royalty payments equivalent to (a) 6% of the net HB4 Soy technology revenues realized by Verdeca, capped at $10 million aggregate amount, and (b) 25% of the net wheat technology revenues resulting from the in-licensed materials.

On April 26, 2021, we voluntarily transferred our stock exchange listing from the NYSE American to The Nasdaq Global Select Market. This new listing enhances the company’s visibility as an Ag-Tech company focused on sustainable solutions.

At the fiscal year ended June 30, 2022, we had 45,870,346 ordinary shares issued and outstanding.

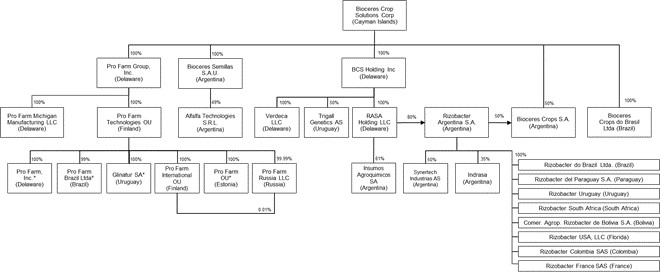

After the end of our fiscal year ended June 30, 2022, on July 12, 2022, we announced the closing of the Pro Farm Merger with Pro Farm Group, Inc. pursuant to which Pro Farm merged into us pursuanto to the Merger Agreement. Upon the closing of the Pro Farm Merger, Pro Farm became a wholly owned subsidiary of Bioceres and each share of Pro Farm common stock was exchanged for our ordinary shares at a fixed exchange ratio of 0.088.

Together with our subsidiaries, we have a combined experience of 45 years introducing top-tier technologies into the global agriculture market. Since our founding, we have developed one of the leading fully integrated biotechnology platforms of its kind to source, validate, develop and commercialize agricultural technologies and products, focused on raising crop yields and reducing the carbon footprint of agriculture. We have strategically targeted some of the most globally prolific crops, namely soy, wheat, alfalfa and corn, in the main agricultural geographies of the world.

In order to bring our products to market in an efficient and cost-effective manner, we have established multiple joint ventures, formed non-joint venture collaborations and created and acquired multiple companies. Our joint ventures include partnerships with important industry participants, such as Florimond Desprez and De Sangosse. Some of our non-joint venture collaborations include those with Corteva, Momentive, Syngenta, Don Mario, and TMG among others.

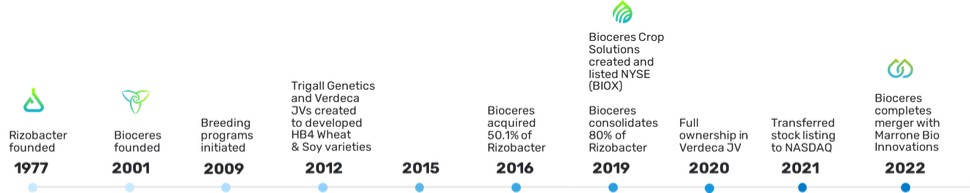

The graph below illustrates our history through joint ventures and acquisitions:

B.Business Overview

Incorporation of Information by Reference

The information provided in Item 1A of the Pro Farm’s annual report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 30, 2022 is incorporated by reference herein.

Our Operational and Organizational Structure

Our principal executive offices are located in Rosario, Santa Fe, Argentina. Our main manufacturing and distribution facilities are located in Pergamino, Argentina. Our manufacturing facilities include a formulation plant for adjuvants with an annual capacity of approximately 2.1 million-gallon, a production facility of liquid inoculants with an annual capacity of 6.6 million gallons, a formulation plant for insecticides and fungicides with a production capacity of 0.5 million gallons per year, a micro-beaded fertilizer facility with a production capacity of 50,000 tons per year, as well as over 375,000 square feet of warehouse space for packaging and logistics. We test and conduct field trials of our key technologies at our main field station, which also has processing capabilities for foundation seed.

We also operate facilities in Brazil, where we have a manufacturing formulation plant for adjuvants in Londrina, Brazil with an annual capacity of 0.5 million-gallon. Additionally, we have sales offices or representatives in eight countries to address the local and regional demand.

42