it are paramount and, in case of direct conflict between federal and state law, the federal law shall apply. The Company faces risks for operating in an industry that is illegal under federal law, including that third party service providers could suspend or withdraw services. See section entitled “Risk Factors” herein.

Until 2018, the federal government provided guidance to federal law enforcement agencies and banking institutions through a series of United States Department of Justice (“DOJ”) memoranda. The most significant of these memoranda was drafted by former Deputy Attorney General James Cole in 2013 (the “Cole Memo”).

The Cole Memo offered guidance to federal enforcement agencies as to how to prioritize civil enforcement, criminal investigations and prosecutions regarding marijuana in all states. The Cole Memo put forth eight prosecution priorities:

17

On January 4, 2018, former United States Attorney General Jefferson Sessions rescinded the Cole Memo by issuing a new memorandum to all United States Attorneys (the “Sessions Memo”). Rather than establish national enforcement priorities particular to marijuana-related crimes in jurisdictions where certain marijuana activity was legal under state law, the Sessions Memo instructs that “[i]n deciding which marijuana activities to prosecute ... with the DOJ’s finite resources, prosecutors should follow the well-established principles that govern all federal prosecutions.” Namely, these include the seriousness of the offense, history of criminal activity, deterrent effect of prosecution, the interests of victims, and other principles.

The former Attorneys Generals who succeeded former Attorney General Sessions following his resignation have not provided a clear policy directive for the United States as it pertains to state-legal marijuana-related activities. It is still not yet known whether the DOJ under President Biden and Attorney General Merrick Garland will re-adopt the Cole Memo or announce a substantive marijuana enforcement policy. Attorney General Garland stated at a confirmation hearing in 2021 before the United States Senate that “It does not seem to me a useful use of limited resources that we have, to be pursuing prosecutions in states that have legalized and that are regulating the use of marijuana, either medically or otherwise. I don’t think that’s a useful use.” Recently, in testimony in February of 2023 before the Senate Judiciary Committee, Attorney General Garland said the DOJ is “still working on a marijuana policy” and that policy – when issued – “will be very close to what was done in the Cole Memorandum.”[1]

Nonetheless, there is no guarantee that state laws legalizing and regulating the sale and use of marijuana will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the United States Congress amends the CSA with respect to marijuana (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current U.S. federal law. Currently, in the absence of uniform federal guidance, as had been established by the Cole Memo, enforcement priorities are determined by respective United States Attorneys, and notwithstanding public statements to the contrary, federal law enforcement could enforce the CSA – and its criminal prohibition on commercial cannabis activity.

[1] John Schroyer, (2021 February 22) Attorney general nominee Garland signals friendlier marijuana stance, available at https://mjbizdaily.com/attorney-general-nominee-merrick-garland-signals-friendlier-marijuana-stance/

2018 Farm Bill

Following the passage of the Agriculture Improvement Act of 2018 (popularly known as the “2018 Farm Bill”), cannabis with a tetrahydrocannabinol (“THC”) content below 0.3% dry weight volume is classified as hemp and has been removed from the CSA. Hemp and products derived from it that are lawfully cultivated or manufactured in accordance with the 2018 Farm Bill, U.S. Department of Agriculture regulations and applicable state laws may now be sold into commerce and transported across state lines. The 2018 Farm Bill explicitly preserves the authority of the FDA to regulate certain products containing cannabis or cannabis-derived compounds such as CBD under the federal Food, Drug and Cosmetic Act (“FD&C Act”) and Section 351 of the Public Health Service Act. In conjunction with the enactment of the 2018 Farm Bill, the FDA released a statement about the regulatory status of CBD, noting the FDA’s position that it is unlawful to introduce food containing added CBD into interstate commerce, or to market CBD products as, or in, dietary supplements, regardless of whether the substances are hemp-derived. In January of 2023, the FDA issued a statement in connection with its denial of three citizen petitions requesting that the agency engage in rulemaking to establish regulations under which CBD derived from hemp could be legally marketed as a dietary ingredient in foods and dietary supplements. FDA stated that it is seeking assistance from Congress to create a new regulatory pathway that is better designed to regulate products that contain hemp derived cannabinoids, including CBD. In the interim, FDA stated that products (including dietary supplements, conventional foods, and animal foods) on the market are at risk of FDA enforcement as the agency deems “appropriate.” To date, the FDA’s enforcement actions against companies manufacturing CBD products has primarily been limited to the issuance of warning letters to companies whose products have made prohibited, misleading, and unapproved drug claims. Various states have also enacted state-specific laws pertaining to the handling, manufacturing, labeling, and sale of CBD and other hemp consumable products. While some states explicitly authorize and regulate the production and sale of hemp-derived CBD consumable products or otherwise provide legal protection for authorized individuals to engage in such activities, other states restrict the sale of CBD products or prohibit such products outright.

Financial Institutions and Banking

Due to the CSA categorization of marijuana as a Schedule I drug, federal law also makes it illegal for financial institutions that depend on the Federal Reserve’s money transfer system to take any proceeds from marijuana sales as deposits. Banks and other financial institutions could be prosecuted and possibly convicted of money laundering for providing services to cannabis businesses under the United States Currency and Foreign Transactions Reporting Act of 1970 (the “Bank Secrecy Act”). Therefore, under the Bank Secrecy Act, banks or other financial institutions that provide a cannabis business with a checking account, debit or credit card, small business loan, or any other service could be charged with money laundering or conspiracy.

18

While there has been no change in U.S. federal banking laws to accommodate businesses in the large and increasing number of U.S. states that have legalized medical and/or adult-use marijuana, the Department of the Treasury Financial Crimes Enforcement Network (“FinCEN”), in 2014, issued guidance to prosecutors of money laundering and other financial crimes (the “FinCEN Guidance”). The FinCEN Guidance advised prosecutors not to focus their enforcement efforts on banks and other financial institutions that serve marijuana-related businesses so long as that business is legal in their state and none of the federal enforcement priorities referenced in the Cole Memo are being violated (such as keeping marijuana away from children and out of the hands of organized crime). The FinCEN Guidance also clarifies how financial institutions can provide services to marijuana-related businesses consistent with their Bank Secrecy Act obligations, including thorough customer due diligence, but makes it clear that they are doing so at their own risk. The customer due diligence steps include:

With respect to information regarding state licensure obtained in connection with such customer due diligence, a financial institution may reasonably rely on the accuracy of information provided by state licensing authorities, where states make such information available.

Because most banks and other financial institutions are unwilling to provide any banking or financial services to marijuana businesses, these businesses can be forced into becoming “cash-only” businesses. While the FinCEN Guidance decreased some risk for banks and financial institutions considering serving the industry, in practice it has not substantially increased banks’ willingness to provide services to marijuana businesses. This is because, as described above, the current law does not guarantee banks immunity from prosecution, and it also requires banks and other financial institutions to undertake time-consuming and costly due diligence on each marijuana business they accept as a customer.

Those state-chartered banks and credit unions that do have customers in the marijuana industry charge marijuana businesses high fees to pass on the added cost of ensuring compliance with the FinCEN Guidance. Unlike the Cole Memo, however, the FinCEN Guidance from 2014 has not been rescinded. Despite the rescission of the Cole Memo in 2018, the Company continues to do the following towards ensuring compliance with the guidance provided by the Cole Memo, the FinCEN Guidance, and other best industry practices:

19

Controlled Substances Act Rescheduling

There have been recent developments regarding the potential for cannabis to be removed from the most restrictive schedule under the CSA. On October 6, 2022, President Joe Biden requested that the Secretary of the U.S. Department of Health and Human Services (“HHS”), Xavier Becerra, and Attorney General Merick Garland initiate a scientific review of the basis for cannabis’ scheduling under the CSA. After approximately 11 months of review, on August 29, 2023, HHS Assistant Secretary of Health, Rachel Levine, sent a letter to Drug Enforcement Administration (“DEA”) Administrator, Anne Milgram, recommending rescheduling marijuana from Schedule I to Schedule III of the CSA. The recommendation was based on a scientific and medical review by the FDA with an analysis of the eight factors determinative of control of a substance under the CSA.

As a result, the DEA can now initiate a formal rule-making process that would potentially reschedule marijuana from its current Schedule I classification. The DEA is bound by the HHS recommendation in regard to the scientific and medical matters but can ultimately make a different scheduling decision. The DEA may also account for the United States’ treaty obligations, including the United Nations Single Convention on Narcotics. The DEA will consider several factors that include: (1) marijuana’s actual or relative potential for abuse, (2) scientific evidence of its pharmacological effect, (3) the state of current scientific knowledge; (4) history and current pattern of abuse, (5) scope, duration, and significance of abuse, (6) risks to public health, (7) psychic or psychological dependence liability, and (8) whether marijuana is an immediate precursor of a substance already controlled under the CSA. The DEA has not yet started a formal rule-making process, which would require a public hearing on the record with an administrative law judge(s) making the final decision whether to adopt the new regulation. The regulation would be subject to challenges and judicial review. The DEA is not under a required timeline to initiate and complete this process and has not yet initiated the process.

On September 13, 2023, the Congressional Research Service (“CRS”) published a report stating that the DEA is “likely” to reschedule marijuana according to the HHS recommendation. According to the CRS report, this would have “broad implications for federal policy” and potentially impact state medical and recreational programs. If rescheduling occurs, various federal agencies such as the DOJ, FDA, FinCEN, and the Internal Revenue Service (“IRS”) may issue additional memoranda providing further regulatory, tax, and enforcement priority instruction as it relates to marijuana that would replace the previous guidance.

Under federal law, cannabis having a concentration of THC greater than 0.3% by dry weight volume is marijuana. The scheduling of marijuana as a Schedule I drug is inconsistent with what the Company believes to be many valuable medical uses for marijuana accepted by physicians, researchers, patients, and others. As evidence of this, the FDA on June 25, 2018 approved Epidiolex (CBD) oral solution for the treatment of seizures associated with two rare and severe forms of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome, in patients two years of age and older. This is the first FDA-approved drug that contains a purified drug substance derived from marijuana. In this case, the substance is cannabidiol, or CBD, a cannabinoid found in both hemp and marijuana, which does not contain the intoxication properties of THC, the primary psychoactive component of marijuana. The Company believes the CSA categorization as a Schedule I drug is not reflective of the medicinal properties of marijuana or the public perception thereof, and numerous studies show cannabis is not able to be abused in the same way as other Schedule I drugs, has medicinal properties, and can be safely administered. Moreover, while certain published studies show that marijuana may be less harmful than alcohol, alcohol is not classified under the CSA. This disparity may reflect the comparative stigma associated with marijuana that factors into scheduling decisions by the DEA.

The federal position is also not necessarily consistent with democratic approval of marijuana at the state government level in the United States. As of December 31, 2023, 37 states, the District of Columbia, Guam, Puerto Rico, the Northern Mariana Islands and the U.S. Virgin Islands have passed laws broadly legalizing marijuana for medicinal use by eligible patients. In the District of Columbia, the Northern Mariana Islands, Guam and 24 of these states –Alaska, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Ohio, Oregon, Rhode Island, Vermont, Virginia and Washington – marijuana is legal for adult-use regardless of medical condition, although not all of those jurisdictions have fully implemented their legalization programs.

Internal Revenue Code, Section 280E

An additional challenge to marijuana-related businesses is that the provisions of the Internal Revenue Code, Section 280E (“Section 280E”), are being applied by the IRS to businesses operating in the medical and adult-use marijuana industry. Section 280E prohibits marijuana businesses from deducting ordinary and necessary business expenses, forcing them to pay higher effective federal tax rates than similar companies in other industries. As a result of Section 280E, the Company’s effective tax rate can be highly variable and depends on how large its ratio of non-deductible expenses is to its total revenues. Therefore, businesses in the legal cannabis industry

20

may be less profitable than they would otherwise be. If rescheduling were to occur, it is anticipated that the IRS will provide additional guidance on Section 280E and its applicability to the Company’s business.

Federal Protections

Moreover, certain temporary federal legislative enactments that protect the medical marijuana industries have also been in effect for several years. For instance, certain marijuana businesses receive a measure of protection from federal prosecution by operation of temporary appropriations measures that have been enacted into law as amendments (or “riders”) to federal spending bills passed by Congress and signed by the past three presidents. For instance, in the Appropriations Act of 2015, Congress included a budget “rider” that prohibits DOJ from expending any funds to enforce any law that interferes with a state’s implementation of its own medical marijuana laws. The rider is known as the “Rohrabacher-Farr Amendment” after its original lead sponsors.

Notably, the Rohrabacher-Farr Amendment has applied only to medical marijuana programs and has not provided the same protections to enforcement against adult-use activities. While the Rohrabacher-Farr Amendment has been included in successive appropriations legislation or resolutions since 2015, its inclusion or non-inclusion is subject to political change.

There is a growing consensus among marijuana businesses and numerous congressmen and congresswomen that guidance and temporary legislation are an inappropriate way to protect cannabis businesses. Numerous bills have been introduced in Congress in recent years to decriminalize aspects of state-legal marijuana trades. This has led to a bipartisan Congressional Marijuana Working Group in Congress. In December 2022, the U.S. House of Representatives and Senate passed, and President Biden signed into law, the Medical Marijuana and Cannabidiol Research Expansion Act, which provides for significantly broader opportunities to study cannabis. Other important measures have received successful votes in congressional committees or passage in the U.S. House of Representatives. For instance, the SAFE Banking Act, which had more than 200 cosponsors and would prevent federal banking regulators from taking adverse actions against financial institutions solely due to an institution’s provision of financial services to state-legal marijuana businesses, passed the U.S. House of Representatives with strong bipartisan support in 2019 and 2021, and again passed the House as an amendment to the America COMPETES Act in 2022. However, the SAFE Banking Act has failed to pass the U.S. Senate.

The Company’s objective is to capitalize on the opportunities presented as a result of the changing regulatory environment governing the cannabis industry in the United States. Accordingly, there are a number of significant risks associated with the business of the Company. Unless and until the U.S. Congress amends the CSA with respect to medical and/or adult-use cannabis (and as to the timing or scope of any such potential amendments there can be no assurance), there is a risk that federal authorities may enforce current federal law, and the business of the Company may be deemed to be producing, cultivating, extracting, or dispensing cannabis or aiding or abetting or otherwise engaging in a conspiracy to commit such acts in violation of the CSA and other federal laws in the United States.

For these reasons, the Company’s investments in the U.S. cannabis market may subject the Company to heightened scrutiny by regulators, stock exchanges, clearing agencies and other Canadian and U.S. authorities. See section entitled “Risk Factors” herein.

State Regulatory Environment

The following sections describe the legal and regulatory landscape in the states in which the Company operates. While The Cannabist Company works to ensure that its operations comply with applicable state laws, regulations, and licensing requirements, for the reasons described above and the risks further described under the heading “Risk Factors”, there are significant risks associated with the business of the Company. Readers are strongly encouraged to carefully read and consider all of the risk factors contained under the heading “Risk Factors” below.

Except as described above and elsewhere in this Annual Report on Form 10-K, the Company is in material compliance with applicable law and has not received any citations or notices of violation which have a material impact on the Company’s licenses, business activities or operations.

ARIZONA

Arizona Regulatory Landscape