Filed pursuant to Rule 253(g)(2)

File No. 024-11017

U.S. SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549

FORM 1-A/A

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES ACT OF 1933

WILEY AREA DEVELOPMENT LLC

(Exact name of issuer as specified in its charter)

Ohio

(State of other jurisdiction of incorporation or organization)

572 Breckenridge Way

Beavercreek, OH 45430

937.410.0041

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Kendall A. Almerico

Almerico Law – Kendall A. Almerico, P.A.

1440 G Street NW Washington DC 20005

(202) 370-1333

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

5810 |

| 81-5422785 |

(Primary Standard Industrial |

| (I.R.S. Employer |

The Offering Circular was originally qualified upon order of the Securities and Exchange Commission on December 13, 2019.

This Offering Circular is following the offering circular format described in Part II of Form 1-A.

PART II –OFFERING CIRCULAR - FORM 1-A: TIER 2

Dated: April 27, 2020

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

![]()

Wiley Area Development LLC d/b/a Tasty Equity (An Ohio Limited Liability Company)

572 Breckenridge Way

Beavercreek, OH 45430

937.410.0041

www.TastyEquity.com

1,000,000 Class B Units at $5.00 per Class B Unit

Minimum Investment: 20 Class B Units ($100.00)

Maximum Offering: $5,000,000.00

See The Offering – Page 14 and Securities Being Offered – Page 93 For Further Details None of the Securities Offered Are Being Sold By Present Security Holders.

This Offering Commenced Upon Qualification of this Offering by the Securities and Exchange Commission on December 13, 2019 and Will Terminate 360 days from the Date of Qualification, Unless Extended or Terminated Earlier By The Issuer.

THIS OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THIS OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PLEASE REVIEW ALL RISK FACTORS ON PAGES PAGE 16 THROUGH PAGE 46 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best efforts” basis, the following disclosures are hereby made:

For sales of securities through Dalmore Group, LLC:

| Price to Public | Commissions (1) | Proceeds to Company (2) | Proceeds to Other Persons (3) |

Per Share | $5.00 | $0.25 | $4.75 | None |

Minimum Investment | $100.00 | $5.00 | $95.00 | None |

Maximum Offering (4) | $5,000,000.00 | $250,000.00 | $4,750,000.00 | None |

(1) The Company shall pay Dalmore Group, LLC (“Dalmore”) a cash success fee equivalent to 5% of the gross proceeds raised in the Offering. In addition to the fees above, the Company shall grant to Dalmore (or their designees and assignees) cashless warrants equivalent to 3% of the gross proceeds raised in the Offering, at no cost. Fees in the charts above only reflect the cash fees and do not reflect the warrants, which are also not represented in the capitalization table herein. The warrants may be exercised by Dalmore or their assigns for no cost and will, when exercised, provide Dalmore or their assigns with Class B Units. A previous broker-dealer, Cuttone & Co., LLC was paid a $15,000 due diligence fee by the Company. See “Plan of Distribution.”

Dalmore may engage the services of additional FINRA member broker-dealers as part of a selling group, and those additional broker-dealers may be paid additional fees to those disclosed herein. Should such additional broker-dealers be engaged, an amendment or supplement to this Offering Circular will be filed disclosing the additional fees. Dalmore is not an underwriter and will not be paid underwriting fees, but will be paid service fees. See “Plan of Distribution.”

(2) Does not reflect payment of expenses of this Offering, which are estimated to not exceed $200,000.00 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, broker-dealer out-of-pocket expenses, administrative services, technology provider fees, banking fees, other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Units, but which do not include fees paid to Dalmore or any type of commissions to be paid to any broker-dealer. If the Company engages the services of additional broker-dealers in connection with the Offering, their commissions will be an additional expense of the Offering. See the “Plan of Distribution” for details regarding the compensation payable in connection with this Offering. This amount represents the proceeds of the Offering to the Company, which will be used as set out in “Use of Proceeds.”

(3) There are no finder’s fees or other fees being paid to third parties from the proceeds, other than those disclosed above. See "Plan of Distribution."

(4) As of the date of this Offering Circular, the company has sold 12,850 Class B Units at $5.00 per Class B Unit in this offering. Total commissions in the chart above represent $3,212.50 paid or to be paid to Cuttone & Company, LLC and iQ Capital (USA), Inc., the previous co-managing broker-dealers in connection with this offering, and $246,787.50 that would be paid to Dalmore, assuming the 987,150 shares that remain available in this offering are sold. As for the warrants, which are not reflected in the chart above, $1,927.50 in warrants shall be issued to Cuttone & Company, LLC and iQ Capital (USA), Inc., the previous co-managing broker-dealers in connection with this offering, or their assigns. See "Plan of Distribution.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This offering consists of Class B Units (the “Units” or individually, each a “Unit”) that are being offered on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold. The term “Offering” refers to the offer of Units pursuant to this Offering Circular. The Units are being offered and sold by Wiley Area Development LLC d/b/a Tasty Equity, an Ohio Limited Liability Company (“Tasty Equity”, “we”, “our” or the “Company”). There are 1,000,000 Units being offered at a price of $5.00 per Unit with a minimum purchase of Twenty (20) Units per investor. The Units are being offered on a best efforts basis to an unlimited number of accredited investors and an unlimited number of non-accredited investors only by the Company and through Dalmore Group LLC (“Dalmore”) a broker/dealer registered with the Securities and Exchange Commission (the “SEC”) and members of the Financial Industry Regulatory Authority (“FINRA”). The maximum aggregate amount of the Units offered is $5,000,000.00 (the “Maximum Offering”). There is no minimum number of Units (other than the per investor minimum of 20 Units) that needs to be sold in order for funds to be released to the Company and for this Offering to hold its first closing.

Wiley Area Development LLC was formed on February 20, 2017 as an Ohio limited liability company. On February 1, 2019, Wiley Area Development LLC registered the trade name Tasty Equity in the state of Ohio in order to do business under that name. The Company was formed to leverage the extensive relationships, operational expertise and in-the-trenches operational experience of its founders to help restaurant owner-operators build their own Rapid Fired Pizza and/or Hot Head Burritos franchises with Tasty Equity as their operating partner.

The Units are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The Units will only be issued to purchasers who satisfy the requirements set forth in Regulation A. This Offering will commence after qualification by the Commission and is expected to expire on the first of: (i) all of the Units offered are sold; or (ii) the close of business 360 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company’s President, or (iii) the date upon which a determination is made by the Company to terminate the Offering in the Company’s sole and absolute discretion. Pending each closing, payments for the Units will be deposited in a bank account to be held for the Company. Funds will be promptly refunded without interest, for sales that are not consummated. All funds received shall be held only in a non-interest-bearing bank account. Upon closing under the terms as set out in this Offering Circular, funds will be immediately transferred to the Company where they will be available for use in the operations of the Company’s business in a manner consistent with the “Use Of Proceeds” in this Offering Circular.

The Company’s website is not incorporated into this Offering Circular.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

BEFORE INVESTING IN THIS OFFERING, PLEASE REVIEW ALL DOCUMENTS CAREFULLY, ASK ANY QUESTIONS OF THE COMPANY’S MANAGEMENT THAT YOU WOULD LIKE ANSWERED AND CONSULT YOUR OWN COUNSEL, ACCOUNTANT AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX AND OTHER RELATED MATTERS CONCERNING THIS INVESTMENT.

THERE IS NO PUBLIC MARKET FOR THE CLASS B UNITS OR ANY OTHER SECURITIES OF THIS COMPANY, NOR WILL ANY SUCH MARKET DEVELOP AS A RESULT OF THIS OFFERING. A LEGALLY COMPLIANT TRADING MARKET FOR THE CLASS B UNITS MAY NEVER BE DEVELOPED. TRADING OF CLASS B UNITS WILL NOT BE PERMITTED UNLESS AND UNITHOLDERS ARE NOTIFIED OTHERWISE BY THE COMPANY, WHICH MAY REQUIRE UNITHOLDERS TO HOLD THEIR UNITS INDEFINITELY. AN INVESTMENT IN THIS OFFERING IS HIGHLY SPECULATIVE, AND YOU SHOULD ONLY INVEST IF YOU ARE PREPARED TO LOSE YOUR ENTIRE INVESTMENT.

THE UNITS ARE OFFERED BY THE COMPANY SUBJECT TO THE COMPANY’S RIGHT TO REJECT ANY TENDERED SUBSCRIPTION, IN WHOLE OR IN PART, IN ITS ABSOLUTE DISCRETION, AT ANY TIME PRIOR TO THE ISSUANCE OF THE UNITS. THE COMPANY MAY REJECT ANY OFFER IN WHOLE OR IN PART AND NEED NOT ACCEPT OFFERS IN THE ORDER RECEIVED.

INVESTORS WILL BE REQUIRED TO REPRESENT THAT THEY ARE ABLE TO BEAR THE ECONOMIC RISK OF THEIR INVESTMENT AND THAT THEY (OR THEIR PURCHASER REPRESENTATIVES) ARE FAMILIAR WITH AND UNDERSTAND THE TERMS AND RISKS OF THIS OFFERING. THE CONTENTS OF THIS OFFERING CIRCULAR ARE NOT TO BE CONSTRUED AS LEGAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OR HER OWN ATTORNEY, ACCOUNTANT OR BUSINESS ADVISOR AS TO LEGAL, TAX AND RELATED MATTERS CONCERNING THIS INVESTMENT. ALL FINAL DECISIONS IN RESPECT TO SALES OF SECURITIES WILL BE MADE BY THE COMPANY, WHICH RESERVES THE RIGHT TO REVOKE THE OFFER AND TO REFUSE TO SELL TO ANY PROSPECTIVE INVESTOR.

NO OFFERING LITERATURE OR ADVERTISING IN ANY FORM SHOULD BE RELIED ON

IN CONNECTION WITH THE OFFERING EXCEPT FOR THIS OFFERING CIRCULAR, ANY EXHIBITS ATTACHED AND THE STATEMENTS CONTAINED IN BOTH. NO PERSONS, EXCEPT THE COMPANY OR ITS AGENTS AND SUCH REGISTERED BROKER-DEALERS AS THE COMPANY MAY ELECT TO UTILIZE, HAVE BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS MEMORANDUM AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE HEREUNDER SHALL UNDER ANY CIRCUMSTANCES CREATE THE IMPLICATION THERE HAS BEEN NO CHANGE IN THE INFORMATION CONTAINED HEREIN SUBSEQUENT TO THE DATE HEREOF.

THE INVESTMENT DESCRIBED IN THIS OFFERING CIRCULAR INVOLVES RISK AND IS OFFERED ONLY TO INDIVIDUALS WHO CAN AFFORD TO ASSUME SUCH RISKS FOR AN INDEFINITE PERIOD OF TIME AND WHO AGREE TO PURCHASE THE SECURITIES THAT ARE BEING OFFERED HEREUNDER ONLY FOR INVESTMENT PURPOSES AND NOT WITH A VIEW TOWARDS A TRANSFER, RESALE, EXCHANGE OR FURTHER DISTRIBUTION OF SUCH. FEDERAL LAW AND STATE SECURITIES LAWS LIMIT THE RESALE OF SUCH SECURITIES AND IT IS THEREFORE URGED THAT EACH POTENTIAL INVESTOR SEEK COUNSEL CONCERNING SUCH LIMITATIONS.

THE COMPANY AS DESCRIBED IN THIS OFFERING CIRCULAR HAS ARBITRARILY DETERMINED THE PRICE OF SECURITIES, AND EACH PROSPECTIVE INVESTOR SHOULD MAKE AN INDEPENDENT EVALUATION OF THE FAIRNESS OF SUCH PRICE UNDER ALL THE CIRCUMSTANCES AS DESCRIBED IN THIS OFFERING CIRCULAR.

THIS OFFERING CIRCULAR DOES NOT KNOWINGLY CONTAIN ANY UNTRUE STATEMENT OF A MATERIAL FACT OR OMIT A MATERIAL FACT, AND ANY SUCH MISSTATEMENT OR OMISSION IS DONE WITHOUT THE KNOWLEDGE OF THE PREPARERS OF THIS DOCUMENT OR THE COMPANY. AS SUCH, THE COMPANY BELIEVES THAT THIS OFFERING CIRCULAR CONTAINS A FAIR SUMMARY OF THE TERMS OF ALL MATTERS, DOCUMENTS AND CIRCUMSTANCES MATERIAL TO THIS OFFERING.

PROSPECTIVE INVESTORS WHO HAVE QUESTIONS CONCERNING THE TERMS AND CONDITIONS OF THE OFFERING OR WHO DESIRE ADDITIONAL INFORMATION OR DOCUMENTATION TO VERIFY THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR SHOULD CONTACT THE CHIEF EXECUTIVE OFFICER OF THE COMPANY. ANY PROJECTIONS CONTAINED HEREIN OR OTHERWISE PROVIDED TO A POTENTIAL INVESTOR MUST BE VIEWED ONLY AS ESTIMATES. ALTHOUGH ANY PROJECTIONS ARE BASED UPON ASSUMPTIONS, WHICH THE COMPANY BELIEVES TO BE REASONABLE, THE ACTUAL PERFORMANCE OF THE COMPANY WILL DEPEND UPON

FACTORS BEYOND THE CONTROL OF THE COMPANY. NO ASSURANCE CAN BE GIVEN THAT THE COMPANY’S ACTUAL PERFORMANCE WILL MATCH THE PROJECTIONS.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

BEFORE INVESTING IN THIS OFFERING, PLEASE REVIEW ALL DOCUMENTS CAREFULLY, ASK ANY QUESTIONS OF THE COMPANY’S MANAGEMENT THAT YOU WOULD LIKE ANSWERED AND EACH PROSPECTIVE INVESTOR SHOULD CONSULT WITH HIS OR HER OWN PROFESSIONAL TAX, LEGAL AND INVESTMENT ADVISORS TO ASCERTAIN THE MERITS AND RISKS OF INVESTING IN THE UNITS DESCRIBED IN THIS OFFERING CIRCULAR PRIOR TO SUBSCRIBING TO SECURITIES OF THE COMPANY.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS).

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE ACT, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED STATES, IT IS THE PURCHASER'S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Form 1-A, Offering Circular and any documents incorporated by reference herein or therein contain forward-looking statements. The forward-looking statements appear in a number of places in this Offering Circular and any documents incorporated by reference and include statements regarding the intent, belief or current expectations of the Company with respect to, among others things: (i) the development of the Company and its products; (ii) the targeting of markets; (iii) trends affecting the Company’s financial condition or results of operation; (iv) the Company’s business plan and growth strategies; (v) the industries in which the Company participates; and (vi) the ability of the Company to generate sufficient cash from operations to meet its operating needs and pay off its existing indebtedness, all of which are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give the Company's current reasonable expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “may,” “could,” “will,” “should,” “can have,” “likely,” “assume,” “expect,” “anticipate,” “plan,” “intend,” “believe,” “predict,” “project,” “estimate,” “forecast,” “outlook,” “potential,” or “continue,” or the negative of these terms, and other comparable terminology and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected, expressed or implied, in the forward-looking statements as a result of various factors. They involve risks, uncertainties (many of which are beyond the Company's control) and assumptions. are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

The Company discloses important factors that could cause its actual results to differ materially from its expectations under the caption “Risk Factors” below. These cautionary statements qualify all

forward-looking statements attributable to the Company or persons acting on its behalf. The Company has based its forward-looking statements on its current expectations about future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Although the Company believes its forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward- looking statements. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

Any forward-looking statement made by the Company in this Offering Circular or any documents incorporated by reference herein speak only as of the date of this Offering Circular or any documents incorporated by reference herein. Factors or events that could cause the Company’s actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company disclaims any obligation, and undertakes no obligation, to update or alter any forward- looking statement, whether as a result of new information, future events/developments or otherwise or to conform these statements to actual results. whether as a result of new information, future events or otherwise. You should not place undue reliance on forward- looking statements. The Company urges you to carefully consider these matters, and the risk factors described in this Offering Circular, prior to making an investment in its Units.

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell, and seeking offers to buy the Units only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents. The Company will provide the opportunity to ask questions of and receive answers from the Company's management concerning terms and conditions of the Offering, the Company or any other relevant matters and any additional reasonable information to any prospective investor prior to the consummation of the sale of the Units. This Form 1-A and Offering Circular do not purport to contain all of the information that may be required to evaluate the Offering and any recipient hereof should conduct its own independent analysis. The statements of the Company contained herein are based on information believed to be reliable. No warranty can be made as to the accuracy of such information or that circumstances have not changed since the date of this Form 1-A and Offering Circular. The Company does not expect to update or otherwise revise this Form 1-A, Offering Circular or other materials supplied herewith. The delivery of this Form 1-A and Offering Circular at any time does not imply that the information

contained herein is correct as of any time subsequent to the date of this Form 1-A and Offering Circular. This Form 1-A and Offering Circular are submitted in connection with the Offering described herein and may not be reproduced or used for any other purpose.

TABLE OF CONTENTS

OFFERING SUMMARY AND RISK FACTORS | 13 |

OFFERING SUMMARY | 13 |

The Offering | 13 |

Summary of Risk Factors | 14 |

Investment Analysis | 16 |

RISK FACTORS | 16 |

DILUTION | 46 |

PLAN OF DISTRIBUTION | 50 |

USE OF PROCEEDS | 54 |

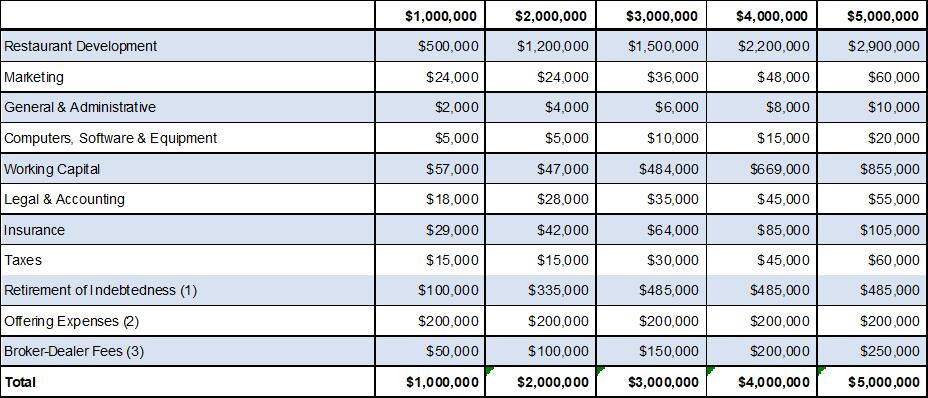

USE OF PROCEEDS TABLE | 55 |

DESCRIPTION OF THE BUSINESS | 58 |

PERKS | 83 |

DESCRIPTION OF PROPERTY | 86 |

LITIGATION | 86 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

86 |

BUSINESS | 86 |

Overview | 87 |

Results of Operations | 87 |

Liquidity and Capital Resources | 88 |

Plan of Operations | 88 |

Trend Information | 92 |

Off-Balance Sheet Arrangements | 94 |

Critical Accounting Policies | 94 |

Revenue Recognition | 95 |

Additional Company Matters | 95 |

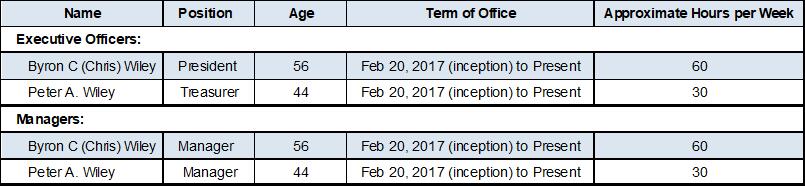

MANAGERS AND EXECUTIVE OFFICERS | 96 |

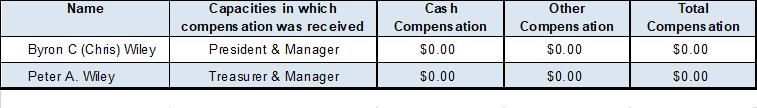

COMPENSATION OF MANAGERS AND EXECUTIVE OFFICERS | 97 |

Executive Compensation | 97 |

Employment Agreements | 98 |

Equity Incentive Plan | 98 |

Board of Managers | 98 |

Committees of the Board of Managers | 98 |

Manager Compensation | 99 |

Limitation of Liability and Indemnification of Officers and Managers | 99 |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS |

99 |

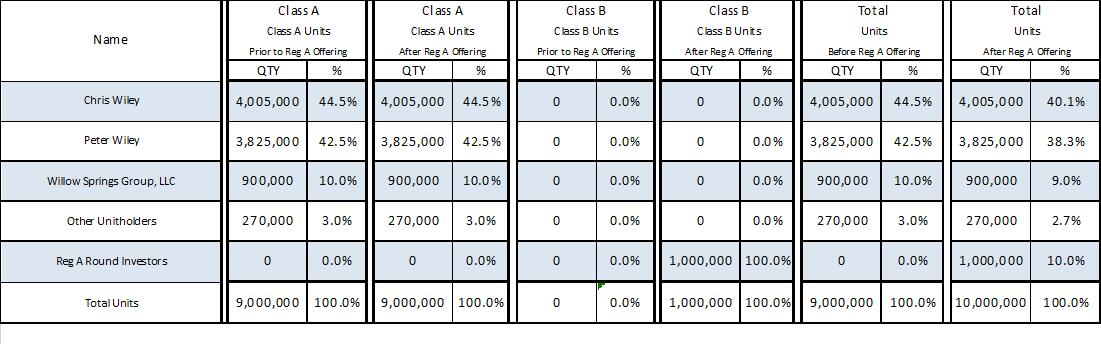

CAPITALIZATION TABLE | 100 |

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN RELATED- PARTY TRANSACTIONS AND AGREEMENTS |

100 |

SECURITIES BEING OFFERED | 101 |

Subscription Price | 102 |

Voting Rights | 103 |

Distributions | 103 |

Liquidation Rights | 105 |

Arbitration and Venue | 105 |

Additional Matters | 106 |

DISQUALIFYING EVENTS DISCLOSURE | 106 |

ERISA CONSIDERATIONS | 106 |

INVESTOR ELIGIBILITY STANDARDS | 108 |

TAXATION ISSUES | 111 |

SIGNATURES | 112 |

ACKNOWLEDGEMENT ADOPTING TYPED SIGNATURES | 113 |

SECTION F/S: FINANCIAL STATEMENTS | 114 |

OFFERING SUMMARY AND RISK FACTORS

OFFERING SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular. For full offering details, please (1) thoroughly review this Form 1-A filed with the Securities and Exchange Commission (2) thoroughly review this Offering Circular and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A and Offering Circular.

Issuer: | Wiley Area Development LLC d/b/a Tasty Equity |

Type of Offering: | Class B Units |

Price Per Unit: | $5.00 per Unit (1,000,000 Units) |

Minimum Investment: | $100.00 per investor |

Maximum Offering: | $5,000,000.00The Company will not accept investments greater than the Maximum Offering amount. |

Maximum Units Offered: | 1,000,000 Class B Units |

Purchasers: | Purchasers may be accredited investors or non- accredited investors. Non-accredited investors are limited in the number of Units they may purchase. |

Use of Proceeds: | See the description in section entitled “Use of Proceeds” on page 54 herein. |

Voting Rights: | The Units have no voting rights. See “Voting Rights” section of “Securities Being Offered” below for details. |

Length of Offering: | Units will be offered on a continuous basis until either (a) the date upon which the Company confirms that it has received in the bank account gross proceeds of $5,000,000.00 in deposited funds; (b) the expiration of 360 days from the date of this Offering Circular unless extended in its sole discretion by the Company; or (c) the date upon which a determination is made by the Company to terminate the Offering in its sole discretion. |

The Offering

Class A Units Outstanding | 9,000,000 Units |

Class B Units Outstanding | 0 Units |

Class A Units in this Offering | 0 Units |

Class B Units in this Offering (1) | 1,000,000 Units |

Units to be outstanding after the Offering (2) | 10,000,000 Units |

There are two classes of Units issued by the Company. For a full description of the rights of the

Units, please see the section of this Offering Circular entitled “Securities Being Offered” below. The total number of Class B Units (1,000,000) in the chart assumes that the maximum number of Class B Units are sold in this Offering.

The number of Units to be outstanding after the Offering assumes that the Offering is fully subscribed, and this number will be less if the Offering is not fully subscribed. Units outstanding after the Offering does not include a number of Units up to 5% of the gross proceeds raised in the Offering, which will be exercisable by the broker-dealers or their assigns via warrants in the future based on the terms of said warrants. The warrants may be exercised by broker-dealers or their assigns for no cost and will, when exercised, provide the broker-dealers or their assigns with Class B Units.

The Company may not be able to sell the Maximum Offering amount. The Company will conduct one or more closings on a rolling basis as funds are received from investors. Funds tendered by investors will be kept in a bank account until the next closing after they are received by the bank. At each closing, with respect to subscriptions accepted by the Company, funds held in the bank account will be distributed to the Company, entitling the investor to receive the Units as set out herein. Investors may not withdraw their funds tendered from the bank account unless the Offering is terminated without a closing having occurred. Investors are not entitled to any refund of funds transmitted by any means to the Company, or to the bank account, for any reason, unless the Investor does not clear compliance by the broker-dealers involved.

Summary of Risk Factors

This Offering involves significant risks and you should consider the Units highly speculative. The following important factors, and those important factors described elsewhere in this Offering Circular, including the matters set forth under the section entitled “Risk Factors,” could affect (and in some cases have affected) the Company’s actual results and could cause such results to differ materially from estimates or expectations reflected in this Offering Circular and in any forward-looking statements made herein or by the Company. These important risk factors include, but are not limited to:

The Company is a relatively newly formed entity with limited tangible assets and its continued operation requires substantial additional funding.

The Company has a short operating history and there is no assurance that the business plan can be executed, or that the Company will generate revenues or profits.

Investors in this Offering risk the loss of their entire investment. The industry in which the Company is participating is highly speculative and extremely risky.

There is no minimum number of Units that needs to be sold in order for funds to be released to the Company and for this Offering to hold its first closing; therefore, there is no assurance the Company will receive funds sufficient to further its business plan.

If you invest and purchase the Units, you will be acquiring a minority interest in the Company and will have little to no effective control over, or input into, the management or decisions of the Company, primarily because the Units have no voting rights.

There is no market for the Company’s Units at present and there is no assurance such a market will develop subsequent to this Offering. The Units are illiquid and should be considered a long-term investment.

The Company and its management, the U.S. and global economy and the restaurant, food service and bar markets have been substantially affected by the coronavirus pandemic.

There are substantial restrictions on the transferability of the Units and in all likelihood, you will not be able to liquidate some or all of your investment in the immediate future.

The Company has broad discretion in its use of proceeds and, as an investor, you are relying on management’s judgment.

The price of the Units is arbitrary and may not be indicative of the value of the Units or the Company.

The tax treatment of the Units is uncertain.

The Company does not expect there to be any market makers to develop a trading market in the Units.

The Company’s operating and financial results and growth strategies are closely tied to the success of franchisees.

The franchisees could take actions that could harm the Company’s business and may not accurately report sales.

If the Company fails to identify, recruit and contract with a sufficient number of qualified owner-operators, the Company’s ability to open new restaurants and increase the Company’s revenues could be materially adversely affected.

If the Company fails to open new restaurants on a timely basis, the Company’s ability to increase the Company’s revenues could be materially adversely affected.

Opening new restaurants in existing markets and aggressive development could cannibalize existing sales and may negatively affect sales at existing restaurants.

The Company’s success depends substantially on corporate reputation and on the value and perception of the rapid fired franchising and hot head franchising brands.

The Company’s success depends in part upon effective advertising and marketing campaigns, which may not be successful, and franchisee support of such advertising and marketing campaigns.

Negative publicity relating to one of the restaurants could reduce sales at some or all of the other restaurants.

The restaurant industry in which the Company operates is highly competitive.

Shortages or interruptions in the availability and delivery of food and other supplies may increase costs or reduce revenues.

The Company’s business may be adversely impacted by changes in consumer discretionary spending and general economic conditions

The planned rapid increase in the number of the Company’s restaurants may make the Company’s future results unpredictable.

The Company’s expansion into new markets may present increased risks due to the Company’s unfamiliarity with those areas.

For a more detailed discussion of these and other significant risks, please thoroughly review and understand “Risk Factors” in the main body of this Offering Circular. Potential investors will be given an opportunity, if the potential investor requests to do so, to review the current status of all material contracts and make appropriate questions of management prior to subscribing to this Offering.

Investment Analysis

The Company believes that it has strong economic prospects by virtue of the following dynamics of the industry, the success of its founders in their related business endeavors, and other reasons:

1.Management believes that the trends for growth in the fast casual restaurant industry in the United States are favorable, despite the coronavirus pandemic.

2.Prior to the coronavirus pandemic, the demand for fast casual restaurants in the United States was expected to grow, creating an opportunity for the Company as it was already ahead of some competitors by having four restaurants opened, and by having a management team with expertise in opening, and operating, restaurants in the fast casual sector. Management is hopeful that when the coronavirus pandemic subsides, the demand for fast casual restaurants in the United States will return and will grow in the future.

3.Management believes that its experience in the fast casual restaurant and franchise restaurant markets positions Tasty Equity for profitable operations and will create new market opportunities in the United States.

Despite management’s beliefs, there is no assurance that Tasty Equity will be profitable, or that management’s opinion of the industry’s favorable dynamics will not be outweighed in the future by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Units. In particular, while the Company and its management are hopeful that the long-term effects will eventually be minimized from the coronavirus pandemic and the related economic issues that have affected the U.S., the global economy and the Company, neither management nor the Company can offer any assurance that what they believe to be the long term favorable conditions will not be outweighed by the occurrence and the past problems and future unknown problems and issues caused by the coronavirus pandemic.

RISK FACTORS

The purchase of the Company’s Class B Units involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Class B Units offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Class B Units and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your investment in the Class B Units. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The Company is, in addition to the risks set out below, subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as

hacking and the ability to prevent hacking). Additionally, early-stage companies inherently involve greater risk than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Before investing, you should carefully read and carefully consider the following:

Risks Relating to The Company

The Company And Its Management, The U.S. And Global Economy And The Food Service, Restaurant and Bar Markets As Well as Their Supply Chains Have Been Substantially Affected By The Coronavirus Pandemic.

In late 2019, a novel coronavirus (COVID-19) surfaced, reportedly, in Wuhan, China. The World Health Organization declared a global emergency on January 30, 2020, with respect to the outbreak and many states and countries, including the United States, have initiated significant restrictions on business operations. The Company faces uncertainty as the ongoing pandemic causes significant disruption to U.S and global markets and business. The overall and long term impacts of the outbreak are unknown and evolving.

This pandemic has already adversely affected our business and this or another pandemic, epidemic or outbreak of an infectious disease in the United States or in another country may adversely affect our business. The spread of this disease or a new disease could lead to even more unfavorable economic conditions, which would adversely impact our operations. The extent to which the coronavirus impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

The effects of such a widespread infectious disease and pandemic has already caused, and may continue to cause or may cause in the future an overall decline in the U.S. and world economy as a whole. The actual effects of the spread of coronavirus or of another pandemic are difficult to assess as the actual effects will depend on many factors beyond the control and knowledge of the Company. However, the spread of the coronavirus, if it continues, and any future similar occurrence may cause an overall decline in the economy as a whole and therefore may materially harm our Company long term.

At the time this filing, there has been significant impact on the restaurant, food service, and bar industry, as well as their supply chains, and there is great uncertainty as to the long-term effect of the coronavirus pandemic on the restaurant, food service, and bar industry, as well as their supply chains, in the U.S. and globally. There is also uncertainly as to what long-term restrictions on the general public or other effects will occur in the market, and in the economy in general in general. There is also uncertainty as to what will happen to in this regard should another health-related outbreak occur in the future. In addition, there is great uncertainty as to how dining out, going to bars and restaurants and leaving one’s home will be affected in the future by the drastic changes brought on with this present pandemic.

All of these risks, and many others known or unknown, related to this outbreak, and future outbreaks,

pandemics or epidemics, could materially affect the short-term and long-term business of the Company, and your investment.

The Company Has Limited Operating History

The Company has a limited operating history and there can be no assurance that the Company's proposed plan of business can be realized in the manner contemplated and, if it cannot be, Unitholders may lose all or a substantial part of their investment. There is no guarantee that the Company will ever realize any significant operating revenues or that its operations will ever be profitable.

The Company is Invested in Restaurant Operations with Independent Owner Operator Franchisees of the Rapid Fired Pizza and Hot Head Burritos Franchise Systems And Has Taken No Distributions From Those Restaurants To Date.

The four restaurants in which Tasty Equity is currently invested in, with restaurant owner- operators, are themselves profitable and self-sustaining as reflected in the Company’s audit report. The Company exercises substantial control over those restaurants and is directing the activities of the independent owner-operators. The Company has made substantial investments in those businesses to build two Rapid Fired Pizza restaurants and acquire two existing Hot Head Burritos restaurants but has not received distributions from them during their initial three years of operation due to continued reinvestment in the two acquired Hot Head Burritos restaurants which had substantial deferred maintenance at the time of the acquisition and accordingly were acquired at a substantial discount to market value. The Company has made additional investments with those independent owner-operators to upgrade the acquired stores and has advanced deposits on projects that are not yet completed including Self-pour alcohol systems on order for one of the Rapid Fired Pizza restaurants. The Company has also advanced deposits and other up front expenses associated with the construction of a fifth restaurant, as the first Rapid Fired Pizza & Taproom format, which Tasty Equity plans to open in fall-2019 with a restaurant owner-operator, which still requires the completion of final bank financing approval and lease negotiations with the landlord before construction can commence. While Tasty Equity may receive distributions from those operations in the near future, there is no guarantee that the Company’s management will chose to take distributions in the foreseeable future, but rather may choose to reinvest in the growth of the Company and additional restaurants. If this occurs, investors may not receive any distributions even if the Company is otherwise profitable.

The Company Has Incurred Operating Losses In The Past, Expects To Incur Operating Losses In The Future And May Never Achieve Or Maintain Profitability.

Since the Company’s inception, Tasty Equity has invested in operational expenses including personnel, infrastructure, marketing expenses, legal expenses and travel in preparation for this Offering. As a result, the Company has experienced net losses and negative cash flows from operations separate from its investments with restaurant owner-operators. The Company expects its operating expenses to increase in the future as it expands its store development operations. If the Company’s revenue does not grow at a greater rate than its operating expenses, the Company will not be able to achieve and maintain profitability. The Company expects to incur losses in the future

for a number of reasons, including without limitation the other risks and uncertainties described herein. Additionally, the Company may encounter unforeseen operating or legal expenses, difficulties, complications, delays and other factors that may result in losses in future periods. If the Company’s expenses exceed its revenue, the Company may never achieve or maintain profitability and the Company’s business may be harmed.

The Company Is Dependent Upon Its Management, Key Personnel and Consultants to Execute the Business Plan, And Some of Them Will Have Concurrent Responsibilities at Other Businesses

The Company's success is heavily dependent upon the continued active participation of the Company's current executive officers, Chris Wiley and Peter Wiley, as well as other key personnel and consultants. Some of them will have concurrent responsibilities at other entities. Loss of the services of one or more of these individuals could have a material adverse effect upon the Company's business, financial condition or results of operations. Further, the Company's success and achievement of the Company's growth plans depend on the Company's ability to recruit, hire, train and retain other highly qualified personnel. Competition for qualified employees and management personnel among companies in industries that the Company is participating in is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of the Company's activities, could have a materially adverse effect on it. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on the Company's business, financial condition or results of operations.

Although Dependent Upon Certain Key Personnel, The Company Does Not Have Any Key Man Life Insurance Policies on Any Such People

The Company is dependent upon management in order to conduct its operations and execute its business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of these key personnel, management or consultants die or become disabled, the Company will not receive any compensation that would assist with such person's absence. The loss of such person could negatively affect the Company and its operations.

The Company Is Subject to Income Taxes as Well As Non-Income Based Taxes, Which May Include Payroll, Sales, Use, Value-Added, Net Worth, Property and Goods and Services Taxes.

Significant judgment is required in determining the Company’s provision for income taxes and other tax liabilities. In the ordinary course of the Company’s business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that the Company’s tax estimates will be reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in the Company’s income tax provisions, expense amounts for non-income based taxes and accruals and

(ii) any material differences could have an adverse effect on the Company’s financial position and results of operations in the period or periods for which determination is made.

The Company Is Not Subject to Sarbanes-Oxley Regulations and Lack the Financial Controls and Safeguards Required of Public Companies.

The Company does not have the internal infrastructure necessary, and is not required, to complete an attestation about the Company’s financial controls that would be required under the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of the Company’s financial controls.

The Company Has Engaged in Certain Transactions with Related Persons or Entities.

The Company has, and will continue to engage in transactions with related parties and/or entities. While the Company believes the terms of such transactions are fair and equitable, these transactions have not been, and will not in the future be, at arm’s length. Please see the section of this Offering Circular entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements” for further details. If you have concerns about these transactions in the past or in the future, you may ask questions of the Company’s management. However, if you choose to invest in the Company, you will do so knowing and understanding that these transactions have occurred and will continue to occur in the future.

Changes in Employment Laws or Regulation Could Harm the Company’s Performance

Various federal and state labor laws govern the Company’s relationship with the Company’s employees and contractors and affect the Company’s operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers' compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect the Company’s operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

The Company’s Bank Accounts Will Not Be Fully Insured

The Company’s regular bank accounts and the bank account for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In the event that any of Company’s banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

The Company’s Business Plan Is Speculative

The Company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues or profits. An investment in the Company’s Class B Units is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The Company Will Likely Incur Debt

The Company will likely incur debt (including secured debt) in the future and in the continuing operations of its business. Complying with obligations under such indebtedness may have a material adverse effect on the Company and on your investment.

The Company’s Expenses Could Increase Without a Corresponding Increase in Revenues

The Company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the Company’s financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges,

changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, (5) increases in borrowing costs, and (5) unexpected increases in costs of supplies, goods, materials, construction, equipment or distribution.

Computer, Website or Information System Breakdown Could Affect the Company’s Business

Computer, website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service its customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s financial results as well as your investment.

Changes in The Economy Could Have a Detrimental Impact

Changes in the general economic climate, both in the United States and internationally, could have a detrimental impact on consumer expenditure and therefore on the Company’s revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may decrease the disposable income that customers have available to spend on products and services like those of the Company and may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on the Company’s financial results and on your investment.

The Amount of Capital the Company Is Attempting to Raise in This Offering Is Not Enough to Sustain the Company's Current Business Plan

In order to achieve the Company's near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If the Company is not able to raise sufficient capital in the future, the Company will not be able to execute the Company’s business plan, the Company’s continued operations will be in jeopardy and the Company may be forced to cease operations and sell or otherwise transfer all or substantially all of the Company’s remaining assets, which could cause you to lose all or a portion of your investment.

Additional Financing May Be Necessary for The Implementation of The Company's Growth Strategy

Whether the Company is successful in selling the maximum number of Units in this Offering or not, the Company may require additional debt, equity or securities financing to pursue the Company’s growth and business strategies. These growth and business strategies include, but are not limited to enhancing the Company’s operating infrastructure and otherwise responding to competitive pressures. Given the Company’s limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to the Company. Lack of additional funding could force the Company to curtail substantially the Company’s growth plans. Furthermore, the issuance by the Company of any additional securities pursuant to any future fundraising activities undertaken by the Company or could result in an issuance of securities whose rights, preferences and privileges are senior to those of existing Unitholders including you, and could dilute the ownership or benefits of ownership of existing Unitholders including, but not limited to reducing the value of Class B Units subscribed for under this Offering.

The Company's Executive Officers and Managers as Class A Members Managers Own or Control a Substantial Portion of Its Outstanding Units

The Company's executive officers and managers as Class A Members control a substantial portion of the Company’s outstanding Units which may limit your ability and the ability of the Company’s other Unitholders, whether acting alone or together, to propose or direct the management or overall direction of the Company. Additionally, this concentration of ownership could discourage or prevent a potential merger or acquisition of the Company that might otherwise result in an investor receiving a premium over the market price for his or her Units. Accordingly, the Company’s managers, executive officers and other Class A Members may have the power to control the election of the Company’s managers and the approval of actions for which the approval of the Company’s Unitholders is required. If you acquire the Company’s Class B Units, you will have no effective voice in the management of the Company. Such concentrated control of the Company may adversely affect the value of the Company’s Class B Units and could also limit the price that investors might be willing to pay in the future for the Company’s Class B Units.

The Company’s Operating Plan Relies in Large Part Upon Assumptions and Analyses Developed by The Company. If These Assumptions or Analyses Prove to Be Incorrect, The Company’s Actual Operating Results May Be Materially Different from The Company’s Forecasted Results

Whether actual operating results and business developments will be consistent with the Company’s expectations and assumptions as reflected in its forecasts depend on a number of factors, many of which are outside the Company’s control, including, but not limited to:

whether the Company can obtain sufficient capital to sustain and grow its business

the Company’s ability to manage its growth

whether the Company can manage relationships with key vendors and third parties

demand for the Company’s products and services

the timing and costs of new and existing marketing and promotional efforts

competition

the Company’s ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel

the overall strength and stability of domestic and international economies, and

consumer habits

Unfavorable changes in any of these or other factors, most of which are beyond the Company’s control, could materially and adversely affect its business, results of operations and financial condition.

The Company May Be Unable to Manage Its Growth or Implement Its Expansion Strategy

The Company may not be able to expand the Company's product and service offerings, the Company's markets, or implement the other features of the Company's business strategy at the rate or to the extent presently planned. The Company's projected growth will place a significant strain on the Company's administrative, operational and financial resources. If the Company is unable to successfully manage the Company's future growth, establish and continue to upgrade the Company's operating and financial control systems, recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, the Company's financial condition and results of operations could be materially and adversely affected.

If The Company Is Unable to Effectively Protect Its Intellectual Property and Trade Secrets, It May Impair The Company’s Ability to Compete

The Company’s success will depend on its ability to obtain and maintain meaningful intellectual property protection for any Company intellectual property. The names and/or logos of Company brands may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Patents, trademarks and copyrights that have been or may be obtained by the Company may be challenged by others, or enforcement of the patents, trademarks and copyrights may be required. The Company also relies upon, and will rely upon in the future, trade secrets. While the Company uses reasonable efforts to protect these trade secrets, the Company cannot assure that its employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose the Company's trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, the Company's competitors may independently develop equivalent knowledge, methods and know- how. If the Company is unable to defend the Company's trade secrets from others use, or if the Company's competitors develop equivalent knowledge, it could have a material adverse effect on the Company's business.

Any infringement of the Company's patent, trademark, copyright or trade secret rights could result in significant litigation costs, and any failure to adequately protect the Company's trade secret rights could result in the Company's competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenues. Existing patent, copyright, trademark and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect the Company's rights to the same extent as do the laws of the United States. Therefore, the Company may not be able to protect the Company's existing patent, copyright, trademark and trade secret rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using the Company's Existing patent, copyright, trademark and trade secret rights

could be expensive and time consuming, and the outcome of such a claim is unpredictable. This litigation could result in diversion of resources and could materially adversely affect the Company's operating results.

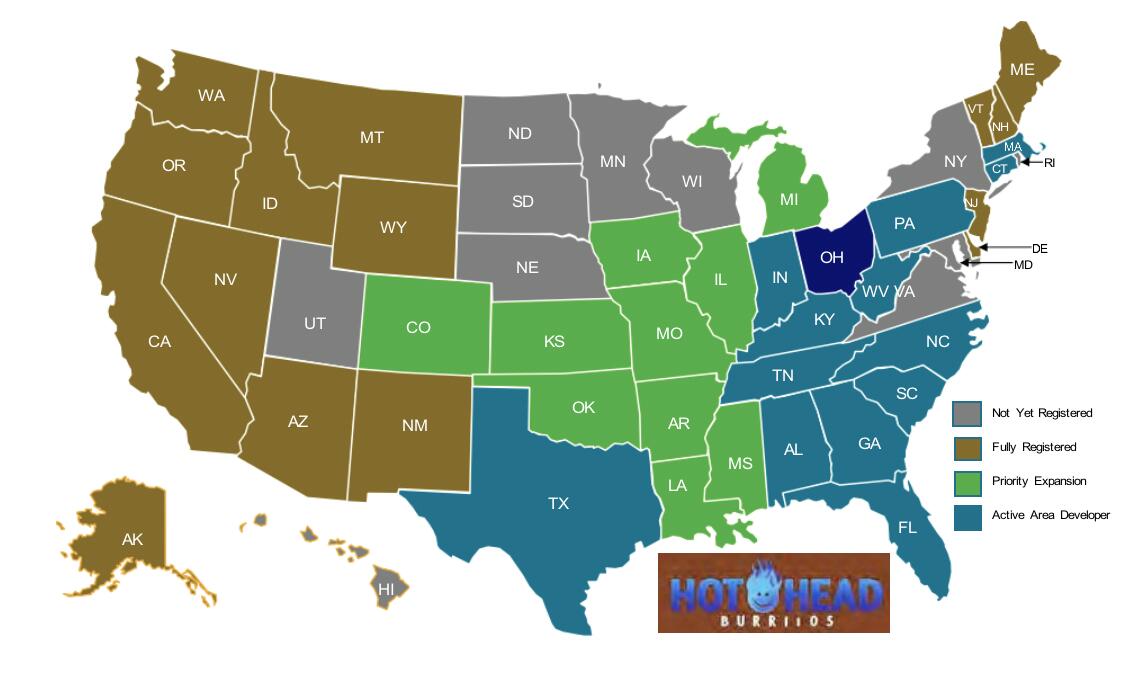

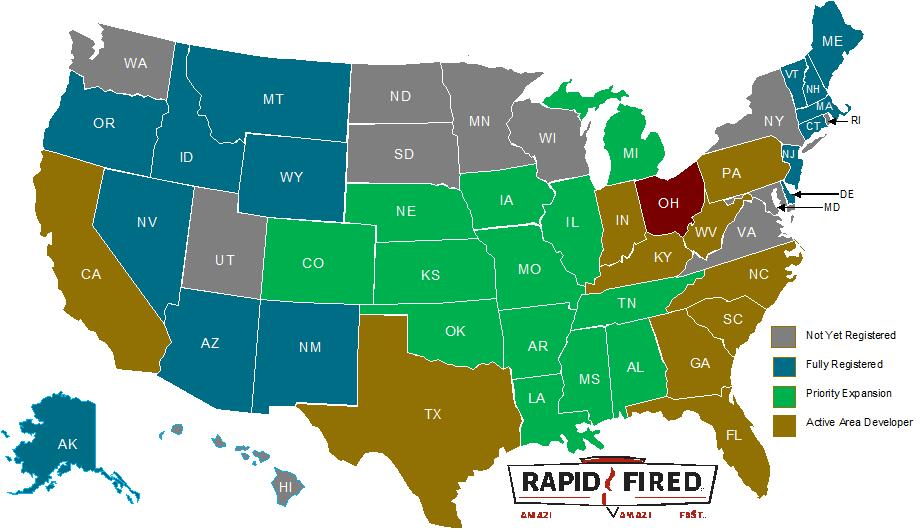

The Company and the independent owner operators that it invests in are licensed franchisees of Rapid Fired Franchising and Hot Head Burritos Franchising and their ability to conduct business as Hot Head Burritos, Hot Head Mexican Grill & Cantina, Rapid Fired Pizza or Rapid Fired Pizza & Taproom is governed by those franchisee and area developer license agreements. The Company has no control over the actions, business or policies of those two franchisors and its business may be materially impacted based upon actions of the franchisors or the Company’s ability to continue to comply with the provisions of those franchise system licensing agreements.

The Company's Business Model Is Evolving

The Company's business model is unproven and is likely to continue to evolve. Accordingly, the Company's initial business model may not be successful and may need to be changed. The Company's ability to generate significant revenues will depend, in large part, on the Company's ability to successfully market the Company's products and services to potential customers who may not be convinced of the need for the Company's products and services or who may be reluctant to rely upon third parties to develop and provide these products. The Company intends to continue to develop the Company's business model as the Company's market continues to evolve.

The Company Faces or Will Face Competition in the Company's Markets

The Company either faces, or will face significant competition in the United States and elsewhere. In some cases, the Company’s competitors have or may have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical and marketing resources. The Company's ability to compete depends, in part, upon a number of factors outside the Company's control, including the ability of the Company's competitors to develop alternatives that are superior. If the Company fails to successfully compete in its markets, or if the Company incurs significant expenses in order to compete, it would have a material adverse effect on the Company's results of operations.

A Data Security Breach Could Expose the Company to Liability and Protracted and Costly Litigation, And Could Adversely Affect the Company's Reputation and Operating Revenues

To the extent that the Company's activities involve the storage and transmission of confidential information and/or other data, the Company and/or third-party processors will receive, transmit and store confidential customer and other information. Encryption software and the other technologies used to provide security for storage, processing and transmission of confidential customer and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to the Company's or these third parties' systems or databases could result in the theft, publication, deletion or modification of confidential customer and other information, as well as numerous other problems. A data security breach of the systems on which sensitive account information are stored could lead to

fraudulent activity involving the Company's products and services, reputational damage, and claims or regulatory actions against the Company. If the Company is sued in connection with any data security breach, the Company could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, the Company might be forced to pay damages and/or change the Company's business practices or pricing structure, any of which could have a material adverse effect on the Company's operating revenues and profitability. The Company would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

The Company Depends on Third-Party Providers for A Reliable Internet Infrastructure and The Failure of These Third Parties, Or the Internet in General, For Any Reason Would Significantly Impair the Company's Ability to Conduct Its Business

The Company will outsource some or all of its online presence and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, its business would be significantly damaged. As has occurred with many Internet-based businesses, the Company may be subject to "denial-of-service" attacks in which unknown individuals bombard its computer servers with requests for data, thereby degrading the servers' performance. The Company cannot be certain it will be successful in quickly identifying and neutralizing these attacks. If either a third-party facility failed, or the Company's ability to access the Internet was interfered with because of the failure of Internet equipment in general or if the Company becomes subject to malicious attacks of computer intruders, its business and operating results will be materially adversely affected.

The Company's Employees May Engage in Misconduct or Improper Activities

The Company, like any business, is exposed to the risk of employee or contractor fraud or other misconduct. Misconduct by employees or contractors could include intentional failures to comply with laws or regulations, provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose unauthorized activities to the Company. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and harm to the Company's reputation.

Limitation on Manager, Officer and Other’s Liability

The Company may provide for the indemnification of managers, officers and others to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of managers, officers and others to the Company and its Unitholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to managers, officers or others controlling or working with the Company

pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. Despite this, should the Company provide such indemnification, it could have a material adverse effect on the Company.

Inability to Maintain and Enhance Product Image Could Affect the Company

It is important that the Company maintains and enhances the image of its existing and new products and services. The image and reputation of the Company’s products may be impacted for various reasons including but not limited to, bad publicity, litigation, customer complaints, and complaints from regulatory bodies. Such problems, even when unsubstantiated, could be harmful to the Company’s image and the reputation of its products. From time to time, the Company may receive complaints from customers regarding products purchased from the Company. The Company may become subject to lawsuits from customers alleging injury because of a purported defect in products or services sold by the Company, claiming substantial damages and demanding payments from the Company. These claims may not be covered by the Company’s insurance policies, if any exist. Any resulting litigation could be costly for the Company, divert management attention, and could result in increased costs of doing business, or otherwise have a material adverse effect on the Company’s business, results of operations, and financial condition. Any negative publicity generated as a result of customer or regulator complaints about the Company or its products could damage the Company’s reputation and diminish the value of the Company’s brand and brand equity (brand image, reputation and product quality), which could have a material adverse effect on the Company’s business, results of operations, and financial condition, as well as your investment.

There Are Doubts About the Company’s Ability to Continue as a Going Concern.

The Company’s independent auditors have raised doubts about the Company’s ability to continue as a going concern. There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources, such as Unit, debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. The Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the commencement of revenues, with interim cash flow deficiencies being addressed through additional financing. The Company anticipates raising additional funds through public or private financing, securities financing and/or strategic relationships or other arrangements in the near future to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations and Unit price and require it to curtail or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s Class B

Units, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that the Company relinquish valuable rights. Any additional financing could have a negative effect on Unitholders.

If The Company’s Efforts To Build Strong Brands And Maintain Customer Satisfaction And Loyalty Are Not Successful, It May Not Be Able To Attract Or Retain Customers, And Its Business May Be Harmed.

The Company believes that increasing, maintaining and enhancing awareness of the Company's brands is critical to achieving widespread acceptance and success of the Company's business. The Company is materially dependent upon Rapid Fired Pizza Franchising and Hot Head Burritos Franchising to build, continually evolve and protect the brands in ways that are beyond the control of the Company. Building and maintaining strong brands is important to attract and retain customers, as potential customers have a large number of restaurant choices. Successfully building a brand is a time consuming and expensive endeavor, and can be positively and negatively impacted by any number of factors. Some of these factors, such as the quality or pricing of the Company’s menu items or its customer service, are at least partially within its control. Other factors will be beyond the Company’s control, yet customers may nonetheless attribute those factors to the Company. The Company’s competitors may be able to achieve and maintain brand awareness and market share more quickly and effectively than the Company can. Many of the Company’s competitors are larger companies and promote their brands through traditional forms of advertising, such as print media and TV commercials, and have substantial resources to devote to such efforts. The Company’s competitors may also have greater resources to utilize Internet advertising or website product placement more effectively than the Company can. If the Company is unable to execute on building strong brands, it may be difficult to differentiate its business, programming and platform from its competitors in the marketplace, therefore its ability to attract and retain customers may be adversely affected and its business may be harmed.

The Company’s Actual Or Perceived Failure To Adequately Protect Personal Data Could Harm Its Business.

A variety of state, national, foreign, and international laws and regulations apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal data. These privacy and data protection-related laws and regulations are evolving, with new or modified laws and regulations proposed and implemented frequently and existing laws and regulations subject to new or different interpretations. Compliance with these laws and regulations can be costly and can delay or impede the development of new products. The Company’s actual, perceived or alleged failure to comply with applicable laws and regulations or to protect personal data, could result in enforcement actions and significant penalties against the Company, which could result in negative publicity, increase the Company’s operating costs, subject the Company to claims or other remedies and may harm its business which would negatively impact the Company’s financial well- being and your investment.

Risks Relating to This Offering and Investment

The Class B Units Are Offered on a “Best Efforts” Basis and The Company May Not Raise the

Maximum Amount Being Offered

Since the Company is offering the Class B Units on a “best efforts” basis, there is no assurance that the Company will sell enough Class B Units to meet its capital needs. If you purchase Class B Units in this Offering, you will do so without any assurance that the Company will raise enough money to satisfy the full Use of Proceeds which the Company has outlined in this Offering Circular or to meet the Company’s working capital needs.

Investor Funds Will Not Accrue Interest While in the Company’s Bank Account Prior To Closing

All funds delivered in connection with subscriptions for the Class B Units will be held in a non- interest-bearing bank account through Prime Trust LLC until a closing of the Offering, if any. Investors in the securities offered hereby may not have the use of such funds or receive interest thereon pending the completion of the Offering or a closing. If the Company fails to hold a closing prior to the termination date, investor subscriptions will be returned without interest or deduction.

The Company Has Not Paid Distributions in The Past and Does Not Expect to Pay Distributions in The Near Future, So Any Return on Investment May Be Limited to The Value of the Class B Units