REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

, every three |

||||

representing two Class A ordinary shares, par |

||||

value US$0.0001 per share |

||||

, |

||||

par value US$0.0001 per share* |

| (1) | * |

☒ |

Accelerated filer ☐ | Non-accelerated filer ☐ |

Emerging growth company | |||||||||||||

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

International Financial Reporting Standards as issued |

Other ☐ | |||

by the International Accounting Standards Board ☐ |

| • | “ADRs” are to the American depositary receipts that may evidence the ADSs; |

| • | “ADSs” are to the American depositary shares, every three of which represent two Class A ordinary shares; |

| • | “Beijing Lexuebang” are to Beijing Lexuebang Network Technology Co., Ltd.; |

| • | “BVI” are to the British Virgin Islands; |

| • | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Hong Kong, Macau and Taiwan; |

| • | “Class A ordinary shares” are to our Class A ordinary shares, par value US$0.0001 per share; |

| • | “Class B ordinary shares” are to our Class B ordinary shares, par value US$0.0001 per share; |

| • | “gross billings” for a specific period are to the total amount of cash received for the sale of course offerings and membership fees from teachers on our online platform in such period, net of the total amount of refunds in such period; |

| • | “GSX,” “we,” “us,” “our company” and “our” are to GSX Techedu Inc., our Cayman Islands holding company and its subsidiaries, its consolidated variable interest entity and the subsidiaries of the consolidated variable interest entity; |

| • | “NYSE” are to the New York Stock Exchange; |

| • | “our VIE” or “Beijing BaiJia” are to Beijing BaiJia Technology Co., Ltd., formerly known as Beijing BaiJia Hulian Technology Co., Ltd.; |

| • | “paid courses” are to our courses that are charged not less than RMB99.00 per course in fees; |

| • | “paid course enrollments” for a certain period are to the cumulative number of paid courses enrolled in and paid for by our students, including multiple paid courses enrolled in and paid for by the same student; |

| • | “RMB” and “Renminbi” are to the legal currency of China; and |

| • | “US$,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States. |

| • | our goals and strategies; |

| • | our ability to retain and increase the number of students and expand our service offerings; |

| • | our future business development, financial condition and results of operations; |

| • | expected changes in our revenues, costs or expenditures; |

| • | competition in our industry; |

| • | relevant government policies and regulations relating to our industry; |

| • | general economic and business conditions globally and in China; and |

| • | assumptions underlying or related to any of the foregoing. |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

A. |

Selected Financial Data |

For the Year Ended December 31, |

||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||

RMB |

RMB |

RMB |

RMB |

US$ |

||||||||||||||||

(in thousands, except for share amounts and per share data) |

||||||||||||||||||||

| Selected Consolidated Statements of Operations |

||||||||||||||||||||

| Net revenues |

97,580 |

397,306 |

2,114,855 |

7,124,744 |

1,091,915 |

|||||||||||||||

| Cost of revenues (1) |

(25,023 | ) | (142,753 | ) | (535,912 | ) | (1,762,548 | ) | (270,122 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

72,557 |

254,553 |

1,578,943 |

5,362,196 |

821,793 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling expenses (1) |

(75,325 | ) | (121,518 | ) | (1,040,906 | ) | (5,816,214 | ) | (891,374 | ) | ||||||||||

| Research and development expenses (1) |

(52,451 | ) | (74,050 | ) | (212,197 | ) | (734,450 | ) | (112,559 | ) | ||||||||||

| General and administrative expenses (1) |

(37,208 | ) | (39,831 | ) | (110,106 | ) | (566,565 | ) | (86,830 | ) | ||||||||||

| Total operating expenses |

(164,984 |

) |

(235,399 |

) |

(1,363,209 |

) |

(7,117,229 |

) |

(1,090,763 |

) | ||||||||||

| (Loss) income from operations |

(92,427 |

) |

19,154 |

215,734 |

(1,755,033 |

) |

(268,970 |

) | ||||||||||||

| Interest income |

189 | 2,193 | 8,861 | 3,372 | 517 | |||||||||||||||

| Realized gains from investments |

— | — | 11,395 | 70,403 | 10,790 | |||||||||||||||

| Other income |

2,004 | 495 | 6,462 | 269,657 | 41,327 | |||||||||||||||

| Other expenses |

(50 | ) | (445 | ) | (213 | ) | (16,011 | ) | (2,454 | ) | ||||||||||

| Impairment loss on equity method investment |

(1,070 | ) | — | — | — | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) income before provision for income tax and share of results of equity investees |

(91,354 |

) |

21,397 |

242,239 |

(1,427,612 |

) |

(218,790 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income tax benefits (expenses) |

4,620 | (2,616 | ) | (16,957 | ) | 34,619 | 5,306 | |||||||||||||

| Share of results of equity investees |

(221 | ) | 869 | 1,348 | 63 | 10 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income |

(86,955 |

) |

19,650 |

226,630 |

(1,392,930 |

) |

(213,474 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Series A convertible redeemable preferred shares redemption value accretion |

(38,930 | ) | (38,930 | ) | (16,772 | ) | — | — | ||||||||||||

| Undistributed earnings allocated to the participating preferred shares |

— | — | (21,698 | ) | — | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to GSX Techedu Inc.’s ordinary shareholders |

(125,885 |

) |

(19,280 |

) |

188,160 |

(1,392,930 |

) |

(213,474 |

) | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income per ordinary share |

||||||||||||||||||||

| Basic |

(1.36 | ) | (0.21 | ) | 1.42 | (8.72 | ) | (1.34 | ) | |||||||||||

| Diluted |

(1.36 | ) | (0.21 | ) | 1.35 | (8.72 | ) | (1.34 | ) | |||||||||||

| Weighted average shares used in net (loss) income per share |

||||||||||||||||||||

| Basic |

92,224,998 | 92,224,998 | 132,400,941 | 159,725,779 | 159,725,779 | |||||||||||||||

| Diluted |

92,224,998 | 92,224,998 | 139,477,898 | 159,725,779 | 159,725,779 | |||||||||||||||

| (1) | Share-based compensation expenses are in cost of revenues and operating expenses as follows: |

For the Year Ended December 31, |

||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||

RMB |

RMB |

RMB |

RMB |

US$ |

||||||||||||||||

(in thousands) |

||||||||||||||||||||

| Share-based compensation expenses |

||||||||||||||||||||

| Cost of revenues |

3 | 283 | 16,504 | 66,422 | 10,180 | |||||||||||||||

| Selling expenses |

373 | 429 | 5,606 | 18,039 | 2,765 | |||||||||||||||

| Research and development expenses |

276 | 782 | 16,357 | 94,952 | 14,552 | |||||||||||||||

| General and administrative expenses |

5,136 | 4,423 | 21,770 | 59,033 | 9,046 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

5,788 |

5,917 |

60,237 |

238,446 |

36,543 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

As of December 31, |

||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||

RMB |

RMB |

RMB |

RMB |

US$ |

||||||||||||||||

(in thousands) |

||||||||||||||||||||

| Cash and cash equivalents |

19,294 | 33,259 | 73,967 | 355,224 | 54,440 | |||||||||||||||

| Short-term investments |

7,974 | 197,991 | 1,473,452 | 7,331,268 | 1,123,566 | |||||||||||||||

| Total current assets |

52,345 | 280,801 | 1,808,901 | 8,457,248 | 1,296,130 | |||||||||||||||

| Long-term investments |

7,604 | 5,221 | 1,188,286 | 530,729 | 81,338 | |||||||||||||||

| Total assets |

103,213 |

338,203 |

3,394,532 |

10,685,792 |

1,637,670 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Current liabilities |

155,013 | 355,912 | 1,637,250 | 4,197,392 | 643,279 | |||||||||||||||

| Total liabilities |

155,500 |

364,682 |

1,837,177 |

4,955,937 |

759,531 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total mezzanine equity |

427,130 | 466,060 | — | — | — | |||||||||||||||

| Total shareholders’ (deficit) equity |

(479,417 |

) |

(492,539 |

) |

1,557,355 |

5,729,855 |

878,139 |

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

For the Year Ended December 31, |

||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||

RMB |

RMB |

RMB |

RMB |

US$ |

||||||||||||||||

(in thousands) |

||||||||||||||||||||

| Selected Consolidated Cash Flow Data: |

||||||||||||||||||||

| Net cash (used in) generated from operating activities |

(49,643 | ) | 241,869 | 1,285,054 | 603,273 | 92,455 | ||||||||||||||

| Net cash used in investing activities |

(10,140 | ) | (198,720 | ) | (2,504,566 | ) | (5,596,304 | ) | (857,671 | ) | ||||||||||

| Net cash generated from (used in) financing activities |

56,531 | (29,193 | ) | 1,246,065 | 5,272,100 | 807,985 | ||||||||||||||

| Effect of exchange rate changes |

(40 | ) | 9 | 14,155 | 2,188 | 335 | ||||||||||||||

| Net (decrease) increase in cash and cash equivalents |

(3,292 | ) | 13,965 | 40,708 | 281,257 | 43,104 | ||||||||||||||

| Cash and cash equivalents at beginning of year |

22,586 | 19,294 | 33,259 | 73,967 | 11,336 | |||||||||||||||

| Cash and cash equivalents at end of year |

19,294 | 33,259 | 73,967 | 355,224 | 54,440 | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

B. |

Capitalization and Indebtedness |

C. |

Reasons for the Offer and Use of Proceeds |

D. |

Risk Factors |

| • | alleged misconduct or other improper activities committed by our students or our directors, officers, teaching staff and other employees, including misrepresentation made by our employees to potential students during sales and marketing activities, and other fraudulent activities to artificially inflate the popularity of our services or course offerings; |

| • | false or malicious allegations or rumors about us or our directors, shareholders, affiliates, officers, and teaching staff and other employees; |

| • | complaints by our students about our education services and sales and marketing activities; |

| • | complaints about the truthfulness or authenticity of the advertisements for our course offerings or services; |

| • | refund disputes of course fees between us and our students or administrative penalties; |

| • | employment-related claims relating to alleged employment discrimination, wage and hour violations; |

| • | governmental and regulatory investigations or penalties resulting from our failure to comply with applicable laws and regulations; and |

| • | governmental or regulatory penalties imposed on our shareholders for any misconduct, whether or not it involves us or our business operations. |

| • | dissatisfaction with these online payment services or decreased use of their services; |

| • | increasing competition, including from other established Chinese internet companies, payment service providers and companies engaged in other financial technology services; |

| • | changes to rules or practices applicable to payment systems that link to third-party online payment service providers; |

| • | breach of customers’ personal information and concerns over the use and security of information collected from buyers; |

| • | service outages, system failures or failures to effectively scale the system to handle large and growing transaction volumes; |

| • | increasing costs to third-party online payment service providers, including fees charged by banks to process transactions through online payment channels, which would also increase our costs of revenues; and |

| • | failure to manage funds accurately or loss of funds, whether due to employee fraud, security breaches, technical errors or otherwise. |

| • | revoking the business licenses and/or operating licenses of such entities; |

| • | imposing fines on us; |

| • | confiscating any of our income that they deem to be obtained through illegal operations; |

| • | discontinuing or placing restrictions or onerous conditions on our operations; |

| • | placing restrictions on our right to collect revenues; and |

| • | shutting down our servers or blocking our app/websites. |

| • | actual or anticipated variations in our revenues, earnings, cash flow and data related to our student base or student engagement; |

| • | announcements of new investments, acquisitions, strategic partnerships or joint ventures by us or our competitors; |

| • | announcements of new product and service offerings, solutions and expansions by us or our competitors; |

| • | changes in financial estimates by securities analysts; |

| • | detrimental adverse publicity about us, our products and services or our industry; |

| • | additions or departures of key personnel; |

| • | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| • | actual or potential litigation or regulatory investigations. |

ITEM 4. |

INFORMATION ON THE COMPANY |

A. |

History and Development of the Company |

B. |

Business Overview |

| • | Live |

| • | Large-class |

| • | Proprietary technology infrastructure |

Elementary School |

Middle School |

High School | ||||||||||||||||||||||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 | |||||||||||||

| Mathematics |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| English |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Chinese |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Physics |

● | ● | ● | ● | ● | ● | ||||||||||||||||||

| Chemistry |

● | ● | ● | ● | ||||||||||||||||||||

| Biology |

● | ● | ● | |||||||||||||||||||||

| History |

● | ● | ● | |||||||||||||||||||||

| Geography |

● | ● | ||||||||||||||||||||||

| Political Science |

● | |||||||||||||||||||||||

| ●: | Offered by us. |

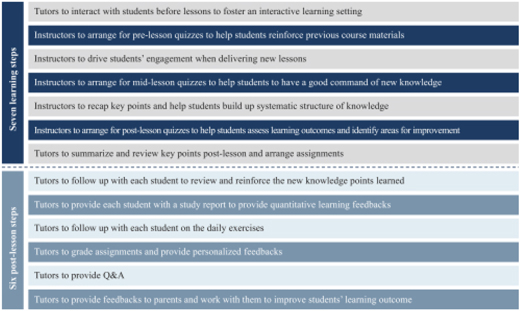

| • | interacting with students and parents of K-12 students frequently to monitor students’ learning progress and facilitate an engaging learning environment; |

| • | responding to students’ in-class queries, correcting students’ post-class exercises in a timely manner after submission and providing prompt and personalized feedback to students and parents; and |

| • | cooperating with instructors to improve student satisfaction and student retention. |

| • | Develop our proprietary course curriculum and educational content. Our content development team mainly focuses on developing, updating and improving our syllabi and course materials to stay abreast of the latest educational trends in their respective subject areas. For example, our course materials for our K-12 courses are typically updated every three months to remain current with evolving formal K-12 education curricula. |

| • | Enhance course materials to cater to our live learning setting. Our content development team works with our instructors to ensure our courses and educational content are delivered in an engaging and effective manner. While our instructors retain control of and flexibility in the way their classes are taught, our content development personnel, leveraging experience and data analytics, recommend to our instructors the best practices in teaching in an online setting. For example, for our elementary school courses, we develop scenario-based multi-media teaching content, including videos, animated materials, AI-supported video assessments, and application of virtual background in live broadcasting, to stimulate children’s learning interest and motivation throughout the learning experience. |

| • | Design course materials. We deliver hard copies of our course materials to students and provide online course materials. Our content development team edits the lay-out and presentation of our course materials. |

| • | quality of education services and students’ learning experience; |

| • | the quality of teaching staff; |

| • | technology infrastructure and data analytics capabilities; |

| • | brand recognition; and |

| • | scope of course offerings. |

C. |

Organizational Structure |

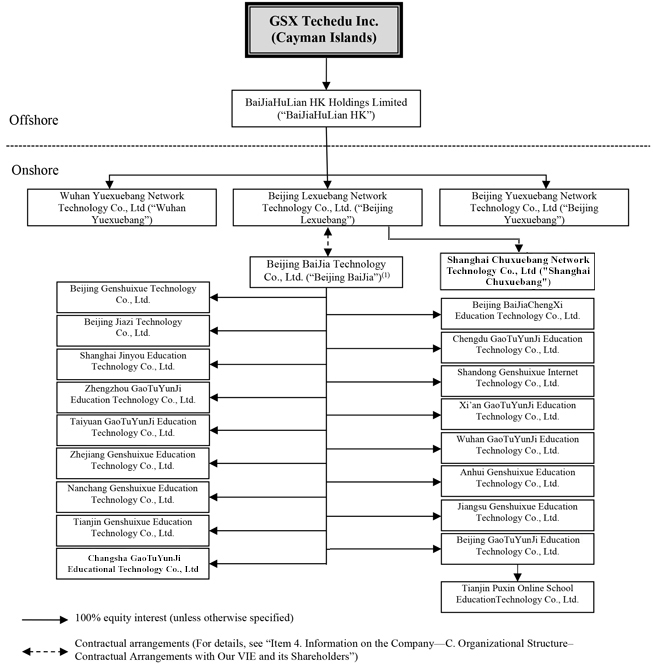

| (1) | Shareholders of Beijing BaiJia and their respective shareholdings in Beijing BaiJia and relationship with our company are Larry Xiangdong Chen (98.28%), chairman of our board of directors and our chief executive officer, and Bin Luo (1.72%), our employee. |

| • | the ownership structures of our VIE and Beijing Lexuebang in China are not in violation of applicable PRC laws and regulations currently in effect; and |

| • | the contractual arrangements between Beijing Lexuebang, our VIE and its shareholders governed by PRC law are valid, binding and enforceable, and will not result in any violation of applicable PRC laws and regulations currently in effect. |

D. |

Property, Plant and Equipment |

ITEM 4.A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

A. |

Operating Results |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||||||

| K-12 courses |

290,890 | 73.2 | 1,706,538 | 80.7 | 6,237,399 | 955,923 | 87.5 | |||||||||||||||||||||

| Foreign language, professional and admission courses |

71,732 | 18.1 | 378,265 | 17.9 | 871,856 | 133,618 | 12.2 | |||||||||||||||||||||

| Other services |

34,684 | 8.7 | 30,052 | 1.4 | 15,489 | 2,374 | 0.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

397,306 |

100.0 |

2,114,855 |

100.0 |

7,124,744 |

1,091,915 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Exclusive Management Services and Business Cooperation Agreement |

| • | Equity Interest Pledge Agreement |

| • | Exclusive Call Option Agreement |

| • | Powers of Attorney |

| • | Spousal Consent Letters |

Grant Date | ||||

2018 |

March 31, 2019 | |||

| Risk-free rate of interest (1) |

3.42%-3.78% |

3.20% | ||

| Volatility (2) |

53.4%-56.2% |

54.60% | ||

| Dividend yield (3) |

— | — | ||

| Exercise multiples (4) |

2.2 | 2.2-2.8 | ||

| Life of options (years) (5) |

10 | 10 | ||

| (1) | We estimate risk-free interest rate based on the daily treasury long term rate of U.S. Department of the Treasury with a maturity period close to the expected term of the options, plus the country default spread of China. |

| (2) | We estimated expected volatility based on the annualized standard deviation of the daily return embedded in historical share prices of comparable companies with a time horizon close to the expected expiry of the term. |

| (3) | We have never declared or paid any cash dividends on our capital stock, and we do not anticipate any dividend payments on our ordinary shares in the foreseeable future. |

| (4) | The expected exercise multiple was estimated as the average ratio of the stock price to the exercise price as at the time when employees would decide to voluntarily exercise their vested options. As we did not have sufficient information of past employee exercise history, it was estimated by referencing to a widely-accepted academic research publication. |

| (5) | Extracted from option agreements. |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentage data) |

||||||||||||||||||||||||||||

| Net revenues |

397,306 |

100.0 |

2,114,855 |

100.0 |

7,124,744 |

1,091,915 |

100.0 |

|||||||||||||||||||||

| Cost of revenues (1): |

(142,753 | ) | (35.9 | ) | (535,912 | ) | (25.3 | ) | (1,762,548 | ) | (270,122 | ) | (24.7 | ) | ||||||||||||||

| Gross profit |

254,553 |

64.1 |

1,578,943 |

74.7 |

5,362,196 |

821,793 |

75.3 |

|||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Selling expenses (1) |

(121,518 | ) | (30.6 | ) | (1,040,906 | ) | (49.3 | ) | (5,816,214 | ) | (891,374 | ) | (81.6 | ) | ||||||||||||||

| Research and development expenses (1) |

(74,050 | ) | (18.6 | ) | (212,197 | ) | (10.0 | ) | (734,450 | ) | (112,559 | ) | (10.3 | ) | ||||||||||||||

| General and administrative expenses (1) |

(39,831 | ) | (10.0 | ) | (110,106 | ) | (5.2 | ) | (566,565 | ) | (86,830 | ) | (8.0 | ) | ||||||||||||||

| Total operating expenses |

(235,399 |

) |

(59.2 |

) |

(1,363,209 |

) |

(64.5 |

) |

(7,117,229 |

) |

(1,090,763 |

) |

(99.9 |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from operations |

19,154 |

4.9 |

215,734 |

10.2 |

(1,755,033 |

) |

(268,970 |

) |

(24.6 |

) | ||||||||||||||||||

| Interest income |

2,193 | 0.6 | 8,861 | 0.4 | 3,372 | 517 | 0.0 | |||||||||||||||||||||

| Realized gains from investments |

— | — | 11,395 | 0.5 | 70,403 | 10,790 | 1.0 | |||||||||||||||||||||

| Other income |

495 | 0.1 | 6,462 | 0.3 | 269,657 | 41,327 | 3.8 | |||||||||||||||||||||

| Other expenses |

(445 | ) | (0.1 | ) | (213 | ) | (0.0 | ) | (16,011 | ) | (2,454 | ) | (0.2 | ) | ||||||||||||||

| Income (loss) before provision for income tax and share of results of equity investees |

21,397 |

5.5 |

242,239 |

11.4 |

(1,427,612 |

) |

(218,790 |

) |

(20.0 |

) | ||||||||||||||||||

| Income tax (expenses) benefits |

(2,616 | ) | (0.7 | ) | (16,957 | ) | (0.8 | ) | 34,619 | 5,306 | 0.4 | |||||||||||||||||

| Share of results of equity investees |

869 | 0.2 | 1,348 | 0.1 | 63 | 10 | 0.0 | |||||||||||||||||||||

| Net income (loss) |

19,650 |

5.0 |

226,630 |

10.7 |

(1,392,930 |

) |

(213,474 |

) |

(19.6 |

) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Share-based compensation expenses were allocated as follows: |

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Share-based compensation expenses |

||||||||||||||||

| Cost of revenues |

283 | 16,504 | 66,422 | 10,180 | ||||||||||||

| Selling Expenses |

429 | 5,606 | 18,039 | 2,765 | ||||||||||||

| Research and development expenses |

782 | 16,357 | 94,952 | 14,552 | ||||||||||||

| General and administrative expenses |

4,423 | 21,770 | 59,033 | 9,046 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

5,917 | 60,237 | 238,446 | 36,543 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Net revenues |

397,306 |

2,114,855 |

7,124,744 |

1,091,915 |

||||||||||||

| Less: other revenues (1) |

— | — | 1,289 | 198 | ||||||||||||

| Add: VAT and surcharges |

26,202 | 134,302 | 434,090 | 66,527 | ||||||||||||

| Add: ending deferred revenue |

272,041 | 1,337,636 | 2,733,739 | 418,964 | ||||||||||||

| Add: ending refund liability |

11,167 | 54,567 | 120,709 | 18,499 | ||||||||||||

| Less: beginning deferred revenue |

46,307 | 272,041 | 1,337,636 | 205,002 | ||||||||||||

| Less: beginning refund liability |

2,475 | 11,167 | 54,567 | 8,363 | ||||||||||||

| Less: deferred revenue from the acquisition of Shanghai Jinyou Education Technology Co., Ltd. |

2,806 | — | — | — | ||||||||||||

| Less: deferred revenue from the Tianjin Puxin acquisition |

— | — | 11,700 | 1,793 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross billings (non-GAAP) |

655,128 |

3,358,152 |

9,008,090 |

1,380,549 |

||||||||||||

B. |

Liquidity and Capital Resources |

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Net cash generated from operating activities |

241,869 | 1,285,054 | 603,273 | 92,455 | ||||||||||||

| Net cash used in investing activities |

(198,720 | ) | (2,504,566 | ) | (5,596,304 | ) | (857,671 | ) | ||||||||

| Net cash (used in) generated from financing activities |

(29,193 | ) | 1,246,065 | 5,272,100 | 807,985 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Effect of exchange rate changes |

9 | 14,155 | 2,188 | 335 | ||||||||||||

| Net increase in cash and cash equivalents |

13,965 | 40,708 | 281,257 | 43,104 | ||||||||||||

| Cash and cash equivalents at the beginning of the year |

19,294 | 33,259 | 73,967 | 11,336 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents at the end of the year |

33,259 | 73,967 | 355,224 | 54,440 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

C. |

Research and Development, Patents and Licenses, etc. |

D. |

Trend Information |

E. |

Off-Balance Sheet Arrangements |

F. |

Tabular Disclosure of Contractual Obligations |

| |

Years ending December 31, |

|||||||||||||||||||||||||||

Total |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 and thereafter |

||||||||||||||||||||||

(RMB in millions) |

||||||||||||||||||||||||||||

| Operating lease commitments (1) |

933.1 | 206.3 | 218.0 | 194.4 | 178.2 | 99.2 | 37.0 | |||||||||||||||||||||

| Real estate purchase obligations |

127.3 | 100.7 | — | 26.6 | — | — | — | |||||||||||||||||||||

| Capital commitments (2) |

102.0 | 67.6 | 33.8 | 0.6 | — | — | — | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Represents minimum payments under non-cancelable operating leases related to offices. |

| (2) | Capital commitments mainly relate to capital expenditures of office space construction and improvement, and are to paid in the following years according to the construction progress. |

G. |

Safe Harbor |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

A. |

Directors and Executive Officers |

| Directors and Executive Officers |

Age |

Position/Title | ||

| Larry Xiangdong Chen |

49 | Chairman of the Board of Directors and Chief Executive Officer | ||

| Xin Fan |

42 | Independent Director | ||

| Yiming Hu |

49 | Independent Director | ||

| Ming Liao |

49 | Independent Director | ||

| Xiuping Qi |

43 | Vice President | ||

| Wei Liu |

35 | Vice President | ||

| Nan Shen |

36 | Chief Financial Officer |

B. |

Compensation of Directors and Executive Officers |

| Name |

Number of Ordinary Shares Underlying Options |

Exercise Price (RMB/Share) |

Date of Grant |

Date of Expiration |

||||||||||||

| Xiuping Qi |

* | 0.01 | |

December 31, 2016 and December 31, 2018 |

|

|

December 31, 2026 and December 31, 2028 |

| ||||||||

| Wei Liu |

* | 0.01 | |

December 31, 2016 and December 31, 2018 |

|

|

December 31, 2026 and December 31, 2028 |

| ||||||||

| Nan Shen |

* | 0.01 | December 31, 2018 | December 31, 2028 | ||||||||||||

| |

|

|||||||||||||||

| Total |

2,020,000 | |||||||||||||||

| |

|

|||||||||||||||

| * | Aggregate number of shares represented by all grants of options to the person accounts for less than 1% of our total ordinary shares on an as-converted basis outstanding as of February 28, 2021. |

| Name |

Number of Ordinary Shares Underlying Restricted Share Units |

Date of Grant |

Date of Expiration |

|||||||

| Xin Fan |

* | August 21, 2019 | August 21, 2029 | |||||||

| Yiming Hu |

* | August 21, 2019 | August 21, 2029 | |||||||

| Ming Liao |

* | August 21, 2019 | August 21, 2029 | |||||||

| |

||||||||||

| Total |

27,000 | |||||||||

| |

||||||||||

| * | Aggregate number of shares represented by all grants of restricted share units to the person accounts for less than 1% of our total ordinary shares on an as-converted basis outstanding as of February 28, 2021. |

C. |

Board Practices |

| • | appointing the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors; |

| • | reviewing with the independent auditors any audit problems or difficulties and management’s response; |

| • | discussing the annual audited financial statements with management and the independent auditors; |

| • | reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposures; |

| • | reviewing and approving all proposed related party transactions; |

| • | meeting separately and periodically with management and the independent auditors; and |

| • | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

| • | reviewing and approving, or recommending to the board for its approval, the compensation for our chief executive officer and other executive officers; |

| • | reviewing and recommending to the board for determination with respect to the compensation of our non-employee directors; |

| • | reviewing periodically and approving any incentive compensation or equity plans, programs or similar arrangements; and |

| • | selecting compensation consultant, legal counsel or other adviser only after taking into consideration all factors relevant to that person’s independence from management. |

| • | selecting and recommending to the board nominees for election by the shareholders or appointment by the board; |

| • | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; |

| • | making recommendations on the frequency and structure of board meetings and monitoring the functioning of the committees of the board; and |

| • | advising the board periodically with regards to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board on all matters of corporate governance and on any remedial action to be taken. |

| • | convening shareholders’ annual and extraordinary general meetings and reporting its work to shareholders at such meetings; |

| • | declaring dividends and distributions; |

| • | appointing officers and determining the term of office of the officers; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | approving the transfer of shares in our company, including the registration of such shares in our share register. |

D. |

Employees |

| Function: |

As of December 31, 2020 |

|||

| Instructors* |

319 | |||

| Tutors |

15,291 | |||

| Technology and content research and development |

2,896 | |||

| User growth |

1,105 | |||

| Sales |

930 | |||

| General and administrative |

2,029 | |||

| |

|

|||

| Total |

22,570 | |||

| |

|

|||

| * | Include instructors for K-12 courses and foreign language, professional and admission courses. |

E. |

Share Ownership |

| • | each of our directors and executive officers; and |

| • | each person known to us to own beneficially more than 5% of our ordinary shares. |

Ordinary Shares Beneficially Owned |

||||||||||||||||

Class A Ordinary Shares |

Class B Ordinary Shares |

% of Total Ordinary Shares† |

% of Aggregate Voting Power†† |

|||||||||||||

| Directors and Executive Officers**: |

| |||||||||||||||

| Larry Xiangdong Chen (1) |

* | 73,305,288 | 43.5 | % | 88.4 | % | ||||||||||

| Xin Fan (2) |

* | — | * | * | ||||||||||||

| Yiming Hu (3) |

* | — | * | * | ||||||||||||

| Ming Liao (4) |

* | — | * | * | ||||||||||||

| Xiuping Qi (5) |

1,714,560 | — | 1.0 | % | * | |||||||||||

| Wei Liu (5) |

* | — | * | * | ||||||||||||

| Nan Shen (5) |

* | — | * | * | ||||||||||||

| All Directors and Executive Officers as a Group |

3,845,120 | 73,305,288 | 45.3 | % | 88.8 | % | ||||||||||

| Principal Shareholders: |

||||||||||||||||

| Ebetter International Group Limited (1) |

* | 73,305,288 | 43.5 | % | 88.4 | % | ||||||||||

| Goldman Sachs & Co. LLC (6) |

31,661,888 | — | 18.6 | % | 3.8 | % | ||||||||||

| Nomura Global Financial Products, Inc. (7) |

10,685,836 | — | 6.3 | % | 1.3 | % | ||||||||||

| Morgan Stanley Capital Services LLC (8) |

9,775,334 | — | 5.7 | % | 1.2 | % | ||||||||||

| Ting Yuan Group Limited (9) |

8,866,839 | — | 5.2 | % | 1.1 | % | ||||||||||

| Credit Suisse AG (10) |

8,641,773 | — | 5.1 | % | 1.0 | % | ||||||||||

| * | Aggregate number of shares accounts for less than 1% of our total ordinary shares on an as-converted basis outstanding as of February 28, 2021. |

| ** | Except as indicated otherwise below, the business address of our directors and executive officers is Tower C, Beyondsoft Building, 7 East Zone, 10 Xibeiwang East Road, Haidian District, Beijing 100193, People’s Republic of China. |

| † | For each person and group included in this column, percentage ownership is calculated by dividing the total number of ordinary shares beneficially owned by such person or group by the sum of the total number of shares outstanding and the number of ordinary shares such person or group has the right to acquire upon exercise of option, warrant or other right within 60 days after February 28, 2021. |

| †† | For each person and group included in this column, percentage of voting power is calculated by dividing the voting power beneficially owned by such person or group by the voting power of all of our Class A and Class B ordinary shares as a single class. Each holder of our Class A ordinary shares is entitled to one vote per share. Each holder of our Class B ordinary shares is entitled to ten votes per share. Our Class B ordinary shares are convertible at any time by the holder into Class A ordinary shares on a one-for-one |

| (1) | Represents 73,305,288 Class B ordinary shares and 800,000 Class A ordinary shares held by Ebetter International Group Limited, a British Virgin Islands company. Ebetter International Group Limited is ultimately owned by The Better Learner Trust, a trust established under the laws of the Cayman Islands and managed by Cantrust (Far East) Limited as the trustee. Mr. Larry Xiangdong Chen is the settlor of The Better Learner Trust, and he and his family members are the trust’s beneficiaries. Under the terms of this trust, Mr. Larry Xiangdong Chen has the power to direct the trustee with respect to the retention or disposal of, and the exercise of any voting and other rights attached to, the shares of the Issuer held by Ebetter International Group Limited. Mr. Larry Xiangdong Chen is the sole director of Ebetter International Group Limited. The registered address of Ebetter International Group Limited is at the offices of OMC Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands. |

| (2) | The business address of Xin Fan is c/o Shanghai Hode Information Technology Co., Ltd., Building 3, Guozheng Center, No. 485 Zhengli Road, Yangpu District, Shanghai, People’s Republic of China. |

| (3) | Represents the Class A ordinary shares held by Mr. Yiming Hu. The business address of Yiming Hu is 908, Block A, West Four Ring, Haidian District, Beijing, People’s Republic of China. |

| (4) | Represents the Class A ordinary shares held by Mr. Ming Liao. The business address of Ming Liao is 22F01, Tower 2, Lippo Centre, 89 Queensway, Admiralty, Hong Kong. |

| (5) | Represents 2,992,120 Class A ordinary shares held by Irefresh Future Limited, a British Virgin Islands company. Irefresh Future Limited is ultimately owned by Irefresh Future Trust, a trust established under a trust deed between us and Maples Trustee Services (Cayman) Limited as trustee. The trust’s participants and beneficiaries are our employees who transferred shares of our company beneficially owned by them to the trust to be held for their benefit. The trust deed provides that the trustee shall not exercise the voting rights attached to the shares held by Irefresh Future Limited in our company unless otherwise directed by the trust administrator, which is an advisory committee consisting of authorized representatives of our company, including Mr. Xiuping Qi, Mr. Wei Liu and Ms. Nan Shen, each of whom is an officer of our company. The registered address of Irefresh Future Limited is at the offices of Maples Corporate Services (BVI) Limited, Kingston Chambers, PO Box 173, Road Town, Tortola, British Virgin Islands. |

| (6) | Represents 31,661,888 Class A ordinary shares held by Goldman Sachs & Co. LLC, a New York company, as reported in a Schedule 13G amendment jointly filed by Goldman Sachs & Co. LLC and The Goldman Sachs Group, Inc. on February 11, 2021. Goldman Sachs & Co. LLC is a wholly owned subsidiary of The Goldman Sachs Group, Inc., a Delaware company. The business address of Goldman Sachs & Co. LLC is 200 West Street, New York, NY 10282. |

| (7) | Represents 10,685,836 Class A ordinary shares held by Nomura Global Financial Products, Inc., a Delaware company, as reported in a Schedule 13G jointly filed by Nomura Global Financial Products, Inc. and Nomura Holdings, Inc. on February 16, 2021. Nomura Global Financial Products, Inc. is a wholly owned subsidiary of Nomura Holdings, Inc., a company incorporated in Japan. The business address of Nomura Global Financial Products, Inc. is Worldwide Plaza, 309 West 49 th Street, New York, NY 10019. |

| (8) | Represents 9,775,334 Class A ordinary shares held by Morgan Stanley Capital Services LLC, a Delaware company, as reported in a Schedule 13G amendment jointly filed by Morgan Stanley Capital Services LLC and Morgan Stanley on February 11, 2021. Morgan Stanley Capital Services LLC is a wholly owned subsidiary of Morgan Stanley, a Delaware company. The business address of Morgan Stanley Capital Services LLC is 1585 Broadway New York, NY 10036. |

| (9) | Represents 8,866,839 Class A ordinary shares held by Ting Yuan Group Limited, a British Virgin Islands company, as reported in a Schedule 13G amendment jointly filed by Huaiting Zhang and Ting Yuan Group Limited on February 9, 2021. Ting Yuan Group Limited is ultimately owned by Ting Yuan Trust, a trust established under the laws of the Island of Jersey and managed by Trident Trust Company (HK) Limited as the trustee. Mr. Huaiting Zhang is the settlor of Ting Yuan Trust, and he and his family members are the trust’s beneficiaries. Mr. Huaiting Zhang is the sole director of Ting Yuan Group Limited. The registered address of Ting Yuan Group Limited is at the offices of Trident Chambers, P.O. Box 146, Road Town, Tortola, British Virgin Islands. |

| (10) | Represents 7,920,554 Class A ordinary shares and options to purchase ADSs representing 721,219 Class A ordinary shares within 60 days after February 26, 2021 held by Credit Suisse AG, a company incorporated in Switzerland, as reported in a Schedule 13G amendment filed by Credit Suisse AG on March 8, 2021. Credit Suisse AG is the direct bank subsidiary of Credit Suisse Group AG, a public company listed on the New York Stock Exchange (NYSE: CS). The registered address of Credit Suisse AG is Uetlibergstrasse 231, P.O. Box 900, CH 8070, Zurich, Switzerland. |

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

A. |

Major Shareholders |

B. |

Related Party Transactions |

C. |

Interests of Experts and Counsel |

ITEM 8. |

FINANCIAL INFORMATION |

A. |

Consolidated Statements and Other Financial Information |

B. |

Significant Changes |

ITEM 9. |

THE OFFER AND LISTING |

A. |

Offering and Listing Details. |

B. |

Plan of Distribution |

C. |

Markets |

D. |

Selling Shareholders |

E. |

Dilution |

F. |

Expenses of the Issue |

ITEM 10. |

ADDITIONAL INFORMATION |

A. |

Share Capital |

B. |

Memorandum and Articles of Association |

| • | the instrument of transfer is lodged with us, accompanied by the certificate for the ordinary shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer; |

| • | the instrument of transfer is in respect of only one class of ordinary shares; |

| • | the instrument of transfer is properly stamped, if required; |

| • | in the case of a transfer to joint holders, the number of joint holders to whom the ordinary share is to be transferred does not exceed four; and |

| • | a fee of such maximum sum as the New York Stock Exchange may determine to be payable or such lesser sum as our directors may from time to time require is paid to us in respect thereof. |

| • | If our directors refuse to register a transfer they shall, within three months after the date on which the instrument of transfer was lodged, send to each of the transferor and the transferee notice of such refusal. |

| • | the designation of the series; |

| • | the number of shares of the series; |

| • | the dividend rights, dividend rates, conversion rights, voting rights; and |

| • | the rights and terms of redemption and liquidation preferences. |

| • | authorize our board of directors to issue preference shares in one or more series and to designate the price, rights, preferences, privileges and restrictions of such preference shares without any further vote or action by our shareholders; and |

| • | limit the ability of shareholders to requisition and convene general meetings of shareholders. |

| • | does not have to file an annual return of its shareholders with the Registrar of Companies; |

| • | is not required to open its register of members for inspection; |

| • | does not have to hold an annual general meeting; |

| • | may issue negotiable or bearer shares or shares with no par value; |

| • | may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first instance); |

| • | may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| • | may register as a limited duration company; and |

| • | may register as a segregated portfolio company. |

| • | the statutory provisions as to the required majority vote have been met; |

| • | the shareholders have been fairly represented at the meeting in question and the statutory majority are acting bona fide without coercion of the minority to promote interests adverse to those of the class; |

| • | the arrangement is such that may be reasonably approved by an intelligent and honest man of that class acting in respect of his interest; and |

| • | the arrangement is not one that would more properly be sanctioned under some other provision of the Companies Act. |

| • | a company acts or proposes to act illegally or ultra vires (and is therefore incapable of ratification by the shareholders); |

| • | the act complained of, although not ultra vires, could only be effected duly if authorized by more than a simple majority vote that has not been obtained; and |

| • | those who control the company are perpetrating a “fraud on the minority.” |

C. |

Material Contracts |

D. |

Exchange Controls |

E. |

Taxation |

| • | banks and other financial institutions; |

| • | insurance companies; |

| • | pension plans; |

| • | cooperatives; |

| • | regulated investment companies; |

| • | real estate investment trusts; |

| • | broker-dealers; |

| • | traders that elect to use a mark-to-market |

| • | certain former U.S. citizens or long-term residents; |

| • | tax-exempt entities (including private foundations); |

| • | persons liable for alternative minimum tax; |

| • | holders who acquire their ADSs or ordinary shares pursuant to any employee share option or otherwise as compensation; |

| • | investors that will hold their ADSs or ordinary shares as part of a straddle, hedge, conversion, constructive sale or other integrated transaction for U.S. federal income tax purposes; |

| • | investors that have a functional currency other than the U.S. dollar; |

| • | persons that actually or constructively own 10% or more of our stock (by vote or value); |

| • | persons required to accelerate the recognition of any item of gross income with respect to their ADSs or ordinary shares as a result of such income being recognized on an applicable financial statement; or |

| • | partnerships or other entities taxable as partnerships for U.S. federal income tax purposes, or persons holding common stock through such entities; |

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created in, or organized under the law of the United States or any state thereof or the District of Columbia; |

| • | an estate the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source; or |

| • | a trust (A) the administration of which is subject to the primary supervision of a U.S. court and which has one or more U.S. persons who have the authority to control all substantial decisions of the trust or (B) that has otherwise validly elected to be treated as a U.S. person under the Code. |

| • | the excess distribution or gain will be allocated ratably over the U.S. Holder’s holding period for the ADSs or ordinary shares; |

| • | the amount allocated to the current taxable year and any taxable years in the U.S. Holder’s holding period prior to the first taxable year in which we are classified as a PFIC (each, a “pre-PFIC year”), will be taxable as ordinary income; and |

| • | the amount allocated to each prior taxable year, other than a pre-PFIC year, will be subject to tax at the highest tax rate in effect for individuals or corporations, as appropriate, for that year, increased by an additional tax equal to the interest on the resulting tax deemed deferred with respect to each such taxable year. |

F. |

Dividends and Paying Agents |

G. |

Statement by Experts |

H. |

Documents on Display |

I. |

Subsidiary Information |

ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

A. |

Debt Securities |

B. |

Warrants and Rights |

C. |

Other Securities |

D. |

American Depositary Shares |

| Service |

Fees | |

| • To any person to which ADSs are issued or to any person to which a distribution is made in respect of ADS distributions pursuant to stock dividends or other free distributions of stock, bonus distributions, stock splits or other distributions (except where converted to cash) |

Up to US$0.05 per ADS issued | |

| • Cancellation of ADSs, including the case of termination of the deposit agreement |

Up to US$0.05 per ADS cancelled | |

| • Distribution of cash dividends |

Up to US$0.05 per ADS held | |

| • Distribution of cash entitlements (other than cash dividends) and/or cash proceeds from the sale of rights, securities and other entitlements |

Up to US$0.05 per ADS held | |

| • Distribution of ADSs pursuant to exercise of rights |

Up to US$0.05 per ADS held | |

| • Distribution of securities other than ADSs or rights to purchase additional ADSs |

Up to US$0.05 per ADS held | |

| • Depositary services |

Up to US$0.05 per ADS held on the applicable record date(s) established by the depositary bank |

| • | Fees for the transfer and registration of shares charged by the registrar and transfer agent for the shares in the Cayman Islands (i.e., upon deposit and withdrawal of shares). |

| • | Expenses incurred for converting foreign currency into U.S. dollars. |

| • | Expenses for cable, telex and fax transmissions and for delivery of securities. |

| • | Taxes and duties upon the transfer of securities, including any applicable stamp duties, any stock transfer charges or withholding taxes (i.e., when shares are deposited or withdrawn from deposit). |

| • | Fees and expenses incurred in connection with the delivery or servicing of shares on deposit. |

| • | Fees and expenses incurred in connection with complying with exchange control regulations and other regulatory requirements applicable to shares, deposited securities, ADSs and ADRs. |

| • | Any applicable fees and penalties thereon. |

ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

ITEM 15. |

CONTROLS AND PROCEDURES |

ITEM 16.A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

ITEM 16.B. |

CODE OF ETHICS |

ITEM 16.C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

2019 |

2020 |

|||||||

RMB |

RMB |

|||||||

(in thousands) |

||||||||

| Audit fees (1) |

11,080 | 13,960 | ||||||

| Audit related fees (2) |

— | 13,586 | ||||||

| Tax fees (3) |

1,276 | 1,776 | ||||||

| All other fees (4) |

— | 1,743 | ||||||

| (1) | “Audit fees” represent the aggregate fees billed for professional services rendered by our principal auditor for the audit of our annual financial statements. |

| (2) | “Audit related fees” represent the aggregate fees billed for professional services rendered by our principal accounting firm for the assurance and related services. |

| (3) | “Tax fees” represent the aggregate fees billed in each of the fiscal years listed for professional services rendered by our principal auditor for tax compliance, tax advice, and tax planning. |

| (4) | “All other fees” represent the aggregate fees billed for each of the fiscal years listed for products and services provided by the principal accountant, other than the services described above. |

ITEM 16.D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

ITEM 16.E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

ITEM 16.F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT |

ITEM 16.G. |

CORPORATE GOVERNANCE |

ITEM 16.H. |

MINE SAFETY DISCLOSURE |

ITEM 17. |

FINANCIAL STATEMENTS |

ITEM 18. |

FINANCIAL STATEMENTS |

ITEM 19. |

EXHIBITS |

| * | Filed herewith. |

| ** | Furnished herewith. |

| GSX Techedu Inc. | ||

| By: | /s/ Larry Xiangdong Chen | |

| Name: | Larry Xiangdong Chen | |

| Title: | Chief Executive Officer | |

| CONTENTS |

PAGE |

|||

| F-2 | ||||

| F-4 | ||||

| F-6 | ||||

| F-7 | ||||

| F-8 | ||||

| F-9 | ||||

| F-11 | ||||

| • | With the assistance of our IT specialists: |

| • | We tested the IT environment in which the revenue order tracking occurs, billing and cash collection is registered, and live streaming services modules reside, including the related tools. |

| • | We tested the automatic controls over revenue recognition with respect to the courses offered including the order initiation, order settlement, and systematic recognition of the tutoring fee. |

| • | We tested the interface controls associated with payment information transmitted from the payment system to the service order systems. |

| • | With the assistance of our data analytics specialists: |

| • | We performed procedures to reconcile the cash collection registered within the Company’s IT systems to the collection through major third-party online payment channels; in addition, we performed reconciliation procedures on the cash deposits from major third-party online payment channels to bank statements. |

| • | We tested the logic of the systematic revenue recognition and recalculated the live interactive tutoring service revenues recognized. |

| • | We performed data analysis on a number of aspects, including student registration, cash payment timing and accounts, student behavior associated with class attendance, acceptance of learning materials shipped, and other areas that we identified through our risk assessment process to identify transactions with characteristics of audit interest. |

| • | We performed an IT infrastructure capacity analysis to verify whether the Company has the IT infrastructure capacity to deliver the volume of classes associated with enrollments. |

| • | We performed test of details over revenue transactions, including billing amounts, cash collection which is tracked in the payment and ordering systems, class login records, acceptance of learning materials, records of interaction between the students and the tutors, and recalculated the revenue recognized in the corresponding period, on a sample basis. |

| • | We tested the reconciliation between the balances to be received from third-party online payment channels recorded in the ledger and the balances confirmed by the third-party online payment channels. |

| As of December 31, | ||||||||||||

| 2019 | 2020 | 2020 | ||||||||||

| RMB | RMB | USD | ||||||||||

| (Note 2) | ||||||||||||

| ASSETS |

||||||||||||

| Current assets |

||||||||||||

| Cash and cash equivalents |

||||||||||||

| Short-term investments (including available-for-sale debt securities of RMB |

||||||||||||

| Inventory |

||||||||||||

| Prepaid expenses and other current assets |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total current assets |

||||||||||||

| |

|

|

|

|

|

|||||||

| Non-current assets |

||||||||||||

| Operating lease right-of-use assets |

||||||||||||

| Property, equipment and software, net |

||||||||||||

| Intangible assets |

||||||||||||

| Land use rights |

||||||||||||

| Long-term investments (including available-for-sale debt securities of RMB |

||||||||||||

| Goodwill |

||||||||||||

| Deferred tax assets |

||||||||||||

| Rental deposit |

||||||||||||

| Other non-current assets |

||||||||||||

| |

|

|

|

|

|

|||||||

| TOTAL ASSETS |

||||||||||||

| |

|

|

|

|

|

|||||||

| LIABILITIES |

||||||||||||

| Current liabilities |

||||||||||||

| Accrued expenses and other current liabilities (including accrued expenses and other current liabilities of the consolidated VIE without recourse to the Group of RMB |

||||||||||||

| Deferred revenue, current portion of the consolidated VIE without recourse to the Group |

||||||||||||

| Current portion of operating lease liabilities (including current portion of operating lease liabilities of the consolidated VIE without recourse to the Group of RMB |

||||||||||||

| Income tax payable of the consolidated VIE without recourse to the Group |

||||||||||||

| Amounts due to related parties of the consolidated VIE without recourse to the Group |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total current liabilities |

||||||||||||

| |

|

|

|

|

|

|||||||

As of December 31, |

||||||||||||

2019 |

2020 |

2020 |

||||||||||

RMB |

RMB |

USD |

||||||||||

(Note 2) |

||||||||||||

Non-current liabilities |

||||||||||||

Deferred revenue, non-current portion of the consolidated VIE without recourse to the Group |

||||||||||||

Non-current portion of operating lease liabilities (including non-current portion of operating lease liabilities of the consolidated VIE without recourse to the Group of RMB |

||||||||||||

Deferred tax liabilities of the consolidated VIE without recourse to the Group |

||||||||||||

Other payables of the consolidated VIE without recourse to the Group |

||||||||||||

TOTAL LIABILITIES |

||||||||||||

Commitments and Contingencies (Note 21) |

||||||||||||

SHAREHOLDERS’ EQUITY |

||||||||||||

Class A ordinary shares (par value of USD issued, |

||||||||||||

Class B ordinary shares (par value of USD |

||||||||||||

Treasury stock, at cost |

( |

) | ( |

) | ( |

) | ||||||

Additional paid-in capital |

||||||||||||

Accumulated other comprehensive income (loss) |

( |

) | ( |

) | ||||||||

Statutory reserves |

||||||||||||

Accumulated deficit |

( |

) | ( |

) | ( |

) | ||||||

TOTAL SHAREHOLDERS’ EQUITY |

||||||||||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

| Year ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | 2020 | |||||||||||||

| RMB | RMB | RMB | USD | |||||||||||||

| (Note 2) | ||||||||||||||||

| Net revenues |

||||||||||||||||

| Cost of revenues (including share-based compensation expenses of RMB |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross profit |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Selling expenses (including share-based compensation expenses of RMB |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Research and development expenses (including share-based compensation expenses of RMB |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| General and administrative expenses (including share-based compensation expenses of RMB |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Interest income |

||||||||||||||||

| Realized gains from investments |

||||||||||||||||

| Other income |

||||||||||||||||

| Other expenses |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income (loss) before provision for income tax and share of results of equity investees |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income tax (expenses) benefits |

( |

) | ( |

) | ||||||||||||

| Share of results of equity investees |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Less: Series A convertible redeemable preferred shares redemption value accretion |

||||||||||||||||

| Less: Undistributed earnings allocated to the participating preferred shares |

||||||||||||||||

| Net (loss) income attributable to GSX Techedu Inc.’s ordinary shareholders |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss) income per ordinary share |

||||||||||||||||

| Basic |

( |

) | ( |

) | ( |

) | ||||||||||

| Diluted |

( |

) | ( |

) | ( |

) | ||||||||||

| Net (loss) income per ADS |

||||||||||||||||

| Basic |

( |

) | ( |

) | ( |

) | ||||||||||

| Diluted |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted average shares used in net (loss) income per share |

||||||||||||||||

| Basic |

||||||||||||||||

| Diluted |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Year ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | 2020 | |||||||||||||

| RMB | RMB | RMB | USD | |||||||||||||

| (Note 2) | ||||||||||||||||

| Net income (loss) |

( |

) | ( |

) | ||||||||||||

| Other comprehensive income (loss), net of tax: |

||||||||||||||||

| Change in cumulative foreign currency translation adjustments |

( |

) | ( |

) | ||||||||||||

| Unrealized gains on available-for-sale investments (net of tax effect of |

||||||||||||||||

| Transfer to statements of operations of realized gains on available-for-sale investments (net of tax effect of |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income (loss) attributable to GSX Techedu Inc. |

( |

) | ( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Attributable to shareholders of the Group |

||||||||||||||||||||||||||||||||

Number of ordinary shares |

Ordinary shares |

Treasury stock, at cost |

Additional paid-in capital |

Accumulated other comprehensive income (loss) |

Statutory reserves |

Accumulated deficit |

Total GSX Techedu Inc. shareholders’ (deficit) equity |

|||||||||||||||||||||||||

| Balance as of January 1, 2018 in RMB |

— | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||

| Net income |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Share-based compensation |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Accretion to redemption value of convertible redeemable preferred shares |

— | — | — | ( |

) | — | — | ( |

) | ( |

) | |||||||||||||||||||||

| Foreign currency translation adjustments |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Unrealized gains on available-for-sale investments |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance as of December 31, 2018 in RMB |

— | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Transfer to statutory reserves |

— | — | — | — | — | ( |

) | — | ||||||||||||||||||||||||

| Issuance of ordinary shares upon initial public offering and exercising the over-allotment option by the underwriters (net of issuance cost of RMB |

— | — | — | — | ||||||||||||||||||||||||||||

| Accretion to redemption value of convertible redeemable preferred shares |

— | — | — | ( |

) | — | — | ( |

) | ( |

) | |||||||||||||||||||||

| Conversion of convertible redeemable Preferred shares |

— | — | — | — | ||||||||||||||||||||||||||||

| Repurchase of ordinary shares |

( |

) | — | ( |

) | — | — | — | — | ( |

) | |||||||||||||||||||||

| Share-based compensation |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Option exercised |

— | — | — | — | ||||||||||||||||||||||||||||

| Foreign currency translation adjustments |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Unrealized gains on available-for-sale investments |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Transfer to statements of operations of realized gains on available-for-sale investments |

— | — | — | — | ( |

) | — | — | ( |

) | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance as of December 31, 2019 in RMB |

( |

) | ( |

) | ||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net loss |

— | — | — | — | — | — | ( |

) | ( |

) | ||||||||||||||||||||||

| Transfer to statutory reserves |

— | — | — | — | — | ( |

) | — | ||||||||||||||||||||||||

| Issuance of ordinary shares through private placement |

— | — | — | — | ||||||||||||||||||||||||||||

| Repurchase of ordinary shares |

( |

) | — | ( |

) | — | — | — | — | ( |

) | |||||||||||||||||||||

| Share-based compensation |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Option exercised and restricted stock units vested |

— | ( |

) | — | — | — | ||||||||||||||||||||||||||

| Foreign currency translation adjustments |

— | — | — | — | ( |

) | — | — | ( |

) | ||||||||||||||||||||||

| Unrealized gains on available-for-sale investments |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Transfer to statements of operations of realized gains on available-for-sale investments |

— | — | — | — | ( |

) | — | — | ( |

) | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance as of December 31, 2020 in RMB |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance as of December 31, 2020 in USD (Note 2) |

( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Year ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | 2020 | |||||||||||||

| RMB | RMB | RMB | USD | |||||||||||||

| (Note 2) | ||||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||||||||||

| Net income (loss) |

( |

) | ( |

) | ||||||||||||

| Adjustments to reconcile net income (loss) to net cash generated from operating activities: |

||||||||||||||||

| Depreciation of property, equipment and software |

||||||||||||||||

| Amortization of intangible assets and land use rights |

||||||||||||||||

| Gain from remeasuring fair value of previously held equity interests upon business acquisition |

( |

) | ||||||||||||||

| Share of results of equity investees |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Realized gains from investments |

( |

) | ( |

) | ( |

) | ||||||||||

| Loss (gain) on disposal of property, equipment and software |

( |

) | ||||||||||||||

| Share-based compensation |

||||||||||||||||

| Changes in operating assets and liabilities: |

||||||||||||||||

| Accrued expenses and other current liabilities |

||||||||||||||||

| Deferred revenue |

||||||||||||||||

| Prepaid expenses and other current assets |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Income tax payable |

( |

) | ( |

) | ||||||||||||

| Amount due from related parties |

||||||||||||||||

| Other assets |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Amount due to related parties |

( |

) | ||||||||||||||

| Deferred tax assets |

( |

) | ( |

) | ||||||||||||

| Deferred tax liabilities |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net cash generated from operating activities |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||||||||||

| Purchase of short-term investments |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Proceeds from maturity of short-term investments |

||||||||||||||||

| Purchase of property, equipment, software and intangible asset s |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Payment for asset acquisition |

( |

) | ( |

) | ||||||||||||

| Purchase of long-term investments |

( |

) | ||||||||||||||

| Proceeds from maturity of long-term investments |

||||||||||||||||

| Proceeds from capital return related to equity method investments |

||||||||||||||||

| Acquisition of businesses |

( |

) | ( |

) | ||||||||||||

| Disposal of property, equipment and software |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Year ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | 2020 | |||||||||||||

| RMB | RMB | RMB | USD | |||||||||||||

| (Note 2) | ||||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||||||||||

| Net proceeds from initial public offering and from exercising the over-allotment option by the underwriters (net of issuance cost of RMB |

||||||||||||||||

| Capital contribution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from private placement financing |

||||||||||||||||

| Repurchase of ordinary shares |

( |

) | ( |

) | ( |

) | ||||||||||

| Payment for asset acquisition after three months of completion |

( |

) | ( |

) | ||||||||||||

| Amount borrowed from related parties |

||||||||||||||||

| Repayment to related parties |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||