|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

||

|

|

|

|

|

Large accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company

|

|

Emerging growth company

|

|

3

|

|||

|

Item 1.

|

3

|

||

|

Item 1A.

|

17 | ||

|

Item 1B.

|

47 | ||

|

Item 2.

|

47 | ||

|

Item 3.

|

48 | ||

|

Item 4.

|

48 | ||

| 49 | |||

|

Item 5.

|

49 | ||

|

Item 6.

|

50 | ||

|

Item 7.

|

50 | ||

|

Item 7A.

|

74 | ||

|

Item 8.

|

75

|

||

|

Item 9.

|

108 | ||

|

Item 9A.

|

108 | ||

|

Item 9B.

|

109 | ||

| 110 | |||

|

Item 10.

|

110 | ||

|

Item 11.

|

110 | ||

|

Item 12.

|

110 | ||

|

Item 13.

|

110 | ||

|

Item 14.

|

110 | ||

| 111 | |||

|

Item 15.

|

111 | ||

|

Item 16.

|

115 | ||

| • |

the impact of the novel coronavirus (“COVID-19”) on our business and results of operations;

|

| • |

general economic conditions, including changes in employment levels, consumer demand, preferences and confidence levels, fuel prices, levels of discretionary income, consumer spending patterns and uncertainty regarding the timing,

pace and extent of an economic recovery in the United States;

|

| • |

economic conditions in certain geographic regions in which we primarily generate our revenue;

|

| • |

credit markets and the availability and cost of borrowed funds;

|

| • |

our business strategy, including acquisitions and same-store growth;

|

| • |

our ability to integrate acquired dealer groups;

|

| • |

our ability to maintain our relationships with manufacturers, including meeting the requirements of our dealer agreements and receiving the benefits of certain manufacturer incentives;

|

| • |

our ability to finance working capital and capital expenditures;

|

| • |

general domestic and international political and regulatory conditions, including changes in tax or fiscal policy and the effects of current restrictions on various commercial and economic activities in response to the COVID-19

pandemic;

|

| • |

global public health concerns, including the COVID-19 pandemic;

|

| • |

demand for our products and our ability to maintain acceptable pricing for our products and services, including financing, insurance and extended service contracts;

|

| • |

our operating cash flows, the availability of capital and our liquidity;

|

| • |

our future revenue, same-store sales, income, financial condition, and operating performance;

|

| • |

our ability to sustain and improve our utilization, revenue and margins;

|

| • |

competition;

|

| • |

seasonality and inclement weather such as hurricanes, severe storms, fire and floods, generally and in certain geographic regions in which we primarily generate our revenue;

|

| • |

effects of industry-wide supply chain challenged and our ability to manage our inventory;

|

| • |

our ability to retain key personnel;

|

| • |

environmental conditions and real or perceived human health or safety risks;

|

| • |

any potential tax savings we may realize as a result of our organizational structure;

|

| • |

uncertainty regarding our future operating results and profitability;

|

| • |

other risks associated with the COVID-19 pandemic including, among others, the ability to safely operate our stores, access to inventory and customer demand; and

|

| • |

plans, objectives, expectations and intentions contained in this Form 10-K that are not historical.

|

| Item 1. |

Business.

|

|

State

|

Number of

Stores

|

Percent of

2020 Revenue

|

||||||

|

Florida

|

30

|

49.4

|

%

|

|||||

|

Texas

|

8

|

14.3

|

||||||

|

Alabama

|

8

|

8.8

|

||||||

|

Georgia

|

8

|

8.6

|

||||||

|

Ohio

|

3

|

5.5

|

||||||

|

Massachusetts

|

2

|

5.4

|

||||||

|

South Carolina

|

4

|

3.9

|

||||||

|

Maryland

|

2

|

2.4

|

||||||

|

Kentucky

|

2

|

0.9

|

||||||

|

North Carolina

|

1

|

0.5

|

||||||

|

New Jersey

|

2

|

0.3

|

||||||

|

Total

|

70

|

100.0

|

%

|

|||||

| • |

the Clean Air Act (“CAA”), which restricts the emission of air pollutants from many sources, including outboard marine engines, and imposes various pre-construction, operational, monitoring, and reporting requirements, and that the

EPA has relied upon as authority for adopting climate change regulatory initiatives relating to greenhouse gas (“GHG”) emissions;

|

| • |

the Federal Water Pollution Control Act (the “Clean Water Act”), which regulates discharges of pollutants from facilities to state and federal waters and establishes the extent to which waterways are subject to federal jurisdiction

and rulemaking as protected waters of the United States;

|

| • |

the Oil Pollution Act (“OPA”), which subjects owners and operators of vessels, onshore facilities, and pipelines, as well as lessees or permittees of areas in which offshore facilities are located, to liability for removal costs and

damages arising from an oil spill in waters of the United States;

|

| • |

the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), which imposes liability on generators, transporters, disposers and arrangers of hazardous substances at sites where hazardous substance releases

have occurred or are threatening to occur;

|

| • |

the Resource Conservation and Recovery Act (“RCRA”), which governs the generation, treatment, storage, transport, and disposal of solid wastes, including hazardous wastes;

|

| • |

the Emergency Planning and Community Right-to-Know Act, which requires facilities to implement a safety hazard communication program and disseminate information to employees, local emergency planning committees, and fire departments

on toxic chemical uses and inventories; and

|

| • |

the Occupational Safety and Health Act, which establishes workplace standards for the protection of the health and safety of employees, including the implementation of hazard communications programs designed to inform employees about

hazardous substances in the workplace, potential harmful effects of these substances, and appropriate control measures.

|

|

Name

|

Position

|

|

P. Austin Singleton

|

Founder, Chief Executive Officer and Director

|

|

Anthony Aisquith

|

President, Chief Operating Officer and Director

|

|

Jack Ezzell

|

Chief Financial Officer and Secretary

|

|

Mitchell W. Legler

|

Director and Chairman of the Board of Directors

|

|

Bari A. Harlam

|

Director

|

|

Christopher W. Bodine

|

Director

|

|

Jeffery B. Lamkin

|

Director

|

|

John F. Schraudenbach

|

Director

|

|

John G. Troiano

|

Director

|

|

Keith R. Style

|

Director

|

| Item 1A. |

Risk Factors.

|

| • |

General economic conditions and consumer spending patterns can have a material adverse effect on our business, financial condition and results of operations.

|

| • |

The ongoing COVID-19 pandemic may adversely affect our revenues, results of operations and financial condition.

|

| • |

The availability and costs of borrowed funds can adversely affect our ability to obtain adequate boat inventory, the ability and willingness of our customers to finance boat purchases and our ability to

fund future acquisitions.

|

| • |

Failure to implement strategies to enhance our performance could have a material adverse effect on our business and financial condition.

|

| • |

Our success depends, in part, on our ability to continue to make successful acquisitions at attractive or fair prices and to integrate the operations of acquired dealer groups and each dealer group we

acquire in the future.

|

| • |

We are required to obtain the consent of our manufacturers prior to the acquisition of other dealer groups.

|

| • |

Our failure to successfully order and manage our inventory to reflect consumer demand and to anticipate changing consumer preferences and buying trends could have a material adverse effect on our business,

financial condition and results of operations.

|

| • |

OneWater Inc. is a holding company. OneWater Inc.’s only material asset is its equity interest in OneWater LLC, and OneWater Inc. will accordingly be dependent upon distributions from OneWater LLC to pay

taxes, make payments under the Tax Receivable Agreement (as defined below) and cover OneWater Inc.’s corporate and other overhead expenses.

|

| • |

If we experience any material weaknesses in the future or otherwise fail to develop or maintain an effective system of internal controls in the future, we may not be able to accurately report our financial

condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our Class A common stock.

|

| • |

The Legacy Owners own a significant amount of our voting stock, and their interests may conflict with those of our other stockholders.

|

| • |

In certain cases, payments under the Tax Receivable Agreement may be accelerated and/or significantly exceed the actual benefits, if any, OneWater Inc. realizes in respect of the tax attributes subject to

the Tax Receivable Agreement.

|

| • |

the termination or nonrenewal of the dealer agreement;

|

| • |

the imposition of additional conditions in subsequent dealer agreements;

|

| • |

limitations on boat inventory allocations;

|

| • |

reductions in reimbursement rates for warranty work performed by the dealer;

|

| • |

loss of certain manufacturer-to-dealer incentives;

|

| • |

denial of approval of future acquisitions; or

|

| • |

the loss of exclusive rights to sell in the geographic territory.

|

| • |

the availability of suitable acquisition candidates at attractive purchase prices;

|

| • |

the ability to compete effectively for available acquisition opportunities;

|

| • |

the availability of cash on hand, borrowed funds, common stock with a sufficient market price or other sources of financing to complete the acquisitions;

|

| • |

the ability to obtain any requisite manufacturer, governmental or other required approvals;

|

| • |

the ability to obtain approval of our lenders under our current credit agreements; and

|

| • |

the absence of one or more manufacturers attempting to impose unsatisfactory restrictions on us in connection with their approval of acquisitions.

|

| • |

our ability to identify new markets in which we can obtain distribution rights to sell our existing or additional product lines;

|

| • |

our ability to lease or construct suitable facilities at a reasonable cost in existing or new markets;

|

| • |

our ability to hire, train and retain qualified personnel;

|

| • |

the timely and effective integration of new stores into existing operations;

|

| • |

our ability to achieve adequate market penetration at favorable operating margins without the acquisition of existing dealer groups; and

|

| • |

our financial resources.

|

| • |

adversely affect the interest rates paid, and the expenses associated with, our obligations, loans and other financial instruments tied to LIBOR rates, due to the significant differences between LIBOR and SOFR;

|

| • |

result in disputes, litigation, or other actions with counterparties regarding the interpretation and enforceability of certain fallback language contained in the Inventory Financing Facility; and/or

|

| • |

require the transition to or development of appropriate systems to effectively transition from LIBOR-based loans to those based on SOFR or another applicable alternative pricing benchmark.

|

| • |

compliance with U.S. and local laws and regulatory requirements as well as changes in those laws and requirements;

|

| • |

transportation delays or interruptions and other effects of less developed infrastructures;

|

| • |

limitations on imports and exports;

|

| • |

foreign exchange rate fluctuations;

|

| • |

imposition of restrictions on currency conversion or the transfer of funds;

|

| • |

maintenance of quality standards;

|

| • |

unexpected changes in regulatory requirements;

|

| • |

differing labor regulations;

|

| • |

potentially adverse tax consequences;

|

| • |

possible employee turnover or labor unrest;

|

| • |

the burdens and costs of compliance with a variety of foreign laws; and

|

| • |

political or economic instability.

|

| • |

changes or anticipated changes to regulations related to some of the products we sell;

|

| • |

consumer preferences, buying trends and overall economic trends;

|

| • |

our ability to identify and respond effectively to local and regional trends and customer preferences;

|

| • |

our ability to provide quality customer service that will increase our conversion of shoppers into paying customers;

|

| • |

competition in the regional market of a store;

|

| • |

atypical weather patterns;

|

| • |

changes in our product availability and mix;

|

| • |

changes in sales of services; and

|

| • |

changes in pricing and average unit sales.

|

| • |

maintain a comprehensive compliance function;

|

| • |

comply with rules promulgated by Nasdaq;

|

| • |

prepare and distribute periodic public reports in compliance with our obligations under the federal securities laws;

|

| • |

accurately implement and interpret U.S. generally accepted accounting principles (“GAAP”);

|

| • |

comply with certain internal policies, such as those relating to insider trading; and

|

| • |

involve and retain to a greater degree outside counsel and accountants in the above activities.

|

| • |

quarterly variations in our financial and operating results;

|

| • |

the public reaction to our press releases, our other public announcements and our filings with the SEC;

|

| • |

strategic actions by our competitors or suppliers;

|

| • |

changes in revenue, same-store sales or earnings estimates, or changes in recommendations or withdrawal of research coverage, by equity research analysts;

|

| • |

the failure of our operating results to meet the expectations of equity research analysts and investors;

|

| • |

speculation in the press or investment community;

|

| • |

the failure of research analysts to continue to cover our Class A common stock;

|

| • |

sales of our Class A common stock by us or other stockholders, or the perception that such sales may occur;

|

| • |

changes in accounting principles, policies, guidance, interpretations or standards;

|

| • |

additions or departures of key management personnel;

|

| • |

actions by our stockholders;

|

| • |

general market conditions, including fluctuations in commodity prices;

|

| • |

the publication of boating industry sales data or new boat registration data;

|

| • |

domestic and international economic, legal and regulatory factors unrelated to our performance; and

|

| • |

the realization of any risks described under this “Risk Factors” section.

|

| • |

dividing our board of directors into three classes of directors, with each class serving staggered three-year terms;

|

| • |

providing that all vacancies, including newly created directorships, may, except as otherwise required by law or, if applicable, the rights of holders of a series of preferred stock, only be filled by the affirmative vote of a

majority of directors then in office, even if less than a quorum;

|

| • |

permitting any action by stockholders to be taken only at an annual meeting or special meeting rather than by a written consent of the stockholders, subject to the rights of any series of preferred stock with respect to such rights;

|

| • |

permitting special meetings of our stockholders to be called only by our Chief Executive Officer, the chairman of our board of directors and our board of directors pursuant to a resolution adopted by the affirmative vote of a

majority of the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships;

|

| • |

subject to the rights of the holders of shares of any series of our preferred stock, requiring the affirmative vote of the holders of at least 66 2⁄3% in voting power of all then outstanding common stock entitled to vote generally in

the election of directors, voting together as a single class, to remove any or all of the directors from office at any time, and directors will be removable only for “cause”;

|

| • |

prohibiting cumulative voting in the election of directors;

|

| • |

establishing advance notice provisions for stockholder proposals and nominations for elections to the board of directors to be acted upon at meetings of stockholders; and

|

| • |

providing that the board of directors is expressly authorized to adopt, or to alter or repeal our bylaws.

|

| • |

changes in the valuation of its deferred tax assets and liabilities;

|

| • |

expected timing and amount of the release of any tax valuation allowances;

|

| • |

tax effects of stock-based compensation; or

|

| • |

changes in tax laws, regulations or interpretations thereof.

|

| Item 2. |

Properties.

|

|

Store Location & Dealer Group

|

Stores Leased

|

Stores Owned

|

||

|

Alabama

|

||||

|

Legendary Marine

|

1

|

—

|

||

|

Rambo Marine

|

2

|

—

|

||

|

Singleton Marine

|

3

|

1

|

||

|

Sunrise Marine

|

1

|

—

|

||

|

Florida

|

||||

|

Caribee Boat

|

1

|

—

|

||

|

Central Marine

|

3

|

—

|

||

|

Legendary Marine

|

3

|

—

|

||

|

Marina Mike’s

|

1

|

—

|

||

|

Ocean Blue Yacht Sales

|

3

|

—

|

||

|

OneWater Yacht Group

|

4

|

—

|

||

|

Roscioli Yachting Center

|

—

|

1

|

||

|

Sundance Marine

|

4

|

—

|

||

|

Sunrise Marine

|

2

|

—

|

||

|

Tom George Yacht Group

|

2

|

—

|

||

|

Walker’s Marine

|

6

|

—

|

||

|

Georgia

|

||||

|

American Boat Brokers

|

1

|

—

|

||

|

Singleton Marine

|

7

|

—

|

||

|

Kentucky

|

||||

|

Lookout Marine

|

2

|

—

|

||

|

Massachusetts

|

||||

|

Bosuns Marine

|

2

|

—

|

||

|

Maryland

|

||||

|

Bosuns Marine

|

1

|

|||

|

OneWater Yacht Group

|

1

|

—

|

||

|

North Carolina

|

||||

|

OneWater Yacht Group

|

1

|

—

|

||

|

New Jersey

|

||||

|

OneWater Yacht Group

|

1

|

—

|

||

|

Stone Harbor Marina

|

1

|

—

|

||

|

Ohio

|

||||

|

South Shore Marine

|

1

|

—

|

||

|

Spend-A-Day Marina

|

2

|

—

|

||

|

South Carolina

|

||||

|

Captain’s Choice Marine

|

2

|

—

|

||

|

Singleton Marine

|

2

|

—

|

||

|

Texas

|

||||

|

Phil Dill Boats

|

1

|

—

|

||

|

Slalom Shop

|

2

|

—

|

||

|

SMG Boats

|

2

|

—

|

||

|

Texas Marine

|

3

|

—

|

| Item 3. |

Legal Proceedings.

|

| Item 4. |

Mine Safety Disclosures.

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

|

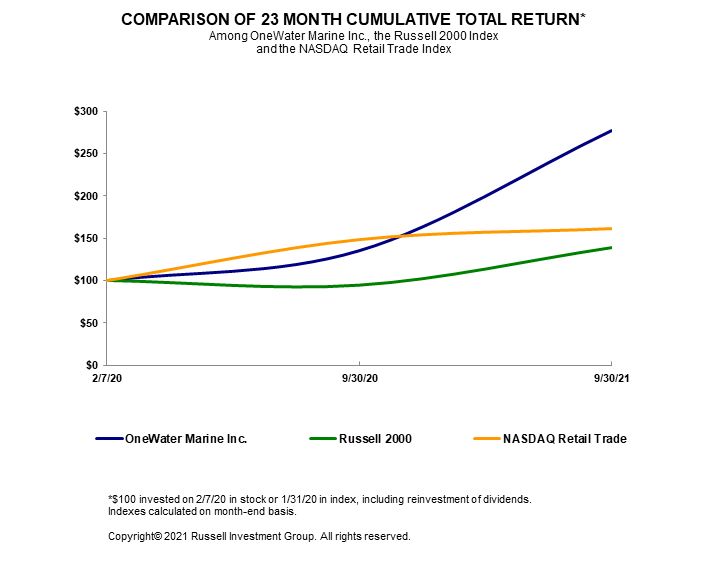

2/7/20

|

9/30/20

|

9/30/21

|

|||||||||

|

OneWater Marine Inc.

|

100.00

|

135.34

|

277.33

|

|||||||||

|

Russell 2000

|

100.00

|

94.34

|

139.32

|

|||||||||

|

NASDAQ Retail Trade

|

100.00

|

148.54

|

161.55

|

|||||||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

| • |

Effective December 1, 2020, we acquired substantially all of the assets of Tom George Yacht Sales, Inc., a full-service marine retailer based in Florida with two stores.

|

| • |

Effective December 31, 2020, we acquired substantially all of the assets of Walker Marine Group, Inc., a full-service marine retailer based in Florida with five stores.

|

| • |

Effective December 31, 2020, we acquired substantially all of the assets of Roscioli Yachting Center, Inc., a full-service marine and yachting facility located in Florida, including the related real estate and in-water slips.

|

| • |

Effective August 1, 2021, we acquired substantially all of the assets of Stone Harbor Marina, Inc., a full-service marine retailer based in New Jersey with one store.

|

| • |

Effective September 1, 2021 we acquired substantially all of the assets of PartsVu, an online marketplace for OEM marine parts, electronics and accessories.

|

| • |

Effective December 1, 2018, OneWater LLC acquired substantially all of the assets of The Slalom Shop, LLC, a dealer group based in Texas with two stores.

|

| • |

Effective February 1, 2019, OneWater LLC acquired substantially all of the assets of Ray Clepper, Inc., d/b/a Ray Clepper Boat Center, a dealer group based in South Carolina with one store.

|

| • |

Effective February 1, 2019, OneWater LLC acquired substantially all of the assets of Ocean Blue Yacht Sales, LLC, a dealer group based in Florida with three stores.

|

| • |

Effective May 1, 2019, OneWater LLC acquired substantially all of the assets of Caribee Boat Sales and Marina, Inc., a dealer group based in Florida with one store.

|

| • |

Effective August 1, 2019, OneWater LLC acquired substantially all of the assets of Central Marine, a dealer group based in Florida with three stores.

|

| • |

OneWater Inc. is subject to U.S. federal, state and local income taxes as a corporation. Our accounting predecessor, OneWater LLC, was and is treated as a partnership for U.S. federal income tax purposes, and as such, was and

is generally not subject to U.S. federal income tax at the entity level. Rather, the tax liability with respect to its taxable income is passed through to its members. Accordingly, the financial data attributable to our

predecessor contains no provision for U.S. federal income taxes or income taxes in any state or locality. OneWater Inc. was subject to U.S. federal, state and local taxes at a blended statutory rate of 24.1% of pre-tax earnings

for fiscal year 2021.

|

| • |

As of September 30, 2019, Goldman and Beekman held the LLC Warrants, which contained conversion features that caused them to be accounted for as a liability on our balance sheet. Changes in this liability were recognized as

income or expense on our statements of operations and increased or reduced our net income in historical periods. In connection with the IPO, Goldman and Beekman exercised all of the LLC Warrants for common units of OneWater LLC.

Giving effect to the IPO and the exercise of the LLC Warrants for common units of OneWater LLC held by Goldman and Beekman, we have eliminated the fair value adjustment for the LLC Warrants for all periods after the IPO, which

eliminated the corresponding impact on our statements of operations.

|

| • |

As we further implement controls, processes and infrastructure applicable to companies with publicly traded equity securities, it is likely that we will incur additional SG&A expenses relative to historical periods. Our

future results will depend on our ability to efficiently manage our combined operations and execute our business strategy.

|

|

For the Year Ended September 30,

|

||||||||||||||||||||||||

|

2021

|

2020

|

|||||||||||||||||||||||

|

Description

|

Amount

|

% of Revenue

|

Amount

|

% of Revenue

|

$ Change

|

% Change

|

||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Revenues

|

||||||||||||||||||||||||

|

New boat

|

$

|

872,680

|

71.1

|

%

|

$

|

717,093

|

70.1

|

%

|

$

|

155,587

|

21.7

|

%

|

||||||||||||

|

Pre-owned boat

|

216,416

|

17.6

|

%

|

205,650

|

20.1

|

%

|

10,766

|

5.2

|

%

|

|||||||||||||||

|

Finance and insurance income

|

42,668

|

3.5

|

%

|

36,792

|

3.6

|

%

|

5,876

|

16.0

|

%

|

|||||||||||||||

|

Service, parts and other

|

96,442

|

7.9

|

%

|

63,435

|

6.2

|

%

|

33,007

|

52.0

|

%

|

|||||||||||||||

|

Total revenues

|

1,228,206

|

100.0

|

%

|

1,022,970

|

100.0

|

%

|

205,236

|

20.1

|

%

|

|||||||||||||||

|

Gross Profit

|

||||||||||||||||||||||||

|

New boat

|

210,916

|

17.2

|

%

|

131,373

|

12.8

|

%

|

79,543

|

60.5

|

%

|

|||||||||||||||

|

Pre-owned boat

|

54,138

|

4.4

|

%

|

37,389

|

3.7

|

%

|

16,749

|

44.8

|

%

|

|||||||||||||||

|

Finance & insurance

|

42,668

|

3.5

|

%

|

36,792

|

3.6

|

%

|

5,876

|

16.0

|

%

|

|||||||||||||||

|

Service, parts & other

|

49,733

|

4.0

|

%

|

29,970

|

2.9

|

%

|

19,763

|

65.9

|

%

|

|||||||||||||||

|

Total gross profit

|

357,455

|

29.1

|

%

|

235,524

|

23.0

|

%

|

121,931

|

51.8

|

%

|

|||||||||||||||

| For the Year Ended September 30, |

||||||||||||||||||||||||

| 2021 |

2020 |

|||||||||||||||||||||||

|

Description

|

Amount |

% of Revenue |

Amount |

% of Revenue |

$ Change |

% Change |

||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Selling, general and administrative expenses

|

199,049

|

16.2

|

%

|

143,575

|

14.0

|

%

|

55,474

|

38.6

|

%

|

|||||||||||||||

|

Depreciation and amortization

|

5,411

|

0.4

|

%

|

3,249

|

0.3

|

%

|

2,162

|

66.5

|

%

|

|||||||||||||||

|

Transaction costs

|

869

|

0.1

|

%

|

3,648

|

0.4

|

%

|

(2,779

|

)

|

(76.2

|

)%

|

||||||||||||||

|

Loss on contingent consideration

|

3,249

|

0.3

|

%

|

6,762

|

0.7

|

%

|

(3,513

|

)

|

(52.0

|

)%

|

||||||||||||||

|

Income from operations

|

148,877

|

12.1

|

%

|

78,290

|

7.7

|

%

|

70,587

|

90.2

|

%

|

|||||||||||||||

|

Interest expense - floor plan

|

2,566

|

0.2

|

%

|

8,861

|

0.9

|

%

|

(6,295

|

)

|

(71.0

|

)%

|

||||||||||||||

|

Interest expense – other

|

4,344

|

0.4

|

%

|

8,828

|

0.9

|

%

|

(4,484

|

)

|

(50.8

|

)%

|

||||||||||||||

|

Change in fair value of warrant liability

|

-

|

0.0

|

%

|

(771

|

)

|

(0.1

|

)%

|

771

|

(100.0

|

)%

|

||||||||||||||

|

Loss on extinguishment of debt

|

-

|

0.0

|

%

|

6,559

|

0.6

|

%

|

(6,559

|

)

|

(100.0

|

)%

|

||||||||||||||

|

Other income, net

|

(248

|

)

|

0.0

|

%

|

(24

|

)

|

0.0

|

%

|

(224

|

)

|

*

|

|||||||||||||

|

Income before income tax expense

|

142,215

|

11.6

|

%

|

54,837

|

5.4

|

%

|

83,378

|

159.3

|

%

|

|||||||||||||||

|

Income tax expense

|

25,802

|

2.1

|

%

|

6,329

|

0.6

|

%

|

19,473

|

307.7

|

%

|

|||||||||||||||

|

Net income

|

116,413

|

9.5

|

%

|

48,508

|

4.7

|

%

|

67,905

|

140.0

|

%

|

|||||||||||||||

|

Less: Net income attributable to non-controlling interests

|

-

|

350

|

||||||||||||||||||||||

|

Less: Net income attributable to non-controlling interests of One Water Marine Holdings, LLC

|

37,354

|

30,733

|

||||||||||||||||||||||

|

Net income attributable to OneWater Marine Inc.

|

$

|

79,059

|

$

|

17,425

|

||||||||||||||||||||

|

For the Year Ended September 30,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Description

|

Amount

|

% of Revenue

|

Amount

|

% of Revenue

|

$ Change

|

% Change

|

||||||||||||||||||

|

($ in thousands)

|

||||||||||||||||||||||||

|

Revenues

|

||||||||||||||||||||||||

|

New boat sales

|

$

|

717,093

|

70.1

|

%

|

$

|

526,774

|

68.6

|

%

|

$

|

190,319

|

36.1

|

%

|

||||||||||||

|

Pre-owned boat sales

|

205,650

|

20.1

|

%

|

153,010

|

20.0

|

%

|

52,640

|

34.4

|

%

|

|||||||||||||||

|

Finance and insurance income

|

36,792

|

3.6

|

%

|

26,151

|

3.4

|

%

|

10,641

|

40.7

|

%

|

|||||||||||||||

|

Service, parts and other sales

|

63,435

|

6.2

|

%

|

61,689

|

8.0

|

%

|

1,746

|

2.8

|

%

|

|||||||||||||||

|

Total revenues

|

1,022,970

|

100.0

|

%

|

767,624

|

100.0

|

%

|

255,346

|

33.3

|

%

|

|||||||||||||||

|

Gross Profit

|

||||||||||||||||||||||||

|

New boat gross profit

|

131,373

|

12.8

|

%

|

92,532

|

12.1

|

%

|

38,481

|

42.0

|

%

|

|||||||||||||||

|

Pre-owned boat gross profit

|

37,389

|

3.7

|

%

|

25,992

|

3.4

|

%

|

11,397

|

43.8

|

%

|

|||||||||||||||

|

Finance & insurance gross profit

|

36,792

|

3.6

|

%

|

26,151

|

3.4

|

%

|

10,641

|

40.7

|

%

|

|||||||||||||||

|

Service, parts & other gross profit

|

29,970

|

2.9

|

%

|

27,451

|

3.6

|

%

|

2,519

|

9.2

|

%

|

|||||||||||||||

|

Total gross profit

|

235,524

|

23.0

|

%

|

172,126

|

22.4

|

%

|

63,398

|

36.8

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

143,575

|

14.0

|

%

|

116,503

|

15.2

|

%

|

27,072

|

23.2

|

%

|

|||||||||||||||

|

Depreciation and amortization

|

3,249

|

0.3

|

%

|

2,682

|

0.3

|

%

|

567

|

21.1

|

%

|

|||||||||||||||

|

Transaction costs

|

3,648

|

0.4

|

%

|

1,323

|

0.2

|

%

|

2,325

|

175.7

|

%

|

|||||||||||||||

|

Loss (gain) on contingent

consideration

|

6,762

|

0.7

|

%

|

(1,674

|

)

|

(0.2

|

)%

|

8,436

|

*

|

|||||||||||||||

|

Income from operations

|

78,290

|

7.7

|

%

|

53,292

|

6.9

|

%

|

24,998

|

46.9

|

%

|

|||||||||||||||

|

Interest expense - floor plan

|

8,861

|

0.9

|

%

|

9,395

|

1.2

|

%

|

(534

|

)

|

(5.7

|

)%

|

||||||||||||||

|

Interest expense – other

|

8,828

|

0.9

|

%

|

6,568

|

0.9

|

%

|

2,260

|

34.4

|

%

|

|||||||||||||||

|

Change in fair value of warrant

liability

|

(771

|

)

|

(0.1

|

)%

|

(1,336

|

)

|

(0.2

|

)%

|

565

|

(42.3

|

)%

|

|||||||||||||

|

Loss on extinguishment of debt

|

6,559

|

0.6

|

%

|

-

|

0.0

|

%

|

6,559

|

100

|

%

|

|||||||||||||||

|

Other (income) expense, net

|

(24

|

)

|

0.0

|

%

|

1,402

|

0.2

|

%

|

(1,426

|

)

|

(101.7

|

)%

|

|||||||||||||

|

Income before income tax expense

|

54,837

|

5.4

|

%

|

37,263

|

4.9

|

%

|

17,574

|

47.2

|

%

|

|||||||||||||||

|

Income tax expense

|

6,329

|

0.6

|

%

|

—

|

0.0

|

%

|

6,329

|

100

|

%

|

|||||||||||||||

|

Net income

|

48,508

|

4.7

|

%

|

37,263

|

4.9

|

%

|

11,245

|

30.2

|

%

|

|||||||||||||||

|

Less: Net income attributable to non-controlling interests

|

350

|

1,606

|

||||||||||||||||||||||

|

Net income attributable to One Water Marine Holdings, LLC

|

—

|

$

|

35,657

|

|||||||||||||||||||||

|

Less: Net income attributable to non-controlling interests of One Water Marine Holdings, LLC

|

30,733

|

|||||||||||||||||||||||

|

Net income attributable to OneWater Marine Inc.

|

$

|

17,425

|

||||||||||||||||||||||

|

Years Ended September 30,

|

||||||||||||

|

Description

|

2021

|

2020

|

Change

|

|||||||||

|

($ in thousands)

|

||||||||||||

|

Net income

|

$

|

116,413

|

$

|

48,508

|

$

|

67,905

|

||||||

|

Interest expense – other

|

4,344

|

8,828

|

(4,484

|

)

|

||||||||

|

Income tax expense

|

25,802

|

6,329

|

19,473

|

|||||||||

|

Depreciation and amortization

|

5,411

|

3,249

|

2,162

|

|||||||||

|

Change in fair value of warrant liability

|

—

|

(771

|

)

|

771

|

||||||||

|

Loss on contingent consideration

|

3,249

|

6,762

|

(3,513

|

)

|

||||||||

|

Transaction costs

|

869

|

3,648

|

(2,779

|

)

|

||||||||

|

Loss on extinguishment of debt

|

—

|

6,559

|

(6,559

|

)

|

||||||||

|

Other income, net

|

(248

|

)

|

(24

|

)

|

(224

|

)

|

||||||

|

Adjusted EBITDA

|

$

|

155,840

|

$

|

83,088

|

$

|

72,752

|

||||||

|

Year Ended September 30,

|

||||||||||||

|

Description

|

2020

|

2019

|

Change

|

|||||||||

|

($ in thousands, unaudited)

|

||||||||||||

|

Net income

|

$

|

48,508

|

$

|

37,263

|

$

|

11,245

|

||||||

|

Interest expense – other

|

8,828

|

6,568

|

2,260

|

|||||||||

|

Income tax expense

|

6,329

|

—

|

6,329

|

|||||||||

|

Depreciation and amortization

|

3,249

|

2,682

|

567

|

|||||||||

|

Change in fair value of warrant liability

|

(771

|

)

|

(1,336

|

)

|

565

|

|||||||

|

Loss (gain) on contingent consideration

|

6,762

|

(1,674

|

)

|

8,436

|

||||||||

|

Transaction costs

|

3,648

|

1,323

|

2,325

|

|||||||||

|

Loss on extinguishment of debt

|

6,559

|

—

|

6,559

|

|||||||||

|

Other expense (income), net

|

(24

|

)

|

1,402

|

(1,426

|

)

|

|||||||

|

Adjusted EBITDA

|

$

|

83,088

|

$

|

46,228

|

$ |

36,860

|

||||||

|

Year Ended September 30,

|

||||||||||||

|

Description

|

2021

|

2020

|

Change

|

|||||||||

|

($ in thousands, unaudited)

|

||||||||||||

|

Net cash provided by operating activities

|

$

|

159,423

|

$

|

212,477

|

$

|

(53,054

|

)

|

|||||

|

Net cash used in investing activities

|

(117,130

|

)

|

(4,672

|

)

|

(112,458

|

)

|

||||||

|

Net cash used in financing activities

|

(36,497

|

)

|

(151,144

|

)

|

114,647

|

|||||||

|

Net change in cash

|

$

|

5,796

|

$

|

56,661

|

$

|

(50,865

|

)

|

|||||

|

Year Ended September 30,

|

||||||||||||

|

Description

|

2020

|

2019

|

Change

|

|||||||||

|

($ in thousands, unaudited)

|

||||||||||||

|

Net cash provided by (used in) operating activities

|

$

|

212,477

|

$

|

(5,725

|

)

|

$

|

218,202

|

|||||

|

Net cash used in investing activities

|

(4,672

|

)

|

(10,998

|

)

|

6,326

|

|||||||

|

Net cash (used in) provided by financing activities

|

(151,144

|

)

|

12,458

|

(163,602

|

)

|

|||||||

|

Net change in cash

|

$

|

56,661

|

$

|

(4,265

|

)

|

$

|

60,926

|

|||||

|

Payments Due by Period

|

||||||||||||||||||||

|

Less than 1 year

|

1 – 3 years

|

3 – 5 years

|

More than 5

years

|

Total

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Credit Facility(1)

|

$

|

5,500

|

$

|

17,887

|

$

|

82,488

|

$

|

—

|

$

|

105,875

|

||||||||||

|

Inventory Financing Facility(2)

|

114,234

|

—

|

—

|

—

|

114,234

|

|||||||||||||||

|

Notes Payable(3)

|

6,393

|

3,686

|

541

|

39

|

10,659

|

|||||||||||||||

|

Estimated interest payments(4)

|

3,222

|

5,365

|

1,155

|

—

|

9,742

|

|||||||||||||||

|

Operating lease obligations(5)

|

13,118

|

24,514

|

22,464

|

53,473

|

113,569

|

|||||||||||||||

|

Total

|

$

|

142,467

|

$

|

51,452

|

$

|

106,648

|

$

|

53,512

|

$

|

354,079

|

||||||||||

| (1) |

Payments are generally made as required pursuant to the Credit Facility discussed above under “—Debt Agreements—Credit Facility.”

|

| (2) |

Payments are generally made as required pursuant to the Inventory Financing Facility discussed above under “—Debt Agreements—Inventory Financing Facility.” Amounts do not include estimated interest payments.

|

| (3) |

Includes notes payable entered into in connection with certain of our acquisitions of dealer groups and notes payable entered into with various commercial lenders in connection with our acquisition of certain vehicles. Payments

are generally made as required pursuant to the terms of the relevant notes payable and as discussed above under “—Debt Agreements—Notes Payable.”

|

| (4) |

Estimated interest payments based on the outstanding principal and stated interest rates on the Credit Facility and Notes Payable.

|

| (5) |

Includes certain physical facilities and equipment that we lease under noncancelable operating leases.

|

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk.

|

| Item 8. |

Financial Statements and Supplementary Data.

|

|

OneWater Marine Inc.

|

Page

|

|

Consolidated Financial Statements

|

|

| 76 |

|

| 78 | |

|

79

|

|

|

80

|

|

| 81 | |

| 82 |

| • |

We tested the reasonableness of the forecasted adjusted EBITDA by (1) comparing projected amounts to historical periods and trends and (2) obtained an

understanding of drivers of underlying projected amounts, including consideration of industry information and economic trends.

|

| • |

We utilized a specialist, who:

|

| o |

Developed an independent estimate of the fair value of the contingent consideration utilizing a different model than management.

|

| • |

We tested the reasonableness of the revenue growth rates by (1) comparing projected amounts to historical periods and trends and (2) obtaining an

understanding of drivers of underlying projected amounts, including consideration of industry information and economic trends.

|

| • |

We utilized a specialist in evaluating the appropriateness of the Company’s methodology and the royalty rates and discount rates used in the valuation.

Our specialists calculated a range of rates using market participant inputs and performed analysis to test sensitivity to changes in the royalty and discount rates.

|

|

September 30, 2021

|

September 30, 2020

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

|

$

|

|

||||

|

Restricted cash

|

|

|

||||||

|

Accounts receivable, net

|

|

|

||||||

|

Inventories

|

|

|

||||||

|

Prepaid expenses and other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Property and equipment, net

|

|

|

||||||

|

Operating lease right-of-use assets

|

|

|

||||||

|

Other assets:

|

||||||||

|

Deposits

|

|

|

||||||

|

Deferred tax assets

|

|

|

||||||

|

Identifiable intangible assets

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Total other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

|

$

|

|

||||

|

Other payables and accrued expenses

|

|

|

||||||

|

Customer deposits

|

|

|

||||||

|

Notes payable – floor plan

|

|

|

||||||

|

Current portion of operating lease liabilities

|

|

|

||||||

|

Current portion of long-term debt

|

|

|

||||||

|

Current portion of tax receivable agreement liability

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Long-term Liabilities:

|

||||||||

|

Other long-term liabilities

|

|

|

||||||

|

Tax receivable agreement liability

|

|

|

||||||

|

Noncurrent operating lease liabilities

|

|

|

||||||

|

Long-term debt, net of current portion and unamortized debt issuance costs

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Stockholders’ Equity:

|

||||||||

|

Preferred stock, $

|

|

|

||||||

|

Class A common stock, $

|

|

|

||||||

|

Class B common stock, $

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Total stockholders’ equity attributable to OneWater Marine Inc.

|

|

|

||||||

|

Equity attributable to non-controlling interests

|

|

|

||||||

|

Total stockholders’ equity

|

|

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

For the Years Ended September 30,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Revenues

|

||||||||||||

|

New boat

|

$

|

|

$

|

|

$

|

|

||||||

|

Pre-owned boat

|

|

|

|

|||||||||

|

Finance & insurance income

|

|

|

|

|||||||||

|

Service, parts & other

|

|

|

|

|||||||||

|

Total revenues

|

|

|

|

|||||||||

|

Cost of sales (exclusive of depreciation and amortization shown separately below)

|

||||||||||||

|

New boat

|

|

|

|

|||||||||

|

Pre-owned boat

|

|

|

|

|||||||||

|

Service, parts & other

|

|

|

|

|||||||||

|

Total cost of sales

|

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

|

|

|

|||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Transaction costs

|

|

|

|

|||||||||

|

Loss (gain) on contingent consideration

|

|

|

(

|

)

|

||||||||

|

Income from operations

|

|

|

|

|||||||||

|

Other expense (income)

|

||||||||||||

|

Interest expense – floor plan

|

|

|

|

|||||||||

|

Interest expense – other

|

|

|

|

|||||||||

|

Change in fair value of warrant liability

|

|

(

|

)

|

(

|

)

|

|||||||

|

Loss on extinguishment of debt

|

|

|

|

|||||||||

|

Other (income) expense, net

|

(

|

)

|

(

|

)

|

|

|||||||

|

Total other expense (income), net

|

|

|

|

|||||||||

|

Income before income tax expense

|

|

|

|

|||||||||

|

Income tax expense

|

|

|

|

|||||||||

|

Net income

|

|

|

|

|||||||||

|

Less: Net income attributable to non-controlling interests

|

|

|

||||||||||

|

Net income attributable to One Water Marine Holdings, LLC

|

$

|

|

||||||||||

|

Less: Net income attributable to non-controlling interests of One Water Marine Holdings, LLC

|

|

|||||||||||

|

Net income attributable to OneWater Marine Inc.

|

$

|

|

$ | |||||||||

|

Earnings per share of Class A common stock – basic (1)

|

$

|

|

$ | |||||||||

|

Earnings per share of Class A common stock – diluted (1)

|

$

|

|

$ | |||||||||

|

Basic weighted-average shares of Class A common stock outstanding (1)

|

|

|||||||||||

|

Diluted weighted-average shares of Class A common stock outstanding (1)

|

|

|||||||||||

|

(1)

|

|

|

Class A Common Stock

|

Class B Common Stock

|

|||||||||||||||||||||||||||||||||||||||

|

Redeemable Preferred Interest in Subsidiary

|

Members’ Equity

|

Shares

|

Amount

|

Shares

|

Amount

|

Additional Paid-in Capital

|

Retained Earnings

|

Non-

controlling Interest

|

Total Stockholders’ and Members’ Equity

|

|||||||||||||||||||||||||||||||

|

Balance at September 30, 2018

|

$ |

|

$ |

|

|

$ |

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||

|

Net income

|

|

|

-

|

|

-

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Distributions to members

|

(

|

)

|

(

|

)

|

-

|

|

-

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||

|

Accumulated unpaid preferred returns

|

|

(

|

)

|

-

|

|

-

|

|

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Accretion of redeemable preferred and issuance costs

|

|

(

|

)

|

-

|

|

-

|

|

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Equity-based compensation

|

-

|

|

-

|

|

-

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Balance at September 30, 2019

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Net (loss) income prior to the initial public offering

|

|

(

|

)

|

-

|

|

-

|

|

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Distributions to members prior to the initial public offering

|

(

|

)

|

(

|

)

|

-

|

|

-

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||

|

Accumulated unpaid preferred returns prior to the initial public offering

|

|

(

|

)

|

-

|

|

-

|

|

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Accretion of redeemable preferred and issuance costs prior to the initial public offering

|

|

(

|

)

|

-

|

|

-

|

|

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Equity-based compensation prior to the initial public offering

|

-

|

|

-

|

|

-

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Effect of the initial public offering and related transactions

|

(

|

)

|

(

|

)

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Effect of September offering

|

-

|

|

|

|

(

|

)

|

(

|

)

|

|

|

(

|

)

|

|

|||||||||||||||||||||||||||

|

Exchange of B shares for A shares

|

-

|

|

|

|

(

|

)

|

(

|

)

|

|

(

|

)

|

|

||||||||||||||||||||||||||||

|

Distributions subsequent to the initial public offering

|

-

|

|

-

|

|

-

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

|||||||||||||||||||||||||||

|

Establishment of liabilities under tax receivable agreement and related changes to deferred tax assets associated with increases in tax basis

|

-

|

|

-

|

|

-

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||||||||||||||

|

Equity-based compensation subsequent to the initial public offering

|

-

|

|

-

|

|

-

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Net income subsequent to the initial public offering

|

-

|

|

-

|

|

-

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Balance at September 30, 2020

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

| Net income |

- | - | ||||||||||||||||||||||||||||||||||||||

| Distributions to members | - | - | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||||||||

| Dividends and distributions | - | - | - | ( |

) | ( |

) | ( |

) | |||||||||||||||||||||||||||||||

| Effect of September offering, including underwriter exercise of option to purchase shares | - | ( |

) | ( |

) | ( |

) | ( |

) | |||||||||||||||||||||||||||||||

| Exchange of B shares for A shares | - | ( |

) | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||

| Establishment of liabilities under tax receivable agreement and related changes to deferred tax assets associated with increases in tax basis | - | - | - | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||

| Shares issued upon vesting of equity-based awards, net of tax withholding | - | ( |

) | ( |

) | |||||||||||||||||||||||||||||||||||

| Shares issued in connection with a business combination | - | |||||||||||||||||||||||||||||||||||||||

| Adjustment to adopt Topic 842 | - | - | - | |||||||||||||||||||||||||||||||||||||

| Equity-based compensation | - | - | - | |||||||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ |

- | $ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||||||||||

|

For the Years Ended September 30,

|

||||||||||||

|

2021

|

2020

|

2019

|

||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Equity-based compensation

|

|

|

|

|||||||||

|

(Gain) loss on asset disposals

|

(

|

)

|

|

|

||||||||

|

Change in fair value of warrant liability

|

|

(

|

)

|

(

|

)

|

|||||||

|

Loss on extinguishment of debt

|

|

|

|

|||||||||

|

Non-cash interest expense

|

|

|

|

|||||||||

|

Deferred income tax provision

|

|

|

|

|||||||||

|

Loss (gain) on contingent consideration

|

|

|

(

|

)

|

||||||||

|

(Increase) decrease in assets:

|

||||||||||||

|

Accounts receivable

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Inventories

|

|

|

(

|

)

|

||||||||

|

Prepaid expenses and other current assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Deposits

|

(

|

)

|

(

|

)

|

|

|||||||

|

Increase (decrease) in liabilities:

|

||||||||||||

|

Accounts payable

|

(

|

)

|

|

(

|

)

|

|||||||

|

Other payables and accrued expenses

|

|

|

|

|||||||||

|

Customer deposits

|

|

|

(

|

)

|

||||||||

|

Net cash provided by (used in) operating activities

|

|

|

(

|

)

|

||||||||

|

Cash flows from investing activities

|

||||||||||||

|

Purchases of property and equipment and construction in progress

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from disposal of property and equipment

|

|

|

|

|||||||||

|

Proceeds from sale and leaseback

|

|

|

|

|||||||||

|

Cash used in acquisitions

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows from financing activities

|

||||||||||||

|

Net (payments) borrowings from floor plan

|

(

|

)

|

(

|

)

|

|

|||||||

|

Proceeds from long-term debt

|

|

|

|

|||||||||

|

Payments on long-term debt

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Payments of debt issuance costs

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Payments of debt extinguishment costs

|

|

(

|

)

|

|

||||||||

|

Payments of initial public offering costs

|

|

(

|

)

|

(

|

)

|

|||||||

|

Payments of September offering costs

|

(

|

)

|

|

|

||||||||

|

Payment of acquisition contingent consideration

|

|

(

|

)

|

|

||||||||

|

Distributions to redeemable preferred interest members and redemption of redeemable preferred interest

|

|

(

|

)

|

(

|

)

|

|||||||

|

Proceeds from issuance of Class A common stock sold in initial public offering, net of underwriting discounts and commissions

|

|

|

|

|||||||||

|

Proceeds from issuance of Class A common stock sold in September offering, net of underwriting discounts and commissions

|

|

|

|

|||||||||

| Payments of tax withholdings for equity-based awards |

( |

) | ||||||||||

| Dividends and distributions |

( |

) | ||||||||||

|

Distributions to members

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash (used in) provided by financing activities

|

(

|

)

|

(

|

)

|

|

|||||||

|

Net change in cash

|

|

|

(

|

)

|

||||||||

|

Cash and restricted cash at beginning of period

|

|

|

|

|||||||||

|

Cash and restricted cash at end of period

|

$

|

|

$

|

|

$

|

|

||||||

|

Supplemental cash flow disclosures

|

||||||||||||

|

Cash paid for interest

|

$

|

|

$

|

|

$

|

|

||||||

|

Cash paid for income taxes

|

|

|

|

|||||||||

|

Noncash items

|

||||||||||||

|

Acquisition purchase price funded by long-term debt

|

$

|

|

$

|

|

$

|

|

||||||

|

Acquisition purchase price funded by seller notes payable

|

|

|

|

|||||||||

|

Acquisition purchase price funded by contingent consideration

|

|

|

|

|||||||||

| Acquisition purchase price funded by issuance of Class A common stock |

||||||||||||

| Accrued purchase consideration |

||||||||||||

|

Purchase of property and equipment funded by long-term debt

|

|

|

|

|||||||||

| Dividends payable |

||||||||||||

| Distributions payable |

||||||||||||

|

Offering costs, accrued not yet paid

|

|

|

|

|||||||||

| Initial operating lease right-of-use-assets for adoption of Topic 842 |

||||||||||||

| 1. |

Description of Company and Basis of Presentation

|

| 2. |

Summary of Significant Accounting Policies

|

| Years | |

|

Company vehicles

|

|

|

Buildings and improvements

|

|

|

Leasehold improvements

|

|

|

Machinery and equipment

|

|

|

Office equipment

|

|

|

($ in thousands)

|

For the Year Ended September 30, 2021 |

For the Year Ended September 30, 2020

|

||||||

|

Beginning contract liability

|

$ |

$

|

|

|||||

|

Revenue recognized from contract

liabilities included in the beginning balance

|

( |

) | ( |

) | ||||

|

Increases due to cash received, net of

amounts recognized in revenue during the period

|

|

|||||||

|

Ending contract liability

|

$ |

$

|

|

|||||

| For the Year Ended September 30, 2021 |

For the Year Ended September 30, 2020

|

|||||||

|

Goods and services transferred at a point

in time

|

% |

|

%

|

|||||

|

Goods and services transferred over time

|

% |

|

%

|

|||||

|

Total Revenue

|

% |

|

%

|

|||||

| 3. |

Recent Accounting Pronouncements

|

| 4. |

Acquisitions

|

|

Summary of Assets Acquired and Liabilities Assumed

|

($ in thousands) | |||

|

Accounts receivable

|

$

|

|

||

|

Inventories

|

|

|||

|

Prepaid expenses

|

|

|||

|

Property and equipment

|

|

|||

|

Identifiable intangible assets

|

|

|||

|

Goodwill

|

|

|||

|

Accounts payable

|

(

|

)

|

||

|

Customer deposits

|

(

|

)

|

||

|

Notes payable – floor plan

|

(

|

)

|

||

|

Total purchase price

|

$

|

|

||

|

Summary of Assets Acquired and Liabilities Assumed

|

($ in thousands) | |||

|

Inventories

|

$

|

|

||

|

Prepaid expenses

|

|

|||

|

Property and equipment

|

|

|||

|

Identifiable intangible assets

|

|

|||

|

Goodwill

|

|

|||

|

Accounts payable

|

(

|

)

|

||

|

Accrued expenses

|

(

|

)

|

||

|

Total purchase price

|

$

|

|

||

| • |

On December 1, 2020, Tom George Yacht Group with

|

| • |

On August 1, 2021, Stone Harbor Marina with

|

| • |

On September 1, 2021, PartsVu, an online marketplace for OEM marine parts, electronics and accessories

|

|

Summary of Assets Acquired and Liabilities Assumed

|

($ in

thousands)