UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from__________ to ___________.

Commission file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report).

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol |

| Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company |

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of May 5, 2021, there were

DraftKings Inc.

Quarterly Report on Form 10-Q

For the Quarter Ended March 31, 2021

Table of Contents

1

PART I. - FINANCIAL INFORMATION

Item 1. Financial Statements.

DRAFTKINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except par value)

March 31, 2021 | ||||||

(Unaudited) | December 31, 2020 | |||||

Assets |

|

| ||||

Current assets: |

|

| ||||

Cash and cash equivalents | $ | | $ | | ||

Cash reserved for users | | | ||||

Receivables reserved for users | | | ||||

Accounts receivable | | | ||||

Prepaid expenses and other current assets |

| | | |||

Total current assets |

| | | |||

Property and equipment, net | | |||||

Intangible assets, net |

| | | |||

Goodwill | | | ||||

Operating lease right-of-use assets | | | ||||

Equity method investment | | | ||||

Deposits and other non-current assets | | | ||||

Total assets | $ | | $ | | ||

Liabilities and Stockholders’ equity (deficit) | ||||||

Current liabilities: | ||||||

Accounts payable and accrued expenses | $ | | $ | | ||

Liabilities to users |

| | | |||

Operating lease liabilities, current portion | | | ||||

Total current liabilities | | | ||||

Convertible notes | | |||||

Non-current operating lease liabilities | | | ||||

Warrant liabilities | | | ||||

Long-term income tax liability | | | ||||

Other long-term liabilities | | | ||||

Total liabilities | $ | | $ | | ||

Commitments and contingent liabilities | ||||||

Stockholders' equity (deficit): | ||||||

Class A common stock, $ |

| | | |||

Class B common stock, $ |

| | | |||

Treasury stock, at cost; | ( | ( | ||||

Additional paid-in capital |

| | | |||

Accumulated deficit |

| ( | ( | |||

Accumulated other comprehensive income | | | ||||

Total stockholders’ equity (deficit) |

| | | |||

Total liabilities and stockholders’ equity (deficit) | $ | | $ | | ||

See accompanying notes to unaudited condensed consolidated financial statements.

2

DRAFTKINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Amounts in thousands, except loss per share data)

Three months ended March 31, | ||||||

| 2021 | 2020 | ||||

Revenue | $ | | $ | | ||

Cost of revenue |

| |

| | ||

Sales and marketing | | | ||||

Product and technology | | | ||||

General and administrative | | | ||||

Loss from operations |

| ( |

| ( | ||

Other income (expense): |

|

| ||||

Interest income (expense), net |

| |

| ( | ||

Loss on remeasurement of warrant liabilities | ( | | ||||

Loss before income tax (benefit) provision and loss from equity method investment | ( | ( | ||||

Income tax (benefit) provision | ( | | ||||

Loss from equity method investment | | | ||||

Net loss attributable to common stockholders | $ | ( | $ | ( | ||

Loss per share attributable to common stockholders: |

|

| ||||

Basic and diluted | $ | ( | $ | ( | ||

See accompanying notes to unaudited condensed consolidated financial statements.

Due to the timing of the Business Combination, the above periods, to the extent applicable, exclude B2B/SBTech activity which occurred prior to April 24, 2020.

3

DRAFTKINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(Amounts in thousands)

| Three months ended | |||||

March 31, | ||||||

2021 | 2020 | |||||

Net loss | $ | ( | $ | ( | ||

Other comprehensive loss: |

|

|

| |||

Foreign currency translation adjustments arising during period, net of |

| ( |

| | ||

Comprehensive loss | $ | ( | $ | ( | ||

See accompanying notes to unaudited condensed consolidated financial statements.

Due to the timing of the Business Combination, the above periods, to the extent applicable, exclude B2B/SBTech activity which occurred prior to April 24, 2020.

4

DRAFTKINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited)

(Amounts in thousands)

|

| Accumulated Other | Treasury | Total | |||||||||||||||||||||||

Class A Common Stock | Class B Common Stock | Additional | Accumulated | Comprehensive | Stock | Stockholders' | |||||||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Paid in Capital |

| Deficit |

| Income | Amount |

| (Deficit)/Equity | |||||||||||

Balances at December 31, 2020 | | $ | | | $ | | $ | | $ | ( | $ | | $ | ( | $ | | |||||||||||

Exercise of stock options |

| | — |

| — | — | | — | — | — | | ||||||||||||||||

Stock-based compensation expense | — | — | — | — | | — | — | — | | ||||||||||||||||||

Purchase of capped call options | — | — | — | — | ( | — | — | — | ( | ||||||||||||||||||

Equity consideration issued for acquisition |

| |

| — |

| — |

| — |

| |

| — | — | — | | ||||||||||||

Shares issued for exercise of warrants |

| |

| — |

| — |

| — |

| |

| — | — | — | | ||||||||||||

Purchase of treasury stock |

| ( |

| — |

| — |

| — |

| — |

| — | — | ( | ( | ||||||||||||

Restricted stock unit vesting | | — | — | — | — | — | — | — | — | ||||||||||||||||||

Foreign currency translation | — | — | — | — | — | — | ( | — | ( | ||||||||||||||||||

Net loss | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||

Balances at March 31, 2021 | | $ | | | | $ | | $ | ( | $ | | $ | ( | $ | | ||||||||||||

|

| Total | |||||||||||||||||||

Class A Common Stock | Class B Common Stock | Additional | Accumulated | Stockholder’s | |||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Paid-in Capital |

| Deficit |

| (Deficit)/Equity | ||||||||

Balances at December 31, 2019 |

| | $ | |

| — | $ | — | $ | | $ | ( | $ | ( | |||||||

Issuance of Series F preferred stock | | — | — | — | | — | | ||||||||||||||

Exercise of stock options | | — | — | — | | — | | ||||||||||||||

Stock-based compensation expense | — | — | — | — | | — | | ||||||||||||||

Net loss | — | — | — | — | — | ( | ( | ||||||||||||||

Balances at March 31, 2020 | | $ | | — | $ | — | $ | | $ | ( | $ | ( | |||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

Due to the timing of the Business Combination, the above periods, to the extent applicable, exclude B2B/SBTech activity which occurred prior to April 24, 2020.

5

DRAFTKINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Amounts in thousands)

Three Months ended March 31, | ||||||

| 2021 | 2020 | ||||

Operating Activities: |

|

| ||||

Net loss | $ | ( | $ | ( | ||

Adjustments to reconcile net loss to net cash flows used in operating activities: |

| |||||

Depreciation and amortization | | | ||||

Non-cash interest expense | | | ||||

Stock-based compensation expense | |

| | |||

Loss from equity method investment | |

| | |||

Loss on remeasurement of warrant liabilities | |

| | |||

Deferred income taxes | ( |

| | |||

Change in operating assets and liabilities, net of effect of business combinations: |

| |||||

Cash reserved for users | ( | | ||||

Receivables reserved for users | | | ||||

Accounts receivable | ( |

| | |||

Prepaid expenses and other current assets | ( | | ||||

Deposits and other non-current assets | ( |

| ( | |||

Operating leases, net | ( |

| ( | |||

Accounts payable and accrued expenses | | ( | ||||

Other long-term liabilities | | | ||||

Long-term income tax liability | |

| | |||

Liabilities to users | |

| ( | |||

Net cash flows used in operating activities | ( |

| ( | |||

Cash Flows from Investing Activities: |

|

| ||||

Purchases of property and equipment | ( |

| ( | |||

Cash paid for internally developed software costs | ( |

| ( | |||

Acquisition of gaming licenses | ( | ( | ||||

Cash paid for acquisition, net of cash acquired | ( |

| | |||

Net cash flows used in investing activities | ( |

| ( | |||

Financing Activities: |

|

| ||||

Proceeds from term notes, net | | | ||||

Proceeds from issuance of convertible notes, net | | | ||||

Purchase of capped call options | ( | | ||||

Proceeds from shares issued for warrants | | | ||||

Purchase of treasury stock | ( |

| | |||

Proceeds from exercise of stock options | | | ||||

Net cash flows provided by financing activities | | | ||||

Effect of foreign exchange rates on cash and cash equivalents | | | ||||

Net increase in cash, cash equivalents and restricted cash | | | ||||

Cash and cash equivalents at the beginning of period | | | ||||

Cash and cash equivalents, end of period | $ | | $ | | ||

Supplemental Disclosure of Noncash Investing and Financing Activities | ||||||

Equity consideration issued for acquisition | $ | | $ | | ||

Increase in accounts payable and accrued expenses from property and equipment and internally developed software costs | | | ||||

Increase in accounts payable and accrued expenses from convertible notes financing costs | | | ||||

Decrease of accounts payable and accrued expenses from gaming licenses | ( | ( | ||||

Extinguishment of promissory notes for Series F Redeemable Convertible Preferred Stock | | ( | ||||

Supplemental Disclosure of Cash Activities |

|

| ||||

Cash paid for interest | $ | | $ | | ||

Due to the timing of the Business Combination, the above periods, to the extent applicable, exclude B2B/SBTech activity which occurred prior to April 24, 2020.

6

DRAFTKINGS INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except loss per share data, unless otherwise noted)

1. | Description of Business |

DraftKings Inc., a Nevada corporation (the “Company” or “DraftKings”), was incorporated in Nevada as DEAC NV Merger Corp., a wholly owned subsidiary of our legal predecessor, Diamond Eagle Acquisition Corp. (“DEAC”), a special purpose acquisition company. On April 23, 2020, DEAC consummated the transactions contemplated by the Business Combination Agreement (the “Business Combination”) dated December 22, 2019, as amended on April 7, 2020 and, in connection therewith, (i) DEAC merged with and into the Company, whereby the Company survived the merger and became the successor issuer to DEAC by operation of Rule 12g-3(a) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (ii) the Company changed its name to “DraftKings Inc.,” (iii) the Company acquired DraftKings Inc., a Delaware corporation (“Old DK”), by way of a merger and (iv) the Company acquired all of the issued and outstanding share capital of SBTech (Global) Limited (“SBTech”). Upon consummation of the preceding transactions, Old DK and SBTech became wholly owned subsidiaries of the Company.

DraftKings is a digital sports entertainment and gaming company. The Company’s business-to-consumer (“B2C”) segment provides users with daily fantasy sports (“DFS”), sports betting (“Sportsbook”) and online casino (“iGaming”) products. The Company’s business-to-business (“B2B”) segment is involved in the design, development and licensing of sports betting and casino gaming software for its Sportsbook and casino gaming products.

In May 2018, the Supreme Court (the “Court”) struck down on constitutional grounds the Professional and Amateur Sports Protection Act of 1992 (“PASPA”), a law that prohibited most states from authorizing and regulating sports betting. Since the Court’s decision, many states have legalized sports betting. As of March 31, 2021, the U.S. jurisdictions with statutes legalizing online sports betting are Colorado, Illinois, Indiana, Iowa, Michigan, Nevada, New Hampshire, New Jersey, Oregon, Pennsylvania, Puerto Rico, Rhode Island, Tennessee, Virginia, Washington, D.C and West Virginia. The jurisdictions with statutes legalizing sports betting at certain land-based retail locations are Arkansas, Colorado, Delaware, Illinois, Indiana, Iowa, Michigan, Mississippi, Montana, Nevada, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Puerto Rico, Rhode Island, Virginia, Washington, Washington, D.C and West Virginia. A few jurisdictions have enacted laws authorizing sports betting in retail locations but have yet to begin operations in those jurisdictions. The jurisdictions with statutes legalizing online casinos are Delaware, Michigan, New Jersey, Pennsylvania and West Virginia.

As of March 31, 2021, the Company operates online Sportsbooks in Colorado, Illinois, Indiana, Iowa, Michigan, New Hampshire, New Jersey, Oregon (B2B), Pennsylvania, Tennessee, Virginia and West Virginia and has retail Sportsbooks in Colorado, Illinois, Iowa, Mississippi, New Hampshire, New Jersey and New York. As of March 31, 2021 the Company offers iGaming products in Michigan, New Jersey, Pennsylvania and West Virginia. The Company also has arrangements in place with land-based casinos to expand operations into additional states upon the passing of the relevant legislation, the issuance of related regulations and the receipt of required licenses.

The novel coronavirus (“COVID-19”) has adversely impacted global commercial activity, disrupted supply chains and contributed to significant volatility in financial markets. In 2020 and continuing into 2021, the COVID-19 pandemic adversely impacted many different industries. The ongoing COVID-19 pandemic could have a continued material adverse impact on economic and market conditions and trigger a period of global economic slowdown. The rapid development and fluidity of this situation precludes any prediction as to the extent and the duration of the impact of COVID-19. COVID-19 therefore presents material uncertainty and risk with respect to us and our performance and could affect our financial results in a materially adverse way.

Since the start of the COVID-19 pandemic, the primary impacts to the Company have been the suspension, cancellation and rescheduling of sports seasons and sporting events. Beginning in March 2020 and continuing through the end of the second quarter of 2020, many sports seasons and sporting events, including the MLB regular season, domestic soccer leagues and European Cup competitions, the NBA regular season and playoffs, the NCAA college basketball tournament, the Masters golf tournament, and the NHL regular season and playoffs, were suspended or cancelled. The suspension of sports seasons and sporting events reduced customers’ use of, and spending on, the Company’s Sportsbook and DFS product offerings. Starting in the third quarter of 2020 and continuing into the fourth quarter of 2020, major professional sports leagues resumed their activities, many of which were held at limited or reduced capacity. MLB began its season after a three-month delay and also completed the World Series, the NHL resumed its season and

7

completed the Stanley Cup Playoffs, the Masters golf tournament was held, most domestic soccer leagues resumed and several European cup competitions were held, and the NFL season began on its regular schedule. During this period, the NBA also resumed its season, completed the NBA Finals and commenced its 2020-2021 season. In the first quarter of 2021, many sports seasons continued and multiple sporting events were held as planned, including the NFL regular season, the NFL Playoffs and Superbowl LV, the NBA regular season, the NHL regular season, the NASCAR Cup Series, various NCAA football bowl games and the NCAA college basketball season and tournament. The continued return of major sports and sporting events generated significant user interest and activity in our Sportsbook and DFS product offerings. However, the possibility remains that sports seasons and sporting events may be suspended, cancelled or rescheduled due to COVID-19 outbreaks. The suspension and alteration of sports seasons and sporting events earlier in 2020 reduced customers’ use of, and spending on, the Company’s Sportsbook and DFS product offerings and caused the Company to issue refunds for canceled events. Additionally, while retail casinos where the Company has branded Sportsbooks have reopened, they continue to operate with reduced capacity.

The Company’s revenues vary based on sports seasons and sporting events amongst other things, and cancellations, suspensions or alterations resulting from COVID-19 have the potential to adversely affect its revenue, possibly materially. However, the Company’s product offerings that do not rely on sports seasons and sporting events, such as iGaming, may partially offset this adverse impact on revenue. DraftKings is also innovating to develop more products that do not rely on traditional sports seasons and sporting events, for example, products that permit wagering and contests on events such as eSports, simulated NASCAR and League of Legends.

A significant or prolonged decrease in consumer spending on entertainment or leisure activities would likely have an adverse effect on demand for the Company’s product offerings, reducing cash flows and revenues, and thereby materially harming the Company’s business, financial condition and results of operations. In addition, a recurrence of COVID-19 cases or an emergence of additional variants or strains of COVID-19 could cause other widespread or more severe impacts depending on where infection rates are highest. As steps taken to mitigate the spread of COVID-19 have necessitated a shift away from a traditional office environment for many employees, the Company has business continuity programs in place to ensure that employees are safe and that the business continues to function with minimal disruptions to normal work operations while employees work remotely. The Company will continue to monitor developments relating to disruptions and uncertainties caused by COVID-19.

2. Summary of Significant Accounting Policies and Practices

Basis of Presentation and Principles of Consolidation

These unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and accounting principles generally accepted in the United States (“U.S. GAAP”) for interim reporting. Accordingly, certain notes or other information that are normally required by U.S. GAAP have been omitted if they substantially duplicate the disclosures contained in the Company’s annual audited consolidated financial statements. Accordingly, the unaudited condensed consolidated financial statements should be read in connection with the Company’s audited financial statements and related notes as of and for the fiscal year ended December 31, 2020, which are included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 as filed with the SEC on February 26, 2021 and as amended by the Form 10-K/A filed with the SEC on May 3, 2021. The accompanying unaudited condensed consolidated financial statements are unaudited; however, in the opinion of management, they include all normal and recurring adjustments necessary for a fair presentation of the Company’s unaudited condensed consolidated financial statements for the periods presented. Results of operations reported for interim periods are not necessarily indicative of results for the entire year, due to seasonal fluctuations in the Company’s revenue as a result of timing of the various sports seasons, sporting events and other factors.

As the Company completed its acquisition of SBTech on April 23, 2020, the presented financial information for the three months ended March 31, 2021 includes the financial information and activities for SBTech; whereas, the financial information for the three months ended March 31, 2020 excludes the financial information and activities for SBTech.

The accompanying unaudited condensed consolidated financial statements include the accounts and operations of the Company. All intercompany balances and transactions have been eliminated. Certain amounts from a prior period, which are not material, have been reclassified to conform with the current period presentation.

8

Cash and cash equivalents

Cash and cash equivalents consist of highly liquid, unrestricted savings, checking and other bank accounts. The Company also utilizes short-term certificates of deposit and money market funds, each with original maturities of three months or less.

Recently Adopted Accounting Pronouncements

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-06, Debt — Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging — Contracts in Entity’s Own Equity (Subtopic 815-40) (“ASU 2020-06”) to simplify accounting for certain financial instruments. ASU 2020-06 eliminates the current models that require separation of beneficial conversion and cash conversion features from convertible instruments and simplifies the derivative scope exception guidance pertaining to equity classification of contracts in an entity’s own equity. The new standard also introduces additional disclosures for convertible debt and freestanding instruments that are indexed to and settled in an entity’s own equity. ASU 2020-06 amends the diluted earnings per share guidance, including the requirement to use the if-converted method for all convertible instruments. ASU 2020-06 is effective January 1, 2022 and should be applied on a full or modified retrospective basis, with early adoption permitted beginning on January 1, 2021. The Company elected to early adopt the new standard as of January 1, 2021 using the modified retrospective approach. In the first quarter of 2021, the Company issued convertible senior notes, whereby the entire proceeds from issuance were recognized as a liability, net of any lender fees and debt financing costs, on our condensed consolidated balance sheet as there is no longer a discount from separation of the conversion feature within equity. Please refer to Note 5 included herein for additional information.

In December 2019, the FASB issued ASU 2019-12, Income Taxes—Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes (“ASU 2019-12”). ASU 2019-12 simplifies the accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. ASU 2019-12 is effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020. The Company adopted this standard as of January 1, 2021. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements and related disclosures.

3. Business Combinations

On March 24, 2021, the Company acquired

Cash consideration | $ | | |

Share consideration (1) |

| | |

Total consideration | $ | |

| (1) | Represents the issuance of |

The acquired assets and assumed liabilities of VSiN were recorded at their estimated fair values. The purchase price allocation is preliminary and as additional information becomes available, we may further revise the preliminary purchase price allocation during the remainder of the measurement period, which will not exceed 12 months from the closing of the acquisition. Measurement period adjustments will be recognized in the reporting period in which the adjustment amounts are determined. Any such adjustments may be material.

9

The purchase price of the VSiN acquisition was allocated on a preliminary basis as follows:

Operating lease right-of-use assets |

| $ | |

Intangible assets |

| | |

Other assets |

| | |

Liabilities |

| ( | |

Goodwill |

| | |

Total | $ | |

Goodwill represents the excess of the gross considerations transferred over the fair value of the underlying net assets acquired and liabilities assumed. Goodwill associated with the VSiN acquisition is assigned as of the acquisition date to the Company’s Media reporting unit. Goodwill recognized is not deductible for local tax purposes.

The intangible assets acquired as part of the VSiN acquisition were as follows:

|

| Weighted-Average | |||

Fair Value | Useful Life (in years) | ||||

|

| ||||

Developed technology - software | $ | |

| ||

Customer relationships |

| |

| ||

Trademarks and trade names |

| |

| ||

Total | $ | |

|

| |

As VSiN’s financial results are not material to the Company’s condensed consolidated financial statements, the Company has elected to not include pro forma results.

4. Intangible Assets and Goodwill

Intangible Assets

The Company has the following intangible assets, net as of March 31, 2021:

| Weighted- |

|

|

| |||||||

Average | |||||||||||

Remaining | Gross | ||||||||||

Amortization | Carrying | Accumulated | |||||||||

| Period |

| Amount |

| Amortization |

| Net | ||||

Developed technology |

| $ | | $ | ( | $ | | ||||

Internally developed software |

| |

| |

| ( |

| | |||

Gaming licenses |

| |

| |

| ( |

| | |||

Trademarks and tradenames |

|

| |

| ( |

| | ||||

Customer relationships |

|

| |

| ( |

| | ||||

Intangible Assets, net | $ | | $ | ( | $ | | |||||

10

The Company has the following intangible assets, net as of December 31, 2020:

| Weighted- |

|

|

| ||||||||

Average | ||||||||||||

Remaining | Gross | |||||||||||

Amortization | Carrying | Accumulated | ||||||||||

Period | Amount | Amortization | Net | |||||||||

Developed technology |

| $ | | $ | ( | $ | | |||||

Internally developed software |

|

| |

| ( |

| | |||||

Gaming licenses |

|

| |

| ( |

| | |||||

Trademarks and tradenames |

|

| |

| ( |

| | |||||

Customer relationships |

|

| |

| ( |

| | |||||

Intangible Assets, net | $ | | $ | ( | $ | | ||||||

Amortization expense was $

Goodwill

The changes in the carrying amount of goodwill for the three months ended March 31, 2021 by reporting unit are:

| B2C |

| B2B |

| Media |

| Total | |||||

Balance as of December 31, 2020 | $ | | $ | | $ | — | $ | | ||||

Goodwill resulting from acquisitions* |

| — |

| — | |

| | |||||

Cumulative translation adjustment |

| — |

| ( | — |

| ( | |||||

Balance as of March 31, 2021 | $ | | $ | | $ | | $ | | ||||

* = Preliminary allocation

5. | Current and Long-term Liabilities |

Convertible Notes

In March 2021, the Company issued zero-coupon convertible senior notes in an aggregate principal amount of $

The Convertible Notes are convertible at an initial conversion rate of

Prior to September 15, 2027, the Convertible Notes will be convertible only upon satisfaction of certain conditions and during certain periods, and thereafter, at any time until the close of business on the second scheduled trading day immediately preceding the maturity date. The Company will satisfy any conversion election by paying or delivering, as the case may be, cash, shares of Class A common stock or a combination of cash and shares of Class A common stock. During the three months ended March 31, 2021, the conditions allowing holders of the Convertible Notes to convert were not met.

In connection with the pricing of the Convertible Notes and the exercise of the option to purchase additional notes, the Company entered into a privately negotiated capped call transaction (“Capped Call Transactions”). The Capped Call Transactions have a strike price of $

11

are expected generally to reduce potential dilution to the Company's Class A common stock upon any conversion of Convertible Notes. As the transaction qualifies for equity classification, the net cost of $

Revolving Line of Credit

In October 2016, the Company entered into an amended and restated loan and security agreement with Pacific Western Bank, which was most recently amended in September 2020 (as amended, the “Credit Agreement”). The Credit Agreement provides a revolving line of credit of up to $

Borrowings under the Credit Agreement bear interest at a variable annual rate equal to the greater of (i)

Indirect Taxes

Taxation of e-commerce is becoming more prevalent and could negatively affect the Company’s business as it pertains to DFS and its users. The ultimate impact of indirect taxes on the Company’s business is uncertain, as is the period required to resolve this uncertainty. The Company’s estimated contingent liability for indirect taxes represents the Company’s best estimate of tax liability in jurisdictions in which the Company believes taxation is probable. The Company frequently reevaluates its tax positions for appropriateness.

Indirect tax statutes and regulations are complex and subject to differences in application and interpretation. Tax authorities may impose indirect taxes on Internet-delivered activities based on statutes and regulations which, in some cases, were established prior to the advent of the Internet and do not apply with certainty to the Company’s business. The Company’s estimated contingent liability for indirect taxes may be materially impacted by future audit results, litigation and settlements, should they occur. The Company’s activities by jurisdiction may vary from period to period, which could result in differences in the applicability of indirect taxes from period to period.

As of March 31, 2021 and December 31, 2020, the Company’s estimated contingent liability for indirect taxes was $

Warrant Liabilities

As part of DEAC’s initial public offering on May 14, 2019, DEAC issued

12

6. | Revenue Recognition |

Deferred Revenue

The Company included deferred revenue within accounts payable and accrued expenses and liabilities to users in the consolidated balance sheets. The deferred revenue balances were as follows:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

Deferred revenue, beginning of the period | $ | | $ | | ||

Deferred revenue, end of the period |

| |

| | ||

Revenue recognized in the period from amounts included in deferred revenue at the beginning of the period |

| |

| | ||

Deferred revenue primarily represents contract liabilities related to the Company’s obligation to transfer future value in relation to in period transactions in which the Company has received consideration. Such obligations are recognized as liabilities when awarded to users and are recognized as revenue when those liabilities are later resolved. The Company included deferred revenue within accounts payable and accrued expenses and liabilities to users on its consolidated balance sheets.

Revenue Disaggregation

Disaggregation of revenue for the three months ended March 31, 2021 and 2020 is as follows:

| Three months ended March 31, | |||||

| 2021 |

| 2020 | |||

Online gaming | $ | | $ | | ||

Gaming software |

| | — | |||

Other |

| |

| | ||

Total Revenue | $ | | $ | | ||

The following table presents the Company’s revenue by geographic region for the periods indicated:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

United States | $ | | $ | | ||

International |

| |

| ( | ||

Total Revenue | $ | | $ | | ||

7. | Stock-Based Compensation |

The Company, historically, has issued

13

The following table shows stock option activity for the three months ended March 31, 2021:

| Weighted |

| Weighted | |||||||||||||||||

Average | Average | |||||||||||||||||||

Exercise | FMV | |||||||||||||||||||

Price of | of | |||||||||||||||||||

| Time-based |

| PSP |

| LTIP |

| Total |

| Options |

| RSUs | |||||||||

Options | RSUs | Options | RSUs | Options | RSUs | |||||||||||||||

Outstanding at December 31, 2020 |

| |

| |

| |

| |

| |

| |

| |

| $ | |

| $ | |

Granted |

| |

| |

| — |

| |

| — |

| |

| |

| |

| | ||

Exercised options / vested RSUs |

| ( |

| ( |

| ( |

| — |

| ( |

| — |

| ( |

| |

| | ||

Forfeited |

| ( |

| ( |

| ( |

| — |

| — |

| ( |

| ( |

| |

| | ||

Outstanding at March 31, 2021 |

| |

| |

| |

| |

| |

| |

| | $ | |

| $ | | |

As of March 31, 2021, total unrecognized stock-based compensation expense of $

Three months ended March 31, 2021 |

| Three months ended March 31, 2020 | ||||||||||||||||

| Options | RSUs | Total |

| Options | RSUs | Total | |||||||||||

Time Based | $ | | $ | | $ | | $ | | $ | — | $ | | ||||||

PSP |

| — | |

| |

| | — |

| | ||||||||

LTIP |

| — | |

| |

| | — |

| | ||||||||

Total | $ | | $ | | $ | | $ | | $ | — | $ | | ||||||

8. | Income Taxes |

Three months ended March 31, 2021 and 2020 is as follows:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

(Benefit) provision for income taxes | $ | ( | $ | | ||

The effective tax rates for the three months ended March 31, 2021 and 2020 were

9. | Segment Information |

The Company operates its business and reports its results through

Operating segments are components of the Company for which separate discrete financial information is available to and evaluated regularly by the chief operating decision maker (“CODM”), who is the Company’s Chief Executive Officer, in making decisions regarding resource allocation and assessing performance. The CODM assesses a combination of metrics such as revenue and Adjusted EBITDA to evaluate the performance of each operating and reportable segment.

Any intercompany revenues or expenses are eliminated in consolidation. All of the Company’s operating revenues and expenses, other than those excluded from Adjusted EBITDA as detailed below, are allocated to the Company’s reportable segments. We define

14

and calculate Adjusted EBITDA as net loss before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: stock-based compensation, transaction-related costs, litigation, settlement and related costs and certain other non-recurring, non-cash and non-core items, as described in the reconciliation below.

A measure of segment assets and liabilities has not been currently provided to the Company’s CODM and therefore is not shown below. Summarized financial information for the Company’s segments is shown in the following tables:

Summarized financial information for the Company’s segments is shown in the following tables:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

Revenue: |

|

|

|

| ||

B2C | $ | | $ | | ||

B2B |

| |

| — | ||

Total revenue |

| |

| | ||

Adjusted EBITDA: |

|

|

|

| ||

B2C |

| ( |

| ( | ||

B2B |

| |

| — | ||

Total adjusted EBITDA |

| ( |

| ( | ||

Adjusted for: |

|

|

|

| ||

Depreciation and amortization |

| |

| | ||

Interest (income) expense, net |

| ( |

| | ||

Income tax (benefit) provision |

| ( |

| | ||

Stock-based compensation |

| |

| | ||

Transaction-related costs |

| |

| | ||

Litigation, settlement and related costs |

| |

| | ||

Loss on remeasurement of warrant liabilities | | — | ||||

Other non-recurring costs and special project costs |

| |

| | ||

Non-operating costs |

| |

| | ||

Net Loss attributable to common shareholders | $ | ( | $ | ( | ||

Due to the timing of the Business Combination, the three-month period ended March 31, 2020 excludes B2B/SBTech activity.

10. | Loss Per Share |

The computation of loss per share and weighted-average shares of the Company’s Class A common stock outstanding for the periods presented are as follows:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

Net loss | $ | ( | $ | ( | ||

Basic and diluted weighted-average common shares outstanding |

| |

| | ||

Loss per share attributable to common stockholders: |

|

|

|

| ||

Basic and diluted | $ | ( | $ | ( | ||

15

For the periods presented, the following securities were not required to be included in the computation of diluted shares outstanding (calculated on a gross settlement or a full conversion basis):

| Three months ended March 31, | |||

2021 | 2020 | |||

Warrants |

| |

| |

Stock options and RSUs |

| |

| |

Convertible notes | | | ||

Total |

| |

| |

11. | Related-Party Transactions |

Media Purchase Agreement (“MPA”)

In July 2015, Old DK entered into an MPA with a related party for various media placements from 2015 through 2018. The MPA was amended to extend through 2021. The annual commitment for calendar years 2017 through 2021 was $

Private Placement Agent

Old DK entered into an engagement letter with a related party (the “Private Placement Agent”) in August 2019, as amended in December 2019. Pursuant to the engagement letter, the Private Placement Agent has acted as the exclusive financial advisor to Old DK, and Old DK agreed to pay certain acquisition and financing fees in connection with the Business Combination with SBTech and DEAC. For the three months ended March 31, 2021 and 2020, Old DK incurred $

Receivables from Equity Method Investment

The Company provides office space and general operational support to DKFS, LLC, an equity-method affiliate. The operational support is primarily in the form of general and administrative services. As of March 31, 2021 and December 31, 2020, the Company had $

Transactions with a Shareholder and their Immediate Family Members

As of March 31, 2021 and December 31, 2020, the Company had $

16

12. | Leases, Commitments and Contingencies |

Leases

The Company leases corporate office facilities, data centers, and motor vehicles under operating lease agreements. The Company’s lease agreements have terms not exceeding

The components of lease expense are as follows:

Three months ended March 31, | ||||

| 2021 |

| 2020 | |

Operating lease cost |

| |

| |

Short term lease cost |

| |

| |

Variable lease cost |

| |

| |

Sublease income |

| ( |

| ( |

Total lease cost |

| |

| |

Other information related to leases are as follows:

Three months ended March 31, | ||||

| 2021 |

| 2020 | |

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

Operating cash flows from operating leases |

| |

| |

Right-of-use assets obtained in exchange for new operating lease liabilities |

| |

| |

The weighted-average remaining lease term and weighted-average discount rate for the Company’s operating leases were

Maturity of lease liabilities are as follows:

| Years ending | ||

December 31, | |||

From April 1, 2021 to December 31, 2021 | $ | | |

2022 |

| | |

2023 |

| | |

2024 |

| | |

2025 |

| | |

Thereafter | | ||

Total undiscounted future cash flows | | ||

Less: Imputed interest |

| ( | |

Present value of undiscounted future cash flows | $ | | |

17

Other Contractual Obligations and Contingencies

The Company is a party to several non-cancelable contracts with vendors where the Company is obligated to make future minimum payments under the terms of these contracts as follows:

| Years ending | ||

December 31, | |||

From April 1, 2021 to December 31, 2021 | $ | | |

2022 |

| | |

2023 |

| | |

2024 |

| | |

2025 |

| | |

Thereafter |

| | |

Total | $ | | |

* The above commitments include $

Contingencies

From time to time, and in the ordinary course of business, the Company may be subject to certain claims, charges and litigation concerning matters arising in connection with the conduct of the Company’s business activities.

In Re: Daily Fantasy Sports Litigation (Multi-District Litigation)

Between late 2015 and early 2016, certain individuals who allegedly registered and competed in daily sports fantasy contests on our and FanDuel’s websites, and their family members, filed numerous actions (primarily purported class actions) against us, FanDuel, and other related parties in courts across the United States. In February 2016, these actions were consolidated in a multi-district litigation in the U.S. District Court for the District of Massachusetts. The plaintiffs asserted 27 claims arising under both state and federal law against the DFS defendants. The plaintiffs’ claims against us generally fall into four categories: (1) the Company’s online daily fantasy sports contests constitute illegal gambling; (2) the Company promulgated false or misleading advertisements that emphasized the ease of play and likelihood of winning; (3) the Company induced consumers to lose money through a deceptive bonus program; and (4) the Company allowed our employees to participate in competitors’ fantasy sports contests using non-public information, which gave such employees an unfair advantage over other contestants. The plaintiffs seek money damages, equitable relief, and disgorgement of gains against the Company. DraftKings intend to vigorously defend this case. If the plaintiffs obtain a judgment in their favor in this matter, the Company could be subject to substantial damages and it could be restricted from offering DFS contests in certain states. The Company has established an accrual for this matter, but it cannot provide any assurance as to the outcome of this lawsuit.

Despite the potential for significant damages, the Company does not believe, based on currently available information, that the outcome of this proceeding will have a material adverse effect on DraftKings’ financial condition, although the outcome could be material to DraftKings’ operating results for any particular period, depending, in part, upon the operating results for such period.

1,000 Mass Arbitration Demands Filed by One Law Firm

On October 21, 2019, a law firm filed

18

The Company intends to vigorously defend all claims. If the claimants successfully compel arbitration and then obtain a judgment in their favor in these arbitrations, the Company could be subject to substantial damages and it could be restricted from offering DFS contests in certain states. Despite the potential for significant damages, the Company does not believe, based on currently available information, that the outcome of this proceeding will have a material adverse effect on DraftKings’ financial condition, although the outcome could be material to DraftKings’ operating results for any particular period, depending, in part, upon the operating results for such period. The Company cannot predict with any degree of certainty the outcome of Abramson or determine the extent of any potential liability or damages should the cases proceed to arbitration. The Company also cannot provide an estimate of the possible loss or range of loss.

Interactive Games LLC

On June 14, 2019, Interactive Games LLC (“IG”) filed suit against the Company in the U.S. District Court for the District of Delaware, alleging that our Daily Fantasy Sports product offering infringes

Internal Revenue Service

The Company is currently under Internal Revenue Service audit for prior tax years, with the primary unresolved issues relating to excise taxation of fantasy sports contests and informational reporting and withholding. The final resolution of that audit, and other audits or litigation, may differ from the amounts recorded in these consolidated financial statements and may materially affect the Company’s consolidated financial statements in the period or periods in which that determination is made.

Letters of Credit

In connection with the Credit Agreement with Pacific Western Bank, the Company has entered into several letters of credit totaling $

13. | Subsequent Events |

In April 2021, the Company acquired Blue Ribbon Software Ltd. (“Blue Ribbon”) for $

19

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q (the “Report”) and the section entitled “Risk Factors.” Unless otherwise indicated, the terms “DraftKings,” “we,” “us,” or “our” refer to DraftKings Inc., a Nevada corporation, together with its consolidated subsidiaries.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 that reflect future plans, estimates, beliefs and expected performance. The forward-looking statements depend upon events, risks and uncertainties that may be outside of our control. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. You are cautioned that our business and operations are subject to a variety of risks and uncertainties, many of which are beyond our control, and, consequently, our actual results may differ materially from those projected.

Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in the section entitled “Risk Factors” included elsewhere in this Report. Any statements contained herein that are not statements of historical fact may be forward-looking statements.

| ● | factors relating to our business, operations and financial performance, including: |

| ● | our ability to effectively compete in the global entertainment and gaming industries; |

| ● | our ability to successfully acquire and integrate new operations; |

| ● | our ability to obtain and maintain licenses with gaming authorities; |

| ● | our inability to recognize deferred tax assets and tax loss carryforwards; |

| ● | market and global conditions and economic factors beyond our control, including the potential adverse effects of the ongoing global coronavirus (“COVID-19”) pandemic on capital markets, general economic conditions, unemployment and our liquidity, operations and personnel; |

| ● | intense competition and competitive pressures from other companies worldwide in the industries in which we operate; |

| ● | our ability to raise financing in the future; |

| ● | our success in retaining or recruiting officers, key employees or directors; and |

| ● | litigation and the ability to adequately protect our intellectual property rights. |

These risks and other factors include those set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (“2020 Annual Report”), filed with the SEC on February 26, 2020 and as amended on Form 10-K/A on May 3, 2021. Due to the uncertain nature of these factors, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any of these statements to reflect events or circumstances occurring after the date of this Report. New factors may emerge and it is not possible to predict all factors that may affect our business and prospects.

20

Our Business

We are a digital sports entertainment and gaming company. We provide users with daily fantasy sports (“DFS”), sports betting (“Sportsbook”) and online casino (“iGaming”) opportunities, and we are also involved in the design, development, and licensing of sports betting and casino gaming software for online and retail sportsbook and casino gaming products.

Our mission is to make life more exciting by responsibly creating the world’s favorite real-money games and betting experiences. We accomplish this by creating an environment where our users can find enjoyment and fulfillment through DFS, Sportsbook and iGaming.

We make deliberate and substantial investments in support of our mission and long-term growth. For example, we have invested in our products and technology in order to continually launch new product innovations, improve marketing, merchandising, and operational efficiency through data science, and deliver a great user experience. We also make significant investments in sales and marketing and incentives to grow and retain our paid user base, including personalized cross-product offers and promotions, and promote brand awareness to attract the “skin-in-the-game” sports fan. Together, these investments have enabled us to create a leading product offering built on scalable technology, while attracting a user base that has resulted in the rapid growth of our business.

Our priorities are to (a) continue to invest in our products and services, (b) launch our product offerings in new geographies, (c) effectively integrate SBTech (Global) Limited (“SBTech”) to form a vertically integrated business, (d) create replicable and predictable state-level unit economics in sports betting and iGaming and (e) expand our consumer offerings. When we launch Sportsbook and iGaming offerings in a new jurisdiction, we invest in user acquisition, retention and cross-selling until the new jurisdiction provides a critical mass of users engaged across our product offerings.

Our current technology is highly scalable with relatively minimal incremental spend required to launch our product offerings in new jurisdictions. We will continue to manage our fixed-cost base in conjunction with our market entry plans and focus our variable spend on marketing, user experience and support and regulatory compliance to become the product of choice for users and maintain favorable relationships with regulators. We expect to further improve our profitability (excluding the impact of amortization of acquired intangibles) through cost synergies and new opportunities driven by vertical integration with SBTech’s technology and expertise.

Our path to profitability is based on the acceleration of positive contribution profit growth driven by marketing efficiencies as we continue the transition from local to regional to national advertising and scale benefits on the technology development component of our cost of revenue. On a consolidated Adjusted EBITDA basis, we expect to achieve profitability when total contribution profit exceeds the fixed costs of our business, which depends, in part, on the percentage of the U.S. adult population that has access to our product offerings and the other factors summarized in the section entitled “Cautionary Statement Regarding Forward-Looking Statements”.

Basis of Presentation

We operate two complementary business segments: our business-to-consumer (“B2C”) business and our business-to-business (“B2B”) business.

B2C

Our B2C business is comprised of the legacy business of DraftKings Inc., a Delaware corporation (“Old DK”), which includes our DFS, Sportsbook and iGaming product offerings. Across these principal offerings, we offer users a single integrated product that provides one account, one wallet, a centralized payment system and responsible gaming controls. Currently, we operate our B2C segment primarily in the United States.

B2B

Our B2B business is comprised of the entirety of the operations of SBTech, which we acquired on April 23, 2020. Our B2B segment’s principal activities involve the design and development of sports betting and casino gaming software. Our B2B services are delivered through our proprietary software, and our complementary service offerings include trading and risk management and support for reporting, customer management and regulatory reporting requirements. The operations of our B2B segment are concentrated mainly in Europe, Asia and the United States.

21

Impact of COVID-19

The COVID-19 pandemic has adversely impacted global commercial activity, disrupted supply chains and contributed to significant volatility in financial markets. In 2020, the COVID-19 pandemic adversely impacted many different industries. The ongoing COVID-19 pandemic could have a continued material adverse impact on economic and market conditions and trigger a period of global economic slowdown. The rapid development and fluidity of this situation precludes any prediction as to the extent and the duration of the impact of COVID-19. The COVID-19 pandemic therefore presents material uncertainty and risk with respect to us and our performance and could affect our financial results in a materially adverse way.

Since the start of the COVID-19 pandemic, the primary impacts to us have been the suspension, cancellation and rescheduling of sports seasons and sporting events. Beginning in March 2020 and continuing through the end of the second quarter of 2020, many sports seasons and sporting events, including the MLB regular season, domestic soccer leagues and European Cup competitions, the NBA regular season and playoffs, the NCAA college basketball tournament, the Masters golf tournament, and the NHL regular season and playoffs, were suspended or cancelled. The suspension of sports seasons and sporting events reduced customers’ use of, and spending on, our Sportsbook and DFS product offerings. Starting in the third quarter of 2020 and continuing into the fourth quarter of 2020, major professional sports leagues resumed their activities, many of which were held at limited or reduced capacity. MLB began its season after a three-month delay and also completed the World Series, the NHL resumed its season and completed the Stanley Cup Playoffs, the Masters golf tournament was held, most domestic soccer leagues resumed and several European cup competitions were held, and the NFL season began on its regular schedule. During this period, the NBA also resumed its season, completed the NBA Finals and commenced its 2020-2021 season. In the first quarter of 2021, many sports seasons continued and multiple sporting events were held as planned, including the NFL regular season, the NFL Playoffs and Superbowl LV, the NBA regular season, the NHL regular season, the NASCAR Cup Series, various NCAA football bowl games and the NCAA college basketball season and tournament. The continued return of major sports and sporting events generated significant user interest and activity in our Sportsbook and DFS product offerings. However, the possibility remains that sports seasons and sporting events may be suspended, cancelled or rescheduled due to COVID-19 outbreaks. The suspension and alteration of sports seasons and sporting events in 2020 reduced customers’ use of, and spending on, our Sportsbook and DFS product offerings and caused us to issue refunds for canceled events. Additionally, while retail casinos where we have branded Sportsbooks have reopened, they continue to operate with reduced capacity.

Our revenues vary based on sports seasons and sporting events amongst other things, and cancellations, suspensions or alterations resulting from COVID-19 have the potential to adversely affect our revenue, possibly materially. However, our product offerings that do not rely on sports seasons and sporting events, such as iGaming, may partially offset this adverse impact on revenue. DraftKings is also innovating to develop more products that do not rely on traditional sports seasons and sporting events, for example, products that permit wagering and contests on events such as eSports, simulated NASCAR and League of Legends.

A significant or prolonged decrease in consumer spending on entertainment or leisure activities would likely have an adverse effect on demand for our product offerings, reducing cash flows and revenues, and thereby materially harming our business, financial condition and results of operations. In addition, a recurrence of COVID-19 cases or an emergence of additional variants or strains of COVID-19 could cause other widespread or more severe impacts depending on where infection rates are highest. As steps taken to mitigate the spread of COVID-19 have necessitated a shift away from a traditional office environment for many employees, we have business continuity programs in place to ensure that employees are safe and that the business continues to function with minimal disruptions to normal work operations while employees work remotely. We will continue to monitor developments relating to disruptions and uncertainties caused by COVID-19.

22

Financial Highlights and Trends

The following table sets forth a summary of our financial results for the periods indicated:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

(amounts in thousands) |

|

|

|

| ||

Revenue (1) | $ | 312,276 | $ | 88,542 | ||

Pro Forma Revenue (2) |

| 312,276 |

| 113,445 | ||

Net Loss (1) |

| (346,344) |

| (68,680) | ||

Pro Forma Net Loss (2) |

| (346,344) |

| (82,081) | ||

Adjusted EBITDA (3) |

| (139,262) |

| (49,460) | ||

Pro Forma Adjusted EBITDA (3) |

| (139,262) |

| (51,600) | ||

| (1) | Due to the timing of the Business Combination (as defined below), the three month period ended March 31, 2021 reflects B2B/SBTech activity and the three month period ending March 31, 2020 excludes B2B/SBTech activity. |

| (2) | Assumes that the Business Combination was consummated on January 1, 2019. See “—Comparability of Financial Information” below. |

| (3) | Adjusted EBITDA and Pro Forma Adjusted EBITDA are non-GAAP financial measures. See “—Non-GAAP Information” below for additional information about these measures and a reconciliation of these measures. |

Revenue grew in the quarter ended March 31, 2021 compared to the quarter ended March 31, 2020 by $223.7 million primarily due to the strong performance of our B2C product offerings as a result of robust customer acquisition and retention, successful launches of our Sportsbook and iGaming product offerings in a number of states since the first quarter of 2020 and the acquisition of SBTech. In addition, revenue growth in the first quarter of 2021 when compared to the same period in 2020 was positively impacted by the suspension and cancellation of major sporting events beginning in early March of 2020 as a result of COVID-19, and resulted in a reduction in customers’ use of, and spending on, our Sportsbook and DFS product offerings.

Pro forma revenue increased by $198.8 million in the three months ended March 31, 2021, compared to the same period in 2020, mainly reflecting the strong performance of our B2C product offerings, as discussed above, and an increase in SBTech revenues as our B2B business was also negatively impacted in the first quarter of 2020 by COVID-19.

Comparability of Financial Results

On April 23, 2020, we completed the business combination, by and among DEAC, Old DK and SBTech (the “Business Combination”). The Business Combination resulted in, among other things, a considerable increase in amortizable intangible assets and goodwill. The amortization of acquired intangibles has materially increased our consolidated cost of sales (and adversely affected our consolidated gross profit margin) for periods after the acquisition and is expected to continue to do so for the foreseeable future. As a result of the Business Combination, we became a public company listed on The Nasdaq Stock Market LLC and have hired personnel and incurred costs that are necessary and customary for our operations as a public company, which has contributed to, and is expected to continue to contribute to, higher general and administrative costs.

In March 2021, we issued zero-coupon convertible senior notes in an aggregate principal amount of $1,265.0 million, which includes proceeds from the full exercise of the over-allotment option (collectively the “Convertible Notes”). In connection with the pricing of the Convertible Notes and the exercise of the option to purchase additional notes, the Company entered into a privately negotiated capped call transaction (“Capped Call Transactions”). The Capped Call Transactions are expected generally to reduce potential dilution to our Class A common stock upon any conversion of the Convertible Notes. The net cost to enter into the Capped Call Transactions was $124.0 million.

We had cash on hand, excluding cash held on behalf of customers, of $2.8 billion as of March 31, 2021, compared to $1.8 billion as of December 31, 2020.

23

We recorded a loss on remeasurement warrant liabilities of $27.0 million in the three months ended March 31, 2021 due to fair value changes in the warrant liability. We did not have similar instruments in the three months ended March 31, 2020 and therefore no loss on remeasurement was recorded in the prior period.

The following discussion of our results of operations for the three months ended March 31, 2021 includes the financial results of SBTech. Accordingly, our consolidated results of operations for the three months ended March 31, 2021 are not comparable to our consolidated results of operations for prior periods. Our B2C segment results, presented and discussed below, are comparable to DraftKings’ legacy operations and our reported consolidated results for prior periods.

To facilitate comparability between periods, we have included in this Report a supplemental discussion of our results of operations for the three months ended March 31, 2021 compared with our unaudited pro forma results of operations for the three months ended March 31, 2020. The pro forma results for the three months ended March 31, 2020 were prepared giving effect to the Business Combination as if it had been consummated on January 1, 2019, and are based on estimates and assumptions, which we believe are reasonable and consistent with Article 11 of Regulation S-X.

Key Performance Indicators – B2C Operations

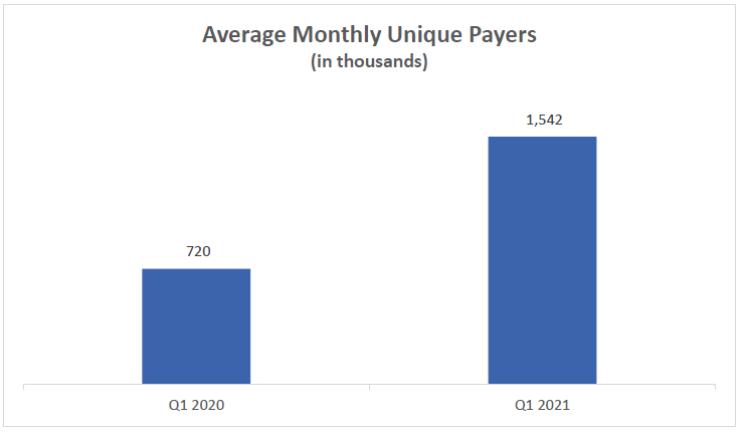

Monthly Unique Payers (“MUPs”). MUPs is the average number of unique paid users (“unique payers”) that use our B2C product offerings on a monthly basis.

MUPs is a key indicator of the scale of our B2C user base and awareness of our brand. We believe that year-over-year MUPs is also generally indicative of the long-term revenue growth potential of our B2C segment, although MUPs in individual periods may be less indicative of our longer-term expectations. We expect the number of MUPs to grow as we attract, retain and re-engage users in new and existing jurisdictions and expand our product offerings to appeal to a wider audience.

We define MUPs as the number of unique payers per month who had a paid engagement (i.e., participated in a real-money DFS contest, sports bet, or casino game) across one or more of our product offerings via our technology. For reported periods longer than one month, we average the MUPs for the months in the reported period.

A “unique paid user” or “unique payer” is any person who had one or more paid engagements via our B2C technology during the period (i.e., a user that participates in a paid engagement with one of our B2C product offerings counts as a single unique paid user or unique payer for the period). We exclude users who have made a deposit but have not yet had a paid engagement. Unique payers or unique paid users include users who have participated in a paid engagement with promotional incentives, which are fungible with other funds deposited in their wallets on our technology. The number of these users included in MUPs has not been material to date and a substantial majority of such users are repeat users who have had paid engagements both prior to and after receiving incentives.

24

The chart below presents our MUPs for the three months ended March 31, 2021 and 2020 respectively:

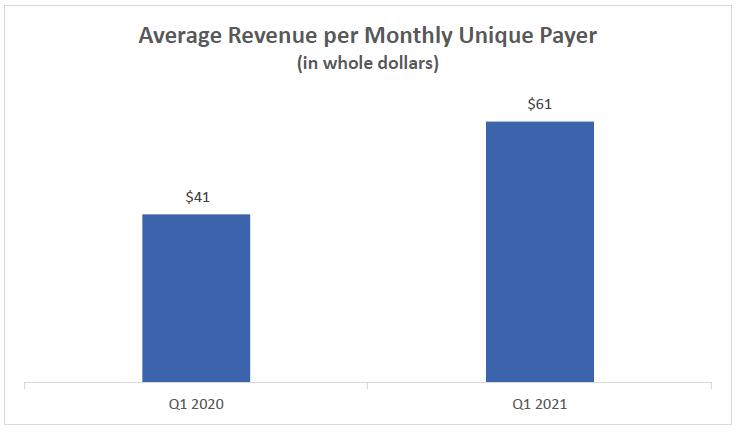

Average Revenue per MUP (“ARPMUP”). ARPMUP is the average B2C segment revenue per MUP, and this key metric represents our ability to drive usage and monetization of our B2C product offerings. The chart below presents our ARPMUP for the three months ended March 31, 2021 and 2020 respectively:

We define and calculate ARPMUP as the average monthly B2C segment revenue for a reporting period, divided by MUPs (i.e., the average number of unique payers) for the same period.

Our period-on-period increase in MUPs for the three months ended March 31, 2021, compared to the same period in 2020, reflects growth in DFS, the expansion of our Sportsbook and iGaming product offerings into new states and increased response rates to our advertising spending. Year-over-year growth in MUPs in the first quarter of 2021 was also positively impacted by the suspension and cancellation of major sporting events beginning in March of 2020 as a result of COVID-19. ARPMUP increased in the three months ended March 31, 2021, compared to the same period in 2020, due to our continued focus on driving engagement across our B2C product offerings, specifically with our Sportsbook and iGaming products being offered in additional jurisdictions but also as we cross sell our

25

users into more products. As a result, we experienced a favorable change in revenue mix as a higher percentage of our total customers engaged with our Sportsbook and iGaming product offerings. There was also some favorability from the normalized sports schedule as our users in Sportsbook and DFS were able to engage with our products for the entire quarter, including the NCAA basketball tournament and the regular seasons of the NBA and NHL.

Non-GAAP Information

This Report includes Adjusted EBITDA and Pro Forma Adjusted EBITDA, which are non-GAAP performance measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted EBITDA and Pro Forma Adjusted EBITDA are useful in evaluating our operating performance, similar to measures reported by our publicly-listed U.S. competitors, and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted EBITDA and Pro Forma Adjusted EBITDA are not intended to be a substitute for any U.S. GAAP financial measure. As calculated, it may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

We define and calculate Adjusted EBITDA as net loss before the impact of interest income or expense, income tax expense or benefit, depreciation and amortization, and further adjusted for the following items: stock-based compensation, transaction-related costs, non-core litigation, settlement and related costs, remeasurement of warrant liabilities, and certain other non-recurring, non-cash or non-core items, as described in the reconciliation below. We define and calculate Pro Forma Adjusted EBITDA as pro forma net loss (giving effect to the Business Combination as if it were consummated on January 1, 2019) before the impact of interest income or expense, income tax expense or benefit and depreciation and amortization, and further adjusted for the same items as Adjusted EBITDA.

We include these non-GAAP financial measures because they are used by management to evaluate our core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring items (for example, in the case of transaction-related costs), non-cash expenditures (for example, in the case of depreciation, amortization, and stock-based compensation), or are not related to our underlying business performance (for example, in the case of interest income and expense and litigation settlement and related costs). Pro Forma Adjusted EBITDA excludes the same categories of expenses and is prepared to give effect to the Business Combination as if it occurred on January 1, 2019.

Adjusted EBITDA

The table below presents our Adjusted EBITDA reconciled to our net loss, the closest U.S. GAAP measure, for the periods indicated:

Three months ended March 31, | ||||||

| 2021 |

| 2020 | |||

(amounts in thousands) |

|

|

|

| ||

Net loss | $ | (346,344) | $ | (68,680) | ||

Adjusted for: |

|

|

|

| ||

Depreciation and amortization (excluding acquired intangibles) |

| 9,062 |

| 4,704 | ||

Amortization of acquired intangibles |

| 19,131 |

| — | ||

Interest (income) expense, net |

| (985) |

| 2,351 | ||

Income tax (benefit) provision |

| (4,595) |

| 9 | ||

Stock-based compensation (1) |

| 151,843 |

| 4,842 | ||

Transaction-related costs (2) |

| 3,023 |

| 5,652 | ||

Litigation, settlement, and related costs (3) |

| 622 |

| 1,330 | ||

Loss on remeasurement of warrant liabilities |

| 26,980 |

| — | ||

Other non-recurring costs and special project costs (4) |

| 1,848 |

| 129 | ||

Other non-operating costs (5) |

| 153 |

| 203 | ||

Adjusted EBITDA | $ | (139,262) | $ | (49,460) | ||

Adjusted EBITDA by segment: |

|

|

|

| ||

B2B | $ | 2,093 | $ | — | ||

B2C | $ | (141,355) | $ | (49,460) | ||

26

| (1) | The amounts for the three months ended March 31, 2021 primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans and, for the three months ended March 31, 2020, primarily reflects stock-based compensation expenses resulting from the issuance of awards under time-based, performance-based and long-term incentive plans. |

| (2) | Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with transactions and offerings, including those relating to the Business Combination for the three months ended March 31, 2020. |

| (3) | Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations. |

| (4) | Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects. |

| (5) | Includes our equity method share of the investee’s losses. |

Pro Forma Adjusted EBITDA

The table below presents our Actual Non-GAAP Adjusted EBITDA reconciled to net loss for the three-month period ending March 31, 2021 compared to a similar reconciliation of our Non-GAAP Pro Forma Adjusted EBITDA to our pro forma net income for the same period in 2020:

Three months ended March 31, | ||||||

2021 | 2020 | |||||

(amounts in thousands) |

| Actual |

| Pro Forma | ||

Net loss | $ | (346,344) | $ | (82,081) | ||

Adjusted for: |

|

|

|

| ||

Depreciation and amortization (excluding acquired intangibles) |

| 9,062 |

| 5,552 | ||

Amortization of acquired intangibles |

| 19,131 |

| 17,699 | ||

Interest (income) expense, net |

| (985) |

| 2,798 | ||

Income tax (benefit) provision |

| (4,595) |

| (2,088) | ||

Stock-based compensation (1) |

| 151,843 |

| 4,858 | ||

Transaction-related costs (2) |

| 3,023 |

| — | ||

Litigation, settlement, and related costs (3) |

| 622 |

| 1,330 | ||

Loss on remeasurement of warrant liabilities |

| 26,980 |

| — | ||

Other non-recurring costs and special project costs (4) |

| 1,848 |

| 129 | ||

Other non-operating costs (5) |

| 153 |

| 203 | ||

Pro forma Adjusted EBITDA | $ | (139,262) | $ | (51,600) | ||

| (1) | The amounts for the three months ended March 31, 2021, primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans and, for the three months ended March 31, 2020, primarily reflects stock-based compensation expenses resulting from the issuance of awards under time-based, performance-based and long-term incentive plans. |

| (2) | Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with transactions and offerings. The transaction costs related to the Business Combination described in footnote 1 to the preceding table have been eliminated in calculating our pro forma net income for the three months ended March 31, 2020 pursuant to the principles of Article 11 of Regulation S-X. |

| (3) | Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations. |

| (4) | Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects. |

| (5) | Includes our equity method share of the investee’s losses. |

27

Results of Operations

Three Months Ended March 31, 2021 Compared to the Three Months Ended March 31, 2020

The following table sets forth a summary of our consolidated results of operations for the interim periods indicated, and the changes between periods.

Three months ended March 31, |

| |||||||||||

| 2021 |

| 2020 |

| $ Change |

| % Change |

| ||||

(amounts in thousands, except percentages) |

|

|

|

|

|

|

|

| ||||

Revenue | $ | 312,276 | $ | 88,542 | $ | 223,734 |

| 252.7 | % | |||

Cost of revenue |

| 183,225 |

| 43,416 |

| (139,809) |

| (322.0) | % | |||

Sales and marketing |

| 228,686 |

| 53,706 |

| (174,980) |