AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY'S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR DATED OCTOBER 14, 2020

MONOGRAM ORTHOPAEDICS, INC.

3913 Todd Lane, Austin, TX 78744

(512) 399-2656

www.monogramorthopedics.com

UP TO 4,784,689 SHARES OF SERIES B PREFERRED STOCK, PLUS UP TO 956,937 BONUS SHARES (1)

UP TO 4,784,689 SHARES OF COMMON STOCK INTO WHICH THE SERIES B PREFERRED STOCK MAY CONVERT(2)

PRICE: $6.27 PER SHARE

Holders of our Series B Preferred Stock have limited voting rights compared to holders of our Common Stock. For instance, holders of our Common Stock will have the right to elect two directors as a single class, while holders of our Series B Preferred Stock will only vote for a single director together with the holders of our Common Stock. See "Securities Being Offered" at Page 38 for more information on the rights of our Series B Preferred Stock.

| Price to Public (3) | Underwriting

discount and commissions (4) | Proceeds to issuer (5) | ||||||||||

| Per share | $ | 6.27 | $ | 0.44 | $ | 5.83 | ||||||

| StartEngine Investor Fee | 0.21 | -- | -- | |||||||||

| Per Share Plus Investor Fee | 6.48 | 0.44 | $ | 5.83 | ||||||||

| Total Maximum | $ | 30,000,000 | $ | 2,100,000 | $ | 27,900,000 | ||||||

| (1) | The company is offering up to 4,784,689 shares of Series B Preferred Stock, plus up to 956,937 additional shares of Series B Preferred Stock eligible to be issued as Bonus Shares to investors based upon an investor’s investment level and whether such investors “reserve” shares prior to investing in the company. See “Plan of Distribution and Selling Securityholders” for further details. |

| (2) | The Series B Preferred Stock is convertible into Common Stock either at the discretion of the investor or automatically upon the occurrence of certain events, like effectiveness of registration of the Common Stock in an initial public offering. The total number of shares of the Common Stock into which the Series B Preferred Stock may be converted will be determined by dividing the original issue price per share by the conversion price per share. See "Securities Being Offered" at page 38 for additional details. |

| (3) | Does not include effective discount that would result from the issuance of Bonus Shares. For details of the effective discount. See “Plan of Distribution and Selling Securityholders.” |

| (4) | The company has engaged StartEngine Primary, LLC, member FINRA/SIPC (“StartEngine Primary”), to act as a placement agent in this offering as set forth in “Plan of Distribution and Selling Securityholder” and its affiliate StartEngine Crowdfunding, Inc. to perform administrative and technology-related functions in connection with this offering. The company will pay a cash commission of 3.5% to StartEngine Primary on sales of the Series B Preferred Stock, and the company will issue warrants to purchase shares of Series B Preferred Stock to StartEngine Primary in an amount equal to 2% of the shares issued to investors in this offering (excluding Bonus Shares). Shares issued to StartEngine Primary upon exercise of the warrants will be subject to a lock-up provision in accordance with FINRA requirements. The company will also pay a $15,000 advance fee for reasonable accountable out of pocket expenses actually anticipated to be incurred by StartEngine Primary. Any unused portion of this fee not actually incurred by StartEngine Primary will be returned to the company. FINRA fees will be paid by the company. See “Plan of Distribution and Selling Securityholders” for details of compensation payable to third parties in connection with this offering. The maximum amount the company would pay StartEngine Primary in commissions is $1,050,000, and the maximum amount of Series B Preferred shares the company would issue StartEngine upon its exercise of the warrants is 95,693. This does not include transaction fees paid directly to StartEngine Primary by investors. |

| (5) | Investors will be required to pay directly to StartEngine Primary a processing fee equal to 3.5% of the investment amount at the time of the investors’ subscription. This fee will be refunded in the event the company does not raise any funds in this offering. See “Plan of Distribution and Selling Securityholders” for additional discussion of this processing fee. |

The company expects that the amount of expenses of the offering that it will pay will be approximately $75,000, not including commissions or state filing fees.

The company has engaged Prime Trust, LLC (the "Escrow Agent") to hold funds tendered by investors. We may hold a series of closings at which we receive the funds from the Escrow Agent and issue the shares to investors. The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) up to three years from the date upon which the Securities and Exchange Commission qualifies the Offering Statement of which this Offering Circular forms a part, or (3) the date at which the offering is earlier terminated by the company in its sole discretion.

The offering is being conducted on a “best efforts” basis without a minimum offering amount, which means that there is no guarantee that any minimum amount will be sold in this offering.

1

INVESTING IN THE SERIES B PREFERRED STOCK OF MONOGRAM ORTHOPAEDICS, INC. IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISKS. YOU SHOULD PURCHASE THESE SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 6 TO READ ABOUT THE MORE SIGNIFICANT RISKS YOU SHOULD CONSIDER BEFORE BUYING THE SERIES B PREFERRED STOCK OF THE COMPANY.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

Sales of these securities will commence on approximately [_].

The company is following the "Offering Circular" format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Implications of Being an Emerging Growth Company.”

2

TABLE OF CONTENTS

In this Offering Circular, the term “Monogram Orthopaedics” “Monogram”, “we”, “us”, “our” or “the company” refers to Monogram Orthopaedics, Inc.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

3

Overview

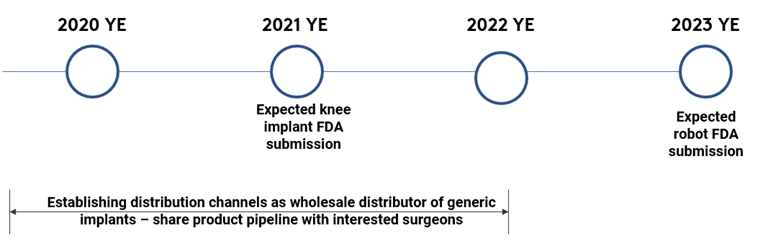

Monogram Orthopaedics, Inc was incorporated under the laws of the State of Delaware on April 21, 2016, as “Monogram Arthroplasty Inc.” On March 27, 2017, the company changed its name to “Monogram Orthopaedics, Inc.” Monogram Orthopaedics is developing a product solution architecture with the intention to enable mass personalization of orthopedic implants by linking 3D printing and robotics via automated digital image analysis algorithms. We have not yet made 510(k) premarket notification submissions or obtained 510(k) clearances for any of product candidates. FDA approval is required to market our products and the company has not obtained FDA approval for any of our product candidates. The company has a robot prototype that can execute optimized paths for high precision insertion of optimized implants in synthetic bone specimens. These implants and cut-paths are prepared based on proprietary Monogram implant designs. Monogram intends to produce and market robotic surgical equipment and related software, orthopaedic implants, tissue ablation tools, navigation consumables, and other miscellaneous instrumentation necessary for the execution of reconstructive joint replacement procedures.

The Offering

| Securities offered: | Maximum of 4,784,689 shares of Series B Preferred Stock, plus up to 956,937 additional shares of Series B Preferred Stock eligible to be issued as Bonus Shares |

| Securities outstanding before the Offering (as of August 12, 2020) | |

| Common Stock | 4,836,935 shares |

| Series A Preferred Stock | 4,897,559 shares |

| Series B Preferred Stock | 0 shares |

| Securities outstanding after the Offering: | |

| Series A Preferred Stock | 4,897,559 (1) (2) |

| Series B Preferred Stock | 5,741,626 shares (1) (2) (3) |

| Common Stock | 4,836,935 shares (1) |

| (1) | Does not reflect the amount of potential shares issuable to Pro-Dex, Inc. (“Pro-Dex”) under the terms of its warrant agreement (filed herewith as Exhibit 6.11) as of the date of this offering circular. Pro-Dex, Inc. has the right to purchase up to 5% of the outstanding Common Stock and Preferred Stock of the company as of the date of the exercise, calculated on a post-exercise basis. After the offering, assuming a maximum raise, Pro-Dex will have the right to acquire up to 325,686 shares of Common Stock, 272,185 shares of Series A Preferred Stock, and 251,825 shares of Series B Preferred Stock, assuming no Bonus Shares are issued in this offering (or 302,190 shares of Series B Preferred Stock assuming a full 20% additional Bonus Shares are issued in this offering). | |

| (2) | Does not reflect the amount of potential shares issuable to ZB Capital Partners, LLC under the terms of its warrant agreement (filed herewith as Exhibit 6.13), which, if exercised, would result in the issuance of 273,972 shares of Series A Preferred Stock, or 171,527 shares of Series B Preferred Stock in this offering. | |

| (3) | Assumes a fully subscribed offering with each investment eligible for the maximum Bonus Shares, which would result in an additional 956,937 shares of Series B Preferred Stock. |

Implications of Being an Emerging Growth Company

As an issuer with less than $1 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant if and when we become subject to the ongoing reporting requirements of the Exchange Act upon filing a Form 8-A. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| · | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| · | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| · | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| · | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| · | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and |

| · | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

4

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards, and hereby elect to do so. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1 billion in annual revenues, have more than $700 million in market value of our Common Stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the Commission’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| · | We are a comparatively early-stage company that has incurred operating losses in the past, expect to incur operating losses in the future, and may never achieve or maintain profitability. |

| · | Monogram depends on a licensing agreement for its intellectual property, which, if terminated, would significantly impair its ability to continue its operations. Significant delays in the development of Monogram’s technology may result in a default on the terms of this agreement, which increases the risk of this licensing agreement being terminated. |

| · | Our technology is not yet fully developed, and there is no guarantee that we will ever successfully develop the technology that is essential to our business. Furthermore, the end products would have an extremely high technical sophistication level that makes it difficult to estimate the costs required to develop those technologies accurately. |

| · | Our business plan is predicated on obtaining market clearance from the Food and Drug Administration (“FDA”) under Section 510(k) of the Federal Food, Drug, and Cosmetic Act, or the FDCA. If we are unable to obtain Section 510(k) clearance, it is unlikely that we will be able to continue to operate as a going concern. |

| · | We could be adversely affected by product liability, product recall, personal injury or other health and safety issues. |

| · | Reductions in third party reimbursement levels, from private or government agency plans, and potential changes in industry pricing benchmarks for joint replacements could materially and adversely affect our results of operations. |

| · | We may be subject to patient data protection requirements. |

| · | We operate in a highly competitive industry that is dominated by several very large, well-capitalized market leaders, and the size and resources of some of our competitors may allow them to compete more effectively than we can. |

| · | We rely on third parties to provide services essential to the success of our business. If the third parties we rely on to provide services necessary to our business become insolvent, it would be materially disruptive to our business, and we may incur high costs and time to secure alternative supply. |

| · | We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses. |

| · | All of our assets are pledged as collateral to a lender. |

| · | The company is controlled by its officers and directors. |

| · | In certain circumstances, investors will not have dissenters’ rights |

| · | Investors in this offering must vote their shares to approve of certain future events, including our sale. |

| · | This investment is illiquid. |

| · | The auditor included a “going concern” note in its audit report. |

| · | Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and investors’ rights agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements. |

| · | We are offering Bonus Shares to some investors in this offering, which effectively gives them a discount on their investment. |

5

The SEC requires the company to identify risks that are specific

to its business and its financial condition. The company is still subject to all the same risks that all companies in its industry,

and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events

and technological developments (such as cyber-attacks and the ability to prevent such attacks). Additionally, early-stage companies

are inherently more risky than more developed companies, and the risk of business failure and complete loss of your investment

capital is present. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to Our Company

We have a limited operating history upon which you can evaluate our performance and have not yet generated profits. Accordingly, our prospects must be considered in light of the risks that any new company encounters. Our company was incorporated under the laws of the State of Delaware on April 21, 2016, and we have not yet generated revenues or profits. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the growth of a business, operation in a competitive industry, and the continued development of our technology and products. We anticipate that our operating expenses will increase for the near future, and there is no assurance that we will be profitable in the near future. You should consider our business, operations, and prospects in light of the risks, expenses, and challenges faced as an emerging growth company.

The auditor included a “going concern” note in its audit report. We may not have enough funds to sustain the business until it becomes profitable. Even if we raise funds through this offering, we may not accurately anticipate how quickly we may use the funds and whether these funds are sufficient to bring the business to profitability.

Our technology is not yet fully developed, and there is no guarantee that we will successfully develop our technology. Monogram is developing sophisticated technology that will require significant technical and regulatory expertise to develop and commercialize. If we are unable to develop and commercialize our technology and products successfully, it will significantly affect our viability as a company.

We are subject to substantial governmental regulation relating to the manufacturing, labeling, and marketing of our products, and will continue to be for the lifetime of our company. The FDA and other governmental authorities in the United States regulate the manufacturing, labeling, and marketing of our products. The process of obtaining regulatory approvals to market a medical device can be expensive and lengthy, and applications may take a long time to be approved if they are approved at all. Our compliance with the quality system, medical device reporting regulations, and other laws and regulations applicable to the manufacturing of products within our facilities and those contracted by third parties is subject to periodic inspections by the FDA and other governmental authorities. Complying with regulations, and, if necessary, remedial actions can be significantly expensive. Failure to comply with applicable regulatory requirements may subject us to a range of sanctions, including substantial fines, warning letters that require corrective action, product seizures, recalls, halting product manufacturing, revocation of approvals, exclusion from future participation in government healthcare programs, substantial fines, and criminal prosecution.

We are subject to federal and state healthcare regulations and laws relating to anti-bribery and anti-corruption, and non-compliance with such laws could lead to significant penalties. State and Federal anti-bribery laws, healthcare fraud and abuse laws dictate how we conduct the relationships that we and our distributors and others that market our products have with healthcare professionals, such as physicians and hospitals. We also must comply with a variety of other laws that protect the privacy of individually identifiable healthcare information. These laws and regulations are broad in scope and are subject to evolving interpretation, and we could be required to incur substantial costs to monitor compliance or to alter our practices if we are found not to be in compliance. In addition, violations of these laws may be punishable by criminal or civil sanctions, including substantial fines, imprisonment of current or former employees, and exclusion from participation in governmental healthcare programs.

Government regulations and other legal requirements affecting our company are subject to change. Such change could have a material adverse effect on our business. We operate in a complex, highly regulated environment. The numerous federal, state and local regulations that our business is subject to include, but are not limited to: federal and state registration and regulation of medical devices; applicable governmental payor regulations including Medicare and Medicaid; data privacy and security laws and regulations including those under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”); the Affordable Care Act (“ACA”) or any successor to that act; laws and regulations relating to the protection of the environment and health and safety matters, including those governing exposure to, and the management and disposal of, hazardous substances; regulations regarding food and drug safety including those of the Food and Drug Administration (“FDA”), and consumer protection and safety regulations including those of the Consumer Product Safety Commission, as well as state regulatory authorities, governing the availability, sale, advertisement and promotion of products we sell; federal and state laws governing health care fraud and abuse; anti-kickback laws; false claims laws; and laws against the corporate practice of medicine. The FDA and state regulatory authorities have broad enforcement powers, including the ability to seize or recall products and impose significant criminal, civil and administrative sanctions for violations of these laws and regulations.

6

Changes in laws, regulations, and policies and the related interpretations and enforcement practices may significantly affect our cost of doing business as we endeavor to maintain compliance with such new policies and laws. Changes in laws, regulations, and policies and the related interpretations and enforcement practices generally cannot be predicted may require extensive system and operational changes. Noncompliance with applicable laws and regulations could result in civil and criminal penalties that could adversely affect our business, including suspension of payments from government programs; loss of required government certifications; loss of authorizations to participate in or exclusion from government programs, including the Medicare and Medicaid programs; loss of licenses; and significant fines or monetary penalties. Any failure to comply with applicable regulatory requirements could result in significant legal and financial exposure, damage our reputation, and have a material adverse effect on our business operations, financial condition, and results of operations.

We have not yet obtained clearance of our products by the U. S. Food and Drug Administration, or FDA, which is critical to our business plan. In order to sell our products, we must obtain market clearance from the Food and Drug Administration (“FDA”) under Section 510(k) of the Federal Food, Drug, and Cosmetic Act, or the FDCA (see “The Company’s Business – Regulation.”). If Monogram is unable to obtain Section 510(k) clearance, we will not be able to sell our products, and it is unlikely that we will be able to continue to operate as a going concern. In addition, the FDA may request clinical data with our 510(k) submission. The FDA has indicated an increased focus on robotic technologies that perform automated operations and may request clinical data for our robot and/or implants. If the FDA requires such information, it will materially and adversely impact our development timeline and increase the cost to obtain market clearance. In addition, our development timeline is currently dependent on the amount of funds we raise in this offering. Depending on the amount of proceeds we receive in this offering , it could take a significant amount of time for us to obtain FDA clearance, and we may be required to raise additional capital from outside sources, which the company may not be able to achieve successfully. These factors combined may impact our ability to continue to operate as a going concern.

We anticipate initially sustaining operating losses. It is expected that we will initially sustain operating losses in seeking Section 510(k) clearance. Our ability to become profitable depends on obtaining 510(k) clearance, and subsequent success in licensing and selling of products. There can be no assurance that this will occur. Unanticipated problems and expenses are often encountered in offering new products, which may impact whether the company is successful. Furthermore, we may encounter substantial delays and unexpected costs related to development, technological changes, marketing, regulatory requirements, and changes to such requirements or other unforeseen difficulties. There can be no assurance that we will ever become profitable. If the company sustains losses over an extended period of time, it may be unable to continue in business.

Our products may not gain market acceptance among hospitals, surgeons, physicians, patients, healthcare payors, and the medical community. A critical element in our commercialization strategy is to persuade the medical community on the efficacy of our products and to educate then on their safe and effective use. Surgeons, physicians, and hospitals may not perceive the benefits of our products and could be unwilling to change from the devices they are currently using. A number of factors may limit the market acceptance of our products, including the following:

| · | rate of adoption by healthcare practitioners; |

| · | rate of a product’s acceptance by the target population; |

| · | timing of market entry relative to competitive products; |

| · | availability of third-party reimbursement; |

| · | government review and approval requirements; |

| · | the extent of marketing efforts by us and third-party distributors or agents retained by us; and |

| · | side effects or unfavorable publicity concerning our products or similar products. |

Notably, in our simulations, our current methods of robotic execution take longer than conventional methods of insertion. If we are unable to reduce the time of our surgical procedure, it may adversely impact market reception of our products. Our inability to successfully commercialize our products will have a material adverse effect on the value of your investment.

We could be adversely affected by product liability, personal injury or other health and safety issues. We could be adversely impacted by the supply of defective products. We are also exposed to risks relating to the surgical robotic technology services and products we provide. Defective products or errors in our technology could lead to serious injury or death. Product liability or personal injury claims may be asserted against us with respect to any of the products we supply or the services we provide. Monogram is also liable for harms caused by any faults in raw materials or products supplied by third-party manufacturers and suppliers that our company utilizes. It is our responsibility to have a quality management system in place and to audit our suppliers to ensure that products supplied to our company meet proper standards. Should a product or other liability issues arise, the coverage limits under insurance programs and the indemnification amounts available to us may not be adequate to protect us against claims and judgments. We also may not be able to maintain such insurance on acceptable terms in the future. We could suffer significant reputational damage and financial liability if we experience any of the foregoing health and safety issues or incidents, which could have a material adverse effect on our business operations, financial condition and results of operations.

7

If third-party payors fail to provide appropriate levels of reimbursement for the use of our products, our revenues could be adversely affected. Sales of our products depend on the availability of adequate reimbursement from third-party payors. In each market in which we do business, our inability to obtain reimbursement approval or the failure of third-party payors to reimburse health care providers at a level that justifies the use of our products instead of cheaper alternatives will hurt our business.

Moreover, we are unable to predict what changes will be made to the reimbursement methodologies used by third-party payors in the future. Changes in political, economic, and regulatory influences may significantly affect healthcare financing and reimbursement practices. For example, there have been multiple attempts through legislative action and legal challenges to repeal or amend the ACA. We cannot predict whether current or future efforts to repeal or amend these laws will be successful, nor can we predict the impact that such a repeal or amendment and any subsequent legislation would have on our business and reimbursement levels. There have also been a number of other proposals and enactments by the federal government and various states to reduce Medicaid reimbursement levels in response to budget deficits, and we expect additional proposals in the future. We cannot assure you that recent or future changes reimbursement policies and practices will not materially and adversely affect our results of operations. Efforts to control healthcare costs, including costs of reconstructive joint replacement, are continuous, and reductions in third party reimbursement levels could materially and adversely affect our results of operations.

We rely on a licensing agreement with the Icahn School of Medicine at Mount Sinai. We are party to a licensing agreement (and related option agreement) with Icahn School of Medicine at Mount Sinai (“Mount Sinai”) pursuant to which Mount Sinai has granted Monogram an exclusive license to patents related to customizable bone implants, surgical planning software, and surgical robots (see “The Company’s Business – Intellectual Property”). The patent, software, technical information, know-how, etc. licensed under this agreement is integral to our company’s core products and technology. As such, we are reliant on the licensing agreement with Mount Sinai to operate our business. Under the terms of our licensing agreement, Mount Sinai has the right to terminate our license for the patent if we materially breach any of our obligations under the licensing agreement. Further, the licensing agreement expires upon the later of (i) 12 years from the first commercial sale of such any product that we sell using the intellectual property covered in the licensed patent or (ii) expiration of the licensed patent. If our arrangement with Mount Sinai were to end, we would no longer be able to use the intellectual property covered by the patent, which could significantly affect our business.

We may default on our obligations under the licensing agreement with the Icahn School of Medicine at Mount Sinai, which could result in termination of the agreement. Pursuant to the terms of the licensing agreement with Mount Sinai (and amendment thereto filed as Exhibits 6.8 and 6.14), we must have a first commercial sale our products within seven (7) years of the Effective Date of the agreement, or by October 10, 2024. Failure to meet this deadline would constitute a breach of our agreement, and Mount Sinai would have the right to give us a notice of default, and could ultimately terminate the licensing agreement if we fail to cure this default within sixty (60) days. A termination of this licensing agreement would also terminate our related option agreement with Mount Sinai, as the option agreement is governed by the terms of the licensing agreement. Currently, we expect to achieve a commercial sale within this timeframe. If we are unsuccessful in doing so, however, we would be in default, and would be exposed to the risk of Mount Sinai terminating the agreement, along with our right to license its intellectual property. Such a result would materially impact our ability to operate as a going concern.

We operate in a highly competitive industry that is dominated by several very large, well-capitalized market leaders and is continuously evolving. New entrants to the market, existing competitor actions, or other changes in market dynamics could adversely impact us. The level of competition in the orthopaedic market is high, with several very large, well-capitalized competitors holding a majority share of the market. Changes in market dynamics or actions of competitors or manufacturers, including industry consolidation and the emergence of new competitors and strategic alliances, could materially and adversely impact our business. Disruptive innovation by existing or new competitors could alter the competitive landscape in the future and require us to accurately identify and assess such changes and make timely and effective changes to our strategies and business model to compete effectively.

Currently, we are not aware of any well-known orthopaedic companies that broadly offer robotic technology in combination with surgical navigation for the insertion of patient-specific press-fit orthopaedic implants. Nonetheless, many of our competitors in this market have significant financial resources. They may seek to extend their robotics and orthopaedic implant technology to accommodate the robotic insertion of patient-specific press-fit implants. Further, several companies offer surgical navigation systems for use in arthroplasty procedures that provide a minimally invasive means of viewing the anatomical site. As such, other companies may create similar technology and/or products to that which we are trying to develop, which would increase competition in our industry. As competition increases, a significant increase in general pricing pressures could occur, which could require us to reevaluate our pricing structures to remain competitive. For example, if we are not able to anticipate and successfully respond to changes in market conditions, it could result in a loss of customers or renewal of contracts or arrangements on less favorable terms.

8

Successful infringement claims against us could result in significant monetary liability or prevent us from selling some of our products. If successfully developed, our products and technology may be highly disruptive to a very large and growing market. Our competitors are well-capitalized with significant intellectual property protection and resources and may initiate infringement lawsuits against our company. Such litigation could be expensive and could also prevent us from selling our products, which would significantly harm our ability to grow our business as planned.

Our failure to attract and retain highly qualified personnel in the future could harm our business. As the company grows, it will be required to hire and attract additional qualified professionals such as software engineers, robotics engineers, machine vision and machine learning experts, biomechanical engineers, project managers, regulatory professionals, sales and marketing professionals, accounting, legal, and finance experts. The company may not be able to locate or attract qualified individuals for such positions, which will affect the company’s ability to grow and expand its business.

We rely on third-party manufacturers and service providers. Our third-party partners provide a variety of essential business functions, including distribution, manufacturing, and many others. It is possible that some of these third parties will fail to perform their services or will perform them in an unacceptable manner. If we encounter problems with one or more of these parties, and they fail to perform to expectations, it would be materially disruptive to our business, and we may incur high costs and time to secure alternative supply, or be unable to secure an alternative supply altogether. Such an occurrence could have a material adverse impact on the company.

Our future success is dependent on the continued service of our small management team. Monogram is managed by four directors and one executive officer. Our success is dependent on their ability to manage all aspects of our business effectively. Because we are relying on our small management team, we lack certain business resources that may hurt our ability to efficiently operate or grow our business. Any loss of key members of our executive team could have a negative impact on our ability to manage and grow our business effectively. We do not maintain a key person life insurance policy on any of the members of our senior management team. As a result, we would have no way to cover the financial loss if we were to lose the services of our directors or officers.

We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses. To fund future growth and development, the company will likely need to raise additional funds in the future by offering shares of its Common or Preferred Stock and/or other classes of equity, or debt that convert into shares of common or Preferred Stock, any of which offerings would dilute the ownership percentage of investors in this offering. See “Dilution.” In order to issue sufficient shares in this regard, we may be required to amend our certificate of incorporation to increase our authorized capital stock, which would require us to obtain the consent of a majority of our shareholders. Furthermore, if the company raises capital through debt, the holders of our debt would have priority over holders of common and Preferred Stock, and the company may be required to accept terms that restrict its ability to incur more debt. We cannot assure you that the necessary funds will be available on a timely basis, on favorable terms, or at all, or that such funds, if raised, would be sufficient. The level and timing of future expenditure will depend on a number of factors, many of which are outside our control. If we are not able to obtain additional capital on acceptable terms, or at all, we may be forced to curtail or abandon our growth plans, which could adversely impact the company, its business, development, financial condition, operating results or prospects.

Any valuation at this stage is difficult to assess. The valuation for this Offering was established by the company. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially early-stage companies, is challenging to assess, and you may risk overpaying for your investment.

If we cannot raise sufficient funds, we will not succeed. We are offering shares of our Series B Preferred Stock in the amount of up to $30,000,000 in this Offering on a best-efforts basis and may not raise the entire amount. Even if the maximum amount is raised, we are likely to need additional funds in the future to grow. The technology and products we are developing are highly sophisticated, and we may also encounter technical challenges that require more capital than anticipated by the management team to overcome. If we cannot raise those funds for whatever reason, including reasons relating to the company itself or to the broader economy, the company may not survive. If we raise a substantially lesser amount than the Maximum Raise, we will have to find other sources of funding for some of the plans outlined in “Use of Proceeds To Issuer.”.

Our technologies are highly complex, and development budget estimates may not be accurately or sufficiently forecasted. While management makes every effort to predict anticipated development costs accurately, the project and technology complexity of the products makes it difficult to forecast these required development costs accurately. It is not uncommon to encounter unforeseen technical challenges that introduce unanticipated development costs. The actual development costs may not be the same as the anticipated development costs. If the actual development costs are materially above those anticipated by management, it could materially adversely impact our business.

Our products may require more technical complexity than anticipated and our engineers may not be able to overcome these technical challenges. While management makes every effort to anticipate the technical challenges of product development, we may encounter unforeseen complexity that we cannot overcome, or that may be difficult to overcome without incurring significant time or cost that was not anticipated or budgeted. For example, we have found it challenging to revise our first-generation tibial design. To facilitate more efficient removal, we may need to make design changes to features like the locking mechanism that were not anticipated and introduce additional cost, time and complexity. Additional unforeseen challenges as this could hinder our plan of operations, slowing our progress and increasing our costs, which may harm your investment in our company.

9

We may not gain acceptance by Group Purchasing Organizations or other purchasing entities. Many hospital systems and Ambulatory Surgery Centers use group purchasing organizations to negotiate pricing and supply from vendors. Many of these organizations are large and risk-averse, and gaining adoption at reasonable terms can be challenging. If we are unable to secure contracts with widely used Group Purchasing Organizations, we may struggle to gain market adoption, which would materially adversely affect our business.

We may use independent distributors to represent our products. Monogram may use contracted employees and independent distributors to represent our products to surgeons, hospitals, and Ambulatory Surgery Centers. Such independent distributors and contractors are not employees of the company and may conduct business in a manner that is unethical or even illegal. Monogram could incur liability for unlawful business practices conducted by such independent distributors or contractors. If a distributor violates the terms of our agreements, it could materially adversely affect our business.

Our products require a level of accuracy that we may never be able to achieve. To obtain FDA approval on our system we will need to demonstrate that we can accurately position implants in robotically prepared bone specimens. The KUKA LBR Med robot that we are using has never before been used or validated for this application, and it may not be able to perform to the accuracies required. Preparing bone to the accuracies required is a highly challenging task with numerous sources of error that we may never be able to overcome. We have not yet achieved high accuracy cuts in a cadaveric bone specimen. If we cannot execute a robotic surgical plan with sufficient accuracy, it will materially adversely impact our business and market reputation.

Our assets may become pledged as collateral to a lender. We may enter into financing arrangements with lenders that contain covenants that limit our ability to engage in specified types of transactions. These covenants may limit our ability to, among other things:

| · | petition for bankruptcy; |

| · | assignment of the notes to other creditors; |

| · | appointment of a receiver of any property of the company; and |

| · | consolidate, merge, sell, or otherwise dispose of all or substantially all of our assets. |

10

A breach of any of these covenants could result in a default under the terms of such a financing in which the lender could elect to declare all amounts outstanding thereunder to be immediately due and payable. We may need to pledge all of our assets as collateral to secure additional financing.

Acquisition opportunities may present themselves that in hindsight did not achieve the positive results anticipated by our management. From time to time, acquisition opportunities may become available to the company. Those opportunities may involve the acquisition of specific assets, like intellectual property or inventory, or may involve the assumption of the business operations of another entity. Our goal with any future acquisition is that any acquisition should be able to contribute neutral to positive EBITDA to the company after integration. To effect these acquisitions, we will likely be required to obtain lender financing or issue additional shares of stock in exchange for the shares of the target entity. If the performance of the acquired assets or entity does not produce positive results for the company, the terms of the acquisition, whether it is interest rate on debt, or additional dilution of stockholders, may prove detrimental to the financial results of the company, or the performance of your particular shares.

The novel coronavirus (COVID-19) pandemic may have an impact on our business, financial condition and results of operations. The COVID-19 pandemic has rapidly escalated in the United States, creating significant uncertainty and economic disruption, and leading to record levels of unemployment nationally. Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines, shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19. The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. In addition to the COVID-19 disruptions possibility adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described here under “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor to minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred

Risks Related to the Securities in this Offering

In certain circumstances, investors will not have dissenters' rights. The investors’ rights agreement that investors will execute in connection with the offering contains a “drag-along” provision whereby investors agree to vote any shares they own in the same manner as the majority holders of our other classes of stock. Specifically, and without limitation, if the majority holders of our other classes of stock determine to sell the company, depending on the nature of the transaction, investors will be forced to sell their stock in that transaction regardless of whether they believe the transaction is the best or highest value for their shares, and regardless of whether they believe the transaction is in their best interests.

We have previously granted anti-dilution rights in the form of preemptive rights to certain holders of our Common Stock. The effect of those rights is that at any time we intend to issue additional shares of our stock that would dilute those holders, they would first have the right to acquire additional shares to maintain their pro rata ownership. While investors in this offering will be granted certain participation rights in future offerings of securities by the company, investors who are not accredited investors may not be able to participate in all of those offerings if such offering relies upon Rule 506(b) or (c) of Regulation D. As a result, upon future issuances of stock by the company, investors in this offering may experience more substantial dilution than other stockholders. See Exhibit 6.8 for further information about the preemptive rights granted to certain holders of our Common Stock.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, the investors’ rights agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements. Investors in this offering will be bound by the subscription agreement and investors’ rights agreement, both of which include a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to these agreements. By signing these agreements, the investor warrants that the investor has reviewed this waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel.

11

If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Texas, which governs the subscription agreement and investors’ rights agreement, and in the Court of Chancery in the State of Delaware. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently, and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement and investors’ rights agreement. You should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement and investors’ rights agreement.

If you bring a claim against the company in connection with matters arising under either the investors’ rights agreement or the subscription agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. If a lawsuit is brought against the company under the either of these agreements, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement or investors’ rights agreement with a jury trial. No condition, stipulation, or provision of the subscription agreement or investors’ rights agreement serves as a waiver by any holder of common shares or by us, or by an investor, of compliance with any provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership of the shares, that were in effect immediately prior to the transfer of the Shares, including but not limited to the investors’ rights agreement or subscription agreement.

We are offering Bonus Shares to some investors in this offering, which effectively gives them a discount on their investment. Certain investors in this offering who invest more than $5,000 or more than $10,000, are entitled to receive Bonus Shares based on the amount of their investment, which effectively gives them a discount on their investment. In addition, investors who “reserve” shares of the company’s Series B Preferred Stock via the online platform provided by StartEngine Crowdfunding, Inc. (“StartEngine”) prior to the qualification of this Offering will be entitled to receive Bonus Shares on the amount of their investment in the company once the offering is qualified, which also effectively gives them a discount on their investment. These Bonus Shares perks are not exclusive, and investors are eligible to receive Bonus Shares in either or both scenarios. (See “Plan of Distribution and Selling Securityholders” for further details). Therefore, the value of shares of investors who either (i) invest less than $5,000 or $10,000 or (ii) do not “reserve” shares prior to investing in the company, and pay the full price for the Series B Preferred Stock in this offering, will be immediately diluted by investments made by investors entitled to receive the Bonus Shares, who will effectively pay less per share.

Our Amended and Restated Certificate of Incorporation also includes a forum selection provision, which could result in less favorable outcomes to the plaintiff(s) in any action against our company. Our Amended and Restated Certificate of Incorporation includes a forum selection provision that requires any claims against the company by stockholders not arising under the federal securities laws to be brought in the Court of Chancery State in the state of Delaware. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims.

This investment is illiquid. There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer. Although the company intends to apply in the future for quotation of its Common Stock on an over-the-counter market, or similar, exchange, there are several requirements that the company may or may not be able to satisfy in a timely manner. Even if we obtain that quotation, we do not know the extent to which investor interest will lead to the development and maintenance of a liquid trading market. You should assume that you may not be able to liquidate your investment for some time or be able to pledge these shares as collateral.

You will need to keep records of your investment for tax purposes. As with all investments in securities, if you sell our Series B Preferred Stock at a profit or loss, you will probably need to pay tax on the long- or short-term capital gains that you realize or apply the loss to other taxable income. If you do not have a regular brokerage account or your regular broker will not hold our Series B Preferred Stock for you (and many brokers refuse to hold securities issued under Regulation A) there will be nobody keeping records for you for tax purposes. You will have to keep your own records and calculate the gain or loss on any sales of the Series B Preferred Stock.

12

The value of your investment may be diluted if the company issues additional options. A pool of unallocated options is typically reserved for future employees, which affects the fully-diluted pre-money valuation for this offering. The price per share of the Series B Preferred Stock has been calculated assuming a 2% post-money unallocated option pool, which may not account for all additional options the company will issue after the offering and may not provide adequate protection against the dilution investors may face due to such additional issuances. Any option issuances by the company over the 2% pool will lower the value of your shares.

Investors in this offering will receive our Series B Preferred Stock, which has limited voting rights compared to our Common Stock. Investors in this offering that purchase our Series B Preferred Stock will have limited voting rights compared to those of the holders of our Common Stock. Our Amended and Restated Certificate of Incorporation states that the holders of our Common Stock are entitled to elect two (2) directors of the corporation to our Board of Directors alone as a class. Our Preferred Stockholders, therefore, will have no choice as to the election of two members of the Board of Directors of the company. The Preferred Stockholders also do not have the right to vote for any directors of the corporation as a standalone class, which is a right granted to our Common Stockholders. The holders of our Preferred Stock are entitled to vote together with the holders of the Common Stock for the election of one (1) independent director, and may vote together with the holders of the Common Stock on any additional directors to be elected to our Board of Directors after the initial (3) directors are elected. Therefore, investors in this offering will very likely not be able to exert the same amount of control over the management of the company as the holders of the Common Stock. See “Securities Being Offered” for more information on the voting rights of our Series B Preferred Stock.

13

Dilution means a reduction in value, control, or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much more significant sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares.

The following table compares the price that new investors are paying for their shares with the effective cash price paid by existing shareholders, giving effect to full conversion of all outstanding convertible notes and assuming that the shares are sold at $6.27 per share. The schedule presents shares and pricing as issued and reflects all transactions since inception, which gives investors a better picture of what they will pay for their investment compared to the company’s insiders than just including such transactions for the last 12 months, which is what the SEC requires.

The following table presents the approximate effective cash price paid for all share and potential shares issuable by the company as of September 30, 2020.

| Date Issued | Issued Shares | Potential Shares | Total Issued

& Potential Shares |

Effective Cash Price per Share at Issuance or Potential Conversion |

||||||||||||||||

| Common Shares: | ||||||||||||||||||||

| Common Shares | 2020 | 519,831 | (3) | — | 519,831 | $ | 0.0001376 | |||||||||||||

| Common Shares | 2019 | 4,227,722 | (4) | — | 4,227,722 | $ | 0.0001542 | |||||||||||||

| Common Shares | 2017 and 2018 | 85,819 | — | 85,819 | $ | 0.0025000 | ||||||||||||||

| Preferred Shares: | ||||||||||||||||||||

| Series-A Preferred Shares | 2020 | 2,940,121 | 2,940,121 | $ | 4.0000000 | |||||||||||||||

| Series-A Preferred Shares | 2019 | 702,021 | — | 702,021 | $ | 4.0000000 | ||||||||||||||

| Convertible Notes: | ||||||||||||||||||||

| Convertible Notes | 2020 | 1,255,417 | (5) | 1,255,417 | $ | 1.1070475 | ||||||||||||||

| Options: | ||||||||||||||||||||

| 2019 Stock Option and Grant Plan | 2020 | — | 1,351,107 | 1,351,107 | $ | 2.9517971 | ||||||||||||||

| 2019 Stock Option and Grant Plan | 2019 | — | 453,200 | 453,200 | $ | 0.6868564 | ||||||||||||||

| Warrants: | ||||||||||||||||||||

| Zimmerman Warrant (1) | 2019 | — | 273,973 | 273,973 | $ | 3.6500000 | ||||||||||||||

| Pro-Dex, Inc. Warrant (2) | 2018 | — | 597,872 | 597,872 | $ | 2.0907477 | ||||||||||||||

| Total Common Share Equivalents | 9,734,493 | 2,474,777 | 12,209,270 | $ | 1.8563524 | |||||||||||||||

| Investors in this offering, assuming $30 Million raised (No Bonus Shares) | 2020 | 4,784,689 | (6) | -- | 4,784,689 | $ | 6.27 | |||||||||||||

| Total After Inclusion of this Offering (No Bonus Shares) | 14,519,182 | 2,474,777 | 16,993,959 | $ | 3.0715168 | |||||||||||||||

| Investors in this offering, assuming $30 Million raised (Bonus Shares) | 2020 | 5,741,626 | (7) | -- | 5,741,626 | $ | 5.22 | |||||||||||||

| Total After Inclusion of this Offering (Bonus Shares) | 2020 | 15,476,119 | 2,525,142 | 18,001,262 | $ | 2.8980479 | ||||||||||||||

14

| (1) | We have entered into a warrant to purchase capital stock with ZB Capital Partners LLC (the “ZB Capital”) (filed herewith as Exhibit 6.13), Under the terms of the warrant, the ZB Capital has the right to acquire $1,000,000 worth of shares of the company’s stock upon the occurrence of the company raising $5,000,000 in an equity financing. We believe it is reasonable to assume that ZB Capital would exercise its right to purchase 273,972 shares of Series A Preferred Stock at a price of $3.65 per share. However, if they so elected and assuming the company raised $5,000,000 in this offering, ZB Capital alternatively has the right to purchase the shares being sold in this offering at the same per share price paid by other investors in this offering, but reduced by the 9.0% total compensation to the StartEngine in this offering. For reference, were ZB Capital to exercise its warrant as part of this offering, it would be able to acquire up to 171,527 shares of our Series B Preferred Stock in exchange for cash consideration of $1,000,000. We have assumed conversion of the ZB Capital Partners warrants into Series-A Preferred Stock for all dilution calculations. |

| (2) | This entry reflects the amount of potential shares issuable to Pro-Dex, Inc. (“Pro-Dex”) under the terms of its warrant agreement (filed herewith as Exhibit 6.11) as of the date of this offering circular. As of the date of this offering circular, Pro-Dex has warrants to acquire 597,872 shares of Monogram’s capital stock. However, the warrant agreement includes automatic, non-dilution provisions, which would increase the number of shares acquirable in the event of capital raising by the company. |

| (3) | The shares of Common Stock issued in 2020 reflects the number of shares of Common Stock issued to Mount Sinai pursuant to the Licensing Agreement included as Exhibit 6.8 to this offering circular. This issuance was triggered by the company’s previous Series A Offering, in which it raised $14,435,668 in gross proceeds. |

| (4) | The shares of Common Stock issued in 2019 were issued to Benjamin Sexson and Douglas Unis in consideration for past and future services to the company and under the terms of the Licensing Agreement included as Exhibit 6.8, respectively. In addition, this number includes the amount of shares of Common Stock issued to Mount Sinai pursuant to the Licensing Agreement. |

| (5) | In 2020, all previous outstanding convertible notes of the company issued between 2017 and 2020 either converted into Series A Preferred Stock of the Company or were repaid. |

| (6) | Does not include up to 956,937 Bonus Shares that may be issued to investors in this offering. | |

| (7) | Includes up to 956,937 Bonus Shares that may be issued to investors in this offering. |

The following table illustrates the dilution that new investors will experience upon investment in the company relative to existing holders of our securities. Because this calculation is based on the net tangible assets of the company, we are calculating based our net tangible book value of $(274,632) as of December 31, 2019, as included in our audited financial statements. As such, this table does not include shares issued in 2019. However, the values have been adjusted to reflect the reverse split effected on May 28, 2019, as noted above.

15

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in the number of shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g., convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early-stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| · | In June 2017 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| · | In December, the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| · | In June 2018, the company has run into serious problems, and in order to stay afloat, it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company, and her stake is worth only $26,660. |

This type of dilution might also happen upon the conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round,” the holders of the convertible notes will dilute existing equity holders, and even more, than the new investors do because they get more shares for their money. Investors should pay careful attention to the amount of convertible notes that the company has issued (and may issue in the future and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

16

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

The company is offering up to 4,784,689 shares of Series B Preferred Stock (not including Bonus Shares) (the “Shares”) on a “best efforts” basis at a cash price of $6.27 per share. The minimum subscription is $250.80, or 40 shares. The aggregate purchase price including the 3.5% processing fee payable directly to StartEngine Primary per share is $5.7132, resulting in a minimum investment of $102.84.

The company has engaged StartEngine Primary as its sole and exclusive placement agent to assist in the placement of its securities. StartEngine Primary is under no obligation to purchase any securities or arrange for the sale of any specific number or dollar amount of securities.

Commissions and Discounts

The following table shows the total discounts and commissions payable to the placement agents in connection with this offering, assuming we raise the maximum amount of offering proceeds:

| Per Share | ||||

| Public offering price | $ | 6.27 | ||

| Placement Agent commissions | $ | 1,050,000 | (1) | |

| Proceeds, before expenses, to us | $ | 28,950,000 | ||

| (1) | StartEngine Primary, LLC will receive commissions of 3.5% of the offering proceeds. |

StartEngine Warrants

The company will also be required to issue to StartEngine Primary warrants to purchase shares of our Series B Preferred Stock on the same terms as other investors in this offering equal to 2.0% of the total amount of shares sold in this offering (excluding Bonus Shares). Shares issued to StartEngine Primary upon exercise of these warrants will be subject to a lock-up provision in accordance with FINRA requirements. If we raise the maximum amount in this offering, StartEngine will receive warrants to purchase95,693 shares of Series B Preferred Stock.

Other Terms

StartEngine Primary has also agreed to perform the following services in exchange for the compensation discussed above:

| · | design, build, and create the company’s campaign page, |

| · | provide the company with a dedicated account manager and marketing consulting services, |

| · | provide a standard purchase agreement to execute between the company and investors, which may be used at the company’s option and |

| · | coordinate money transfers to the company. |

In addition to the commission described above, the company agrees to pay StartEngine Primary a fee of $15,000 for out of pocket accountable expenses paid prior to commencing. Any portion of this amount not expended and accounted for will be returned to the company. Assuming the full amount of the offering is raised, we estimate that the total fees and expenses of the offering payable by the company to StartEngine Primary will be approximately $1,065,000.

StartEngine Primary will charge you a non-refundable processing fee equal to 3.5% of the amount you invest at the time you subscribe for our securities, equivalent to $0.2195 per share. This fee will be refunded in the event the company does not raise any funds in this offering.

StartEngine Primary intends to use an online platform provided by StartEngine Crowdfunding, Inc. (“StartEngine”), an affiliate of StartEngine Primary, at the domain name www.startengine.com (the “Online Platform”) to provide technology tools to allow for the sales of securities in this offering. In addition, StartEngine will assist with the facilitation of credit and debit card payments through the Online Platform. Fees for credit and debit card payments will be passed onto investors at cost, and the company will reimburse StartEngine for transaction fees and return fees that it incurs for returns and chargebacks, pursuant to a Credit Card Services Agreement.

17

Bonus Shares for Certain Investors

Certain investors in this offering are eligible to receive bonus shares of Series B Preferred Stock, which effectively gives them a discount on their investment. Those investors will receive, as part of their investment, additional shares for their shares purchased (“Bonus Shares”). The amount of Bonus Shares investors in this offering are eligible to receive and the criteria for receiving such Bonus Shares is as follows:

| (i) | “Reserved” Shares. Prior to the qualification by the SEC of the company’s offering, the company will offer investors the opportunity to “reserve” shares via the StartEngine website. To reserve shares, an investor must create and login to his or her StartEngine account and navigate to the company’s campaign page. On our campaign page, the investor may select the green "Reserve My Shares" button, which will bring the investor to a new page where the investor will indicate the amount of shares (and amount of money) he or she would like to reserve in the company. The reservation is finalized by clicking the green “Reserve My Shares” button. Investors who reserve shares in this manner will receive 10% additional Bonus Shares on their actual investment once this offering is qualified by the SEC (rounded down to the nearest whole share). For example, if an investor reserves 100 shares, and subsequently confirms this reservation and purchases the 100 shares, such investor will receive an additional 10 shares of the company’s Series B Preferred Stock, for a total of 110 shares. “Reserving” shares is simply an indication of interest. There is no binding commitment for investors that reserve shares in this manner to ultimately invest and purchase the shares reserved of the company, or to purchase any shares of the company whatsoever. |

| (ii) | Investment Amount. Investors will be eligible to receive Bonus Shares based on the amount of their investment in this offering. Investors that invest at least $5,000 in this offering will receive additional Bonus Shares equal to 5% of the number of shares purchased, rounded down to the nearest whole share. Investors that invest at least $10,000 will additional Bonus Shares equal to 10% of the number of shares purchased, rounded down to the nearest whole share. For example, if an investor invests $6,270, the investor will receive 5% more shares of Series B Preferred Stock, and will receive an additional 31 Bonus Shares of Series B Preferred Stock, for a total of 658 shares. |

Investors receiving the 5% bonus will pay an effective price of approximately $5.97 per share before the StartEngine processing fee, while investors receiving the 10% bonus will pay an effective price of approximately $5.70 per share before the StartEngine processing fee. The StartEngine processing fee will be assessed on the full share price of $6.27, and not the effective, post bonus price.

Investors may be eligible to receive both Bonus Share perks described above. As such, investors in this offering are eligible to receive up to 20% additional Bonus Shares on their investment in this Offering

Subscription Procedure