Table of Contents

As filed with the Securities and Exchange Commission on October 1, 2020

Registration No. 333-239650

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CARVANA RECEIVABLES DEPOSITOR LLC

(Depositor with respect to the Issuing Entities Described Herein)

(Exact Name of Registrant as Specified in its Charters)

| Delaware | 83-3243432 | 333-239650 | 0001770373 | |||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Commission File Number of depositor) |

(Central Index Key Number of depositor) |

Carvana Receivables Depositor LLC

1930 West Rio Salado Parkway

Tempe, AZ 85281

(480) 719-8809

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CARVANA, LLC

(Sponsor with respect to the Issuing Entities Described Herein)

(Exact name of Sponsor as Specified in its Charter)

| Arizona | 0001576462 | |

| (State or other jurisdiction of incorporation or organization) |

(Central Index Key Number of sponsor) |

Paul Breaux, Vice President

Carvana Receivables Depositor LLC

1930 West Rio Salado Parkway

Tempe, AZ 85281

(480) 719-8809

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies To:

| Janette A. McMahan Kirkland & Ellis LLP (212) 446-4754 (Counsel to the Registrant and Sponsor) |

R.J. Carlson (Counsel to the Underwriters) |

Approximate Date of Commencement of Proposed Sale to the Public: from time to time after the effective date of this Registration Statement as determined in light of market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form SF-3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form SF-3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Unit |

Proposed Offering Price |

Amount of Registration Fee(1) | ||||

| Asset Backed Notes |

(2) | 100% | (2) | (2) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(s) of the Securities Act of 1933. |

| (2) | An unspecified amount of asset backed notes of each identified class is being registered as may from time to time be offered at unspecified prices. The Registrant is deferring payment of all of the registration fees for any such asset backed notes in accordance with Rule 456(c) and 457(s) of the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and is subject to change, completion or amendment without notice. We may not sell the Notes until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell the Notes or a solicitation of an offer to buy the Notes, nor shall there be any sale of the Notes in any state where such offer, solicitation or sale is not permitted.

Subject to Completion, dated [ ] [ ]. 20[ ]

PROSPECTUS

$[ ][(1)]

Carvana Auto Receivables Trust 20[ ]-[ ]

Issuing Entity

(CIK: )

$ Class A-1 % Asset Backed Notes

$ Class A-2[a] % Asset Backed Notes[(2)]

[$ Class A-2b % Asset Backed Notes(2)(3)]

$ Class A-3 % Asset Backed Notes

$ Class B % Asset Backed Notes

$ Class C % Asset Backed Notes

$ Class D % Asset Backed Notes

$ Class E % Asset Backed Notes

[$ Class N % Asset Backed Notes]

| [(1) | [The Issuing Entity will issue notes with an aggregate principal amount of $[ ] or an aggregate principal amount of $[ ] on the Closing Date. The Depositor will make the determination regarding the principal amount of the Notes based on, among other considerations, market conditions at the time of pricing.] [At least 5% (by initial principal amount) of each class of the Notes offered hereby will initially be retained by Carvana or one or more of its majority-owned affiliates in satisfaction of Carvana’s risk retention obligations.] [Carvana, or one of its majority-owned affiliates, will retain [the Class RR Notes/a single vertical security] in satisfaction of the risk retention requirements.] [All or a portion of the Class [ ] Notes may initially be retained by the Depositor or one or more affiliates thereof on the Closing Date.] [All or a portion of the Class [ ] Notes may initially be retained by the Depositor or one or more affiliates thereof on the Closing Date.] |

| [(2) | The allocation of the principal amount between the Class A-2a Notes and the Class A-2b Notes will be determined on the day of pricing of the Notes.] |

| [(3) | The Class A-2b Notes will accrue interest at a floating rate based on a benchmark plus a spread. The benchmark initially will be [One-Month LIBOR] but may be changed in certain circumstances.] |

[NOTE: The number of classes, principal repayment and interest accrual terms are for illustrative purposes only. In a particular transaction, there may be more or fewer classes of notes offered (including one or more or no subordinated classes), one or more or no floating rate classes, one or more classes of notes that pay principal and interest pro rata with another class, and one or more classes may be retained or offered privately.]

| Carvana Receivables Depositor LLC | Carvana, LLC | |

| Depositor (CIK: 0001770373) |

Sponsor and Administrator (CIK: 0001576462) |

The underwriters are offering the following classes of Notes pursuant to this prospectus:

| Price to Investor | Underwriting Discounts | Net Proceeds* | ||||||||||||||||||||||

| Class A-1 Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class A-2[(a)] Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| [Class A-2(b) Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class A-3 Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class B Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class C Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class D Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Class E Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| [Class N Notes |

$ | . | . | % | $ | . | . | % | $ | . | . | % | ||||||||||||

| Total |

$ | . | $ | . | $ | . | ||||||||||||||||||

| * | The net proceeds to the Depositor exclude expenses, estimated at $[ ]. |

YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS BEGINNING ON PAGE [ ] IN THIS PROSPECTUS.

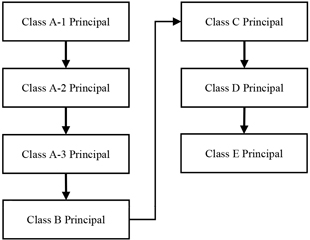

The Notes will be obligations of the Issuing Entity only and will not be obligations of or interests in Carvana, the Depositor, or any of their affiliates and are not insured or guaranteed by any government agency. The Notes are payable solely from the assets of the Issuing Entity. The primary assets of the Issuing Entity will be [indirect ownership of] a pool of fixed rate retail installment contracts used to finance the purchase of cars and light trucks. The Issuing Entity will pay interest and principal on the Notes on the [ ] day of each month, or, if [ ] is not a Business Day, the next Business Day, starting on [ ], 20[ ]. The Issuing Entity will generally pay principal sequentially to each class of Offered Notes in order of seniority (starting with the Class A-1 Notes) until each class is paid in full.

The credit enhancement for the Notes will include subordination, overcollateralization, a reserve account and excess collections on the Receivables. Delivery of the Notes, in book-entry form only, will be made through The Depository Trust Company against payments in immediately available funds on or about [ ] [ ], 20[ ].

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

[Underwriters]

The date of this prospectus is [ ] [ ], 20[ ].

Table of Contents

| ii | ||||

| 1 | ||||

| 9 | ||||

| 9 | ||||

| 13 | ||||

| 19 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 39 | ||||

| 43 | ||||

| 55 | ||||

| 56 | ||||

| 64 | ||||

| 65 | ||||

| 70 | ||||

| 74 | ||||

| 78 | ||||

| 94 | ||||

| 95 | ||||

| 98 | ||||

| 104 | ||||

| 105 | ||||

| 107 | ||||

| 108 | ||||

| 111 | ||||

| 115 | ||||

| 116 | ||||

| 117 | ||||

| 118 | ||||

| 119 | ||||

| 120 | ||||

| 121 | ||||

| 126 |

i

Table of Contents

You should rely only on the information provided in this prospectus [and any pricing supplement hereto], including the information incorporated by reference in this prospectus. We have not authorized anyone to provide you with other or different information. We are not offering the Notes in any state where the offer is not permitted.

This prospectus provides information regarding the pool of Receivables held by the Issuing Entity and the terms of the Offered Notes.

This prospectus begins with two introductory sections describing the Issuing Entity and the Offered Notes in abbreviated form:

| • | “Prospectus Summary,” which gives a brief introduction of the key features of the Offered Notes and a description of the Receivables; and |

| • | “Risk Factors,” which describes risks that apply to the Offered Notes issued by the Issuing Entity. |

This prospectus includes cross references to sections in this prospectus where you can find further related discussions. The “Table of Contents” in this prospectus identifies the pages where these sections are located.

You can find definitions of certain capitalized terms used in this prospectus in the “Glossary,” which appears at the end of this prospectus.

For all tables and charts in this prospectus, the balances and percentages may not total to 100% due to rounding.

To understand the structure of, and risks related to, the Notes, you must read carefully this prospectus in its entirety.

In this prospectus, the terms “Depositor,” “we,” “us” and “our” refer to Carvana Receivables Depositor LLC, and “Carvana” refers to Carvana, LLC, individually and in its roles as administrator and sponsor, as applicable.

TRADEMARKS AND TRADENAMES

This prospectus includes Carvana’s trademark and service mark, “Carvana,” which is protected under applicable intellectual property laws and is the property of the issuer or its subsidiaries. This prospectus also includes references to FICO scores. FICO is a is a federally registered servicemark of Fair Isaac Corporation. Solely for convenience, trademarks and trade names referred to in this prospectus supplement may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we or the Fair Isaac Corporation will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names.

FORWARD LOOKING STATEMENTS

This prospectus, including information included or incorporated by reference in this prospectus, may contain certain forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, such as statements about our future financial performance, including any underlying assumptions, are forward-looking statements.

Forward-looking statements include statements using the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of these words, or similar expressions which are intended to identify these forward-looking statements. The absence of these words does not mean that a statement is not forward-looking. All statements herein, other than statements of historical fact, including statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results.

The forward-looking statements made in this prospectus speak only as of the date stated on the cover of this prospectus. The Issuing Entity and the Depositor undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by federal securities law.

ii

Table of Contents

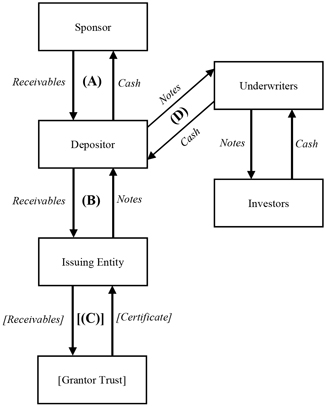

This summary describes the material terms of the notes offered by the prospectus (the “Offered Notes”) and this securitization transaction. The Offered Notes will be issued pursuant to an indenture, to be dated as of the Closing Date, among the Issuing Entity[, the Grantor Trust,] and the Indenture Trustee (the “Indenture”). This summary does not contain all of the information that may be important to you in making an investment decision. Material risks of ownership of the Notes are discussed under the heading “Risk Factors.”

THE OFFERED NOTES(1)

| Class A-1 Notes[(6)] |

Class A-2[a] Notes[(9)] |

[Class A-2b Notes |

Class A-3 Notes |

Class B Notes |

Class C Notes |

Class D Notes |

Class E Notes |

[Class N Notes | ||||||||||

| Principal Amount[(2)] |

$[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | |||||||||

| Offered Amount(3) |

$[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | $[ ] | |||||||||

| Interest Rate |

[ ]% | [ ]% | [LIBOR]+ %(10) |

[ ]% | [ ]% | [ ]% | [ ]% | [ ]% | [ ]% | |||||||||

| Interest Accrual(4) |

[Actual/ 360] |

30/360 | [Actual/ 360] |

30/360 | 30/360 | 30/360 | 30/360 | 30/360 | 30/360 | |||||||||

| Payment Frequency(5) |

[Monthly] | [Monthly] | [Monthly] | [Monthly] | [Monthly] | [Monthly] | [Monthly] | [Monthly] | [Monthly] | |||||||||

| Expected Final Distribution Date (Distribution Date In) (7) |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] | |||||||||

| Final Scheduled Distribution Date (Distribution Date In) |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] |

[ ] 20[ ] | |||||||||

| Minimum Denominations (Integral Multiples) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) |

$[ ] ($[ ]) | |||||||||

| Subordinated Classes |

A-2, A-3,(8) B, C, D, |

A-3, (8) B, C, D, E, [N] (7) |

A-3, (8) B, C, D, E, [N] (7) |

B, C, D, E, [N] (8) |

C, D, E[, N] | D, E[, N] | E[, N] | [N] | None | |||||||||

| Pari Passu Classes |

A-2, A-3(8) | A-1(8), [A-2b,] A-3 |

A-1(8), [A-2a,] A-3 |

A-1(8), A-2 | None | None | None | None | None | |||||||||

| Price to Investors |

% | % | %] | % | % | % | % | % | %] |

| (1) | The Issuing Entity will also issue [the Class XS Notes (collectively with the Offered Notes, the “Notes”) pursuant to the Indenture and] certificates that evidence beneficial interests in the Issuing Entity (the “Certificates” and, together with the Notes, the “Securities”), which are not being offered by this prospectus. [All or a portion of the Class [ ] Notes may be retained by the Depositor or one or more of its affiliates on the Closing Date.] [See “Description of the Notes—The Class XS Notes.”] |

| [(2) | The Notes will have an aggregate principal amount of $[ ] or an aggregate principal amount of $[ ] on the Closing Date. If the aggregate principal amount of the Notes is $[ ], the Notes will be issued in the following applicable initial principal amounts: $[ ] of Class A-1 Notes, $[ ] of Class A-2 Notes, $[ ] of Class A-3 Notes, $[ ] of Class B Notes, $[ ] of Class C Notes, $[ ] of Class D Notes, [and] $[ ] of Class E Notes[, and $[ ] of Class N Notes]. The Depositor will make the determination regarding the initial principal amount of the Notes based on, among other considerations, market conditions at the time of pricing. See “Risk Factors—Risks Related to the Notes and the Issuing Entity—Risks associated with unknown aggregate principal amount of the Notes prior to pricing.” Unless stated otherwise, the discussions in the prospectus assume the aggregate principal amount of Notes issued to be $[ ].] |

| (3) | [At least 5% (by principal amount) of each class of the Notes will be retained by Carvana or one or more if its majority-owned affiliates in satisfaction of Carvana’s risk retention obligations described under “Credit Risk Retention.”][Carvana will retain [the Class RR Notes/a single vertical security] in satisfaction of the risk retention requirements.] |

| (4) | Interest will accrue on the Notes from and including the Closing Date to but excluding the first Distribution Date and for each period thereafter, as set forth in the table above. See “Description of the Notes—Interest Payments.” |

| (5) | The Issuing Entity will pay interest and principal on the Notes on the [ ] day of each month, or, if such day is not a Business Day (each, a “Distribution Date”), the next Business Day, starting in [ ], 20[ ]. [The Issuing Entity will not pay principal on the Notes on any Distribution Date related to the Revolving Period.] See “Description of the Notes—Interest Payments,” “Description of the Notes—Payments of Principal,” “Distribution Date Payments,” and “Distribution Date Payments—Distribution Date Payments After Acceleration of the Notes.” |

| [(6) | The Class A-1 Notes will be structured to be “eligible securities” for purchase by money market funds under Rule 2a-7 under the Investment Company Act. See “Money Market Investments.”] |

| (7) | The Expected Final Distribution Date of the Offered Notes to be based upon certain prepayment assumptions based on [ ]% ABS [and that the Servicer (or its designee) exercises its cleanup call option]. See “Prepayment and Yield Considerations.” |

| (8) | Payments of interest are made ratably to the Class A Notes. If the Notes are accelerated following the occurrence of an Event of Default under the Indenture, principal payments will be made ratably to the Class A-2 Notes, and the Class A-3 Notes after the Class A-1 Notes have been paid in full. |

| [(9) | The allocation of the principal amount between the Class A-2a Notes and the Class A-2b Notes will be determined on the day of pricing of the Notes.] [The Depositor expects that the principal amount of the Class A-2b Notes will not exceed $[ ] [if the aggregate principal amount of the Offered Notes is $[ ] on the Closing Date, and $[ ], if the aggregate principal amount of the Offered Notes is $[ ]]. |

| [(10) | If the sum of One-Month LIBOR plus the applicable spread is less than 0.00% for any interest accrual period, then the interest rate for the Class A-2b Notes for such interest accrual period will be deemed to be zero. See “Description of the Notes—Interest Payments” and “Distribution Date Payments.”] [The Issuing Entity will enter into a corresponding interest rate [swap] [cap] with respect to each class or tranche of floating rate notes. See “Credit Enhancement—Interest Rate [Swaps][Caps].”] |

[NOTE: The number of classes, principal repayment and interest accrual terms are for illustrative purposes only. In a particular transaction, there may be more or fewer classes of notes offered (including one or more or no subordinated classes), one or more or no floating rate classes, one or more classes of notes that pay principal and interest pro rata with another class, and one or more classes may be retained or offered privately.]

1

Table of Contents

2

Table of Contents

3

Table of Contents

4

Table of Contents

5

Table of Contents

6

Table of Contents

7

Table of Contents

8

Table of Contents

Investment in the Offered Notes involves certain risks. In addition to the other information contained in this prospectus, prospective investors should carefully consider the following risk factors before purchasing the Offered Notes. Although the following risks are generally described separately, prospective investors in the Offered Notes should consider the potential effects of the occurrence of multiple risks simultaneously. Where more than one significant risk is present, the risk of loss may be significantly increased. The order in which these considerations are presented is not intended to represent the magnitude of risks discussed.

[Adverse events arising from the global Coronavirus outbreak could result in delays in payments or losses on your Securities

An outbreak of a new strain of coronavirus (“COVID-19”) has spread throughout the world, including to the United States. The outbreak has been declared to be a public health emergency of international concern by the World Health Organization, and the president of the United States has made a declaration under the Robert T. Stafford Disaster Relief and Emergency Assistance Act. A significant number of countries and the majority of U.S. state governments have also made emergency declarations related to the outbreak and have attempted to slow community spread of COVID-19 by providing social distancing guidelines, issuing stay-at-home orders and mandating the closure of certain non-essential businesses. The outbreak has caused substantial disruption and volatility in the credit markets which may continue for an extended period or indefinitely, may lead to a recession or depression in the United States and globally and may adversely affect the performance and value of the Securities. These circumstances may also have an adverse effect on the ability of obligors to make timely payments and market for used vehicles which may increase the losses related to defaulted Receivables and result in losses on the Securities.

It is unclear how many obligors have been and will continue to be adversely affected by the outbreak and related efforts by the government to slow the spread of COVID-19 throughout the nation. Certain governmental authorities, including federal, state or local governments, could enact, and in some cases already have enacted, laws, regulations, executive orders or other guidance that allow obligors to forgo making scheduled payments for some period of time, require modifications to the Receivables (e.g., waiving accrued interest), or preclude creditors from exercising certain rights or taking certain actions with respect to collateral, including repossession or liquidation of the financed vehicles. Additionally, the continued spread of COVID-19 may ultimately result in staffing problems in various industries and businesses as staff members become ill or seek to avoid becoming ill. Many businesses are reviewing and adjusting their business continuity plans to change how and from where their staff members work in light of the outbreak. Consequently, the ability of Carvana, the Servicer, or other transaction parties to perform their respective obligations under the Transaction Documents could be diminished by regulatory actions related to the outbreak and disruptions in the economy and the financial markets.

Furthermore, as discussed under “The Transaction Documents— The Servicing Agreement and Servicing of the Receivables—Duties of the Servicer,” to the extent the COVID-19 outbreak or an economic downturn results in increased financial hardship for obligors, the Servicer has, and may continue to implement, a range of actions with respect to affected obligors and the related Receivables to extend or modify the payment schedule consistent with the Servicer’s customary servicing practices. The Servicer has experienced a sharp increase in requests for extensions and modifications related to COVID-19 nationwide, and this increase may continue.

Because a pandemic such as COVID-19 has not occurred in recent years, historical loss experience is likely to not accurately predict the performance of the Receivables. All of the foregoing could have a negative effect on the performance of the Receivables and, as a result, you may experience delays in payments or losses on your Securities.

To the extent the COVID-19 pandemic adversely affects the United States economy (including the ability of obligors to make timely payments on the Receivables), financial markets, or the business or operations of Carvana or the Servicer, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section, such as those related to the ability of obligors to make timely payments on the Receivables, used vehicle values, the risks of geographic concentration of the obligors, and the performance, market value, credit ratings and secondary market liquidity of your Securities.]

RISKS RELATED TO THE RECEIVABLES

[The characteristics of the Receivables in the Final Pool may differ from the characteristics of the Receivables in the Initial Pool

This prospectus describes only the characteristics of the Initial Pool. The Receivables purchased by the Issuing Entity during the [Revolving Period][Funding Period] may have characteristics that differ from the Receivables in the Initial Pool. [See “The Receivables— Criteria Applicable to the Selection of Additional Receivables During the [Funding Period] [Revolving Period]” and “Risk Factors—Risks Related to the Transaction Parties—The Servicer has discretion over the servicing the Receivables and selling Charged-Off Receivables and the manner in which the Servicer applies that discretion may impact the amount and timing of funds available to pay principal and interest on the Notes.”]

There can be no assurance that the characteristics of the Final Pool will not materially differ from the characteristics of the Initial Pool disclosed in this prospectus, including differences in credit quality and seasoning, the distribution by annual percentage rate, and geographic distribution. See “The Receivables.” As the weighted average life of the Notes will be influenced by the rate at which the principal balances of the Receivables are paid, some of these variations will affect the weighted average life of the Notes. See “Prepayment and Yield Considerations.”]

9

Table of Contents

Receivables with non-prime obligors have higher default rates than Receivables with prime obligors, which may affect the performance of the Receivables

[Some of] [Substantially all of] the Receivables are obligations of non-prime obligors who do not qualify for conventional motor vehicle financing as a result of, among other things, a lack of or adverse credit history, low income levels or the inability to provide adequate down payments. While Carvana’s underwriting criteria are designed to establish that the obligor would be a reasonable credit risk, the Receivables will nonetheless experience higher default rates than a portfolio of Receivables with all prime obligors. In the event of a default, repossession of the related financed vehicle is the most likely alternative for recovery. As a result, losses on Charged-Off Receivables are likely because net liquidation proceeds from the sale of repossessed vehicles are expected to be insufficient to satisfy amounts owed by the related obligors under the Receivables in full. See “The Receivables—Certain Legal Considerations of the Receivables.” In addition, the concentration of Receivables with non-prime obligors may also have the effect of heightening many of the other risks, including those relating to general macroeconomic forces and economic downturns, described in this “Risk Factors” section. If delinquencies and losses create shortfalls, which exceed the available credit enhancement, you may experience delays in payments due to you and you could suffer a loss on your Notes. [For information regarding non-prime obligors, see “Historical Performance—Delinquencies and Net Losses—Delinquency Experience (Non-Prime Obligors)” and “Historical Performance—Delinquencies and Net Losses—Net Loss Experience (Non-Prime Obligors).”]

Carvana’s proprietary credit scoring system may not perform as expected and may fail to properly quantify the credit risks associated with Carvana’s customers, resulting in higher than anticipated delinquencies and credit losses on the Receivables

Carvana has developed, and revises from time to time, complex proprietary credit scoring models that use traditional and non-traditional variables to assess credit risk and determine credit offer parameters. There is no guarantee that Carvana’s credit scoring models will perform as intended.

If Carvana made errors in developing or validating its credit scoring models, trained or validated its models on incomplete, inaccurate, or biased data sets, or used model development or validation techniques that result in bias or instability, Carvana may fail to gauge credit risk as expected and make credit decisions that result in higher delinquencies and credit losses.

Carvana’s credit scoring models are generally developed and validated on samples of consumer data and loan performance pertaining to a distinct period of time in the past. Changes in the macroeconomy, consumer behavior, creditor reporting behavior, and third party data reporting methods between a model’s development and validation periods and between a model’s development period and when the model is used by Carvana could materially impact the relationship between inputs to Carvana’s models and expected credit outcomes, resulting in a reduction of the ability of Carvana’s credit scoring models to assess credit risk as expected.

Carvana’s credit scoring models rely heavily on data obtained from third parties, including credit bureaus. If the data Carvana obtains from third parties for use in its models is incomplete, inaccurate, biased, or not provided consistent with the methods and practices used by such third parties during the time period of the sample upon which Carvana built or validated our models, the output of Carvana’s models may be unreliable and fail to properly quantify credit risk, resulting in it making credit decisions that result in higher delinquencies and credit losses.

Information provided to Carvana by customers, credit data partners, and others may be incorrect or fraudulent, and Carvana’s Verification Process may fail to ensure that reliable information is incorporated into the extension of credit offers to Carvana’s customers, resulting in higher than anticipated delinquencies and credit losses on the Receivables

In deciding whether to extend credit to customers and the parameters of such credit offers, Carvana relies heavily on information furnished to it by customers, credit data partners, and others, and such data may be incorrect or fraudulent. Carvana has developed a Verification Process that attempts to ensure that information considered by its proprietary financing technology belongs to the customer(s) receiving a credit offer, and that such information is reasonably accurate. There is no guarantee that Carvana’s Verification Process will perform as expected, detect fraudulent or incorrect data, or otherwise achieve its goals, which may result in credit loss and delinquency rates on the Receivables being higher than anticipated.

Further, Carvana utilizes identity and fraud checks based on customer provided documents and inputs, as well as data provided by external databases to authenticate each customer’s identity. There have been instances in the past in which these checks have failed or been ineffective, and there is a risk that these checks could also fail or be ineffective in the future, which could result in significant losses related to fraud being borne by investors in the Securities. Fraudulent activity or significant increases in fraudulent activity could also lead to regulatory intervention, negatively impacting the operating results and reputation of both Carvana and the Servicer.

Economic developments may adversely affect the performance of the Receivables and the market value of your Securities

The United States has in the past experienced and in the future may experience a recession or period of economic contraction. During the economic downturn following the 2008 financial crisis, elevated unemployment, decreases in home values, and reductions in available credit led to increased delinquency and default rates on retail installment contracts. If another financial crisis or economic downturn were to occur again, [including as a result of COVID-19,] delinquencies and losses with respect to motor vehicle receivables could increase, which could result in losses on your Securities. In addition, decreased consumer demand for motor vehicles and an increase in the inventory of used motor vehicles may depress the price at which repossessed motor vehicles may be sold or delay the timing of those sales. If the default rate on the Receivables increases and the price at which the related vehicles may be sold declines, you may experience losses with respect to your Securities.

Market factors may reduce the value of used vehicles, which could result in increased losses on the Receivables

[Obligors with lower FICO scores generally are less capable of making payments on their loans than obligors with higher FICO scores and are therefore more likely to experience repossession.] Vehicles that are repossessed are typically sold at vehicle auctions. The pricing of used cars is affected by the supply and demand for those cars, which, in turn, is affected by consumer demand and tastes, recalls, economic factors (including the price of gasoline and closure of dealerships), the introduction and pricing of new car models and other factors, including legislation related to emissions and fuel efficiency. Decisions by a manufacturer with respect to new vehicle production and brands, pricing and incentives may affect used car prices, particularly those for the same or similar models. Adverse changes in these factors may depress the price at which repossessed motor vehicles may be sold or delay the timing of those sales. An increase in the supply or a decrease in the demand for used cars may negatively impact the resale value of the vehicles securing the Receivables. Decreases in the value of those vehicles may, in turn, reduce the incentive of obligors to make payments on the Receivables and decrease the proceeds realized from vehicle repossessions, which could result in losses on the Securities.

Longer term Receivables may increase the frequency and amount of losses

The frequency and amount of losses may be greater for Receivables with longer terms, because these Receivables tend to have a somewhat greater frequency of delinquencies and defaults and because the slower rate of amortization of the principal balance of a longer term Receivable may result in a longer period during which the value of the related financed vehicle is less than the remaining principal balance of such Receivable. See “The Receivables—Distribution of the Receivables by Original Term to Maturity as of the [Initial] Cutoff Date” for the percentage of Receivables with original terms of greater than [72] months as of the [Initial] Cutoff Date.

Prepayments on and repurchases of the Receivables could shorten the average life of the Notes

Obligors may prepay the Receivables in full or in part at any time. We cannot predict the rate of prepayments on the Receivables. A variety of unpredictable economic, social, and other factors influence prepayment rates. In addition, the Receivables may be prepaid as a result of defaults, from credit life, disability or physical damage insurance, or, in limited circumstances, voluntarily by Carvana. Also, Carvana may be required to repurchase Receivables in specified circumstances and the Servicer (or its designee) may purchase all remaining Receivables pursuant to the optional redemption. See “The Transaction Documents—Sale and Assignment of Receivables.”

A prepayment, repurchase, purchase or liquidation of the Receivables, including liquidation of Charged-Off Receivables, could shorten the average life of the Notes.

[The yield on the Class N Notes will be more sensitive to prepayments and defaults on the Receivables, in particular prepayments and defaults on Receivables with a higher APR. If there are increased charge-offs, your yield or return on the Class N Notes will be reduced and may be less than your investment in the Class N Notes.]

You will bear all reinvestment risk resulting from a faster or slower rate of prepayment, repurchase or extension of the Receivables held by the [grantor] trust.

10

Table of Contents

Consumer protection laws and limited enforceability of the Receivables may reduce or delay the funds available to make payments on your Securities

Federal and state consumer protection laws impose requirements upon creditors in connection with extensions of credit and collections on retail installment loans and retail installment contracts such as the Receivables. Specific statutory liabilities are imposed upon creditors who fail to comply with these regulatory provisions. In some cases, this liability could affect an assignee’s ability to enforce secured loans such as the Receivables or make an assignee of the loan or contract liable to the obligor for any violation by the originator. Any liabilities of the Issuing Entity under these laws could reduce Available Funds.

If an obligor had a claim for violation of these laws prior to the its applicable Cutoff Date that materially and adversely affected the interests of the investors, taken as a whole, in the related Receivables, Carvana must repurchase the Receivable under the circumstances set forth under “The Transaction Documents—Sale and Assignment of Receivables” unless the breach is cured. If Carvana fails to repurchase the Receivable, you might experience reductions or delays in payments on your Securities. See “Certain Regulatory Considerations—Consumer Protection Laws.”

For more information regarding consumer protection laws, see “Certain Regulatory Considerations —Consumer Protection Laws.”

Terrorist attacks and conflicts involving the United States military could result in delays in payment or losses on your Securities

Any effect that terrorist attacks, any current or future military action by or against the United States and the rising tensions in certain regions of the world may have on the performance of the Receivables is unclear, but there could be an adverse effect on general economic conditions, consumer confidence and general market liquidity. Investors should consider the possible effects on delinquency, default and prepayment experience of the Receivables. In particular, under the Servicemembers Civil Relief Act, members of the military on active duty, including reservists, who have entered into an obligation, such as a retail installment contract or retail installment loan for the purchase of a vehicle, before entering into military service may be entitled to reductions in interest rates to 6% and a stay of foreclosure and similar actions. In addition, pursuant to the laws of various states, under certain circumstances residents thereof called into active duty with the National Guard or the reserves can apply to a court to delay payments on retail installment contracts or installment loans such as the Receivables. No information can be provided as to the number of Receivables that may be affected. If the Servicer reduces the APR or Principal Balance of a Receivable in accordance with the Servicer’s procedures for complying with the Servicemembers Civil Relief Act and any similar applicable state law, the Servicer will not be required to indemnify for any such reduced amounts and the Issuing Entity will bear the risk of any shortfalls. Any resulting shortfalls in interest or principal will reduce Available Funds and you may experience delays or reductions in payments on your Notes.

For more information regarding the Servicemembers Civil Relief Act, see “Certain Regulatory Considerations—Consumer Protection Laws” and “The Receivables—Certain Legal Considerations of the Receivables—Other Matters.”

Lack of first priority liens on financed vehicles or the Receivables could make the Receivables uncollectible and reduce or delay payments on the Securities

Financing statements under the UCC will be filed reflecting the sale of the Receivables by Carvana to the Depositor, by the Depositor to the Issuing Entity, [by the Issuing Entity to the Grantor Trust,] and the pledge by the Issuing Entity of substantially all of its assets to the Indenture Trustee]. The financing statements will perfect the security interests of the Depositor, the Issuing Entity, [the Grantor Trust,] and the Indenture Trustee in the Receivables. [The security interest in the financed vehicles will be assigned also to the [Issuing Entity] [Grantor Trust]. Due to the administrative burden and expenses, however, the certificates of title to the financed vehicles will not be amended or reissued to identify the [Issuing Entity] [Grantor Trust] as the new secured party.]

If the security interests in the financed vehicles as described in “The Receivables—Certain Legal Considerations of the Receivables —Security Interests in the Financed Vehicles” are not properly perfected, the interests of the Depositor, the Issuing Entity[, Grantor Trust,] and the Indenture Trustee in the financed vehicles would be subordinate to, among others, the following:

| • | bankruptcy trustee of the obligor, |

| • | subsequent purchaser of the financed vehicle and |

| • | holder of a perfected security interest. |

The Issuing Entity[, the Grantor Trust,] and the Indenture Trustee may not be able to collect on a Charged-Off Receivable in the absence of a perfected security interest in the related financed vehicle. Even if the Issuing Entity[, the Grantor Trust,] and the Indenture Trustee were to have a perfected security interest in the financed vehicles, events could jeopardize the enforceability of that interest, such as:

| • | fraud or forgery by the vehicle owner, |

| • | negligence or fraud by the Servicer, the Collateral Custodian or another party, |

| • | mistakes by government agencies, |

| • | liens for repairs or unpaid taxes, and |

| • | confiscations of vehicles by the government. |

See “The Receivables—Certain Legal Considerations of the Receivables —Security Interests in the Financed Vehicles.”

11

Table of Contents

Carvana will be obligated to repurchase any Receivable as to which a perfected security interest in favor of the Depositor (or its affiliate) in the related financed vehicle did not exist as of the later of the date such Receivable was transferred to the Issuing Entity or, in certain circumstances, 180 days from the [Initial] Cutoff Date. [The Servicer may be obligated to provide indemnification for actual losses on a Receivable if the security interest in a financed vehicle or the related Receivable becomes impaired.] As a result of the foregoing, the Issuing Entity may not have a perfected interest in certain Receivables or its interest, although perfected, could be junior to that of another party. Either circumstance could affect the Servicer’s ability to repossess and sell the underlying financed vehicles. Therefore, you may be subject to delays in payment on your Securities and you may incur losses on your investment in the Securities.

If the Collateral Custodian does not maintain control of the Receivables evidenced by electronic contracts, the Grantor Trust may not have a perfected interest in those Receivables

As described in “Underwriting of Receivables—Electronic Contracts and Electronic Contracting,” Carvana and the Collateral Custodian have contracted with an e-vault provider, a third-party provider of electronic transaction management product and services, to process the origination and execution of, to vault and to manage contracts in electronic form through its technology system. The e-vault provider’s systems are designed to enable Carvana (and its subsequent assignees) to perfect their respective interests in the Receivables evidenced by electronic contracts by satisfying the UCC’s requirements for “control” of electronic chattel paper. Carvana (and its subsequent assignees) will obtain “control” of an electronic contract if (a) there is a “single authoritative copy” of the electronic contract that is readily distinguishable from all other copies and which identifies Carvana as the owner, (b) all other copies of the electronic contract indicate that they are not the “authoritative copy” of the electronic contract, (c) any revisions to the authoritative copy of the electronic contract are readily identifiable as either authorized or unauthorized revisions, and (d) authorized revisions of the “authoritative copy” of the electronic contract cannot be made without Carvana’s participation.

It is possible that another person could acquire an interest in an electronic contract that is superior to Carvana’s interest. This could occur if Carvana ceases to have “control” over the electronic contract that is maintained by Carvana or on behalf of Carvana and another party purchases that electronic contract (without knowledge that such purchase violates Carvana’s rights in the electronic contract) and obtains “control” over the electronic contract. Carvana also could lose control over an electronic contract if through fraud, forgery, negligence or error, or as a result of a computer virus or a failure of or weakness in the e-vault provider’s technology system, a person other than Carvana (or its assignees) were able to modify or duplicate the authoritative copy of the contract.

Although Carvana will perfect its assignment of its interest in the electronic contracts to the Depositor, the Issuing Entity[, the Grantor Trust] and the Indenture Trustee by filing financing statements, the fact that Carvana’s interest in the Receivables may not be perfected by control may affect the priority of the Issuing Entity’s interest in the Receivables, which may cause its interests in the Receivables junior to another party acquiring “control” over the electronic contract. Carvana and the Depositor will represent that Carvana has a perfected interest in the Receivables evidenced by electronic contracts by means of control and that the interest has been transferred to the Depositor and thereafter to the Issuing Entity [and the Grantor Trust].

There can be no assurances that the e-vault provider’s technology system will perform as represented to Carvana in maintaining the systems and controls required to provide assurance that Carvana (and its subsequent assignees) maintains control over an electronic contract. In that event, there may be delays in obtaining copies of the electronic contract or confirming ownership and control of the electronic contract.

There has been limited legal interpretation of the UCC provisions governing perfection of a security interests in electronic contracts by control. As a result, there is a risk that the systems employed by the e-vault provider to maintain control of the electronic contracts may not be sufficient as a matter of law to give Carvana (and accordingly, the Issuing Entity [and the Grantor Trust]) a perfected interest in the Receivables evidenced by electronic contracts.

As noted above, Carvana will file financing statements to perfect its assignment in the electronic contracts to the Depositor, the Issuing Entity [and the Grantor Trust]. The law governing the perfection of ownership and security interests in electronic contracts, electronic modifications and “control” has not been meaningfully tested in court. Accordingly, there can be no assurance that financing statements will be effective to perfect each party’s interest in any electronic contracts or electronic modifications of physical contracts.

Geographic concentrations of the Receivables may result in more risk to you and adversely affect payments on the Receivables and Notes

The Receivables related to obligors with mailing addresses in the following two states constituted the largest geographic concentrations as shown by percentage of Pool Balance as of the [Initial] Cutoff Date:

| State |

Percentage of Pool Balance as of the [Initial] Cutoff Date | |

|

|

[ ]% | |

|

|

[ ]% |

If one or more of these states experience adverse economic changes (such as those precipitated by an increase in the unemployment rate, interest rates or the rate of inflation) or extreme weather conditions or other natural events (such as hurricanes, tornadoes, floods, drought, wildfires, mudslides, earthquakes and other extreme conditions), obligors in those states may be unable to make timely payments on

12

Table of Contents

their Receivables and you may experience payment delays on your Notes, acceleration of payments on the Notes resulting from prepayments using insurance proceeds or losses on your investment. We cannot predict, for any state or region, whether adverse economic changes or other adverse events will occur or to what extent those events would affect the Receivables or repayment of your Notes.

[To be inserted if applicable — For any state or other geographic region where 10% or more of the Receivables are or will be located, description of any economic or other factors specific to such state or region that may materially impact the pool assets or pool asset cash flows.]

RISKS RELATED TO THE NOTES AND THE ISSUING ENTITY

Only the assets of the Issuing Entity are available to pay the Offered Notes

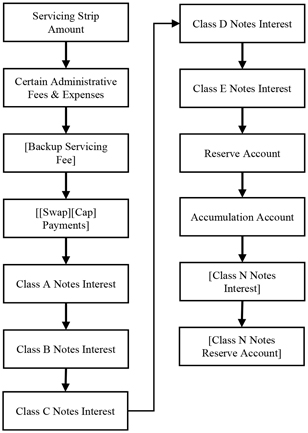

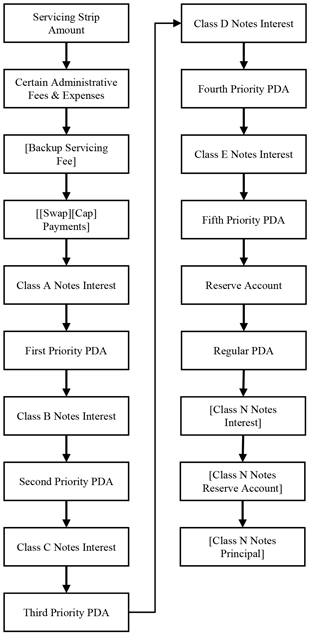

The Notes represent indebtedness of the Issuing Entity and will not be insured or guaranteed by Carvana, the Depositor, [the Grantor Trust,] the Servicer, [the Backup Servicer,] the Indenture Trustee, the Owner Trustee, [the Grantor Trust Trustee,] the Collateral Custodian, the Asset Representations Reviewer, any of their respective affiliates, or any other person or entity other than the Issuing Entity. The Issuing Entity’s ability to make principal and interest payments on the Offered Notes [(other than the Class N Notes)] will depend on the amount of collections on the Receivables and, if and to the extent available, any credit or cash flow enhancement for the Issuing Entity[, including amounts, if any, in the Negative Carry Account up to the Negative Carry Amount, net amounts received by the Issuing Entity under the interest rate [swaps] [caps]] and the amounts available in the Reserve Account]. Therefore, you must rely solely on the assets of the Issuing Entity for repayment of the Offered Notes. [The Issuing Entity’s ability to make principal and interest payments on the Class N Notes will depend on the amount of collections on the Receivables and on the amount on deposit in the Class N Reserve Account.]

If there are decreased collections, increased defaults, [lower [net] amounts received by the Issuing Entity under the interest rate [swap] [cap],] or insufficient funds in the Reserve Account [or the Class N Reserve Account, as applicable,] you may experience delays or reductions in payments on the Offered Notes, may not receive back your full principal investment or all interest due to you and may suffer losses on the Offered Notes.

[A lack of availability of additional Receivables during the [Revolving Period] [Funding Period] could shorten the average life of the Notes]

[During the Revolving Period, the Issuing Entity will not make payments of principal on the Notes. Instead, the Issuing Entity will purchase Receivables from Carvana through the Depositor.] [During the Funding Period, the Issuing Entity will purchase Receivables from Carvana through the Depositor.] The purchase of Receivables will lengthen the average life of the Notes compared to a transaction without a [Revolving Period] [Funding Period]. Nevertheless, [an unexpectedly high rate of collections on the Receivables during the Revolving Period,] a significant decline in the number of Receivables available and eligible for purchase could affect the amount of additional Receivables that the Issuing Entity is able to purchase. If the Issuing Entity is unable to reinvest the amounts available in the [Accumulation Account] [Pre-Funding Account] by the end of the [Revolving Period][Funding Period], then the average life of the Notes will shorten.

[Amounts allocable to principal payments on the Notes that are not used to purchase Receivables during the Revolving Period will be deposited into the Accumulation Account. Among other early amortization events, it will be an early amortization event if for [ ] consecutive Distribution Dates, the amount in the Accumulation Account is less than the excess of the Aggregate Note Principal Amount plus the Overcollateralization Target Amount over the Pool Balance. See “Description of the Notes—The Revolving Period.” If an early amortization event happens, the Revolving Period will terminate and the Amortization Period will commence, shortening the average life of the Notes.]

A variety of unpredictable economic and other factors may influence the availability of additional Receivables. You will bear all reinvestment risk resulting from a longer or shorter than anticipated average life of the Notes.]

Lack of liquidity in the secondary market, volatility, and financial market disruptions may adversely affect the market value of the Offered Notes and your ability to resell the Offered Notes

13

Table of Contents

The Offered Notes will not be listed on any securities exchange. Therefore, in order to resell the Offered Notes, you will need to find a willing buyer. The underwriters of the Offered Notes may participate in making a secondary market in the Offered Notes but are under no obligation to do so. We cannot assure you that a secondary market will develop or, if it does develop, that it will continue or be sufficiently liquid to permit the resale of the Offered Notes. The secondary market for asset-backed securities generally has experienced, and may continue to experience, reduced liquidity. Any period of illiquidity may adversely affect the market value of the Offered Notes and, in some circumstances, you may not be able to resell the Offered Notes when you want to do so. Illiquidity can have a severe adverse effect on the prices of securities that are especially sensitive to prepayment, credit or interest rate risk on the underlying assets, such as the Receivables underlying the Notes and consequently the Notes themselves. As a result, you may be unable to obtain the price that you wish to receive for the Offered Notes or you may suffer a loss on your investment. Even if a sufficiently liquid secondary market develops, the market values of the Offered Notes are likely to fluctuate from time to time. These fluctuations may be significant and could result in significant losses on the Offered Notes.

Additionally, events in the global financial markets, including the failure, acquisition or government seizure of major financial institutions, the establishment of government bailout programs for financial institutions, problems related to financial assets, the de-valuation of various assets in secondary markets, the forced sale of asset-backed and other securities as a result of the de-leveraging of structured investment vehicles, hedge funds, financial institutions and other entities, the lowering of ratings on certain asset-backed securities and the exit of the United Kingdom (the “UK”) from the European Union (“EU”) (and the potential exit of any other country from the EU) have caused, and could in the future cause, a significant reduction in liquidity in the secondary market for asset-backed securities. Such market declines or disruptions could adversely affect the liquidity of, and market for, the Offered Notes independent of the performance of the Receivables. A period of illiquidity following market declines or disruptions may adversely affect both the market value of the Offered Notes and your ability to resell the Offered Notes.

Retained Notes may reduce the liquidity of your notes and subsequent sales by the Depositor may adversely affect their value

Some or all of the Notes may initially be retained by the Depositor, and, in any event, a portion of each class of Offered Notes will be retained by Carvana or one or more of its majority-owned affiliates in satisfaction of Carvana’s risk retention obligations. A significant reduction in liquidity in the secondary market for any classes of such retained Notes may result if the Depositor retains any class or classes of such Notes. In addition, if any retained Notes are subsequently sold by the Depositor, the demand and the market price of the Notes already in the market could be adversely affected.

The Overcollateralization Target Amount may not be reached or maintained

The amount of overcollateralization is expected to increase over time to the Overcollateralization Target Amount as excess collections are applied to make principal payments on the Notes (other than the Class XS Notes) in an amount greater than the decrease in the Pool Balance. There can be no assurance, however, that the Overcollateralization Target Amount will be reached or maintained or that the Receivables will generate sufficient collections to pay the Notes in full.

See “Credit Enhancement—Overcollateralization” for a further discussion of overcollateralization.

The amount on deposit in the Reserve Account [and the Class N Reserve Account] may not be sufficient to assure payment of the Notes

The amount on deposit in the Reserve Account will be used to fund the payment of the Servicing Strip Amount, interest payments on the Notes, certain expenses of various service providers to the Issuing Entity, and certain distributions of principal on the Notes on each Distribution Date if collections on the Receivables, including amounts recovered in connection with the repossession and sale of financed vehicles that secure Charged-Off Receivables, are not sufficient to make that payment. [The amount on deposit in the Class N Reserve Account will be used to fund certain distributions on the Class N Notes if collection on the Receivables, including amounts recovered in connection with the repossession and sale of financed vehicles that secure Charged-Off Receivables, are not sufficient to make that payment.] There can be no assurance that the amount on deposit in the Reserve Account [and the Class N Reserve Account] will be sufficient on any Distribution Date to assure payment on the Notes. If the Receivables experience higher losses than were projected in determining the amount required to be on deposit in the Reserve Account, the amount on deposit in the Reserve Account [and the Class N Reserve Account] may be insufficient to cover any shortfall in collections. If collections on the Receivables and any credit or cash flow enhancement, including the amount on deposit in the Reserve Account [and the Class N Reserve Account], are not sufficient on any Distribution Date to pay in full interest on the Notes, certain expenses, and certain distributions of principal on the Notes, you may experience payment delays with respect to your Notes. If the amount of that insufficiency is not offset by excess collections on the Receivables on subsequent Distribution Dates, you may experience losses with respect to your Notes.

See “Credit Enhancement—Reserve Account” and [“Credit Enhancement—Class N Reserve Account”] for a further discussion of the Reserve Account [and the Class N Reserve Account].

You may receive an early return of your investment or incur a shortfall in the return of your investment following an Event of Default under the Indenture

If an Event of Default occurs under the Indenture, the Requisite Noteholders may declare the accrued interest and outstanding principal immediately due and payable. In that event, the Indenture Trustee may be directed to sell the Receivables and assets of the Issuing Entity and apply the proceeds to repay the Notes. The manner of sale will affect the amount of proceeds received and available for distribution.

14

Table of Contents

The liquidation and distribution of the Issuing Entity’s assets may result in an early return of principal to investors. You may not be able to reinvest the principal repaid to you for a rate of return or maturity date that is as favorable as those on your Notes. Also, the proceeds from sale of the Issuing Entity assets may not be sufficient to fully pay amounts owed on the Notes. Those circumstances may result in losses to certain investors. As long as a more senior class of Notes is outstanding, no holder of any subordinated class of Notes will be able to direct the Indenture Trustee’s actions and directions.

Some Notes have greater risk because they are subordinate to other classes of Notes

The Notes with a lower alphabetical designation are subordinated with respect to interest and principal payments to the Notes with a higher alphabetical designation. The [Class E Notes are subordinated to the Class A Notes, the Class B Notes, the Class C Notes and the Class D Notes, the] Class D Notes are subordinated to the Class A Notes, the Class B Notes and the Class C Notes, the Class C Notes are subordinated to the Class A Notes and the Class B Notes, the Class B Notes are subordinated to the Class A Notes. The Class A-2 Notes are subordinated with respect to principal payments to the Class A-1 Notes. The Class A-3 Notes are subordinated with respect to principal payments to the Class A-1 Notes and the Class A-2 Notes and the Class A-2 Notes are subordinated with respect to principal payments to the Class A-1 Notes. If the Notes have been accelerated following the occurrence of an Event of Default under the Indenture, the priority of interest and principal distributions will change. The subordination arrangements could result in delays or reductions in interest or principal payments on classes of Notes with lower alphabetical designations or, in the case of the Class A Notes in certain circumstances, higher numerical designations.

See “Description of the Notes—Interest Payments,” “Description of the Notes—Payments of Principal,” “Distribution Date Payments” and “Distribution Date Payments—Distribution Date Payments After Acceleration of the Notes” for a further discussion of interest and principal payments.

You may suffer losses because you have limited control over actions of the Issuing Entity and conflicts between classes of Notes may occur

If an Event of Default under the Indenture has occurred, the Indenture Trustee will, at the direction of the Requisite Noteholders, take one or more of the actions specified in the Indenture relating to the property of the Issuing Entity. In addition, the Indenture Trustee may, and at the direction of the Requisite Noteholders will, have the right to terminate the Servicer and the Requisite Noteholders may waive any Servicer Termination Event. The Requisite Noteholders constitute a majority of the Controlling Class, and the interests of the Controlling Class may differ from the interests of the other classes of Notes. The Controlling Class will not be required to consider the effect of its actions on the holders of the other classes of Notes.

See “The Transaction Documents—The Servicing Agreement and Servicing of the Receivables—Termination of the Servicer,” “The Transaction Documents—The Servicing Agreement and Servicing of the Receivables—Waiver of Servicer Termination Events” and “The Transaction Documents— Indenture—Events of Default” for a further discussion of the rights of the Noteholders with respect to events of servicing termination and Events of Default.

[Risks associated with unknown aggregate initial principal amount of the Notes prior to pricing

Whether the Issuing Entity will issue Notes with an aggregate initial principal amount of $[ ] or $[ ] on the Closing Date is not expected to be known until the day of pricing. The Depositor will make the determination regarding the aggregate initial principal amount of the Notes based on, among other considerations, market conditions at the time of pricing. The size of a class of Notes may affect liquidity of that class, with smaller classes being less liquid than a larger class may be. In addition, if your class of Notes is larger than you expected, then you will hold a smaller percentage of that class of Notes and the voting power of your Notes will be diluted.]

[Risks associated with unknown allocation between any Class [ ][a] Notes and any Class [ ][b] Notes

The allocation of the principal amount between any Class [ ][a] Notes and any Class [ ][b] Notes may not be determined until the day of pricing. Therefore, investors should not expect disclosure of this allocation prior to entering into commitments to purchase these classes of Notes.

[The higher the initial principal amount of the floating rate Class [ ][b] Notes, the greater the Issuing Entity’s exposure will be to volatility in floating rates. See “Risk Factors—The Issuing Entity will not enter into any interest rate swaps and you may suffer losses on your Notes if interest rates rise.” Moreover, a reduction in liquidity in the secondary market for any Class [ ][a] Notes or Class [ ][b] Notes may result if the Class [ ][a] Notes or Class [ ][b] Notes, if any, have a small principal amount compared to the Class [ ][b] Notes or Class [ ][a] Notes, respectively.]]

[Risks associated with unknown allocation between Class [A-2] Notes and Class [A-3] Notes

The allocation of the principal amount of the Notes between the Class [A-2] Notes and the Class [A-3] Notes may not be known until the day of pricing and may result in any of a number of possible allocation scenarios. Nevertheless, the aggregate principal amount of the Class [A-2] Notes and Class [A-3] Notes will equal $[ ]. Because the aggregate principal amount of Class [A-2] Notes and Class [A-3] Notes is predetermined, the allocation between the Class [A-2] Notes and the Class [A-3] Notes may result in one of such classes being issued in only a very small principal amount, which may reduce the liquidity of such class of Notes.]

[You may experience reduced returns on your Notes resulting from distribution of amounts in the [Pre-Funding Account][Accumulation Account].

15

Table of Contents

[The Issuing Entity has a [Pre-Funding Account] [Accumulation Account]. The Issuing Entity will purchase additional Receivables from Carvana through the Depositor with funds on deposit in the [Pre-Funding Account][Accumulation Account].] On the Distribution Date immediately following the end of the [Funding Period] [Revolving Period], the Issuing Entity will make a prepayment of principal on the Notes with any amounts remaining in the [Pre-Funding Account] [Accumulation Account]. This prepayment of principal could have the effect of shortening the weighted average life of your Notes. The inability of the Issuing Entity to obtain eligible Receivables during the [Funding Period] [Revolving Period] will increase the likelihood of a prepayment of principal. In addition, you will bear the risk that you may be unable to reinvest any principal prepayment at yields at least equal to the yield on the Notes.]

[The Issuing Entity will not enter into any interest rate swaps and you may suffer losses on your Notes if interest rates rise

The Receivables bear interest at a fixed rate while the floating rate notes bear interest at a floating rate based on [One-Month LIBOR] plus an applicable spread, if any. If floating rate notes are issued, the Issuing Entity will not enter into any interest rate swaps or other derivative transactions in connection with the issuance of the Notes.

The Issuing Entity will make payments on the floating rate notes out of Available Funds—not solely from funds that are dedicated to the floating rate notes. Therefore, an increase in interest rates would reduce the amounts available for distribution on all Notes, not just the holders of the floating rate note. If the Issuing Entity does not have sufficient funds to make payments on the Notes, you may experience delays or reductions in the interest and principal payments on your Notes.]

[Uncertainty about the future of [LIBOR] and its potential discontinuance may have an adverse impact on your floating rate notes

The interest rates to be borne by the floating rate notes are based on a spread over [One-Month] LIBOR. The London Interbank Offered Rate (“LIBOR”) serves as a global benchmark for home mortgages and student loans, and is what various issuers pay to borrow money.

Regulators and law-enforcement agencies in a number of different jurisdictions have conducted and continue to conduct civil and criminal investigations into potential manipulation or attempted manipulation of LIBOR submissions to the British Bankers’ Association. The British Bankers’ Association was replaced by ICE Benchmark Administration Limited as LIBOR administrator as of February 1, 2014, and additional reforms to LIBOR, and related submission and calculation procedures, are anticipated. Investors in the floating rate notes should be aware that the administrator of LIBOR will not have any involvement in the administration of the Issuing Entity or the floating rate notes and may take actions in respect of LIBOR without regard to the effect of such actions on the floating rate notes. Any changes to LIBOR could affect the level and volatility of the published [One-Month] LIBOR and any uncertainty in the value of LIBOR or the development of a widespread market view that LIBOR has been manipulated, or any uncertainty in the prominence of LIBOR as a benchmark interest rate due to the recent regulatory reform may adversely affect the liquidity and market value of the floating rate notes in the secondary market.

No assurance can be provided as to which entity or entities will assume responsibility for setting the applicable rates in the future. In addition, no assurance can be provided that LIBOR accurately represents the offered rate applicable to loans in U.S. dollars for a [one-month] period between leading European banks or that LIBOR’s prominence as a benchmark interest rate will be preserved. Further, the chief executive of the Financial Conduct Authority of the United Kingdom (the “FCA”), in a speech on July 27, 2017, indicated that the FCA intends to phase out LIBOR by the end of 2021, and after such time will no longer seek to compel panel banks to provide LIBOR submissions. No prediction can be made as to future levels of [One-Month] LIBOR or as to the timing of any changes thereto the effect of the FCA’s recent announcement, or whether banks will continue to provide LIBOR submissions to the ICE Benchmark Administration, each of which will directly affect the yield of the floating rate notes.

No prediction can be made as to future levels of [One-Month] LIBOR or as to the timing of any changes thereto, each of which will directly affect the yield of the floating rate notes and could impact the amount of funds available to make payments on other classes of the Notes.

If [One-Month] LIBOR is unavailable at any time after the Closing Date, the rate of interest on the floating rate notes will be determined using the alternative methods described under the heading “Description of the Notes—Interest Payments.” These alternative methods may (A) result in lower interest payments than would have been made if LIBOR were available in its current form, (B) be subject to factors that make LIBOR impossible or impracticable to determine, and (C) result in a rate of interest on the floating rate notes for a determination date that is the same as on the preceding determination date, and such rate could remain the rate of interest on the floating rate notes for the remaining life of the floating rate notes.

[Further, following the occurrence of a Benchmark Transition Event and its related Benchmark Replacement Date (as described below under “Description of the Notes—Interest Payments”), [One-Month] LIBOR will be replaced as the benchmark for the floating rate notes. The Benchmark Transition Events generally include the making of public statements or publication of information by the administrator of the benchmark, its regulatory supervisor or certain other governmental authorities that the benchmark will no longer be provided or is no longer representative of the underlying market or economic reality. We cannot provide any assurances that these events will be sufficient to trigger a change in the benchmark at all times when the then-current benchmark is no longer representative of market interest rates, or that these events will align with similar events in the market generally or in other parts of the financial markets, such as the derivatives market.]

16

Table of Contents

[As described under “Description of the Notes—Interest Payments,” the benchmark replacement will depend on the availability of various alternative benchmarks, the first of which is Term SOFR, the second of which is Compounded SOFR and the last two of which are not currently specified. The Secured Overnight Financing Rate (“SOFR”), was selected by the Alternative Reference Rates Committee (“ARRC”) of the Federal Reserve Bank of New York (“FRBNY”) as the replacement for [One-Month] LIBOR. However, because SOFR is a secured, risk-free rate, while LIBOR is an unsecured rate reflecting counterparty risk, SOFR will not be representative of [One-Month] LIBOR. The FRBNY started publishing SOFR in April 2018. The FRBNY has also started publishing historical indicative SOFR dating back to 2014, although such historical indicative data inherently involves assumptions, estimates and approximations. Since the initial publication of SOFR, daily changes in SOFR have, on occasion, been more volatile than daily changes in comparable benchmark or market rates, and SOFR over the term of the floating rate notes may bear little or no relation to the historical actual or historical indicative data. Moreover, [One-Month] LIBOR is a forward-looking term rate. Term SOFR, which is expected to be a similar forward-looking term rate that will be based on SOFR, is the first alternative among the benchmark replacements, but is currently being developed under the sponsorship of the FRBNY, and we cannot provide any assurances that the development of Term SOFR will be completed. If Term SOFR is not available as of the Benchmark Replacement Date, the next available benchmark replacement is Compounded SOFR. Compounded SOFR is a backward-looking rate generally calculated using actual rates during the interest accrual period, and may be even less representative of [One-Month] LIBOR. Finally, if a benchmark replacement other than Term SOFR is chosen because Term SOFR is not initially available, Term SOFR will become the benchmark replacement if it later becomes available, which could lead to further volatility in the applicable interest rate on the floating rate notes. In order to compensate for these differences in the benchmark, a benchmark replacement adjustment will be included in any benchmark replacement.]

However, we cannot provide any assurances that any benchmark replacement adjustment will be sufficient to produce the economic equivalent of [One-Month] LIBOR, or any other then-current benchmark, either at the Benchmark Replacement Date or over the life of the floating rate notes. As a result of each of the foregoing factors, we cannot provide any assurances that the characteristics of any benchmark replacement will be similar to [One-Month] LIBOR, or any other then-current benchmark that it is replacing, or that any benchmark replacement will produce the economic equivalent of the then-current benchmark that it is replacing.