| R EGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| A NNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| T RANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| S HELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered | ||

| |

| * | |

| Large accelerated filer ☐ |

Non- accelerated filer ☐ |

Emerging growth company |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| U.S. GAAP ☐ | International Accounting Standards Board ☒ |

Other ☐ |

| • | “ADRs” refers to the American depositary receipts that evidence our ADSs; |

| • | “ADSs” refers to our American depositary shares, each of which represents one Class A ordinary share; |

| • | “AMTD,” “we,” “us,” “our company,” or “our” refers, prior to the restructuring which was completed in April 2019, to our investment banking, asset management, and strategic investment businesses and, after the completion of the restructuring, to AMTD IDEA Group (formerly known as AMTD International Inc.), a Cayman Islands exempted company with limited liability, and its subsidiaries; |

| • | “AMTD Group” or “Controlling Shareholder” refers to AMTD Group Company Limited, a British Virgin Islands company; |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong, and Macau; |

| • | “Class A ordinary shares” refers to our Class A ordinary shares of par value US$0.0001 each; |

| • | “Class B ordinary shares” refers to our Class B ordinary shares of par value US$0.0001 each; |

| • | “HK$” or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| • | “HKSFC” refers to the Securities and Futures Commission of Hong Kong; |

| • | “SEC” refers to the United States Securities and Exchange Commission; |

| • | “SEHK” refers to the Stock Exchange of Hong Kong Limited; |

| • | “SGX-ST” refers to the Singapore Exchange Securities Trading Limited; |

| • | “shares” or “ordinary shares” refers to our Class A ordinary shares and Class B ordinary shares; and |

| • | “US$” or “U.S. dollars” refers to the legal currency of the United States. |

| • | our goals and strategies; |

| • | our future business development, financial condition and results of operations; |

| • | the trends in, expected growth and market size of the financial services industry in Hong Kong; |

| • | expected changes in our revenues, costs or expenditures; |

| • | our expectations regarding demand for and market acceptance of our products and services; |

| • | competition in our industry; |

| • | our proposed use of proceeds; |

| • | government policies and regulations relating to our industry; and |

| • | fluctuations in general economic and business conditions in Hong Kong, Mainland China and globally, and |

| • | assumptions underlying or related to any of the foregoing. |

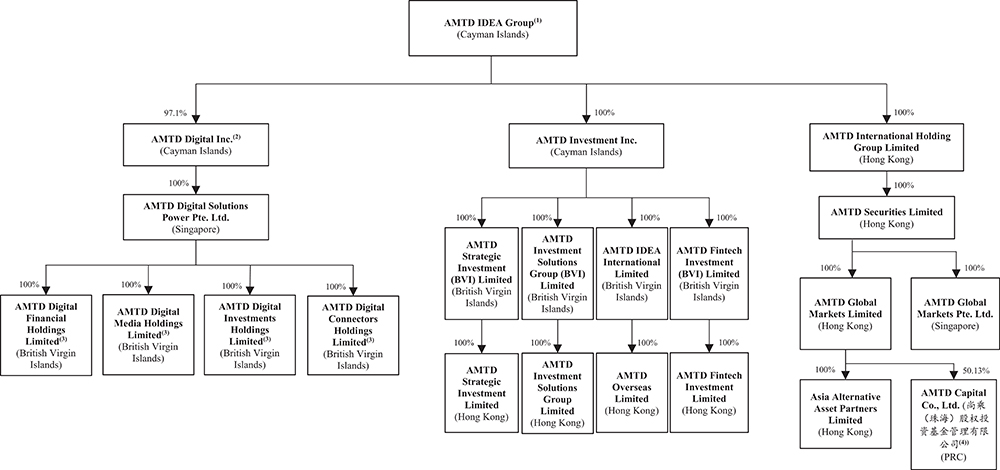

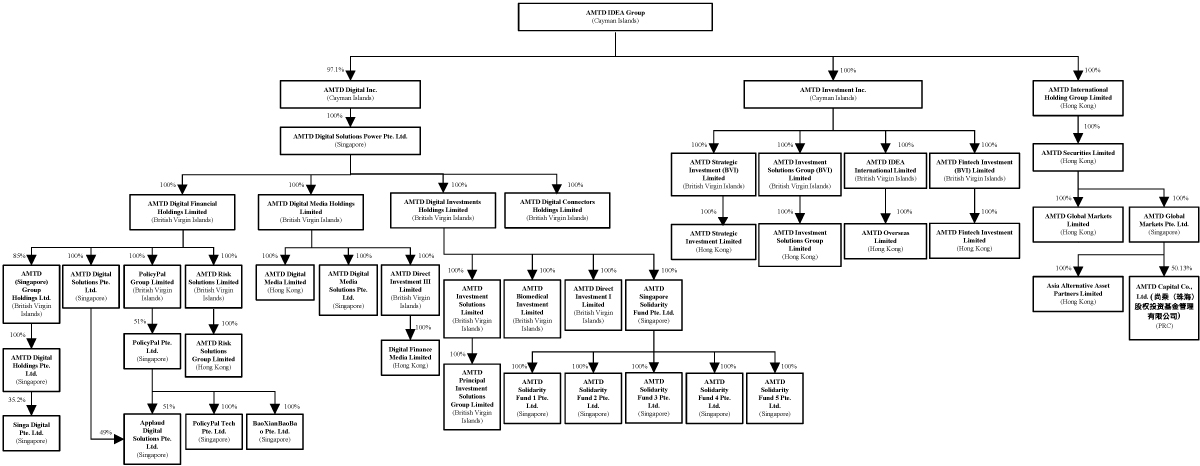

| (1) | Our shareholders include (i) holders of our ordinary shares such as AMTD Group, Infinity Power Investments Limited and Century City International Holdings Limited, and (ii) public investors. For details relating to our share ownership, see “Item 4. Information on the Company—E. Share Ownership.” |

| (2) | The other shareholders of AMTD Digital Inc. include third party investors and two of our employees. |

| (3) | AMTD Digital Financial Holdings Limited has 11 subsidiaries in British Virgin Islands, Singapore and Hong Kong. AMTD Digital Media Holdings Limited has four subsidiaries in British Virgin Islands, Singapore and Hong Kong. AMTD Digital Investments Holdings Limited has 10 subsidiaries in British Virgin Islands and Singapore. |

| (4) | The other shareholder of AMTD Capital Co., Ltd. is a third party investor. |

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

HK$ |

HK$ |

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||||||||

(in thousands, except for share, per share and per ADS data) |

||||||||||||||||||||||||

| Selected Consolidated Statements of Profit or Loss and Other Comprehensive Income Data |

||||||||||||||||||||||||

| Revenue |

||||||||||||||||||||||||

| Fee and commission income |

278,976 | 367,538 | 580,006 | 607,263 | 680,478 | 87,245 | ||||||||||||||||||

| Dividend and gain related to disposed investments |

69,509 | 99,228 | 100,552 | 171,027 | 173,823 | 22,286 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Sub-total |

348,485 | 466,766 | 680,558 | 778,290 | 854,301 | 109,531 | ||||||||||||||||||

| Net fair value changes on investments, stock loan and derivatives |

684,679 | 256,460 | 523,616 | 340,250 | 543,543 | 69,689 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

1,033,164 |

723,226 |

1,204,174 |

1,118,540 |

1,397,844 |

179,220 |

||||||||||||||||||

| Other income |

17,915 | 15,393 | 22,090 | 111,867 | 125,538 | 16,095 | ||||||||||||||||||

| Impairment losses under expected credit loss model on financial assets |

— | — | — | (17,109 | ) | — | — | |||||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

HK$ |

HK$ |

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||||||||

(in thousands, except for share, per share and per ADS data) |

||||||||||||||||||||||||

| Other operating expenses, staff costs and finance costs |

(242,493 | ) | (129,654 | ) | (237,010 | ) | (219,643 | ) | (192,206 | ) | (24,642 | ) | ||||||||||||

| Net fair value changes on derivative financial liability |

— | — | — | 7,765 | — | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit before tax |

808,586 |

608,965 |

989,254 |

1,001,420 |

1,331,176 |

170,673 |

||||||||||||||||||

| Income tax (expense)/credit |

(135,214 | ) | (83,840 | ) | (158,350 | ) | 137,541 | (109,295 | ) | (14,013 | ) | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit for the year |

673,372 |

525,125 |

830,904 |

1,138,961 |

1,221,881 |

156,660 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other comprehensive income for the year |

— | — | — | 1,022 | 739 | 94 | ||||||||||||||||||

| Profit and other comprehensive income attributable to: |

||||||||||||||||||||||||

| —Ordinary shareholders |

568,266 | 468,061 | 938,272 | 1,060,996 | 1,096,896 | 140,634 | ||||||||||||||||||

| —Holders of perpetual securities |

— | — | — | 78,987 | 125,743 | 16,122 | ||||||||||||||||||

| Non-controlling interests |

105,106 | 57,064 | (107,368 | ) | — | (19 | ) | (2 | ) | |||||||||||||||

| Total comprehensive income for the year |

673,372 |

525,125 |

830,904 |

1,139,983 |

1,222,620 |

156,754 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Class A ordinary shares: |

||||||||||||||||||||||||

| Profit per share attributable to ordinary shareholders |

||||||||||||||||||||||||

| Basic |

— | — | 4.34 | 4.34 | 4.81 | 0.62 | ||||||||||||||||||

| Diluted |

— | — | 4.34 | 4.22 | 4.81 | 0.62 | ||||||||||||||||||

| Weighted average number of ordinary shares used in per share calculation |

||||||||||||||||||||||||

| Basic |

— | — | 16,113 | 57,474 | 62,328 | 62,328 | ||||||||||||||||||

| Diluted |

— | — | 16,117 | 58,966 | 62,328 | 62,328 | ||||||||||||||||||

| Class B ordinary shares: |

||||||||||||||||||||||||

| Profit per share attributable to ordinary shareholders |

||||||||||||||||||||||||

| Basic |

2.84 | 2.34 | 4.34 | 4.34 | 4.81 | 0.62 | ||||||||||||||||||

| Diluted |

2.84 | 2.34 | 4.34 | 4.34 | 4.81 | 0.62 | ||||||||||||||||||

| Weighted average number of ordinary shares used in per share calculation |

||||||||||||||||||||||||

| Basic |

200,000 | 200,000 | 200,149 | 186,987 | 165,666 | 165,666 | ||||||||||||||||||

| Diluted |

200,000 | 200,000 | 200,205 | 186,987 | 165,666 | 165,666 | ||||||||||||||||||

As of December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

HK$ |

HK$ |

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Selected Consolidated Statements of Financial Position Data |

||||||||||||||||||||||||

| Total non-current assets |

15,623 | 15,302 | 15,202 | 2,209,103 | |

2,801,265 |

|

359,155 | ||||||||||||||||

| Total current assets |

6,025,994 | 7,091,887 | 8,255,491 | 8,317,188 | 3,885,573 | 498,176 | ||||||||||||||||||

| Total assets |

6,041,617 |

7,107,189 |

8,270,693 |

10,526,291 |

6,686,838 |

857,331 |

||||||||||||||||||

| Total non-current liabilities (interest-bearing) |

— | — | 116,810 | 116,233 | 125,723 | 16,119 | ||||||||||||||||||

| Total non-current liabilities (non-interest-bearing) |

130,209 | 163,357 | 242,914 | — | — | — | ||||||||||||||||||

| Total current liabilities (interest-bearing) |

351,610 | 322,000 | 317,722 | 232,280 | 388,871 | 49,857 | ||||||||||||||||||

As of December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

HK$ |

HK$ |

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Total current liabilities (non-interest- bearing) |

2,890,522 | 3,427,430 | 764,752 | 453,602 | 383,371 | 49,153 | ||||||||||||||||||

| Total liabilities |

3,372,341 |

3,912,787 |

1,442,198 |

802,115 |

897,965 |

115,129 |

||||||||||||||||||

| Share capital and capital reserve |

1,312,960 | 1,312,960 | 4,551,380 | 4,551,380 | 4,551,376 | 583,540 | ||||||||||||||||||

| Treasury shares |

— | — | — | — | (5,000,000 | ) | (641,059 | ) | ||||||||||||||||

| Exchange reserve |

— | — | — | 1,023 | 1,467 | 189 | ||||||||||||||||||

| Retained profits |

870,781 | 1,338,842 | 2,277,115 | 3,337,088 | 4,449,490 | 570,477 | ||||||||||||||||||

| Total ordinary shareholders’ equity |

2,183,741 | 2,651,802 | 6,828,495 | 7,889,491 | 4,002,333 | 513,147 | ||||||||||||||||||

| Non-controlling interests |

485,535 | 542,600 | — | — | 15,496 | 1,987 | ||||||||||||||||||

| Holders of perpetual securities |

— | — | — | 1,834,685 | 1,771,044 | 227,068 | ||||||||||||||||||

| Total equity |

2,669,276 |

3,194,402 |

6,828,495 |

9,724,176 |

5,788,873 |

742,202 |

||||||||||||||||||

| Total liabilities and equity |

6,041,617 |

7,107,189 |

8,270,693 |

10,526,291 |

6,686,838 |

857,331 |

||||||||||||||||||

Subsidiaries |

To Holding Company HK$ (in million) |

From Holding Company HK$ (in million) |

||||||

| AMTD Global Markets Limited |

375.4 | 413.1 | ||||||

| AMTD Investment Solutions Group Limited |

166.5 | — | ||||||

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

| C. | Reasons for the Offer and Use of Proceeds |

| D. | Risk Factors |

| • | The PRC government’s significant authority to intervene in or influence the Mainland China operations of an offshore holding company at any time could limit our ability to transfer or use our cash outside of PRC, and could otherwise result in a material adverse change to our business operations, including our Hong Kong operations and cause the ADSs to significantly decline in value or become worthless. |

| • | Uncertainties arising from the legal system in China, including uncertainties regarding the interpretation and enforcement of PRC laws and the possibility that regulations and rules can change quickly with little advance notice, could hinder our ability to offer or continue to offer the ADSs, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause the ADSs to significantly decline in value or become worthless. |

| • | The PCAOB is currently unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor deprives our investors with the benefits of such inspections. |

| • | The ADSs will be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, in 2024 if the PCAOB is unable to inspect or fully investigate auditors located in Mainland China and Hong Kong, or as early as 2023 if proposed changes to the law are enacted. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| • | We may be subject to a variety of laws and other obligations, including those regarding cybersecurity and data protection, and failure to comply with any of them may result in proceedings against us by government authorities or others and harm our public image and reputation, which could materially and adversely affect our business, financial condition, and results of operations. |

| • | If we were to be required to obtain any permission or approval from the CSRC, the CAC, or other PRC authorities in connection with our overseas offering under PRC law, we may be fined or subject to other sanctions, and our business, reputation financial condition, and results of operations may be materially and adversely affected. |

| • | We have a relatively short operating history of our current businesses compared to some of our globally established competitors and face numerous risks and challenges as we continue to expand our business in a rapidly evolving market, which makes it difficult to effectively assess our future prospects. |

| • | Unfavorable financial markets and economic conditions in Asia and elsewhere in the world could materially and adversely affect our business, financial condition, and results of operations. |

| • | The financial services industry is intensely competitive. If we are unable to compete effectively, we may lose our market share and our results of operations and financial condition may be materially and adversely affected. |

| • | Our businesses depend on key management executives and professional staff, and our business may suffer if we are unable to recruit and retain them. |

| • | We make strategic investments using our own capital, and may not be able to realize any profits from these investments for a considerable period of time, or may lose some or all of the principal amounts of these investments. |

| • | Our strategic investment business is subject to liquidity risks. |

| • | Our results of operations and financial condition may be materially affected by fluctuations in the fair value of our equity investments in our investee companies. |

| • | Our investments are subject to liquidity, concentration, regulatory, credit and other risks. |

| • | A substantial portion of our revenue is derived from investment banking business, which is not long-term contracted source of revenue and is subject to intense competition, and declines in these engagements could materially and adversely affect our financial condition and results of operations. |

| • | Our investment banking business depends on our ability to identify, execute, and complete projects successfully and is subject to various risks associated with underwriting and financial advisory services. We cannot assure you that the income level of our investment banking business can be sustained. |

| • | If we cannot identify or effectively control the various risks involved in the asset management products that we offer or manage under our asset management business or otherwise achieve expected investment returns for our asset management clients, our reputation, client relationships, and asset management business will be adversely affected. |

| • | We are subject to extensive and evolving regulatory requirements, non-compliance with which may result in penalties, limitations, and prohibitions on our future business activities or suspension or revocation of our licenses, and consequently may materially and adversely affect our business, financial condition, and results of operations. In addition, we may, from time to time, be subject to regulatory inquiries and investigations by relevant regulatory authorities or government agencies in Hong Kong or other applicable jurisdictions. |

| • | Our revenue and profits are highly volatile, and fluctuate significantly from quarter to quarter, which may result in volatility of the price of our ADSs or our Class A ordinary shares. |

| • | We have limited experience operating as a stand-alone public company. |

| • | Our financial information included in this annual report may not be representative of our financial condition and results of operations if we had been operating as a stand-alone company. |

| • | We may not continue to receive the same level of support from our Controlling Shareholder. |

| • | Our agreements with our Controlling Shareholders or any of its controlling shareholders may be less favorable to us than similar agreements negotiated between unaffiliated third parties. In particular, our non-competition agreement with our Controlling Shareholder limits the scope of business that we are allowed to conduct. |

| • | We may have conflicts of interest with our Controlling Shareholders or any of its controlling shareholders and, because of our Controlling Shareholder’s controlling ownership interest in our company, we may not be able to resolve such conflicts on terms favorable to us. |

| • | An active public market may not develop for the ADSs on the NYSE or our Class A ordinary shares on the SGX-ST, and you may not be able to resell the ADSs or Class A ordinary shares at or above the price you paid, or at all. |

| • | The trading price of the ADSs or Class A ordinary shares may be volatile, which could result in substantial losses to you. |

| • | The characteristics of the U.S. capital markets and the Singapore capital markets are different |

| • | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions against us or our directors and officers named in the annual report based on foreign laws. |

| • | build and maintain a well-recognized and respected brand domestically and globally; |

| • | establish and expand our client base, win capital markets and advisory mandates, and increase our assets under management, or AUM; |

| • | maintain and enhance our relationships with our business partners; |

| • | attract, retain, and motivate talented employees; |

| • | anticipate and adapt to changing market conditions and competitive landscape; |

| • | manage our future growth and business and geographic expansion; |

| • | ensure that the performance of our products and services meets client expectations; |

| • | maintain or improve our operational efficiency; |

| • | navigate a complex and evolving regulatory environment; |

| • | defend ourselves in any legal or regulatory actions against us; |

| • | enhance our technology infrastructure and maintain the security of our system and the confidentiality of the information provided and utilized across our system; |

| • | identify operational system or infrastructure inefficiency or those of third parties, avoid and remedy operating errors as a result of human or system errors or other misconduct; |

| • | identify and address conflicts of interest; |

| • | manage our strategic investments (including but not limited to monitoring of market risks and operating performance of our investments and derivatives); and |

| • | identify, account for and appropriately manage our related party transactions. |

| • | we may have insufficient experience or expertise in offering new products and services and dealing with inexperienced counterparties and clients may harm our reputation; |

| • | we may be subject to stricter regulatory scrutiny, or increasing tolerance of credit risks, market risks, compliance risks, and operational risks; |

| • | we may be unable to provide clients with adequate levels of service for our new products and services; |

| • | our new products and services may not be accepted by our clients or meet our profitability expectations; and |

| • | our new products and services may be quickly copied by our competitors so that its attractiveness to our clients may be diluted; and our internal information technology infrastructure may not be sufficient to support our product and service offerings. |

| • | Indemnification arrangements with our Controlling Shareholder |

| • | Non-competition arrangements with our Controlling Shareholdernon-competition agreement under which our Controlling Shareholder agrees not to compete with us in our investment banking and asset management businesses that are both primarily targeting institutional and corporate clients, except for owning non-controlling equity interest in any company competing with us. We have agreed not to compete with our Controlling Shareholder in businesses currently conducted by our Controlling Shareholder, except that we may (i) continue to provide investment |

| banking and asset management products and services to our existing individual clients, and (ii) own non-controlling equity interests in any company competing with our Controlling Shareholder. |

| • | Employee recruiting and retention non-competition agreement and have a non-solicitation arrangement with our Controlling Shareholder that restricts us and our Controlling Shareholder from hiring any of each other’s employees. |

| • | Our board members or executive officers may have conflicts of interest |

| • | Sale of shares or assets in our company lock-up period and subject to certain restrictions under relevant securities laws and stock exchange rules, as well as other relevant restrictions, our Controlling Shareholder may decide to sell all or a portion of our shares that it holds to a third party, including to one of our competitors, thereby giving that third party substantial influence over our business and our affairs. In addition, our Controlling Shareholder may decide, or be obligated under any of its applicable debt covenant, to sell all or a portion of our shares or our assets in the event of default of our Controlling Shareholder or any of its controlling shareholders under any applicable debt or other obligations or otherwise becomes insolvent. Such a sale of our shares or our assets could be contrary to the interests of our employees or our other shareholders. In addition, our Controlling Shareholder may also discourage, delay, or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of the ADSs or Class A ordinary shares. |

| • | Allocation of business opportunities |

| • | Developing business relationships with our Controlling Shareholder’s competitors |

| • | regulatory developments affecting us or our industry; |

| • | variations in our revenue, profit, and cash flow; |

| • | changes in the economic performance or market valuations of other financial services firms; |

| • | actual or anticipated fluctuations in our quarterly results of operations and changes or revisions of our expected results; |

| • | changes in financial estimates by securities research analysts; |

| • | detrimental negative publicity about us, our services, our officers, directors, Controlling Shareholder, other beneficial owners, our business partners, or our industry; |

| • | announcements by us or our competitors of new service offerings, acquisitions, strategic relationships, joint ventures, capital raisings or capital commitments; |

| • | additions to or departures of our senior management; |

| • | litigation or regulatory proceedings involving us, our officers, directors, or Controlling Shareholders; |

| • | release or expiry of any transfer restrictions on our outstanding shares or the ADSs; and |

| • | sales or perceived potential sales of additional ordinary shares or ADSs. |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

ITEM 4. |

INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

| B. | Business Overview |

| • | Investment Banking |

| • | Asset Management |

| • | Strategic Investment |

| • | Full service capabilities |

| • | Full value chain’s client focuses |

| • | Industry expertise |

| • | Senior bankers’ participation |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Investment Banking Revenue |

||||||||||||||||||||||||||||

| Underwriting commission and brokerage fee |

403,574 | 88.5 | 165,473 | 44.0 | 29,052 | 3,725 | 4.9 | |||||||||||||||||||||

| Financial advisory fee |

52,382 | 11.5 | 210,852 | 56.0 | 568,046 | 72,830 | 95.1 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

455,956 |

100.0 |

376,325 |

100.0 |

597,098 |

76,555 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Asset Management Revenue |

||||||||||||||||||||||||||||

| Management fee and performance-based incentive fees |

103,509 | 83.4 | 196,352 | 85.0 | 57,230 | 7,338 | 68.6 | |||||||||||||||||||||

| Brokerage, handling, and other fees |

20,541 | 16.6 | 34,586 | 15.0 | 26,150 | 3,352 | 31.4 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

124,050 |

100.0 |

230,938 |

100.0 |

83,380 |

10,690 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Leveraging “AMTD SpiderNet.” |

| • | Value investment |

| • | Synergy with portfolio companies |

| • | management team with strong track record and complementary industry expertise; |

| • | high growth potential with sustainability; |

| • | core competitive advantage in the relevant sector; and |

| • | potential for significant synergies with our existing businesses. |

| • | to maintain and promote the fairness, efficiency, competitiveness, transparency, and orderliness of the securities and futures industry; |

| • | to promote understanding by the public of financial services including the operation and functioning of the securities and futures industry; |

| • | to provide protection for members of the public investing in or holding financial products; |

| • | to minimize crime and misconduct in the securities and futures industry; |

| • | to reduce systemic risks in the securities and futures industry; and |

| • | to assist the Financial Secretary of Hong Kong in maintaining the financial stability of Hong Kong by taking appropriate actions in relation to the securities and futures industry. |

| • | Brokers, investment advisers, fund managers, and intermediaries carrying out the regulated activities as listed in “—Licensing Regime Under the HKSFO—Types of Regulated Activities” below, |

| • | Listed companies, |

| • | Hong Kong Exchanges and Clearing Limited, and |

| • | Market participants (including investors). |

| • | grant licenses to those who are appropriately qualified and can demonstrate their fitness and properness to be licensed under the HKSFO; |

| • | maintain online a public register of licensed persons and registered corporations; |

| • | monitor the ongoing compliance of licensing requirements by licensees, substantial shareholders of licensed corporations, and directors of licensed corporations; and |

| • | initiate policies on licensing issues. |

| • | carrying on a business in a regulated activity (or holding out as carrying on a regulated activity), or |

| • | actively marketing, whether in Hong Kong or from a place outside Hong Kong, to the public such services it provides, would constitute a regulatory activity if provided in Hong Kong, |

| Company |

Type of Regulated Activities | |

| AMTD Global Markets Limited (1) |

Type 1, Type 2, Type 4, Type 6, and Type 9 | |

| Asia Alternative Asset Partners Limited (2) |

Type 1, Type 4, and Type 9 |

| (1) | The following conditions are currently imposed on the HKSFC license of AMTD Global Markets Limited: |

| • | For Type 6 regulated activity, the licensee shall not act as sponsor in respect of an application for the listing on a recognized stock market of any securities. |

| • | For Type 6 regulated activity, the licensee shall not advise on matters/transactions falling within the ambit of the Codes on Takeovers and Mergers and Share Buy-backs issued by the HKSFC. |

| (2) | The following conditions are currently imposed on the HKSFC license of Asia Alternative Asset Partners Limited: |

| • | The licensee shall only provide services to professional investors. The term “professional investor” is as defined in the HKSFO and its subsidiary legislation. |

| • | The licensee shall not hold client assets. The terms “hold” and “client assets” are as defined under the HKSFO. |

| • | For Type 1 regulated activity, the licensee shall only carry on the business of dealing in collective investment schemes. The terms “collective investment scheme” and “dealing” are as defined under the HKSFO. |

| • | “Guidelines on Competence”; |

| • | “the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission,” or the Code of Conduct; |

| • | “the Management, Supervision and Internal Control Guidelines for Persons Licensed by or Registered with the HKSFC”; |

| • | “Corporate Finance Adviser Code of Conduct”; and |

| • | “Fund Manager Code of Conduct.” |

| (a) | overall management oversight; |

| (b) | key business lines; |

| (c) | operational control and review; |

| (d) | risk management; |

| (e) | finance and accounting; |

| (f) | information technology; |

| (g) | compliance; and |

| (h) | anti-money laundering and counter-terrorist financing. |

| • | financial status or solvency; |

| • | educational or other qualifications or experience having regard to the nature of the functions to be performed; |

| • | ability to carry on the regulated activity concerned competently, honestly, and fairly; and |

| • | reputation, character, reliability, and financial integrity of the applicant and other relevant persons as appropriate. |

| • | an individual who applies for license or is licensed under Part V of the HKSFO; |

| • | a licensed representative who applies for approval or is approved as a responsible officer under Part V of the HKSFO; |

| • | a corporation which applies for license or is licensed under Part V of the HKSFO; |

| • | an authorized financial institution which applies for registration or is registered under Part V of the HKSFO; |

| • | an individual whose name is to be or is entered in the register maintained by the Hong Kong Monetary Authority under section 20 of the Banking Ordinance (Cap. 155) of Hong Kong; and |

| • | an individual who applies to be or has been given consent to act as an executive director of a registered institution under section 71C of the Banking Ordinance (Cap. 155 of Hong Kong). |

| • | decisions made by such relevant authorities as stated in section 129(2)(a) of the HKSFO or any other authority or regulatory organization, whether in Hong Kong or elsewhere, in respect of that person; |

| • | in the case of a corporation, any information relating to: |

○ |

any other corporation within the group of companies; or |

○ |

any substantial shareholder or officer of the corporation or of any of its group companies; |

| • | in the case of a corporation licensed under section 116 or 117 of the HKSFO or registered under section 119 of the HKSFO or an application for such license or registration: |

○ |

any information relating to any other person who will be acting for or on its behalf in relation to the regulated activity; and |

○ |

whether the person has established effective internal control procedures and risk management systems to ensure its compliance with all applicable regulatory requirements under any of the relevant provisions; |

| • | in the case of a corporation licensed under section 116 or section 117 of the HKSFO or an application for the license, any information relating to any person who is or to be employed by, or associated with, the person for the purposes of the regulated activity; and |

| • | the state of affairs of any other business which the person carries on or proposes to carry on. |

| • | maintenance of minimum paid-up share capital and liquid capital, and submission of financial returns to the HKSFC in accordance with the requirements under the Securities and Futures (Financial Resources) Rules (as discussed in more detail below); |

| • | maintenance of segregated account(s), and custody and handling of client securities in accordance with the requirements under the Securities and Futures (Client Securities) Rules (Chapter 571H of the Laws of Hong Kong); |

| • | maintenance of segregated account(s), and holding and payment of client money in accordance with the requirements under the Securities and Futures (Client Money) Rules (Chapter 571I of the Laws of Hong Kong); |

| • | maintenance of proper records in accordance with the requirements prescribed under the Securities and Futures (Keeping of Records) Rules (Chapter 5710 of the Laws of Hong Kong); |

| • | maintenance of insurance against specific risks for specified amounts in accordance with the requirements under the Securities and Futures (Insurance) Rules (Chapter 571A1 of the Laws of Hong Kong); and |

| • | payment of annual fees and submission of annual returns to the HKSFC within one month after each anniversary date of the license; and implementation of appropriate policies and procedures relating to client acceptance, client due diligence, record keeping, identification, and reporting of suspicious transactions and staff screening, education, and training in accordance with the requirements under the Guideline on Anti-Money Laundering and Counter-Terrorist Financing issued by the HKSFC. |

| (a) | has an interest in shares in the corporation— |

| (i) | the aggregate number of which shares is equal to more than 10% of the total number of issued shares of the corporation; or |

| (ii) | which entitles the person, either alone or with any of his associates and either directly or indirectly, to exercise or control the exercise of more than 10% of the voting power at general meetings of the corporation; or |

| (b) | holds shares in any other corporation which entitles him, either alone or with any of his associates and either directly or indirectly, to exercise or control the exercise of 35% or more of the voting power at general meetings of the other corporation, or of a further corporation, which is itself entitled, either alone or with any of its associates and either directly or indirectly, to exercise or control the exercise of more than 10% of the voting power at general meetings of the corporation. |

| • | revocation or suspension of a license or a registration; |

| • | revocation or suspension of part of a license or registration in relation to any of the regulated activities for which a regulated person is licensed or registered; |

| • | revocation or suspension of the approval granted to a responsible officer; |

| • | public or private reprimand on a regulated person; |

| • | prohibition of a regulated person from applying to be licensed or registered or to be approved as a responsible officer; |

| • | prohibition of a regulated person from applying to be given consent to act or continue to act as an executive officer of a registered institution; |

| • | prohibition of a regulated person from re-entry to be licensed or registered; and |

| • | pecuniary penalty of not exceeding the amount of HK$10 million or three times the amount of the profit gained or loss avoided as a result of the misconduct. |

| Exchange / Clearing House |

Type of Participantship | |

| The Stock Exchange of Hong Kong Limited |

Participant | |

| Hong Kong Securities Clearing Company Limited, or HKSCC |

Direct Clearing Participant |

| Hong Kong Stock Exchange Participant / Stock Options / Exchange Participant |

Future Exchange Participant | |||

| Legal Status | Being a company limited by shares incorporated in Hong Kong | |||

| HKSFC Registration | Being a licensed corporation qualified to carry out Type 1 regulated activity under the HKSFO | Being a licensed corporation qualified to carry out Type 2 regulated activity under the HKSFO | ||

| Trading Right | Holding a Stock Exchange Trading Right | Holding a Futures Exchange Trading Right | ||

| Financial Standing | Having good financial standing and integrity | |||

| Financial Resources Requirement | Complying with the minimum capital requirement, liquid capital requirement and other financial resources requirements as specified by the FRR | |||

| • | to be an Exchange Participant of the SEHK; |

| • | to undertake to (i) sign a participant agreement with HKSCC; (ii) pay to HKSCC an admission fee of HK$50,000 in respect of each Stock Exchange Trading Right held by it; and (iii) pay to HKSCC its contribution to the Guarantee Fund of HKSCC as determined by HKSCC from time to time subject to a minimum cash contribution of the higher of HK$50,000 or HK$50,000 in respect of each Stock Exchange Trading Right held by it; |

| • | to open and maintain a single current account with one of the Central Clearing and Settlement System, or CCASS, designated banks and execute authorizations to enable the designated bank to accept electronic instructions from HKSCC to credit or debit the account for CCASS money settlement, including making payment to HKSCC; |

| • | to provide a form of insurance to HKSCC as security for liabilities arising from defective securities deposited by it into CCASS, if so required by HKSCC; and |

| • | to have a minimum liquid capital of HK$3,000,000. |

| (a) | an authorized financial institution registered under the HKSFO for Type 1 or Type 4 regulated activity, or both; |

| (b) | a corporation licensed under the HKSFO to carry on Type 1 or Type 4 regulated activity, or both; |

| (c) | an insurer authorized under the Insurance Ordinance (Cap. 41) of Hong Kong, or IO, to carry on long term insurance business; and |

| (d) | an authorized long term insurance broker under the IO. |

| (a) | an individual licensed under the HKSFO to carry on Type 1 or Type 4 regulated activity, or both; |

| (b) | an individual registered under the Banking Ordinance (Chapter 155, Laws of Hong Kong) to carry on Type 1 or Type 4 regulated activity, or both; |

| (c) | a licensed individual insurance agent, as defined under the IO, who is eligible to engage in long term business; |

| (d) | a licensed insurance agency, as defined under the IO, or Licensed Insurance Agency, who is eligible to engage in long term business; |

| (e) | a licensed technical representative (agent), as defined under the IO who is appointed as an agent by a Licensed Insurance Agency; and |

| (f) | a technical representative (broker), as defined under the IO, who is appointed as an agent by a licensed insurance broker company as defined under the IO. |

| (a) | inviting or inducing, or attempting to invite or induce, another person to make a specified MPF decision; or |

| (b) | giving advice to another person concerning a specified MPF decision. |

| • | he or she must be attached to a PI and have sufficient authority within the PI, and will be provided with sufficient, resources, and support for carrying out specified responsibilities in relation to the PI; |

| • | the approval of the SI as a responsible officer has not been revoked by MPFA under section 34ZW(4)(a)(i) of the MPFSO within one year immediately before the date of the application; and |

| • | he or she is not disqualified by MPFA under section 34ZW(4)(a)(ii) of the MPFSO from being approved as a responsible officer with specified responsibilities in relation to a PI. |

| • | take all reasonable measures to ensure that proper safeguards exist to mitigate the risks of money laundering and terrorism financing, or ML/TF, and to prevent a contravention of any requirement; |

| • | establish and implement adequate and appropriate anti-money laundering and counter-financing of terrorism systems; |

| • | consider the characteristics of the products and wits that it offers end the extent to which these are vulnerable to ML/TF abuse; |

| • | consider its delivery/distribution chattels end the testing to which these are vulnerable to ML/TF abuse; |

| • | when assessing the customer risk, consider who their customers are, when they do and any other information that may suggest the customer is of higher risk; |

| • | be vigilant where the customer is of such a legal form that enables individuals to divest themselves of ownership of property whilst retaining an element of control over it or the business/industrial sector to which a customer has business connections is more vulnerable to corruption; |

| • | consider risks inherent in the nature of the activity of the customer sold the possibility that the transaction may itself be a criminal transaction; and |

| • | pay particular attention to countries or geographical locations of operation with which its customers and intermediaries are connected where they are subject to high levels of organized crime, increased vulnerabilities to corruption and inadequate systems to prevent and detect ML/TF. |

| C. | Organizational Structure |

| • | administrative support; |

| • | marketing and branding support; |

| • | technology support; and |

| • | provision of office space and facilities. |

| D. | Property, Plants and Equipment |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| A. | Operating Results |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Revenue |

||||||||||||||||||||||||||||

| Fee and commission income |

580,006 | 48.2 | 607,263 | 54.3 | 680,478 | 87,245 | 48.7 | |||||||||||||||||||||

| Dividend and gain related to disposed investments |

100,552 | 8.3 | 171,027 | 15.3 | 173,823 | 22,286 | 12.4 | |||||||||||||||||||||

| Net fair value changes on financial assets at FVTPL, stock loan and derivatives |

523,616 | 43.5 | 340,250 | 30.4 | 543,543 | 69,689 | 38.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

1,204,174 |

100.0 |

1,118,540 |

100.0 |

1,397,844 |

179,220 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Fee and Commission Income |

||||||||||||||||||||||||||||

| Investment banking fees and commissions |

455,956 | 78.6 | 376,325 | 62.0 | 597,098 | 76,555 | 87.7 | |||||||||||||||||||||

| Asset management fees and other income |

124,050 | 21.4 | 230,938 | 38.0 | 83,380 | 10,690 | 12.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

580,006 |

100.0 |

607,263 |

100.0 |

680,478 |

87,245 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| AUM |

||||||||||||||||

| Balance at the beginning of the period |

18,263,267 | 26,199,526 | 26,097,459 | 3,346,000 | ||||||||||||

| Net change in clients’ portfolio (1) |

7,936,259 | (102,067 | ) | (1,849 | ) | (237 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at the end of the period |

26,199,526 | 26,097,459 | 26,095,610 | 3,345,763 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Net change in clients’ portfolio represents net deposit of clients’ cash and stock and net balance of dividend and coupon received, fee charges, and fair value change of clients’ portfolio. |

For the Year Ended December 31, |

||||||||||||

2019 |

2020 |

2021 |

||||||||||

| Weighted Average Asset Management Fee Rate (1) |

0.55 | % | 0.88 | % | 0.32 | % | ||||||

| (1) | Calculated by dividing total asset management fee income for the period by average AUM for the corresponding period, which is in turn calculated by dividing the sum of AUM at the beginning and end of the relevant period by two. |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Other Operating Expenses |

||||||||||||||||||||||||||||

| Marketing and brand promotional expenses |

12,904 | 11.3 | 5,697 | 5.5 | 598 | 77 | 0.7 | |||||||||||||||||||||

| Premises costs and office utilities |

21,118 | 18.4 | 20,846 | 20.1 | 22,048 | 2,827 | 26.3 | |||||||||||||||||||||

| Traveling and business development expenses |

19,363 | 16.9 | 5,636 | 5.4 | 3,747 | 480 | 4.5 | |||||||||||||||||||||

| Commissions and bank charges |

2,307 | 2.0 | 1,957 | 1.9 | 1,308 | 168 | 1.6 | |||||||||||||||||||||

| Administrative service fee, and office and maintenance expenses |

13,431 | 11.7 | 24,505 | 23.6 | 24,385 | 3,126 | 29.1 | |||||||||||||||||||||

| Legal and professional fees |

23,179 | 20.2 | 36,315 | 35.0 | 24,663 | 3,162 | 29.4 | |||||||||||||||||||||

| Staff welfare and staff recruitment expenses |

2,472 | 2.2 | 1,224 | 1.2 | 2,322 | 298 | 2.8 | |||||||||||||||||||||

| Stamp duty |

2,116 | 1.8 | — | — | — | — | — | |||||||||||||||||||||

| Others |

17,807 | 15.5 | 7,543 | 7.3 | 4,723 | 606 | 5.6 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

114,697 |

100.0 |

103,723 |

100.0 |

83,794 |

10,744 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Staff Costs |

||||||||||||||||

| Salaries and bonuses |

93,704 | 93,661 | 94,776 | 12,151 | ||||||||||||

| Pension scheme contributions (defined contribution schemes) |

903 | 749 | 810 | 104 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

94,607 |

94,410 |

95,586 |

12,255 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

HK$ |

% |

HK$ |

% |

HK$ |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Revenue |

||||||||||||||||||||||||||||

| Fee and commission income |

580,006 | 48.2 | 607,263 | 54.3 | 680,478 | 87,245 | 48.7 | |||||||||||||||||||||

| Dividend and gain related to disposed investments |

100,552 | 8.3 | 171,027 | 15.3 | 173,823 | 22,286 | 12.4 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Sub-total |

680,558 | 56.5 | 778,290 | 69.6 | 854,301 | 109,531 | 61.1 | |||||||||||||||||||||

| Net fair value changes on investments, stock loan and derivatives |

523,616 | 43.5 | 340,250 | 30.4 | 543,543 | 69,689 | 38.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenue |

1,204,174 |

100.0 |

1,118,540 |

100.0 |

1,397,844 |

179,220 |

100.0 |

|||||||||||||||||||||

| Other income |

22,090 | 1.8 | 111,867 | 10.0 | 125,538 | 16,095 | 9.0 | |||||||||||||||||||||

| Impairment loss under expected credit loss made on financial assets |

— | — | (17,109 | ) | (1.5 | ) | — | — | — | |||||||||||||||||||

| Other operating expenses |

(114,697 | ) | (9.5 | ) | (103,723 | ) | (9.3 | ) | (83,794 | ) | (10,743 | ) | (6.0 | ) | ||||||||||||||

| Staff costs |

(94,607 | ) | (7.8 | ) | (94,410 | ) | (8.5 | ) | (95,586 | ) | (12,255 | ) | (6.8 | ) | ||||||||||||||

| Finance costs |

(27,706 | ) | (2.3 | ) | (21,510 | ) | (1.9 | ) | (12,826 | ) | (1,644 | ) | (0.9 | ) | ||||||||||||||

| Net fair value changes on derivative financial liability |

— | — | 7,765 | 0.7 | — | — | — | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Profit before tax |

989,254 |

82.2 |

1,001,420 |

89.5 |

1,331,176 |

170,673 |

95.3 |

|||||||||||||||||||||

| Income tax (expense)/credit |

(158,350 | ) | (13.2 | ) | 137,541 | 12.3 | (109,295 | ) | (14,013 | ) | (7.8 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Profit for the year |

830,904 |

69.0 |

1,138,961 |

101.8 |

1,221,881 |

156,660 |

87.5 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Investment Banking |

||||||||||||||||

| Segment revenue |

455,956 | 376,325 | 597,098 | 76,555 | ||||||||||||

| Segment results (1) |

413,354 | 339,933 | 580,773 | 74,462 | ||||||||||||

| Asset Management |

||||||||||||||||

| Segment revenue |

124,050 | 230,938 | 83,380 | 10,690 | ||||||||||||

| Segment results (1) |

109,182 | 225,338 | 77,731 | 9,966 | ||||||||||||

| Strategic Investment |

||||||||||||||||

| Segment revenue |

624,168 | 511,277 | 717,367 | 91,975 | ||||||||||||

| Segment results (1) |

624,168 | 511,277 | 717,367 | 91,975 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total segment results |

1,146,704 |

1,076,548 |

1,375,871 |

176,403 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | The segment results represent segment revenue that excludes (i) unallocated corporate and other expenses, (ii) unallocated finance costs, and (iii) unallocated other income. |

| • | Investment banking segment |

| • | Asset management segment |

| • | Investment banking segment |

| • | Asset management segment |

As of December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Selected Consolidated Statements of Financial Position Data |

||||||||||||||||

| Assets: |

||||||||||||||||

| Accounts receivable |

346,380 | 77,350 | 86,515 | 11,092 | ||||||||||||

| Due from immediate holding company |

2,921,839 | 6,477,266 | 2,144,975 | 275,011 | ||||||||||||

| Financial assets at fair value through profit or loss—current |

1,572,698 | 62,520 | — | — | ||||||||||||

| Stock loan—current |

1,200,980 | — | — | — | ||||||||||||

| Financial assets at fair value through profit or loss—non-current |

— | 1,315,337 | 2,574,696 | 330,106 | ||||||||||||

| Stock loan—non-current |

— | 878,483 | 211,331 | 27,095 | ||||||||||||

| Derivative financial asset |

1,165,220 | 1,023,903 | 969,895 | 124,352 | ||||||||||||

| Total assets |

8,270,693 |

10,526,291 |

6,686,838 |

857,331 |

||||||||||||

| Liabilities and Equity: |

||||||||||||||||

| Accounts payable |

492,039 | 201,986 | 155,021 | 19,875 | ||||||||||||

| Margin loans payable |

317,722 | — | — | — | ||||||||||||

| Bank borrowings |

— | 232,280 | 388,871 | 49,857 | ||||||||||||

| Total liabilities |

1,442,198 |

802,115 |

897,965 |

115,129 |

||||||||||||

| Perpetual securities |

— | 1,834,685 | 1,771,043 | 227,068 | ||||||||||||

| Total equity |

6,828,495 |

9,724,176 |

5,788,873 |

742,202 |

||||||||||||

| Total liabilities and equity |

8,270,693 |

10,526,291 |

6,686,838 |

857,331 |

||||||||||||

As of December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Accounts receivable: |

||||||||||||||||

| Receivable from investment banking services |

66,740 | 21,977 | 54,764 | 7,021 | ||||||||||||

| Receivable from brokers and clearing house |

261,330 | 19,864 | 21,406 | 2,745 | ||||||||||||

| Clients’ receivables |

18,310 | 35,509 | 10,345 | 1,326 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

346,380 |

77,350 |

86,515 |

11,092 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

As of December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Not yet due |

294,542 | 67,241 | 74,048 | 9,494 | ||||||||||||

| Past due |

||||||||||||||||

| – Within 1 month |

41,032 | 7,797 | 54 | 7 | ||||||||||||

| – 1 to 3 months |

5,232 | 221 | 5,166 | 662 | ||||||||||||

| – Over 3 months |

5,574 | 2,091 | 7,247 | 929 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

346,380 |

77,350 |

86,515 |

11,092 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

As of December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Accounts payable: |

||||||||||||||||

| Clients’ payables |

256,423 | 138 | 147 | 19 | ||||||||||||

| Payables to clearing house and brokers |

9,063 | 1,312 | 8,590 | 1,101 | ||||||||||||

| Clients’ monies held on trust |

226,553 | 200,536 | 146,284 | 18,755 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

492,039 |

201,986 |

155,021 |

19,875 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

As of December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Within 1 month |

265,486 | 1,450 | 155,021 | 19,875 | ||||||||||||

| Repayable on demand |

226,553 | 200,536 | — | — | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

492,039 |

201,986 |

155,021 |

19,875 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| C. | Liquidity and Capital Resources |

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

HK$ |

HK$ |

HK$ |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Summary Consolidated Cash Flow Data |

||||||||||||||||

| Net cash generated from operating activities |

709,500 | 1,993,977 | 434,760 | 55,741 | ||||||||||||

| Net cash used in investing activities |

(2,957,940 | ) | (3,581,341 | ) | (358,669 | ) | (45,986 | ) | ||||||||

| Net cash (used in)/generated from financing activities |

2,888,015 | 1,274,407 | (6,660 | ) | (854 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net increase/(decrease) in cash and cash equivalents |

639,575 | (312,957 | ) | 69,431 | 8,901 | |||||||||||

| Cash and cash equivalents at the beginning of year |

126,856 | 766,431 | 453,967 | 58,204 | ||||||||||||

| Effect of foreign exchange rate change, net |

493 | 2,808 | 361 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents at the end of year |

766,431 | 453,967 | 526,206 | 67,466 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| D. | Research and Development, Patents and Licenses, etc. |

| E. | Trend Information |

| F. | Off-Balance Sheet Arrangements |

| G. | Tabular Disclosure of Contractual Obligations |

Total |

Less Than 1 Year |

1-3 Years |

3-5 Years |

More Than 5 Years |

||||||||||||||||

(HK$ in millions) |

||||||||||||||||||||

| Convertible bond with principal and interest |

125.3 | — | 125.3 | — | — | |||||||||||||||

| Bank borrowings, with principal and interest |

393.6 | 393.6 | — | — | — | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

518.9 | 393.6 | 125.3 | — | — | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. | Directors and Senior Management |

| Directors and Executive Officers |

Age |

Position/Title | ||

| Dr. Feridun Hamdullahpur (1)(2)(3) |

67 | Chairman of the Board of Directors and Independent Director | ||

| Dr. Timothy Tong (1)(2)(3) |

68 | Independent Director | ||

| Dr. Annie Koh (1)(3) |

68 | Independent Director | ||

| Marcellus Wong (2) |

68 | Director | ||

| Raymond Yung |

61 | Director | ||

| Frederic Lau |

70 | Chairman of Executive Management Committee | ||

| William Fung |

41 | Chief Executive Officer | ||

| Xavier Ho Sum Zee |

47 | Chief Financial Officer | ||

| Jason Man Chun Chiu |

37 | Co-Chief Financial Officer | ||

| Bert Chun Lung Tsang |

35 | Chief Accounting Officer | ||

| Ming Lin Cheung |

37 | Head of Global Markets |

| (1) | Member of our audit committee. |

| (2) | Member of our compensation committee. |

| (3) | Member of our nominating and corporate governance committee. |

| B. | Compensation |

| C. | Board Practices |

| • | selecting the independent registered public accounting firm and pre-approving all auditing and non-auditing services permitted to be performed by the independent registered public accounting firm; |

| • | reviewing with the independent registered public accounting firm any audit problems or difficulties and management’s response; |

| • | reviewing and approving all proposed related party transactions, as defined in Item 404 of Regulation S-K under the Securities Act; |

| • | discussing the annual audited financial statements with management and the independent registered public accounting firm; |

| • | reviewing major issues as to the adequacy of our internal controls and any special audit steps adopted in light of material control deficiencies; |

| • | annually reviewing and reassessing the adequacy of our audit committee charter; |

| • | meeting separately and periodically with management and the independent registered public accounting firm; and reporting regularly to the board. |

| • | reviewing the total compensation package for our executive officers and making recommendations to the board with respect to it; |

| • | reviewing the compensation of our non-employee directors and making recommendations to the board with respect to it; and periodically reviewing and approving any long-term incentive compensation or equity plans, programs or similar arrangements, annual bonuses, and employee pension and welfare benefit plans. |

| • | recommending nominees to the board for election or re-election to the board, or for appointment to fill any vacancy on the board; |

| • | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, age, skills, experience and availability of service to us; |

| • | selecting and recommending to the board the names of directors to serve as members of the audit committee and the compensation committee, as well as of the nominating and corporate governance committee itself; |

| • | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance; and |

| • | undertaking generally such other functions and duties as may be required by law or the Listing Manual of the SGX-ST, and by amendments made thereto from time to time. |

| • | All decisions at any meeting of the nominating and corporate governance committee are decided by a majority of votes of the members presents and voting and such decision at all times exclude the vote, approval or recommendation of any member who has a conflict of interest in the subject matter under consideration. |

| • | convening shareholders’ annual general meetings and reporting its work to shareholders at such meetings; |

| • | declaring dividends and distributions; |

| • | appointing officers and determining the term of office of the officers; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | approving the transfer of shares in our company, including the registration of such shares in our share register. |

| D. | Employees |

| Function |

Number of Employees |

Percentage |

||||||

| Executive officers |

6 | 15.4 | % | |||||

| Licensed professionals |

21 | 53.8 | % | |||||

| Supporting staff |

12 | 30.8 | % | |||||

| |

|

|

|

|||||

| Total |

39 | 100.0 |

% | |||||

| |

|

|

|

|||||

| E. | Share Ownership |

| • | each of our directors and executive officers; and |

| • | each person known to us to own beneficially more than 5% of our ordinary shares. |

Class A Ordinary Shares |

Class B Ordinary Shares |

Percentage of Beneficial Ownership† |

Percentage of Voting Power†† |

|||||||||||||

| Directors and Executive Officers:* |

||||||||||||||||

| Dr. Feridun Hamdullahpur (1) |

— | — | — | — | ||||||||||||

| Dr. Timothy Tong (2) |

— | — | — | — | ||||||||||||

| Dr. Annie Koh (3) |

— | — | — | — | ||||||||||||

| Marcellus Wong |

— | — | — | — | ||||||||||||

| Raymond Yung |

— | — | — | — | ||||||||||||

| Frederic Lau |

— | — | — | — | ||||||||||||

| William Fung |

— | — | — | — | ||||||||||||

| Xavier Ho Sum Zee |

— | — | — | — | ||||||||||||

| Jason Man Chun Chiu |

— | — | — | — | ||||||||||||

| Bert Chun Lung Tsang |

— | — | — | — | ||||||||||||

| Ming Lin Cheung |

— | — | — | — | ||||||||||||

| All directors and executive officers as a group |

— | — | — | — | ||||||||||||

| Principal Shareholders: |

||||||||||||||||

| AMTD Group (4) |

41,729,647 | 149,322,836 | 50.6 | 88.2 | ||||||||||||

| Infinity Power Investments Limited (5) |

13,562,135 | 63,589,392 | 20.4 | 51.3 | ||||||||||||

| Century City International Holdings Limited (6) |

21,844,724 | — | 5.8 | 0.6 | ||||||||||||

| * | Less than 1% of our total outstanding ordinary shares. |

| ** | Except as indicated otherwise below, the business address of our directors and executive officers is 23/F Nexxus Building, 41 Connaught Road Central, Hong Kong. |

| † | Beneficial ownership is determined in accordance with the SEC rules, and includes voting or investment power with respect to the securities. For each person and group included in this column, percentage of beneficial ownership is calculated by dividing the number of shares beneficially owned by such person or group by the sum of the total number of shares outstanding and the number of shares such person or group has the right to acquire upon exercise of option, warrant, or other right within 60 days after the date of this annual report. |

| †† | For each person and group included in this column, percentage of voting power is calculated by dividing the voting power beneficially owned by such person or group by the voting power of all of our Class A and Class B ordinary shares as a single class. Each holder of Class B ordinary shares is entitled to twenty votes per share, and each holder of our Class A ordinary shares is entitled to one vote per share on all matters submitted to them for a vote. Our Class A ordinary shares and Class B ordinary shares vote together as a single class on all matters submitted to a vote of our shareholders, except as may otherwise be required by law. Our Class B ordinary shares are convertible at any time by the holder thereof into Class A ordinary shares on a one-for-one |

| (1) | The business address of Dr. Feridun Hamdullahpur is University of Waterloo, 200 University Avenue, West Waterloo, Ontario, Canada N2L3G1. |

| (2) | The business address of Dr. Timothy Tong is 23/F-25/F, Nexxus Building, 41 Connaught Road Central, Hong Kong. |

| (3) | The business address of Dr. Annie Koh is Singapore Management University, 81 Victoria Street, Singapore 188065. |

| (4) | AMTD Group directly holds 149,322,836 Class B ordinary shares of the Company and indirectly and effectively holds 41,729,647 Class A ordinary shares of the Company through its subsidiaries including AMTD Assets Alpha Group and AMTD Education Group. AMTD Group is a British Virgin Islands company, with its registered address at the offices of Vistra (BVI) Limited, Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands. The board of directors of AMTD Group consists of Dr. Calvin Choi, Marcellus Wong, Yu Gao, and Dr. Feridun Hamdullahpur. |

| (5) | Infinity Power Investments Limited directly holds (i) 15,059,470 Class B ordinary shares of the Company and (ii) 32.5% of the issued and outstanding shares of AMTD Group, which in turn effectively holds 41,729,647 Class A ordinary shares and 149,322,836 Class B ordinary shares of the Company. Infinity Power Investments Limited is a British Virgin Islands company wholly-owned by Dr. Calvin Choi. The registered address of Infinity Power Investments Limited is Vistra Corporate Services Center, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands. |

| (6) | Century City International Holdings Limited, a Bermuda company with its shares listed on the Stock Exchange of Hong Kong (stock code: 355), through its subsidiaries, namely P&R Finance Limited, Clear Radiant Limited and Unicorn Star Limited, holds 21,844,724 Class A ordinary shares of the Company. Such shareholding information is based on the information set forth in the Schedule 13D filed by P&R Finance Limited, Clear Radiant Limited, Unicorn Star Limited and Century City International Holdings Limited jointly on |

| January 13, 2022. |

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| A. | Major Shareholders |

| B. | Related Party Transactions |

| C. | Interests of Experts and Counsel |

ITEM 8. |

FINANCIAL INFORMATION |

| A. | Consolidated Statements and Other Financial Information |

| B. | Significant Changes |

ITEM 9. |

THE OFFER AND LISTING |

| A. | Offer and Listing Details |

| B. | Plan of Distribution |

| C. | Markets |

| D. | Selling Shareholders |

| E. | Dilution |

| F. | Expenses of the Issue |

ITEM 10. |

ADDITIONAL INFORMATION |

| A. | Share Capital |

| B. | Memorandum and Articles of Association |

| • | the instrument of transfer is lodged with us, accompanied by the certificate for the ordinary shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer; |

| • | the instrument of transfer is in respect of only one class of shares; |

| • | the instrument of transfer is properly stamped, if required; |

| • | in the case of a transfer to joint holders, the number of joint holders to whom the ordinary share is to be transferred does not exceed four; and a fee of such maximum sum as the NYSE may determine to be payable or such lesser sum as our directors may from time to time require is paid to us in respect thereof. |

| • | the designation of the class or series; |

| • | the number of shares of the class or series; |

| • | the dividend rights, dividend rates, conversion rights, voting rights; and the rights and terms of redemption and liquidation preferences. |

| • | authorize our board of directors to create and issue new classes or series of shares (including preferred shares) and to designate the price, rights, preferences, privileges and restrictions of such preferred shares without any further vote or action by our shareholders; and |

| • | limit the ability of shareholders to requisition and convene general meetings of shareholders. |

| • | does not have to file an annual return of its shareholders with the Registrar of Companies; |

| • | is not required to open its register of members for inspection; |

| • | does not have to hold an annual general meeting; |

| • | may issue negotiable or bearer shares or shares with no par value; |

| • | may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first instance); |

| • | may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| • | may register as a limited duration company; and may register as a segregated portfolio company. |

| C. | Material Contracts |

| D. | Exchange Controls |

| (a) | The ability to transfer funds by or to the Company in the form of repatriation of capital and remittance of profits; |

| (b) | The availability of cash and cash equivalents for use by the Company; and |

| E. | Taxation |

| • | No profit tax is imposed in Hong Kong in respect of capital gains from the sale of the ADSs and/or Class A ordinary shares. |