Table of Contents

As filed with the Securities and Exchange Commission on April 27, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

EXCHANGERIGHT INCOME FUND

(Exact name of registrant as specified in its charter)

| Maryland | 36-7729360 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1055 E. Colorado Blvd, Suite 310, Pasadena, California 91106

(Address of principal executive offices) (Zip Code)

(855) 317-4448

(Registrant’s telephone number, including area code)

Correspondence to:

David Van Steenis

Chief Financial Officer and Chief Investment Officer

ExchangeRight Income Fund

9215 Northpark Drive

Johnston, Iowa 50131

(626) 773-3481

Copies to:

David P. Hooper, Esq.

Barnes & Thornburg LLP

11 S. Meridian Street

Indianapolis, Indiana 46204

(317) 236-1313

Securities to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

None

Securities to be registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

Class A Common Shares, $0.01 par value per share

Class I Common Shares, $0.01 par value per share

Class S Common Shares, $0.01 par value per share

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

| Page | ||||||

| i | ||||||

| iii | ||||||

| ITEM 1. |

1 | |||||

| ITEM 1A. |

16 | |||||

| ITEM 2. |

58 | |||||

| ITEM 3. |

80 | |||||

| ITEM 4. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

88 | ||||

| ITEM 5. |

91 | |||||

| ITEM 6. |

96 | |||||

| ITEM 7. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

97 | ||||

| ITEM 8. |

105 | |||||

| ITEM 9. |

MARKET PRICE OF DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

105 | ||||

| ITEM 10. |

109 | |||||

| ITEM 11. |

115 | |||||

| ITEM 12. |

132 | |||||

| ITEM 13. |

133 | |||||

| ITEM 14. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

133 | ||||

| ITEM 15. |

134 | |||||

| F - 1 | ||||||

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10 other than historical facts may be considered “forward-looking statements,” and, as such, may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of ExchangeRight Income Fund (the “Company”) to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “may”, “will”, “should”, “estimates”, “projects”, “anticipates”, “believes”, “expects”, “intends”, “future” and words of similar import, or the negative thereof. Forward-looking statements in this registration statement include information about possible or assumed future events, including, among other things, discussion and analysis of our future financial condition, results of operations, our strategic plans and objectives, occupancy, leasing rates and trends, liquidity and ability to meet future obligations, anticipated expenditures of capital and other matters. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this registration statement is filed with the Securities and Exchange Commission.

Any such forward-looking statements are subject to unknown risks, uncertainties and other factors, which in some cases are beyond our control and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to shareholders and maintain the value of our real estate properties, may be significantly hindered.

Factors that could cause actual results, performance or achievements to differ materially from current expectations include, but are not limited to:

| • | risks inherent in the real estate business, including tenant defaults, illiquidity of real estate investments, potential liability relating to environmental matters and potential damages from natural disasters; |

| • | general business and economic conditions; |

| • | the accuracy of our assessment that certain businesses are e-commerce resistant and recession-resilient; |

| • | the accuracy of the tools we use to determine the creditworthiness of our tenants; |

| • | concentration of our business within certain tenant categories; |

| • | ability to renew leases, lease vacant space or re-lease space as existing leases expire; |

| • | our ability to successfully execute our acquisition strategies; |

| • | the degree and nature of our competition; |

| • | inflation and interest rate fluctuations; |

| • | failure, weakness, interruption or breach in security of our information systems; |

| • | our failure to generate sufficient cash flows to service our outstanding indebtedness; |

| • | continued volatility and uncertainty in the credit markets and broader financial markets; |

| • | our ability to maintain our qualification as a real estate investment trust (“REIT”) for federal income tax purposes; |

| • | our limited operating history as a REIT, which may adversely affect our ability to make distributions to our shareholders; |

| • | changes in, or the failure or inability to comply with, applicable laws or regulations; and |

i

Table of Contents

| • | future sales or issuances of our common shares or other securities convertible into our common shares, or the perception thereof, could cause the value of our common shares to decline and could result in dilution. |

The foregoing list is only a summary of the principal risks that may materially adversely affect our business, financial condition, results of operations and cash flows. The foregoing should be read in conjunction with the complete discussion of risk factors we face, which are set forth in “Item 1A. Risk Factors” in this registration statement.

ii

Table of Contents

Except as otherwise specified in this registration statement, the terms: “we,” “us,” “our,” “our company” and the “Company” refer to ExchangeRight Income Fund, a Maryland statutory trust, together with its subsidiaries. Additionally, the following is a glossary of certain terms used in this registration statement.

“Class A Common Shares” means the Class A Common Shares of beneficial interest, $0.01 par value per share, of the Company.

“Class A Common Units” means the Class A Common Units of limited partnership interest of the Operating Partnership.

“Class I Common Shares” means the Class I Common Shares of beneficial interest, $0.01 par value per share, of the Company.

“Class I Common Units” means the Class I Common Units of limited partnership interest of the Operating Partnership.

“Class S Common Shares” means the Class S Common Shares of beneficial interest, $0.01 par value per share, of the Company.

“Class S Common Units” means the Class S Common Units of limited partnership interest of the Operating Partnership.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Shares” means, collectively, the Company’s Class A Common Shares, Class I Common Shares and Class S Common Shares.

“Company” means ExchangeRight Income Fund, doing business as ExchangeRight Essential Income REIT, a Maryland statutory trust, together with its subsidiaries, which serves as the sole general partner of the Operating Partnership.

“Declaration of Trust” means the Declaration of Trust of the Company, as the same may be amended and restated from time to time.

“DST” means Delaware statutory trust.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“ExchangeRight” means ExchangeRight Real Estate, LLC, a California limited liability company.

“ExchangeRight DST Portfolios” mean portfolios of net-leased properties acquired and managed by ExchangeRight through its previous DST offerings.

“ExchangeRight Secured Loans” means short-term secured loans made at any time or from time to time by the Company to ExchangeRight under the RSLCA.

“FINRA” means the Financial Industry Regulatory Authority, Inc., or any successor thereto.

“FFO” means funds from operations, which is a commonly accepted and reported measure of the operating performance of a REIT. FFO is equal to the Company’s net income (calculated in accordance with GAAP), excluding the following: depreciation and amortization related to real estate; gains and losses from the sale of real estate assets; gains and losses from changes in control; and impairment write-downs of real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the Company. The foregoing definition of FFO is consistent with the definition of “funds from operations” published by the National Association of Real Estate Investment Trusts (Nareit®).

iii

Table of Contents

“GAAP” means accounting principles generally accepted in the United States.

“Insignificant Participation Exception” means the exception to the plan asset regulations which provides that an ERISA investor’s assets will not include any of the underlying assets of an entity in which it invests if at all times less than 25% of the value of each class of equity interests in the entity is held by ERISA investors.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Key Principals” means Joshua Ungerecht, Warren Thomas and David Fisher.

“NAV” means the net asset value of the Company.

“Operating Partnership” or the “Partnership” means ExchangeRight Income Fund Operating Partnership, LP, a Delaware limited partnership, together with its subsidiaries.

“Operating Partnership Agreement” means the Amended and Restated Limited Partnership Agreement of ExchangeRight Income Fund Operating Partnership, LP, dated April 4, 2022.

“OP Units” mean the common units of limited partnership interest in the Operating Partnership.

“REIT” means real estate investment trust.

“RSLCA” means the Amended and Restated Uncommitted Senior Revolving Secured Line of Credit Agreement dated April 4, 2022 between ExchangeRight Real Estate, LLC, as borrower, and ExchangeRight Income Fund Operating Partnership, LP., as lender.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“Securities Act” means the Securities Act of 1933, as amended.

“TCJA” means the Tax Cuts and Jobs Act of 2017.

“Trustee” means ExchangeRight Income Fund Trustee, LLC, a Delaware limited liability company.

iv

Table of Contents

| ITEM 1. | BUSINESS. |

We are filing this Form 10 to register our Common Shares pursuant to Section 12(g) of the Exchange Act. As a result of the registration of our Common Shares pursuant to the Exchange Act, following the effectiveness of this Form 10, we will be subject to the requirements of the Exchange Act and the rules promulgated thereunder. In particular, we will be required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K and otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements to register a class of securities pursuant to Section 12(g) of the Exchange Act. This registration statement does not constitute an offering of securities of the Company or any other entity. We are an emerging growth company as defined in the JOBS Act and will take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act.

General

ExchangeRight Income Fund, doing business as ExchangeRight Essential Income REIT, a Maryland statutory trust, is a self-administered real estate company, formed on January 11, 2019, focusing on investing in single-tenant, primarily investment-grade net-leased real estate. The Company, through the Operating Partnership, owned 336 properties in 34 states (collectively, the “Trust Properties”) that were 99.8% leased as of December 31, 2022. The Trust Properties are occupied by 36 different national, primarily investment-grade necessity-based retail tenants as of December 31, 2022 and are additionally diversified by industry, geographic region and lease term. The Company has had 100% collection of all of its contractual rents from its net-leased properties since inception, including through the COVID-19 pandemic and for the year ended December 31, 2022.

We are structured as an umbrella partnership REIT, commonly called an UPREIT, and own all of our assets and conduct substantially all of our business through ExchangeRight Income Fund Operating Partnership, LP, a Delaware limited partnership, which was formed on January 9, 2019. The Company is the sole general partner and a limited partner of the Operating Partnership. As of the date of this registration statement, an aggregate of 22,624,817 OP Units in the Operating Partnership are issued and outstanding. The Company owns 15,098,630 of the issued and outstanding OP Units in the Operating Partnership, investors who completed tax-deferred Code Section 721 exchanges into the Operating Partnership own 7,448,879 of the issued and outstanding OP Units in the Operating Partnership and ExchangeRight owns 77,308 of the issued and outstanding OP Units in the Operating Partnership. Additionally, ExchangeRight owns 600,000 of the Company’s 15,098,630 issued and outstanding OP Units in the Operating Partnership disclosed above through its ownership in ExchangeRight Income Fund GP, LLC (“EIFG”).

On February 9, 2019, we commenced an offering of up to $100.0 million of our Common Shares under a private placement to qualified investors who meet the definition of “accredited investor” under Regulation D of the Securities Act. We expect to conduct the offering on a continuous basis until the Trustee determines to terminate the offering. The maximum dollar amount of the offering has been increased over time. The following table details the increases in the maximum dollar amount of the offering of our Common Shares, prior to selling commissions, as approved by the Trustee, since the inception of the offering:

| Effective date |

Maximum offering amount |

|||

| Inception |

$ | 100,000,000 | ||

| May 18, 2020 |

$ | 200,000,000 | ||

| March 2, 2021 |

$ | 500,000,000 | ||

| April 4, 2022 |

$ | 2,165,000,000 | ||

As of the date of this registration statement, the Company had issued 5,594,034 Class I Common Shares and 9,804,288 Class A Common Shares pursuant to the offering, resulting in gross offering proceeds of approximately $417.4 million since inception. Of these issued Common Shares, 5,439,500 Class I Common Shares and 9,659,130 Class A Common Shares remained outstanding as of the date of this registration statement.

1

Table of Contents

After deductions for payments of selling commissions (net of support received from ExchangeRight), marketing and diligence allowances, wholesale selling costs and expenses, and other offering expenses, we have received net offering proceeds since inception of approximately $401.2 million as of the date of this registration statement. The net offering proceeds have been contributed to the Operating Partnership in exchange for OP Units, and the Operating Partnership has used the net proceeds of the offering to acquire the Trust Properties, and to pay certain fees and expenses related to the offering and acquisition of the Trust Properties.

Our executive offices are located at 1055 E. Colorado Blvd., Suite 310, Pasadena, CA 91106. Our telephone number is (855) 317-4448. Our internet website is www.exchangeright.com. The information contained in, or that can be accessed through our website, is not incorporated by reference in or otherwise a part of this Form 10.

REIT Status

The Company has elected and is qualified to be taxed as a REIT for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2019. We intend to operate in a manner that allows us to continue qualifying as a REIT for U.S. federal income tax purposes commencing with such taxable year, and to continue qualifying as a REIT for each subsequent year. To maintain REIT status, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income, determined without regard for any deduction for distributions paid and excluding any net capital gain, to our shareholders. As a REIT, we generally are not subject to U.S. federal income tax on the REIT taxable income we distribute to our shareholders. Even though we qualify as a REIT, we may still be subject to some federal, state and local taxes on a certain portion of our income or property. If we fail to qualify as a REIT in any taxable year, including the current year, we will be subject to federal income tax at regular corporate rates.

Operating Partnership and Managers

Substantially all of the Company’s business is conducted through the Operating Partnership. The Trust Properties are owned and controlled by the Company and are managed by ExchangeRight Net-Leased Property Management, LLC (the “Property Manager”) and ExchangeRight Net-Leased Asset Management, LLC (the “Asset Manager”), which are both wholly-owned subsidiaries of ExchangeRight, pursuant to executed property management and asset management agreements (collectively the “Management Agreements”) with each respective entity. ExchangeRight is the sole member and manager of the Trustee, who as Trustee, has a fiduciary obligation to act on behalf of our shareholders. Under Maryland law and our Declaration of Trust, our Trustee must act in good faith, in a manner it reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances.

Since 2012, ExchangeRight has been active in syndicating ownership in primarily investment-grade single-tenant, net-leased necessity-based retail assets through DST programs that qualify for tax-deferred exchange treatment under Section 1031 of the Code. ExchangeRight provides a vertically integrated, fully scalable real estate platform consisting of underwriting and acquisitions, financing and structuring, leasing and tenant retention, marketing and dispositions, asset and property management, analysis and legal and institutional-quality investor reporting. ExchangeRight and its affiliates have acquired over 1,100 properties and manage over approximately $5.4 billion of assets as of March 31, 2023. ExchangeRight and its affiliates utilize fair market value, when available, to calculate its assets under management. When fair market value is not available, which is the case for its DST programs, ExchangeRight utilizes the original offering price of such offerings. The assets under management total over 22 million square feet and ExchangeRight’s net-leased platform is diversified across 78 national tenants and 47 different states as of the date of this registration statement.

We depend on ExchangeRight and its affiliates, including the Property Manager and Asset Manager, to provide certain services essential to the Company, such as asset management services, supervision of the

2

Table of Contents

management of the Trust Properties, asset acquisition and disposition services, as well as other administrative responsibilities for the Company, including accounting services, investor communications and investor relations. As a result of these relationships, we are dependent upon ExchangeRight and its affiliates.

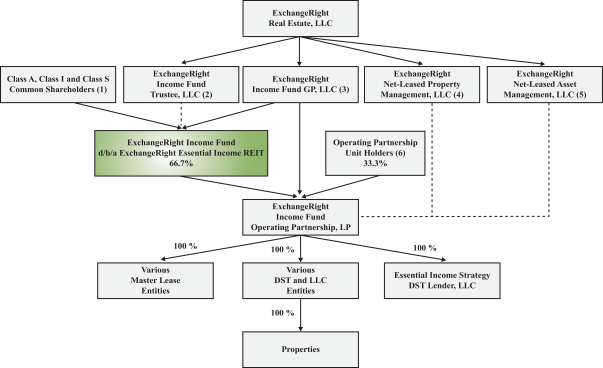

Ownership Structure

The following chart illustrates our current operating structure and ownership as of the date of this registration statement. The solid-line arrows in the chart represent equity ownership relationships between the applicable parties, and the dotted lines represent contractual or service-provider relationships between the parties.

| (1) | As of the date of this registration statement, an aggregate of 613,007 Common Shares, representing 4.1% of the total outstanding Common Shares were beneficially owned by (i) our Trustee; (ii) our Key Principals; (iii) our executive officers and (iv) EIFG. See “Item 4. Security Ownership of Certain Beneficial Owners and Management” for further ownership information. |

| (2) | ExchangeRight Income Fund Trustee, LLC serves as the sole trustee of the Company. |

| (3) | EIFG owns 600,000 Class I Common Shares as of the date of this registration statement, which were purchased on the same terms as all other holders of Class I Common Shares at acquisition. Additionally, EIFG owns a special limited partner interest in the Operating Partnership which entitles it to receive a promote interest in the profits of the Operating Partnership upon an investor receiving their preferred return plus a return of capital. See “Item 7. Certain Relationships and Related Transactions, and Director Independence” for further ownership information. |

| (4) | ExchangeRight Net-Leased Property Management, LLC (referred to herein as the “Property Manager”) manages certain Trust Properties owned by the Operating Partnership pursuant to a Property Management Agreement dated February 28, 2019, as described elsewhere in this registration statement. |

| (5) | ExchangeRight Net-Leased Asset Management, LLC (referred to herein as the “Asset Manager”) manages certain Trust Properties owned by the Operating Partnership pursuant to an Asset Management Agreement dated February 28, 2019, as described elsewhere in this registration statement. |

3

Table of Contents

| (6) | The holders of the Operating Partnership Class I Common Units have the right to cause their Class I Common Units to be redeemed by the Operating Partnership for cash, unless we, in our sole discretion, elect to purchase such Class I Common Units in exchange for Class I Common Shares of the Company, issuable on a 1:1 basis, subject to adjustment under certain circumstances. We currently intend to elect to pay the redemption price for all Class I Common Units tendered for redemption in Class I Common Shares. The Class I Common Units have the same economic rights as a Class I Common Shares. As of the date of this registration statement, an aggregate of 142,548 OP Units, representing 1.9% of the total outstanding OP Units were beneficially owned by (i) ExchangeRight; (ii) our Trustee; (iii) our Key Principals and (iv) our executive officers. See “Item 4. Security Ownership of Certain Beneficial Owners and Management” for further information. |

Management Structure

The Company operates under the direction of the Trustee, which in turn is managed by ExchangeRight as the sole manager of the Trustee. The business and affairs of ExchangeRight are managed by the Key Principals as the sole managers of ExchangeRight, who have full and complete authority, power and discretion to manage and control the business, affairs and properties of ExchangeRight, to make all decisions regarding those matters and to perform any and all other acts or activities customary or incident to the management of ExchangeRight’s business. As a result, the Key Principals act in effect as directors of the Company.

For additional information regarding the Key Principals and individuals acting as the executive officers of the Company, see “Item 5. Directors and Executive Officers” below.

Investment Objectives and Strategy

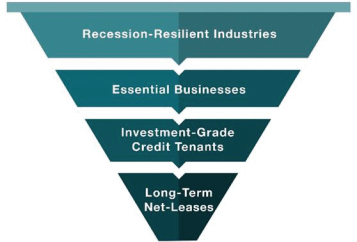

The Company seeks to provide capital preservation and stable income by focusing primarily on investment-grade necessity-based retail tenants that are additionally diversified by industry, geographic region and lease term. We intend to take advantage of ExchangeRight’s fully scalable platform and deep industry relationships to strategically acquire a diversified portfolio. The Company is structured to target:

| • | capital preservation throughout economic cycles with a focus on recession-resilient tenants and industries; |

| • | stable distributions paid monthly that are covered by cash flow from operations; |

| • | significant tax deferral and deductions provided to increase the tax-equivalent yield; |

| • | clearly-defined aggregation strategy that is structured to benefit from the diversification and scale of ExchangeRight’s proprietary acquisitions pipeline and existing assets under management; and |

| • | an investor-centric structure and significant alignment of interest. |

Capital preservation throughout economic cycles with a focus on recession-resilient tenants and industries – In order to achieve these objectives, the Company focuses on acquiring a diversified portfolio consisting primarily of:

| • | long-term net-leased properties; |

| • | backed by national, investment-grade and recession-resilient tenants; |

| • | that operate essential businesses; |

| • | in online-resilient; and |

| • | recession-resilient necessity retail industry. |

Long-term, net-leased properties – We focus on net leases that obligate the tenant to pay not only their rent, but also the costs of property taxes, insurance and property maintenance, often including repairs and replacements. The net-lease structure shields the landlord from the burden of those costs that are typically borne

4

Table of Contents

by the landlord in most other asset classes of real estate. By shifting the burden of many of these operating expenses from the landlord to the tenant, net-leased real estate provides investors with an income stream that is more stable and predictable and that is less likely to experience significant volatility throughout the lease term.

National, investment-grade and recession-resilient tenants – We focus on national tenants that exhibit strong balance sheets and financial performance, primarily carrying investment-grade credit ratings from S&P and/or Moody’s rating agencies, which are nationally recognized statistical rating organizations (“NRSROs”). Based on research from S&P and Moody’s, investment-grade credit tenants have historically had an 11.07x to 14.39x lower likelihood of defaulting over a 10-year horizon compared to speculative- or junk-rated credit tenants. We focus on investment-grade credit tenants so that we can rely on their strong balance sheets to weather economic crises and recessions and continue to meet their financial obligations under the leases.

Operate essential businesses – We focus on properties occupied by businesses that are essential and that remained open and operating throughout the COVID-19 crisis. Essential businesses provide the goods and services that people need and are therefore generally able to continue to be profitable in most economic environments. We focus on tenants with strong balance sheets to weather a crisis, and more particularly on those tenants whose balance sheets get stronger even in the midst of a crisis.

Online-resilient – We focus on tenants and industries that have historically exhibited consistent resilience and growth in the face of the competitive expansion of online retail. The growth of online retail has impacted a number of real estate sectors, especially the discretionary retail sector that we avoid. By primarily focusing on pharmaceutical, grocery, healthcare, necessity-based retail, farm and rural supply, and discount retail, the Company’s targeted tenants provide essential goods and services that are expected to be less susceptible to being replaced by online retail given the needs-based component of their business plan, the accommodation of immediate-fulfillment needs or desires, the provision of in-person services that are not or cannot be competitively duplicated online and/or the low-cost nature of products offered. In addition, the tenants we focus on have adapted their business models to utilize their locations to provide in-person services and experiences. Our focus on necessity-based sectors that are less susceptible to economic shocks and online retail is intended to protect and insulate the Company’s long-term income.

| • | Discount necessity retailers have converted approximately 15-20% of their floor space to groceries and provide necessity goods at a price point that is uneconomical for online retailers to compete against. Online retailers target demographics that have a much higher discretionary income that does not overlap significantly with discount necessity retailers. Furthermore, in recessions, a larger portion of the population tends to shop at discount necessity retailers in order to save money. |

| • | Pharmaceutical retailers frequently include health hubs, minute clinics and medical testing centers that deliver discount healthcare like flu shots, vaccines and medical testing within their stores and also immediately provide any prescriptions needed. They also provide a viable and convenient alternative to going to an urgent care facility to address non-urgent illnesses. |

| • | Grocers focus on perishable goods that online retailers have struggled to provide competitively. Certain online retailers had to ultimately acquire a brick-and-mortar retail grocer to compete in the grocery space. Many grocers have also created a one-stop-shop destination by adding cafes, pharmacies, restaurants, dry cleaners and banks to their stores and higher margin products like meals on-the-go that cannot be replicated online. |

| • | Discount specialty and apparel retailers provide discount home goods, decor, and clothing that consumers often prefer to shop for in-person, that are discounted and therefore, less economical to ship and that target a demographic that is less likely to overlap with online retailers’ target demographic. |

| • | Farm and rural supply stores provide essential products for agriculture, livestock, and pet care while also carrying products related to home improvement, truck maintenance and lawn and garden care. Many of these products tend to be larger and less economical to ship to customers and are needed more immediately than shipping can accommodate. |

5

Table of Contents

| • | Automotive stores typically provide for the immediate and ongoing supply chain needs of local auto repair shops in addition to meeting the immediate needs of local consumers. |

| • | Healthcare providers provide in-person health care services that are either difficult or impossible to deliver through an online format. |

Recession-resilient necessity retail industry – The necessity retail industry is an industry in which people continue to spend money even in recessions because the goods and services they provide are a necessity and not a discretionary choice. Therefore, this industry tends to be more recession-resilient than others. We focus on this industry to align ourselves with tenants that continue to be profitable and resilient even during economic crises and/or recessionary periods.

Diversification Strategy

While focusing almost exclusively on those properties that meet all of the investment factors discussed above, we will then take the pursuit of risk mitigation a step further with broad diversification by property, location, tenant, industry, lease term and debt term so that we avoid significant concentrations of income coming from any one factor.

When we put these all together, the intended result is a diversified, long-term stream of cash flow that is shielded from many of the potential costs of real estate ownership and that is ultimately guaranteed by tenants with strong balance sheets. The tenants we focus on operate businesses that performed well throughout the COVID-19 pandemic, and historically have performed well in recessions.

Each of these separate investment factors build upon each other and, in combination, create an investment strategy that can provide stable income and value for investors. The combination of all of these factors and the potential to aggregate a large, diversified portfolio of similar quality net-leased real estate through ExchangeRight’s

6

Table of Contents

proprietary pipeline and existing assets under management also create upside potential as it is well-positioned to continue to perform through a variety of economic conditions, including recessionary environments.

Stable distributions paid monthly that are covered by cash flow from operations – The Company’s net-leased portfolio has provided a diversified and secure stream of distributable cash flows that has thus far proven to be resilient in the face of significant economic turmoil. The distribution rate has been increased by our Trustee five times since our inception and has never been reduced, delayed or suspended. Based on the current monthly distribution rate of $0.1449 per Common Share, the distribution yield, when compared to the March 31, 2023 declared NAV per Common Share of $27.74, was 6.27%. Paying distributions out of operations is important as it avoids the dilution and capital destruction that results from paying distributions out of equity capital or financing and can provide retained earnings that can allow for excess reserves and be reinvested on behalf of shareholders or maintain consistent distributions in the face of difficult circumstances. Our distribution policy is to pay distributions only out of cash flows from operations, rather than investor equity or financing, subject only to REIT qualification requirements or to avoid incurring federal income tax.

Significant tax deferral and deductions provided to increase the tax-equivalent yield – The Company is structured to take advantage of a number of tax deductions and depreciation benefits, including the REIT pass-through deduction included in the TCJA. Distributions to investors in 2022 were reported as a 56.98% non-taxable return of capital for federal income tax purposes, meaning that only 43.02% were treated as taxable distributions. In addition, so long as the Company continues to satisfy the various requirements for qualification as a REIT, non-corporate shareholders of the Company that receive distributions characterized as ordinary dividends for U.S. federal income tax purposes will be eligible to claim a tax deduction for the taxable year prior to January 1, 2026 equal to 20% of the ordinary dividends distributed to them in each such taxable year. In addition, the Company, and any of its subsidiaries that qualify as a real property trade or business, intend to make an election to be exempt from rules limiting the amount of interest expense a taxpayer is permitted to deduct each taxable year. Individual circumstances will vary by investor, and each investor should consult with their own tax advisor.

Clearly-defined aggregation strategy that is structured to benefit from the diversification and scale of ExchangeRight’s proprietary acquisitions pipeline and existing assets under management – The Company is structured to provide partial liquidity to investors through redemptions on a quarterly basis of up to 5% of the Company’s issued and outstanding shares per fiscal year. We also intend to take advantage of ExchangeRight’s fully scalable platform and deep industry relationships to continue to strategically acquire single-tenant, net-leased necessity-based retail assets. This aggregation strategy is intended to leverage the significant synergies between its net lease DST and REIT platforms in order to reduce risk and enhance value through increased diversification; expand capacity to accommodate liquidity needs; unlock additional access to capital; and optimize estate planning benefits on behalf of investors across both platforms. There is no guarantee that any aggregation strategy will be executed or that they will produce enhanced liquidity or returns.

An investor-centric structure and significant alignment of interest – The Company’s fee arrangements with ExchangeRight are structured to have ongoing performance fees that are on average more favorable than what we believe are market fees. ExchangeRight currently has invested $15.0 million in Class I Common Shares and $2.0 million in OP Units alongside investors as of the date of this registration statement, creating what we believe to be a strong alignment of interest in the success of the Company. Moreover, should ExchangeRight achieve at least a 100% return of capital and a 7% annual return on behalf of investors, ExchangeRight may participate in up to 20% of the potential upside above those returns, thus creating an additional incentive for ExchangeRight to perform.

Real Estate Investments

The Company, through the Operating Partnership, owned 336 properties in 34 states as of December 31, 2022. The Trust Properties were 99.8% leased as of December 31, 2022 and occupied by 36 different national primarily investment-grade necessity-based retail tenants as of December 31, 2022, and are additionally diversified by industry, geographic region and lease term. The portfolio has had 100% collection of all of its rents

7

Table of Contents

from its net-leased properties since inception, including through the COVID-19 pandemic and for the year ended December 31, 2022. The following table details information about our tenants as of December 31, 2022:

| Parent credit rating (a) |

Weighted average lease term (yrs) (m) |

|||||||||||||||||||||||||

| Number of leases |

Annualized base rents | |||||||||||||||||||||||||

| Tenant |

GLA | Total | % of total |

Per sq. ft |

||||||||||||||||||||||

| Dollar General |

BBB | 112 | 1,063,000 | $ | 11,537,700 | 18.0 | % | $ | 10.85 | 6.3 | ||||||||||||||||

| Walgreens |

BBB | 30 | 434,900 | 9,821,200 | 15.3 | % | $ | 22.58 | 6.5 | |||||||||||||||||

| Tractor Supply |

BBB | 17 | 349,600 | 4,679,500 | 7.3 | % | $ | 13.39 | 7.9 | |||||||||||||||||

| Family Dollar |

BBB (b) | 40 | 345,600 | 4,416,400 | 6.9 | % | $ | 12.78 | 4.2 | |||||||||||||||||

| Hobby Lobby |

n/a | 9 | 513,400 | 4,037,900 | 6.3 | % | $ | 7.87 | 7.0 | |||||||||||||||||

| Advance Auto Parts |

BBB- | 32 | 233,900 | 3,513,000 | 5.5 | % | $ | 15.02 | 5.4 | |||||||||||||||||

| Stop & Shop |

BBB+ | 1 | 102,100 | 2,940,000 | 4.6 | % | $ | 28.80 | 13.9 | |||||||||||||||||

| CVS Pharmacy |

BBB | 10 | 122,700 | 2,866,100 | 4.5 | % | $ | 23.36 | 5.6 | |||||||||||||||||

| Kroger |

BBB | 4 | 263,200 | 2,826,100 | 4.4 | % | $ | 10.74 | 8.3 | |||||||||||||||||

| Fresenius Medical Care |

Baa3 (c) | 10 | 83,100 | 2,629,700 | 4.1 | % | $ | 31.65 | 7.7 | |||||||||||||||||

| Napa Auto Parts |

n/a | 18 | 155,000 | 1,824,900 | 2.8 | % | $ | 11.77 | 13.1 | |||||||||||||||||

| Publix |

n/a | 2 | 96,800 | 1,548,400 | 2.4 | % | $ | 16.00 | 17.4 | |||||||||||||||||

| Hy-Vee |

NAIC2 (d) | 1 | 101,200 | 1,415,800 | 2.2 | % | $ | 13.99 | 16.1 | |||||||||||||||||

| AutoZone |

BBB | 9 | 65,900 | 994,700 | 1.6 | % | $ | 15.09 | 3.6 | |||||||||||||||||

| Old National Bank |

A3 (c) (e) | 2 | 38,200 | 989,300 | 1.5 | % | $ | 25.90 | 7.8 | |||||||||||||||||

| Dollar Tree |

BBB | 9 | 84,200 | 880,200 | 1.4 | % | $ | 10.45 | 2.6 | |||||||||||||||||

| Giant Eagle |

n/a | 1 | 81,800 | 848,300 | 1.3 | % | $ | 10.37 | 8.3 | |||||||||||||||||

| Walmart Neighborhood Market |

AA | 1 | 41,800 | 738,600 | 1.2 | % | $ | 17.67 | 8.8 | |||||||||||||||||

| BioLife Plasma Services L.P. |

BBB+ (f) | 1 | 15,500 | 672,400 | 1.0 | % | $ | 43.38 | 12.9 | |||||||||||||||||

| Goodwill |

n/a | 2 | 42,800 | 653,200 | 1.0 | % | $ | 15.26 | 7.4 | |||||||||||||||||

| Verizon Wireless |

BBB+ (g) | 2 | 11,300 | 569,800 | 0.9 | % | $ | 50.42 | 4.5 | |||||||||||||||||

| Sherwin Williams |

BBB | 7 | 45,400 | 566,700 | 0.9 | % | $ | 12.48 | 3.3 | |||||||||||||||||

| O’Reilly |

BBB (h) | 6 | 41,400 | 542,000 | 0.8 | % | $ | 13.09 | 6.4 | |||||||||||||||||

| Food Lion |

BBB+ (i) | 1 | 41,300 | 351,400 | 0.5 | % | $ | 8.51 | 5.8 | |||||||||||||||||

| Ross Stores |

BBB+ | 1 | 25,800 | 335,400 | 0.5 | % | $ | 13.00 | 6.1 | |||||||||||||||||

| Indianapolis Osteopathic Hospital, Inc |

A2 (c) | 1 | 11,500 | 320,000 | 0.5 | % | $ | 27.83 | 0.6 | |||||||||||||||||

| PNC Bank, N.A. |

A | 1 | 6,100 | 266,800 | 0.4 | % | $ | 43.74 | 5.8 | |||||||||||||||||

| HomeGoods |

A(j) | 1 | 22,200 | 255,800 | 0.4 | % | $ | 11.52 | 8.3 | |||||||||||||||||

| MedSpring |

Baa3 (c) | 1 | 4,600 | 193,100 | 0.3 | % | $ | 41.98 | 4.2 | |||||||||||||||||

| Franciscan Alliance, Inc. |

Aa3 (c) | 1 | 6,000 | 182,100 | 0.3 | % | $ | 30.35 | 1.4 | |||||||||||||||||

| The Christ Hospital |

A3 (c) | 1 | 9,300 | 174,300 | 0.3 | % | $ | 18.74 | 5.0 | |||||||||||||||||

| Five Below |

n/a | 1 | 8,500 | 135,700 | 0.2 | % | $ | 15.96 | 8.1 | |||||||||||||||||

| TCF National Bank |

BBB+ (k) | 1 | 4,500 | 116,700 | 0.2 | % | $ | 25.93 | 4.0 | |||||||||||||||||

| Aaron’s |

n/a | 1 | 7,200 | 101,900 | 0.2 | % | $ | 14.15 | 3.2 | |||||||||||||||||

| Truist Bank |

A- (l) | 1 | 2,700 | 101,400 | 0.2 | % | $ | 37.56 | 6.0 | |||||||||||||||||

| Athletico Physical Therapy |

B- | 1 | 3,400 | 77,000 | 0.1 | % | $ | 22.65 | 3.8 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

339 | 4,485,900 | $ | 64,123,500 | 100.0 | % | $ | 14.29 | 7.4 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

| Vacant (n) |

16,400 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total Portfolio |

4,502,300 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| (a) | Credit rating of parent entity of a tenant, if applicable, is derived from S&P, unless otherwise noted. In certain instances, the parent entity of the tenant will provide a guarantee of the tenant’s lease. |

| (b) | Family Dollar’s leases are made primarily with Family Dollar Stores, Inc. This entity is a wholly owned subsidiary of Dollar Tree, Inc., which is S&P rated “BBB”. |

8

Table of Contents

| (c) | Moody’s rating. |

| (d) | A “Grade 2” rating is the equivalent of a BBB-, BBB or BBB+ rating by S&P. |

| (e) | Our leases were originally with First Midwest Bank as lessee. In February 2022 First Midwest Bancorp Inc., the former parent entity of First Midwest Bank, merged with Old National Bancorp, which is Moody’s rated “A3”. Subsequent to the merger, our leases are now with Old National Bank. |

| (f) | BioLife Plasma Services L.P.’s lease is guaranteed by Takeda Pharmaceuticals U.S.A., Inc. This entity is a wholly owned subsidiary of Takeda Pharmaceutical Co. Ltd., which is S&P rated “BBB+”. |

| (g) | Verizon Wireless’s leases are entered into with Cellco Partnership. This entity is a wholly owned subsidiary of Verizon Communications, Inc., which is S&P rated “BBB+”. Verizon Communications, Inc. has provided a parent support agreement whereby it has agreed to guarantee certain of the payment obligations of Cellco Partnership. |

| (h) | O’Reilly’s leases are entered into with various wholly owned subsidiaries of O’Reilly Automotive Inc., which is S&P rated “BBB”. |

| (i) | Food Lion’s lease is guaranteed by Delhaize America, Inc. This entity is a wholly owned subsidiary of Ahold Delhaize N.V., which is S&P rated “BBB”. |

| (j) | HomeGoods lease is guaranteed by HomeGoods, Inc. This entity is a wholly owned subsidiary of TJX Companies, Inc. which is S&P rated “A”. |

| (k) | Our lease was originally with TCF Bank as lessee. In June 2021 TCF Financial Corporation, the former parent entity of TCF Bank, merged with Huntington Bancshares Inc., which is S&P rated “BBB+”. |

| (l) | Our lease was originally with BB&T Bank as lessee. In December 2019 BB&T Corporation, the former parent entity of BB&T Bank, merged with SunTrust Banks, Inc. in a merger of equals to form Truist Financial Corporation, which is S&P rated “A-”. Subsequent to the merger, our lease is now with Truist Bank. |

| (m) | Weighted based on annualized base rents. |

| (n) | Includes 9,300 square feet that was leased to Archana Grocery in November 2022 with expected occupancy occurring prior to June 2023. |

The following table details the industries in which our tenants operate as of December 31, 2022:

| Number of leases |

GLA | Annualized base rents | ||||||||||||||||||

| Industry |

Square feet | % of total | Dollars | % of total | ||||||||||||||||

| Discount Necessity Retail |

161 | 1,492,800 | 33.2 | % | $ | 16,834,300 | 26.3 | % | ||||||||||||

| Pharmaceutical Retailers |

40 | 557,600 | 12.4 | % | 12,687,300 | 19.8 | % | |||||||||||||

| Grocery |

11 | 728,200 | 16.2 | % | 10,668,600 | 16.6 | % | |||||||||||||

| Discount Automotive |

65 | 496,200 | 11.0 | % | 6,874,600 | 10.7 | % | |||||||||||||

| Discount Specialty Retail |

13 | 586,900 | 13.0 | % | 5,082,600 | 7.9 | % | |||||||||||||

| Farm and Rural Supply |

17 | 349,600 | 7.8 | % | 4,679,500 | 7.3 | % | |||||||||||||

| Medical Care |

11 | 89,100 | 2.0 | % | 2,811,800 | 4.4 | % | |||||||||||||

| Banking Services |

5 | 51,500 | 1.1 | % | 1,474,200 | 2.3 | % | |||||||||||||

| Healthcare Providers |

4 | 39,700 | 0.9 | % | 1,243,700 | 1.9 | % | |||||||||||||

| Necessity Retail |

2 | 11,300 | 0.3 | % | 569,800 | 0.9 | % | |||||||||||||

| Paint and Supplies |

7 | 45,400 | 1.0 | % | 566,700 | 0.9 | % | |||||||||||||

| Discount Apparel |

1 | 25,800 | 0.6 | % | 335,400 | 0.5 | % | |||||||||||||

| Urgent Care |

1 | 4,600 | 0.1 | % | 193,100 | 0.3 | % | |||||||||||||

| Rental & Leasing Services |

1 | 7,200 | 0.2 | % | 101,900 | 0.2 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

339 | 4,485,900 | 99.6 | % | $ | 64,123,500 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Vacant (a) |

16,400 | 0.4 | % | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Total Portfolio |

4,502,300 | 100.0 | % | |||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (a) | Includes 9,300 square feet that was leased to Archana Grocery in November 2022 with expected occupancy occurring prior to June 2023. |

9

Table of Contents

The following table details our contractual lease expirations as of December 31, 2022 (assuming no exercise of contractual extension options):

| Number of leases |

GLA | Annualized base rents | ||||||||||||||||||||||

| Year |

Square feet | % of total | Dollars | % of total | Per sq. ft. | |||||||||||||||||||

| MTM |

1 | 8,400 | 0.2 | % | $ | 145,700 | 0.2 | % | $ | 17.35 | ||||||||||||||

| 2023 |

5 | 46,300 | 1.0 | % | 699,600 | 1.1 | % | $ | 15.11 | |||||||||||||||

| 2024 |

19 | 169,100 | 3.8 | % | 2,451,000 | 3.8 | % | $ | 14.49 | |||||||||||||||

| 2025 |

23 | 197,200 | 4.4 | % | 2,289,200 | 3.6 | % | $ | 11.61 | |||||||||||||||

| 2026 |

43 | 496,300 | 11.1 | % | 5,893,900 | 9.2 | % | $ | 11.88 | |||||||||||||||

| 2027 |

36 | 474,600 | 10.6 | % | 6,717,300 | 10.5 | % | $ | 14.15 | |||||||||||||||

| 2028 |

55 | 600,300 | 13.4 | % | 9,212,600 | 14.4 | % | $ | 15.35 | |||||||||||||||

| 2029 |

30 | 374,800 | 8.4 | % | 5,296,500 | 8.3 | % | $ | 14.13 | |||||||||||||||

| 2030 |

29 | 431,200 | 9.6 | % | 6,939,400 | 10.8 | % | $ | 16.09 | |||||||||||||||

| 2031 |

39 | 629,400 | 14.0 | % | 8,323,000 | 13.0 | % | $ | 13.22 | |||||||||||||||

| 2032 |

25 | 398,300 | 8.9 | % | 5,323,900 | 8.3 | % | $ | 13.37 | |||||||||||||||

| 2033 |

5 | 46,300 | 1.0 | % | 764,700 | 1.2 | % | $ | 16.52 | |||||||||||||||

| 2034 |

5 | 135,400 | 3.0 | % | 1,439,000 | 2.2 | % | $ | 10.63 | |||||||||||||||

| 2035 |

8 | 71,400 | 1.6 | % | 1,317,500 | 2.1 | % | $ | 18.45 | |||||||||||||||

| 2036 |

6 | 140,500 | 3.1 | % | 3,521,400 | 5.5 | % | $ | 25.06 | |||||||||||||||

| 2037 |

5 | 54,200 | 1.2 | % | 633,800 | 1.0 | % | $ | 11.69 | |||||||||||||||

| 2038 |

2 | 14,200 | 0.3 | % | 190,800 | 0.3 | % | $ | 13.44 | |||||||||||||||

| 2039 |

2 | 149,600 | 3.3 | % | 2,214,200 | 3.5 | % | $ | 14.80 | |||||||||||||||

| 2040 |

1 | 48,400 | 1.1 | % | 750,000 | 1.2 | % | $ | 15.50 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

339 | 4,485,900 | 100.0 | % | $ | 64,123,500 | 100.0 | % | $ | 14.29 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

The following table details annualized base rents by state for our portfolio as of December 31, 2022:

| Number of leases |

GLA | Annualized base rents | ||||||||||||||||||

| State |

Square feet | % of total | Dollars | % of total | ||||||||||||||||

| Illinois |

37 | 379,100 | 8.4 | % | $ | 6,839,000 | 10.7 | % | ||||||||||||

| Ohio |

41 | 559,100 | (a) | 12.4 | % | 6,479,300 | 10.1 | % | ||||||||||||

| Texas |

36 | 389,900 | 8.7 | % | 5,650,600 | 8.8 | % | |||||||||||||

| Louisiana |

39 | 404,600 | 9.0 | % | 4,872,500 | 7.6 | % | |||||||||||||

| Wisconsin |

19 | 282,500 | 6.3 | % | 4,234,600 | 6.6 | % | |||||||||||||

| Alabama |

15 | 268,800 | 6.0 | % | 3,896,800 | 6.1 | % | |||||||||||||

| Florida |

21 | 216,300 | 4.8 | % | 3,308,600 | 5.2 | % | |||||||||||||

| Georgia |

14 | 264,300 | 5.9 | % | 3,034,200 | 4.7 | % | |||||||||||||

| Tennessee |

16 | 207,400 | 4.6 | % | 2,941,700 | 4.6 | % | |||||||||||||

| Massachusetts |

1 | 102,100 | 2.3 | % | 2,940,000 | 4.6 | % | |||||||||||||

| Indiana |

12 | 230,600 | 5.1 | % | 2,571,500 | 4.0 | % | |||||||||||||

| North Carolina |

14 | 210,000 | 4.7 | % | 2,525,500 | 3.9 | % | |||||||||||||

| South Carolina |

15 | 186,100 | 4.1 | % | 2,510,300 | 3.9 | % | |||||||||||||

| Pennsylvania |

13 | 129,200 | 2.9 | % | 2,102,300 | 3.3 | % | |||||||||||||

| Virginia |

7 | 91,800 | 2.0 | % | 1,457,100 | 2.3 | % | |||||||||||||

| Minnesota |

1 | 101,200 | 2.2 | % | 1,415,800 | 2.2 | % | |||||||||||||

| Missouri |

7 | 72,700 | 1.6 | % | 1,352,000 | 2.1 | % | |||||||||||||

| Nevada |

2 | 31,100 | 0.7 | % | 1,076,000 | 1.7 | % | |||||||||||||

| Oklahoma |

5 | 53,800 | 1.2 | % | 685,300 | 1.1 | % | |||||||||||||

| Michigan |

2 | 53,200 | 1.2 | % | 638,900 | 1.0 | % | |||||||||||||

| Utah |

2 | 44,700 | 1.0 | % | 618,200 | 1.0 | % | |||||||||||||

10

Table of Contents

| Number of leases |

GLA | Annualized base rents | ||||||||||||||||||

| State |

Square feet | % of total | Dollars | % of total | ||||||||||||||||

| Connecticut |

3 | 38,000 | 0.8 | % | 547,300 | 0.9 | % | |||||||||||||

| California |

1 | 25,800 | 0.6 | % | 335,400 | 0.5 | % | |||||||||||||

| Iowa |

3 | 29,300 | 0.7 | % | 304,200 | 0.5 | % | |||||||||||||

| Arizona |

2 | 16,700 | 0.4 | % | 293,900 | 0.5 | % | |||||||||||||

| Maryland |

1 | 20,000 | 0.4 | % | 292,700 | 0.5 | % | |||||||||||||

| Arkansas |

3 | 29,400 | 0.7 | % | 261,900 | 0.4 | % | |||||||||||||

| Idaho |

1 | 22,000 | 0.5 | % | 255,000 | 0.4 | % | |||||||||||||

| Wyoming |

1 | 7,000 | 0.2 | % | 132,200 | 0.2 | % | |||||||||||||

| Rhode Island |

1 | 8,400 | 0.2 | % | 131,400 | 0.2 | % | |||||||||||||

| Colorado |

1 | 8,000 | 0.2 | % | 109,600 | 0.2 | % | |||||||||||||

| Mississippi |

1 | 9,300 | 0.2 | % | 106,400 | 0.2 | % | |||||||||||||

| Kansas |

1 | 7,200 | 0.2 | % | 101,900 | 0.2 | % | |||||||||||||

| New Jersey |

1 | 2,700 | 0.1 | % | 101,400 | 0.2 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Portfolio |

339 | 4,502,300 | 100.0 | % | $ | 64,123,500 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Includes 9,300 square feet that was leased to Archana Grocery in November 2022 with expected occupancy occurring prior to June 2023. |

Identified Trust Properties

As part of the Company’s aggregation strategy, we intend to take advantage of ExchangeRight’s fully scalable platform and deep industry relationships to strategically acquire single-tenant, net-leased necessity-based retail assets with the goal of creating additional size and diversification in order to seek enhanced, recession-resilient returns and liquidity for shareholders. The Company, through the Operating Partnership, has entered into non-binding agreements to acquire a diversified portfolio of 478 single-tenant, net-leased properties leased primarily to investment-grade tenants that are part of existing ExchangeRight DST Portfolios as well as 129 additional properties (collectively, the “Identified Trust Properties”). The 478 properties that are part of the ExchangeRight DST Portfolios are currently owned by various ExchangeRight DSTs as of December 31, 2022, and can be acquired by the Company for an aggregate purchase price of $2.4 billion. The Identified Trust Properties are leased and operated by tenants that are primarily investment-grade tenants that have proven to be recession-resilient in the past. These tenants operate successfully in the necessity-based retail space, and are diversified by geography, tenant, industry, lease term, and debt maturities. The Identified Trust Properties were selected for their proven operating history and cash flows as well as management’s experience in managing the majority of these locations and tenants. In limited circumstances, certain portfolio acquisitions may require the inclusion of individual properties that are vacant; however, when considering portfolio acquisitions that include such properties, the Company will consider the portfolio composition, diversification, and value as a whole. Moreover, we intend to only acquire properties and portfolios that result in a post-acquisition Company NAV that is higher than or equal to the pre-acquisition Company NAV at the time of property identification and approval, including the valuation of all properties in the acquired portfolio. The majority of the Identified Trust Properties have built-in rent escalations in their primary term or option periods that are intended to provide increased income and inflation protection.

The Identified Trust Properties are anticipated to provide several distinct advantages to the Company:

| • | The properties are expected to provide the Company with a pre-determined initial portfolio of properties and the ability to achieve an attractive diversification level; |

| • | There is reduced blind pool risk or counterparty execution risk as the properties are already controlled and managed by ExchangeRight; |

| • | The ExchangeRight DST Portfolios have a proven history as they are currently managed by ExchangeRight with a long-term track record of performance; |

11

Table of Contents

| • | The tenants and lease terms are known, providing the Company with more certainty regarding potential rental increases, inflation protection, and its underwriting projections of cash flows to investors; |

| • | The acquisition agreements for the properties give flexibility to the Company to acquire the properties in stages and over a period of time, thereby improving the Company’s ability to invest capital and earn a return to fully cover investor distributions; |

| • | There will be no acquisition fees charged to the Company to acquire any ExchangeRight DST Portfolios; |

| • | The ExchangeRight DST Portfolios often have loans that can be assumed with limited lender costs that on average have interest rates that are more favorable than market interest rates as of December 31, 2022; and |

| • | The Operating Partnership is expected to grow more quickly than it would otherwise as a result of DST investors electing to perform a tax-deferred Code Section 721 exchange, providing long-term tax-sensitive investors for the Operating Partnership and the Company who are aligned with the long-term aggregation strategy and reducing the amount of new cash the Company must raise to acquire additional net-leased portfolios. |

The non-binding agreements to acquire certain of the Identified Trust Properties are subject to obtaining the consent of the current mortgage lenders secured by the corresponding Identified Trust Properties and provide the Company with the unilateral right to acquire the Identified Trust Properties. See “Item 1A. Risk Factors” for certain risks relating to the acquisition and ownership of the Identified Trust Properties.

If any of the Identified Trust Properties that the Company does not currently own are not available for acquisition at the time we seek to purchase them, or if our Trustee believes that the acquisition of different properties is in the best interests of the Company, we may acquire properties other than the Identified Trust Properties consistent with our investment objectives, including properties owned or controlled by ExchangeRight or its affiliates.

Our Trustee may increase the maximum aggregate amount of the Company’s Common Share offering, in its sole discretion, to acquire additional properties consistent with our investment objectives, which are intended to include properties owned or controlled by ExchangeRight, to take advantage of ExchangeRight’s diversification and scale as well as its aggregation strategy. Our Trustee may expand the offering to achieve those objectives if such an expansion would result in a projected NAV that is equivalent to or at a premium to the then-current NAV per share of the Company based in part on an independent real estate valuation. Before the maximum aggregate offering amount of our offering is increased, we expect to enter into definitive agreements to acquire these properties. ExchangeRight’s current portfolio is similar to, yet more diversified by tenant, geography, lease and debt maturity than the Company’s portfolio, and is intended to provide additional diversification and size benefits that are anticipated to be attractive in executing the Company’s aggregation strategy.

Competition

We compete for tenants with numerous traded and non-traded public REITs, private REITs, private equity investors, institutional investment funds, individuals, banks and insurance companies, many of which own properties similar to ours in the same markets in which our properties are located. If our competitors offer space at rental rates below current market rates or below the rental rates we currently charge our tenants, we may lose existing or potential tenants and we may be pressured to reduce our rental rates or to offer more substantial rent abatements, tenant improvements or below-market renewal options in order to retain tenants when our leases expire. Competition for tenants could decrease the occupancy and rental rates of our properties.

Additionally, we face competition for acquisitions of real property from investors, including traded and non-traded public REITs, private REITs, private equity investors, institutional investment funds, individuals,

12

Table of Contents

banks and insurance companies, some of which have greater financial resources than we do, a greater ability to borrow funds to acquire properties and the ability to accept more risk than we can prudently manage. This competition may increase the demand for the types of properties in which we typically invest and, therefore, reduce the number of suitable investment opportunities available to us which may impede our growth and increase the prices paid for such acquisition properties. This competition will increase if investments in real estate become more attractive relative to other types of investments. Accordingly, competition for the acquisition of real property could materially and adversely affect us. However, the Company already has non-binding agreements to acquire the Identified Trust Properties, which may offset the effects of the foregoing competitive factors.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the JOBS Act. We will remain an “emerging growth company” until the earliest to occur of (i) the last day of the first fiscal year during which our total annual gross revenues equal or exceed $1.235 billion, (ii) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, (iii) the date on which we have issued more than $1.0 billion in non-convertible debt during the previous three-year period, and (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. For so long as we remain an “emerging growth company,” we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including but not limited to, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We have not yet made a decision as to whether we will take advantage of any or all of these exemptions. To the extent we take advantage of some or all of the reduced reporting requirements applicable to “emerging growth companies,” an investment in our Common Shares may be less attractive to investors.

Section 404 of the Sarbanes-Oxley Act requires annual management assessments of the effectiveness of the registrant’s internal control over financial reporting, and generally requires in the same report a report by an independent registered public accounting firm on the effectiveness of internal control over financial reporting. Under the JOBS Act, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act until we are no longer an “emerging growth company.”

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period under the JOBS Act. Accordingly, our consolidated financial statements may not be comparable to the financial statements of reporting companies that comply with such new or revised accounting standards.

Human Capital

The Company has no direct employees. Services necessary for our business are provided by individuals who are employees of ExchangeRight or its affiliates, pursuant to the terms of the Management Agreements, and we pay fees associated with such services. See “Item 7. Certain Relationships and Related Transactions, and Director Independence” for a summary of the fees paid to ExchangeRight and its affiliates during the years ended December 31, 2022 and 2021.

13

Table of Contents

Investment Company Act Limitations

We conduct our operations, and the operations of our Operating Partnership, and any other subsidiaries, so that no such entity meets the definition of an “investment company” under Section 3(a)(1) of the Investment Company Act. Under the Investment Company Act, in relevant part, a company is an “investment company” if:

| • | pursuant to Section 3(a)(1)(A), it is, or holds itself out as being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

| • | pursuant to Section 3(a)(1)(C), it is engaged, or proposes to engage, in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis (the 40% test). “Investment securities” excludes U.S. government securities and securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act. |

We intend to continue to acquire a diversified portfolio of income-producing real estate assets; however, our portfolio may include, to a much lesser extent, other real estate-related investments. We anticipate that our assets generally will be held in wholly and majority-owned subsidiaries of our Operating Partnership, each formed to hold a particular asset. We monitor our operations and our assets on an ongoing basis in order to ensure that neither we nor any of our subsidiaries meet the definition of “investment company” under Section 3(a)(1) of the Investment Company Act.

We believe that neither we nor our Operating Partnership will be considered investment companies under Section 3(a)(1)(A) of the Investment Company Act because neither of these entities will engage primarily or hold themselves out as being engaged primarily in the business of investing, reinvesting or trading in securities. Rather, we, through our Operating Partnership, are primarily engaged in non-investment company businesses related to real estate. Consequently, we expect that we and our Operating Partnership will be able to continue to conduct our respective operations such that neither entity will be required to register as an investment company under the Investment Company Act.

In addition, because we are organized as a holding company that conducts its business primarily through our Operating Partnership, which in turn is a holding company that conducts its business through its subsidiaries, we intend to conduct our operations, and the operations of our Operating Partnership and any other subsidiary, so that we will not meet the 40% test under Section 3(a)(1)(C) of the Investment Company Act, as described above.

To avoid meeting the definition of an “investment company” under Section 3(a)(1) of the Investment Company Act, we may be unable to sell assets we would otherwise want to sell and may need to sell assets we would otherwise wish to retain. Similarly, we may have to acquire additional income or loss generating assets that we might not otherwise have acquired or may have to forgo opportunities to acquire interests in companies that we would otherwise want to acquire and that would be important to our investment strategy. In addition, a change in the value of any of our assets could negatively affect our ability to avoid being required to register as an investment company.

If we are required to register as an investment company under the Investment Company Act, we would become subject to substantial regulation with respect to our capital structure (including our ability to use borrowings), management, operations, transactions with affiliated persons (as defined in the Investment Company Act) and portfolio composition, including restrictions with respect to diversification and industry concentration and other matters. Compliance with the Investment Company Act would, accordingly, limit our ability to make certain investments and could require us to significantly restructure our business plan, which could materially adversely affect our business, financial condition and results of operations.

14

Table of Contents

Conflicts of Interest

We are subject to conflicts of interest arising out of our relationship with ExchangeRight and its affiliates. See “Item 1A. Risk Factors” and “Item 7. Certain Relationships and Related Transactions, and Director Independence” for further details regarding conflicts of interest.

Regulation

Environmental. As an owner of real estate, we are subject to various environmental laws of federal, state and local governments. Compliance with existing laws has not had a material adverse effect on our financial condition or results of operations, and our management does not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on properties we currently own, or on properties that may be acquired in the future.

Americans with Disabilities Act and Other Regulations. Our properties must comply with Title III of the Americans with Disabilities Act (the “ADA”), to the extent that such properties are public accommodations as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. Many states and localities have similar requirements that are in addition to, and sometimes more stringent than, federal requirements. We believe our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA or a comparable state or local requirement could result in the imposition of fines or an award of damages to private litigants. The obligation to make readily accessible accommodations is an ongoing one, and we will continue to assess our properties and make alterations as appropriate in this respect. In addition, our properties are subject to fire and safety regulations, building codes and other land use regulations.

Healthcare Regulatory Matters. Certain material healthcare laws and regulations may affect our operations and our tenants. Although there is presently no federal regulation on the lessor itself from federal government agencies that regulate and inspect the tenants and no regulation of the lessor in the states in which we own real property, certain of our tenants (including the operators of plasma and blood donation centers and other healthcare providers) are subject to extensive federal, state and local government healthcare laws and regulations. These laws and regulations include requirements related to licensure, conduct of operations, ownership of the facilities, operation, addition or expansion of facilities and services, prices for services, billing for services and the confidentiality and security of health-related information. Different properties within our portfolio may be more or less subject to certain types of regulation, some of which are specific to the type of facility or provider. These laws and regulations are wide-ranging and complex, may vary or overlap from jurisdiction to jurisdiction, and are subject frequently to change. Compliance with these regulatory requirements can increase operating costs and, thereby, adversely affect the financial viability of our tenants’ businesses. Our tenants’ failure to comply with these laws and regulations could adversely affect their ability to successfully operate our properties, or receive reimbursement for services rendered within them, which could negatively impact their ability to satisfy their contractual obligations to us. Our leases will require the tenants to comply with all applicable laws, including healthcare laws.

Our tenants which operate in the healthcare industry are subject directly to healthcare laws and regulations, because of the broad nature of some of these restrictions. We intend for all of our business activities and operations to conform in all material respects with all applicable laws and regulations, including healthcare laws and regulations. We expect that the healthcare industry will continue to face increased regulation and pressure in the areas of fraud, waste and abuse, cost control, healthcare management and provision of services.

15

Table of Contents

Industry Segments

Our current business is focused on the ownership and operation of net-leased, primarily investment-grade tenanted properties. We review operating and financial information for each property on an individual basis and, accordingly, each property represents an individual operating segment. We evaluate financial performance using property net operating income, which consists of rental income and other property income, less operating expenses. No individual property constitutes more than 10% of our revenue or property operating income, and the Company has no operations outside of the United States of America. Therefore, we have aggregated our properties into one reportable segment as the properties share similar long-term economic characteristics and have other similarities including the fact that they are operated using consistent business strategies.

| ITEM 1A. | RISK FACTORS |

The following factors and other factors discussed in this Form 10 could cause the Company’s actual results to differ materially from those contained in forward-looking statements made in this registration statement or presented elsewhere in future SEC reports. You should carefully consider each of the risks, assumptions, uncertainties and other factors described below and elsewhere in this registration statement, as well as any reports, amendments or updates reflected in subsequent filings or furnishings with the SEC. We believe these risks, assumptions, uncertainties and other factors, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results and could materially and adversely affect our business operations, results of operations, financial condition and liquidity.

Risk Factors Summary

Our business, financial condition and results of operations are subject to numerous risks and uncertainties. Below is a summary of the principal factors that make an investment in our Common Shares speculative or risky. This summary does not address all of the risks that we face and should be read in conjunction with the full risk factors contained below in this “Risk Factors” section in this Form 10.

Risks Related to Our Business and Real Estate

| • | Global economic, political and market conditions, including uncertainty about the financial stability of the United States, could have a significant adverse effect on our business, financial condition and results of operations. |

| • | Illiquidity of real estate investments and restrictions imposed by the Code could significantly impede our ability to respond to adverse changes in the performance of our properties. |

| • | We are subject to risks associated with the current interest rate environment and increases in interest rates may negatively impact us. |

| • | Continued increases in inflation may adversely affect our financial condition, cash flows, and results of operations. |

| • | Our assessment that certain businesses are e-commerce resistant and recession-resilient may prove to be incorrect. |

| • | We are subject to risks related to commercial real estate ownership that could reduce the value of our properties. |

| • | Our revenues and expenses are not directly correlated, and because a large percentage of our expenses are fixed, we may not be able to lower our cost structure to offset declines in our revenue. |

| • | We could be subject to increased property-level operating expenses. |

| • | Our business depends on our tenants successfully operating their businesses and satisfying their obligations to us. |

16

Table of Contents

| • | We may be unable to renew leases, lease vacant space or re-lease space as leases expire on favorable terms or at all. |

| • | Our financial monitoring and periodic site inspections may fail to mitigate the risk of tenant defaults, and if a tenant defaults, we may experience difficulty or a significant delay in re-leasing or selling the property. |