As filed with the U.S. Securities and Exchange Commission on December 9, 2021

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| China Liberal Education Holdings Limited |

| (Exact name of registrant as specified in its charter) |

| Cayman Islands |

| Not Applicable |

| (State or other jurisdiction of |

| (I.R.S. Employer Identification No.) |

Room 1618 Zhongguangcun MOOC Times Building,

18 Zhongguangcun Street, Haidian District

Beijing, People’s Republic of China 100190

(Address of Principal Executive Offices) (Zip Code)

China Liberal Education Holdings Limited 2021 Share Incentive Plan

(Full title of the plan)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name and address of agent for service)

800-221-0102

(Telephone number, including area code, of agent for service)

Copies to:

Ying Li, Esq.

Hunter Taubman Fischer & Li, LLC

800 Third Avenue, Suite 2800

New York, NY 10022

212- 530-2206

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of securities to be registered |

| Amount to be |

|

|

| Proposed |

|

| Proposed |

|

| Amount of | ||

| Ordinary shares, par value $0.001 per share |

|

| 1,500,000 | (3) |

| US$ | 1.57 |

| US$ | 2,355,000 |

| US$ | 218.31 | |

| (1) | This registration statement on Form S-8 (this “Registration Statement”) registers ordinary shares, par value of US$0.001 per share (the “ordinary shares”), of China Liberal Education Holdings Limited (the “Registrant”) issuable pursuant to the China Liberal Education Holdings Limited 2021 Share Incentive Plan (the “2021 Plan”). In accordance with Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of additional securities which may be offered and issued under the 2021 Plan to prevent dilution from stock splits, stock dividends or similar transactions as provided in the 2021 Plan. |

|

|

|

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and 457(h) under the Securities Act, based on the average of the high and low selling prices of the Registrant’s ordinary shares as reported on the Nasdaq Capital Market on December 8, 2021. |

|

|

|

| (3) | Includes 372,000 ordinary shares issuable to certain selling shareholders under the 2021 Plan and may be offered for resale by these selling shareholders. |

|

|

EXPLANATORY NOTE

This Registration Statement on Form S-8 is being filed by the Registrant pursuant to and in accordance with the requirements of General Instruction E to Form S-8 under the Securities Act in order to register 1,500,000 ordinary shares issuable pursuant to the 2021 Plan.

This Registration Statement on Form S-8 contains two parts. It registers under the Securities Act an aggregate of 1,500,000 ordinary shares, which is the estimated aggregate number of shares that are reserved for future award grants under the 2021 Plan by the end of 2021. This Registration Statement also covers the reoffer and resale by certain selling shareholders of an aggregate of 372,000 ordinary shares, which constitute “controlled securities”, as such term is defined in General Instruction C to Form S-8, to be issued under the 2021 Plan to “affiliates” of the Company, as that term is defined in Rule 405 of under the Securities Act.

This Registration Statement has been prepared and filed pursuant to and in accordance with the requirements of General Instruction E of the General Instructions to Form S-8, General Instruction C of the General Instructions to Form S-8.

|

|

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

| * | The documents containing the information specified in this Part I of Form S-8 (Plan Information and Registration Information and Employee Plan Annual Information) will be sent or given to recipients of the grants under the 2021 Plan as specified by the U.S. Securities and Exchange Commission (the “Commission”) pursuant to Rule 428(b)(1) of the Securities Act. Such documents are not required to be and are not filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant will provide a written statement to participants advising them of the availability without charge, upon written or oral request, of the documents incorporated by reference in Item 3 of Part II hereof and including the statement in the preceding sentence. The written statement to all participants will indicate the availability without charge, upon written or oral request, of other documents required to be delivered pursuant to Rule 428(b) of the Securities Act, and will include the address and telephone number to which the request is to be directed. |

|

|

REOFFER PROSPECTUS

372,000 ORDINARY SHARES

ISSUABLE UNDER THE 2021 SHARE INCENTIVE PLAN

CHINA LIBERAL EDUCATION HOLDINGS LIMITED

This prospectus relates to 372,000 ordinary shares, par value US$0.001 per share of the Company (the “ordinary shares”), which may be offered from time to time by the selling shareholders of the Company named herein (the “Selling Shareholders”, each a “Selling Shareholder”), for such Selling Shareholders’ own account. We will not receive any proceeds from any sale of ordinary shares offered pursuant to this prospectus.

The Selling Shareholders may offer and sell the ordinary shares at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. The ordinary shares may be sold at the market price of the ordinary shares at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of shares. The ordinary shares may be sold through underwriters or dealers that the Selling Shareholders may select. If underwriters or dealers are used to sell the ordinary shares, we will name them and describe their compensation in a prospectus supplement. For a description of the various methods by which the Selling Shareholders may offer and sell the ordinary shares described in this prospectus, see the section entitled “Plan of Distribution.”

We face legal and operational risks associated with having a substantial majority of our operations in China. The PRC government has significant authority to exert influence on the ability of a China-based company, such as us, to conduct its business. Therefore, investors of our Company and our business face potential uncertainty from the PRC government. Changes in China’s economic, political or social conditions or government policies could materially adversely affect our business and results of operations. These risks could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. In particular, recent statements and regulatory actions by China’s government, such as those related to the use of variable interest entities and data security or anti-monopoly concerns, as well as the PCAOB’s ability to inspect our auditors, may impact our Company’s ability to conduct our business, accept foreign investments, or continue being listed on a U.S. or other foreign stock exchange. For details, see “Risk Factors — Risks Related to Doing Business in China.”

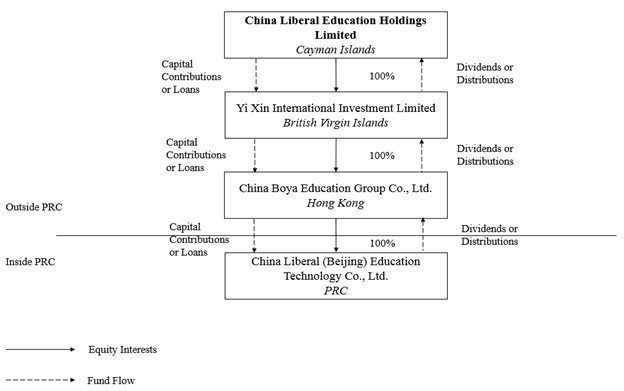

We are an offshore holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, our operations are conducted in China through our wholly owned PRC subsidiaries, China Liberal Beijing and Fujian China Liberal. We directly hold 100% of the equity interests in our subsidiaries, and we do not currently use a variable interest entity (“VIE”) structure. Our ordinary shares are the shares of the offshore holding company in the Cayman Islands, instead of shares of our operating companies in China. Therefore, you will not directly hold any equity interests in our operating companies.

Our ordinary shares are currently listed on the Nasdaq Capital Market under the symbol “CLEU.” On December 8, 2021, the closing price for the ordinary shares on the Nasdaq Capital Market was US$1.56 per ordinary share.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities described herein or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 9, 2021.

|

|

TABLE OF CONTENTS

|

|

| Page |

|

| PART I | |||

|

|

|

|

|

|

| ii |

| |

|

|

|

|

|

|

| 1 |

| |

|

|

|

|

|

|

| 2 |

| |

|

|

|

|

|

|

| 7 |

| |

|

|

|

|

|

|

| 8 |

| |

|

|

|

|

|

|

| 9 |

| |

|

|

|

|

|

|

| 10 |

| |

|

|

|

|

|

|

| 11 |

| |

|

|

|

|

|

|

| 11 |

| |

|

|

|

|

|

|

| 11 |

| |

|

|

|

|

|

|

|

|

|

|

|

| II-1 |

| |

|

|

|

|

|

|

| II-5 |

| |

|

|

|

|

|

|

| II-6 |

| |

| i |

This prospectus contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical fact in this prospectus are forward-looking statements. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words and phrases such as “may,” “should,” “intend,” “predict,” “potential,” “continue,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “believe,” “is /are likely to” or the negative form of these words and phrases or other comparable expressions. The forward-looking statements included in this prospectus relate to, among other things:

|

| · | our mission, goals and strategies; |

|

| · | the impact of COVID-19 on our operations; |

|

| · | our future business development, financial conditions and results of operations; |

|

| · | the expected growth of the PRC study abroad consulting and training services industry in China; |

|

| · | our expectations regarding demand for and market acceptance of our services; |

|

| · | our expectations regarding our relationships with our clients and partners; |

|

| · | competition in our industry; |

|

| · | our proposed use of proceeds; and |

|

| · | relevant government policies and regulations relating to our industry. |

These forward-looking statements involve various risks, assumptions and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from or worse than our expectations. You should read this prospectus and the documents that we refer to in this prospectus with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this prospectus include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

| ii |

Unless otherwise indicated or the context requires otherwise, references in this reoffer prospectus to:

|

| · | “Affiliated Entities” are to our subsidiaries; | |

|

| · | “Boya Hong Kong” are to China Boya Education Group Co., Limited, a Hong Kong limited liability company; | |

|

| · | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan and the special administrative regions of Hong Kong and Macau for the purposes of this annual report only; | |

|

| · | “China Liberal” are to China Liberal Education Holdings Limited, a Cayman Islands exempted company with limited liability; | |

|

| · | “China Liberal Beijing” are to China Liberal (Beijing) Education Technology Co., Ltd., a PRC limited liability company and our operating subsidiary; | |

|

| · | “Company,” “the Group”, “we”, “our” and “us” are to one or more of China Liberal Education Holdings Limited, and its Affiliated Entities, as the case may be; | |

|

| · | “EAP” are to Australia English for Academic Purposes, which prepares international students for vocational or tertiary-level study in Australia and other contexts where English is the language of instruction, and it aims to develop student awareness, knowledge and skills in the use of English as the language of teaching and learning in a vocational and/or university environment; | |

|

| · | “FMP” are to Fuzhou Melbourne Polytechnic; | |

|

| · | “FPEC” are to Fujian Preschool Education College; | |

|

| · | “FUT” are to Fujian University of Technology; | |

|

| · | “IELTS” are to International English Language Testing System, an international standardized test of English language proficiency for non-native English language speakers, and accepted by most Australian, British, Canadian and New Zealand academic institutions; | |

|

| · | “IGEC” are to International General Education Courses, a Sino-foreign joint education program developed and introduced by the Chinese Service Center for Scholarly Exchange, a public organization under the Ministry of Education of the PRC, in order to improve the overall reform and internationalization of PRC’s higher education; | |

|

| · | “ISEC” are to International Scholarly Exchange Curriculum, a PRC government sponsored and highly profiled program affiliated with the China Scholarship Council directly under the Ministry of Education in the PRC; | |

|

| · | “NZTC” are to New Zealand Tertiary College; | |

|

| · | “RMB” and “Renminbi” are to the legal currency of China; | |

|

| · | “shares,” “Shares,” or “ordinary shares” are to the ordinary shares of the Company, par value US$0.001 per share; | |

|

| · | “Sino-foreign Jointly Managed Academic Programs” are to education programs offered by joint ventures of the PRC and foreign institutions; | |

|

| · | “TOEFL” are to Test of English as Foreign Language, an international standardized test of English language proficiency for non-native English language speakers, and commonly accepted by American academic institutions; | |

|

| · | “US$,” “dollars” or “U.S. dollars” are to the legal currency of the United States; and | |

|

| · | “Yi Xin BVI” are to Yi Xin International Investment Limited, a company incorporated in the British Virgin Islands. | |

| 1 |

Overview

We face legal and operational risks associated with having a substantial majority of our operations in China. The PRC government has significant authority to exert influence on the ability of a China-based company, such as us, to conduct its business. Therefore, investors of our Company and our business face potential uncertainty from the PRC government. Changes in China’s economic, political or social conditions or government policies could materially adversely affect our business and results of operations. These risks could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. In particular, recent statements and regulatory actions by China’s government, such as those related to the use of variable interest entities and data security or anti-monopoly concerns, as well as the PCAOB’s ability to inspect our auditors, may impact our Company’s ability to conduct our business, accept foreign investments, or continue being listed on a U.S. or other foreign stock exchange. For details, see “Risk Factors — Risks Related to Doing Business in China.”

We are an offshore holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, our operations are conducted in China through our wholly owned PRC subsidiaries, China Liberal Beijing and Fujian China Liberal. We directly hold 100% of the equity interests in our subsidiaries, and we do not currently use a VIE structure. Our ordinary shares are the shares of the offshore holding company in the Cayman Islands, instead of shares of our operating companies in China. Therefore, you will not directly hold any equity interests in our operating companies.

China Liberal Beijing is required to obtain, and has obtained, its business license for its operations in China. The business operations of China Liberal Beijing are within the scope of its business license. Currently, we and our subsidiaries are not required to obtain any other material license or approval for our operations in China.

We believe that we and our subsidiaries have obtained all material licenses and approvals necessary to operate in China and are not required to obtain approval from any PRC government authorities, including the China Securities Regulatory Commission, or the CSRC, Cyberspace Administration of China, or the CAC, or any other government entity, to issue ordinary shares to foreign investors. However, the relevant PRC government agencies could reach a different conclusion.

Restrictions on Foreign Exchange and the Ability to Transfer Cash Between Entities, Across Borders and to U.S. Investors

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our income is received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders.

Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, our PRC subsidiaries can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries are restricted to transfer a portion of their net assets to us either in the form of dividends, loans or advances. Even though we currently does not require any such dividends, loans or advances from the PRC subsidiaries for working capital and other funding purposes, we may in the future require additional cash resources from our PRC subsidiaries due to changes in business conditions or to fund future acquisitions and developments.

| 2 |

Cash Transfers Through Our Organization

As of the date of this prospectus, there has been no actual cash flow or transfer of other assets between China Liberal Education Holdings Limited, our holding company, and its subsidiaries. As of the date of this prospectus, we have not declared any dividends or made any distributions to our shareholders.

The following diagram illustrates the manner of cash flows in a hypothetical scenario within our Group:

Our Business

We are an exempted company with limited liability incorporated in the Cayman Islands on February 25, 2019. Through our operating company, China Liberal Beijing, incorporated in the PRC on August 10, 2011, we are an educational service provider operating under the “China Liberal” brand in the PRC. Our mission is to provide China’s students with the tools to excel in a global environment. We strive to meet the needs of the ever growing number of young talents in China.

| 3 |

We provide a wide variety of educational services and products intended to address the needs of our partnering schools and our students:

|

| · | Services provided under Sino-foreign jointly managed academic programs (“Sino-foreign Jointly Managed Academic Programs”), which services represent the core of our business; |

|

|

|

|

|

| · | Sales of textbooks and course materials; |

|

|

|

|

|

| · | Overseas study consulting services (“Overseas Study Consulting Services”); |

|

|

|

|

|

| · | Technological consulting services provided to targeted Chinese universities to improve campus information and data management systems and optimize teaching, operating and management environment, creating a “smart campus”; these consulting services include campus intranet solution buildout, school management software customization, smart devices (mainly Internet of things, or IoT devices, extending the Internet connectivity to physical devices) installation and testing, and school management data collection and analysis, all of which can be specifically tailored to meet a client’s particular needs (“Technological Consulting Services for Smart Campus Solutions”); and |

|

|

|

|

|

| · | Tailored job readiness training to graduating students (“Integration of Enterprises and Vocational Education”), acting as the key bridge between our partner schools and employers. |

In December 2020, we launched our proprietary AI-Space, an all-in-one machine designed to provide highly integrated visualization solutions in classrooms and other professional settings.

We started generating revenue in the year ended December 31, 2012 through our services provided under certain Sino-foreign Jointly Managed Academic Programs. We continued to maintain and expand this core business throughout the years, giving us revenues of $2,410,781, $2,484,194 and $2,772,679 for the years ended December 31, 2018, 2019 and 2020, respectively, representing 50.1%, 47.3% and 55.2% of our net revenues for those respective periods. Our revenues generated under Sino-foreign Jointly Managed Academic Programs increased from $1,264,823 for the six months ended June 30, 2020 to $1,420,418 for the six months ended June 30, 2021. A vast majority of these revenues derives from our two major partners, Fuzhou Melbourne Polytechnic, or FMP and Minjiang University.

Additionally, since starting our Overseas Study Consulting Services in 2017, this line of business has been a source of revenue. We generated $547,521, $525,878, $129,485, and $26,033 in revenues from our Overseas Study Consulting Services for the years ended December 31, 2018, 2019 and 2020 and the six months ended June 30, 2021, respectively, representing 11.4%, 10.0%, 2.6% and 1.4% of our total revenue of those respective periods. We also started generating revenues from our Technological Consulting Services for Smart Campus Solutions business in 2017, with revenues of $1,820,974, $2,232,588, $1,995,559 and $338,003, representing 37.9%, 42.4%, 39.7% and 18.3% of our net revenues for the years ended December 31, 2018, 2019 and 2020 and the six months ended June 30, 2021, respectively. Our Integration of Enterprises and Vocational Education business (tailored job readiness training services) only started generating revenue in second half of 2019. In 2019, we generated de minimis revenue from this business line due to limited students enrolled for our services. For the fiscal year ended December 31, 2020 and the six months ended June 30, 2021, we generated revenue of $76,400 and $66,097 from this business line, respectively, representing 1.5% and 3.6% of our net revenues in respective periods.

We started our operations in Beijing where our headquarters are located. We established our first branch in Fujian Province in 2011 and currently have branches in Fuzhou and Beijing, China.

Corporate Information

Our principal executive office is located at Room 1618, Zhongguangcun MOOC Times Building, 18 Zhongguangcun Street, Haidian District, Beijing, PRC. Our telephone at this address is +86-10-6597-8118. Our registered office in the Cayman Islands is located at the Office of Campbells Corporate Services Limited, Floor 4, Willow House, Cricket Square George Town Grand Cayman KY1, 9010,, Cayman Islands. We maintain a corporate website at http://www.chinaliberal.com. The information contained on our website is not part of this prospectus.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, after the date of this prospectus or to reflect the occurrence of unanticipated events, except as otherwise required by the U.S. federal securities laws.

| 4 |

Summary of Risk Factors

Investing in our ordinary shares involves significant risks. You should carefully consider all of the information in this reoffer prospectus before making an investment in our ordinary shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully under “Item 3. Key Information—D. Risk Factors” in our most recent annual report on Form 20-F, as amended, and in the section titled “Risk Factors” below.

Risks Related to Our Business

|

| · | We partner with a limited number of Chinese host universities for certain Sino-foreign Jointly Managed Academic Programs and our revenues are highly concentrated from a limited number of major partners. If we are not able to continue to secure agreements with some or all of our existing partners, or secure new agreements with additional partners, our results of operations and financial condition may be materially and adversely affected. |

|

|

|

|

|

| · | The services we provide under the Sino-foreign Jointly Managed Academic Programs may be subject to regulatory and policy changes, as well as the continuous approval of and supervision by relevant PRC authorities. |

|

|

|

|

|

| · | Our partnering schools have the ability to withhold our portion of tuition payments in certain circumstances, and to the extent that our portion is withheld, our revenue, results of operations and financial condition may be materially and adversely affected. |

|

|

|

|

|

| · | We rely heavily on the continuous reputation of our partnering schools in order to attract and maintain a significant number of students enrolled in our courses offered in these schools. |

|

|

|

|

|

| · | If one or more of the Sino-foreign Jointly Managed Academic Programs were to lose their Sino-foreign program permits, our results of operations and financial condition may suffer substantially. |

|

|

|

|

|

| · | Changes to immigration policies in the countries our students plan to attend schools in may negatively affect our results of operations and financial condition. |

|

|

|

|

|

| · | If we and our partnering schools fail to increase student enrollments, our net revenues may decline, and we may not be able to maintain growth. |

|

|

|

|

|

| · | If we fail to implement and maintain an effective system of internal controls, we may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our ordinary shares may be materially and adversely affected. |

Risks Related to Our Corporate Structure

|

| · | In the event we are presented with business combination opportunities, we may be unable to complete such transactions efficiently or on favorable terms due to complicated merger and acquisition regulations and certain other PRC regulations. |

|

|

|

|

|

| · | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

| 5 |

Risks Related to Doing Business in China

|

| · | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, and it is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. For details, see “Risk Factors— Risks Related to Doing Business in China—Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.” |

|

|

|

|

|

| · | Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our ordinary shares. For details, see “Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system could adversely affect us.” |

|

|

|

|

|

| · | PRC government has significant authority in regulating our operations and its oversight and control over securities offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. For details, see “Risk Factors— Risks Related to Doing Business in China—The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our ordinary shares.” |

|

|

|

|

|

| · | We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to conduct our business. |

|

|

|

|

|

| · | If we are classified as a PRC resident enterprise for PRC enterprise income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. |

Risks Related to the Trading Market

|

| · | The trading price of our ordinary shares is likely to be volatile, which could result in substantial losses to investors. |

|

|

|

|

|

| · | Because we do not expect to pay dividends in the foreseeable future, you must rely on a price appreciation of our ordinary shares for a return on your investment. |

|

|

|

|

|

| · | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| 6 |

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described in this prospectus and the documents incorporated herein by reference, including the risks described under the headings “Item 3. Key Information—3.D. Risk Factors” in the documents incorporated herein by reference, including in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, as amended, and any risk factors set forth under the heading “Risk Factors” in our Registration Statement on Form F-1 filed with the SEC on July 24, 2020, as amended, and in our other filings that we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including our Annual Reports on Form 20-F and Reports of Foreign Private Issuer on Form 6-K, as well as other information we include or incorporate by reference. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment.

| 7 |

The proceeds from the sale of the ordinary shares offered pursuant to this prospectus are solely for the account of the Selling Shareholders. We will not receive any of the proceeds from any sale of ordinary shares by the Selling Shareholders.

| 8 |

This prospectus covers the public resale of our ordinary shares to be issued to the Selling Shareholders referred to below. Such Selling Shareholders may from time to time offer and sell pursuant to this prospectus any or all of the ordinary shares owned by them. The Selling Shareholders, however, make no representations that the ordinary shares will be offered for sale. The table below presents information regarding the Selling Shareholders and the ordinary shares that each may offer and sell from time to time under this prospectus.

The ordinary shares being registered by this prospectus consist of 372,000 ordinary shares to be issued to the Selling Shareholders under the 2021 Plan in connection with their service with the Company.

We are registering these ordinary shares to permit the Selling Shareholders to resell these ordinary shares when they deem appropriate. The Selling Shareholders may resell all, a portion, or none of the ordinary shares, at any time and from time to time. The Selling Shareholders may also sell, transfer or otherwise dispose of some or all of the ordinary shares in transactions exempt from the registration requirements of the Securities Act, as amended. We do not know when or in what amounts the Selling Shareholders may offer the ordinary shares for sale under this prospectus.

The following table sets forth: (i) the name of each Selling Shareholder and (ii) the number of ordinary shares that may be offered for resale for the account of the Selling Shareholder under this prospectus.

| Selling Shareholder |

| Shares Beneficially Owned (1) |

|

| Percentage of Ordinary Shares Beneficially Owned |

|

| Number of |

|

| Beneficially Owned After |

|

| Percentage of Ordinary Shares Beneficially Owned After |

| |||||

| Jianxin Zhang |

|

| — |

|

|

| — |

|

|

| 300,000 |

|

|

| — |

|

|

| — |

|

| Joseph Levinson |

|

| * |

|

|

| * |

|

|

| 42,000 |

|

|

| * |

|

|

| * |

|

| Nan Hu |

|

| — |

|

|

| — |

|

|

| 30,000 |

|

|

| — |

|

|

| — |

|

| * | Indicates less than 1%. |

|

|

|

| (1) | As used in this table, a beneficial owner of a security includes any person who, directly or indirectly, through contract, arrangement, understanding or otherwise has or shares (i) the power to vote or direct the voting of such security or (ii) investment power, which includes the power to dispose or to direct the disposition of such security. In addition, a person is deemed to be the beneficial owner of a security, if that person has the right to acquire beneficial ownership of such security within 60 days. Without limiting the generality of the foregoing, includes shares originally issued to the above named person and held as of December 9, 2021, pursuant to trust and other estate and retirement planning arrangements in favor of other third parties that may be deemed the beneficial owner thereof. |

|

|

|

| (2) | Includes ordinary shares to be issued to each Selling Shareholder under the 2021 Plan. |

|

|

|

| (3) | Calculated with reference to 12,348,333 ordinary shares issued and outstanding as of December 9, 2021 and assumes for each Selling Shareholder the resale of all shares offered by that particular Selling Shareholder under this reoffer prospectus. |

The Company may supplement this reoffer prospectus from time to time as required by the rules of the SEC to include certain information concerning the security ownership of the Selling Shareholders or any new Selling Shareholders, the number of securities offered for resale and the position, office, or other material relationship which a Selling Shareholder has had within the past three years with the Company or any of its predecessors or affiliates.

| 9 |

The purpose of this reoffer prospectus is to allow the Selling Shareholders to offer for sale and sell all or a portion of their shares acquired in connection with the provision of services to the Company. The Selling Shareholders may sell the ordinary shares registered pursuant to this reoffer prospectus directly to purchasers or through broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling shareholders or the purchasers. These commissions as to any particular broker-dealer or agent may be in excess of those customary in the types of transactions involved. Neither we nor the selling shareholders can presently estimate the amount of this compensation.

The ordinary shares offered under this reoffer prospectus may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market prices, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve block transactions, on any national securities exchange on which the Company’s ordinary shares may be then-listed.

The aggregate proceeds to the Selling Shareholders from the sale of the ordinary shares will be the purchase price of the ordinary shares less discounts and commissions, if any. The Selling Shareholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of the ordinary shares to be made directly or through agents. We will not receive any of the proceeds from a sale of the ordinary shares by the Selling Shareholders.

The Selling Shareholders and any broker-dealers or agents that participate in the sale of the ordinary shares may be deemed to be “underwriters” under the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the ordinary shares may be underwriting discounts and commissions under the Securities Act. If a selling shareholder is an “underwriter” under the Securities Act, the selling shareholder will be subject to the prospectus delivery requirements of the Securities Act.

For so long as the Company does not meet the requirements for registering securities on Form F-3, the ordinary shares to be offered or resold by means of this reoffer prospectus by the Selling Shareholders may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act. In addition, any securities covered by this reoffer prospectus which qualify for sale pursuant to Rule 144 of the Securities Act may be sold under Rule 144 of the Securities Act rather than pursuant to this reoffer prospectus.

There can be no assurance that the selling shareholders will sell any or all of the securities offered by them hereby.

| 10 |

The validity of the ordinary shares to be offered by this prospectus and certain legal matters as to Cayman Islands law have been passed upon by Ogier.

The consolidated financial statements of China Liberal Education Holdings as of and for the year ended December 31, 2020 incorporated in this prospectus by reference to the Annual Report on Form 20-F for the year ended December 31, 2020, as amended, have been so incorporated in reliance on the report of Friedman LLP, an independent registered public accounting firm, given the authority of said firm as experts in auditing and accounting.

The business address of Friedman LLP is located at One Liberty Plaza, 165 Broadway, Floor 21, New York, NY 10006.

WHERE YOU CAN FIND MORE INFORMATION

We file annual reports and other information with the Commission under the Exchange Act. Our Commission filings, including the complete registration statement of which this prospectus is a part, are available to the public from commercial document retrieval services and also available at the Internet website maintained by the Commission at www.sec.gov.

| 11 |

372,000 Ordinary Shares

China Liberal Education Holdings Limited

REOFFER PROSPECTUS

December 9, 2021

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Registrant is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and, accordingly, files periodic reports and other information with the Commission. Reports and other information concerning the Registrant filed with the Commission may be inspected and copies may be obtained (at prescribed rates) at the Commission’s Public Reference Section, Room 1024, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The Commission also maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the Commission, including the Registrant. The address for the Commission’s website is “http://www.sec.gov.” The following documents are incorporated by reference in this Registration Statement:

(a) The Registrant’s Annual Report on Form 20-F (File No. 001-39259) for the fiscal year ended December 31, 2020 filed with the Commission on April 30, 2021 and amended on November 15, 2021.

(b) The Registrant’s Current Reports on Form 6-K furnished to the Commission on July 23, 2021, August 17, 2021, September 21, 2021, October 21, 2021 and December 3, 2021, respectively; and

(c) The description of the Registrant’s ordinary shares incorporated by reference in the Registrant’s registration statement on Form 8-A, filed with the SEC on March 31, 2020, and any amendment or report filed for the purpose of updating such description.

Except to the extent such information is deemed furnished and not filed pursuant to securities laws and regulations, all documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act and, to the extent specifically designated therein, reports on Form 6-K furnished by the Registrant to the Commission, in each case, prior to the filing of a post-effective amendment to this Registration Statement indicating that all securities offered under this Registration Statement have been sold, or deregistering all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing or furnishing of such documents.

Any statement contained herein or in a document all or a portion of which is incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

None.

| II-1 |

Item 6. Indemnification of Directors and Officers.

Cayman Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. The Registrant’s amended and restated memorandum and articles of association provide, to the extent permitted by law, that the Registrant shall indemnify each existing or former secretary, director (including alternate director), and any other officers of the Registrant and their personal representatives against all actions, proceedings, costs, charges, expenses, losses, damages, liabilities, judgments, fines, settlements and other amounts incurred or sustained by such secretary, director or officer in or about the conduct of the Registrant's business or affairs (including as a result of any mistake of judgment) or in the execution or discharge of such secretary's, director's, or officer's duties, powers, authorities, or discretions, together with all costs, expenses, losses, or liabilities incurred by such secretary, director, or officer in defending or investigating (whether successfully or otherwise) any civil, criminal, administrative, or investigative proceedings concerning or in any way related to the Registrant or its affairs in any court whether in the Cayman Islands or elsewhere. The Registrant’s amended and restated memorandum and articles of association also provide that no such secretary, director, or officer shall be indemnified in respect of any matter arising out of such person’s own dishonesty.

Pursuant to the indemnification agreements with Mr. Wandong Chen and Ms. Xinyu Deng, directors of the Registrant, the form of which is filed as Exhibit 10.2 to the Registrant’s Registration Statement on Form F-1/A, as amended (file No. 333-233016), the Registrant has agreed to indemnify them against certain liabilities and expenses that they incur in connection with claims made by reason of their being such a director or officer of the Registrant.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

See the Index to Exhibits attached hereto.

| II-2 |

Item 9. Undertakings.

| (a) | The undersigned registrant hereby undertakes: |

|

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

|

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

|

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement. |

|

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement. |

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b).

|

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

|

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

|

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

|

| (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

|

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

| II-3 |

|

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

|

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

|

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

|

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

|

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

| II-4 |

| Exhibit |

| Description |

|

| ||

|

| ||

|

| ||

|

| ||

|

| China Liberal Education Holdings Limited 2021 Share Incentive Plan | |

|

| ||

|

| ||

|

|

___________

| * | Filed herewith. |

| II-5 |

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Beijing, China, on December 9, 2021.

|

| China Liberal Education Holdings Limited |

| |

|

|

|

|

|

|

| By: | /s/ Ngai Ngai Lam |

|

|

|

| Ngai Ngai Lam Chief Executive Officer, Chairperson of the Board of Directors (Principal Executive Officer) |

|

Each person whose signature appears below hereby appoints Ngai Ngai Lam and Wenhuai Zhuang, and each of them severally, acting alone and without the other, his or her true and lawful attorney-in-fact with full power of substitution or re-substitution, for such person and in such person’s name, place and stead, in any and all capacities, to sign on such person’s behalf, individually and in each capacity stated below, any and all amendments, including post-effective amendments to this Registration Statement, and to sign any and all additional registration statements relating to the same offering of securities of the Registration Statement that are filed pursuant to Rule 462 of the Securities Act of 1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

| Title |

| Date |

|

|

|

|

|

|

| /s/ Ngai Ngai Lam |

| Chief Executive Officer and Chairperson of the Board of Directors |

| December 9, 2021 |

| Name: Ngai Ngai Lam |

| (Principal Executive Officer) |

| |

|

|

|

|

| |

| /s/ Wenhuai Zhuang |

| Chief Financial Officer |

| December 9, 2021 |

| Name: Wenhuai Zhuang |

| (Principal Accounting and Financial officer) |

|

|

|

|

|

|

| |

| /s/ Nan Hu |

| Director |

| December 9, 2021 |

| Name: Nan Hu |

|

|

| |

|

|

|

|

| |

| /s/ Ngo Yin Tsang |

| Director |

| December 9, 2021 |

| Name: Ngo Yin Tsang |

|

|

| |

|

|

|

|

| |

| /s/ Xinyu Deng |

| Director |

| December 9, 2021 |

| Name: Xinyu Deng |

|

|

| |

|

|

|

|

| |

| /s/ Wandong Chen |

| Director |

| December 9, 2021 |

| Name: Wandong Chen |

|

|

|

| II-6 |

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities Act of 1933 as amended, the undersigned, the duly authorized representative in the United States of America of China Liberal Education Holdings Limited, has signed this registration statement thereto in New York, NY on December 9, 2021.

|

| Cogency Global Inc. Authorized U.S. Representative |

| |

|

|

|

|

|

|

| By: | /s/ Colleen A. De Vries |

|

|

| Name: | Colleen A. De Vries |

|

|

| Title: | Senior Vice President on behalf of Cogency Global Inc. |

|

| II-7 |