As filed with the U.S. Securities and Exchange Commission on July 14, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________

*

(Exact Name of Registrant as Specified in its Charter)

______________

| | 6199 | N/A | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

Room 1108, 11th Floor, Block B

New Mandarin Plaza, 14 Science Museum Road

Tsimshatsui East, Kowloon, Hong Kong

(852) 6872 0258

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

_______________________

Copies to:

|

Lawrence Venick, Esq. Giovanni Caruso, Esq. Jane Tam, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 Phone: (212) 407-4000 |

Ng Wing Fai Shu Pei Huang, Desmond Trust Tower 68 Johnston Road, Wan Chai Hong Kong SAR Phone: +852 3601 8363 |

Maria Pedersen, Esq. Gregory Schernecke, Esq. Dechert LLP Cira Centre, 2929 Arch Street Philadelphia, PA 19104-2808 Phone: +1 (215) 994-2222 |

_______________________

Approximate date of commencement of proposed sale to public:

From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| | ☒ | Smaller reporting company | | |||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

____________

* Upon the closing of the Business Combination, the name of AGBA Acquisition Limited is expected to change to AGBA Group Holding Limited.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

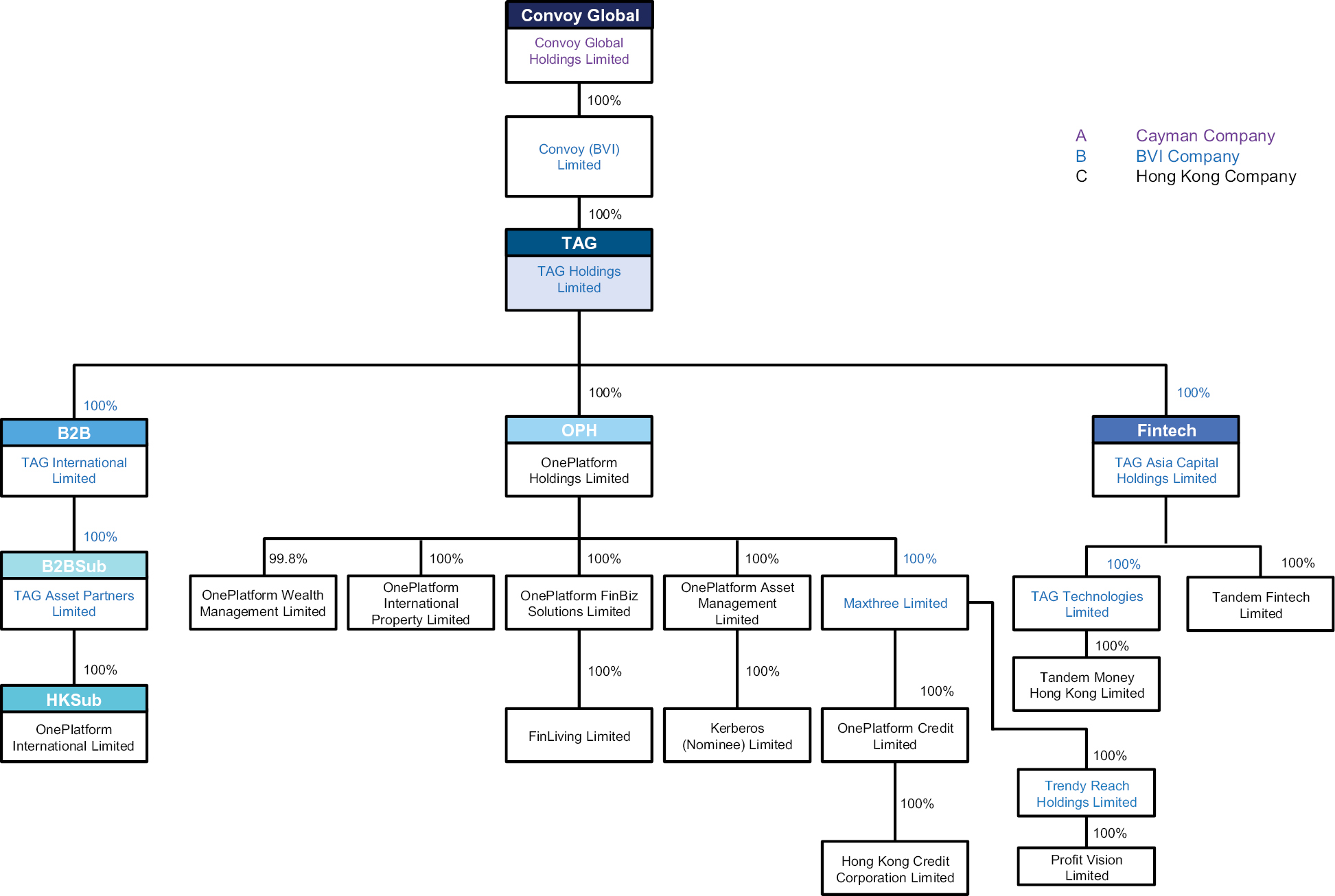

EXPLANATORY NOTE

This registration statement registers the resale of up to 55,500,000 shares (the “AGBA Shares”), par value $0.0001 per share, of AGBA Acquisition Limited, a BVI company (“AGBA”), by the selling shareholders named in this prospectus (or their permitted transferees) (the “Selling Shareholders”). The Selling Shareholders are expected to be issued the AGBA Shares in connection with the consummation of the proposed business combination (the “Business Combination”) pursuant to that certain business combination agreement by and among AGBA, TAG International Limited (“B2B”), TAG Asset Partners Limited (“B2B Sub”), OnePlatform International Limited (“HKSub”), OnePlatform Holdings Limited (“OPH”), TAG Asia Capital Holdings Limited (“Fintech”), and TAG Holdings Limited (“TAG”).

The AGBA Shares will not be issued and outstanding at the time of the extraordinary general meeting of AGBA’s shareholders relating to the Business Combination and, accordingly, will not be entitled to vote at the extraordinary general meeting and will not have redemption rights in connection therewith. Further, the holders of the AGBA Shares will not receive any proceeds from the trust account established in connection with AGBA’s initial public offering in the event AGBA does not consummate an initial business combination by August 16, 2022 (or November 14, 2022 if further extended, such date being the maximum extension granted by the Nasdaq Hearings Panel on June 23, 2022). In the event the Business Combination is not approved by AGBA shareholders or the other conditions precedent to the consummation of the Business Combination are not met or waived, the AGBA Shares will not be issued and AGBA will seek to withdraw this registration statement prior to its effectiveness.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED JULY 14, 2022 |

AGBA ACQUISITION LIMITED

55,500,000 Ordinary Shares

_______________________

This prospectus relates to the resale from time to time of certain securities to be issued pursuant to the terms of that certain business combination agreement dated as of November 3, 2021, as amended, and as may be further amended, supplemented or otherwise modified from time to time, (the “Business Combination Agreement”) by and among AGBA Acquisition Limited (“AGBA”), TAG Asset Partners Limited, a BVI business company (“B2BSub”), OnePlatform International Limited, a Hong Kong company (“HKSub”), OnePlatform Holdings Limited, a Hong Kong company (“OPH”), TAG Asia Capital Holdings Limited, a BVI business company, (“Fintech”), and TAG Holdings Limited, a BVI business company, (“TAG”). In connection with the closing of the transactions (the “Closing”) contemplated in the Business Combination Agreement (the “Business Combination”): (i) AGBA has become, through an acquisition merger, the 100% owner of the issued and outstanding securities of each of OPH and Fintech, in exchange for 55,500,000 ordinary shares of AGBA, par value US$0.001 per share (the “Aggregate Stock Consideration”); (ii) the governing documents of AGBA have been amended and restated and become the Fifth Amended and Restated Memorandum and Articles of Association as described in this prospectus, a copy of which is filed as an exhibit to the registration statement of which this prospectus is a part; and (iii) AGBA was renamed “AGBA Group Holding Limited” which we also refer to as “Post-Combination Company” in this registration statement.

As described herein, the selling securityholders identified in this prospectus or their permitted transferees (collectively, the “Selling Shareholders”), may sell from time to time up to 55,500,000 ordinary shares of AGBA, US$0.001 par value per share, (“AGBA Shares”) that were issued to them, as the ultimate beneficial shareholders of TAG, in connection with the Business Combination.

We will bear all costs, expenses and fees in connection with the registration of the AGBA Shares and will not receive any proceeds from the sale of the AGBA Shares. The Selling Shareholders will bear all commissions and discounts, if any, attributable to their respective sales of the AGBA Shares.

Since the consummation of the Business Combination, the Post Combination Company’s ordinary shares and warrants have been trading on The Nasdaq Capital Market (“Nasdaq”) under the symbols “AGBA” and “AGBAW,” respectively.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our ordinary shares is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

Table of Contents

|

Page |

||

|

ii |

||

|

iii |

||

|

vi |

||

|

1 |

||

|

8 |

||

|

ONEPLATFORM HOLDINGS LIMITED AND TAG ASIA CAPITAL HOLDINGS LIMITED SUMMARY FINANCIAL INFORMATION |

9 |

|

|

11 |

||

|

12 |

||

|

44 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

45 |

|

|

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS |

51 |

|

|

55 |

||

|

56 |

||

|

76 |

||

|

109 |

||

|

114 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

119 |

|

|

121 |

||

|

127 |

||

|

130 |

||

|

SECURITIES ACT RESTRICTIONS ON RESALE OF AGBA GROUP HOLDING LIMITED SECURITIES |

131 |

|

|

132 |

||

|

148 |

||

|

150 |

||

|

150 |

||

|

150 |

||

|

150 |

||

|

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Shareholders may sell up to 55,500,000 AGBA Shares from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of AGBA Shares by the Selling Shareholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the AGBA Shares, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we, nor the Selling Shareholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Shareholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Shareholders will not make an offer to sell AGBA Shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

ii

Frequently used terms

Unless otherwise stated in this prospectus or unless the context requires otherwise, references in this prospectus to:

• “AGBA,” “we,” “us” or “our company” means AGBA Acquisition Limited;

• “AGBA Group Holding Limited” or the “Post-Combination Company” means AGBA following the consummation of the Business Combination;

• “AGBA Holding Limited” or the “Sponsor” means AGBA Holding Limited;

• “AGBA Rights” means the rights to receive one-tenth (1/10) of one AGBA Share upon the consummation of an initial business combination by AGBA;

• “AGBA Shares” means the ordinary shares of AGBA, US$0.001 par value per share;

• “AGBA Units” means the units issued in the IPO, consisting of one AGBA Share, one AGBA Warrant, and one AGBA Right;

• “AGBA Warrants” means the redeemable warrants entitling the holder thereof to purchase one-half of one AGBA Share;

• “Aggregate Stock Consideration” means the 55,500,000 AGBA Shares, with a deemed price of US$10.00 per share, to be issued to the ultimate beneficial shareholders of TAG, as directed by TAG in its capacity as sole shareholder of B2B and Fintech, in accordance with the terms of the Business Combination Agreement;

• “B2B” means TAG International Limited, a BVI business company and wholly-owned subsidiary of TAG;

• “B2BSub” means TAG Asset Partners Limited, a BVI business company and wholly-owned subsidiary of B2B;

• “Business Combination” means the transactions contemplated by the Business Combination Agreement;

• “Business Combination Agreement” means that certain Business Combination Agreement dated November 3, 2021 by and among AGBA, B2B, B2BSub, HKSub, OPH, Fintech, and TAG, as amended on November 18, 2021, January 4, 2022, and May 4, 2022, and as may be further amended, supplemented or otherwise modified from time to time, and its schedules and exhibits thereto;

• “Business Day” means any day (except any Saturday, Sunday, or public holiday) on which banks in New York City, New York are open for business;

• “BVI” means the British Virgin Islands;

• “BVI Companies Law” means the BVI Business Companies Act, 2004 (as amended from time to time);

• “CFS” means Convoy Financial Services Limited, a member of the Legacy Group;

• “China,” “mainland China,” or the “PRC” means the People’s Republic of China;

• “Closing” means closing of the Business Combination in accordance with the terms of the Business Combination Agreement;

• “Convoy Global” means Convoy Global Holdings Limited, TAG’s ultimate parent company;

• “COVID-19” means the novel coronavirus, SARS-CoV-2;

• “DTC” means Depository Trust Company;

• “Exchange Act” means the Securities Exchange Act of 1934, as amended;

iii

• “Existing Charter” means AGBA’s Fourth Amended and Restated Memorandum and Articles of Association, as amended and restated on May 3, 2022;

• “extraordinary general meeting” means the meeting of the shareholders of AGBA;

• “fintech” means financial technology;

• “Fintech” means TAG Asia Capital Holdings Limited;

• “Group Parties” means, collectively, B2B, B2BSub, HKSub, OPH, Fintech, and their respective subsidiaries, and each a “Group Party”;

• “HKCC” means Hong Kong Credit Corporation Limited;

• “HKSub” means OnePlatform International Limited, a Hong Kong company and wholly-owned subsidiary of B2BSub;

• “Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China;

• “Hong Kong Dollars” or “HK$” means the lawful currency of Hong Kong;

• “IFA” means the Legacy Group’s independent financial advisory business, conducted by CFS;

• “IFA Restructuring” means the transfer of CFS’s independent financial advisors to OnePlatform Wealth Management Limited;

• “Initial Shareholders” means the Sponsor and the officers and directors of AGBA who hold Insider Shares and 225,000 Private Placement Units;

• “Insider Shares” means the aggregate of 1,150,000 AGBA Shares sold to our Initial Shareholders in October 2018 and February 2019 for an aggregate purchase price of US$25,000;

• “IPO” means the initial public offering of AGBA, completed on May 16, 2019, pursuant to which the AGBA Units were listed on Nasdaq;

• “Legacy Group” means, prior to the Closing, Convoy Global Holdings Limited and its subsidiaries and affiliates, and after the Closing, Convoy Global Holdings Limited and its subsidiaries and affiliates, excluding the TAG Business, its subsidiaries, B2B, B2BSub, and HKSub;

• “Merger Sub I” means AGBA Merger Sub I Limited, a BVI business company and wholly-owned subsidiary of AGBA;

• “Merger Sub II” means AGBA Merger Sub II Limited, a BVI business company and wholly-owned subsidiary of AGBA;

• “Merger Subs” means, together Merger Sub I and Merger Sub II;

• “Nasdaq” means the Nasdaq Capital Market;

• “OAM” means OnePlatform Asset Management Limited;

• “OIP” means OnePlatform International Property Limited;

• “OPH” means, as the context requires, OnePlatform Holdings Limited prior to the OPH Merger, and, with respect to the entities that comprise the TAG Business, B2B following the OPH Merger;

• “OPH Merger” means the merger of OPH with and into HKSub, with HKSub as the surviving entity;

• “OWM” means OnePlatform Wealth Management Limited;

• “PCAOB” means the Public Company Accounting Oversight Board of the United States;

• “PIPE Investment” means a private placement or other private financing to be consummated simultaneously with the Closing;

iv

• “Post-Combination Company” means AGBA following the consummation of the Business Combination;

• “Private Placement Units” means private AGBA Units held by the Sponsor, which were acquired by the Sponsor at the consummation of the IPO;

• “Private Warrants” means warrants sold as part of the Private Placement Units at the consummation of the IPO;

• “Public Warrants” means warrants sold as part of the ABGA Units sold in the IPO;

• “SEC” or “Securities and Exchange Commission” means the Securities and Exchange Commission of the United States;

• “Securities Act” means the Securities Act of 1933, as amended;

• “Sponsor” means AGBA Holding Limited, the sponsor of AGBA;

• “TAG” means TAG Holdings Limited, a member of the Legacy Group;

• “TAG Business” means, as the context requires, OPH and Fintech together, prior to the OPH Merger, and B2B and Fintech together, after the OPH Merger, in each case including such entities’ respective subsidiaries;

• “Transfer Agent” or “Continental” means Continental Stock Transfer & Trust Company;

• “trust account” means the trust account of AGBA that holds the proceeds of the IPO;

• “U.S. Dollars,” “USD,” and “US$” means the legal currency of the United States; and

• “U.S. GAAP” means the accounting principles generally accepted in the United States.

Reporting Currency

The reporting currency of AGBA is the U.S. Dollar. This prospectus also contains translations of certain foreign currency amounts into U.S. Dollars for the convenience of the reader. The reporting currency of the TAG Business is the U.S. Dollar and the accompanying combined and consolidated financial statements have been expressed in U.S. Dollars. In addition, the TAG Business and its subsidiaries operating in Hong Kong maintain their books and record in their local currency, Hong Kong Dollars, which is a functional currency being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not U.S. Dollars are translated into U.S. Dollars, in accordance with ASC Topic 830-30, “Translation of Financial Statements”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the year. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statements of changes in shareholder’s equity. We make no representation that the Hong Kong Dollar or U.S. Dollar amounts referred to in this prospectus could have been or could be converted into U.S. Dollars or Hong Kong Dollars, as the case may be, at any particular rate or at all.

v

cautionary statement on forward-looking statements

This prospectus contains forward-looking statements. Forward-looking statements provide our current expectations or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “might”, “ongoing,” “plan,” “possible”, “potential,” “predict,” “project,” “should”, “strive”, “would”, “will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Examples of forward-looking statements in this prospectus include, but are not limited to, statements regarding our disclosure concerning the TAG Business’s operations, cash flows, financial position, and dividend policy.

Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations of the TAG Business,” and “Information About the TAG Business.” The risks and uncertainties include, but are not limited to:

• future operating or financial results;

• future payments of dividends and the availability of cash for payment of dividends;

• the TAG Business’s expectations relating to dividend payments and forecasts of its ability to make such payments;

• future acquisitions, business strategy and expected capital spending;

• assumptions regarding interest rates and inflation;

• the Post-Combination Company’s financial condition and liquidity, including its ability to obtain additional financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

• estimated future capital expenditures needed to preserve AGBA’s capital base;

• the ability of the Post-Combination Company to effect future acquisitions and to meet target returns;

• the possibility that COVID-19 may hinder AGBA’s ability to consummate the Business Combination;

• the possibility that COVID-19 may adversely affect the results of operations, financial position and cash flows of the Post-Combination Company; and

• other factors discussed in the section entitled “Risk Factors.”

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described in the “Risk Factors” section of this prospectus. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this prospectus. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this prospectus or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks that we describe in the reports we will file from time to time with the SEC after the date of this prospectus.

vi

Prospectus Summary

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our ordinary shares, and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our ordinary shares, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 12 and the financial statements of AGBA and TAG Business and related notes included in this prospectus.

Business Combination Agreement

This subsection of the prospectus describes the material provisions of the Business Combination Agreement but does not purport to describe all of the terms of the Business Combination Agreement. You should read the Business Combination Agreement in its entirety because it is the primary legal document that governs the Business Combination. The Business Combination Agreement contains representations, warranties, and covenants that the respective parties made to each other as of the date of the Business Combination Agreement or other specific dates. The assertions embodied in those representations, warranties, and covenants were made for purposes of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the Business Combination Agreement. The representations, warranties, and covenants in the Business Combination Agreement are also modified in part by the underlying disclosure schedules of the parties (together, the “disclosure schedules”), which are not filed publicly and which are subject to a contractual standard of materiality different from that generally applicable to shareholders and were used for the purpose of allocating risk among the parties rather than establishing matters as facts. We do not believe that the disclosure schedules contain information that is material to an investment decision. Additionally, the representations and warranties of the parties to the Business Combination Agreement may or may not have been accurate as of any specific date and do not purport to be accurate as of the date of this prospectus. Accordingly, no person should rely on the representations and warranties in the Business Combination Agreement or the summaries thereof in this prospectus as characterizations of the actual state of facts about AGBA, the Merger Subs, the TAG Business, B2B, B2BSub, HKSub, TAG, or any other matter.

Parties to and Structure of the Acquisition Merger

On November 3, 2021, each of AGBA, TAG International Limited (“B2B”), TAG Asset Partners Limited (“B2BSub”), OnePlatform International Limited (“HKSub”), OnePlatform Holdings Limited (“OPH”), TAG Asia Capital Holdings Limited (“Fintech”), and TAG Holdings Limited (“TAG”) entered into the Business Combination Agreement. On November 18, 2021, these same parties entered into an amendment to the Business Combination Agreement which provided for a change in the terms of the OPH Merger so that HKSub will be the surviving entity in such merger. On January 4, 2022, these parties and the Merger Subs, which had acceded to the Business Combination Agreement in accordance with its terms, entered into a second amendment of the Business Combination Agreement, extending the timeline for the parties to agree on the ancillary agreements thereto and the deadline for the consummation of the Business Combination. On May 4, 2022, the parties to the Business Combination Agreement executed a third amendment to the agreement, further extending those deadlines. At Closing, AGBA became, through an acquisition merger, the beneficial owner of all of the issued and outstanding shares and other equity interests in and of each of OPH and Fintech, and AGBA, in exchange, issued 55,500,000 of its ordinary shares to the ultimate beneficial shareholders of TAG (the “Aggregate Stock Consideration”), in compliance with any applicable laws.

To effect this acquisition TAG incorporated B2B (a BVI business company and wholly-owned subsidiary of TAG), B2BSub (a BVI business company and wholly-owned subsidiary of B2B), and HKSub (a Hong Kong company and a wholly-owned subsidiary of B2BSub), while AGBA incorporated Merger Sub I and Merger Sub II (each a BVI business company and wholly-owned subsidiary of AGBA). The Merger Subs were incorporated for the purpose of effecting the acquisition merger contemplated by the Business Combination Agreement. AGBA owns 100% of the issued and outstanding shares of each of the Merger Subs. As the Merger Subs were not incorporated at the time of signing of the Business Combination Agreement, Merger Sub I and Merger Sub II were obligated to accede to and become parties to the Business Combination Agreement upon their due incorporation. Promptly following their incorporation, the Merger Subs acceded to the Business Combination Agreement, in accordance with its terms, on December 3, 2021.

1

In connection with the Closing, OPH has merged with and into HKSub, with HKSub as the surviving entity, as a result of which HKSub, as the combined surviving company has become an indirect, wholly-owned subsidiary of B2B (the “OPH Merger”). Then, pursuant to the terms of Business Combination Agreement, (i) Merger Sub I merged with and into B2B, with B2B as the surviving entity, as a result of which B2B has become a wholly-owned subsidiary of AGBA, and (ii) Merger Sub II merged with and into Fintech, with Fintech as the surviving entity, as a result of which Fintech has become a wholly-owned subsidiary of AGBA (these mergers together, the “Acquisition Merger”).

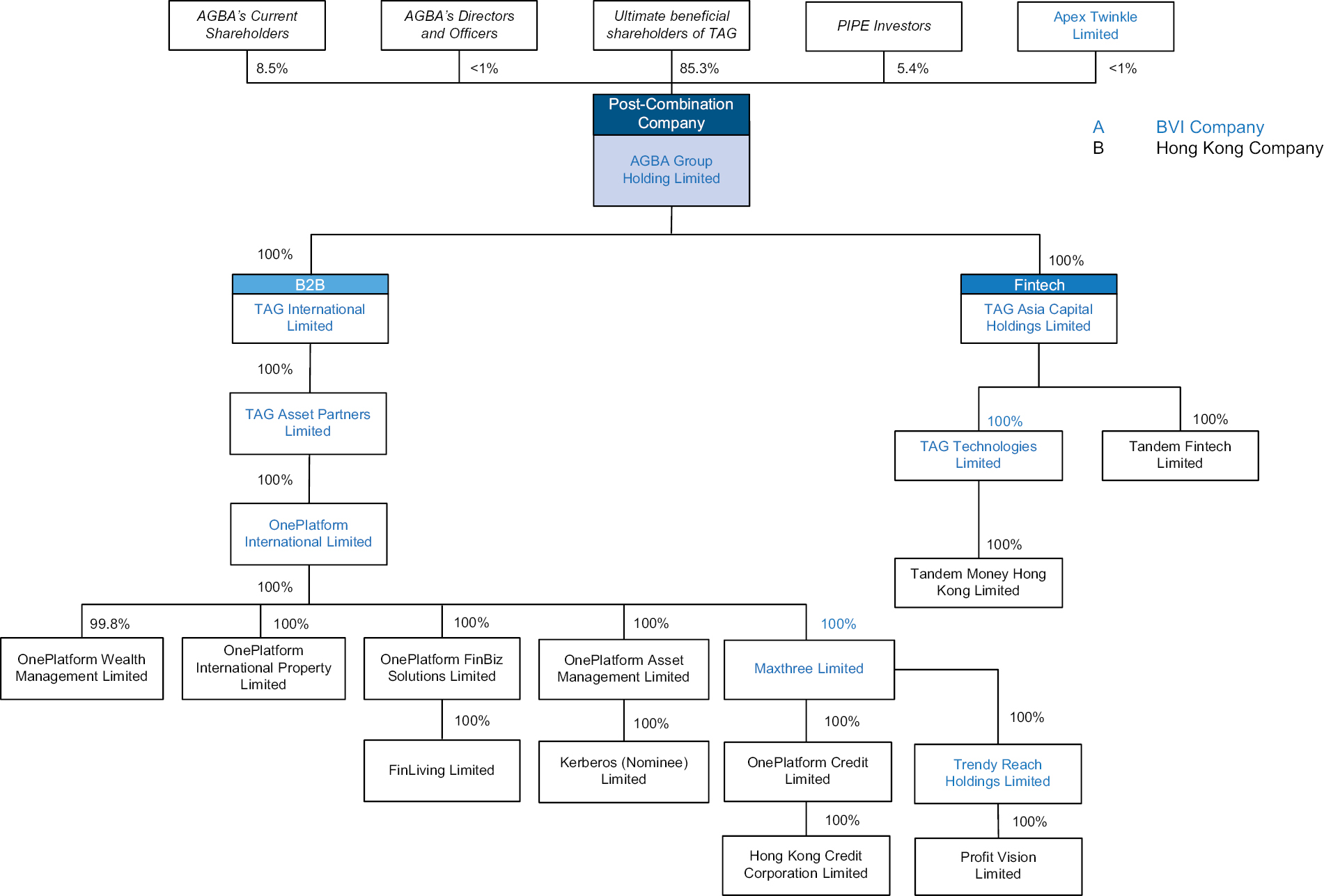

Organizational Structure

The following chart depicts the organizational structure of the Post-Combination Company immediately following the Business Combination.

Immediately following Closing, each of B2B, Fintech and their subsidiaries have now become wholly-owned subsidiaries of AGBA (directly or through intermediate subsidiaries, as reflected in the organization charts set out on page 2 of this prospectus), with the exception of OnePlatform Wealth Management Limited, which is held 99.8% by OPH.

Consideration

At the effective time of the Acquisition Merger, among other things, all equity securities of each of B2B and Fintech issued and outstanding as of immediately prior to the effective time of the Acquisition Merger have been cancelled and automatically converted into TAG’s right, as sole shareholder of B2B and Fintech, to direct receipt of the Aggregate Stock Consideration to its ultimate beneficial shareholders in compliance with any applicable laws. The aggregate value of the Aggregate Stock Consideration paid by AGBA in the Business Combination was US$555,000,000 (calculated as follows: 55,500,000 AGBA Shares issued, multiplied by US$10.00 (the deemed value of the shares in the Business Combination Agreement)).

Pursuant to the Business Combination Agreement, AGBA issued the full amount of the Aggregate Stock Consideration, less certain Holdback Shares (for indemnification purposes), to the ultimate beneficial shareholders of TAG, as directed by TAG in its capacity as sole shareholder of B2B and Fintech, subject to legal and regulatory requirements. On the day following the last day of the survival period (i.e. six months following the Closing), AGBA shall issue the

2

Holdback Shares to the ultimate beneficial shareholders of TAG, as directed by TAG in its capacity as sole shareholder of B2B and Fintech, subject to compliance with applicable Law, and deliver such Holdback Shares in accordance with the terms and conditions of the Business Combination Agreement.

Management and Board of Directors Following the Business Combination

Effective as at Closing, the board of directors of AGBA consists of the following five (5) members, designated by TAG in accordance with the Business Combination Agreement, three of whom were previously members of AGBA’s board of directors and now act as independent directors under the Nasdaq rules: Lee Jin Yi, Ng Wing Fai, Brian Chan, Thomas Ng, and Felix Wong. Lee Jin Yi is Chairman and Ng Wing Fai is the Deputy Chairman and Executive Director of the Post-Combination Company. See “Management” in this prospectus for additional information.

Additional Agreements Relating to the Business Combination

In addition to the Business Combination Agreement, the following agreements have been entered into in connection with the Business Combination.

Plans and Articles of Merger

Pursuant to the terms of the Business Combination Agreement (as amended), the relevant parties to the Acquisition Merger have entered into plans and articles of merger to effect the transactions contemplated in the Business Combination Agreement.

As a result of the Acquisition Merger, each of B2B and Fintech became wholly-owned subsidiaries of AGBA. TAG, as the sole shareholder of each of B2B and Fintech, was entitled to receive or direct receipt of AGBA Shares equal to the Aggregate Stock Consideration. The Acquisition Merger became effective upon the filing and registration of the relevant Articles of Mergers with the Registrar of Corporate Affairs of the BVI, or such later time, not more than 30 calendar days from the registration of such filings, in accordance with the BVI Companies Law.

Employment Agreements

AGBA did not entered into any employment agreements with our previous executive officers and did not make any agreements to provide benefits upon termination of employment.

Prior to Closing and as required by the Business Combination Agreement, the parties to the Business Combination Agreement agreed upon the new employment contracts of the key personnel of TAG, who now continue their employment with the Post-Combination Company. The new employment contracts of such key personnel contain compensation and benefits that are no less favorable than that to which the relevant key personnel were entitled to immediately prior to Closing.

Lock-up Agreements

The parties to the Business Combination Agreement agreed that each person who receives 1% or more of the Aggregate Stock Consideration will be required to lock-up those AGBA Shares for at least 180 days from Closing. The parties have executed relevant lock-up agreements with the relevant ultimate shareholders of TAG.

Risk Factors

In evaluating any potential investment in the Post-Combination Company, you should carefully read this prospectus and especially consider the factors discussed in the section entitled “Risk Factors”. The occurrence of one or more of the events or circumstances described in that section, alone or in combination with other events or circumstances, may have a material adverse effect on the business, cash flows, financial condition and results of operations of the TAG Business and, therefore, the Post-Combination Company following consummation of the Business Combination.

3

Risks relating to the TAG Business’s Hong Kong operations and proximity to the PRC include, but are not limited to, the following:

• The TAG Business’s business, financial condition, results of operations, and prospects potentially being materially and adversely affected if certain laws and regulations of the PRC become applicable to the TAG Business or its subsidiaries;

• The PRC government, despite the current Hong Kong legal environment of “One Country, Two Systems,” exerting substantial influence, discretion, oversight, and control over the manner in which Hong Kong-based companies must conduct their business activities;

• TAG Business’s securities being delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act if the PCAOB were unable to fully inspect its current auditor (or any future auditor of the Post-Combination Company);

• The TAG Business becoming subject to PRC laws governing security offerings that are conducted overseas and/or foreign investment in China-based issuers;

• The governments of the jurisdictions in which the TAG Business operates or intends to operate potentially restricting or controlling the ability of foreign investors to invest in businesses located in such jurisdictions;

• The TAG Business being subject to many of the economic and political risks associated with emerging markets due to its operations in Hong Kong. Adverse changes in Hong Kong’s or China’s economic, political, and social conditions as well as government policies could adversely affect the TAG Business’s business and prospects;

• Risks associated with the TAG Business’s growth strategy of potential expansion in China;

• The TAG Business’s financial services revenues being highly dependent on macroeconomic conditions as well as Hong Kong, China, and global market conditions. Disruptions in the global financial markets and economic conditions could adversely affect the TAG Business and its institutional clients and customers;

• Recent litigation and negative publicity surrounding China-based companies listed in the United States resulting in increased regulatory scrutiny of the Post-Combination Company and negatively impacting the trading price of its shares, which could have a material adverse effect upon its business, including its results of operations, financial condition, cash flows, and prospects;

• Failure to comply with existing or future laws and regulations related to data protection or data security leading to liabilities, administrative penalties or other regulatory actions, which could negatively affect the TAG Business’s operating results, business, and prospects;

• PRC laws and regulations that may make it more difficult for the TAG Business to pursue growth opportunities in China; and

• The PRC may prevent the cash maintained by the Post-Combination Company in Hong Kong from leaving, or the PRC could restrict deployment of such cash for the Post-Combination Company’s business purposes or for the payment of dividends

Risks relating to the TAG Business include, but are not limited to, the following:

• The ability of the TAG Business and its subsidiaries to continue as a going concern being dependent on its ability to raise additional funds and implement its business plan;

• The success and growth of the TAG Business depending, in part, on its ability to be a leader in technological innovation in its industries;

• The technologies that the TAG Business uses possibly containing undetected errors, which could result in customer dissatisfaction, damage to the TAG Business’s reputation, or loss of customers;

4

• Fintech recently launching the Tandem Hong Kong platform. If Tandem Hong Kong cannot acquire new customers or exploit new business lines from this new platform, its business prospects may be adversely affected;

• OPH and its subsidiaries relying on their business relationships with the issuers of financial products and the success of those product issuers, and OPH’s future development depends, in part, on the growth of such product issuers and their continued collaboration with OPH and its subsidiaries;

• The international property agency segment of OPH historically operating on thin margins, which expose it to risk of non-profitability;

• The TAG Business relying on third parties for various aspects of its business and the services and solutions that it offers thereby and those third parties potentially failing to provide sufficient (or any) services.

• Failing to maintain and enlarge the TAG Business’s customer base or strengthen customer engagement;

• A number of the TAG Business’s business partners being commercial banks and other financial institutions that are highly regulated, and the tightening of laws, regulations or standards in the financial services industry potentially harming its business;

• Significant fluctuations in customer transactions potentially disrupting the TAG Business’s ability to efficiently process and settle transactions;

• The TAG Business operating in a competitive and evolving industry which, if it fails to compete, could limit its growth potential;

• The TAG Business’s ability to protect and promote its brand and reputation from damage thereby reducing its business and prospects;

• Breach of the TAG Business’s security measures or those of any third-party cloud computing platform provider, or other third-party service providers, resulting in the TAG Business’s data, IT systems, and services being perceived as not being, or not actually being, secure;

• Unexpected network interruptions, security breaches, or computer virus attacks and failures in the TAG Business’s information technology systems having a material adverse effect on its business, financial condition, and results of operations;

• The TAG Business’s potential inability to use software licensed from third-parties, including open-source software;

• The TAG Business potentially experiencing negative impacts to its financial and operating performance as a result of the COVID-19 pandemic and its effects on the jurisdictions in which the TAG Business operates;

• The TAG Business being exposed to liquidity risk, particularly in its money lending segment;

• The TAG Business being exposed to interest rate risks, particularly in its money lending segment;

• The TAG Business being exposed to credit risk, particularly in its money lending segment;

• The financial leverage of the TAG Business adversely affecting its ability to raise additional capital;

• The TAG Business’s performance depending on key management and personnel, who are anticipated to continue in substantially similar roles in the Post-Combination Company and who may be difficult or impossible to replace;

• The Legacy Group having experienced significant reputational damage in the past in connection with its previous management, which could adversely affect the market prospects and reputation of the TAG Business and/or the scope and quality of the services rendered by the Legacy Group to the TAG Business;

• The TAG Business’s ability to maintain its corporate culture and the innovation, collaboration, and focus on the mission arising from that culture that contribute to its business;

5

• Substantially all of the TAG Business’s operations being housed in one location, and thus subject to damage or being rendered inoperable by natural or man-made disasters;

• The TAG Business’s inability to identify or pursue suitable acquisition or expansion opportunities or achieve optimal results in future acquisitions or expansions, and it potentially encountering difficulties in successfully integrating and developing acquired assets or businesses;

• The TAG Business and its directors, management, and employees currently being, and may in the future be, subject to litigation and regulatory investigations and proceedings;

• The TAG Business not having sufficient insurance coverage to cover its business risks;

• The TAG Business not being able to prevent others from unauthorized use of its intellectual property, which could harm its business and competitive position;

• The TAG Business having the right to use all required intellectual property for its operations, and failing to protect its existing intellectual property rights;

• The TAG Business being subject to intellectual property infringement claims, which may be expensive to defend and may disrupt its business and operations;

• Members of the TAG Business’s group being party to certain related party transactions.

• The TAG Business operating in a variety of heavily regulated industries in Hong Kong and globally, which expose its business activities to risks of noncompliance with an increasing body of complex laws and regulations;

• The TAG Business being subject to evolving regulatory requirements, and failure to comply with these regulations or to adapt to regulatory changes, could materially and adversely affect its operations, business, and prospects;

• The TAG Business being adversely affected by the complexity, uncertainties, and changes in regulation of internet-related businesses and companies, and any lack of requisite approvals, licenses, or permits applicable to the TAG Business’s business potentially having a material adverse effect on its business and results of operations;

• Uncertainties in the interpretation and enforcement of laws and regulations, particularly relating to new technologies;

• Fluctuations in exchange rates having a material adverse effect on the TAG Business’s results of operations and the price of the Post-Combination Company’s shares;

• Risks related to natural disasters, health epidemics, civil and social disruption and other outbreaks, which could significantly disrupt the TAG Business’s operations; and

• Russia’s invasion of Ukraine may present risks to the TAG Business’s operations and investments.

Emerging Growth Company

AGBA is an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). It is anticipated that after the consummation of the transactions, the Post-Combination Company will continue to be an “emerging growth company.” As an emerging growth company, the Post-Combination Company is eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statement, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and the requirement to obtain shareholder approval of any golden parachute payments not previously approved.

6

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. AGBA has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, AGBA, as an emerging growth company, will not adopt the new or revised standard until the time private companies are required to adopt the new or revised standard. This approach may make comparison of AGBA’s financial statements with another public company, which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

The Post-Combination Company could remain an emerging growth company until the last day of its fiscal year following the fifth anniversary of the consummation of its predecessor’s initial public offering. However, if the Post-Combination Company’s non-convertible debt issued within a three-year period or its total revenues exceed US$1.07 billion or the market value of its shares of ordinary shares that are held by non-affiliates exceeds US$700 million on the last day of the second fiscal quarter of any given fiscal year, the Post-Combination Company would cease to be an emerging growth company as of the following fiscal year.

Domestic Issuer Status

The Business Combination the Post-Combination Company will remain a domestic filer until June 30, 2023, on which date it will reassess whether the Post-Combination Company qualifies as a “foreign private issuer”. The Post-Combination Company may qualify as a “foreign private issuer” on June 30, 2023, after which the Post-Combination Company would become exempt from certain rules under the Exchange Act that would otherwise apply if the Post-Combination Company was a domestic issuer. For example, as a “foreign private issuer” the Post-Combination Company:

• would not be required to provide as many Exchange Act reports, or as frequently or as promptly, as domestic issuers with securities registered under the Exchange Act. For example, the Post-Combination Company would only be required to furnish current reports on Form 6-K any information that the Post-Combination Company (a) makes or is required to make public under the laws of the British Virgin Islands, (b) files or is required to file under the rules of any stock exchange, or (c) otherwise distributes or is required to distribute to its shareholders. In addition, the Post-Combination Company would not be required to file its annual report on Form 10-K, which may be due as soon as 60 days after its fiscal year end. As a “foreign private issuer”, the Post-Combination Company would be required to file an annual report on Form 20-F within four months after its fiscal year end;

• would not be required to provide the same level of disclosure on certain issues, such as executive compensation or be required to conduct advisory votes on executive compensation;

• would be exempt from filing quarterly reports under the Exchange Act with the SEC;

• would not be subject to the requirement to comply with Regulation Fair Disclosure, or Regulation FD, which imposes certain restrictions on the selected disclosure of material information;

• would not be required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

• would not be required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

7

The Offering

|

Issuer |

AGBA Acquisition Limited, to be renamed AGBA Group Holding Limited in connection with the Business Combination |

|

|

Shares that may be offered and sold from time to time by the Selling Shareholders named herein |

|

|

|

AGBA Ordinary shares issued and outstanding |

|

|

|

Ordinary shares to be issued and outstanding |

|

|

|

Use of proceeds |

All of the ordinary shares offered by the Selling Shareholders pursuant to this prospectus will be sold by the Selling Shareholders for their respective accounts. We will not receive any of the proceeds from these sales. |

|

|

Lock-up |

In connection with the Business Combination, each ultimate beneficial shareholder of TAG who will receive 1% or more of the Aggregate Stock Consideration has entered into an agreement, requiring them to lock-up those AGBA Shares received for at least 180 days from Closing. |

|

|

NASDAQ Capital Market symbol |

“AGBA” |

|

|

Risk Factors |

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 12 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our ordinary shares. |

____________

1 Represents the number of AGBA shares outstanding at Closing assuming that none of AGBA’s public shareholders exercise their redemption rights in connection with the Extraordinary Meeting.

8

OnePlatform Holdings Limited AND TAG ASIA CAPITAL HOLDINGS LIMITED SUMMARY FINANCIAL INFORMATION

The data below for the three-month periods ended March 31, 2022 and 2021 has been derived from the TAG Business’s unaudited combined financial statements for such periods, which are included in this prospectus. The data below as for the years ended December 31, 2021 and 2020 has been derived from the audited combined financial statements of the TAG Business for such years, which are included in this prospectus. The TAG Business’s combined financial statements are prepared and presented in accordance with U.S. GAAP.

The TAG Business’s historical results are not necessarily indicative of results to be expected for any future period. The information is only a summary and should be read in conjunction with the TAG Business’s combined financial statements and related notes, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the TAG Business” contained elsewhere herein. The historical results included below and elsewhere in this prospectus are not indicative of the future performance of the TAG Business or the Post-Combination Company.

The following table represents the TAG Business’s selected combined statements of operations and comprehensive (loss) income for the three months ended March 31, 2022 and 2021 and for the years ended December 31, 2021 and 2020:

Selected Combined Statements of Operations and Comprehensive (Loss) Income:

|

For the Three Months Ended |

For the Years Ended |

|||||||||||||||

|

2022 |

2021 |

2021 |

2020 |

|||||||||||||

|

USD |

USD |

USD |

USD |

|||||||||||||

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Audited) |

|

|

(Audited) |

|

|||||

|

Operating revenues |

$ |

2,076,323 |

|

$ |

3,351,363 |

|

$ |

11,468,603 |

|

$ |

14,046,918 |

|

||||

|

Operating expenses |

|

(3,988,640 |

) |

|

(3,892,364 |

) |

|

(19,915,726 |

) |

|

(15,917,234 |

) |

||||

|

Loss from operations |

|

(1,912,317 |

) |

|

(541,001 |

) |

|

(8,447,123 |

) |

|

(1,870,316 |

) |

||||

|

Other income (expense), net |

|

1,884,420 |

|

|

6,290,766 |

|

|

128,416,091 |

|

|

(13,586,804 |

) |

||||

|

Provision for income taxes |

|

(419,497 |

) |

|

(1,227,689 |

) |

|

(23,505,445 |

) |

|

(683,525 |

) |

||||

|

Net (loss) income |

|

(447,394 |

) |

|

4,522,076 |

|

|

96,463,523 |

|

|

(16,140,645 |

) |

||||

|

Other comprehensive income (loss) |

|

(274,351 |

) |

|

(48,911 |

) |

|

(393,601 |

) |

|

91,552 |

|

||||

|

Comprehensive (loss) income |

$ |

(721,745 |

) |

$ |

4,473,165 |

|

$ |

96,069,922 |

|

$ |

(16,049,093 |

) |

||||

The following table represents the TAG Business’s selected combined balance sheet data as of March 31, 2022 and December 31, 2021 and 2020:

Selected Combined Balance Sheet Data:

|

As of |

As of |

|||||||||

|

2021 |

2020 |

|||||||||

|

USD |

USD |

USD |

||||||||

|

|

(Unaudited) |

|

(Audited) |

|

(Audited) |

|

||||

|

Current assets |

$ |

62,410,583 |

$ |

83,779,515 |

$ |

71,156,529 |

|

|||

|

Non-current assets |

|

43,943,278 |

|

38,730,785 |

|

105,785,089 |

|

|||

|

Total assets |

|

106,353,861 |

|

122,510,300 |

|

176,941,618 |

|

|||

|

Total liabilities |

|

63,367,839 |

|

61,364,728 |

|

182,303,773 |

|

|||

|

Total shareholders’ (deficit) equity |

$ |

42,986,022 |

$ |

61,145,572 |

$ |

(5,362,155 |

) |

|||

9

The following table represents the TAG Business’s selected combined cash flow data for the years ended December 31, 2020 and 2021 and the three months ended March 31, 2021 and 2022:

Selected Combined Cash Flow Data:

|

For the Three Months Ended |

For the Years Ended |

|||||||||||||||

|

2022 |

2021 |

2021 |

2020 |

|||||||||||||

|

USD |

USD |

USD |

USD |

|||||||||||||

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Audited) |

|

|

(Audited) |

|

|||||

|

Net cash provided by (used in) operating |

$ |

1,330,672 |

|

$ |

(3,316,155 |

) |

$ |

(2,154,059 |

) |

$ |

21,963,557 |

|

||||

|

Net cash (used in) provided by investing activities |

|

(6,852,870 |

) |

|

— |

|

|

177,494,053 |

|

|

(6,765,248 |

) |

||||

|

Net cash used in financing activities |

|

(14,524,849 |

) |

|

(4,374,926 |

) |

|

(163,871,706 |

) |

|

(5,899,270 |

) |

||||

|

Effect of exchange rate on cash and |

|

(100,353 |

) |

|

271,644 |

|

|

(155,154 |

) |

|

441,019 |

|

||||

|

Change in cash, cash equivalents and restricted cash |

|

(20,147,400 |

) |

|

(7,419,437 |

) |

|

11,313,134 |

|

|

9,740,058 |

|

||||

|

Cash, cash equivalents and restricted |

|

73,081,407 |

|

|

61,768,273 |

|

|

61,768,273 |

|

|

52,028,215 |

|

||||

|

Cash, cash equivalents and restricted |

$ |

52,934,007 |

|

$ |

54,348,836 |

|

$ |

73,081,407 |

|

$ |

61,768,273 |

|

||||

10

SELECTED HISTORICAL FINANCIAL INFORMATION OF AGBA

The following table sets forth selected historical financial information derived from AGBA’s unaudited financial statements as of March 31, 2022 and for the three months ended March 31, 2022 and 2021 and AGBA’s audited financial statements as of and for the years ended December 31, 2021 and 2020, each of which is included elsewhere in this prospectus. Such financial information should be read in conjunction with the audited financial statements and related notes included elsewhere in this prospectus. All figures presented below are presented in U.S. Dollars.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. You should carefully read the following selected financial information in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of AGBA” and AGBA’s financial statements and the related notes appearing elsewhere in this prospectus.

|

Three Months |

Three Months |

|

|

|||||||||||||

|

USD |

USD |

USD |

USD |

|||||||||||||

|

Income Statement Data: |

|

|

|

|

|

|

|

|

||||||||

|

Operating expenses |

$ |

(322,739 |

) |

$ |

(133,043 |

) |

$ |

(683,796 |

) |

$ |

(521,506 |

) |

||||

|

Other (expense) income, net |

$ |

(28,997 |

) |

$ |

1,239 |

|

$ |

(85,520 |

) |

$ |

484,080 |

|

||||

|

Net loss |

$ |

(351,736 |

) |

$ |

(131,804 |

) |

$ |

(769,316 |

) |

$ |

(37,426 |

) |

||||

|

Basic and diluted net (loss) income per |

$ |

(0.03 |

) |

$ |

0.01 |

|

$ |

0.15 |

|

$ |

(0.01 |

) |

||||

|

Basic and diluted weighted average shares outstanding, subject to possible |

|

3,646,607 |

|

|

4,243,062 |

|

|

3,988,613 |

|

|

4,600,000 |

|

||||

|

Basic and diluted net loss per share |

$ |

(0.18 |

) |

$ |

(0.13 |

) |

$ |

(1.00 |

) |

$ |

(0.01 |

) |

||||

|

Basic and diluted weighted average shares |

|

1,375,000 |

|

|

1,375,000 |

|

|

1,375,000 |

|

|

1,375,000 |

|

||||

|

|

|

December 31, |

||||||||||

|

USD |

USD |

USD |

||||||||||

|

Balance Sheet Data: |

|

|

|

|

|

|

||||||

|

Total assets |

$ |

41,022,817 |

|

$ |

40,606,332 |

|

$ |

48,954,047 |

|

|||

|

Total liabilities |

$ |

7,778,105 |

|

$ |

7,009,884 |

|

$ |

4,435,024 |

|

|||

|

Ordinary shares subject to possible redemption |

$ |

40,989,461 |

|

$ |

40,441,469 |

|

$ |

46,000,000 |

|

|||

|

Total stockholders’ deficit |

$ |

(7,744,749 |

) |

$ |

(6,845,021 |

) |

$ |

(1,480,977 |

) |

|||

11

risk factors

You should carefully review and consider the following risk factors and the other information contained in this prospectus, including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary Note Regarding Forward-Looking Statements,” in evaluating an investment in AGBA’s ordinary shares. The following risk factors apply to the business and operations of the TAG Business, and, therefore, also apply to the business and operations of the Post-Combination Company following the consummation of the Business Combination. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition and results of operations of the Post-Combination Company following the consummation of the Business Combination. We may face additional risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations.

Risk Factors Relating to the TAG Business’s Hong Kong Operations and Proximity to the PRC

The business, financial condition, results of operations, and prospects of the TAG Business may be materially and adversely affected if certain laws and regulations of the PRC become applicable to the TAG Business or its subsidiaries. The TAG Business may be subject to the risks and uncertainties associated with the evolving laws and regulations in the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice.

The TAG Business currently does not have operations in mainland China. Although the TAG Business and its subsidiaries do service Chinese clients, all sales of financial products offered by the TAG Business and its subsidiaries occur in Hong Kong. The TAG Business does not sell any financial products in mainland China, and all of the TAG Business’s customer data is maintained outside of mainland China. Accordingly, none of the TAG Business or its subsidiaries are regulated by any regulatory authorities in mainland China. See the section of this prospectus entitled “Regulation” for further information. Pursuant to the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which is a national law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law and applied locally by promulgation or local legislation. The Basic Law expressly provides that the national laws of the PRC which may be listed in Annex III of the Basic Law shall be confined to those relating to defense and foreign affairs as well as other matters outside the autonomy of Hong Kong. While the National People’s Congress of the PRC has the power to amend the Basic Law, the Basic Law also expressly provides that no amendment to the Basic Law shall contravene the established basic policies of the PRC regarding Hong Kong. As a result, national laws of the PRC not listed in Annex III of the Basic Law do not apply to Hong Kong-based businesses.

However, the laws and regulations in the PRC are evolving, and their enactment timetable, interpretation, and implementation involve significant uncertainties. To the extent that any PRC laws and regulations become applicable to the TAG Business, the TAG Business and the Post-Combination Company may be subject to the risks and uncertainties associated with the evolving laws and regulations in the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice. If certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future, were to become applicable to companies such as the TAG Business or its subsidiaries in the future, the application of such laws and regulations may have a material adverse impact on the business, financial condition, results of operations, and prospects of the TAG Business and its ability to offer securities to investors, any of which may, in turn, cause the value of the Post-Combination Company’s securities to significantly decline or become worthless.

Relevant organs of the PRC government have made recent statements or recently taken regulatory actions related to data security, anti-monopoly, and overseas listings of mainland China businesses. For example, in addition to the PRC Data Security Law and the Measures for Cybersecurity Review issued by the Cyberspace Administration of China which became effective on February 15, 2022 (the “Measures”), relevant PRC government agencies have recently taken anti-trust enforcement action against certain mainland China-based businesses. The management of the TAG Business understands that such enforcement action was taken pursuant to the PRC Anti-Monopoly Law which applies to monopolistic activities in domestic economic activities in mainland China and monopolistic activities outside

12

mainland China which eliminate or restrict market competition in mainland China. In addition, in July 2021, the PRC government provided new guidance on PRC-based companies raising capital outside of the PRC, including through arrangements called variable interest entities (“VIEs”). In light of such developments, the SEC has imposed enhanced disclosure requirements on China-based companies seeking to register securities with the SEC.

While the TAG Business currently does not have any operations in mainland China, there is no guarantee that the recent statements or regulatory actions by the relevant organs of the PRC government, including statements relating to the PRC Data Security Law, the PRC Personal Information Protection Law, and VIEs as well as the anti-monopoly enforcement actions will continue not to apply to the TAG Business. Should such statements or regulatory actions apply to companies such as the TAG Business or its subsidiaries in the future, it could have a material adverse impact on the business, financial condition, results of operations, and prospects of the Post-Combination Company, the Post-Combination Company’s ability to accept foreign investments, and the Post-Combination Company’s ability to offer or continue to offer securities to investors on a U.S. or other international securities exchange, any of which may, in turn, cause the value of the Post-Combination Company’s securities to significantly decline or become worthless. Neither AGBA nor TAG can predict the extent of such impact if such events were to occur.

The TAG Business may also become subject to the laws and regulations of the PRC to the extent that the TAG Business commences business and customer facing operations in mainland China as a result of any future partnership, acquisition, expansion, or organic growth. See “Information about the TAG Business — Strategic Growth Plans of the TAG Business.”

The PRC government exerts substantial influence, discretion, oversight, and control over the manner in which companies incorporated under the laws of PRC must conduct their business activities. The TAG Business is a Hong Kong-based company with no operations in mainland China; however, there can be no guarantee that the PRC government will not seek to intervene or influence the operations of the TAG Business or its subsidiaries at any time.

Because (i) the TAG Business currently does not have operations in mainland China, (ii) all sales of financial products offered by the TAG Business and its subsidiaries, including those to PRC citizens, occur in Hong Kong, and (iii) the TAG Business does not sell any financial products in mainland China, the PRC government currently does not directly govern the manner in which the TAG Business conducts its business activities outside of mainland China. However, the PRC legal system is evolving quickly, and PRC laws, regulations, and rules may change quickly with little advance notice, including with respect to Hong Kong-based businesses. As a result, there can be no assurance that the TAG Business will not be subject to direct influence or discretion over its business from organs of the PRC government in the future, due to changes in laws or other unforeseeable reasons or due to the TAG Business’s expansion or acquisition of operations in or involving mainland China. See “Information about the TAG Business — Strategic Growth Plans of the TAG Business.”

The PRC government has exercised and continues to exercise substantial control over many sectors of the PRC economy, including through regulation and/or state ownership. PRC government actions have had, and may continue to have, a significant effect on economic conditions in the PRC and the businesses which are subject to them. If the TAG Business became subject to the direct intervention or influence of the PRC government at any time due to changes in laws or other unforeseeable reasons or as a result of the TAG Business’s development, expansion, or acquisition of operations in the PRC, the TAG Business may be required to make material changes in its operations, which may result in increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply, or both. Neither AGBA nor TAG can be assured that the PRC government will not, in the future, release regulations or policies regarding other industries, which, if applicable to the TAG Business or its subsidiaries, may adversely affect the business, financial condition and results of operations of the Post-Combination Company.

In addition, the various segments of the TAG Business are regulated by a number of Hong Kong regulators, including, the Hong Kong Insurance Authority and the Mandatory Provident Fund Schemes Authority. See “Regulation” in this prospectus. PRC government influence or oversight over such Hong Kong regulators may have an indirect but material impact on the TAG Business, including but not limited to with respect to capital requirements, its ability to operate certain businesses, its operations in certain jurisdictions (including the markets in which the TAG Business or its subsidiaries may operate in the future) and/or the implementation of certain controls and procedures in relation to risk management or cybersecurity. Furthermore, the market prices and/or liquidity of the securities of the Post-Combination Company could be adversely affected as a result of anticipated negative impacts of any such government actions, as

13

well as negative investor sentiment towards Hong Kong-based companies subject to direct PRC government oversight and regulation, regardless of actual operating performance. There can be no assurance or guarantee that the PRC government would not intervene in or influence the operations of the TAG Business, directly or indirectly, at any time.

The securities of the Post-Combination Company may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act (and the Accelerating Holding Foreign Companies Accountable Act, if passed into law) if the PCAOB were unable to fully inspect the company’s auditor.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted into U.S. law on December 18, 2020. The HFCA Act states that if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board of the United States (the “PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit its securities from being traded on a national securities exchange or in the over-the-counter trading market in the U.S. On December 16, 2021, the Public Company Accounting Oversight Board of the United States (the “PCAOB”) issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (i) China, and (ii) Hong Kong. The management of the TAG Business believes that this determination does not impact the TAG Business, as the auditor of both AGBA and the TAG Business, Friedman LLP, (i) is headquartered in New York, U.S.A., (ii) is an independent registered public accounting firm with the PCAOB, and (iii) has been inspected by the PCAOB on a regular basis. Nonetheless, there can be no assurance that future changes in laws or regulations will not impact the TAG Business, Friedman LLP, or any future auditor of the Post-Combination Company. Accordingly, there can be no assurance that Friedman LLP (or any future auditor of the Post-Combination Company) will be able to meet the requirements of the HFCA Act and that the Post-Combination Company will not suffer the resulting material and adverse impact on its stock performance, as a company listed in the United States.

On April 21, 2020, SEC and PCAOB released a joint statement highlighting the risks associated with investing in companies based in or have substantial operations in emerging markets, including China. The joint statement emphasized the risks associated with the lack of access for the PCAOB to inspect auditors and audit work papers in China and higher risks of fraud in emerging markets.

On May 20, 2020, the U.S. Senate passed the HFCA Act that requires a foreign company to certify it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a national exchange. On December 2, 2020, the U.S. House of Representatives approved the HFCA Act, and on December 18, 2020, the HFCA Act was signed into law. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act. The bill, if enacted, would shorten the three-consecutive-year compliance period under the HFCA Act to two consecutive years. As a result, the time period before the Post-Combination Company’s securities may be prohibited from trading or delisted will be reduced. On December 2, 2021, the SEC adopted final amendments implementing congressionally mandated submission and disclosure requirements of the HFCA Act.