An Offering Statement pursuant to Regulation A relating to these securities has been filed with Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of such state. The company may elect to satisfy its obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of the company’s sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR DATED MAY 27, 2020

Quara Devices Inc.

1712 Pearl Street

Boulder, CO 80302

+1 (888) 887-6658

quaralife.com

UP TO 3,082,779 SHARES OF COMMON STOCK OFFERED BY THE ISSUER

UP TO 365,497 SHARES OF COMMON STOCK OFFERED BY THE SELLING SHAREHOLDERS

We are seeking to raise up to $17,880,118 and our selling shareholders are seeking to raise $2,119,883 from the sale of Common Stock to the public. As a result, the maximum offering amount is $20,000,001. There is no minimum offering dollar amount.

SEE “SECURITIES BEING OFFERED” AT PAGE 33

| Price | Underwriting discount and commissions (1) | Proceeds to Issuer (2) | Proceeds to Selling Shareholders (2) | |||||||||||||

| Per share | $ | 5.80 | $ | 0.058 | $ | 5.742 | $ | 5.742 | ||||||||

| Total Maximum | $ | 20,000,001 | $ | 200,000 | $ | 17,701,317 | $ | 2,098,684 | ||||||||

| (1) | We have not engaged any placement agent or underwriter in connection with this offering. To the extent that we do so, we will file a supplement to the Offering Statement of which this Offering Circular is a part. The company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to perform administrative and technology related functions in connection with this offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fees payable by the company to Dalmore. See “Plan of Distribution and Selling Security Holders” for details. |

| (2) | Does not include other expenses of the offering. See “Plan of Distribution and Selling Security Holders” for a description of these expenses. |

The minimum investment amount for shares of our Common Stock is $580.00, or 100 shares.

We expect that, not including state filing fees, the amount of expenses of the offering that we will pay will be approximately $900,000.

The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is three years from this offering being qualified by the United States Securities and Exchange Commission (the “SEC”), or (3) the date at which the offering is earlier terminated by the company in its sole discretion. The company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to the company and the selling shareholders. The offering is being conducted on a best-efforts basis.

The company has engaged Prime Trust, LLC as an escrow agent to hold funds tendered by investors. We may hold a series of closings at which we and the selling shareholders receive the funds from the Escrow Agent and issue or sell the shares to investors.

Each holder of Common Stock is entitled to one vote for each share on all matters submitted to a vote of the shareholders. See “Securities Being Offered.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 5.

Sales of these securities will commence on approximately _______, 2020.

The company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Implications of Being an Emerging Growth Company.

TABLE OF CONTENTS

In this Offering Circular, the term “Quara,” “we,” “us”, “our” or “the company” refers to Quara Devices Inc.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| 1 |

Implications of Being an Emerging Growth Company

We are not subject to the ongoing reporting requirements of the Exchange Act of 1934, as amended (the “Exchange Act”) because we are not registering our securities under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

| ● | annual reports (including disclosure relating to our business operations for the preceding three fiscal years, or, if in existence for less than three years, since inception, related party transactions, beneficial ownership of the issuer’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the issuer’s liquidity, capital resources, and results of operations, and two years of audited financial statements), | |

| ● | semiannual reports (including disclosure primarily relating to the issuer’s interim financial statements and MD&A) and | |

| ● | current reports for certain material events. |

In addition, at any time after completing reporting for the fiscal year in which our offering statement was qualified, if the securities of each class to which this offering statement relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); | |

| ● | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); | |

| ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and | |

| ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

| 2 |

The Company

Quara is an emerging med-tech & biotech company focusing on the development and commercialization of a handheld bacterial quorum sensing device to provide rapid early warning to the presence of harmful pathogens. This PathogenometerTM, which we call QuaraSenseTM is a handheld, battery operated device that uses proprietary fluorescent detection proteins to detect the molecules bacteria release when they become virulent. Once testing of QuaraSense is complete, we intend to commercialize it, focusing initially on shrimp diseases in the aquaculture market and urinary tract infections (“UTIs” or “UTI” in the singular) in the human health market, subject to regulatory approval. Thereafter, we intend to further develop QuaraSense to be used more broadly in the aquaculture market as well as in the veterinary, health care, food processing and home monitoring markets, among others.

Control of virulent bacteria is currently heavily reliant on the use of antibiotics. Unfortunately, this overuse of antibiotics has led to the evolution of bacteria known as superbugs that are resistant to several antibiotics. Superbugs are expected to cost the global economy $100 trillion in health care and lost productivity by 2050 (as per the International Federation of Pharmaceutical Manufacturers & Associations, November, 2018). The current over-use of antibiotics is due, in part, to a failure to detect infections early enough and the lack of timely feedback on the effectiveness of drugs that are administered.

Quara seeks to mitigate costly and sometimes deadly challenges with proprietary technology combined with the following key attributes:

| ● | handheld and portable, | |

| ● | simple to use, | |

| ● | cost effective, | |

| ● | broad detection of over 160 bacterial species, and | |

| ● | rapid, early warning of a bacterial infection, providing results in minutes. |

We have a functioning prototype that is ready for commercialization for detection of shrimp disease in the aquaculture market. We anticipate it will take us 9 to 12 months from funding to begin shipping QuaraSense to shrimp producers that are capable of detecting the signaling molecule that is a general indicator of many of the most common types of bacteria. We expect that further development of our technology to be able to detect additional types of virulent bacteria specific to our other target markets, and to expand our technology portfolio to the detection of pathogenic viruses.

Our mission and strategy is strongly supported by our high quality, knowledgeable and successful team of officers, directors and advisors, including scientists who are experts in the fields of biology, biophysics and bioengineering and senior management and advisors with extensive experience in bringing new products to market and expertise in capital markets, marketing and executive leadership.

The Offering

| Securities offered by us: | Maximum of 3,082,779 shares of Common Stock. | |

| Securities offered by the selling shareholders (1): | Maximum of 365,497 shares of Common Stock | |

| Common Stock outstanding before the offering (2): | 38,457,361 shares | |

| Common Stock outstanding after the offering (2): | 41,540,140 shares, assuming we raise the maximum offering amount | |

| Use of proceeds: | Purchase of intellectual property, product commercialization, marketing and brand development, payment of deferred salaries and working capital reserves. |

| (1) | See “Plan of Distribution and Selling Security Holders” |

| (2) | We have granted 3,500,000 options under our 2019 Stock Option Plan (“Stock Option Plan”). Our Stock Option Plan reserves for issuance a number of shares equal to 15% of the number of shares of Common Stock that are issued, or 5,768,604 shares of Common Stock currently. The number of shares of Common Stock outstanding before and after the offering shown above does not include shares of Common Stock issuable upon exercise of options issue under our Stock Option Plan or any shares of Common Stock that will remain reserved for issuance pursuant to our Stock Option Plan. It also does not reflect shares of common stock that we have agreed to issue to Colorado State University Research Foundation as discussed under “The Company’s Business—Intellectual Property.” |

| 3 |

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ● | We have a limited history upon which an investor can evaluate our performance and future prospects. | |

| ● | We may not be able to develop commercially viable sensor products on the timetable we anticipate, or at all, or successfully execute on our business plan. | |

| ● | We may not be able to raise enough capital to acquire the intellectual property from Pebble Labs, Inc. (“Pebble Labs”) by the contractual due date or to commercialize our product and begin generating revenue. | |

| ● | Our ability to raise capital and to commercialize our sensor products may be materially impacted by the COVID-19 pandemic. | |

| ● | We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business viability. | |

| ● | We will compete with other companies that are developing or have developed analyzers designed to exploit similar markets to those in which we intend to penetrate. Many of these other companies have substantially greater resources than we do. | |

| ● | We expect to be highly dependent on third party suppliers and contractors that will need to have a high level of expertise and meet strict quality standards. | |

| ● | Failure to obtain approval to market our sensor products for human health applications may limit our prospects for growth. | |

| ● | Adverse regulatory or policy changes could have a material impact on our business. | |

| ● | If we fail to effectively protect our intellectual property, our business may suffer. | |

| ● | Our business and its prospects for success are dependent on key personnel who are not easy to recruit and retain, especially in the life sciences industry which requires a high level of expertise. | |

| ● | We may be subject to product liability claims which could have a material adverse effect on our business, our prospects and our reputation. | |

| ● | We have identified a significant deficiency in our internal controls over financial reporting. | |

| ● | Our valuation has been established by us, is difficult to assess and you may risk overpaying for your investment. | |

| ● | Because this is a “best efforts” offering with no minimum, any investment made could be the only investment in this offering, leaving the company without adequate capital to pursue its business plan or even to cover the expenses of this offering. | |

| ● | This offering involves “rolling closings,” which may mean that earlier investors may not have the benefit of information that later investors have. | |

| ● | The value of your investment may be diluted if we issue additional options or shares of Common Stock. |

| 4 |

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, relatively early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to our Business

We may not be able to develop commercially viable sensor products on the timetable we anticipate, or at all. Our sensor technology may be difficult to scale to a commercially viable level since it must meet expectations that it is equivalent or superior to traditional diagnostic technology in terms of reliability and cost efficiency. We still need to develop and refine the technology necessary to ensure that our sensors meet performance goals and cost targets. We need to perform additional laboratory and field testing, and we may encounter problems and delays. If the tests reveal technical defects or reveal that our products do not meet performance goals and cost targets, our commercialization schedule could be delayed as we attempt to devise solutions to the defects or problems. If we are unable to find solutions, our business may not be viable.

We recently entered into an agreement with the Colorado State University Research Foundation to license certain intellectual property that we believe will allow us to develop a device to detect virulent viral pathogens such as HIV, hepatitis C, dengue, Zika and severe acute respiratory syndrome coronavirus 2 (“SARS-Cov-2”), responsible for COVID-19. We strongly caution you that our ability to integrate this technology into our device portfolio, conduct sufficient testing to establish the safety and efficacy of using our device for viral testing, obtain required approval to market our device from the FDA and to successfully commercialize it for this use is highly uncertain at this early stage of development, and is likely to be a lengthy process. Even if we were able to successfully test and obtain FDA approval, by that time many other competing testing methods may be so prevalent that we would not be able to capture enough market share to make commercialization financially feasible.

We may not be able to successfully execute our business plan. In addition to the requirement to successfully develop the technology for commercially viable sensors, we must also raise significant amounts of capital, foster relationships with key suppliers and attract customers. There is no guarantee that we will be able to achieve or sustain any of the foregoing within our anticipated timeframe or at all. We may exceed our budget, encounter obstacles in research and development activities, or be hindered or delayed in implementing our commercialization plans, any of which could imperil our ability to secure customer contracts and begin generating revenues. In addition, any such delays or problems would require us to secure additional funding over and above what we currently anticipate we require to sustain our business, which we may not be able to raise.

We may not be able to raise enough capital to acquire intellectual property from Pebble Labs by the contractual due date or to commercialize our product and begin generating revenue. We are required to pay Pebble Labs $500,000 by September 30, 2020 in order to perfect the purchase of the intellectual property related to their propriety fluorescent detection proteins. If we fail to raise a sufficient amount of net proceeds prior to September 30, 2020, we will need to ask Pebble Labs for an extension. They have no obligation to grant an extension and if they fail to do so, we will not have access to the protein developed by Pebble Labs that may be needed to expand the capabilities of our current prototype device for use in certain markets, and we may not have access to some of their employees who currently act as advisors to us. With the purchase of the intellectual property from OptiEnz Sensors, LLC we do have a detection protein, hardware and software providing us with a viable prototype to commercialize for the aquaculture and other markets. In addition, if we fail to raise at least $900,000 we may not have sufficient funds to commercialize our product at all. There is no assurance that we will be able to raise additional capital in the future. As the Company may make potential acquisitions or expand its product line, the need to raise additional capital may be even more important for our future growth, and if we are unable to raise the necessary money on acceptable terms, we may be unable to pursue or realize our objectives and be hindered in our growth.

| 5 |

Our ability to raise capital and to commercialize our sensor products may be materially impacted by the COVID-19 pandemic. The full impact on the economy and the capital markets in the U.S. and the rest of the world from the COVID-19 pandemic are uncertain, in terms of both scale and duration. The high level of volatility in the capital markets may make it difficult to raise funds, especially for early stage companies that involve higher risk. If we are able to raise sufficient funds to begin the work of commercializing our sensor products, we may have difficulty securing supplies needed or manufacturing and distribution partners. The impact of social distancing measures and related workforce reductions may negatively impact the ability of suppliers to deliver us the components we need for manufacture or the ability of any of our potential partners to operate effectively to meet our requirements. In addition, many of the third parties that we would rely on for production and distribution are likely to be highly engaged in manufacturing products aimed at combatting the pandemic by manufacturing testing supplies and equipment, medical equipment and/or potential treatments. We cannot assure you that, should we raise sufficient funds, we will be able to contract with suppliers, manufacturing partners or distribution partners at a level that would allow us to achieve profitability, or at all.

We are an early stage company with a limited operating history. The company was formed on February 5, 2019. Accordingly, we have a limited history upon which an investor can evaluate our performance and future prospects. Our activities to date have focused on research and development activity to create a prototype of our sensor and as a result, we have incurred only net losses to date. Our financial statements do not reflect any operating revenues. We cannot assure you that we will be in a position to generate revenues or profits in the foreseeable future.

We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business viability. We intend to use the proceeds of this offering to help us achieve commercialization of our sensing device for the aquaculture market and further develop it to address other markets. We have no experience in producing sensors for market and may face significant challenges in developing, staffing and managing the production of sensing devices reliably and efficiently on a high-volume, low-cost basis. Manufacturing a sophisticated high-tech product with exacting specifications requires expertise and experience which we currently do not have and may have difficulty in securing. In addition, our future operating results will depend on our ability to effectively build and manage supplier and customer relationships across a broad geographic footprint. Managing growth is made more difficult by the fact that we currently have no corporate offices or permanent physical locations and, therefore, our senior management team generally coordinates through electronic communications and by phone. Our failure to effectively manage our growth could negatively impact our business results and prospects as well as our reputation.

The diagnostics market is highly complex and competitive. We will compete with other companies that are developing or have developed analyzers designed to exploit similar markets to those in which we intend to penetrate. Many of these other companies have substantially greater resources than we do. We cannot assure you that developments by other companies will not adversely affect the competitiveness of our products. The diagnostic industry is also characterized by extensive research efforts and rapid technological change. Competition can be expected to increase as technological advances are made and commercial applications for diagnostic technologies increase. Our competitors may use different technologies or approaches to develop products similar to the products which we are seeking to develop or may develop new or enhanced products or processes that may be more effective and less expensive. We may not be able to market our products to compete successfully in the existing competitive environment. Moreover, national laboratories and universities around the world are also researching as well as developing similar sensors. New developments may render the Company’s products obsolete or uneconomical. Competition in all these forms may impede the Company’s ability to produce and sell a commercially viable product or be disadvantaged in some other manner which could materially impact the Company’s business prospects.

We expect to be highly dependent on third party suppliers and contractors. We expect to rely heavily on manufacturing partners to co-develop and produce the necessary technology and components for our sensing devices. Due to the complexity of the technology in our devices, our suppliers and manufacturing partners require a high level of expertise and will need to meet strict quality standards. We have established good working relationships with prospective partners; however, if we are unable to secure contracts with them, or if any contract is terminated for reasons outside of our control, it may be difficult for us to find new suppliers or contractors that are able to meet these standards. Furthermore, to the extent that any of our suppliers provides us with products that prove to be defective or fail to meet our specifications, or there are failures in manufacturing our devices by a third party, our business and reputation will likely suffer.

| 6 |

Failure to obtain approval to market our sensor products for human health applications may limit our prospects for growth. We will require approval from the U.S. Food and Drug Administration (“FDA”) and similar agencies in other countries prior to marketing our sensor products for human health applications. We will need to establish, to the satisfaction of those organizations, that our products are safe and effective for use. Because our technology tests for the presence of virulent bacteria in a different manner than currently exists, we cannot refer to existing technology to support our application and, as a result, cannot assure you that we will receive approval. In addition, we believe that the resources of the FDA are heavily engaged in monitoring, reviewing and approving testing solutions for COVID-19 and the underlying virus, SARS-Cov-2, and they may not have sufficient staffing or other resources to review our application in a timely manner. As a result, we may not be in a position to pursue human health applications for a significant period of time, if at all.

Adverse regulatory or policy changes could have a material impact on our business. Our business is premised on our bacterial detection systems being able to meet regulations and policies in our target markets. If the regulatory framework in these markets becomes more restrictive to the point where our products are unable to meet these standards, the Company will have difficulty in selling its products and potential customers may seek alternative technologies altogether.

If we fail to effectively protect our intellectual property, our business may suffer. We will rely on patents pending to protect our intellectual property. There is no assurance that any patents will be issued with the desired breadth of claim coverage or at all. The failure to obtain patents for our current technology or any future technology could materially impair our business prospects or, in the case of future development, impair our ability to expand our business into other markets. If any patents are granted, they will, as is generally the case with patents, be subject to uncertainty with respect to their validity, scope and enforceability and thus we cannot guarantee you that our patents, or patents that we may license from third parties, will not be invalidated, circumvented, challenged, or become unenforceable. In cases where the Company must license intellectual property from third parties, there is no guarantee that the Company will be able to do so on acceptable terms.

Some of our proprietary processes, technologies and know-how are not under patent protection. Although we intend to seek patent protection where possible and in the best interests of the company, in some cases we must rely on the law of trade secrets to protect our intellectual property. Accordingly, there is a risk that such trade secrets may not stay secret. This risk also applies to confidentiality agreements and inventors’ rights agreements with our strategic partners and employees. There is no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, or that such persons or institutions will not assert rights to intellectual property arising out of these relationships. Finally, effective patent, trade secret, trademark and copyright protection may be unavailable, limited or not applied for in certain countries.

We may also be subject to allegations of infringement of other parties’ intellectual property, or conversely, be forced to sue those who infringe our intellectual property. Such litigation is usually costly, time-consuming, and would divert resources away from the Company. If we lose such lawsuits, we may be compelled to pay damages or to cease development, manufacture, use or sale of the infringing product.

Our business and its prospects for success are dependent on key personnel. We rely on key personnel in management, research and development, operations, manufacturing and marketing who are not easy to recruit and retain, especially in the life sciences industry which requires a high level of expertise. We believe that we have and will continue to offer key personnel competitive compensation packages, but we cannot assure you that our key personnel will remain with the company or that we will be able to hire additional personnel with the correct skill sets and qualifications in the future. In particular, our Chief Executive Officer does not receive any compensation in connection with his position. We do not maintain any key person insurance and the loss of any of our key personnel could significantly impair our ability to establish a viable business.

In addition, our key personnel are serial entrepreneurs. It is possible that some, if not all, of our key personnel may exit the business within the next three years. In the event one or more of our key personnel exit the business the company may experience financial loss, disruption to our operations and technology development, damage to our brand and reputation and, if any departing person joins a competitor, a weakening of our competitive position.

| 7 |

We may be subject to product liability claims as product malfunction is always a possibility. Depending on the magnitude of the damage, any of these occurrences could lead to civil lawsuits for which our insurance policies may not be adequate or available, and in certain cases, may even lead to criminal sanctions. We may be forced to pay significant damages, curtail operations or shut down, which could have a material adverse effect on our business, our prospects and our reputation.

We have identified a significant deficiency in our internal controls over financial reporting. Ensuring that we have adequate internal financial and accounting controls and procedures in place to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Our management has identified a significant deficiency in our internal controls. While management is working to remediate the deficiencies, there is no assurance that such changes, when economically feasible and sustainable, will remediate the identified deficiencies or that the controls will prevent or detect future significant deficiencies. If we are not able to maintain effective internal control over financial reporting, our financial statements, including related disclosures, may be inaccurate, which could have a material adverse effect on our business. We may discover additional deficiencies in our internal financial and accounting controls and procedures that need improvement from time to time.

Management is responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with United States generally accepted accounting principles. Management does not expect that our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, within the company will have been detected.

Risks Related to the Securities and the Offering

Any valuation at this stage is difficult to assess. The valuation for the offering was established by the company. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially startups, is difficult to assess and you may risk overpaying for your investment.

There is no minimum amount set as a condition to closing this offering. Because this is a “best efforts” offering with no minimum, we will have access to any funds tendered. This might mean that any investment made could be the only investment in this offering, leaving the company without adequate capital to pursue its business plan or even to cover the expenses of this offering.

This offering involves “rolling closings,” which may mean that earlier investors may not have the benefit of information that later investors have. We may conduct closings on funds tendered in the offering at any time. At that point, investors whose subscription agreements have been accepted will become our shareholders. We may file supplements to our Offering Circular reflecting material changes and investors whose subscriptions have not yet been accepted will have the benefit of that additional information. These investors may withdraw their subscriptions and get their money back. Investors whose subscriptions have already been accepted, however, will already be our shareholders and will have no such right.

This investment is illiquid. There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer.

The value of your investment may be diluted if the company issues additional options or shares of Common Stock. Our Articles of Incorporation provides that we can issue an unlimited number of shares of our Common Stock, whether in a subsequent offering, in connection with an acquisition or otherwise. We have granted 3,500,000 options under our Stock Option Plan. Our Stock Option Plan reserves for issuance a number of shares equal to 15% of the number of shares of Common Stock that are issued, or 5,768,604 shares of Common Stock currently and we may in the future increase the number or percentage of shares reserved for issuance under this plan or adopt another plan. We have also agreed to issue shares of common stock to Colorado State University Research Foundation as discussed under “The Company’s Business—Intellectual Property.” The issuance of additional shares of Common Stock, or additional option grants under our Stock Option Plan or other stock based incentive program may dilute the value of your holdings. The company views stock based incentive compensation as an important competitive tool, particularly in attracting both managerial and technological talent.

| 8 |

Dilution means a reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares.

The following table demonstrates the price that new investors are paying for their shares with the effective cash price paid by the existing shareholder. The table gives effect to the sale of shares by us at $5,000,000, $10,000,000 and $20,000,001 (the maximum amount offered), in each case excluding shares being offered by the selling shareholders.

| $5,000,000 Raise | $10,000,000 Raise | $20,000,001 Raise | ||||||||||

| Price per Share for new investors | $ | 5.80 | $ | 5.80 | $ | 5.80 | ||||||

| Shares issued to new investors | 603,448 | 1,358,640 | 3,082,779 | |||||||||

| Gross proceeds raised | $ | 3,499,998 | $ | 7,880,112 | $ | 17,880,118 | ||||||

| Less: Offering costs | $ | (718,000 | ) | $ | (775,000 | ) | $ | (900,000 | ) | |||

| Net offering proceeds | $ | 2,781,998 | $ | 7,105,112 | $ | 16,980,118 | ||||||

| Adjusted net tangible book value pre-financing (as of 12/31/2019) | $ | (9,891 | ) | $ | (9,891 | ) | $ | (9,891 | ) | |||

| Adjusted net tangible book value post-financing | $ | 2,772,107 | $ | 7,095,221 | $ | 16,970,227 | ||||||

| Shares issued and outstanding pre-financing | 38,457,361 | 38,457,361 | 38,457,361 | |||||||||

| Post-financing shares issued and outstanding | 39,060,809 | 39,816,001 | 41,540,140 | |||||||||

| Net tangible book value per share prior to offering | $ | (0.000 | ) | $ | (0.000 | ) | $ | (0.000 | ) | |||

| Increase/(Decrease) per share attributable to new investors | $ | 0.071 | $ | 0.178 | $ | 0.409 | ||||||

| Net tangible book value per share after offering | $ | 0.071 | $ | 0.178 | $ | 0.409 | ||||||

| Dilution per share to new investors | $ | 5.73 | $ | 5.62 | $ | 5.39 | ||||||

| Dilution per share to new investors | 98.8 | % | 96.9 | % | 93.0 | % | ||||||

As of December 31, 2019, the Company had not issued any options pursuant to the Company’s Stock Option Plan. In 2020 to date, the Company has issued 3,500,000 options to its directors, consultants and advisors. The above table excludes the future issuance of up to 3,500,000 shares of Common Stock that will be underlying those options. If all options to be issued were exercised, the adjusted net tangible book value post-financing would increase by $4,812,500, the post-financing shares issued and outstanding would be 42,560,809, 43,316,001 and 45,040,140 at the 25%, 50% and 100% levels, the net tangible book value per share after offering would be $0.178, $0.275 and $0.484 at those levels and the dilution per share to new investors would be $5.62 (96.9%), $5.53 (95.3%), and $5.32 (91.7%), respectively.

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another Regulation A round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

| 9 |

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| ● | In June 2019 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. | |

| ● | In December 2019 the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. | |

| ● | In June 2020 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the number of shares of Common Stock underlying convertible notes that the company may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

| 10 |

We estimate that the net proceeds from this offering will be approximately $16,980,118 assuming we raise the maximum offering amount and after deducting the estimated offering expenses of approximately $900,000 (excluding state filing fees).

The following table below sets forth the uses of proceeds assuming an offering amount of $5,000,000, $10,000,000, and $20,000,001 (the maximum offering amount), excluding in each case the shares to be sold by the selling shareholders. For further discussion, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Plan of Operations.”

$5,000,000 Offering | $10,000,000 Offering | $20,000,001 Offering | ||||||||||

| Offering Proceeds | ||||||||||||

| Shares Sold | 603,448 | 1,358,640 | 3,082,779 | |||||||||

| Gross Proceeds to the Company from this Offering | $ | 3,499,998 | $ | 7,880,112 | $ | 17,880,118 | ||||||

| Offering Expenses (1) | $ | 718,000 | $ | 775,000 | $ | 900,000 | ||||||

| Total Offering Proceeds Available for Use | $ | 2,781,998 | $ | 7,105,112 | $ | 16,980,118 | ||||||

| Estimated Expenditures | ||||||||||||

| Purchase of Intellectual Property from Pebble Labs | $ | 500,000 | $ | 500,000 | $ | 500,000 | ||||||

| Commercialization of QuaraSense Device | $ | 700,000 | $ | 1,500,000 | $ | 1,500,000 | ||||||

| Commercialization of Viral Detection Technology | 700,000 | 1,500,000 | 1,500,000 | |||||||||

| Brand Development | $ | 400,000 | $ | 2,000,000 | $ | 2,000,000 | ||||||

| Payment of Deferred Compensation | $ | 444,000 | $ | 444,000 | $ | 444,000 | ||||||

| Total Expenditures | $ | 2,744,000 | $ | 5,944,000 | $ | 5,944,000 | ||||||

| Working Capital Reserves | $ | 37,998 | $ | 1,161,112 | $ | 11,036,118 | ||||||

| (1) | Excludes state filing fees of approximately $12,000. |

For a discussion of our agreement to acquire intellectual property from Pebble Labs Inc. please see “The Company’s Business.” We anticipate that expenditures for commercialization of the QuaraSense device will include development of production version of prototype device, improvement of the performance of the fluorescent resonance energy transfer (“FRET”) detection protein, development of sample pretreatment protocol development and other customer feedback dependent tasks. In addition, we intend to invest in marketing and branding activities to develop our brand and market our product. At this time, we estimate that the expenditures for commercialization of the viral detection technology will be similar to the QuaraSense device.

The above figures represent only estimated costs. This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering. Furthermore, if we fail to raise at least $900,000 we anticipate that we will need to secure additional funding to fully commercialize our QuaraSense device. Please see “Risk Factors.”

We reserve the right to change the above use of proceeds if management believes it is in the best interests of the Company.

| 11 |

Overview

Quara is an emerging med-tech & biotech company focusing on the development and commercialization of a handheld bacterial quorum sensing device to provide rapid early warning to the presence of harmful pathogens. This PathogenometerTM, which we call QuaraSenseTM is a handheld, battery operated device that uses proprietary fluorescent detection proteins to detect the molecules bacteria release when they become virulent. Once testing of QuaraSense is complete, we intend to commercialize it, focusing initially on shrimp diseases in the aquaculture market and UTIs in the human health market, subject to regulatory approval. Thereafter, we intend to further develop QuaraSense to be used more broadly in the aquaculture market as well as in the veterinary, health care, food processing and home monitoring markets, among others.

Control of virulent bacteria is currently heavily reliant on the use of antibiotics. Unfortunately, this overuse of antibiotics has led to the evolution of bacteria known as superbugs that are resistant to several antibiotics. Superbugs are expected to cost the global economy $100 trillion in health care and lost productivity by 2050 (as per the International Federation of Pharmaceutical Manufacturers & Associations, November 2018). The current over-use of antibiotics is due, in part, to a failure to detect infections early enough and the lack of timely feedback on the effectiveness of drugs that are administered.

Quara seeks to mitigate costly and sometimes deadly challenges with proprietary technology combined with the following key attributes:

| ● | handheld and portable, | |

| ● | simple to use, | |

| ● | cost effective, | |

| ● | broad detection of over 160 bacterial species including most common pathogens, and | |

| ● | rapid, early warning of a bacterial infection, providing results in minutes. |

We have a functioning prototype that is ready for commercialization for detection of shrimp disease in the aquaculture market. We believe QuaraSense has substantial potential for the broader aquaculture market as well as the veterinary, health care, food processing and home health monitoring markets. We believe QuaraSense will help to improve people’s lives and reduce food production costs as we seek to provide an early warning of harmful pathogens in our bodies, our pets, and food production systems and processing equipment. We believe that potential market is massive, and we believe we have the management and scientific teams to launch our QuaraSense successfully.

Our History

Quara was formed in 2019 to acquire and commercialize intellectual property from OptiEnz Sensors, LLC (www.optienz.com), which initially developed our device and was founded by our Chief Science Officer, and from Pebble Labs, Inc. (www.pebblelabs.com) of Los Alamos, New Mexico. OptiEnz and Pebble Labs have highly educated and experienced research teams. Pebble Labs has emerged as one of North America’s top privately-owned bio-tech R&D organizations. In addition, both the OptiEnz team and the Pebble Labs team have committed to supporting our company, providing ongoing research into related sensors, regulatory expertise, industry support and expanding the technology of QuaraSense.

The work of Pebble Labs in conjunction with OptiEnz Sensors, LLC, resulted in development of a prototype device, QuaraSense, that we are using for ongoing testing purposes. These achievements were led by the OptiEnz founder and Chief Technology Officer, Ken Reardon Ph.D. and Dr. Reardon now serves as our Chief Science Officer.

Market Opportunity

Bacterial infections have enormous impact upon the entire human population as well as those of other species: pets, livestock, and the shrimp and fish. produced by the aquaculture industry that are essential to the world’s future food security. Currently combatting harmful bacteria relies on extensive use of antibiotics across all these segments. For a variety of reasons, primarily overuse and preventative use, more and more bacteria are developing resistance to antibiotics. When a bacterium is resistant to several commonly used antibiotics, it is referred to as a “superbug”.

| 12 |

The traditional and still primary method of detecting a bacterial infection is to take a sample (for example, blood, urine, or saliva) from the patient — whether human, pet, or other animal — and put it in a special environment in a laboratory to grow any bacteria that are present. Since the test relies on bacterial growth, several days may be required to obtain results. For many diseases, the time required to test for an infection represents a critical period when the infection could grow to dangerous levels. For example, it takes between 48 and 72 hours to diagnose a sepsis causing infection. Current testing based upon growth may fail to detect evasive strains of bacteria. Furthermore, not all bacteria can be cultured in the laboratory.

Other laboratory-based methods of bacterial detection and identification typically require long processing times, can lack sensitivity and specificity, and/or require highly specialized equipment and trained technicians and are therefore costly and not available in all countries. These other methods include biochemical assays, immunological tests, and genetic analyses.

Aquaculture

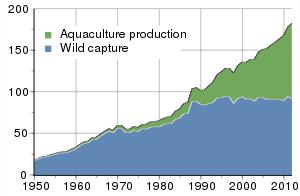

It has been reported by the Marine Science Agency of the United Kingdom that more than half of all seafood consumed globally (160 million metric tons per year) is from aquaculture as opposed to wild-capture fisheries. Aquaculture production is trending to increasingly dominate the market over wild capture.

Global harvest of aquatic organisms

in million tons 1950-2010

FishStat Database 2014

In specific sectors, such as shrimp, disease losses may exceed 40% of global yield capacity with emergent diseases, such as Early Mortality Syndrome, threatening to collapse production in all nations. The global shrimp consumption market is in excess of $40 billion and is expected to reach $68 billion in the next ten years. It is estimated that there are over 50,000 shrimp producers with over 500,000 ponds and the numbers are expanding each year to keep pace with demand. QuaraSense would allow in situ testing in ponds with results available in minutes rather than days, increasing the ability for early detection and remediation.

Concerns surrounding the ability to rapidly confirm disease is the major constricting factor for expansion of the aquaculture industry to 2050 and could potentially cost the sector $6 billion in yield loss each year. Currently, shrimp diseases are detected by taking shrimp to a laboratory, dissecting them, and examining their organs under a microscope. This is time consuming and subject to sampling challenges as well as substantial environmental and biological perturbations.

QuaraSense has been developed to help reduce the more than $6 billion in aquaculture products (shrimp, salmon and others) lost annually to disease. Early notice of the outbreak of virulent bacteria can reduce overuse of antibiotics, thereby diminishing antibiotic resistance. Quara will also provide data services to allow users to track bacterial challenge over time to determine efficacy of treatment and key relationships between weather, feeding and other variables important for aquaculture production processes. With the cost effective and rapid response time that QuaraSense will be able to offer, we expect the demand for QuaraSense technology to be significant and to increase as aquaculture grows to meet world food demand.

| 13 |

Human Health

Superbugs are expected to cost the global economy $100 trillion in health care and lost productivity by 2050. Globally, more than 700,000 people die from superbug bacterial infections annually, a number that is increasing every year. For example, sepsis, a condition resulting from the body’s overwhelming and life-threatening response to infection, can lead to tissue damage, organ failure, and death. According to the Sepsis Alliance, on average approximately 30% of patients diagnosed with severe sepsis do not survive. Up to 50% of survivors suffer from post-sepsis syndrome. According to a 2006 study published in Critical Care Medicine, the risk of death from sepsis increases by an average of up to 7.6% with every hour that passes before treatment begins, often using a broad-spectrum antibiotic. Sepsis has been named as the most expensive in-patient cost in American hospitals by the Healthcare Cost and Utilization Project. One report stated the costs were $24 billion in 2014. Though not all sepsis-related infections are bacterial, it is the most common cause. Early detection and treatment are essential for survival and limiting disability for survivors.

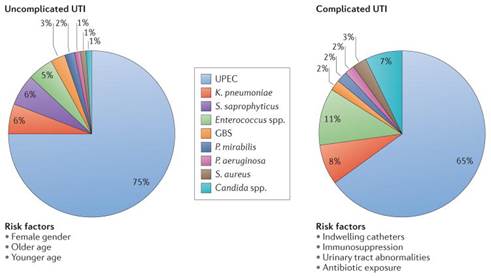

Urinary tract infections, or UTIs are a severe public health problem exacerbated by the rise in multidrug resistant strains of bacteria and high recurrence rates. They are some of the most common bacterial infections, affecting 150 million people each year worldwide.1 In 2007, in the United States alone, there were an estimated 10.5 million office visits for UTI symptoms. Currently, the societal costs of these infections, including health care costs and time missed from work, are approximately USD $3.5 billion per year in the United States alone. UTIs are a significant cause of morbidity in infant boys, older men and females of all ages. UTI is a common catheter-induced illness as the result of patients staying in a hospital or clinic and these catheter-inducted UTIs are a major cause of extended hospital stays. In the US, Medicare is penalizing hospitals that fail to address UTI on the length of the hospital stay by reducing overall reimbursement.

UTIs are caused by a wide range of pathogens, including Gram-negative and Gram-positive bacteria, as well as fungi. Uncomplicated UTIs typically affect women, children and elderly patients who are otherwise healthy. Complicated UTIs are usually associated with indwelling catheters, urinary tract abnormalities, immunosuppression or exposure to antibiotics.

1 Flores-Mireles, A., Walker, J., Caparon, M. et al. Urinary tract infections: epidemiology, mechanisms of infection and treatment options. Nat Rev Microbiol 13, 269–284 (2015). https://doi.org/10.1038/nrmicro3432.

| 14 |

UTIs are responsible for a surprisingly diverse array of symptoms which are frequently misinterpreted. If an infection can be detected or ruled out quickly in the hospital setting, a patient may receive treatment before the infection becomes life threatening or, if ruled out, medical professionals can more quickly turn to analyzing other causes. If left untreated, a UTI can lead to death. UTIs may lead to a form of sepsis called urosepsis. Infections are a major cause of hospitalization and death in nursing homes. Nearly 380,000 people die of infections in US nursing homes every year.

QuaraSense is designed to quickly detect an infection and the need for treatment which is critically important for a number of infections. A follow up test with QuaraSense several hours after the start of treatment may also show whether the approach is effective. In cases where a different antibiotic is required, this confirmation of efficacy may help reduce the use of unnecessary antibiotics as well as help to limit the time of suffering or discomfort for patients. QuaraSense is also expected to be much more cost effective than current testing regimes and systems.

We estimate the total addressable market at $6.5 billion for medical device sales, $3.3 billion in annual data services revenue and $35 billion per year. These internal estimates are based on various external studies for home based medical device sales.

Animal Health

Global livestock populations are significantly endangered by disease. In order to avoid epidemics and spread of infection from animal to animal (and animal to humans), these infections should be monitored effectively. There are several examples of animal diseases such as brucellosis, respiratory and reproductive disorders and tuberculosis being commonly found in animals. Currently, these various disorders in livestock are detected using veterinary diagnostics carried out in laboratories using various techniques relying on samples of blood, feces and tissue. New techniques and techniques developed for human diagnosis are also being widely used in veterinary diagnostics. Immunoassay, hematology, and DNA test are various techniques currently used for detection of infection in animals. All of these are limited in throughput, response time, and expense.

We expect that veterinarians and animal owners will be able to use QuaraSense to quickly determine if their livestock or pet has a harmful bacterial infection. Seventy percent of antibiotics in the U.S. are given to livestock for prophylactic reasons. With QuaraSense, antibiotics may be given only when a bacterial threat is present, saving millions of dollars and limiting the rise of superbugs caused by the overuse of antibiotics. And early detection of infection will help mitigate suffering and will reduce veterinary costs for pets and their owners.

The global veterinary diagnostics market size is estimated to grow at a compound annual growth rate of over 7% from 2019 to 2026 and reach a global market value around $5.4 billion by 2026. Of that, the pet diagnostic market size was valued at over USD 2.1 billion in 2018 and the global market is expected to be $4 billion by 2026, according to a 2019 study by Grand View Research. Increasing demand for point of care diagnostics is expected further propel the growth of the pet diagnostics market.

Food Processing

Biofilms form when bacteria adhere to surfaces in aqueous environments and begin to excrete a slimy, glue-like substance that can anchor them to a variety of materials including metals, plastics, soil particles, medical implant materials and, most significantly, human or animal tissue. For example, biofilms can develop on the interiors of pipes, which can lead to clogging and corrosion. Biofilms on floors and counters can make sanitation difficult particularly in food preparation areas.

Bacterial infections that go undetected can have devastating impacts on businesses and the economy. The Center for Disease Control in a 2011 study estimated that each year roughly 1 in 6 Americans (48 million people) get sick, 128,000 are hospitalized, and 3,000 die as a result of foodborne diseases. In 2015, some customers of Blue Bell Ice Cream became ill and some died. The CDC detected Listeria bacteria in the manufacturer’s plants, resulting in the company having to issue a national recall of over 8 million gallons of ice cream, lay off 1,450 of its 3,900 employees and furlough another 1,400, and borrow $125 million to undertake a decontamination of its plants and the replacement of some equipment that could not be cleaned as a result of the said biofilm having been created by bacteria. The temporary shutdown of this one company led to hundreds of layoffs across other direct and indirect local supporting industries as the 200,000 tourists to the plant also disappeared.

| 15 |

Lately, nearly every month the Centers for Disease Control and Prevention report similar listeria infections linked to food products, such as milk, cheese, ice cream, and pork products. Inadequate detection and control of bacteria costs billions in food production losses each year. The annual global cost of food-borne illnesses is estimated at over $110 billion and over 48 million Americans are stricken ill each year with over 23,000 deaths from antibiotic-resistant bacteria.

These human and financial tolls were due to not detecting the virulent bacterial infection early enough. QuaraSense is expected to provide cost effective, near real-time testing for bacterial outbreaks in equipment, from food processing to water and oil pipelines. Early detection of a bacterial threat will help to minimize the creation of harmful biofilms that in some cases necessitates significant rebuilds of food infrastructure systems, often the only way to get rid of the infection within the processing equipment.

Our Technology

Our planned offering is centered around three product offerings:

QuaraSenseTM: handheld bacterial detection through proprietary quorum-sensing technology

QuaraViewTM: QuaraSense data services and consultation

QuaraTestTM: QuaraSense consumable cartridges

Quara Technology is Quorum Sensing

Bacteria communicate with each other in a population-dependent manner using a variety of chemical signal molecules called autoinducers, some of these molecules are species-specific and others are more general. The process is known as quorum sensing (“QS”). QS molecules are synthesized inside bacterial cells and are exported into the bacterial surroundings, where they may accumulate in increasing concentrations. Bacteria have receptors on their outer surface that bind QS molecules. At a certain level of receptor binding a cascade of events is triggered that change bacterial gene expression patterns, followed by changes in bacterial metabolism and operational mode. QS signal molecules may regulate a diverse array of functions, including antibiotic production, virulence, biofilm formation, stress and defense responses, motility, metabolism, and activities involved in interactions with hosts. The proprietary Quara technology focuses upon the same quorum sensing cues that the bacteria themselves rely upon to shift behavior from a minor to a major threat to the host organism (people and animals).

For example, one of the most serious pathogens of marine fish and invertebrates, particularly shrimp, is the bacterium Vibrio harveyi. This bacterium uses (2S,4S)-2-methyl-2,3,3,4- tetrahydroxy-tetrahydrofuran borate (BAI-2) as its QS signal. Hence, detection of BAI-2 may be a means to detect the presence of V. harveyi in industrial shrimp aquaculture operations. Other bacteria that affect shrimp may also use BAI-2 or the related AI-2, and Quara has evidence that AI-2 can be used as an indicator to detect gram-negative bacterial pathogens generally. Quara also has evidence that this approach can be used to detect other bacterial pathogens and pathogenic yeast.

Fluorescence Resonance Energy Transfer or “FRET” Technology

FRET is a physical phenomenon that is increasingly being used in biomedical research and drug discovery. It is the distance-dependent transfer of energy from one fluorescent molecule (the donor) to another fluorescent molecule (the acceptor). The transfer of energy leads to a reduction in the donor’s fluorescence intensity and an increase in the acceptor’s emission intensity. Due to its sensitivity to distance, FRET has been used to investigate molecular interactions. Quara technology uses FRET to rapidly measure the presence and magnitude of autoinducers or messaging molecules.

Quara Innovation Technology

A former Los Alamos National Laboratory Level 6 scientist, and the rest of his Pebble Labs Inc. research team developed and validated a protein that allows the bacterial QS molecule, BAI-2, to be detected using FRET. Further work by Pebble Labs in conjunction with OptiEnz Sensors, LLC, led by our Chief Science Officer Ken Reardon Ph.D., resulted in development of a prototype hardware unit that is being used for ongoing testing purposes. This operational prototype device has demonstrated the ability to obtain quantitative measurements of BAI-2 over a wide concentration range in laboratory solutions. We have also established a method of extending the functional lifetime of the detection protein, setting the stage for a measurement device with replaceable FRET protein cartridges, or QuaraTest, our primary consumable product.

| 16 |

Strategy

Once testing of our QuaraSense product is complete, we intend to commercialize our product, initially focusing on shrimp diseases in the aquaculture market and UTIs in the human health market. This will involve:

| ● | Contracting with manufacturers to produce the device and the QuaraTest consumable products to scale. We have identified several manufacturers capable of meeting our quality standards and believe we will be able to move forward quickly into production. | |

| ● | Signing customers who have indicated an interest. | |

| ● | Hiring sales and marketing personnel. | |

| ● | Entering into licensing agreement with distributors to expand our customer outreach. |

We have given priority to preparing QuaraSense for these markets for the following reasons:

Aquaculture

| ● | The aquaculture market needs better disease diagnostics. | |

| ● | Given the large economic losses due to bacterial infection in aquaculture, we may be able to demonstrate a substantial economic benefit. | |

| ● | QuaraSense portability is a good fit for potential aquaculture customers. | |

| ● | Quara and its partners have strong relationships existing players in the aquaculture market. | |

| ● | There are few regulatory hurdles compared with human health applications. | |

| ● | The market is currently underserved. |

UTIs in the Human Health Market

| ● | They are some of the most common bacterial infections, affecting 150 million people each year worldwide. | |

| ● | There are large economic losses each year due to infections. | |

| ● | Quara has been invited to participate in a clinical study along with the University of Utah School of Medicine. |

We anticipate it will take us 9 to 12 months from funding to begin shipping QuaraSense to shrimp producers that are capable of detecting the signaling molecule that is a general indicator of many of the most common types of bacteria. We expect that further development of our technology to be able to detect additional types of bacteria specific to the broader aquaculture market as well as the veterinary, health care, food processing and home health monitoring markets.

We have established advisory relationships with key opinion leaders and researchers in the field of urology at the University of Utah Medical School for the purpose of conducting clinical research structured around QuaraSense’s potential to detect UTIs and catheter induced UTI infections in human patients. This large market has substantial unmet needs. Quara is examining time frames required to commercialize its technology for this market in either remote point-of-care or hospital applications. All applications will require approval of the U.S. FDA (or other authority such as the CE marking in the EU) following regulatory classification, regulatory risk assessment and favorable clinical outcomes. We believe that this application is an appropriate application of Quara technology that, if successful, could yield significant benefits to patients and revenues for our company.

We recently entered into an agreement with Colorado State University Research Foundation to license certain intellectual property rights that we believe will enable us to develop a viral detection device to detect specific nucleic acids in patient samples. This is a platform technology that can be used for the diagnosis of infectious virus-based diseases such as HIV/AIDS, hepatitis C, dengue, Zika and COVID-19. Commercialization of a device with this functionality will depend on a significant amount of field testing, and approval to market the product from the FDA, which is a time consuming process and is far from certain at this stage.

| 17 |

In parallel with the above efforts, we will begin work to further develop our sensing technology to address the veterinary services and animal diagnostics market as there are few significant regulatory hurdles and it is also an underserved, large and growing market.

Intellectual Property

We have purchased, for a payment of $50,000, all of the intellectual property rights of OptiEnz Sensors, LLC in a portable instrument and associated software for measuring FRET between pairs of fluorophores in the field of the detection of microbial pathogens. The instrument, software, and methods developed can be used to measure FRET between any fluorophore pair and can make simultaneous measurements of multiple fluorophore pairs. We have agreed to grant OptiEnz Sensors, LLC an exclusive perpetual license to use that intellectual property for research purposes and to pay OptiEnz Sensors, LLC a royalty payment of 5% of our net sales up to a total payment of $450,000 and thereafter a royalty payment of 1.5% of net sales. Our Chief Science Officer, Dr. Ken Reardon is a founder and principal of OptiEnz.

We have an agreement to acquire, for a payment of $500,000, which is due by September 30, 2020, all of the intellectual property rights of Pebble Labs related to the “Improved Fluorescent Resonance Energy Transfer Based Biosensor Proteins and Their Methods of Use Thereof”, U.S. Provisional Patent No. 6273,0424 filed on September 12, 2018. On September 12, 2019, the provisional patent was converted to Patent Application US 19/50813. Following payment of the purchase price for that intellectual property, as discussed in “Use of Proceeds Below,” we have agreed to grant Pebble Labs an exclusive perpetual license to use that intellectual property for research purposes and to pay Pebble Labs a royalty payment of 1.5% of our net sales derived from products resulting from the Patent Application. If we fail to raise sufficient funds to make the payment to Pebble Labs by September 30, 2020, we will need to request an extension of the payment due date, which Pebble Labs is under no obligation to grant.

On May 14, 2020, the Company licensed from the Colorado State University Research Foundation an exclusive right in all territories and for all fields to the patent rights and know-how relating to technology known as PadLock-RCA-Nuclease Protection Lateral Flow Assay for the detection of pathogen sequences at the point of care. The Company will pay an upfront fee of $5,000 and pay royalties ranging from 3% to 4% based on volume of annual net sales. The Company will be subject to minimum royalty payments beginning in 2023 of $5,000 and $10,000 beginning in 2025. The Company has also agreed to milestone payments based on net sales ranging from $10,000 to $1 million. In addition, the Company will issue common shares to Colorado State University Research Foundation upon the Company completing proof of concept work demonstrating utility in detecting SARS-CoV-2 in an amount equal to 1% of all issued and outstanding shares on a fully diluted basis calculated on a post-closing basis.

Competition

Nearly all medical bacterial assays use the approach of trying to determine whether (and at what concentration) a specific bacterial species/strain is present. There are many types of pathogenic bacteria and, since bacteria can be beneficial, harmful, or neutral, it is difficult to find a feature that differentiates pathogenic from non-pathogenic bacteria.

Traditional testing relied on culturing cells from samples of blood, urine, or saliva. Culturing cells for this purpose is slow and insensitive. New technologies based on the Polymerase Chain Reaction (“PCR”) are being developed for medical microbial tests, and some are on the market. PCR is a way to make copies of a specific part of the bacterial DNA. This requires identification of a gene or other part of the DNA that is unique to the targeted bacterium (meaning that the user needs to know what species and strain to look for). This is potentially a challenge for diseases such as UTIs that are caused by a wide range of pathogens. Furthermore, the DNA must be extracted from the cells for processing. Relatively large, complex, and expensive equipment is required to process the samples, make copies via PCR, and quantify the outcome, and the procedure typically takes several hours. False negative measurements are frequently an issue. Current PCR-based devices must be used in a laboratory setting with highly trained technicians.

| 18 |