As filed with the Securities and Exchange Commission on May 8, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DYNAMIC SHARES TRUST

(Exact name of registrant as specified in its charter)

| Delaware | 6221 | 32-6540728 | ||

| (State of Organization) | (Primary Standard Industrial | (I.R.S. Employer | ||

| Classification Code Number) | Identification Number) |

401 W Superior St, Suite 300

Chicago, IL 60654

(678) 834-4218

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Xinyu Jiang

c/o Dynamic Shares LLC

401 W Superior St, Suite 300

Chicago, IL 60654

(678) 834-4218

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Weixuan Zhang c/o Dynamic Shares LLC 401 W Superior St, Suite 300 Chicago, IL 60654

|

Bilal H. Malik, Esq. Malik Law Group LLC 1175 Peachtree Street, 10th Floor Atlanta, GA 30361

|

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony L.G., PLLC 625 N. Flagler Drive, Suite 600 West Palm Beach, FL 33401 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. [X]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Dynamic Short Short-Term Volatility Futures ETF

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed

Maximum Aggregate Offering Price | Amount of Registration Fee† | ||||||

| Dynamic Short Short-Term Volatility Futures ETF Common Units of Beneficial Interest | $ | 100,000,000.00 | $ | 12,980.00 | ||||

| Total: | $ | 100,000,000.00 | $ | 12,980.00 | ||||

† The amount of the registration fees for the indicated securities have been calculated in reliance upon Rule 457(o) under the Securities Act and using the proposed maximum aggregate offering price as described above.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus Subject to Completion, dated May 8, 2020

DYNAMIC SHARES TRUST

Common Units of Beneficial Interest

| Fund | Proposed Maximum Aggregate Offering Price Per Fund | |||

| Dynamic Short Short-Term Volatility Futures ETF (WEIX) | $ | 100,000,000.00 | ||

Dynamic Shares Trust (the “Trust”) is a Delaware statutory trust organized into separate series. The Trust may from time to time offer to sell common units of beneficial interests (“Shares”) of the series of the Trust listed above (the “Fund”) or other series of the Trust. Shares represent units of fractional undivided beneficial interest in and ownership of a series of the Trust. The Fund’s Shares will be offered on a continuous basis. The offering shall terminate on the third anniversary following the date the registration statement of which this prospectus forms a part is declared effective by the Securities and Exchange Commission, unless suspended or terminated at any earlier time for certain reasons specified in this prospectus or unless extended as permitted under the rules of the Securities Act of 1933. The Shares have been approved for listing on the NYSE Arca, Inc. (the “Exchange” or “NYSE Arca”), subject to notice of issuance, under the ticker symbol WEIX.

As of the date of this Prospectus, the trust has one series (the Fund). Please note that the Trust may in the future have series other than the Fund.

Dynamic Short Short-Term Volatility Futures ETF has not, prior to the date of this Prospectus, commenced trading and does not have any performance history.

The Dynamic Short Short-Term Volatility Futures ETF is expected to be offered beginning in the second quarter of 2020 but will not be offered unless and until this Registration Statement is declared effective by the Securities and Exchange Commission.

The Fund seeks to provide better risk management than passively managed short VIX short-term futures ETFs. Unlike traditional short VIX short-term futures ETFs, the Fund seeks to dynamically manage its notional exposure to VIX futures. For instance, when the VIX Index is below its historical average, the Fund’s notional exposure is lower than a traditional short VIX short term futures ETF, which may maintain a fixed notional exposure every day. When the VIX Index is going up, the Fund gradually increases its notional exposure, up to a ceiling of -0.5*. The Fund expects that its notional exposure will not exceed -0.5*, but that its notional exposure may exceed -0.5* during intraday trading before recalibration.

The Fund is actively managed and is not benchmarked to the VIX Index. As such the Fund can be expected to perform very differently from the inverse of the VIX Index.

In addition, investors in the Fund should understand the consequences of seeking daily inverse investment results that are subject to compounding and market volatility risk. The pursuit of the Fund’s daily investment objective means that the Fund’s return for a period longer than a full trading day will be the product of the series of daily returns, with daily repositioned exposure, for each trading day during the relevant period. As a consequence, the return for investors that invest for periods less than a full trading day or for a period different than a trading day will not be the product of the return of the Fund’s stated daily inverse investment objective. During periods of high volatility, the Fund may not perform as expected and the Fund may have losses when an investor may have expected gains if the Fund is held for a period that is different than one trading day.

INVESTING IN THE SHARES INVOLVES SIGNIFICANT RISKS. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 14.

The Fund is not appropriate for all investors and presents different risks than other funds. The Fund includes risks relating to investing in and seeking exposure to VIX Futures Contracts. An investor should only consider an investment in the Fund if he or she understands the consequences of seeking exposure to VIX Futures Contracts. The Fund uses leverage and is riskier than similar exchange-traded funds that do not use leverage. An investor should only consider an investment in a Fund if he or she understands the consequences of seeking daily inverse leveraged investment results.

The Funds’ investments may be illiquid and/or highly volatile and the Fund may experience large losses from buying, selling or holding such investments. An investor in the Fund could potentially lose the full principal value of his/her investment within a single day.

Shareholders who invest in the Fund should actively manage and monitor their investment, as frequently as daily.

The Fund is not benchmarked to the VIX Index (which is commonly referred to as the “VIX”). The performance of the Fund can be expected to be very different from the performance of the VIX.

NEITHER THE TRUST NOR THE FUND IS A MUTUAL FUND OR OTHER TYPE OF INVESTMENT COMPANY AS DEFINED IN THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “1940 ACT”), AND NEITHER IS SUBJECT TO REGULATION THEREUNDER. SHAREHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED WITH OWNERSHIP OF SHARES IN AN INVESTMENT COMPANY REGISTERED UNDER THE 1940 ACT. SEE RISK FACTOR ENTITLED “SHAREHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED WITH OWNERSHIP OF SHARES IN AN INVESTMENT COMPANY REGISTERED UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “1940 ACT)” ON PAGE 22 OF THIS PROSPECTUS FOR MORE INFORMATION.

The Fund continuously offers and redeems, or will continuously offer and redeem, its Shares in blocks of Shares (each such block, a “Creation Unit”). Only Authorized Participants (as defined herein) may purchase and redeem Shares from a Fund and then only in Creation Units. An Authorized Participant is an entity that has entered into an Authorized Participant Agreement with the Trust and Dynamic Shares LLC (the “Sponsor”).

It is expected that after the date of this Prospectus, the initial Authorized Participant will, subject to certain terms and conditions, make purchases of initial Creation Units of 100,000 Shares of the Fund at an initial price per Share of $20.00, equal to $1,000,000 per Creation Unit.

The Fund will not commence trading unless and until the initial Authorized Participant effects the minimum initial purchase. Following initial purchases by the initial Authorized Participant, Shares of the Fund are offered to Authorized Participants in Creation Units at the Fund’s NAV. Authorized Participants may then offer to the public, from time to time, Shares from any Creation Unit they create at a per-Share market price.

The form of Authorized Participant Agreement and the related Authorized Participant Procedures Handbook set forth the terms and conditions under which an Authorized Participant may purchase or redeem a Creation Unit. Authorized Participants will not receive from the Fund, the Sponsor, or any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based brokerage accounts.

The Fund will distribute to shareholders a Schedule K-1 that will contain information regarding the income and expenses of the Fund.

These securities have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

_________________, 2020

These Shares are neither interests in nor obligations of any of the Sponsor, Wilmington Trust, National Association (the “Trustee”), or any of their respective affiliates. The Shares are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

It is anticipated that the initial Authorized Participant will purchase the initial Creation Units of the Fund, equal to $1,000,000 per Creation Unit.

This prospectus has two parts: the offered series disclosure and the general pool disclosure. These parts are bound together and are incomplete if not distributed together to prospective participants.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THE DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL, AT PAGES 40 THROUGH 42 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 40.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 14 THROUGH 29.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE REGISTRATION STATEMENT OF THE TRUST. iNVESTORS CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SEC IN WASHINGTON, D.C.

the trust will file quarterly and annual reports with the sec. investors can read and copy these REPORTS at the sec public REFERENCE facilities in washington, d.c. please call the sec at 1-800-sec-0330 for further information.

the filing of the trust are posted at the sec website at www.sec.gov.

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE TRUST, ANY FUND, THE SPONSOR, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY OFFER, SOLICITATION, OR SALE OF THE SHARES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE ANY SUCH OFFER, SOLICITATION, OR SALE.

AUTHORIZED PARTICIPANTS MAY BE REQUIRED TO DELIVER A PROSPECTUS WHEN TRANSACTING IN SHARES. SEE “PLAN OF DISTRIBUTION” IN PART TWO OF THIS PROSPECTUS.

SHAREHOLDERS HAVE THE RIGHT, DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. MONTHLY ACCOUNT STATEMENTS CONFORMING TO THE COMMODITY FUTURES TRADING COMMISSION (“CFTC”) AND THE NATIONAL FUTURES ASSOCIATION (THE “NFA”) REQUIREMENTS WILL BE POSTED ON THE SPONSOR’S WEBSITE AT www.dynamicsharesetf.com. ADDITIONAL REPORTS MAY BE POSTED ON THE SPONSOR’S WEBSITE AT THE DISCRETION OF THE SPONSOR OR AS REQUIRED BY REGULATORY AUTHORITIES. THERE WILL SIMILARLY BE DISTRIBUTED TO SHAREHOLDERS, NO MORE THAN 90 DAYS AFTER THE CLOSE OF THE FUNDS’ FISCAL YEAR, CERTIFIED AUDITED FINANCIAL STATEMENTS. THE TAX INFORMATION RELATING TO SHARES OF EACH FUND NECESSARY FOR THE PREPARATION OF SHAREHOLDERS’ ANNUAL FEDERAL INCOME TAX RETURNS WILL ASLO BE DISTRIBUTED.

Dynamic Shares Trust

TABLE OF CONTENTS

| i |

| ii |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Some forward-looking statements appear under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business.” When used in this prospectus, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this prospectus.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this prospectus in the sections captioned “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business.” Some of the factors that we believe could affect our results include future business and financial performance or conditions, anticipated sales growth across markets, distribution channels and product categories, competition from larger, more established companies with greater economic resources than we have, expenses and gross margins, profits or losses, new product introductions, financing and working capital requirements and resources, control by our principal equity holders and the other factors set forth herein, including those set forth under “Risk Factors.”

There are likely other factors that could cause our actual results to differ materially from the results referred to in the forward-looking statements. All forward-looking statements attributable to us in this prospectus apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. Except as expressly required by federal securities laws, the Trust assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Investors should not place undue reliance on any forward-looking statements.

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

| 1 |

OFFERED SERIES DISCLOSURE

Investors should read the following summary together with the more detailed information in this Prospectus before investing in Shares of the Fund, including under the caption “Risk Factors,” and all exhibits to this Prospectus, including the financial statements and the notes to those financial statements and other information incorporated by reference in this Prospectus.

For ease of reference, any references throughout this Prospectus to various actions taken by the Fund are actually actions taken by the Trust on behalf of the Fund.

Definitions used in this Prospectus may be found in the Glossary in Appendix A and throughout this Prospectus.

The Fund Has not commenced trading and does not have any performance history.

Important Information About the Fund

The Fund is not appropriate for all investors and presents different risks than other funds. The Fund includes risks relating to investing in and seeking exposure to VIX Futures Contracts. An investor should only consider an investment in the Fund if he or she understands the consequences of seeking exposure to VIX Futures Contracts. The Fund uses leverage and is riskier than similar exchange-traded funds that do not use leverage. An investor should only consider an investment in a Fund if he or she understands the consequences of seeking daily inverse leveraged investment results.

The Fund seeks to provide investors with inverse exposure to the implied volatility of the broad-based, large-cap U.S. equity market.

The performance of the Fund can be expected to be very different from the performance of the VIX.

The Fund’s investments may be illiquid and/or highly volatile and the fund may experience large losses from buying, selling or holding such investments. An investor in the Fund could potentially lose the full principal value of his/her investment within a single day.

Shareholders who invest in the fund should actively manage and monitor their investments, as frequently as daily.

The Fund seeks to achieve its investment objective, under normal circumstances, by obtaining investment exposure to an actively managed portfolio of short positions in futures contracts with monthly expirations (“VIX Futures Contracts”), which are based on the Chicago Board Options Exchange, Incorporated (“CBOE”) Volatility Index (the “VIX Index” or “VIX”).

The value of the Fund’s Shares relates directly to the value of, and realized profit or loss from, the financial instruments and other assets held by the Fund, including VIX Futures Contracts. Fluctuations in the price of these financial instruments or assets could materially adversely affect an investment in the Fund.

The Fund expects to primarily take short positions in VIX Futures Contracts by shorting the next two near term VIX Futures Contracts and rolling the nearest month VIX Futures Contract to the next month on a daily basis. As such, the Fund expects to have a constant one-month rolling short position in first and second month VIX Futures Contracts.

| 2 |

The VIX Index seeks to measure the market’s current expectation of 30-day volatility of the S&P 500® Index, as reflected by the prices of near-term S&P 500® options. The market’s current expectation of the possible rate and magnitude of movements in an index is commonly referred to as the “implied volatility” of the index. Because S&P 500® options derive value from the possibility that the S&P 500® may experience movement before such options expire, the prices of near-term S&P 500® options are used to calculate the implied volatility of the S&P 500®.

Unlike many indexes, the VIX Index is not an investable index. Rather, the VIX Index serves as a market volatility forecast. The Fund does not seek to track the performance of the VIX Index or the S&P 500® and, in fact, can be expected to perform very differently from the VIX Index over all periods of time.

The value of a VIX Futures Contract is based on the expected reading of the VIX Index at the expiration of such VIX Futures Contract, and therefore represents forward implied volatility of the S&P 500® over the 30-day period following the expiration of the VIX Futures Contracts. As a result, a movement in the VIX Index today will not necessarily result in a corresponding movement in the price of VIX Futures Contracts. For example, a VIX Futures Contract purchased in March that expires in May is a forward contract on what the VIX Index, as a measure of 30-day implied volatility, will be on the May expiration date. The forward volatility reading of the VIX Index may not correlate directly to the current volatility reading of the VIX Index because the implied volatility of the S&P 500® at a future expiration date may be different from the current implied volatility of the S&P 500®. Furthermore, VIX Futures Contracts that have longer durations often may not reflect the VIX Index’s readings as precisely as VIX Futures Contracts that are closer to expiration due to the increased potential for the implied volatility of the S&P 500® to shift, at a future date, from the current level of implied volatility. VIX Futures Contracts are standard futures contracts that settle for cash based on the VIX Special Opening Quotation, the final settlement value for VIX Futures Contracts that is calculated using opening prices of constituent S&P 500® options.

The Fund will experience positive or negative performance based on changes in the implied level of future market volatility to the extent these changes are reflected in the price of VIX Futures Contracts. The Fund generally will experience positive performance, before accounting for fees and expenses, to the extent that the implied level of future volatility, as reflected by the value of the Fund’s short position in VIX Futures Contracts, decreases. Similarly, the Fund generally will experience negative performance, before accounting for fees and expenses, to the extent that the implied level of future volatility increases.

Futures contracts, by their terms, have stated expirations and, at a specified point in time prior to expiration, trading in a futures contract for the current delivery month will cease. Therefore, to maintain consistent exposure to VIX Futures Contracts, the Fund must periodically migrate our VIX Futures Contracts nearing expiration into VIX Futures Contracts with later expirations – a process referred to as “rolling.” The effect of this continuous process of selling contracts nearing expiration and buying longer-dated contracts is called “roll yield.”

Investments in derivative instruments, such as futures, have the economic effect of creating financial leverage in the Fund’s portfolio because such investments may give rise to losses that exceed the amount the Fund has invested in those instruments. Financial leverage will magnify, sometimes significantly, the Fund’s exposure to any increase or decrease in prices associated with a particular reference asset resulting in increased volatility in the value of the Fund’s portfolio.

At the close of each trading day, the Fund expects to recalibrate its notional exposure value upon the change of the VIX Index and contango on that day. The Fund expects its notional exposure to range from -0.1 to -0.5 after each calibration. Movements of the VIX Futures Contracts during the day will affect whether the Fund’s portfolio needs to be repositioned. For example, if the levels of the VIX Futures Contracts have risen on a given day, net assets of the Fund should fall. As a result of the calibration, the Fund’s inverse exposure will generally increase to a level not beyond -0.5. Conversely, if the levels of the VIX Futures Contracts have fallen on a given day, net assets of the Fund should rise. As a result of the calibration, the Fund’s inverse exposure will generally decrease to as low as -0.1. The Fund will immediately close all of its positions if its net asset value goes down more than 90% at any time during the Exchange’s regulator trading hours.

In seeking to achieve the Fund’s investment objectives, the Sponsor uses a proprietary algorithm, which learns from VIX Futures Contracts historical prices and contango trend, to optimize VIX Futures Contracts trading risks and returns. The algorithm starts with a relatively low notional exposure (-0.1 to -0.15) and recalibrates its notional exposure upon the change of price and contango of VIX Futures Contracts. The Sponsor expects the algorithm to slightly increase the Fund’s notional exposure when the price of VIX Futures Contracts go up to a level not beyond -0.5, and, when the price of VIX Futures Contracts goes down, the Sponsor expects the algorithm to decrease the Fund’s notional exposure to lower levels to prepare for potential upcoming spikes in the price of VIX Futures Contracts. In the event that the fund’s notional exposure has already reached -0.5 and the price of VIX Futures Contracts increases, the Fund expects to maintain its notional exposure at -0.5 at the close of each trading day. Conversely, if the price of VIX Futures Contracts decreases when the Fund’s notional exposure is below -0.1, the Fund expects to maintain its notional exposure at -0.1 when calibrating its notional exposure.

| 3 |

The Sponsor has the power to change the Fund’s investment objective or investment strategy and may liquidate the Fund at any time, subject to applicable regulatory requirements.

Dynamic Shares LLC, a Delaware limited liability company, serves as the Trust’s Sponsor, and serves as the Trust’s CFTC registered commodity pool operator. The principal office of the Sponsor and the Fund is located at 401 W Superior St, Suite 300, Chicago, IL 60654. The telephone number of the Sponsor and the Fund is (678) 834-4218.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the beginning of the first fiscal year following the fifth anniversary of our initial public offering, (2) the beginning of the first fiscal year after our annual gross revenue is $1.07 billion (subject to adjustment for inflation) or more, (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities and (4) as of the end of any fiscal year in which the market value of our common equity held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

For as long as we remain an “emerging growth company,” we may take advantage of certain exemptions from the various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation and financial statements in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote to approve executive compensation and shareholder approval of any golden parachute payments not previously approved. We will take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

Purchases and Sales in the Secondary Market, on the NYSE Arca

The Shares of the Fund have been approved for listing on the NYSE Arca, subject to notice of issuance, under the ticker symbol WEIX. Secondary market purchases and sales of Shares are subject to ordinary brokerage commissions and charges.

Creation and Redemption Transactions

Only an Authorized Participant may purchase (i.e. create) or redeem Shares in the Fund. Authorized Participants may purchase or redeem Shares only in blocks, which are expected to be of 50,000 Shares (each such block, a “Creation Unit”) in the Fund. An “Authorized Participant” is an entity that has entered into an Authorized Participant Agreement with the Trust and the Sponsor. Creation Units are offered to Authorized Participants at each Fund’s NAV.

Creation Units in a Fund are expected to be created when there is sufficient demand for Shares in such Fund that the market price per Share is at a premium to the NAV per Share. Authorized Participants will likely sell such Shares to the public at prices that are expected to reflect, among other factors, the trading price of the Shares of such Fund and the supply of and demand for the Shares at the time of sale. Similarly, it is expected that Creation Units in a Fund will be redeemed when the market price per Share of such Fund is at a discount to the NAV per Share. The Sponsor expects that the exploitation of such arbitrage opportunities by Authorized Participants and their clients will tend to cause the public trading price of the Shares to track the NAV per Share of a Fund over time. Retail investors seeking to purchase or sell Shares on any day are expected to effect such transactions in the secondary market at the market price per Share, rather than in connection with the creation or redemption of Creation Units.

| 4 |

A creation transaction, which is subject to acceptance by Capital Investment Group, Inc. (“CIG” or the “Distributor”), generally takes place when an Authorized Participant deposits a specified amount of cash (unless as provided otherwise in this Prospectus) in exchange for a specified number of Creation Units. Similarly, Shares can be redeemed only in Creation Units, generally for cash (unless as provided otherwise in this Prospectus). Except when aggregated in Creation Units, Shares are not redeemable. The prices at which creations and redemptions occur are based on the next calculation of NAV after an order is received in a form described in the Authorized Participant Agreement and the related Authorized Participant Procedures Handbook. The manner by which Creation Units are purchased and redeemed is governed by the terms of this Prospectus, the Authorized Participant Agreement and the Authorized Participant Procedures Handbook. Creation and redemption orders are not effective until accepted by the Distributor and may be rejected or revoked as described herein. By placing a purchase order, an Authorized Participant agrees to deposit cash (unless as provided otherwise in this Prospectus) with BMO Harris Bank N.A. (the “Custodian”), acting in its capacity as custodian of the Fund.

Creation and redemption transactions must be placed each day with the Distributor by the create/redeem cutoff time (stated below) to receive that day’s NAV. The cut-off time may be earlier if, for example, the Exchange or other exchange material to the valuation or operation of the Fund closes before such cut-off time. Because the primary trading session for the futures contracts underlying the Fund have different closing (or fixing) times than U.S. Equity markets, the create/redeem cut-off time and NAV calculation time for the Fund may differ. See the section herein titled “Net Asset Value” for additional information about NAV calculations.

| Create/Redeem Cutoff (Eastern Time) | NAV Calculation Time (Eastern Time) | |

| 2:00 p.m. | 4:15 p.m. |

Breakeven Table

See “Charges—Breakeven Table” on page 32 of this Prospectus for detailed Breakeven Table.

The Fund will be profitable only if returns from the Fund’s investments exceed its “breakeven amount.” Estimated breakeven amounts are set forth in the table below. The estimated breakeven amount represents the estimated amount of trading income that the Fund would need to achieve during one year to offset the Fund’s estimated fees, costs and expenses, net of any interest income earned by the Fund on its investments. It is not possible to predict whether the Fund will break even at the end of the first twelve months of an investment or any other period. See “Charges-Breakeven Table,” beginning on page 32, for a more detailed table showing Breakeven Amounts and Table.

| Fund | Breakeven Amount (% Per Annum of Average Daily NAV)* |

Assumed Selling Price Per Share* |

Breakeven Amount ($ for the Assumed Selling Price Per Share)* |

|||||||||

| Dynamic Short Short-Term Volatility Futures ETF | 2.45% | $ | 20.00 | $ | 0.49 | |||||||

*The breakeven analysis set forth in this table assumes that the Shares have a constant NAV equal to the amount shown. The actual NAV of the Fund differs and is likely to change on a daily basis. The numbers in this chart have been rounded to the nearest 0.01.

Please note that the Fund will distribute to shareholders a Schedule K-1 that will contain information regarding the income and expense items of the Fund. The Schedule K-1 is a complex form and shareholders may find that preparing tax returns may require additional time or may require the assistance of an accountant or other tax preparer, at an additional expense to the shareholder.

| 5 |

Risk Factors

An investment in the Shares has risks. The “Risk Factors” section of this Prospectus contains a detailed discussion of the most important risks. Please refer to the “Risk Factors” section for a more detailed discussion of the risks summarized below and other risks of investment in the Shares.

Risks Related to the Fund’s Operations and Management

| ● | The Fund is subject to the risks associated with being newly organized, which may adversely affect the operations of the Fund. There is risk that the objectives of the Fund will not be met. | |

| ● | The Fund has no operating history, and, as a result, investors may not rely on past performance in deciding whether to buy the Shares. | |

| ● | Investors cannot be assured of the Sponsor’s continued services, which discontinuance may be detrimental to the Fund. | |

| ● | Investors may be adversely affected by redemption or purchase orders that are subject to postponement, suspension or rejection under certain circumstances. | |

| ● | An investor may be adversely affected by lack of independent advisers representing investors. | |

| ● | Possibility of termination of the Fund may adversely affect an investor’s portfolio. | |

| ● | The value of the Shares of the Fund relates directly to the value of, and realized profit or loss from, the financial instruments and other assets held by the Fund and fluctuations in the price of these assets could materially adversely affect an investment in the Shares. | |

| ● | The NAV may not always correspond to market price and, as a result, investors may be adversely affected by the creation or redemption of Creation Units at a value that differs from the market price of the Shares. | |

| ● | The Fund will be subject to counterparty risks, credit risks and other risks, including, but not limited to, risks associated with futures contracts, which could result in significant losses to the Fund. | |

| ● | Fees are charged regardless of profitability and may result in depletion of assets. | |

| ● | Competing claims of intellectual property rights may adversely affect the Fund and an investment in the Shares. | |

| ● | Investors may be adversely affected by an overstatement or understatement of the NAV calculation of a Fund due to the valuation method employed when a settlement price is not available on the date of NAV calculation. |

Risks Related to the Fund’s Shares

| ● | The lack of active trading markets for the Shares of the Fund may result in losses on investors’ investments at the time of disposition of his, her, or its Shares. | |

| ● | The Shares of the Fund are new securities products and their value could decrease if unanticipated operational or trading problems arise. | |

| ● | Shareholders that are not Authorized Participants may only purchase or sell their Shares in secondary trading markets, and the conditions associated with trading in secondary markets may adversely affect investors’ investment in the Shares. | |

| ● | NYSE Arca may halt trading in the Shares of a Fund which would adversely impact investors’ ability to sell Shares. | |

| ● | Shareholders will not have the protections associated with ownership of shares in an investment company registered under the 1940 Act. |

| 6 |

| ● | Shareholders do not have the rights enjoyed by investors in certain other vehicles and may be adversely affected by a lack of statutory rights and by limited voting and distribution rights. | |

| ● | The value of the Shares will be adversely affected if the Fund is required to indemnify the Trustee. | |

| ● | Although the Shares of the Fund are limited liability investments, certain circumstances such as bankruptcy of the Fund will increase a shareholder’s liability. | |

| ● | A court could potentially conclude that the assets and liabilities of the Fund are not segregated from those of another series of the Trust and may thereby potentially expose assets in the Fund to the liabilities of another series of the Trust. | |

| ● | Shareholders’ tax liability will exceed cash distributions on the Shares. | |

| ● | Investors could be adversely affected if items of income, gain, deduction, loss and credit with respect to Shares of a Fund are reallocated in the event that the IRS does not accept the assumptions or conventions used by the Fund in allocating Fund tax items. | |

| ● | Investors could be adversely affected if the current treatment of long-term capital gains under current U.S. federal income tax law is changed or repealed in the future. |

Risks Related to Regulatory Requirements and Potential Legislative Changes

| ● | The Fund will be subject to regulatory risk associated with futures contracts that could adversely affect the Fund’s operations and profitability and cause conflicts of interest. | |

| ● | Failure of FCMs to segregate assets may increase losses in the Fund. | |

| ● | Regulatory changes or actions, including the implementation of new legislation, may alter the operations and profitability of the Fund. | |

| ● | Regulatory and exchange accountability levels may restrict the creation of Creation Units and the operation of the Trust |

The Fund seeks to provide better risk management than passively managed short VIX short-term futures ETFs. Unlike traditional short VIX short-term futures ETFs, the Fund seeks to dynamically manage its notional exposure to VIX futures. For instance, when the VIX Index is below its historical average, the Fund’s notional exposure is lower than a traditional short VIX short term futures ETF, which may maintain a fixed notional exposure every day. When the VIX Index is going up, the Fund gradually increases its notional exposure, up to a ceiling of -0.5*. The Fund expects that its notional exposure will not exceed -0.5*, but that its notional exposure may exceed -0.5* during intraday trading before recalibration.

There can be no assurance that the Fund will achieve its investment objective or avoid substantial losses.

Principal Investment Strategies

In seeking to achieve each Fund’s investment objective, the Sponsor uses a mathematical approach to investing. Using this approach, the Sponsor determines the type, quantity and mix of investment positions that the Sponsor believes in combination should produce daily returns consistent with a Fund’s objective. The Sponsor relies upon a pre-determined model to generate orders that will result in repositioning each Fund’s investments in accordance with its daily investment objectives. Substantially all the proceeds of the offering of the Shares of the Fund are, or will be, used to make portfolio investments in a manner consistent with its investment objective. The Fund will also hold cash or cash equivalents such as U.S. Treasury securities or other high credit quality, short-term fixed income or similar securities (such as shares of money market funds) as collateral for financial instruments and pending investment in financial instruments. To the extent that the Fund does not invest the proceeds of the offering of the Shares in the manner described above on the day such proceeds are received, such proceeds may be deposited with the Custodian.

The Fund expects that its notional exposure will not exceed -0.5*, but that its notional exposure may exceed -0.5* during intraday trading before recalibration.

The Fund’s notional exposure is currently determined by using the methodology below.

First, the Fund will calculate a ratio as follows:

| Annotation | Expiration Date | Number of Contract | End of Day Price | |||||

| Calculation | ||||||||

| Previous Month | V0 | Date0 | ||||||

| Current Month | V1 | Date1 | N1 | P1 | ||||

| Next Month | V2 | Date2 | N2 | P2 |

For the next trading day “Next Day”: Date0<Next Day<=Date1

D0 = Number of Trading Days from Date0 (exclude) to Date1 (include)

D1 = Number of Trading Days from Next Day (exclude) to Date1 (include)

D2 = D0 – D1

Ratio = (D1*P1 + D2*P2)/D0 (The value of the ratio is calculated at 4:00 p.m. eastern time every day.)

Second, the following table will be used to calculate the expected exposure level.

| Interval of Ratio | Exposure Level | |

| (0, 10] | -5.0% | |

| (10, 12] | 15.0% - 2.0% * Ratio | |

| (12, 13] | 33.0% - 3.5% * Ratio | |

| (13, 14] | 52.5% - 5.0% * Ratio | |

| (14, 15] | 66.5% - 6.0% * Ratio | |

| (15, 16] | 44.0% - 4.5% * Ratio | |

| (16, 17] | 36.0% - 4.0% * Ratio | |

| (17, 18] | 2.0% - 2.0% * Ratio | |

| (18, 19] | 38.0% - 4.0% * Ratio | |

| (19, 21] | 57.0% - 5.0% * Ratio | |

| (21, 22] | -6.0% - 2.0% * Ratio | |

| 22+ | -50.0% |

After calculating the expected exposure percentage of the Fund, the following function will be used to determine the expected holdings of VIX Futures Contracts:

Exposure%*NAV= -(N1*P1+N2*P2)

N1/N2=D1/D2

The Fund expects to short N1 contracts of current month VIX Futures Contracts and N2 contracts of next month VIX Futures Contracts after recalibration.

| 7 |

The Sponsor

Dynamic Shares LLC, a Delaware limited liability company formed on June 4, 2018, is the Sponsor of the Trust, the Fund, and any other series of the Trust. The Sponsor will serve as both commodity pool operator of the Trust and the Fund. The Sponsor is registered as a commodity pool operator with the CFTC and is a member in good standing of the NFA. As a registered commodity pool operator, with respect to the Trust, the Sponsor must comply with various regulatory requirements under the CEA, and the rules and regulations of the CFTC and the NFA, including investor protection requirements, antifraud prohibitions, disclosure requirements, and reporting and recordkeeping requirements. The Sponsor will also be subject to periodic inspections and audits by the CFTC and NFA.

Under the Trust Agreement (as defined below), the Sponsor has exclusive management and control of all aspects of the business of the Fund. The Trustee has no duty or liability to supervise the performance of the Sponsor, nor will the Trustee have any liability for the acts or omissions of the Sponsor.

The Fund pays the Sponsor a management fee (the “Management Fee”), monthly in arrears, in an amount equal to 1.85% per annum of its average daily net assets (calculated by summing the month-end net assets of the Fund and dividing by the number of calendar days in the month). The Management Fee is paid in consideration of the Sponsor’s trading advisory services and the other services provided to the Fund that the Sponsor pays directly or indirectly.

The Administrator

The Trust, on behalf of itself and on behalf of the Fund, has appointed The Nottingham Company, a North Carolina business corporation, as the Administrator of the Fund and The Nottingham Company will enter into a fund accounting and administration service agreement (the “Accounting and Administration Agreement”) with the Trust (for itself and on behalf of the Fund) and the Sponsor in connection therewith. In addition, The Nottingham Company will provide certain accounting services to the Fund pursuant to the Administration Agency Agreement. The Administrator’s fees are paid on behalf of the Fund by the Sponsor.

Pursuant to the terms of the Accounting and Administration Agreement and under the supervision and direction of the Sponsor, The Nottingham Company will prepare and file certain regulatory filings on behalf of the Fund. The Nottingham Company may also perform other services for the Fund pursuant to the Accounting and Administration Agreement as mutually agreed to from time to time.

The Sponsor, on behalf of the Fund, is expected to retain the services of one or more additional service providers to assist with certain tax reporting requirements of the Fund and their shareholders.

The Custodian

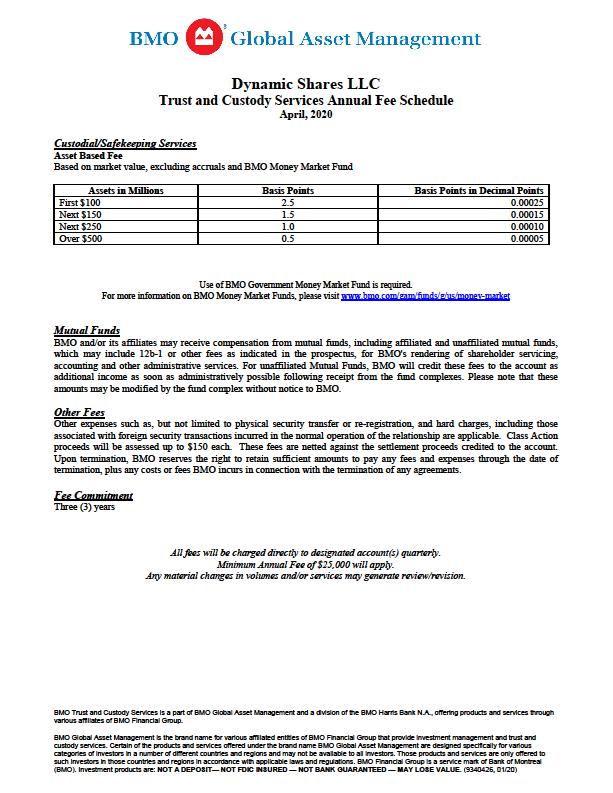

BMO Harris Bank N.A. will serve as the Custodian of the Fund and has entered into an institutional custody agreement (the “Institutional Custody Agreement”) with the Trust (for itself and on behalf of the Fund) in connection therewith.

Pursuant to the terms of the Institutional Custody Agreement, the Custodian will be responsible for the holding and safekeeping of assets delivered to it by the Fund and performing various administrative duties in accordance with instructions delivered to the Custodian by the Fund. The Custodian’s fees are paid by the Trust and reimbursed by the Sponsor.

The Transfer Agent

Nottingham Shareholder Services, LLC, will serve as the Transfer Agent of the Fund for Authorized Participants and will enter into a dividend disbursing and transfer agent agreement (the “Transfer Agent Agreement”). Pursuant to the terms of the Transfer Agent Agreement, the Transfer Agent will be responsible for processing purchase and redemption orders and maintaining records of ownership of the Fund. The Transfer Agent fees are paid on behalf of the Fund by the Sponsor.

The Distributor

Capital Investment Group, Inc. (“CIG”) will serve as the Distributor of the Fund and will assist the Sponsor and the Administrator with functions and duties relating to distribution and marketing, which include the following: taking creation and redemption orders, and consulting with the marketing staff of the Sponsor and its affiliates with respect to compliance matters in connection with marketing efforts. CIG will retain all marketing materials separately for the Fund, at the offices of 100 E. Six Forks Road, Suite 200, Raleigh, NC 27609; telephone: (919) 831-2370. The Trust will enter into a distribution agreement (the “Distribution Agreement”) with CIG. The Sponsor pays the Distributor for performing its duties on behalf of the Fund.

| 8 |

The Trustee

Wilmington Trust, National Association (the “Trustee”), a national banking association, is the sole trustee of the Trust. Under a Trust Agreement, as may be further amended from time to time (the “Trust Agreement”), the Trustee does not have the power and authority to manage the Trust’s business and affairs and has only nominal duties and liabilities to the Trust.

Futures Commission Merchant

The Fund intends to use Wedbush, in its capacity as a registered Futures Commission Merchant (“FCM”), as its FCM. Wedbush, in its capacity as a registered FCM, serves as a clearing broker to the Trust and the Fund and as such arranges for the execution and clearing of the Fund’s futures transactions. Wedbush acts as clearing broker for many other funds and individuals. A variety of executing brokers may execute futures transactions on behalf of the Fund. The executing brokers will give up all such transactions to Wedbush, as applicable.

Limitation of Liabilities

Investors’ investment in a Fund is part of the assets of that Fund, and it will therefore only be subject to the risks of that Fund’s trading. Investors cannot lose more than their investment in a Fund, and they will not be subject to the losses or liabilities of a Fund in which they have not invested. The Trust will receive an opinion of counsel that the Fund will be entitled to the benefits of the limitation on inter-series liability provided under the Delaware Statutory Trust Act (the “DSTA”). Each Share, when purchased in accordance with the Trust Agreement of the Trust, shall, except as otherwise provided by law, be fully paid and non-assessable.

The debts, liabilities, obligations, claims and expenses of the Fund will be enforceable against the assets of the Fund only, and not against the assets of other series or the assets of the Trust generally, and, unless otherwise provided in the Trust Agreement, none of the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to the Trust generally or any other series thereof will be enforceable against the assets of such Fund, as the case may be.

Creation and Redemption of Shares

The Fund will create and redeem Shares from time to time, but only in one or more Creation Units. A Creation Unit is expected to be a block of 50,000 Shares of a Fund. Creation Units may be created or redeemed only by Authorized Participants. Except when aggregated in Creation Units, the Shares are not redeemable securities. Authorized Participants pay a fixed transaction fee in connection with each order to create or redeem a Creation Unit. Authorized Participants may sell the Shares included in the Creation Units they purchase from the Fund to other investors. The form of Authorized Participant Agreement and related Authorized Participant Handbook sets forth the procedures for the creation and redemption of Creation Units of Shares and for the delivery of cash required for such creations or redemptions.

See “Creation and Redemption of Shares” for more details.

The initial Authorized Participant is expected to purchase the initial Creation Units of 100,000 Shares of the Fund, equal to $1,000,000 per Creation Unit, at an initial offering per Share of $20 for the Fund and each Creation Unit, which is expected to consist of a block of 50,000 Shares of the Fund.

The effective date will be the date on which the SEC declares the registration statement relating to this Prospectus effective. The proceeds are expected to be invested after cash is received from the initial Authorized Participant. The Shares of the Fund are expected to begin trading on the second day following the purchase of the initial Creation Units of the Fund by the initial Authorized Participant. Thereafter, the Fund will issue Shares in Creation Units to Authorized Participants in the manner described in “Creation and Redemption of Shares.”

| 9 |

Authorized Participants

Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant, such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in the Depository Trust Company, or DTC, and (3) have entered into an agreement with the Trust and the Sponsor (an Authorized Participant Agreement).

A list of the current Authorized Participants can be obtained from the Distributor. See “Creation and Redemption of Shares” for more details.

Net Asset Value (“NAV”)

The NAV in respect of the Fund, means the total assets of that Fund, including but not limited to all cash and cash equivalents or other debt securities less total liabilities of the Fund, consistently applied under the accrual method of accounting. The Fund’s NAV is calculated on each day other than a day when the Exchange is closed for regular trading. The Fund computes its NAV only once each trading day as of the times set forth below (the “NAV Calculation Time”), except as follows. The Fund may calculate its NAV as of an earlier time if the Exchange or other exchange material to the valuation or operation of the Fund closes early.

| Fund | NAV Calculation Time | |

| Dynamic Short Short-Term Volatility Futures ETF | 4:15 p.m. (Eastern Time) |

The NAV will be calculated as described under “Description of the Shares; The Funds; Certain Material Terms of the Trust Agreement—Net Asset Value.”

Clearance and Settlement

The Shares of each Fund are evidenced by global certificates that the Fund issues to DTC. The Shares of each Fund are available only in book-entry form. Shareholders may hold Shares of a Fund through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC.

Use of Proceeds

Substantially all the proceeds of the offering of the Shares of the Fund are, or will be, used to make portfolio investments in a manner consistent with its investment objective. The Fund will also hold cash or cash equivalents such as U.S. Treasury securities or other high credit quality, short-term fixed income or similar securities (such as shares of money market funds) as collateral for financial instruments and pending investment in financial instruments. To the extent that the Fund does not invest the proceeds of the offering of the Shares in the manner described above on the day such proceeds are received, such proceeds may be deposited with the Custodian. See “Use of Proceeds” for more details.

Fees and Expenses

| Management Fee | The Fund will pay the Sponsor a Management Fee, monthly in arrears, in an amount equal to 1.85% per annum of its average daily NAV. | |

| Organization and Offering Expenses | The Sponsor is responsible for the offering costs of the Fund. Normal and expected expenses incurred in connection with the continuous offering of Shares of the Fund are paid by the Sponsor. |

| 10 |

| Brokerage Commissions and Fees | The Fund will pay all its respective brokerage commissions, including applicable exchange fees, NFA fees and give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities for the Fund’s investments in CFTC regulated investments, except as provided in the following sentence. The Sponsor will pay for any brokerage commissions on VIX Futures Contracts that exceed 0.6% of the Fund’s average net assets annually. | |

| Other Transaction Costs | The Fund will bear other transaction costs including financing costs/fees associated with the use of financial instruments and costs relating to the purchase of U.S. Treasury securities or similar high credit quality, short-term fixed-income or similar securities (such as shares of money market funds, bank deposits, bank money market accounts, certain variable rate-demand notes and collateralized repurchase agreements). | |

| Routine Operational, Administrative and Other Ordinary Expenses | From the Management Fee, the Sponsor is responsible for paying the fees and expenses of the Administrator, Custodian (by reimbursing the Trust), Distributor, Transfer Agent and all routine operational, administrative and other ordinary expenses of the Fund. | |

| Non-Recurring Fees and Expenses | The Fund pays all its non-recurring and unusual expenses, if any, as determined by the Sponsor. Non-recurring and unusual fees and expenses are fees and expenses which are unexpected or unusual in nature, such as legal claims and liabilities and litigation costs or indemnification or other unanticipated expenses. Extraordinary fees and expenses also include material expenses which are not currently anticipated obligations of the Fund. Routine operational, administrative and other ordinary expenses are not deemed extraordinary expenses. |

Investors may pay customary brokerage commissions in connection with purchases of the Shares.

Authorized Participants will be required to pay the Fund a fixed transaction fee of up to $500 in connection with each order to create and redeem a Creation Unit in order to reimburse the Fund for transaction-related expenses. Investors who use the services of a broker or other such intermediary to purchase Shares of a Fund may pay additional fees for such services.

Distributions

Each Fund will make distributions at the discretion of the Sponsor. The Funds currently do not expect to make distributions with respect to capital gains or income. Depending on the Fund’s performance for the taxable year and an investor’s own tax situation for such year, an investor’s income tax liability for the taxable year for his, her or its allocable share of such Fund’s net ordinary income or loss and capital gain or loss may exceed any distributions an investor receives with respect to such year.

Fiscal Year

The fiscal year of the Fund ends on December 31 of each year.

Financial Information

Other than as set forth below in “Summary Historical Financial Data”, no financial information is available for the Fund because it has not commenced operations as of the date of this Prospectus.

U.S. Federal Income Tax Considerations

Subject to the discussion below in “Material U.S. Federal Income Tax Considerations,” the Fund will not be classified as an association taxable as a corporation. Instead, the Fund will be classified as a partnership for U.S. federal income tax purposes. Accordingly, the Fund will not incur U.S. federal income tax liability; rather, each beneficial owner of the Fund’s Shares will be required to take into account its allocable share of the Fund’s income, gain, loss, deductions and other items for the Fund’s taxable year ending with or within the beneficial owner’s taxable year.

| 11 |

The treatment of an investment in the Fund by an entity that is classified as a regulated investment company for U.S. federal income tax purposes, or a RIC, will depend, in part, on whether the Fund is classified as a qualified publicly traded partnership, or a qualified PTP, for purposes of the RIC rules. Prospective RIC investors should refer to the discussion in “Material U.S. Federal Income Tax Considerations—Regulated Investment Companies” and consult a tax adviser regarding the treatment of an investment in the Fund under current tax rules and in light of their particular circumstances.

Additionally, please refer to the “Material U.S. Federal Income Tax Considerations” section below for information on the potential U.S. federal income tax consequences of the purchase, ownership and disposition of Shares in the Fund.

Reports to Shareholders

The Sponsor will furnish an annual report of the Fund in the manner required by the rules and regulations of the SEC as well as those reports required by the CFTC and the NFA, including, but not limited to, annual audited financial statements of the Fund examined and certified by independent registered public accountants and any other reports required by any other governmental authority that has jurisdiction over the activity of the Fund. Monthly account statements conforming to CFTC and NFA requirements will be posted on the Sponsor’s website at www.dynamicsharesetf.com. Shareholders of record will also be provided with appropriate information to permit them to file U.S. federal and state income tax returns with respect to Shares held. Additional reports may be posted on the Sponsor’s website at the discretion of the Sponsor or as required by regulatory authorities.

Corporate Information

The Trust was organized as a Delaware statutory trust under the DSTA on March 8, 2019 under the name Dynamic Shares Trust. The Trust’s principal executive offices are located at c/o Dynamic Shares LLC, 401 W Superior St, Suite 300, Chicago, IL 60654, and our telephone number at that location is (678) 834-4218. The URL for our website is www.dynamicsharesetf.com. The information contained on or connected to our website is not incorporated by reference into, and you must not consider the information to be a part of, this prospectus.

The Trust is managed by Dynamic Shares LLC, the Sponsor, whose office is located at 401 W Superior St, Suite 300, Chicago, IL 60654.

The books and records of the Fund are maintained as follows: all marketing materials are maintained at the offices of the Distributor at 100 E. Six Forks Road, Suite 200, Raleigh, NC 27609; Telephone: (919) 831-2370. Creation Unit creation and redemption books and records, certain financial books and records and certain trading and related documents received from FCM(s) are maintained by the Administrator, 1116 South Franklin Street, Rocky Mount, North Carolina 27804.

All other books and records of the Fund are maintained at the Fund’s principal office, c/o Dynamic Shares LLC, 401 W Superior St, Suite 300, Chicago, IL 60654.

Trust books and records located at the foregoing addresses, are available for inspection and copying (upon payment of reasonable reproduction costs) by Fund shareholders or their representatives for any purposes reasonably related to such shareholder’s interest as a beneficial owner during regular business hours as provided in the Trust Agreement. The Sponsor will maintain and preserve the Trust’s books and records for a period of not less than six years.

| 12 |

SUMMARY HISTORICAL FINANCIAL DATA

The Trust

The following tables presents a summary of the Trust’s and Fund’s historical financial data for the period from March 8, 2019 (inception) through December 31, 2019, which are derived from the Trust’s and Fund’s audited financial statements, respectively. The summary of the Trust’s and Fund’s historical financial data for the three months ended March 30, 2020 and the balance sheet data as of March 30, 2020 are derived from the Trust’s and Fund’s unaudited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results the Trust and Fund expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Trust”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Fund”, and Trust’s and Fund’s financial statements and related notes appearing elsewhere in this prospectus.

The Trust March

8, 2019 (inception) through |

The Fund March

8, 2019 (inception) through |

|||||||

| Statement of Operations Data | ||||||||

| Revenues | $ | - | $ | - | ||||

| Cost of Revenue | - | - | ||||||

| Gross margin | - | - | ||||||

| Total operating expenses | - | - | ||||||

| Net loss | $ | - | $ | - | ||||

| Net loss per share, basic and diluted | $ | - | $ | - | ||||

| Balance Sheet Data (at period end) | ||||||||

| Cash | $ | 100 | $ | 100 | ||||

| Working capital (1) | $ | 100 | $ | 100 | ||||

| Total assets | $ | 100 | $ | 100 | ||||

| Total liabilities | $ | $ | ||||||

| Stockholders’ equity | $ | 100 | $ | 100 | ||||

(1) Working capital represents total current assets less total current liabilities.

The Trust Three months ended March 31, 2020 |

The Fund Three months ended March 31, 2020 |

|||||||

| (unaudited) | (unaudited) | |||||||

| Statement of Operations Data | ||||||||

| Revenues | $ | - | $ | - | ||||

| Cost of Revenue | - | - | ||||||

| Gross margin | - | - | ||||||

| Total operating expenses | - | - | ||||||

| Net loss | $ | - | $ | - | ||||

| Net loss per share, basic and diluted | $ | - | $ | - | ||||

| Balance Sheet Data (at period end) | ||||||||

| Cash | $ | 100 | $ | 100 | ||||

| Working capital (1) | $ | 100 | $ | 100 | ||||

| Total assets | $ | 100 | $ | 100 | ||||

| Total liabilities | $ | $ | ||||||

| Stockholders’ equity | $ | 100 | $ | 100 | ||||

(1) Working capital represents total current assets less total current liabilities.

Other than the above, no financial information is available for the Trust and the Fund because they have not commenced operations as of the date of this Prospectus.

| 13 |

Before investors invest in the Shares, they should be aware that there are various risks. Investors should consider carefully the risks described below together with all the other information included in this Prospectus, as well as information found in documents incorporated by reference in this Prospectus, before they decide to purchase any Shares. These risk factors may be amended, supplemented or superseded from time to time by risk factors contained in any periodic report, prospectus supplement or post-effective amendment or in other reports filed with the SEC in the future.

Principal Risks

Active Management Risk

The Sponsor continuously evaluates the Fund’s holdings, purchases and sales with a view to achieving the Fund’s investment objective. However, the achievement of the stated investment objective cannot be guaranteed over short- or long-term market cycles. The Sponsor’s judgments about the markets, the economy, or companies may not anticipate actual market movements, economic conditions or company performance, and these judgments may affect the return on your investment.

Authorized Participant Concentration Risk

Only an Authorized Participant (as defined herein) may engage in creation or redemption transactions directly with the Fund. The Fund may have a limited number of financial institutions that act as Authorized Participants. To the extent that those Authorized Participants exit the business or are unable to process creation and/or redemption orders, and no other Authorized Participant can step forward to create and redeem, Shares may trade at discount to NAV and possibly face trading halts and/or de-listing. Further, to the extent that those Authorized Participants exit the business, the liquidity of the Shares will likely decrease, which could adversely affect the market price of the Shares and result in investors incurring a loss on their investment.

Cash Transactions Risk

Unlike most other ETFs, the Fund expects to effect its creations and redemptions in exchange for a significant cash component and a smaller component, if any, of in-kind securities. Paying redemption proceeds in cash rather than through in-kind delivery of portfolio securities may require the Fund to dispose of or sell portfolio investments to obtain the cash needed to distribute redemption proceeds at an inopportune time. This may cause the Fund to recognize gains or losses that it might not have incurred if it had made a redemption in-kind. As a result, the Fund may pay out higher or lower annual capital gains distributions than ETFs that redeem in kind. As a practical matter, only institutions and large investors, such as market makers or other large broker-dealers, purchase or redeem Creation Units. Most investors will buy and sell shares of the Fund on an exchange.

Commodity Pool Regulatory Risk

The Fund’s investment exposure to VIX Futures Contracts will cause it to be deemed to be a commodity pool, thereby subjecting the Fund to regulation under the Commodity Exchange Act and Commodity Futures Trading Commission (“CFTC”) rules. The Sponsor is registered as a Commodity Pool Operator (“CPO”), and the Fund will be operated in accordance with applicable CFTC rules. Registration as a CPO imposes additional compliance obligations on the Sponsor and the Fund related to additional laws, regulations and enforcement policies, which could increase compliance costs and may affect the operations and financial performance of the Fund.

Compounding Risk

The Fund’s performance for periods greater than a single day will be the result of each day’s returns compounded over the period. A “single day” is measured from the time a Fund calculates its net asset value to the time of the Fund’s next net asset value calculation. Particularly during periods of higher volatility of underlying instruments, compounding will cause results for periods longer than a single day to vary from the return of the underlying instruments.

Compounding affects all investments, but has a more significant impact on an inverse fund. This effect becomes more pronounced as volatility increases.

| 14 |

Counterparty Risk

The Fund will be subject to credit risk (i.e. the risk that a counterparty is unwilling or unable to make timely payments to meet its contractual obligations) with respect to the amount the Fund expects to receive from counterparties to financial instruments entered into by the Fund. Such a default may cause the value of an investment in the Fund to decrease.

Derivatives Risk

The Fund will invest in and have investment exposure to VIX Futures Contracts, which are types of derivative contracts. A derivative refers to any financial instrument whose value is derived, at least in part, from the price of an underlying security, asset, rate, or index. The use of derivatives presents risk different from, and possibly greater than, the risks associated with investing directly in traditional securities. Changes in the value of a derivative may not correlate perfectly with the underlying security, asset, rate or index. Gains or losses in a derivative may be magnified and may be much greater than the derivative’s original cost.

VIX Futures Contracts Risk

VIX Futures Contracts are unlike traditional futures contracts and are not based on a tradable reference asset. The VIX Index is not directly investable, and the settlement price of a VIX Futures Contract is based on the calculation that determines the level of the VIX Index. As a result, the behavior of a VIX Futures Contract may be different from traditional futures contracts whose settlement price is based on a specific tradable asset. In addition, when economic uncertainty increases and there is an associated increase in expected volatility, the value of VIX Futures Contracts will likely also increase. Similarly, when economic uncertainty recedes and there is an associated decrease in expected volatility, the value of VIX Futures Contracts will likely also decrease. When the Fund has an open futures contract position, it is subject to daily variation margin calls that could be substantial in the event of adverse price movements. Because futures require only a small initial investment in the form of a deposit or margin, they involve a high degree of leverage. If the Fund has insufficient cash to meet daily variation margin requirements, it might need to sell securities at a time when such sales are disadvantageous. Futures markets are highly volatile and the use of or exposure to futures contracts may increase volatility of the Fund’s NAV. Futures contracts are also subject to liquidity risk.

Several factors may affect the price and/or liquidity of VIX Futures Contracts, including, but not limited to: prevailing market prices and forward volatility levels of the U.S. stock markets, the S&P 500®, the equity securities included in the S&P 500® and prevailing market prices of options on the S&P 500®, the VIX Index, options on the VIX Index, VIX Futures Contracts, or any other financial instruments related to the S&P 500® and the VIX Index or VIX Futures Contracts; interest rates, economic, financial, political, regulatory, geographical, biological or judicial events that affect the current volatility reading of the VIX Index or the market price or forward volatility of the U.S. stock markets, the equity securities included in the S&P 500®, the S&P 500®, the VIX Index or the relevant futures or option contracts on the VIX Index; supply and demand as well as hedging activities in the listed and over-the-counter (“OTC”) equity derivatives markets; disruptions in trading of the S&P 500®, futures contracts on the S&P 500® or options on the S&P 500®; and the level of contango or backwardation in the VIX Futures Contracts market. These factors interrelate in complex ways, and the effect of one factor on the market value of the Fund may offset or enhance the effect of another factor.

Early Closing Risk

An unanticipated early closing of the NYSE Arca may result in a shareholder’s inability to buy or sell Shares of the Fund on that day. If the Exchange closes early on a day when a shareholder needs to execute trades late in the trading day, the shareholder might incur trading losses.

Historical correlation trends between the VIX Futures Contracts and other asset classes may not continue or may reverse, limiting or eliminating any potential diversification or other benefit from owning the Fund.

To the extent that an investor purchases Shares of the Fund seeking diversification benefits based on the historic correlation (whether positive or negative) between the VIX Futures Contracts and other asset classes, such historic correlation may not continue or may reverse itself. In this circumstance, the diversification or other benefits sought may be limited or non-existent.

Index Calculation and VIX Futures Contract Pricing Risk

The Policies of S&P and the CBOE and changes that affect the composition and valuation of the S&P 500® and the VIX Index could affect the level of such indexes and/or the value of VIX Futures Contracts and, therefore, the value of the Fund’s Shares.

| 15 |

Interest Rate and Investment Risk due to Market Fluctuations