cs

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of August 2, 2024, the registrant had

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

TABLE OF CONTENTS

|

|

Page |

PART I. |

1 |

|

Item 1. |

1 |

|

|

Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023 |

1 |

|

2 |

|

|

3 |

|

|

Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2024 and 2023 |

4 |

|

5 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

Item 3. |

26 |

|

Item 4. |

26 |

|

PART II. |

28 |

|

Item 1. |

28 |

|

Item 1A. |

28 |

|

Item 2. |

28 |

|

Item 3. |

28 |

|

Item 4. |

28 |

|

Item 5. |

28 |

|

Item 6. |

29 |

|

32 |

||

i

Special Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Quarterly Report”), including the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the documents incorporated by reference herein may contain express or implied “forward-looking statements” within the meaning of the federal securities laws, Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under Part II, Item 1A, “Risk Factors” in this Quarterly Report. Except as required by law, we assume no obligation to update these forward-looking statements, whether as a result of new information, future events or otherwise. These statements, which represent our current expectations or beliefs concerning various future events, may contain words such as “may,” “will,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate” or other words indicating future results, though not all forward-looking statements necessarily contain these identifying words. Such statements may include, but are not limited to, statements concerning the following:

ii

These and other forward-looking statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. In addition, historic results of scientific research, preclinical and clinical trials do not guarantee that future research or trials will suggest the same conclusions, nor that historic results referred to herein will be interpreted in the same manner due to additional research, preclinical and clinical trial results or otherwise. The forward-looking statements contained in this Quarterly Report are subject to risks and uncertainties, including those discussed in our other filings with the United States Securities and Exchange Commission (the “Commission”). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof unless specifically stated otherwise. Although we currently believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

iii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

June 30, |

|

|

December 31, |

|

||

(in thousands, except par value information) |

|

(unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

|

||

Accounts receivable |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Operating lease right-of-use assets, net |

|

|

|

|

|

|

||

Non-current restricted cash |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and stockholders’ equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued liabilities |

|

|

|

|

|

|

||

Deferred revenue |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Deferred revenue, net of current portion |

|

|

|

|

|

|

||

Operating lease liability, net of current portion |

|

|

|

|

|

|

||

Other non-current liabilities |

|

|

— |

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

||

Stockholders’ equity |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

(in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Collaboration revenue |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Grant revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development, net |

|

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

(Loss) gain from foreign currency |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Gain on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

Finance income, net |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss before income taxes |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Provision for income taxes |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited)

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|||||

|

|

Common Stock |

|

|

Paid-In |

|

|

Accumulated |

|

|

Stockholders’ |

|

||||||||

(in thousands) |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||

Balance at December 31, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Share-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Issuance of common stock upon exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Balance at March 31, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Share-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Issuance of common stock upon exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Balance at June 30, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|||||

|

|

Common Stock |

|

|

Paid-In |

|

|

Accumulated |

|

|

Stockholders’ |

|

||||||||

(in thousands) |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||

Balance at December 31, 2022 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Share-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at March 31, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Share-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Issuance of common stock upon exercise of stock options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Balance at June 30, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

Six Months Ended June 30, |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Share-based compensation expense |

|

|

|

|

|

|

||

Foreign currency transaction loss |

|

|

|

|

|

|

||

Gain on debt extinguishment |

|

|

— |

|

|

|

( |

) |

Other non-cash expenses |

|

|

— |

|

|

|

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

|

|

|

( |

) |

|

Prepaid expense and other assets |

|

|

( |

) |

|

|

|

|

Right-of-use assets |

|

|

|

|

|

|

||

Accounts payable |

|

|

|

|

|

|

||

Accrued liabilities |

|

|

|

|

|

( |

) |

|

Deferred revenue |

|

|

( |

) |

|

|

|

|

Lease liabilities |

|

|

( |

) |

|

|

( |

) |

Net cash (used in) provided by operating activities |

|

|

( |

) |

|

|

|

|

Investing activities |

|

|

|

|

|

|

||

Acquisition of property and equipment |

|

|

( |

) |

|

|

( |

) |

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities |

|

|

|

|

|

|

||

Proceeds from exercise of stock options |

|

|

|

|

|

|

||

Payments on debt obligations |

|

|

— |

|

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

|

|

|

( |

) |

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

( |

) |

Cash, cash equivalents and restricted cash at beginning of the period |

|

|

|

|

|

|

||

Cash, cash equivalents and restricted cash at end of the period |

|

$ |

|

|

$ |

|

||

|

|

Six Months Ended June 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

— |

|

|

$ |

|

|

Non-cash investing activities |

|

|

|

|

|

|

||

Non-cash asset disposal |

|

$ |

|

|

$ |

— |

|

|

Right-of-use assets acquired through operating leases |

|

$ |

|

|

$ |

— |

|

|

Purchase of property and equipment in accounts payable |

|

$ |

— |

|

|

$ |

|

|

|

|

|

|

|

|

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Description of Business, Basis of Presentation and Summary of Significant Accounting Policies

Description of Business

Arcturus Therapeutics Holdings Inc. (the “Company” or "Arcturus") is a global messenger RNA medicines company focused on the development of infectious disease vaccines and significant addressing unmet medical needs within liver and respiratory rare diseases. The Company became a clinical stage company during 2020 when it announced that its Investigational New Drug (“IND”) application for ornithine transcarbamylase (“OTC”) deficiency and its Clinical Trial Application (“CTA”) for candidate LUNAR-COV19 were approved by applicable health authorities.

Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of Arcturus and its subsidiaries and are unaudited. All intercompany accounts and transactions have been eliminated in consolidation. These condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In management’s opinion, the accompanying condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of the results for the interim periods presented.

Interim financial results are not necessarily indicative of results anticipated for the full year. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and footnotes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

These condensed consolidated financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions regarding the valuation of certain debt and equity instruments, share-based compensation, accruals for liabilities, income taxes, revenue and deferred revenue, leases, and other matters that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Although these estimates are based on management’s knowledge of current events and actions the Company may undertake in the future, actual results may ultimately differ from these estimates and assumptions.

Joint Ventures, Equity Method Investments and Variable Interest Entities

Investments for which the Company exercises significant influence, but does not have control are accounted for under the equity method. Equity method investment activity is related to the Company's joint venture in ARCALIS, Inc. with Axcelead, Inc. (“Axcelead”). The Company’s share of the investee's results is presented as either income or loss from equity-method investment in the accompanying condensed consolidated statements of operations and comprehensive loss.

Liquidity

The Company has incurred significant operating losses since its inception. As of June 30, 2024 and December 31, 2023, the Company had an accumulated deficit of $

The Company’s activities since inception have consisted principally of research and development activities, general and administrative activities, and raising capital. The Company’s activities are subject to significant risks and uncertainties, including failing to secure additional funding before the Company achieves sustainable revenues and profit from operations. From the Company’s inception through June 30, 2024, the Company has funded its operations principally with the proceeds from revenues earned through collaboration agreements, the sale of capital stock, expense reimbursements from government contracts and proceeds from long-term debt. At June 30, 2024, the Company’s balance of cash and cash equivalents, including restricted cash, was $

Management believes that it has sufficient working capital on hand to fund operations through at least the next twelve months from the date these condensed consolidated financial statements were available to be issued. There can be no assurance that the Company will be successful in securing additional funding, that the Company’s projections of its future working capital needs will prove accurate, or that any additional funding would be sufficient to continue operations in future years.

5

Segment Information

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision-maker in making decisions regarding resource allocation and assessing performance. The Company and its chief operating decision-maker view the Company’s operations and manage its business in

Revenue Recognition

At contract inception, the Company analyzes its collaboration arrangements to assess whether such arrangements involve joint operating activities performed by parties that are both active participants in the activities and exposed to significant risks and rewards dependent on the commercial success of such activities and therefore within the scope of Accounting Standards Codification (“ASC”) Topic 808, Collaborative Arrangements (“ASC 808”). For collaboration arrangements within the scope of ASC 808 that contain multiple elements, the Company first determines which elements of the collaboration reflect a vendor-customer relationship and are therefore within the scope of ASC 606.

The Company determines revenue recognition for arrangements within the scope of ASC 606 by performing the following five steps: (i) identify the contract; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when, or as, the company satisfies a performance obligation.

The terms of the Company’s revenue agreements include license fees, upfront payments, development or regulatory milestone payments, profit-sharing arrangements, reimbursement for research and development activities, option exercise fees, drug substance and drug product supply fees, consulting and related technology transfer fees and royalties on sales of commercialized products. The event-based milestone payments represent variable consideration, and the Company uses the most likely amount method to estimate this variable consideration because the Company will either receive the milestone payment or will not, which makes the potential milestone payment a binary event. The most likely amount method requires the Company to determine the likelihood of earning the milestone payment. Given the high degree of uncertainty around achievement of these milestones, the Company determines the milestone amounts to be fully constrained and does not recognize revenue until the uncertainty associated with these payments is resolved. The Company will recognize revenue from sales-based royalty payments when or as the sales occur. The Company will re-evaluate the transaction price in each reporting period as uncertain events are resolved and other changes in circumstances occur.

A performance obligation is a promise in a contract to transfer a distinct good or service to the collaborative partner and is the unit of account in ASC 606. A contract’s transaction price is allocated to each distinct performance obligation based on relative standalone selling price and recognized as revenue when, or as, the performance obligation is satisfied.

For performance obligations that are recognized over time, the Company measures the progress using an input method. The input methods used are based on the effort expended or costs incurred toward the satisfaction of the performance obligation. The Company estimates the amount of effort expended, including the time estimated it will take to complete the activities, or costs incurred in a given period, relative to the estimated total effort or costs to satisfy the performance obligation. This approach requires the Company to make numerous estimates and use significant judgment. If estimates or judgments change over the course of the collaboration, a cumulative catch up of revenue is recognized in the period such changes are identified.

See “Note 2, Revenue” for specific details surrounding the Company’s arrangements.

Leases

The Company determines if an arrangement is a lease at inception. Lease right-of-use assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. For operating leases with an initial term greater than 12 months, the Company recognizes operating lease right-of-use assets and operating lease liabilities based on the present value of lease payments over the lease term at the commencement date. Operating lease right-of-use assets are comprised of the lease liability plus any lease payments made and excludes lease incentives. Lease terms include options to renew or terminate the lease when the Company is reasonably certain that the renewal option will be exercised or when it is reasonably certain that the termination option will not be exercised. For the Company's operating leases, if the interest rate used to determine the present value of future lease payments is not readily determinable, the Company estimates its incremental borrowing rate as the discount rate for the lease. The Company's incremental borrowing rate is estimated to approximate the interest rate on a collateralized basis with similar terms and payments, and in similar economic environments. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The Company has elected the practical expedient to not separate lease and non-lease components.

See “Note 9, Commitments and Contingencies” for specific details surrounding the Company’s leases.

6

Research and Development Costs, Net

All research and development costs are expensed as incurred. Research and development costs consist primarily of salaries, employee benefits, costs associated with preclinical studies and clinical trials (including amounts paid to clinical research organizations and other professional services), in-process research and development expenses, pre-launch inventory and license agreement expenses. Research and development expenses are presented net of any grants. Payments made prior to the receipt of goods or services to be used in research and development are capitalized until the goods are received or the services are performed.

The Company records accruals for estimated research and development costs, comprising payments for work performed by third party contractors, laboratories, participating clinical trial sites, and others. Some of these contractors bill monthly based on actual services performed, while others bill periodically based upon achieving certain contractual milestones. For the latter, the Company accrues the expenses as goods or services are used or rendered.

Clinical trial activities performed by third parties are accrued and expensed based upon estimates of the proportion of work completed over the life of the individual clinical trial and patient enrollment rates in accordance with agreements established with Clinical Research Organizations ("CROs") and clinical trial sites. Estimates are determined by reviewing contracts, vendor agreements and purchase orders, and through discussions with internal clinical personnel and external service providers as to the progress or stage of completion of trials or services and the agreed-upon fee to be paid for such services.

Pre-Launch Inventory

Prior to obtaining initial regulatory approval for an investigational product candidate, the Company expenses costs relating to production of inventory as research and development expense in its condensed consolidated statements of operations and comprehensive loss, in the period incurred. When the Company believes regulatory approval and subsequent commercialization of an investigational product candidate is probable, and the Company also expects future economic benefit from the sales of the investigational product candidate to be realized, it will then capitalize the costs of production as inventory.

Restricted Cash

Restricted cash includes collateral pledged and held at the Company’s securities accounts pursuant to a security agreement with Wells Fargo Bank, National Association (“Wells Fargo”) (Note 5). At June 30, 2024, such collateral amounted to $

Restricted cash also includes cash required to be set aside as security for lease payments and to maintain a letter of credit for the benefit of the landlord for the Company’s offices. At June 30, 2024 and 2023, the Company had restricted cash of $

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the unaudited condensed consolidated balance sheets that sum to the total of the same such amounts shown in the unaudited condensed consolidated statement of cash flows as of June 30, 2024 and 2023:

(in thousands) |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

|

||

Non-current restricted cash |

|

|

|

|

|

|

||

Total cash, cash equivalents and restricted |

|

$ |

|

|

$ |

|

||

Net Loss per Share

Basic net loss per share is calculated by dividing the net loss by the weighted-average number of shares of common stock outstanding for the period, without consideration for common stock equivalents. Diluted net loss per share is calculated by dividing the net loss by the weighted-average number of shares of common stock and dilutive common stock equivalents outstanding for the period determined using the treasury-stock method. Dilutive shares of common stock for the three and six months ended June 30, 2024 were comprised of stock options and restricted stock units. Dilutive shares of common stock for the three and six months ended June 30, 2023 were comprised of stock options.

Recently Issued Accounting Standards Not Yet Adopted

7

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on the condensed consolidated financial statements and disclosures.

8

Note 2. Revenue

The Company has entered into license agreements and collaborative research and development arrangements with pharmaceutical and biotechnology companies, as well as consulting, related technology transfer, product revenue and government grant agreements. Under these arrangements, the Company is entitled to receive license fees, consulting fees, product fees, technological transfer fees, upfront payments, milestone payments if and when certain research and development milestones, technology transfer milestones or success-based milestones are achieved, royalties on approved product sales and reimbursement for research and development activities. The Company’s costs of performing these services are included within research and development expenses. The Company’s milestone payments are typically defined by achievement of certain preclinical, clinical, and commercial success criteria. Preclinical milestones may include in vivo proof of concept in disease animal models, lead candidate identification, and completion of IND-enabling toxicology studies. Clinical milestones may, for example, include successful enrollment of the first patient in or completion of Phase 1, 2 and 3 clinical trials, and commercial milestones are often tiered based on net or aggregate sale amounts. The Company cannot guarantee the achievement of these milestones due to risks associated with preclinical and clinical activities required for development of nucleic acid medicine-based therapeutics and vaccines.

The following table presents changes during the six months ended June 30, 2024 in the balances of contract assets and liabilities as compared to what was disclosed in the Company’s Annual Report.

(in thousands) |

|

December 31, 2023 |

|

|

Additions |

|

|

Deductions |

|

|

June 30, 2024 |

|

||||

Contract Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Accounts receivable |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Contract Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Deferred revenue |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

The following table summarizes the Company’s revenues for the periods indicated.

|

|

For the Three Months |

|

|

For the Six Months |

|

||||||||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Collaboration Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

CSL Seqirus |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Janssen |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Other collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total collaboration revenue |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Grant revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

BARDA |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Total grant revenue |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

The following paragraphs provide information regarding the nature and purpose of the Company’s most significant collaboration and grant arrangements.

9

CSL Seqirus

On November 1, 2022, the Company entered into a Collaboration and License Agreement (as amended, the “CSL Collaboration Agreement”) with Seqirus, Inc., a part of CSL Limited (“CSL Seqirus”), for the global exclusive rights to research, develop, manufacture, and commercialize vaccines. Under the terms of the CSL Collaboration Agreement, the Company provides CSL Seqirus with an exclusive global license to its mRNA technology (including STARR®) and LUNAR® lipid-mediated delivery, along with mRNA drug substance and drug product manufacturing process. CSL Seqirus will lead development and commercialization of vaccines under the collaboration. The collaboration plans to advance vaccines against SARS-CoV-2 (COVID-19), influenza, pandemic preparedness as well as three other respiratory infectious diseases.

The Company received a $

In evaluating the CSL Collaboration Agreement in accordance with ASC 606, the Company concluded that CSL Seqirus is a customer. The Company identified all promised goods/services within the CSL Collaboration Agreement, and when combining certain promised goods/services, the Company concluded that there are five distinct performance obligations. The nature of the performance obligations consists of delivery of the vaccine license, research and development services for COVID and non-COVID vaccines and regulatory activities for COVID vaccines. For each performance obligation, the Company estimated the standalone selling price based on 1) in the case of the license, the fair value using costs to recreate plus margin method and 2) in the case of research and development services and regulatory activities, cost plus margin for estimated full-time equivalent (“FTE”) costs, direct costs including laboratory supplies, contractors, and other out-of-pocket expenses for research and development services and regulatory activities.

As of June 30, 2024, the transaction price consisted of upfront consideration received and milestones achieved. Additional variable consideration was not included in the transaction price at June 30, 2024 because the Company could not conclude that it is probable that including the variable consideration will not result in a significant revenue reversal.

The Company allocated the transaction price to the performance obligations in proportion to their standalone selling price. The vaccine license was recognized at the point in time it was transferred in 2022. The research and development and regulatory activities performance obligations are recognized over a period of time based on the percentage of services rendered using the input method, meaning actual costs incurred divided by total costs budgeted to satisfy the performance obligation. Any consideration related to sales-based royalties will be recognized when the amounts are probable of non-reversal, provided that the reported sales are reliably measurable and the Company has no remaining promised goods/services, as they are constrained and therefore have also been excluded from the transaction price. The revenue recognized in the second quarter of 2024 relates to the license delivered, milestones achieved and services performed through June 30, 2024.

Total deferred revenue as of June 30, 2024 and December 31, 2023 for the CSL Collaboration Agreement was $

During 2023, the Company also received an advance payment of $

During 2023, the Company entered into an amendment to the CSL Collaboration Agreement, pursuant to which the Company agreed to sponsor and conduct a Phase 1 clinical study in the influenza field. As part of the amendment, the Company received $

During the fourth quarter of 2023, the Company received an advance payment of $

10

concluded that the promise to perform manufacturing activities is a customer option as part of the CSL Collaboration Agreement and is accounted for as a separate contract. The advance payments are included in deferred revenue as of June 30, 2024 and will be recognized as revenue when the vaccine product is transferred to CSL Seqirus.

In March 2024, the Company entered into an amendment to the CSL Collaboration Agreement, pursuant to which the parties agreed to, among other things, adjust (i) the development plans for certain product candidates, (ii) various development milestones related to such product candidates, (iii) provisions of the CSL Collaboration Agreement related to specific royalty payments, (iii) provisions of the CSL Collaboration Agreement related to distributors, and (iv) proprietary payment calculations related to the foregoing.

BARDA Grant

In August 2022, the Company entered into a cost reimbursement contract (the “BARDA Contract”) with the Biomedical Advanced Research and Development Authority ("BARDA"), a division of the Office of the Assistant Secretary for Preparedness and Response (ASPR) within the U.S. Department of Health and Human Services (HHS) for an award of up to $

The Company determined that the BARDA Contract is not in the scope of ASC 808 or ASC 606. Applying International Accounting Standards No. 20 ("IAS 20"), Accounting for Government Grants and Disclosure of Government Assistance, by analogy, the Company recognizes grant revenue from the reimbursement of direct out-of-pocket expenses, overhead allocations and fringe benefits for research costs associated with the grant. The costs associated with these reimbursements are reflected as a component of research and development expense in the Company’s condensed consolidated statements of operations and comprehensive income (loss).

The Company recognized $

Note 3. Fair Value Measurements

The Company establishes the fair value of its assets and liabilities using the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Company established a fair value hierarchy based on the inputs used to measure fair value.

The three levels of the fair value hierarchy are as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly.

Level 3: Unobservable inputs in which little or no market data exists and are therefore determined using estimates and assumptions developed by the Company, which reflect those that a market participant would use.

The carrying value of cash, restricted cash, accounts receivable, accounts payable and accrued liabilities approximate their respective fair values due to their relative short maturities.

As of June 30, 2024 and December 31, 2023, all assets measured at fair value on a recurring basis consisted of cash equivalents and money market funds, which were classified within Level 1 of the fair value hierarchy. The fair value of these financial instruments was measured based on quoted prices.

Note 4. Balance Sheet Details

Property and equipment, net balances consisted of the following:

(in thousands) |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

||

Research equipment |

|

$ |

|

|

$ |

|

||

Computers and software |

|

|

|

|

|

|

||

Office equipment and furniture |

|

|

|

|

|

|

||

Leasehold improvements |

|

|

|

|

|

|

||

Construction in progress |

|

|

— |

|

|

|

|

|

Total |

|

|

|

|

|

|

||

Less accumulated depreciation and amortization |

|

|

( |

) |

|

|

( |

) |

Property and equipment, net |

|

$ |

|

|

$ |

|

||

11

Depreciation and amortization expense was $

Accrued liabilities consisted of the following:

(in thousands) |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

||

Accrued compensation |

|

$ |

|

|

$ |

|

||

Cystic Fibrosis Foundation liability |

|

|

|

|

|

|

||

Income tax payable |

|

|

— |

|

|

|

|

|

Current portion of |

|

|

|

|

|

|

||

Clinical trial accruals |

|

|

|

|

|

|

||

Vinbiocare contractual liabilities |

|

|

|

|

|

|

||

Other accrued research and development expenses |

|

|

|

|

|

|

||

Total |

|

$ |

|

|

$ |

|

||

Note 5. Debt

Wells Fargo Credit Agreement

The Company’s wholly-owned subsidiary, Arcturus Therapeutics, Inc. (“Arcturus Therapeutics”) entered into a credit agreement with Wells Fargo Bank on April 21, 2023, and amended on June 26, 2024, whereby Wells Fargo will make a $

Borrowings under the agreement will bear interest at a rate of

The term of the agreement was originally

Note 6. Stockholders’ Equity

Net Loss per Share

Potentially dilutive securities that were not included in the calculation of diluted net loss per share for the three and six months ended June 30, 2024 as they were anti-dilutive totaled

12

Sales Agreement

On December 23, 2022, the Company entered into a Controlled Equity Offering℠ Sales Agreement, which was amended on August 7, 2023 (as amended, the “Sales Agreement”) with Cantor Fitzgerald & Co. (“Cantor”),Wells Fargo Securities, LLC (“Wells Fargo Securities”), and William Blair & Company, L.L.C. (“William Blair”) relating to shares of the Company's common stock. In accordance with the terms of the Sales Agreement, the Company may offer and sell shares of its common stock having an aggregate offering price of up to $

Note 7. Share-Based Compensation Expense

In June 2024 at the Company’s 2024 Annual Meeting of Stockholders (the "2024 Annual Meeting"), the stockholders of the Company approved an amendment to the Company’s 2019 Omnibus Equity Incentive Plan (as amended, the “2019 Plan”) which, among other things, increased the aggregate number of shares authorized for use in making awards to eligible persons under the 2019 Plan by

In October 2021, the Company adopted the 2021 Inducement Equity Incentive Plan which covers the award of up to

Stock Options

Share-based compensation expense included in the Company’s condensed consolidated statements of operations and comprehensive loss for the three and six months ended June 30, 2024 and 2023 was as follows:

|

|

For the Three Months |

|

|

|

For the Six Months |

|

||||||||||||

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

||||

Research and development |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

||||

Note 8. Income Taxes

The Company is subject to taxation in the United States and various states. The Company computes its quarterly income tax provision by using a forecasted annual effective tax rate and adjusts for any discrete items arising during the quarter. The primary difference between the effective tax rate and the federal statutory tax rate is due to federal and state income tax expense offset by valuation allowance on the Company's deferred tax assets.

For the three and six months ended June 30, 2024, the Company recorded $(

Note 9. Commitments and Contingencies

Cystic Fibrosis Foundation Agreement

On September 25, 2023, the Company amended its Development Program Letter Agreement, dated May 16, 2017 and as amended July 13, 2018 and August 1, 2019, with the Cystic Fibrosis Foundation (“CFF”). Pursuant to the amendment, CFF increased the amount it will award to advance LUNAR-CF to $

13

related to the agreement. As of June 30, 2024 and December 31, 2023, $

Leases

In October 2017, the Company entered into a non-cancellable operating lease agreement for office space adjacent to its previously occupied headquarters. The commencement of the lease began in March 2018 and the lease extends for approximately

The Company entered into an irrevocable standby letter of credit with the landlord for a security deposit of $

In February 2020, the Company entered into a second non-cancellable operating lease agreement for office space near its current headquarters. The lease extended for

In September 2021, the Company entered into a third non-cancellable lease agreement for office, research and development, engineering and laboratory space near its current headquarters, and such lease term commenced during the second quarter of 2022. The initial term of this lease extends

Operating lease right-of-use asset and liability on the condensed consolidated balance sheets represent the present value of remaining lease payments over the remaining lease terms. The Company does not allocate lease payments to non-lease components; therefore, payments for common-area-maintenance and administrative services are not included in the operating lease right-of-use asset and liability. The Company uses its incremental borrowing rate to calculate the present value of the lease payments, as the implicit rate in the lease is not readily determinable.

As of June 30, 2024, the remaining payments of the operating lease liability were as follows:

(in thousands) |

|

Remaining Lease Payments |

|

|

2024 |

|

$ |

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

Thereafter |

|

|

|

|

Total remaining lease payments |

|

|

|

|

Less: imputed interest |

|

|

( |

) |

Total operating lease liabilities |

|

$ |

|

|

Weighted-average remaining lease term |

|

|

|

|

Weighted-average discount rate |

|

|

% |

|

Operating lease costs consist of the fixed lease payments included in operating lease liability and are recorded on a straight-line basis over the lease terms. Operating lease costs were $

14

Note 10. Related Party Transactions

See “Note 1, Joint Ventures, Equity Method Investments and Variable Interest Entities” for specific details surrounding the Company’s agreement with Axcelead to form the joint venture entity, ARCALIS, Inc.

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following is a discussion of the financial condition and results of operations of Arcturus Therapeutics Holdings Inc. for the three and six month periods ended June 30, 2024. Unless otherwise specified herein, references to the “Company,” “Arcturus,” “we,” “our” and “us” mean Arcturus Therapeutics Holdings Inc. and its consolidated subsidiaries. You should read the following discussion and analysis together with the interim condensed consolidated financial statements and related notes included elsewhere herein. For additional information relating to our management’s discussion and analysis of financial conditions and results of operations, please see our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”), which was filed with the U.S. Securities and Exchange Commission (the “Commission”) on March 14, 2024. Unless otherwise defined herein, capitalized words and expressions used herein shall have the same meanings ascribed to them in the 2023 Annual Report.

This report includes forward-looking statements which, although based on assumptions that we consider reasonable, are subject to risks and uncertainties which could cause actual events or conditions to differ materially from those currently anticipated and expressed or implied by such forward-looking statements.

You should read this report and the documents that we reference in this report and have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. You should also review the factors and risks we describe in the reports we will file or submit from time to time with the Commission after the date of this report.

Overview

We are a global messenger RNA medicines company focused on the development of infectious disease vaccines and opportunities within liver and respiratory rare diseases. In addition to our messenger RNA (“mRNA”) platform, our proprietary lipid nanoparticle (“LNP”) delivery system, LUNAR®, may enable multiple nucleic acid medicines. Our proprietary self-amplifying mRNA technology (STARR® technology) provides a longer-lasting and broader response at lower dose levels than conventional mRNA. In 2023, our COVID-19 vaccine, ARCT-154 (also referred to as Kostaive®), received marketing authorization approval in Japan and became the world’s first approved self-amplifying RNA (sa-mRNA) vaccine.

We are leveraging our proprietary LUNAR platform and our nucleic acid technologies to develop and advance a pipeline of mRNA-based vaccines and therapeutics for infectious diseases and rare genetic disorders with significant unmet medical needs. We continue to expand this platform by adding new innovative delivery solutions that allow us to expand our discovery efforts. Our proprietary LUNAR technology is intended to address the major hurdles in RNA drug development, namely the effective and safe delivery of RNA therapeutics to disease-relevant target tissues. We believe the versatility of our platform to target multiple tissues, its compatibility with various nucleic acid therapeutics, and our expertise in developing scalable manufacturing processes can allow us to deliver on the next generation of nucleic acid medicines.

16

Business Updates

Vaccine Collaboration with CSL Seqirus

In November 2022, we entered into a Collaboration and License Agreement (as amended, the “CSL Collaboration Agreement”) with Seqirus, Inc. (“CSL Seqirus”), a part of CSL Limited, and one of the world’s leading influenza vaccine providers, for global exclusive rights to research, develop, manufacture and commercialize self-amplifying mRNA vaccines against COVID-19, influenza and three other respiratory infectious diseases and global non-exclusive rights to pandemic pathogens. The CSL Collaboration Agreement became effective on December 8, 2022. The collaboration combines CSL Seqirus’ established global vaccine commercial and manufacturing infrastructure with Arcturus’ manufacturing expertise and innovative STARR self-amplifying mRNA vaccine and LUNAR delivery platform technologies. Under the framework of our collaboration with CSL Seqirus, we continue the development of the COVID-19 vaccine to establish a differentiated platform and address routine recommendations for periodic vaccine composition updates in a timely manner.

In November 2023, ARCT-154, our self-amplifying RNA (sa-mRNA) vaccine, received marketing authorization approval from the Japanese Ministry of Health, Labour and Welfare for use as a primary immunization and booster in Japan. The approval was based on positive clinical data from several ARCT-154 studies, including the pivotal 19,000 subject efficacy, safety and immunogenicity study performed in Vietnam as well as the pivotal Phase 3 booster study in Japan.

In May 2024, we announced that Nature Communications published results from the 19,000 subject study performed in Vietnam, with results demonstrating that two 5µg doses of ARCT-154 were well-tolerated, immunogenic and provided significant protection against multiple strains of COVID-19. The Japanese Pharmaceuticals and Medical Devices Agency (PMDA) is currently reviewing a partial change application to update our COVID-19 vaccine (Kostaive®) with the JN.1 Variant of Concern. The European Medicines Agency (EMA) is currently reviewing a marketing authorization application for ARCT-154. The review procedure started on August 17, 2023.

We continue to collect data from the various ongoing studies described below.

Key Updates on Our COVID Collaboration Program

Pivotal Phase 3 Non-Inferiority Study of ARCT-154 in Japan

Meiji Holdings Co., Ltd. (“Meiji”) sponsored a randomized, multicenter, Phase 3, observer-blind, active-controlled comparative study to evaluate the safety and immunogenicity of a booster dose of ARCT-154 and to evaluate the non-inferiority of ARCT-154 over COMIRNATY (Monovalent, Original strain). The study targeted a total of 780 adult participants, with half in the ARCT-154 group and half in a comparator group, and completed enrollment with 828 participants in February 2023. As previously announced, the study met all primary and secondary immunogenicity endpoints, including a secondary pre-defined superiority assessment over COMIRNATY (Omicron BA.4/5 strain). Overall, the safety and immunogenicity results of the study support the favorable benefit/risk profile of the ARCT-154 vaccine when administered as a booster dose in adult individuals who previously received other mRNA COVID-19 vaccines.

On February 1, 2024, the journal Lancet Infectious Diseases published the article ‘Persistence of immune responses of a self-amplifying RNA COVID-19 vaccine (ARCT154) versus BNT162b2’ (https://www.thelancet.com/journals/laninf/article/PIIS1473-3099(24)00060-4/fulltext), with 6-month follow-up results from this study. These additional data demonstrate the extended persistence of neutralizing antibodies after ARCT-154 compared with conventional mRNA vaccine in the clinical setting, indicating longer-lasting immunity and implying a longer duration of protection by ARCT-154.

Phase 3 Study of Bivalent Version of COVID-19 Vaccine Candidate in Japan

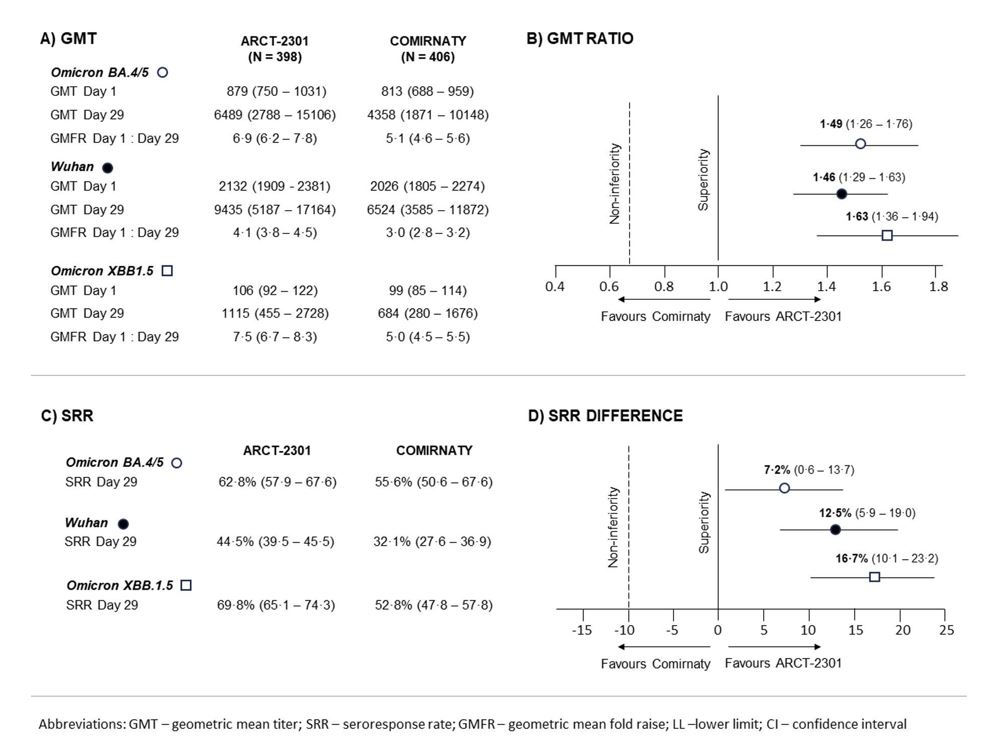

On September 29, 2023, Meiji initiated an additional Phase 3 clinical study with a bivalent version of our COVID-19 vaccine candidate (ARCT-2301, which combines ancestral strain, ARCT-154 and Omicron BA.4/5) to further support immunogenicity and safety data for our self-amplifying mRNA platform, which may facilitate the timely release of future seasonal updates of our COVID-19 vaccine against evolving variants of concern. On March 19, 2024, Meiji announced that the bivalent vaccine met the primary endpoint (non-inferiority) in the study. The study enrolled 930 healthy adults and individuals with comorbidities, who previously received three to five doses of mRNA COVID-19 vaccines, including the last booster at least three months prior to recruitment. The study compares the investigational vaccine (ARCT-2301) and COMIRNATY (ancestral strain and BA.4/5), to evaluate safety and immunogenicity between observer-blind groups. Both the geometric mean titer (GMT) ratio and seroresponse rate (SRR) difference of neutralizing antibodies against SARS-CoV-2 (Omicron strain BA.4/5) met non-inferiority criteria. In addition, the superiority of

17

ARCT-2301 to COMIRNATY (BA.4/5) was confirmed for both SARS-CoV-2 (Omicron strain BA.4/5 and Wuhan strain). There were no causally-associated severe or serious adverse events with ARCT-2301.

The results of this study of the bivalent version of our COVID-19 vaccine candidate were not required for approval of ARCT-154 in Japan but will facilitate the timely release of future seasonal updates of the COVID-19 vaccine.

Figure: Geometric mean titers (GMT) of surrogate neutralizing antibodies at Days 1 (baseline) and 29, and geometric mean-fold rises (GMFR) in titers from Day 1 to Day 29; B) GMT Ratio; C) seroresponse rates (SRR) at Day 29; D) SRR Difference – Study ARCT-2301-J01. Note: GMT – Geometric Mean Titer; SRR – seroresponse rate. All values are from the Per Protocol Subset 1 (PPS-1) and are shown with 95% confidence intervals in parentheses. Solid circles (●) represent the Wuhan variant, open circles (○) represent the Omicron BA.4/5 variant, and open squares (☐) represent the Omicron XBB.1.5 variant. Vertical lines represent the threshold for achieving the non-inferiority and superiority comparisons of ARCT-154 to Comirnaty.

Bivalent ARCT-2301, when administered intramuscularly as a booster dose in subjects who had received three to five doses of authorized mRNA COVID-19 vaccines at least three months before the recruitment, demonstrated immunological superiority over the comparator vaccine (COMIRNATY® bivalent: Wuhan strain/Omicron strain BA.4/5), as measured by GMT ratios and seroresponse rates differences for both vaccine strains (prototype Wuhan strain and Omicron BA.4/65 variant). In addition, ARCT-2301 induced a higher immune response against the epidemiologically dominant Omicron XBB.1.5 variant.

Phase 3 Study in Southern Hemisphere of Monovalent XBB1.5 COVID-19 Vaccine Candidate

In March 2024, Arcturus and CSL Seqirus initiated a Phase 3 pivotal study with the ARCT-2303 candidate vaccine containing the XBB1.5 Omicron variant. The purpose of this study is to generate additional immunogenicity and safety data in multiple ethnicities to support regulatory filings globally. In addition, the study will assess the co-administration of the ARCT-2303 vaccine

18

with the age-appropriate seasonal influenza vaccines. Overall, 1,499 young and older adults were recruited in the study in Australia, Costa Rica, Honduras and the Philippines. The results of this study are expected in the fourth quarter of 2024.

Flu Collaboration Program Updates

LUNAR-qsFLU (Quadrivalent Seasonal Influenza)

Our LUNAR-qsFLU (qs; quadrivalent seasonal) program, now exclusively licensed to CSL Seqirus, has the objective of producing a safe and effective seasonal influenza vaccine candidate with significant advantages over the traditional egg-based inactivated quadrivalent vaccine. Inaccurate predictions of circulating influenza strains as well as mutations due to adaptation in egg-grown vaccines can substantially reduce efficacy on a year-to-year basis. We believe the ability of mRNA platforms to nimbly adapt to new viral strains should help improve efficacy. In addition, we do not expect mRNA vaccines to face the challenge from mutations common to egg-grown vaccines.

LUNAR-qsFLU has been designed to take advantage of our expertise in both LUNAR lipid delivery systems and our STARR self-amplifying mRNA technology. This platform has been shown to deliver effective protection against COVID-19 and has been optimized to elicit robust immunogenicity with acceptable reactogenicity at a lower dose than conventional mRNA vaccines with the objective of creating a highly effective influenza vaccine for use in general and high-risk populations. Working with CSL Seqirus, we generated a comprehensive non-clinical data package to support the initiation of the Phase 1 clinical trial with a novel influenza mRNA vaccine candidate. A Phase 1 dose-finding safety and immunogenicity study was initiated in January 2024 in Australia. As of August 1, 2024, 100 healthy young adults and 35 older adults were recruited in the study and received one of four dose levels of the study vaccine or a licensed influenza vaccine.

Pandemic Influenza Program

Our LUNAR-pandFLU program continues to progress under the award from the Biomedical Advanced Research and Development Authority (“BARDA”) that we obtained in 2022. The program includes all non-clinical, manufacturing, and regulatory support to advance a vaccine to protect against disease caused by H5N1 highly-pathogenic avian influenza. A pre-IND meeting was granted and Written Response Only (“WRO”) was received for integration into future development plans. Nonclinical safety studies have been completed that will enable the Phase 1 clinical trial. Enrollment for a Phase 1 clinical trial designed to evaluate the safety and immunogenicity of ARCT-2304 (LUNAR-pandFLU candidate vaccine) is expected to begin before the end of 2024.

Key Updates on Arcturus-Owned mRNA Therapeutic Development Candidates

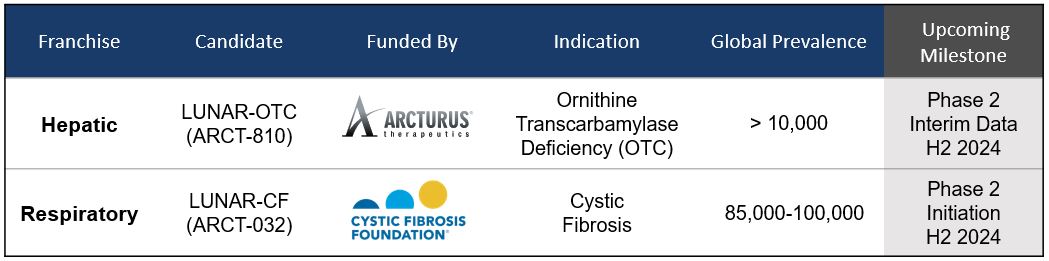

The following chart represents our current pipeline of Arcturus-owned mRNA therapeutic candidates:

19

Updates on Collaboration Agreements

CSL Collaboration Agreement.

In March 2024, we entered into Amendment Number Two to Collaboration and License Agreement between CSL and the Company to reflect updates to the development program and other adjustments consistent with our prior disclosures regarding the Collaboration and License Agreement (“Amendment Number Two”). Amendment Number Two, among other things, adjusts (i) the development plans for certain product candidates, (ii) various development milestones related to such product candidates, (iii) provisions of the CSL Collaboration Agreement related to specific royalty payments, (iii) provisions of the CSL Collaboration Agreement related to distributors, and (iv) proprietary payment calculations related to the foregoing.

Updates on Research and Platform Activities

We continue to conduct exploratory platform development activities, including the evaluation of genome editing, and new targeting approaches, where our LUNAR® and STARR® platforms could potentially be useful for identification and development of additional products for our portfolio.

Discovery Programs – Vaccine Programs (Lyme Disease and Gonorrhea)

Based on the clinical and regulatory validation of LUNAR and STARR technologies provided by the approval of ARCT-154, our next-generation vaccine for COVID-19, we have initiated new vaccine discovery programs for Lyme disease and gonorrhea. The new discovery programs rely on the evidence of superior immunogenicity, durability, and breadth of immune response compared to conventional mRNA vaccines, as observed in the COVID-19 program.

Lyme disease is a bacterial infection and is the most common vector-borne disease in the United States. Infection can spread to joints, the heart and the nervous system. Gonorrhea is a sexually transmitted disease (STD) that can infect the mucous membranes of the reproductive tract. It is the second most commonly reported bacterial sexually transmitted infection in the United States. We selected these diseases based on high unmet medical needs, good understanding of the path forward in vaccine target selection, and demonstration of proof of concept, as well as platform advantages that may be translated in a favorable vaccine product.

Updates on Supply and Manufacturing

20

We have built a global manufacturing footprint with our partners, including Aldevron, Catalent, Recipharm, Polymun and ARCALIS. With such collaborations we have established an Integrated Global Supply Chain Network with our primary and secondary sourcing contract development & manufacturing organizations (CDMOs) based in the United States, EU and Asia for producing critical raw materials, drug substance, and packaged finished product. As the market for COVID vaccines shifts from multi-dose vial formats to lower and single-dose vial formats, we continue, with our collaborator CSL Seqirus, to evaluate and advance manufacturing process and capabilities and technology transfers, and prepare for stockpiling and commercialization of COVID vaccines.

Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and related notes appearing elsewhere in this Report and our audited financial statements and related notes for the year ended December 31, 2023. Our historical results of operations and the year-to-year comparisons of our results of operations that follow are not necessarily indicative of future results.

Revenue

We enter into arrangements with pharmaceutical and biotechnology partners and government agencies that may contain upfront payments, license fees for research and development arrangements, research and development funding, milestone payments, option exercise and exclusivity fees, royalties on future sales, consulting fees and payments for technology transfers. The following table summarizes our total revenues for the periods indicated:

|

|

Three Months Ended June 30, |

|

|

2023 to 2024 |

|||||||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

% change |

|||

Revenue |

|

$ |

49,859 |

|

|

$ |

10,519 |

|

|

$ |

39,340 |

|

|

* |

* Greater than 100%

Revenue increased by $39.3 million during the three months ended June 30, 2024 as compared to the three months ended June 30, 2023. The increase was primarily attributable to the receipt of a milestone payment from CSL pursuant to the CSL agreement as $45.9 million total revenue was recognized during the second quarter of 2024, compared to $7.6 million total revenue related to CSL during the second quarter of 2023, resulting in an increase of $38.3 million primarily due to the timing and value of milestone achievements and the recognition of revenue from a supply agreement during the current quarter. Additionally, there was an increase in revenue of $2.9 million related to the BARDA Contract during the second quarter of 2024 as compared to the second quarter of 2023. The total increase in revenue was offset by a $1.9 million decrease in revenue recognized from other agreements during the second quarter of 2024 as compared to the second quarter of 2023 due to lower activity or completion of collaboration agreements.

|

|

Six Months Ended June 30, |

|

|

2023 to 2024 |

|

||||||||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

% change |

|

||||

Revenue |

|

$ |

87,871 |

|

|

$ |

90,804 |

|

|

$ |

(2,933 |

) |

|

|

-3.2 |

% |

Revenue decreased by $2.9 million during the six months ended June 30, 2024 as compared to the six months ended June 30, 2023. We received revenue under the CSL agreement of $78.3 million during the six months ended June 30, 2024, compared to $85.8 million total revenue related to CSL during the six months ended June 30, 2023, resulting in a decrease of $7.5 million primarily due to the timing and value of milestone achievements and the achievement of a conditional payment during the first half of 2023, offset by the recognition of revenue from a supply agreement during the current year. Additionally, there was a decrease of $3.2 million in revenue recognized under other agreements during the six months ended June 30, 2024 as compared to the six months ended June 30, 2023 due to lower activity or completion of collaboration agreements. The total decrease in revenue was offset by a $7.8 million increase in revenue recognized from the BARDA Contract during the six months ended June 30, 2024 as compared to the six months ended June 30, 2023.

Our operating expenses consist of research and development and general and administrative expenses.

|

|

Three Months Ended June 30, |

|

|

2023 to 2024 |

|

|

Six Months Ended June 30, |

|

|

2023 to 2024 |

|

||||||||||||||||||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

% change |

|

|

2024 |

|

|

2023 |

|

|

$ change |

|

|

% change |

|

||||||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Research and development, net |

|

$ |

58,669 |

|

|

$ |

52,668 |

|

|

$ |