0001772720DEFR14Afalseiso4217:USD00017727202023-01-012023-12-3100017727202022-01-012022-12-310001772720spru:TechMember2021-01-012021-12-310001772720spru:KazarinoffMember2021-01-012021-12-3100017727202021-01-012021-12-310001772720spru:FongMember2023-01-012023-12-310001772720spru:TechMember2023-01-012023-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720spru:KazarinoffMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720spru:KazarinoffMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720spru:KazarinoffMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberspru:KazarinoffMemberecd:PeoMember2021-01-012021-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberspru:KazarinoffMemberecd:PeoMember2021-01-012021-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberspru:TechMember2021-01-012021-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberspru:KazarinoffMemberecd:PeoMember2021-01-012021-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001772720ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

______________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

______________

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Under Rule 14a-12

Spruce Power Holding Corporation

(Name of Registrant as Specified In Its Charter)

________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box):

x No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Explanatory Note

This amended and restated proxy statement is being filed to amend and restate in its entirety the Proxy Statement on Schedule 14A previously filed by Spruce Power Holding Corporation (the “Company”) on June 24, 2024 (the “Original Proxy Statement”) in connection with the 2024 Annual Meeting of Stockholders. This amended and restated proxy statement has been revised to correct certain information in the Original Proxy Statement. The Company will distribute and make available to its stockholders this amended and restated proxy statement in lieu of the Original Proxy Statement.

Spruce Power Holding Corporation

2000 S Colorado Blvd, Suite 2-825

Denver, Colorado 80222

June 24, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 annual meeting of stockholders of Spruce Power Holding Corporation (the "Company") to be held at 11:00 a.m. Eastern Time on August 12, 2024 (as it may be adjourned or postponed from time to time, the “Annual Meeting”).

This year’s Annual Meeting will be conducted solely via live audio webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.viewproxy.com/SPRU/2024. You will not be able to attend the Annual Meeting in person.

Details regarding the meeting, the business to be conducted at the meeting, and information about Spruce Power Holding Corporation that you should consider when you vote your shares are described in the accompanying proxy statement.

At the annual meeting, two (2) persons will be elected to our board of directors. In addition, we will ask stockholders to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024 and to provide an advisory vote regarding the total compensation paid to our named executive officers. Our board of directors recommends the approval of each of the proposals.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On July 1, 2024, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2024 Annual Meeting of Stockholders and our 2023 annual report to stockholders. The Notice also provides instructions on how to vote online or by telephone, how to access the virtual annual meeting and how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether or not you plan to attend the annual meeting, we hope you will vote promptly. Information about voting methods is set forth in the accompanying proxy statement.

Thank you for your continued support of Spruce Power Holding Corporation. We look forward to seeing you at the annual meeting.

Sincerely,

Christopher Hayes

Chief Executive Officer

_________________________________________________________________________

Spruce Power Holding Corporation

2000 S Colorado Blvd, Suite 2-825

Denver, Colorado 80222

June 24, 2024

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TIME: 11:00 a.m. Eastern Time DATE: August 12, 2024

ACCESS: This year’s annual meeting will be held virtually via live webcast on the Internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting www.viewproxy.com/SPRU/2024. and entering the 12-digit control number included in the proxy card that you receive. There is no physical location for the Annual Meeting. For further information about the virtual annual meeting, please see the Questions and Answers about the Meeting beginning on page 3. We believe that holding annual stockholder meetings virtually creates responsible custodianship of resources and maximizes the number of stockholders who may wish to attend the annual meeting.

PURPOSES:

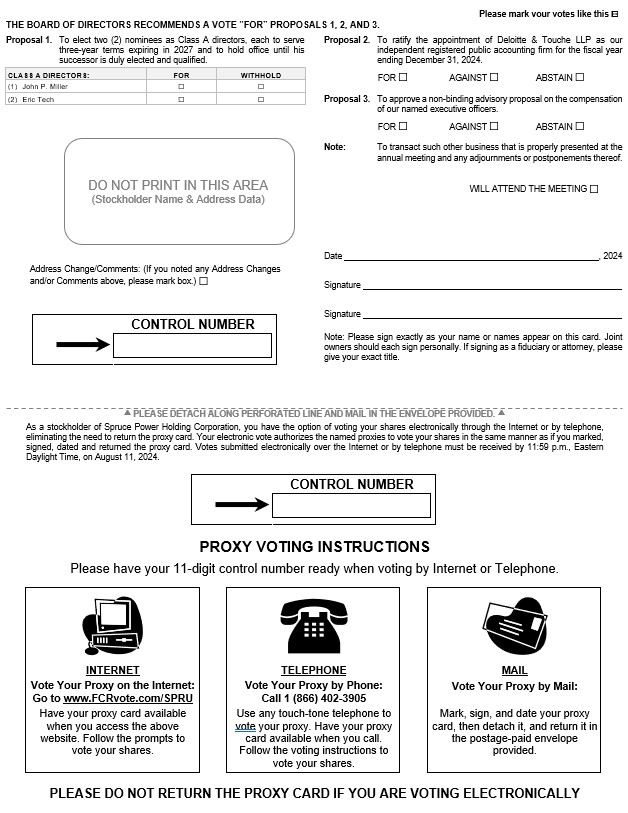

1.To elect two (2) nominees as Class A directors, each to serve three-year terms expiring in 2027 and to hold office until his successor is duly elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

3.To conduct an advisory vote on the compensation of the named executive officers of the Company as described in the proxy statement accompanying this notice; and

4.To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof.

ADJOURNMENTS AND POSTPONEMENTS: Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

RECORD DATE: You are entitled to vote only if you were a Spruce Power Holding Corporation stockholder of record as of the close of business on the record date, June 21, 2024 (the “Record Date”). Only holders of record of Spruce Power Holding Corporation common stock on the Record Date are entitled to notice of and to vote at the Annual Meeting.

MEETING ADMINISTRATION: You are entitled to attend the virtual Annual Meeting only if you were a Spruce Power Holding Corporation stockholder as of the close of business on the Record Date or otherwise hold a valid proxy for the Annual Meeting. If you are not a stockholder of record but hold shares through a broker, bank, trustee, or nominee (i.e., in “street name”), you should contact your broker, bank, trustee or nominee to obtain a legal proxy or broker’s proxy card in order to vote.

VOTING: Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement accompanying this notice and submit your proxy or voting instructions as soon as possible.

For specific instructions on how to vote your shares, please refer to the instructions in the section entitled “Important Information About The Annual Meeting And Voting” beginning on page 3 of the proxy statement accompanying this notice.

BY ORDER OF OUR BOARD OF DIRECTORS

Christopher Hayes

Chief Executive Officer

__________________________________________________________________________

TABLE OF CONTENTS

| | | | | |

| PAGE |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

__________________________________________________________________________________________

i

SPRUCE POWER HOLDING CORPORATION

2000 S Colorado Blvd, Suite 2-825

Denver, Colorado 80222

PROXY STATEMENT FOR THE SPRUCE POWER HOLDING CORPORATION ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 12, 2024

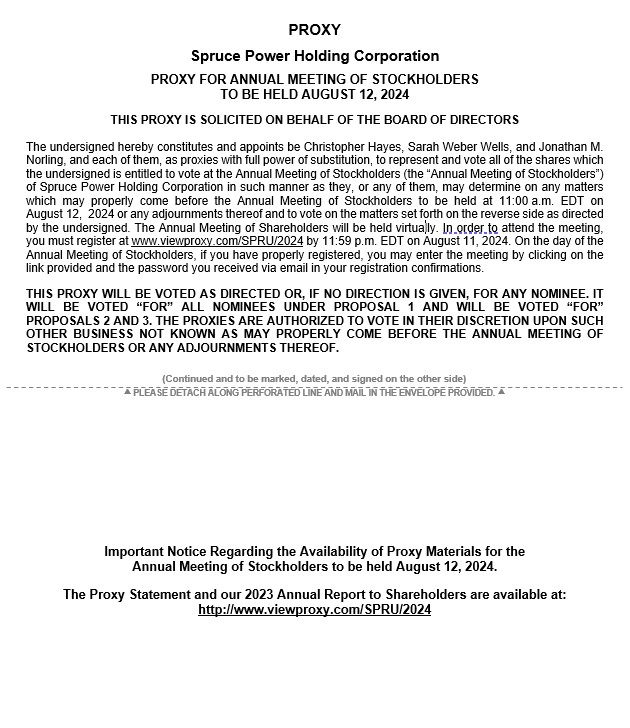

This proxy statement, along with the accompanying notice of 2024 annual meeting of stockholders, contains information about the 2024 annual meeting of stockholders of Spruce Power Holding Corporation, including any adjournments or postponements of the Annual Meeting (collectively, the “Annual Meeting”). We are holding the annual meeting at 11:00 a.m., Eastern Time, on August 12, 2024. You will not be able to attend the annual meeting in person.

The Annual Meeting will be a virtual meeting via live audio webcast on the internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting www.viewproxy.com/SPRU/2024. and entering the control number included in the proxy card that you receive. For further information about the virtual annual meeting, please see the Questions and Answers about the Meeting beginning on page 3. We believe that holding annual stockholder meetings virtually creates responsible custodianship of resources and maximizes the number of stockholders who may wish to attend the annual meeting.

In this proxy statement, we refer to Spruce Power Holding Corporation as the “Company,” “we,” “us” and “our.” Spruce Holding Company 1 LLC, Spruce Holding Company 2 LLC and Spruce Holding Company 3 LLC, which were acquired by the Company on September 9, 2022, are collectively referred to in this proxy statement as “Spruce Power.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the Annual Meeting.

This proxy statement and the accompanying proxy card are being mailed on or about July 1, 2024. Additionally, we are mailing the Notice of Internet Availability of Proxy Materials (the "Notice") on or about July 1, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON AUGUST 12, 2024

This proxy statement, the Notice of Annual Meeting of Stockholders, our form of proxy card and our 2023 annual report to stockholders are available for viewing, printing and downloading at www.viewproxy.com/SPRU/2024.. To view these materials please have your control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended December 31, 2023, on the website of the Securities and Exchange Commission (the "SEC"), at www.sec.gov, or in the “SEC Filings” section of the “Investors Relations” section of our website at www.sprucepower.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Spruce Power Holding Corporation, Attention: Corporate Secretary, 2000 S Colorado Blvd, Suite 2-825, Denver, Colorado 80222. Exhibits will be provided upon written request and payment of an appropriate processing fee.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our Board of Directors (the "Board") is soliciting your proxy to vote at the Annual Meeting to be held virtually, on August 12, 2024, at 11:00 a.m. Eastern Time and any adjournments or postponements of the meeting, which we refer to as the annual meeting. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting. Proxies will be solicited on behalf of the Board by the Company’s directors, director nominees, and executive officers.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 because you owned shares of our common stock on the record date, which is June 21, 2024 (the Record Date"). We intend to commence distribution of this proxy statement to stockholders on or about July 1, 2024. Additionally, we are mailing the Notice on or about July 1, 2024.

What is the Purpose of the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following items of business:

1.To elect two (2) nominees as Class A directors, each to serve three-year terms expiring in 2027 and to hold office until his successor is duly elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

3.To conduct an advisory vote on the compensation of our named executive officers as described in this proxy statement; and

4.To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof.

How Does Our Board of Directors Recommend that I Vote on the Proposals?

Our board of directors recommends that you vote as follows:

•“FOR” the election of each of the Board's nominees, John P. Miller and Eric Tech, as Class A directors;

•“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and

•“FOR” the non-binding approval of the compensation of our named executive officers as described in this proxy statement.

What is a Proxy?

A proxy is your legal designation of another person to vote the stock you own, in the event that you are unable to cast your vote directly at the meeting. The person you designate is your “proxy,” and you give the proxy authority to vote your shares at the meeting—according to your instructions—by submitting your voting instructions online, by telephone, or via a physical proxy card. We have designated our President and Chief Executive Officer (“CEO”), Christopher Hayes, our Chief Financial Officer, Sarah Weber Wells, and our Chief Legal Officer, Jonathon M. Norling to serve as proxies for the Annual Meeting.

What Happens if Additional Matters are Presented at the Annual Meeting?

Other than the items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders will have the discretion to vote on such other matters as may properly come before the meeting or any adjournments or postponements thereof, including, without limitation, procedural and other matters related to conduct of the meeting (such as an adjournment to later time and place) and the election of a substitute or alternate nominee if any nominee named herein is unwilling or unable to, or for good cause will not, serve.

What Shares Can I Vote?

Each share of our common stock issued and outstanding as of the close of business on June 21, 2024, the Record Date for our Annual Meeting, is entitled to vote on all items being considered at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares you own through an account with a broker, bank, trustee, or other intermediary, sometimes referred to as owning in “street name.” As of the close of business on the Record Date, we had 18,557,200 shares of common stock issued and outstanding and entitled to vote. Our common stock is our only class of voting stock outstanding.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

What is the Difference Between Holding Shares as a Stockholder of Record and as a Beneficial Owner?

Many stockholders beneficially own shares held in “street name” by a broker, bank, trustee, or other nominee rather than holding the shares directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you by our mailing agent. As the stockholder of record, you have the right to grant your voting proxy directly to our designated proxies or to vote at the Annual Meeting. You may vote online or by telephone or mail as described below under the heading “How Do I Vote?” and by following the instructions on your proxy card.

Beneficial Owner. If your shares are held in a brokerage account or by another intermediary, you are considered the beneficial owner of shares held in street name, and the proxy materials were forwarded to you by your broker, bank, trustee, or other nominee. As the beneficial owner, you have the right to direct your broker, bank, trustee, or other nominee how to vote your shares, and you are also invited to attend the Annual Meeting. Since a beneficial owner is not the stockholder of record, you may not vote your shares at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the Annual Meeting. If you are a beneficial owner and do not wish to vote the Annual Meeting or you will not be attending the Annual Meeting, you may vote by following the instructions provided by your broker, bank, trustee, or other nominee.

How can I contact the Company’s transfer agent?

You may contact our transfer agent by writing Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, NY 10004. You may also contact our transfer agent by calling (212) 509-4000.

How Can I Vote My Shares?

Stockholders may vote their shares as follows:

By Telephone or via the Internet

If you are a stockholder of record as of the Record Date, you may vote by following the telephone or Internet voting instructions on the enclosed proxy card.

If you are a beneficial owner of shares, your broker, bank, trustee, or other nominee may make telephone or Internet voting available to you. The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank, trustee, or other nominee. Therefore, we recommend that you follow the voting instructions in the materials you receive from your broker, bank, trustee, or other nominee and instruct your broker, bank, trustee, or other nominee to vote your shares using the enclosed proxy card.

By Mail

If you are a stockholder of record, complete, sign and date the enclosed proxy card and return it in the return envelope provided (which is postage prepaid if mailed in the United States). If the prepaid envelope is missing, please mail your completed proxy card to Vote Processing, c/o Alliance Advisors, PO Box 2400, Pittsburgh, PA, 15230-9762. Your signed and dated proxy card must be received prior to the Annual Meeting in order to be voted. Submitting your proxy, whether by telephone, through the Internet, or by mail, will not affect your right to vote should you decide to attend the Annual Meeting.

If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card as proxy holders—Christopher Hayes and Sarah Weber Wells —will vote the shares represented by your proxy card as recommended by our Board and in their discretion on any other matters as may properly come before the Annual Meeting.

If you are a beneficial owner of shares and you received a printed copy of the proxy materials from your broker, bank, trustee, or other nominee, we recommend that you follow the voting instructions in the materials you receive from your broker, bank, trustee, or other nominee and instruct your broker, bank, trustee, or other nominee to vote your shares using the enclosed proxy card.

By Attending the Meeting via the Virtual Meeting Website

Any stockholder can attend the Annual Meeting by visiting www.viewproxy.com/SPRU/2024. where stockholders of record and beneficial owners who have a valid legal proxy may vote and submit questions during the meeting. The meeting starts at 11:00 a.m. Eastern Time on August 12, 2024. Please have your unique link and password to join the Annual Meeting. Instructions on how to attend and participate via the Internet are included in the proxy materials sent to you. See the description under the heading “How Do I Access the Virtual Annual Meeting?” below for more information.

Your vote is important. Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. You may attend the Annual Meeting even if you have already voted by proxy.

All proxies will be voted in accordance with the instructions specified. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board stated above. With respect to Proposal 1, you may mark instructions with respect to any or all nominees. You are permitted to vote for fewer than two (2) nominees.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described below) and will have no effect on the approval of the proposals.

May I Change My Vote or Revoke My Proxy?

You may change your vote or revoke your proxy at any time before the taking of the vote at the Annual Meeting. You may change your vote or revoke your proxy in any one of the following ways:

•by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above;

•by re-voting by Internet or by telephone as instructed above;

•by notifying our Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or

•by attending the Annual Meeting and voting at the meeting. Attending the Annual Meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that it be revoked.

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted. For shares held in street name, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting at the meeting.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available for examination on the Internet through the virtual web conference during the Annual Meeting and from our Corporate Secretary for ten (10) days prior to the meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., at our corporate headquarters at 2000 S Colorado Blvd, Suite 2-825, Denver, Colorado 80222.

What Constitutes a Quorum for the Annual Meeting?

As of the Record Date, there were 18,557,200 shares of our common outstanding and entitled to vote. Each holder of our common stock is entitled to one vote for each share of common stock held as of the Record Date. A quorum will be present at the Annual Meeting if the holders of a majority in voting power of the shares of our capital stock issued and outstanding and entitled to vote as of the Record Date are present at the Annual Meeting by remote communication or represented by proxy. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a broker, bank, trustee, or other nominee holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting or the holders of a majority of the stock issued and outstanding present at the Annual Meeting may adjourn the meeting to another date.

What Vote is Required to Approve Each Proposal?

| | | | | | | | | | | |

Proposal | | Vote Required | Discretionary Voting Allowed? |

| Proposal 1: Election of Class A Directors | | The nominees for director who receive the most votes (also known as a "plurality" of the votes cast) will be elected | No |

Proposal 2: Ratify Appointment of

Independent Registered Public

Accounting Firm | | The affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes) | Yes |

Proposal 3: An advisory vote on the

compensation of our

named executive officers | | The affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes) | No |

If you are a beneficial owner, your broker, bank, trustee, or other nominee is typically permitted to vote your shares on the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024, even if the broker, bank, trustee or other nominee does not receive voting instructions from you.

Election of Class A Directors

The Class A Directors elected to the Board will be elected by a plurality of the votes cast. The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote "FOR" or "WITHHOLD" your vote from either of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broke non-vote. Such broker non-votes will have no effect on the results of this vote.

Ratify Appointment of Independent Registered Public Accounting Firm

The affirmative “FOR” vote of a majority of the votes cast (excluding abstentions and broker non-votes) on the proposal is required to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes are not included in the tabulation of voting results on this proposal and will not affect the outcome of voting on this proposal. Notwithstanding the appointment of Deloitte & Touche LLP and even if our stockholders ratify the appointment, our Audit Committee of the Board, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our Audit Committee believes that such a change would be in the best interests of our Company and our stockholders.

Advisory Vote on the Compensation of the Named Executive Officers of the Company

The affirmative “FOR” vote of a majority of the votes cast (excluding abstentions and broker non-votes) is required to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non‑votes are not included in the tabulation of voting results on this proposal and will not affect the outcome of voting on this proposal. Although the vote is non-binding, our Board and our Compensation Committee of the Board value the opinions of our stockholders in this matter and, to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, we will take stockholders’ views into account in setting compensation for future time periods.

Who Will Count the Votes?

A representative of Alliance Advisors, LLC (“Alliance Advisors”) will tabulate the votes. Alliance Advisors, LLC, acting as the inspector of election, will certify the votes.

Is Voting Confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the annual meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

Who Will Pay the Costs of Soliciting these Proxies?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made at the Annual Meeting, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We may also reimburse brokerage firms, banks, trustees, and other nominees for the cost of forwarding proxy materials to beneficial owners. We have hired Alliance Advisors to act as our proxy solicitor in connection with the proposals to be acted upon at the Annual Meeting. We expect to pay Alliance Advisors a fee that is not expected to exceed $50,000 plus approved reimbursement of reasonable out-of-pocket expenses, and Alliance Advisors partners will, among other things, provide advice regarding proxy solicitation issues and solicit proxies from our stockholders on our behalf in connection with the Annual Meeting. Proxy solicitations will be made primarily through the mail, but may be supplemented by telephone, facsimile, Internet, or personal solicitation by Alliance Advisors.

Why Are You Holding a Virtual Annual Meeting?

This year’s Annual Meeting will be held in a virtual meeting format only. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting. We also believe that holding a virtual meeting creates better stewardship of resources and the environment.

How Do I Access the Virtual Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively online via live webcast. You are entitled to attend and participate in the Annual Meeting only if you were a stockholder as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. If you are not a stockholder of record but beneficially own shares held in street name, you should contact your broker, bank, trustee or nominee to obtain a legal proxy or broker’s proxy card in order to vote. If you do not comply with the procedures outlined above, you may not be admitted to the virtual Annual Meeting.

Please let us know if you plan to attend the meeting by indicating your plans when prompted if you vote online or by telephone, or by marking the appropriate box on your proxy card if you vote by mail.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by registering at www.viewproxy.com/SPRU/2024. before 11:59 p.m. Eastern Time on August 11, 2024. You also will be able to vote your shares by attending the Annual Meeting online. To participate in the Annual Meeting, you will need the unique link and password provided to you upon registration. Stockholders who wish to submit a question to us prior to the Annual Meeting may do so at www.viewproxy.com/SPRU/2024. before 11:59 p.m. Eastern Time on August 11, 2024.

The online meeting will begin promptly at 11:00 a.m. Eastern Time on August 12, 2024. We encourage you to access the meeting prior to the start time. Online check-in will open 15 minutes prior to the start of the Annual Meeting to allow time for you to log-in and test your device’s audio system. You should ensure you have a strong Internet connection wherever you intend to participate in the Annual Meeting. You should also allow plenty of time to log in and ensure that you can hear streaming audio prior to the start of the Annual Meeting.

Will I be able to ask questions and have these questions answered during the Virtual Annual Meeting?

Stockholders may submit questions for the Annual Meeting after logging in. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.viewproxy.com/SPRU/2024., typing your question into the ‘‘Ask a Question” field, and clicking ‘‘Submit.” Please submit any questions before the start time of the meeting.

Appropriate questions related to the business of the Annual Meeting (the proposals being voted on) will be answered during the Annual Meeting, subject to time constraints. Additional information regarding the ability of stockholders to ask questions during the Annual Meeting, related to rules of conduct and other materials for the Annual Meeting will be available at www.viewproxy.com/SPRU/2024.. We reserve the right to exclude questions that are, among other things, irrelevant to the business of the Annual Meeting, irrelevant to our business, related to material non‑public information of the company, derogatory or in bad taste, in furtherance of the stockholder’s personal or business interests, related to pending or threatened litigation; repetitious or already made by another stockholder, related to personal matters or grievances, or out of order or otherwise not suitable for the conduct of the Annual Meeting (as determined by the chairperson of our Board or our corporate secretary in their reasonable discretion).

What Happens if There Are Technical Difficulties during the Annual Meeting?

If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any situation, we will promptly notify stockholders of the decision via www.viewproxy.com/SPRU/2024.. If you encounter technical difficulties accessing our meeting or asking questions during the meeting, please email virtualmeeting@viewproxy.com or call (866) 612-8937.

What is “Householding” and How Does it Affect Me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of the proxy materials unless one or more of these stockholders notifies us that they wish to receive individual copies. Stockholders who participate in householding will continue to be able to request and receive separate proxy materials. This procedure will reduce our printing costs and postage fees.

If you are eligible for householding but you and other stockholders of record with whom you share an address received multiple copies of the proxy materials, or if you hold stock in more than one account, and, in either case, you wish to receive only a single copy of the proxy materials for your household, please contact our mailing agent, Alliance Advisors, either by calling (866) 612-8937, or via email at requests@viewproxy.com.

If you participate in householding and wish to receive a separate copy of the proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies in the future, please contact Alliance Advisors as indicated above.

Upon request, we will promptly deliver a separate copy of the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents.

Beneficial owners can request information about householding from their broker, banks, trustee, or other nominee.

Can I Opt for Electronic Delivery of Future Stockholder Communications from the Company?

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. You can choose this option and save us the cost of producing and mailing these documents by contacting Alliance Advisors, either by calling (866) 612-8937, or via email at requests@viewproxy.com.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of June 21, 2024 for (a) the executive officers named in the Summary Compensation Table on page 22 of this proxy statement, (b) each of our directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of our common stock that may be acquired by an individual or group within 60 days of June 21, 2024 pursuant to the exercise of options or warrants or the vesting of restricted stock units to be outstanding for the purpose of computing the percentage ownership of such individual or group, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of our common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 18,557,200 shares of our common stock outstanding on June 21, 2024.

Shares Beneficially Owned

| | | | | | | | |

| Name and Address | Number | Percent |

Directors and Named Executive Officers(1) | | |

Christopher Hayes(2) | 216,740 | 1.2 | % |

| Christian Fong | 196,675 | 1.1 | % |

| Sarah Weber Wells | 19,020 | * |

| Jonathan M. Norling | 22,244 | * |

Donald Klein(3) | 45,158 | * |

Stacey Constas(4) | 14,270 | * |

Eric Tech(5) | 167,293 | * |

Kevin Griffin(6) | 744,222 | 3.9 | % |

Jonathan J. Ledecky(7) | 640,584 | 3.4 | % |

| John P. Miller | 54,545 | * |

| Ja-chin Audrey Lee, Ph. D. | — | * |

| Clara Nagy McBane | — | * |

All directors and current executive officers as a group (9 persons)(9) | 1,864,648 | 9.6 | % |

| Five Percent Holders: | | |

| James S. Davis | 1,422,489 | 7.7 | % |

* Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

(1)The business address of the stockholder is c/o Spruce Power Holding Corporation, 2000 S Colorado Blvd, Suite 2-825, Denver, Colorado 80222.

(2)Consists of (a) 54,093 shares held of record and (b) options to purchase 162,647 shares of our common stock.

(3)The beneficial ownership information for Mr. Klein is based on the most recent information provided to the Company as of the time of Mr. Klein’s departure from his position as Chief Financial Officer as of May 19, 2023.

(4)Includes (a) 12,898 shares held of record and (b) options to purchase 1,372 shares of our common stock. The beneficial ownership information for Ms. Constas is based on the most recent information provided to the Company as of the time of Ms. Constas’s departure from her position as General Counsel as of July 21, 2023.

(5)Consists of (a) 111,430 shares held of record, (b) 3,125 shares held by Mr. Tech's daughter, and (c) options to purchase 52,738 shares of our common stock. Mr. Tech disclaims ownership of the shares of our common stock held by his daughter.

(6)Consists of (a) 39,100 shares held of record, (b) options to purchase 2,414 shares of our common stock, (c) 438,125 shares of our common stock managed by MGG Investment Group, LP (“MGG”), that allocates to various held funds of which Mr. Griffin is the Chief Executive Officer and Chief Investment Officer, and (d) 264,583 shares of common stock issuable upon exercise of warrants held by MGG, of which Mr. Griffin is the Chief Executive Officer and Chief Investment Officer. Notwithstanding his dispositive and voting control over such shares, Mr. Griffin disclaims beneficial ownership of the shares of our common stock and warrants held by MGG, except to the extent of his proportionate pecuniary interest therein. The business address of each of the foregoing is c/o Graubard Miller, The Chrysler Building, 405 Lexington Avenue, 11th Floor, New York, New York 10174.

(7)Consists of (a) 45,463 shares held of record, (b) options to purchase 2,413 shares of our common stock, and (c) 328,125 shares and 264,583 shares of common stock issuable upon exercise of warrants held by Ironbound Partners Fund, LLC, an affiliate of Mr. Ledecky. Notwithstanding his dispositive and voting control over such shares, Mr. Ledecky disclaims beneficial ownership of the shares of our common stock and warrants held by Ironbound Partners Fund, LLC, except to the extent of his proportionate pecuniary interest therein. The business address of Mr. Ledecky is c/o Graubard Miller, The Chrysler Building, 405 Lexington Avenue, 44th Floor, New York, New York 10174.

(8)See footnotes (2) and (5) – (7) above. Includes options to purchase a total of 220,212 shares and 857,291 shares of common stock issuable upon exercise of warrants.

MANAGEMENT AND CORPORATE GOVERNANCE

Our Executive Officers

The executive officers of the Company as of the date of this proxy statement are as follows:

| | | | | | | | | | | | | | |

| Name | | Age | | Principal Occupation During the Past Five Years |

Christopher Hayes(1) | | 50 | | Chief Executive Officer and President of the Company since April 2024, and a director of the Company since December 2020. From January 2023 to April 2024, Mr. Hayes served as the Chair of the Board of the Company. From August 2019 until December 2020, Mr. Hayes served as a member of the Board of the Company’s predecessor, XL Hybrids Inc. From August 2016 to January 2017, Mr. Hayes served as the Senior Vice President of Edison Energy, LLC, an indirect subsidiary of Edison International, a publicly traded energy and power markets company, following Edison’s acquisition of Altenex, a renewable energy procurement company cofounded by Mr. Hayes in 2011. Most recently, Mr. Hayes served as managing partner and director of Alturus, a sustainable infrastructure investment company he cofounded in 2018. |

| Sarah Weber Wells | | 46 | | Chief Financial Officer of the Company since May 2023. Prior thereto, Senior Vice President, Finance and Accounting, and Head of Sustainability of the Company since February 2023; prior thereto Chief Financial Officer of Spruce Holding Company 1 LLC, Spruce Holding Company 2 LLC and Spruce Holding Company 3 LLC, which were acquired by the Company on September 9, 2022 (collectively, “Spruce Power”), from May 2022 to February 2023. Prior to joining Spruce Power, Finance Manager of Cornerstone Building Brands, a building products manufacturer, from November 2013 to November 2018. |

| Jonathan M. Norling | | 55 | | Chief Legal Officer of the Company since February 2023; prior thereto General Counsel of Spruce Power from January 2019 to February 2023, Deputy General Counsel of Spruce Power from January 2018 to January 2019, and Interim General Counsel of Spruce Power from July 2017 to January 2018. |

(1) Christopher Hayes, who served as Chair of the Board in fiscal year 2023 has become President and Chief Executive Officer as of April 12, 2024, replacing Christian Fong who served as Chief Executive Officer from February 1, 2023 until April 12, 2024.

There are no family relationships or other arrangements or understandings (as defined under applicable SEC regulations) among any of the directors or executive officers of the Company.

Our Board of Directors

Set forth below are the names of the persons nominated by our Board of Directors for election as directors and those directors whose terms do not expire this year, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our board of directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

| | | | | | | | | | | | | | |

| Name | | Age | | Position with the Company |

Christopher Hayes(1) | | 50 | | Chief Executive Officer and Chair of the Board |

| Eric Tech | | 60 | | Director |

| Kevin Griffin | | 47 | | Director |

| Jonathan J. Ledecky | | 66 | | Director |

| John P. Miller | | 66 | | Lead Director |

| Ja-chin Audrey Lee, Ph. D. | | 45 | | Director |

| Clara Nagy McBane | | 37 | | Director |

(1) Christopher Hayes qualifications are discussed above under Our Executive Officers.

Our Board of Directors has reviewed the materiality of any relationship that each of our directors has with the Company, either directly or indirectly. Based upon this review, our Board of Directors has determined that the following members of our Board of Directors are “independent directors” as defined by New York Stock Exchange: Kevin Griffin, Jonathan J. Ledecky, John P. Miller (Lead Director), Ja-chin Audrey Lee, Ph. D and Clara Nagy McBane.

Eric Tech has served as a member of the Board of Directors since December 2021 and served as Chief Executive Officer of the Company from December 2021 until February 1, 2023. Mr. Tech brings nearly 35 years of automotive and mobility industry experience to the Company. From June 2006 through August 2021, he held senior leadership positions of increasing responsibility at Navistar International Corporation (“Navistar”), a publicly traded global manufacturer and marketer of medium and heavy duty vehicles and parts, finishing his career there as Senior Vice President of Corporate Development. The board believes that, as former CEO, Mr. Tech is uniquely positioned to report to the board on Company activities and guide discussions regarding potential strategic priorities.

Kevin Griffin has served as a member of our Board of Directors since April 2019. Mr. Griffin founded MGG Investment Group in 2014 and serves as the Managing Partner, CEO, and CIO of the firm. In this capacity, Mr. Griffin is responsible for overseeing all aspects of the firm, including the investment process from origination through portfolio monitoring as well as the strategic vision for the firm. Mr. Griffin’s investment and mergers & acquisitions background provides significant benefit to the board when analyzing and assessing acquisition opportunities. Mr. Griffin also serves on the board of KLDiscovery (NYSE: KLDI). Mr. Miller serves on the Board of Capstone Green Energy Holdings, INC. (Capstone). Capstone is a provider of customized microgrid solutions, on-site resilient green Energy as a Service (EaaS) solutions, and on-site energy technology systems focused on helping customers around the globe meet their environmental, energy savings, and resiliency goals.

Jonathan J. Ledecky has served as a member of our Board of Directors since our inception. From our inception until December 2020, Mr. Ledecky served as our Chair and Chief Executive Officer. Mr. Ledecky has been a co-owner of the National Hockey League’s New York Islanders franchise since October 2014. He also serves as an Alternate Governor on the Board of Governors of the NHL and as President of NY Hockey Holdings LLC. Mr. Ledecky has served as chairman of Ironbound Partners Fund LLC, a private investment management fund since March 1999. He served as President and Chief Financial Officer and as a director of Newtown Lane Marketing, Incorporated, from October 2015 until October 2021, when it consummated its merger with Cyxtera Cybersecurity. He has continued to serve as a director of the company (now Appgate Inc.) since such date. He served as the President and Chief Operating Officer and as a director of Northern Star Acquisition Corp. from September 2020 until it consummated an initial business combination with Barkbox, Inc., the leading global brand for dogs, in June 2021. Mr. Ledecky served as a director of Bark, Inc. until October 2022. He has also served as the President, Chief Operating Officer and director of Northern Star Investment Corp. II since November 2020, President, Chief Operating Officer and director of Northern Star Investment Corp. III since November 2020, President, Chief Operating Officer and director of Northern Star Investment Corp. IV since November 2020 and Chief Executive Officer, Chief Financial Officer and a director of Yale Transaction Finders Inc. since March 2022, each of which is a blank check company seeking to consummate a business combination. From August 2018 to December 2019, he served as Chairman and Chief Executive Officer of Pivotal Acquisition Corp. until it consummated its business combination with KLDiscovery In. (NYSE: KLDI). Mr. Ledecky continued to serve as a member of the board of KLDiscovery from its merger until June 2021. From October 2020 until December 2023, he served as Chairman of the Board of Pivotal Investment Corporation III, a blank check company that was unable to consummate an initial business combination and dissolved. Mr. Ledecky continued to serve as a member of the board of KLDiscovery

from its merger until June 2021. Mr. Ledecky’s lengthy history of acquisitions, and his knowledge of emerging market opportunities, provides a dynamic voice to board discussions and deliberations.

John P. Miller was appointed by the board to become a director in March 2022. Mr. Miller has over 40 years of broad-based executive management experience in the transportation, manufacturing and distribution industries in both public and private equity companies. From 2017 to 2021, he served as Chief Executive Officer of Power Solutions International (OTC Pink: PSIX), a leader in the design, engineering, and manufacturing of a broad range of advanced, emission-certified engines and power systems. Prior to Power Solutions, from 2008 through 2016, Mr. Miller served in operational and financial management positions of increasing responsibility at Navistar International Corporation, a global manufacturer of commercial and military trucks, school buses, and diesel engines. Mr. Miller’s substantial financial experience is of great assistance to the board as continued exploration of short and longer term growth strategies occurs.

Ja-chin Audrey Lee, Ph. D. was appointed by the board to become a director in April 2024. Ms. Lee is a clean energy executive with 20 years of experience in the private and public sectors. She is a strategic leader pioneering the next generation of energy solutions with expertise at the intersection of technology, product, and market development. She continues to serve as Senior Director of Energy Strategy at Microsoft Corporation since 2021, where she leads global technology, resilience, infrastructure, and commercial strategy on the Microsoft datacenter energy team to enable a resilient and sustainable cloud. From 2017 to 2020, she served as Vice President of Energy Services at Sunrun Inc., a leading provider of residential solar. She serves on the board of Redaptive Inc., deploying energy-as-a-service across commercial and industrial real estate portfolios. She also serves as a board member of Gridworks, Linux Foundation Energy, and Clean Energy for America Education Fund. Ms. Lee brings substantial experience in the renewable energy industry, as well as, critical power solutions that will enable the Company’s growth strategies.

Clara Nagy McBane was appointed by the board to become a director in June 2024. Ms. McBane is the founder and Chief Executive Officer of Ventura Energy Partners LLC, which is a developer of behind-the-meter and community sized solar and storage systems, a position she has held since February 2021. Ms. McBane has been working in the renewables industry for the last 13 years and is an expert in renewable energy finance and operations. Her previous positions include SVP of Business Development at SOURCE Global PBC from September 2019 to May 2022, and Director of Business Development at Advanced Microgrid Solutions (which was sold to Fluence Energy, Inc.) from May 2018 to September 2019. Ms. McBane’s qualifications to serve on the Board include her extensive experience in the renewables industry.

Cooperation Agreement

Pursuant to a Cooperation Agreement, dated as of June 21, 2024 (the “Cooperation Agreement”), between the Company and Clayton Capital Appreciation Fund, L.P. and Clayton Partners LLC (collectively, the “Clayton”), our Board appointed Clara Nagy McBane as a director on June 21, 2024 to serve as a Class B director with a term expiring at the Company’s 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) and to hold office until her successor has been duly elected and qualified or until her earlier, death, resignation or removal. The Company also agreed to appoint Ms. McBane to its Compensation Committee and Nominating and Corporate Governance Committee.

The Cooperation Agreement includes various terms, conditions and provisions, including that the Company shall consider nominating Ms. McBane for re-election to the Board at the 2025 Annual Meeting in good faith and in the same manner the Board considers the nomination of all incumbent directors. Under the Cooperation Agreement, subject to certain exceptions, Clayton agreed to vote at each of the Company’s Annual Meetings of Stockholders all of its beneficially owned shares of the Company’s common stock in accordance with the Board’s recommendation with respect to all nominations and other proposals submitted to stockholders at such annual meetings. In addition, the Cooperation Agreement provides for certain customary standstill provisions that restrict Clayton from, among other things, engaging in any solicitation of proxies with respect to the voting securities of the Company or acquiring any securities of the Company that would result in Clayton having beneficial ownership of more than 14.9% of the Company's common stock. Unless otherwise mutually agreed to in writing by each party, the Cooperation Agreement will remain in effect until the date that is the earlier of (i) the date Clayton receives notice that the Company will not nominate Ms. McBane for re-election to the Board at the 2025 Annual Meeting, (ii) immediately following the closing of the polls on the election of directors at the 2025 Annual Meeting, (iii) August 31, 2025 if the 2025 Annual Meeting has not been held by that date, and (iv) in the event that any party materially breaches the Cooperation Agreement, the date that is thirty (30) calendar days following written notice of such breach from the non-breaching party, if such breach (if capable of being cured) has not been cured by such date, or, if impossible to cure within thirty (30) calendar days, such party has not taken substantive action to correct by such date.

Committees of Our Board of Directors and Meetings

The Board maintains the following standing committees: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The complete text of each committee’s charter is available on the Company’s website, www.sprucepower.com, under the Governance tab.

Meeting Attendance. During the fiscal year ended December 31, 2023, there were 11 meetings of our board of directors. No director attended fewer than 75% of the total number of meetings of our board of directors and of committees of our board of directors on which he or she served during fiscal year 2023. Each member of our board of directors is strongly encouraged but is not required to attend each annual meeting of our stockholders. Several times each year, as circumstances dictate, non-management directors meet in executive session without management. All non-management directors of the Company are independent as determined under applicable NYSE guidelines. Such independence is assessed and confirmed annually by the Nominating and Corporate Governance Committee, as reported to the full board.

Audit Committee. The Company’s Audit Committee (the “Audit Committee”) is an "audit committee" for purposes of Section 3(a)(58)(A) of the Exchange Act. The Audit Committee met six times during fiscal 2023 and currently has three members, John P. Miller (Chair), Jonathan J. Ledecky, and Kevin Griffin. John P. Miller is an “Audit Committee Financial Expert,” as determined by the Board of Directors. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter (found on the Company’s website, www.sprucepower.com, under the Governance tab), and include the authority to appoint, compensate, retain, oversee and terminate the services of our independent registered public accounting firm. In addition, the Audit Committee assists the board of directors in overseeing the integrity of our financial statements, compliance with legal and regulatory requirements and the qualifications, performance and independence of the external auditors. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the New York Stock Exchange, as such standards apply specifically to members of audit committees. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

Compensation Committee. Our Compensation Committee (the "Compensation Committee") met six times during fiscal year 2023. This committee currently has four members, Kevin Griffin (Chair), Ja-chin Audrey Lee, Clara Nagy McBane and John P. Miller. Our Compensation Committee’s role and responsibilities are set forth in the Compensation Committee’s written charter (found on the Company’s website, www.sprucepower.com, under the Governance tab), and includes reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of our board of directors are carried out and that such policies, practices and procedures contribute to our success, including undertaking an annual review of its own performance. Our Compensation Committee also administers our 2020 Equity Incentive Plan. The Compensation Committee is responsible for the determination of the compensation of our chief executive officer, and shall conduct its decision-making process with respect to that issue without the chief executive officer present. All members of the Compensation Committee qualify as independent under the definition promulgated by the New York Stock Exchange.

The Compensation Committee has adopted the following processes and procedures for the consideration and determination of executive and director compensation:

•The Compensation Committee establishes a compensation policy for executive officers that includes (i) an annual base salary, (ii) incentive compensation which is awarded for the achievement of predetermined financial, strategic or other designated objectives of the Company as a whole and of the executive officers individually and (iii) long-term incentive compensation in the forms of equity participation and other awards with the goal of aligning, where appropriate, the long-term interests of executive officers with those of the Company’s stockholders and otherwise encouraging the achievement of superior results over an extended time period.

•The Compensation Committee establishes a compensation policy for the Company’s executive officers that (i) enhances the profitability of the Company and increases stockholder value, (ii) recognizes individual initiative, leadership, achievement and other contributions and (iv) provides competitive compensation that will attract and retain qualified executives.

•The Compensation Committee annually reviews the compensation policy for the Company’s directors, Chief Executive Officer and other executive officers, which review includes (i) a review and approval of corporate goals and objectives relevant to the compensation of the Chief Executive Officer and other executive officers, (ii) an evaluation of the Chief Executive Officer’s performance in light of relevant corporate goals and objectives, (iii) a performance evaluation of the Company’s management (iv) a review of executive supplementary benefits and, as appropriate, the Company’s retirement, benefit and special compensation programs involving significant cost, (v) a review of the Company’s equity-based plans that are subject to approval by our board of directors and (v) a review of competitive practices and trends to determine the adequacy of the executive compensation program.

•The Compensation Committee has the authority to retain or obtain the advice of such compensation consultants, legal counsels, experts and other advisors as the committee may deem appropriate in its sole discretion.

•The Compensation Committee has the authority, to the extent permitted by and consistent with applicable law and the provisions of the Company’s 2020 Equity Incentive Plan, to delegate to one or more executive officers of the Company the power to grant options or other stock awards pursuant to the Company’s 2020 Equity Incentive Plan.

The Compensation Committee further assists the board in its oversight of the development and implementation of the Company’s human capital management, including those policies and strategies regarding recruiting, retention, career development, opportunity, advancement, and succession and employment practices to ensure appropriate attraction, development, and retention of employees whose contributions are critical to the success of the Company.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee (“Nominating Committee”) met six times during fiscal year 2023 and currently has four members, John P. Miller (Chair), Jonathan J. Ledecky, Ja-chin Audrey Lee and Clara Nagy McBane. All members of the Nominating and Corporate Governance Committee qualify as independent under the definition promulgated by the New York Stock Exchange. The Nominating Committee’s responsibilities are set forth in the Nominating Committee’s written charter and include, among other things:

•identifying, reviewing and making recommendations of candidates to serve on our board of directors;

•evaluating the performance of our board of directors, its committees and individual directors and determining whether continued service on our board of directors is appropriate;

•evaluating nominations by stockholders of candidates for election to our board of directors;

•evaluating the current size, composition and organization of our board of directors and its committees and making recommendations to our board of directors for approvals;

•developing a set of corporate governance policies and principles and recommending to our board of directors any changes to such policies and principles;

•reviewing issues and developments related to corporate governance and identifying and bringing to the attention of our board of directors current and emerging corporate governance trends; and

•reviewing periodically the Nominating Committee charter, structure and membership requirements and recommending any proposed changes to our board of directors, including undertaking an annual review of its own performance.

Generally, our Nominating Committee considers candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. Once identified, the Nominating Committee will evaluate a candidate’s qualifications in accordance with our Nominating Committee Policy Regarding Qualifications of Directors appended to our Nominating Committee’s written charter. Threshold criteria include: integrity and ethical values, commitment to the long term value of the Company and its stockholders, absence of conflicts of interest, fair and equal representation of all stockholders of the Company, achievement in the fields of business, professional, governmental, community, scientific or educational endeavors, the ability to function effectively in an oversight role, a diversity of backgrounds, perspectives, experience, age, gender, ethnicity and citizenship, understanding of the Company’s business, ability to devote adequate time to our board of directors and its committees, no conflicts with any applicable board policies. Our Nominating Committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees. However, the Nominating Committee will consider issues of diversity among its members in identifying and considering nominees for director and strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experiences, ages, genders, ethnicities and countries of citizenship on our board of directors and its committees. The board believes that diversity of membership is important to foster various points of view, improving the quality of dialogue, contributing to a more effective decision-making process, and enhancing overall culture in the boardroom.

The Nominating Committee undertakes an annual assessment of each director’s skills and experiences in order to ensure that the board is most effectively responding to the needs of the business, acting in the best interests of stockholders. The Committee reviews how the experiences and skills of each director complement those of fellow board members to create a balanced board with diverse viewpoints and deep expertise.

If a stockholder wishes to propose a candidate for consideration as a nominee for election to our board of directors, they must follow the procedures described in our Bylaws and under the heading “Stockholder Proposals and Nominations for Director” at the end of this proxy statement. In general, persons recommended by stockholders will be considered in accordance with our Policy on Stockholder Recommendation of Candidates for Election as Directors appended to our Nominating Committee’s written charter. Any such recommendation should be made in writing to the Nominating Committee, care of our Corporate Secretary at our principal office and should be accompanied by the following information concerning each recommending stockholder and the beneficial owner, if any, on whose behalf the nomination is made:

•as to each recommending stockholder, (i) the name and address of such recommending stockholder (including, if applicable, the name and address that appear on the Company’s books and records) and (ii) the number of shares of each class or series of stock of the Company that are, directly or indirectly, owned of record or beneficially owned (within the meaning of Rule 13d-3 under the Exchange Act) by such recommending stockholder;

•as to each recommending stockholder, (i) the full notional amount of any securities that, directly or indirectly, underlie any “derivative security” (as such term is defined in Rule 16a-1(c) under the Exchange Act) that constitutes a “call equivalent position” (as such term is defined in Rule 16a- 1(b) under the Exchange Act) (“Synthetic Equity Position”) and that is, directly or indirectly, held or maintained by such recommending stockholder with respect to any shares of any class or series of stock of the Company; provided that, for the purposes of the definition of “Synthetic Equity Position,” the term “derivative security” shall also include any security or instrument that would not otherwise constitute a “derivative security” as a result of any feature that would make any conversion, exercise or similar right or privilege of such security or instrument becoming determinable only at some future date or upon the happening of a future occurrence, in which case the determination of the amount of securities into which such security or

instrument would be convertible or exercisable shall be made assuming that such security or instrument is immediately convertible or exercisable at the time of such determination; and, provided, further, that any recommending stockholder satisfying the requirements of Rule 13d-1(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”) (other than a recommending stockholder that so satisfies Rule 13d-1(b)(1) under the Exchange Act solely by reason of Rule 13d-1(b)(1)(ii)(E)) shall not be deemed to hold or maintain the notional amount of any securities that underlie a Synthetic Equity Position held by such recommending stockholder as a hedge with respect to a bona fide derivatives trade or position of such recommending stockholder in the ordinary course of such recommending stockholder’s business as a derivatives dealer, (ii) any rights to dividends on the shares of any class or series of stock of the Company owned beneficially by such recommending stockholder that are separated or separable from the underlying shares of the Company, (iii) any material pending or threatened legal proceeding in which such recommending stockholder is a party or material participant involving the Company or any of its officers or directors, or any affiliate of the Company, (iv) any other material relationship between such recommending stockholder, on the one hand, and the Company or any affiliate of the Company, on the other hand, (v) any direct or indirect material interest in any material contract or agreement of such recommending stockholder with the Company or any affiliate of the Company (including, in any such case, any employment agreement, collective bargaining agreement or consulting agreement) and (vi) any other information relating to such recommending stockholder that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies or consents by such recommending stockholder in support of the business proposed to be brought before the meeting pursuant to Section 14(a) of the Exchange Act (the disclosures to be made pursuant to the foregoing clauses (i) through (vi) are referred to as “Disclosable Interests”); provided, however, that Disclosable Interests shall not include any such disclosures with respect to the ordinary course business activities of any broker, dealer, commercial bank, trust company or other nominee who is a recommending stockholder solely as a result of being the stockholder directed to prepare and submit the notice required by our Bylaws on behalf of a beneficial owner; and

•as to each candidate whom a recommending stockholder proposes to nominate for election as a director, (i) all information with respect to such candidate for nomination that would be required to be set forth in a stockholder’s notice if such candidate for nomination were a recommending stockholder, (ii) all information relating to such candidate for nomination that is required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14(a) under the Exchange Act (including such candidate’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected), (iii) a description of any direct or indirect material interest in any material contract or agreement between or among any recommending stockholder, on the one hand, and each candidate for nomination or any other participants in such solicitation, on the other hand, including, without limitation, all information that would be required to be disclosed pursuant to Item 404 under Regulation S-K if such recommending stockholder were the “registrant” for purposes of such rule and the candidate for nomination were a director or executive officer of such registrant and (iv) a completed and signed questionnaire, and other supporting materials.

A copy of the Nominating Committee’s written charter is publicly available on our website at www.sprucepower.com under the Governance tab.

Board Leadership Structure and Role in Risk Oversight