Exhibit 99.2

UpHealth

Reshaping Healthcare

May 2021

Current SPAC Ticker: GIX Future NYSE Ticker: UPH

Disclaimer

This presentation (this

“Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination among UpHealth Holdings, Inc.

(“UpHealth”), Cloudbreak Health, LLC (“Cloudbreak” and, together with UpHealth, each a “Company” and collectively, the “Companies”) and GigCapital2 Inc. (“GigCapital2”) and related transactions (the

“Proposed Business Combination”) and for no other purpose.

No representations or warranties, express or implied are given in, or in respect of, this

Presentation. To the fullest extent permitted by law in no circumstances will GigCapital2, UpHealth, Cloudbreak or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or

agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in

relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes.

None of GigCapital2, UpHealth or Cloudbreak has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not

purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of UpHealth, Cloudbreak or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of

UpHealth and Cloudbreak and of the relevance and adequacy of the information and should make such other investigations as they deem necessary.

Forward Looking

Statements

Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions

under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and

similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial

and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of UpHealth’s, Cloudbreak’s and

GigCapital2’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of

UpHealth, Cloudbreak and GigCapital2. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the

parties to successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the

combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of GigCapital2, UpHealth or Cloudbreak is not obtained; failure to realize the anticipated benefits of the Proposed Business

Combination; risks relating to the uncertainty of the projected financial information with respect to UpHealth and Cloudbreak; risks related to the rollout of each of UpHealth’s and Cloudbreak’s business and the timing of expected business

milestones; the effects of competition on each of UpHealth’s and Cloudbreak’s future business; the amount of redemption requests made by GigCapital2’s stockholders; the ability of GigCapital2 or the combined company to issue equity or

equity-linked securities or obtain debt financing in connection with the Proposed Business Combination or in the future, and those factors discussed in GigCapital2’s final prospectus dated June 7, 2019 and Annual Report on Form 10-K for the

fiscal year ended December 31, 2019, in each case, under the heading “Risk Factors,” and other documents of GigCapital2 filed, or to be filed, with the Securities and Exchange Commission (“SEC”). If any of these risks materialize

or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that none of GigCapital2, UpHealth or Cloudbreak presently know or that

GigCapital2, UpHealth or Cloudbreak currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

GigCapital2’s,UpHealth’s and Cloudbreak’s expectations, plans or forecasts of future events and views as of the date of this Presentation. GigCapital2, UpHealth and Cloudbreak anticipate that subsequent events and developments will

cause GigCapital2’s, UpHealth’s and Cloudbreak’s assessments to change. However, while GigCapital2, UpHealth and Cloudbreak may elect to update these forward-looking statements at some point in the future, GigCapital2, UpHealth and

Cloudbreak specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing GigCapital2’s, UpHealth’s and Cloudbreak’s assessments as of any date subsequent to the date of this

Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Certain market data information in this Presentation is based on the estimates of UpHealth, Cloudbreak and GigCapital2 management. UpHealth,

Cloudbreak and GigCapital2 obtained the industry, market and competitive position data used throughout this Presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third

parties. UpHealth, Cloudbreak and GigCapital2 believe their estimates to be accurate as of the date of this Presentation. However, this information may prove to be inaccurate because of the method by which UpHealth, Cloudbreak or GigCapital2

obtained some of the data for its estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process.

Use of Projections

This Presentation contains projected financial information with respect to

UpHealth and Cloudbreak. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and

estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” above.

Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any

person that the results reflected in such forecasts will be achieved.

2

Disclaimer

Important Information And Where To Find

It

In connection with the Proposed Business Combination, GigCapital2 filed a registration statement on Form S-4, on February 8, 2021 including a proxy

statement/prospectus (the “Registration Statement”), with the Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement to be distributed to holders of GigCapital2’s common stock in

connection with GigCapital2’s solicitation of proxies for the vote by GigCapital2’s stockholders with respect to the Proposed Business Combination and other matters as described in the Registration Statement, and a prospectus relating to

the offer of the securities to be issued to each of UpHealth’s and Cloudbreak’s stockholders in connection with the Proposed Business Combination. After the Registration Statement has been declared effective, GigCapital2 will mail a

definitive proxy statement/prospectus, when available, to its stockholders and UpHealth’s and Cloudbreak’s stockholders. Investors and security holders and other interested parties are urged to read the proxy statement/prospectus, and any

amendments thereto and any other documents filed with the SEC as they become available, carefully and in their entirety because they contain important information about GigCapital2, UpHealth, Cloudbreak and the Proposed Business Combination.

Investors and security holders may obtain free copies of the preliminary proxy statement/prospectus and definitive proxy statement/prospectus (when available) and other documents filed with the SEC by GigCapital2 through the website maintained by

the SEC at http://www.sec.gov, or by directing a request to: GigCapital2, Inc., 1731 Embarcadero Road, Suite 200, Palo Alto, CA 94303.

No Offer Or Solicitation

This communication does not constitute an offer to sell or a solicitation of an offer to buy, or the solicitation of any vote or approval in any jurisdiction in

connection with a proposed potential business combination among UpHealth, Cloudbreak and GigCapital2 or any related transactions, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom,

such offer, solicitation or sale may be unlawful. Any offering of securities or solicitation of votes regarding the proposed transaction will be made only by means of a proxy statement/prospectus that complies with applicable rules and regulations

promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and Securities Exchange Act of 1934, as amended or pursuant to an exemption from the Securities Act or in a transaction not subject to the registration

requirements of the Securities Act.

Participants In The Solicitation

GigCapital2, UpHealth and Cloudbreak and their respective directors and certain of their respective executive officers and other members of management and

employees may be considered participants in the solicitation of proxies with respect to the Proposed Business Combination. Information about the directors and executive officers of GigCapital2 in its Annual Report on Form 10-K, filed with the SEC on

March 30, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct interests, by security holdings or otherwise, will be set forth in the Registration Statement and other relevant materials

to be filed with the SEC regarding the Proposed Business Combination. Stockholders, potential investors and other interested persons should read the Registration Statement carefully before making any voting or investment decisions. These documents,

when available, can be obtained free of charge from the sources indicated above.

Financial Information; Non-GAAP Financial Measures

The financial information and data contained in this Presentation are unaudited and do not conform to Regulation S-X. Accordingly, such information and data may not be included in,

may be adjusted in or may be presented differently in, the Registration Statement or any other document to be filed by GigCapital2 with the SEC. Some of the financial information and data contained in this Presentation, such as earnings before

income taxes, depreciation and amortization (“EBITDA”), have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). GigCapital2, UpHealth and Cloudbreak believe these non-GAAP

measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to UpHealth’s and Cloudbreak’s financial condition and results of operations, respectively. Each

of UpHealth’s and Cloudbreak’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. GigCapital2, UpHealth and Cloudbreak believe that the use of these non-GAAP financial measures provides an

additional tool for investors to use in evaluating projected operating results and trends in and in comparing each of UpHealth’s and Cloudbreak’s financial measures with other similar companies, many of which present similar non-GAAP

financial measures to investors. Each of UpHealth and Cloudbreak is not able to forecast net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP, and

therefore has not provided a reconciliation for forward-looking EBITDA. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of

these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in UpHealth’s and Cloudbreak’s financial statements, respectively. In addition, they are subject to inherent

limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP

financial measures in connection with GAAP results. You should review each of UpHealth’s and Cloudbreak’s audited financial statements, which will be included in the Registration Statement.

Trademarks And Intellectual Property

All trademarks, service marks, and trade names of

UpHealth, Cloudbreak or GigCapital2 or their respective affiliates used herein are trademarks, service marks, or registered trade names of UpHealth, Cloudbreak or GigCapital2, respectively, as noted herein. Any other product, company names, or logos

mentioned herein are the trademarks and/or intellectual property of their respective owners, and their use is not intended to, and does not imply, a relationship with UpHealth, Cloudbreak or GigCapital2, or an endorsement or sponsorship by or of

UpHealth, Cloudbreak or GigCapital2. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way,

that UpHealth, Cloudbreak or GigCapital2 will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

3

UpHealth’s SPAC Sponsor is a Proven Innovator with A Unique Approach

GigCapital2, Inc. (NYSE: GIX) is a $174M publicly traded Special Purpose Acquisition Company (“SPAC”) / Private-to-Public-Equity (“PPE”)

GigCapital2’s IPO was completed in June 2019

Led by a proven management team of

experienced entrepreneurs and executives Extensive public company management and board experience Complementary and overlapping networks Deep understanding and proven experience of M&A, strategy and technology

Track Record of Successful SPAC / PIPE Transactions

IPO (NYSE: GIG) IPO (NYSE: GIX) IPO (NYSE:

GIK) IPO (NASDAQ:GIGGU)

DEC ‘17 NOV’19 JUN ‘19 1ST HALF’21 MAY’20 1st HALF ‘21 FEB ‘21

Closed Targeted Close Targeted Close

(NYSE:KLR) (NYSE: UPH) (NYSE: ZEV)

Executive Chairman and Founding Managing Partner of GigCapital Global and all its entities, includingGigCapital2 Founder, COB, CEO GigOptix / GigPeak (NYSE: GIG) Serial

entrepreneur and angel investor Dr. Avi Katz with 30+ years of experience in the

Executive Chairman technology sector

Board of Directors Member and Founding Managing Partner of GigCapital Global, CEO, President of GigCapital2 Previously General Manager / Vice President at Integrated Device

Technology (IDT), which was acquired by Renesas Electronics Corp.

Dr. Raluca Dinu COO of GigPeak, led the transfer and

CEO, President & integration of the team from GigPeak into IDT BOD Member post the acquisition of GigPeak by IDT in 2017

Board of Directors Member

Previously Partner at KPMG, where he spent 27 years before retiring

in 2006 SEC reviewing partner while at KPMG

Served on the Board of Directors of Micrel Neil Miotto from 2007 to 2015 and GigPeak from2008 BOD Member until its sale

in 2017

GigCapital Team Experience

4

Presenters

Ramesh Balakrishnan

Co-Chief Executive Officer

Jamey Edwards

Chief Executive Officer of Cloudbreak(1)

Martin Beck

Chief Financial Officer

Notes: (1) Jamey Edwards will be the Chief Operating Officer of

UpHealth upon transaction close.

UpHealth Is Combining to Form One of the Only

Profitable, Global, Digital Health

Companies Serving the

Enterprise Healthcare Marketplace

6

Investment Highlights

UpHealth provides a unique

investment opportunity in a rapidly growing sector with significant scale, business visibility, profitability and experienced management

Integrated Global Health

Platform

Addressing Massive Markets with Critical Unmet Needs

Proven

Solutions with Significant Contracted Growth Globally

Bookings Provide Exceptional Visibility into Accelerating Topline Growth & Profitability

Opportunities to Drive Significant Additional

Growth Both Organically & Via M&A

Executive Team with a Proven Track Record of

Building Industry Leaders in

Competitive Segments

7

UpHealth at a Glance

UpHealth’s solutions

simplify some of healthcare’s most complex issues through providing easy to use digital health infrastructure powering digital transformation across the care continuum

$117mm 1,800+

2020E Revenue 58%

Revenue US Healthcare

7% CAGR’21 Venues Served by Domestic Telehealth ‘20 Adj.

EBITDA Margin

13k 14k+ 2.5mm+

Video Annual Prescribers Endpoints Encounters

Global

9mm Operations + in 50 Lives 10 State Rx Licenses Nations

Empowering providers, health systems, health plans and government payors to improve outcomes, quality, access and cost of healthcare

Health Systems/ Health Government Employer Education Medical Groups Plans Agencies Health

Notes: The UpHealth financial information presented is unaudited, includes non-GAAP financial measures and reflects the pro-forma combination of the individual

business entities

8

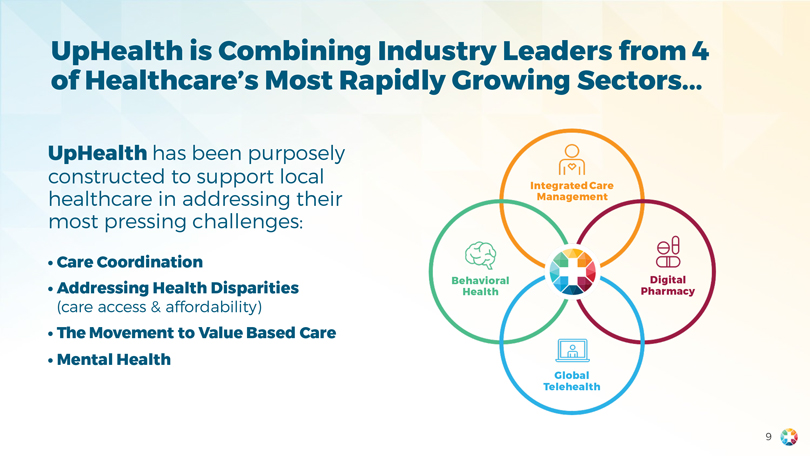

UpHealth is Combining Industry Leaders from 4 of Healthcare’s Most Rapidly Growing Sectors

UpHealth has been purposely constructed to support local

Integrated Care

healthcare in addressing their most pressing challenges:

Management

• Care Coordination

• Addressing Health Disparities Behavioral Digital

Health Pharmacy

(care access & affordability)

• The Movement to Value Based Care • Mental Health

9

...Delivering OneUPHealth to Power Digital Health’s Transformation Across the Continuum

IntegratedCare Global Digital Behavioral Management Telehealth Pharmacy Health

BUSINESS

DESCRIPTION: BUSINESS DESCRIPTION: BUSINESS DESCRIPTION: BUSINESS DESCRIPTION: BUSINESS DESCRIPTION:

Population Health & Resolving Health Digital Primary &

Full Service Digital Integrated Behavioral & Chronic CareManagement Disparities via Unified Specialty Care in Pharmacy forCompounded Substance AbuseSolutions Telemedicine International Markets & ManufacturedRx’s

BUSINESS MODEL: BUSINESS MODEL: BUSINESS MODEL: BUSINESS MODEL: BUSINESS MODEL:

Per Member Per

Month w/ Multi-Year Recurring Multi-Year Large Scale Cash Pay Fee for Service Multi-Year Contracts Revenue Contracts Contracts w/ Auto Renewals

END USERS: END

USERS: END USERS: END USERS: END USERS:

Payors / Government / Health Systems / Clinics / Government Agencies Physician Offices Commercial Insurers Healthcare

Providers Schools / Employers (In and Out of Network), Government Payors

REPRESENTATIVE CLIENTS: REPRESENTATIVE CLIENTS: REPRESENTATIVE CLIENTS: REPRESENTATIVE

CLIENTS: REPRESENTATIVE CLIENTS:

6mmPatients 1,800 Healthcare Venues 10+Nations& 13,000 Physician BCBS, TriCare, United Lives Covered Across the U.S. Provinces

Prescribers Across theU.S. Healthcare, Medicare

10

...Operating Across Key Major Verticals with Main Roles in Healthcare Delivery...

Health Systems / Health Government Employer Education Medical Groups Plans Agencies Health

11

...Connecting the Dots to Create

Digitally Enabled

Careat Care Communities... Home

Care

UpHealth’s care communities AtWork

surround a patient with the resources they need when they need it, combining disparate data sources, unifying DigitalDriven

Encounter

communication and aligning

Health

unique points on the care System continuum into digitally enabled collaborative care team.

12

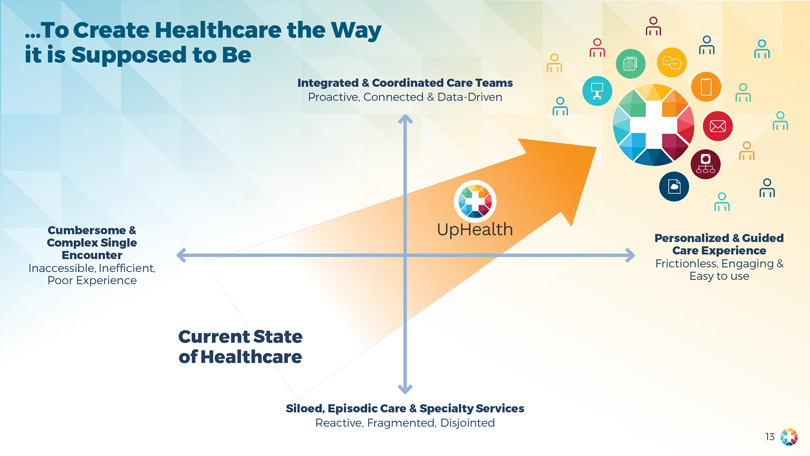

...To Create Healthcare the Way it is Supposed to Be

Integrated & Coordinated Care Teams

Proactive, Connected &

Data-Driven

Cumbersome &

Complex Single Personalized & Guided

Encounter Care Experience

Inaccessible, Inefficient, Frictionless, Engaging & Poor Experience Easy to use

Current State of Healthcare

Siloed, Episodic Care & SpecialtyServices

Reactive, Fragmented, Disjointed

13

The

Opportunity

Healthcare, One of the Largest Economic Markets in the World, Is Broken…

$4 Trillion Sick

(1)

$ in Costs VS

(17.7% of GDP) #1 Cause

Rife withHealth Preventive

of Personal

Disparities Bankruptcy

Patients Providers Nearly Half

of U.S. Physicians

Overwhelming

Care

Complexity

42%

report burnout,

Payors Pharma costing an estimated Sources:

$4.6bn in annual losses(2) (1) Centers for

Medicare and Medicaid Services, Office of the Actuary, 2020 (2) Medscape National Physician Burnout & Suicide Report, 2020

15

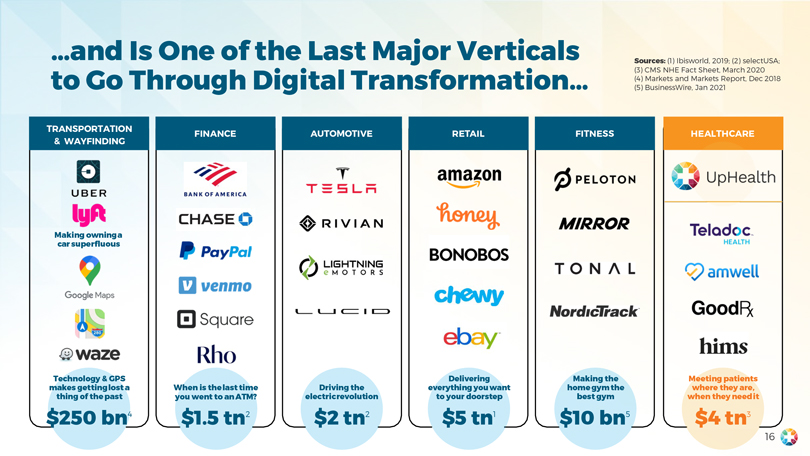

…and Is One of the Last Major Verticals Sources: (1) Ibisworld, 2019; (2) selectUSA;

(3) CMS NHE Fact Sheet, March 2020 to Go Through Digital Transformation… (4) Markets and Markets Report, Dec 2018 (5) BusinessWire, Jan 2021

TRANSPORTATION

FINANCE AUTOMOTIVE RETAIL FITNESS HEALTHCARE

& WAYFINDING

Making owninga carsuperfluous

Technology & GPS Delivering Making the Meeting patients makes gettinglost a When is thelast time Driving the everything youwant homegymthe where they are, thing of thepast you

went to anATM? electricrevolution to your doorstep best gym when they needit

$250 bn4 $1.5 tn2 $2 tn2 $5 tn1 $10 bn5 $4 tn3

16

...With UpHealth Sitting at the Nexus of Multiple Massive &

Rapidly Growing Markets at the Beginning of the Adoption Curve

Global Telehealth

$61B Integrated Care Global Market in 2019(1)

Management $1.35T

Medicare & Medicaid Spend(4)

Behavioral Health

Digital $100B Pharmacy

Additional U.S. Behavioral Health Spend in 2020 and 2021 caused by

COVID(2)

$500B U.S. Drug Prescription Market(3)

Sources: (1) Fortune Business

Insights; (2) McKinsey & Company; (3) Fierce Healthcare; 4) Centers for Medicare &

Medicaid Services (CMS.gov) 17

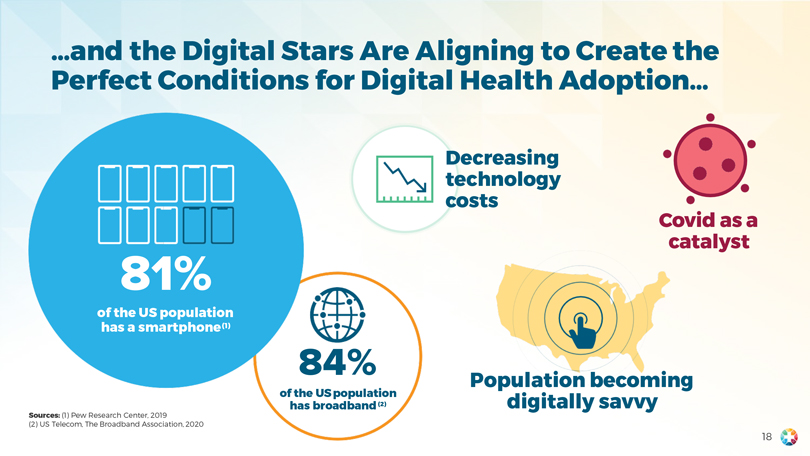

...and the Digital Stars Are Aligning to Create the Perfect

Conditions for Digital Health Adoption...

Decreasing technology costs Covid as a catalyst

81% of the US population has a smartphone(1)

Population becoming digitally savvy

Sources: (1) Pew Research Center, 2019

(2) US Telecom, The Broadband Association, 2020 18

...With Care Being Pushed Out Into the Community Away From

Traditional Brick and Mortar Settings

The “gold standard” in healthcare is no longer the in-person visit, it is the Digitally Driven Encounter.

In today’s world, that might be email, audio, video, chat or in-person and could happen on-demand or scheduled, either real-time (synchronously) or time

shifted (asynchronously).

Fast, efficient and cost effective digitally driven encounters

that delivers more meaningful in-person engagements

19

...Supported by a Strong Movement to Value Based Care Focused on Quality and Outcomes

There is a movement away from Fee For Service (FFS) healthcare where clinicians get paid based on what they do to somebody to value based care where they get paid for how healthy

they can keep them in the first place.

Whole person care demands better tools & technology, more collaboration, reshaping care across traditional boundaries

and partners like UpHealth to support enterprise change management.

+ = Quality Service Value Cost 20

UpHealth will leverage its large installed base, technology, expertise & care communities to reshape healthcare by making the

complex simple, the costly cost effective and the inhumane human.

For UpHealth, healthcare just got personal.

21

Business Overview

A Proven Leadership Team

Proven track record of

success in creating industry leaders in Healthcare, Technology, Services & Finance

Dr. Chirinjeev Kathuria

Co-Chairman & Co-Founder

Dr. Avi Katz

Co-Chairman

AlGatmaitan, DSc, FACHE

Co-Chief Executive Officer

Dr. RameshBalakrishnan

Co-Chief Executive Officer

Jamey Edwards

Chief Operating Officer

Martin Beck

Chief Financial Officer

Mariya Pylypiv, Ph.D.

Co-Founder & Chief Strategy Officer

Jeffery Bray

Chief of Legislative & Regulatory Affairs

Nashina Asaria

Chief Product & Marketing Officer

Syed Sabahat Azim,MD

Chief Executive Officer, International

Notes: UpHealth Executive Leadership Team upon

transaction close.

23

...Recognized for Expertise in Building Innovative Industry Leaders...

World Economic Forum

Becker’s SocialEntrepreneur PatrickSoon-Shiong DigitalHealth

Entrepreneur360 Healthcare

HospitalReview of the Year Innovation Award Global 100 Top Entrepreneurial Supplier of theYear

260+ telehealth 2020 Journal of mHealth Company (3x) LA Business Journal Companies to Know 2019, 2018 & 2017

HIMSS Top 40 Healthcare E&YEntrepreneur UCSF Digital Medika Life

Changemaker Transformer

of the Year Health Awards #30 on Top 50 Voices

2020 Finalist Best Telemedicine in Healthcare in 2021 Company - Finalist

MedTech

2020: Best Overall MedTech Company 2019: Best Overall MedTech Software 2018: Best

Video Conferencing Solution

UNAIDS Health Innovation Exchange

Columbus Smart

50 IndianTelemedicine Public Appreciation Award Top 10 Influential 2019 Customer Value 2020 People

Leadership Award In digital pharma 2020 2020

24

With an Extensive Reach Across Major Health Systems & Payors Globally

Academic

Health

Indiana university health

Nyu langone

Medical center

Penn medicine

Medicine

keck medical center of usc keck medicine of usc

Vcu health

Ucsf health

Ucsan diego health system

University hospitals

Ucdavis health

Huh howard university hospital

Health care university of missouri health system

Specialty

MEMORIAL SLOAN KETTERING CANCER CENTER

CHILDREN’S HOSPITAL OF MICHIGAN

CHILDREN’S MINNESOTA

CHILDREN’S NATIONAL

HSS HOSPITAL FOR SPECIAL SURGERY

ACCESS OHIO

MENTAL HEALTH CENTER OF EXCELLENCE

SCOTTISH RITE

FOR CHILDREN

CHOC CHILDREN’S

CHILDREN,S MERCY HOSPITALS & CLINICS KANSAS CITY

RAINBOW BABIES & CHILDREN’S

HOSPITAL

MCVS MARYLAND CARDIO VASCULAR SPECIALISTS

VALLEYGATE DENTAL SURGERY

CENTER

BARBARA ANN KARMANOS CANCER INSTITUTE

COMMUNITY

SCENSION

BEAUMONT

AMITA HEALTH

CEDARS SINAI

SPARROW

CATHOLIC HEALTH INITIATIVES

OHIO HEALTH BELIEVE IN WE”

OCHSNER

MARINHEALTH

UNITYPONT HEALTH

LEE HEALTH CARING PEOPLE INSPIRING HEALTH

THE QUEEN’S MEDICAL CENTER

PIPELINE HEALTH

MAYO CLINIC

PEACE HEALTH

UNIVERSAL HEALTH SERVICES, INC.

ADVENTIST HEALTH

MARTIN LUTHER KING, JR COMMUNITY HOSPITAL

THEDA CARE

ANTELOPE VALLEY HOSPITAL

CENTRA CARE

Payor / Gov’t /Other

COUNTY OF ALAMEDA

LA CARE

GENESEE COMMUNITY HEALTH CENTER

AMS AFRICAN MEDICAL SOLUTION

MAKE A WISH

GOVERNMENT OF ODISHA OFFICIAL PORTAL

CHARLES B WANG COMMUNITY HEALTH CENTER

PRIMARY ONE HEALTH YOUR FIRST CHOICE FOR QUALITY

CARE’

CHILD ADVOCACY CENTER WHERE SMALL VOICE CAN BE HEARD

THE JANE

PAULEY COMMUNITY HEALTH CENTER CARING FOR OUR

STARK COUNTY COMMUNITIES JOB & FAMILY SERVICES

EDUCATIONAL SERVICE CENTER OF CENTRAL OHIO

THE CITY OF COLUMBUS ANDREW J GINTHER MAYOR

COLUMBUD PUBLIC HEALTH

25 ALL CARE HEALTH CENTER

26 ...Delivering Value to the 4P’s of Healthcare

UpHealth will serve as a single source for services and technologies essential to the delivery of affordable and effective care to all healthcare stakeholders

Platform Offerings ValueDelivered

Patients

Providers Payors Pharma

A full suite of digital health tools connecting patients to their

local continuum of care

A non-competitive digital health partner with industry leading solutions customized to their exact strategy Comprehensive technology

backbone tying together disparate information sources with workflow Full digital pharmacy delivering Rx manufacturing and compounding to all 50 states

A

personalized, convenient, connected whole person healthcare experience meeting them where they are, when they need it

An entire care eco-system at clinical

team’s fingertips, following patients throughout their care journey Delivering visibility, insights & the ability to manage care for complex and chronic healthcare populations Easy to use digital pharmacy enabling personalized medication

regimens, and full pharmacist team support to physicians

27 UpHealth’s Unified Platform and Ability to Deliver Across the Continuum of Care is What Local Healthcare Wants

Our B2B and B2B2C business model that provides game changing technologies and tech enabled services fully integrated with major end users’ workflows and systems

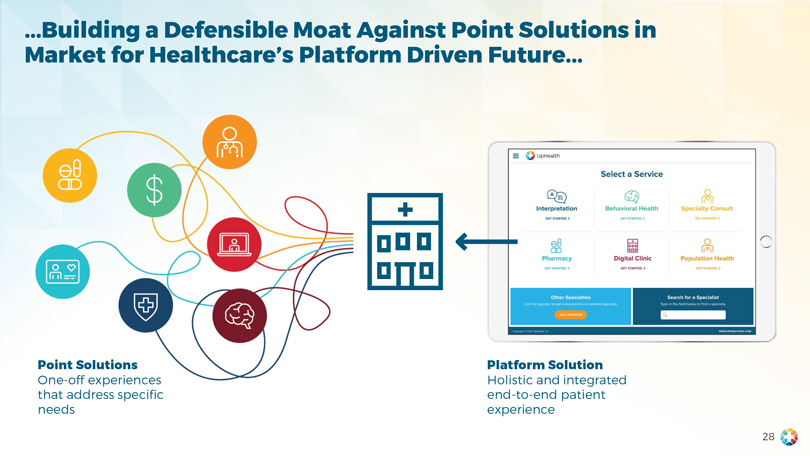

28 ...Building a Defensible Moat Against Point Solutions in Market for Healthcare’s Platform Driven Future...

Point Solutions

One-off experiences that address specific needs

Platform Solution

Holistic and integrated end-to-end patient experience

Uphealth

Select a service

Interpretation Get Started

Behavioral Health Get Started

Speciality consult Get Started

Pharmacy Get Started

Digital Clinic Get Started

Population Health Get Started

Other specialities

Call the operator to get connected to an unlisted speciality

Call operator

Search for a specialist

Type in the field below to find a speciality

29 ...Via Delivering a “One Stop Shop” (OneUPHealth) for Digital Health Enablement at the Point of Care

• Simplifying: Replacing disparate point solutions with an easy to use platform putting critical resources at clinical teams fingertips • Scaling: Rapidly growing &

purely complementary solutions serving local healthcare across the care continuum • Connecting: Building person centric care communities increasing access & resolving disparities

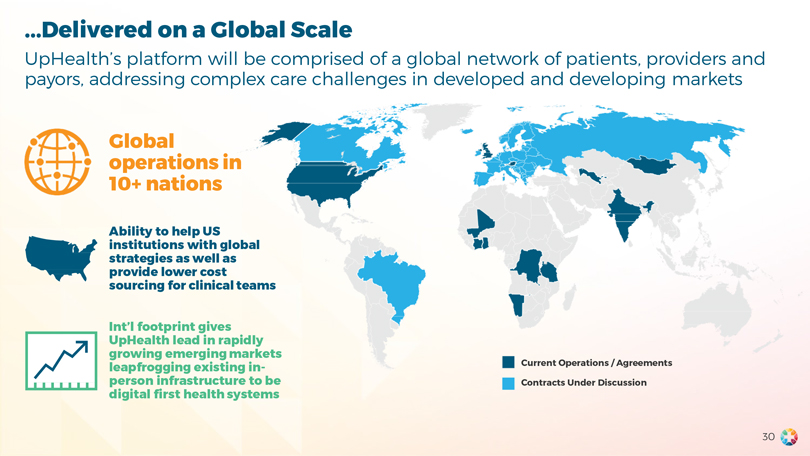

...Delivered on a Global Scale

30 UpHealth’s

platform will be comprised of a global network of patients, providers and payors, addressing complex care challenges in developed and developing markets

Global

operations in 10+ nations

Ability to help US institutions with global strategies as well as provide lower cost sourcing for clinical teams

Int’l footprint gives UpHealth lead in rapidly growing emerging markets leapfrogging existing in-person infrastructure to be digital first health systems

Current Operations / Agreements

Contracts Under Discussion

UpHealth is Focused on 3 Levels of Integration Post Combination

Go-to-Market: Sales operations & enablement coordinating company offerings and allowing us to offer OneUphealth at the point of care.

Product Integration: Integrating technology via API’s & Open Platforms to offer integrated solutions and make it easy to add additional services to existing endpoints in

the field. Also creating centers of excellence that all verticals can use in AI / Machine Learning, Unified Communications, Data Analytics & Visualizations & Interoperability.

Corporate Services: Moving core services like accounting, finance, IT, HR and other functions to corporate level to best coordinate back office activities across the enterprise. 31

The UpHealth Platform

UpHealth is Combining to Deliver “OneUPHealth” at the Point of Care

CLOUD BREAK

Tele-Interpretation Services

Powered by Cloudbreak

MEDQUEST PHARMACY

Integrated Full Service ePharmacy Capabilities

Powered by MedQuest

GLOCAL HEALTHCARE

Digitally Driven Primary Care

Powered by Glocal

Tele-Psychiatry Capabilities

Powered by BHS & Transformations

CLOUDBREAK

Specialty Consults

Powered by Cloudbreak

THRASYS

Integrated Care

Management Intelligence

Powered by Thrasys

uphealth

Select a Service

Interpretation

GET STARTED

Pharmacy

GET STARTED

Behavioral Health

GET STARTED >

Digital Clinic

GET STARTED

Specialty Consult

GET STARTED

Population Health

GET STARTED

Other Specialties

Call the operator to get connected to an unlisted specialty.

call operator

Search for a Specialist

Type in the field below to find a specialty

33

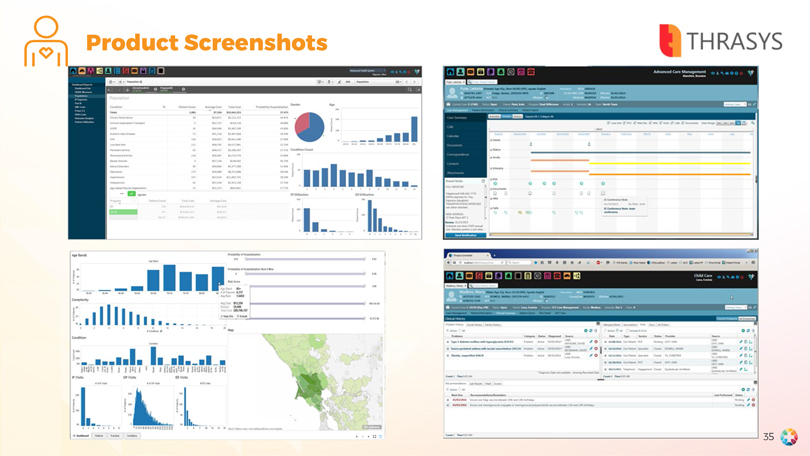

Starting with Population Health and Care Coordination...

Healthcare Funding Sources

Public / Government Payor Premiums

Payments for Outcomes, Quality & Performance

Outpatient& Diagnostics Services

Physicians

Care Community

Patients& Families

syntranet™ Core Platform

Clinical Network

Care Managers

Home and community-Based Team

THRASYS

Thrasys organizes the healthcare continuum by linking together disparate systems across industry verticals into a cohesive system aggregating data, coordinating care plans and

creating communities of care to support chronic care and population health.

Core Features

Integrate and organize information across provider, plan, county and other data sources

Advanced analytics with predictive models to gain insight into population and individual health

Workflow applications coordinate program care teams across in/out-patient, home & community-based settings

State of the art architecture with expert system based rules, configurable workflows and scalable microservices

34

Product Screenshots

THRASYS

35

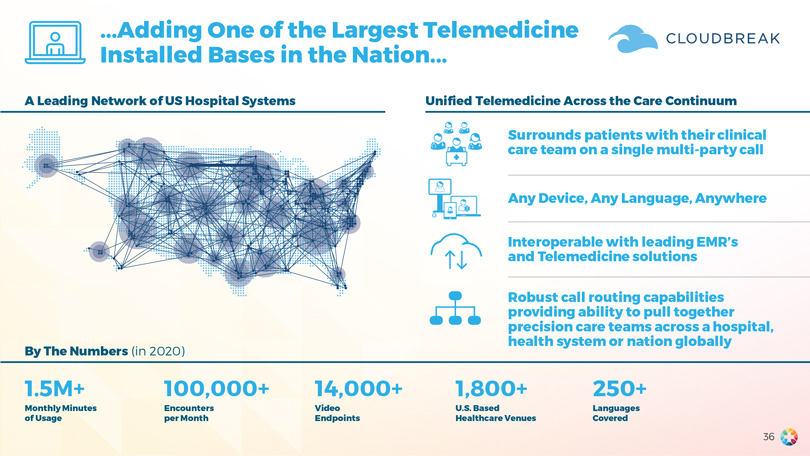

Adding One of the Largest Telemedicine Installed Bases in the Nation...

A Leading Network of US Hospital Systems

By The Numbers (in 2020)

Unified Telemedicine Across the Care Continuum

Surrounds patients with their clinical care

team on a single multi-party call

Any Device, Any Language, Anywhere

Interoperable with leading EMR’s and Telemedicine solutions

Robust call

routing capabilities providing ability to pull together precision care teams across a hospital, health system or nation globally

1.5M+

MonthlyMinutes of Usage

100,000+

Encounters per Month

14,000+

Video Endpoints

1,800+

U.S. Based Healthcare Venues

250+

Languages Covered

36

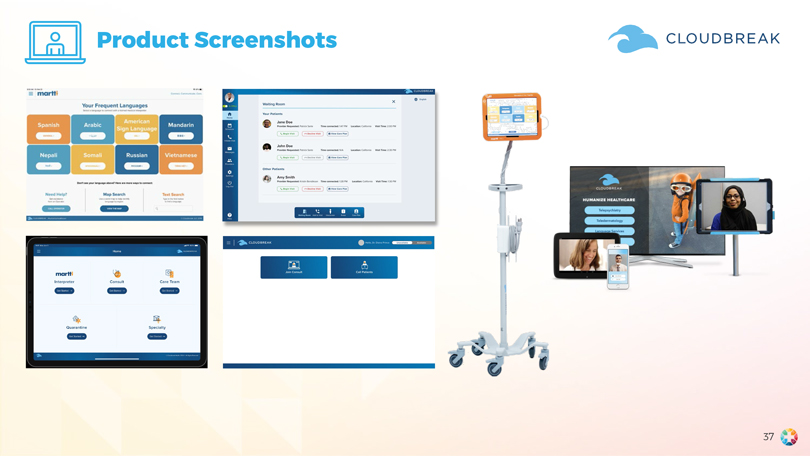

Product Screenshots

CLOUDBREAK

37

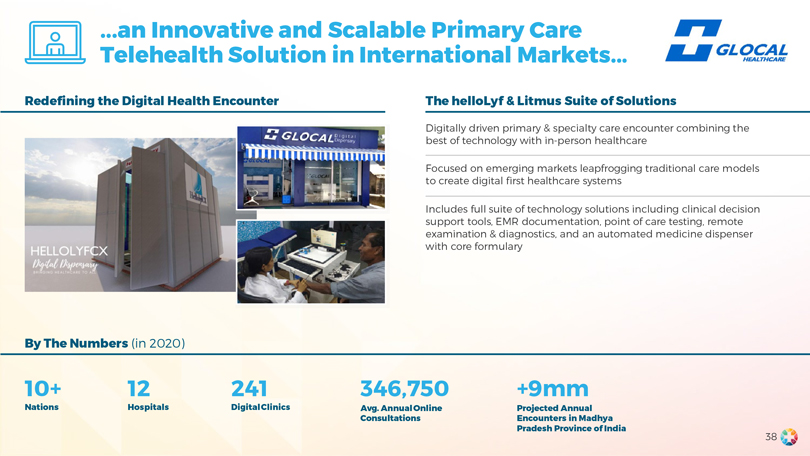

...an Innovative and Scalable Primary Care Telehealth Solution in International Markets...

Redefining the Digital Health Encounter

By The Numbers (in 2020)

The helloLyf & Litmus Suite of Solutions

Digitally driven primary & specialty care

encounter combining the best of technology with in-person healthcare

Focused on emerging markets leapfrogging traditional

care models to create digital first healthcare systems

Includes full suite of technology solutions including clinical decision support tools, EMR documentation,

point of care testing, remote examination & diagnostics, and an automated medicine dispenser with core formulary

10+

Nations

12

Hospitals

241

DigitalClinics

346,750

Avg. AnnualOnline

Consultations

+9mm

Projected Annual Encounters in Madhya Pradesh Province of India

GLOCAL

HEALTHCARE

38

...Integrating Digital Pharmacy with Licenses in All 50 States...

Digital Pharmacy At a Glance

A full-service manufacturing & compounding pharmacy

Full pharmacist support throughout patient care journey

Robust medical

education platform

Operates a 40,000 square foot facility with the ability to expand another 40,000 square feet at the same location

eMedplus system certified by the DEA as EPCS Certified

Directly integrated with

Testing services with

and

By The Numbers (in 2020)

13,000

Number of Prescribers

50

State Licenses

>95%

OrdersShipped within 24Hours

Product Lines

Manufacturing & Compounding RX’s

Cosmeceuticals

NutritionalSupplements

Contract Manufacturing

Lab Services

Testing

MEDQUEST

PHARMACY

SURESCRIPTS labcorp quest DiagnosticsTM

39

Product Screenshots

MEDQUEST

40

Product Screenshots

MED QUEST PHARMACY

HORMONE MARKETING & EDUCATION KIT

DESIGNED FOR BHRT PROVIDERS

20 Healthy Aging Brochures:

An easy to understand and comprehensive reference about the aging

process and hormone replacement therapy (HRT). Find helpful information about the most commonly prescribed hormones, discover answers to frequently asked question and learn the basic science behind the use of HRT to achieve healthy aging.

20 MedQuest Pharmacy Contract Cards:

All of the important information you and

your patients need for ordering customized HRT preparations. Easily locate our phone number, website, hours of operation and shipping details on these handy MedQuest Pharmacy contact cards.

Nutrascriptives Supplements at wholesale Pricing:

Enjoy special introductory pricing on a

one-time order of any bottle(s) of our clinical grade supplements at wholesale savings. No minimum order required for this offer.

Hormone Education video

Presentation for office Use:

A continuous video animated and full of valuable and captivating educational HRT content to display in your office or share with

patients. Delivered as a Power point presentation. final side can be edited with providers information.

1 Free Copy of How to Achieve Healthy Aging, by neal

Rouzier:

Get even more information and fascinating insights about Hormones and HRT from Dr. Rouzier in this popular book. How to Achieve Healthy Aging.

to claim offer watch for a one-time email immediately following this conference or visit the online exhibitors portal on www.worldlinkmedical.com. offer only to worldlink Part I

attendees.

maqrx.com 888.222.2956

Upgrade the way you prescribe compounded

medications

e emedplus

specifically designed for e-prescribing compounded

medications

669 west 900 North, North Salt Lake, UT 84054 Phone 888.222.2956 Fax 866.373.2979

Delivery Device Instructions

tube with measuring Stick and Tube Winder

sleek topi Pump

Mega-Pump

Topi-Click topi-Click(R) Perl

How Much Cream Should You Use?

41

...and Tech Enabled Behavioral Health...

A

Comprehensive Mental Health Offering

Evidence based medical and clinical care

Holistic treatment & comprehensive suite of services

Strong veteran &

first responder relationships

Specialized programming for individualized patient needs

By The Numbers (in 2020) 29 PsychMDs

170 Midlevel & AlliedHealth Professionals

Services Mental Health, rehabilitation & substance use disorder

services across the full

continuum of care - Residential, partial hospitalization, intensive outpatient & outpatient

Acute and chronic / specialized behavioral health services from low

to high acuity Dramatically expanded use of telehealth for medical and clinical services, leveraging the UpHealth platform and clinical services, leveraging the UpHealth platform

Integrating telehealth and Medication Assisted Treatment (MAT) in intensive outpatient and outpatient services offerings

42

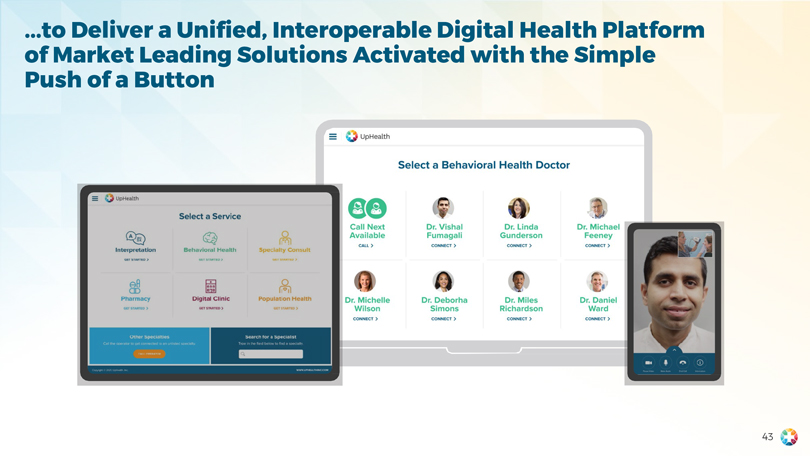

...to Deliver a Unified, Interoperable Digital Health Platform of Market Leading Solutions Activated with the Simple Push of a Button

Select a Behavioral Health Doctor

Dr. Vishal Fumagali Dr. Linda

Gunderson Dr. Michael Feeney Dr. Michelle Wilson Dr. Deborha Simons Dr. Miles Richardson Dr. Daniel Ward Call Next Available Connect

Select a Service

Interpretation Behavioral Health Specialty Consult Pharmacy Digital Clinic Population Health

Search a specialist Other Specialties

call the operator to get connected to

an unlisted specialty

Type in the filed below to find a specialty.

www.UPHEALTHINC.COM

Copyright @2021, Uphealth. Inc.

43

Financial Profile

UpHealth is a Unique Group of Assets...

Strategically Selected Digital Health Capabilities Addressing a Global Market Need.

A Unified Platform Streamlining the Delivery of Effective, Affordable Care.

NEAR-TERM

PROJECTIONS

78%

2021E Domestic Revenue

1. Diversified Revenue Base and Unique Positioning in the Market Profitable with pro forma $117M revenue and $8M EBITDA in 2020 growing to between $180-190M and $16-$20M,

respectively, in 2021 – 91% USA / 9% ROW revenue in 2020

68%

2020-2022

Revenue CAGR

2. Significant Growth at Scale within Established US & International Footprint Expanding profitability enables reinvestment into the

platform’s growth engines, driving expansion across domestic and international markets

71%

2021E Growth Is Contracted

3. Substantial Visibility into Accelerating Growth Signed contracts

provide visibility into near-term revenue forecast

$16- $20M 2021E EBITDA

4.

Expanding Gross Margin over time as fastest growing segments of UpHealth are higher margin, improving profitability mix relative to current status quo

5.

Significant Inherent Operating Leverage Post 2021 as investments made create scale in ‘22 and beyond while synergies offer upside to projections

45

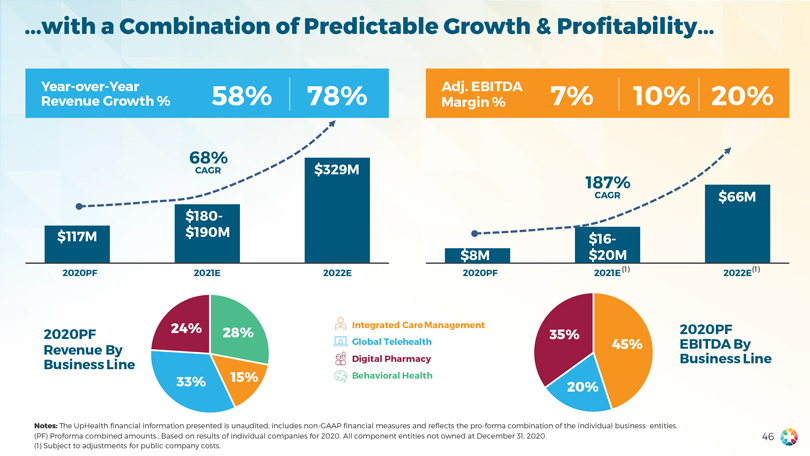

...with a Combination of Predictable Growth & Profitability...

Year-over-Year 58% 78% Revenue Growth %

Adj. EBITDA Margin % 7% 10% 20%

68%

CAGR

$117M

$180-

$190M

$329M

187%

CAGR

$8M $20M

$16-

$66M

2020PF 2021E 2022E

2020PF 201E(1) 2022E(1)

2020PF

Revenue By

Business Line

Integrated CareManagement

Global Telehealth

Digital Pharmacy

Behavioral Health

45%

35%

20%

2020PF

EBITDA By

Business Line

Notes: The UpHealth financial information presented is unaudited, includes non-GAAP financial measures and reflects the pro-forma combination of the individual business entities.

(PF) Proforma combined amounts.. Based on results of individual companies for 2020. All component entities not owned at December 31, 2020.

(1) Subject to

adjustments for public company costs.

46

...with Diversified Growth Engines...

By Business

Unit

2021E

$180-

$190M

Global Telehealth

$42M

2020PF

$117M

Integrated Care Management

$11M

Digital

Pharmacy

$6M

Behavioral

Health

$9M

By Growth

Category

2021E

$180-

$190M

Additional

Organic Growth

Contracted Services

& Implementation

$32M

2020PF

$117M

Product

Expansion

$17M

$14M

Contracted Volume

Based Revenue

Integrated Care Management Global Telehealth Digital Pharmacy Behavioral Health

Notes: The

UpHealth financial information presented is unaudited, includes non-GAAP financial measures and reflects the pro-forma

combination of the individual business

entities

47

Valuation

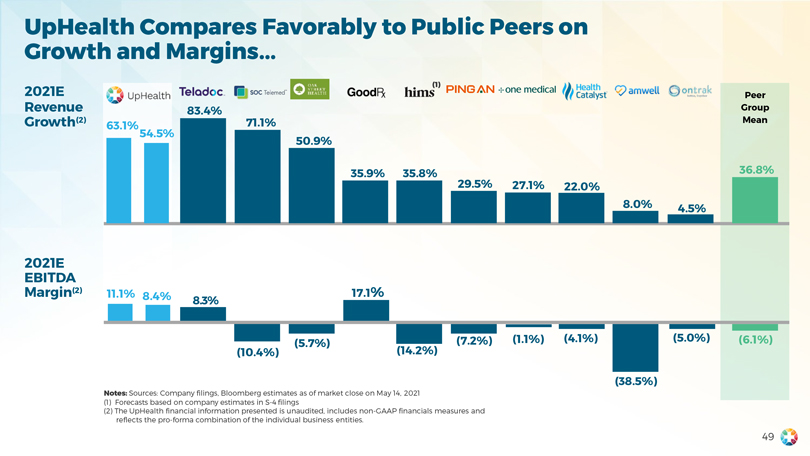

UpHealth Compares Favorably to Public Peers on Growth and Margins...

2021E Revenue Growth(2)

Up Health

63.1%

54.5%

Teladoc

83.4%

SOC Telemed

71.1%

OAK STREET HEALTH

50.9%

GoodPx

35.9%

hims(1)

35.8%

PINGAN

29.5%

One medical

27.1%

Health Catalyst

22.0%

amWell

8.0%

ontrack

4.5%

Peer Group Mean

36.8%

2021E EBITDA Margin(2)

11.1% 8.4%

8.3%

(10.4%)

(5.7%)

17.1%

(14.2%)

(7.2%)

(1.1%)

(4.1%)

(38.5%)

(5.0%)

(6.1%)

Notes: Sources: Company filings, Bloomberg estimates as of market close on May 14,

2021 (1) Forecasts based on company estimates in S-4 filings

(2) The UpHealth financial information presented is unaudited,

includes non-GAAP financials measures and reflects the pro-forma combination of the individual business entities.

49

…is Being Priced at a Discount Initially…

2021E Revenue Multiple(1)

Up Health

7.6x 7.2x

GoodPx

16.6x

Teladoc

11.6x

OAK STREET HEALTH

10.8x

Health Catalyst

10.0x

One medical

9.5x

hims

9.1x

amwell

8.0x

PINGAN

7.9x

ONTRACK

7.8x

SOC Telemed

6.2x

Peer Group Mean

9.8x

Discount to Guidance:

Low end:

54%

34%

30%

23%

19%

16%

5%

3%

2%

(11%)

22%

High end:

57%

37%

33%

27%

24%

21%

10%

9%

7%

(5%)

26%

Notes: Sources: Company filings, Bloomberg estimates and values as of market close on May 14, 2021

(1) The UpHealth financial information presented is unaudited, includes non-GAAP financials measures and reflects the pro-forma combination of the individual business entities.

50

...With Enormous Potential to Trade Up in the Near Term

Enterprise Value

$23.2B

Mean EV / $14.4B

‘21E Revenue: 9.8x $12.5B $10.9B

~1.3x $4.6B $2.3B $2.1B $1.8B $1.8B $0.7B $0.7B $1.4B

Peer Group EV / Revenue Enterprise Value

Mean Valuations: Now vs. IPO(1) 9.8x $7.3B

~1.3x ~2.2x 7.6x $3.3B

At IPO

Current At IPO Current

Notes: Sources: Company filings, Bloomberg and FactSet estimates and values as of market close on May 14, 2021 (1) EV / Revenue calculated

using forward looking revenue (fiscal year ended after IPO and ‘21E Revenues)

51

The

Transaction

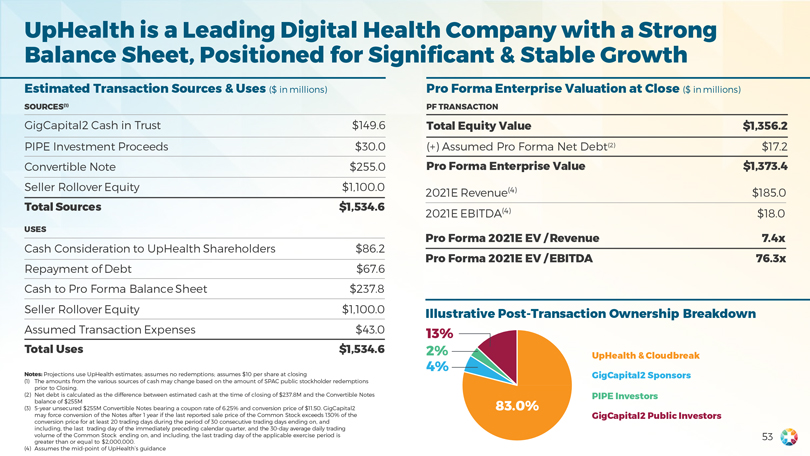

UpHealth is a Leading Digital Health Company with a Strong Balance Sheet, Positioned for Significant & Stable Growth

Estimated Transaction Sources & Uses ($ in millions) Pro Forma Enterprise Valuation at Close ($ in millions)

SOURCES(1) PF TRANSACTION

GigCapital2 Cash in Trust $149.6 Total Equity Value $1,356.2 PIPE

Investment Proceeds $30.0 (+) Assumed Pro Forma Net Debt(2) $17.2 Convertible Note $255.0 Pro Forma Enterprise Value $1,373.4

Seller Rollover Equity $1,100.0 (4)

2021E Revenue $185.0

Total Sources $1,534.6 (4)

2021E EBITDA $18.0

USES

Cash Consideration to UpHealth Shareholders $86.2 Pro Forma 2021E EV / Revenue 7.4x

Repayment

of Debt $67.6 Pro Forma 2021E EV /EBITDA 76.3x

Cash to Pro Forma Balance Sheet $237.8

Seller Rollover Equity $1,100.0 Illustrative Post-Transaction Ownership Breakdown

Assumed

Transaction Expenses $43.0 13%

Total Uses $1,534.6 2%

UpHealth

&Cloudbreak

Projections use UpHealth estimates; assumes 4%

Notes: no

redemptions; assumes $10 per share at closing GigCapital2 Sponsors (1) The amounts from the various sources of cash may change based on the amount of SPAC public stockholder redemptions prior to Closing.

(2) Net debt is calculated as the difference between estimated cash at the time of closing of $237.8M and the Convertible Notes PIPE Investors balance of $255M

(3) 5-year unsecured $255M Convertible Notes bearing a coupon rate of 6.25% and conversion price of $11.50. GigCapital2 83.0% may force conversion of the Notes after 1 year if the

last reported sale price of the Common Stock exceeds 130% of the GigCapital2 Public Investors conversion price for at least 20 trading days during the period of 30 consecutive trading days ending on, and including, the last trading day of the

immediately preceding calendar quarter, and the 30-day average daily trading volume of the Common Stock ending on, and including, the last trading day of the applicable exercise period is greater than or equal to $2,000,000.

(4) Assumes the mid-point of UpHealth’s guidance

53

UpHealth Is Combining to Form One of the Only

Profitable, Global, Digital Health

Companies Serving the

Enterprise Healthcare Marketplace

54

Thank You

VISIT OUR WEBSITES:

GigCapital2 UpHealth, Inc. www.gigcapital2.com www.uphealthinc.com

FOR GIGCAPITAL2

INFORMATION, CONTACT:

Brian Ruby, ICR ir@gigcapital2.com

FOR UPHEALTH &

CLOUDBREAK INFORMATION, CONTACT:

Investor Relations: Reed Anderson reed.anderson@icrinc.com

Media: Phil Denning phil.denning@icrinc.com