An Offering Statement pursuant to Regulation A relating to these securities has been filed with Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of such state. The company may elect to satisfy its obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of the company’s sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR DATED AUGUST 4, 2020

Quara Devices Inc. (dba Edoceo Devices)

1712 Pearl Street

Boulder, CO 80302

+1 (888) 887-6658

edoceodevices.com

UP TO 3,082,779 SHARES OF COMMON STOCK OFFERED BY THE ISSUER

UP TO 365,497 SHARES OF COMMON STOCK OFFERED BY THE SELLING SHAREHOLDERS

We are seeking to raise up to $17,880,118 and our selling shareholders are seeking to raise $2,119,883 from the sale of Common Stock to the public. As a result, the maximum offering amount is $20,000,001. There is no minimum offering dollar amount.

SEE “SECURITIES BEING OFFERED” AT PAGE 37

| Price | Underwriting discount and commissions (1) | Proceeds to Issuer (2) | Proceeds to Selling Shareholders (2) | |||||||||||||

| Per share | $ | 5.80 | $ | 0.058 | $ | 5.742 | $ | 5.742 | ||||||||

| Total Maximum | $ | 20,000,001 | $ | 200,000 | $ | 17,701,317 | $ | 2,098,684 | ||||||||

| (1) | We have not engaged any placement agent or underwriter in connection with this offering. To the extent that we do so, we will file a supplement to the Offering Statement of which this Offering Circular is a part. The company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to perform administrative and technology related functions in connection with this offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the company to Dalmore. See “Plan of Distribution and Selling Security Holders” for details. |

| (2) | Does not include other expenses of the offering. See “Plan of Distribution and Selling Security Holders” for a description of these expenses. |

The minimum investment amount for shares of our Common Stock is $580.00, or 100 shares.

We expect that, not including state filing fees, the amount of expenses of the offering that we will pay will be approximately $900,000.

The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is three years from this offering being qualified by the United States Securities and Exchange Commission (the “SEC”), or (3) the date at which the offering is earlier terminated by the company in its sole discretion. The company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to the company and the selling shareholders. The offering is being conducted on a best-efforts basis.

The company intends to engage Prime Trust, LLC as an escrow agent to hold funds tendered by investors. We may hold a series of closings at which we and the selling shareholders receive the funds from the Escrow Agent and issue or sell the shares to investors.

Each holder of Common Stock is entitled to one vote for each share on all matters submitted to a vote of the shareholders. See “Securities Being Offered.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 5.

Sales of these securities will commence on approximately _______, 2020.

The company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Implications of Being an Emerging Growth Company.

TABLE OF CONTENTS

In this Offering Circular, the term “Edoceo,” “we,” “us”, “our” or “the company” refers to Quara Devices Inc. (dba Edoceo Devices).

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| 1 |

Implications of Being an Emerging Growth Company

We are not subject to the ongoing reporting requirements of the Exchange Act of 1934, as amended (the “Exchange Act”) because we are not registering our securities under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

| ● | annual reports (including disclosure relating to our business operations for the preceding three fiscal years, or, if in existence for less than three years, since inception, related party transactions, beneficial ownership of the issuer’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the issuer’s liquidity, capital resources, and results of operations, and two years of audited financial statements), | |

| ● | semi-annual reports (including disclosure primarily relating to the issuer’s interim financial statements and MD&A) and | |

| ● | current reports for certain material events. |

In addition, at any time after completing reporting for the fiscal year in which our offering statement was qualified, if the securities of each class to which this offering statement relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); | |

| ● | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); | |

| ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and | |

| ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

| 2 |

The Company

Edoceo is an emerging med-tech & biotech company focusing on the development and commercialization of portable, easy to use devices for rapid, sensitive, and accurate detection of bacterial and viral infections. These devices are urgently needed in a range of markets, including aquaculture, as well as human and animal health. The company is currently developing two product platforms: one for detection of bacterial infections and another for detection of viruses. Both platforms are versatile and the same core instrumentation within each platform can potentially be used across many applications to detect many different bacteria or viruses. For each platform, our product line will comprise three components:

| ● | the portable device itself – B-DetectTM, our bacterial testing portable device, and V-DetectTM, our viral testing portable device, | |

| ● | consumable testing units that contain reagents, receive the bacterial or viral sample and are inserted into the device for testing, which we call B-TestTM and V-TestTM and | |

| ● | software providing data collection and configuration functionality, which we call B-ViewTM and V-ViewTM. |

B-Detect is a portable, battery-operated unit that uses fluorescent detection proteins to detect the molecules bacteria release when they become virulent. V-Detect is a portable, battery-operated unit using proprietary technology to detect specific viral pathogens via the integration of different types of molecular assays.

For our bacterial testing platform, we intend to focus on further refining and subsequently commercializing B-Detect and the related consumable products and data software to address shrimp diseases in the aquaculture market. We also intend to begin development and study of B-Detect for the detection of urinary tract infections (“UTIs”) in the human health market.

In terms of our viral testing platform, we will focus initially on the continued development and commercialization of V-Detect and the related consumables and software to address the detection of severe acute respiratory syndrome coronavirus 2 (“SARS-CoV-2”), the virus responsible for COVID-19. Thereafter, we intend to further develop the virulent bacterial detection device to be used more broadly in the aquaculture market as well as in the veterinary, health care, food processing and home monitoring markets, among others.

The Offering

| Securities offered by us: | Maximum of 3,082,779 shares of Common Stock. | |

| Securities offered by the selling shareholders (1): | Maximum of 365,497 shares of Common Stock | |

| Common Stock outstanding before the offering (2): | 38,457,361 shares | |

| Common Stock outstanding after the offering (2): | 41,540,140 shares, assuming we raise the maximum offering amount | |

| Use of proceeds: | Product commercialization, marketing and brand development, purchase of intellectual property, payment of deferred salaries and working capital reserves. |

| (1) | See “Plan of Distribution and Selling Security Holders” |

| (2) | We have granted 3,550,000 options under our 2019 Stock Option Plan (“Stock Option Plan”). Our Stock Option Plan reserves for issuance a number of shares equal to 15% of the number of shares of Common Stock that are issued, or 5,768,604 shares of Common Stock currently, which will increase as a result of this offering. The number of shares of Common Stock outstanding before and after the offering shown above does not include shares of Common Stock issuable upon exercise of options issue under our Stock Option Plan or any shares of Common Stock that will remain reserved for issuance pursuant to our Stock Option Plan. It also does not reflect shares of common stock that we have agreed to issue to Colorado State University Research Foundation as discussed under “The Company’s Business—Intellectual Property.” |

| 3 |

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ● | We have a limited history upon which an investor can evaluate our performance and future prospects. | |

| ● | We may not be able to develop commercially viable sensor products on the timetable we anticipate, or at all, or successfully execute on our business plan. | |

| ● | We may not be able to raise enough capital to commercialize our product and begin generating revenue. | |

| ● | Our ability to raise capital and to commercialize our sensor products may be materially impacted by the COVID-19 pandemic. | |

| ● | We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business viability. | |

| ● | We will compete with other companies that are developing or have developed testing devices or methods designed to exploit similar markets to those in which we intend to penetrate. Many of these other companies have substantially greater resources than we do. | |

| ● | We expect to be highly dependent on third party suppliers and contractors that will need to have a high level of expertise and meet strict quality standards. | |

| ● | Failure to obtain approval to market our sensor products for human health applications may limit our prospects for growth. | |

| ● | If we are not able to meet the requirements of our licensing agreement with Colorado State University Research Foundation, they may terminate the agreement and it is highly unlikely that we would be able to pursue the commercialization of our viral testing platform. | |

| ● | Adverse regulatory or policy changes could have a material impact on our business. | |

| ● | If we fail to effectively protect our intellectual property, our business may suffer. | |

| ● | Our business and its prospects for success are dependent on key personnel who are not easy to recruit and retain, especially in the life sciences industry which requires a high level of expertise. | |

| ● | We may be subject to product liability claims which could have a material adverse effect on our business, our prospects and our reputation. | |

| ● | We have identified a significant deficiency in our internal controls over financial reporting. | |

| ● | Our valuation has been established by us, is difficult to assess and you may risk overpaying for your investment. | |

| ● | Because this is a “best efforts” offering with no minimum, any investment made could be the only investment in this offering, leaving the company without adequate capital to pursue its business plan or even to cover the expenses of this offering. | |

| ● | This offering involves “rolling closings,” which may mean that earlier investors may not have the benefit of information that later investors have. | |

| ● | The value of your investment may be diluted if we issue additional options or shares of Common Stock. |

| 4 |

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, relatively early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to our Business

We may not be able to develop commercially viable sensor products on the timetable we anticipate, or at all. Our sensor technology may be difficult to scale to a commercially viable level since it must meet expectations that it is equivalent or superior to traditional diagnostic technology in terms of reliability and cost efficiency. We still need to develop and refine the technology necessary to ensure that our sensors meet performance goals and cost targets. We need to perform additional laboratory and field testing, and we may encounter problems and delays. If the tests reveal technical defects or reveal that our products do not meet performance goals and cost targets, our commercialization schedule could be delayed as we attempt to devise solutions to the defects or problems. If we are unable to find solutions, our business may not be viable.

We recently entered into an agreement with the Colorado State University Research Foundation to license certain intellectual property that we believe will allow us to develop a device to detect virulent viral pathogens such as HIV, hepatitis C, dengue, Zika and SARS-CoV-2 , responsible for COVID-19. We strongly caution you that our ability to develop our V-Detect and the related components, conduct sufficient testing, obtain required approval to market our device from the FDA and to successfully commercialize it for this use is highly uncertain at this early stage of development, and is likely to be a lengthy process. Even if we were able to successfully test and obtain FDA approval, by that time many other competing testing methods may be so prevalent that we would not be able to capture enough market share to make commercialization financially feasible.

We may not be able to successfully execute our business plan. In addition to the requirement to successfully develop the technology for commercially viable sensors, we must also raise significant amounts of capital, foster relationships with key suppliers and attract customers. There is no guarantee that we will be able to achieve or sustain any of the foregoing within our anticipated timeframe or at all. We may exceed our budget, encounter obstacles in research and development activities, or be hindered or delayed in implementing our commercialization plans, any of which could imperil our ability to secure customer contracts and begin generating revenues. In addition, any such delays or problems would require us to secure additional funding over and above what we currently anticipate we require to sustain our business, which we may not be able to raise.

We may not be able to raise enough capital to commercialize our product and begin generating revenue. If we fail to raise at least $1,184,000 we may not have sufficient funds to commercialize any of our product lines and begin generating revenue. If we fail to raise that amount in this offering, we would need to seek additional financing. As part of an intellectual property purchase agreement, we agreed to pay Pebble Labs Inc. $500,000 by September 30, 2020 in order to perfect the purchase of the intellectual property related to their proprietary fluorescent detection protein. If we fail to raise a sufficient amount of net proceeds prior to September 30, 2020 to make this payment, we will need to ask Pebble Labs for an extension. They have no obligation to grant an extension and if they fail to do so, we will not have access to the protein developed by Pebble Labs and may not be able to commercialize a bacterial sensor based on fluorescent detection, though we may be able to adapt our V-Detect device to detect targeted bacteria providing us with a viable technology to commercialize for the aquaculture and other markets. There is no assurance that we will be able to secure this financing in the future and if we fail to do so, we would not have a viable business. Furthermore, to expand our product line in the future, we will need to raise additional capital, and if we are unable to raise the capital on acceptable terms, we may be unable to expand our business and be hindered in our growth.

| 5 |

Our ability to raise capital and to commercialize our sensor products may be materially impacted by the COVID-19 pandemic. The full impact on the economy and the capital markets in the U.S. and the rest of the world from the COVID-19 pandemic are uncertain, in terms of both scale and duration. The high level of volatility in the capital markets may make it difficult to raise funds, especially for early stage companies that involve higher risk. If we are able to raise sufficient funds to begin the work of commercializing our sensor products, we may have difficulty securing supplies needed or manufacturing and distribution partners. The impact of social distancing measures and related workforce reductions may negatively impact the ability of suppliers to deliver us the components we need for manufacture or the ability of any of our potential partners to operate effectively to meet our requirements. In addition, many of the third parties that we would rely on for production and distribution are likely to be highly engaged in manufacturing products aimed at combatting the pandemic by manufacturing testing supplies and equipment, medical equipment and/or potential treatments. We cannot assure you that, should we raise sufficient funds, we will be able to contract with suppliers, manufacturing partners or distribution partners at a level that would allow us to achieve profitability, or at all.

We are an early stage company with a limited operating history. The company was formed on February 5, 2019. Accordingly, we have a limited history upon which an investor can evaluate our performance and future prospects. Our activities to date have focused on research and development activity to create a prototype of our sensor and as a result, we have incurred only net losses to date. Our financial statements do not reflect any operating revenues. We cannot assure you that we will be in a position to generate revenues or profits in the foreseeable future.

We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business viability. We intend to use the proceeds of this offering to help us achieve commercialization of our sensing device for the aquaculture market and further develop it to address other markets. We have no experience in producing sensors for market and may face significant challenges in developing, staffing and managing the production of sensing devices reliably and efficiently on a high-volume, low-cost basis. Manufacturing a sophisticated high-tech product with exacting specifications requires expertise and experience which we currently do not have and may have difficulty in securing. In addition, our future operating results will depend on our ability to effectively build and manage supplier and customer relationships across a broad geographic footprint. Managing growth is made more difficult by the fact that we currently have no corporate offices or permanent physical locations and, therefore, our senior management team generally coordinates through electronic communications and by phone. Our failure to effectively manage our growth could negatively impact our business results and prospects as well as our reputation.

The diagnostics market is highly complex and competitive. We will compete with other companies that are developing or have developed testing devices or methods designed to exploit similar markets to those in which we intend to penetrate. Many of these other companies have substantially greater resources than we do. We cannot assure you that developments by other companies will not adversely affect the competitiveness of our products. The diagnostic industry is also characterized by extensive research efforts and rapid technological change. Competition can be expected to increase as technological advances are made and commercial applications for diagnostic technologies increase. Our competitors may use different technologies or approaches to develop products similar to the products which we are seeking to develop or may develop new or enhanced products or processes that may be more effective and less expensive. We may not be able to market our products to compete successfully in the existing competitive environment. Moreover, national laboratories and universities around the world are also researching as well as developing similar sensors. New developments may render the Company’s products obsolete or uneconomical. Competition in all these forms may impede the Company’s ability to produce and sell a commercially viable product or be disadvantaged in some other manner which could materially impact the Company’s business prospects.

We expect to be highly dependent on third party suppliers and contractors. We expect to rely heavily on suppliers and manufacturing partners to produce the necessary technology and components for our sensing devices. Due to the complexity of the technology in our devices, our suppliers and manufacturing partners require a high level of expertise and will need to meet strict quality standards. We have established good working relationships with prospective partners; however, if we are unable to secure contracts with them, or if any contract is terminated for reasons outside of our control, it may be difficult for us to find new suppliers or contractors that are able to meet these standards. Furthermore, to the extent that any of our suppliers provides us with products that prove to be defective or fail to meet our specifications, or there are failures in manufacturing our devices by a third party, our business and reputation will likely suffer.

| 6 |

Failure to obtain approval to market our sensor products for human health applications may limit our prospects for growth. We will require approval from the U.S. Food and Drug Administration (“FDA”) and similar agencies in other countries prior to marketing our sensor products for human health applications. We will need to establish, to the satisfaction of those organizations, that our products are safe and effective for use. We intend to seek FDA marketing approval under the Emergency Use Authorization (EUA) for our V-Detect that tests for the presence of SARS-CoV-2. We cannot assure you that we will receive approval under the EUA or more generally for other human health applications . In addition, we believe that the resources of the FDA are heavily engaged in monitoring, reviewing and approving testing solutions related to COVID-19 and the underlying virus, SARS-Cov-2, and they may not have sufficient staffing or other resources to review our applications in a timely manner, even our application under the EUA. As a result, we may not be in a position to pursue human health applications other than for SARS-CoV-2 for a significant period of time, if at all.

If we are not able to meet the requirements of our licensing agreement with Colorado State University Research Foundation, we may lose all rights to the intellectual property they have licensed to us. We are required to submit to Colorado State University Research Foundation a development plan by October 15, 2020 describing how we intend to bring our viral testing products to market, including time frames for specific events, as described under “The Company’s Business—Intellectual Property.” Our failure to substantially perform in accordance with the development plan we submit or to meet each of these development milestones would constitute a material breach of our agreement with Colorado State University Research Foundation, which would enable them to terminate the agreement if we fail to cure the breach within 30 days. If they were to terminate the licensing agreement, we would no longer have access to their proprietary technology, and it is highly unlikely that we would be able to pursue the commercialization of our viral testing platform, regardless of the amount of development time or funds invested up to that point.

Adverse regulatory or policy changes could have a material impact on our business. Our business is premised on our bacterial detection systems being able to meet regulations and policies in our target markets. If the regulatory framework in these markets becomes more restrictive to the point where our products are unable to meet these standards, the Company will have difficulty in selling its products and potential customers may seek alternative technologies altogether.

If we fail to effectively protect our intellectual property, our business may suffer. We will rely on patents pending to protect our intellectual property, including intellectual property we have licensed from others. There is no assurance that any patents will be issued with the desired breadth of claim coverage or at all. The failure to obtain patents for our current technology or any future technology could materially impair our business prospects or, in the case of future development, impair our ability to expand our business into other markets. If any patents are granted, they will, as is generally the case with patents, be subject to uncertainty with respect to their validity, scope and enforceability and thus we cannot guarantee you that our patents, or patents that we license from third parties, will not be invalidated, circumvented, challenged, or become unenforceable. In cases where the Company must license intellectual property from third parties, there is no guarantee that the Company will be able to do so on acceptable terms.

Some of our proprietary processes, technologies and know-how are not under patent protection. Although we intend to seek patent protection where possible and in the best interests of the company, in some cases we must rely on the law of trade secrets to protect our intellectual property. Accordingly, there is a risk that such trade secrets may not stay secret. This risk also applies to confidentiality agreements and inventors’ rights agreements with our strategic partners and employees. There is no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, or that such persons or institutions will not assert rights to intellectual property arising out of these relationships. Finally, effective patent, trade secret, trademark and copyright protection may be unavailable, limited or not applied for in certain countries.

We may also be subject to allegations of infringement of other parties’ intellectual property, or conversely, be forced to sue those who infringe our intellectual property. Such litigation is usually costly, time-consuming, and would divert resources away from the Company. If we lose such lawsuits, we may be compelled to pay damages or to cease development, manufacture, use or sale of the infringing product.

Our business and its prospects for success are dependent on key personnel. We will rely on key personnel in management, research and development, operations, manufacturing and marketing who are not easy to recruit and retain, especially in the life sciences industry which requires a high level of expertise. We believe that we have and will continue to offer key personnel competitive compensation packages, but we cannot assure you that our key personnel will remain with the company or that we will be able to hire additional personnel with the correct skill sets and qualifications in the future. We do not maintain any key person insurance and the loss of any of our key personnel could significantly impair our ability to establish a viable business.

In addition, our key personnel are serial entrepreneurs. It is possible that some, if not all, of our key personnel may exit the business within the next three years. In the event one or more of our key personnel exit the business the company may experience financial loss, disruption to our operations and technology development, damage to our brand and reputation and, if any departing person joins a competitor, a weakening of our competitive position.

| 7 |

We may be subject to product liability claims as product malfunction is always a possibility. Depending on the magnitude of the damage, any of these occurrences could lead to civil lawsuits for which our insurance policies may not be adequate or available, and in certain cases, may even lead to criminal sanctions. We may be forced to pay significant damages, curtail operations or shut down, which could have a material adverse effect on our business, our prospects and our reputation.

We have identified a significant deficiency in our internal controls over financial reporting. Ensuring that we have adequate internal financial and accounting controls and procedures in place to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Our management has identified a significant deficiency in our internal controls. While management is working to remediate the deficiencies, there is no assurance that such changes, when economically feasible and sustainable, will remediate the identified deficiencies or that the controls will prevent or detect future significant deficiencies. If we are not able to maintain effective internal control over financial reporting, our financial statements, including related disclosures, may be inaccurate, which could have a material adverse effect on our business. We may discover additional deficiencies in our internal financial and accounting controls and procedures that need improvement from time to time.

Management is responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with United States generally accepted accounting principles. Management does not expect that our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, within the company will have been detected.

Risks Related to the Securities and the Offering

Any valuation at this stage is difficult to assess. The valuation for the offering was established by the company. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially startups, is difficult to assess and you may risk overpaying for your investment.

There is no minimum amount set as a condition to closing this offering. Because this is a “best efforts” offering with no minimum, we will have access to any funds tendered. This might mean that any investment made could be the only investment in this offering, leaving the company without adequate capital to pursue its business plan or even to cover the expenses of this offering.

This offering involves “rolling closings,” which may mean that earlier investors may not have the benefit of information that later investors have. We may conduct closings on funds tendered in the offering at any time. At that point, investors whose subscription agreements have been accepted will become our shareholders. We may file supplements to our Offering Circular reflecting material changes and investors whose subscriptions have not yet been accepted will have the benefit of that additional information. These investors may withdraw their subscriptions and get their money back. Investors whose subscriptions have already been accepted, however, will already be our shareholders and will have no such right.

This investment is illiquid. There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer.

The value of your investment may be diluted if the company issues additional options or shares of Common Stock. Our Articles of Incorporation provides that we can issue an unlimited number of shares of our Common Stock, whether in a subsequent offering, in connection with an acquisition or otherwise. We have granted 3,550,000 options under our Stock Option Plan. Our Stock Option Plan reserves for issuance a number of shares equal to 15% of the number of shares of Common Stock that are issued, or 5,768,604 shares of Common Stock currently , which amount will increase as a result of this offering. We may in the future increase the number or percentage of shares reserved for issuance under this plan or adopt another plan. We have also agreed to issue shares of common stock to Colorado State University Research Foundation as discussed under “The Company’s Business—Intellectual Property.” The issuance of additional shares of Common Stock, or additional option grants under our Stock Option Plan or other stock based incentive program may dilute the value of your holdings. The company views stock-based incentive compensation as an important competitive tool, particularly in attracting both managerial and technological talent.

| 8 |

Dilution means a reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares.

The following table demonstrates the price that new investors are paying for their shares with the effective cash price paid by the existing shareholder. The table gives effect to the sale of shares by us at $5,000,000, $10,000,000 and $20,000,001 (the maximum amount offered), in each case excluding shares being offered by the selling shareholders.

| $5,000,000 Raise | $10,000,000 Raise | $20,000,001 Raise | ||||||||||

| Price per Share for new investors | $ | 5.80 | $ | 5.80 | $ | 5.80 | ||||||

| Shares issued to new investors | 603,448 | 1,358,640 | 3,082,779 | |||||||||

| Gross proceeds raised | $ | 3,499,998 | $ | 7,880,112 | $ | 17,880,118 | ||||||

| Less: Offering costs | $ | (718,000 | ) | $ | (775,000 | ) | $ | (900,000 | ) | |||

| Net offering proceeds | $ | 2,781,998 | $ | 7,105,112 | $ | 16,980,118 | ||||||

| Adjusted net tangible book value pre-financing (as of 12/31/2019) | $ | (9,891 | ) | $ | (9,891 | ) | $ | (9,891 | ) | |||

| Adjusted net tangible book value post-financing | $ | 2,772,107 | $ | 7,095,221 | $ | 16,970,227 | ||||||

| Shares issued and outstanding pre-financing | 38,457,361 | 38,457,361 | 38,457,361 | |||||||||

| Post-financing shares issued and outstanding | 39,060,809 | 39,816,001 | 41,540,140 | |||||||||

| Net tangible book value per share prior to offering | $ | (0.000 | ) | $ | (0.000 | ) | $ | (0.000 | ) | |||

| Increase/(Decrease) per share attributable to new investors | $ | 0.071 | $ | 0.178 | $ | 0.409 | ||||||

| Net tangible book value per share after offering | $ | 0.071 | $ | 0.178 | $ | 0.409 | ||||||

| Dilution per share to new investors | $ | 5.73 | $ | 5.62 | $ | 5.39 | ||||||

| Dilution per share to new investors | 98.8 | % | 96.9 | % | 93.0 | % | ||||||

As of December 31, 2019, the Company had not issued any options pursuant to the Company’s Stock Option Plan. In 2020 to date, the Company has issued 3,550,000 options to its directors, consultants and advisors. The above table excludes the future issuance of up to 3,550,000 shares of Common Stock that will be underlying those options. If all options to be issued were exercised, the adjusted net tangible book value post-financing would increase by $4,881,250, the post-financing shares issued and outstanding would be 42,610,809, 43,366,001 and 45,090,140 at the 25%, 50% and 100% levels, the net tangible book value per share after offering would be $0.18, $0.276 and $0.485 at those levels and the dilution per share to new investors would be $5.62 (96.9%), $5.52 (95.2%), and $5.32 (91.6%), respectively.

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another Regulation A round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

| 9 |

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| ● | In June 2019 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. | |

| ● | In December 2019 the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. | |

| ● | In June 2020 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the number of shares of Common Stock underlying convertible notes that the company may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

| 10 |

We estimate that the net proceeds from this offering will be approximately $16,980,118 assuming we raise the maximum offering amount and after deducting the estimated offering expenses of approximately $900,000 (excluding state filing fees).

The following table below sets forth the uses of proceeds assuming an offering amount of $5,000,000, $10,000,000, and $20,000,001 (the maximum offering amount), excluding in each case the shares to be sold by the selling shareholders. For further discussion, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Plan of Operations.”

$5,000,000 Offering | $10,000,000 Offering | $20,000,001 Offering | ||||||||||

| Offering Proceeds | ||||||||||||

| Shares Sold by the Company | 603,448 | 1,358,640 | 3,082,779 | |||||||||

| Gross Proceeds to the Company from this Offering | $ | 3,499,998 | $ | 7,880,112 | $ | 17,880,118 | ||||||

| Offering Expenses (1) | $ | 718,000 | $ | 775,000 | $ | 900,000 | ||||||

| Total Offering Proceeds Available for Use | $ | 2,781,998 | $ | 7,105,112 | $ | 16,980,118 | ||||||

| Estimated Expenditures | ||||||||||||

| Commercialization of viral testing platform | 1,184,000 | 2,700,000 | 5,100,000 | |||||||||

| Commercialization of bacterial testing platform | 1,191,000 | 2,700,000 | 5,100,000 | |||||||||

| Purchase of Intellectual Property from Pebble Labs | $ | - | $ | 500,000 | $ | 500,000 | ||||||

| Payment of Deferred Compensation | $ | 344,000 | $ | 444,000 | $ | 444,000 | ||||||

| Total Expenditures | $ | 2,719,000 | $ | 6,344,000 | $ | 11,144,000 | ||||||

| Working Capital Reserves | $ | 62,998 | $ | 761,112 | $ | 5,836,118 | ||||||

| (1) | Excludes state filing fees of approximately $12,000. |

We anticipate that expenditures for commercialization of our B-Detect device and its related components for our bacterial testing platform will include development of a production version of the prototype device, improvement of the performance of the fluorescent resonance energy transfer (“FRET”) detection protein, development of the sample pre-treatment protocol development and other customer feedback dependent tasks, for an aggregate cost of $891,000. Please see detailed objectives below in “The Company’s Business—Strategy.” To build the first 100 units, including the reagents, contracted manufacturing and marketing expenses, we estimate an additional cost of $300,000, which is included in the total amount above.

We anticipate that expenditures for commercialization of our V-Detect device and its related components for our viral testing platform will be very similar to the B-Detect Device, as discussed in more detail in “The Company’s Business—Strategy,” and is expected to cost $884,000 plus an additional cost of $300,000 to build the first 100 units taking us to first revenues.

If we raise $5 million or less, we expect as a priority to complete the development and commercialization of V-Detect and its related components to address the urgent need for corona virus testing. The next priority will be to develop and commercialize B-Detect and its related components to address shrimp disease in the aquaculture market and UTI’s in the human health market.

If we raise in excess of $5 million, we intend to invest in marketing and branding activities to develop our brand and market our product and thereafter apply additional funding to further develop our product platforms for additional markets, beginning with bacterial testing to address UTI’s.

The above figures represent only estimated costs. This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering. If we fail to raise at least $1,184,000 we anticipate that we will need to secure additional funding to fully commercialize our V-Detect device.

We reserve the right to change the above use of proceeds if management believes it is in the best interests of the Company.

| 11 |

Overview

Edoceo is an emerging med-tech & biotech company focusing on the development and commercialization of portable, easy to use devices for rapid, sensitive, and accurate detection of bacterial and viral infections. These devices are urgently needed in a range of markets, including aquaculture and human and animal health. The company is currently developing two product platforms: one for detection of bacterial infections and another for detection of viruses. Both platforms are versatile and the same core instrumentation within each platform can be used across many applications to detect many different bacteria and viruses. For each platform, our product line will comprise three components:

| ● | the portable device itself – B-Detect, our bacterial testing portable device, and V-Detect, our viral testing portable device, | |

| ● | consumable testing units that contain reagents, receive the bacterial or viral sample and are inserted into the device for testing, which we call B-Test and V-Test and | |

| ● | software providing data collection and configuration functionality, which we call B-View and V-View. |

B-Detect is a portable, battery-operated unit that uses fluorescent detection proteins to detect the molecules bacteria release when they become virulent. V-Detect is a portable, battery-operated unit using proprietary technology to detect specific viral pathogens via the integration of different types of molecular assays.

For our bacterial testing platform, we intend to focus on further refining and subsequently commercializing B-Detect and the related consumable products and data software to address shrimp diseases in the aquaculture market. We also intend to begin development and study of B-Detect for the detection of urinary tract infections in the human health market.

In terms of our viral testing platform, we will focus initially on the continued development and commercialization of V-Detect and the related consumables and software to address the detection of SARS-CoV-2, the virus responsible for COVID-19. Thereafter, we intend to further develop the virulent bacterial detection device to be used more broadly in the aquaculture market as well as in the veterinary, health care, food processing and home monitoring markets, among others.

Bacterial Infections – the Problem and How We Address it

Control of virulent bacteria is currently heavily reliant on the use of antibiotics. Unfortunately, this overuse of antibiotics has led to the evolution of bacteria known as superbugs that are resistant to several antibiotics. Superbugs are expected to cost the global economy $100 trillion in health care and lost productivity by 2050 (as per the International Federation of Pharmaceutical Manufacturers & Associations, November 2018). The current over-use of antibiotics is due, in part, to an inability to detect the cause of infections early enough and the lack of timely feedback on the effectiveness of drugs that are administered.

Edoceo seeks to mitigate these costly and sometimes deadly challenges with proprietary technology that is being designed to have the following key attributes:

| ● | portable, | |

| ● | simple to use, | |

| ● | cost effective, | |

| ● | broad detection of infections from over 160 bacterial species including most common pathogens, and | |

| ● | rapid, early warning of a bacterial infection, providing results in minutes. |

We have a functioning prototype that has been demonstrated to quantitatively detect a bacterial signalling molecule that is produced by virulent bacteria. See “Our Technology.” This prototype will be developed further for commercialization for detection of shrimp disease in the aquaculture market by creating a simple reagent platform, validating the measurements with shrimp health evaluation, and devising a calibration protocol. We believe our device has substantial potential for the broader aquaculture market as well as the veterinary, health care, food processing and home health monitoring markets. We believe our device will help to improve people’s lives and reduce food production costs as we seek to provide an early warning of harmful pathogens in our bodies, our pets, and food production systems and processing equipment. We believe that the potential addressable market is vast, as discussed in “Markets” below, and we believe we have the management and scientific team to launch our bacterial detection device successfully.

| 12 |

Viral Diseases – the Problem and How We Address it

COVID-19 is in the news daily with an estimated global death count of more than 570,000 as of July 13, 2020 and with the number of people dying each day from the disease exceeding 3,500 globally. In addition, each day there are more than 27,000 deaths globally from communicable diseases according to World Economic Forum data. In just the last 20 years, Visualcapitalist.com reports that there have been five new epidemics/pandemics caused by viral pathogens in addition to ongoing diseases such as HIV/AIDS, dengue, Zika, hepatitis and others. Leading global health organization are calling for rapid, accurate testing to help slow the spread of these diseases. A recent report by Meticulous Research, states the value of the global infectious disease diagnostics market is expected to reach in excess of US$23 billion by 2027. Notably, this study pre-dates COVID-19, which has generally raised the awareness of the importance of testing.

A 2013 policy statement by the Infectious Disease Society of America states:

Whether caring for an individual patient with an infectious disease or responding to a worldwide pandemic, the rapid and accurate establishment of a microbial cause is fundamental to quality care. Despite dramatic advances in diagnostic technologies, many patients with suspected infections receive empiric antimicrobial therapy rather than appropriate therapy dictated by the rapid identification of the infectious agent. The result is overuse of our small inventory of effective antimicrobials, whose numbers continue to dwindle due to increasing levels of antimicrobial resistance.

New tests are needed that can identify a specific pathogen or at a minimum, distinguish between bacterial and viral infections, and also provide information on susceptibility to antimicrobial agents. Tests should be easy to use and provide a rapid result (ideally within an hour) to have a positive impact on care.

Edoceo seeks to address viral disease challenges with proprietary technology that is being designed to have the following key attributes:

| ● | portable, | |

| ● | simple to use, | |

| ● | cost effective, | |

| ● | ability to target new viruses by simply changing reagents used in the V-Test consumable units, and | |

| ● | sensitive and accurate quantitation of virus levels in a sample, providing results in 30 minutes or less. |

For sensitive, accurate detection of viruses, we are developing a novel genomic-based assay to detect specific nucleic acid sequences in samples. We have a functioning prototype and have achieved proof-of-concept detection of SARS-CoV-2 and another target sequence. This device is based on a method that uses isothermal amplification of the target sequence, so the hardware can be much smaller than current laboratory-based instruments, and a combination of biochemical procedures that we expect to provide sensitivity and specificity that are much better than current portable instruments. Once testing of this device is complete, subject to regulatory approval, we intend to commercialize it, focusing initially on detection of SARS-CoV-2 virus. Thereafter, we intend to further develop this technology to be used in the aquaculture market as well as in the veterinary and health care markets, among others.

Our History

Our company was formed in 2019 to acquire and commercialize intellectual property from OptiEnz Sensors, LLC (www.optienz.com), which initially developed our virulent bacterial detection device and was founded by our Chief Science Officer, and from Pebble Labs, Inc. (www.pebblelabs.com) of Los Alamos, New Mexico. The company will operate under the trade name of Edoceo Devices (Edoceo means to “fully inform” in Latin). The achievement of developing a prototype device for detecting virulent bacteria that we are using for ongoing testing purposes was led by the OptiEnz founder and Chief Technology Officer, Ken Reardon Ph.D. Dr. Reardon now serves as our Chief Science Officer. Edoceo and the OptiEnz team have forged a close working relationship and have entered into a master research agreement providing for collaborative ongoing research and development into our products and related sensors, industry support and expanding the technology. Additionally, Dr. Brian Heinze, the R&D Director of OptiEnz is a member of our scientific advisory committee.

We recently entered into an agreement with Colorado State University Research Foundation to license certain intellectual property rights that we believe will enable us to develop our V-Detect and related components. For ongoing technical support of this technology, the original inventors, Dr. Dandy, Dr. Henry and Dr. Geiss, all professors and researchers at Colorado State University, who have been working on this technology for more than a year, have joined our scientific advisory committee.

Market Opportunity

Introduction

Bacterial and viral infections have enormous impact upon the entire human population as well as those of other species: pets, livestock, and the shrimp and fish produced by the aquaculture industry. Early detection is always vital to treatment since higher doses of antibiotics and antiviral compounds are required for late-stage infections. In the case of bacteria, the extensive use of antibiotics across all markets has resulted in more and more bacteria developing resistance to antibiotics. When a bacterium is resistant to several commonly used antibiotics, it is referred to as a “superbug”.

| 13 |

The traditional and still primary method of detecting a bacterial infection is to take a sample (for example, blood, urine, or saliva) from the patient — whether human, pet, or other animal — and put it in a special environment in a laboratory to grow any bacteria that are present. Since the test relies on bacterial growth, several days may be required to obtain results. For many diseases, the time required to test for an infection represents a critical period when the infection could grow to dangerous levels. For example, it takes between 48 and 72 hours to diagnose a sepsis causing infection. Current testing based upon growth may fail to detect evasive strains of bacteria. Furthermore, not all bacteria can be cultured in the laboratory.

Other laboratory-based methods of bacterial detection and identification typically require long processing times, can lack sensitivity and specificity, and/or require highly specialized equipment and trained technicians and are therefore costly and not available in all countries. These other methods include biochemical assays, immunological tests, and genetic analyses.

For detection of viral infections, the considered current gold standard for testing is the genetic analyzer based on the use of polymerase chain reaction (PCR) for DNA viruses or reverse-transcriptase PCR (RT-PCR) for RNA viruses. This is the most common diagnostic test used to identify people currently infected with SARS-CoV-2, for example. It works by detecting viral RNA in a fluid sample from a person —most often collected from their nasal passage.

The accuracy of a test is based on two key factors: sensitivity and specificity. A sensitive test will correctly identify that the virus or bacterium is present in the sample, while a specific test will correctly indicate that the virus or bacterium is not present in the sample. RT-PCR tests are considered the gold standard and within laboratory situations have high sensitivity and high specificity. However, in the real-world, testing conditions and processes are far from perfect and accuracy suffers. For example, it has been stated that researchers still don’t know what the real-world false negative test rate is for SARS-CoV-2, but one clinical study determined the range in sensitivity of RT-PCR tests to be from 66 to 80%, meaning that at the 66% level nearly one in three infected samples tested will receive false negative results.

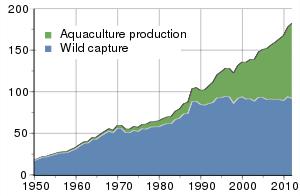

Aquaculture

It has been reported by the Marine Science Agency of the United Kingdom that more than half of all seafood consumed globally (160 million metric tons per year) is from aquaculture as opposed to wild-capture fisheries. Aquaculture production is trending to increasingly dominate the market over wild capture.

Global harvest of aquatic organisms

in million tons 1950-2010

FishStat Database 2014

It has been estimated that more than $6 billion in aquaculture products (shrimp, salmon and others) are lost annually to disease. In specific sectors, such as shrimp, disease losses may exceed 40% of global yield capacity with emergent diseases, such as Early Mortality Syndrome, threatening to collapse production in all nations. The global shrimp consumption market is in excess of $40 billion and is expected to reach $68 billion in the next ten years. It is estimated that there are over 50,000 shrimp producers with over 500,000 ponds and the numbers are expanding each year to keep pace with demand.

Concerns surrounding the ability to rapidly confirm disease is the major constricting factor for expansion of the aquaculture industry to 2050. Currently, shrimp diseases are detected by taking shrimp to a laboratory, dissecting them, and examining their organs under a microscope. This is time consuming and subject to sampling challenges as well as substantial environmental and biological perturbations. B-Detect, by contrast, is expected to provide in situ testing for virulent bacteria in ponds with results available in minutes rather than days, increasing the ability for early detection and remediation.

Early notice of the outbreak of virulent bacteria can reduce overuse of antibiotics, thereby diminishing antibiotic resistance. Rapid, simple detection of viral aquaculture diseases is similarly needed. For example, the shrimp pathogen White Spot Syndrome Virus is one of the most pathogenic and lethal diseases in aquaculture, causing up to 100% mortality within 3 to 10 days. Early detection can help treatments be more successful or can allow a producer to protect other parts of the production system.

| 14 |

Human Health

Bacterial Testing Market

Superbugs are expected to cost the global economy $100 trillion in health care and lost productivity by 2050. Globally, more than 700,000 people die from superbug bacterial infections annually, a number that is increasing every year. For example, sepsis, a condition resulting from the body’s overwhelming and life-threatening response to infection, can lead to tissue damage, organ failure, and death. According to the Sepsis Alliance, on average approximately 30% of patients diagnosed with severe sepsis do not survive. Up to 50% of survivors suffer from post-sepsis syndrome. According to a 2006 study published in Critical Care Medicine, the risk of death from sepsis increases by an average of up to 7.6% with every hour that passes before treatment begins, often using a broad-spectrum antibiotic. Sepsis has been named as the most expensive in-patient cost in American hospitals by the Healthcare Cost and Utilization Project. One report stated the costs were $24 billion in 2014. Though not all sepsis-related infections are bacterial, it is the most common cause. Early detection and treatment are essential for survival and limiting disability for survivors.

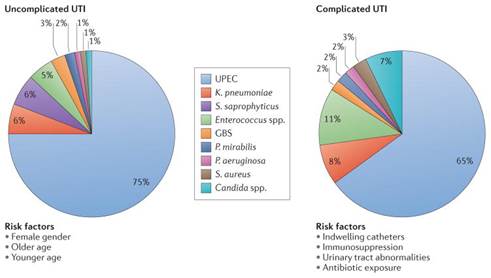

Urinary tract infections (UTIs) are a severe public health problem exacerbated by the rise in multidrug resistant strains of bacteria and high recurrence rates. They are some of the most common bacterial infections, affecting 150 million people each year worldwide.1 UTIs are caused by a wide range of pathogens, including Gram-negative and Gram-positive bacteria, as well as fungi. Uncomplicated UTIs typically affect women, children and elderly patients who are otherwise healthy. Complicated UTIs are usually associated with indwelling catheters, urinary tract abnormalities, immunosuppression or exposure to antibiotics. In 2007, in the United States alone, there were an estimated 10.5 million office visits for UTI symptoms. Currently, the societal costs of these infections, including health care costs and time missed from work, are approximately $3.5 billion per year in the United States alone. UTIs are a significant cause of morbidity in infant boys, older men and females of all ages. UTIs are a common catheter-induced illness as the result of patients staying in a hospital or clinic and these catheter-inducted UTIs are a major cause of extended hospital stays. In the United States , Medicare is penalizing hospitals that fail to address UTI on the length of the hospital stay by reducing overall reimbursement.

1 Flores-Mireles, A., Walker, J., Caparon, M. et al. Urinary tract infections: epidemiology, mechanisms of infection and treatment options. Nat Rev Microbiol 13, 269–284 (2015). https://doi.org/10.1038/nrmicro3432.

| 15 |

Epidemiology of urinary tract infections

As shown above, of the various epidemiological causes of both complicated and uncomplicated UTIs, the vast majority are bacterial in nature, with only Candida species being fungal in nature.

UTIs are responsible for a surprisingly diverse array of symptoms that are frequently misinterpreted. If an infection can be detected or ruled out quickly in the hospital setting, a patient may receive treatment before the infection becomes life threatening or, if ruled out, medical professionals can more quickly turn to analyzing other causes. If left untreated, a UTI can lead to death. UTIs may lead to a form of sepsis called urosepsis. UTI infections are a major cause of hospitalization and death in nursing homes. Nearly 380,000 people die of infections in US nursing homes every year.

We estimate the global addressable market at $6.5 billion for medical device sales, $3.3 billion in annual data services revenue and $35 billion per year for consumables. These internal estimates are based on various external studies for home based medical device sales.

Viral Testing Market

As humans have spread across the world, so have infectious diseases caused by viruses and bacteria. Even in this modern era, outbreaks are nearly constant, though not every outbreak reaches pandemic levels. According to VisualCapitalist.com, some of the major virus-caused epidemics/pandemics that have occurred over time are:

| Name | Time period | Type / Pre-human host | Death toll (approx.) | |||

| Antonine Plague | 165-180 | Believed to be either smallpox or measles (viruses) | 5M | |||

| Japanese smallpox epidemic | 735-737 | Variola major virus | 1M | |||

| New World Smallpox Outbreak | 1520 – onwards | Variola major virus | 56M | |||

| Yellow Fever | Late 1800s | Virus / Mosquitoes | 100,000-150,000 (U.S.) | |||

| Russian Flu | 1889-1890 | Believed to be H2N2 influenza virus / Avian origin | 1M | |||

| Spanish Flu | 1918-1919 | H1N1 virus / Pigs | 40-50M | |||

| Asian Flu | 1957-1958 | H2N2 virus / Avian origin | 1.1M | |||

| Hong Kong Flu | 1968-1970 | H3N2 virus / Avian origin | 1M | |||

| HIV/AIDS | 1981-present | Virus / Chimpanzees | 25-35M | |||

| Swine Flu | 2009-2010 | H1N1 virus / Pigs | 200,000 | |||

| SARS | 2002-2003 | Coronavirus / Bats, Civets | 770 | |||

| Ebola | 2014-2016 | Ebolavirus / Wild animals | 11,000 | |||

| MERS | 2015-Present | Coronavirus / Bats, camels | 850 | |||

| COVID-19 | 2019-Present | Coronavirus – Unknown | 570,000 (Johns Hopkins University estimate as of July 13, 2020) |

| 16 |

“Testing, testing, testing” has been the mantra repeated again and again by World Health Organization Director-General Tedros Adhanom Ghebreyesus. Widespread diagnostic testing, along with isolation of the infected, contact tracing, and quarantining of those contacts, seems to have been key to those countries that have suppressed the spread of COVID-19. A June 1, 2020 analysis by Market Study Report, LLC estimates that the global COVID-19 diagnostic testing industry is expected to exceed $44 billion in 2020 with the number of tests projected to exceed 329 million by the end of the year.

Animal Health

Global livestock populations are significantly endangered by bacterial and viral diseases. In order to avoid epidemics and spread of infection from animal to animal (and animal to humans), these infections should be monitored effectively. There are several examples of animal diseases such as brucellosis, respiratory and reproductive disorders and tuberculosis being commonly found in animals. Currently, these various disorders in livestock are detected using veterinary diagnostics carried out in laboratories using various techniques to detect bacteria and viruses in samples of blood, feces and tissue. New techniques and techniques developed for human diagnosis are also being widely used in veterinary diagnostics. Immunoassays and hematology are among the techniques currently used for detection of infection in animals. All of these are limited in throughput, response time, and expense.

Seventy percent of antibiotics in the U.S. are given to livestock for prophylactic reasons. In contrast, our B-Detect is expected to enable targeted use of antibiotics only when a bacterial threat is present, saving millions of dollars and limiting the rise of superbugs caused by the overuse of antibiotics. Similarly, V-Detect may allow early detection of viral infection so that treatment with antivirals is more effective. Early detection of bacterial or viral infection will help mitigate suffering and will reduce costs to treat pets and livestock.

The global veterinary diagnostics market size is estimated to grow at a compound annual growth rate of over 7% from 2019 to 2026 and reach a global market value around $5.4 billion by 2026. Of that, the global pet diagnostic market size was valued at over $2.1 billion in 2018 and is expected to be $4 billion by 2026, according to a 2019 study by Grand View Research. Increasing demand for point of care diagnostics is expected further propel the growth of the pet diagnostics market.

Food Processing

Biofilms form when bacteria adhere to surfaces in aqueous environments and begin to excrete a slimy, glue-like substance that can anchor them to a variety of materials including metals, plastics, soil particles, medical implant materials and, most significantly, human or animal tissue. For example, biofilms can develop on the interiors of pipes, which can lead to clogging and corrosion. Biofilms on floors and counters can make sanitation difficult particularly in food preparation areas.

Bacterial infections that go undetected can have devastating impacts on businesses and the economy. The Centers for Disease Control and Prevention in a 2011 study estimated that each year roughly 1 in 6 Americans (48 million people) get sick, 128,000 are hospitalized, and 3,000 die as a result of foodborne diseases. In 2015, some customers of Blue Bell Ice Cream became ill and some died. The CDC detected Listeria bacteria in the manufacturer’s plants, resulting in the company having to issue a national recall of over 8 million gallons of ice cream, lay off 1,450 of its 3,900 employees and furlough another 1,400, and borrow $125 million to undertake a decontamination of its plants and the replacement of some equipment that could not be cleaned as a result of the said biofilm having been created by bacteria. The temporary shutdown of this one company led to hundreds of layoffs across other direct and indirect local supporting industries as the 200,000 tourists to the plant also disappeared.

Lately, nearly every month the CDC reports similar Listeria infections linked to food products, such as milk, cheese, ice cream, and pork products. Inadequate detection and control of bacteria costs billions in food production losses each year. The annual global cost of food-borne illnesses is estimated at over $110 billion and over 48 million Americans are stricken ill each year with over 23,000 deaths from antibiotic-resistant bacteria.

These human and financial tolls were due to not detecting the virulent bacterial infection early enough. B-Detect is expected to provide cost effective, near real-time testing for bacterial outbreaks in equipment, from food processing to water and oil pipelines. Early detection of a bacterial threat will help to minimize the creation of harmful biofilms that in some cases necessitates significant rebuilds of food infrastructure systems, often the only way to get rid of the infection within the processing equipment.

| 17 |

Our Technology

B-Detect

For our bacterial detection device, our planned offering is centered around three components for virulent bacterial detection:

| B-Detect: | portable device for bacterial detection through proprietary quorum-sensing technology | |

| B-View: | software providing data capture and customization | |

| B-Test: | consumable cartridges |

The B-Detect is our physical device that will perform detection process and produce results. B-View will be software incorporated within the device where not only the results of the test are recorded but the operator can record pertinent details. For example, a shrimp producer would record data such as time and date of test, weather conditions and feed used. We are designing the software to be customizable to meet the user’s needs. B-Test is the consumable cartridge that will contain the reagents and to which the sample will be added for analysis by the B-Detect unit.

B-Detect Technology is Quorum Sensing