As filed with the Securities and Exchange Commission on July 8, 2019.

Registration No. 333-231655

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biophytis S.A.

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant's name into English)

| France (State or Other Jurisdiction of Incorporation or Organization) |

2834 (Primary Standard Industrial Classification Code Number) |

Not Applicable (I.R.S. Employer Identification Number) |

Biophytis S.A.

Sorbonne University—BC 9, Bâtiment A 4ème étage

4 place Jussieu

75001 Paris, France

+33 1 44 27 23 00

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302)738-6680

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||

Aron Izower Reed Smith LLP 599 Lexington Avenue, 26nd Floor New York, NY 10022 +1 (212) 521-5400 |

Linda Hesse Jones Day 2 rue Saint-Florentin 75001 Paris France +33 1 56 59 39 39 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ý

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee |

||

|---|---|---|---|---|

Ordinary shares, €0.20 nominal value per share(2)(3)(4) |

$12,075,000 | $1,464(5) | ||

|

||||

- (1)

- Estimated

solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, or the

Securities Act.

- (2)

- Consists

of ordinary shares and ordinary shares to be offered in the form of American Depositary Shares, or ADSs (including ADSs that the underwriters have the

option to purchase), in the United States and in countries outside the United States, but which may be resold in the United States in transactions requiring registration under the Securities Act or an

exemption therefrom. The total number of ordinary shares and ADSs to be offered and sold in the ADS offering and the ordinary shares offering is subject to reallocation between these offerings as

permitted under applicable laws and regulations.

- (3)

- Each

ADS represents the right to receive 10 ordinary shares. The ADSs issuable upon deposit of the ordinary shares registered hereby are being registered under a

separate registration statement on Form F-6 (File No. 333-232305).

- (4)

- Pursuant

to Rule 416 under the Securities Act, the ordinary shares registered hereby also include an indeterminate number of additional ordinary shares as may

from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or similar transactions.

- (5)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 8, 2019

P R O S P E C T U S

13,125,000 Ordinary Shares

(Including 8,750,000 Ordinary Shares in the form of American Depositary Shares)

$ per American Depositary Share

€ per Ordinary Share

We are offering an aggregate of 13,125,000 ordinary shares in a global offering.

We are offering 8,750,000 ordinary shares in the form of American Depositary Shares, or ADSs, primarily in the United States, but also in countries outside the United States including the European Union, referred to herein as the ADS offering. Each ADS represents the right to receive 10 ordinary shares. The ADSs may be evidenced by American Depositary Receipts, or ADRs.

We are concurrently offering 4,375,000 ordinary shares, primarily to qualified investors in the European Union and to investors in countries outside the United States, but also in the United States, referred to herein as the ordinary share offering.

This is our initial public offering of ADSs. Prior to this offering there has been no public market for the ADSs. We have applied to list the ADSs on the Nasdaq Capital Market under the symbol "BPTS." Our ordinary shares are listed on the Euronext Growth Paris under the symbol "ALBPS."

The offering price is expected to be between $7.00 and $9.00 per ADS, or between €0.62 and €0.80 per ordinary share. The final offering price per ADS in U.S. dollars and the corresponding offering price per ordinary share in euros will be determined through negotiations between us and H.C. Wainwright & Co., LLC, or Wainwright, as the representative of the several underwriters, and by reference to the prevailing market prices of our ordinary shares on the Euronext Growth Paris after taking into account market conditions and other factors. On July 8, 2019, the last reported sale price of our ordinary shares on the Euronext Growth Paris was €0.88 per ordinary share, corresponding to a price of $9.87 per ADS, assuming an exchange rate of €0.89 per U.S. dollar, the Banque de France exchange rate on July 8, 2019, and based on an assumed ratio of 10 ordinary shares for each ADS.

The closings of the ADS offering and the ordinary share offering, which are together referred to as the global offering, will occur simultaneously. The total number of ordinary shares and ADSs to be offered and sold in the ADS offering and the ordinary share offering is subject to reallocation between these offerings as permitted under applicable laws and regulations.

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in the ADSs and ordinary shares involves risks. See "Risk Factors" beginning on page 13.

Neither the Securities and Exchange Commission nor any U.S. state or other securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

||||||

| |

Per Ordinary Share |

Per ADS |

Total |

|||

|---|---|---|---|---|---|---|

Public Offering Price |

€ | $ | $ | |||

Underwriting Discounts and Commissions(1) |

€ | $ | $ | |||

Proceeds to us, before expenses |

€ | $ | $ | |||

|

||||||

- (1)

- See "Underwriting" beginning on page 209 of this prospectus for additional information regarding underwriting compensation.

Wainwright may also exercise its option to purchase up to an additional 1,968,750 ordinary shares (to be delivered in the form of an aggregate of 196,875 ADSs) from us in the global offering, at the public offering price, less underwriting discounts and commissions, within 30 days after the date of this prospectus. If Wainwright exercises this option in full, the total underwriting commissions payable by us will be € ($ ) and the total proceeds to us, before expenses, will be € ($ ), based on the Banque de France exchange rate on , 2019.

The underwriters expect to deliver the ADSs to purchasers in the ADS offering on or about , 2019 through the book-entry facilities of The Depository Trust Company. The underwriters expect to deliver the ordinary shares to purchasers in the ordinary share offering on or about , 2019 through the book-entry facilities of Euroclear France.

Sole Book-Running Manager

H.C. Wainwright & Co.

Co-Manager

Invest Securities S.A.

The date of this prospectus is , 2019.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. We and the underwriters have not authorized any person to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state or jurisdiction where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby.

For investors outside the United States: Neither we nor the underwriters have taken any action in any jurisdiction outside the United States to permit a public offering of the ADSs or the ordinary shares, or possession or distribution of this prospectus in that jurisdiction. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions as to this global offering and the distribution of the prospectus applicable to that jurisdiction.

We are incorporated in France, and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or SEC, we are currently eligible for treatment as a "foreign private issuer." As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic

i

registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

The financial statements included in this prospectus are presented in euros. All references in this prospectus to "$," "US$," "U.S.$," "U.S. dollars," "dollars" and "USD" mean U.S. dollars and all references to "€" and "euros," mean euros, unless otherwise noted. Throughout this prospectus, references to ADSs mean ADSs or ordinary shares represented by ADSs, as the case may be.

MARKET, INDUSTRY AND OTHER DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size estimates, is based on information from independent industry analysts, third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us based on such data and our knowledge of such industry and market, which we believe to be reasonable. Although we are responsible for all of the disclosures contained in this prospectus, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading "Risk Factors."

This prospectus may contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies' trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

ii

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in the ADSs and/or ordinary shares. You should read the entire prospectus carefully, including "Risk Factors" and our financial statements and the related notes appearing elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in the sections of this prospectus titled "Business," and "Management's Discussion and Analysis of Financial Condition and Results of Operations" before making an investment decision. Unless otherwise indicated, "Biophytis," "the company," "our company," "we," "us" and "our" refer to Biophytis S.A. and its consolidated subsidiary.

Overview

We are a clinical-stage biotechnology company focused on the development of therapeutics that slow the degenerative processes associated with aging and improve functional outcomes for patients suffering from age-related diseases. Our goal is to become a leader in the emerging field of aging science by delivering life-changing therapies to the growing number of patients in need. To accomplish this goal, we have assembled an experienced and skilled group of industry professionals, scientists, clinicians and key opinion leaders from leading industry and academic institutions from around the world.

The global population of people over the age of 60 is expected to double from approximately 962 million in 2017 to 2.1 billion by 2050, according to estimates from the United Nations' World Population Prospects: the 2017 Revision. Healthcare costs, including costs associated with treatments and long-term care for age-related diseases associated with this demographic shift, are expected to rise proportionally, as effective treatment solutions are currently lacking. We believe that developing treatments to slow disease progression and reduce the risk of severe disability associated with age-related diseases is of the utmost importance.

As we age, our natural ability to compensate for stress and remain functional, called biological resilience, degrades. The decline in biological resilience contributes to the acceleration of the degenerative processes and the impairment of functional performance, which, in turn, can lead to severe disability, reduced healthspan and ultimately death. Our therapeutic approach is aimed at targeting and activating key biological resilience pathways that can protect against and counteract the effects of the multiple biological and environmental stresses, including inflammatory, oxidative and metabolic stresses that lead to age-related diseases.

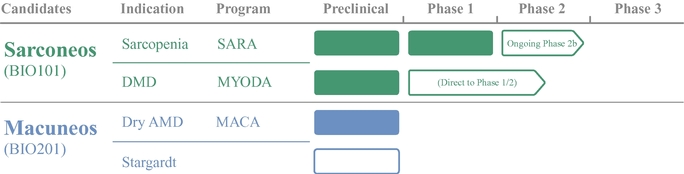

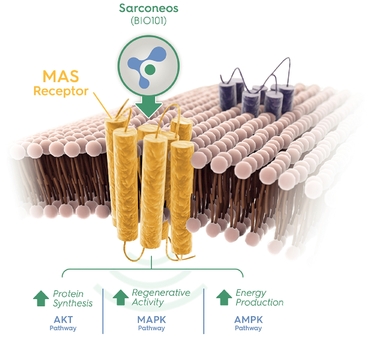

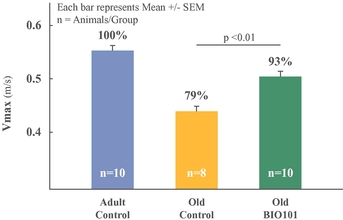

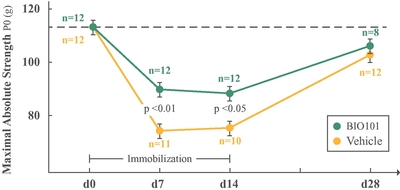

We are focusing our efforts to develop our lead drug candidate, Sarconeos (BIO101), an orally administered small molecule in development for the treatment of neuromuscular diseases. Sarconeos (BIO101) is a plant-derived pharmaceutical-grade purified 20-hydroxyecdysone. We have completed preclinical studies and a Phase 1 clinical trial in healthy human volunteers, which are necessary for pursuing further clinical development of Sarconeos (BIO101). Our early data indicates that Sarconeos (BIO101) stimulates biological resilience and muscle anabolism in cellular models, and preserves strength, mobility and respiratory capacity in animal models of certain neuromuscular diseases. While we are still in the early stages of development, we believe that these results support further investigation and clinical development of Sarconeos (BIO101) in patients with neuromuscular diseases.

The initial indication we are seeking approval for is sarcopenia, an age-related degeneration of skeletal muscle, which is characterized by a loss of muscle mass, strength and function in elderly people (adults 65 years of age and older) leading to mobility disability and increased risk of adverse health events and hospitalization, and potential death resulting from falls, fractures, and physical disability. We are currently testing the safety and efficacy of Sarconeos (BIO101) in an ongoing global, randomized, multicenter, double-blind, placebo-controlled Phase 2b clinical trial (SARA-INT) of 334 elderly patients

1

with sarcopenia at risk of mobility disability. There is currently no approved medication for sarcopenia, which is highly prevalent in the elderly with an estimated prevalence between six and 22 percent.

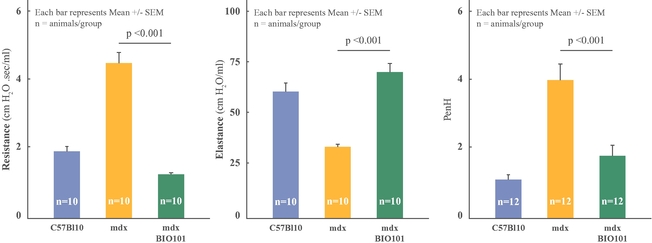

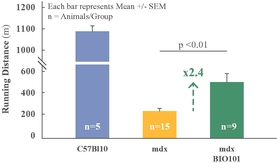

We are also developing Sarconeos (BIO101) for Duchenne muscular dystrophy, or DMD, a rare genetic neuromuscular disease in male children and young adults, which is characterized by accelerated degeneration of muscle and is responsible for a loss of mobility, respiratory failure and cardiomyopathy, leading to premature death. There is currently no cure and limited treatment options for DMD, which affects approximately one in 5,000 newborn boys (approximately 20,000 new cases annually worldwide). In 2018, we received orphan drug designation for Sarconeos (BIO101) in DMD from the U.S. Food and Drug Administration, or FDA, and the European Medicines Agency, or EMA.

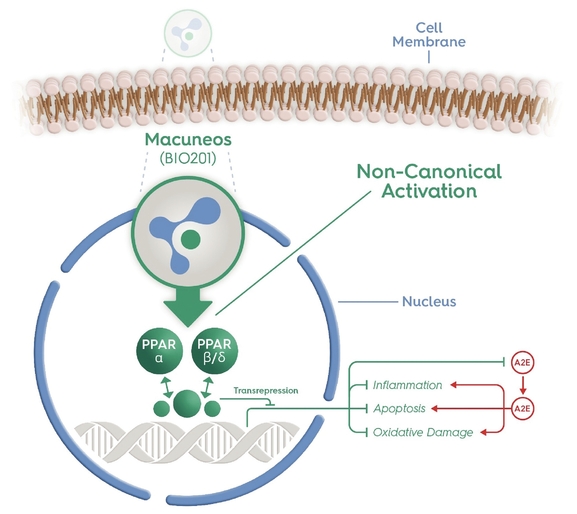

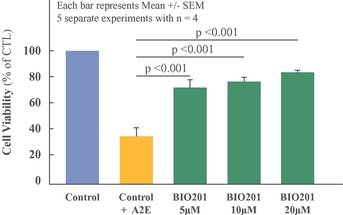

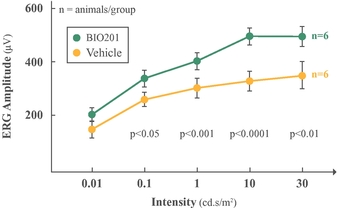

Our second drug candidate, Macuneos (BIO201), is an orally administered small molecule in development for the treatment of diseases of the retina, or retinopathies. It is a plant-derived pharmaceutical-grade purified 9 cis-norbixin, or norbixin. We have completed preclinical cellular and animal studies of Macuneos (BIO201) for the treatment of retinopathies. While we are still in the early stages of development, we believe that the results from our preclinical studies support continued investigation into whether Macuneos (BIO201) may stimulate biological resilience and protect the retina against phototoxic damage that leads to vision loss. The initial indication we plan to seek approval for is dry age-related macular degeneration, or AMD, a common eye disorder among people over the age of 50 that affects central vision, impairing functions such as reading, driving, and facial recognition, and has a major impact on quality of life and the ability to live independently. There are currently no approved treatments for dry AMD, which, based on our estimates from publicly available information, affects approximately 145 million people worldwide and is expected to increase over time as the population ages.

We are also exploring Macuneos (BIO201) as a potential treatment for Stargardt disease, which shares many of the characteristics of AMD. Stargart disease is the most common form of inherited macular degeneration that typically develops in childhood and leads to vision loss and, in some cases, blindness.

Subject to our entering into commercialization agreements with one of our research collaborators in relation to two patent applications we recently filed, we will hold exclusive commercialization rights through licenses for each of our drug candidates. We currently plan to develop our drug candidates through clinical proof-of-concept, or PoC (typically Phase 2), and then seek licensing and/or partnership opportunities for further clinical development through regulatory approval and commercialization.

We have developed our lead drug candidate Sarconeos (BIO101), preclinical drug candidate Macuneos (BIO201), and a preclinical pipeline of life-cycle extension products, consisting of BIO103 and BIO203, through a drug discovery platform in collaboration with Sorbonne University in Paris, France based on work with medicinal plants. The platform is based on a reverse pharmacology approach that tests a collection of bioactive secondary metabolites along with chemical analogs that we have synthesized in phenotypic screens of various age-related diseases. Our long-term goal is to advance the field of aging science with the continued discovery and development of new drug candidates that treat age-related diseases by stimulating biological resilience pathways that are involved in the aging process and/or age-related diseases.

We have assembled an executive team of scientific, clinical, and business leaders with broad expertise in biotechnology and clinical drug development. Stanislas Veillet, our co-founder, Chairman and Chief Executive Officer, has held positions in the biotechnology, pharmaceutical and nutritional industries for the last 25 years. He holds a Ph.D. in genetics and has authored more than a dozen patents. Our other co-founder and Chief Scientific Officer, René Lafont, is a biochemist (Ecole Normale Supérieure), Professor Emeritus and former Dean of the Department of Life Sciences at Sorbonne University. He has authored over 170 scientific publications and a dozen patents and is also notably a Chevalier de l'Ordre des Palmes Académiques and a Laureate of the Karlson Foundation in

2

Germany. Dr. Samuel Agus, our Chief Medical Officer, holds a Doctor in Medicine, is a board-certified neurologist with academic training in biostatistics and bioinformatics, and has over 15 years of clinical development experience in the pharmaceutical industry.

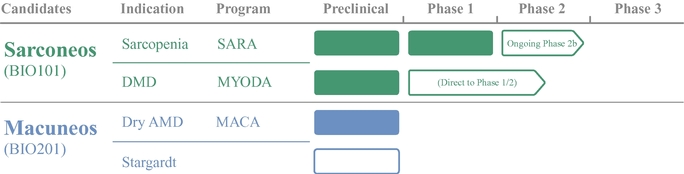

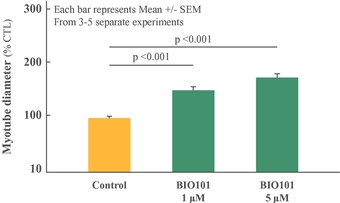

Our Clinical Pipeline

We are developing a portfolio of programs targeting biological resilience pathways that slow the degenerative processes associated with aging and improve functional outcomes for patients suffering from age-related diseases. Our current pipeline of drug candidates is illustrated below.

Sarconeos (BIO101)

We are developing Sarconeos (BIO101) for the treatment of certain neuromuscular diseases, including sarcopenia and DMD. Both are diseases of muscular degeneration, but with different causes and pathophysiologies. However, similar key muscular processes are impaired in each of these diseases as well as other muscle wasting conditions, including metabolism, mitochondrial function, stem cell proliferation and loss of biological resilience, which are mediated through multiple signaling pathways. Early cellular and animal model data suggest that Sarconeos (BIO101) directly targets muscle tissue and cells, and improves several key muscle cell functions, including protein syntheses, regeneration and energy production that may have the potential to improve muscle function and preserve strength, mobility and respiratory capacity in various muscle wasting diseases.

Sarcopenia (the SARA clinical program)

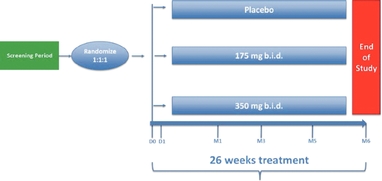

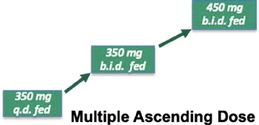

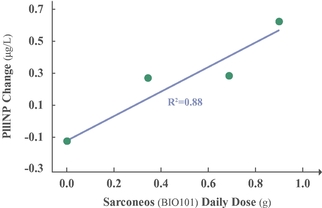

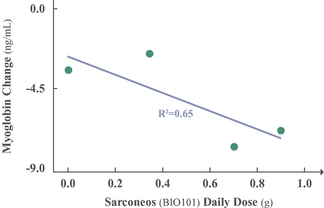

We are currently testing the safety and efficacy of Sarconeos (BIO101) in an ongoing global, randomized, multicenter, double-blind, placebo-controlled Phase 2b clinical trial (SARA-INT) of 334 elderly patients with sarcopenia at risk of mobility disability. We enrolled the first patient in this trial in May 2018 and currently expect to complete enrollment in 2020. We completed a Phase 1 clinical trial (SARA-PK) of 54 healthy adult and elderly subjects in 2017 that allowed us to determine the two dosing levels (175 and 350 mg b.i.d.) for our ongoing SARA-INT trial. Based on results from our cellular and animal studies, we believe Sarconeos (BIO101) stimulates biological resilience and preserves muscle strength, function and mobility. While preclinical studies provide only limited data, particularly in diseases whose pathophysiology is not well understood, and may not be indicative of the likelihood of success of future trials, we believe that the results of our Phase 1 clinical trial and cellular and animal studies support continued research and clinical development of Sarconeos (BIO101) in sarcopenia.

If approved by regulatory authorities for commercial use, we believe there is a market potential for Sarconeos (BIO101) in sarcopenia, which is highly prevalent in the elderly with an estimated prevalence between six and 22 percent. There is currently no approved medication for sarcopenia. Based on our review of research in this area, we believe Sarconeos (BIO101) is currently the only drug candidate being tested in an interventional Phase 2 clinical trial for the treatment of sarcopenia. There is

3

currently no widely accepted standard of care for sarcopenia. Current non-medicinal treatment recommendations primarily focus on moderate physical activity, such as 30 minutes of walking per day or resistance-based (strength) training, as they exert effects on both the nervous and muscular systems that are critical to positive physiological and functional adaptations in older adults, and nutritional intervention. Other potential drug modalities that have been tested in the clinic for sarcopenia have yet to demonstrate effectiveness on clinically meaningful outcomes (strength and mobility) and/or safety in larger clinical trials, and/or have not progressed through the clinic. Based on our understanding and discussions with regulatory agencies, including the FDA and EMA, functional mobility endpoints must be achieved in order to obtain marketing approval for sarcopenia We believe that based on our potential mechanism-of-action and preclinical cellular and animal data that Sarconeos (BIO101) directly targets muscle tissue and cells and improves key muscle cell functions, and that it has the potential to achieve clinically relevant functional mobility endpoints necessary for marketing approval.

DMD (the MYODA clinical program)

Subject to regulatory approval of our protocol, we plan to test the safety and efficacy of Sarconeos (BIO101) in a global, multicentric, double-blind placebo-controlled clinical PoC trial (MYODA-INT) in approximately 48 patients with DMD utilizing a seamless clinical trial design with a primary endpoint defined as a composite score combining muscle strength, mobility, and respiratory outcomes, which is adapted to the stage of severity of the disease in each patient. We are preparing to submit an investigational new drug, or IND, application to the FDA and clinical trial applications to the applicable regulatory agencies in Europe in the second half of 2019 to initiate clinical development as early as 2020, subject to regulatory approval. We had pre-IND correspondence with the FDA in October 2018 and a scientific advisory meeting with the Committee for Medicinal Products for Human Use, or the CHMP, of the EMA in December 2018. In 2018, we received orphan drug designation from the FDA and EMA for Sarconeos (BIO101) in DMD.

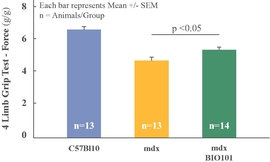

We have observed a positive effect on muscle function, mobility, and respiratory capacity (a major disability in later stage DMD disease progression) in mdx mice models of DMD that were treated with Sarconeos (BIO101). While preclinical studies provide only limited data, particularly in diseases whose pathophysiology is not well understood, and may not be indicative of the likelihood of success of future trials, we believe that the results of our cellular and animal studies support continued research and clinical development of Sarconeos (BIO101) in DMD.

If approved by regulatory authorities for commercial use, we believe there is market potential for Sarconeos (BIO101) in DMD, which affects approximately one in 5,000 newborn boys (approximately 20,000 new cases annually worldwide). There is currently no cure for DMD and there are only limited treatment options that aim to control the symptoms and slow the disease progression. In many countries, corticosteroids are the standard drug therapy, however, corticosteroids typically only slow the progression of muscle weakness and delay the loss of ambulation by up to two years. They have also been associated with adverse side effects and are generally not suitable for long-term administration. There are two targeted therapies (i.e., therapies targeting a specific dystrophin mutation by exon skipping or with stop codons) available on the market (one in the United States and one in Europe). As these therapies each target a specific gene mutation, they can only address approximately 13% of the overall DMD patient population with those genetic mutations. We believe that Sarconeos (BIO101) directly targets muscle tissue and cells, increases key muscle cell functions that are impaired independent of the genetic mutation that causes the disease, and has the potential to be used complementarily with corticosteroids, current targeted therapies and other gene therapies under development. We also believe that because Sarconeos (BIO101) targets various impaired muscle tissues and cells relevant to muscle strength, mobility and respiratory function, it has the potential to be used in all stages of DMD progression, including both ambulatory and non-ambulatory patients.

4

Macuneos (BIO201)

Dry AMD (the MACA clinical program)

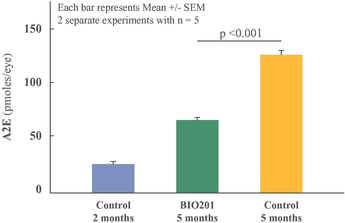

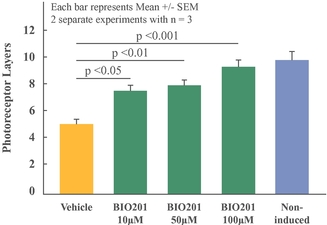

We plan to hold, in the second half of 2019, scientific advice meetings with the EMA and applicable regulatory agencies in Europe regarding our clinical development plan for Macuneos (BIO201) in dry AMD and, subject to regulatory review and approval of the protocol, commence a Phase 1 clinical trial (MACA-PK) in healthy volunteers. We expect the MACA-PK Phase 1 clinical trial will assess the safety, pharmacokinetics, or PK, and pharmacodynamics, or PD, of Macuneos (BIO201). We have completed chronic and acute animal toxicology studies to support IND and clinical trial applications. We have observed that Macuneos (BIO201) appears to protect the retina against phototoxic damage caused by A2E (a by-product of the visual pigment cycle) accumulation that leads to vision loss in several cellular and animal models of dry AMD and Stargardt disease.

If approved by regulatory authorities for commercial use, we believe that there is market potential for Macuneos (BIO201) in dry AMD. Therapeutic options for dry AMD have proven challenging with no currently approved therapies available that can slow or reverse the disease progression.

We intend to investigate whether Macuneos (BIO201) may also be an effective treatment for Stargardt disease, the most common form of inherited juvenile macular degeneration. The pathophysiology of Stargardt disease is similar to that of AMD, in that it may also be characterized by accelerated retinal degeneration.

Our Strategy

We are focused on the development of therapeutics that improve functional outcomes for patients suffering from age-related diseases. Our goal is to build Biophytis into a leading biotechnology company focused on targeting biological resilience pathways that slow the degenerative processes associated with age-related disease progression in order to improve the lives of patients that have limited or no treatment options. We currently plan to develop our drug candidates through clinical PoC (Phase 2) and then seek licensing and/or partnership opportunities for further clinical development through regulatory approval and commercialization. To achieve our goal, we are pursuing the following strategies:

- •

- Demonstrate clinical proof-of-concept (PoC) of Sarconeos (BIO101) in

sarcopenia. Our resources and business efforts are primarily focused on advancing the clinical development of Sarconeos (BIO101) for the

treatment of neuromuscular disorders, with an initial focus on sarcopenia. Our goal is to demonstrate clinical PoC (Phase 2) safety and efficacy of Sarconeos (BIO101) to treat sarcopenia in our

ongoing SARA-INT Phase 2b clinical trial. Upon successful completion, we plan to pursue licensing and/or partnership opportunities to advance Sarconeos (BIO101) into a confirmatory or

Phase 3 clinical trial necessary to secure marketing approval for commercial use. We believe this indication has significant value and that establishing clinical PoC may help attract partners

for further clinical development and commercialization.

- •

- Initiate clinical development of Sarconeos (BIO101) in

DMD. Our efforts are also focused on leveraging our knowledge and the development of Sarconeos (BIO101) in sarcopenia to commence and advance the

development of Sarconeos (BIO101) for the treatment of DMD, independent of genetic mutation and across the disease spectrum. We are preparing to submit an IND application to the FDA and clinical trial

applications to the applicable regulatory agencies in Europe in the second half of 2019 to initiate clinical development starting with the MYODA-INT clinical PoC stage (Phase 1/2) as early as 2020,

subject to regulatory approval.

- •

- Advance the development of our second drug candidate, Macuneos (BIO201). We are also focused on continuing the preclinical development of our second drug candidate, Macuneos (BIO201), for the treatment of retinopathies, with an initial focus on dry AMD. We plan to hold, in the

5

- •

- Expand our presence in the United States to support co-development in Europe and the United

States. We plan to continue the expansion of our company in the United States and Europe. In 2018, we opened offices in Cambridge, Massachusetts and New York, New York to

support our growing clinical, regulatory, and operational efforts, and we hired a U.S.-based Chief Financial Officer and Chief Medical Officer. Our goal is to continue to build our clinical and

regulatory operations to support clinical trials and obtain regulatory approval in both the United States and Europe. We plan to work with patient associations, regulatory agencies, government and

third-party payors and other key constituencies in both regions.

- •

- Expand our pipeline and explore potential strategic partnerships and alliances to maximize the value of our development programs. We plan to continue to leverage our collaborations with leading scientific and academic institutions in order to pursue new INDs for our existing drug candidates, including Sarconeos (BIO101), BIO103, Macuneos (BIO201) and BIO203. We believe that our drug candidates may be applicable for additional age-related diseases. We plan to explore the commercial potential of our drug candidates after establishing clinical PoC through Phase 2.

second half of 2019, scientific advice meetings with the EMA and applicable regulatory agencies in Europe regarding our clinical development plan for Macuneos (BIO201) in dry AMD and, subject to regulatory review and approval of the protocol, commence a Phase 1 clinical trial (MACA-PK) in healthy volunteers.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

- •

- We are a clinical-stage biotechnology company, with no products approved for commercial sale. We have incurred significant losses since

inception and anticipate that we will continue to incur losses for the foreseeable future.

- •

- We will require substantial additional financing to achieve our goals and a failure to obtain this capital when needed on acceptable terms, or

at all, could force us to delay, limit, reduce or terminate our drug development or other operations.

- •

- Our indebtedness could restrict our operations and make us more vulnerable to adverse economic conditions.

- •

- Our business is dependent on the successful development, regulatory approval, manufacture and commercialization of our drug candidates, each of

which is in the early stages of development.

- •

- The denial or delay of regulatory approval for our drug candidates would preclude or delay the commercialization of our drug candidates and

adversely impact our potential to generate revenue and/or raise financing, our business and our results of operations.

- •

- Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials, especially

preclinical data and early phase clinical trial data, may not be predictive of future trial results.

- •

- We rely on third parties to provide the raw materials necessary for our drug candidates and to manufacture preclinical and clinical supplies of our drug candidates and we intend to rely on third parties to produce commercial supplies of any approved drug candidate. The loss of these suppliers or manufacturers, or their failure to comply with applicable regulatory requirements or

6

- •

- We rely on third parties in the conduct of all of our preclinical studies and clinical trials and intend to rely on third parties in the

conduct of all of our future clinical trials. If these third parties do not successfully carry out their contractual duties, fail to comply with applicable regulatory requirements or meet expected

deadlines, we may be unable to obtain regulatory approval for our drug candidates.

- •

- Our existing collaborations as well as additional collaboration arrangements that we may enter into in the future may not be successful, which

could adversely affect our ability to develop and commercialize our drug candidates.

- •

- Our ability to compete may decline if we do not adequately protect our proprietary rights.

- •

- The requirements of being a U.S. public company may strain our resources, divert management's attention and affect our ability to attract and

retain executive management and qualified board members.

- •

- There has been no market for the ADSs prior to the global offering and an active and liquid market for our securities may fail to develop,

which could harm the market price of the ADSs.

- •

- The rights of shareholders in companies subject to French corporate law differ in material respects from the rights of shareholders of

corporations incorporated in the United States.

- •

- As a foreign private issuer, we are exempt from a number of rules under the U.S. securities laws and are permitted to file less information

with the SEC than a U.S. company. This may limit the information available to holders of ADSs and ordinary shares.

- •

- We are an "emerging growth company" under the JOBS Act and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make the ADSs less attractive to investors.

to provide us with sufficient quantities at acceptable quality levels or prices, or at all, would materially and adversely affect our business.

Corporate Information

We were incorporated as a société anonyme, or SA, on September 27, 2006. We are registered at the Paris Registre du Commerce et des Sociétés under the number 492 002 225. Our principal executive offices are located at Sorbonne University—BC 9, Bâtiment A 4ème étage, 4 place Jussieu 75001 Paris, France and our telephone number is +1 44 27 23 00. Our website address is www.biophytis.com. Our agent for service of process in the United States is Puglisi & Associates. The reference to our website is an inactive textual reference only and the information contained in, or that can be accessed through, our website is not a part of this prospectus.

Implications of Being an "Emerging Growth Company"

We qualify as an "emerging growth company," as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and regulatory requirements in contrast to those otherwise applicable generally to public companies. These provisions include:

- •

- the requirement to have only two years of audited financial statements and only two years of related Management's Discussion and Analysis of

Financial Condition and Results of Operations disclosure; and

- •

- exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404 the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act.

7

We may take advantage of these reduced reporting and other regulatory requirements for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our ordinary shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. In addition, the JOBS Act provides that an emerging growth company may delay adopting new or revised accounting standards until those standards apply to private companies. We have irrevocably elected not to avail ourselves of this delayed adoption of new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as public companies that are not emerging growth companies. If we choose to take advantage of any of these reduced reporting burdens, the information that we provide shareholders may be different than you might get from other public companies.

Implications of Being a Foreign Private Issuer

Upon consummation of the global offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

- •

- the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under

the Exchange Act;

- •

- the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for

insiders who profit from trades made in a short period of time; and

- •

- the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K upon the occurrence of specified significant events.

We intend to take advantage of these exemptions as a foreign private issuer.

8

Global offering |

13,125,000 ordinary shares offered by us, consisting of ordinary shares in the form of ADSs offered in the ADS offering and ordinary shares offered in the ordinary share offering. The closings of the ADS offering and the ordinary share offering will occur simultaneously. The total number of ordinary shares and ADSs to be offered and sold in the ADS offering and ordinary share offering is subject to reallocation between these offerings as permitted under applicable laws and regulations. | |

ADS offering |

875,000 ADSs, each representing 10 ordinary shares |

|

Ordinary share offering |

4,375,000 ordinary shares |

|

Offering price |

The offering price is expected to be between $7.00 and $9.00 per ADS, or between €0.62 and €0.80 per ordinary share. The final offering price per ADS in U.S. dollars and the corresponding offering price per ordinary share in euros will be determined by reference to the prevailing market prices of our ordinary shares on the Euronext Growth Paris after taking into account market conditions and other factors. |

|

Ordinary shares (including ordinary shares in the form of ADSs) to be outstanding immediately after the global offering |

26,588,413 ordinary shares (including ordinary shares in the form of ADSs), or 28,557,163 ordinary shares (including ordinary shares in the form of ADSs) if Wainwright exercises its option to purchase additional ADSs in full. |

|

Option to purchase additional ADSs in the global offering |

We have granted Wainwright an option, which is exercisable within 30 days from the date of this prospectus, to purchase up to an additional 1,968,750 ordinary shares (to be delivered in the form of an aggregate of 196,875 ADSs) from us at the public offering price, less the underwriting discounts and commissions. |

|

The ADSs |

Each ADS represents 10 ordinary shares, nominal value €0.20 per share. The ADSs may be evidenced by ADRs. Purchasers of ADSs in the ADS offering will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and all holders and beneficial owners of ADSs issued thereunder. To better understand the terms of the ADSs, you should carefully read the section in this prospectus titled "Description of American Depositary Shares." We also encourage purchasers of ADSs to read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

|

Depositary |

The Bank of New York Mellon |

9

Use of proceeds |

We estimate that the net proceeds to us from the global offering will be approximately €6.8 million ($7.6 million), based on an assumed public offering price of $8.00 per ADS in the ADS offering, which is the midpoint of the price range set forth on the cover page of this prospectus, corresponding to €0.71 per ordinary share in the ordinary share offering (assuming an exchange rate of €0.89 per U.S. dollar), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use the net proceeds we receive from the global offering to advance our Phase 2b clinical trial (SARA-INT) of Sarconeos (BIO101) in sarcopenia, to continue our development of Sarconeos (BIO101) in DMD through submission of an IND application to the FDA and clinical trial applications to the applicable regulatory agencies in Europe, and to continue to build our preclinical research and development platform on retinopathies and for other new and on-going research and development activities, working capital and other general corporate purposes. See the section of this prospectus titled "Use of Proceeds." |

|

Dividend policy |

We do not expect to pay any dividends on ordinary shares or ADSs in the foreseeable future. |

|

Risk factors |

You should read the "Risk Factors" section of this prospectus for a discussion of factors to consider carefully before deciding to invest in the ADSs or ordinary shares. |

|

Proposed Nasdaq trading symbol for the ADSs |

"BPTS" |

|

Euronext Growth Paris trading symbol for our ordinary shares |

"ALBPS" |

The number of our ordinary shares (including ordinary shares in the form of ADSs) that will be outstanding immediately following the completion of the global offering is based on 13,463,413 ordinary shares outstanding and zero ADSs outstanding as of March 31, 2019, and excludes:

- •

- 1,063,409 ordinary shares issuable upon the exercise of warrants issued to investors outstanding as of March 31, 2019, with a

weighted-average exercise price of €3.59 per ordinary share; and

- •

- 998,500 ordinary shares issuable upon the exercise of warrants issued pursuant to equity incentive awards and outstanding as of March 31, 2019, with a weighted average exercise price of €6.35 per ordinary share, 125,000 of which expired on May 21, 2019 with a weighted average exercise price of €2.06 per ordinary share and 35,000 of which expired on June 30, 2019 with a weighted average exercise price of €7.53 per ordinary share.

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of Wainwright's option to purchase up to an additional 1,968,750 ordinary shares (to be delivered in the form of an aggregate of 196,875 ADSs) from us in the global offering.

10

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data for the periods and as of the dates indicated below. We derived the summary statement of consolidated operations data for the years ended December 31, 2017 and 2018 from our audited consolidated financial statements included elsewhere in this prospectus. Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. The following summary statement of consolidated operations data for the three months ended March 31, 2018 and 2019 and statement of consolidated financial position data as of March 31, 2019 have been derived from our unaudited interim condensed consolidated financial statements as of March 31, 2019 and for the three months ended March 31, 2018 and 2019 included elsewhere in this prospectus. The unaudited interim condensed consolidated financial statements as of March 31, 2019 and for the three months ended March 31, 2018 and 2019 were prepared in accordance with IAS 34, Interim Financial Reporting, the standard of the IFRS applicable to interim financial statements.

Our historical results are not necessarily indicative of the results that may be expected in the future. You should read these data together with our consolidated financial statements and related notes beginning on page F-1, as well as the sections of this prospectus titled "Selected Financial and Other Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the other financial information included elsewhere in this prospectus.

| |

Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2018 | 2018 | 2019 | ||||||||||||

| |

€ | € | € | € | U.S. $(1) | |||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||

Statement of Consolidated Operations Data: |

||||||||||||||||

Operating expenses: |

||||||||||||||||

Research and development, net |

7,043 | 9,513 | 2,017 | 2,289 | 2,570 | |||||||||||

General and administrative expenses |

2,865 | 4,348 | 865 | 1,211 | 1,360 | |||||||||||

Total operating expenses |

9,908 | 13,861 | 2,882 | 3,500 | 3,930 | |||||||||||

Operating loss |

(9,908 | ) | (13,861 | ) | (2,882 | ) | (3,500 | ) | (3,930 | ) | ||||||

Financial expenses |

(3,293 | ) | (215 | ) | (26 | ) | (276 | ) | (310 | ) | ||||||

Financial income |

37 | 17 | 4 | 49 | 55 | |||||||||||

Change in fair value of financial instruments |

1,756 | — | — | — | — | |||||||||||

Financial loss |

(1,500 | ) | (198 | ) | (22 | ) | (227 | ) | (255 | ) | ||||||

Net loss before taxes |

(11,408 | ) | (14,059 | ) | (2,904 | ) | (3,727 | ) | (4,185 | ) | ||||||

Income tax benefit |

— | 72 | — | — | — | |||||||||||

| | | | | | | | | | | | | | | | | |

Net loss |

(11,408 | ) | (13,987 | ) | (2,904 | ) | (3,727 | ) | (4,185 | ) | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings (losses) per share(2) |

||||||||||||||||

Basic |

(1.24 | ) | (1.04 | ) | (0.22 | ) | (0.28 | ) | (0.31 | ) | ||||||

Diluted |

(1.24 | ) | (1.04 | ) | (0.22 | ) | (0.28 | ) | (0.31 | ) | ||||||

Weighted average number of ordinary shares outstanding used for computing Basic |

9,188,179 | 13,463,413 | 13,463,413 | 13,463,413 | 13,463,413 | |||||||||||

Weighted-average number of ordinary shares outstanding used for computing Diluted |

9,188,179 | 13,463,413 | 13,463,413 | 13,463,413 | 13,463,413 | |||||||||||

- (1)

- Translated

solely for convenience into dollars at an exchange rate of €1.00 = US$1.1228, the noon buying rate of the Federal Reserve Bank of

New York on March 29, 2019.

- (2)

- See Note 2.22 to our audited consolidated financial statements and Note 15 to our unaudited interim condensed consolidated financial statements for further details on the calculation of basic and diluted loss per ordinary share.

11

| |

As of March 31, 2019 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1)(2) |

|||||||||||

| |

€ | US$(3) | € | US$(3) | |||||||||

| |

(in thousands) |

||||||||||||

Statement of Consolidated Financial Position Data: |

|||||||||||||

Cash and cash equivalents |

11,152 | 12,521 | 17,933 | 20,112 | |||||||||

Total assets |

19,446 | 21,834 | 26,227 | 29,424 | |||||||||

Non-controlling interests |

(31 | ) | (35 | ) | (31 | ) | (35 | ) | |||||

Total shareholders' equity |

2,383 | 2,676 | 9,164 | 10,221 | |||||||||

Total non-current liabilities |

7,688 | 8,632 | 7,688 | 8,632 | |||||||||

Total current liabilities |

9,375 | 10,526 | 9,375 | 10,526 | |||||||||

- (1)

- As

adjusted basis gives effect to the issuance and sale of 13,125,000 ordinary shares (including 8,750,000 ordinary shares in the form of ADSs) in the global

offering at an assumed offering price of $8.00 per ADS in the ADS offering, which is the midpoint of the price range set forth on the cover page of this prospectus, corresponding to

€0.71 per ordinary share in the ordinary share offering (assuming an exchange rate of €0.89 per U.S. dollar), after deducting estimated underwriting discounts and

commissions and estimated offering expenses payable by us and the application of net proceeds from the global offering described under "Use of Proceeds."

- (2)

- Each

€0.89 ($1.00) increase or decrease in the assumed offering price of $8.00 per ADS in the ADS offering which is the midpoint of the price range

set forth on the cover page of this prospectus, corresponding to €0.71 per ordinary share in the ordinary share offering (assuming an exchange rate of €0.89 per U.S.

dollar), would increase or decrease each of as adjusted cash and cash equivalents, total assets and total shareholders' equity by €1.1 million ($1.2 million), assuming

that the number of ordinary shares offered by us (including ordinary shares in the form of ADSs), as set forth on the cover page of this prospectus, remains the same and after deducting underwriting

commissions and estimated offering expenses payable by us and applying the net proceeds from the global offering. Subject to applicable law, we may also increase or decrease the number of ordinary

shares (including ordinary shares in the form of ADSs) we are offering in the global offering. Each increase or decrease of 1,000,000 ordinary shares (including ordinary shares in the form of ADSs)

offered by us would increase or decrease each of as adjusted cash and cash equivalents, total assets and total shareholders' equity by €0.7 million ($0.7 million),

assuming that the assumed offering price per ordinary share remains the same, and after deducting estimated underwriting commissions and offering expenses payable by us and applying the net proceeds

from the global offering.

- The

as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price, the actual number of

ordinary shares and ADSs offered by us, and other terms of the global offering determined at pricing.

- (3)

- Translated solely for convenience into dollars at an exchange rate of €1.00 = US$1.1228, the noon buying rate of the Federal Reserve Bank of New York on March 29, 2019 except as it relates to the impact of the assumed proceeds, which are translated into U.S. dollars at an exchange rate of €1.00 = US$1.1215, the exchange rate of the Banque de France on July 8, 2019.

12

Investing in our ordinary shares (including ordinary shares in the form of ADSs) involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase our securities. If any of the following risks are realized, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the market price of our securities could decline, and you could lose part or all of your investment.

Risks Related to Our Limited Operating History, Financial Condition, and Capital Requirements

We are a clinical-stage biotechnology company with no products approved for commercial sale. We have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future.

Biotechnology product development is a highly speculative undertaking because it entails substantial upfront capital expenditures and significant risk that any potential drug candidate will not demonstrate adequate effectiveness in the targeted indication or an acceptable safety profile, gain regulatory approval or become commercially viable. We have incurred significant losses since our inception in 2006, and we anticipate that we will continue to incur losses for the foreseeable future, which, together with our limited operating history, may make it difficult to assess our future viability.

We incurred losses of €11.4 million, €14.0 million and €3.7 million for the years ended December 31, 2017 and 2018 and the three months ended March 31, 2019, respectively. As of March 31, 2019, we had an accumulated deficit of €43.4 million. Substantially all of our losses have resulted from expenses incurred in connection with our preclinical and clinical programs and other research and development activities and from general and administrative costs associated with our operations. We expect to continue to incur losses for the foreseeable future, and we anticipate these losses will increase as we continue to develop our drug candidates, conduct clinical trials and pursue research and development activities. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our shareholders' equity and working capital.

We will require substantial additional financing to achieve our goals, and a failure to obtain this capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product development or other operations.

Since our inception, we have invested a significant portion of our efforts and financial resources on our preclinical studies and clinical trials and other research and development activities. We believe that we will continue to expend substantial resources for the foreseeable future in connection with the preclinical and clinical development of our current drug candidates and the discovery and development of any other drug candidates we may choose to pursue. These expenditures will include costs associated with conducting preclinical studies and clinical trials and obtaining regulatory approvals, and any expenses associated with commercializing, marketing and selling products approved for sale that we elect to commercialize ourselves. In addition, other unanticipated costs may arise. Because the outcome of any preclinical study or clinical trial is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development of our current drug candidates or any future drug candidates we may choose to pursue.

We estimate that the net proceeds from the global offering will be approximately €6.8 million ($7.6 million), based on an assumed public offering price of $8.00 per ADS in the ADS offering, which is the midpoint of the price range set forth on the cover page of this prospectus, corresponding to €0.71 per ordinary share in the ordinary share offering (assuming an exchange rate of €0.89 per U.S. dollar), and after deducting the underwriting discounts and commissions and estimated offering

13

expenses payable by us. As of March 31, 2019, we had capital resources consisting of cash, cash equivalents, and marketable securities of €11.2 million. We expect our existing capital resources, including our ability to draw down on our credit facility with Bracknor Fund Limited, or Bracknor Fund (as described in further detail in the section of this prospectus titled "Management's Discussion and Analysis of Financial Condition and Results of Operations"), together with the proceeds from the global offering, will be enough to fund our planned operating expenses for the next 12 months. However, our current operating plans may change as a result of many factors currently unknown to us, and we may need to seek additional funds even sooner than planned, through public or private equity or debt financings or other sources, such as strategic collaborations. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

Our future capital requirements depend on many factors, including:

- •

- the scope, progress, data and costs of researching and developing our current drug candidates any other drug candidates we may choose to pursue

in the future, and conducting preclinical studies and clinical trials;

- •

- the timing of, and the costs involved in, obtaining regulatory approvals for our current drug candidates or any future drug candidates we may

choose to pursue;

- •

- the number and characteristics of any additional drug candidates we develop or acquire;

- •

- any costs associated with manufacturing our current drug candidates and any future drug candidates;

- •

- the cost of sourcing purified extracts and a supply chain in sufficient quantity and quality to meet our needs;

- •

- the cost of commercialization activities associated with any of our current drug candidates or any future drug candidates that are approved for

sale and that we choose to commercialize ourselves, including marketing, sales and distribution costs;

- •

- our ability to maintain existing, and establish new, strategic collaborations, licensing or other arrangements and the financial terms of any

such agreements, including the timing and amount of any future milestone, royalty or other payments due under any such agreement;

- •

- any product liability or other lawsuits related to any current or future drug candidates that are approved for sale;

- •

- the expenses needed to attract, hire and retain skilled personnel;

- •

- the costs associated with being a public company;

- •

- the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing our intellectual property portfolio;

and

- •

- the timing, receipt and amount of sales of any future approved products, if any.

Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis on terms acceptable to us, we may be required to:

- •

- delay, limit, reduce or terminate preclinical studies, clinical trials or other development activities for our current drug candidates or any

future drug candidate;

- •

- seek corporate partners for our drug candidates when we would otherwise develop our drug candidates on our own, or at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available;

14

- •

- delay, limit, reduce or terminate our research and development activities; or

- •

- delay, limit, reduce or terminate any efforts to establish manufacturing and sales and marketing capabilities or other activities that may be necessary to commercialize our current drug candidates or any future drug candidates.

We do not expect to realize revenue from sales of products or royalties from licensed products in the foreseeable future, if at all, and unless and until our drug candidates are clinically tested, approved for commercialization and successfully marketed. To date, we have primarily financed our operations through the sale of debt and equity securities, as well as public aid for innovation and reimbursement of the French research tax credit, described elsewhere in this prospectus. We will need to seek additional funding in the future and currently intend to do so through collaborations, public or private equity offerings or debt financings, credit or loan facilities, public funding, or a combination of one or more of these funding sources. Our ability to raise additional funds will depend on financial, economic and other factors, many of which are beyond our control. Additional funds may not be available to us on acceptable terms or at all. If we enter into arrangements with collaborators or others, we may be required to relinquish rights to some of our drug candidates that we would otherwise pursue on our own. If we raise additional funds by issuing equity securities, our shareholders will suffer dilution and the terms of any financing may adversely affect the rights of our shareholders. In addition, as a condition to providing additional funds to us, future investors may demand, and may be granted, rights superior to those of existing shareholders. Debt financing, if available, is likely to involve restrictive covenants limiting our flexibility in conducting future business activities, and, in the event of insolvency, debt holders would be repaid before holders of our equity securities received any distribution of our corporate assets.

We have benefited from certain reimbursable financial advances and non-reimbursable subsidiaries from the French government that if terminated or reduced may restrict our ability to successfully develop, manufacture and commercialize our drug candidates.

We have benefited from certain reimbursable advances and non-reimbursable subsidies from the French government and intend to continue to seek advances and/or subsidies from these agencies in the future in order to accelerate the development of our drug candidates. There is no assurance that these benefits will continue to be available to us in the future. If such benefits and programs were to be terminated or reduced, it could have an adverse effect on our business, operating results and financial condition and could deprive us of financial resources necessary for research and development of our drug candidates. Furthermore, in the event that we do not comply with the contractual conditions of the subsidies, we may be required to reimburse the French government for these payments and could be liable for any damages incurred by such agencies resulting from the breach of contract.

Due to the significant resources required for the development of our drug candidates, we must prioritize development of certain drug candidates and/or certain disease indications. We may expend our limited resources on candidates or indications that do not yield a successful product and fail to capitalize on drug candidates or indications that may be more profitable or for which there is a greater likelihood of success.

We plan to develop a pipeline of drug candidates to treat age-related diseases and diseases whose progression and symptoms are similar to those associated with aging. Due to the significant resources required for the development of drug candidates, we must focus our attention and resources on specific diseases and disease pathways and decide which drug candidates to pursue and the amount of resources to allocate to each.

Our decisions concerning the allocation of research, development, collaboration, management and financial resources toward particular drug candidates or therapeutic areas may not lead to the development of any viable commercial product and may divert resources away from better

15

opportunities. Similarly, any decision to delay, terminate or collaborate with third parties in respect of certain programs may subsequently prove to be suboptimal and could cause us to miss valuable opportunities. If we make incorrect determinations regarding the viability or market potential of any of our programs or drug candidates or misread trends in the aging or healthspan, or biotechnolgy industry, our business, financial condition and results of operations could be materially adversely affected. As a result, we may fail to capitalize on viable commercial products or profitable market opportunities, be required to forego or delay pursuit of opportunities with other drug candidates or other diseases and disease pathways that may later prove to have greater commercial potential than those we choose to pursue, or relinquish valuable rights to such drug candidates through collaboration, licensing or other royalty arrangements in cases in which it would have been advantageous for us to invest additional resources to retain development and commercialization rights.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict.

Our operating results may fluctuate significantly, which makes it difficult for us to predict our future operating results. These fluctuations may occur due to a variety of factors, many of which are outside of our control and may be difficult to predict, including:

- •

- the timing and cost of, and level of investment in, research, development and, if approved, any commercialization activities relating to our

drug candidates, which may change from time to time;

- •

- the timing and status of enrollment for our clinical trials;

- •

- the cost of manufacturing our drug candidates, as well as building out our supply chain, which may vary depending on the quantity of production

and the terms of our agreements with manufacturers;

- •

- expenditures that we may incur to acquire, develop or commercialize additional drug candidates;

- •

- the timing and amount of any future milestone, royalty or other payments due under any collaboration or license agreement;

- •

- future accounting pronouncements or changes in our accounting policies;

- •

- the timing and success or failure of preclinical studies and clinical trials for our drug candidates and/or redesign, delays and/or change of

scope of our preclinical or clinical trials;

- •

- the timing of receipt of approvals for our drug candidates from regulatory authorities in the United States and internationally;

- •

- the timing and success of competing drug candidates, or any other change in the competitive landscape of our industry, including consolidation

among our competitors or partners;

- •

- coverage and reimbursement policies with respect to our drug candidates, if approved; and

- •

- the level of demand for our products, if approved, which may vary significantly over time.

The cumulative effects of these factors could result in large fluctuations and unpredictability in our annual operating results. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Investors should not rely on our past results as an indication of our future performance.

This variability and unpredictability could also result in our failing to meet the expectations of industry or financial analysts or investors for any period. If our revenue or operating results fall below the expectations of analysts or investors or below any forecasts we may provide to the market, or if the forecasts we provide to the market are below the expectations of analysts or investors, the price of our

16

ordinary shares and ADSs could decline substantially. Such a stock price decline could occur even when we have met any previously publicly stated revenue or earnings guidance we may provide.

Our indebtedness could restrict our operations and make us more vulnerable to adverse economic conditions.

On September 10, 2018, we entered into a Venture Loan Agreement and Bonds Issue Agreement with Kreos Capital V (UK) Ltd., or Kreos, which provides for up to €10 million in financing to us. Pursuant to the terms of the agreements, Kreos agreed to subscribe for up to €10 million in non-convertible bonds, to be issued by us in up to four tranches of €2.5 million each. The first two tranches were issued in September 2018, a third tranche was issued in December 2018, and the final tranche was issued on March 1, 2019. Each tranche bears a 10% annual interest rate and must be repaid in 36 monthly installments, with monthly payments of €320,004 commencing in April 2019. In connection with the first tranche, we issued a warrant to Kreos giving them the right to purchase 442,477 new ordinary shares at an exercise price of €2.67 per share over a 7-year period from the issue date.

If we are unable to make the required payments, we may need to refinance all or a portion of our indebtedness, sell assets, delay capital expenditures or seek additional equity. The terms of our existing or future debt agreements may also restrict us from affecting any of these alternatives. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. Further, changes in the credit and capital markets, including market disruptions and interest rate fluctuations, may increase the cost of financing, make it more difficult to obtain favorable terms, or restrict our access to these sources of future liquidity. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness on commercially reasonable terms or at all. Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance or restructure our obligations on commercially reasonable terms or at all, could have a material adverse effect on our business, financial condition and results of operations, as well as on our ability to satisfy our obligations in respect of our indebtedness.

Pursuant to the terms of the agreements, we have the right, at any time but with no less than 30 days prior notice to Kreos, to prepay or purchase the bonds, exclusively in full. The prepayment will be equal to (i) the principal amount outstanding, plus (ii) the sum of all interest repayments which would have been paid throughout the remainder of the term of the relevant tranche discounted by 10% per annum.

Our debt agreements contain restrictions that limit our flexibility in operating our business.

Our Venture Loan Agreement and Bonds Issue Agreement with Kreos and our convertible notes agreement with Bracknor Fund impose certain operating and financial restrictions. These covenants may limit our ability and the ability of our subsidiaries, under certain circumstances, to, among other things:

- •

- incur additional indebtedness;

- •

- create or incur liens;

- •

- sell or transfer assets; and

- •

- pay dividends and distributions.

These agreements also contain certain customary affirmative covenants and events of default, including a change of control.

As a result of the covenants and restrictions contained in our existing debt agreements, we are limited in how we conduct our business, and we may be unable to raise additional debt to compete

17

effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We cannot guarantee that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from Kreos and/or amend the covenants.